SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

TIAA-CREF Funds

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | | |

| |

730 Third Avenue New York, NY 10017-3206 | | |

TIAA-CREF Funds

Important notice regarding availability of proxy materials for the Special Meeting of Shareholders to be held on July 17, 2019. The Proxy Statement for this meeting is available at: www.proxy-direct.com/tia-30640

Notice of Special Meeting — July 17, 2019

This notice is being given to the shareholders (the “Shareholders”) of theTIAA-CREF Funds (the “Trust”). Only Shareholders of the Trust are eligible to vote at the special meeting.

The Trust will hold a special meeting of Shareholders on July 17, 2019, at 1:00 p.m. EDT, at the New York Office of Teachers Insurance and Annuity Association of America (“TIAA”), 730 Third Avenue, New York, NY 10017. This proxy statement was mailed to Shareholders of the investment portfolios offered by the Trust (each, a “Fund” and collectively, the “Funds”) starting on or about June 6, 2019.

The purpose of the meeting is:

| 1. | To elect ten individuals to serve as Trustees for indefinite terms and until their successors shall take office; and |

| 2. | To address any other business that may properly come before the meeting. |

The Board of Trustees has set May 30, 2019 as the Record Date for determining the number of votes entitled to be cast. You may vote at the meeting only if you were a Shareholder with voting rights as of the Record Date.

By order of the Board of Trustees,

Mona Bhalla

Corporate Secretary

Please vote as soon as possible before the meeting, even if you plan to attend the meeting. You can vote quickly and easily by toll-free telephone call, over the Internet or by mail. Just follow the simple instructions that appear on your proxy card.

If you plan to attend the meeting, please call877-535-3910, ext.22-2440, to obtain an admission pass. In accordance with the Trust’s security procedures, a pass and appropriate picture identification will be required to enter the Trust’s special meeting. Please note that no laptop computers, recording equipment or cameras will be permitted. All cell phones must be turned off when entering the meeting and remain off during the meeting. Please read the instructions on the admission pass for additional information.

June 6, 2019

TIAA-CREF Funds

Proxy Statement for Special Meeting to be held on July 17, 2019

The Board of Trustees (“Board”) of the TIAA-CREF Funds (the “Trust”) has sent you this proxy statement to ask for your vote on certain matters affecting the Trust. The accompanying proxy will be voted at a special meeting of the shareholders (the “Shareholders”) of the Trust being held on July 17, 2019, at 1:00 p.m. EDT, at the New York Office of Teachers Insurance and Annuity Association of America (“TIAA”), 730 Third Avenue, New York, NY 10017. This proxy statement was mailed to Shareholders starting on or about June 6, 2019.

The Trust’s Shareholders are being asked to vote on the following:

| | 1. | The election of ten individuals to serve as Trustees for indefinite terms and until their successors shall take office; and |

| | 2. | Any other business that may properly come before the meeting or any adjournments or postponements thereof. |

At this time, the Board does not know of any other matters being presented at the meeting or any adjournments or postponements thereof.

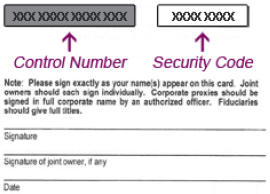

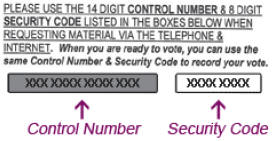

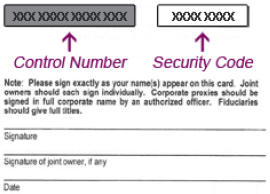

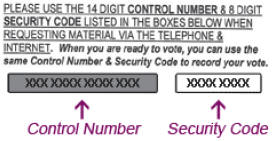

How do I vote?

You can vote in any one of four ways:

| | (1) | By logging on to the Internet site shown on your proxy card and following theon-screen instructions; |

| | (2) | By marking, signing and mailing the proxy card in the envelope provided; |

| | (3) | By calling the toll-free telephone number shown on your proxy card and following the recorded instructions; or |

| | (4) | By voting in person at the meeting. |

If you vote by Internet or telephone, please do not mail your proxy card.

| | | | | | | | | | | | | | |

| | | | | | | | |

| | Vote on the Internet | |  | | Vote by phone | |  | | Vote

by mail | |  | | Vote in person |

| | | | |

| Vote online at the website listed on your proxy card. Follow the on-screen instructions. | | Call the phone number listed on your proxy card. Follow the recorded instructions available 24 hours. | | Vote, sign, and date the proxy card and return it using the postage-paid envelope. | | Attend the Meeting of Shareholders July 17, 2019, at 1:00 p.m. EDT at TIAA’s New York Office, 730 Third Avenue, New York, NY 10017. |

2

Can I cancel or change my vote?

You can cancel or change your vote at any time up until 5:00 p.m. EDT on July 16, 2019. You can do this by simply voting again — by executing and returning a later-dated proxy card, voting through the Internet or by a toll-free telephone call, voting in person at the meeting — or you can cancel your vote by writing the Trust’s Corporate Secretary at: c/o the TIAA-CREF Funds, 730 Third Avenue, New York, New York 10017-3206. Cancelled or changed votes (other than votes cast in person at the meeting) must be received by the 5:00 p.m. July 16, 2019 deadline.

How does a proxy work?

When you vote by proxy, you are instructing the agents named on the proxy card how to vote on your behalf at the meeting. If you sign and return the proxy card, but do not specifically instruct the agents otherwise, they will vote FOR the election of all the nominees listed herein for Trustee. At this time, the Board does not know of any other matters being presented at the meeting. If other matters are brought before the meeting, the proxy agents will vote the proxies using their own best judgment in their discretion, as allowed by the proxy. All proxies solicited by the Board that are properly executed and received by the Corporate Secretary prior to the meeting, and are not cancelled, will be voted at the meeting.

3

Who may vote; How many votes do I get?

Each person having voting rights on May 30, 2019 (the “Record Date”) may vote at the meeting with respect to each item on the proxy ballot. On May 20, 2019, there were 15,266,924,876.27 total votes eligible to be cast, broken down as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class | | | | |

| Fund | | Institutional | | | Advisor | | | Premier | | | Retirement | | | Retail | | | W | | | Fund total | |

| Bond | | | 130,481,634.02 | | | | 91,143,478.33 | | | | 1,414,482.77 | | | | 18,556,118.02 | | | | 8,842,478.11 | | | | 363,302,750.75 | | | | 613,740,941.99 | |

| Bond Index | | | 865,344,824.46 | | | | 128,193.56 | | | | 2,060,193.66 | | | | 25,771,278.61 | | | | 2,001,864.41 | | | | 458,468,044.82 | | | | 1,353,774,399.51 | |

| Bond Plus | | | 118,081,625.86 | | | | 3,541,218.27 | | | | 1,062,449.40 | | | | 41,912,152.43 | | | | 24,639,308.83 | | | | 233,531,938.45 | | | | 422,768,693.24 | |

| Emerging Markets Debt | | | 2,495,034.05 | | | | 814,240.06 | | | | 93,540.86 | | | | 1,598,747.75 | | | | 2,219,439.80 | | | | 43,798,295.08 | | | | 51,019,297.60 | |

| Emerging Markets Equity | | | 25,623,067.33 | | | | 21,589.74 | | | | 841,129.10 | | | | 13,531,885.91 | | | | 837,896.06 | | | | 107,845,476.04 | | | | 148,701,044.18 | |

Emerging Markets Equity Index | | | 79,333,552.87 | | | | 1,007,875.41 | | | | 2,371,682.97 | | | | 24,004,069.28 | | | | 1,364,159.96 | | | | 106,678,609.47 | | | | 214,759,949.96 | |

| Equity Index | | | 414,575,946.03 | | | | 2,173,632.32 | | | | 2,822,791.81 | | | | 29,764,015.64 | | | | 46,438,362.67 | | | | 463,983,661.74 | | | | 959,758,410.21 | |

