EXHIBIT (c)(4)(1)

REAL PROPERTY APPRAISAL REPORT

Exhibit (c)(4)(1)

REAL ESTATE

APPRAISAL REPORT

of

COMMERCIAL PROPERTY

at

PARCEL I: 2674 E. WALNUT AVENUE

PASADENA, CALIFORNIA

PARCEL II: 89 N. SAN GABRIEL BOULEVARD

PASADENA, CALIFORNIA

PARCEL III: 2675 N. NINA STREET

PASADENA, CALIFORNIA

VALUATION DATE:

OCTOBER 28, 2005

TYPE OF REPORT:

SUMMARY NARRATIVE APPRAISAL REPORT

REPORT DATE:

NOVEMBER 16, 2005

Prepared By:

ANCHOR PACIFIC COMPANY

2450 Mission Street, Suite 5

San Marino, California 91108

(626) 403-8470• FAX (626) 403-8473

November 16, 2005

Ms. Paula Barnett, Esq.

17967 Boris Drive

Encino, California 91316

| | |

| RE: | | Commercial Properties at

2674 E. Walnut Avenue, 89 N. San Gabriel Boulevard

and 2675 Nina Street

Pasadena, California |

Dear Ms. Barnett:

At the request of your office an appraisal has been made of the (3) commercial properties located at the above referenced addresses. The purpose of this appraisal was to determine the Market Value of the Fee interest in the subject properties as of the current inspection on October 28, 2005.

This is a Summary Report which is intended to comply with the reporting requirements set forth under Standards Rule 2-2(b) of the Uniform Standards of Professional Appraisal Practice for a Summary Appraisal Report. As such, it presents only summary discussions of the data, reasoning and analyses that were used in the appraisal process to develop the appraiser’s opinion of value. Supporting documentation concerning the data, reasoning and analyses is retained in the appraiser’s files. The depth of discussion contained in this report is specific to the needs of the client and for the intended use. The appraiser is not responsible for the unauthorized use of this report.

Personal property was not included in this appraisal assignment and values for same were not considered.

The date of our inspection was October 28, 2005. The following estimate of value is subject to the Assumptions and Limiting Conditions and included herein. The value conclusion represents a “cash” or “cash equivalent” value. The value estimate is based on a “normal” marketing time and reflects normal marketing conditions, discounting was not considered in this case. Considering economic conditions, “normal” marketing time was estimated to be from 10 to 12 months.

This report will be the result of a Complete Appraisal process in that the Departure Provision of the Uniform Standards of Professional Appraisal Practice was not invoked. The appraiser is and will remain in compliance with the Competency Provision of USPAP.

Ms. Barnett

November 18, 2005

Page 2

As a result of the analysis and subject to the Assumptions and Limiting Conditions, it is estimated the Market Value for the subject properties was:

| | | | | |

| Parcel I: | | $ | 3,651,000 | |

| Parcel II: | | $ | 2,572,000 | |

| Parcel III: | | $ | 1,085,000 | |

| | | | |

| Total: | | $ | 7,308,000 | |

| | | | |

Your attention is directed to the Assumptions and Limiting Conditions in the full report, specifically the items dealing with potential hazardous waste on the site and the lack of the appraiser’s expertise in detecting such potential hazards.

