| July 17, 2008 |  | |

Jeffrey P. Berg jberg@bakerlaw.com |

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, DC 20549-0404

Attn: Russell Mancuso, Legal Branch Chief

Re: Searchlight Minerals Corp.

Registration Statement on Form S-1/A

(File No. 333-132929)

Dear Mr. Mancuso:

On behalf of Searchlight Minerals Corp. (the “Company”), we are writing to respond to the comments set forth in the comment letter of the staff of the Securities and Exchange Commission (the “Commission”), dated July 17, 2007 (the “comment letter”) relating to the above-referenced Registration Statement on Form SB-2 (File No. 333-132929) which was filed on June 15, 2007. The Company also has responded to the comment letter by the filing of the Pre-Effective Amendment No. 4 to the Registration Statement on Form S-1/A (the “Amended Registration Statement”) with the Commission. The Amended Registration Statement has been filed electronically pursuant to EDGAR, and we will provide you with an additional copy, marked to show all changes.

The following responses correspond to the numbered paragraphs in your comment letter. The responses and undertakings contained in this letter are the positions of the Company, except as reflected in the response to your Comment 5 regarding the opinion of this firm included as Exhibit 5.1 to the Amended Registration Statement. For your convenience, we have set forth each comment in bold typeface and included the Company’s response below the relevant comment:

Summary, page 4

| 1. | Please highlight the length of time that you and previous owners of the sites have been testing the sites, whether through third parties or otherwise. |

| In response to your comments, the Company has revised the Registration Statement at page 1 in the section entitled “Summary - Our Company,” in accordance with your comments. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 2

Risk Factors, page 6

| 2. | Given the status of your properties, it would be appropriate to include risk factors that address the risks associated with estimates based only on a pre-feasibility study. Please address the risks associated with the following points: |

| · | The limited amount of drilling completed to date. |

| · | The process testing is limited to small pilot plants and bench scale testing. |

| · | The difficulty obtaining expected metallurgical recoveries when scaling up to production scale from pilot plant scale. |

| · | The preliminary nature of the mine plans and processing concepts. |

| · | The resulting preliminary operating and capital cost estimates. |

| · | Metallurgical flow sheets and recoveries are in development. |

| · | The history of pre-feasibility studies typically underestimating capital and operating costs. |

Also, please note it is the staff’s position that prior to declaring reserves, the company should have obtained a “final” or “bankable” feasibility study, and employed the historic three-year average price for the economic analysis. In addition, the company should have submitted all necessary permits and authorizations, including environmental, to governmental authorities.

| In response to your comments, the Company has revised the Registration Statement by adding new risk factors at pages 5-6 in the section entitled “Risk Factors,” in accordance with your comments. |

Selling Security Holders, page 11

| 3. | Please tell us whether any of the selling security holders are broker-dealers or affiliates of broker-dealers. |

| The Company has identified in the prospectus the selling stockholders who have represented to us that they are affiliated with one or more registered broker-dealers, as requested pursuant to your comment. In addition, the Company has identified, as underwriters, in the prospectus the selling stockholders who have represented to us that they are registered broker-dealers, as requested pursuant to your comment. Please note the revised sections entitled "Plan of Distribution" and "Selling Stockholders" at pages 15-21. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 3

| 4. | Please disclose in this section the cash and any other consideration paid to your placement agents who are selling security holders. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Plan of Distribution” at pages 20-21 in accordance with your comments. |

Directors, Executive Officers…page 20

| 5. | We note your response to prior comment 15 and reissue it. Absent information as to annual revenues or similar indication it remains unclear what operations, if any, were conducted by CSA. Also, please provide a clear description of the business model referred to as “does not have any employees but relies on third party consultants for the provision of services.” Provide similar disclosure regarding the business of Nanominerals Corp. |

| In response to your comments, the Company has revised the Registration Statement at page 61 in the biography of Carl Ager in accordance with your comments. |

| 6. | Please tell us when you submitted proxy material to your shareholders for them to consider creating a classified board. |

| The provision for election of a classified board of directors are included in the company’s bylaws. Under Nevada law and the company’s bylaws, a bylaw provision may be amended by vote of the Company’s board of directors. |

| 7. | We note certain of your directors, officers, promoters and other members of management serve as directors, officers, promoters and members of management of other junior mining companies. Please advise us as to the following: |

| · | The full extent of the relationship of the Company, and its directors, executive officers and other members of management, with these other entities, including the percentage of ownership held by each in the other entity; |

| · | Whether these other entities are engaged in the same line of business in the same geographical areas as the Company; |

| · | The measure(s) that you have instituted to prevent officer and director conflicts of interest other than self-policing, such as whether independent directors or shareholders are required to approve any related party transactions or you have executed non-competition agreements with these officers/directors; |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 4

| · | The transactions you have consummated with these entities, including the material terms thereof; and |

| · | State whether the terms of any transactions with these entities are fair to the Company and its disinterested shareholders. |

Revise your disclosure in each appropriate section to discuss each of the above matters in appropriate detail. Also, please add a risk factor regarding the potential conflicts of interest of the officers and directors that details the information you describe and the material risks associated with such a situation. We may issue further comments.

| In response to your comments, the Company has revised the Registration Statement in the sections entitled “Management” at pages 61-62, “Certain Relationships and Related Transactions” at pages 69-72 and “Risk Factors” at page 10 in accordance with your comments. |

Security Ownership…page 24

| 8. | From your response to prior comment 17, it remains unclear why you do not include in the beneficial ownership of Messrs. McNeil and Ager the shares held in the name of Nanominerals. Therefore, we reissue the comment. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Security Ownership of Certain Beneficial Owners and Management” at pages 72-73 in accordance with your comments. |

Organization Within the Last Five Years, page 27

| 9. | We note your response to prior comment 43. If you are unable to determine the reasons for Mr. Harlingten’s transfer of 47,700,000 as part of your restructuring or the consideration received, please comply with Rule 409. Given your relationship with Mr. Matheson, it is unclear why you cannot obtain the information required to provide complete disclosure regarding the reorganization. See Rule 409(b). |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions” at page 68 in accordance with your comments. |

