THIRD QUARTER 2019 RESULTS NOVEMBER 1st, 2019

Safe Harbor for Forward-Looking Statements Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2019 Financial Guidance. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in those statements. Readers should carefully review the Risk Factors slide of this presentation. These forward-looking statements are based on management’s expectations or beliefs as of November 1, 2019 as well as those set forth in our Annual Report on Form 10-K filed by us on March 1, 2019 with the Securities and Exchange Commission (“SEC”) and the other reports we file from time to time with the SEC. We undertake no obligation to revise or publicly release any updates to such statements based on future information or actual results. Such forward-looking statements address the following subjects, among others: • Future operating results • Ability to acquire businesses on acceptable terms and integrate and recognize synergies from acquired businesses • Deployment of cash and investment balances to grow the company • Subscriber growth, retention, usage levels and average revenue per account • Cloud service and digital media growth and continued demand for fax services • International growth • New products, services, features and technologies • Corporate spending including stock repurchases • Intellectual property and related licensing revenues • Liquidity and ability to repay or refinance indebtedness • Systems capacity, coverage, reliability and security • Regulatory developments and taxes All information in this presentation speaks as of November 1, 2019 and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. 2

Risk Factors The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to be materially adversely affected: • Inability to sustain growth or profitability, and any related impact of U.S. or worldwide economic issues on customer acquisition, retention and usage levels, advertising spend and credit and debit card payment declines • Inability to acquire businesses on acceptable terms or successfully integrate and realize anticipated synergies • Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures or otherwise • Failure to offer compelling digital media content causing reduced traffic and advertising levels; loss of advertisers or reduction in advertising spend; increased prevalence or effectiveness of advertising blocking technologies; inability to monetize handheld devices and handheld traffic supplanting monetized traffic; and changes by our vendors or partners that impact our traffic or publisher audience acquisition and/or monetization • New or unanticipated costs and/or fees or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales, value-added and telecommunications taxes • Inability to manage certain risks inherent to our business, such as fraudulent activity, system failure or a security breach; inability to manage reputational risks associated with our businesses • Competition from others with regard to price, service, content and functionality • Inadequate intellectual property (IP) protection, expiration, invalidity or loss of key patents, violations of 3rd party IP rights or inability or significant delay in monetizing IP • Inability to continue to expand our business and operations internationally • Inability to maintain required services on acceptable terms with financially stable telecom, co-location and other critical vendors; and inability to obtain telephone numbers in sufficient quantities on acceptable terms and in desired locations • Level of debt limiting availability of cash flow to reinvest in the business; inability to repay or refinance debt when due; and restrictive covenants relating to debt imposing operating and financial restrictions on business activities or plans • Inability to maintain and increase our customer base or average revenue per user • Inability to achieve business or financial results in light of burdensome telecommunications, internet, advertising, health care, consumer, privacy or other regulations, or being subject to existing regulations • Inability to adapt to technological change and diversify services and related revenues at acceptable levels of financial return • Loss of services of executive officers and other key employees • Other factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2019 with the SEC and the other reports we file from time to time with the SEC 3

