www.ziffdavis.com©2022 Ziff Davis. All rights reserved. FULL YEAR AND FOURTH QUARTER 2021 PRELIMINARY UNAUDITED RESULTS FEBRUARY 14, 2022

2 Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2022 Financial Guidance. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in those statements. Readers should carefully review the Risk Factors slide of this presentation. These forward-looking statements are based on management’s expectations or beliefs as of February 14, 2022 as well as those set forth in our Annual Report on Form 10-K filed by us on March 1, 2021 with the Securities and Exchange Commission (“SEC”) and the other reports we file from time to time with the SEC. We undertake no obligation to revise or publicly release any updates to such statements based on future information or actual results. Such forward-looking statements address the following subjects, among others: • Future operating results • Ability to acquire businesses on acceptable terms and integrate and recognize synergies from acquired businesses • Deployment of cash and investment balances to grow the company • Subscriber growth, retention, usage levels and average revenue per account • Digital media and cloud services growth • International growth • New products, services, features and technologies • Corporate spending including stock repurchases • Intellectual property and related licensing revenues • Liquidity and ability to repay or refinance indebtedness • Systems capacity, coverage, reliability and security • Regulatory developments and taxes All information in this presentation speaks as of February 14, 2022 and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. Third Party Information All third-party trademarks, including names, logos and brands, referenced by the Company in this presentation are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law. Industry, Market and Other Data Certain information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Non-GAAP Financial information Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") designed to supplement, and not substitute, Ziff Davis’s financial information presented in accordance with GAAP. The non-GAAP measures as defined by Ziff Davis may not be comparable to similar non-GAAP measures presented by other companies. The presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that Ziff Davis’s future results or leverage will be unaffected by other unusual or non-recurring items. Please see the appendix to this presentation for how we define these non-GAAP measures, a discussion of why we believe they are useful to investors and certain limitations thereof, and reconciliations thereof to the most directly comparable GAAP measures. Pro Forma Financial Information, Continuing Operations Unless otherwise specified, all financial data and operating metrics presented herein for Ziff Davis are presented on a pro forma (“PF”) basis adjusted non-GAAP for Ziff Davis continuing operations, giving effect to the divestitures of the Voice assets in Australia, New Zealand, and the United Kingdom, as well as the sale of the Company’s B2B Backup businesses and the separation of Consensus Cloud Solutions, Inc. as described in the Form 10 filed by Consensus with the Securities and Exchange Commission, as if they had occurred on January 1, 2020. Preliminary Unaudited Results These fourth quarter and full year 2020 and 2021 results are preliminary, unaudited, and subject to adjustments. In particular, due to the complexity of the October 7, 2021 spin-off of Consensus and the related transactions (including the debt-for-debt exchange), the presentation of the transaction's impact on the Company's financial statements (including the presentation of continuing and discontinued operations and the size of the gain associated with the retention of the 19.9% stake in Consensus) is still being finalized. Any change to the impact of the unrealized gain on investment of $290 million associated with the retention of the 19.9% stake in Consensus could be material to our GAAP net income from continuing operations. As a result of the foregoing, certain information provided herein is subject to change. Safe Harbor for Forward-looking Statements

3 The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to be materially adversely affected: • Inability to continue to expand our business and operations internationally • Inability to maintain required services on acceptable terms with financially stable critical vendors • Level of debt limiting availability of cash flow to reinvest in the business; inability to repay or refinance debt when due; and restrictive covenants relating to debt imposing operating and financial restrictions on business activities or plans • Inability to maintain and increase our customer base or average revenue per user • Inability to achieve business or financial results in light of burdensome internet, advertising, health care, consumer, privacy or other regulations, or being subject to existing regulations • Inability to adapt to technological change and diversify services and related revenues at acceptable levels of financial return • Loss of services of executive officers and other key employees • Other factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2021 with the SEC and the other reports we file from time to time with the SEC • Inability to sustain growth or profitability, and any related impact of U.S. or worldwide issues on customer acquisition, retention and usage levels, advertising spend and credit and debit card payment declines • Inability to acquire businesses on acceptable terms or successfully integrate and realize anticipated synergies • Failure to offer compelling digital media content causing reduced traffic and advertising levels; loss of advertisers or reduction in advertising spend; increased prevalence or effectiveness of advertising blocking technologies; inability to monetize handheld devices and handheld traffic supplanting monetized traffic; and changes by our vendors or partners that impact our traffic or publisher audience acquisition and/or monetization • New or unanticipated costs and/or fees or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales and value- added taxes • Inability to manage certain risks inherent to our business, such as fraudulent activity, system failure or a security breach; inability to manage reputational risks associated with our businesses • Competition from others with regard to price, service, content and functionality • Inadequate intellectual property (IP) protection, expiration, invalidity or loss of key patents, violations of 3rd party IP rights or inability or significant delay in monetizing IP Risk Factors

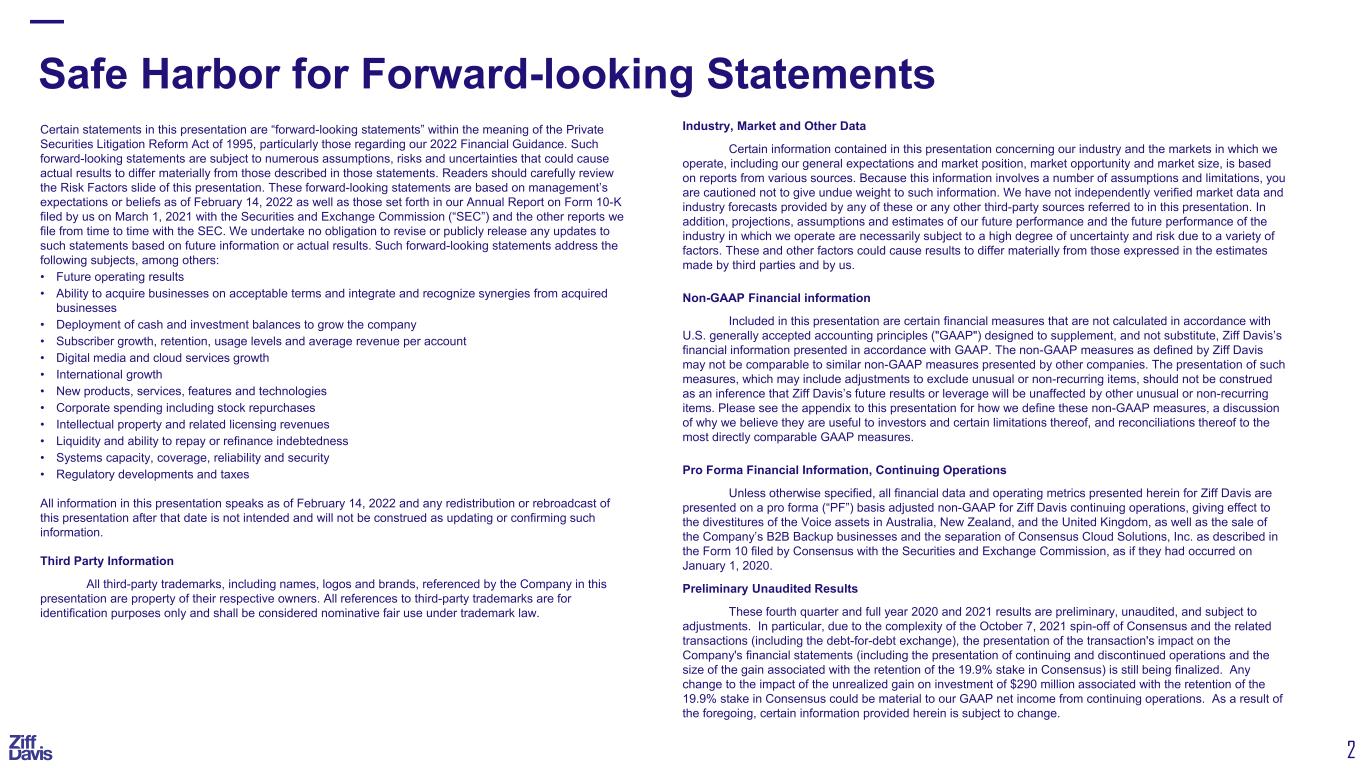

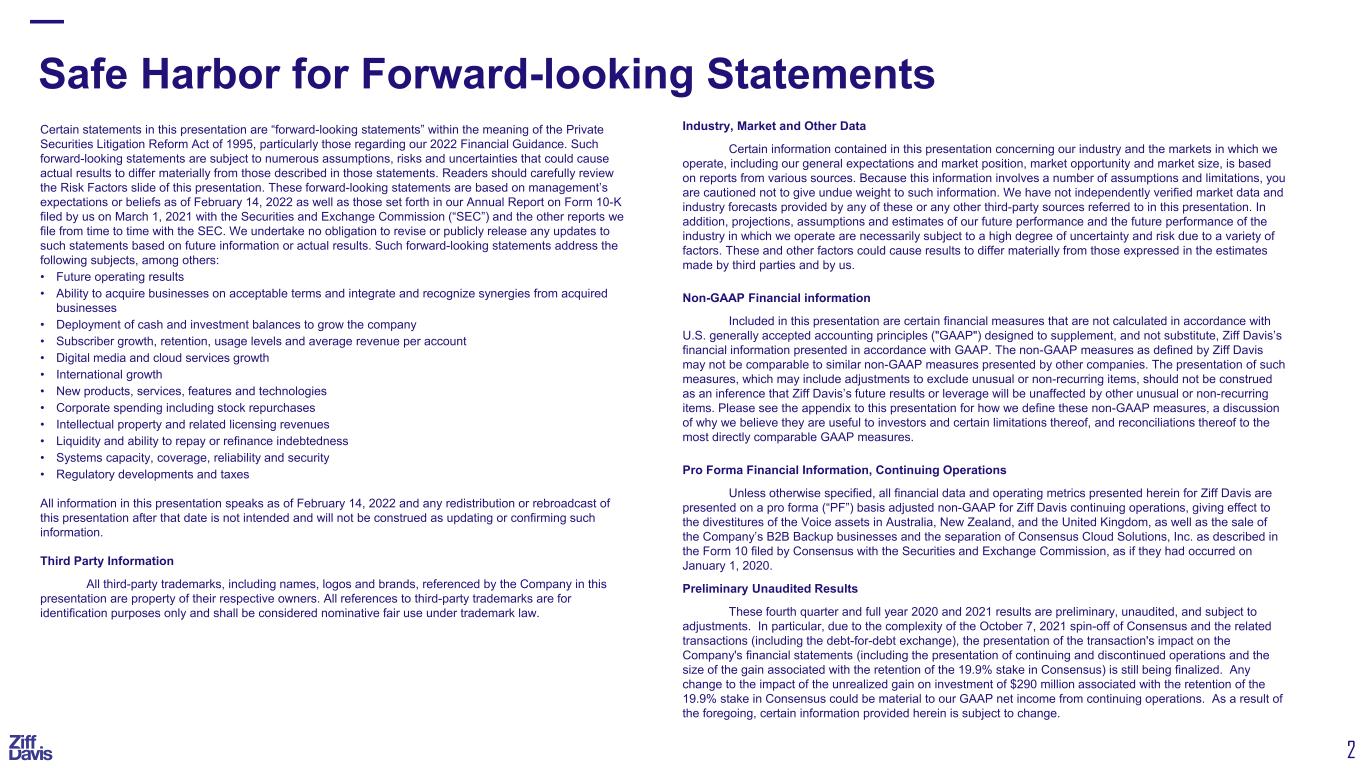

4 Q4 2021 Consolidated Financial Snapshot (1)(2) 1.Figures are adjusted non-GAAP; see slide 21 for a reconciliation of the pro-forma adjustments for excluded assets consisting of certain Voice assets in Australia and New Zealand that were sold in the third quarter of 2020, certain Voice assets in the United Kingdom that were sold in February 2021, and the certain assets of the Company’s B2B Backup business, which were sold in September 2021 2. See slides 14, 16-20 for a GAAP to non-GAAP reconciliation of adjusted gross profit, adjusted EBITDA and adjusted earnings per diluted share for the Company and by Business, and Slide 21 for a reconciliation of non-GAAP to pro-forma Note: Pro Forma Results from Continuing Operations excludes divested Voice UK, ANZ Voice, and B2B Backup assets