5–15 Year LadderedTax-Exempt Bond | | | 494,754.10 | | | | 21,667.66 | | | | — | | | | — | | | | 25,092,319.45 | | | | — | | | | 25,608,741.21 | |

| Green Bond | | | 2,105,570.54 | | | | 100,000.00 | | | | 100,000.01 | | | | 183,816.47 | | | | 138,964.49 | | | | — | | | | 2,628,351.51 | |

| Growth & Income | | | 110,804,758.70 | | | | 125,056.83 | | | | 8,846,062.83 | | | | 36,239,803.75 | | | | 61,751,695.75 | | | | 225,297,410.99 | | | | 443,064,788.85 | |

| High-Yield | | | 296,249,463.00 | | | | 1,446,204.07 | | | | 2,802,676.03 | | | | 39,650,783.48 | | | | 33,943,836.77 | | | | 30,706,175.70 | | | | 404,799,139.04 | |

| Inflation-Linked Bond | | | 141,235,599.47 | | | | 26,636.16 | | | | 269,563.90 | | | | 19,023,392.24 | | | | 9,714,749.71 | | | | 102,858,343.80 | | | | 273,128,285.30 | |

| International Bond | | | 64,915.24 | | | | 13,096.53 | | | | 10,285.14 | | | | 553,243.60 | | | | 111,761.13 | | | | 38,789,937.53 | | | | 39,543,239.16 | |

| International Equity | | | 225,061,131.15 | | | | 444,649.73 | | | | 13,889,900.15 | | | | 42,644,742.47 | | | | 37,734,029.39 | | | | 135,197,138.43 | | | | 454,971,591.32 | |

| International Equity Index | | | 383,674,910.86 | | | | 2,695,106.50 | | | | 12,813,749.23 | | | | 54,205,264.99 | | | | — | | | | 161,053,101.68 | | | | 614,442,133.26 | |

| International Opportunities | | | 7,659,439.59 | | | | 16,700.68 | | | | 110,757.52 | | | | 13,950,138.61 | | | | 322,663.34 | | | | 109,638,222.38 | | | | 131,697,922.10 | |

| Large-Cap Growth | | | 60,556,601.85 | | | | 106,542.47 | | | | 987,753.10 | | | | 16,752,515.74 | | | | 47,752,168.86 | | | | 138,107,411.87 | | | | 264,262,993.89 | |

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class | | | | |

| Fund | | Institutional | | | Advisor | | | Premier | | | Retirement | | | Retail | | | W | | | Fund total | |

| Large-Cap Growth Index | | | 191,529,768.19 | | | | 1,410,631.20 | | | | — | | | | 21,167,604.97 | | | | — | | | | — | | | | 214,108,004.36 | |

| Large-Cap Value | | | 133,215,941.82 | | | | 7,585.87 | | | | 10,567,119.83 | | | | 37,696,416.21 | | | | 8,130,797.07 | | | | 166,812,508.52 | | | | 356,430,369.31 | |

| Large-Cap Value Index | | | 278,671,524.52 | | | | 1,285,525.66 | | | | — | | | | 41,119,861.81 | | | | — | | | | — | | | | 321,076,911.98 | |

| Lifecycle 2010 | | | 61,132,487.38 | | | | 11,778.47 | | | | 10,111,630.43 | | | | 28,526,130.46 | | | | — | | | | — | | | | 99,782,026.73 | |

| Lifecycle 2015 | | | 113,293,102.85 | | | | 13,352.16 | | | | 18,380,351.75 | | | | 46,609,114.01 | | | | — | | | | — | | | | 178,295,920.77 | |

| Lifecycle 2020 | | | 232,287,582.96 | | | | 20,532.70 | | | | 41,342,008.43 | | | | 83,120,334.64 | | | | — | | | | — | | | | 356,770,458.73 | |

| Lifecycle 2025 | | | 283,098,842.64 | | | | 12,612.74 | | | | 49,611,476.08 | | | | 88,720,211.07 | | | | — | | | | — | | | | 421,443,142.52 | |

| Lifecycle 2030 | | | 284,258,460.31 | | | | 11,810.90 | | | | 51,335,404.84 | | | | 81,545,211.69 | | | | — | | | | — | | | | 417,150,887.73 | |

| Lifecycle 2035 | | | 287,127,253.73 | | | | 11,020.34 | | | | 55,122,612.99 | | | | 72,966,038.20 | | | | — | | | | — | | | | 415,226,925.27 | |

| Lifecycle 2040 | | | 339,002,470.94 | | | | 13,142.13 | | | | 68,513,399.74 | | | | 85,728,753.14 | | | | — | | | | — | | | | 493,257,765.94 | |

| Lifecycle 2045 | | | 161,254,154.92 | | | | 9,795.81 | | | | 36,609,918.44 | | | | 50,774,912.89 | | | | — | | | | — | | | | 248,648,782.06 | |

| Lifecycle 2050 | | | 106,035,460.21 | | | | 9,806.24 | | | | 26,746,088.26 | | | | 33,635,620.45 | | | | — | | | | — | | | | 166,426,975.16 | |

| Lifecycle 2055 | | | 29,515,706.22 | | | | 8,731.60 | | | | 9,923,126.90 | | | | 11,413,688.18 | | | | — | | | | — | | | | 50,861,252.89 | |

| Lifecycle 2060 | | | 7,184,927.27 | | | | 10,305.82 | | | | 1,649,832.88 | | | | 2,380,780.93 | | | | — | | | | — | | | | 11,225,846.89 | |

| Lifecycle Index 2010 | | | 22,179,568.66 | | | | 7,469.17 | | | | 2,185,818.21 | | | | 4,616,669.45 | | | | — | | | | — | | | | 28,989,525.49 | |

| Lifecycle Index 2015 | | | 41,358,543.21 | | | | 11,107.03 | | | | 6,031,866.48 | | | | 8,368,210.74 | | | | — | | | | — | | | | 55,769,727.46 | |

| Lifecycle Index 2020 | | | 97,727,673.59 | | | | 42,242.99 | | | | 15,521,752.37 | | | | 19,213,550.04 | | | | — | | | | — | | | | 132,505,218.98 | |

| Lifecycle Index 2025 | | | 119,662,906.31 | | | | 56,727.17 | | | | 19,046,328.20 | | | | 23,522,281.40 | | | | — | | | | — | | | | 162,288,243.07 | |

| Lifecycle Index 2030 | | | 124,214,719.40 | | | | 71,558.36 | | | | 17,567,688.09 | | | | 21,617,216.25 | | | | — | | | | — | | | | 163,471,182.10 | |

| Lifecycle Index 2035 | | | 107,994,199.43 | | | | 53,322.81 | | | | 15,574,153.68 | | | | 18,639,041.54 | | | | — | | | | — | | | | 142,260,717.46 | |

| Lifecycle Index 2040 | | | 114,471,241.46 | | | | 103,534.74 | | | | 13,434,159.91 | | | | 17,293,869.90 | | | | — | | | | — | | | | 145,302,806.01 | |

5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class | | | | |

| Fund | | Institutional | | | Advisor | | | Premier | | | Retirement | | | Retail | | | W | | | Fund total | |

| Lifecycle Index 2045 | | | 73,013,087.56 | | | | 58,387.32 | | | | 10,025,649.24 | | | | 12,130,126.85 | | | | — | | | | — | | | | 95,227,250.96 | |

| Lifecycle Index 2050 | | | 53,454,007.32 | | | | 60,072.92 | | | | 8,038,894.21 | | | | 10,340,537.86 | | | | — | | | | — | | | | 71,893,512.31 | |

| Lifecycle Index 2055 | | | 27,420,592.56 | | | | 46,608.92 | | | | 3,660,570.75 | | | | 6,220,278.03 | | | | — | | | | — | | | | 37,348,050.25 | |

| Lifecycle Index 2060 | | | 9,018,065.66 | | | | 47,074.01 | | | | 704,605.50 | | | | 2,093,981.42 | | | | — | | | | — | | | | 11,863,726.58 | |

Lifecycle Index Retirement Income | | | 21,078,791.39 | | | | 11,160.28 | | | | 2,071,892.29 | | | | 2,413,458.36 | | | | — | | | | — | | | | 25,575,302.32 | |

| Lifecycle Retirement Income | | | 17,103,738.67 | | | | 26,251.47 | | | | 2,558,226.60 | | | | 16,078,086.26 | | | | 10,435,750.37 | | | | — | | | | 46,202,053.36 | |

Lifestyle Aggressive Growth | | | 1,616,620.89 | | | | 10,042.34 | | | | 23,501.18 | | | | 2,736,150.57 | | | | 3,167,993.80 | | | | — | | | | 7,554,308.79 | |

| Lifestyle Conservative | | | 2,230,503.71 | | | | 30,883.94 | | | | 56,968.75 | | | | 3,639,595.52 | | | | 12,908,128.58 | | | | — | | | | 18,866,080.49 | |

| Lifestyle Growth | | | 2,298,685.13 | | | | 23,507.58 | | | | 105,983.92 | | | | 2,781,884.04 | | | | 5,880,948.56 | | | | — | | | | 11,091,009.24 | |

| Lifestyle Income | | | 780,261.78 | | | | 10,006.81 | | | | 73,270.83 | | | | 1,407,625.77 | | | | 4,374,422.17 | | | | — | | | | 6,645,587.35 | |

| Lifestyle Moderate | | | 2,906,349.19 | | | | 52,017.01 | | | | 73,767.42 | | | | 6,874,433.47 | | | | 15,919,530.70 | | | | — | | | | 25,826,097.79 | |

| Managed Allocation | | | 1,504,260.37 | | | | — | | | | — | | | | 5,753,373.92 | | | | 61,195,597.18 | | | | — | | | | 68,453,231.46 | |

| Mid-Cap Growth | | | 38,185,744.25 | | | | 8,678.67 | | | | 2,995,236.58 | | | | 17,173,472.63 | | | | 9,552,055.87 | | | | — | | | | 67,915,188.00 | |

| Mid-Cap Value | | | 105,944,371.00 | | | | 34,569.11 | | | | 8,584,227.72 | | | | 32,521,106.16 | | | | 12,299,680.09 | | | | — | | | | 159,383,954.07 | |

| Money Market | | | 708,190,955.92 | | | | 1,501,650.79 | | | | 69,191,059.08 | | | | 203,968,373.24 | | | | 303,817,825.47 | | | | — | | | | 1,286,669,864.49 | |

| Quant International Equity | | | 16,264,514.19 | | | | 28,062.41 | | | | — | | | | — | | | | — | | | | 241,102,274.36 | | | | 257,394,850.98 | |

