13830 14294 13242 4.6 0.1 12985 4.6 11609 17625 11436 12309 1.5 38.5 12468 15951 14687 27.4 10000 10049 13541 31.5 10549 21.0 14566 0.1 16101 11381 12645 65.0 36.7 1.3 3.8 26 17734 13380 19.8 17.1 4.6 14.1 31.7 1.5 13745 16325 13.7 0.1 7.5 34.9 16.2 10607 3.5 10464 23.0 0.2 12985 0.2 30.4 19310 24.0 10542 15293 0.1 12653 50.8 4.6 39.1 10631 14823 3.5 10.0 27.9 9.6 30.2 7.5 5.50 13547 33.90 9.6 44.8 10000 10000 10000 10000 10000 10000 10015 10063 10000 9857 10000 10000 10000 10000 10000 10000 10000 10000 10000 14593 10000 10000 10000 10000 10000 9423 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10155 10000 10000 10000 10000 10000 10000 10000 10000 10036 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 9940 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10125 10000 10000 10000 10000 10000 10000 10000 10000 10777 10000 10000 10000 10000 10000 10000 10000 10000 9821 10000 10000 10000 10000 10000 10000 9847 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000 14664 19159 14376 14153 12535 15718 18634 9872 21740 22541 15413 22767 14640 17136 17865 17067 23041 10000 18267 15636 19175 19351 18608 14354 16332 12685 17094 14135 18654 16730 10000 22754 19283 18489 18349 20776 17690 10000 19031 15952 14698 13315 21967 17901 18562 14796 12553 17529 22541 18201 14028 15113 15864 14817 14263 19113 18866 18526 18095 15100 15316 23254 12678 17327 18616 22531 18751 17013 14607 15030 14176 19965 14447 22077 17401 17165 14588 18746 17478 13433 15783 16592 17722 15996 14476 15429 18690 15222 15632 15185 16061 13494 23034 16040 16509 14084 18853 16620 18850 15236 18924 16104 16364 15598 14396 16740 15751 13985 14067 21081 10000 12051 16207 9789 18453 15985 15653 16736 10704 13489 19575 17631 16358 15699 9889 20679 9788 17882 17091 22538 18257 9805 18980 21712 15957 10000 13531 9918 18070 22566 15578 13984 18763 13662 21317 17467 20497 17258 9751 20162 23889 23187 23306 22485 19243 15610 9930 16915 23540 23591 20547 9920 23398 21634 16012 20081 12562 10000 17000 19869 13238 16835 14673 22706 22001 14285 23054 10000 9787 23052 15583 10000 9920 18023 10000 16095 16645 18945 22814 13761 16012 18208 16383 22213 23274 22722 9778 15834 22050 10000 16230 19162 18675 18851 9930 18540 15421 23046 15774 20360 21099 20377 10000 22868 15440 17728 9838 18181 4.6 60.1 60.9 10139 9.5 10000 12.9 4.6 13467 12751 18066 10740 10000 10494 10000 10000 10626 10738 10000 10000 13523 10000 10000 10000 9425 10000 10000 9425 9869 9426 9938 10766 15743 14099 10000 10000 9425 9821 10000 9425 10000 10000 10000 10000 10000 23093 9920 56 0.1 5.50 32.5 7.1 10730 10750 10630 10000 10459 10000 10253 9875 10000 10069 10000 11985 10766 9949 10766 10000 10034 9768 10499 10000 10614 10000 10143 9861 10631 10716 9714 13316 10750 19601 32.0 12.4 13315 33.90 20680 10500 11968 9754 9938 9910 9885 9765 9906 9860 10480 9764 9866 12284 9819 10511 10482 9820 10645 10252 9890 9832 10000 13470 10412 9813 10472 10490 10490 13142 11507 14543 0.1 36.80 31.9 11922 13813 11752 11275 11486 10295 10000 10663 9912 9951 9826 12252 9764 12037 9832 11330 12012 12191 9910 14520 12219 9813 9902 11034 14640 10746 12223 60.9 15264 13860 13750 11984 13278 13697 12001 10602 12597 13284 13755 11293 9774 10000 13191 10995 9887 12729 19465 9922 13691 56 11789 31.8 0.1 39.3 13040 10000 12304 13815 13497 12240 11452 10917 18144 14870 13770 13471 13740 10000 12604 13785 11531 11977 23.2 0.1 16055 36.80 32.3 39.8 14439 4.6 14790 14590 14557 14789 12971 12817 14829 14121 11488 20766 13460 9936 12157 18212 13147 14749 12389 14748 10000 10750 19323 20637 19438 12661 17808 19058 21671 10000 20619 14394 16280 17502 20434 13479 19045 20451 15216 14126 0.1 11824 0.10 16742 14.10 16.2 14228 5.50 13873 0.1 9.5 32.3 10000 10497 11798 12.9 58.6 0.1 0.1 65.0 19455 13415 13808 13713 17346 10645 10459 10662 10744 10479 10634 10092 11582 10470 10610 10714 10093 10516 9930 10489 10553 10466 10831 10055 10735 9814 11030 10756 10602 10725 10651 10681 10879 10736 10345 12751 10132 10646 12635 10552 10830 10669 10665 10000 10597 10692 10913 10665 10693 10729 10722 10792 9879 10038 10783 10336 10821 10733 10691 10758 10496 10702 10157 9945 10809 10433 12648 10740 10555 10512 10121 10477 10653 10325 12738 9855 10778 10061 10167 11094 10835 10748 10800 10321 10309 10892 10450 12648 10537 11531 11433 10570 10762 10318 10338 10513 10761 10813 10111 10679 10755 10656 9961 10889 11636 10483 10306 10604 10000 10803 10435 10735 10760 9984 10831 10529 10488 12776 10810 10000 17765 16370 14687 12434 19265 17706 19011 19089 19183 11809 10004 15997 14229 13207 19528 17378 10450 10000 12124 0.1 13822 19380 23768 17828 19383 12169 19221 16330 13221 17829 11815 17581 14701 19220 16111 14131 10188 14.1 18161 11751 12715 15572 12808 18453 20809 23196 14753 16987 23531 11707 19318 21854 23538 23201 10000 20813 22314 40.0 14698 12906 40.0 10000 10000 10000 10000 10670 9.5 21 4.6 39.7 10666 10649 10614 13033 10416 10547 12.4 59.4 10.0 39.9 24.1 39.2 21.8 30.2 18319 9.90 10458 10452 12075 10434 13.2 13615 10431 33.90 27.9 0.0 11644 18348 11991 7.1 13529 12048 11863 19959 0.2 10000 10802 10391 12163 13870 13421 14263 20083 18282 18431 22490 15624 32.8 24960 13092 13375 16983 13379 12574 13485 27.4 3.5 4.6 58.7 12138 9.5 27.4 18109 12563 16769 13339 13264 12744 13079 13945 11.8 0.1 15697 10780 19644 13928 13756 13524 13861 19452 12.9 0.00 9.6 3.5 11635 0.0 0.2 65.0 8.4 12345 18218 21.1 1.3 0.2 12814 13097 4.6 14465 10497 5.5 10426 27.9 0.1 13.7 26.2 23775 9427 11081 14186 12067 13759 30.2 10440 12146 11775 10439 10468 10449 10445 10415 10462 10488 10398 12949 11306 10428 12648 10454 10420 10437 10424 10165 10468 10366 10424 10369 10542 12063 11999 10462 10450 10418 10407 10454 11664 10450 10480 10495 10419 11767 12101 10370 11704 10429 10443 10520 11661 11717 10411 10478 10431 10432 10406 10076 10747 10423 10503 9811 10439 11417 10397 10502 10454 11700 10483 10526 11078 10406 10459 11494 10470 10446 12117 10429 11702 10420 11188 10454 10421 10476 10420 10491 10168 10755 10000 13118 10430 10360 10419 10453 10466 11663 10000 10359 10370 10367 10611 12710 10419 10522 10452 10397 10435 10471 11632 10453 10444 10473 11759 10283 11792 11784 10499 10393 11171 10483 10521 10401 10466 19104 16618 18270 12021 18189 19349 33.90 16.7 60.9 15172 13285 18174 17085 15651 17951 10000 18407 11221 10525 9.5 13061 30.2 31.7 15737 17179 18080 10000 22282 18306 58.6 52.2 10.0 13936 22150 10000 21743 12166 17621 20054 10000 14935 4.6 12132 58.6 10000 11896 13194 61.0 13698 12452 10581 19354 18.20 58.6 1.5 4.6 16522 59.5 10455 0.3 11754 10491 0.1 14492 10000 15066 12837 9.5 61.0 4.6 10389 1.3 11302 39.8 13194 12418 4.6 14024 19.8 13684 8.4 32.0 4.6 0.1 10492 19.8 19479 19193 10472 9.90 5.5 19530 10 10612 24.1 15525 10507 12762 43.1 39.1 36.7 26.2 10000 36.7 0.1 0.2 5.9 30.4 10488 10 10000 15008 9.6 26 14680 12068 11776 12175 12168 11301 11623 12135 11397 13630 11968 12147 13074 13418 11331 12114 13842 11654 13398 11955 11971 12132 12154 11834 12445 11252 10897 12235 12189 11916 11514 11477 12055 11896 11742 13885 11424 11414 11813 11927 12199 11331 12839 11848 11733 12608 11872 12203 13431 11529 12877 11764 10922 12096 11656 12187 12010 12304 12067 11550 11798 11480 11634 9788 11358 11377 10377 11707 11809 11212 12209 10965 12259 11290 11837 10967 10930 11314 11906 10676 11916 13313 12009 11017 11889 12196 12215 11324 13268 12263 13546 10667 11500 11403 12148 9749 11714 11294 12128 9830 11956 11969 13088 11951 12903 11779 11745 12068 10469 13210 11763 12155 11829 12055 12096 11095 12221 11765 13594 11724 11963 12918 14.6 11543 13655 0.1 56.6 38.5 17375 0.0 60.9 10259 0.1 16303 12945 16337 9.5 11396 13731 14420 0.1 10000 10728 10404 12041 13372 13475 14496 19359 17952 18120 21512 14.4 36.7 16435 18402 18775 21.1 2.8 4.6 10000 7.2 26.2 13.2 10000 10679 18222 11874 19.8 10511 19.8 12897 15397 39.6 9.9 17402 11893 39.6 14372 12782 26.2 10797 10054 9940 27 5.9 20192 11379 10.0 10.0 13382 10364 24981 39.9 39.5 7.5 3.5 12158 13.7 20.0 39.7 1.5 31.9 10.0 0.0 12621 13996 11857 13130 12091 11247 12786 12195 12282 13019 13570 14025 13237 13370 13365 12313 12581 11305 11455 14166 11832 13423 13928 11910 13104 14087 13667 13707 12660 11598 12331 12290 13652 12920 11754 12954 12970 12876 12089 13913 13690 13144 13250 13764 13155 13570 11259 13421 13648 12838 12559 11523 13513 13624 13141 12505 9813 11292 9874 11982 12197 12927 14011 13878 13770 12799 12744 13109 13500 12459 11979 13365 13384 12733 11975 14561 13297 12308 12330 12203 12018 11877 13968 12738 11689 12031 13518 12049 12603 11992 13552 12888 13447 14433 13699 13425 12118 13629 13232 13938 14094 14406 14512 14529 13499 12166 12540 13610 12698 13821 11177 12868 13769 13152 14394 13682 11808 12641 12816 13014 0.0 27.9 13270 38.6 15712 14617 1.5 7.2 13268 44.8 13.7 23.0 14359 0.2 10543 4.6 16303 18292 12502 14093 22305 1.5 2.6 17081 11607 11746 36.7 17071 19.8 13518 12880 14743 19582 10519 0.1 18330 1.5 13827 0.1 10041 56.6 17.1 0.10 15715 0.1 10334 0.0 12.4 40.0 10.00 56.6 39.9 10432 19.8 5.0 10000 23.0 56 18649 0.1 59.4 11504 0.2 23.7 0.2 3.5 19410 9.4 32.3 12858 13628 12592 13253 12801 14503 13556 13452 13540 13055 13585 12422 13701 17267 13489 14214 10000 14988 11533 12407 14210 11759 14295 13352 13108 11587 13553 12251 13064 12082 18845 9849 11646 12804 13482 13080 13826 13293 13038 12389 12242 14255 12007 12606 11582 10000 14188 12226 13181 12843 11688 13372 11942 13204 13412 12556 13964 12504 14586 12580 15516 12321 18608 12150 12476 13768 12682 13771 12894 12324 12742 12214 13347 12964 13646 12852 13282 13486 12688 13599 13029 12745 13535 12730 12317 13452 13491 14613 9782 13667 12832 13070 13525 12311 13738 12172 13709 13143 12154 13353 13307 13377 14052 12620 13585 13324 14110 12933 13727 12708 13418 12868 11643 18124 12971 10480 19.8 16460 27.2 10747 40.0 12041 10580 0.0 11723 9.9 10000 12291 26.2 16.7 0.2 39.2 10000 39.9 24.1 40.0 23.7 14829 14620 9.9 15143 16537 9.4 38.6 10578 3.5 10451 14093 10528 17569 13289 17569 10488 12.4 12402 52.2 13716 27 5.5 26.2 26.20 11.8 2.8 14765 0.2 1.5 13136 10.0 16130 5.0 5.5 13366 31.8 12.7 39.6 59.5 4.6 0.0 13191 3.8 10415 58.7 59.5 31.5 7.5 11596 30.2 3.5 13851 10634 0.2 10000 0.1 14656 14387 12188 20338 12913 14330 14036 19923 14748 15988 13669 16839 14620 13327 14523 12987 13522 17174 14284 12504 13411 14711 19058 13776 13826 19278 14126 19749 13150 13875 14350 13968 13115 13729 14659 13317 14173 18307 14544 19888 14476 12727 17504 13489 14281 14554 14695 17384 14710 13891 13115 12948 12283 20086 20278 14984 12907 14390 13617 14128 13476 14417 12993 19353 14327 13222 14460 19564 14799 20219 13599 14418 19413 15505 13888 12898 13887 14430 14253 13642 13689 13422 13701 14150 13201 14337 14088 13681 13615 14533 13349 14576 12222 14244 13962 14577 13310 20207 17017 13550 12961 12690 13905 13262 16674 13635 12916 13949 14206 14214 15935 12413 11.8 12857 4.6 1.5 23.7 50.8 10000 19443 30.9 15126 39.8 0.1 32.8 27.9 20678 39.6 12319 30.9 27 32.9 13425 39.2 0.2 9956 11689 13359 12952 13801 19465 17756 17953 21922 10000 0.1 21.1 4.6 4.6 31.7 10677 14884 10425 15740 0.3 9.9 10000 60.3 14798 3.5 0.2 12713 32.5 7.5 13012 11407 0.0 4.6 4.6 14.6 34.9 13990 12502 10432 30.9 4.6 11426 0.1 12401 18620 11741 21.0 10590 14815 0.3 39.80 5.5 20 0.2 15220 16459 13977 15272 15917 18928 15089 15474 19800 14475 17308 17715 19957 20107 19487 17431 20100 20624 20546 16180 17794 15576 17624 14036 16089 12474 16804 20432 18729 15896 21073 18368 18494 16933 15326 17688 13202 14414 18829 17498 20413 17357 20139 16745 17355 20497 19552 16350 17858 14993 18831 16624 16177 15827 18894 18507 17273 15495 18101 18281 13551 20157 13502 18602 20858 15220 17080 20712 15600 17847 17165 20217 15949 16446 17852 17194 19217 18415 17053 16477 18046 11810 19358 14480 14337 17921 18925 17405 19929 17659 16342 13817 17973 11886 15396 19694 14934 20324 18285 18770 15922 12207 20283 20310 15809 13719 18645 15439 18912 13432 15298 15543 9983 11902 13399 23.2 15647 10000 26.20 23720 0.1 31.5 1.5 15382 10000 10739 32.5 12653 5.50 5.50 24040 14.1 2.6 3.5 1.5 18763 23.0 32.0 10471 15957 19.8 20624 39.7 16651 36.80 16597 3.5 0.1 15181 4.6 17349 18412 14758 10000 0.0 13.2 10337 7.5 5.9 12110 32.9 10766 15491 12430 32.0 19820 12.9 21 14593 34.9 39.9 7.5 32.3 11336 12600 13.2 39.6 14.4 18283 39.6 7.1 4.6 44.8 2.6 7.5 13486 13931 7.1 17029 15329 13407 18450 14238 14405 14884 18315 18992 15365 15244 15191 14331 17551 14159 18600 16596 17600 18980 16200 17252 15864 15685 14507 16618 17300 20412 18439 15072 15484 15717 16331 20545 17208 14357 18088 18648 14652 19078 14780 15286 18554 18326 18681 14048 15441 14893 17896 12655 15170 14233 18182 18525 16973 15751 16381 18550 18236 17012 17384 18090 18417 15534 12529 19738 13456 17288 15935 14881 18530 16004 17099 18899 17699 12512 17836 18688 11943 19100 21032 18904 14048 16084 14535 18039 17533 18303 15618 16715 18851 15901 19122 18425 15583 15188 15765 18939 16041 18028 11968 14143 14763 16511 16714 18683 12731 15658 13966 14483 16948 14012 18699 18.20 27.2 14962 17710 7.2 21 60.1 12736 32.8 1.5 12152 10465 13451 10.0 17175 13667 10.0 18649 13706 12156 27.9 60.1 4.6 24.1 65.0 7.5 10000 4.6 11723 12.7 0.0 7.5 31.9 17.1 7.2 0.1 39.5 26 27.2 14334 23.2 10226 23605 10489 16080 10 39.9 10.00 0.1 0.0 12.9 10 16748 13972 13257 0.1 3.5 0.1 44.8 14198 13168 59.4 12.4 32.8 13655 12349 11329 39.6 4.6 14845 39.8 26.2 21 14125 14840 39.6 12225 13.7 0.1 9.5 0.0 11705 10000 11254 16224 23737 30.4 10651 0.10 12.9 9.5 39.9 16112 21.8 0.1 10000 0.1 39.1 15557 36.7 12887 39.6 5.50 40.0 10088 23.0 0.1 21081 18621 10479 0.1 27.2 12220 60.3 4.6 0.2 32.8 0.0 0.1 10.0 0.2 9.9 15351 18479 52.2 12462 11409 0.1 0.0 15578 22307 32.8 61.0 2.8 10000 58.7 15901 16189 5.5 10000 14.4 0.2 12313 0.10 11110 27.9 0.1 18.20 18427 23.7 4.6 15448 30.2 16631 40.0 1.5 11022 19438 7.5 10000 24.0 39.6 11155 12653 10504 14845 7.5 7.5 19407 0.2 14.10 10369 11484 61.0 21.1 21.8 11434 34.9 3.5 16.2 59.5 13875 13.7 0.1 0.1 52.2 15383 4.6 34.9 9.1 10000 12046 0.1 16.7 11045 11534 19.8 39.6 14622 16916 12246 5.0 31.5 32.8 36.7 12783 2.8 10000 0.3 4.6 3.8 39.3 10515 17937 10472 13582 11885 39.80 10000 17295 11183 19245 21575 0.1 0.2 0.1 10750 15560 39.5 7.5 16.7 10607 10000 15833 15558 11.8 27.9 16640 10000 39.6 4.6 3.5 10000 30.2 27.9 19807 10449 56.6 0.3 38.5 16.2 12806 14.6 10000 32.5 13371 0.1 15384 0.1 11347 32.8 11310 10509 12801 8.4 10000 22182 13170 5.9 15746 39.5 0.1 10351 4.6 19.8 4.6 39.1 39.2 13680 60.3 60.1 4.6 10155 36.80 3.8 60.3 0.1 24529 58.7 9.5 7.1 14554 14.6 10444 65.0 9.5 10.0 38.6 0.0 10542 12353 13.7 39.7 19503 7.5 0.1 13.2 0.1 14161 14.1 16130 10000 0.1 23.2 17344 43.1 10619 10445 10374 19.8 17461 16325 4.6 0.1 7.5 0.0 21.1 4.6 0.0 9.1 52 12179 10474 13307 40.0 24.0 10494 39.8 0.2 19.8 40.0 10000 39.7 4.6 56 10.0 3.5 0.2 1.5 21.8 0.0 21434 15252 11211 27.9 0.1 5.5 52.0 27.4 9.9 16052 17530 12881 12402 11725 2.6 0.1 32.9 27.0 0.1 9.5 16957 14.4 0.1 15533 12446 17382 39.3 30.2 12106 31.7 17931 9888 8.4 14628 14.1 1.5 14.1 52.0 0.3 24.0 16406 5.50 4.6 4.6 12685 31.8 14.1 0.1 10479 18.20 21.0 4.6 4.6 4.6 5.0 9.4 12256 50.8 0.2 39.2 20.0 19.8 0.1 0.1 39.8 22184 14414 12343 12.9 9.4 43.1 4.6 12.9 10510 38.5 11619 0.3 59.4 10477 9.1 16226 10498 27.9 10000 12020 40.0 12.7 12965 17.1 0.0 9.1 11924 0.1 27.9 12.7 20786 4.6 30.9 43.1 0.1 4.6 31.9 3.5 0.00 10509 0.1 10303 20030 14088 19198 21438 15684 0.1 12174 36.7 31.8 5.5 1.5 10309 16779 0.1 0.3 39.9 30.4 10000 0.1 20 13354 13750 13365 50.8 27.9 39.9 26 12309 13805 11934 10632 12100 52 11428 14710 0.2 10798 31295 18176 32.9 15585 11186 11754 11950 13.7 38.6 52.2 1.3 4.6 5.50 0.1 0001084380 false 0001084380 tcf:SAndPTargetDate2035IndexMember 2023-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-09301 |

