Investor Presentation

(Based upon Fourth Quarter 2009 Results)

February 18, 2010

Future operating results

Global economic conditions

Subscriber growth, retention and usage levels

Fax and voice service growth

New products, services and features

Corporate spending

Intellectual property

Liquidity

Network capacity, coverage and security

Regulatory developments

Taxes

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, particularly those contained in the “2010 Guidance” slides. These forward-

looking statements are based on management’s current expectations or beliefs as of February 18, 2010 and are

subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those

described in the forward-looking statements. We undertake no obligation to revise or publicly release the results of

any revision to these forward-looking statements. Readers should carefully review the risk factors described in this

presentation. Such forward-looking statements address the following subjects, among others:

Safe Harbor for Forward-Looking Statements

All information in this presentation speaks as of February 18, 2010 and any

distribution of this presentation after that date is not intended and will not be

construed as updating or confirming such information.

Risk Factors

Inability to sustain growth in our customer base, revenue or profitability, particularly in light of the uncertain U.S. or

worldwide economy and the related impact on customer acquisitions, cancelations and credit card payment declines

Competition in price, quality, features and geographic coverage

Higher than expected tax rates or exposure to additional tax liability

Inability to obtain telephone numbers in sufficient quantities on acceptable terms in desired locations

Enactment of burdensome telecommunications or Internet regulations including increased taxes or fees

Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures

Inadequate intellectual property protection or violations of third party intellectual property rights

System failures or breach of system or network security and resulting harm to our reputation

Inability to adapt to technological change, or third party development of new technologies superior to ours

Loss of services of executive officers and other key employees

Inability to maintain existing or enter into new supplier and marketing relationships on acceptable terms

Other factors set forth in our Annual Report on Form 10-K, and the other reports filed by us from time to time with the

Securities and Exchange Commission

The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to

be materially adversely affected:

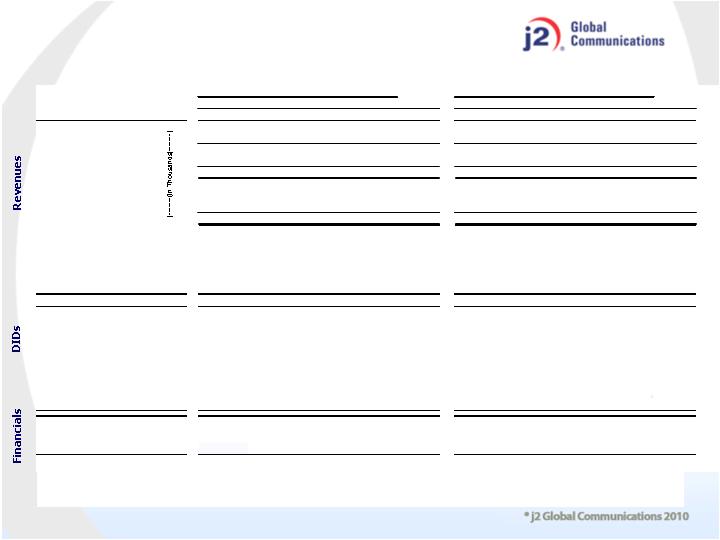

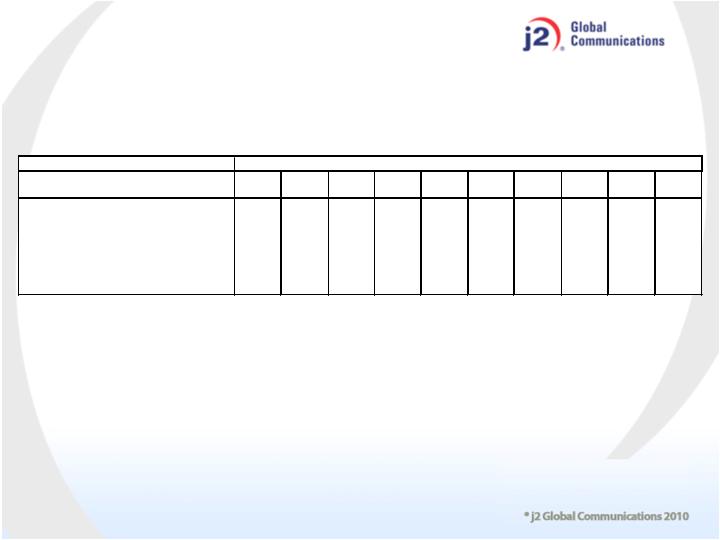

Q4 ’09 GAAP & Non-GAAP Results

(1) Non-GAAP excludes share-based compensation, impairment of auction rate and related securities, gain on sale of investments and disposal of long lived asset, in each case, net of tax.

