www.ziffdavis.com©2025 Ziff Davis. All rights reserved. FOURTH QUARTER AND FULL YEAR 2024 RESULTS February 24, 2025 Exhibit 99.2

2 Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2025 financial guidance. These forward-looking statements are based on management’s current expectations or beliefs as of February 24, 2025 (“Release Date”) and are subject to numerous assumptions, risks, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These factors and uncertainties include, among other items: the Company’s ability to grow advertising, licensing, and subscription revenues, profitability, and cash flows, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of economic downturn or recession; the Company’s ability to make interest and debt payments; the Company’s ability to identify, close, and successfully transition acquisitions; customer growth and retention; the Company’s ability to create compelling content; our reliance on third-party platforms; the threat of content piracy and developments related to artificial intelligence; increased competition and rapid technological changes; variability of the Company’s revenue based on changing conditions in particular industries and the economy generally; protection of the Company’s proprietary technology or infringement by the Company of intellectual property of others; the risk of losing critical third-party vendors or key personnel; the risks associated with fraudulent activity, system failure, or a security breach; risks related to our ability to adhere to our internal controls and procedures; the risk of adverse changes in the U.S. or international regulatory environments, including but not limited to the imposition or increase of taxes or regulatory-related fees; the risks related to supply chain disruptions, inflationary conditions, and rising interest rates; the risk of liability for legal and other claims; and the numerous other factors set forth in the Company’s filings with the Securities and Exchange Commission (“SEC”). For a more detailed description of the risk factors and uncertainties affecting the Company, refer to our most recent Annual Report on Form 10-K and the other reports filed by the Company from time-to-time with the SEC, each of which is available at www.sec.gov. The forward-looking statements provided in this presentation, including those regarding our 2025 financial guidance, are based on limited information available to the Company as of the Release Date and are subject to change. Although management’s expectations may change after the Release Date, the Company undertakes no obligation to revise or update these statements. All information in this presentation speaks as of the Release Date and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. Capitalized terms not otherwise defined in this presentation have the meanings set forth in the Company’s earnings press release issued on the Release Date. Third-Party Information Any third-party trademarks, including names, logos and brands, referenced by the Company in this presentation are property of their respective owners. Any references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law. Industry, Market and Other Data Certain information that may be contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Non-GAAP Financial information Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") and are not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The non-GAAP measures, as defined by Ziff Davis, may not be comparable to similar non-GAAP measures presented by other companies, limiting their usefulness for comparison purposes. The presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that Ziff Davis’ future results or leverage will be unaffected by other unusual or non-recurring items. Please see the "Supplemental Information" to this presentation for details related to how we define these non-GAAP measures and reconciliations thereof to the most directly comparable GAAP measures. We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results or, in certain cases, may be non-cash in nature. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making, (2) certain measures are used to determine the amount of annual incentive compensation paid to our named executive officers, and (3) they are used by the analyst community to help them analyze the health of our business. Safe Harbor for Forward-looking Statements

3 Some factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements contained in this presentation include, but are not limited to, our ability and intention to: • Manage certain risks inherent to our business, such as costs associated with fraudulent activity, system failure, or security breach; effectively maintaining and managing our billing systems; the time and resources required to manage our legal proceedings; liability for legal and other claims; or adhering to our internal controls and procedures; • Compete with other similar providers with regard to price, service, functionality; • Achieve business and financial objectives in light of burdensome domestic and international laws and regulations, including those related to data privacy, access, security, retention, and sharing; • Successfully adapt to technological changes and diversify services and related revenues at acceptable levels of financial return; • Successfully develop and protect our intellectual property, both domestically and internationally, including our brands, content, copyrights, patents, trademarks, and domain names from infringement by third parties, and avoid infringing upon the proprietary rights of others; • Manage certain risks associated with environmental, social, and governmental matters, including related reporting obligations, that could adversely affect our reputation and performance; • Recruit and retain key personnel and maintain the beneficial aspects of our corporate culture globally; • Meet our publicly announced guidance or other expectations about our business and future operating results; and • Respond to other factors set forth in our most recent Annual Report on Form 10-K filed by us with the SEC and the other reports we file from time to time with the SEC. • Sustain growth or profitability, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of an economic downturn or recession, continuing inflation, supply chain disruptions, and other factors and their related impacts on customer acquisition and retention rates, customer usage levels, and credit and debit card payment declines; • Maintain and increase our customer base and average revenue per customer; • Generate sufficient cash flow to make interest and debt payments, reinvest in our business, and pursue desired activities and businesses plans while satisfying restrictive covenants relating to debt obligations; • Acquire businesses on acceptable terms, execute on our investment strategies, successfully manage our growth, and integrate and realize anticipated synergies from such acquisitions; • Continue to expand our businesses and operations internationally in the wake of numerous risks, including adverse currency fluctuations, difficulty in staffing and managing international operations, higher operating costs as a percentage of revenues, or the implementation of adverse regulations; • Maintain our financial position, operating results and cash flows in the event that we incur new or unanticipated costs or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales, value-added, and telecommunication taxes; • Manage certain risks related to the unauthorized use of our content and the infringement of our intellectual property rights by developers and users of generative artificial intelligence ("AI"); • Prevent system failures, security breaches, and other technological issues; • Accurately estimate the assumptions underlying our effective worldwide tax rate; • Maintain favorable relationships with critical third-party vendors that are financially stable; • Create compelling digital media content facilitating increased traffic and advertising levels and additional advertisers or an increase in advertising spend, and effectively target digital media advertisements to desired audiences; Risk Factors

4 New Reportable Segments

5 Adjusted Revenues by Segment (1) $ in 000's Years ended December 31, 2020 2021 2022 2023 2024 CAGR (2020-2024) Technology & Shopping $ 283,380 $ 439,606 $ 384,929 $ 330,557 $ 361,882 6.3% % Growth 55.1 % (12.4) % (14.1) % 9.5 % Gaming & Entertainment 152,619 162,764 166,325 168,821 180,276 4.3% % Growth 6.6 % 2.2 % 1.5 % 6.8 % Health & Wellness 257,854 312,407 335,883 361,923 362,408 8.9% % Growth 21.2 % 7.5 % 7.8 % 0.1 % Connectivity 117,277 153,699 191,254 211,518 213,620 16.2% % Growth 31.1 % 24.4 % 10.6 % 1.0 % Cybersecurity & Martech (2) 279,553 314,750 312,606 291,209 283,502 0.4% % Growth 12.6 % (0.7) % (6.8) % (2.6) % Total (2) $ 1,090,683 $ 1,383,226 $ 1,390,997 $ 1,364,028 $ 1,401,688 6.5% % Growth 26.8 % 0.6 % (1.9) % 2.8 % 1. Following changes to our internal reporting structure, the Company concluded that it has five operating segments, which are now presented as five reportable segments: 1) Technology & Shopping, 2) Gaming & Entertainment, 3) Health & Wellness, 4) Connectivity, and 5) Cybersecurity & Martech. Prior period segment information is presented on a comparable basis to conform to this new segment presentation with no effect on previously reported consolidated results. 2. Amounts presented above for Cybersecurity & Martech and Total revenues in 2020 and 2021 are non-GAAP measures as they exclude revenues associated with certain divested businesses. Refer to the "Supplemental Information" for reconciliations to the GAAP revenues.