TIAA-CREF Funds

(Exact name of registrant as specified in charter)

730 Third Avenue

New York, New York 10017-3206

(Address of principal executive offices) (Zip code)

Jeremy D. Franklin, Esq.

TIAA-CREF Funds

8500 Andrew Carnegie Boulevard

Charlotte, North Carolina 28262-8500

(Name and address of agent for service)

Registrant’s telephone number, including area code: (704) 595‑1000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2010 Fund

(Formerly known as TIAA-CREF Lifecycle 2010 Fund)

Retirement Class Shares/TCLEX

Annual Shareholder Report

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle 2010 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Retirement Class Shares | | $51 | | 0.51% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

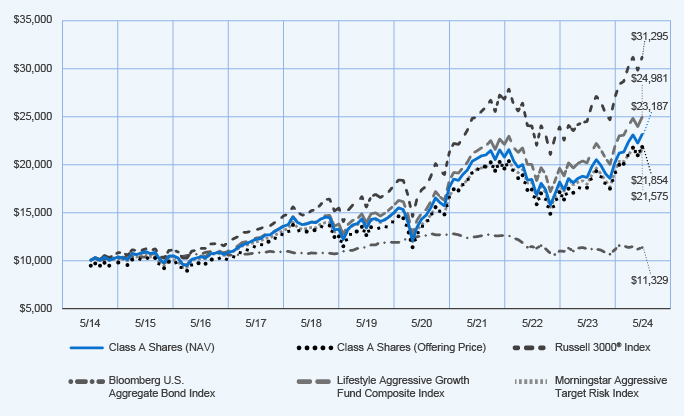

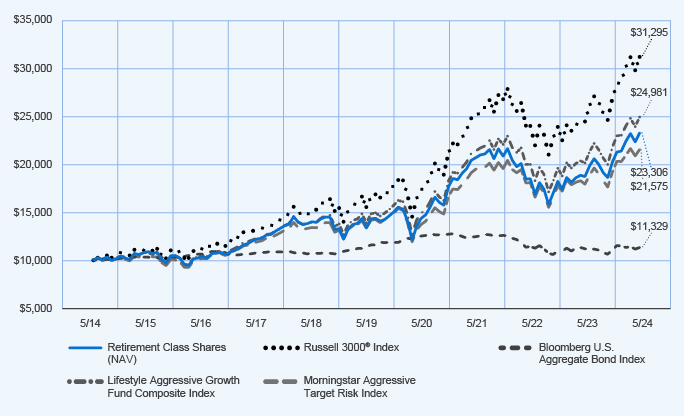

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2010 Fund returned 10.11% for Retirement Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the Lifecycle 2010 Fund Composite Index, which returned 9.75%. • The Lifecycle 2010 Fund Composite Index consisted of: 40.0% Bloomberg U.S. Aggregate Bond Index; 23.5% Russell 3000® Index; 12.6% MSCI All Country World Index ex USA Investable Market Index; 13.9% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 10.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

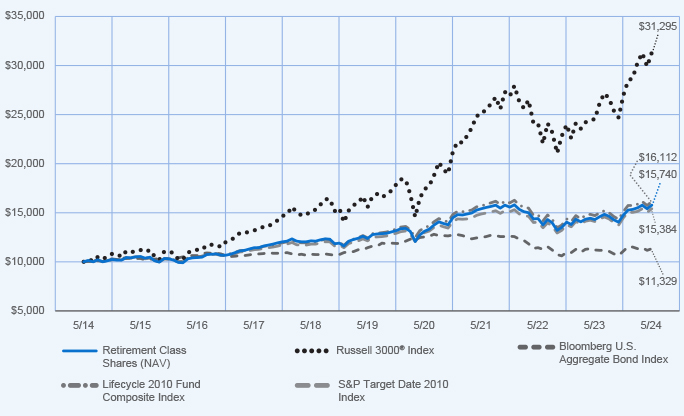

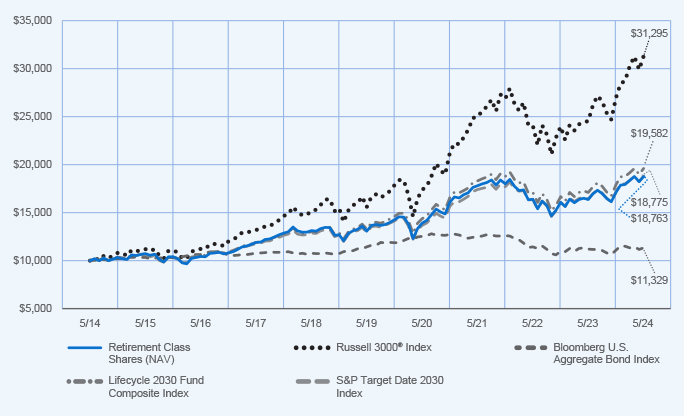

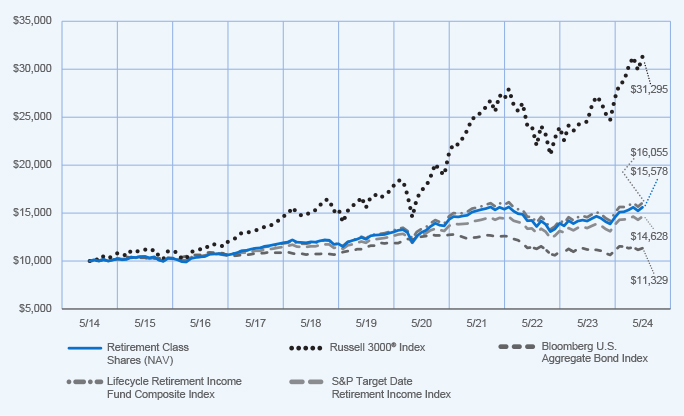

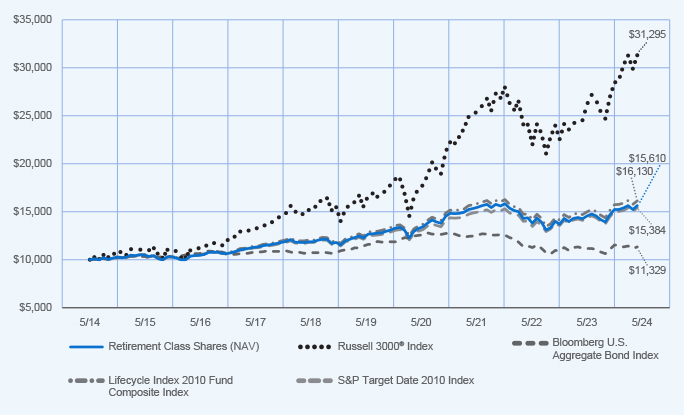

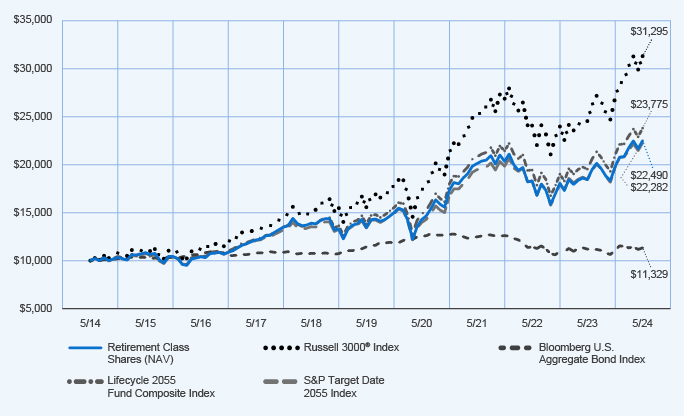

How did the Fund perform over the last 10 years?

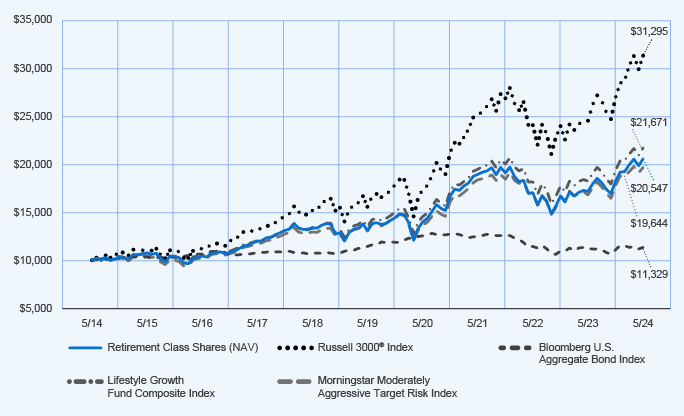

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Retirement Class Shares at NAV | | | 10.11 | % | | | 4.96 | % | | | 4.64 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2010 Fund Composite Index | | | 9.75 | % | | | 5.32 | % | | | 4.89 | % |

| S&P Target Date 2010 Index | | | 9.20 | % | | | 4.91 | % | | | 4.40 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en-us/mutual-funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 804,466,356 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 14% | |

| Total advisory fees paid for the year | | $ | 3,211,719 | |

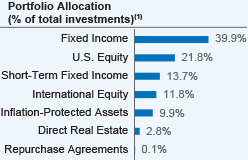

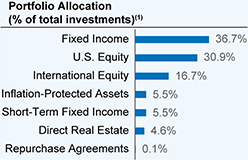

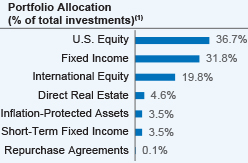

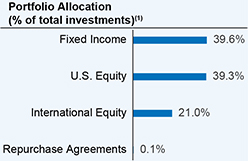

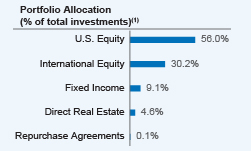

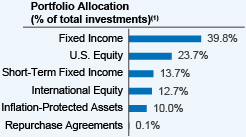

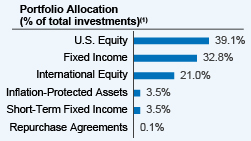

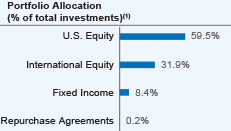

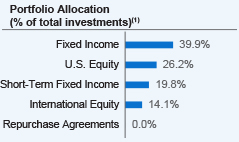

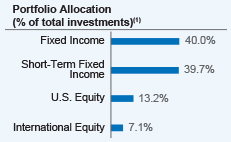

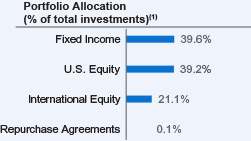

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2010 Fund to Nuveen Lifecycle 2010 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87244W458_AR_0524 3613681-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2010 Fund

(Formerly known as TIAA-CREF Lifecycle 2010 Fund)

Class R6 Shares (Formerly known as Institutional Class Shares)/TCTIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle 2010 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class R6 Shares | | $26 | | 0.26% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

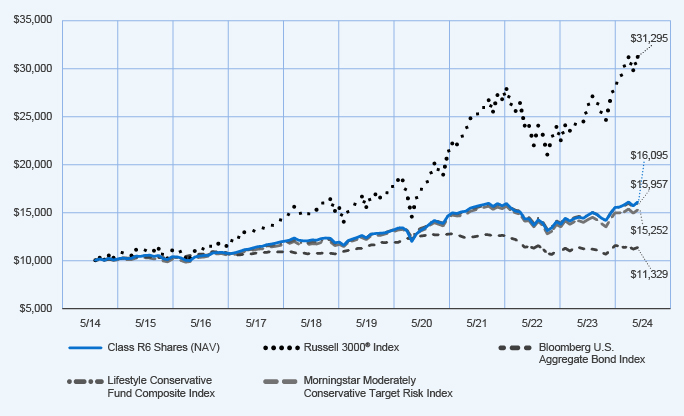

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2010 Fund returned 10.31% for Class R6 shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the Lifecycle 2010 Fund Composite Index, which returned 9.75%. • The Lifecycle 2010 Fund Composite Index consisted of: 40.0% Bloomberg U.S. Aggregate Bond Index; 23.5% Russell 3000® Index; 12.6% MSCI All Country World Index ex USA Investable Market Index; 13.9% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 10.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

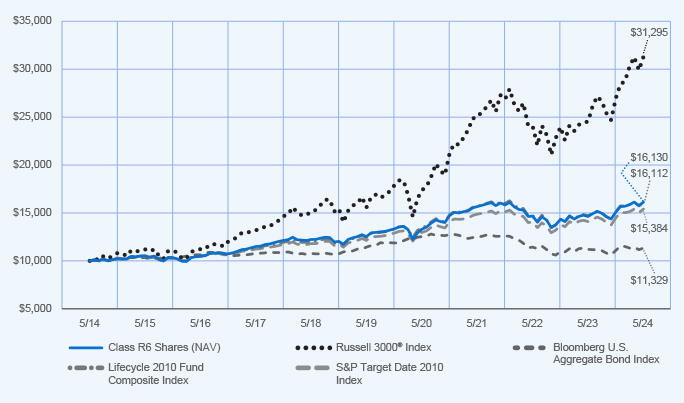

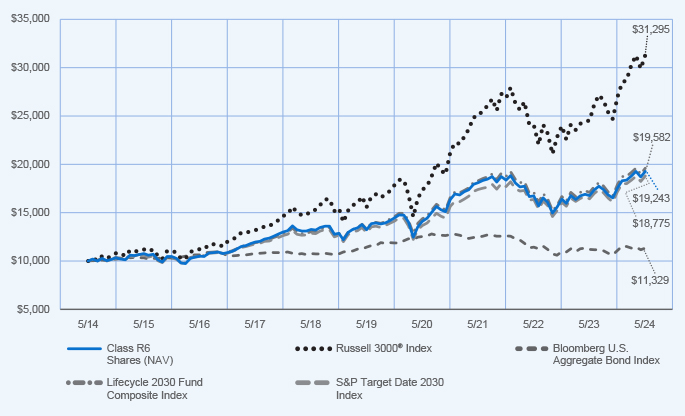

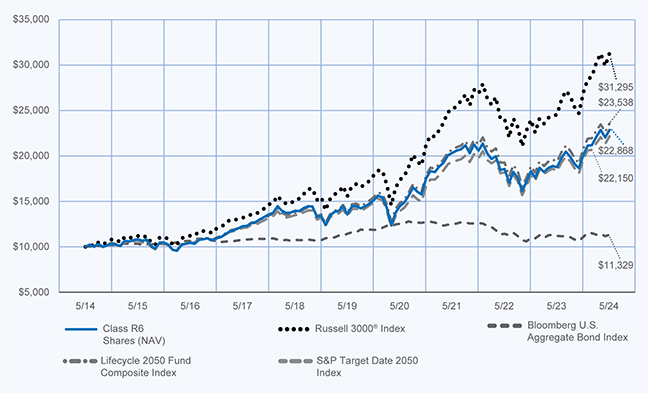

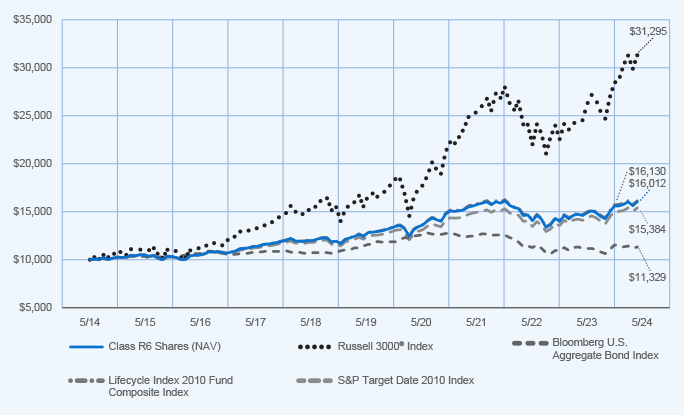

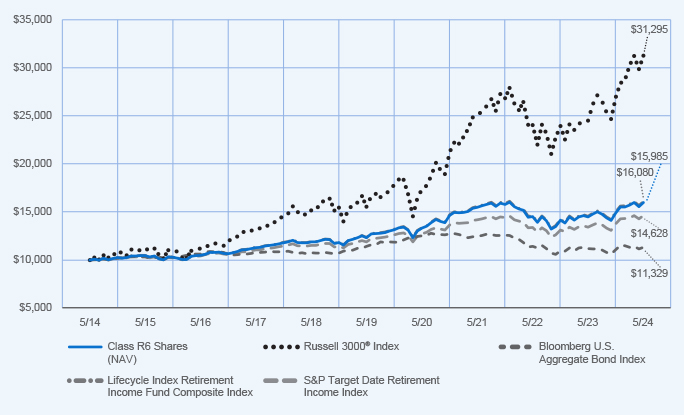

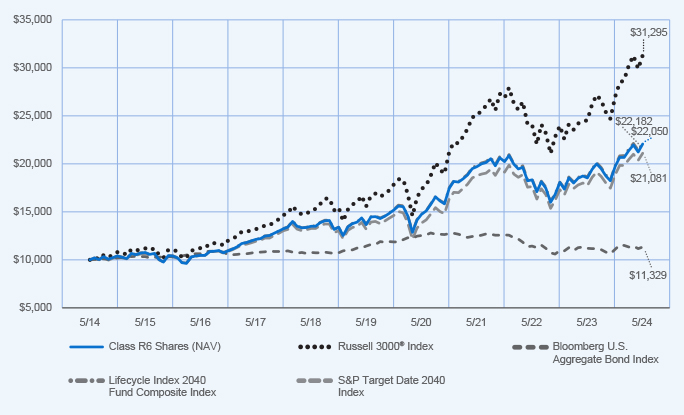

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Class R6 Shares at NAV | | | 10.31 | % | | | 5.23 | % | | | 4.90 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2010 Fund Composite Index | | | 9.75 | % | | | 5.32 | % | | | 4.89 | % |