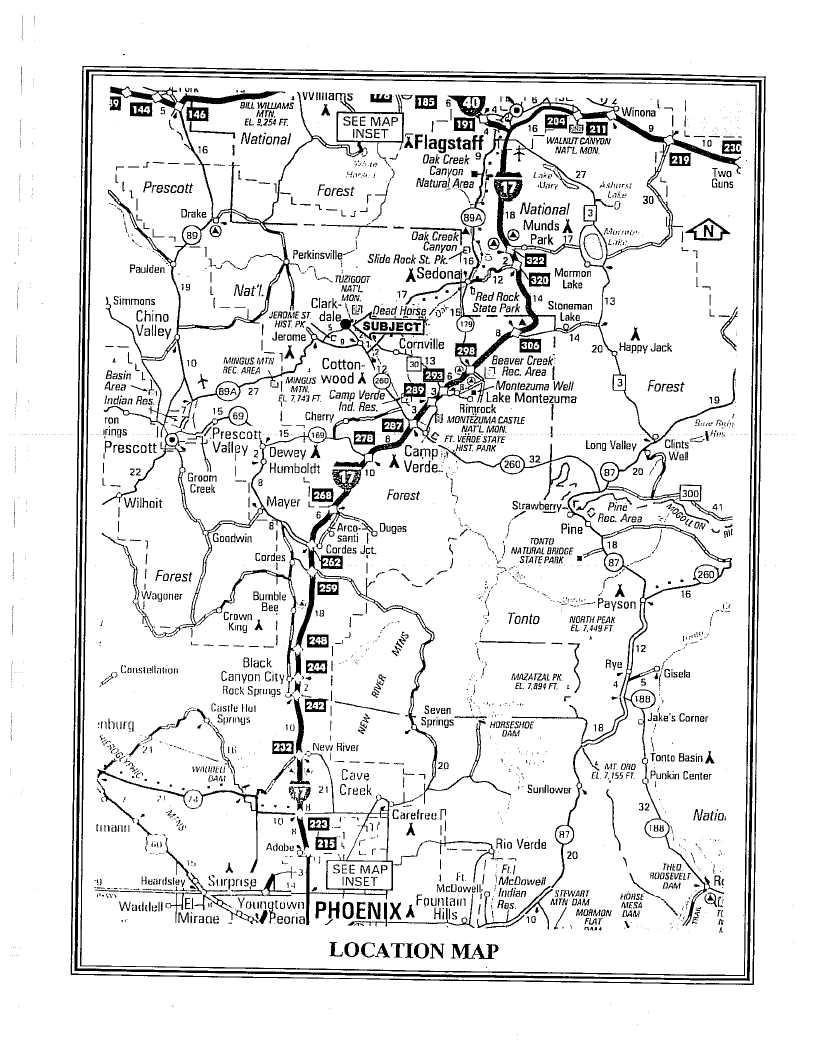

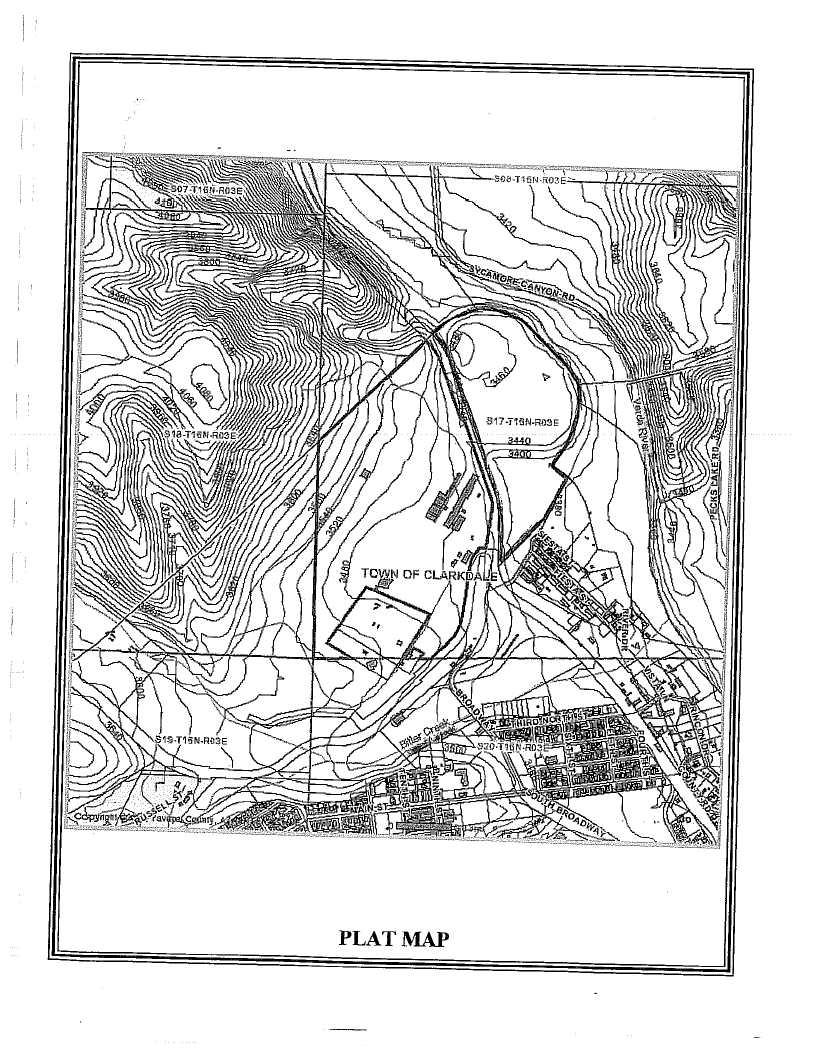

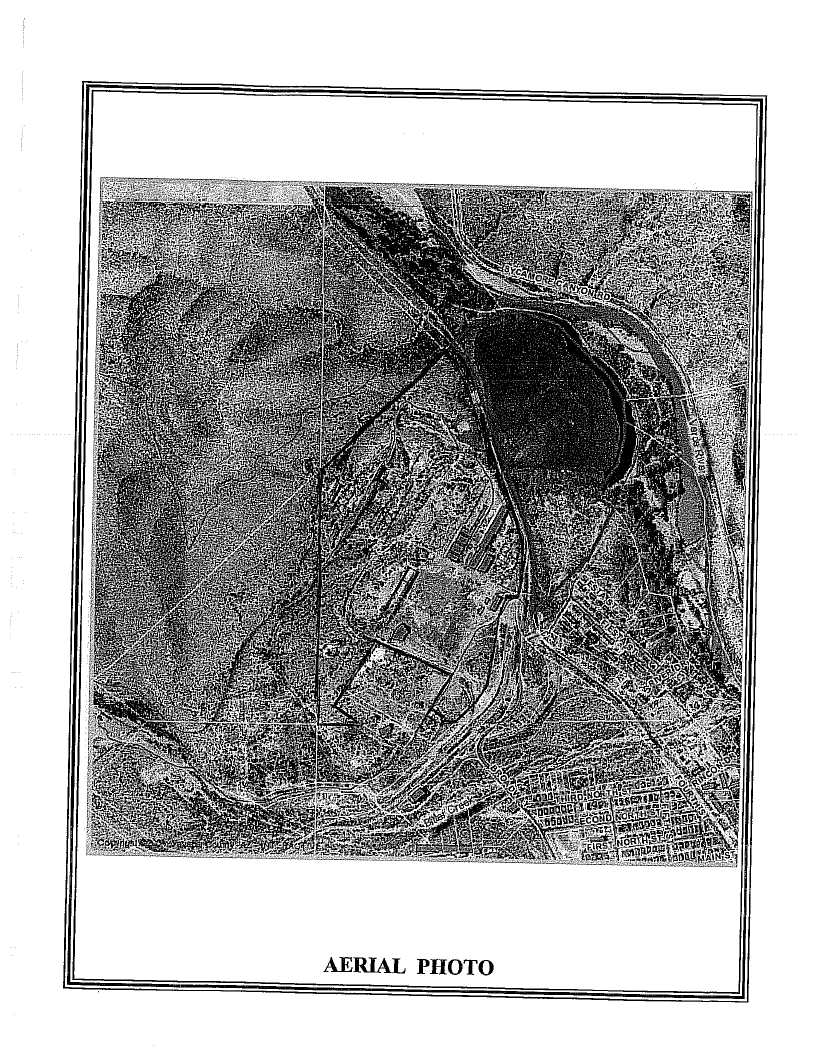

Clarkdale Slag Project, page 29

| 10. | We recommend that a brief description of the QA/QC protocols be provided to inform readers regarding sample preparation, controls, custody. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 5

| The Company has set forth a detailed description, in the section entitled “Business-Clarkdale Slag Project,” at pages 42-52 of the Registration Statement, of testing by independent consultants and the results of those tests. Within that description is a detailed discussion of the drilling, sampling and testing process, including the use of chain custody based sampling and testing programs by the various consultants. |

| 11. | Please clarify what you mean by a “unit (module) of production.” |

In response to your comments, the Company has revised the Registration Statement to give a more detailed description of the “module” in the “Executive Overview” section of the “Management’s Discussion and Analysis” section at pages 25-26 and the section entitled “Business-Clarkdale Slag Project” at pages 43-44 in accordance with your comments.