Quant International Small-Cap Equity | | | 4,474,388.26 | | | | 8,209.16 | | | | 7,326.90 | | | | 325,571.78 | | | | 90,207.32 | | | | 88,661,515.07 | | | | 93,567,218.48 | |

| Quant Large-Cap Growth | | | 12,950,087.37 | | | | 87,931.42 | | | | — | | | | — | | | | — | | | | 179,352,129.32 | | | | 192,390,148.11 | |

| Quant Large-Cap Value | | | 9,415,552.79 | | | | 508,370.12 | | | | — | | | | — | | | | — | | | | 244,413,890.31 | | | | 254,337,813.22 | |

Quant Small/Mid-Cap Equity | | | 3,105,497.82 | | | | 124,380.91 | | | | 100,000.01 | | | | 999,383.81 | | | | 487,039.19 | | | | 51,630,463.55 | | | | 56,446,765.29 | |

6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class | | | | |

| Fund | | Institutional | | | Advisor | | | Premier | | | Retirement | | | Retail | | | W | | | Fund total | |

| Quant Small-Cap Equity | | | 96,201,697.93 | | | | 65,257.87 | | | | 8,387,650.59 | | | | 29,731,166.15 | | | | 8,639,126.24 | | | | 42,832,665.00 | | | | 185,857,563.78 | |

| Real Estate Securities | | | 94,454,366.32 | | | | 439,537.90 | | | | 4,112,497.14 | | | | 24,663,550.48 | | | | 15,141,837.85 | | | | — | | | | 138,811,789.68 | |

| S&P 500 Index | | | 116,006,140.56 | | | | 2,190,473.11 | | | | — | | | | 39,969,007.91 | | | | — | | | | — | | | | 158,165,621.58 | |

Short Duration Impact Bond | | | 2,196,053.77 | | | | 100,000.00 | | | | 100,000.01 | | | | 148,089.69 | | | | 107,574.11 | | | | — | | | | 2,651,717.57 | |

| Short-Term Bond | |

| 79,756,054.54

|

| | | 787,713.44 | | | | 696,685.90 | | | | 11,335,746.27 | | | | 10,677,901.96 | | | | 87,937,396.85 | | | | 191,191,498.97 | |

| Short-Term Bond Index | | | 4,431,662.97 | | | | 87,347.21 | | | | 64,493.58 | | | | 5,681,310.04 | | | | 268,791.44 | | | | 42,624,027.44 | | | | 53,157,632.68 | |

| Small-Cap Blend Index | | | 107,689,502.58 | | | | 442,638.58 | | | | — | | | | 36,556,871.71 | | | | — | | | | — | | | | 144,689,012.86 | |

| Social Choice Bond | | | 210,635,556.85 | | | | 60,477,392.99 | | | | 3,577,375.09 | | | | 48,126,863.38 | | | | 17,198,165.87 | | | | — | | | | 340,015,354.18 | |

| Social Choice Equity | | | 166,121,043.70 | | | | 1,073,885.54 | | | | 5,591,956.10 | | | | 29,331,043.11 | | | | 26,304,141.46 | | | | — | | | | 228,422,069.90 | |

Social Choice International Equity | | | 11,952,132.54 | | | | 91,413.46 | | | | 124,526.69 | | | | 1,641,937.19 | | | | 495,172.51 | | | | — | | | | 14,305,182.39 | |

Social Choice Low Carbon Equity | | | 7,057,373.83 | | | | 70,713.26 | | | | 169,948.01 | | | | 6,700,636.06 | | | | 1,044,134.79 | | | | — | | | | 15,042,805.95 | |

| Total | | | 8,006,517,026.53 | | | | 175,512,720.73 | | | | 650,868,070.05 | | | | 1,738,361,148.51 | | | | 831,042,521.31 | | | | 3,864,623,389.14 | | | | 15,266,924,876.27 | |

The number of votes you have is equal to the dollar value of your investment in each of the Funds as of the Record Date. We will count votes expressed to two decimal points.

7

Certain funds within the TIAA-CREF Fund Complex (the “Fund of Funds”) invest in shares of other funds in the Trust (the “Underlying Funds”). Shares of each Underlying Fund held by a Fund of Funds are expected to be voted by the Fund of Funds in the same proportion as the vote of other shareholders of the Underlying Funds (sometimes referred to as “echo” voting).

How many votes are needed for a quorum or to pass a vote?

There will be a quorum for the meeting if 10 percent of the total number of votes entitled to be cast vote in person or by proxy. Abstentions are counted in determining whether a quorum has been reached. A Trustee shall be elected to the Board if he or she receives a majority of the votes cast at a meeting where a quorum is present. Approval of any other proposals also requires a majority of the votes cast at a meeting where a quorum is present. Abstentions from voting are not treated as votes cast for the election of Trustees or any other proposal. No votes are cast by brokers.

If a quorum is not present at the meeting, or if a quorum is present at the meeting but sufficient votes to approve one or more of the proposed items are not received, or if other matters arise requiring Shareholder attention, the persons named as proxy agents may propose one or more adjournments of the meeting to permit further solicitation of additional votes.

I. Election of Trustees

The purpose of the meeting is to elect members to the Board. The Trustees will be elected to serve indefinite terms until his or her successor shall take office. Pursuant to a resolution of the Board, the maximum number of Trustees has been fixed at ten. Under the law, the Board can fill vacancies between meetings if, in doing so, after an appointment, at leasttwo-thirds of the Trustees then holding office would have been elected by the Shareholders.

At this meeting, you are being asked to elect to the Board nine current members (including Prof. Eberly, Mr. Forrester and Mr. Kenny who were previously appointed as Trustees by the Board) and one new nominee, Joseph A. Boateng. Information about each of the ten nominees is set forth below. It is intended that properly executed and returned proxies will be voted FOR the election of the ten nominees unless otherwise indicated in the proxy.

Each of the ten nominees was first recommended by the Nominating and Governance Committee of the Board. This Committee consists of Trustees who are also themselves nominees and, like all the other members of the Board, are not “interested persons” as such term is defined in the Investment Company Act of 1940 (the “1940 Act”). The three current Trustees who were previously appointed by the Board (Prof. Eberly, Mr. Forrester and Mr. Kenny) were each recommended to the Nominating and Governance Committee by current Trustees after being identified by a retained third-party search firm. Mr. Boateng was recommended to the Nominating and Governance Committee by a retained third-party search firm.

8

Each of the nominees has consented to serve if elected. If any nominee is unavailable to serve when the meeting is held, the proxy agents may cast your votes for a substitute chosen by the current Board.

Proxies cannot be voted for a greater number of persons than the number of nominees.

The Board, which is composed entirely of Trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust or of Teachers Advisors, LLC (“Advisors”), the Trust’s investment adviser, unanimously recommends that the Shareholders of the Trust vote FOR the election of each of the nominees.

Management of the Trust

Board of Trustees

The Trust is governed by its Board, which oversees the Trust’s business and affairs. The Board delegates theday-to-day management of the Funds to Advisors and the officers of the Trust (see below).

Board of Trustees leadership structure and related matters

The Board currently is composed of nine Trustees, all of whom are independent or disinterested, which means that they are not “interested persons” of the Funds as defined in Section 2(a)(19) of the 1940 Act (“independent Trustees”). One of the independent Trustees, Thomas J. Kenny, serves as the Chairman of the Board. The Chairman’s responsibilities include: coordinating with management in the preparation of the agenda for each meeting of the Board; presiding at all meetings of the Board; and serving as a liaison with other Trustees, the Trust’s officers and other management personnel, and counsel to the independent Trustees. The Chairman performs such other duties as the Board may from time to time determine. The principal executive officer of the Trust does not serve on the Board.

The Board meets periodically to review, among other matters, the Funds’ activities, contractual arrangements with affiliated andnon-affiliated companies that provide services to the Funds and the performance of the Funds’ investment portfolios. The Board holds regularly scheduledin-person meetings and regularly scheduled meetings by telephone each year and may hold special meetings, as needed, either in person or by telephone, to address matters arising between regularly scheduled meetings. During a portion of each regularly scheduledin-person meeting and, as the Board may determine at its other meetings, the Board meets without management present.