| S&P Target Date 2010 Index | | | 9.20 | % | | | 4.91 | % | | | 4.40 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 804,466,356 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 14% | |

| Total advisory fees paid for the year | | $ | 3,211,719 | |

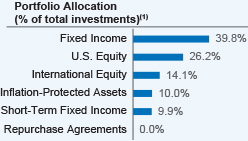

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2010 Fund to Nuveen Lifecycle 2010 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Institutional Class shares of the Fund were renamed Class R6 shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

886315662_AR_0524 3613681-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2010 Fund

(Formerly known as TIAA-CREF Lifecycle 2010 Fund)

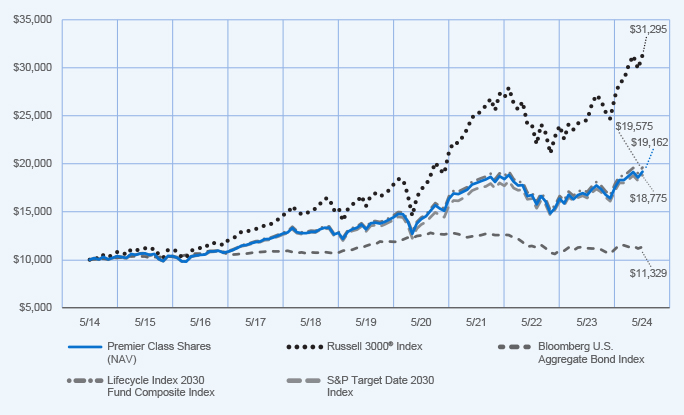

Premier Class Shares/TCTPX

Annual Shareholder Report

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle 2010 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Premier Class Shares | | $41 | | 0.41% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2010 Fund returned 10.27% for Premier Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the Lifecycle 2010 Fund Composite Index, which returned 9.75%. • The Lifecycle 2010 Fund Composite Index consisted of: 40.0% Bloomberg U.S. Aggregate Bond Index; 23.5% Russell 3000® Index; 12.6% MSCI All Country World Index ex USA Investable Market Index; 13.9% Bloomberg U.S. 1–3 Year Government/Credit Bond Index; and 10.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

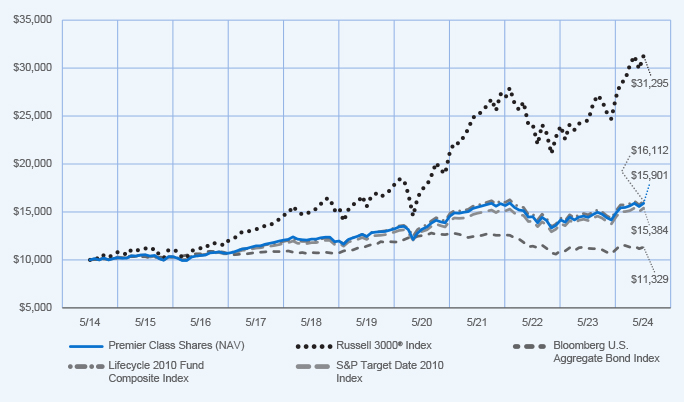

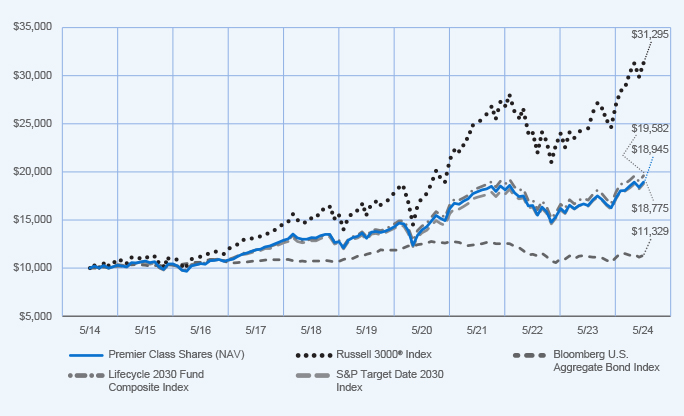

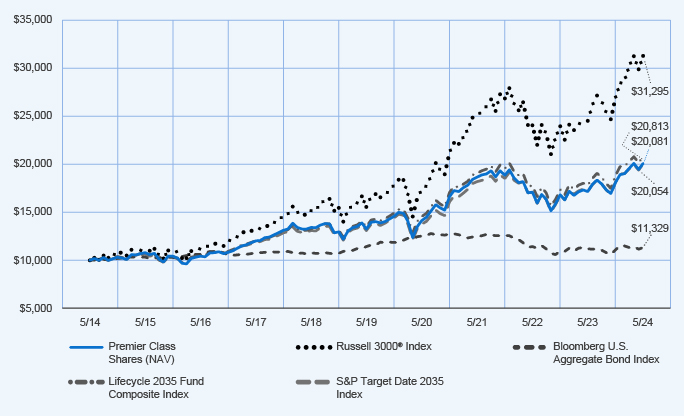

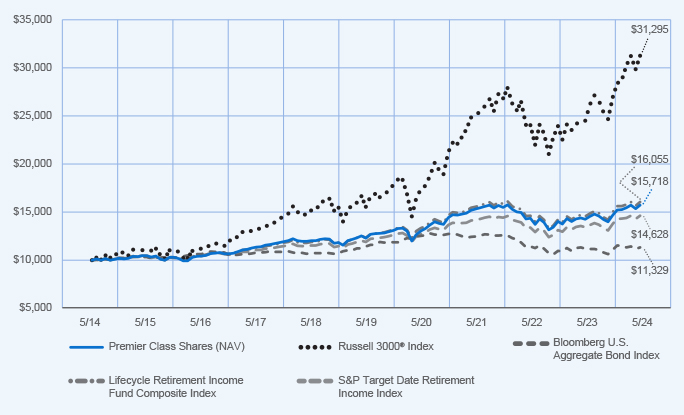

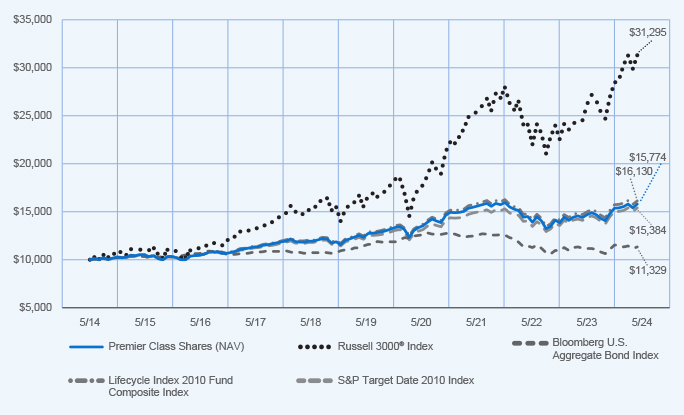

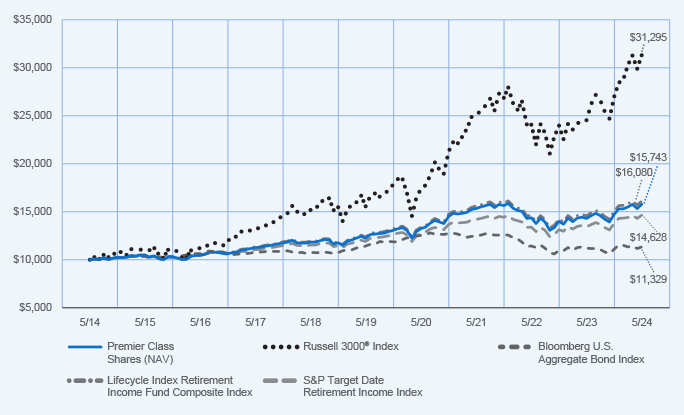

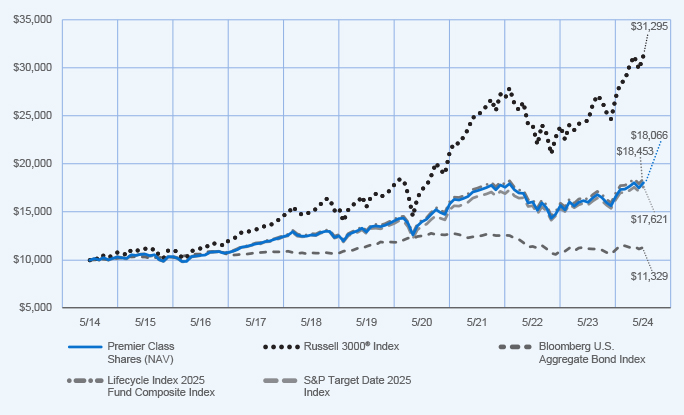

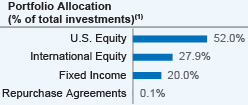

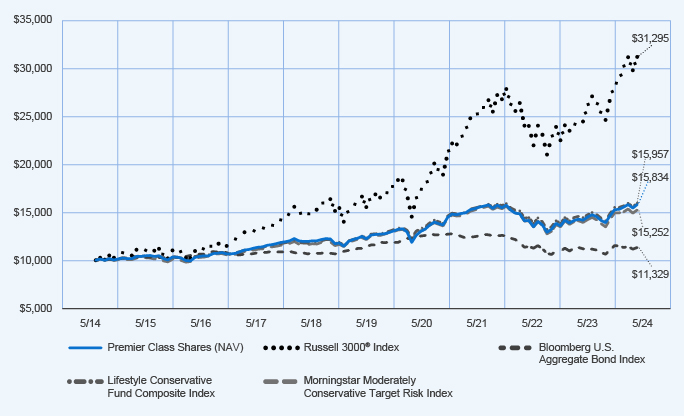

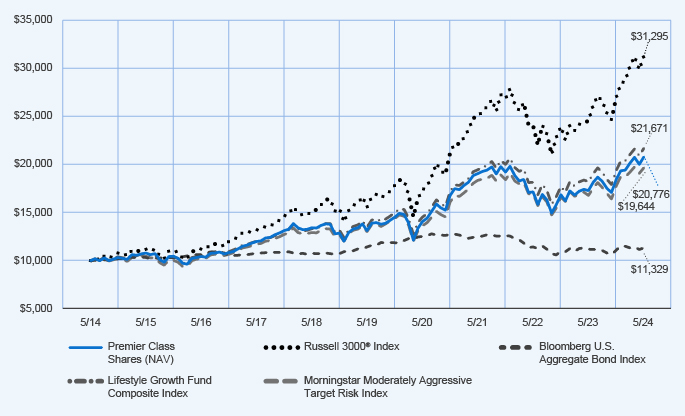

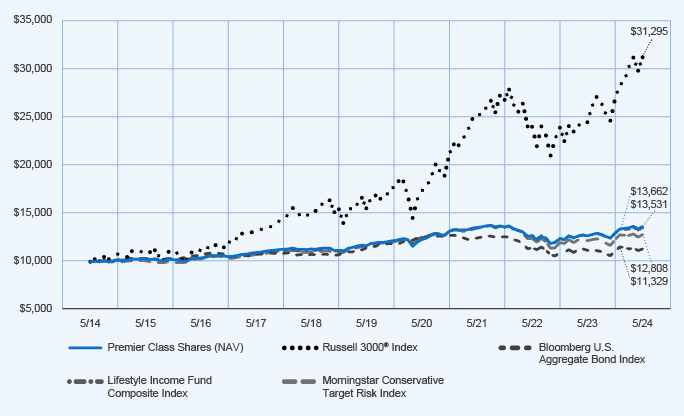

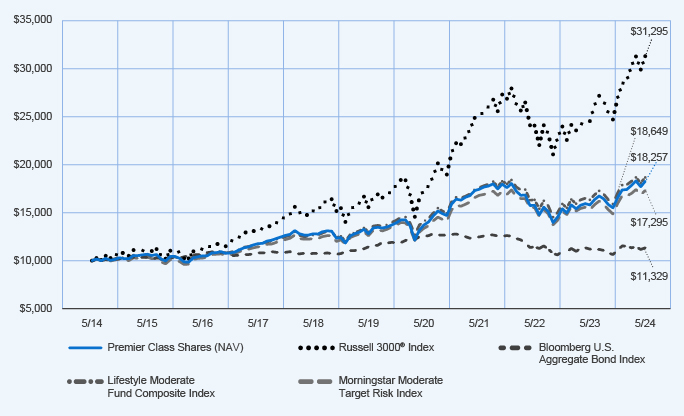

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Premier Class Shares at NAV | | | 10.27 | % | | | 5.08 | % | | | 4.75 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2010 Fund Composite Index | | | 9.75 | % | | | 5.32 | % | | | 4.89 | % |

| S&P Target Date 2010 Index | | | 9.20 | % | | | 4.91 | % | | | 4.40 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 804,466,356 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 14% | |

| Total advisory fees paid for the year | | $ | 3,211,719 | |

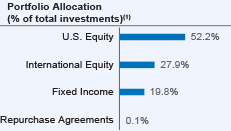

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2010 Fund to Nuveen Lifecycle 2010 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245M434_AR_0524 3613681-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2010 Fund

(Formerly known as TIAA-CREF Lifecycle 2010 Fund)

Class I Shares (Formerly known as Advisor Class Shares)/TCLHX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle 2010 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class I Shares | | $32 | | 0.32% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2010 Fund returned 10.33% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the Lifecycle 2010 Fund Composite Index, which returned 9.75%. • The Lifecycle 2010 Fund Composite Index consisted of: 40.0% Bloomberg U.S. Aggregate Bond Index; 23.5% Russell 3000® Index; 12.6% MSCI All Country World Index ex USA Investable Market Index; 13.9% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 10.0% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

