www.ziffdavis.com©2023 Ziff Davis. All rights reserved. FOURTH QUARTER AND FULL YEAR 2022 RESULTS February 15, 2023

2 Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2023 Financial Guidance. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in those statements. These forward-looking statements are based on management’s expectations or beliefs as of February 15, 2023. Readers should carefully review the Risk Factors slide of this presentation, as well as the risk factors set forth in our Annual Report on Form 10-K filed by us on March 15, 2022 with the Securities and Exchange Commission (“SEC”) and the other reports we file from time to time with the SEC. We undertake no obligation to revise or publicly release any updates to such statements based on future information or actual results. Such forward-looking statements address the following subjects, among others: • Future operating results • Ability to acquire businesses on acceptable terms and integrate and recognize synergies from acquired businesses • Deployment of cash and investment balances to grow the company • Subscriber growth, retention, usage levels and average revenue per account • Digital media and cloud services growth • International growth • New products, services, features and technologies • Corporate spending including stock repurchases • Intellectual property and related licensing revenues • Liquidity and ability to repay or refinance indebtedness • Systems capacity, coverage, reliability and security • Regulatory developments and taxes All information in this presentation speaks as of February 15, 2023 and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. Capitalized terms not otherwise defined in this presentation have the meanings set forth in Ziff Davis' February 15, 2023 earnings press release. Third Party Information All third-party trademarks, including names, logos and brands, referenced by the Company in this presentation are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law. Industry, Market and Other Data Certain information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Non-GAAP Financial information Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") designed to supplement, and not substitute, Ziff Davis’ financial information presented in accordance with GAAP. The non- GAAP measures as defined by Ziff Davis may not be comparable to similar non-GAAP measures presented by other companies. The presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that Ziff Davis’ future results or leverage will be unaffected by other unusual or non-recurring items. Please see the appendix to this presentation for how we define these non-GAAP measures, a discussion of why we believe they are useful to investors and certain limitations thereof, and reconciliations thereof to the most directly comparable GAAP measures. Results from Operations Excluding Divested Businesses Unless otherwise specified, all financial data and operating metrics presented herein for Ziff Davis are presented giving effect to the February 2021 divestiture of the Voice assets in the United Kingdom, as well as the September 2021 sale of the Company’s B2B Backup businesses, together, (the “Divested Businesses”), and the separation of Consensus Cloud Solutions, Inc. (“Consensus”) as described in the Form 10 filed by Consensus with the Securities and Exchange Commission, as if they had occurred prior to the periods presented. Safe Harbor for Forward-looking Statements

3 Some factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements contained in this presentation include, but are not limited to, our ability and intention to: • Manage certain risks inherent to our business, such as costs associated with fraudulent activity, system failure or security breach; effectively maintaining and managing our billing systems; time and resources required to manage our legal proceedings; liability for legal and other claims; or adhering to our internal controls and procedures; • Compete with other similar providers with regard to price, service, functionality; • Achieve business and financial objectives in light of burdensome domestic and international telecommunications, internet or other regulations, including regulations related to data privacy, access, security, retention, and sharing; • Successfully manage our growth, including but not limited to our operational and personnel-related resources, and integration of newly acquired businesses; • Successfully adapt to technological changes and diversify services and related revenues at acceptable levels of financial return; • Successfully develop and protect our intellectual property, both domestically and internationally, including our brands, patents, trademarks and domain names, and avoid infringing upon the proprietary rights of others; • Recruit and retain key personnel; • Realize the expected benefits of the cloud fax spin-off transaction or the sale of the B2B Backup business; and • Other factors set forth in our Annual Report on Form 10-K filed by us on March 15, 2022 with the SEC and the other reports we file from time to time with the SEC. • Sustain growth or profitability, particularly in light of an uncertain U.S. or worldwide economy, including inflation, supply chain and other factors and their related impact on customer acquisition and retention rates, customer usage levels, and credit and debit card payment declines; • Maintain and increase our customer base and average revenue per user; • Generate sufficient cash flow to make interest and debt payments, reinvest in our business, and pursue desired activities and businesses plans while satisfying restrictive covenants relating to debt obligations; • Acquire businesses on acceptable terms and successfully integrate and realize anticipated synergies from such acquisitions; • Continue to expand our businesses and operations internationally in the wake of numerous risks, including adverse currency fluctuations, difficulty in staffing and managing international operations, higher operating costs as a percentage of revenues, or the implementation of adverse regulations; • Maintain our financial position, operating results and cash flows in the event that we incur new or unanticipated costs or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales, value-added and telecommunication taxes; • Accurately estimate the assumptions underlying our effective worldwide tax rate; • Maintain favorable relationships with critical third-party vendors whose financial condition will not negatively impact the services they provide; • Create compelling digital media content causing increased traffic and advertising levels; additional advertisers or an increase in advertising spend; and effectively target digital media advertisements to desired audiences; Risk Factors