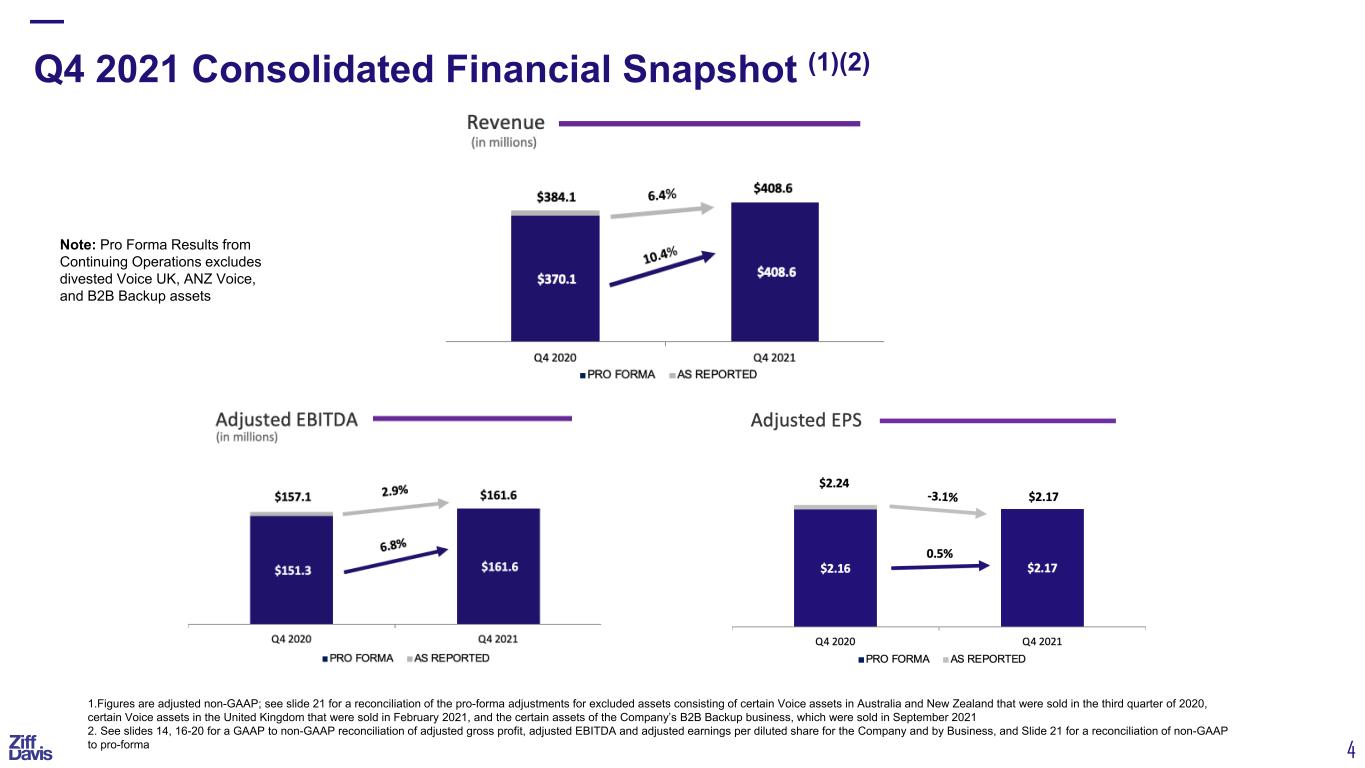

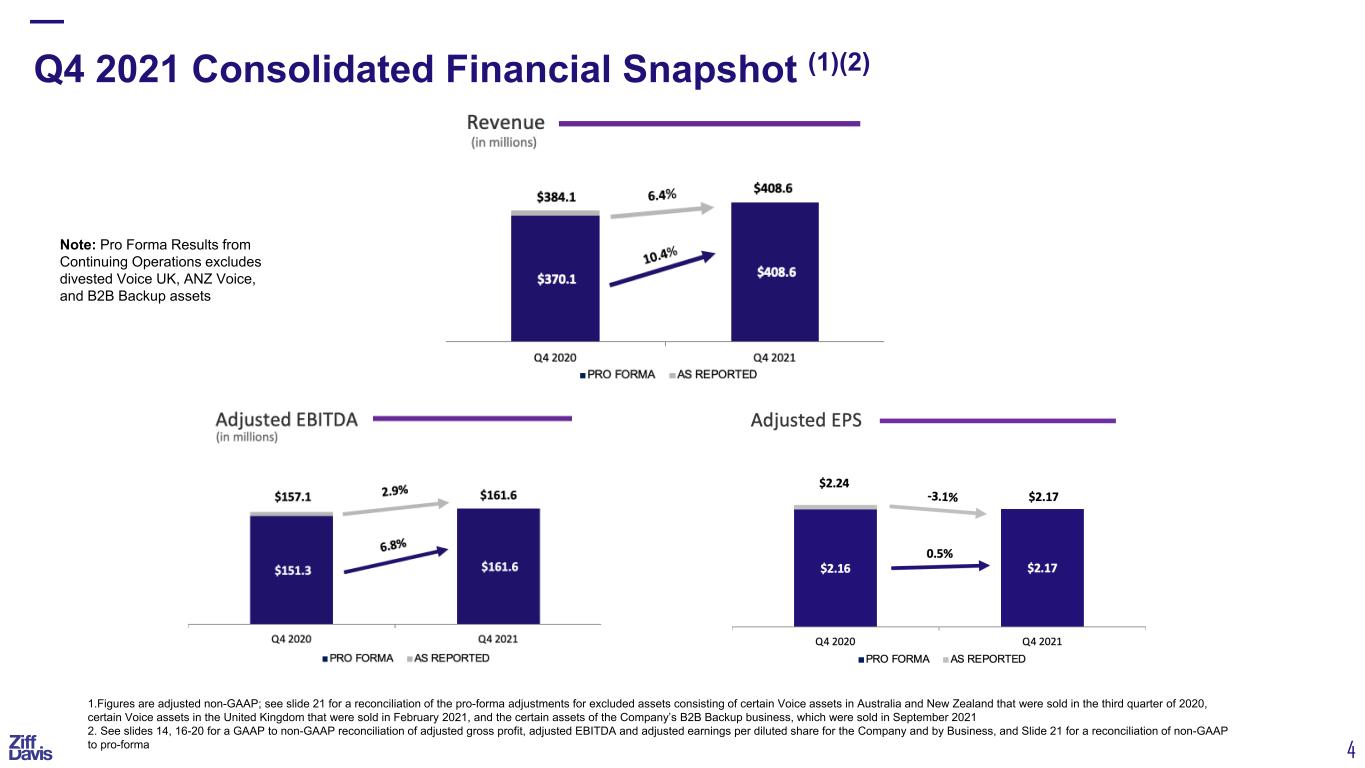

5 FY 2021 Consolidated Financial Snapshot (1)(2) 1. Figures are adjusted non-GAAP; see slide 21 for a reconciliation of the pro-forma adjustments for excluded assets consisting of certain Voice assets in Australia and New Zealand that were sold in the third quarter of 2020, certain Voice assets in the United Kingdom that were sold in February 2021, and the certain assets of the Company’s B2B Backup business, which were sold in September 2021 2. See slides 14, 16-20 for a GAAP to non-GAAP reconciliation of adjusted gross profit, adjusted EBITDA and adjusted earnings per diluted share for the Company and by Business, and Slide 21 for a reconciliation of non-GAAP to pro-forma Note: Pro Forma Results from Continuing Operations excludes divested Voice UK, ANZ Voice, and B2B Backup assets