| | | | | |

| | Respectfully submitted,

| |

| | /s/ William H. Bortz | |

| | William H. Bortz | |

| | Certified General Appraiser

State of California No. AG012078 | |

| |

Cc: Mr. Todd Kaltman

Duff & Phelps, LLC

2029 Century Park East

Suite #820

Los Angeles, CA 90067

WB:bz

Enclosures

TABLE OF CONTENTS

| | | |

| | | PAGE |

| Executive Summary | | 1-4 |

| | | |

| Assumptions and Limiting Conditions | | 5-8 |

| | | |

| Scope of the Appraisal | | 9 |

| | | |

| Certification | | 10 |

| | | |

| Estate Appraised | | 11 |

| | | |

| Regional Data – Los Angeles County | | 12-13 |

| | | |

| The City | | 14-15 |

| | | |

| Introduction/Definition of Market Value | | 16-19 |

| | | |

| Site Data | | 20-25 |

| | | |

| Highest and Best Use | | 26-27 |

| | | |

| Method of Appraisal | | 28 |

| | | |

| Summary Description of Improvements | | 29-32 |

| | | |

| Market Data Approach-Parcel I | | 33-34 |

| | | |

| Income Approach-Parcel I | | 35-39 |

| | | |

| Market Data Approach-Parcel II | | 40-41 |

| | | |

| Income Approach-Parcel II | | 42-46 |

| | | |

| Site Valuation | | 47-53 |

| | | |

| Correlation of the Value Estimate | | 54 |

Addendum

EXECUTIVE SUMMARY-PARCEL I

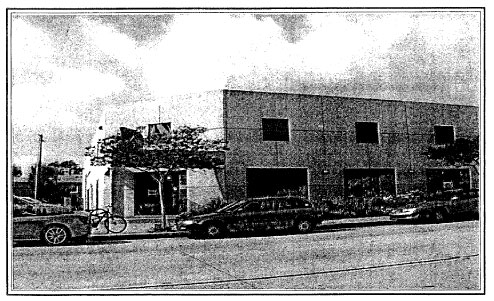

(2674 E. WALNUT STREET)

| | | |

| Property Use: | | Light Industrial |

| | | |

| Ownership: | | Tsann Kuen, USA, Inc. |

| | | |

| Estate Appraised: | | Fee |

| | | |

| Purpose: | | Market Value |

| | | |

| Location: | | Los Angeles County |

| | | |

| Access: | | Walnut Street |

| | | |

| Thomas Bros. Map: | | 566-E4 |

| | | |

| Census Tract: | | 4629.00 |

| | | |

| Assessor’s Parcel No.: | | 5748-005-032 |

| | | |

| General Plan & Zoning: | | East Pasadena Specific Plan, District 1, Industrial General; EPSP-d1-IG |

| | | |

| Flood Hazard: | | Minimal |

| | | |

| Environmental Hazards: | | None identified |

| | | |

| Lot Site Size/Shape: | | 20,656 Square Feet, irregular |

| | | |

| Topography/Soils: | | Level to street grade; sandy loam. |

| | | |

| Off-Sites/Utilities: | | Paved public street, 80’ wide, concrete curbs, gutters and sidewalks. All services in place. |

| | | |

| Improvements: | | One class “C” two story office building of 17,800 square feet. |

| | | |

| Quality, Condition & Economic Life: | | Average quality building shell and tenant improvements; actual estimated at 45 years; effective age 15 years; total expected life 90 years; estimated remaining economic life 35+ years. |

| | | |

| Current Use: | | Office building |

| | | |

| Highest and Best Use: | | Same as current use. |

| | | |

| Valuation Date: | | October 28, 2005 - “as is” |

| | | |

| Inspection Date: | | October 28, 2005 |

-1-

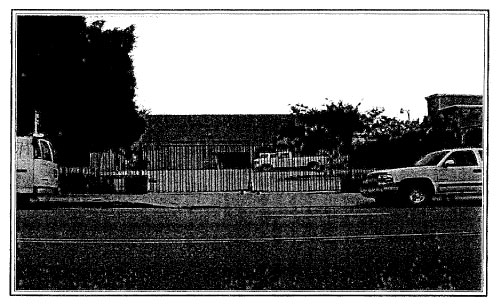

EXECUTIVE SUMMARY-PARCEL II

(89 N. SAN GABRIEL BOULEVARD)

| | | |

| Property: | | Light Industrial Building |

| | | |

| Ownership: | | Tsann Kuen, USA, Inc. |

| | | |

| Estate Appraised: | | Fee |

| | | |

| Purpose: | | Market Value |

| | | |

| Location: | | Los Angeles County |

| | | |

| Access: | | Walnut Street and San Gabriel Boulevard |

| | | |

| Thomas Bros. Map: | | 566-E4 |

| | | |

| Census Tract: | | 4629.00 |

| | | |

| Assessor’s Parcel No.: | | 5748-005-001 |

| | | |

| General Plan & Zoning: | | EPSP-1d-IG (East Pasadena Specific Plan, District 1, Industrial General) |

| | | |

| Flood Hazard: | | Minimal |

| | | |

| Environmental Hazards: | | None identified |

| | | |

| Lot Site Size/Shape: | | 13,778 Square Feet, irregular |

| | | |

| Topography: | | Level to street grade |

| | | |

| Off-Sites/Utilities: | | Corner of a paved public street, concrete curbs, gutters and sidewalks. East-West thoroughfare. All services in place. |