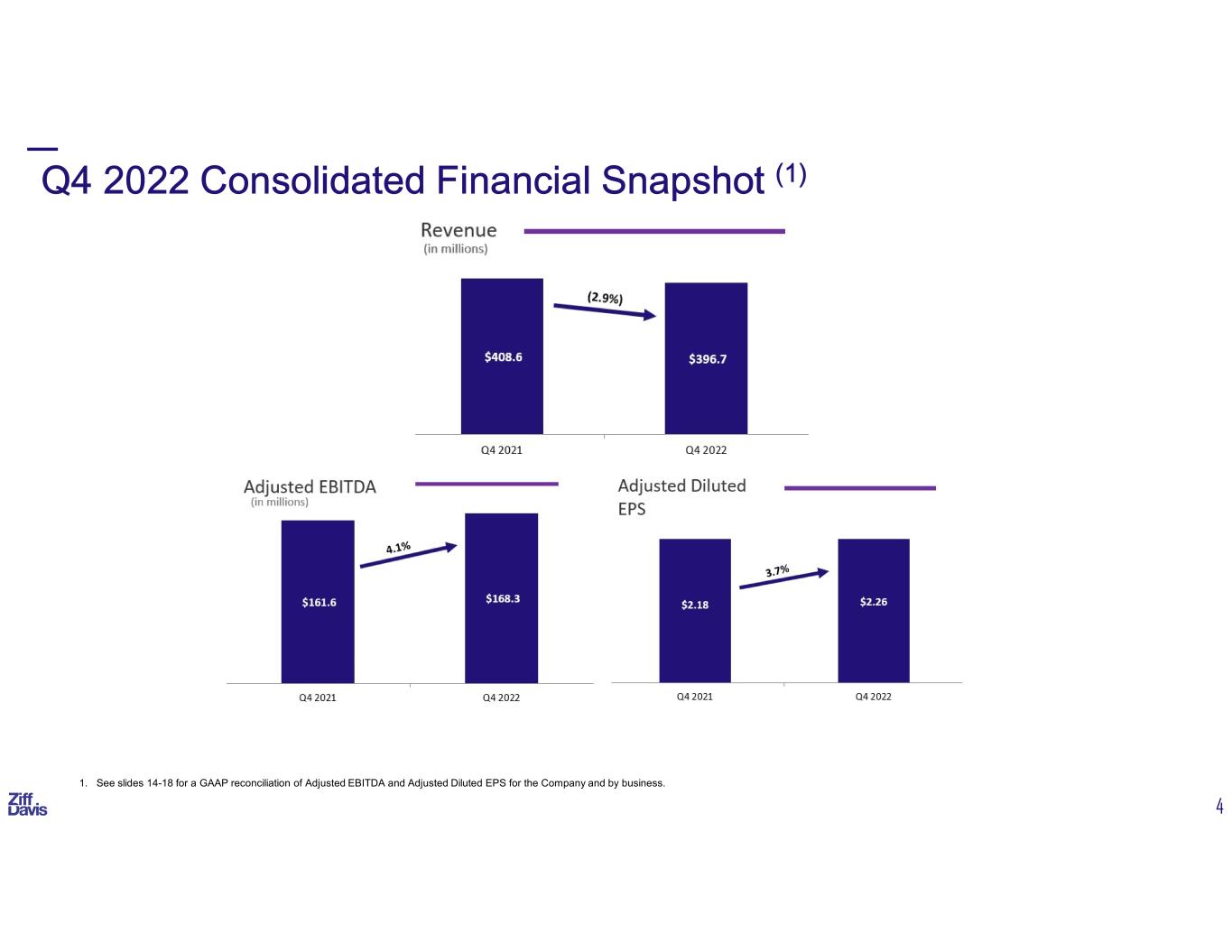

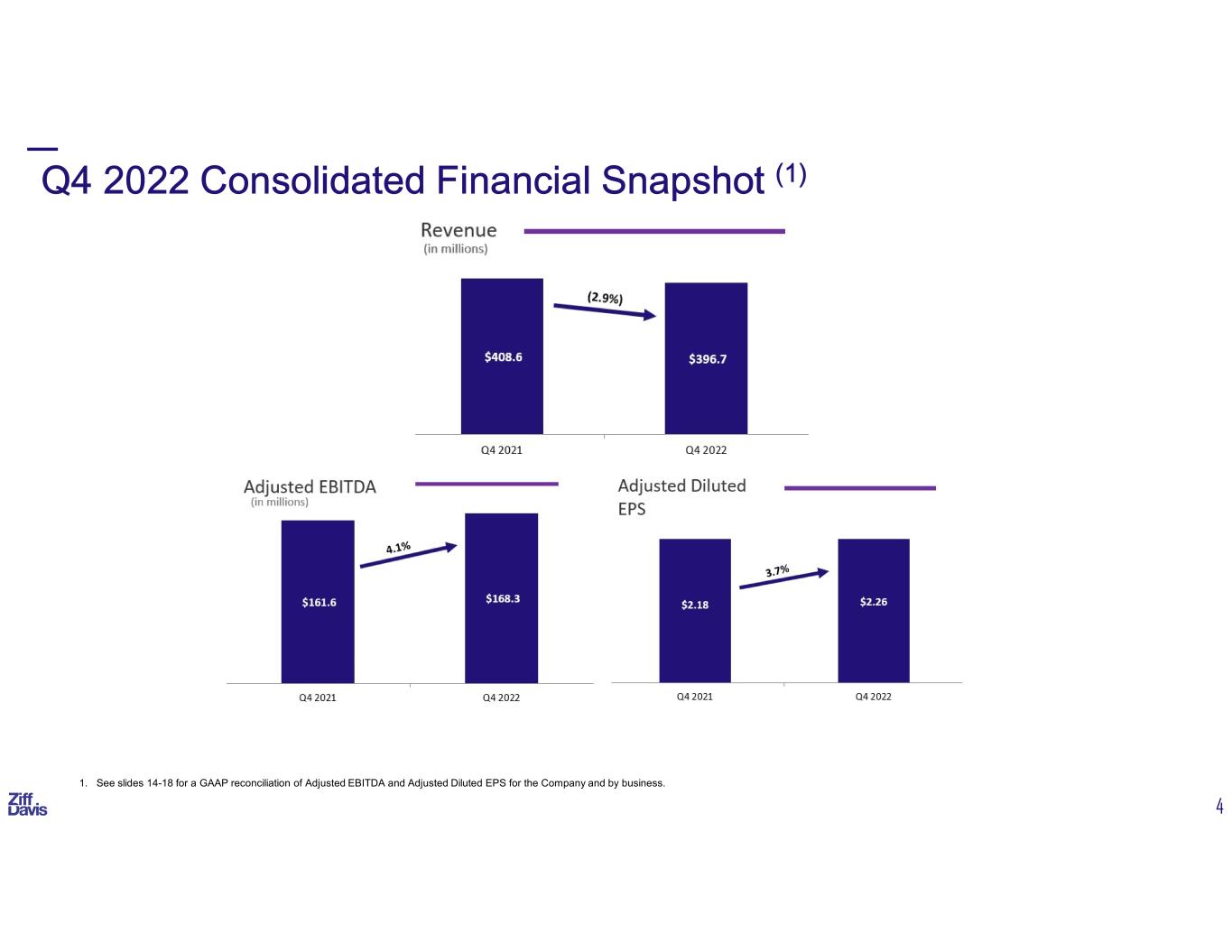

4 Q4 2022 Consolidated Financial Snapshot (1) 1. See slides 14-18 for a GAAP reconciliation of Adjusted EBITDA and Adjusted Diluted EPS for the Company and by business.

5 FY 2022 Consolidated Financial Snapshot (1) 1. See slides 14-18 for a GAAP to non-GAAP reconciliation of Adjusted EBITDA and Adjusted Diluted EPS for the Company and by Business, and Slide 22-23 for key financial results excluding the Divested Businesses.

6 1. Figures exclude any intercompany eliminations; 2021 presentations included the elimination of intercompany revenues. 2. Net Advertising Revenue Retention = (Revenue Recognized by Prior Year Advertisers in Current Year Period (excluding revenue from acquisitions during the stub period)) / (Revenue Recognized by Prior Year Advertisers in Prior Year Period (excluding revenue from acquisitions during the stub period)). Excludes advertisers that generated less than $10,000 of revenue in the measurement period; combined retention is the weighted average net advertising revenue retention of the company. As a result of the aggregation of certain reporting systems related to the integration of several acquisitions, retention data for Q1 2021 and Q2 2021 reflects certain estimates. 3. Excludes advertisers that spent less than $2,500 in the quarter in either the Tech, Shopping, Entertainment or Health & Wellness business units. 4. Total gross quarterly advertising revenues divided by advertisers as defined in footnote (3). Advertising Performance Quarterly Advertising Metrics Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net Revenue Retention (2) 103.7% 111.2% 114.1% 111.9% 106.6% 99.6% 94.1% 92.0% Advertisers (3) 1,705 1,913 1,908 2,198 1,950 2,016 1,953 2,044 Quarterly Revenue per Advertiser (4) $103,981 $103,704 $104,189 $119,932 $87,214 $93,848 $95,710 $118,370 2021 2022