(2) Non-GAAP excludes share-based compensation, impairment of auction rate and related securities, gain on sale of investments and disposal of long lived asset, in each case, net of tax.

Q4’s GAAP tax rate is 31.4% and non-GAAP is 30.7%.

(3) See slide 15 for computation of free cash flow.

$

Margin

Q4 2009 GAAP

Revenues

$60.9M

$60.9M

Gross Profit/Margin (1)

$50.4M

82.8%

$50.8M

83.3%

Operating Profit/Margin (1)

$23.8M

39.0%

$29.1M

47.8%

EPS (2)

$0.39/Share

$0.45/Share

Free Cash Flow (3)

$22.2M

Cash and Investments

$243.7M

$

Margin

Q4 2009 Non-GAAP

FY ’09 GAAP & Non-GAAP Results

(1) Non-GAAP excludes share-based compensation, impairment of auction rate and related securities, gain on sale of investments and disposal of long lived asset, in each case, net of tax.

(2) Non-GAAP excludes share-based compensation, impairment of auction rate and related securities, gain on sale of investments and disposal of long lived asset, in each case, net of tax.

Full year GAAP tax rate is 31.7% and non-GAAP is 29.6%.

(3) See slide 15 for computation of free cash flow.

$

Margin

FY 2009 GAAP

Revenues

$245.6M

$245.6M

Gross Profit/Margin (1)

$200.8M

81.8%

$202.1M

82.3%

Operating Profit/Margin (1)

$104.5M

42.5%

$104.5M

48.0%

EPS (2)

$1.48/Share

$1.85/Share

Free Cash Flow (3)

$101.6M

Cash and Investments

$243.7M

$

Margin

FY 2009 Non-GAAP

2009 Recap and 2010 Outlook

Recap 2009 Guidance: Modest increase in Revenues and Non-GAAP EPS

Financial Results

1.7% Revenue Growth

8.8% Non-GAAP EPS Growth

11.4% EBITDA Growth

13.1% FCF Growth

Operational Results

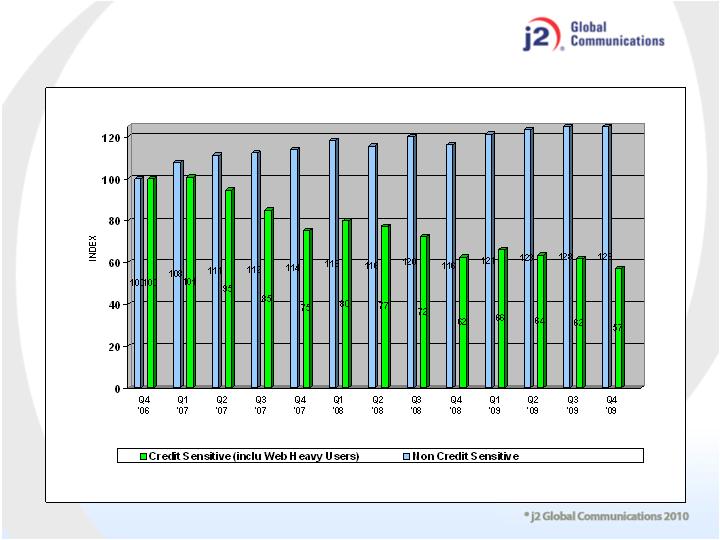

Cancel rate peaked @ 3.7% in March 2009; highest level since Q1 2003 (3.6%)