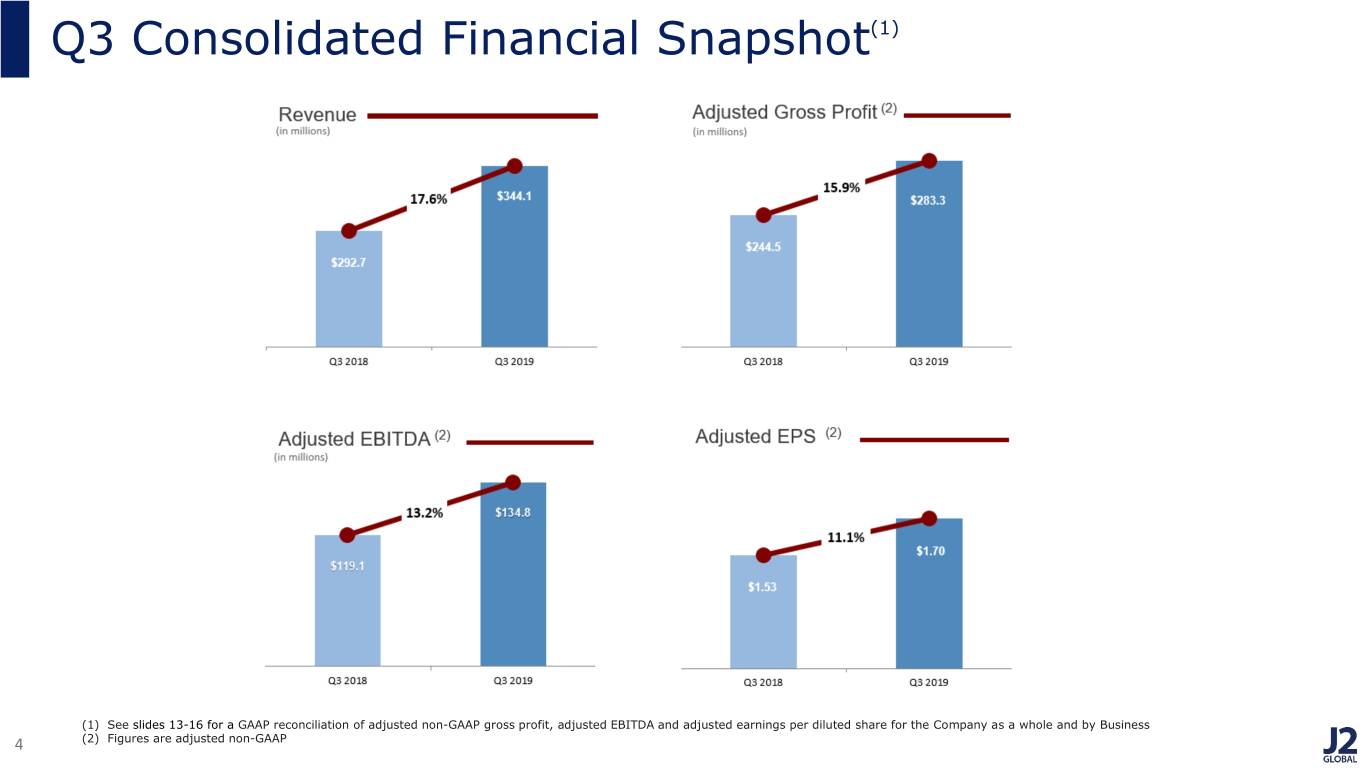

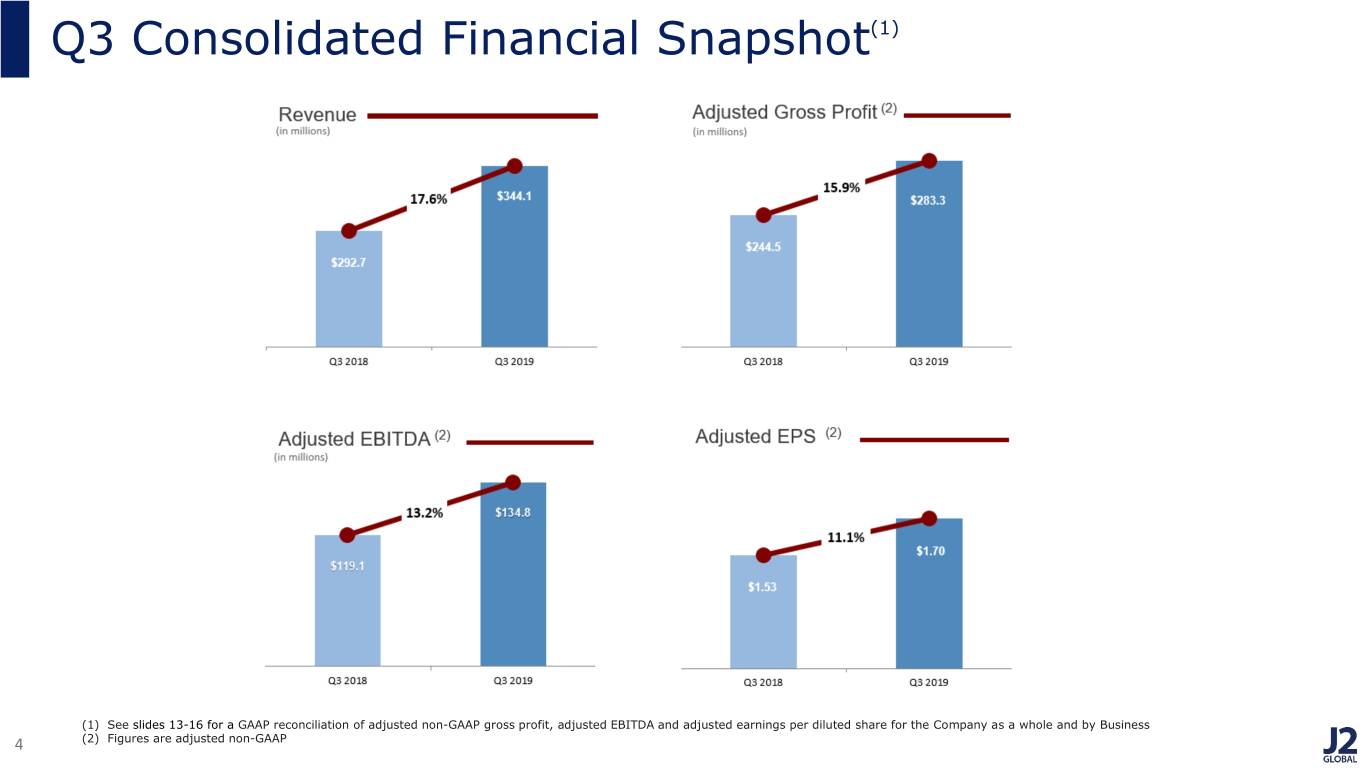

Q3 Consolidated Financial Snapshot(1) (1) See slides 13-16 for a GAAP reconciliation of adjusted non-GAAP gross profit, adjusted EBITDA and adjusted earnings per diluted share for the Company as a whole and by Business 4 (2) Figures are adjusted non-GAAP