| | | |

| Improvements: | | One class “D” warehouse/industrial building of 10,717 square feet. |

| | | |

| Quality, Condition & Economic Life: | | Average quality building shell and tenant improvements; actual age is 58 years; effective age 25-30 years; total expected life 75 years; estimated remaining economic life 17 years. |

| | | |

| Current Use: | | Warehouse |

| | | |

| Highest and Best Use: | | Same as current use. |

| | | |

| Valuation Date: | | October 28, 2005 – “as is” |

| | | |

| Inspection Date: | | October 28, 2005 |

-2-

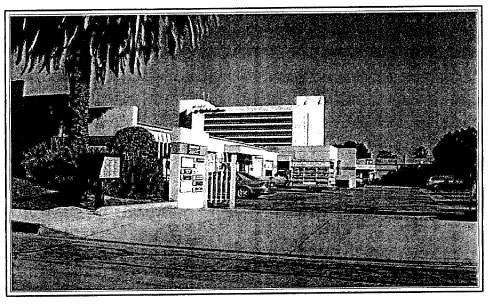

EXECUTIVE SUMMARY-PARCEL III

(2675 NINA STREET)

| | | |

| Property: | | Parking lot - General Commercial |

| | | |

| Ownership: | | Tsann Kuen, USA, Inc. |

| | | |

| Estate Appraised: | | Fee |

| | | |

| Purpose: | | Market Value |

| | | |

| Location: | | Los Angeles County |

| | | |

| Access: | | Nina Street |

| | | |

| Thomas Bros. Map: | | 566-E4 |

| | | |

| Census Tract: | | 4629.00 |

| | | |

| Assessor’s Parcel No.: | | 5748-005-013 |

| | | |

| General Plan & Zoning: | | EPSP-d1-IG (East Pasadena Specific Plan, District 1, Industrial General) |

| | | |

| Flood Hazard: | | Minimal |

| | | |

| Environmental Hazards: | | None identified |

| | | |

| Lot Site Size/Shape: | | 10,332 Square Feet, rectangular |

| | | |

| Topography/Soils: | | Level to street grade. |

| | | |

| Off-Sites/Utilities: | | Paved public street, 60’ wide, concrete curbs, gutters and sidewalks. |

| | | |

| Improvements: | | Commercial building |

| | | |

| Current Use: | | Parking lot/commercial building |

| | | |

| Highest and Best Use: | | Vacant land |

| | | |

| Valuation Date: | | October 28, 2005 – “as is” |

| | | |

| Inspection Date: | | October 28, 2005 |

| | | |

| *Special Note: | | The improvements measuring 10,331 square feet as shown in the public record werenot found in the current investigation. Rather a small building which was seen to have little or no commercial value. |

-3-

EXECUTIVE SUMMARY-PARCELS I, II & III

(Continued)

| | | |

| Marketing Time/Exposure Period: | | Six to twelve months, if professionally marketed to end-users and local investors. |

| | | |

| Prepared for: | | Ms. Paula Barnett, Attorney |

| | | |

| Prepared by: | | William Bortz |

-4-

ASSUMPTIONS AND LIMITING CONDITIONS

The covering letter and the following report are made expressly subject to these contingent and limiting conditions.

That the legal description is correct. That the title is good and marketable. That the property was free and clear of all encumbrances, except for current taxes of record.

That no responsibility is assumed by the appraiser for matters which are legal in nature such as title defects, liens, encumbrances, encroachments, boundaries, etc. This appraisal is not a legal opinion.

That no guarantee is made as to correctness of estimates or opinions furnished by others and used in making this appraisal.

That, for the purpose of this appraisal, areas have been estimated, have not been calculated by the engineer, are approximate only and are not guaranteed to be correct from an engineering standpoint.

The appraisal herein is not required to give expert testimony, appear in court or appear before any Government Hearing with reference to the property appraised except on the basis of arrangements previously agreed upon.

It is assumed that the utilization of the land and improvements is within the boundaries of the property lines of the property described and that there is no encroachment or trespass unless noted with the report.

No survey of the property has been made by the appraiser and no responsibility is assumed in connection with such matters. Any maps, plats, or drawings reproduced and included in this report are intended only for the purpose of showing spatial relationships. The reliability of the information contained on any such map or drawing is assumed by the appraiser and cannot be guaranteed to be correct.