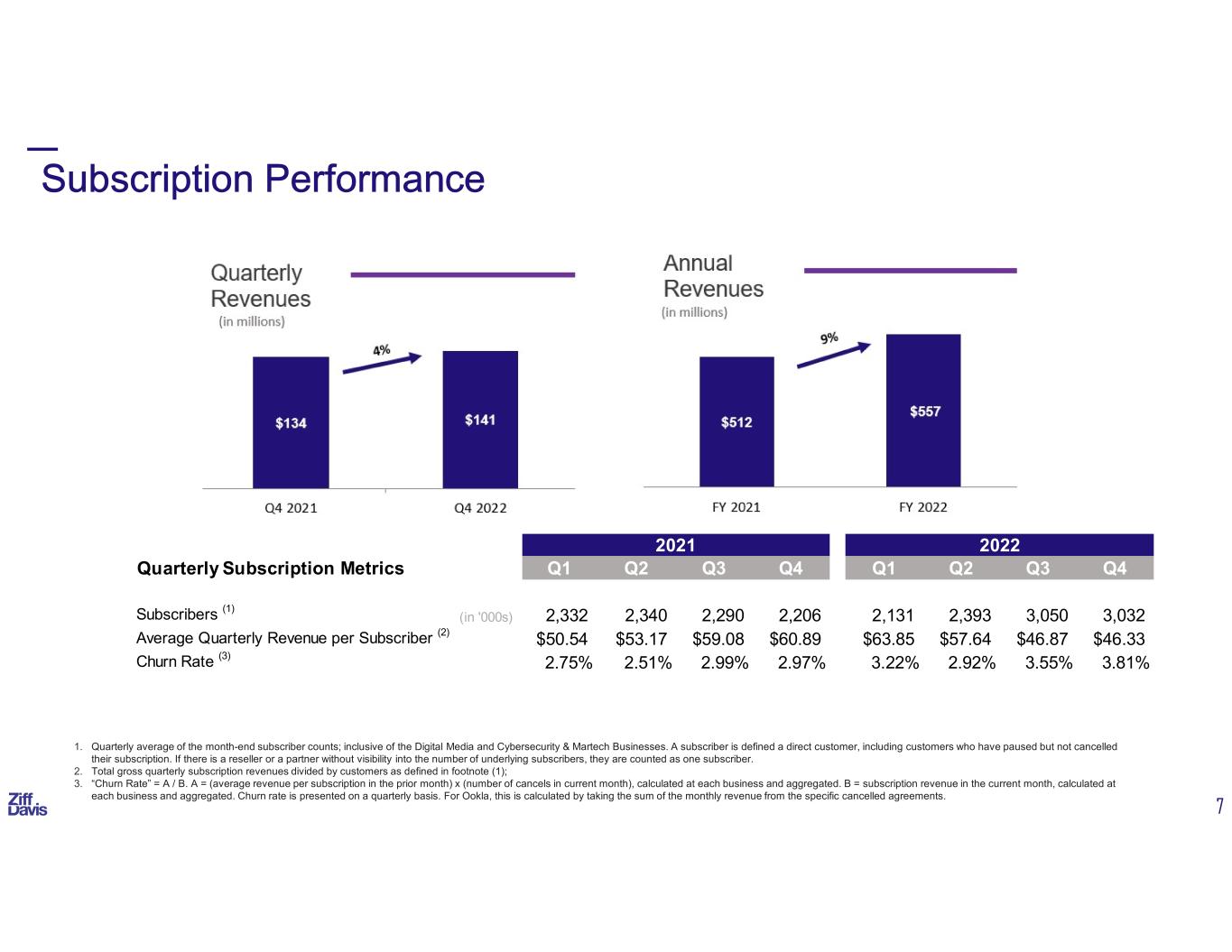

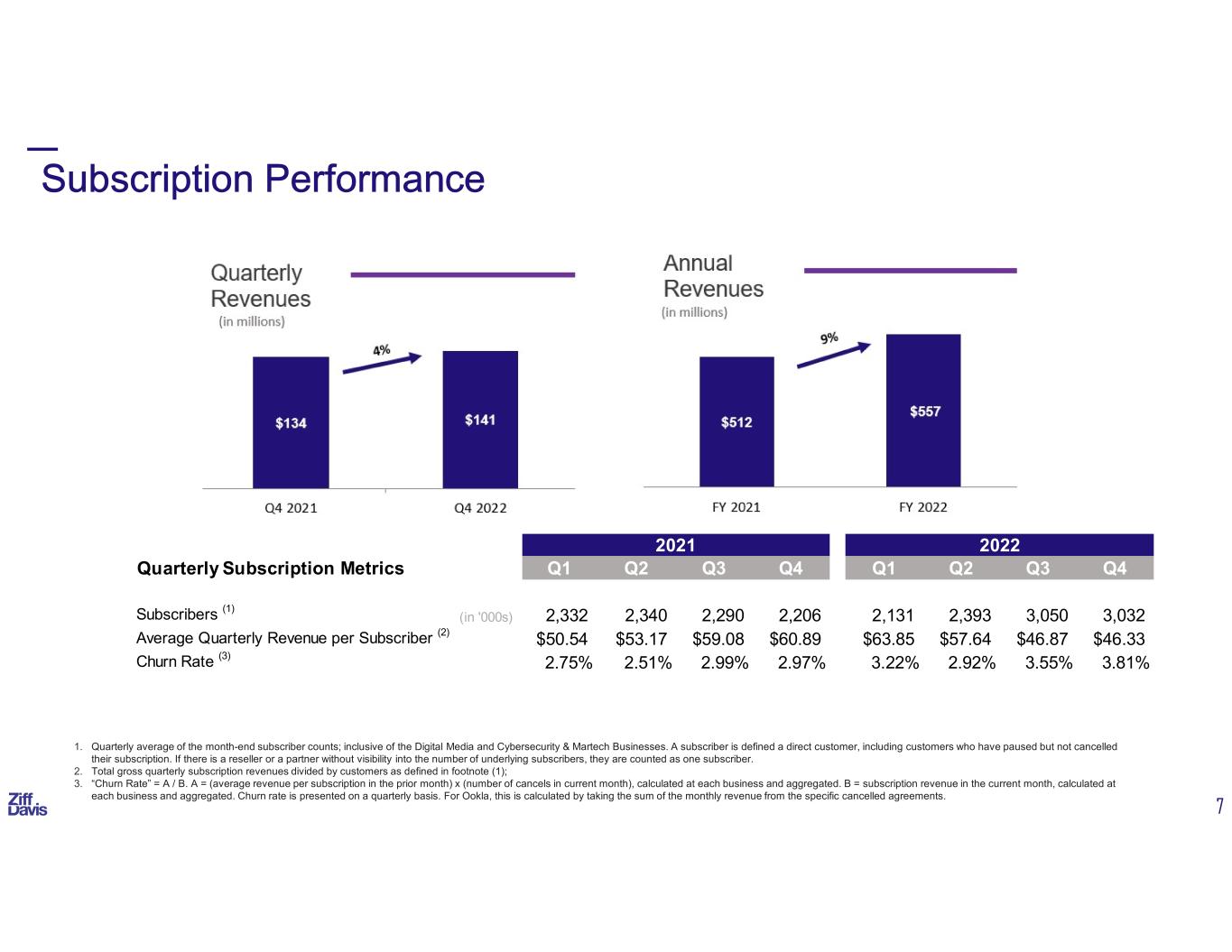

7 1. Quarterly average of the month-end subscriber counts; inclusive of the Digital Media and Cybersecurity & Martech Businesses. A subscriber is defined a direct customer, including customers who have paused but not cancelled their subscription. If there is a reseller or a partner without visibility into the number of underlying subscribers, they are counted as one subscriber. 2. Total gross quarterly subscription revenues divided by customers as defined in footnote (1); 3. “Churn Rate” = A / B. A = (average revenue per subscription in the prior month) x (number of cancels in current month), calculated at each business and aggregated. B = subscription revenue in the current month, calculated at each business and aggregated. Churn rate is presented on a quarterly basis. For Ookla, this is calculated by taking the sum of the monthly revenue from the specific cancelled agreements. Subscription Performance Quarterly Subscription Metrics Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Subscribers (1) (in '000s) 2,332 2,340 2,290 2,206 2,131 2,393 3,050 3,032 Average Quarterly Revenue per Subscriber (2) $50.54 $53.17 $59.08 $60.89 $63.85 $57.64 $46.87 $46.33 Churn Rate (3) 2.75% 2.51% 2.99% 2.97% 3.22% 2.92% 3.55% 3.81% 2021 2022