Acquisition of Clarkdale Slag Project, page 32

| 12. | Please clarify the paragraph numbered (v) on page 33. Given the $500,000 cap and the fact that you must pay $500,000 annually, it appears that you are obligated to pay $500,000 each year. If so, please say so directly without recitation of complex contract terms that do not appear to change the obligation. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Business-Reorganization with Transylvania International Inc.” at page 42 in accordance with your comments. |

| 13. | Please clearly explain the operation of the “priority distribution of cash flow” mentioned on the paragraph numbered (vi) on page 33. Also tell us which section of which exhibit governs this payment. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Business-Reorganization with Transylvania International Inc.” at page 42 in accordance with your comments. The Company believes that the reference to “priority distribution” no longer is of relevance because the concept regarding distributions related to distributions from joint venture under the Joint Venture Agreement with Verde River which has been terminated following the reorganization with Transylvania International. Instead, the only relevant provision relates to the payment of the $3,500,000 from “net cash flow,” which is set forth in the letter agreements between the Company and Verde River. Please also see response to Comment 61 below. |

Clarkdale Slag Pile, page 35

| 14. | Refer to the last paragraph of this section. Please clarify when the advances occurred. Likewise, please revise the disclosure in the first paragraph under “Metallurgy” on page 43 to clarify when the “years” of research occurred and whether you conducted the research. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 6

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Business-Clarkdale Slag Project,” at pages 42-52 in accordance with your comments. |

Current Status, page 36

| 15. | Please revise to describe the agreements you have entered into to pursue the current plan of operation to complete the materials study, pilot testing, and construction of the first “unit.” File these agreements as exhibits, or tell us which filed exhibits embody the agreements. |

| In response to your comments, the Company has revised the Registration Statement to describe the relationships with its various consultants in the section entitled “Business-Clarkdale Slag Project,” at pages 42-52 in accordance with your comments. In addition, the Company has filed the related agreements as exhibits to the registration statement (see Exhibits 10.49-10.51). |

Acquisition of Searchlight Claims, page 42

| 16. | Please expand this section and your related-party transactions section, as appropriate, to disclose: |

| · | The duration of the option; |

| · | The schedule on which you are required to issue the balance of the shares to the claim owners; and |

| · | The total amount you are obligated to reimburse Mr. Matheson and his related companies, in addition to the $85,000 you mention in the first paragraph. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Business-Acquisition of Searchlight Gold Project Claims” at page 40 and “Certain Relationships and Related Transactions-Transactions with Searchlight Claim Owners and Affiliates of K. Ian Matheson” at pages 69-70 in accordance with your comments. |

Plan of Operation, page 47

| 17. | We note that in response to prior comment 39 you deleted the references from the first paragraph regarding cash payments and minimum expenditures. Please tell us with specificity where you have now disclosed these obligations with the level of specificity requested in prior comment 39. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 7

| The Company has deleted the reference at the head of the “Management’s Discussion and Analysis” section and has described the remaining obligations under the Transylvania International agreement in the section entitled “Business-Reorganization with Transylvania International Inc.” at page 42 in accordance with your comments. Also, as noted in the section “Certain Relationships and Related Transactions-Transactions with Searchlight Claim Owners and Affiliates of K. Ian Matheson,” at page 70, the Company has completed its payment obligations to the holders of the Searchlight Claims. Further, the Company has set forth as described a specific one year budget at page 27 of the Registration Statement in the section entitled “Anticipated Cash Requirements.” |

Certain Relationships, page 53

| 18. | Please provide the disclosure required by Regulation S-B Item 404(c)(1)(ii). |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions - Transactions with Nanominerals Corp. and Affiliates” at pages 70-71 in accordance with your comments. |

| 19. | Please tell us why you have deleted the disclosure regarding Dr. Charles Ager’s report. See instruction 9 to Regulation S-B Item 404(a). |

| The Company believes that the initial report from Dr. Ager has been superseded in materiality by the subsequent reports and findings of its independent consultants that are described in the section entitled “Business-Clarkdale Slag Project,” at pages 42-52. |

| 20. | In the fifth paragraph on page 54 please clarify whether additional shares or other consideration may be issued in connection with the acquisition of claims. Disclose the timetable for payment of the additional shares. |

| All of the 5,600,000 shares required to be issued to the Searchlight Claim Owners have been issued as of June 30, 2008. In response to your comments, the Company has revised the Registration Statement in the section entitled “Business-Acquisition of Searchlight Gold Project Claims” at page 40 and the section entitled “Certain Relationships and Related Transactions-Transactions with Searchlight Claim Owners and Affiliates of K. Ian Matheson” at pages 69-70 in accordance with your comments. |

| 21. | The penultimate sentence of the fifth paragraph on page 54 appears to be incomplete. Please clarify. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions - Transactions with Nanominerals Corp. and Affiliates” at pages 70-71 in accordance with your comments. In addition, the Company has added clarifying footnotes regarding Geotech and Geosearch in the section entitled “Security Ownership of Certain Beneficial Owners and Management” at pages 72-73. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 8

| 22. | We note your response to prior comment 42. When you use the term “dated for reference” please clarify when you actually entered into the agreement, rather than just the date you chose to include in the document for reference. |

| In response to your comments, the Company has revised the Registration Statement and deleted the term “dated for reference” with respect to the Nanominerals and Transylvania International agreements in the Registration Statement in accordance with your comments. |

| 23. | Please update your disclosure throughout this section. For example, we note that the disclosure in the last paragraph on page 55 is not updated beyond December 31, 2006. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions” at pages 69-72 to update all related party transactions in accordance with your comments. |

Nanominerals Corp., page 55

| 24. | If you and your affiliates are Nanominerals’ principal or sole client, please disclose that fact. |

| The Company has been advised by Nanominerals that the Company is not the principal or sole client of Nanominerals. |

| 25. | Please disclose the reasons for each amendment to the assignment agreement. |

| The first amendment to the Nanominerals agreement is not material for disclosure purposes. The second amendment includes a discussion of the meaning of the term “net smelter returns,” which is discussed in the context of a discussion of the integrated agreement in the section entitled “Acquisition of Clarkdale Slag Project-Assignment Agreement with Nanominerals” and “Reorganization with Transylvania Inc.” at pages 41-42 of the Registration Statement in accordance with your comments. At this point, the Company does not believe that it is useful to the reader to describe the integrated agreement rather than to give a chronological history of the amendments. |

| 26. | Please disclose the amount of the “certain payments” mentioned in the second paragraph. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 9

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions - Transactions with Nanominerals Corp. and Affiliates” at pages 70-71 in accordance with your comments. |

| 27. | Please tell us why you have not disclosed the 2005 payments for activities mentioned in the last paragraph of this section. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions - Transactions with Nanominerals Corp. and Affiliates” at pages 70-71 in order to include reimbursements made in 2005 to Nanominerals in accordance with your comments. |

Market for Common Equity, page 56 |

| 28. | It remains unclear whether the prices for the second and third quarters of 2005 have been adjusted for the subsequent two for one split. Please clarify. |

| In response to your comments, the Company confirms that the Registration Statement in the section entitled “Price Range of Common Stock” at page 22 in accordance with your comments, reflects that all reference to number of shares in the prospectus have been adjusted to reflect the stock split. |

Summary Compensation Table, page 57

| 29. | Please reconcile the information in the table with the disclosure regarding the agreements with your executives on pages 54 and 59. |

| In response to your comments, the compensation information included in the table on pages 65-66 reflects actual compensation for the periods presented. The narrative discloses the employment contract terms and discloses the dates for changes in compensation amounts. |

Director Compensation, page 58

| 30. | Please clarify the reasons for the difference between the $28,000 reported for Mr. Matheson in this table and the $24,500 disclosed on page 54. |

| The correct amount in the prior table for 2006 director compensation for Mr. Matheson should have been $24,500. In response to your comments, the Company has revised the Registration Statement in the section entitled “Certain Relationships and Related Transactions-Transactions with Searchlight Claim Owners and Affiliates of K. Ian Matheson” at page 70. |

| 31. | Please disclose the nature of the “services relating to the Clarkdale Slag Project acquisition” mentioned in footnote 3. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 10