The Board has established a committee structure that includes six standing committees and one special committee, each composed solely of independent Trustees and chaired by an independent Trustee, as described below. The Board, with the assistance of its Nominating and Governance Committee, periodically evaluates its structure and composition as well as various aspects of its

9

operations. The Board believes that its leadership and operating structure, which includes its committees and an independent Trustee in the position of Chairman of the Board and of each committee, provides for independent oversight of management and is appropriate for the Trust in light of, among other factors, the asset size and nature of the Trust and the Funds, the number of Funds overseen by the Board, the number of other funds overseen by the Trustees as trustees of other investment companies in the TIAA-CREF Fund Complex (as defined below), the arrangements for the conduct of the Funds’ operations, the number of Trustees, and the Board’s responsibilities.

The Trust is part of the TIAA-CREF Fund Complex, which is composed of 69 funds within the Trust (including the TIAA-CREF Lifecycle Funds, TIAA-CREF Lifecycle Index Funds, TIAA-CREF Lifestyle Funds and the TIAA-CREF Managed Allocation Fund), the 11 funds within TIAA-CREF Life Funds (“TCLF”), the 8 accounts within the College Retirement Equities Fund (“CREF”) and the single portfolio within the TIAA Separate Account VA-1 (“VA-1”). All of the persons that serve on the Board also serve on, and the same person serves as the Chairman of, the respective Boards of Trustees of CREF and TCLF and the Management Committee ofVA-1.

Qualifications of Trustees

The Board believes that each of the nominees is qualified to serve as a Trustee of the Trust based on a review of the experience, qualifications, attributes or skills of each nominee. The Board bases this view on its consideration of a variety of criteria, no single one of which is controlling. Generally, the Board looks for: character; integrity; ability to review critically, evaluate, question and discuss information provided and exercise effective business judgment in protecting shareholder interests; willingness and ability to commit the time necessary to perform the duties of a Trustee; and significance of each nominee’s background, experience, qualifications, attributes or skills in the context of overall diversity of the Board’s composition. Each nominee’s ability to perform his or her duties effectively is evidenced by his or her experience in one or more of the following fields: management, consulting and/or board experience in the investment management industry; academic positions in relevant fields; management, consulting and/or board experience with public companies in other fields,non-profit entities or other organizations; educational background and professional training; and experience as a Trustee of the Trust and other funds in theTIAA-CREF Fund Complex. With respect to diversity, the Board generally considers the manner in which each nominee’s professional experience, education, expertise in relevant matters, general leadership experience and life experiences are complementary and, as a whole, contribute to the ability of the Board to perform its duties.

Information indicating certain of the specific experience and relevant qualifications, attributes and skills of each nominee relevant to the Board’s belief that the nominee should serve in this capacity is provided in the “Disinterested Trustees and Nominees” table set forth below. This table includes, for each Trustee, positions held with the Trust, length of office and time served, and principal occupations in the last five years. The table also

10

includes the number of portfolios in the TIAA-CREF Fund Complex overseen by each Trustee and certain directorships held by each of them.

Risk oversight

Day-to-day management of the various risks relating to the administration and operation of the Trust and the Funds is the responsibility of management, which includes professional risk management staff. The Board oversees this risk management function consistent with and as part of its oversight responsibility. The Board performs this risk management oversight directly and, as to certain matters, through its standing committees (which are described below) and, at times, through its use of ad hoc committees. The following provides an overview of the principal, but not all, aspects of the Board’s oversight of risk management for the Trust and the Funds. The Board recognizes that it is not possible to identify all of the risks that may affect the Trust and the Funds or to develop procedures or controls that eliminate the Trust’s and the Funds’ exposure to all of these risks.

In general, a Fund’s risks include, among others, market risk, credit risk, liquidity risk, valuation risk, operational risk, reputational risk, regulatory compliance risk and cyber security risk. The Board has adopted, and periodically reviews, policies and procedures designed to address certain (but not all) of these and other risks to the Trust and the Funds. In addition, under the general oversight of the Board, Advisors, the investment manager and administrator for each Fund, and other service providers to the Funds have adopted a variety of policies, procedures and controls designed to address particular risks to the Funds. Different processes, procedures and controls are employed with respect to different types of risks.

The Board also oversees risk management for the Trust and the Funds through receipt and review by the Board and/or its committee(s) of regular and special reports, presentations and other information from officers of the Trust and other persons, including from the Chief Risk Officer or senior risk management personnel for Advisors and its affiliates. Senior officers of the Trust, senior officers of Advisors and its affiliates, and the Funds’ Chief Compliance Officer (“CCO”) regularly report to the Board and/or one or more of the Board’s standing committees on a range of matters, including those relating to risk management. The Board also regularly receives reports, presentations and other information from Advisors with respect to the investments and securities trading of the Funds. At least annually, the Board receives a report from the Funds’ CCO regarding the effectiveness of the Funds’ compliance program. Also, on an annual basis, the Board receives reports, presentations and other information from TIAA in connection with the Board’s consideration of the renewal of the Trust’s investment management agreements with Advisors and the Trust’s distribution plans underRule 12b-1 under the 1940 Act. In addition, on an annual basis, Advisors, in its capacity as administrator of the Funds’ liquidity risk management program pursuant to applicable Securities and Exchange

11

Commission (“SEC”) regulations, provides the Board with a written report that addresses the operation, adequacy and effectiveness of the program.

Officers of the Trust and officers and personnel of TIAA also report regularly to the Audit and Compliance Committee on the Trust’s internal controls over financial reporting and accounting and financial reporting policies and practices. The Funds’ CCO reports regularly to the Audit and Compliance Committee on compliance matters, and TIAA’s Chief Auditor reports regularly to the Audit and Compliance Committee regarding internal audit matters. In addition, the Audit and Compliance Committee receives regular reports from the Trust’s independent registered public accounting firm on internal controls and financial reporting matters.

The Operations Committee receives regular and special reports, presentations and other information from the Trust’s officers and Fund management personnel regarding valuation and other operational matters. In addition to regular reports, presentations and other information received from Advisors and other TIAA personnel, the Operations Committee receives reports, presentations and other information regarding certain other service providers to the Trust, either directly or through the Trust’s officers, including the CCO and Advisors personnel, or other TIAA personnel, on a periodic or regular basis.

The Investment Committee regularly receives reports, presentations and other information from Advisors with respect to the investments, securities trading, portfolio liquidity and other portfolio management aspects of the Funds.

The Corporate Governance and Social Responsibility Committee regularly receives reports, presentations, and other information from Advisors regarding, among other matters, the voting of proxies of the Funds’ portfolio companies.

The Nominating and Governance Committee routinely monitors various aspects of the Board’s structure and oversight activities, including reviewing matters such as the workload of the Board, the balance of responsibilities delegated among the committees of the Board and the relevant skill sets of the Board members. On an annual basis, the Nominating and Governance Committee reviews the independent status of each Trustee under the 1940 Act and the independent status of counsel to the independent Trustees.

Current Trustees, Nominees and Executive Officers of the Trust

The following table includes certain information about the Trust’s current Trustees, nominees and executive officers, including positions currently held with the Trust, length of office and time served, and principal occupations in the last five years and other relevant experience and qualifications. The table also includes the number of portfolios in the TIAA-CREF Fund Complex overseen by each nominee and certain directorships held by each of them. The first table includes information about the Trust’s’ disinterested Trustees and nominees and the second table includes information about the Trust’s officers.

12

Disinterested Trustees and Nominees

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | | |

| Forrest Berkley | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1954 | | Trustee | | Indefinite term. Trustee since 2006. | | Retired Partner (since 2006), Partner (1990–2005) and Head of Global Product Management (2003–2005), GMO (formerly, Grantham, Mayo, Van Otterloo & Co.) (investment management), and member of asset allocation portfolio management team, GMO (2003–2005). Mr. Berkley has particular experience in investment management, global operations and finance, as well as experience withnon-profit organizations and foundations. | | 89 | | Director, Save the Children Foundation, Inc.; Investment Committee member, Maine Community Foundation and the Elmina B. Sewall Foundation. |

| | | | | |

| Joseph A. Boateng | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1963 | | Nominee and Consultant to the Board of Trustees since 2018. | | N/A | | Chief Investment Officer, Casey Family Programs (since 2007). Director of U.S. Pension Plans at Johnson & Johnson (2002–2006); Manager, Financial Services Consultant, KPMG Consulting (2000–2002); several positions, Xerox Corporation (1988–2000). Mr. Boateng has particular experience in investment management, pension plan management, and finance. | | 8 | | Board member, Year Up Puget Sound; Investment Advisory Committee Chair, Seattle City Employees’ Retirement System; Investment Committee member, The Seattle Foundation. |