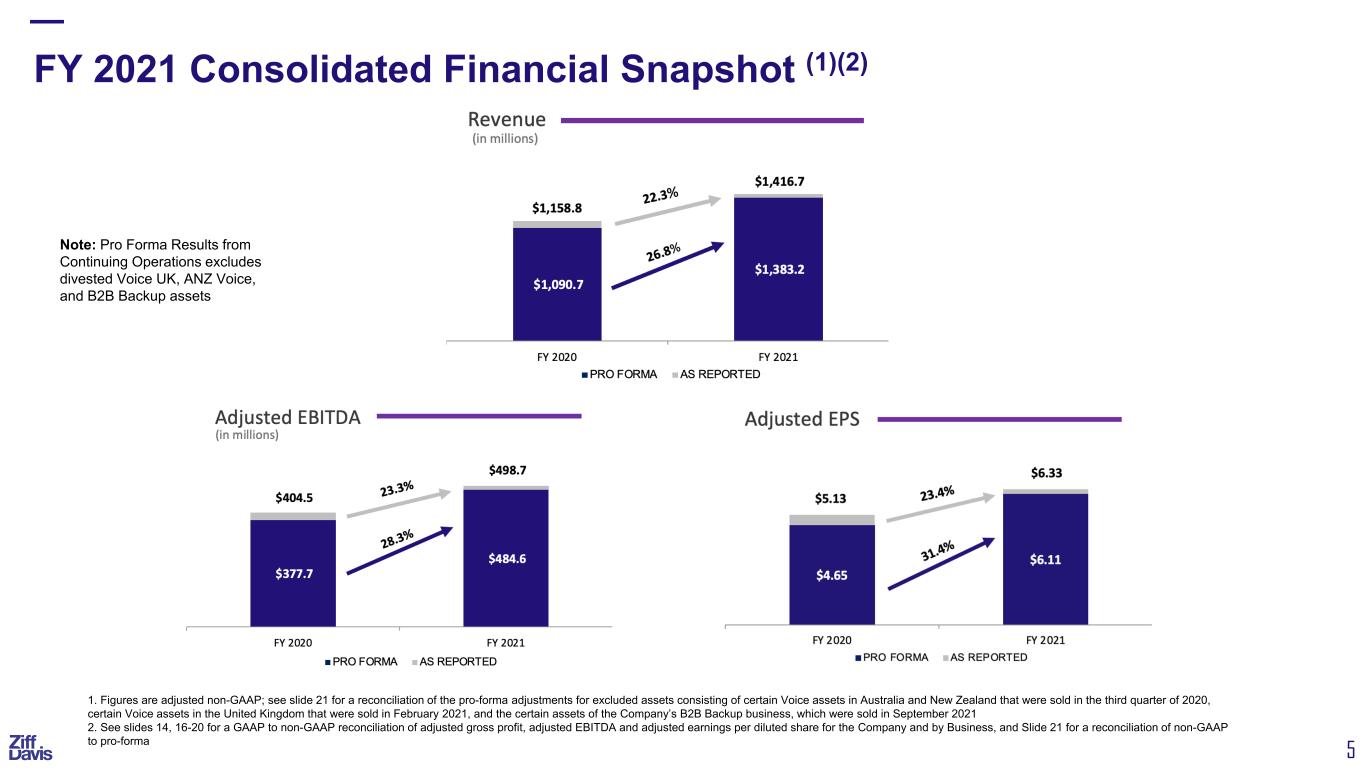

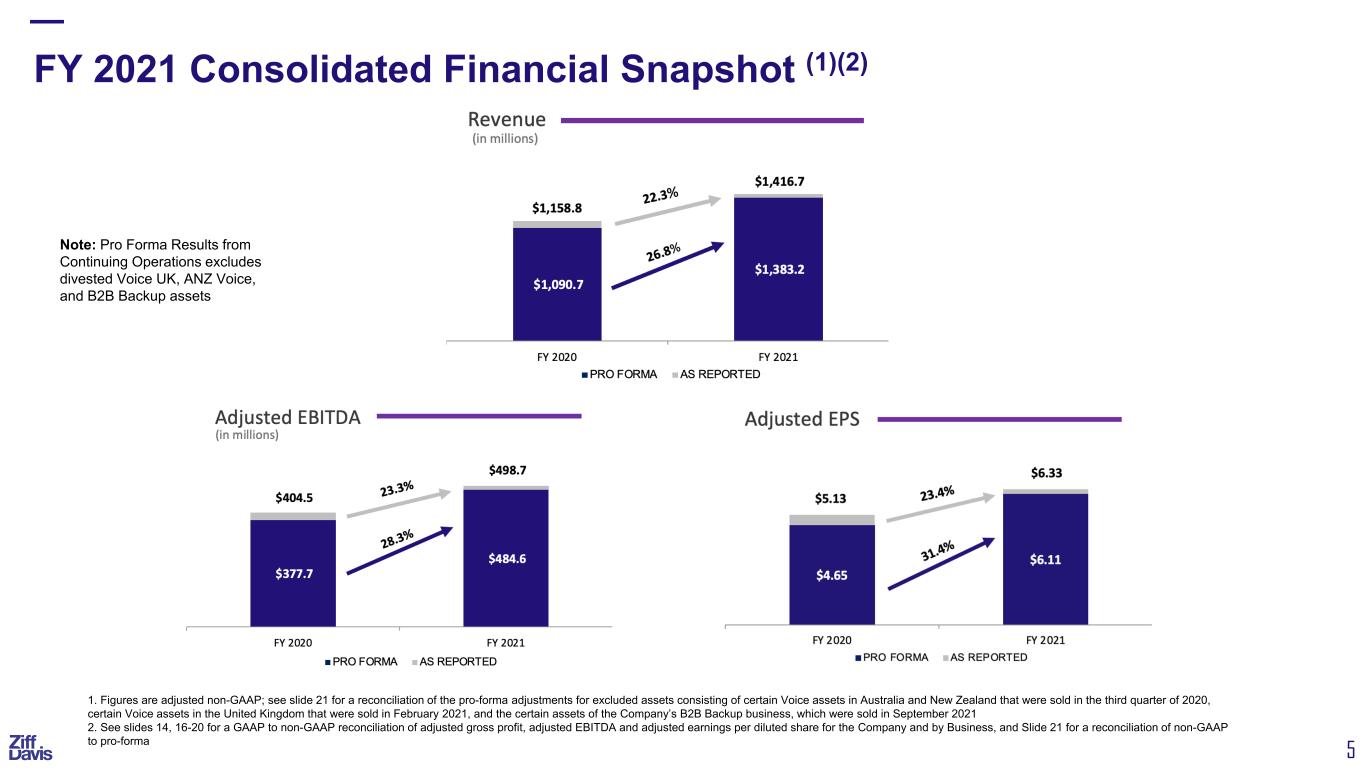

6 1. Figures are adjusted non-GAAP 2. Net Advertising Revenue Retention = (Amount Spent by Prior Year Advertisers in Current Year Period (excluding revenue from acquisitions during the stub period)) / (Amount Spent by Prior Year Advertisers in Prior Year Period (excluding revenue from acquisitions during the stub period)). Excludes advertisers that generated less than $10,000 of revenue on a TTM basis; combined retention is the weighted average net advertising revenue retention of the two digital media divisions. As a result of the aggregation of certain reporting systems related to the integration of several acquisitions, retention data for Q1 2021 and Q2 2021 reflects certain estimates 3. Excludes advertisers that spent less than $2,500 in the quarter 4. Total gross quarterly advertising revenues divided by advertisers as defined in footnote (2) Advertising Performance Quarterly Advertising Metrics Q1 Q2 Q3 Q4 Net Revenue Retention (2) 104% 111% 114% 112% Advertisers (3) 1,526 1,682 1,696 2,009 Quarterly Revenue per Advertiser (4) $116,360 $117,870 $117,150 $131,308 2021

7 1. Figures are adjusted non-GAAP 2. Quarterly average of the end of month customer counts; inclusive of the Digital Media and Cybersecurity & Martech Businesses 3. Total gross quarterly subscription revenues divided by customers as defined in footnote (1) 4. “Churn Rate” = A / B. A = (average revenue per subscription in the prior month) x (number of cancels in current month), calculated at each business and aggregated. B = subscription revenue in the current month, calculated at each business and aggregated. Churn rate is presented on a quarterly basis. For Ookla, this is calculated by taking the sum of the monthly revenue from the specific cancelled agreements Subscriptions Performance Quarterly Subscription Metrics Q1 Q2 Q3 Q4 Customers (2) (in '000s) 2,389 2,396 2,355 2,268 Average Monthly Revenue per Customer (3) $16.38 $17.29 $19.15 $19.89 Churn Rate (4) 2.7% 2.5% 3.0% 3.0% 2021

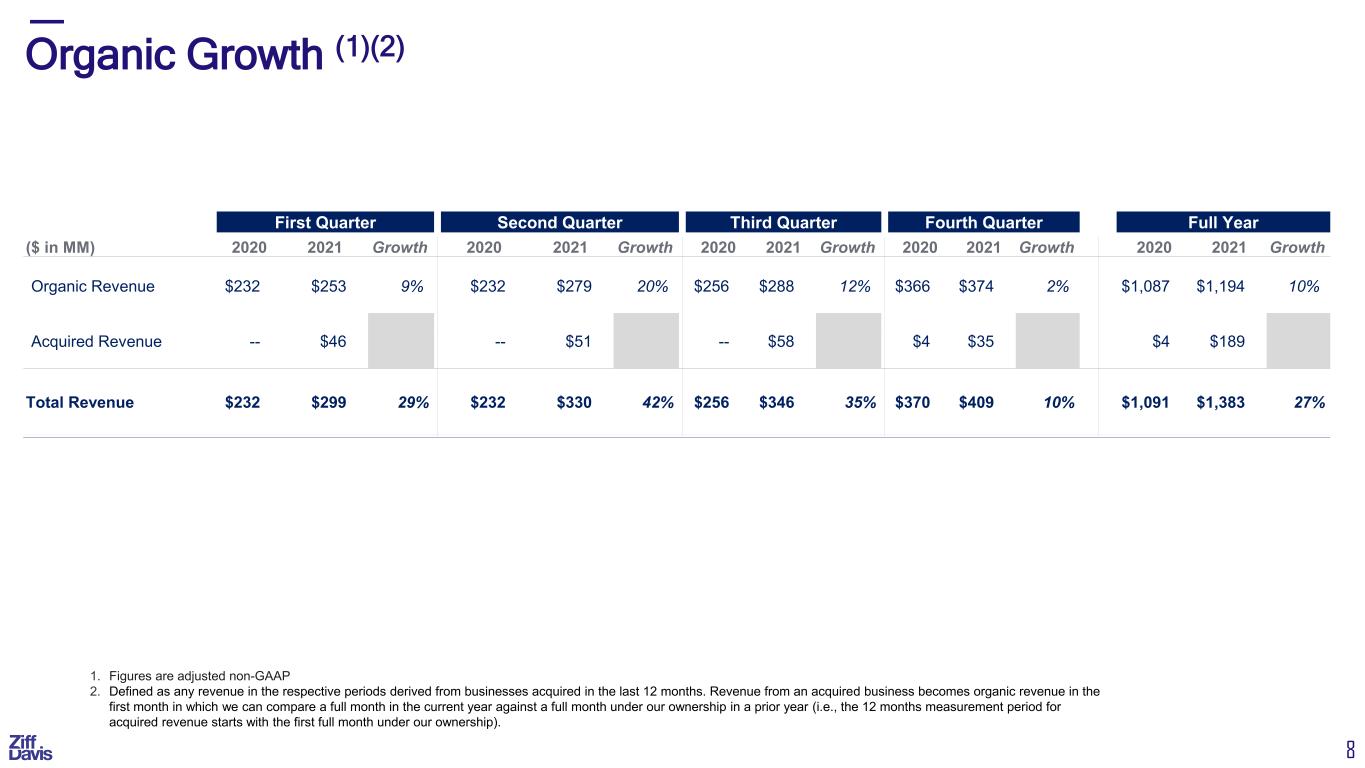

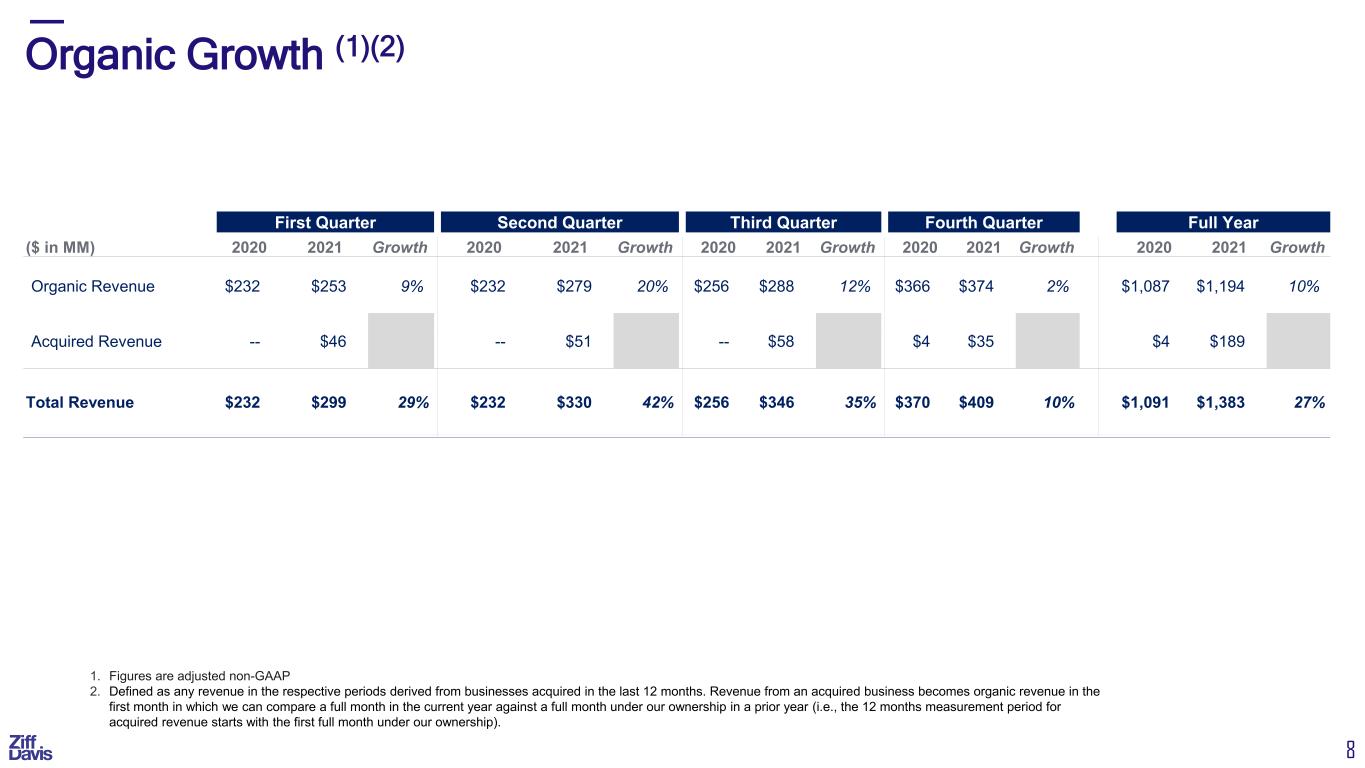

8 Organic Growth (1)(2) 1. Figures are adjusted non-GAAP 2. Defined as any revenue in the respective periods derived from businesses acquired in the last 12 months. Revenue from an acquired business becomes organic revenue in the first month in which we can compare a full month in the current year against a full month under our ownership in a prior year (i.e., the 12 months measurement period for acquired revenue starts with the first full month under our ownership). First Quarter Second Quarter Third Quarter Fourth Quarter Full Year ($ in MM) 2020 2021 Growth 2020 2021 Growth 2020 2021 Growth 2020 2021 Growth 2020 2021 Growth Organic Revenue $232 $253 9% $232 $279 20% $256 $288 12% $366 $374 2% $1,087 $1,194 10% Acquired Revenue -- $46 -- $51 -- $58 $4 $35 $4 $189 Total Revenue $232 $299 29% $232 $330 42% $256 $346 35% $370 $409 10% $1,091 $1,383 27%