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Director Compensation” at page 68 in accordance with your comments. |

| 32. | Please tell us how the table represents the $1,000 payments mentioned at the top of page 59. |

| In response to your comments, the Company has revised the Registration Statement in the section entitled “Director Compensation” at page 68 in accordance with your comments. |

Financial Statements, page 60

| 33. | Please revise to include financial statements of Transylvania International, Inc. and pro forma financial statements reflecting the acquisition of Transylvania International, Inc. in the registration statement. Refer to Item 310 of Regulation S-B. |

| The pro forma results of operations reflecting the acquisition of Transylvania International have been included in note 18 of the financial statements filed with the Registration Statement. The balance sheet effect has been included in the historical 2007 balance sheet with acquisition information presented in the notes to the 2007 financial statements (see note 3 to the financial statements) outlining the details of the acquisition. |

| Audited financial statements of Transylvania International, Inc. (the target company) for 2005 and 2006 have been included in this Registration Statement. |

Financial Statements for the year ended December 31, 2006

| 34. | Please update the financial statements, as necessary, as required by Item 310 of Regulation S-B. |

| In response to your comments, the Company has updated the financial statements filed with the Registration Statement. |

Report of Independent Registered Public Accounting Firm

| 35. | We see that the report of Kyle L. Tingle dated April 10, 2006 covers the period January 14, 2000 (inception) through December 31, 2005. However, we do not see that the period from January 14, 2000 (inception) through December 31, 2006 has been audited. Please advise. |

| Updated auditor reports and consents have been included in the Registration Statement to cover the periods presented. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 11

Balance Sheet, page F-3

| 36. | Please change the reference of accumulated deficit during development stage to accumulated deficit during exploration stage. |

| In response to your comments, the Company has changed the description in financial statements filed with the Registration Statement. |

Statement of Cash Flows, page F-8

| 37. | Please tell us how your measurement of the effect of changes in exchange rates on cash balances is consistent with paragraph 25 and Example 2 of Appendix C to SFAS 95. In that regard, also tell us why the effect of foreign currency exchange rate on cash is the same as your foreign currency translation adjustment on the statement of stockholder’s equity. |

| In response to your comments, the financial statements included with the Registration Statement have been updated to reflect the effect of the exchange rate on related expense item. Further, in reference to Comment 38, the effect on the related expense item has been restated to be reported as discontinued operations. |

Note 1. Description of Business, History and Summary of Significant Policies, page F-9 History

| 38. | Refer to prior comment 49 in our letter dated November 27, 2006. It appears that the former biotech business was a component of the entity since that was your only operation prior to reorganizing into a mineral exploration company. It is unclear how paragraph 10 of SFAS 131 applies or how only having one activity impacts the analysis. Please revise to report the biotech research and development company as a discontinued operation. |

| In response to your comments, the financial statements included with the Registration Statement have been updated to reflect the effect of the exchange rate on related expense item. Further, the effect on the related expense item has been restated to be reported as discontinued operations. |

Note 3. Mining Claims, page F-15

| 39. | We note your response to prior comment 50 in our letter dated November 27, 2006. Regarding the acquisition of mining concessions in Searchlight, Nevada, we still do not understand the basis for valuing the cost of the acquisition based on $2,000 per claim (an agreed upon price). We note that your stock appears to have been thinly traded at the time of the acquisition and that paragraph 6 of SFAS 141 states that measurement should be based on the fair value of the consideration given or the fair value of the asset acquired, whichever is more clearly evident and, thus, more reliably measurable. However, we do not see how an agreed upon price between the buyer and seller is an objective determination of the fair value of the asset acquired. We reference paragraph 23 of SFAS 141 which states that both the net assets received, including goodwill, and the extent of any adjustment of the quoted market price of the shares issued shall be weighed to determine the amount to be recorded. All aspects of the acquisition, including the negotiations, shall be studied, and independent appraisals may be used as an aid in determining the fair value of securities issued. Please provide evidence that the agreed upon value of the mining concessions is the fair value and support how this was recorded in accordance with the accounting literature or revise to record the purchase price based upon a more objective measure of fair value of the consideration given or the fair value of the asset acquired, whichever is more clearly evident and reliably measureable. Please revise disclosures to clarify your accounting treatment. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 12

In response to your comments, the Company has performed additional research on the accounting treatment of this transaction and determined that the acquisition of the mining claims represents an acquisition of tangible assets in accordance with EITF 04-02: Whether Mineral Rights Are Tangible or Intangible Assets and should be accounted for in accordance with EITF 98-03: Determining Whether a Nonmonetary Transaction Involves Receipt of Productive Assets or of a Business and the related deferred income tax effect in accordance with guidance outlined in EITF 98-11: Accounting for Acquired Temporary Differences in Certain Purchase Transactions That Are Not Accounted for as Business Combinations. The Company has restated its financial statements for 2005 and 2006 to reflect this treatment and recorded the 2007 claim acquisition payments in accordance with this treatment. The Company also determined that the quoted market price of the shares at the time of the transaction issued for consideration in the transaction was the most objective measure of fair value. |

| 40. | Regarding your response to prior comment 51, please tell us the basis for the internal evaluation of future cash flows in your impairment analysis. Tell us why you believe, based on the current status of the Searchlight, Nevada claims, and based on the fact that you have not determined the economic feasibility of the project, that the amount recorded as an asset is recoverable. Please provide us with your impairment analysis under the provisions of SFAS 144. |

| In response to your comments, the Company has made its determination based on the following analysis: |

| At the acquisition date of the Company’s mineral assets, and at the date of each reporting period, there were no events or changes in circumstances that would suggest that an impairment of amounts initially capitalized under EITF 04-02 should be recognized. Irrespective of whether exploration activities have advanced sufficiently to quantify Value Beyond Proven and Probable Reserves (“VBPP”), the Company is required under EITF 04-02 and FAS 144 to recognize these tangible assets on its balance sheet based on the fair value of the relevant purchase consideration, until such time that a change in circumstances occurs indicating the need for an impairment review. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 13

EITF 04-02 indicates that these mineral rights are tangible assets and should be capitalized as a separate component of property, plant and equipment. EITF 04-3 Mining Assets - Impairment and Business Combinations indicates that VBPP should be considered to the extent that a market participant would include VBPP in determining the fair value of the assets. Although as of the dates of acquisition of these individual rights, exploration activities had not sufficiently advanced to quantify specific amounts, the Company’s business decision to acquire the assets was based on the indication of VBPP. |

| In reaching this conclusion, the Company considered the following examples of changes in circumstances, as outlined in paragraph 8 of FAS 144 that would indicate the need for an impairment review: |

a. A significant decrease in the market price of a long-lived asset (asset group);

b. A significant adverse change in the extent or manner in which a long-lived asset (asset group) is being used or in its physical condition;

c. A significant adverse change in legal factors or in the business climate that could effect the value of a long-lived asset (asset group), including an adverse action or assessment by a regulator;

d. An accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset (asset group);

e. A current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset (asset group); or

f. A current expectation that, more likely than not, a long-lived asset (asset group) will be sold or otherwise disposed of significantly before the end of its previously estimated useful life.

| The mining assets acquired were “Long-Lived Assets,” as contemplated by FAS 144 and only subject to FAS 144’s impairment considerations whenever events or changes in circumstances indicated that their carrying amount might not be recoverable. |

| 41. | We reference your response to prior comment 52. We see that you issued 1.4 million shares of common stock during 2006 related to the continuing obligation for the purchase of the mining concessions and that those shares were recorded at $0.001 per share. Please tell us the basis for your accounting for these additional shares under SFAS 141, including how you determined the values assigned to these shares. If the issuance of these shares is a form of licensing or leasing arrangement, tell us why you should not expense the fair value of the shares issued over the period of use. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 14

| The Company refers to its response to your Comment 39 and has treated the 2005, 2006 and 2007 share issuances in consideration for the Searchlight Claims acquisition consistently with that analysis. |