13

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | | |

Janice C. Eberly | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1962 | | Trustee | | Indefinite term. Trustee since 2018. | | James R. and Helen D. Russell Professor of Finance at the Kellogg School of Management at Northwestern University (2002–2011 and since 2013), and Chair of the Finance Department (2005–2007). Assistant Secretary for Economic Policy, United States Department of the Treasury (2011–2013). Professor Eberly has particular experience in education, finance and public economic policy. | | 89 | | Member of the Board of the Office of Finance, Federal Home Loan Banks; Director, Avant, LLC. |

| | | | | |

| Nancy A. Eckl | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1962 | | Trustee | | Indefinite term. Trustee since 2007. | | Vice President (1990–2006), American Beacon Advisors, Inc. and of certain funds advised by American Beacon Advisors, Inc. Ms. Eckl has particular experience in investment management, mutual funds, pension plan management, finance, accounting and operations. Ms. Eckl is licensed as a certified public accountant in the State of Texas. | | 89 | | Independent Director, The Lazard Funds, Inc., Lazard Retirement Series, Inc., Lazard Global Total Return and Income Fund, Inc., and Lazard World Dividend & Income Fund, Inc. |

14

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | |

Michael A. Forrester | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1967 | | Trustee | | Indefinite term. Trustee since 2007. | | Chief Executive Officer (since 2014), and Chief Operating Officer, Copper Rock Capital Partners, LLC (2007–2014). Chief Operating Officer, DDJ Capital Management (2003–2006). Mr. Forrester has particular experience in investment management, institutional marketing and product development, operations management, alternative investments and experience withnon-profit organizations. | | 89 | | Director, Copper Rock Capital Partners, LLC (investment adviser); Trustee, Dexter Southfield School. |

| | | | | |

| Howell E. Jackson | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1954 | | Trustee | | Indefinite term. Trustee since 2005. | | James S. Reid, Jr. Professor of Law (since 2004), Senior Adviser to the President and Provost

(2010–2012), Acting Dean (2009), Vice Dean for Budget (2003–2006), and on the faculty (since 1989) of Harvard Law School. Professor Jackson has particular experience in law, including the federal securities laws, consumer protection, finance, pensions and Social Security, and organizational management and education. | | 89 | | Director, Commonwealth(non-profit organization). |

15

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | | |

| Thomas J. Kenny | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1963 | | Chairman of the Board of Trustees and Trustee | | Indefinite term. Chairman for term ending July 1, 2021. Trustee since 2011. Chairman since September 13, 2017. | | Advisory Director (2010–2011), Partner (2004–2010), Managing Director (1999–2004),Co-Head of Global Cash and Fixed Income Portfolio Management Team (2002–2010), Goldman Sachs Asset Management. Mr. Kenny has particular experience in investment management of mutual funds and alternative investments, finance, and operations management, as well as experience onnon-profit boards. | | 89 | | Director and Chair of the Finance and Investment Committee, Aflac Incorporated; Director and Investment Committee member, Sansum Clinic; Director, ParentSquare; Investment Committee member, Cottage Health System; Member, University of California at Santa Barbara Arts and Lectures Advisory Council. |

| | | | | |

| James M. Poterba | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1958 | | Trustee | | Indefinite term. Trustee since 2006. | | President and Chief Executive Officer, National Bureau of Economic Research (“NBER”) (since 2008); Mitsui Professor of Economics, Massachusetts Institute of Technology (“MIT”) (since 1996); Affiliated Faculty Member of the Finance Group, Alfred P. Sloan School of Management of MIT (since 2014); Head (2006–2008) and Associate Head (1994–2000 and 2001–2006), Economics Department of MIT; and Program Director, NBER (1990–2008). Professor Poterba has particular experience in education, economics, finance, tax, and organizational development. | | 89 | | Director, National Bureau of Economic Research and the Alfred P. Sloan Foundation; Member, Congressional Budget Office Panel of Economic Advisers. |

16

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | | |

| Maceo K. Sloan | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1949 | | Trustee | | Indefinite term. Trustee since 1999. | | Chairman, President and Chief Executive Officer, Sloan Financial Group, Inc. (1991–2018); Chairman and Chief Executive Officer (1991–2016), Chief Investment Officer (1991–2013) and Chief Compliance Officer (2015–2016), NCM Capital Management Group, Inc.; Chairman, Chief Executive Officer (2003–2016), Chief Investment Officer (2003–2013) and Chief Compliance Officer (2015–2016) NCM Capital Advisers, Inc.; and Chairman, President and Principal Executive Officer, NCM Capital Investment Trust (2007–2012). Mr. Sloan has particular experience in investment management, finance and organizational development. He is designated as an audit committee financial expert. | | 89 | | N/A |

17

| | | | | | | | | | |

Name, address

and year of birth

(“YOB”) | | Position(s) held with

the Trust | | Term of

office and length of time served | | Principal occupation(s) during past 5 years and other relevant experience and qualifications | | Number of portfolios in fund complex overseen by Trustee | | Other directorships held by Trustee |

| | | | | |

| Laura T. Starks | | | | | | | | | | |

| | | | | |

c/o Corporate Secretary 730 Third Avenue New York, NY 10017-3206 YOB: 1950 | | Trustee | | Indefinite term. Trustee since 2006. | | Charles E. and Sarah M. Seay Regents Chair in Finance (since 2002),Co-Executive Director, Social Innovation Initiative (since 2015), Director, AIM Investment Center (2000–2016), Associate Dean for Research (2011–2016), Chairman, Department of Finance (2002–2011) and Professor (since 1987), McCombs School of Business, University of Texas at Austin. Professor Starks has particular experience in education, finance, mutual funds and retirement systems. | | 89 | | Member of the Board of Governors of the Investment Company Institute, the Governing Council of Independent Directors Council (an association for mutual fund directors), and Investment Advisory Committee, Employees Retirement System of Texas. |

Officers

| | | | | | |

Name, address and year of birth (“YOB”) | | Position(s) held with the Trust | | Term of office and length of time served | | Principal occupation(s) during past 5 years |

| | | |

| Vijay Advani | | | | | | |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1960 | | Executive Vice President | | One-year term. Executive Vice President since 2018. | | Chief Executive Officer, Nuveen. Executive Vice President of the TIAA-CREF Fund Complex. Prior to joining Nuveen, Mr. Advani served asCo-President of Franklin Resources, Inc. (Franklin Templeton Investments). |

|

| Mona Bhalla |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1969 | | Senior Managing Director and Corporate Secretary | | One-year term. Senior Managing Director and Corporate Secretary since 2017. | | Senior Managing Director and Corporate Secretary of TIAA and the TIAA-CREF Fund Complex. Prior to joining TIAA, Ms. Bhalla served as Senior Vice President, Counsel and Corporate Secretary of AllianceBernstein L.P. |

18

| | | | | | |

Name, address and year of birth (“YOB”) | | Position(s) held with the Trust | | Term of office and length of time served | | Principal occupation(s) during past 5 years |

|

| Richard S. Biegen |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1962 | | Chief Compliance Officer | | One-year term. Chief Compliance Officer since 2008. | | Senior Managing Director, TIAA. Chief Compliance Officer of the TIAA-CREF Fund Complex. |

|

| Bradley Finkle |

| | | |

TIAA

730 Third Avenue

New York, NY 10017-3206

YOB: 1973 | | Principal Executive Officer and President | | One-year term. Principal Executive Officer and President since 2017. | | Senior Managing Director, Chief Operating Officer, Nuveen. Principal Executive Officer and President of the TIAA-CREF Funds and TIAA-CREF Life Funds. Formerly, Senior Managing Director,Co-Head of Nuveen Equities & Fixed Income and President of TIAA Investments. |

|

| Jose Minaya |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1971 | | Executive Vice President | | One-year term. Executive Vice President since 2018. | | Executive Vice President, Chief Investment Officer and President, Nuveen Global Investments. Executive Vice President of the TIAA-CREF Fund Complex. Formerly, Senior Managing Director, President, Global Investments, TIAA. |

|

| Phillip T. Rollock |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1962 | | Executive Vice President, Chief Legal Officer | | One-year term. Executive Vice President and Chief Legal Officer since 2018. | | Executive Vice President and Chief Legal Officer of TIAA and the TIAA-CREF Fund Complex. Formerly, Senior Managing Director, Deputy General Counsel and Corporate Secretary of TIAA and the TIAA-CREF Fund Complex. |

|

| Christopher A. Van Buren |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1962 | | Executive Vice President | | One-year term. Executive Vice President since 2018. | | Executive Vice President and Chief Risk Officer of TIAA. Executive Vice President of the TIAA-CREF Fund Complex. Prior to joining TIAA, Mr. Van Buren served as Managing Director, Group Risk Control of UBS. |

|

| E. Scott Wickerham |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1973 | | Principal Financial Officer, Principal Accounting Officer and Treasurer | | One-year term. Principal Financial Officer, Principal Accounting Officer and Treasurer since 2017. | | Senior Managing Director, Head, Publics Investment Finance. Principal Financial Officer, Principal Accounting Officer and Treasurer of the TIAA-CREF Funds, TIAA-CREF Life Funds, and TIAA Separate AccountVA-1; Treasurer of CREF; and Vice President and Controller of the Nuveen Funds. Formerly, Managing Director, Head, TC Fund Administration, Nuveen. |

|

| Sean N. Woodroffe |

| | | |

TIAA 730 Third Avenue New York, NY 10017-3206 YOB: 1963 | | Executive Vice President | | One-year term. Executive Vice President since 2018. | | Senior Executive Vice President, Chief Human Resources Officer of TIAA. Executive Vice President of the TIAA-CREF Fund Complex. Prior to joining TIAA, Mr. Woodroffe served as Chief People Officer at National Life Group. |

19

Trustee Equity ownership

The following table includes information relating to equity securities owned beneficially by all nominees in the Trust and in all registered investment companies in the TIAA-CREF Fund Complex as of December 31, 2018. The amounts reported below include amounts contributed to the Funds for the benefit of the disinterested Trustees pursuant to the Trust’s long-term compensation plan for non-employee Trustees.