Because no detailed inspection was made, and because such knowledge goes beyond the scope of this appraisal, any observed condition comments given in this appraisal report should not be taken as a guarantee that a problem does not exist. Specifically, no guarantee is made as to the adequacy or condition of the foundation, roof, exterior walls, interior walls, floors, heating systems, air conditioning system, plumbing, electrical service, insulation, or any other detailed construction matters. If any interested party is concerned about the existence, condition, or adequacy of any particular item, we would strongly suggest that a construction expert be hired for a detailed report.

Information provided by informed local sources, such as government agencies, financial institutions, realtors, buyers, sellers, property owners, bookkeepers, accountants, attorneys, and others is assumed to be true, correct, and reliable. No responsibility for the accuracy of such information is assumed by the appraiser.

-5-

ASSUMPTIONS AND LIMITING CONDITIONS

(Continued)

The comparable sales data relied upon in the appraisal is believed to be from reliable sources. Though all the comparables were examined, it was not possible to inspect them all in detail. The value conclusions are subject to the accuracy of said data.

All values shown in the appraisal report are projections based on our analysis as of the date of the appraisal. These values may not be valid in other time periods or as conditions change. Since the projected mathematical models are based on estimates and assumptions which are inherently subject to uncertainty and variation depending upon evolving events, we do not represent them as results that will actually be achieved.

The appraiser reserves the right to make adjustments to this appraisal at a later date if more reliable data becomes available for review.

It is assumed that there was full compliance with all applicable federal, state, and local environmental regulations and laws unless noncompliance is stated, defined, and considered in the appraisal report. It is assumed that all applicable zoning and use of regulations and restrictions have been compiled with, unless a non-conformity has been stated, defined and considered in the appraisal report.

It is assumed that all required licenses, consents, or other legislative or administrative authority from any local, state or national government or private entity or organization have been or can be obtained or renewed for any use on which the value estimate contained in this report is based.

The appraisal should not be considered a report on the specific physical items that are a part of this property. Although the appraisal may contain information about the physical items being appraised (including their adequacy and/or condition), it should be clearly understood that this information is only to be used as a general guide for the property valuation and not as a complete or detailed physical report. The appraisers are not construction, engineering, or legal experts, and any opinion given on these matters in this report should be considered preliminary in nature.

The observed condition of the foundation, roof, exterior walls, interior walls, floors, heating system, plumbing, insulation, electrical service, and all mechanical and construction is based on a casual inspection only and no detailed inspection was made. For instance, we are not experts on heating systems and no attempt was made to inspect the heating unit. The structures were not checked for building code violations and it is assumed that all buildings meet the building codes unless so stated in the report.

Some items such as conditions behind walls, above ceilings, behind locked doors, or under the ground are not exposed to casual view and, therefore, were not inspected. The existence of insulation (if any is mentioned) was found by conversation with others and/or circumstantial evidence. Since it is not exposed to view, the accuracy of any statements about insulation cannot be guaranteed.

-6-

ASSUMPTIONS AND LIMITING CONDITIONS

(Continued)

It is assumed that there are no hidden or unapparent conditions of the property, sub-soil, or structures which would render it more or less valuable. No responsibility is assumed for such conditions or the engineering which may be required to discover such factors. Since no engineering or percolation tests were made, no liability is assumed for soil conditions. Subsurface rights (mineral and oil) were not considered in making this appraisal.

Possession of this report or any copy thereof does not carry with it the right to publication, nor may the same be used for any purpose by any but the applicant without the previous written consent of the appraiser or the applicant, and in any event, only in its entirety.

The appraiser is not qualified to detect hazardous waste and/or toxic materials. Any comment by the appraiser that might suggest the possibility or presence of such substances should not be taken as confirmation of the presence of hazardous waste and/or toxic materials. Such a determination would require investigation by a qualified expert in the field of environmental assessment. The presence of substances such as asbestos, ureaformaldehyde foam insulation or other potentially hazardous materials may affect the value of the property. The appraiser’s value estimate is predicated on the assumption that there is no such material on or in the property that would cause a loss in value unless otherwise stated in the report. No responsibility is assumed for any environmental conditions, or for any expertise or engineering knowledge required to discover them. The appraiser’s descriptions and resulting comments are the result of routine observations made during the appraisal process.

The appraiser has examined the available flood maps that are provided by the Federal Emergency Management Agency (or other data sources) and has noted in the appraisal report whether the subject site is located in an identified Special Flood Hazard Area. Because the appraiser is not a surveyor, no guarantees, express or implied, are made regarding this determination.