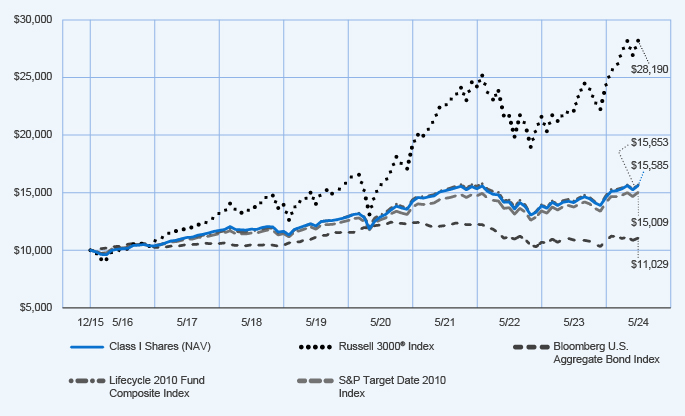

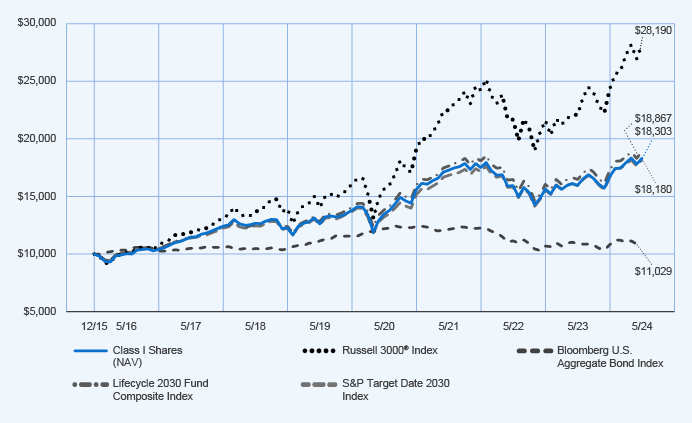

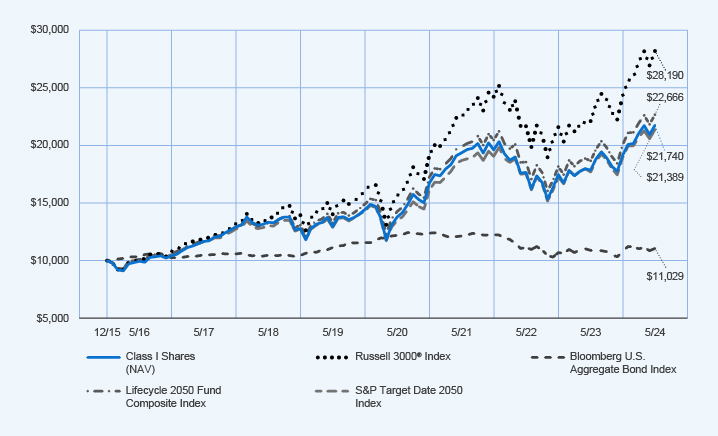

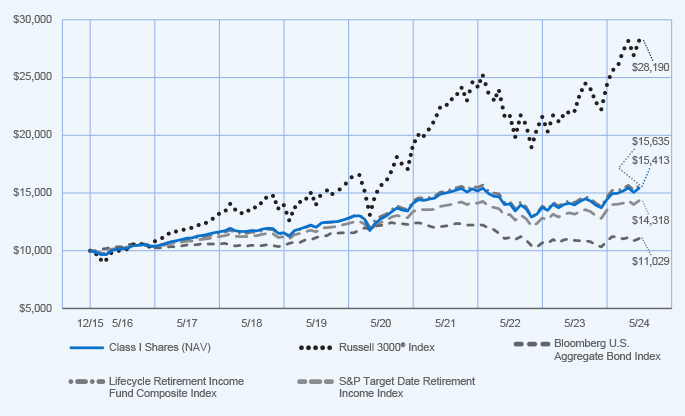

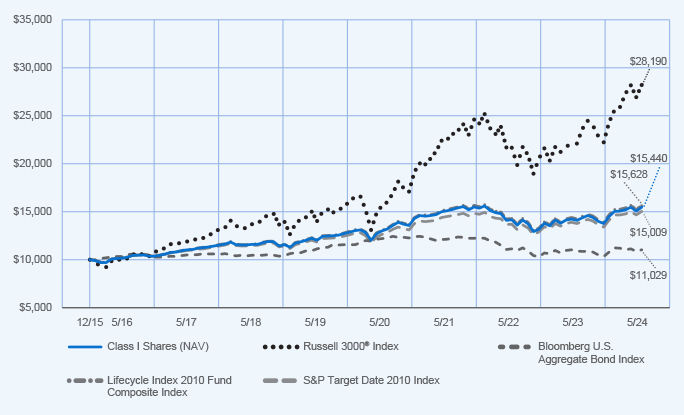

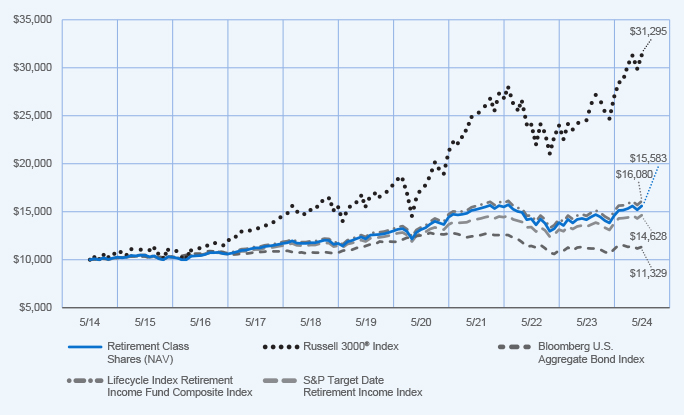

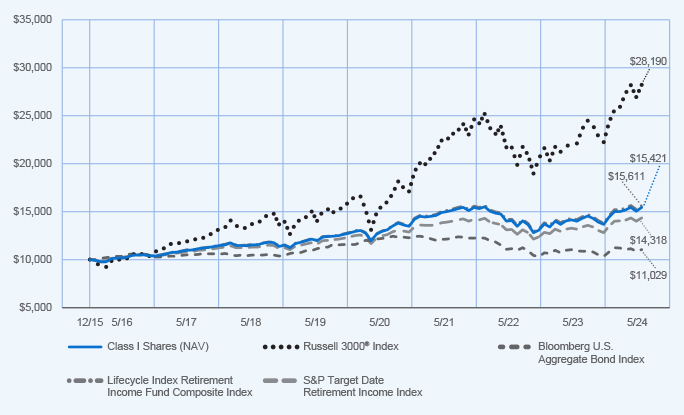

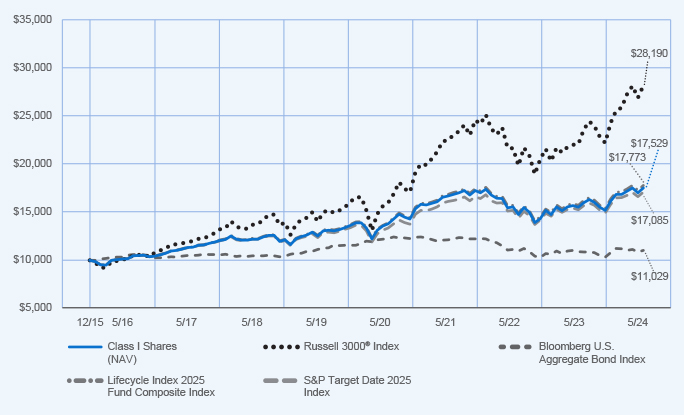

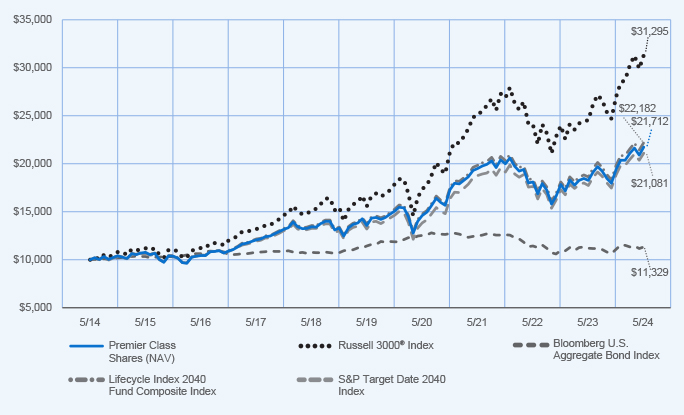

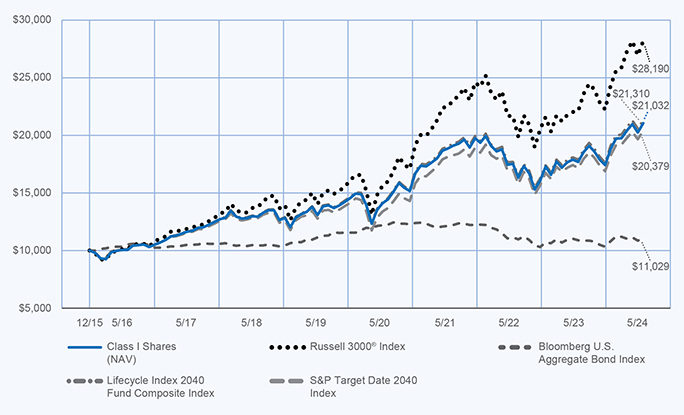

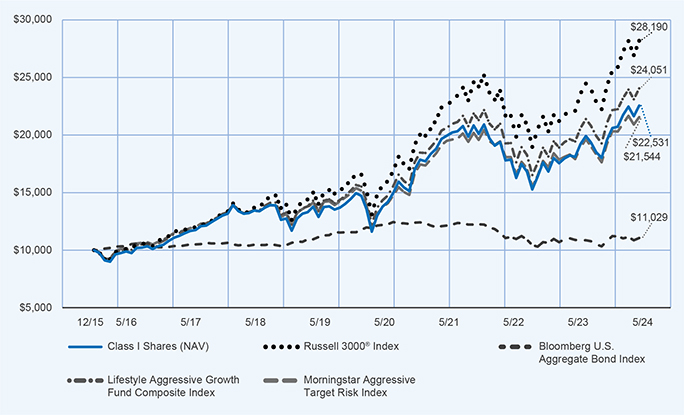

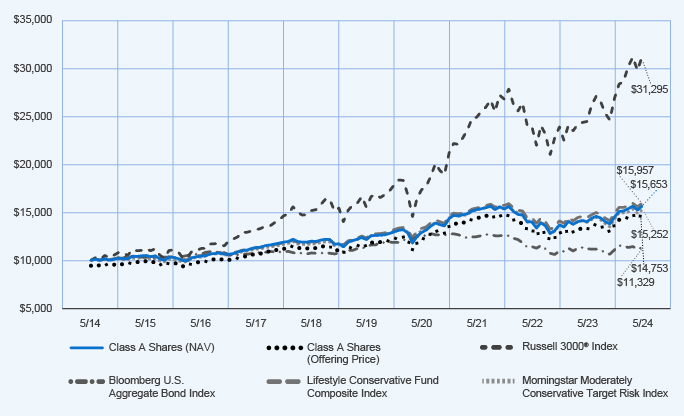

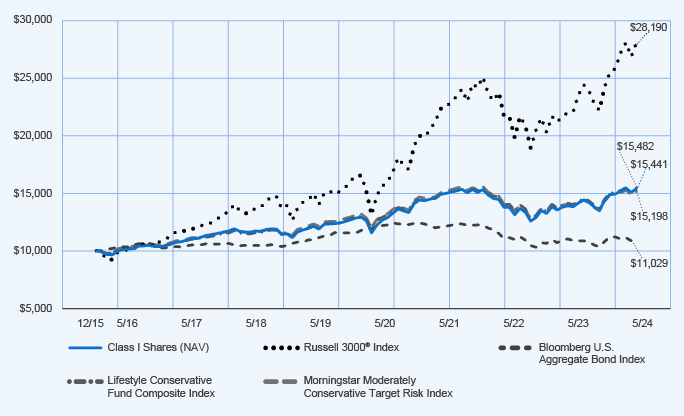

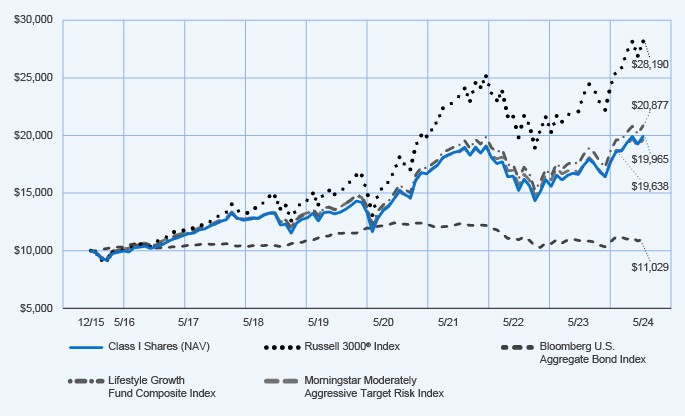

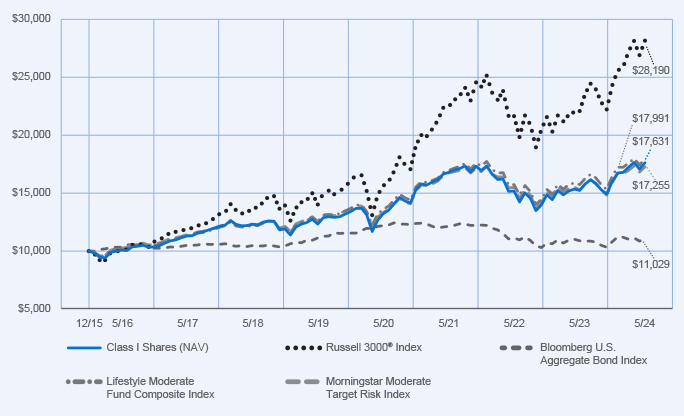

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

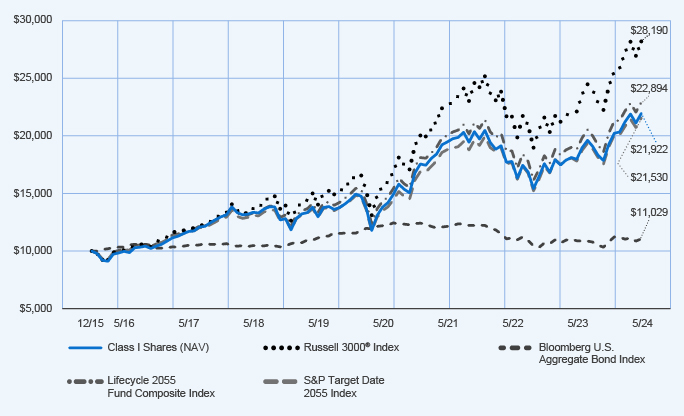

Fund Performance (December 4, 2015 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | Since Inception | |

| Class I Shares at NAV | | | 10.33 | % | | | 5.19 | % | | | 5.37 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.98 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.16 | % |

| Lifecycle 2010 Fund Composite Index | | | 9.75 | % | | | 5.32 | % | | | 5.42 | % |

| S&P Target Date 2010 Index | | | 9.20 | % | | | 4.91 | % | | | 4.90 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 804,466,356 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 14% | |

| Total advisory fees paid for the year | | $ | 3,211,719 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2010 Fund to Nuveen Lifecycle 2010 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Advisor Class shares of the Fund were renamed Class I shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en-us/mutual-funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245P205_AR_0524 3613681-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2015 Fund

(Formerly known as TIAA-CREF Lifecycle 2015 Fund)

Class R6 Shares (Formerly known as Institutional Class Shares)/TCNIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle 2015 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class R6 Shares | | $24 | | 0.24% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2015 Fund returned 10.82% for Class R6 shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2015 Fund Composite Index, which returned 10.74%. • The Lifecycle 2015 Fund Composite Index consisted of: 39.8% Bloomberg U.S. Aggregate Bond Index; 26.6% Russell 3000® Index; 14.4% MSCI All Country World Index ex USA Investable Market Index; 9.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 9.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

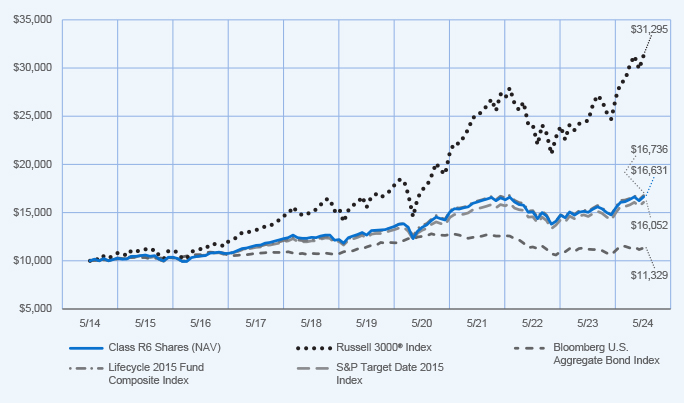

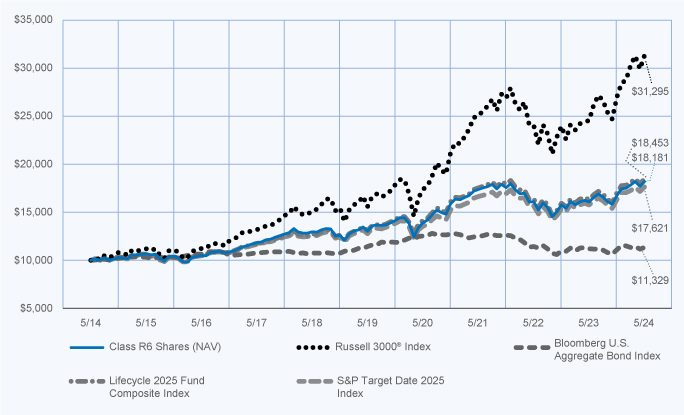

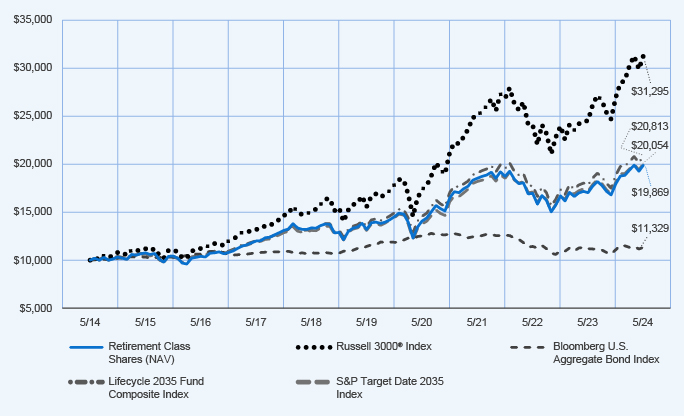

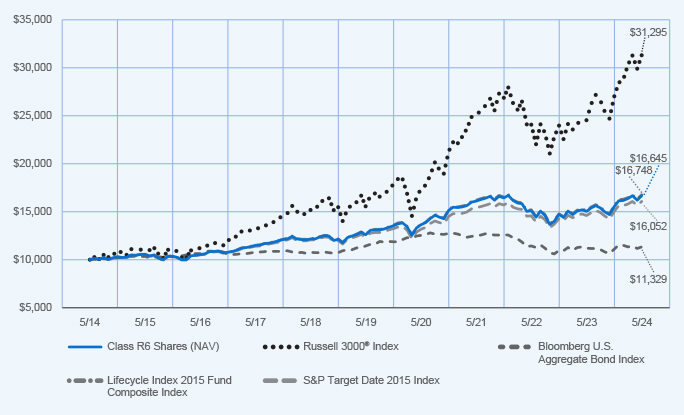

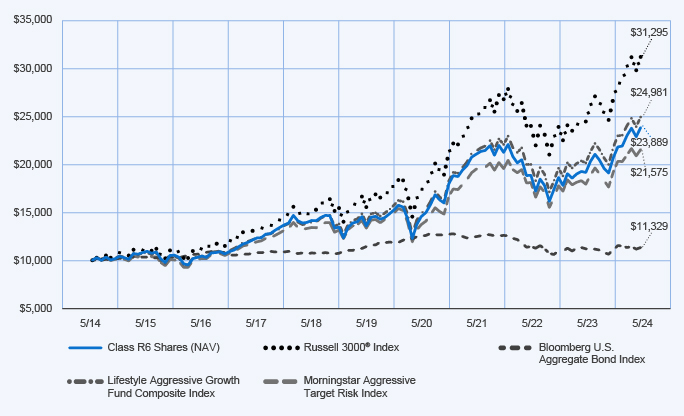

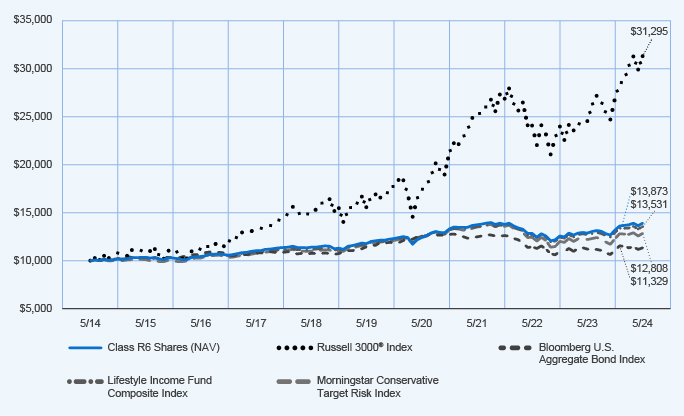

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Class R6 Shares at NAV | | | 10.82 | % | | | 5.62 | % | | | 5.22 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2015 Fund Composite Index | | | 10.74 | % | | | 5.85 | % | | | 5.28 | % |

| S&P Target Date 2015 Index | | | 9.99 | % | | | 5.38 | % | | | 4.85 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 1,158,115,781 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 4,598,952 | |