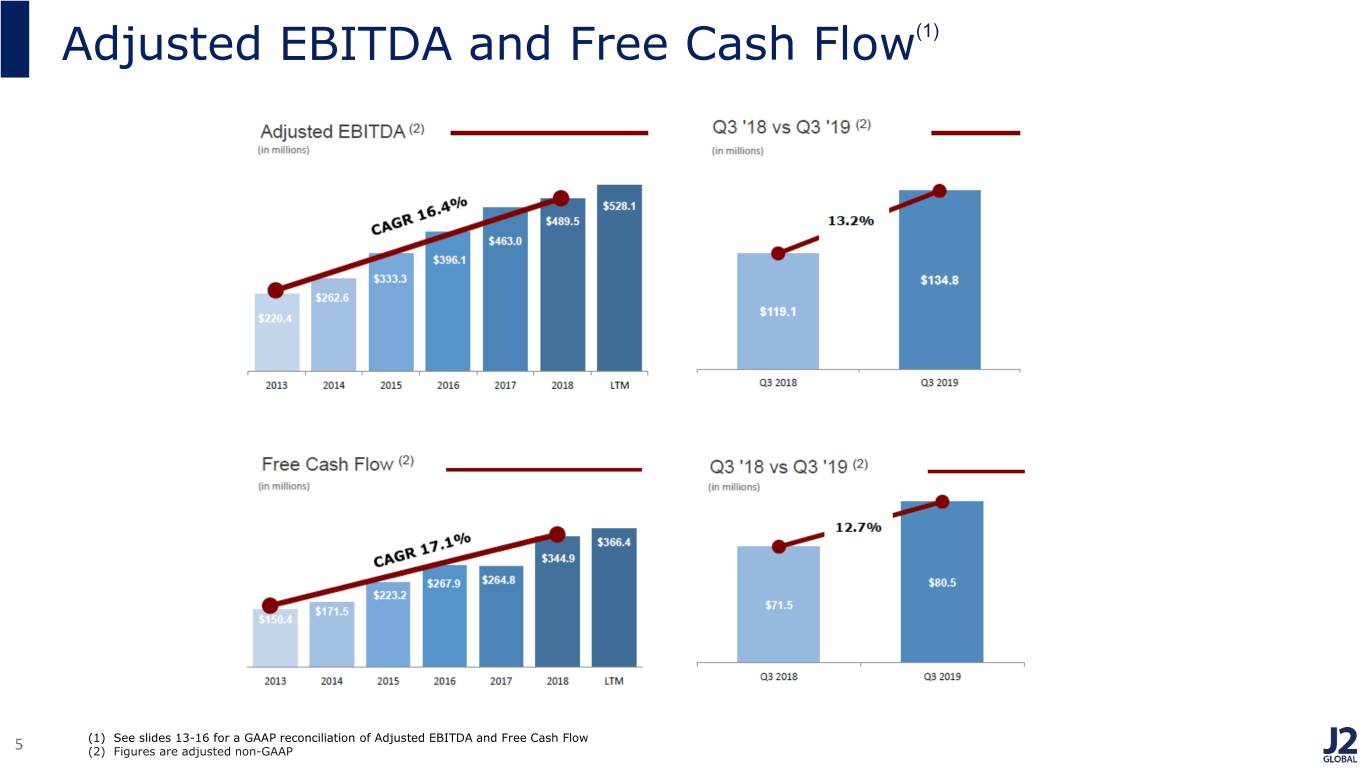

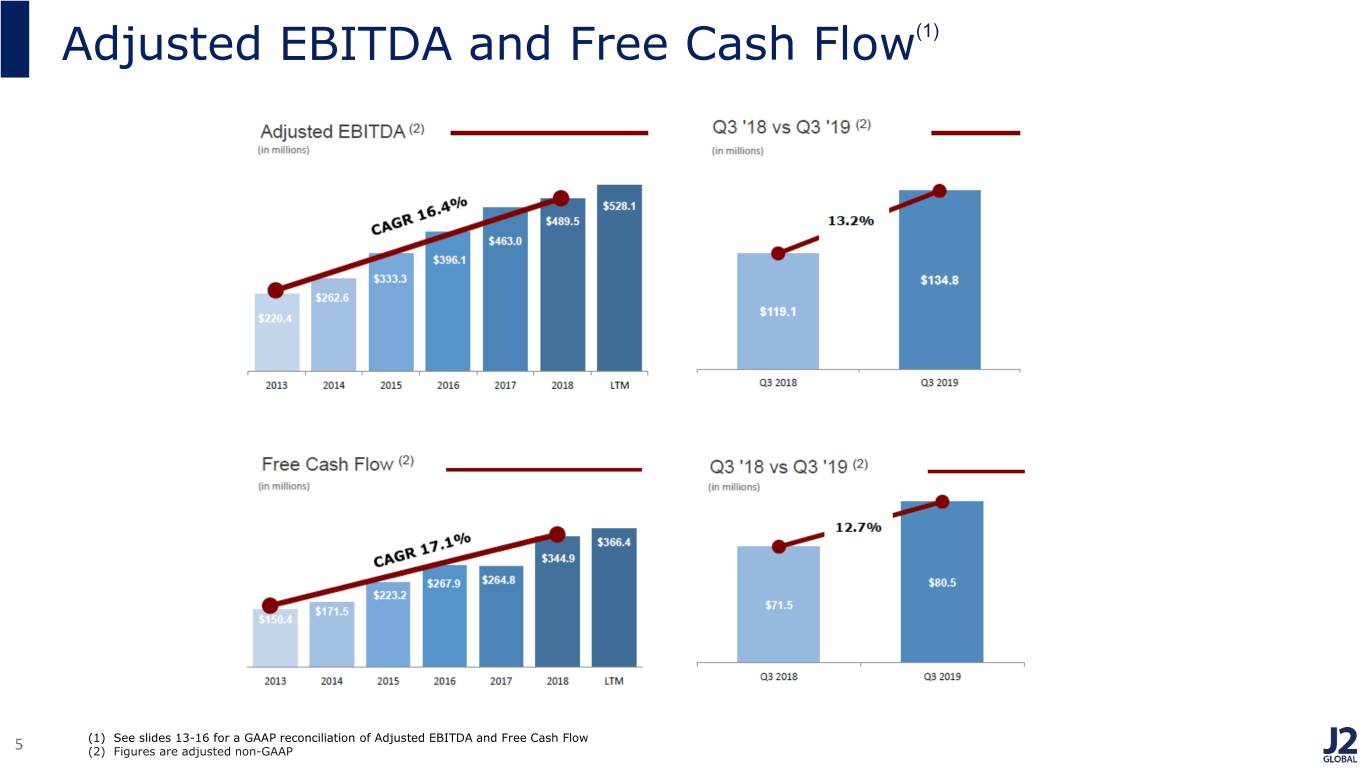

Adjusted EBITDA and Free Cash Flow(1) (1) See slides 13-16 for a GAAP reconciliation of Adjusted EBITDA and Free Cash Flow 5 (2) Figures are adjusted non-GAAP

Q3 2019 Financial Snapshot By Business (1) (1) See slides 14-16 for a GAAP reconciliation of adjusted EBITDA for the Company as a whole and by Business (2) Figures are adjusted non-GAAP; Certain shared corporate expenses at J2 Global, Inc. were allocated to Cloud Services and Digital Media resulting in reductions to Adjusted EBITDA as follows: Cloud Services Adjusted EBITDA was reduced by $1.5MM and $2.6MM in Q3 2018 and Q3 2019, respectively, and Digital Media Adjusted EBITDA was reduced by $1.5MM and 6 $2.9MM in Q3 2018 and Q3 2019, respectively. No allocations occurred prior to 2018