Unless otherwise stated in this report, the subject property is appraised without a specific compliance survey having been conducted to determine if the property is or is not in conformance with the requirements of the Americans with Disabilities Act. The existence of architectural and communications barriers that are structural in nature that would restrict access by disabled individuals may adversely affect the property’s value, marketability or utility.

Any proposed improvements are assumed to be completed in a workmanlike manner in accordance with the submitted plans and specifications.

-7-

ASSUMPTIONS AND LIMITING CONDITIONS

(Continued)

This is a Summary Appraisal Report which is intended to comply with the reporting requirements set forth under Standard Rule 2-2(b) of the Uniform Standards of Professional Appraisal Practice for a Summary Appraisal Report. As such it might not include full discussions of the data, reasoning and analyses that were used in the appraisal process to develop the appraiser’s opinion of value. Supporting documentation concerning the data, reasoning and analyses is retained in the appraiser’s files. The information contained in this report is specific to the needs of the client and for the intended use stated in this report.

Since earthquakes are a part of the geological make-up of all Southern California no responsibility is assumed for their possible effect on the subject property.

-8-

SCOPE OF THE APPRAISAL

The appraisal process included:

| 1. | | A detailed inspection and analysis of the site and improvements. |

| |

| 2. | | Collection, assemblage and analysis of neighborhood, community and general area data that influence the subject property. |

| |

| 3. | | Collection, assemblage and analysis of comparable cost data in arriving at a replacement cost estimate of the subject improvements plus a depreciation analysis. |

| |

| 4. | | Collection and analysis of comparable sales and comparable rentals within the neighborhood and/or competitive marketing area and the selection of the most relevant market data that can be reasonably compared to the subject property. |

| |

| 5. | | Processing, analyzing and correlating all relevant data to arrive at value indicators. |

| |

| 6. | | Analyzing and correlating the value indicators to arrive at a reasonable market value conclusion for the subject property. |

-9-

CERTIFICATION

I certify to the best of my knowledge and belief:

The statements of fact contained in this report are true and correct.

The reported analyses, opinions, and conclusions are limited only by the reported assumptions and limiting conditions, and are my personal, unbiased professional analyses, opinions and conclusions.

I have no present or prospective interest in the property that is the subject of this report, and I have no personal interest or bias with respect to the parties involved.

My compensation is not contingent on an action or event resulting from the analyses, opinions, or conclusions in, or the use of, this report.

My analyses, opinions and conclusions were developed, and this report has been prepared, in conformity with the Uniform Standards of Professional Appraisal Practice (USPAP) as developed by the Appraisal Foundation and the Code of Professional Ethics of the Appraisal Institute.

Norman Smith, Senior researcher at Anchor Pacific Company provided professional assistance to the person signing this report.

I made a physical and visual inspection of the property on October 28, 2005. Any other information regarding the physical aspects of the subject property were extracted from a property profile obtained from a title insurance company, agent for owner, and/or other published sources of public record.

The appraisal assignment was not based on a requested minimum valuation, a specific valuation or the approval of a loan. Additionally, no agent or employee exerted any undue pressure which could lead to a misleading or inaccurate appraisal.

No change of any item in the appraisal report shall be made by anyone other than the appraiser, and the appraiser shall have no responsibility for any such unauthorized change.

Neither all nor any part of the contents of this report, including the conclusions as to the value, the identify of the appraiser or the firm which he or she is connected shall be disseminated to the public through the advertising media, public relations media, sales media, or any means of communications without prior written consent and approval of the undersigned.

| | | | | |

| | | |

| | /s/ William H. Bortz | |

| | William H. Bortz | |

| | Certified General Real Estate Appraiser

State of California No. AG012078 | |

-10-

ESTATE APPRAISED

The value estimate is based on a fee simple estate. The property is occupied by tenants. A leased fee or leasehold interest has been established.