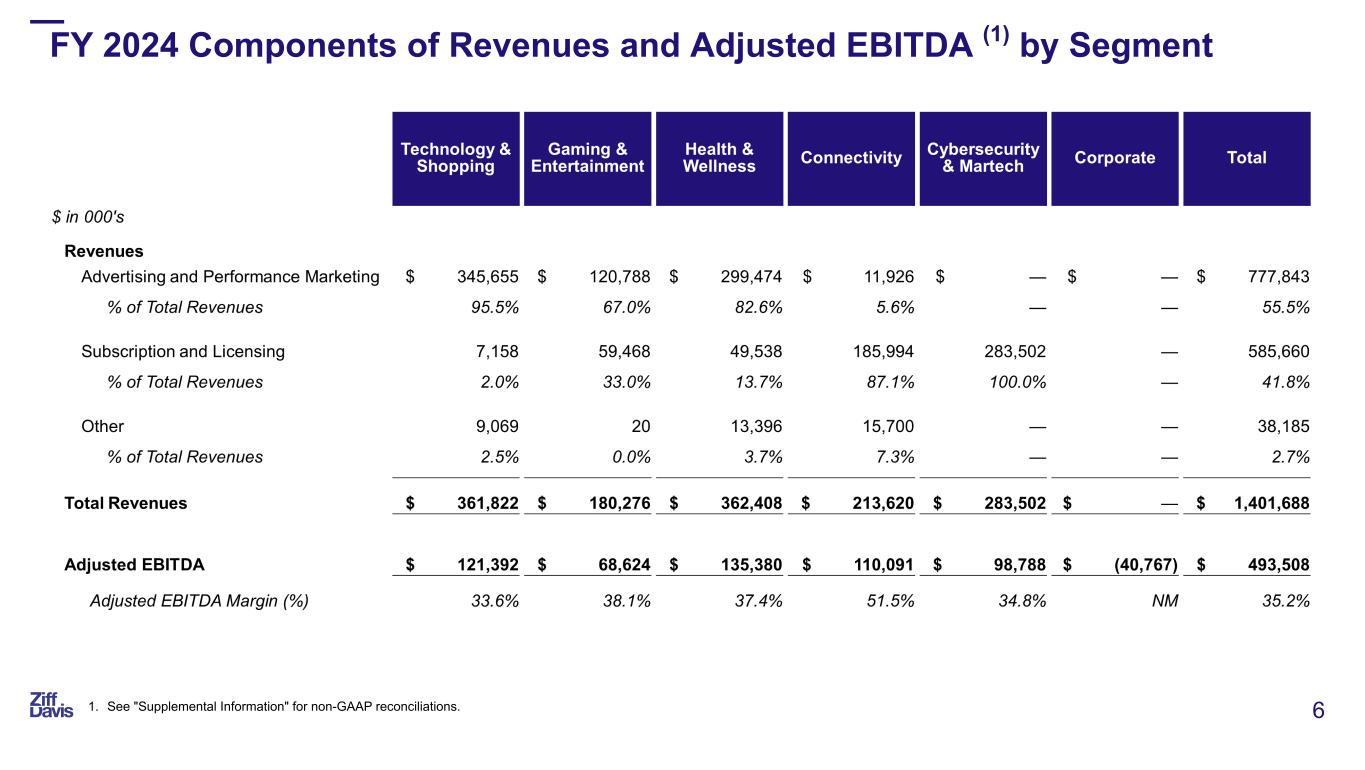

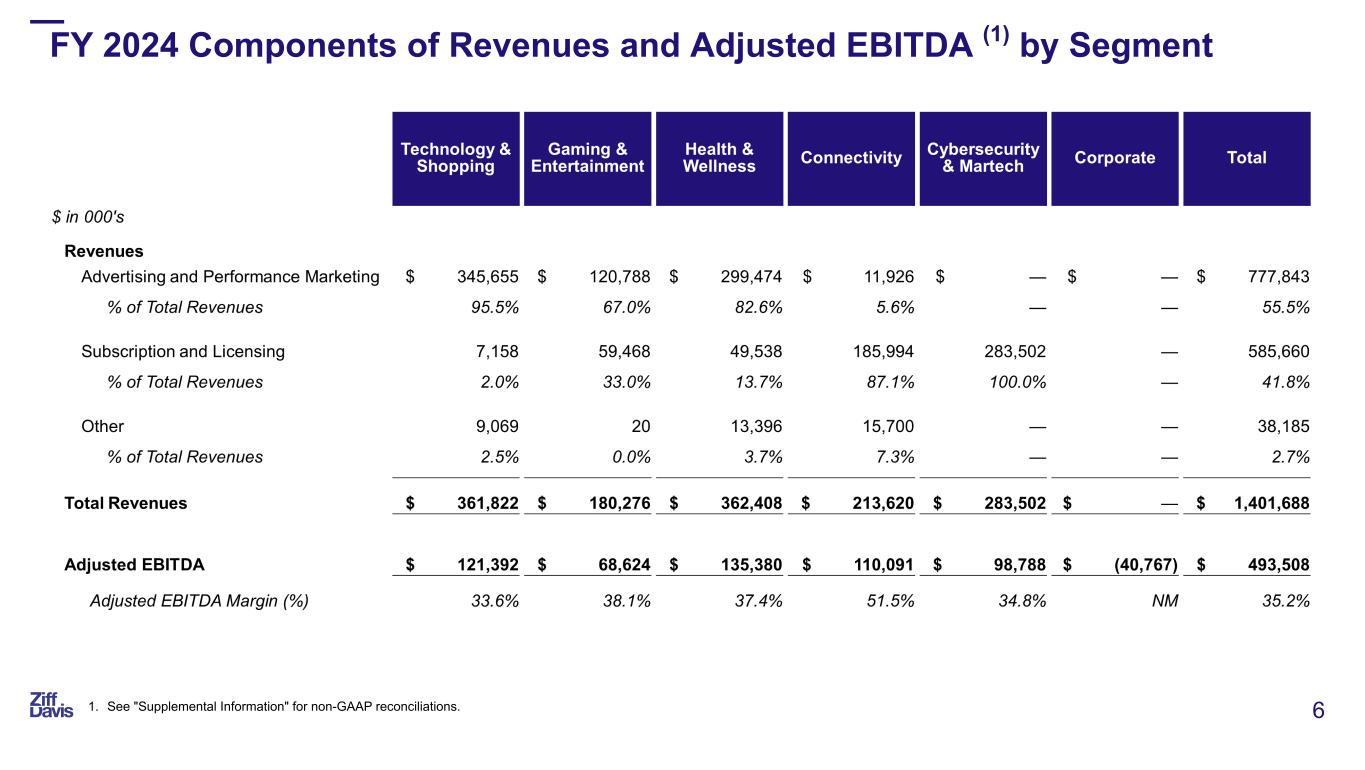

6 FY 2024 Components of Revenues and Adjusted EBITDA (1) by Segment 1. See "Supplemental Information" for non-GAAP reconciliations.

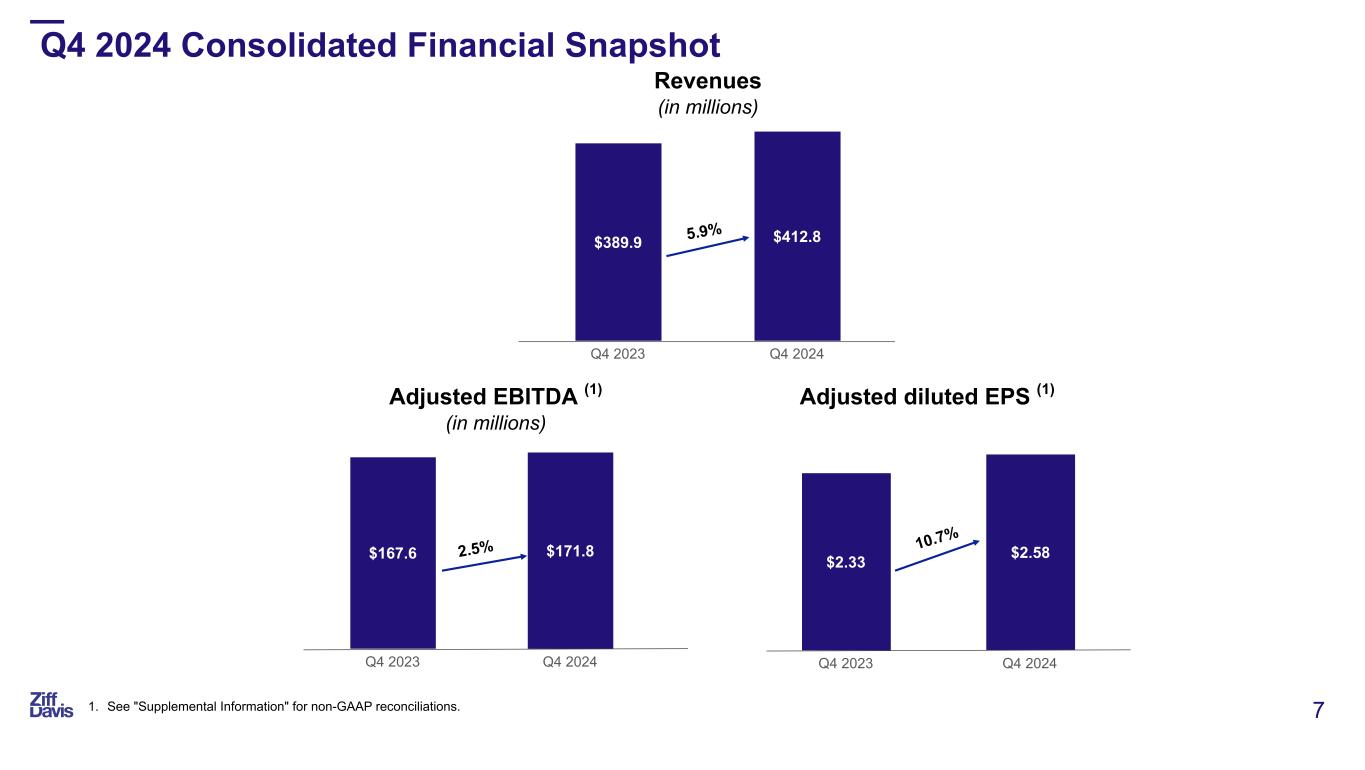

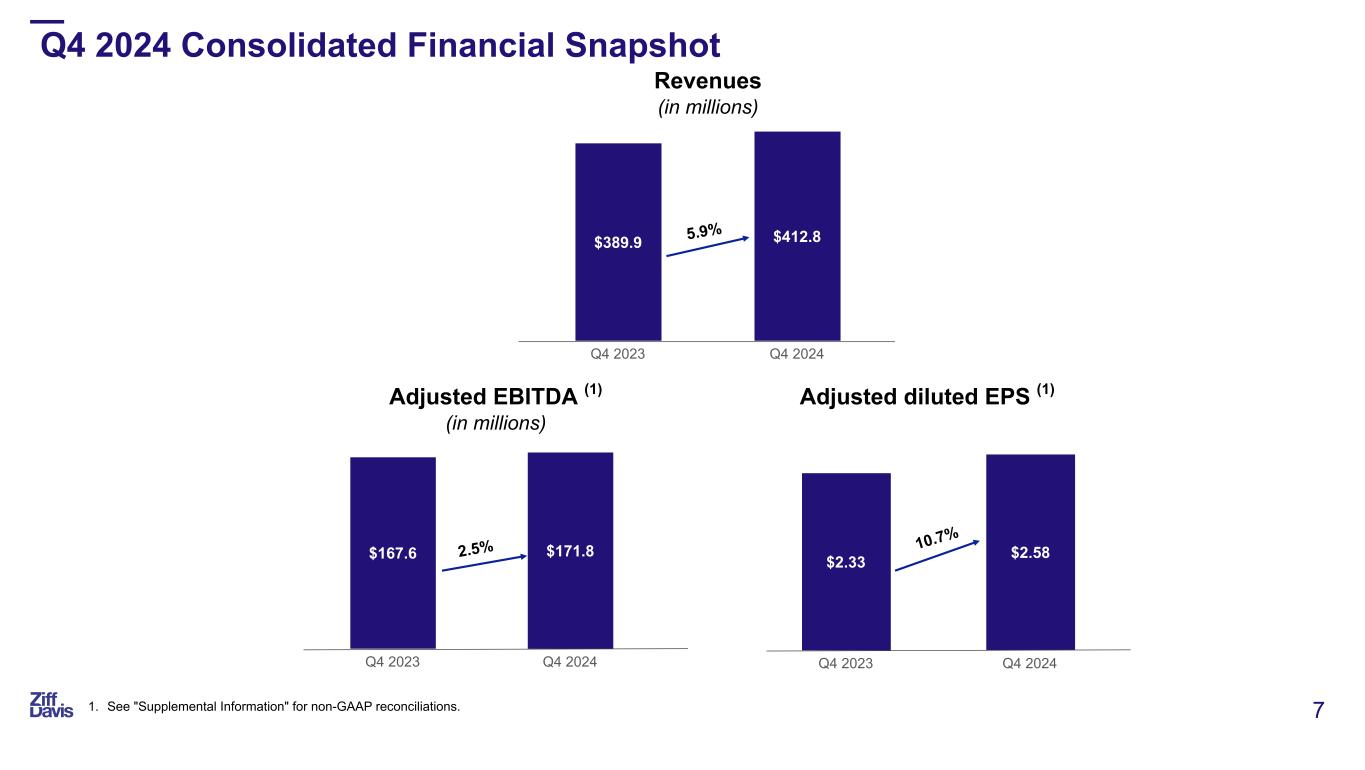

7 $389.9 $412.8 Q4 2023 Q4 2024 5.9% $167.6 $171.8 Q4 2023 Q4 2024 $2.33 $2.58 Q4 2023 Q4 2024 2.5% 10.7% Adjusted EBITDA (1) (in millions) Adjusted diluted EPS (1) Revenues (in millions) Q4 2024 Consolidated Financial Snapshot 1. See "Supplemental Information" for non-GAAP reconciliations.