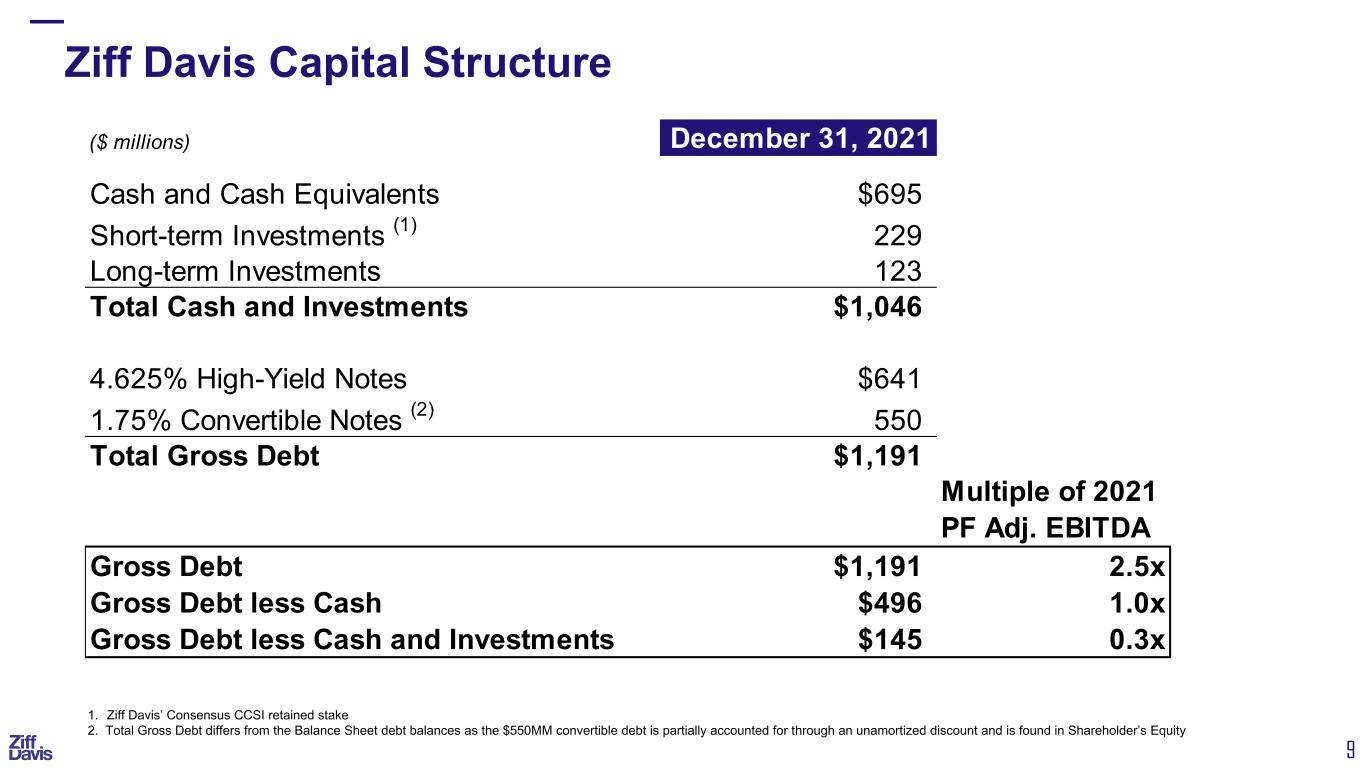

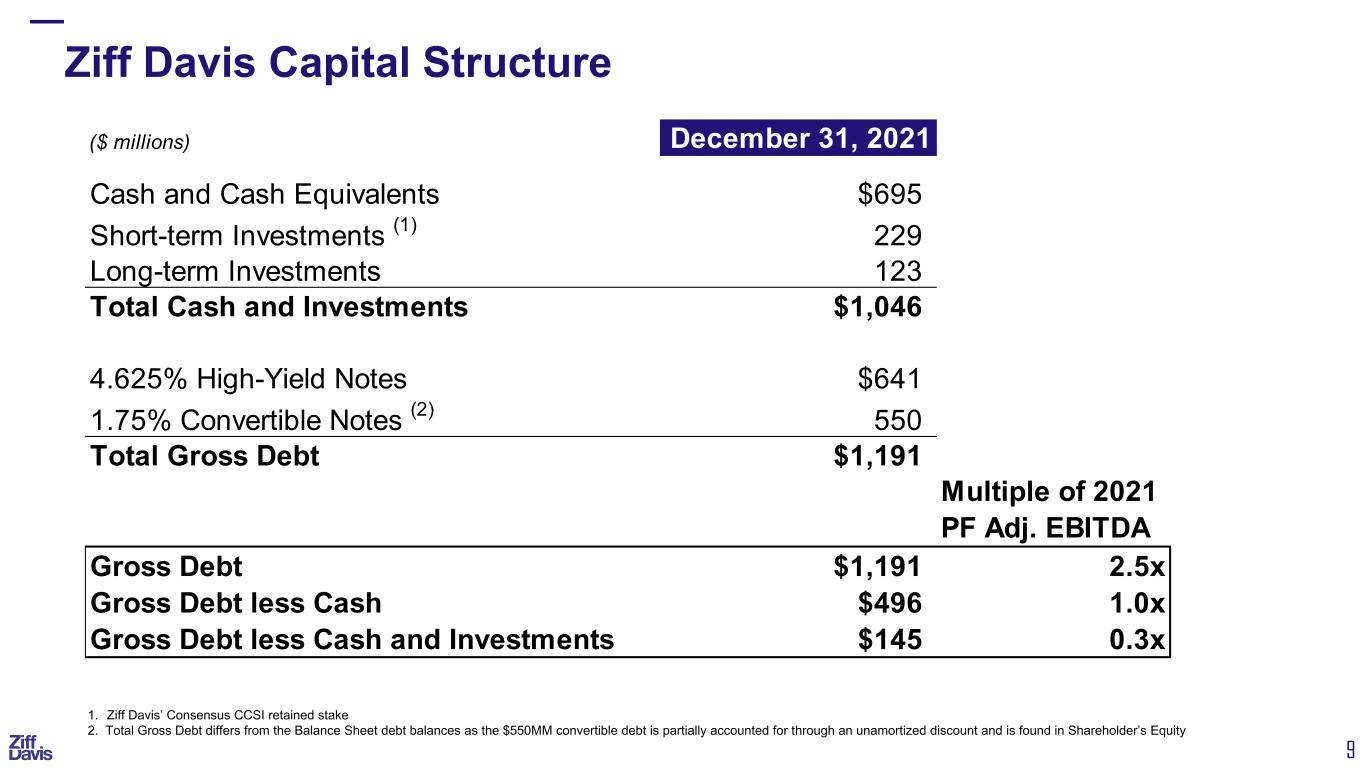

9 Ziff Davis Capital Structure 1. Ziff Davis’ Consensus CCSI retained stake 2. Total Gross Debt differs from the Balance Sheet debt balances as the $550MM convertible debt is partially accounted for through an unamortized discount and is found in Shareholder’s Equity ($ millions) December 31, 2021 Cash and Cash Equivalents $695 Short-term Investments (1) 229 Long-term Investments 123 Total Cash and Investments $1,046 4.625% High-Yield Notes $641 1.75% Convertible Notes (2) 550 Total Gross Debt $1,191 Multiple of 2021 PF Adj. EBITDA Gross Debt $1,191 2.5x Gross Debt less Cash $496 1.0x Gross Debt less Cash and Investments $145 0.3x