2019 FINANCIAL GUIDANCE

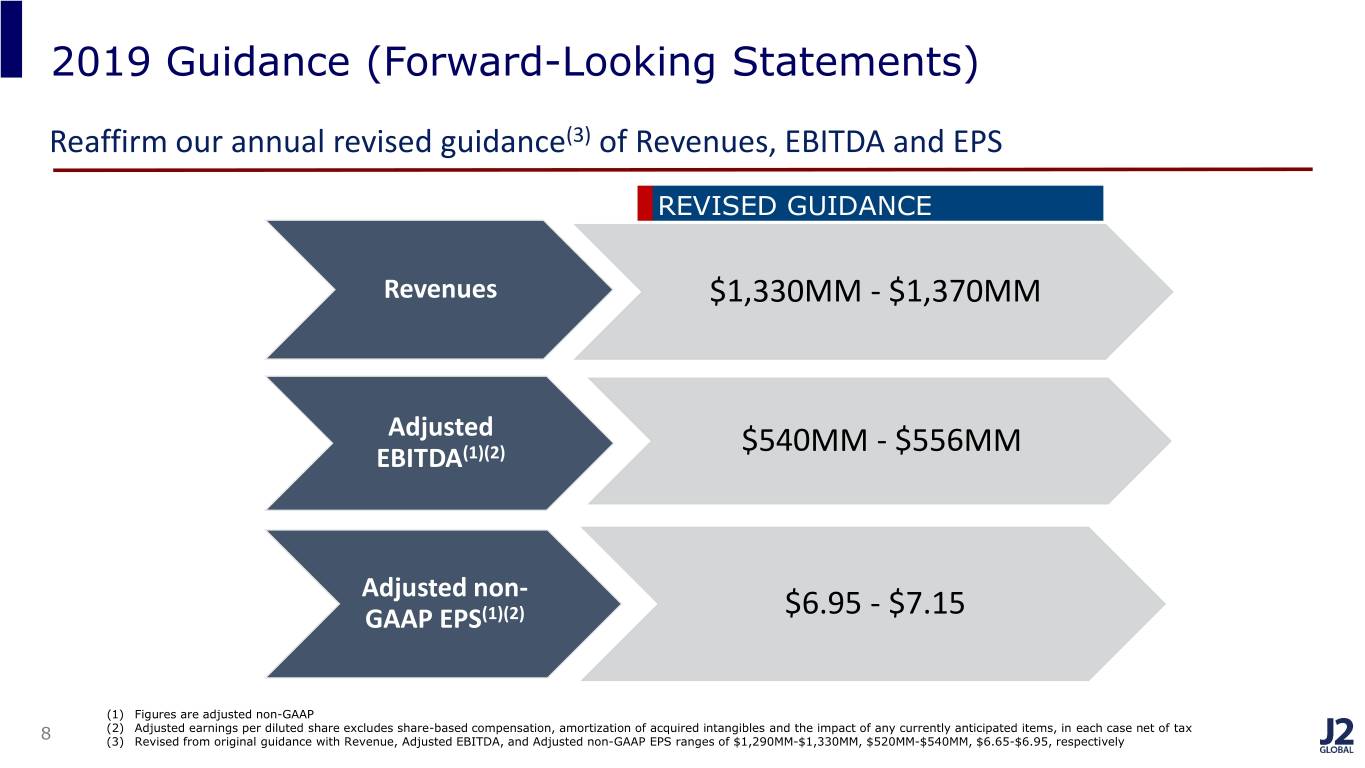

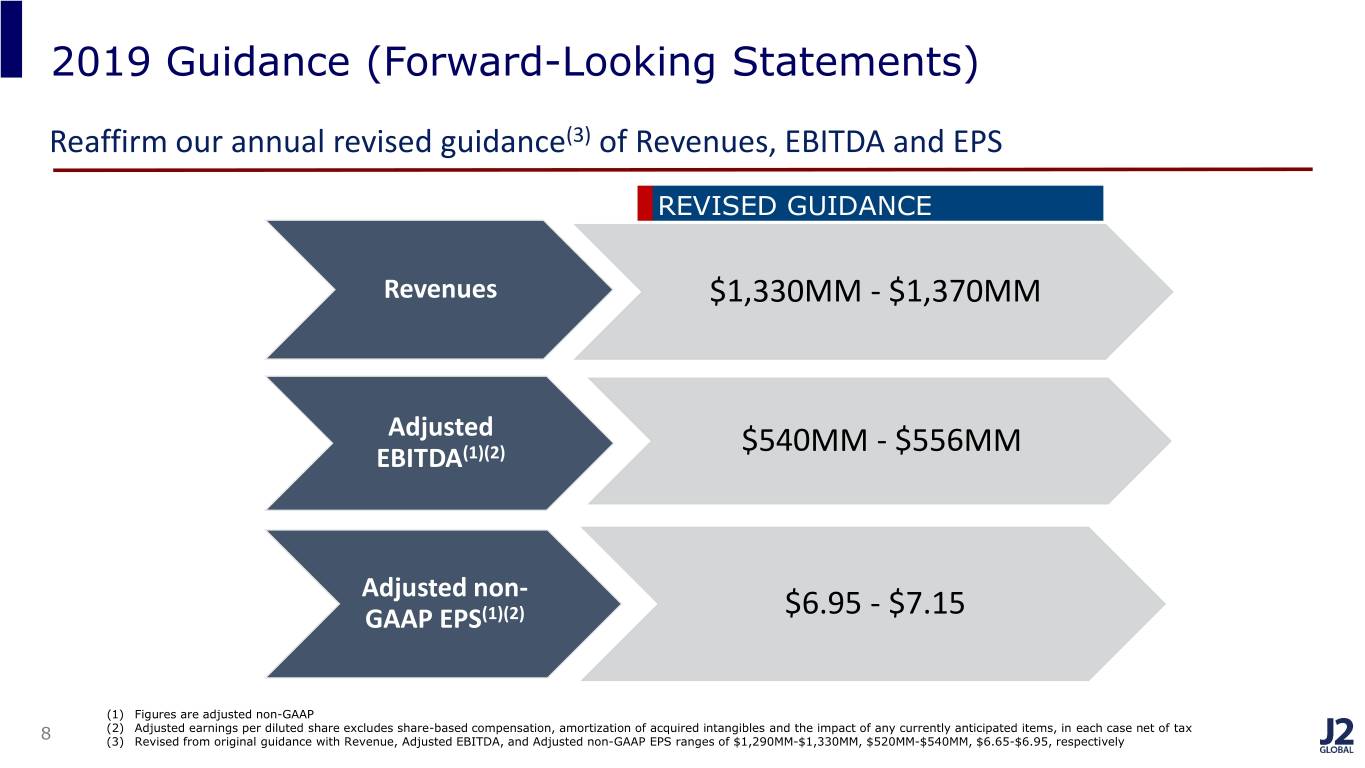

2019 Guidance (Forward-Looking Statements) Reaffirm our annual revised guidance(3) of Revenues, EBITDA and EPS REVISED GUIDANCE Revenues $1,330MM - $1,370MM Adjusted $540MM - $556MM EBITDA(1)(2) Adjusted non- GAAP EPS(1)(2) $6.95 - $7.15 (1) Figures are adjusted non-GAAP (2) Adjusted earnings per diluted share excludes share-based compensation, amortization of acquired intangibles and the impact of any currently anticipated items, in each case net of tax 8 (3) Revised from original guidance with Revenue, Adjusted EBITDA, and Adjusted non-GAAP EPS ranges of $1,290MM-$1,330MM, $520MM-$540MM, $6.65-$6.95, respectively