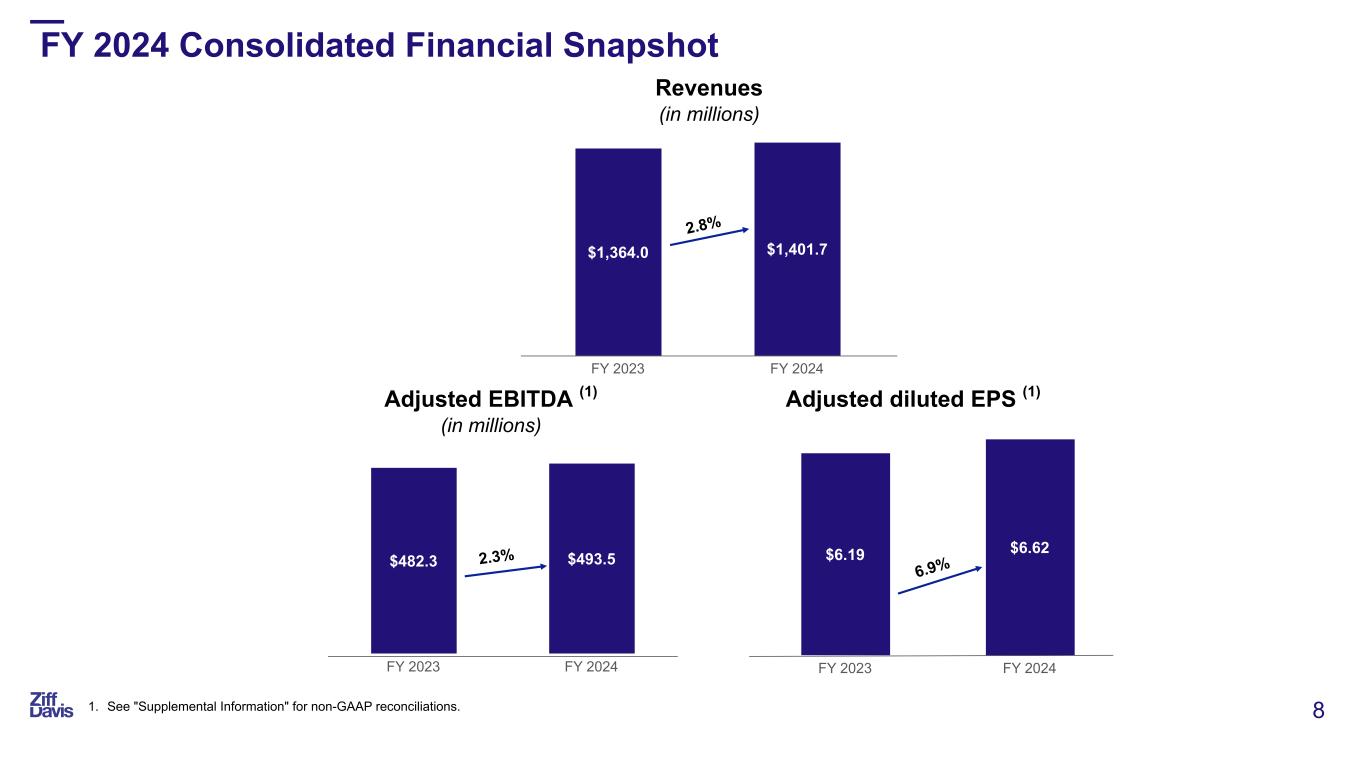

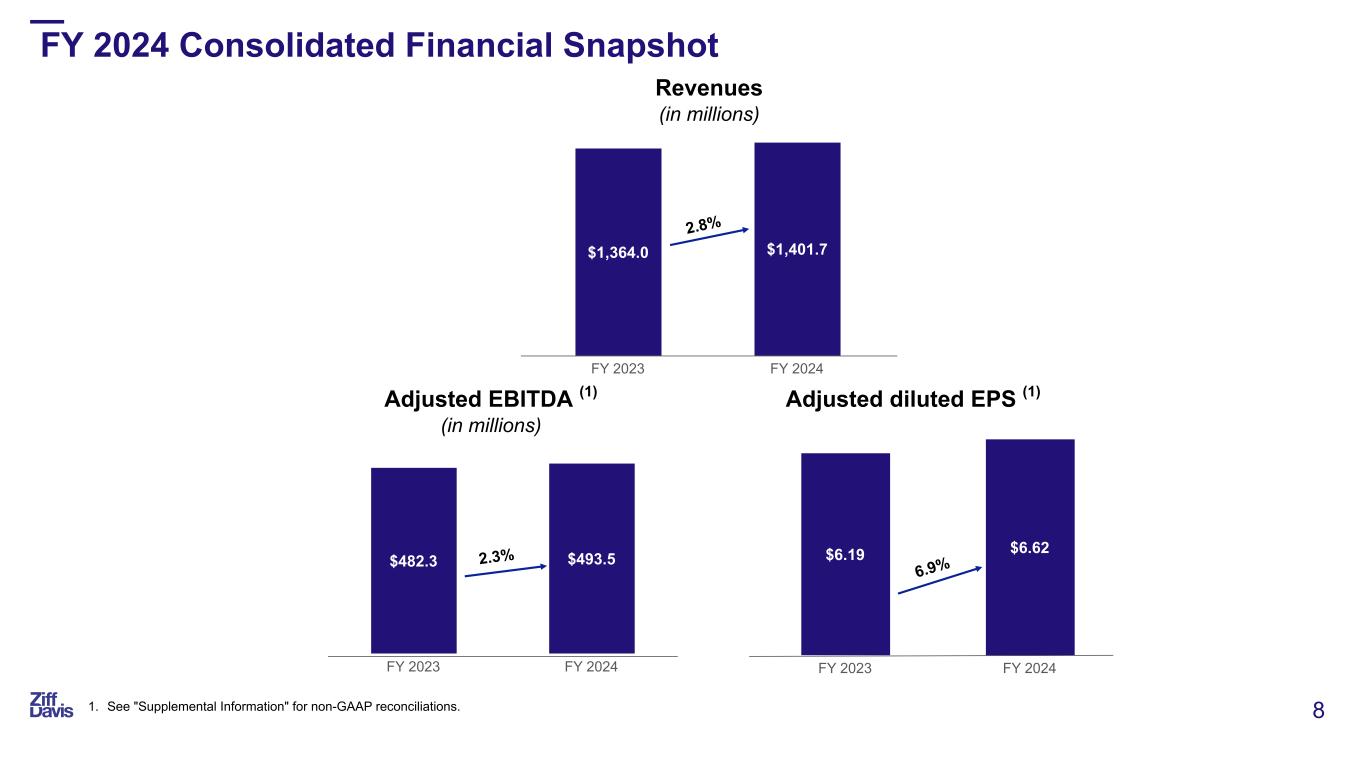

8 $1,364.0 $1,401.7 FY 2023 FY 2024 2.8% $482.3 $493.5 FY 2023 FY 2024 $6.19 $6.62 FY 2023 FY 2024 2.3% 6.9% Adjusted EBITDA (1) (in millions) Adjusted diluted EPS (1) Revenues (in millions) FY 2024 Consolidated Financial Snapshot 1. See "Supplemental Information" for non-GAAP reconciliations.

9 $233 $258 Q4 2023 Q4 2024 10.6% $747 $778 FY 2023 FY 2024 4.1% Quarterly Advertising and Performance Marketing Metrics (2) Q4 2023 Q4 2024 Net Revenue Retention (3) 87.1% 92.0% Customers (4) 1,943 1,899 Quarterly Revenue per Customer (5) $119,975 $135,762 Quarterly Revenues (1) (in millions) Fiscal Year Revenues (1) (in millions) Advertising and Performance Marketing 1. Figures are net of inter-segment revenues. 2. Refer to the "Supplemental Information" for quarterly advertising and performance marketing metrics for each of the segments. 3. Net advertising and performance marketing revenue retention equals (i) the trailing twelve months revenue recognized related to prior year customers in the current year period (excluding revenue from acquisitions during the stub period) divided by (ii) the trailing twelve month revenue recognized related to prior year customers in the prior year period (excluding revenue from acquisitions during the stub period). This excludes customers that generated less than $10,000 of revenue in the measurement period. 4. Excludes customers that spent less than $2,500 in the quarter. 5. Represents total gross quarterly advertising and performance marketing revenues divided by customers as defined in footnote (4).