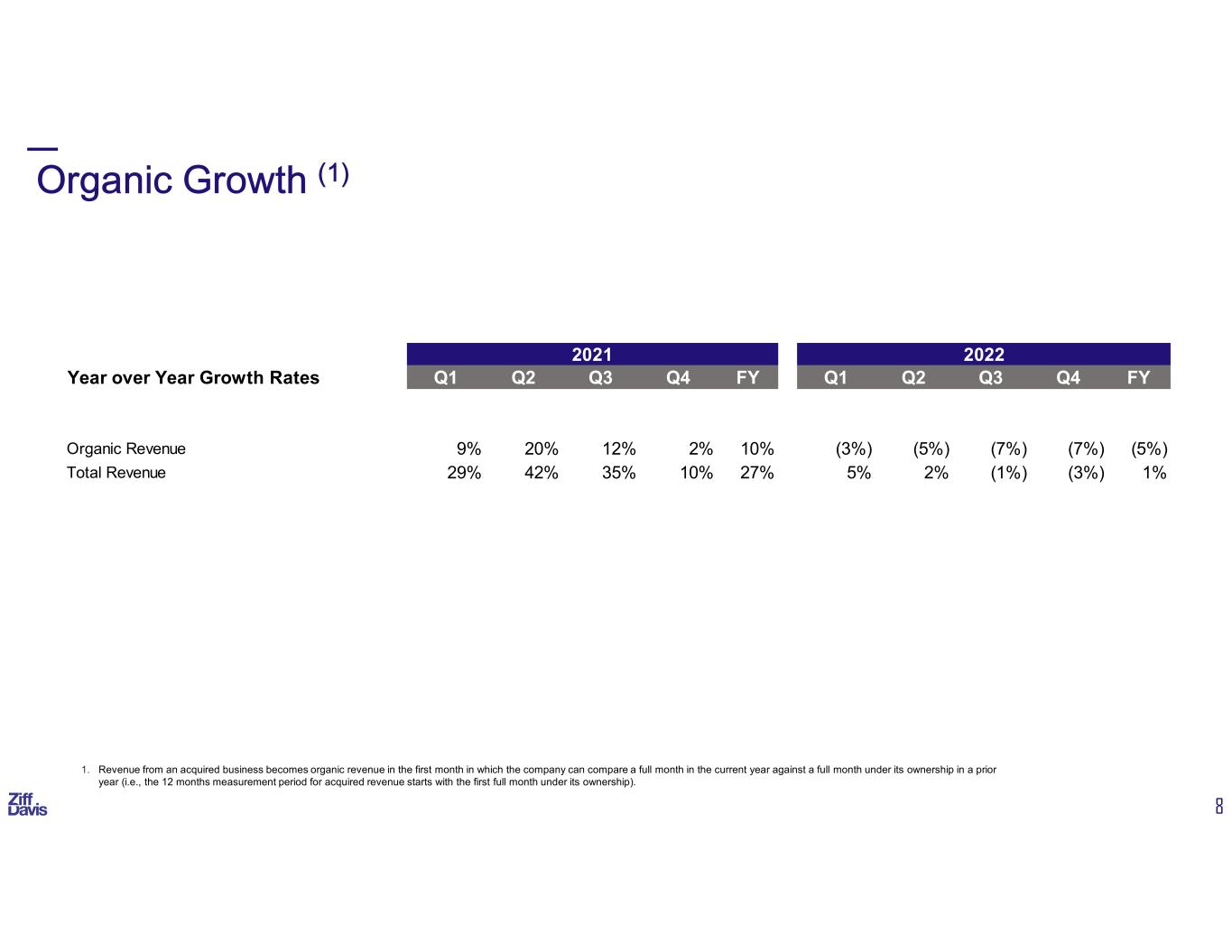

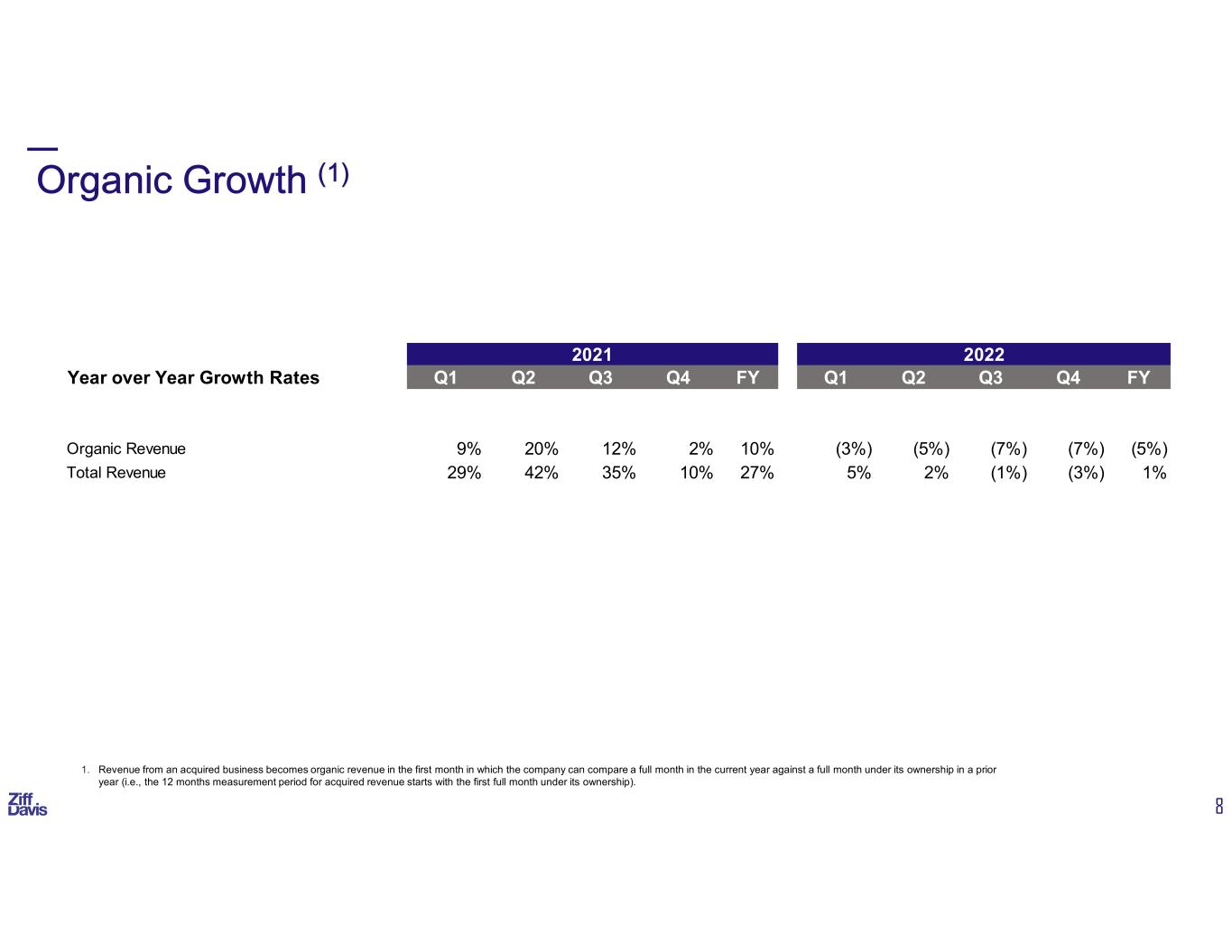

8 1. Revenue from an acquired business becomes organic revenue in the first month in which the company can compare a full month in the current year against a full month under its ownership in a prior year (i.e., the 12 months measurement period for acquired revenue starts with the first full month under its ownership). Organic Growth (1) Year over Year Growth Rates Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Organic Revenue 9% 20% 12% 2% 10% (3%) (5%) (7%) (7%) (5%) Total Revenue 29% 42% 35% 10% 27% 5% 2% (1%) (3%) 1% 2021 2022