Disinterested Trustees and Nominees

| | | | |

| Name | | Dollar range of equity securities in the registrant | | Aggregate dollar range of equity securities in all registered

investment companies overseen

in family of investment companies |

| Forrest Berkley | | International Equity Fund: Over $100,000 International Equity Index Fund: Over $100,000 Large-Cap Growth Index Fund: Over $100,000 | | Over $100,000 |

| Joseph A. Boateng | | None | | None |

| Janice C. Eberly | | None | | Over $100,000 |

| Nancy A. Eckl | | Emerging Markets Equity Index Fund: Over $100,000 Equity Index Fund: $1–10,000 Growth & Income Fund: Over $100,000 International Equity Fund: $50,001–100,000 International Equity Index Fund: $1–10,000 Large-Cap Value Fund: $50,001–100,000 Large-Cap Value Index Fund: $1–10,000 Quant Small-Cap Equity Fund: $1–10,000 Small-Cap Blend Index Fund: $50,001–100,000 Social Choice Equity Fund: $50,001–100,000 | | Over $100,000 |

| Michael A. Forrester | | None | | Over $100,000 |

| Howell E. Jackson | | Bond Index Fund: Over $100,000 International Equity Index Fund: Over $100,000 | | Over $100,000 |

| Thomas J. Kenny | | Emerging Markets Equity Index Fund: Over $100,000 High-Yield Fund: Over $100,000 International Equity Fund: Over $100,000 International Equity Index Fund: Over $100,000 Large-Cap Value Index Fund: Over $100,000 Mid-Cap Value Fund: $10,001–50,000 Quant Small-Cap Equity Fund: Over $100,000 Real Estate Securities Fund: $50,001–100,000 | | Over $100,000 |

| James M. Poterba | | S&P 500 Index Fund: Over $100,000 | | Over $100,000 |

20

| | | | |

| Name | | Dollar range of equity securities in the registrant | | Aggregate dollar range of equity securities in all registered

investment companies overseen

in family of investment companies |

| Maceo K. Sloan | | Emerging Markets Equity Fund: $50,001–100,000 Emerging Markets Equity Index Fund: $50,001–100,000 Growth & Income Fund: Over $100,000 International Equity Index Fund: Over $100,000 Large-Cap Growth Fund: Over $100,000 Large-Cap Value Fund: Over $100,000 Mid-Cap Growth Fund: Over $100,000 Mid-Cap Value Fund: Over $100,000 Quant Small-Cap Equity Fund: Over $100,000 Real Estate Securities Fund: Over $100,000 S&P 500 Index Fund: Over $100,000 | | Over $100,000 |

| Laura T. Starks | | Emerging Markets Equity Fund: $50,001–100,000 Growth & Income Fund: Over $100,000 High-Yield Fund: $10,001–50,000 International Equity Index Fund: Over $100,000 Large-Cap Growth Fund: Over $100,000 Large-Cap Growth Index Fund: $10,001–50,000 Large-Cap Value Fund: Over $100,000 Large-Cap Value Index Fund: $10,001–50,000 Mid-Cap Growth Fund: Over $100,000 Mid-Cap Value Fund: Over $100,000 Quant Small-Cap Equity Fund: Over $100,000 S&P 500 Index Fund: Over $100,000 Short-Term Bond Fund: Over $100,000 Small-Cap Blend Index Fund: Over $100,000 Social Choice Equity Fund: Over $100,000 | | Over $100,000 |

As of December 31, 2018, to the knowledge of the Trust’s management, the current Trustees and officers owned as a group less than 1% of the securities of any Fund.

Trustee compensation

The following tables disclose the aggregate compensation received from the Trust and the TIAA-CREF Fund Complex by each nominee for the fiscal year ended May 31, 2018 for the Asset Allocation Funds; October 31, 2018 for the Equity, Emerging Markets Debt and International Bond Funds; and March 31, 2019 for the Fixed Income and Real Estate Securities Funds (other than the Emerging Markets Debt Fund and the International Bond Fund). The Trust’s officers receive no direct compensation from any fund in the TIAA-CREF Fund Complex. For purposes of the chart, the TIAA-CREF Fund Complex consists of the Trust, CREF, TCLF and VA-1, each a registered investment company.

21

Disinterested Trustees

Fiscal year ended May 31, 2018

| | | | | | | | | | | | |

| Name | | Aggregate compensation from the Trust* | | | Long-Term compensation contribution as part of the

Trust’s expenses† | | | Total compensation from TIAA-CREF Fund Complex* | |

| Forrest Berkley‡ | | $ | 37,653.34 | | | $ | 10,404.29 | | | $ | 307,500.00 | |

| Joseph A. Boateng§ | | | — | | | | — | | | | — | |

| Janice C. Eberly‡ | | $ | 15,724.67 | | | $ | 4,222.92 | | | $ | 128,416.67 | |

| Nancy A. Eckl | | $ | 41,143.66 | | | $ | 10,404.29 | | | $ | 336,000.00 | |

| Michael A. Forrester‡ | | $ | 42,552.04 | | | $ | 10,404.29 | | | $ | 347,500.00 | |

| Howell E. Jackson | | $ | 43,286.85 | | | $ | 10,404.29 | | | $ | 353,500.00 | |

| Thomas J. Kenny‡ | | $ | 48,001.85 | | | $ | 10,404.29 | | | $ | 392,000.00 | |

| Bridget A. Macaskill** | | $ | 41,327.37 | | | $ | 10,404.29 | | | $ | 337,500.00 | |

| James M. Poterba‡ | | $ | 44,205.35 | | | $ | 10,404.29 | | | $ | 361,000.00 | |

| Maceo K. Sloan | | $ | 44,021.65 | | | $ | 10,404.29 | | | $ | 359,500.00 | |

| Laura T. Starks | | $ | 45,368.80 | | | $ | 10,404.29 | | | $ | 370,500.00 | |

| * | Compensation figures include cash and amounts deferred under both the long-term compensation plan and optional deferred compensation plan described below. |

| † | Amounts deferred under the long-term compensation plan described below. |

| § | Effective December 4, 2018, Mr. Boateng was retained as a consultant to the Boards and Management Committee of TCF, TCLF and VA-1. Mr. Boateng receives a consulting fee, in cash, equal to the compensation paid to an independent Trustee and Manager of the Boards and Management Committee. |

| ‡ | A portion of this compensation was not actually paid based on the prior election of the Trustee to defer receipt of payment in accordance with the provisions of a deferred compensation plan for Trustees described below. For the fiscal year ended May 31, 2018, Mr. Berkley elected to defer $221,250,Prof. Eberly elected to defer $65,741, Mr. Forrester elected to defer $267,500, Mr. Kenny elected to defer $281,750 and Prof. Poterba elected to defer $269,250 of total compensation earned from the TIAA-CREF Fund Complex. |

| ** | Effective July 20, 2018, Ms. Macaskill no longer serves as a Trustee. |

Fiscal year ended October 31, 2018

| | | | | | | | | | | | |

| Name | | Aggregate compensation from the

Trust* | | | Long-Term compensation contribution as part of the

Trust’s expenses† | | | Total compensation from TIAA-CREF Fund Complex* | |

| Forrest Berkley‡ | | $ | 79,961.89 | | | $ | 22,142.51 | | | $ | 325,000.00 | |

| Joseph A. Boateng§ | | | — | | | | — | | | | — | |

| Janice C. Eberly‡ | | $ | 72,806.36 | | | $ | 19,559.22 | | | $ | 295,916.67 | |

| Nancy A. Eckl | | $ | 88,573.29 | | | $ | 22,142.51 | | | $ | 360,000.00 | |

| Michael A. Forrester‡ | | $ | 87,343.09 | | | $ | 22,142.51 | | | $ | 355,000.00 | |

22

| | | | | | | | | | | | |

| Name | | Aggregate compensation from the Trust* | | | Long-Term compensation contribution as part of the