SUPPLEMENTAL INFORMATION

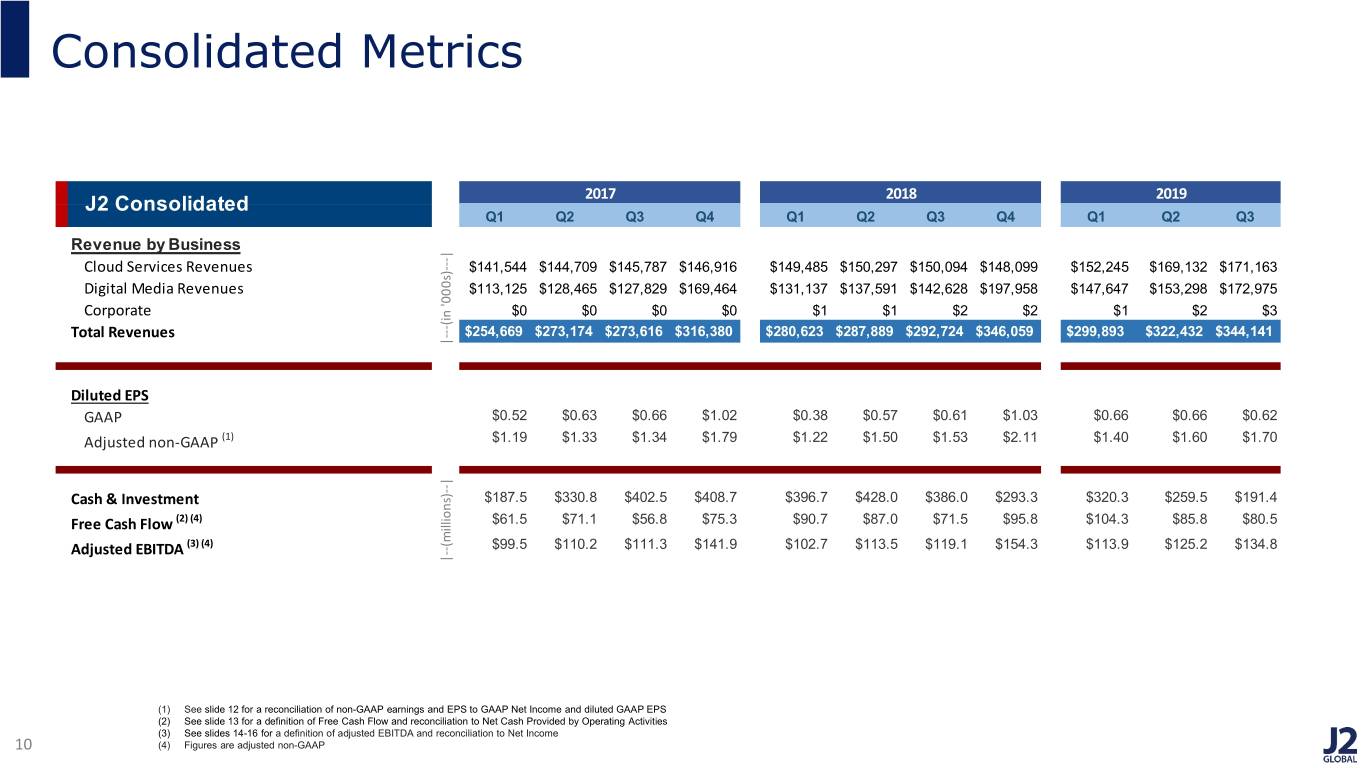

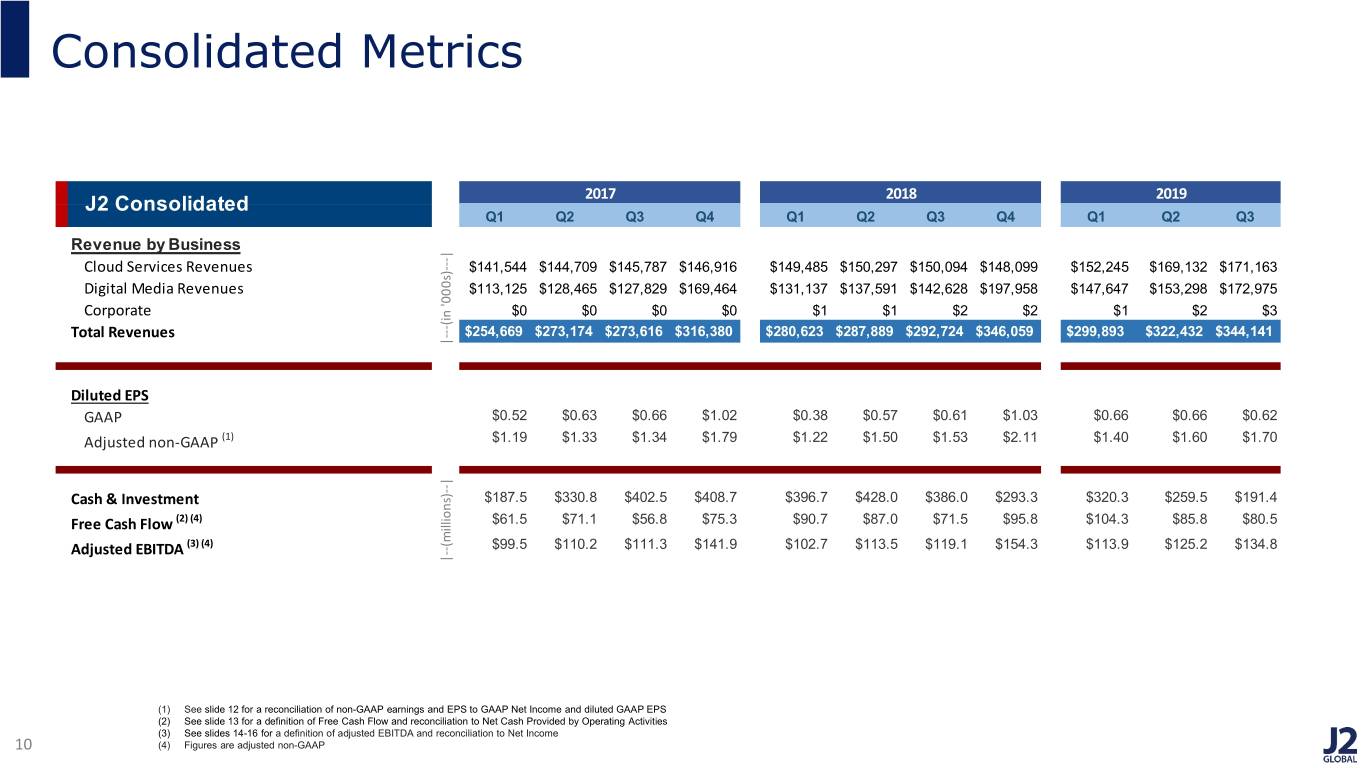

Consolidated Metrics 2017 2018 2019 J2 Consolidated Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Revenue by Business Cloud Services Revenues $141,544 $144,709 $145,787 $146,916 $149,485 $150,297 $150,094 $148,099 $152,245 $169,132 $171,163 Digital Media Revenues $113,125 $128,465 $127,829 $169,464 $131,137 $137,591 $142,628 $197,958 $147,647 $153,298 $172,975 Corporate $0 $0 $0 $0 $1 $1 $2 $2 $1 $2 $3 Total Revenues $254,669 $273,174 $273,616 $316,380 $280,623 $287,889 $292,724 $346,059 $299,893 $322,432 $344,141 |---(in '000s)---| Diluted EPS GAAP $0.52 $0.63 $0.66 $1.02 $0.38 $0.57 $0.61 $1.03 $0.66 $0.66 $0.62 Adjusted non-GAAP (1) $1.19 $1.33 $1.34 $1.79 $1.22 $1.50 $1.53 $2.11 $1.40 $1.60 $1.70 Cash & Investment $187.5 $330.8 $402.5 $408.7 $396.7 $428.0 $386.0 $293.3 $320.3 $259.5 $191.4 Free Cash Flow (2) (4) $61.5 $71.1 $56.8 $75.3 $90.7 $87.0 $71.5 $95.8 $104.3 $85.8 $80.5 Adjusted EBITDA (3) (4) $99.5 $110.2 $111.3 $141.9 $102.7 $113.5 $119.1 $154.3 $113.9 $125.2 $134.8 |--(millions)--| (1) See slide 12 for a reconciliation of non-GAAP earnings and EPS to GAAP Net Income and diluted GAAP EPS (2) See slide 13 for a definition of Free Cash Flow and reconciliation to Net Cash Provided by Operating Activities (3) See slides 14-16 for a definition of adjusted EBITDA and reconciliation to Net Income 10 (4) Figures are adjusted non-GAAP