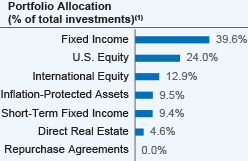

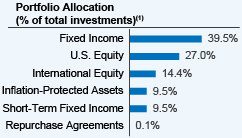

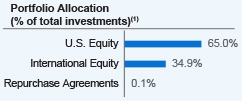

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2015 Fund to Nuveen Lifecycle 2015 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Institutional Class shares of the Fund were renamed Class R6 shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

886315654_AR_0524 3613689-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2015 Fund

(Formerly known as TIAA-CREF Lifecycle 2015 Fund)

Premier Class Shares/TCFPX

Annual Shareholder Report

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle 2015 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Premier Class Shares | | $39 | | 0.39% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2015 Fund returned 10.56% for Premier Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2015 Fund Composite Index, which returned 10.74%. • The Lifecycle 2015 Fund Composite Index consisted of: 39.8% Bloomberg U.S. Aggregate Bond Index; 26.6% Russell 3000® Index; 14.4% MSCI All Country World Index ex USA Investable Market Index; 9.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 9.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

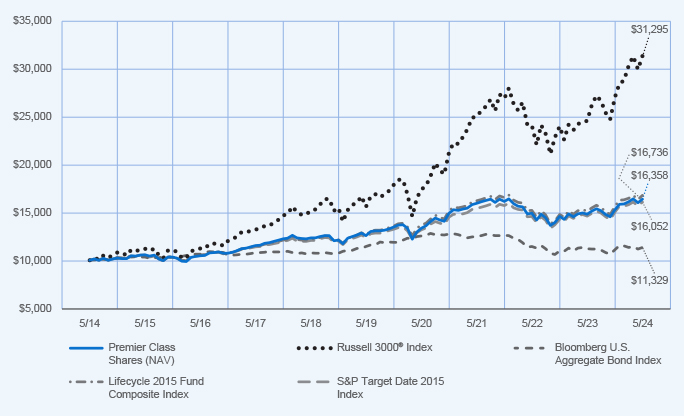

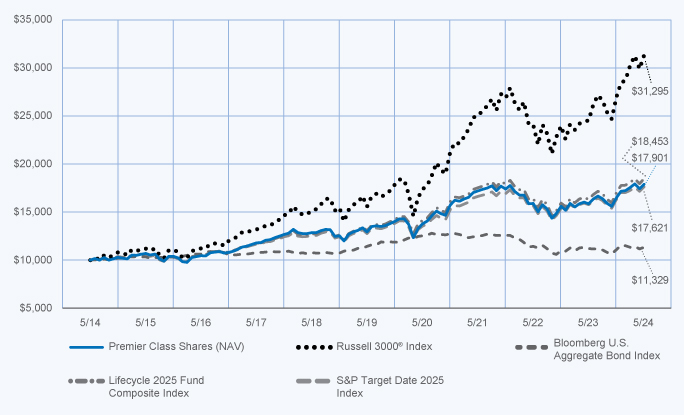

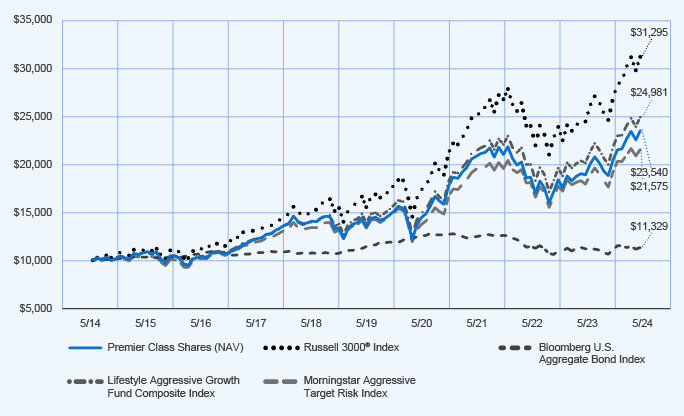

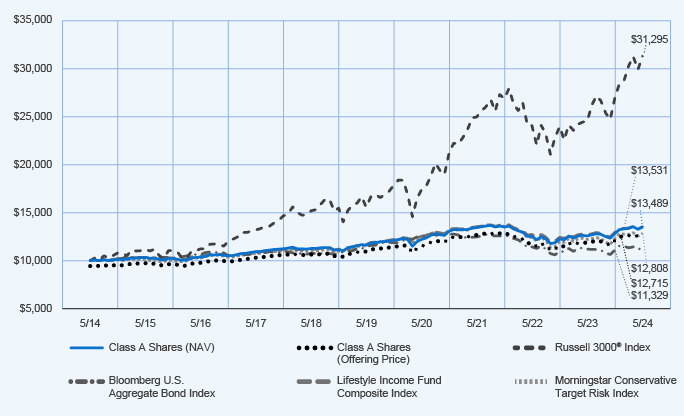

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Premier Class Shares at NAV | | | 10.56 | % | | | 5.43 | % | | | 5.04 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2015 Fund Composite Index | | | 10.74 | % | | | 5.85 | % | | | 5.28 | % |

| S&P Target Date 2015 Index | | | 9.99 | % | | | 5.38 | % | | | 4.85 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 1,158,115,781 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 4,598,952 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2015 Fund to Nuveen Lifecycle 2015 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245M426_AR_0524 3613689-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2015 Fund

(Formerly known as TIAA-CREF Lifecycle 2015 Fund)

Class I Shares (Formerly known as Advisor Class Shares)/TCNHX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle 2015 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class I Shares | | $28 | | 0.28% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2015 Fund returned 10.74% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2015 Fund Composite Index, which returned 10.74%. • The Lifecycle 2015 Fund Composite Index consisted of: 39.8% Bloomberg U.S. Aggregate Bond Index; 26.6% Russell 3000® Index; 14.4% MSCI All Country World Index ex USA Investable Market Index; 9.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 9.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

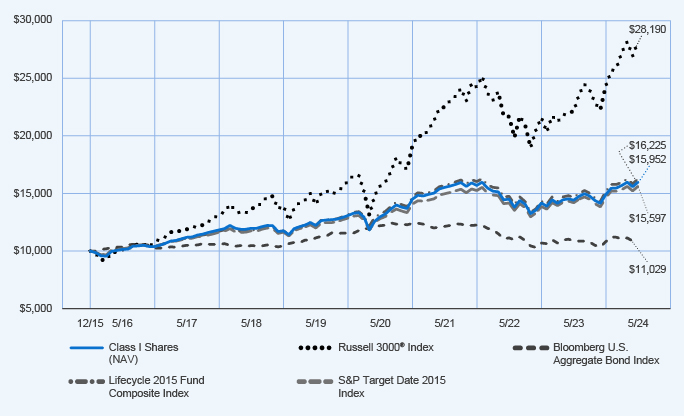

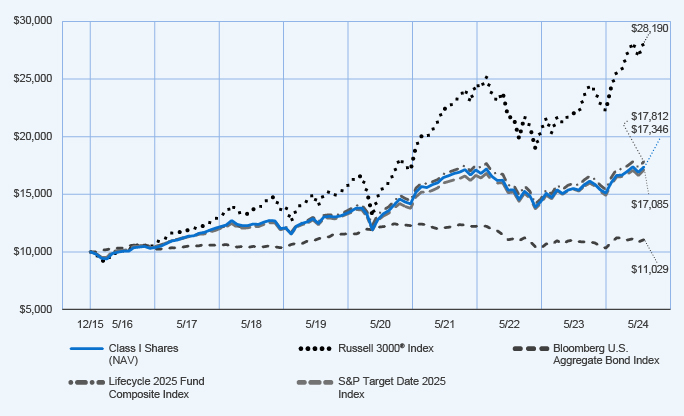

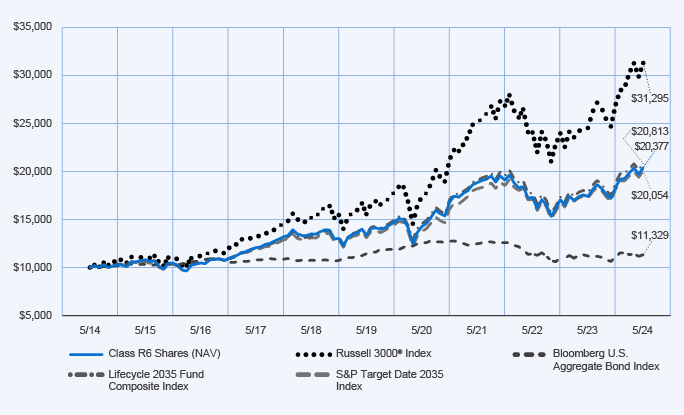

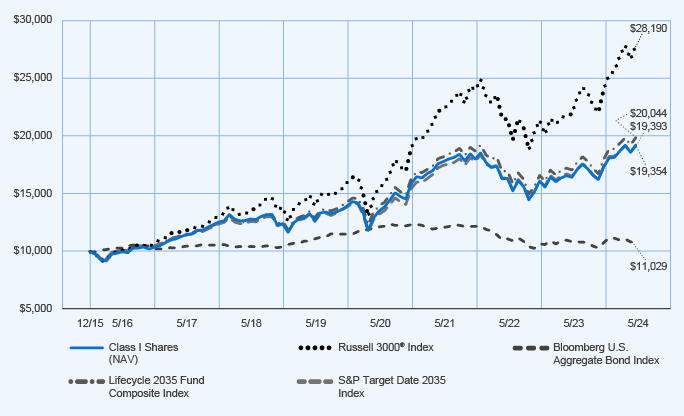

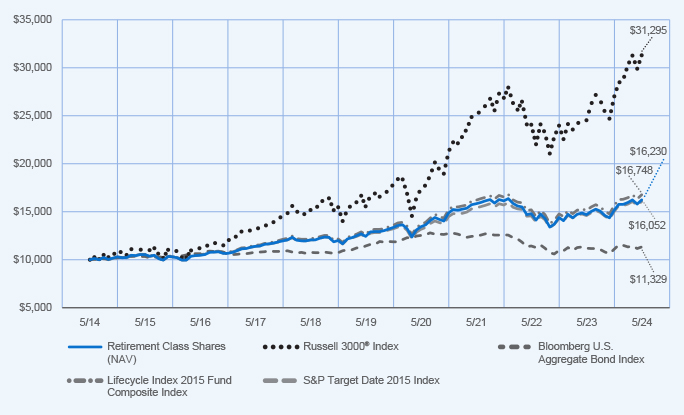

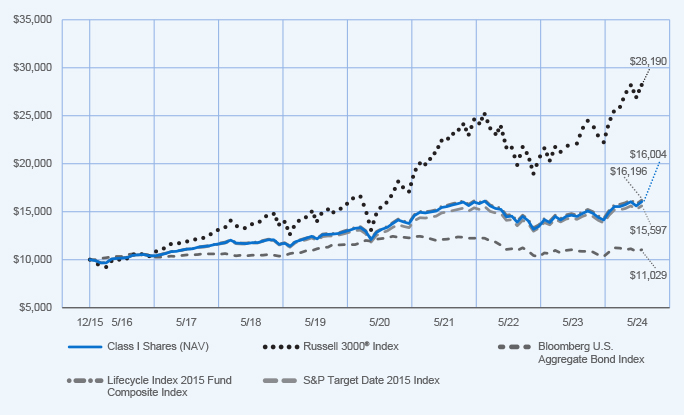

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 4, 2015 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | Since Inception | |

| Class I Shares at NAV | | | 10.74 | % | | | 5.52 | % | | | 5.65 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.98 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.16 | % |

| Lifecycle 2015 Fund Composite Index | | | 10.74 | % | | | 5.85 | % | | | 5.87 | % |

| S&P Target Date 2015 Index | | | 9.99 | % | | | 5.38 | % | | | 5.37 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 1,158,115,781 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 4,598,952 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2015 Fund to Nuveen Lifecycle 2015 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Advisor Class shares of the Fund were renamed Class I shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245P304_AR_0524 3613689-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2015 Fund

(Formerly known as TIAA-CREF Lifecycle 2015 Fund)

Retirement Class Shares/TCLIX

Annual Shareholder Report

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle 2015 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Retirement Class Shares | | $49 | | 0.49% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2015 Fund returned 10.52% for Retirement Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2015 Fund Composite Index, which returned 10.74%. • The Lifecycle 2015 Fund Composite Index consisted of: 39.8% Bloomberg U.S. Aggregate Bond Index; 26.6% Russell 3000® Index; 14.4% MSCI All Country World Index ex USA Investable Market Index; 9.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 9.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

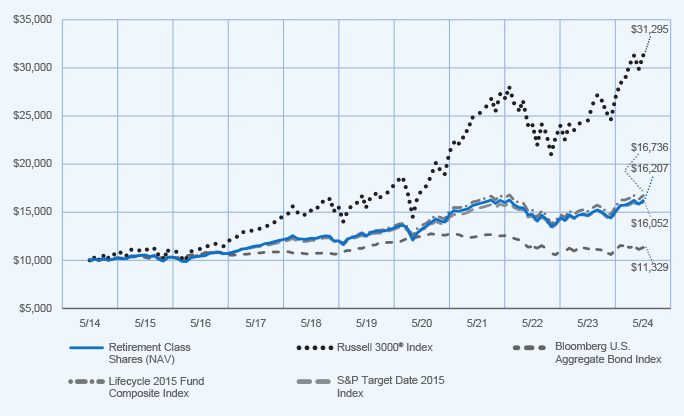

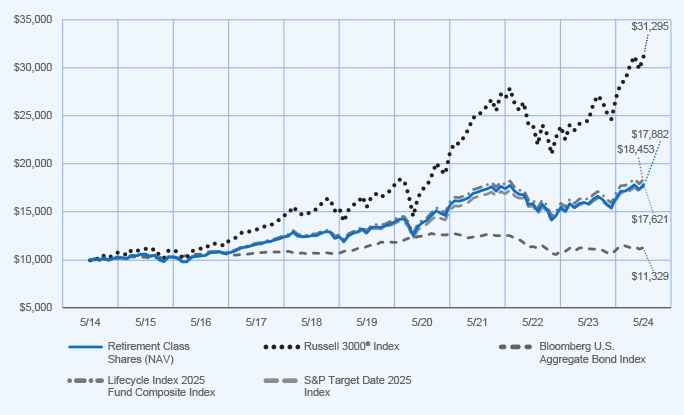

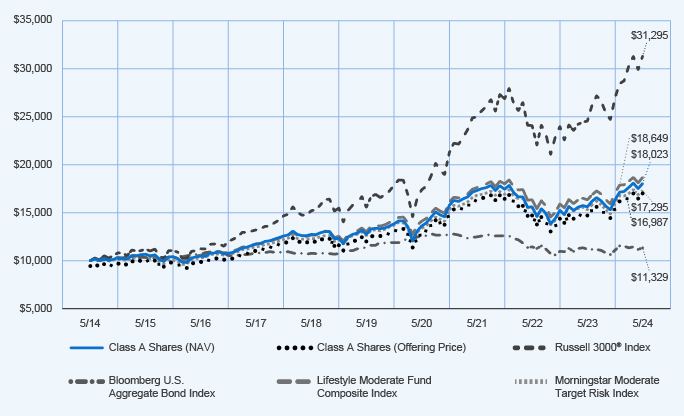

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Retirement Class Shares at NAV | | | 10.52 | % | | | 5.32 | % | | | 4.95 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2015 Fund Composite Index | | | 10.74 | % | | | 5.85 | % | | | 5.28 | % |

| S&P Target Date 2015 Index | | | 9.99 | % | | | 5.38 | % | | | 4.85 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 1,158,115,781 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 4,598,952 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2015 Fund to Nuveen Lifecycle 2015 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87244W441_AR_0524 3613689-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2020 Fund

(Formerly known as TIAA-CREF Lifecycle 2020 Fund)

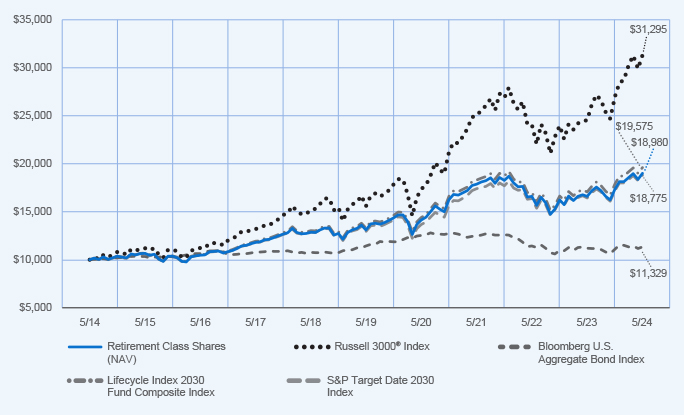

Retirement Class Shares/TCLTX

Annual Shareholder Report

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle 2020 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Retirement Class Shares | | $51 | | 0.51% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2020 Fund returned 11.50% for Retirement Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2020 Fund Composite Index, which returned 11.75%. • The Lifecycle 2020 Fund Composite Index consisted of: 38.8% Bloomberg U.S. Aggregate Bond Index; 29.9% Russell 3000® Index; 16.1% MSCI All Country World Index ex USA Investable Market Index; 7.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 7.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