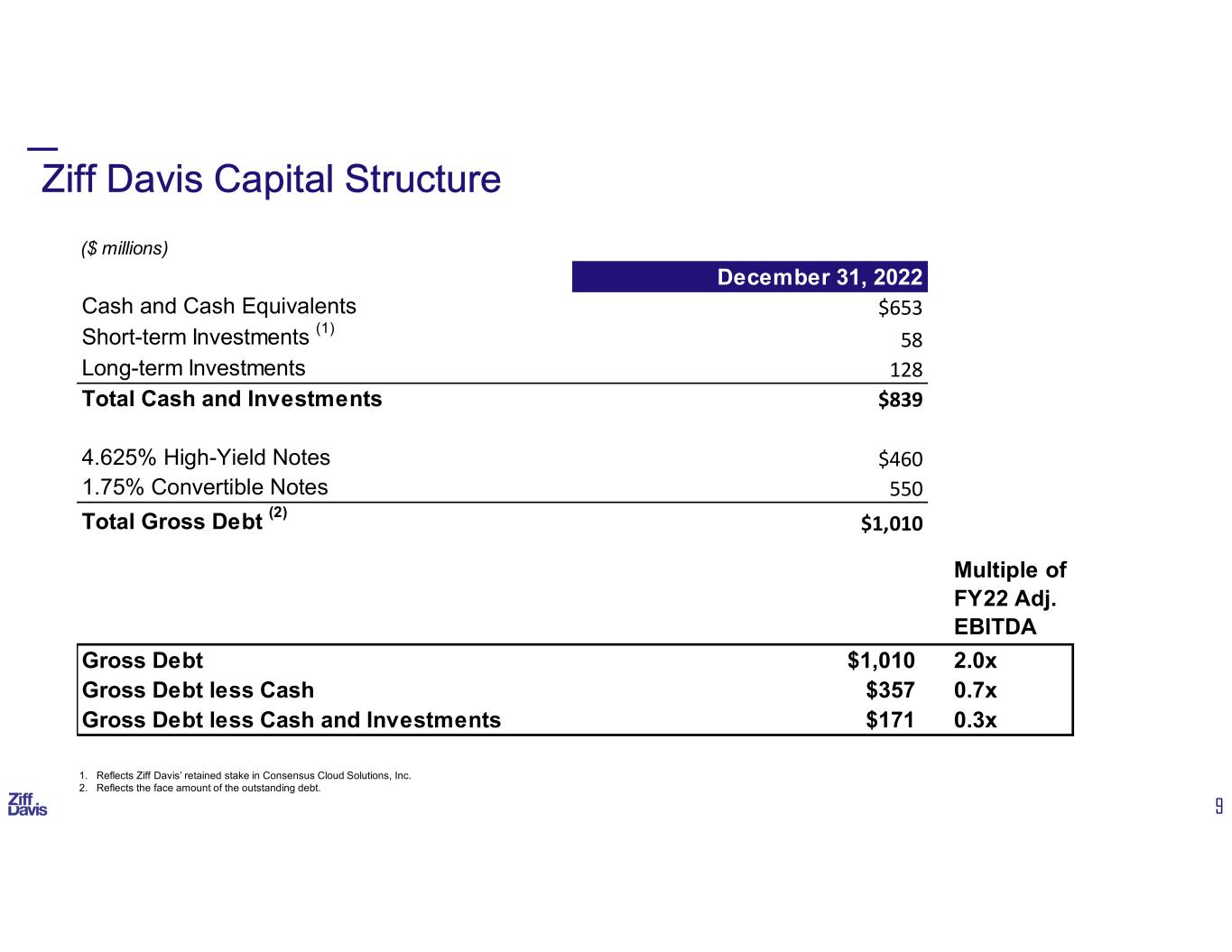

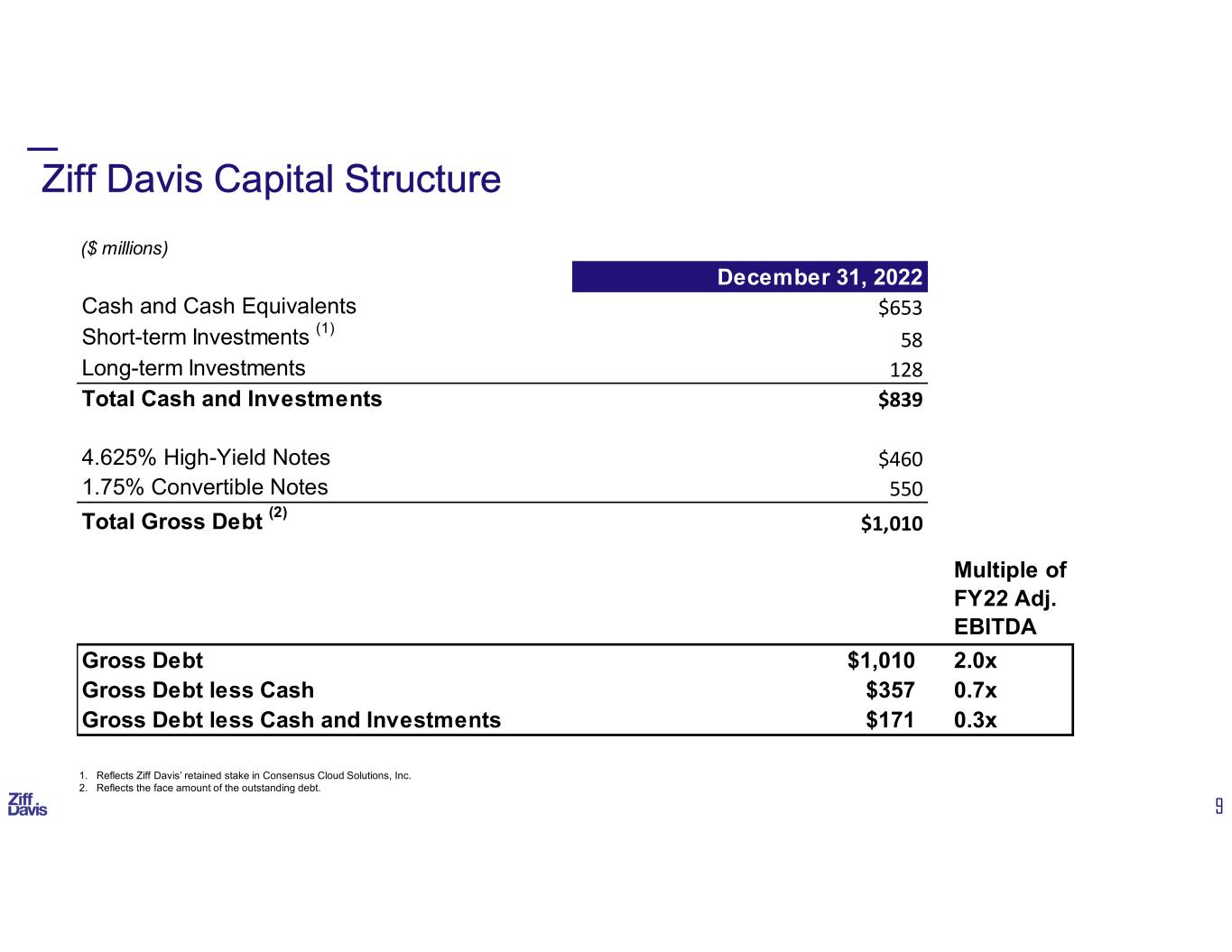

9 Ziff Davis Capital Structure 1. Reflects Ziff Davis’ retained stake in Consensus Cloud Solutions, Inc. 2. Reflects the face amount of the outstanding debt. ($ millions) December 31, 2022 Cash and Cash Equivalents $653 Short-term Investments (1) 58 Long-term Investments 128 Total Cash and Investments $839 4.625% High-Yield Notes $460 1.75% Convertible Notes 550 Total Gross Debt (2) $1,010 Multiple of FY22 Adj. EBITDA Gross Debt $1,010 2.0x Gross Debt less Cash $357 0.7x Gross Debt less Cash and Investments $171 0.3x

2023 FINANCIAL GUIDANCE

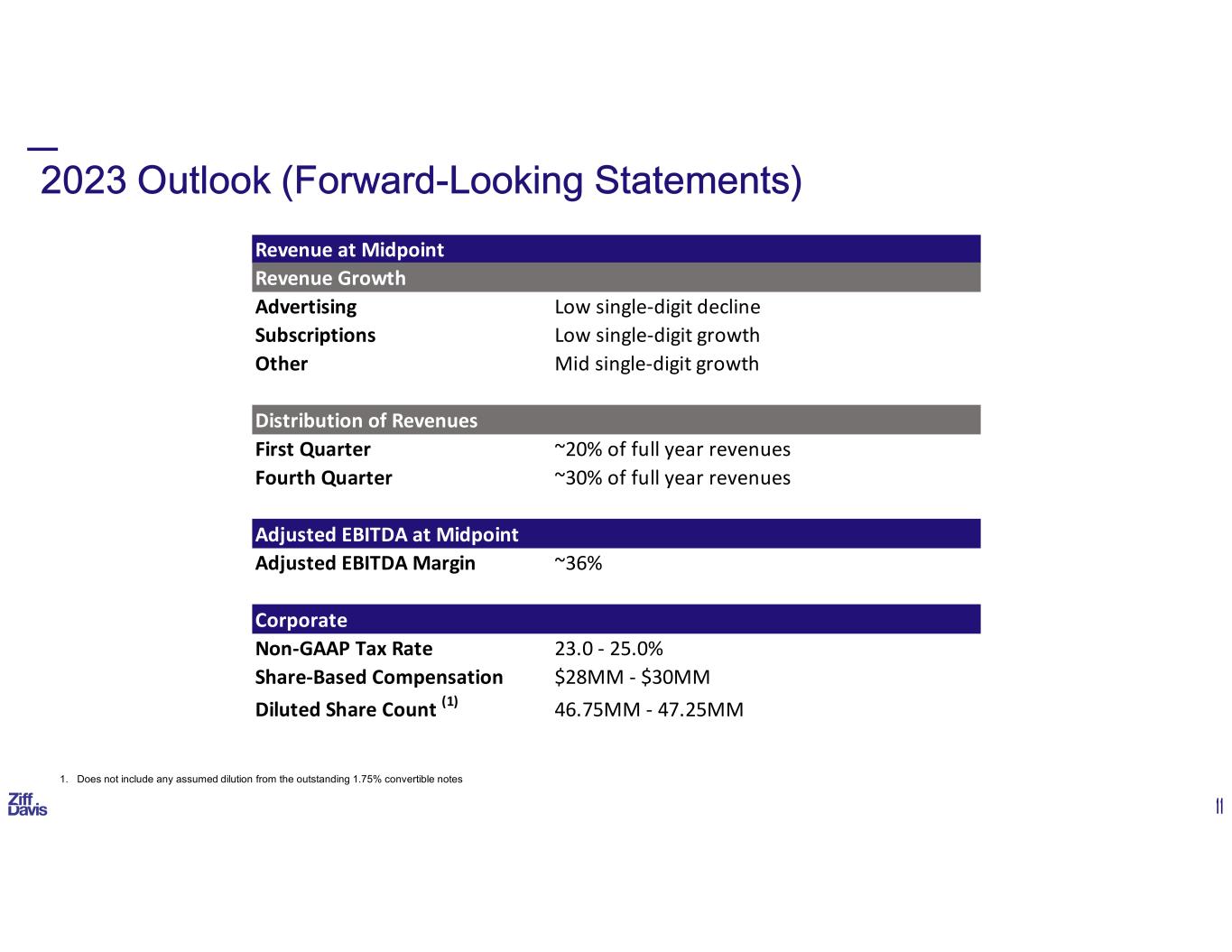

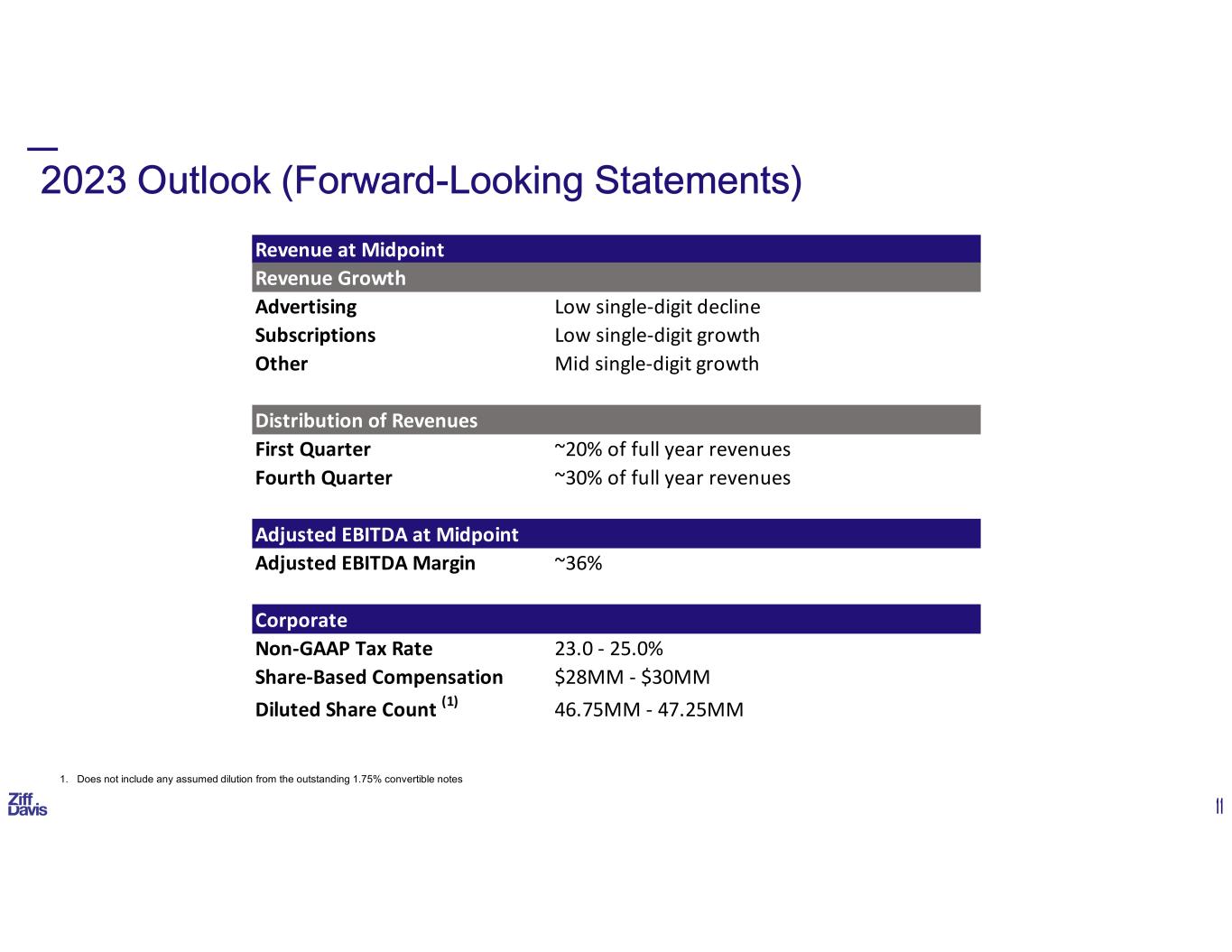

11 2023 Outlook (Forward-Looking Statements) 1. Does not include any assumed dilution from the outstanding 1.75% convertible notes Revenue at Midpoint Revenue Growth Advertising Low single-digit decline Subscriptions Low single-digit growth Other Mid single-digit growth Distribution of Revenues First Quarter ~20% of full year revenues Fourth Quarter ~30% of full year revenues Adjusted EBITDA at Midpoint Adjusted EBITDA Margin ~36% Corporate Non-GAAP Tax Rate 23.0 - 25.0% Share-Based Compensation $28MM - $30MM Diluted Share Count (1) 46.75MM - 47.25MM