2022 FINANCIAL GUIDANCE

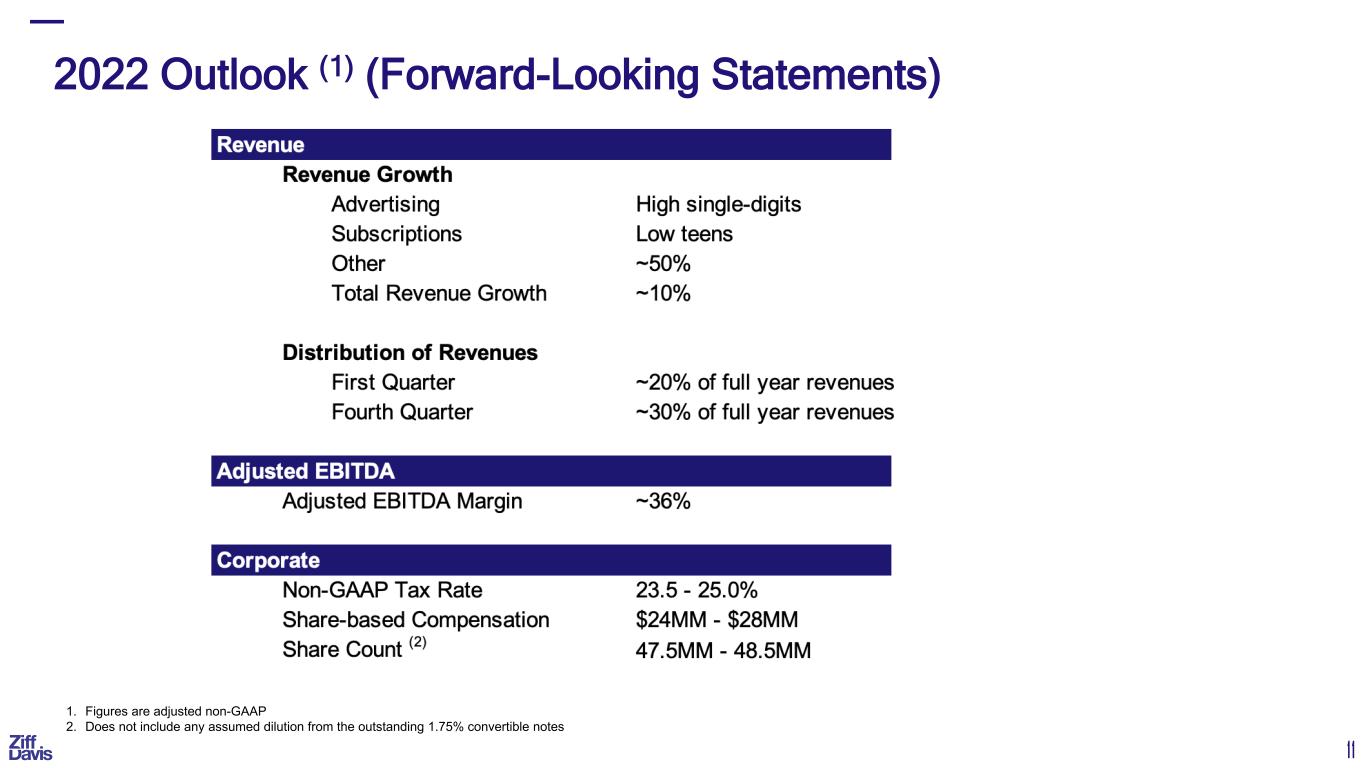

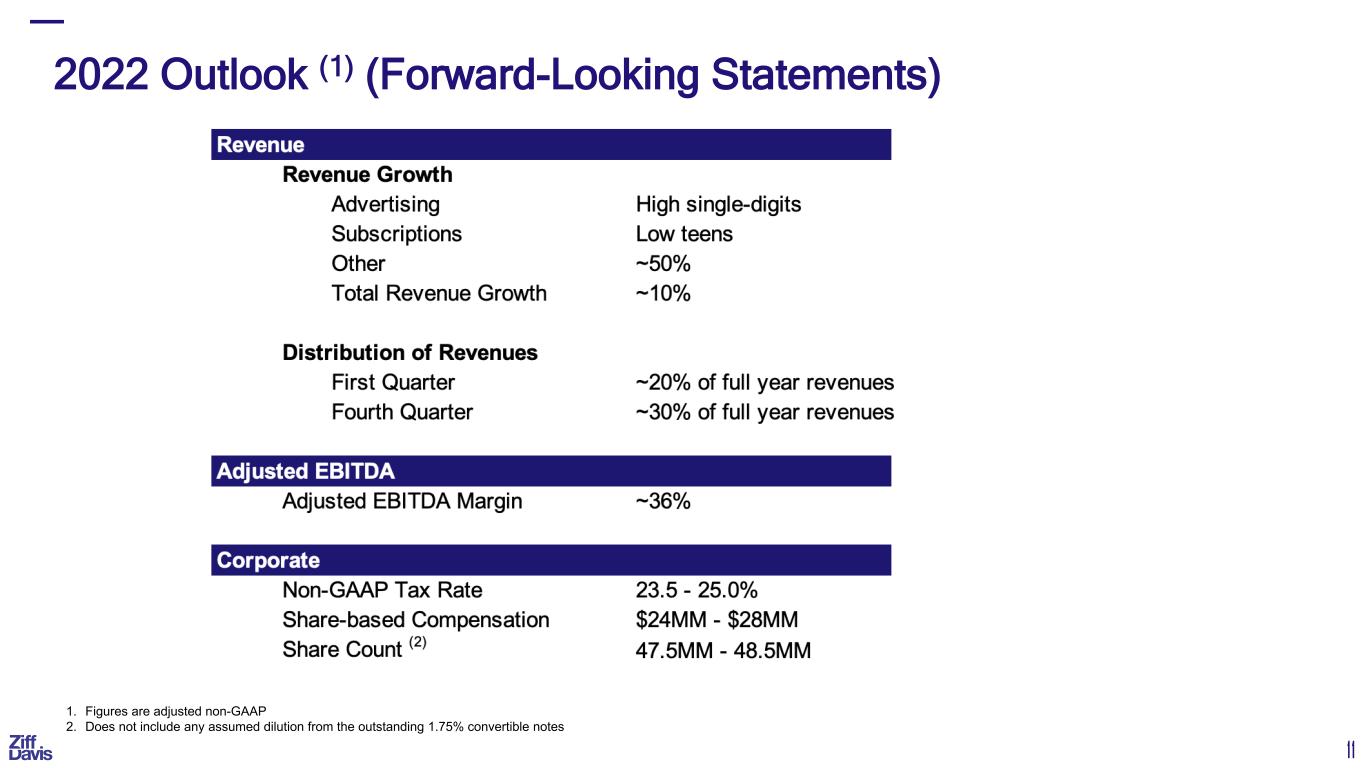

11 2022 Outlook (1) (Forward-Looking Statements) 1. Figures are adjusted non-GAAP 2. Does not include any assumed dilution from the outstanding 1.75% convertible notes

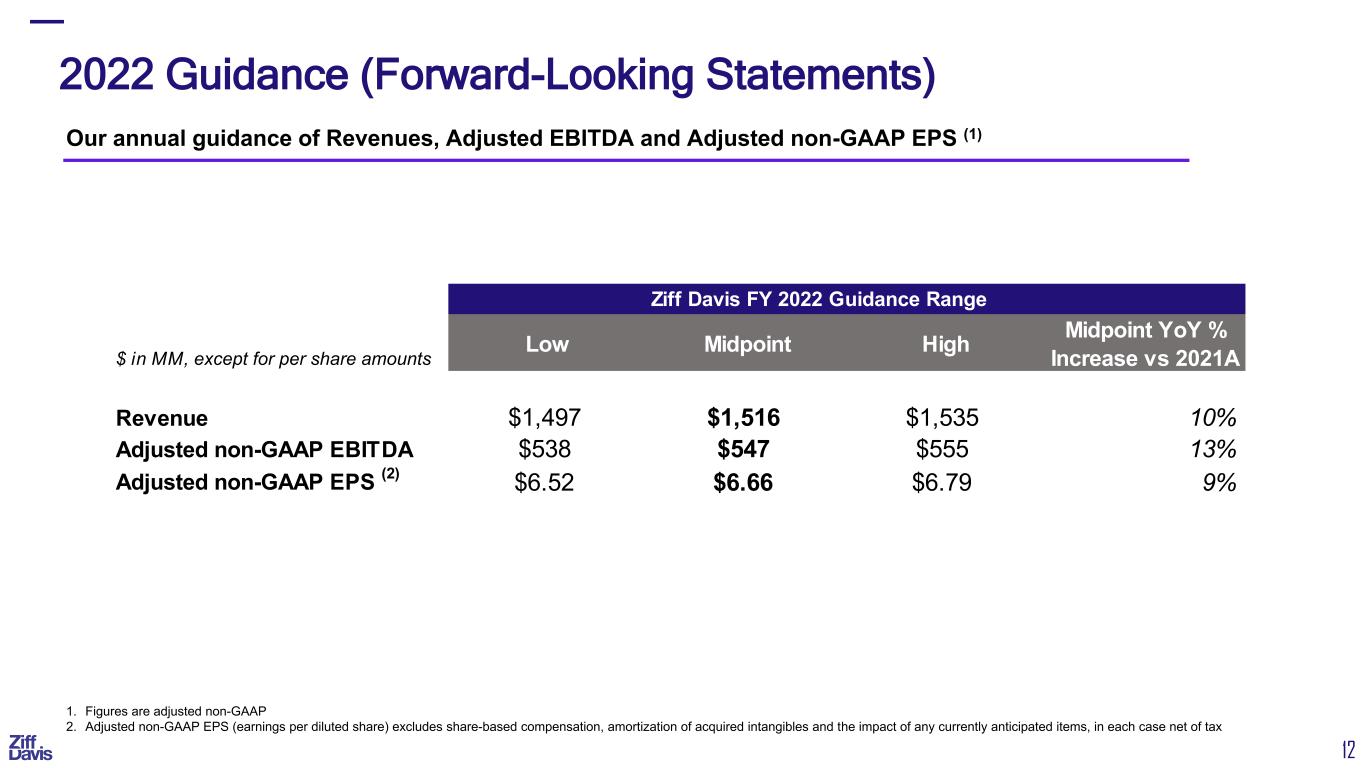

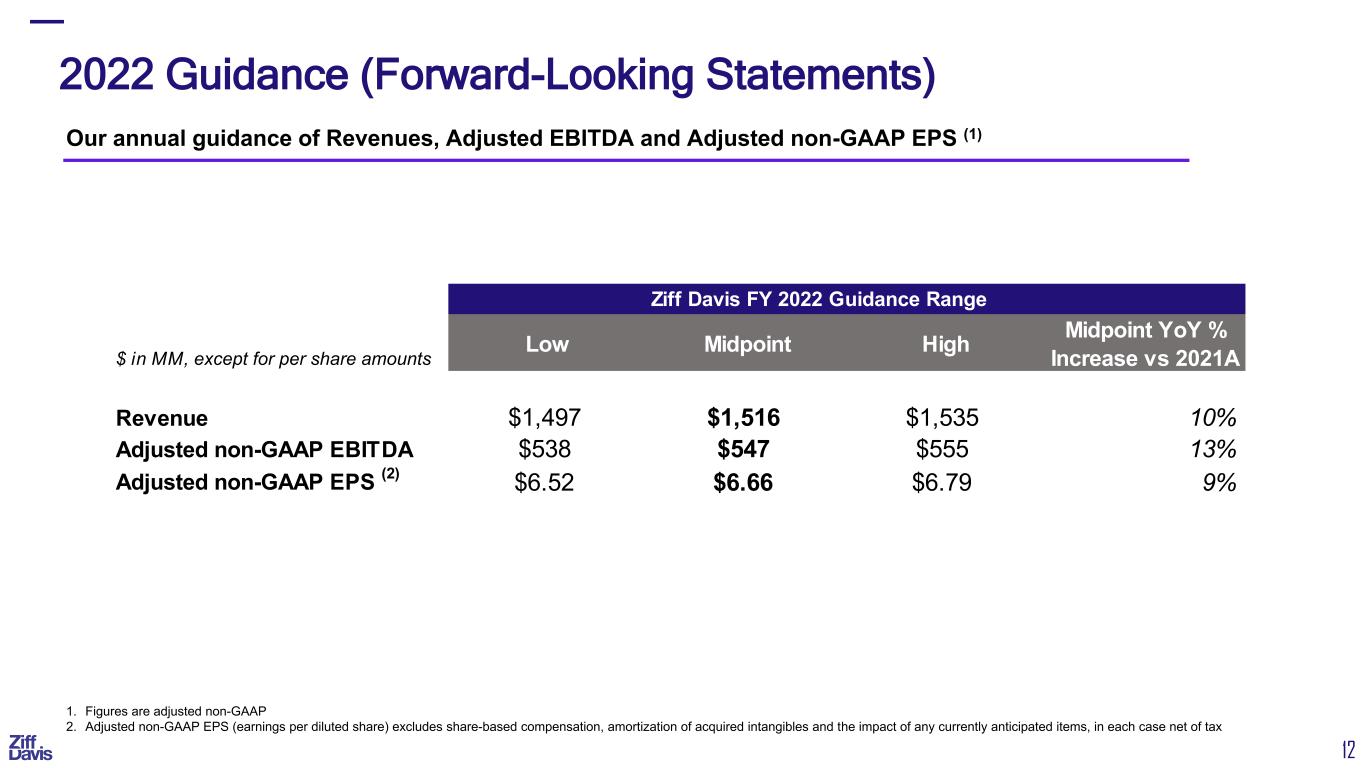

12 2022 Guidance (Forward-Looking Statements) Our annual guidance of Revenues, Adjusted EBITDA and Adjusted non-GAAP EPS (1) 1. Figures are adjusted non-GAAP 2. Adjusted non-GAAP EPS (earnings per diluted share) excludes share-based compensation, amortization of acquired intangibles and the impact of any currently anticipated items, in each case net of tax Ziff Davis FY 2022 Guidance Range $ in MM, except for per share amounts Low Midpoint High Midpoint YoY % Increase vs 2021A Revenue $1,497 $1,516 $1,535 10% Adjusted non-GAAP EBITDA $538 $547 $555 13% Adjusted non-GAAP EPS (2) $6.52 $6.66 $6.79 9%