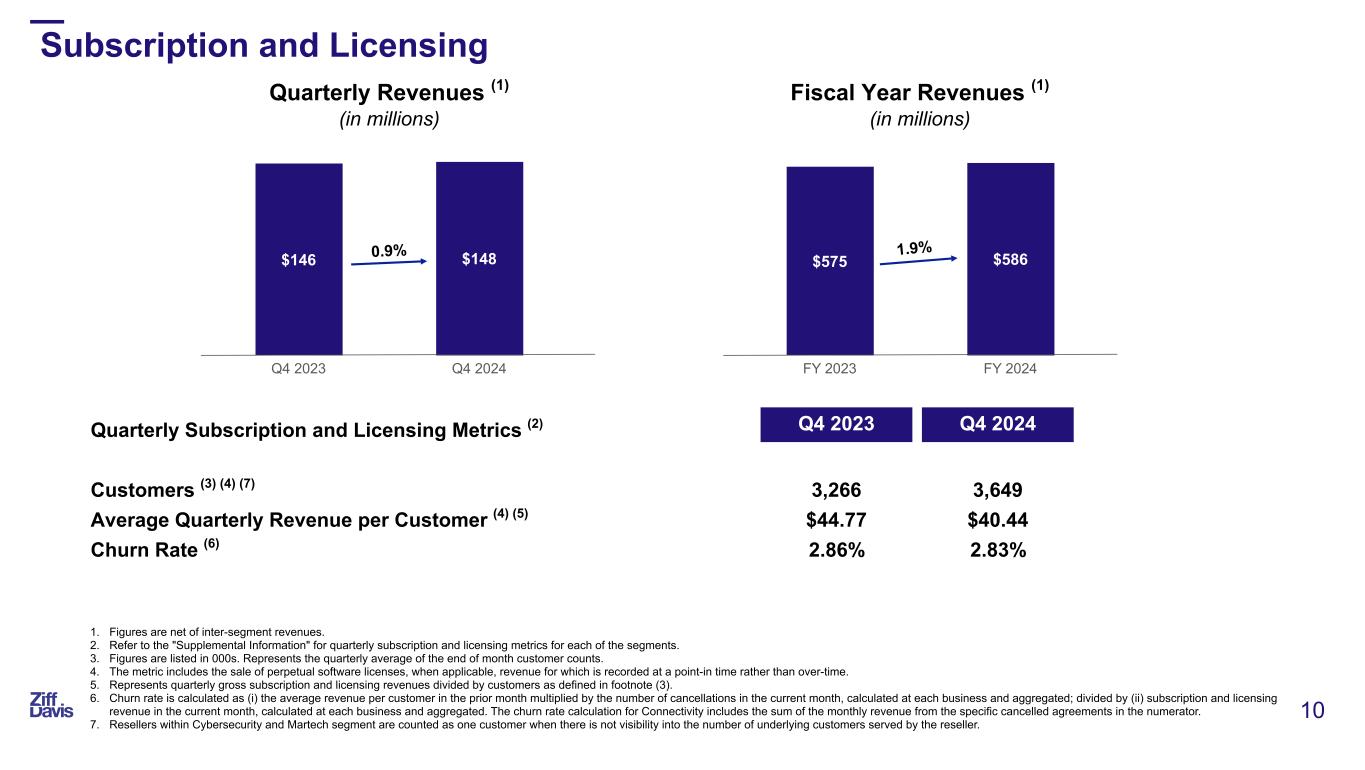

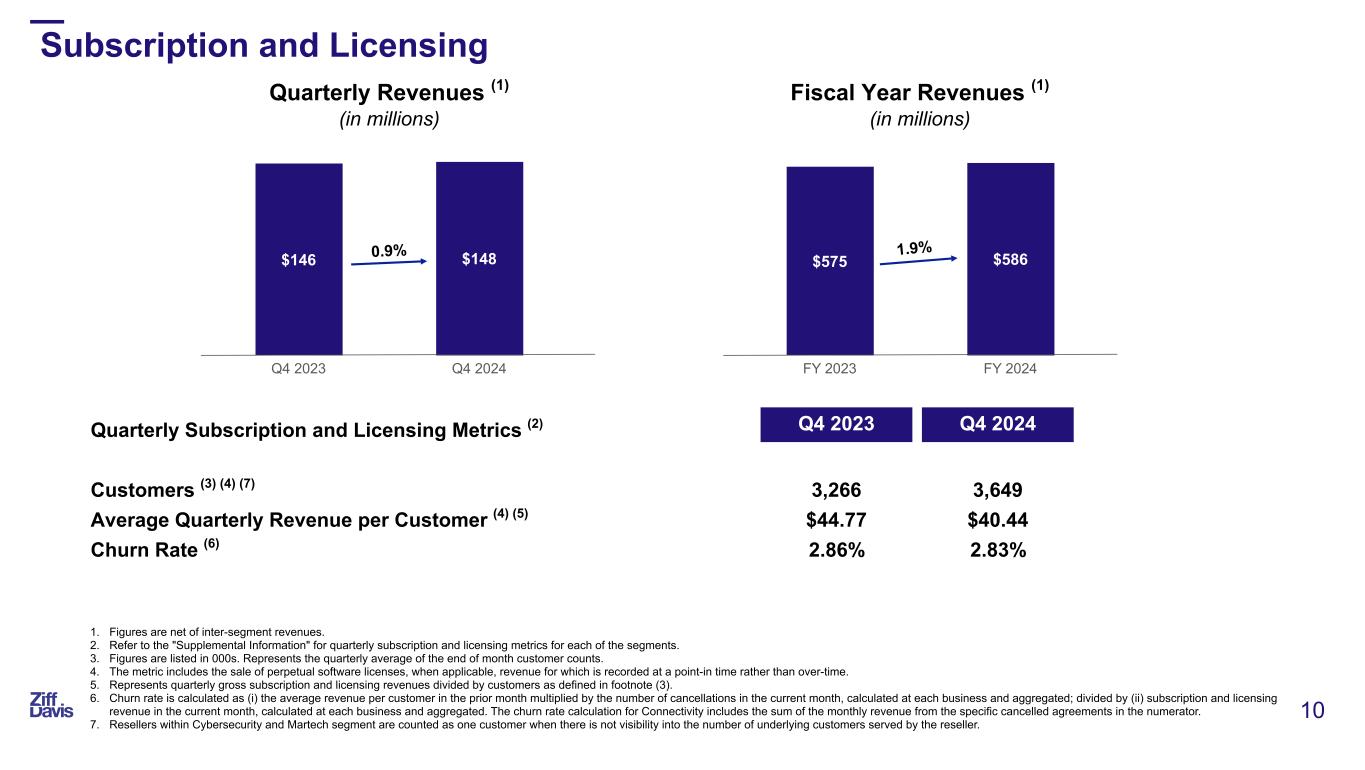

10 $146 $148 Q4 2023 Q4 2024 0.9% $575 $586 FY 2023 FY 2024 1.9% Quarterly Subscription and Licensing Metrics (2) Q4 2023 Q4 2024 Customers (3) (4) (7) 3,266 3,649 Average Quarterly Revenue per Customer (4) (5) $44.77 $40.44 Churn Rate (6) 2.86% 2.83% Quarterly Revenues (1) (in millions) Fiscal Year Revenues (1) (in millions) Subscription and Licensing 1. Figures are net of inter-segment revenues. 2. Refer to the "Supplemental Information" for quarterly subscription and licensing metrics for each of the segments. 3. Figures are listed in 000s. Represents the quarterly average of the end of month customer counts. 4. The metric includes the sale of perpetual software licenses, when applicable, revenue for which is recorded at a point-in time rather than over-time. 5. Represents quarterly gross subscription and licensing revenues divided by customers as defined in footnote (3). 6. Churn rate is calculated as (i) the average revenue per customer in the prior month multiplied by the number of cancellations in the current month, calculated at each business and aggregated; divided by (ii) subscription and licensing revenue in the current month, calculated at each business and aggregated. The churn rate calculation for Connectivity includes the sum of the monthly revenue from the specific cancelled agreements in the numerator. 7. Resellers within Cybersecurity and Martech segment are counted as one customer when there is not visibility into the number of underlying customers served by the reseller.

11 ($ in millions) December 31, 2024 Cash and Cash Equivalents $ 506 Long-term Investments 158 Total Cash and Investments $ 664 4.625% High-Yield Notes $ 460 1.75% Convertible Notes 149 3.625% Convertible Notes 263 Total Gross Debt (1) $ 872 Multiple of FY 2024 Adj. EBITDA Gross Debt $ 872 1.8x Gross Debt less Cash $ 366 0.7x Gross Debt less Cash and Investments $ 208 0.4x Ziff Davis Capital Structure 1. Reflects the outstanding principal amount of gross debt.

2025 FINANCIAL GUIDANCE

13 Revenue at Midpoint Revenue Growth Advertising and Performance Marketing 4-6% growth Subscription and Licensing 3-5% growth Other Low teens growth Distributions of Revenues First Quarter >20% of full year revenues Fourth Quarter ~30% of full year revenues Corporate Non-GAAP Tax Rate 23.25% - 25.25% Diluted Share Count (1) ~43MM 1. Does not include any potential dilution from the outstanding 1.75% Convertible notes and 3.625% Convertible notes. 2025 Guidance (Forward-Looking Statements)

14 Annual guidance for Revenues, Adjusted EBITDA (1), and Adjusted diluted EPS (1) Ziff Davis FY 2025 Guidance Range $ in millions, except for per share amounts Low Midpoint High Midpoint YoY % Increase vs 2024A Revenues $1,442 $1,472 $1,502 5.0% Adjusted EBITDA (1) $505 $523 $542 6.0% Adjusted diluted EPS (1) $6.64 $6.96 $7.28 5.1% 1. See "Supplemental Information" for non-GAAP reconciliations. A reconciliation of forward-looking Adjusted EBITDA and Adjusted diluted EPS to the corresponding GAAP financial measures is not available without unreasonable effort due primarily to variability and difficulty in making accurate forecasts and projections of certain non-operating items such as (Gain) loss on investments, net, Other (income) loss, net, and other unanticipated items that may arise in the future. 2025 Guidance (Forward-Looking Statements)

SUPPLEMENTAL INFORMATION

16 Non-GAAP Financial Measures The below non-GAAP financial measures are not measures presented in accordance with GAAP, and our use of these terms may vary from that of other companies, limiting their usefulness for comparison purposes. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. These non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations determined in accordance with GAAP. Non-GAAP financial measures exclude the certain items listed below. We believe that excluding these items from the non-GAAP measures facilitates comparisons to historical operating results and comparisons to peers, many of which exclude similar items. We believe that non-GAAP financial measures provide meaningful supplemental information regarding operational performance. We further believe these measures are useful to investors in that they allow for greater transparency of certain line items in the Company’s financial statements. Adjusted Revenues is defined as Revenues that exclude the results of certain divested Voice assets in Australia and New Zealand that were sold in the third quarter of 2020, certain Voice assets in the United Kingdom that were sold in February 2021, and certain assets of the Company's B2B Backup business that were sold in September 2021. Adjusted EBITDA is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain items including, but not limited to: Interest expense, net; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; (Gain) loss on investments, net; Other (income) loss, net; Income tax (benefit) expense; (Income) loss from equity method investments, net; Depreciation and amortization; Share-based compensation; Acquisition, integration, and other costs; Disposal related costs; Lease asset impairments and other charges; and Goodwill impairment. Adjusted net income (loss) is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain statement of operations items including, but not limited to: Interest, net; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; (Gain) loss on investments, net; (Income) loss from equity method investments, net; Amortization; Share-based compensation; Acquisition, integration, and other costs; Disposal related costs; Lease asset impairments and other charges; and Goodwill impairment. Adjusted diluted EPS is calculated by dividing Adjusted net income (loss) by the diluted weighted average shares of common stock outstanding excluding the effect of convertible debt dilution. Free cash flow is defined as Net cash provided by operating activities, less purchases of property and equipment, plus changes in contingent consideration (if any). Adjusted effective tax rate is calculated based upon the GAAP effective tax rate with adjustments for the tax applicable to non-GAAP adjustments to Net income (loss), generally based upon the effective marginal tax rate of each adjustment.