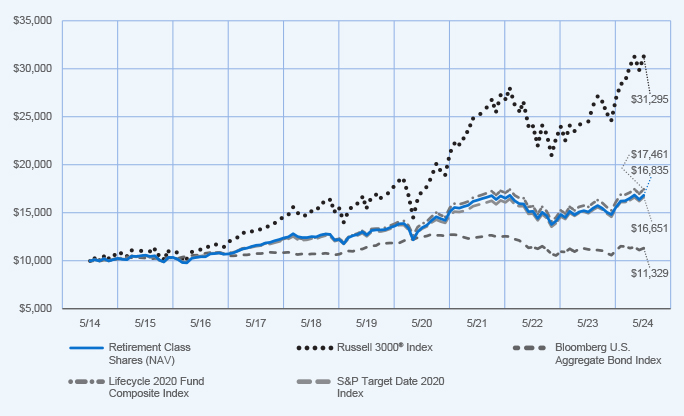

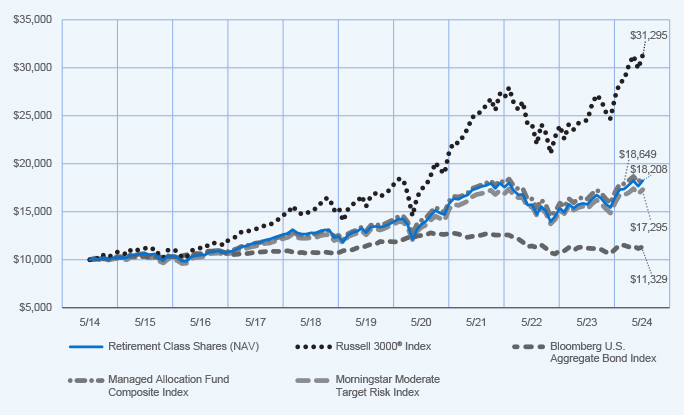

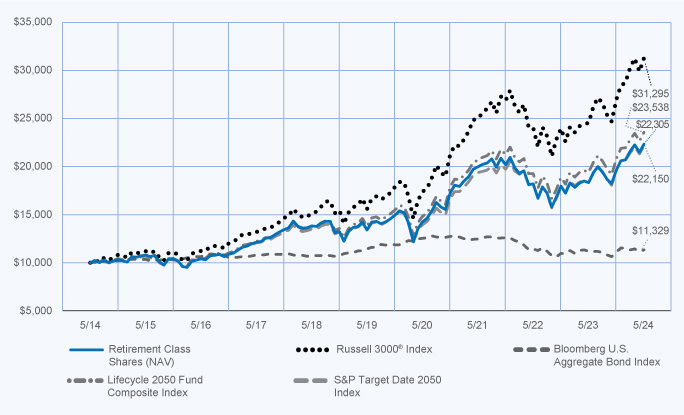

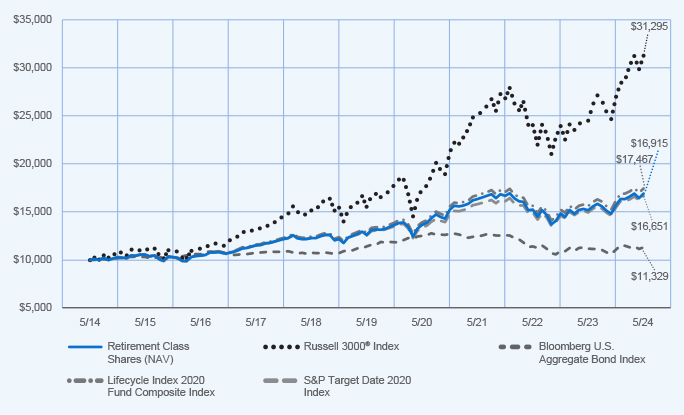

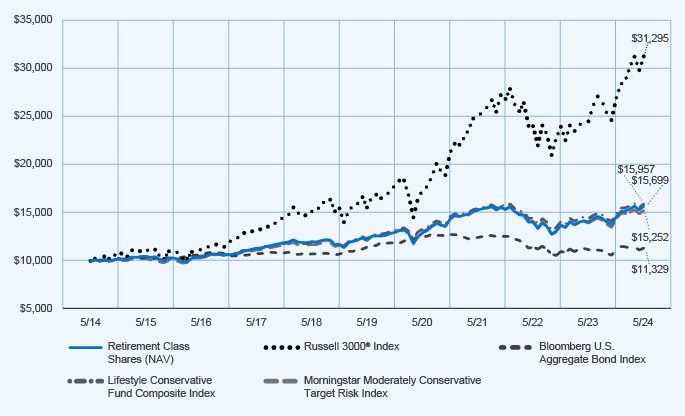

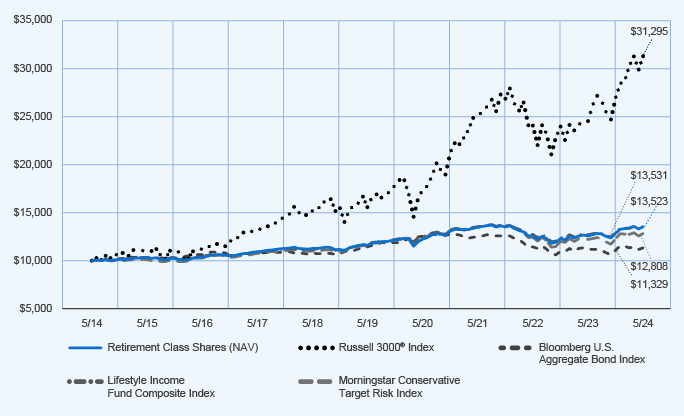

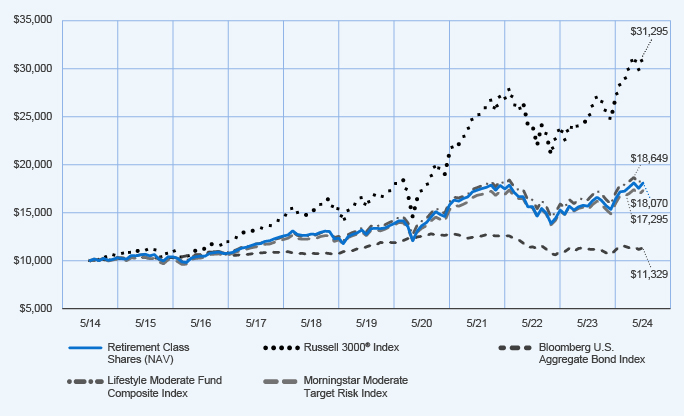

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Retirement Class Shares at NAV | | | 11.50 | % | | | 5.82 | % | | | 5.35 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2020 Fund Composite Index | | | 11.75 | % | | | 6.40 | % | | | 5.73 | % |

| S&P Target Date 2020 Index | | | 11.28 | % | | | 5.80 | % | | | 5.23 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 2,514,613,559 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 12% | |

| Total advisory fees paid for the year | | $ | 10,191,037 | |

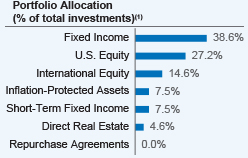

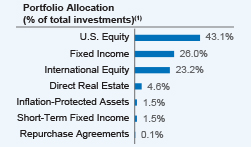

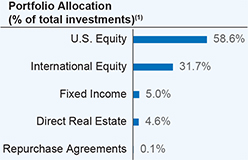

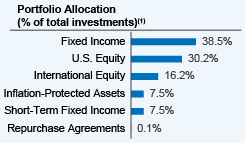

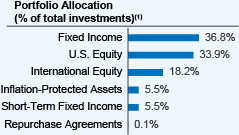

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2020 Fund to Nuveen Lifecycle 2020 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87244W433_AR_0524 3613701-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2020 Fund

(Formerly known as TIAA-CREF Lifecycle 2020 Fund)

Class R6 Shares (Formerly known as Institutional Class Shares)/TCWIX

Annual Shareholder Report

This annual shareholder report contains important information about the Class R6 Shares of the Nuveen Lifecycle 2020 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class R6 Shares | | $26 | | 0.26% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2020 Fund returned 11.86% for Class R6 shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2020 Fund Composite Index, which returned 11.75%. • The Lifecycle 2020 Fund Composite Index consisted of: 38.8% Bloomberg U.S. Aggregate Bond Index; 29.9% Russell 3000® Index; 16.1% MSCI All Country World Index ex USA Investable Market Index; 7.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 7.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. | | Performance Attribution  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund  Nuveen Core Equity Fund  Nuveen Real Property Fund LP |

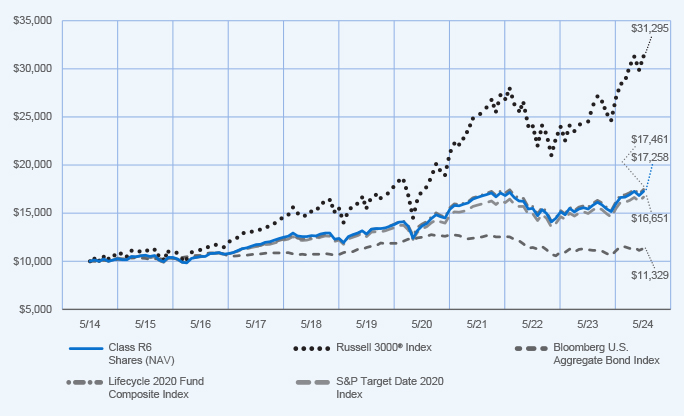

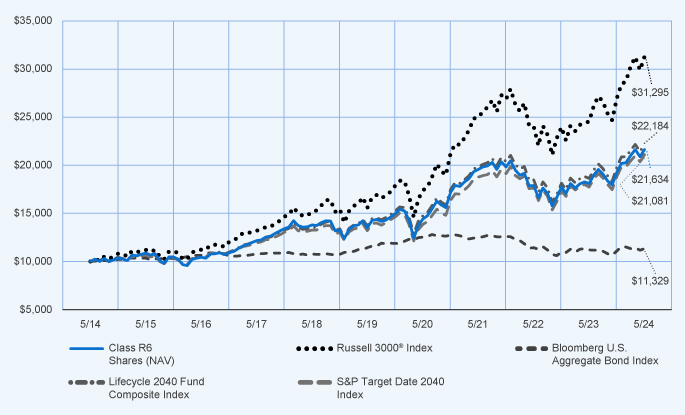

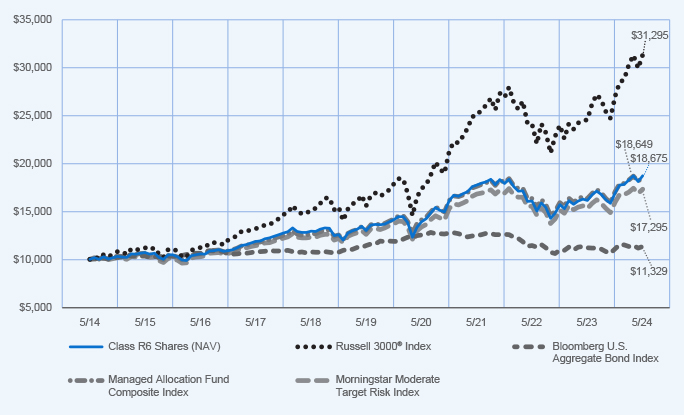

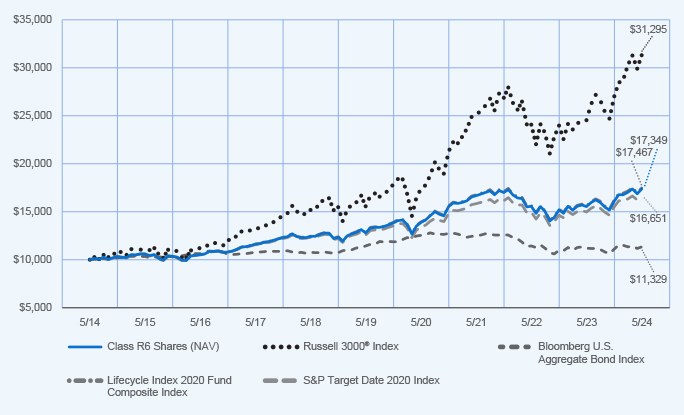

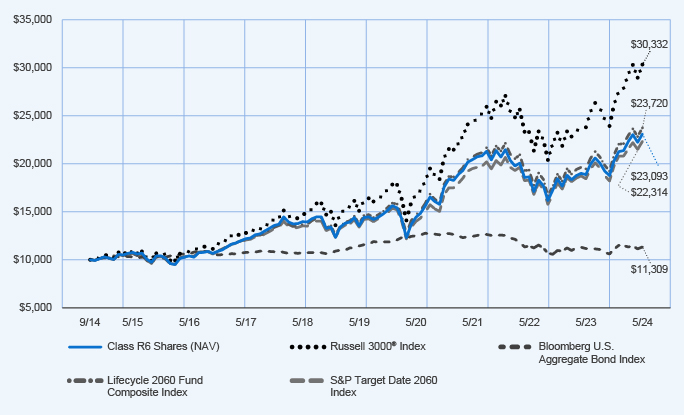

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Class R6 Shares at NAV | | | 11.86 | % | | | 6.09 | % | | | 5.61 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2020 Fund Composite Index | | | 11.75 | % | | | 6.40 | % | | | 5.73 | % |

| S&P Target Date 2020 Index | | | 11.28 | % | | | 5.80 | % | | | 5.23 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 2,514,613,559 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 12% | |

| Total advisory fees paid for the year | | $ | 10,191,037 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2020 Fund to Nuveen Lifecycle 2020 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Institutional Class shares of the Fund were renamed Class R6 shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

886315647_AR_0524 3613701-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

Nuveen Lifecycle 2020 Fund

(Formerly known as TIAA-CREF Lifecycle 2020 Fund)

Premier Class Shares/TCWPX

Annual Shareholder Report

This annual shareholder report contains important information about the Premier Class Shares of the Nuveen Lifecycle 2020 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Premier Class Shares | | $41 | | 0.41% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2020 Fund returned 11.68% for Premier Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2020 Fund Composite Index, which returned 11.75%. • The Lifecycle 2020 Fund Composite Index consisted of: 38.8% Bloomberg U.S. Aggregate Bond Index; 29.9% Russell 3000® Index; 16.1% MSCI All Country World Index ex USA Investable Market Index; 7.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 7.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1‑10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