SUPPLEMENTAL INFORMATION

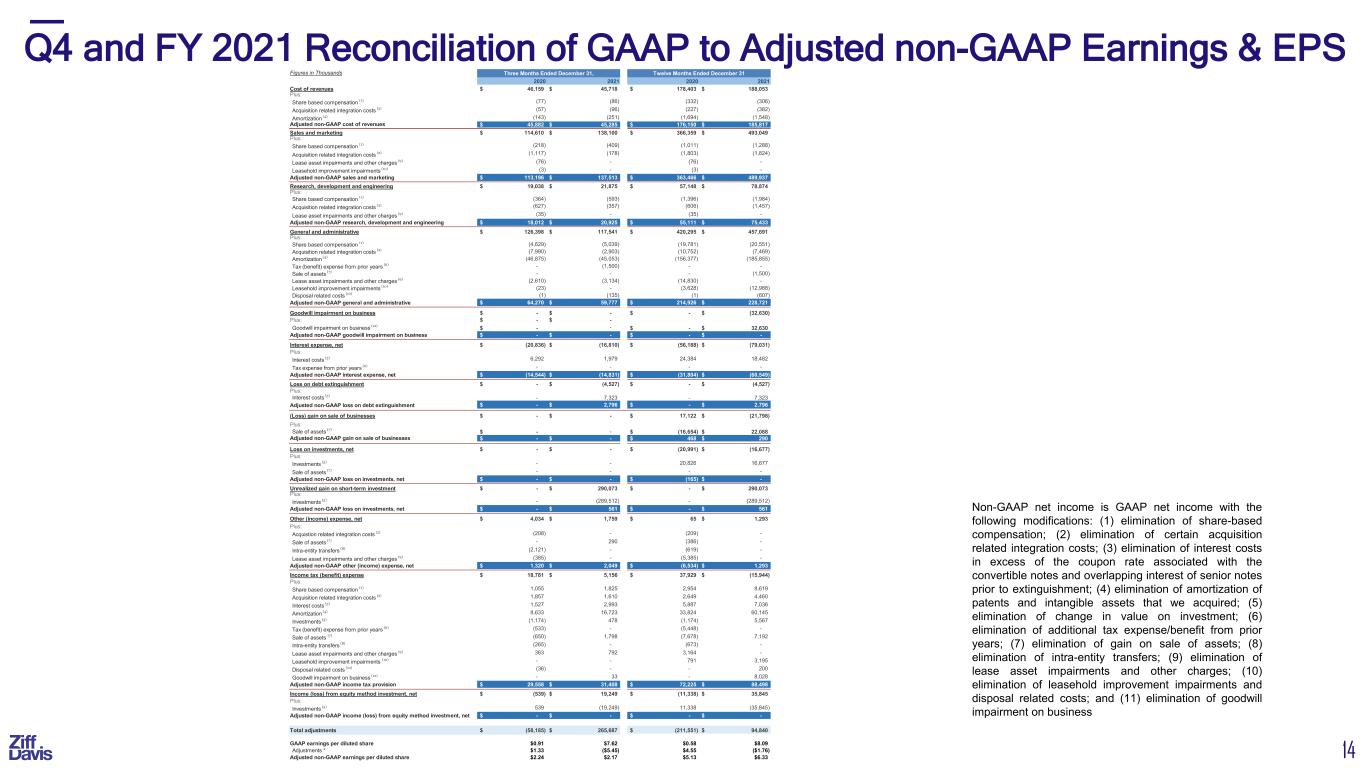

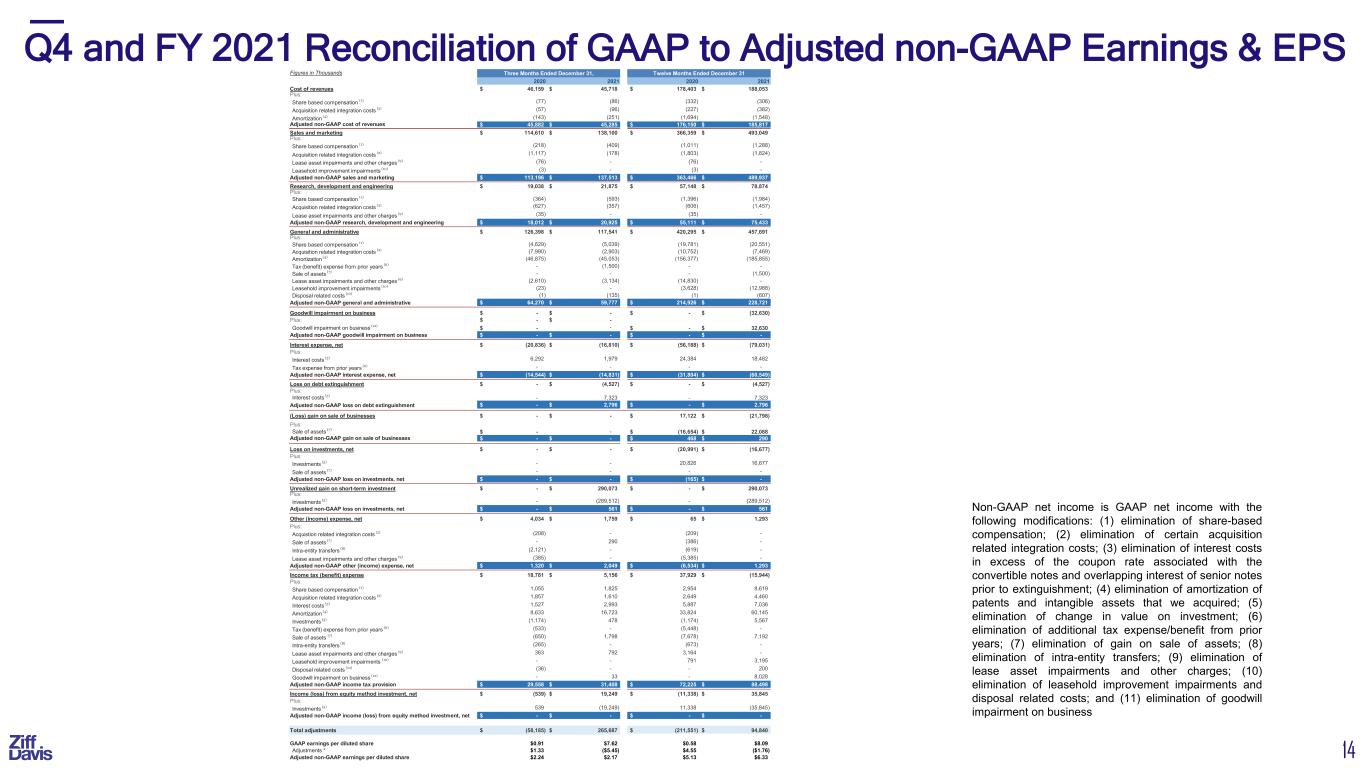

14 Q4 and FY 2021 Reconciliation of GAAP to Adjusted non-GAAP Earnings & EPS Non-GAAP net income is GAAP net income with the following modifications: (1) elimination of share-based compensation; (2) elimination of certain acquisition related integration costs; (3) elimination of interest costs in excess of the coupon rate associated with the convertible notes and overlapping interest of senior notes prior to extinguishment; (4) elimination of amortization of patents and intangible assets that we acquired; (5) elimination of change in value on investment; (6) elimination of additional tax expense/benefit from prior years; (7) elimination of gain on sale of assets; (8) elimination of intra-entity transfers; (9) elimination of lease asset impairments and other charges; (10) elimination of leasehold improvement impairments and disposal related costs; and (11) elimination of goodwill impairment on business Figures in Thousands 2020 2021 2020 2021 Cost of revenues 46,159$ 45,718$ 178,403$ 188,053$ Plus: Share based compensation (1) (77) (86) (332) (306) Acquisition related integration costs (2) (57) (96) (227) (382) Amortization (4) (143) (251) (1,694) (1,548) Adjusted non-GAAP cost of revenues 45,882$ 45,285$ 176,150$ 185,817$ Sales and marketing 114,610$ 138,100$ 366,359$ 493,049$ Plus: Share based compensation (1) (218) (409) (1,011) (1,288) Acquisition related integration costs (2) (1,117) (178) (1,803) (1,824) Lease asset impairments and other charges (9) (76) - (76) - Leasehold improvement impairments (10) (3) - (3) - Adjusted non-GAAP sales and marketing 113,196$ 137,513$ 363,466$ 489,937$ Research, development and engineering 19,038$ 21,875$ 57,148$ 78,874$ Plus: Share based compensation (1) (364) (593) (1,396) (1,984) Acquisition related integration costs (2) (627) (357) (606) (1,457) Lease asset impairments and other charges (9) (35) - (35) - Adjusted non-GAAP research, development and engineering 18,012$ 20,925$ 55,111$ 75,433$ General and administrative 126,398$ 117,541$ 420,295$ 457,691$ Plus: Share based compensation (1) (4,629) (5,039) (19,781) (20,551) Acquisition related integration costs (2) (7,990) (2,903) (10,752) (7,469) Amortization (4) (46,875) (45,053) (156,377) (185,855) Tax (benefit) expense from prior years (6) - (1,500) - - Sale of assets (7) - - - (1,500) Lease asset impairments and other charges (9) (2,610) (3,134) (14,830) - Leasehold improvement impairments (10) (23) - (3,628) (12,988) Disposal related costs (10) (1) (135) (1) (607) Adjusted non-GAAP general and administrative 64,270$ 59,777$ 214,926$ 228,721$ Goodwill impairment on business -$ -$ -$ (32,630)$ Plus: -$ -$ Goodwill impairment on business (12) -$ - -$ 32,630$ Adjusted non-GAAP goodwill impairment on business -$ -$ -$ -$ Interest expense, net (20,836)$ (16,810)$ (56,188)$ (79,031)$ Plus: Interest costs (3) 6,292 1,979 24,384 18,482 Tax expense from prior years (6) - - - - Adjusted non-GAAP interest expense, net (14,544)$ (14,831)$ (31,804)$ (60,549)$ Loss on debt extinguishment -$ (4,527)$ -$ (4,527)$ Plus: Interest costs (3) - 7,323 - 7,323 Adjusted non-GAAP loss on debt extinguishment -$ 2,796$ -$ 2,796$ (Loss) gain on sale of businesses -$ -$ 17,122$ (21,798)$ Plus: Sale of assets (7) -$ - (16,654)$ 22,088$ Adjusted non-GAAP gain on sale of businesses -$ -$ 468$ 290$ Loss on investments, net -$ -$ (20,991)$ (16,677)$ Plus: Investments (5) - - 20,826 16,677 Sale of assets (7) - - - - Adjusted non-GAAP loss on investments, net -$ -$ (165)$ -$ Unrealized gain on short-term investment -$ 290,073$ -$ 290,073$ Plus: Investments (5) - (289,512) - (289,512) Adjusted non-GAAP loss on investments, net -$ 561$ -$ 561$ Other (income) expense, net 4,034$ 1,759$ 65$ 1,293$ Plus: Acquistion related integration costs (2) (208) - (209) - Sale of assets (7) - 290 (386) - Intra-entity transfers (8) (2,121) - (619) - Lease asset impairments and other charges (9) (385) - (5,385) - Adjusted non-GAAP other (income) expense, net 1,320$ 2,049$ (6,534)$ 1,293$ Income tax (benefit) expense 18,781$ 5,156$ 37,929$ (15,944)$ Plus: Share based compensation (1) 1,055 1,825 2,954 8,619 Acquisition related integration costs (2) 1,857 1,610 2,649 4,460 Interest costs (3) 1,527 2,993 5,887 7,036 Amortization (4) 8,633 16,723 33,824 60,145 Investments (5) (1,174) 478 (1,174) 5,567 Tax (benefit) expense from prior years (6) (533) - (5,448) - Sale of assets (7) (650) 1,798 (7,678) 7,192 Intra-entity transfers (8) (265) - (673) - Lease asset impairments and other charges (9) 363 792 3,164 - Leasehold improvement impairments (10) - - 791 3,195 Disposal related costs (10) (36) - - 200 Goodwill impairment on business (12) - 33 - 8,028 Adjusted non-GAAP income tax provision 29,558$ 31,408$ 72,225$ 88,498$ Income (loss) from equity method investment, net (539)$ 19,249$ (11,338)$ 35,845$ Plus: Investments (5) 539 (19,249) 11,338 (35,845) Adjusted non-GAAP income (loss) from equity method investment, net -$ -$ -$ -$ Total adjustments (58,185)$ 265,687$ (211,551)$ 94,840$ GAAP earnings per diluted share $0.91 $7.62 $0.58 $8.09 Adjustments * $1.33 ($5.45) $4.55 ($1.76) Adjusted non-GAAP earnings per diluted share $2.24 $2.17 $5.13 $6.33 Three Months Ended December 31, Twelve Months Ended December 31