17 $ in 000's Ziff Davis Three months ended December 31, 2024 2023 Net income $ 64,087 $ 63,422 Interest expense, net 6,391 2,251 Income on investment, net — (1,065) Other (income) loss, net (2,438) 3,486 Income tax expense 13,610 12,962 Income from equity method investments, net (3,128) (336) Depreciation and amortization 59,971 69,633 Share-based compensation 10,282 7,527 Acquisition, integration, and other costs 23,386 9,649 Disposal related costs (350) 375 Lease asset impairments and other charges (9) (338) Adjusted EBITDA $ 171,802 $ 167,566 Non-GAAP reconciliation: Adjusted EBITDA

18 Q4 2024 Technology & Shopping Gaming & Entertainment Health & Wellness Connectivity Cybersecurity & Martech Corporate (1) Total $ in 000's Income (loss) from operations $ 22,245 $ 20,244 $ 27,058 $ 17,500 $ 9,095 $ (17,620) $ 78,522 Depreciation and amortization 25,313 2,869 13,849 9,397 8,505 38 59,971 Share-based compensation 1,164 190 1,411 638 1,097 5,782 10,282 Acquisition, integration, and other costs 9,710 1,323 4,509 1,987 3,587 2,270 23,386 Disposal related costs — — — — — (350) (350) Lease asset impairments and other charges (179) 94 — — 76 — (9) Total $ 58,253 $ 24,720 $ 46,827 $ 29,522 $ 22,360 $ (9,880) $ 171,802 Non-GAAP reconciliation: Adjusted EBITDA by Segment Q4 2023 Technology & Shopping Gaming & Entertainment Health & Wellness Connectivity Cybersecurity & Martech Corporate (1) Total $ in 000's Income (loss) from operations $ 25,621 $ 22,147 $ 24,169 $ 17,281 $ 5,430 $ (13,928) $ 80,720 Depreciation and amortization 19,569 2,067 18,074 11,456 18,457 10 69,633 Share-based compensation 1,001 80 1,136 419 932 3,959 7,527 Acquisition, integration, and other costs 4,114 551 3,421 1,109 420 34 9,649 Disposal related costs 180 — — — — 195 375 Lease asset impairments and other charges (663) — 34 — 206 85 (338) Total $ 49,822 $ 24,845 $ 46,834 $ 30,265 $ 25,445 $ (9,645) $ 167,566 1. Corporate includes certain unallocated overhead costs that were historically presented within the Digital Media reportable segment.

19 $ in 000's Ziff Davis Years ended ended December 31, 2024 2023 2022 Net income $ 63,047 $ 41,503 $ 65,466 Interest expense, net 13,988 20,031 33,842 Gain on debt extinguishment, net — — (11,505) Loss on sale of businesses 3,780 — — Loss on investment, net 7,654 28,138 53,888 Other (income) loss, net (4,968) 9,468 (8,437) Income tax expense 41,370 24,142 57,957 (Income) loss from equity method investments, net (11,223) 7,829 7,730 Depreciation and amortization 211,916 236,966 233,400 Share-based compensation 40,915 31,920 26,601 Acquisition, integration, and other costs 40,194 21,000 17,426 Disposal related costs 201 2,217 1,328 Lease asset impairments and other charges 1,361 2,245 2,178 Goodwill impairment 85,273 56,850 27,369 Adjusted EBITDA $ 493,508 $ 482,309 $ 507,243 Non-GAAP reconciliation: Adjusted EBITDA

20 FY 2024 Technology & Shopping Gaming & Entertainment Health & Wellness Connectivity Cybersecurity & Martech Corporate (1) Total $ in 000's Income (loss) from operations $ (71,072) $ 54,001 $ 67,207 $ 79,374 $ 54,961 $ (70,823) $ 113,648 Depreciation and amortization 83,424 10,733 52,766 31,882 33,025 86 211,916 Share-based compensation 5,014 1,070 5,604 2,658 4,631 21,938 40,915 Acquisition, integration, and other costs 18,554 2,727 9,788 (3,823) 5,395 7,553 40,194 Disposal related costs (24) — — — 20 205 201 Lease asset impairments and other charges 223 93 15 — 756 274 1,361 Goodwill impairment on a business 85,273 — — — — — 85,273 Total $ 121,392 $ 68,624 $ 135,380 $ 110,091 $ 98,788 $ (40,767) $ 493,508 Non-GAAP reconciliation: Adjusted EBITDA by Segment FY 2023 Technology & Shopping Gaming & Entertainment Health & Wellness Connectivity Cybersecurity & Martech Corporate (1) Total $ in 000's Income (loss) from operations $ (50,498) $ 57,299 $ 63,575 $ 70,591 $ 43,210 $ (51,566) $ 132,611 Income from equity method investment, net — — — — — (1,500) (1,500) Depreciation and amortization 83,271 10,368 59,870 31,793 52,618 (954) 236,966 Share-based compensation 4,941 758 4,843 2,014 4,186 15,178 31,920 Acquisition, integration, and other costs 4,452 2,441 10,004 2,820 887 396 21,000 Disposal related costs 633 — — — 202 1,382 2,217 Lease asset impairments and other charges 1,019 — 510 — 471 245 2,245 Goodwill impairment on a business 56,850 — — — — — 56,850 Total $ 100,668 $ 70,866 $ 138,802 $ 107,218 $ 101,574 $ (36,819) $ 482,309 1. Corporate includes certain unallocated overhead costs that were historically presented within the Digital Media reportable segment.

21 FY 2022 Technology & Shopping Gaming & Entertainment Health & Wellness Connectivity Cybersecurity & Martech Corporate (1) Total $ in 000's Income (loss) from operations $ 3,565 $ 53,425 $ 66,215 $ 78,362 $ 50,962 $ (53,588) $ 198,941 Depreciation and amortization 93,187 10,045 55,981 25,445 48,714 28 233,400 Share-based compensation 1,844 764 3,229 1,380 4,280 15,104 26,601 Acquisition, integration, and other costs 2,658 2,224 9,840 (571) 2,111 1,164 17,426 Disposal related costs — — — 11 — 1,317 1,328 Lease asset impairments and other charges 220 871 550 (16) 547 6 2,178 Goodwill impairment on a business 27,369 — — — — — 27,369 Total $ 128,843 $ 67,329 $ 135,815 $ 104,611 $ 106,614 $ (35,969) $ 507,243 Non-GAAP reconciliation: Adjusted EBITDA by Segment 1. Corporate includes certain unallocated overhead costs that were historically presented within the Digital Media reportable segment.

22 $ in 000's Ziff Davis Three months ended December 31, 2024 2024 Per diluted share (1) 2023 Per diluted share (1) Net income $ 64,087 $ 1.43 $ 63,422 $ 1.29 Interest, net 60 — (20) — Loss on sale of business — — 276 0.01 Loss (income) on investments, net 942 0.02 (775) (0.02) Income from equity method investments, net (3,128) (0.07) (336) (0.01) Amortization 25,040 0.59 31,105 0.68 Share-based compensation 5,178 0.12 6,289 0.14 Acquisition, integration, and other costs 18,265 0.43 7,011 0.15 Disposal related costs (262) (0.01) 238 0.01 Lease asset impairments and other charges 7 — (224) — Dilutive effect of the convertible debt — 0.07 — 0.08 Adjusted net income $ 110,189 $ 2.58 $ 106,986 $ 2.33 Non-GAAP reconciliation: Adjusted net income and Adjusted diluted EPS 1. The reconciliation of Net income (loss) per diluted share to Adjusted net income per diluted share may not foot since each is calculated independently.

23 $ in 000's Ziff Davis Years ended December 31, 2024 2024 Per diluted share (1) 2023 Per diluted share (1) Net income $ 63,047 $ 1.42 $ 41,503 $ 0.89 Interest, net 132 — 5,881 0.13 Loss on sale of business 103 — 3,797 0.08 Loss on investments, net 8,019 0.18 21,103 0.45 (Income) loss from equity method investments, net (11,223) (0.25) 8,204 0.18 Amortization 87,052 1.96 106,593 2.30 Share-based compensation 31,013 0.70 27,100 0.58 Acquisition, integration, and other costs 29,805 0.67 13,498 0.29 Disposal related costs 195 — 1,538 0.03 Lease asset impairments and other charges 1,045 0.02 1,295 0.04 Goodwill impairment 85,273 1.92 56,850 1.22 Adjusted net income $ 294,461 $ 6.62 $ 287,362 $ 6.19 Non-GAAP reconciliation: Adjusted net income and Adjusted diluted EPS 1. The reconciliation of Net income (loss) per diluted share to Adjusted net income per diluted share may not foot since each is calculated independently.