- Rate declined to 3.0% by Q4

2009 Growth Drivers:

- Voice year-over-year revenue growth of 28%

- Corporate revenue growth of 4% with 22 wins, ending the year with 76 large

accounts

- International revenue growth ~ 5%, mostly in local currencies

2009 Recap

M&A

Quexion anti-spam/virus protection, hosted email and security

Reality Telecom UK based voice service, fully compatible with

eReceptionist

Trustfax U.S. based fax to email for individuals and SMB; top 5 in U.S.

market

M&A pipeline – solid pipeline with multiple targets in multiple countries;

predominantly international opportunities for fax and voice with email deals

available globally

2010 Outlook M&A

Fax

Geographic expansion – planning accelerated growth in telephone numbers around the

world: adding both countries and area codes outside of the U.S. and Europe

Organizational enhancements to permit focus on EMEA (Europe, Middle East and Africa)

and ROW (Rest of the World)

EMEA revenue run rate approx. $30M; headquarters in Dublin managed by recently

recruited in-country European VP

Expansion and penetration into ROW territories led by our International VP who built

EMEA from almost zero to a $30M business. Focus on Canada, Asia-Pacific, and Latin

America

Expect Fax DID growth to surpass total revenue growth of 5%

eFax Corporate: Increase our enterprise sales staff by 20% and increase sales in the

government sector

Voice

Crack the code for free-to-paid model a-la’ eFax free, provide high value free trial to

business users

Focus on branding strategy and market leadership, EU expected to be higher growth

Continue cross-selling efforts, improving retention, and rolling out new features

Advertising

Reinvest in our fax brands, focus on eFax U.S. via free offering and media spend

Additional marketing spend outside of search engines for Onebox and eVoice

Expand in Japan market, multi-year plan

2010 Outlook Organic Growth

2010 GUIDANCE

Economy

Assume economy is in recovery mode but pace will be slow and volatile

Expect minimal increase in new hiring

Slightly weaker USD relative to GBP and Euro for 2010

Operational View

Continue to leverage current infrastructure/efficiencies

Increased Investment in IP

Expect increase in cash outlay for cases based on patents that are out of re-exam

M&A/opportunistic investments for our cash

Other Assumptions

Interest Income flat with 2009

Tax rate (30.5%): assume no current R&D credits will be approved by Congress

Stock based compensation expense for 2010 will be ~ $0.20

2010 Assumptions/Guidance

2010 Guidance

2010 EPS is based on Non-GAAP which excludes SFAS 123(R) non-cash compensation

expense, net of tax benefit.

2010 Plan

Revenues (M) 3% - 7% increase vs. 2009

Non-GAAP EPS similar to 2009

Supplemental Information

Metrics

Free cash flow is net cash provided by operating activities, plus excess tax benefits from share based compensation, less purchases of property and equipment. See slide 15 for computation of free cash flow.

(3)

within calendar month), and DIDs related to enterprise customers beginning with their first day of service. Calculated monthly and expressed here as an average over the three months of the quarter.

Cancel Rate is defined as individual customer DIDs with greater than 4 months of continuous service (continuous service includes customer DIDs which are administratively cancelled and reactivated

(2)

Paid DIDs reflect reserves for: anticipated product migration and/or price increase.

(1)