15 GAAP Reconciliation – Free Cash Flow (1)(2) 1. Free Cash Flow is defined as net cash provided by operating activities, less purchases of property, plant and equipment, plus contingent consideration. Free Cash Flow amounts are not meant as a substitute for GAAP, but are solely for informational purposes. 2. Figures are adjusted non-GAAP; includes Consensus and the divested assets $MM Ziff Davis 2020 2021 2020 2021 Net cash provided by operating activities from continuing and discontinued operations 124,070$ 85,319$ 480,079$ 515,571$ Less: Purchase of property and equipment (21,286) (26,245) (92,552) (113,740) Add: Contingent consideration 99 - 20,202 685 Free cash flow from continuing and discontinued operations (2) 102,883$ 59,074$ 407,729$ 402,516$ Three Months Ended December 31st, Twelve Months Ended December 31st,

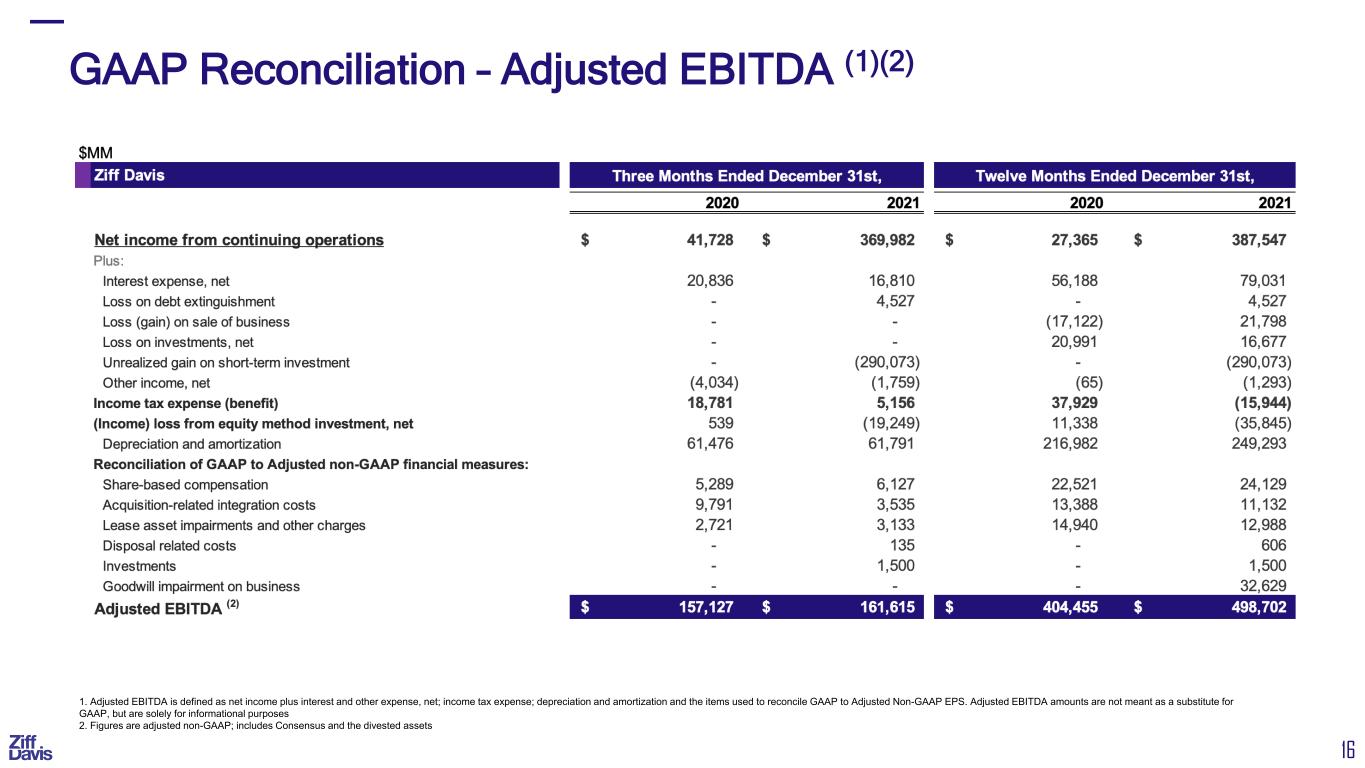

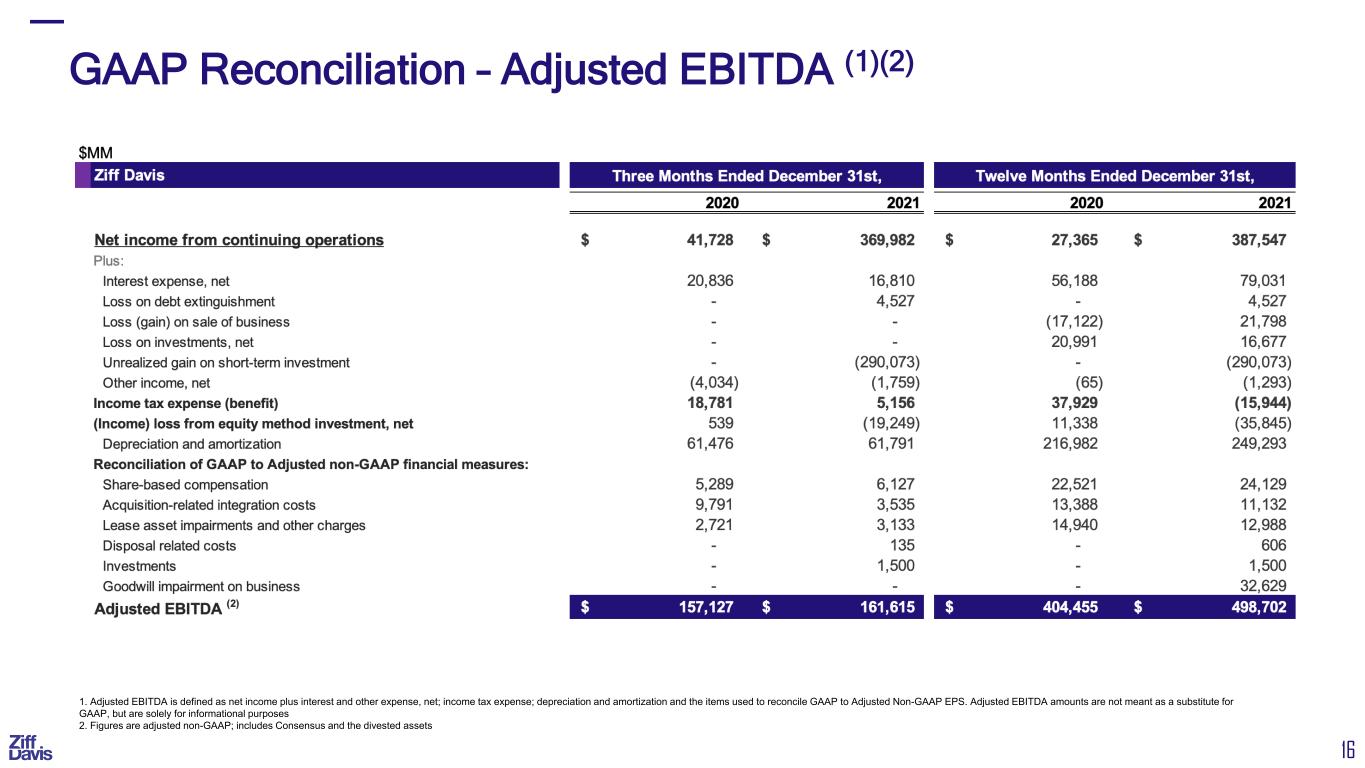

16 GAAP Reconciliation – Adjusted EBITDA (1)(2) 1. Adjusted EBITDA is defined as net income plus interest and other expense, net; income tax expense; depreciation and amortization and the items used to reconcile GAAP to Adjusted Non-GAAP EPS. Adjusted EBITDA amounts are not meant as a substitute for GAAP, but are solely for informational purposes 2. Figures are adjusted non-GAAP; includes Consensus and the divested assets