Note 7. Stockholder’s Equity, page F-17

| 42. | We reference the disclosure on page F-18 that 35,000,000 shares were returned to the company and cancelled in February 2005. Please reconcile that disclosure with the presentation on the Statement of Stockholder’s Equity, which states that 70,000,000 shares were cancelled and returned. |

| In response to your comments, the Company has revised the financial statement footnotes to reflect the split-adjusted share quantity as 70,000,000. |

Note 8. Option Plan, page F-19

| 43. | We see the significant number of “cancelled” options during fiscal year 1005. Tell us whether you granted any options to the employees whose options were “cancelled.” If so, tell us how you considered the requirements of FIN 44 and whether re-pricing accounting is required. |

| The “cancelled” options were issued prior to December 31, 2004 and no further options were granted to those optionees as they were no longer associated with the Company. |

| 44. | Please tell us your accounting treatment for the 12 million warrants exercisable at $.375 per share issued in connection with the Nanominerals assignment agreement. |

| In response to your comments, the Company performed additional research on the accounting treatment related to this transaction and restated the 2005 transaction to reflect the valuation of the warrants issued. The Company applied valuation techniques consistent with our other share based payments and has included updated disclosure in notes 1, 3 and 9 to the financial statements in the Registration Statement. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 15

Note 12. Concentration of Activity, page F-24

| 45. | We note that you purchased services from a related party in the amount of $495,000 during the year ended December 31, 2006. Please tell us why the amount should not be separately stated on the face of the statement of operations in accordance with Rule 4-08(k) of Regulation S-X. |

| In response to your comments, the Company has updated the financial statements included in the Registration Statement to reflect the breakout of the services purchased from a related party. |

Consolidated Financial Statements for the three months ended March 31, 2007 Note 2. Fixed Assets, page F-14

| 46. | We see that you have a recorded an income property asset and have recognized rental income during the three months ended March 31, 2007. Please revise to disclose the nature of the income property and the terms of the rental agreement. |

| In response to your comments, the Company has included disclosure related to rental income and rental agreement terms in Footnote 10 to the financial statements included in the Registration Statement. |

Note 3. Merger with Transylvania International, Inc., page F-15

| 47. | Please tell us whether Transylvania International was an affiliate or related party and whether there was any common stock ownership prior to the merger. |

| In response to your comments, Transylvania International was not an affiliate or related party and the Company held no equity interest in Transylvania International prior to the merger. |

| 48. | We reference your statement that the assignment agreement with Nanominerals as discussed in Note 4 to your financial statements for the year ended December 31, 2006 was superseded by the merger with Transylvania International. Please tell us whether you are still required to comply with the conditions listed on page F-16 and, if so, how you are accounting for those payments and conditions. |

| In response to your comments, the Company has updated the financial statements to more clearly reflect the terms of the transaction. The terms of the joint venture option no longer were applicable based on the termination of the joint venture and were replaced with the terms of the merger which are disclosed in the financial statements at Notes 1, 3, 6,15 and 16. |

| 49. | Please revise to disclose how you are accounting for the 2.5% royalty and the $500,000 annual advance royalty payment due to VRIC in connection with the acquisition. We reference paragraph 28 of SFAS 141 which describes the accounting treatment for contingent consideration based on future period earning levels. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 16

| In response to your comments, the Company has updated the financial statements to more clearly reflect the terms of the transaction. The terms of the joint venture option no longer were applicable based on the termination of the joint venture and were replaced with the terms of the merger which are disclosed in the financial statements at Notes 1, 3, 6, 15 and 16. |

| 50. | As a related matter, please disclose how you are accounting for the $3,500,000 priority distribution of cash flow and tell us the basis for your accounting treatment. |

| In response to your comments, the Company has updated the financial statements to more clearly reflect the terms of the transaction. The terms of the joint venture option no longer were applicable based on the termination of the joint venture and were replaced with the terms of the merger which are disclosed in the financial statements at Notes 1, 3, 6, 15 and 16. |

| 51. | Please revise to provide the disclosures required by paragraph 58 of SFAS 141. For example, we do not see where you have disclosed the primary reasons for the acquisition, the period for which the results of operations of the acquired entity are included in the income statement, and the basis for determining the value assigned to the shares issued as consideration. |

| In response to your comments, the Company has updated the financial statements to include the primary reasons for the acquisition as outlined in Note 3 to the financial statements. |

| 52. | Please revise to clarify the nature, valuation and basis for your accounting for each of the non-cash amounts included in your purchase price allocation, including the common stock issued, monthly payments and the deferred income tax liability. |

| In response to your comments, the Company has updated the financial statements to include the components of the purchase price acquisition for the acquisition as outlined in Notes 3, 7 and 16 to the financial statements. |

| 53. | Please revise to clarify how the value allocated to the Clarkdale slag project of $111 million was determined. The basis for the statement that the project was valued based on “the overall consideration given” is not clear. Please tell us how you complied with the requirements of paragraph 6 of SFAS 141 which states that measurement should be based on the fair value of the consideration given or the fair value of the asset acquired, whichever is more clearly evident and, thus, more reliably measurable. We also reference paragraph 37(f) of SFAS 141 which states that land, natural resources should be recorded at the appraised values. In addition, tell us how your accounting complies with EITF 04-03 and how you considered the fact that the economic feasibility of the project has not been determined as indicated on page 47. Clarify how you determined “economic value,” which considers the estimated costs of the slag project. Additionally, please tell us the nature of the asset recorded as “Clarkdale slag project.” |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 17

| In response to your comments, the Company has performed additional research on the accounting treatment of this transaction and determined the acquisition of the mining claims represents an acquisition of tangible assets in accordance with EITF 04-02 and should be accounted for in accordance with EITF 98-03, and the related deferred income tax effect in accordance with guidance outlined in EITF 98-11. |

| The Company has restated the financial statements for the warrants issued in connection with the Clarkdale Slag acquisition and recorded the 2007 acquisition transaction in accordance with research supported by EITF 98-03 and EITF 98-11. The Company also restated its financial statements to remove from the acquisition accounting treatment any future payments that meet the definition of contingent payments, as defined in SFAS 141 and further clarified by SEC guidance on accounting for contingent payments. |