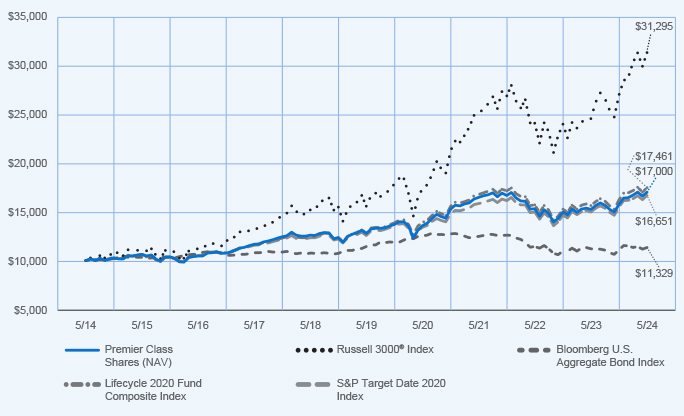

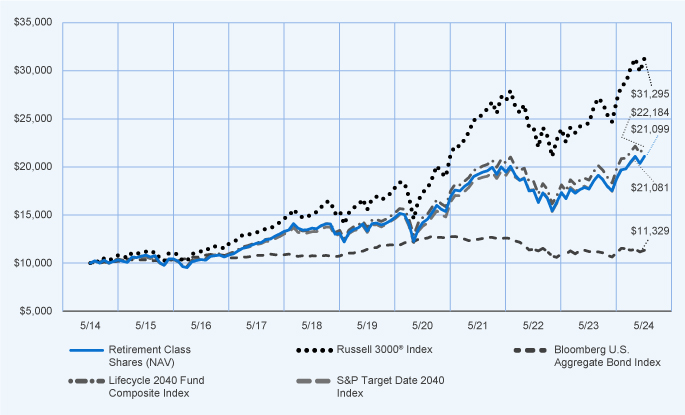

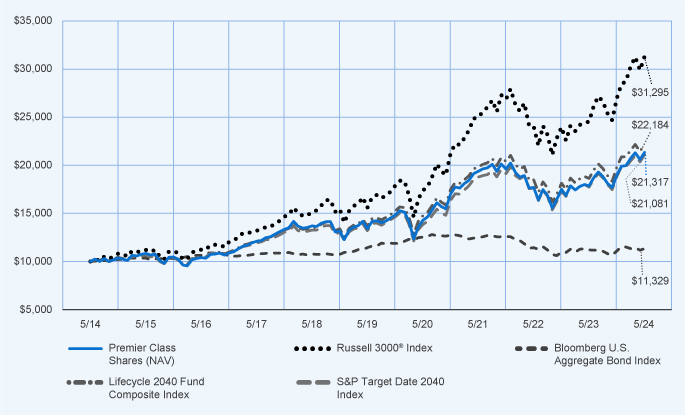

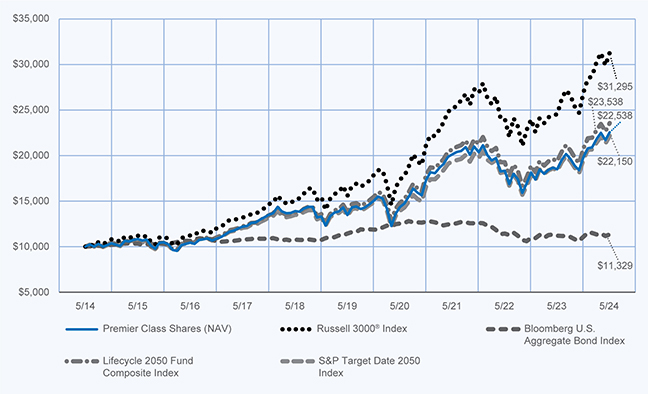

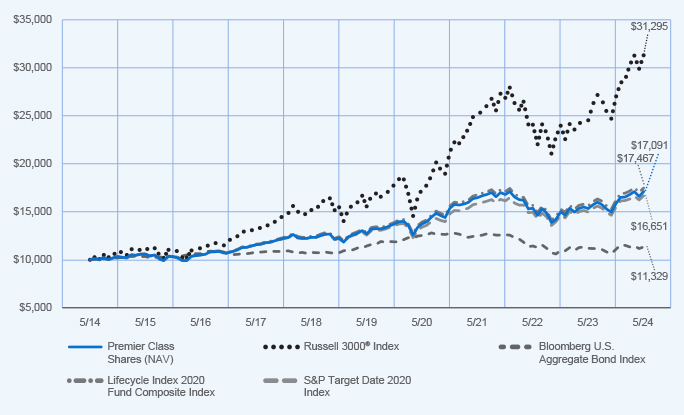

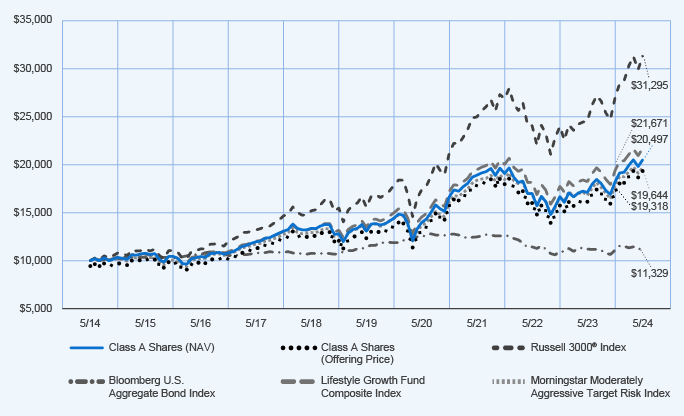

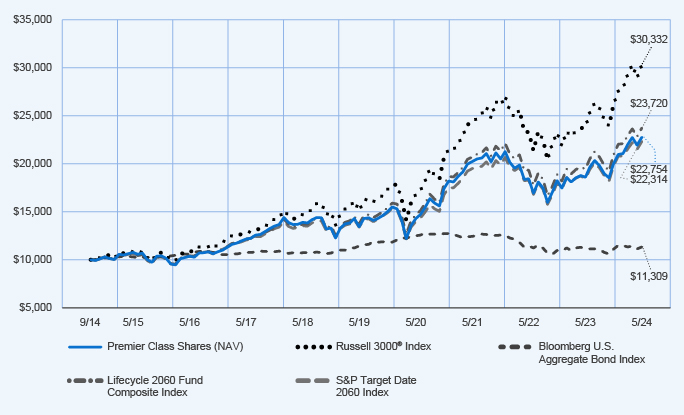

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Premier Class Shares at NAV | | | 11.68 | % | | | 5.94 | % | | | 5.45 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.09 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.26 | % |

| Lifecycle 2020 Fund Composite Index | | | 11.75 | % | | | 6.40 | % | | | 5.73 | % |

| S&P Target Date 2020 Index | | | 11.28 | % | | | 5.80 | % | | | 5.23 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 2,514,613,559 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 12% | |

| Total advisory fees paid for the year | | $ | 10,191,037 | |

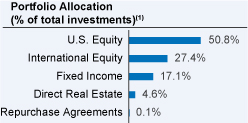

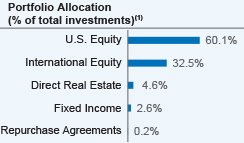

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2020 Fund to Nuveen Lifecycle 2020 Fund. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245M418_AR_0524 3613701-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

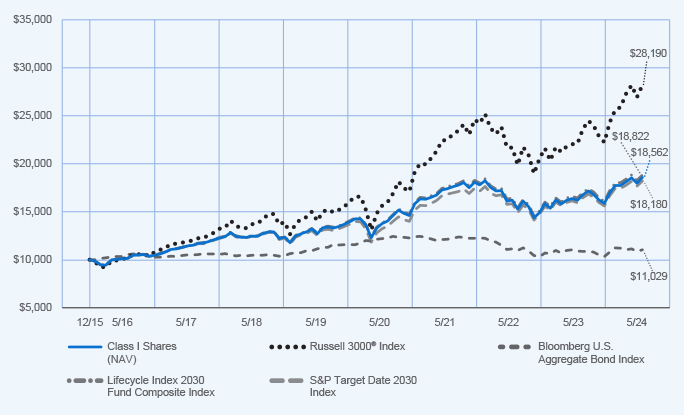

Nuveen Lifecycle 2020 Fund

(Formerly known as TIAA-CREF Lifecycle 2020 Fund)

Class I Shares (Formerly known as Advisor Class Shares)/TCWHX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Lifecycle 2020 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class I Shares | | $35 | | 0.35% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2020 Fund returned 11.65% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2020 Fund Composite Index, which returned 11.75%. • The Lifecycle 2020 Fund Composite Index consisted of: 38.8% Bloomberg U.S. Aggregate Bond Index; 29.9% Russell 3000® Index; 16.1% MSCI All Country World Index ex USA Investable Market Index; 7.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 7.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen Dividend Growth Fund  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

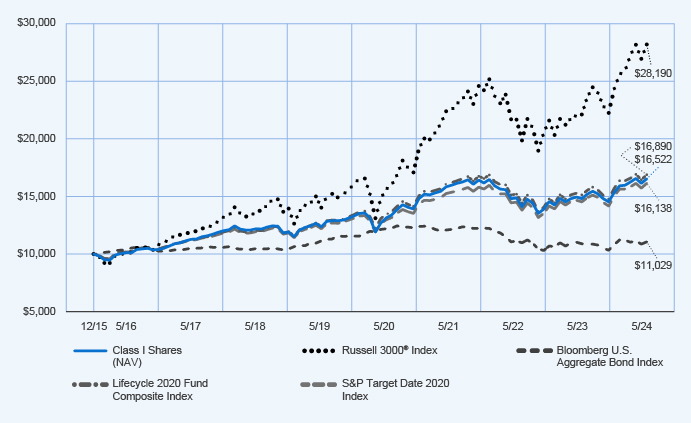

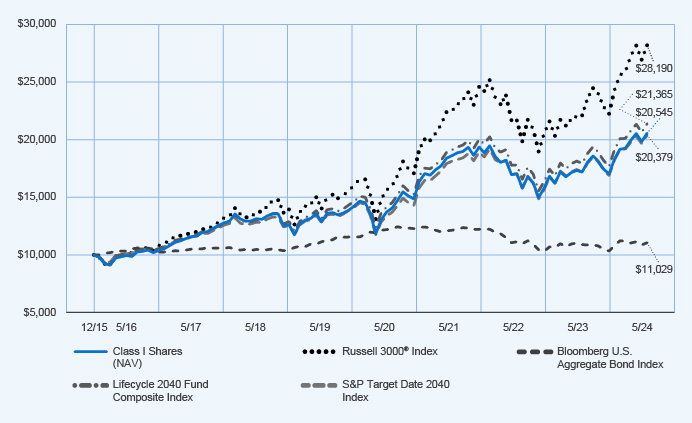

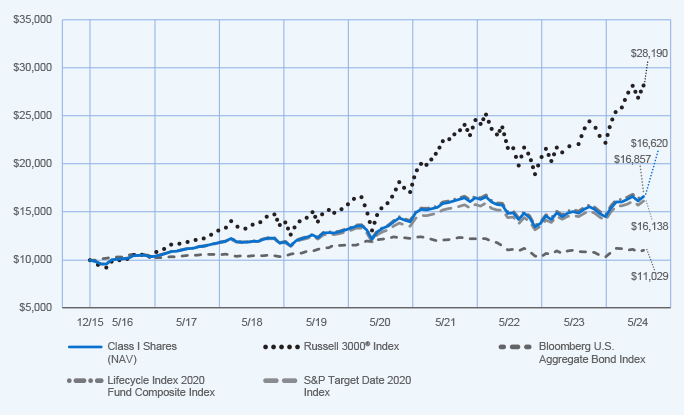

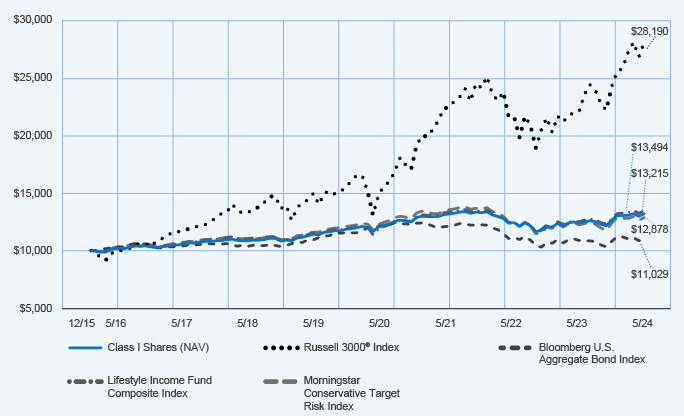

How did the Fund perform over the period since inception?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (December 4, 2015 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1 year | | | 5 years | | | Since Inception | |

| Class I Shares at NAV | | | 11.65 | % | | | 6.01 | % | | | 6.09 | % |

Russell 3000® Index | | | 27.58 | % | | | 15.00 | % | | | 12.98 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1.31 | % | | | (0.17 | )% | | | 1.16 | % |

| Lifecycle 2020 Fund Composite Index | | | 11.75 | % | | | 6.40 | % | | | 6.37 | % |

| S&P Target Date 2020 Index | | | 11.28 | % | | | 5.80 | % | | | 5.80 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 2,514,613,559 | |

| Total number of portfolio holdings | | | 21 | |

| Portfolio turnover (%) | | | 12% | |

| Total advisory fees paid for the year | | $ | 10,191,037 | |

What did the Fund invest in? (as of May 31, 2024)

(1) Affiliated investment companies, except for repurchase agreements.

How has the Fund changed?

| | • | | Name change: Effective May 1, 2024, the Fund’s name changed from TIAA-CREF Lifecycle 2020 Fund to Nuveen Lifecycle 2020 Fund. | |

| | • | | Share class name change: Effective May 6, 2024, Advisor Class shares of the Fund were renamed Class I shares. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

87245P403_AR_0524 3613701-INV-Y-07/25 (I, R6, Premier, Retirement) | | |

| | |

| | Annual Shareholder Report May 31, 2024 |

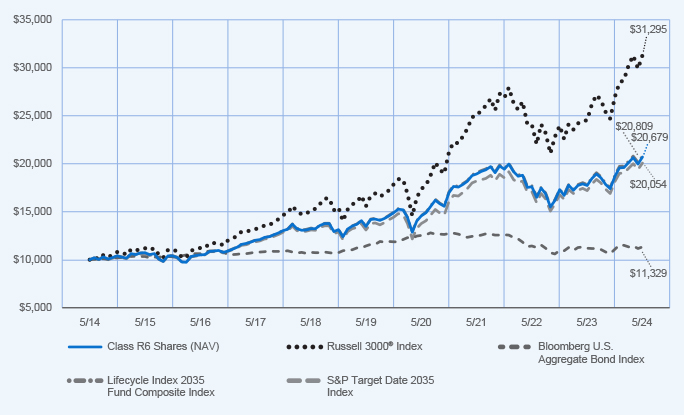

Nuveen Lifecycle 2025 Fund

(Formerly known as TIAA-CREF Lifecycle 2025 Fund)

Retirement Class Shares/TCLFX

Annual Shareholder Report

This annual shareholder report contains important information about the Retirement Class Shares of the Nuveen Lifecycle 2025 Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Retirement Class Shares | | $53 | | 0.53% |

(1) These costs include the expenses of underlying funds in which the Fund invests except for the expenses of the Nuveen Dividend Growth Fund, Nuveen Dividend Value Fund, Nuveen Growth Opportunities ETF and TIAA-CREF Real Property Fund.

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Lifecycle 2025 Fund returned 12.79% for Retirement Class shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the Lifecycle 2025 Fund Composite Index, which returned 13.00%. • The Lifecycle 2025 Fund Composite Index consisted of: 37.1% Bloomberg U.S. Aggregate Bond Index; 33.6% Russell 3000® Index; 18.1% MSCI All Country World Index ex USA Investable Market Index; 5.6% Bloomberg U.S. 1-3 Year Government/Credit Bond Index; and 5.6% Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1-10 Year Index. • Top detractors from relative performance » An allocation to the Nuveen Real Property Fund LP. » A position in the Nuveen International Opportunities Fund. • Top contributors to relative performance » Strong performance of the underlying funds investing in fixed income, led by the Nuveen Core Bond Fund and the Nuveen Core Plus Bond Fund. » Strong overall performance of the underlying funds investing in U.S. equities, led by the Nuveen Core Equity Fund. | | Performance Attribution  Nuveen Real Property Fund LP  Nuveen International Opportunities Fund  Nuveen Core Bond Fund  Nuveen Core Plus Bond Fund |