12 2023 Guidance (Forward-Looking Statements) 1. Refer to slides 14-18 for examples of adjustments to Adjusted EBITDA and Adjusted Diluted EPS. Our annual guidance of Revenues, Adjusted EBITDA and Adjusted Diluted EPS (1) $ in MM, except for per share amounts Low Midpoint High Midpoint YoY % Increase vs 2022A Revenue $1,350 $1,379 $1,408 (0.9%) Adjusted EBITDA (1) $479 $497 $514 (2.0%) Adjusted Diluted EPS (1) $6.02 $6.28 $6.54 (5.6%) Ziff Davis FY 2023 Guidance Range

SUPPLEMENTAL INFORMATION

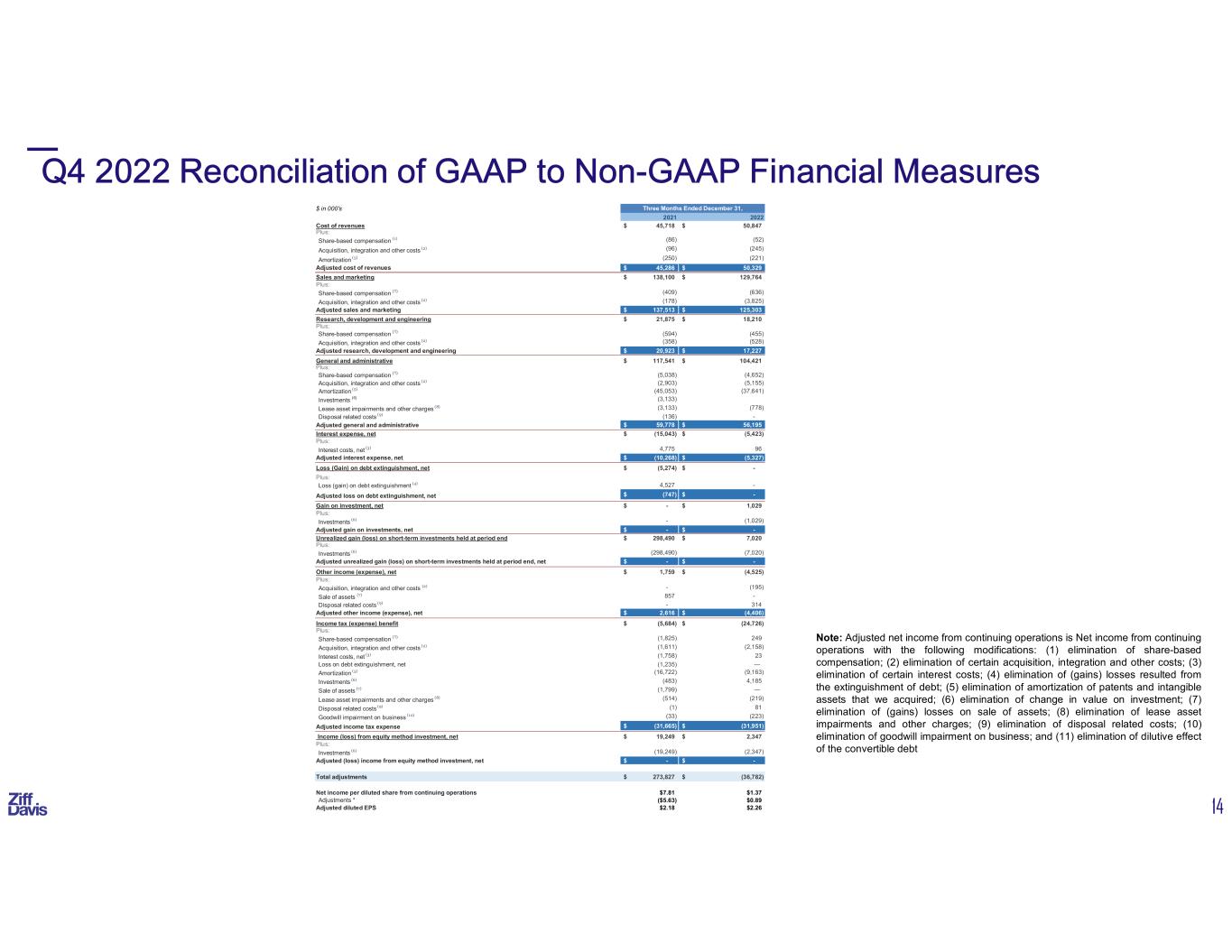

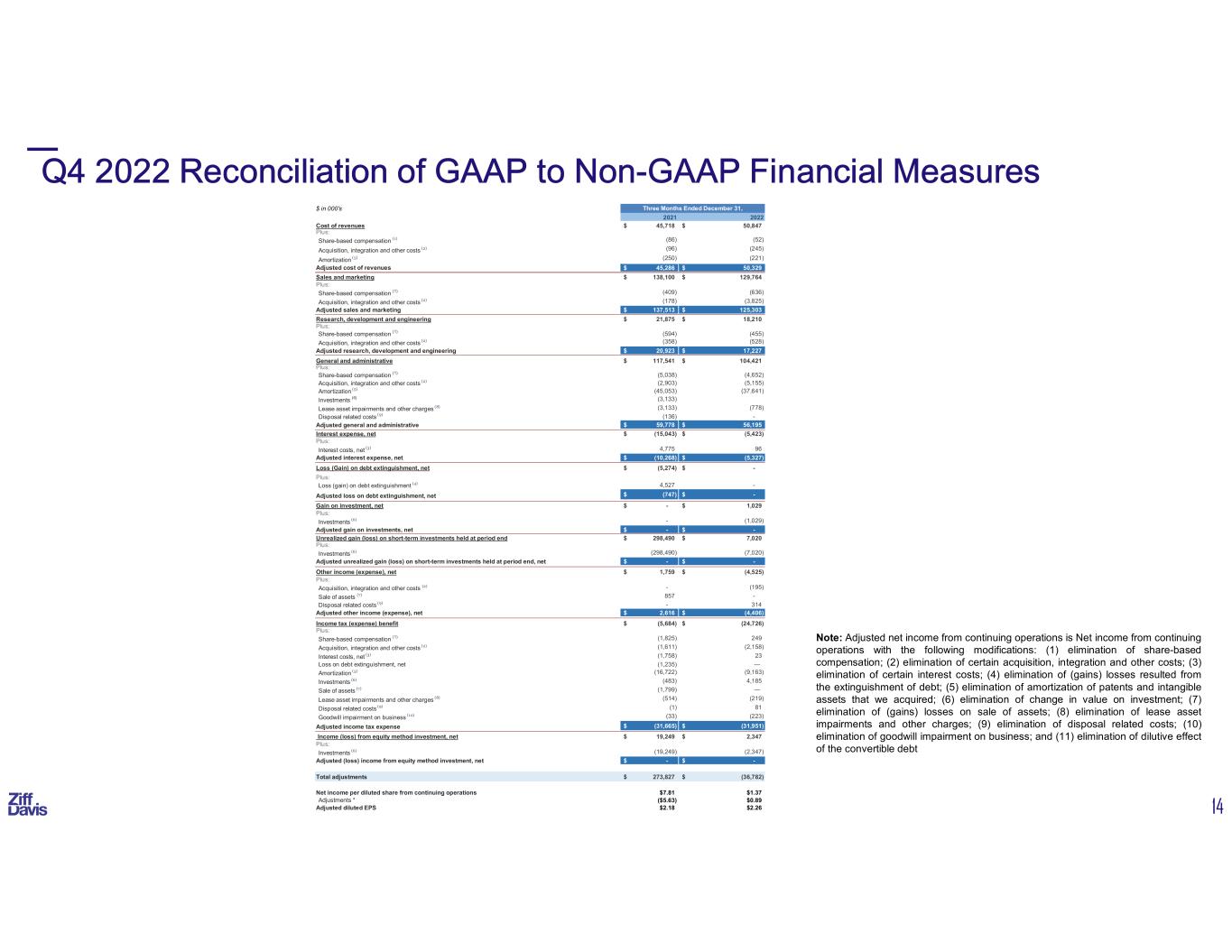

14 Q4 2022 Reconciliation of GAAP to Non-GAAP Financial Measures Note: Adjusted net income from continuing operations is Net income from continuing operations with the following modifications: (1) elimination of share-based compensation; (2) elimination of certain acquisition, integration and other costs; (3) elimination of certain interest costs; (4) elimination of (gains) losses resulted from the extinguishment of debt; (5) elimination of amortization of patents and intangible assets that we acquired; (6) elimination of change in value on investment; (7) elimination of (gains) losses on sale of assets; (8) elimination of lease asset impairments and other charges; (9) elimination of disposal related costs; (10) elimination of goodwill impairment on business; and (11) elimination of dilutive effect of the convertible debt $ in 000's 2021 2022 Cost of revenues 45,718$ 50,847$ Plus: Share-based compensation (1) (86) (52) Acquisition, integration and other costs (2) (96) (245) Amortization (5) (250) (221) Adjusted cost of revenues 45,286$ 50,329$ Sales and marketing 138,100$ 129,764$ Plus: Share-based compensation (1) (409) (636) Acquisition, integration and other costs (2) (178) (3,825) Adjusted sales and marketing 137,513$ 125,303$ Research, development and engineering 21,875$ 18,210$ Plus: Share-based compensation (1) (594) (455) Acquisition, integration and other costs (2) (358) (528) Adjusted research, development and engineering 20,923$ 17,227$ General and administrative 117,541$ 104,421$ Plus: Share-based compensation (1) (5,038) (4,652) Acquisition, integration and other costs (2) (2,903) (5,155) Amortization (5) (45,053) (37,641) Investments (6) (3,133) Lease asset impairments and other charges (8) (3,133) (778) Disposal related costs (9) (136) - Adjusted general and administrative 59,778$ 56,195$ Interest expense, net (15,043)$ (5,423)$ Plus: Interest costs, net (3) 4,775 96 Adjusted interest expense, net (10,268)$ (5,327)$ Loss (Gain) on debt extinguishment, net (5,274)$ -$ Plus: Loss (gain) on debt extinguishment (4) 4,527 - Adjusted loss on debt extinguishment, net (747)$ -$ Gain on investment, net -$ 1,029$ Plus: Investments (6) - (1,029) Adjusted gain on investments, net -$ -$ Unrealized gain (loss) on short-term investments held at period end 298,490$ 7,020$ Plus: Investments (6) (298,490) (7,020) Adjusted unrealized gain (loss) on short-term investments held at period end, net -$ -$ Other income (expense), net 1,759$ (4,525)$ Plus: Acquisition, integration and other costs (2) - (195) Sale of assets (7) 857 - Disposal related costs (9) - 314 Adjusted other income (expense), net 2,616$ (4,406)$ Income tax (expense) benefit (5,684)$ (24,726)$ Plus: Share-based compensation (1) (1,825) 249 Acquisition, integration and other costs (2) (1,611) (2,158) Interest costs, net (3) (1,758) 23 Loss on debt extinguishment, net (1,235) — Amortization (5) (16,722) (9,163) Investments (6) (483) 4,185 Sale of assets (7) (1,799) — Lease asset impairments and other charges (8) (514) (219) Disposal related costs (9) (1) 81 Goodwill impairment on business (10) (33) (223) Adjusted income tax expense (31,665)$ (31,951)$ Income (loss) from equity method investment, net 19,249$ 2,347$ Plus: Investments (6) (19,249) (2,347) Adjusted (loss) income from equity method investment, net -$ -$ Total adjustments 273,827$ (36,782)$ Net income per diluted share from continuing operations $7.81 $1.37 Adjustments * ($5.63) $0.89 Adjusted diluted EPS $2.18 $2.26 Three Months Ended December 31,