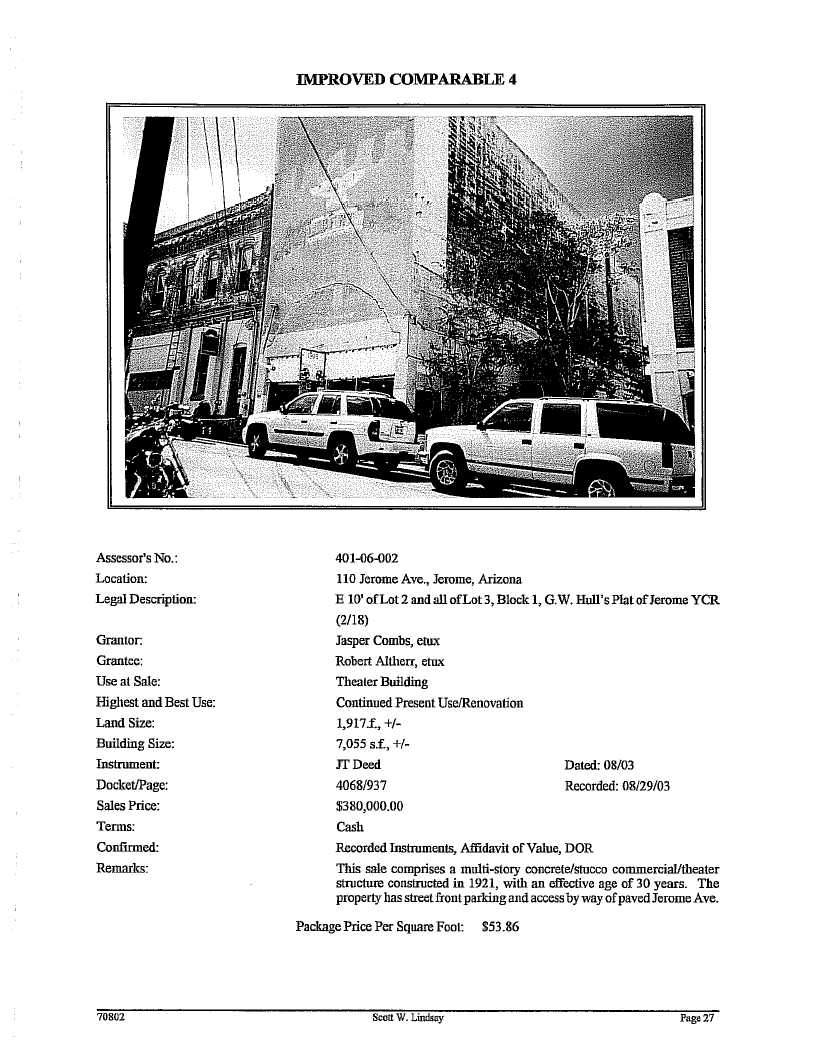

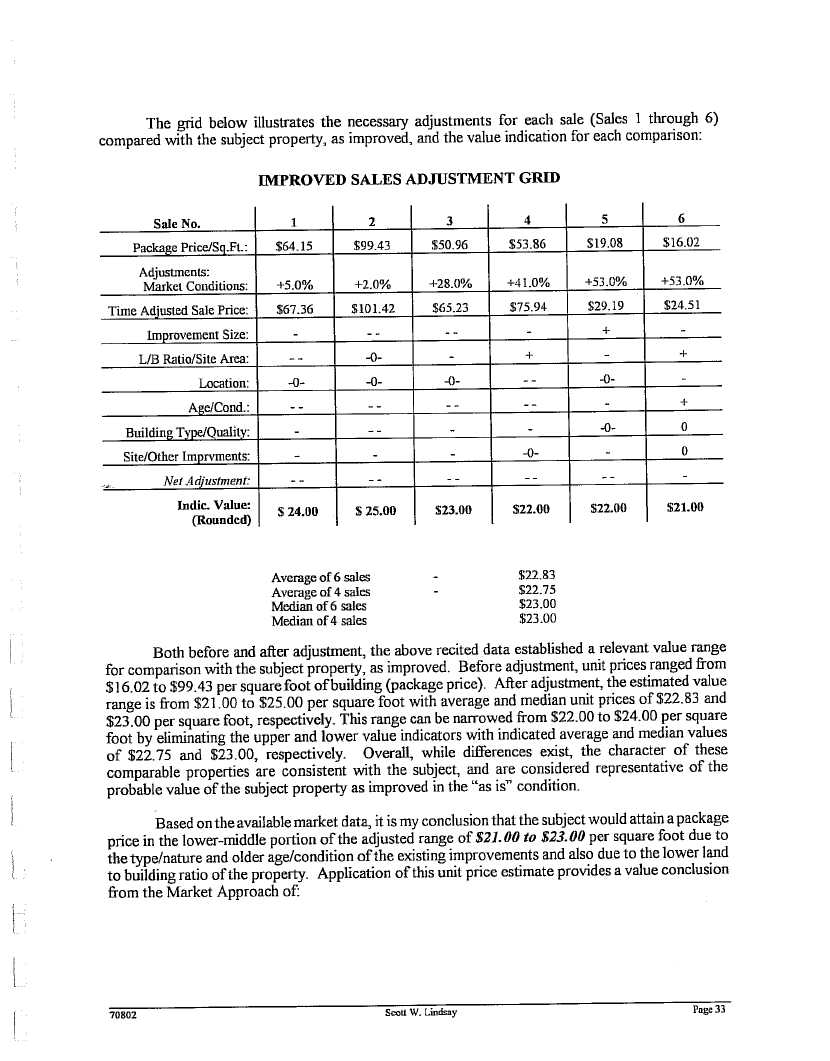

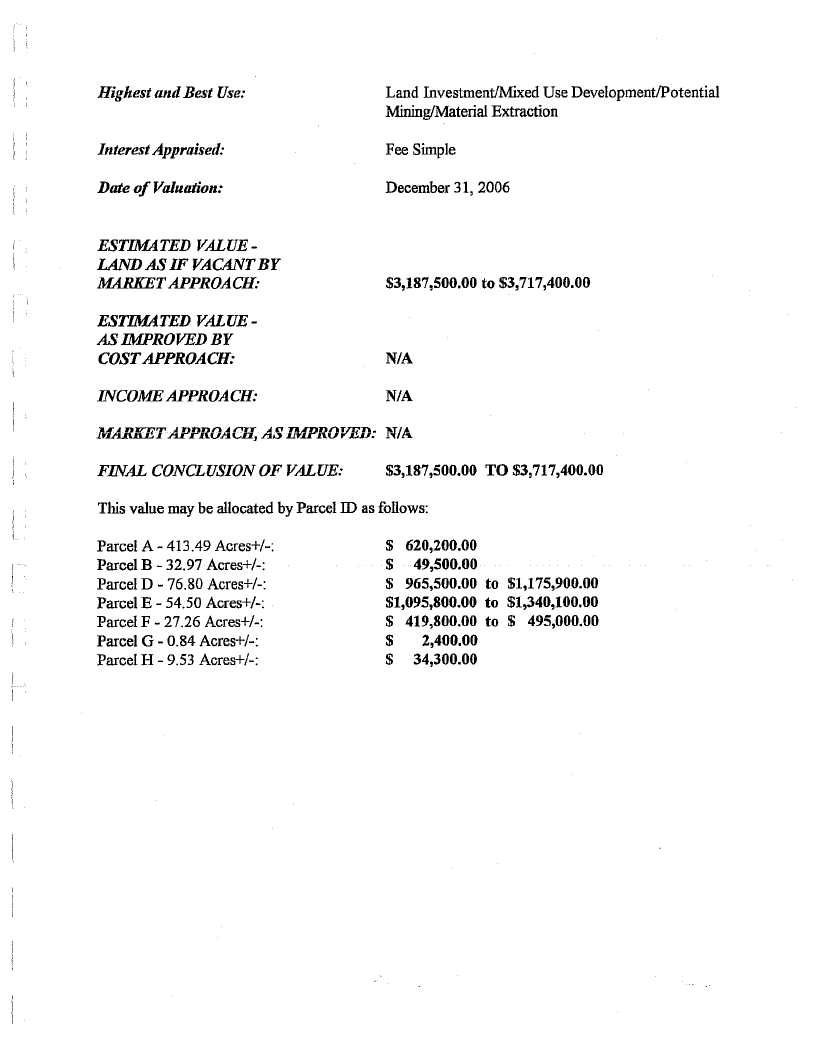

| The Company has attached a copy of the appraisal to this letter as supplemental information, and has obtained the necessary consent of the named expert, which is attached to the Registration Statement as Exhibit 23.9. |

| In response to your comments related to economic feasibility of the Clarkdale Slag project, the Company refers to its response to Comment 54. |

| 54. | Tell us how you have assessed the possible impairment of the Clarkdale slag project in accordance with the requirements of SFAS 144. Tell us how you considered EITF 04-03 in your analysis. |

| In response to your comments, the Company has made its determination based on the following analysis: |