24 Q4 2024 GAAP amount Interest, net (Gain) loss on sale of business (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment Adjusted non-GAAP amount $ in 000's Direct costs $(53,242) $– $– $– $– $– $57 $425 $– $– $– $(52,760) Sales and marketing $(150,510) – – – – – 891 13,366 – – – $(136,253) Research, development, and engineering $(17,549) – – – – – 735 3,926 – – – $(12,888) General, administrative, and other related costs $(53,029) – – – – – 8,599 5,669 (350) (9) – $(39,120) Depreciation and amortization $(59,971) – – – – 34,965 – – – – – $(25,006) Interest expense, net $(6,391) 80 – – – – – – – – – $(6,311) Other income, net $2,438 – – – – – – (237) – – – $2,201 Income tax expense (1) $(13,610) (20) – 942 – (9,925) (5,104) (4,884) 88 16 – $(32,497) Loss from equity method investment, net $3,128 – – – (3,128) – – – – – – $– Total non-GAAP adjustments $60 $— $942 $(3,128) $25,040 $5,178 $18,265 $(262) $7 $— Q4 2023 GAAP amount Interest, net (Gain) loss on sale of business (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment Adjusted non-GAAP amount $ in 000's Direct costs $(45,070) $– $– $– $– $– $15 $2,561 $– $– $– $(42,494) Sales and marketing $(126,449) – – – – – 392 1,668 – – – $(124,389) Research, development, and engineering $(15,532) – – – – – 660 177 – – – $(14,695) General, administrative, and other related costs $(52,483) – – – – – 6,460 5,243 375 (338) – $(40,743) Depreciation and amortization $(69,631) – – – – 44,991 – – – – – $(24,640) Interest expense, net $(2,251) (11) – – – – – – – – – $(2,262) Gain on investments, net $1,065 – – (1,065) – – – – – – – $– Other loss, net $(3,486) – 422 – – – 459 – – – $(2,605) Income tax expense (2) $(12,962) (9) (146) 290 – (13,886) (1,238) (3,097) (137) 114 – $(31,071) Income from equity method investment, net $336 – – – (336) – – – – – – $– Total non-GAAP adjustments $(20) $276 $(775) $(336) $31,105 $6,289 $7,011 $238 $(224) $— 1. Adjusted effective tax rate was approximately 22.8% for the three months ended December 31, 2024. The calculation is based on a ratio where the numerator is the adjusted income tax expense of $32,497 and the denominator is $142,686, which equals adjusted net income of $110,189 plus adjusted income tax expense. 2. Adjusted effective tax rate was approximately 22.5% for the three months ended December 31, 2023. The calculation is based on a ratio where the numerator is the adjusted income tax expense of $31,071 and the denominator is $138,057, which equals adjusted net income of $106,986 plus adjusted income tax expense. Q4 2024 and Q4 2023 Reconciliation of GAAP to Non-GAAP Financial Measures

25 FY 2024 GAAP amount Interest, net (Gain) loss on sale of business (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment Adjusted non-GAAP amount $ in 000's Direct costs $(200,323) $– $– $– $– $– $248 $760 $– $– $– $(199,315) Sales and marketing $(519,694) – – – – – 3,756 19,072 – – – $(496,866) Research, development, and engineering $(67,373) – – – – – 3,665 6,516 40 – – $(57,152) General, administrative, and other related costs $(203,461) – – – – – 33,246 13,846 161 1,361 – $(154,847) Depreciation and amortization $(211,916) – – – – 117,748 – – – – – $(94,168) Goodwill impairment $(85,273) – – – – – – – – – 85,273 $– Interest expense, net $(13,988) 176 – – – – – – – – – $(13,812) Loss on sale of business $(3,780) – 3,780 – – – – – – – – $– Loss on investments, net $(7,654) – – 7,654 – – – – – – – $– Other income (loss), net $4,968 – (4,903) – – – – (774) – – – $(709) Income tax expense (1) $(41,370) (44) 1,226 365 – (30,696) (9,902) (9,615) (6) (316) – $(90,358) Income from equity method investment, net $11,223 – – – (11,223) – – – – – – $– Total non-GAAP adjustments $132 $103 $8,019 $(11,223) $87,052 $31,013 $29,805 $195 $1,045 $85,273 FY 2023 GAAP amount Interest, net (Gain) loss on sale of business (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment Adjusted non-GAAP amount $ in 000's Direct costs $(185,650) $– $– $– $– $– $262 $2,752 $– $– $– $(182,636) Sales and marketing $(487,365) – – – – – 2,686 4,796 4 – – $(479,879) Research, development, and engineering $(68,860) – – – – – 3,245 712 3 – – $(64,900) General, administrative, and other related costs $(195,726) – – – (1,500) – 25,727 12,740 2,210 2,245 – $(154,304) Depreciation and amortization $(236,966) – 0 – – 145,571 – – – – – $(91,395) Goodwill impairment $(56,850) – – – – – – – – – 56,850 $– Interest expense, net $(20,031) 7,797 (538) – – – – – – – – $(12,772) Loss on investments, net $(28,138) – – 28,138 – – – – – – – $– Other loss, net $(9,468) – 5,655 – – – – 459 – – – $(3,354) Income tax expense (2) $(24,142) (1,916) (1,320) (7,035) 375 (38,978) (4,820) (7,961) (679) (950) – $(87,426) Loss from equity method investment, net $(9,329) – – – 9,329 – – – – – – $– Total non-GAAP adjustments $5,881 $3,797 $21,103 $8,204 $106,593 $27,100 $13,498 $1,538 $1,295 $56,850 FY 2024 and FY 2023 Reconciliation of GAAP to Non-GAAP Financial Measures 1. Adjusted effective tax rate was approximately 23.5% for the year ended December 31, 2024. The calculation is based on a ratio where the numerator is the adjusted income tax expense of $90,358 and the denominator is $384,819, which equals adjusted net income of $294,461 plus adjusted income tax expense. 2. Adjusted effective tax rate was approximately 23.3% for the year ended December 31, 2023. The calculation is based on a ratio where the numerator is the adjusted income tax expense of $87,426 and the denominator is $374,788, which equals adjusted net income of $287,362 plus adjusted income tax expense.