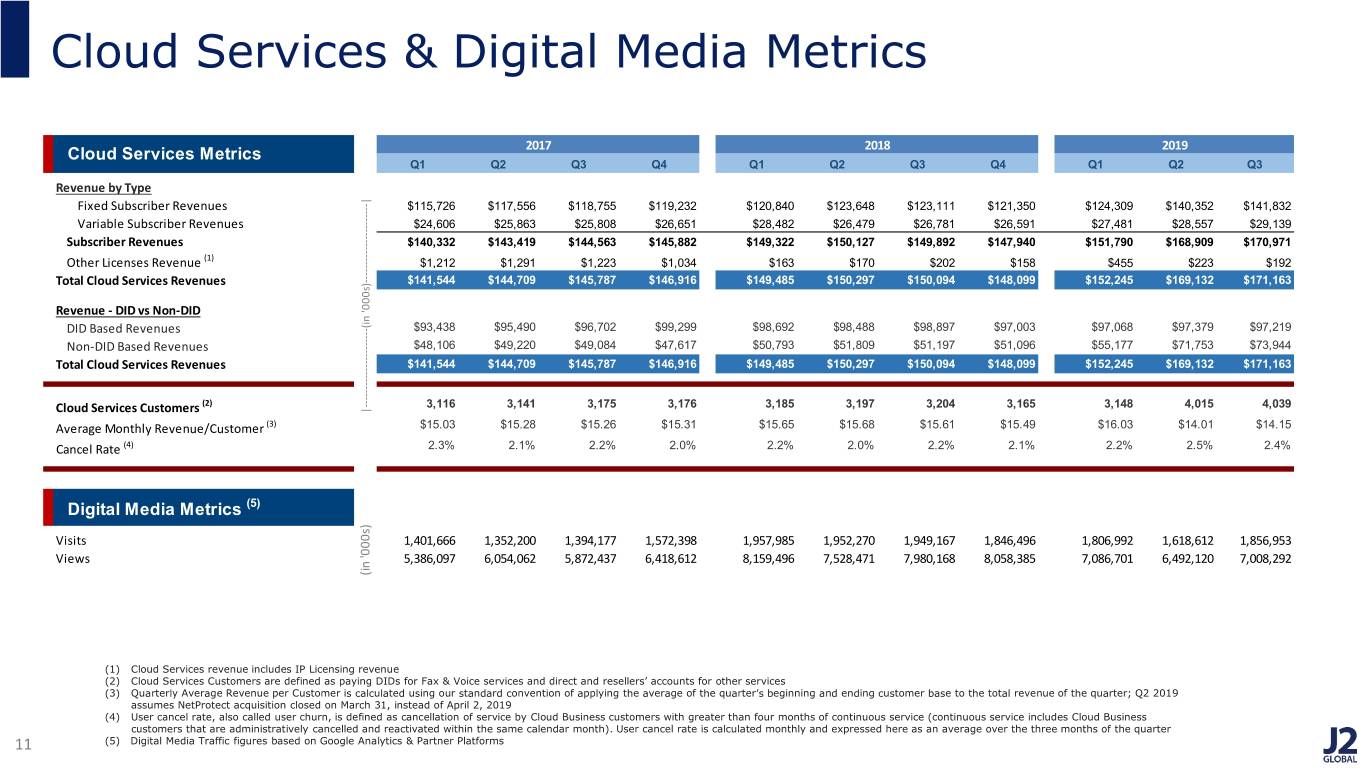

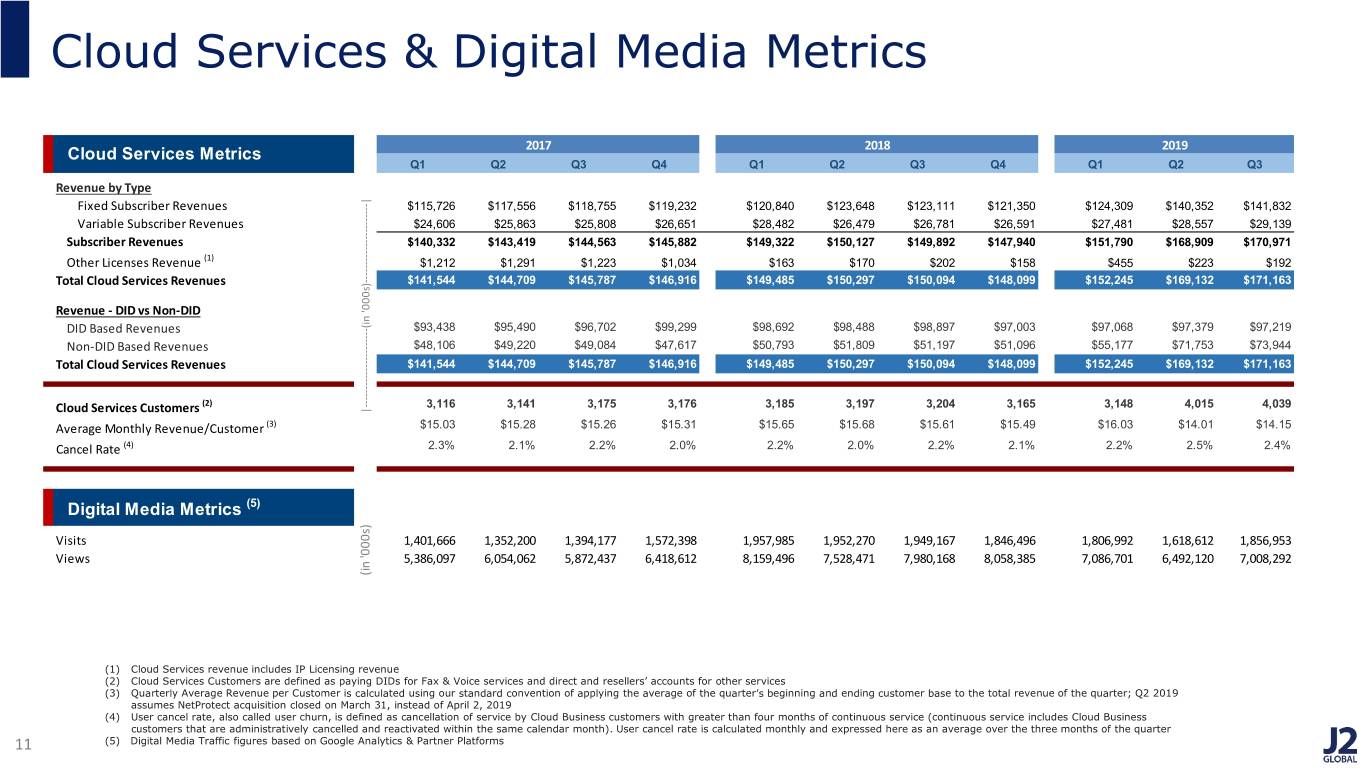

Cloud Services & Digital Media Metrics 2017 2018 2019 Cloud Services Metrics Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Revenue by Type Fixed Subscriber Revenues $115,726 $117,556 $118,755 $119,232 $120,840 $123,648 $123,111 $121,350 $124,309 $140,352 $141,832 Variable Subscriber Revenues $24,606 $25,863 $25,808 $26,651 $28,482 $26,479 $26,781 $26,591 $27,481 $28,557 $29,139 Subscriber Revenues $140,332 $143,419 $144,563 $145,882 $149,322 $150,127 $149,892 $147,940 $151,790 $168,909 $170,971 (1) Other Licenses Revenue $1,212 $1,291 $1,223 $1,034 $163 $170 $202 $158 $455 $223 $192 Total Cloud Services Revenues $141,544 $144,709 $145,787 $146,916 $149,485 $150,297 $150,094 $148,099 $152,245 $169,132 $171,163 Revenue - DID vs Non-DID DID Based Revenues $93,438 $95,490 $96,702 $99,299 $98,692 $98,488 $98,897 $97,003 $97,068 $97,379 $97,219 Non-DID Based Revenues $48,106 $49,220 $49,084 $47,617 $50,793 $51,809 $51,197 $51,096 $55,177 $71,753 $73,944 Total Cloud Services Revenues $141,544 $144,709 $145,787 $146,916 $149,485 $150,297 $150,094 $148,099 $152,245 $169,132 $171,163 (2) 3,116 3,141 3,175 3,176 3,185 3,197 3,204 3,165 3,148 4,015 4,039 Cloud Services Customers |----------------------(in '000s)----------------------| Average Monthly Revenue/Customer (3) $15.03 $15.28 $15.26 $15.31 $15.65 $15.68 $15.61 $15.49 $16.03 $14.01 $14.15 Cancel Rate (4) 2.3% 2.1% 2.2% 2.0% 2.2% 2.0% 2.2% 2.1% 2.2% 2.5% 2.4% Digital Media Metrics (5) Visits 1,401,666 1,352,200 1,394,177 1,572,398 1,957,985 1,952,270 1,949,167 1,846,496 1,806,992 1,618,612 1,856,953 Views 5,386,097 6,054,062 5,872,437 