15 FY 2022 Reconciliation of GAAP to Non-GAAP Financial Measures Note: Adjusted net income from continuing operations is Net income from continuing operations with the following modifications: (1) elimination of share-based compensation; (2) elimination of certain acquisition, integration and other costs; (3) elimination of certain interest costs; (4) elimination of (gains) losses resulted from the extinguishment of debt; (5) elimination of amortization of patents and intangible assets that we acquired; (6) elimination of change in value on investment; (7) elimination of (gains) losses on sale of assets; (8) elimination of lease asset impairments and other charges; (9) elimination of disposal related costs; (10) elimination of goodwill impairment on business; and (11) elimination of dilutive effect of the convertible debt $ in 000's 2021 2022 Cost of revenues 188,053$ 195,554$ Plus: Share-based compensation (1) (306) (341) Acquisition, integration and other costs (2) (382) (364) Amortization (5) (1,547) (1,000) Adjusted cost of revenues 185,818$ 193,849$ Sales and marketing 493,049$ 490,777$ Plus: Share-based compensation (1) (1,288) (3,083) Acquisition, integration and other costs (2) (1,824) (6,293) Adjusted sales and marketing 489,937$ 481,401$ Research, development and engineering 78,874$ 74,093$ Plus: Share-based compensation (1) (1,984) (2,503) Acquisition, integration and other costs (2) (1,457) (1,199) Adjusted research, development and engineering 75,433$ 70,391$ General and administrative 456,777$ 404,263$ Plus: Share-based compensation (1) (20,551) (20,674) Acquisition, integration and other costs (2) (6,987) (9,570) Amortization (5) (185,855) (156,922) Investments (6) (1,500) - Lease asset impairments and other charges (8) (12,860) (2,178) Disposal related costs (9) (607) (1,328) Adjusted general and administrative 228,417$ 213,591$ Goodwill impairment on business 32,629$ 27,369$ Plus: Goodwill impairment on business (10) (32,629) (27,369) Adjusted goodwill impairment on business -$ -$ Interest expense, net (72,023)$ (33,842)$ Plus: Interest costs, net (3) 21,278 433 Adjusted interest expense, net (50,745)$ (33,409)$ Loss (Gain) on debt extinguishment, net (5,274)$ 11,505$ Plus: Loss (gain) on debt extinguishment (4) 4,527 (12,060) Adjusted loss on debt extinguishment, net (747)$ (555)$ Gain on sale of businesses (21,798)$ -$ Plus: Sale of assets (7) 21,798 - Adjusted gain on sale of businesses -$ -$ Gain on investment, net (16,677)$ (46,743)$ Plus: Investments (6) 16,677 46,743 Adjusted gain on investments, net -$ -$ Unrealized gain (loss) on short-term investments held at period end 298,490$ (7,145)$ Plus: Investments (6) (298,490) 7,145 Adjusted unrealized gain (loss) on short-term investments held at period end, net -$ -$ Other income (expense), net 1,293$ 8,437$ Plus: Acquisition, integration and other costs (2) - (195) Sale of assets (7) 857 - Disposal related costs (9) - 203 Adjusted other income (expense), net 2,150$ 7,821$ Income tax (expense) benefit 14,199$ (57,957)$ Plus: Share-based compensation (1) (8,619) (3,392) Acquisition, integration and other costs (2) (3,978) (3,954) Interest costs, net (3) (5,802) (60) Loss on debt extinguishment, net (1,234) 2,967 Amortization (5) (60,144) (38,752) Investments (6) (5,572) 15,686 Sale of assets (7) (7,193) - Lease asset impairments and other charges (8) (3,527) (538) Disposal related costs (9) (200) (81) Goodwill impairment on business (10) (8,027) (6,956) Adjusted income tax expense (90,097)$ (93,037)$ Income (loss) from equity method investment, net 35,845$ (7,730)$ Plus: Investments (6) (35,845) 7,730 Adjusted (loss) income from equity method investment, net -$ -$ Total adjustments 103,717$ (247,119)$ Net income per diluted share from continuing operations $8.38 $1.39 Adjustments * ($1.94) $5.26 Adjusted diluted EPS $6.44 $6.65 Year ended December 31,

16 GAAP Reconciliation – Free Cash Flow (1)(2) 1. Free cash flow from continuing and discontinued operations is defined as net cash provided by operating activities from continuing and discontinued operations, less purchases of property and equipment from continuing operations, plus contingent consideration from continuing and discontinued operations. 2. 2021 figures include the contribution from Consensus and the divested B2B Backup and Voice UK assets. $ in 000's Ziff Davis 2021 2022 2021 2022 Net cash provided by operating activities from continuing and discontinued operations 86,284$ 43,225$ 516,536$ 336,444$ Less: Purchases of property and equipment (26,245) (25,387) (113,740) (106,154) Add: Contingent consideration - - 685 - Free cash flow from continuing and discontinued operations (2) 60,039$ 17,838$ 403,481$ 230,290$ Three Months Ended December 31, Year Ended December 31,