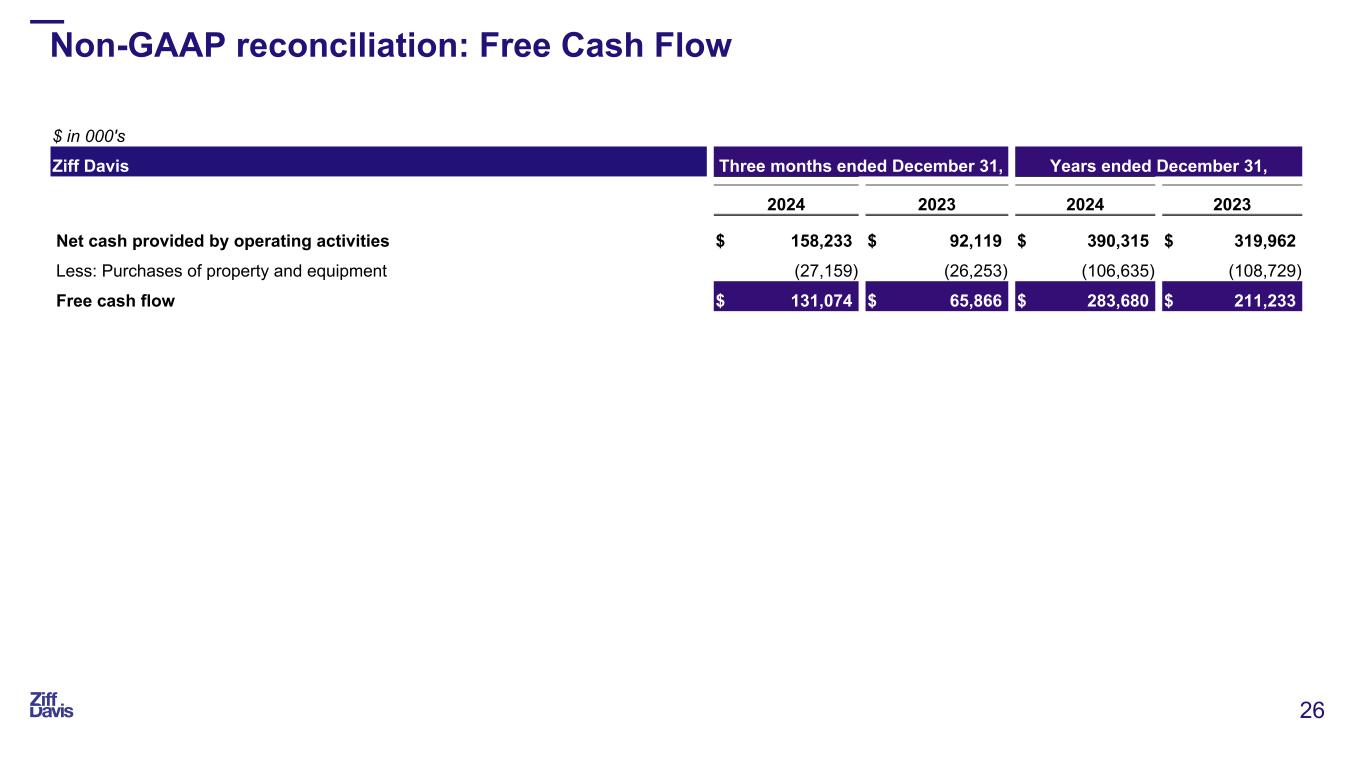

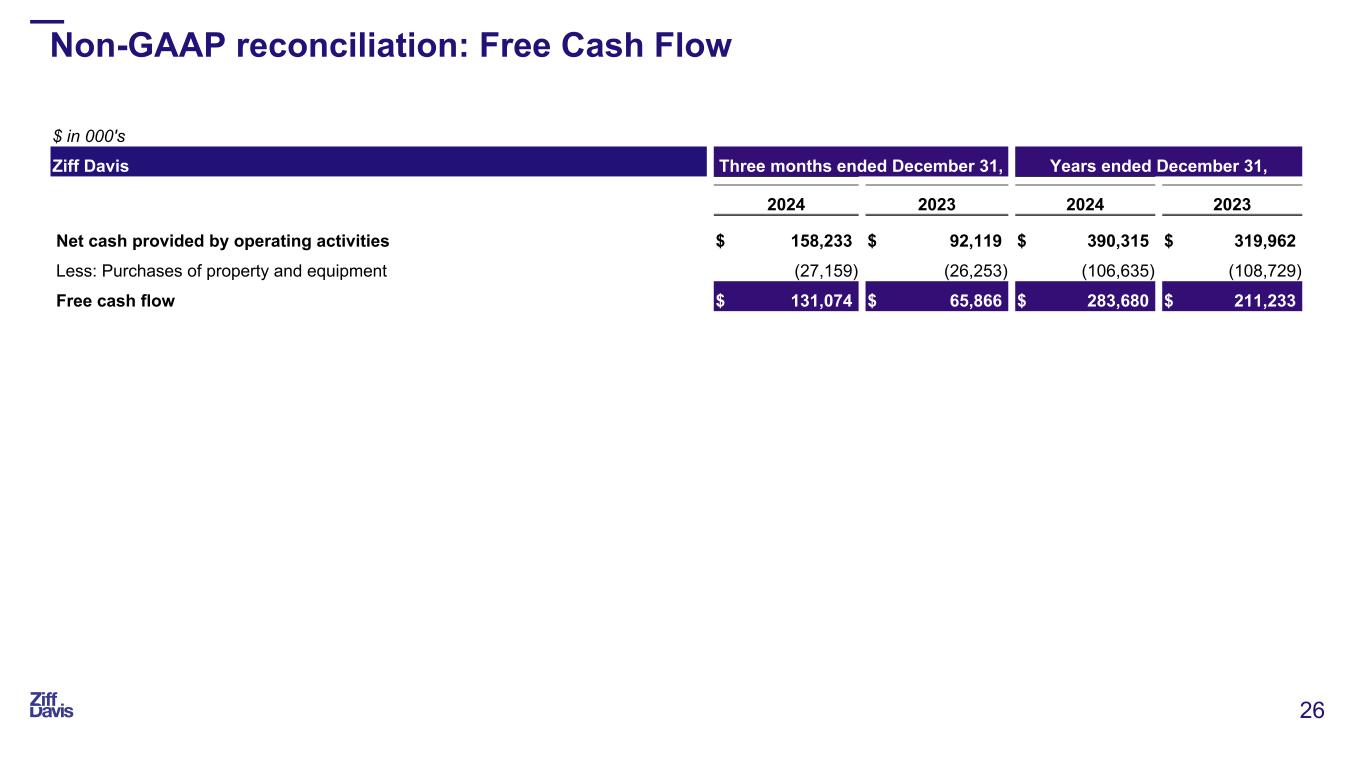

26 $ in 000's Ziff Davis Three months ended December 31, Years ended December 31, 2024 2023 2024 2023 Net cash provided by operating activities $ 158,233 $ 92,119 $ 390,315 $ 319,962 Less: Purchases of property and equipment (27,159) (26,253) (106,635) (108,729) Free cash flow $ 131,074 $ 65,866 $ 283,680 $ 211,233 Non-GAAP reconciliation: Free Cash Flow

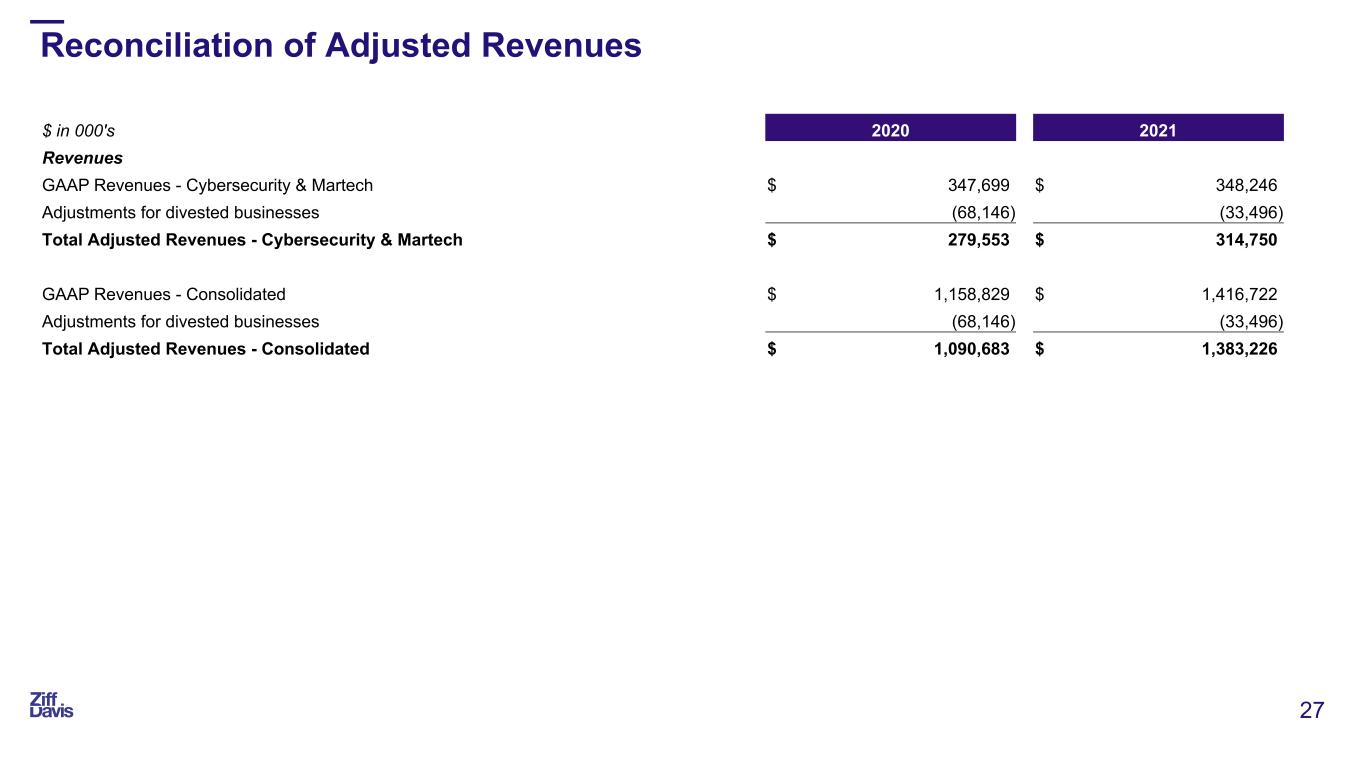

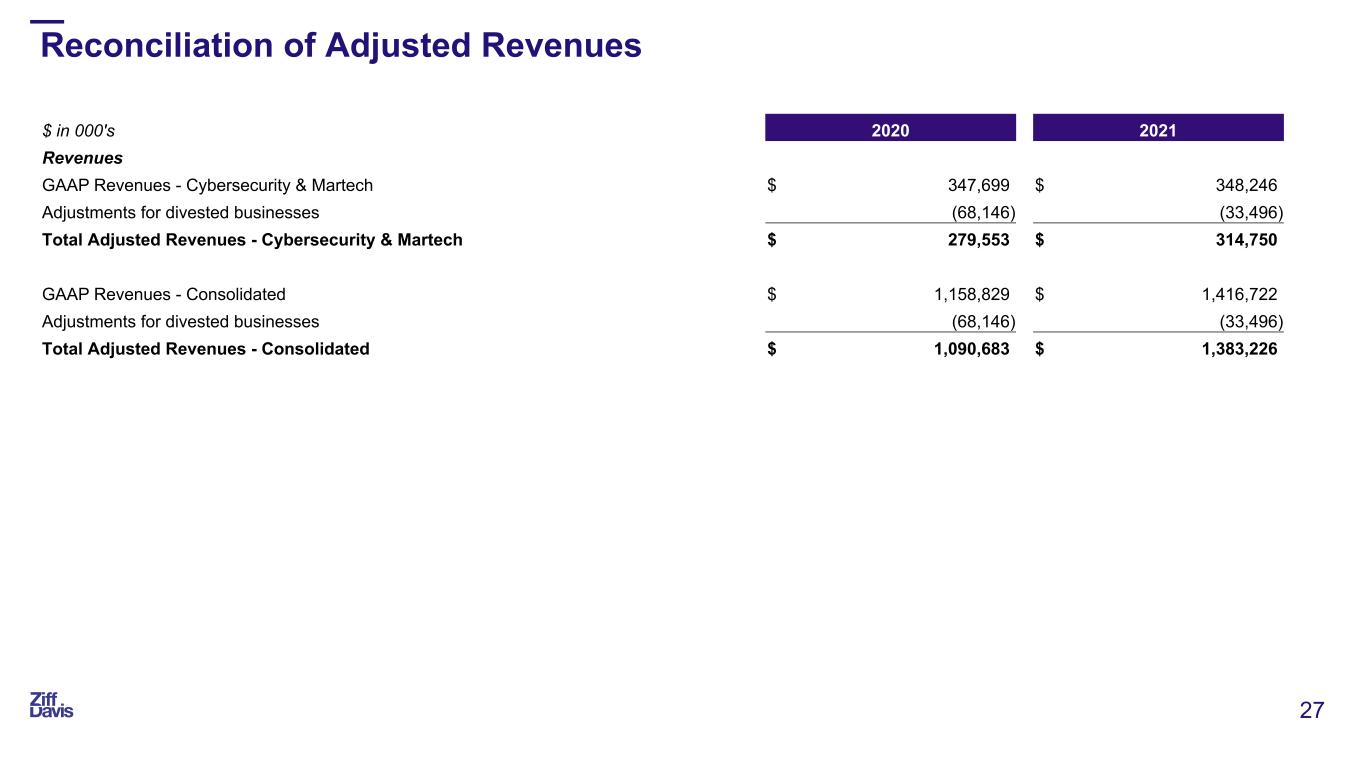

27 $ in 000's 2020 2021 Revenues GAAP Revenues - Cybersecurity & Martech $ 347,699 $ 348,246 Adjustments for divested businesses (68,146) (33,496) Total Adjusted Revenues - Cybersecurity & Martech $ 279,553 $ 314,750 GAAP Revenues - Consolidated $ 1,158,829 $ 1,416,722 Adjustments for divested businesses (68,146) (33,496) Total Adjusted Revenues - Consolidated $ 1,090,683 $ 1,383,226 Reconciliation of Adjusted Revenues

28 2022 2023 2024 Year over Year Growth Rates Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Organic Revenues (1) (3%) (5%) (7%) (7%) (5%) (6%) (6%) 0% (2%) (4%) 0% (5%) (2%) (5%) (3%) Total Revenues 5% 2% (1%) (3%) 1% (3%) (3%) 0% (2%) (2%) 2% (2%) 4% 6% 3% Organic Growth (1) 1. The Company includes revenue from an acquired business in organic revenue in the first month in which the Company can compare that full month in the current year against the corresponding full month under its ownership in the prior year. Similarly, the Company excludes revenue from divested assets beginning with the quarter of the disposal of the asset, as well as from the prior year's comparable period(s).