6,418,612 8,159,496 7,528,471 7,980,168 8,058,385 7,086,701 6,492,120 7,008,292 (in '000s) (in (1) Cloud Services revenue includes IP Licensing revenue (2) Cloud Services Customers are defined as paying DIDs for Fax & Voice services and direct and resellers’ accounts for other services (3) Quarterly Average Revenue per Customer is calculated using our standard convention of applying the average of the quarter’s beginning and ending customer base to the total revenue of the quarter; Q2 2019 assumes NetProtect acquisition closed on March 31, instead of April 2, 2019 (4) User cancel rate, also called user churn, is defined as cancellation of service by Cloud Business customers with greater than four months of continuous service (continuous service includes Cloud Business customers that are administratively cancelled and reactivated within the same calendar month). User cancel rate is calculated monthly and expressed here as an average over the three months of the quarter 11 (5) Digital Media Traffic figures based on Google Analytics & Partner Platforms

Q3 2019 Reconciliation of GAAP to Adjusted Non-GAAP Earnings & EPS (1) Non-GAAP net income is GAAP net income with the following modifications: (1) elimination of share-based compensation and the associated payroll tax expense; (2) elimination of certain acquisition- related integration costs; (3) elimination of interest costs in excess of the coupon rate associated with the convertible notes; (4) elimination of amortization of patents and intangible assets that we acquired; (5) elimination of change in value on investment; and (6) elimination of additional tax or indirect tax related expense/benefit from prior years 12