Trust’s expenses† | | | Total compensation from TIAA-CREF Fund Complex* | |

| Howell E. Jackson | | $ | 87,343.09 | | | $ | 22,142.51 | | | $ | 355,000.00 | |

| Thomas J. Kenny‡ | | $ | 106,411.19 | | | $ | 22,142.51 | | | $ | 432,500.00 | |

| Bridget A. Macaskill** | | $ | 47,157.05 | | | $ | 12,301.39 | | | $ | 191,666.67 | |

| James M. Poterba‡ | | $ | 94,109.19 | | | $ | 22,142.51 | | | $ | 382,500.00 | |

| Maceo K. Sloan | | $ | 91,033.69 | | | $ | 22,142.51 | | | $ | 370,000.00 | |

| Laura T. Starks | | $ | 92,509.93 | | | $ | 22,142.51 | | | $ | 376,000.00 | |

| | * | Compensation figures include cash and amounts deferred under both the long-term compensation plan and optional deferred compensation plan described below. |

| | † | Amounts deferred under the long-term compensation plan described below. |

| | § | Effective December 4, 2018, Mr. Boateng was retained as a consultant to the Boards and Management Committee of TCF, TCLF and VA-1. Mr. Boateng receives a consulting fee, in cash, equal to the compensation paid to an independent Trustee and Manager of the Boards and Management Committee. |

| | ‡ | A portion of this compensation was not actually paid based on the prior election of the Trustee to defer receipt of payment in accordance with the provisions of a deferred compensation plan for Trustees described below. For the fiscal year ended October 31, 2018, Mr. Berkley elected to defer $228,750, Prof. Eberly elected to defer $108,617, Mr. Forrester elected to defer $263,750, Mr. Kenny elected to defer $337,250 and Prof. Poterba elected to defer $286,250 of total compensation from the TIAA-CREF Fund Complex. |

| ** | Effective July 20, 2018, Ms. Macaskill no longer serves as a Trustee. |

Fiscal year ended March 31, 2019

| | | | | | | | | | | | |

| Name | | Aggregate compensation from the Trust* | | | Long-Term compensation contribution as part of the

Trust’s expenses† | | | Total compensation from TIAA-CREF Fund Complex* | |

| Forrest Berkley‡ | | $ | 93,746.34 | | | $ | 25,920.03 | | | $ | 335,000.00 | |

| Joseph A. Boateng | | $ | 35,698.66 | | | | — | | | $ | 107,375.00 | |

| Janice C. Eberly‡ | | $ | 106,703.04 | | | $ | 29,050.41 | | | $ | 384,666.67 | |

| Nancy A. Eckl | | $ | 105,337.14 | | | $ | 25,920.03 | | | $ | 376,000.00 | |

| Michael A. Forrester‡ | | $ | 100,626.19 | | | $ | 25,920.03 | | | $ | 360,000.00 | |

| Howell E. Jackson | | $ | 101,954.85 | | | $ | 25,920.03 | | | $ | 364,750.00 | |

| Thomas J. Kenny‡ | | $ | 122,145.45 | | | $ | 25,920.03 | | | $ | 437,000.00 | |

| Bridget A. Macaskill** | | $ | 27,500.34 | | | $ | 7,173.77 | | | $ | 105,416.67 | |

| James M. Poterba‡ | | $ | 109,250.27 | | | $ | 25,920.03 | | | $ | 391,000.00 | |

| Maceo K. Sloan | | $ | 101,800.14 | | | $ | 25,920.03 | | | $ | 364,500.00 | |

| Laura T. Starks | | $ | 104,408.90 | | | $ | 25,920.03 | | | $ | 374,500.00 | |

| * | Compensation figures include cash and amounts deferred under both the long-term compensation plan and optional deferred compensation plan described below. |

23

| † | Amounts deferred under the long-term compensation plan described below. |

| ‡ | A portion of this compensation was not actually paid based on the prior election of the Trustee to defer receipt of payment in accordance with the provisions of a deferred compensation plan for Trustees described below. For the fiscal year end March 31, 2019, Mr. Berkley elected to defer $242,500, Prof. Eberly elected to defer $215,242, Mr. Forrester elected to defer $267,500, Mr. Kenny elected to defer $344,500 and Prof. Poterba elected to defer $298,500 of total compensation earned from the TIAA-CREF Fund Complex. |

| ** | Effective July 20, 2018, Ms. Macaskill no longer serves as a Trustee. |

Prior to January 1, 2018, the Board had approved Trustee compensation at the following rates, effective since January 1, 2015: an annual retainer of $175,000; an annual long-term compensation contribution of $80,000; an annual committee chair fee of $20,000 ($30,000 for the chairs of the Operations Committee and Audit and Compliance Committee); an annual Board chair fee of $80,000; and an annual committee retainer of $20,000 ($25,000 for the Operations Committee and Audit and Compliance Committee).

The Board subsequently approved Trustee compensation at the following rates, effective January 1, 2018: an annual retainer of $180,000; an annual long-term compensation contribution of $90,000; an annual committee chair fee of $20,000 ($30,000 for the chairs of the Operations and Audit and Compliance Committees); an annual Board chair fee of $90,000; and an annual committee retainer of $20,000 ($25,000 for the Operations Committee and Audit and Compliance Committee).

At its meeting on December 4, 2018, the Board approved Trustee compensation at the following rates, effective January 1, 2019: an annual retainer of $190,000, an annual long-term compensation contribution of $100,000 (further described below); an annual committee chair fee of $20,000 ($30,000 for the chairs of the Operations Committee and Audit and Compliance Committee); an annual Board chair fee of $100,000; and an annual committee retainer of $20,000 ($25,000 for the Operations Committee and Audit and Compliance Committee).

The chair and members of the Executive Committee and the Special Emergency Valuation Committee continue to not receive fees for service on those committees. The Trustees may also continue to receive special, working group or ad hoc committee fees, or related chair fees, as determined by the Board. The level of compensation is evaluated regularly and is based on a study of compensation at comparable companies, the time and responsibilities required of the Trustees, and the need to attract and retain well-qualified Board members.

The TIAA-CREF Fund Complex has a long-term compensation plan for Trustees. Currently, under this unfunded deferred compensation plan, annual contributions equal to $100,000 are allocated to notional investments in TIAA-CREF Fund Complex products (such as certain CREF annuities and/or certain Funds) selected by each Trustee. After the Trustee leaves the Board, benefits will be paid in a lump sum or in annual installments over 5, 10, 15 or 20 years, as requested by the Trustee. The Board may waive the mandatory retirement policy for the Trustees, which would delay the commencement of benefit payments until after the Trustee eventually retires from the Board. Pursuant to a separate deferred compensation plan, Trustees also have the option to defer payments of

24

their basic retainer, additional retainers and/or meeting fees and allocate those amounts to notional investments in TIAA-CREF Fund Complex products (such as certain CREF annuities and/or certain Funds) selected by each Trustee. Benefits under that plan are also paid in a lump sum or annual installments over 5, 10, 15 or 20 years, as requested by the Trustee. The compensation table above does not reflect any payments under the long-term compensation plan.

The Trust has adopted a mandatory retirement policy for its Board of Trustees. Under this policy, Trustees shall cease to be members of the Board and resign their positions effective as of no later than the completion of the last scheduledin-person meeting of the Board while such persons are 72 years of age. Such requirement may be waived with respect to one or more Trustees for reasonable time periods upon the unanimous approval and at the sole discretion of the Board, and the Trustees eligible for the waiver are not permitted to vote on such proposal regarding their waiver.

Committees

The Board has appointed the following standing committees, each with specific responsibilities for aspects of the Trust’s operations, and whose charters are available upon request. In addition, the Board has established a special committee. These committees, which each consist of only independent Trustees, are:

| | (1) | An Audit and Compliance Committee, which assists the Board in fulfilling its oversight responsibilities for financial reporting, internal controls over financial reporting and certain compliance matters. The Audit and Compliance Committee is charged with approving and/or recommending for Board approval the appointment, compensation and retention (or termination) of the Funds’ independent registered public accounting firm. |

| | (2) | A Corporate Governance and Social Responsibility Committee, which assists the Board in fulfilling its oversight responsibilities for corporate social responsibility and governance issues, including the voting of proxies of portfolio companies of the Funds. |

| | (3) | An Executive Committee, which generally is vested with full Board powers on matters that arise between Board meetings. |

| | (4) | An Investment Committee, which assists the Board in fulfilling its oversight responsibilities for the Funds’ investments. |

| | (5) | A Nominating and Governance Committee, which assists the Board in addressing internal governance matters of the Trust, including nominating certain Trust officers and the members of the standing committees of the Board, recommending candidates for election as Trustees, reviewing their qualifications and independence, conducting evaluations of the Trustees and of the Board and its committees and periodically reviewing proposed changes to the Trust’s governing documents. |

| | (6) | An Operations Committee, which assists the Board in fulfilling its oversight responsibilities with respect to operational matters of the Trust, including oversight of contracts with third-party service providers, and certain legal, compliance, finance, sales and marketing matters. |

25

| | (7) | A Special Emergency Valuation Committee (the “Special Valuation Committee”), which considers one or more fair value determinations or methodologies to be used for fair valuation of portfolio securities in the event that a meeting is requested by Advisors or TIAA-CREF Investment Management, LLC (“Investment Management”) due to extraordinary circumstances. At least three members of the Board shall be needed to constitute the Special Valuation Committee, and the chair shall be the member who is the longest serving Trustee on the Board. |