29 2023 2024 Q4 Q4 Technology & Shopping Net advertising and performance marketing revenue retention (1) 88.0% 92.9% Customers (2) 736 793 Quarterly revenue per customer (3) $138,376 $163,947 Gaming & Entertainment Net advertising and performance marketing revenue retention (1) 51.0% 92.7% Customers (2) 426 432 Quarterly revenue per customer (3) $84,355 $80,900 Health & Wellness Net advertising and performance marketing revenue retention (1) 92.0% 91.4% Customers (2) 882 778 Quarterly revenue per customer (3) $103,883 $115,604 Connectivity Net advertising and performance marketing revenue retention (1) 67.0% 77.4% Customers (2) 35 33 Quarterly revenue per customer (3) $91,668 $99,130 Consolidated Total Net advertising and performance marketing revenue retention (1) 87.1% 92.0% Customers (2) 1,943 1,899 Quarterly revenue per customer (3) $119,975 $135,762 Key Operating Metrics by Segment - Advertising and Performance Marketing 1. Net advertising and performance marketing revenue retention equals (i) the trailing twelve months revenue recognized related to prior year customers in the current year period (excluding revenue from acquisitions during the stub period) divided by (ii) the trailing twelve month revenue recognized related to prior year customers in the prior year period (excluding revenue from acquisitions during the stub period). This excludes customers that generated less than $10,000 of revenue in the measurement period. 2. Excludes customers that spent less than $2,500 in the quarter. 3. Represents total gross quarterly advertising and performance marketing revenues divided by customers as defined in footnote (2).

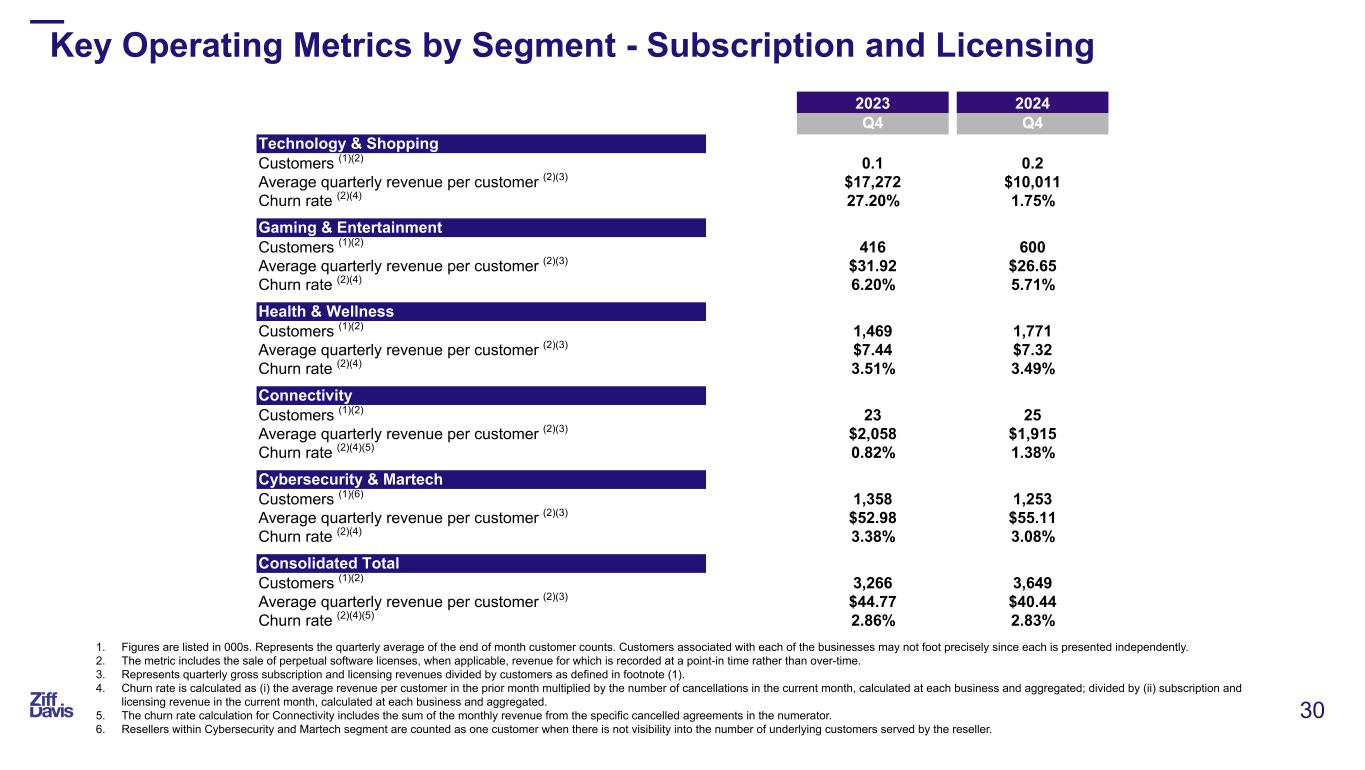

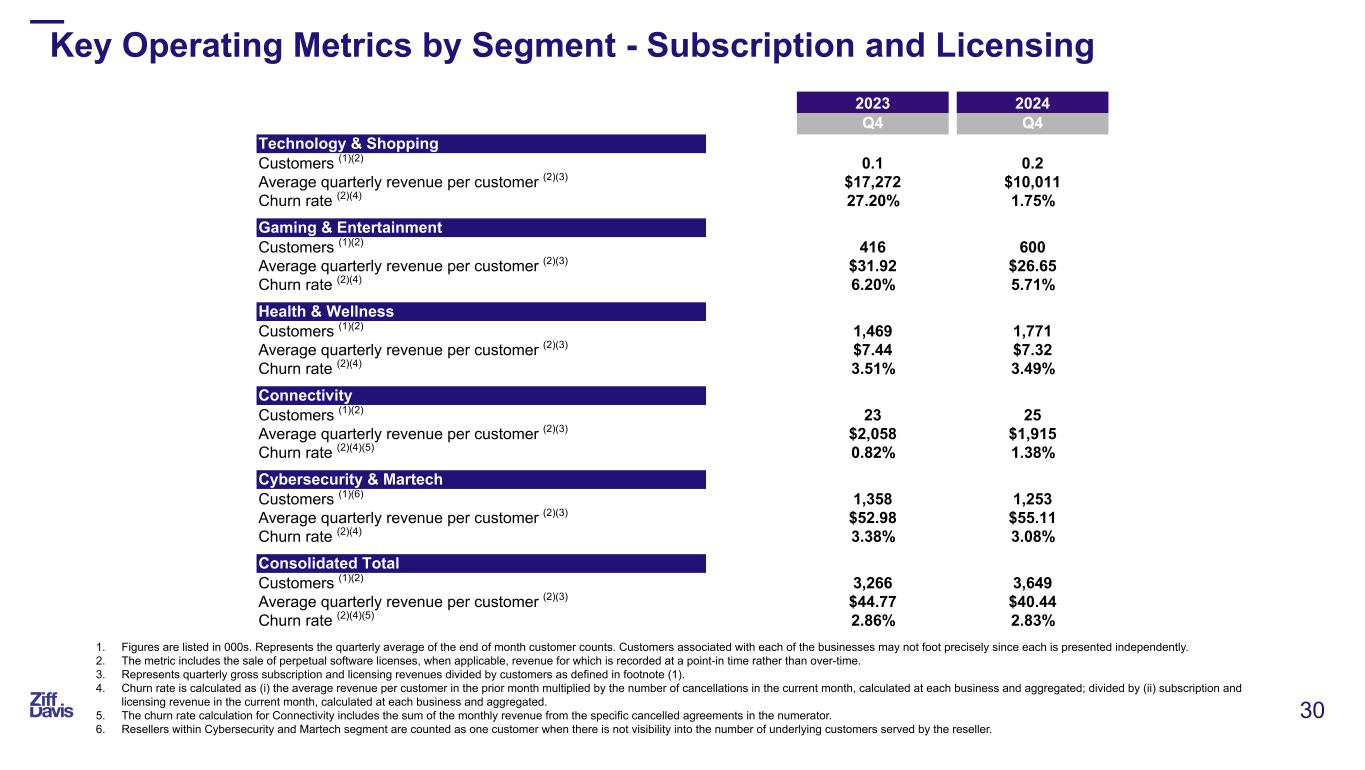

30 2023 2024 Q4 Q4 Technology & Shopping Customers (1)(2) 0.1 0.2 Average quarterly revenue per customer (2)(3) $17,272 $10,011 Churn rate (2)(4) 27.20% 1.75% Gaming & Entertainment Customers (1)(2) 416 600 Average quarterly revenue per customer (2)(3) $31.92 $26.65 Churn rate (2)(4) 6.20% 5.71% Health & Wellness Customers (1)(2) 1,469 1,771 Average quarterly revenue per customer (2)(3) $7.44 $7.32 Churn rate (2)(4) 3.51% 3.49% Connectivity Customers (1)(2) 23 25 Average quarterly revenue per customer (2)(3) $2,058 $1,915 Churn rate (2)(4)(5) 0.82% 1.38% Cybersecurity & Martech Customers (1)(6) 1,358 1,253 Average quarterly revenue per customer (2)(3) $52.98 $55.11 Churn rate (2)(4) 3.38% 3.08% Consolidated Total Customers (1)(2) 3,266 3,649 Average quarterly revenue per customer (2)(3) $44.77 $40.44 Churn rate (2)(4)(5) 2.86% 2.83% Key Operating Metrics by Segment - Subscription and Licensing 1. Figures are listed in 000s. Represents the quarterly average of the end of month customer counts. Customers associated with each of the businesses may not foot precisely since each is presented independently. 2. The metric includes the sale of perpetual software licenses, when applicable, revenue for which is recorded at a point-in time rather than over-time. 3. Represents quarterly gross subscription and licensing revenues divided by customers as defined in footnote (1). 4. Churn rate is calculated as (i) the average revenue per customer in the prior month multiplied by the number of cancellations in the current month, calculated at each business and aggregated; divided by (ii) subscription and licensing revenue in the current month, calculated at each business and aggregated. 5. The churn rate calculation for Connectivity includes the sum of the monthly revenue from the specific cancelled agreements in the numerator. 6. Resellers within Cybersecurity and Martech segment are counted as one customer when there is not visibility into the number of underlying customers served by the reseller.