17 GAAP Reconciliation – Adjusted EBITDA $ in 000's Ziff Davis 2021 2022 2021 2022 Net income from continuing operations 378,891$ 69,180$ 401,395$ 65,466$ Plus: Interest expense, net 15,043 5,423 72,023 33,842 Loss (gain) on debt extinguishment, net 5,274 - 5,274 (11,505) Loss on sale of businesses - - 21,798 - Unrealized (gain) loss on short-term investments held at the reporting date (298,490) (7,020) (298,490) 7,145 (Gain) loss on investments, net - (1,029) 16,677 46,743 Other (income) loss, net (1,759) 4,525 (1,293) (8,437) Income tax expense (benefit) 5,684 24,726 (14,199) 57,957 Loss (income) from equity method investment, net (19,249) (2,347) (35,845) 7,730 Depreciation and amortization 61,791 58,520 249,292 233,400 Reconciliation of GAAP to Non-GAAP financial measures: Share-based compensation 6,127 5,795 24,129 26,601 Acquisition-related integration costs 3,535 9,753 10,650 17,426 Lease Impairments and other charges 3,133 778 12,860 2,178 Investments 1,500 - 1,500 - Disposal related costs 135 - 606 1,328 Goodwill impairment on business - - 32,629 27,369 Adjusted EBITDA 161,615$ 168,304$ 499,006$ 507,243$ Three Months Ended December 31, Year Ended December 31,

18 NOTE: Table above excludes certain intercompany allocations Q4 2022 Reconciliation of GAAP to Adjusted EBITDA $ in 000's Revenues Revenues 321,670$ 75,030$ -$ 396,700$ Operating profit Income (loss) from operations 95,015$ 11,554$ (13,111)$ 93,458$ Non-GAAP adjustments: Share-based compensation 2,225 563 3,007 5,795 Acquisition, integration, and other costs 7,784 1,179 790 9,753 Amortization 29,731 8,121 10 37,862 Lease asset impairments and other charges 791 (13) - 778 Adjusted operating profit (loss) 135,546 21,404 (9,304) 147,646 Depreciation 16,630 4,028 - 20,658 Adjusted EBITDA 152,176$ 25,432$ (9,304)$ 168,304$ Digital Media Cybersecurity and Martech Corporate Total

19 NOTE: Table above excludes certain intercompany allocations Q4 2021 Reconciliation of GAAP to Adjusted EBITDA $ in 000's Revenues Revenues 325,747$ 82,881$ -$ 408,628$ Operating profit Income (loss) from operations 92,422$ 9,492$ (16,520)$ 85,394$ Non-GAAP adjustments: Share-based compensation 2,178 1,227 2,722 6,127 Acquisition, integration, and other costs 855 1,473 1,207 3,535 Amortization 32,746 12,486 71 45,303 Lease asset impairments and other charges 3,666 (533) - 3,133 Investments - - 1,500 1,500 Disposal related costs - 84 51 135 Adjusted operating profit (loss) 131,867$ 24,229$ (10,969)$ 145,127$ Depreciation 13,597 2,636 255 16,488 Adjusted EBITDA 145,464$ 26,865$ (10,714)$ 161,615$ Digital Media Cybersecurity and Martech Corporate Total

20 NOTE: Table above excludes certain intercompany allocations FY 2022 Reconciliation of GAAP to Adjusted EBITDA $ in 000's Revenues Revenues 1,078,391$ 312,606$ -$ 1,390,997$ Operating profit Income (loss) from operations 198,171$ 50,960$ (50,190)$ 198,941$ Non-GAAP adjustments: Share-based compensation 10,433 4,280 11,888 26,601 Acquisition related integration costs 14,121 2,111 1,194 17,426 Amortization 122,869 35,025 28 157,922 Lease asset impairments and other charges 1,631 547 - 2,178 Disposal related costs 11 - 1,317 1,328 Goodwill impairment on business 27,369 - - 27,369 Adjusted operating profit (loss) 374,605$ 92,923$ (35,763)$ 431,765$ Depreciation 61,789 13,689 - 75,478 Adjusted EBITDA 436,394$ 106,612$ (35,763)$ 507,243$ Corporate TotalDigital Media Cybersecurity and Martech

21 FY 2021 Reconciliation of GAAP to Adjusted EBITDA NOTE: Table above excludes certain intercompany allocations $ in 000's Revenues Revenues 1,068,476$ 348,246$ -$ 1,416,722$ Operating profit Income (loss) from operations 216,950$ 10,769$ (60,379)$ 167,340$ Non-GAAP adjustments: Share-based compensation 7,734 4,481 11,914 24,129 Acquisition related integration costs 3,449 5,968 1,233 10,650 Amortization 144,621 42,493 288 187,402 Lease asset impairments and other charges 12,229 631 - 12,860 Investments - 1,500 1,500 Disposal related costs - 84 522 606 Goodwill impairment on a business - 32,629 - 32,629 Adjusted operating profit (loss) 384,983$ 97,055$ (44,922)$ 437,116$ Depreciation 49,151 12,484 255 61,890 Adjusted EBITDA 434,134$ 109,539$ (44,667)$ 499,006$ Digital Media Cybersecurity and Martech Corporate Total

22 Quarterly Adjusted Income Statement Excluding the Divested Businesses $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Advertising 177,288$ 198,385$ 198,794$ 263,608$ 170,067$ 189,198$ 186,921$ 241,949$ Subscriptions 117,937 124,591 135,488 134,451 136,070 137,811 142,972 140,467 Other 3,961 7,293 11,625 10,992 9,184 10,601 12,195 14,363 Less : Intercompany Eliminations (118) (292) (356) (423) (253) (254) (215) (79) Adjusted Revenues 299,068$ 329,977$ 345,551$ 408,628$ 315,068$ 337,356$ 341,873$ 396,700$ Cost of Revenues 37,906 44,306 45,797 45,286 45,687 45,599 52,233 50,329 Sales and Marketing 105,048 118,479 124,178 137,513 116,503 121,014 118,580 125,303 Research, Development and Engineering 18,679 16,764 18,319 20,923 17,580 18,675 16,910 17,227 General and Administrative 55,776 53,253 57,532 59,778 52,078 52,002 53,315 56,195 Adjusted Operating Income 81,659$ 97,175$ 99,725$ 145,128$ 83,220$ 100,066$ 100,835$ 147,646$ Add: Depreciation 14,244 14,899 15,613 16,487 17,568 17,971 19,279 20,658 Adjusted EBITDA 95,903$ 112,074$ 115,338$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ Adjusted Net Income from continuing operations 53,066 63,230 66,085 105,064 57,928 74,425 74,269 105,963 Adjusted Diluted EPS excluding Divested Businesses $1.19 $1.41 $1.40 $2.18 $1.23 $1.58 $1.58 $2.26

23 Reconciliation of Financial Results Excluding the Divested Businesses $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Revenues Stated Revenues 311,657$ 341,293$ 355,144$ 408,628$ 315,068$ 337,356$ 341,873$ 396,700$ Adjustments (12,589) (11,316) (9,593) - - - - - Total Adjusted Revenues 299,068$ 329,977$ 345,551$ 408,628$ 315,068$ 337,356$ 341,873$ 396,700$ Cost of Revenues Stated Cost of Revenues 43,137$ 48,333$ 49,062$ 45,286$ 45,685$ 45,599$ 52,233$ 50,329$ Adjustments (5,231) (4,027) (3,265) - - - - - Total Adjusted Cost of Revenues 37,906$ 44,306$ 45,797$ 45,286$ 45,685$ 45,599$ 52,233$ 50,329$ Sales and Marketing Stated Sales and Marketing 106,848$ 120,166$ 125,410$ 137,513$ 116,503$ 121,014$ 118,580$ 125,303$ Adjustments (1,800) (1,687) (1,232) - - - - - Total Adjusted Sales and Marketing 105,048$ 118,479$ 124,178$ 137,513$ 116,503$ 121,014$ 118,580$ 125,303$ Research, Development and Engineering Stated Research, Development and Engineering 18,933$ 17,041$ 18,534$ 20,923$ 17,580$ 18,675$ 16,910$ 17,227$ Adjustments (254) (277) (215) - - - - - Total Adjusted Research, Development and Engineering 18,679$ 16,764$ 18,319$ 20,923$ 17,580$ 18,675$ 16,910$ 17,227$ General and Administrative Stated General and Administrative 56,903$ 53,671$ 58,067$ 59,778$ 52,078$ 52,002$ 53,315$ 56,195$ Adjustments (1,127) (418) (535) - - - - - Total Adjusted General and Administrative 55,776$ 53,253$ 57,532$ 59,778$ 52,078$ 52,002$ 53,315$ 56,195$ Adjusted EBITDA Stated Adjusted EBITDA 100,705$ 116,977$ 119,709$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ Adjustments (4,802) (4,903) (4,371) - - - - - Total Adjusted EBITDA 95,903$ 112,074$ 115,338$ 161,615$ 100,788$ 118,037$ 120,114$ 168,304$ Diluted EPS Stated Adjusted Non-GAAP Net Income per Diluted EPS 1.24$ 1.50$ 1.49$ 2.18$ 1.23$ 1.58$ 1.58$ 2.26$ Adjustments (0.05) (0.09) (0.09) - - - - - Total Adjusted Diluted EPS 1.19$ 1.41$ 1.40$ 2.18$ 1.23$ 1.58$ 1.58$ 2.26$