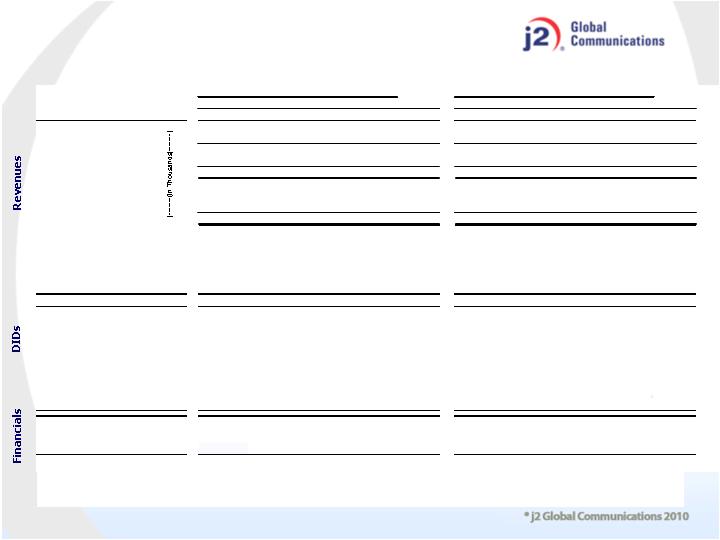

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Fixed Subscriber Revenues

$44,260

$46,593

$47,481

$48,125

$186,459

$48,799

$49,726

$49,782

$49,612

$197,918

Variable Subscriber Revenues

12,956

12,943

12,985

11,503

50,388

10,842

11,322

11,264

10,576

44,004

Subscriber Revenues

$57,216

$59,536

$60,466

$59,628

236,847

$59,640

$61,049

$61,046

$60,188

241,923

Other Revenues

1,433

1,140

1,086

1,014

4,673

751

1,415

756

727

3,648

Total Revenues

$58,649

$60,676

$61,552

$60,642

241,520

$60,391

$62,464

$61,801

$60,915

245,571

DID - Based Revenues

$55,301

$57,551

$58,440

$57,698

$228,990

$57,449

$58,904

$58,969

$58,121

$233,443

Non-DID Revenues

3,348

3,125

3,112

2,944

12,529

2,942

3,560

2,832

2,793

12,128

Total Revenues

$58,649

$60,676

$61,552

$60,642

241,519

$60,391

$62,464

$61,801

$60,915

245,571

Subscriber Revenues/Total Revenues

97.6%

98.1%

98.2%

98.3%

98.1%

98.8%

97.7%

98.8%

98.8%

98.5%

DID - Based/Total Revenues

94.3%

94.8%

94.9%

95.1%

94.8%

95.1%

94.3%

95.4%

95.4%

95.1%

%

Fixed

Subscriber Revenues

77.4%

78.3%

78.5%

80.7%

78.7%

81.8%

81.5%

81.5%

82.4%

81.8%

%

Variable

Subscriber Revenues

22.6%

21.7%

21.5%

19.3%

21.3%

18.2%

18.5%

18.5%

17.6%

18.2%

Paid DIDs

(1)

1,098,650

1,162,872

1,198,950

1,236,079

1,273,876

1,274,145

1,274,240

1,275,486

Average Monthly Revenue/DID

$16.30

$16.29

$15.87

$15.29

$14.85

$14.96

$15.03

$14.85

Cancel Rate

(2)

2.8%

2.9%

3.0%

3.1%

3.5%

3.3%

3.1%

3.0%

Free DIDs (MM)

10.1

10.2

10.4

10.4

10.1

10.1

10.0

9.9

Average Monthly Revenue/DID

$0.08

$0.07

$0.07

$0.06

$0.05

$0.06

$0.05

$0.04

Cities Covered

3,084

3,126

3,137

3,135

3,207

3,327

3,500

3,539

Countries Covered

44

45

46

46

46

46

46

46

Cash & Investment

(millions)

$181.3

$149.9

$151.8

$161.9

$179.3

$194.8

$222.5

$243.7

Free Cash Flow

(3)

(millions)

$27.2

$23.2

$15.0

$24.4

$89.8

$30.4

$22.9

$26.1

$22.2

$101.6

2008

2009

(1)

Free cash flow is defined as net cash provided by operating activities, less purchases of property, plant and equipment, plus

excess tax benefit from share based compensation. Free cash flow amounts are not meant as a substitute for GAAP, but are

solely for informational purposes.

Computation of Free Cash Flow

($ in millions)

Q4 '07

Q1 '08

Q2 '08

Q3 '08

Q4 '08

Q1 '09

Q2 '09

Q3 '09

Q4 '09

Net cash provided by operating activities

$25.779

$27.411

$23.840

$15.676

$23.789

$31.152

$20.362

$26.469

$23.850

Purch. of property & equipment

($4.340)

($0.469)

($0.796)

($0.937)

($0.305)

($0.721)

($0.217)

($0.767)

($1.546)

Excess tax benefit from share based compensation

$1.271

$0.239

$0.204

$0.212

$0.910

$0.005

$2.718

$0.403

($0.063)

Free Cash Flow

(1)