The following table lists the current membership of each standing committee and the number of meetings each committee held in 2018.

| | | | | | | | | | | | | | |

| | | Audit &

Compliance | | Corporate Governance and Social Responsibility | | Executive | | Operations | | Investment | | Nominating

and Governance | | Special

Emergency

Valuation

Committee1 |

Forrest Berkley | | | | | | | | ✓ | | ✓ | | | | |

Joseph A. Boateng | | | | | | | | ✓ | | ✓ | | | | |

Janice C. Eberly | | ✓ | | ✓ | | | | | | ✓ | | | | |

Nancy A. Eckl | | | | | | ✓ | | Chair | | ✓ | | ✓ | | |

Michael A. Forrester | | | | | | ✓ | | ✓ | | ✓ | | Chair | | |

Howell E. Jackson | | | | | | ✓ | | ✓ | | ✓ | | ✓ | | |

Thomas J. Kenny | | ✓ | | | | Chair | | | | ✓ | | ✓ | | |

James M. Poterba | | Chair | | ✓ | | ✓ | | | | ✓ | | | | |

Maceo K. Sloan2 | | ✓ | | ✓ | | | | | | Chair | | | | |

Laura T. Starks | | ✓ | | Chair | | | | | | ✓ | | | | |

2018 Meetings | | 6 | | 5 | | 0 | | 5 | | 6 | | 9 | | 0 |

| 1 | See committee list entry (7) above. |

| 2 | Mr. Sloan has been designated as an “audit committee financial expert” as defined by the rules of the SEC. |

Board of Trustees meetings

There were eight meetings of the Board during 2018. All current Trustees who served during 2018, attended at least 75 percent of the meetings of the Board and the committees of the Board of which they were members. Professor Eberly joined the Board as of February 13, 2018 and Mr. Boateng became a consultant to the Board as of December 4, 2018.

Trustee nomination process

The Board has a Nominating and Governance Committee (“Committee”), which is responsible for nominating candidates for the Board. The Committee considers recommendations from a variety of sources, including participating institutions and educational organizations.

The Committee may, from time to time, retain third-party search firms to identify nominee candidates whose competencies meet the criteria the Board deems important to the Trust. In addition, the Committee may invite recommendations from current Trustees and others.

26

The Committee reviews the information submitted on the backgrounds and qualifications of those persons recommended. Although the Trust does not have a formal policy regarding diversity, in preparing a slate of Trustee candidates, the Committee seeks to ensure a broad, diverse representation of academic, business and professional experience and gender, race and age.

Recommendations from Shareholders regarding nominations

Shareholders may submit recommendations to the Committee by forwarding the names and background of nominees to the Corporate Secretary of the TIAA-CREF Funds, by submitting candidate recommendations to the following website:www.tiaa.org/crefnominee or mailing the information to the Corporate Secretary of the TIAA-CREF Funds, 730 Third Avenue, New York,NY 10017-3206.

Qualifications of nominees

The Board has determined that its members should be individuals who can contribute sound business judgment to Board deliberations and decisions, based on their relevant business, management, professional, academic or governmental service experience. Candidates for the Board should have reached a senior level in their chosen field, be of uncompromised integrity, and be able to fulfill their responsibilities as Trustees without conflict with the Trust. At least one Trustee should qualify as an audit committee financial expert for service on the Audit and Compliance Committee. Each Trustee should be prepared to devote substantial time and effort to the Trust’s Board duties and should limit the number of his or her other board memberships in order to provide such service to the Trust. One consideration for candidates for the Board is that they be individuals with prior and/or ongoing academic experience, and a demonstrated ability to work in a constructive manner with other Board members and management.

When seeking to fill a specific opening on the Board, the Committee will consider the specific needs of the Board at the time to assure an overall balance and range of specialized knowledge, skills, expertise and diversity to provide the foundation for a successful Board.

A candidate for service as an independent Trustee must not be an “interested person,” as that term is defined in the 1940 Act, of the Trust or Advisors. Each candidate must provide such information requested by the Trust as may be reasonably necessary to enable the Board to assess the candidate’s eligibility.

Shareholder communications with Trustees

Letters or emails from Shareholders addressed to the Board or individual Trustees may be sent to the TIAA-CREF Funds Trustees c/o Corporate Secretary, 730 Third Avenue, New York, NY 10017-3206 or via email to: trustees@tiaa.org. Certain communications will be forwarded to the Board’s Chairman in accordance with established policies concerning Shareholder communications that have been approved by a majority of independent Trustees.

27

Trustee attendance at Shareholder meetings

The Trust is not required to and does not typically hold annual meetings of Shareholders. Consequently, the Trust does not have a policy with regard to a Trustee’s attendance at Shareholder meetings.

Proposals for action at future Shareholder meetings

Any proposals of persons with voting rights to be included in the proxy statement for the Trust’s next special meeting must be received by the Trust within a reasonable period of time prior to the meeting. The Trust is not required to and does not typically hold meetings of Shareholders. There are no current plans to hold another special meeting in 2019.

II. Information on the Trust’s independent registered public accounting firm

PricewaterhouseCoopers LLP (“PwC”) served as the independent registered public accounting firm (“Independent Auditor”) to the Trust for the fiscal years ended October 31, 2018, March 31, 2019 and May 31, 2019. Both the Audit and Compliance Committee and the Board, each of which consists solely of independent Trustees, have chosen to continue with the services of PwC for the fiscal years ending October 31, 2019, March 31, 2020 and May 31, 2020. PwC was initially selected in 2005 following a competitive bidding process and has served as the Independent Auditor to the Trust as well as to the other funds within the TIAA-CREF Fund Complex since that time.

The aggregate fees billed by PwC as disclosed below for the fiscal years ended October 31, 2018, March 31, 2019, May 31, 2019 and October 31, 2017, March 31, 2018, May 31, 2018 may not align with the figures reported and filed with the Securities and Exchange Commission inForm N-CEN orForm N-CSR for each period, respectively, (SEC FileNo. 811-09301) because the fees disclosed in this proxy statement reflect fees updated after the date of thatForm N-CEN orForm N-CSR for the relevant period.

In making its selection, the Audit and Compliance Committee discussed with PwC issues involving relationships among PwC, TIAA, Nuveen, LLC, Nuveen Finance, LLC and the TIAA-CREF Fund Complex, and their affiliates that could reasonably be thought to bear on PwC’s independence. PwC confirmed its independence to the Audit and Compliance Committee. As part of this process, the Audit and Compliance Committee considered that while PwC would also serve as the Independent Auditor for TIAA, Nuveen, LLC and Nuveen Finance, LLC, it relied upon PwC’s determination that this would not compromise its independence. The Audit and Compliance Committee considered that this arrangement would produce a more cost-effective audit.

As the Trust’s Independent Auditor, PwC will perform independent audits of the Trust’s financial statements for the fiscal years ending October 31, 2019, March 31, 2020 and May 31 2020.

28

Representatives of PwC will attend the special meeting and be available at the special meeting to respond to questions, but it is not expected that they will make any statement at the special meeting.

Audit fees

For the fiscal years ended October 31, 2018 and October 31, 2017, PwC’s aggregate fees for the audit of the Trust’s annual financial statements were $1,104,995 and $1,119,750, respectively.

For the fiscal years ended March 31, 2019 and March 31, 2018, PwC’s aggregate fees for the audit of the Trust’s annual financial statements were $635,310 and $531,515, respectively.

For the fiscal years ended May 31, 2019 and May 31, 2018, PwC’s aggregate fees for the audit of the Trust’s annual financial statements were $418,440 and $388,395, respectively.

Audit-related fees

Audit-related fees are fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under audit fees. The Trust did not pay any fees to PwC for audit-related services for the fiscal years ended October 31, 2018, and October 31, 2017, March 31, 2019 and March 31, 2018, and May 31, 2019 and May 31, 2018.

Tax fees

For fiscal years ended October 31, 2018 and October 31, 2017, PwC’s aggregate fees to the Funds for professional services related to tax compliance, tax advice and tax planning were $347,230 and $351,810, respectively.

For fiscal years ended March 31, 2019 and March 31, 2018, PwC’s aggregate fees for professional services related to tax compliance, tax advice and tax planning were $171,380 and $141,150, respectively.

For fiscal years ended May 31, 2019 and May 31, 2018, PwC’s aggregate fees for professional services related to tax compliance, tax advice and tax planning were $361,950 and $353,100, respectively.

All other fees

For the fiscal years ended October 31, 2018 and October 31, 2017, PwC’s aggregate fees for all other services billed to the Trust were $12,995 and $11,995, respectively. For the fiscal years ended March 31, 2019 and March 31, 2018, PwC’s aggregate fees for all other services billed to the Trust were $5,500 and $5,500, respectively. For the fiscal years ended May 31, 2019 and May 31, 2018, PwC’s aggregate fees for all other services billed to the Trust were $12,675 and $12,675, respectively.

29

Preapproval policy