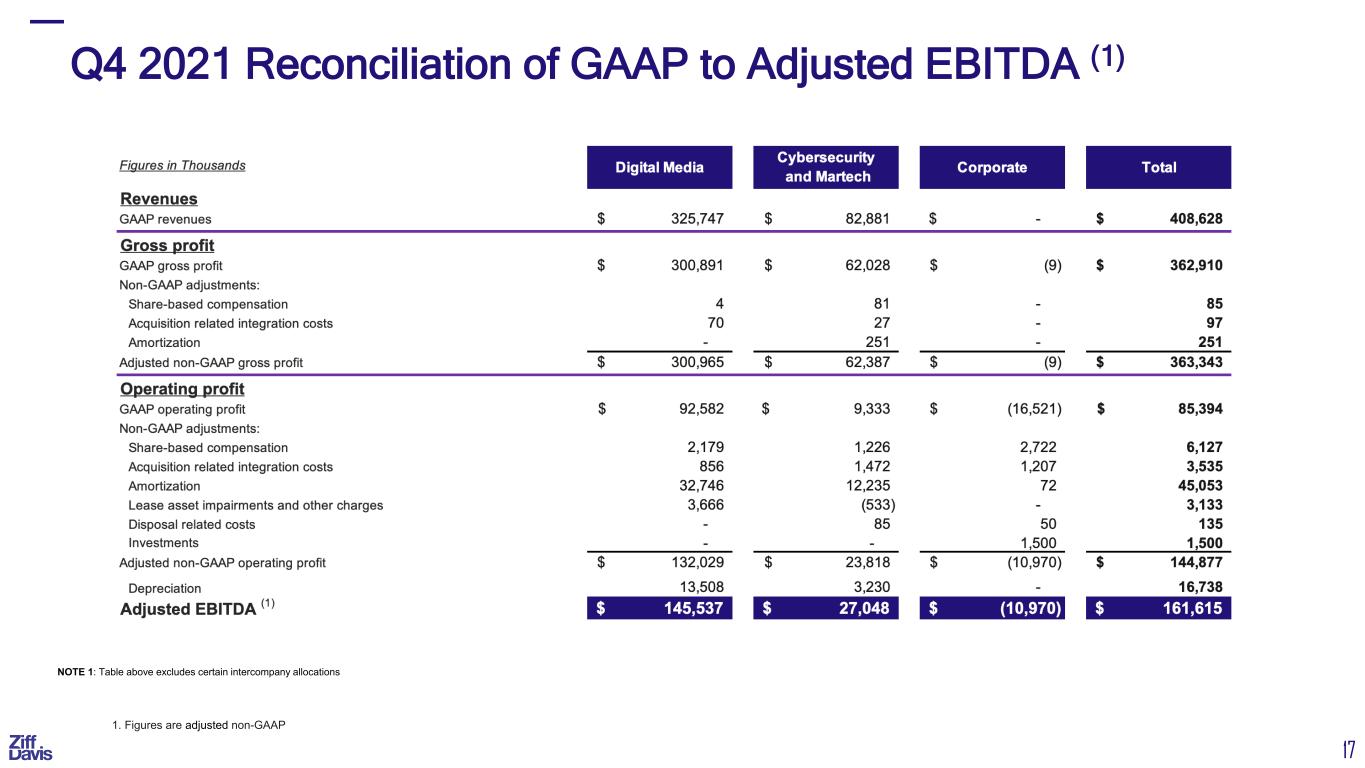

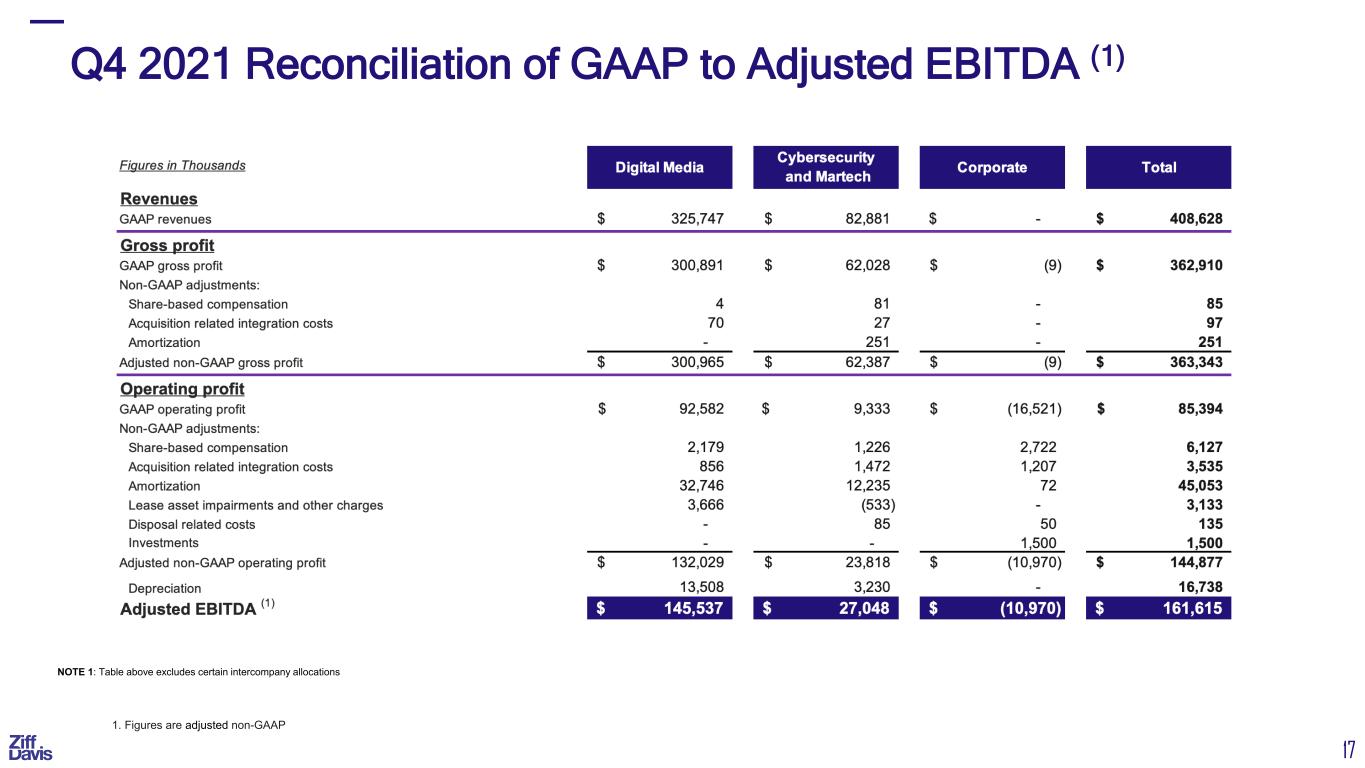

17 NOTE 1: Table above excludes certain intercompany allocations 1. Figures are adjusted non-GAAP Q4 2021 Reconciliation of GAAP to Adjusted EBITDA (1)

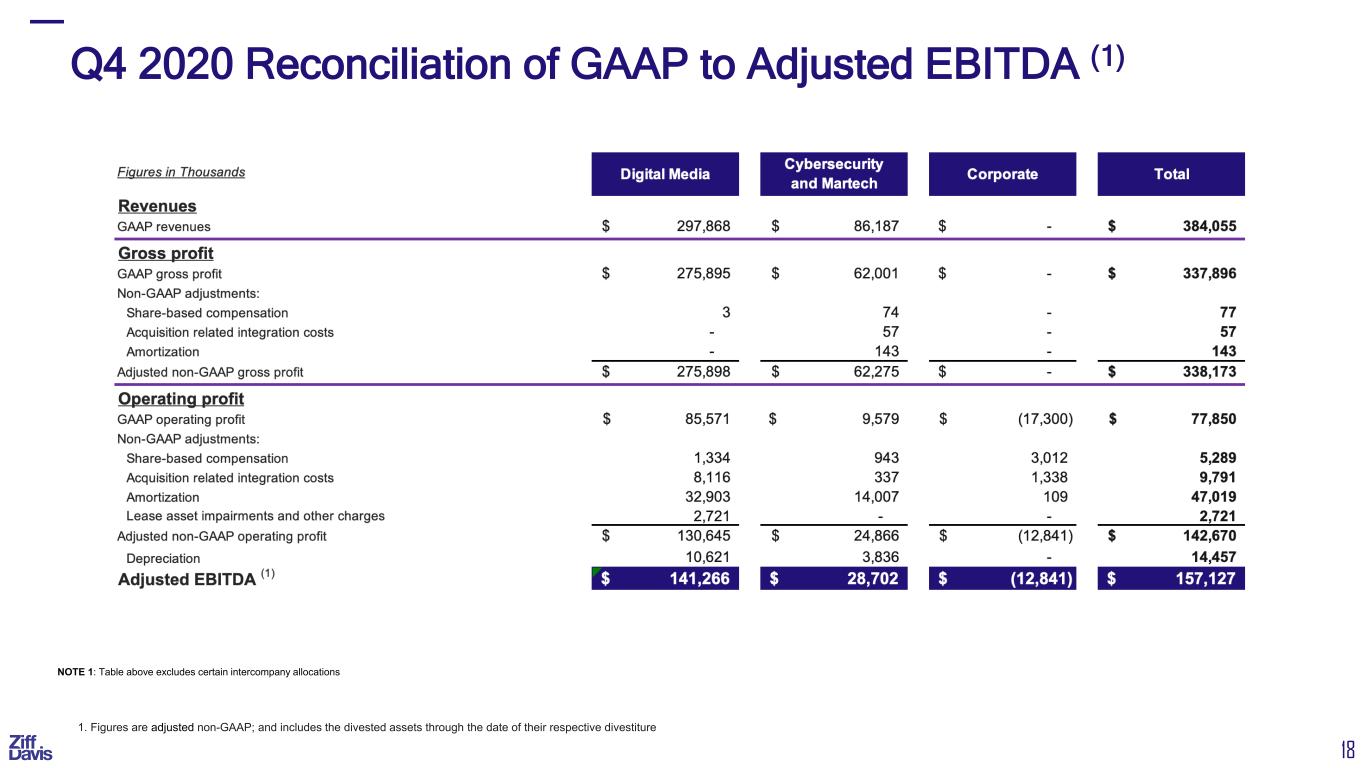

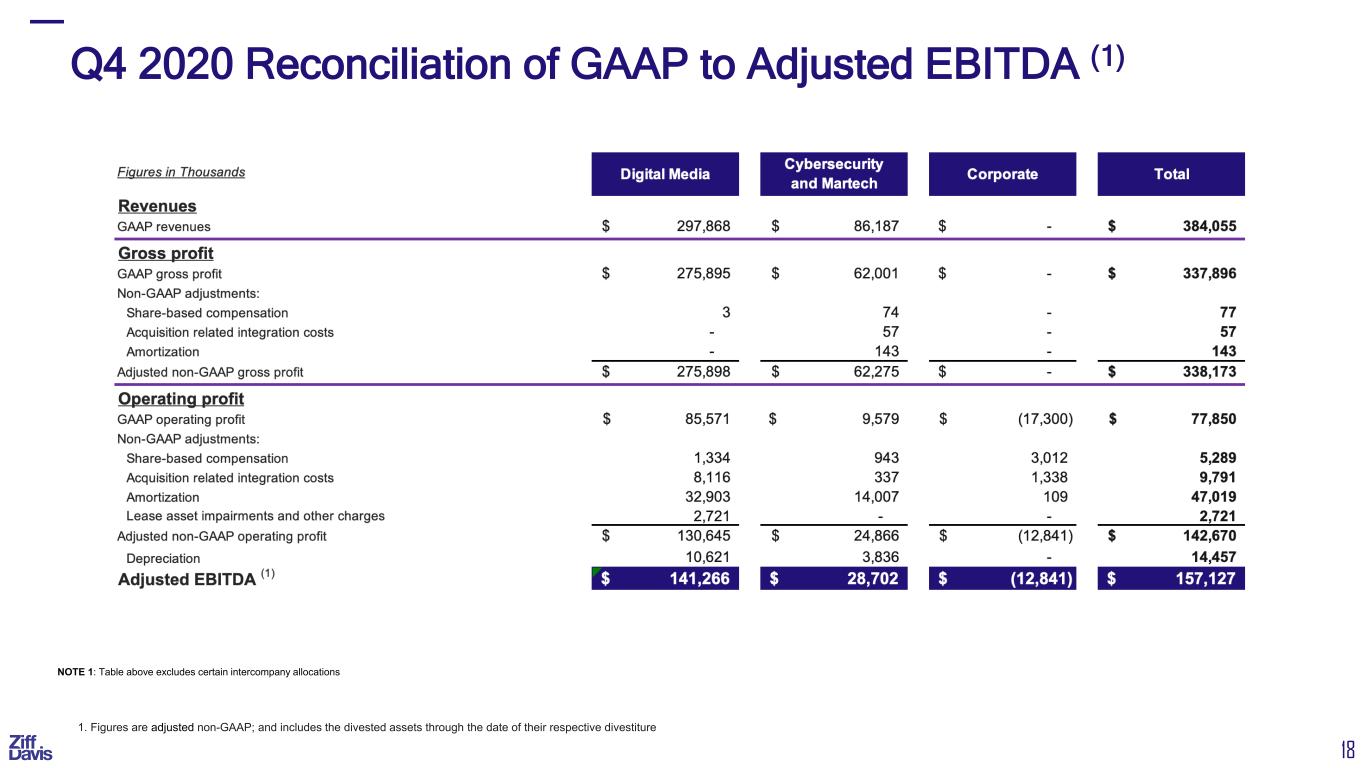

18 Q4 2020 Reconciliation of GAAP to Adjusted EBITDA (1) 1. Figures are adjusted non-GAAP; and includes the divested assets through the date of their respective divestiture NOTE 1: Table above excludes certain intercompany allocations

19 FY 2021 Reconciliation of GAAP to Adjusted EBITDA (1) NOTE 1: Table above excludes certain intercompany allocations 1. Figures are adjusted non-GAAP; and includes the divested assets through the date of their respective divestiture

20 FY 2020 Reconciliation of GAAP to Adjusted EBITDA (1) NOTE 1: Table above excludes certain intercompany allocations 1. Figures are adjusted non-GAAP; and includes the divested assets through the date of their respective divestiture

21 Reconciliation of Non-GAAP to Pro-Forma 1. Adjustments for excluded assets consist of certain Voice assets in Australia and New Zealand that were sold in the third quarter of 2020, certain Voice assets in the United Kingdom that were sold in February 2021, and the certain assets of the Company’s B2B Backup business, which were sold in September 2021 Q4 2020 Q4 2021 FY 2020 FY 2021 Revenue Stated Revenues $384.1 $408.6 $1,158.8 $1,416.7 Adjustments (1) ($14.0) $0.0 ($68.1) ($33.5) Total Adjusted Pro-Forma Revenue $370.1 $408.6 $1,090.7 $1,383.2 EBITDA Stated EBITDA $157.1 $161.6 $404.5 $498.7 Adjustments (1) ($5.8) $0.0 ($26.8) ($14.1) Total Adjusted Pro-Forma EBITDA $151.3 $161.6 $377.7 $484.6 EPS Stated Diluted non-GAAP EPS $2.24 $2.17 $5.13 $6.33 Adjustments (1) ($0.08) $0.00 ($0.48) ($0.22) Total Adjusted Pro-Forma EPS $2.16 $2.17 $4.65 $6.11