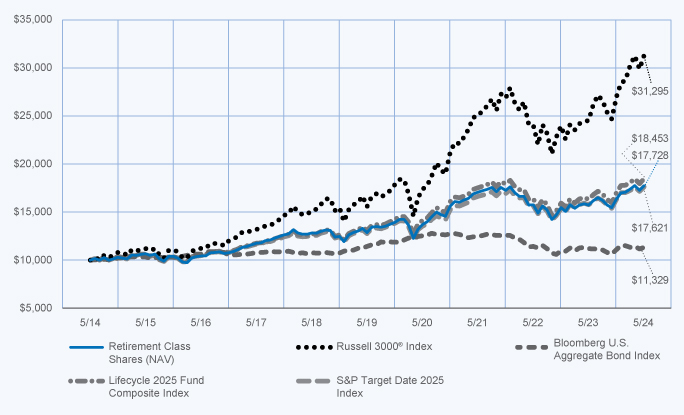

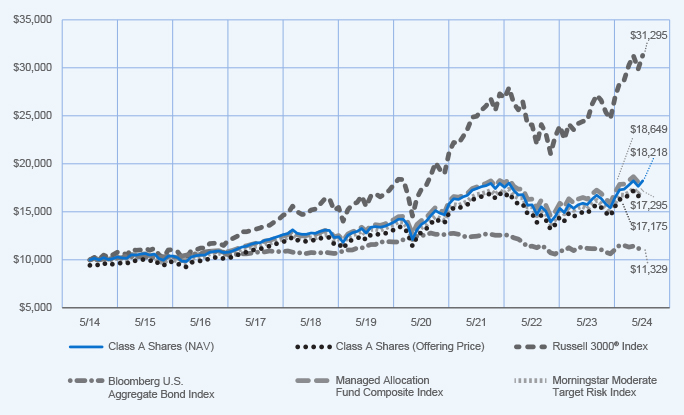

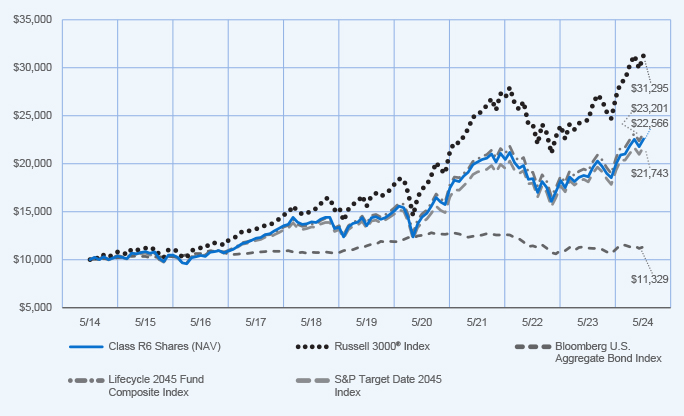

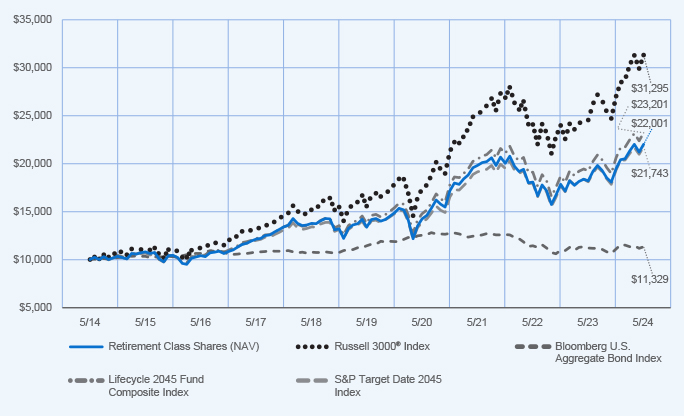

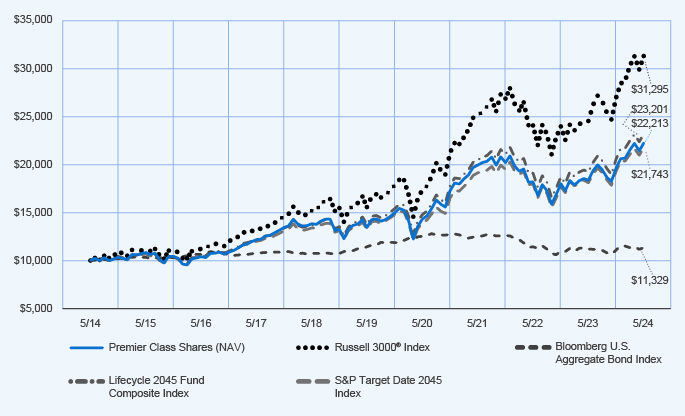

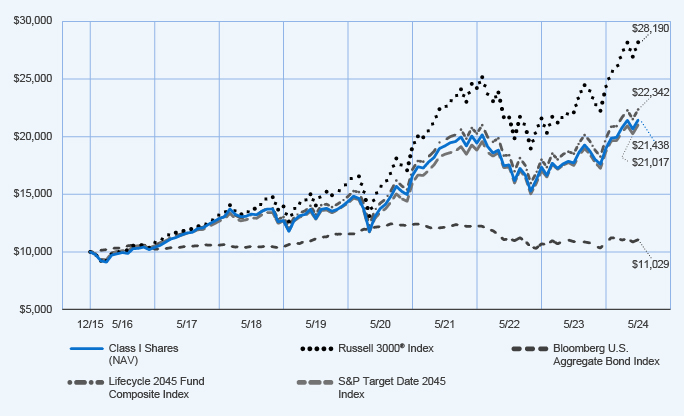

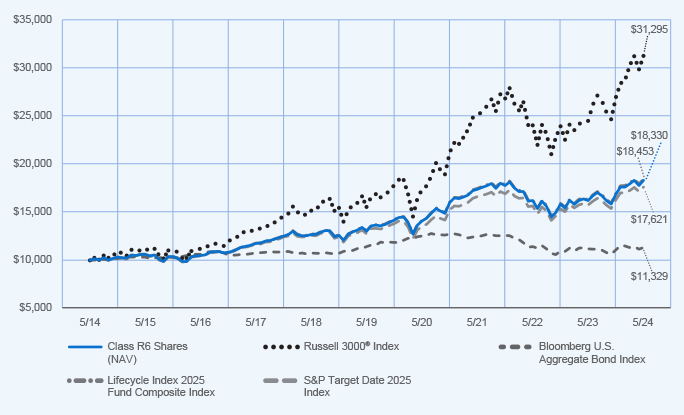

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

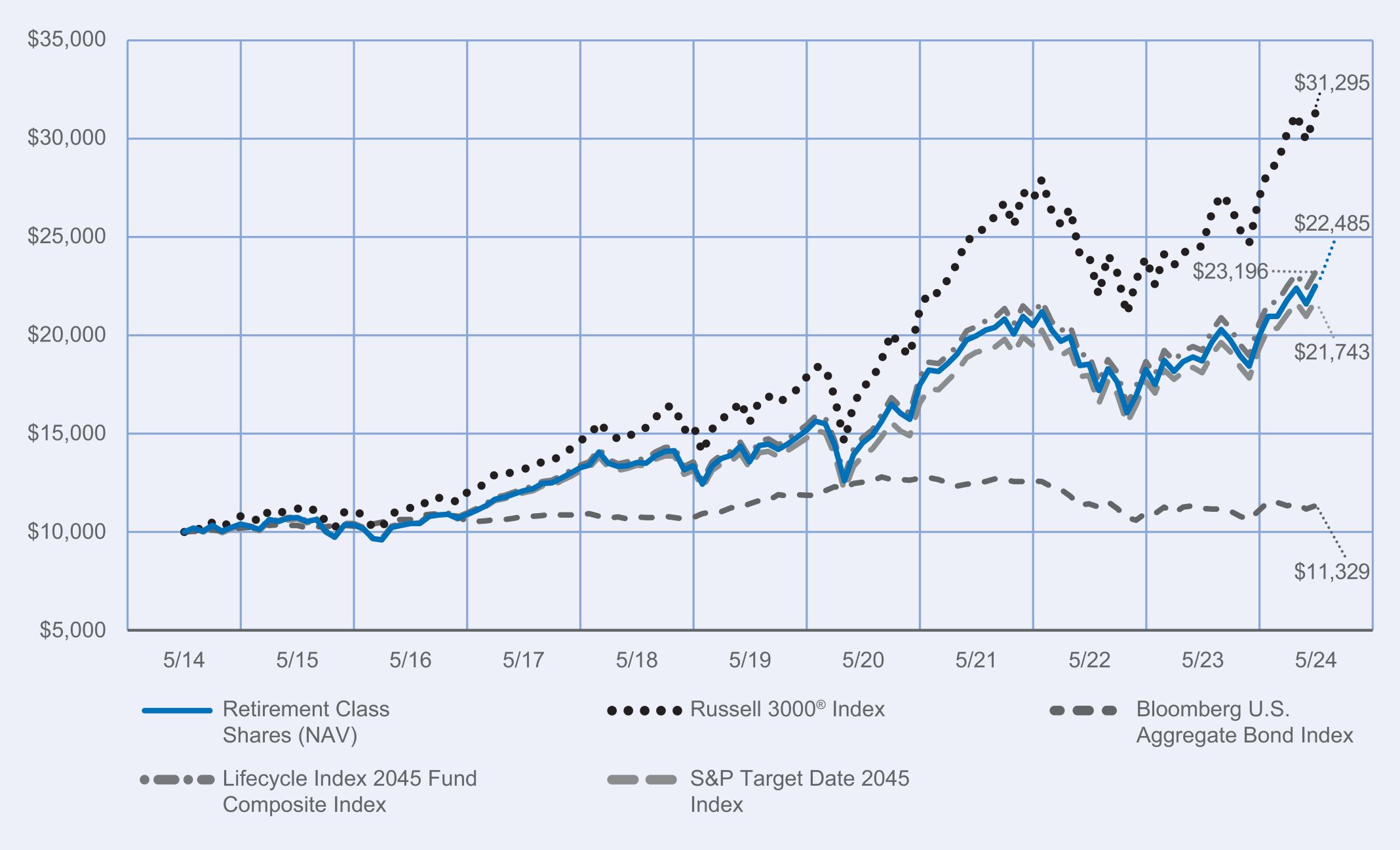

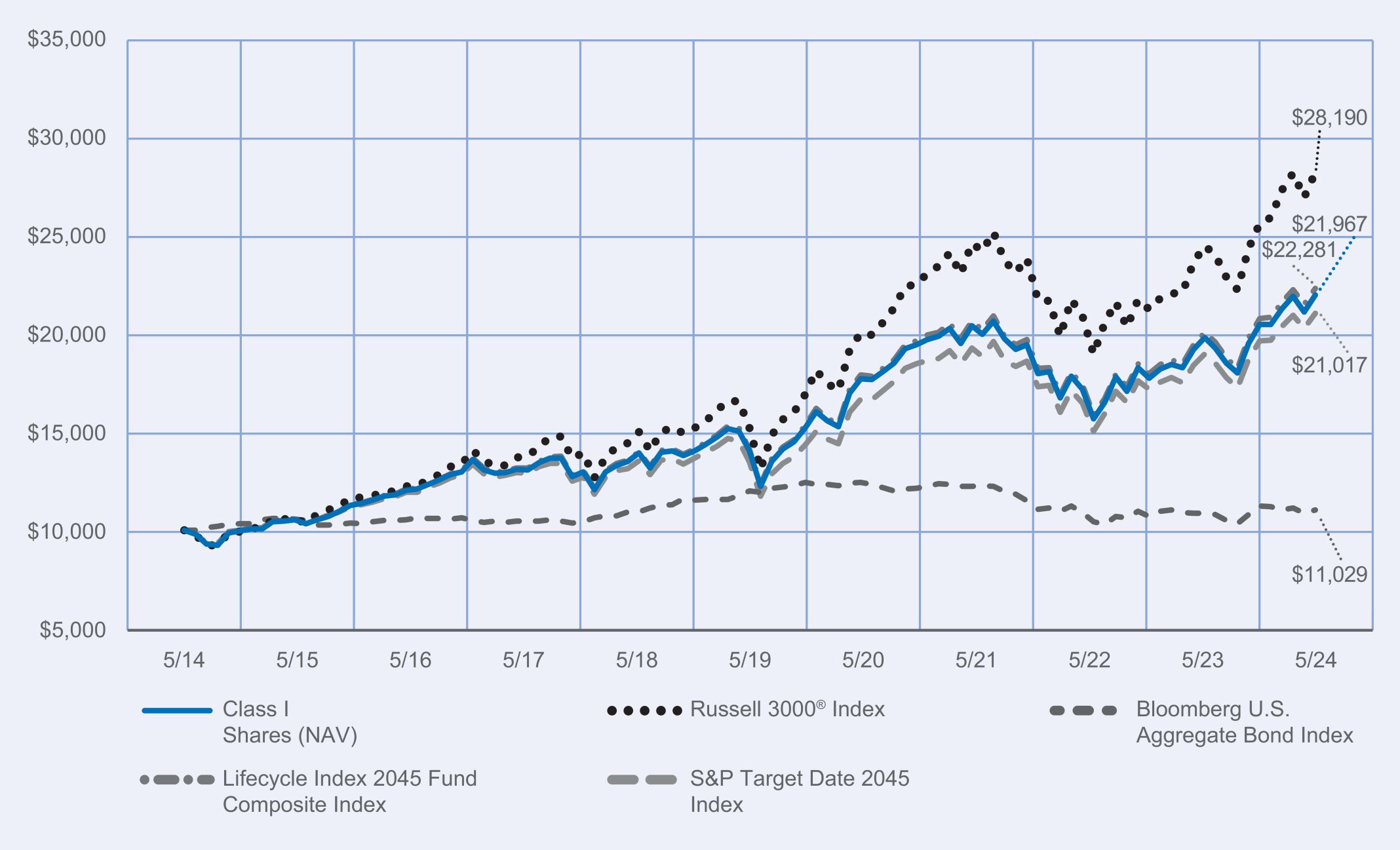

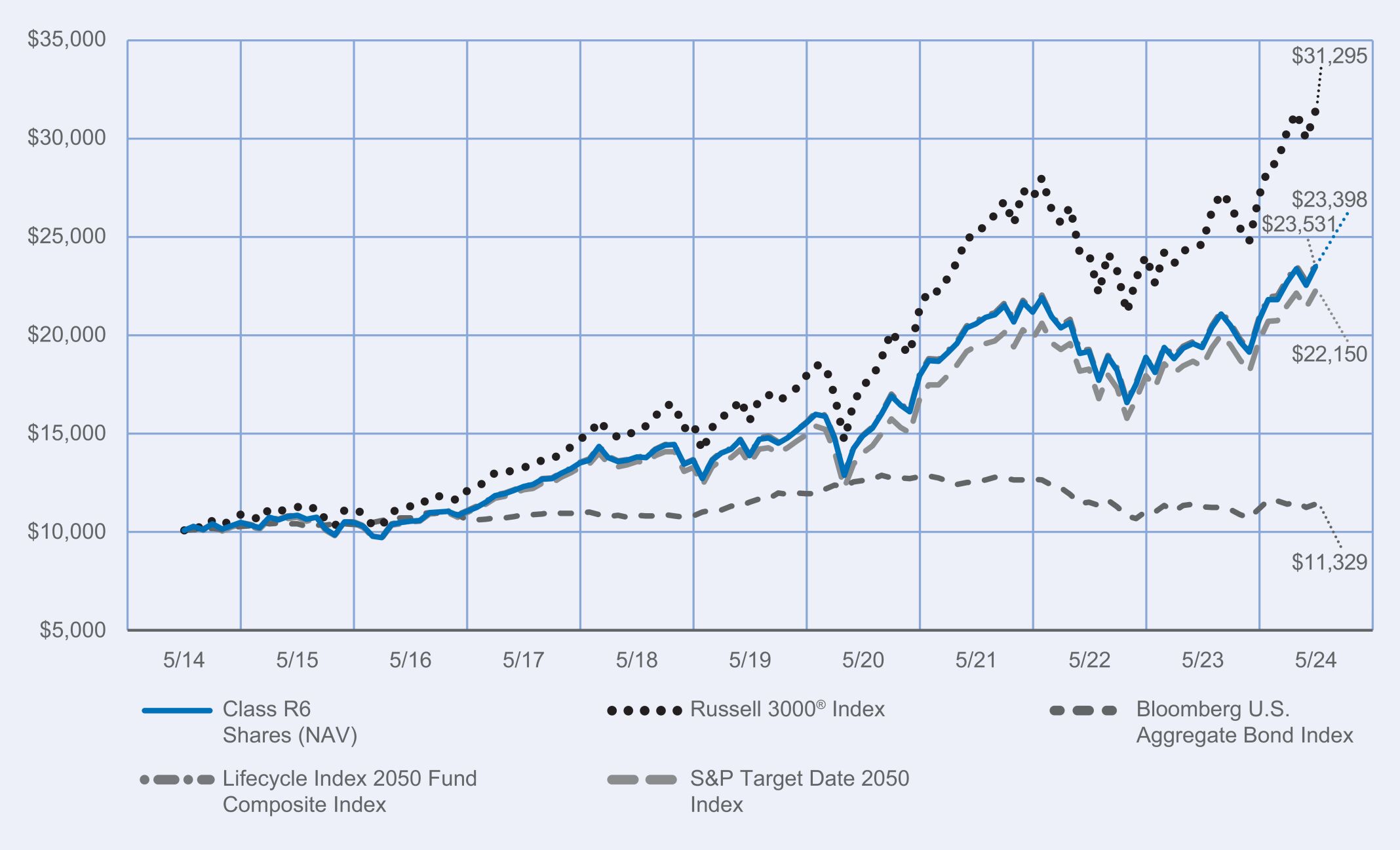

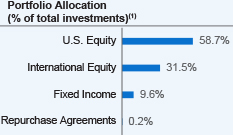

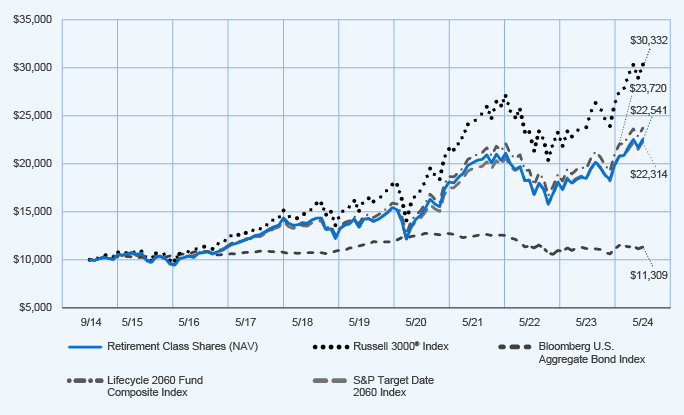

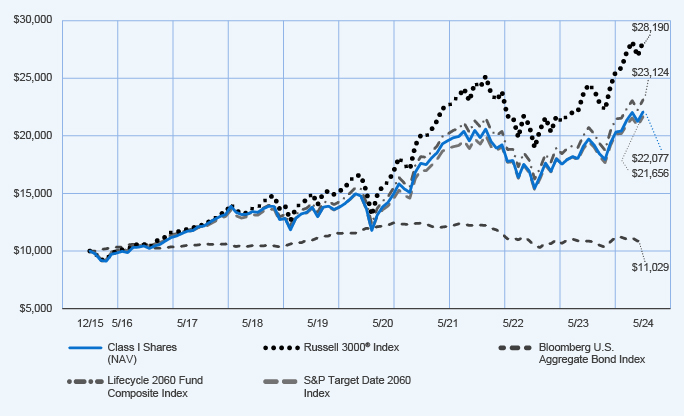

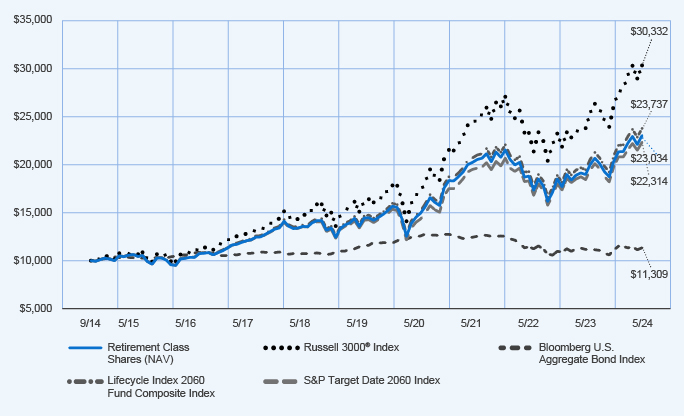

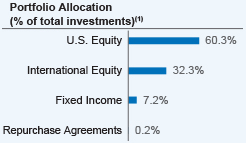

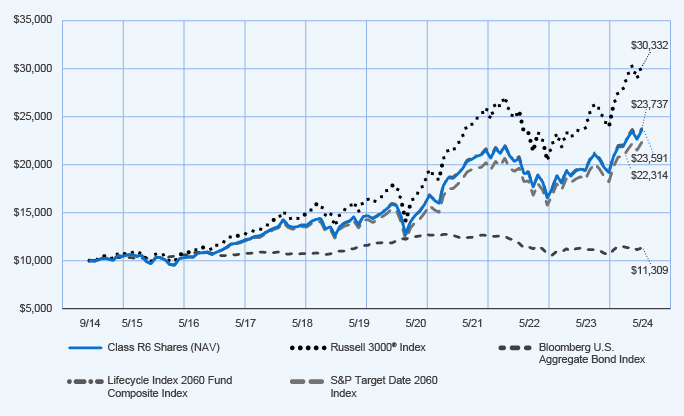

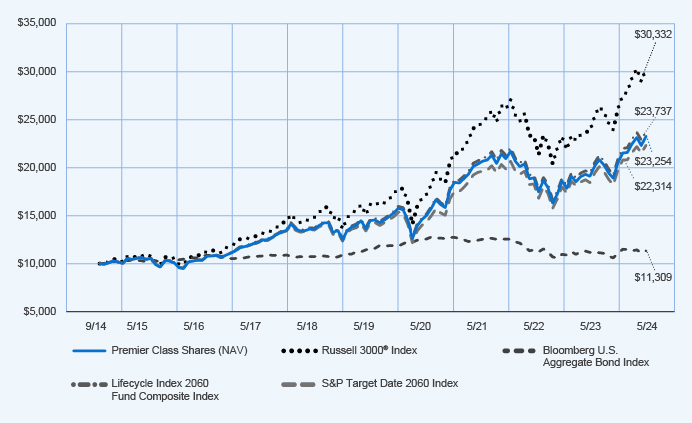

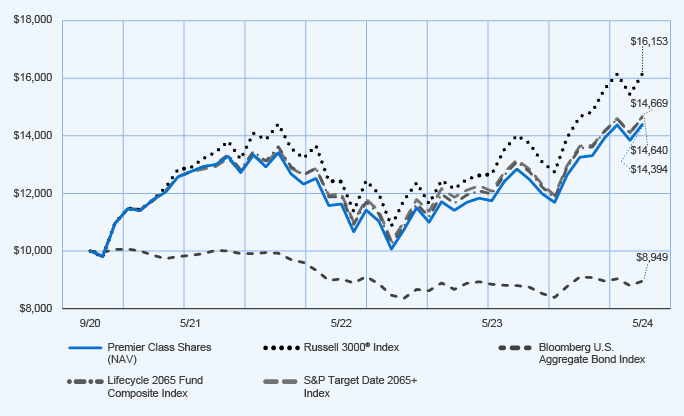

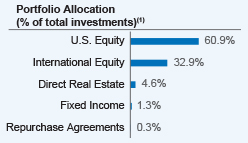

| | | | | | | | | | | | |