| At the acquisition date of the Company’s mineral assets, and at the date of each reporting period, there were no events or changes in circumstances that would suggest that an impairment of amounts initially capitalized under EITF 04-02 should be recognized. Regardless of whether exploration activities have advanced sufficiently to quantify VBPP, the Company is required under EITF 04-02 and FAS 144 to recognize these tangible assets on its balance sheet based on the fair value of the relevant purchase consideration, until such time that a change in circumstances occurs indicating the need for an impairment review. |

| EITF 04-02 indicates that these mineral rights are tangible assets and should be capitalized as a separate component of property, plant, and equipment. EITF 04-03 indicates that VBPP should be considered to the extent that a market participant would include VBPP in determining the fair value of the assets. Although as of the dates of acquisition of these individual rights, exploration activities had not sufficiently advanced to quantify specific amounts. The Company’s business decision to acquire the assets was based on the existence of VBPP. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 18

| In reaching this conclusion, the Company considered the following examples of changes in circumstances, as outlined in paragraph 8 of FAS 144 that would indicate the need for an impairment review: |

a. A significant decrease in the market price of a long-lived asset (asset group);

b. A significant adverse change in the extent or manner in which a long-lived asset (asset group) is being used or in its physical condition;

c. A significant adverse change in legal factors or in the business climate that could effect the value of a long-lived asset (asset group), including an adverse action or assessment by a regulator;

d. An accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset (asset group);

e. A current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset (asset group); or

f. A current expectation that, more likely than not, a long-lived asset (asset group) will be sold or otherwise disposed of significantly before the end of its previously estimated useful life.

| The mining assets acquired were “Long-Lived Assets,” as contemplated by FAS 144 and only subject to FAS 144’s impairment considerations whenever events or changes in circumstances indicated that their carrying amount might not be recoverable. |

| 55. | Please revise to disclose the amortization period for the Clarkdale slag project assets that were recorded in the acquisition. |