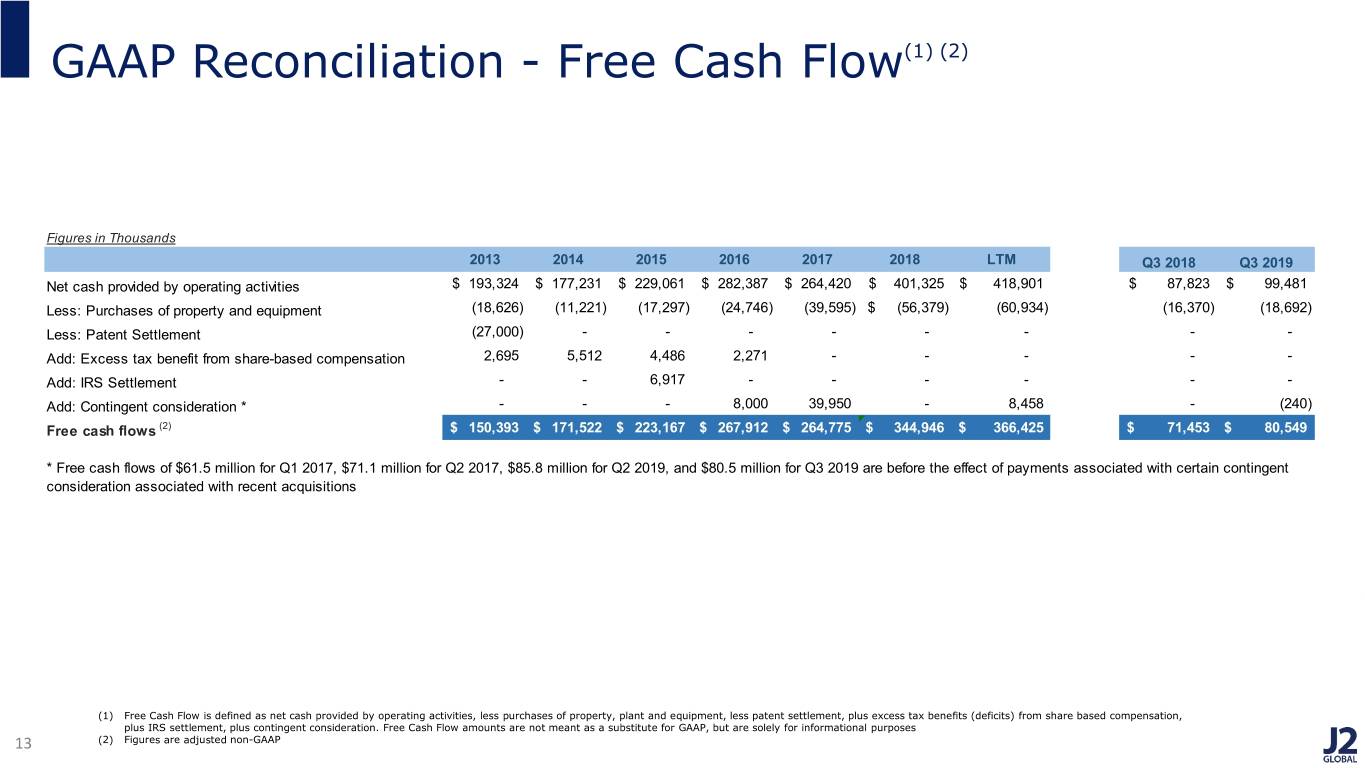

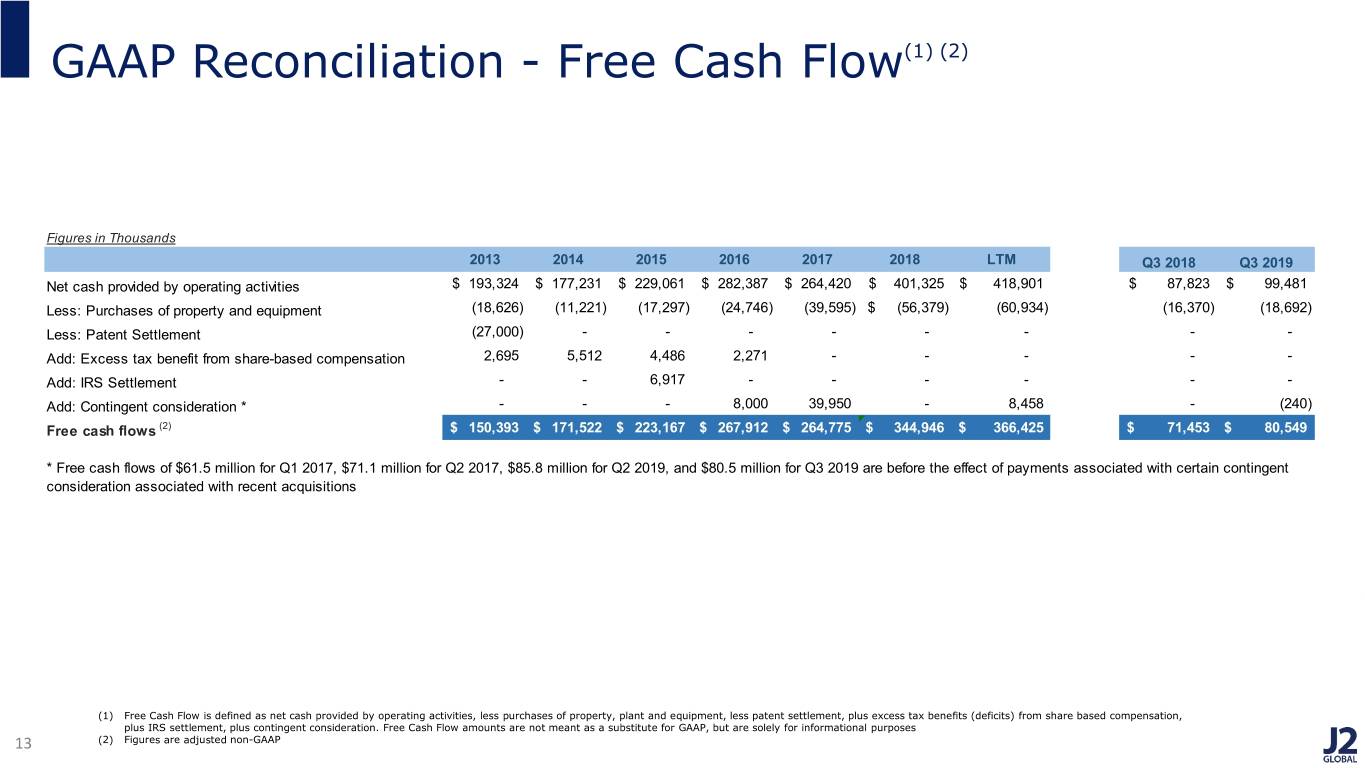

GAAP Reconciliation - Free Cash Flow(1) (2) Figures in Thousands 2013 2014 2015 2016 2017 2018 LTM Q3 2018 Q3 2019 Net cash provided by operating activities $ 193,324 $ 177,231 $ 229,061 $ 282,387 $ 264,420 $ 401,325 $ 418,901 $ 87,823 $ 99,481 Less: Purchases of property and equipment (18,626) (11,221) (17,297) (24,746) (39,595) $ (56,379) (60,934) (16,370) (18,692) Less: Patent Settlement (27,000) - - - - - - - - Add: Excess tax benefit from share-based compensation 2,695 5,512 4,486 2,271 - - - - - Add: IRS Settlement - - 6,917 - - - - - - Add: Contingent consideration * - - - 8,000 39,950 - 8,458 - (240) Free cash flows (2) $ 150,393 $ 171,522 $ 223,167 $ 267,912 $ 264,775 $ 344,946 $ 366,425 $ 71,453 $ 80,549 * Free cash flows of $61.5 million for Q1 2017, $71.1 million for Q2 2017, $85.8 million for Q2 2019, and $80.5 million for Q3 2019 are before the effect of payments associated with certain contingent consideration associated with recent acquisitions (1) Free Cash Flow is defined as net cash provided by operating activities, less purchases of property, plant and equipment, less patent settlement, plus excess tax benefits (deficits) from share based compensation, plus IRS settlement, plus contingent consideration. Free Cash Flow amounts are not meant as a substitute for GAAP, but are solely for informational purposes 13 (2) Figures are adjusted non-GAAP

GAAP Reconciliation - Adjusted EBITDA(1) (2) (1) Adjusted EBITDA is defined as net income plus interest and other expense, net; income tax expense; depreciation and amortization and the items used to reconcile GAAP to Adjusted Non-GAAP EPS. Adjusted EBITDA amounts are not meant as a substitute for GAAP, but are solely for informational purposes 14 (2) Figures are adjusted non-GAAP

(1) Q3 2019 Reconciliation of GAAP to Adjusted EBITDA (1) Figures are adjusted non-GAAP 15

(1) Q3 2018 Reconciliation of GAAP to Adjusted EBITDA (1) Figures are adjusted non-GAAP 16