$22.710

$27.181

$23.248

$14.951

$24.394

$30.436

$22.863

$26.105

$22.241

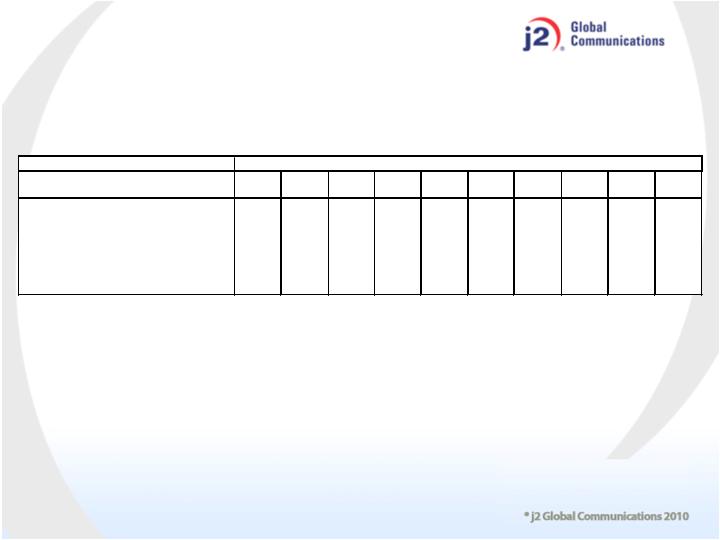

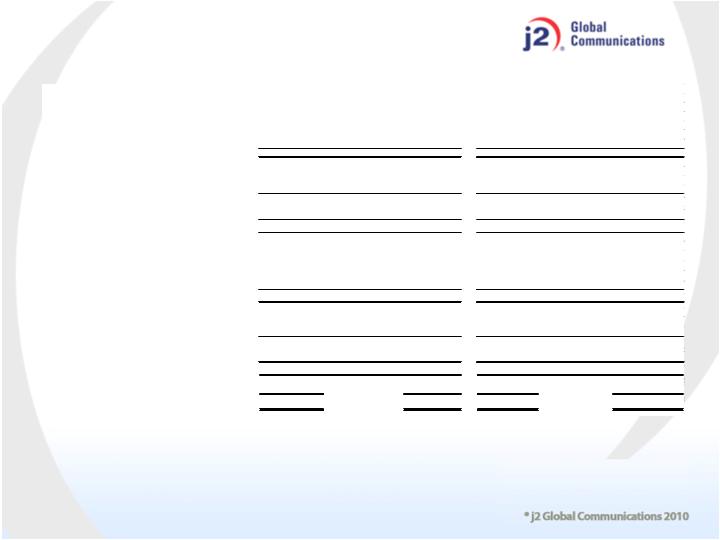

j2 Global Key Financial & Operating Metrics, 2000-2009

(1) EBITDA is defined as Operating Income adjusted to include depreciation and amortization and, for 2009, excludes loss on disposal of long lived asset

(2) FCF is defined as net cash provided by operating activities, less purchases of property, plant and equipment, plus excess tax benefit from share based

compensation. Free cash flow amounts are not meant as a substitute for GAAP, but are solely for informational purposes. See slide 15 for additional

information on the computation of free cash flow.

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Total Revenue ($ in Millions)

$13.9

$33.3

$48.2

$71.6

$106.3

$143.9

$181.1

$220.7

$241.5

$245.6

Annual Growth

139%

45%

49%

48%

35%

26%

22%

9%

2%

Paid DIDs

(in thousands)

N/A

N/A

270

400

554

740

907

1,064

1,236

1,275

Avg. Revenue per User (Subscriber Rev)

N/A

N/A

$14.57

$15.88

$16.82

$16.75

$16.45

$16.75

$15.96

$15.09

EBITDA ($ in Millions)

(1)

($18.0)

$0.7

$17.4

$31.2

$50.3

$68.4

$80.0

$104.0

$119.1

$132.6

Margin (%)

-129%

2%

36%

44%

47%

47%

44%

47%

49%

54%

Free Cash Flow ($ in Millions)

(2)

($14.4)

$0.2

$13.5

$29.1

$43.8

$55.4

$67.3

$88.6

$89.8

$101.6

(1) Stock-based compensation is as follows: for Q4, Cost of revenues is $328K, Sales and Marketing is $480K, R&D is $219K, and G&A is $1,896K, for 12 months of 2009, Cost of revenue is

$1,263K, Sales and Marketing is $1,818K, R&D is $853K, and G&A is $7,084K.