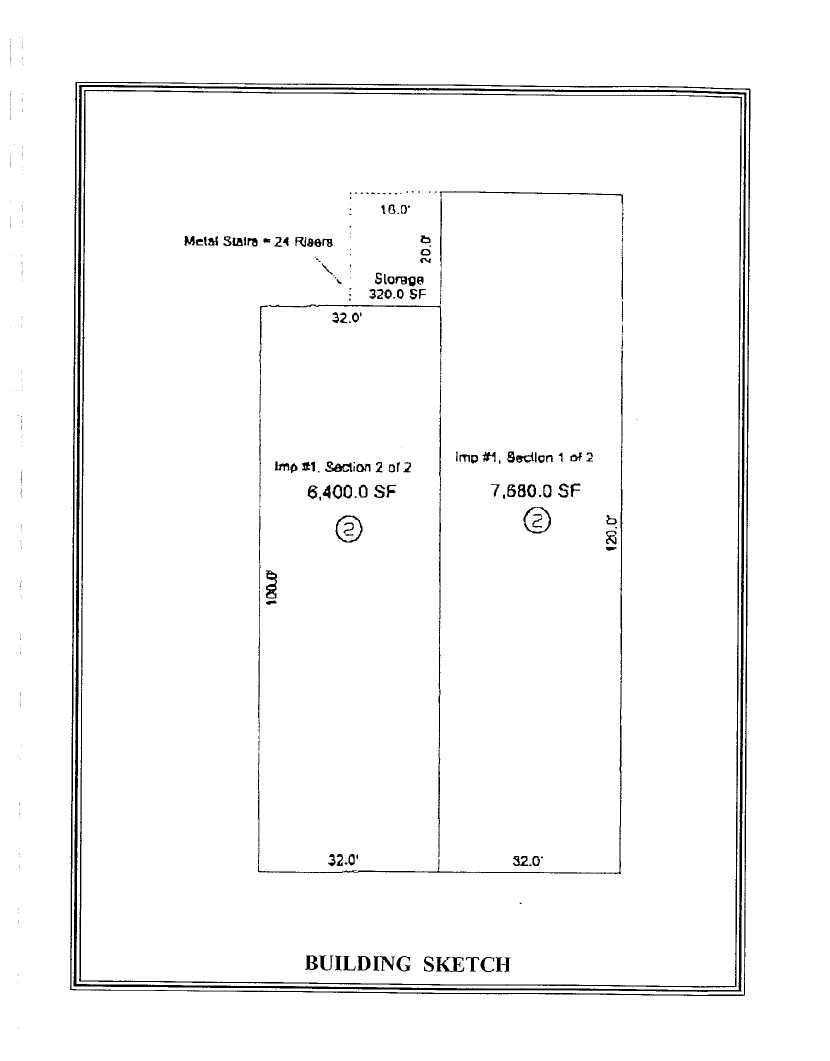

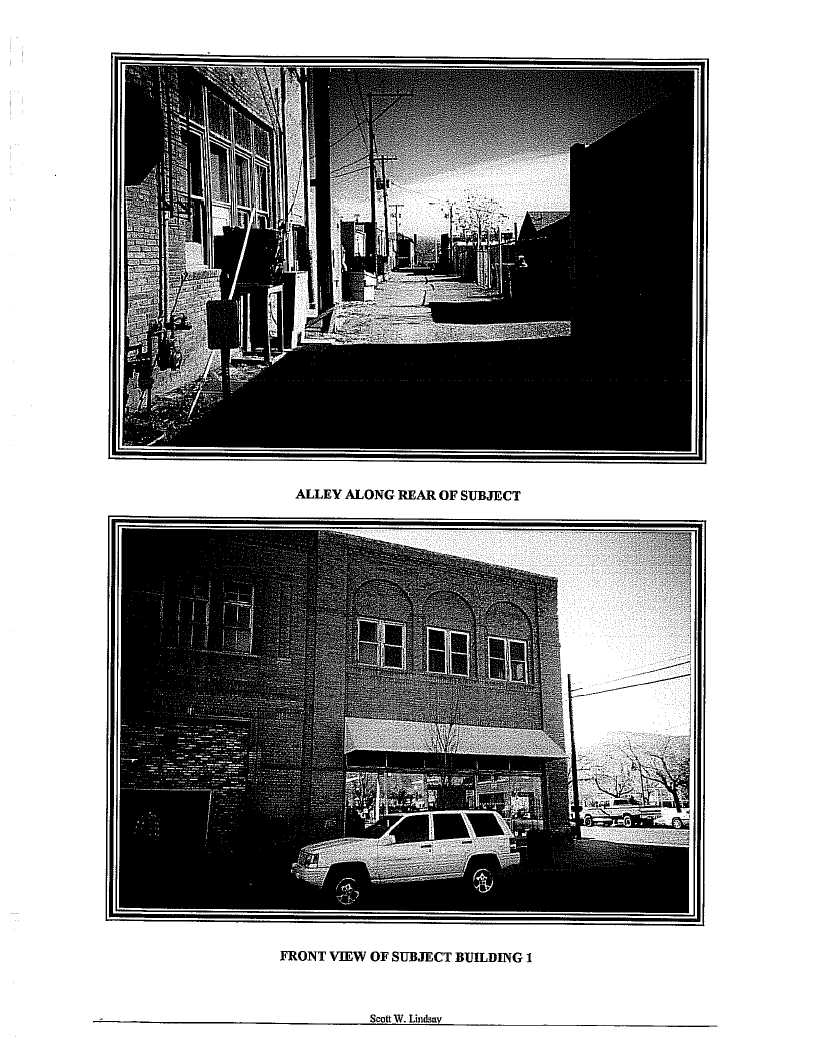

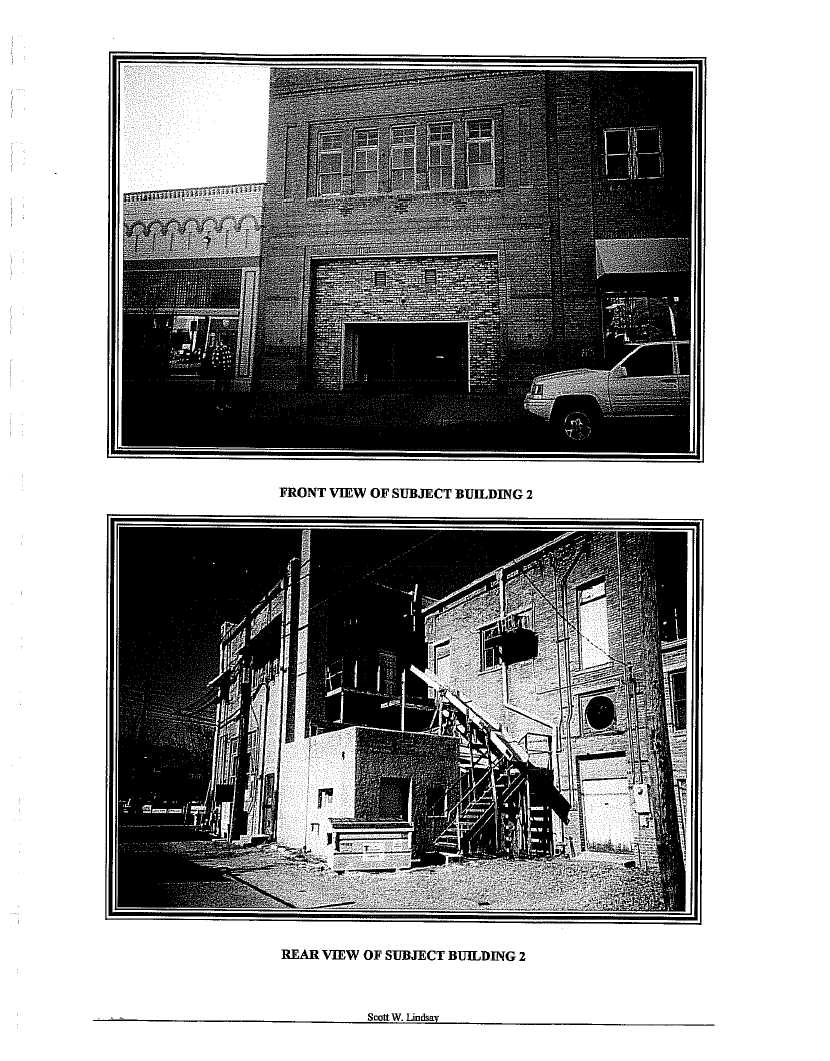

| The assets acquired are not of an amortizable nature. The assets consist of the slag material, bare land underneath the slag pile, vacant land and the income property buildings. The mineral asset will be depleted over the production life based on units of production. The income property buildings will be subject to depreciation over 39 years. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 19

| 56. | Please tell us the accounting basis for the reclassification of the $690,000 joint venture asset that was previously capitalized to the Clarkdale slag project asset. |

| The consideration for the option to enter into the joint venture was paid in cash in the amount of $690,000 and is part of the overall cost to the Company to acquire the Clarkdale Slag project. |

| 57. | We note the disclosure on page F-16 that the real property assets were based on fair market values determined using an independent real estate appraisal firm. While management may elect to take full responsibility for valuing the equity instruments, if you choose to continue to refer to the expert in any capacity, please revise the filing to name the independent valuation expert and include its consent as an exhibit. Refer to Rule 436 and Item 601(b)(23) of Regulation S-B. |

| The Company has attached a copy of the appraisal to this letter as supplemental information, and has obtained the necessary consent of the named expert, which is attached to the Registration Statement as Exhibit 23.9. |

Recent Sales, page 63

| 58. | Please reconcile the information in paragraph 8 on page 50 with the information on page F-19. |

| In response to your comments, the Company has revised the Registration Statement to correct the warrant amount to 612,500 as reflected in the financial statements. |

Exhibits, page 67

| 59. | We note your response to prior comment 60; however, exhibits required to be filed by Regulation S-B Item 601 must be included in your filing. Please provide us your analysis regarding why the documents are not required as exhibits. |

| As noted in the prior correspondence of June 13, 2007, the Company has filed the relevant warrants as exhibits to the Registration Statement under Item 4. Also, the Company has filed as exhibits the Searchlight option agreements, the Transylvania International agreements, the Nanominerals agreements and the various employment agreements. However, at this point, the Company does not believe that the subscription agreements for the various private placements are material contracts or add beneficial disclosure in light of the disclosure of the terms of the private placements in the Registration Statement. |

| 60. | Please ensure that your exhibit index accurately identifies the location of exhibits. For example, your reference to footnote 18 for exhibit 10.26 appears to be incorrect. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 20

| In response to your comments, the Company has revised the Registration Statement in the exhibit table in Part II of the Registration Statement at pages II-6-9 in accordance with your comments. |

Form 8-K dated February 15, 2007

Pro Forma Financial Statements of Searchlight Minerals Corp. as of December 31, 2006 and for the year ended December 31, 2006

| 61. | Please revise to disclose the following, as required by Article 11 of Regulation S-X: |

| · | Provide a schedule showing the calculation of purchase price, including how you determined the value assigned to non-cash consideration with reference to the GAAP literature you relied on; |

| · | Disclose any contingent consideration, why the amounts have not been recorded in the calculation of total purchase price, and the potential impact of contingent consideration on future earnings; |

| · | Clarify how you determined the purchase price allocation and the basis for the significant amounts allocated to the Clarkdale slag project; |

| · | Disclose the nature of the monthly payments included in the purchase price and how these amounts were determined; |

| · | Disclose the nature of the $33 million deferred income tax liability, how this amount was determined and why this is part of the purchase price; |

| · | Clarify your accounting for the $3.5 million “priority distribution”; |

| · | Disclose the expected useful lives or amortization periods of significant assets acquired in the business combination; |

| · | Disclose the nature and accounting for the liabilities incurred in the purchase transaction Note H; |

| · | Disclose how the fair value of the assets acquired was determined in Note F; |

| · | Please tell us why where are no pro forma adjustments in the pro forma statement of operations. |

| In response to your comments, the Company performed additional review of authoritative guidance on the accounting treatment of this transaction and determined that the acquisition of the mining claims represents an acquisition of tangible assets in accordance with EITF 04-02 and should be accounted for in accordance with EITF 98-03, and the related deferred income tax effect in accordance with guidance outlined in EITF 98-11. |

| The Company has restated the financial statements for the warrants issued in connection with the Clarkdale Slag acquisition and recorded the 2007 acquisition transaction in accordance with research supported by EITF 98-03 and EITF 98-11. The Company also has restated the financial statements to remove from the acquisition accounting any future payments that meet the definition of contingent payments, as defined in SFAS 141, and further clarified by SEC guidance on accounting for contingent payments. |

United States Securities and Exchange Commission

Russell Mancuso, Legal Branch Chief

July 17, 2008

page 21

In connection with the Company’s response to your comment letter, the Company acknowledges that:

1. The Company is responsible for the adequacy and accuracy of the disclosure in the filing of the Registration Statement;

2. The staff’s comments or changes to disclosure in response to staff comments, do not foreclose the Commission from taking any action with respect to the filings; and

3. The Company may not assert the staff’s comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

We hope that our responses fully address your inquiries. Please contact us if you have any further questions at the address and phone number in our letterhead.

Very truly yours, /s/ Jeffrey P. Berg Jeffrey P. Berg of BAKER & HOSTETLER LLP |

| CC: | CARL S. AGER |

KRISTIN LOCHHEAD

ALAN MORRIS

IAN MCNEIL

MELVIN WILLIAMS