(2) Loss on disposal of long-lived asset is $2,442 for Q4.

(3) Impairment charge for auction rate securities in Q4 is $150K, for 12 months of 2009 is $9,343K.

(4) Interest and other income is $1,812 for Q4

(5) Income tax expense adjusted for the net impact of item 3 above is $965K.

Non-GAAP Results & Reconciliation to GAAP

Reported

Non-GAAP

Reported

Non-GAAP

Revenues

Subscriber

60,188

$

-

$

60,188

$

241,922

$

-

$

241,922

$

Other

727

-

727

3,649

-

3,649

Total revenue

60,915

-

60,915

245,571

-

245,571

Cost of revenues

(1)

10,480

(328)

(1)

10,152

44,730

(1,263)

(1)

43,467

Gross profit

50,435

328

50,763

200,841

1,263

202,104

Operating expenses:

Sales and marketing

(1)

9,563

(480)

(1)

9,083

37,006

(1,818)

(1)

35,188

Research, development and engineering

(1)

2,972

(219)

(1)

2,753

11,657

(853)

(1)

10,804

General and administrative

(1)

11,693

(1,896)

(1)

9,797

45,275

(7,084)

(1)

38,191

Loss on disposal of long-lived asset

(2)

2,442

(2,442)

(2)

-

2,442

(2,442)

(2)

-

Total operating expenses

26,670

(5,037)

21,633

96,380

(12,197)

84,183

Operating earnings

23,765

5,365

29,130

104,461

13,460

117,921

Other-than-temporary impairment losses

(3)

(150)

150

(3)

-

(9,343)

9,343

(3)

-

Interest and other income, net

(4)

2,184

(1,812)

(4)

372

2,661

(1,812)

(4)

849

Earnings before income taxes

25,799

3,703

29,502

97,779

20,991

118,770

Income tax expense

(5)

8,095

965

(5)

9,060

30,952

4,204

(5)

35,156

Net earnings

17,704

$

2,738

$

20,442

$

66,827

$

16,787

$

83,614

$

Diluted net earnings per share

0.39

$

0.45

$

1.48

$

1.85

$

Diluted weighted average shares outstanding

45,244,333

45,244,333

45,138,001

45,138,001

TWELEVE MONTHS ENDED DECEMBER 31, 2009

Non-GAAP Entries

j2 GLOBAL COMMUNICATIONS, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL RESULTS

(UNAUDITED, IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS)

Non-GAAP Entries

THREE MONTHS ENDED DECEMBER 31, 2009

THREE MONTHS AND TWELVE MONTHS ENDED DECEMBER 31, 2009

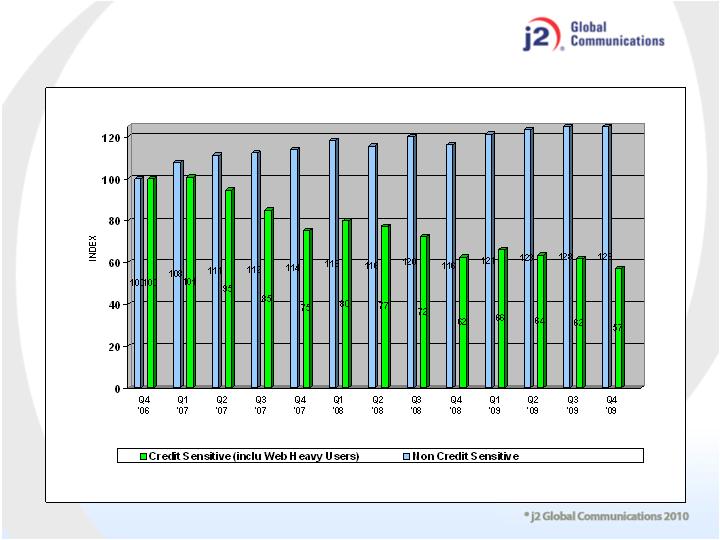

Usage of Corporate and Web High Volume Users