PROPERTY RIGHTS DEFINED

Property interests are defined as follows:

Fee Simple Estate: an absolute ownership unencumbered by any other interest or estate, subject only to the limitations imposed by the governmental powers of taxation eminent domain, police power, and escheat.1

Leased Fee Interest: the lessor’s or landlord interest. A leased fee estate is an ownership interest held by a landlord with the right of use and occupancy conveyed by lease to others; the rights of lessor (the leased fee owner) and lessee (leaseholder) are specified by contract terms contained within the lease. Although the specific details of leases vary, a leased fee generally provides the lessor with rent to be paid by the lessee under stipulated terms; the right of repossession at the termination of the lease; default provisions; and the rights to sell, mortgage, or bequeath the property, subject to the lessee’s rights, during the lease period.2

Leasehold Interest: the lessee’s, or tenant’s estate. A leasehold estate is the interest held by the lessee (tenant or renter) through a lease transferring specified rights, including the right of use and occupancy, for a stated term under certain conditions. When a lease is transmitted, a tenant usually acquires the rights to possess the property for the lease period, to sublease the property if allowed or desired, and perhaps to improve the property under the restrictions specified in the lease. In return, the tenant is obligated to pay rent, surrender possession of the property at the termination of the lease, remove any improvements the lessee has modified or constructed if specified, and abide by the lease provisions.3 Normally, tenant improvements may not be removed by the lessee unless permitted under the lease contract.

| | |

| 1 | | The Appraisal of Real Estate, Appraisal Institute, Eleventh Edition, 1996, page 137. |

| |

| 2 | | Ibid., page 138. |

| |

| 3 | | Ibid., page 138. |

-11-

REGIONAL DATA – LOS ANGELES COUNTY

LOS ANGELES COUNTY PROFILE

| • | | Los Angeles County (Los Angeles-Long Beach PMSA) covers 4,752 square miles, and has a July 1, 2001 population of 9,748,500, an increase of 888,200 since 1990. The County’s population would make it equivalent to the ninth largest state in the nation, just behind Michigan. |

| |

| • | | A quick demographic profile of Los Angeles County indicates that: 44.6% of the population is Hispanic; 31.1% White non-Hispanic; 12.0% is Asian-Pacific Islander; and 9.5% Black (2000 Census). 70% of the population has a high school diploma or more, while 22% has a bachelor’s degree or more (1990 Census). |

| |

| • | | There is a diverse economic base in Los Angeles County (based on the concept of “export: of goods or services) using 2001 average employment as a measure. The leading industries are: 1) business & professional management services (including management consulting, engineering and advertising) with 488,600; 2) tourism with 314,200; 3) health services/bio-med with 305,600; 4) direct international trade with 287,000; and 5) motion picture/TV production with 246,600. |

| |

| • | | The “new economy” of Los Angeles County often is technology driven, and would include bio-med, digital information technology, multimedia, and advanced transportation technology. This builds on the vibrant technological research capabilities of the County. Another key driver is the creative resources, and there is a growing fusion between technology and creativity. |

| |

| • | | Los Angeles is the second largest major manufacturing center in the U.S., with 605,700 workers in these activities in 2001. The largest components are: apparel with 91,400; instruments with 50,900; aircraft & parts with 47,800; printing/publishing and fabricated metal products both with 47,200; food & kindred products with 46,100; industrial machinery with 44,400; and electronic products with 41,200. |

| |

| • | | International trade is a major component of the area’s economy. The “Los Angeles Customs District” (including the ports of Long Beach and Los Angeles, Port Hueneme, and Los Angeles International Airport) is the nation’s second largest, based on value of two-way trade. In 2001, this totaled $212.5 billion, compared with $214.1 billion of the first place New York. Major investments are being made in port and transportation facilities, including the $2.4 billion Alameda Corridor project which was completed on-time and on-budget in April, 2002. There are also three foreign trade zone designations. |

| |

| • | | Higher and specialized education is a strength of Los Angeles County, with 159 college and university campuses. These range from California Institute of Technology, the Claremont Colleges, UCLA, and USC, to specialized institutions such as the California Institute for the Arts, the Art Center College of Design, the Fashion Institute of Design and Merchandising, and the Otis Art Institute. Medical education is also a strong point with two each of medical schools, dental schools, and eye institutes, as well as specialized research and treatment facilities such as the City of Hope. The community colleges offer an array of innovative programs, such as fashion design, multimedia, and computer assisted design and manufacturing training. |

-12-

REGIONAL DATA – LOS ANGELES COUNTY

LOS ANGELES COUNTY PROFILE

(Continued)

| • | | Transportation service in Los Angeles County is extensive. In addition to the ports and airports noted above, there are three other commercial airports (Glendale-Burbank-Pasadena, Fox Field and Long Beach). Besides the extensive freeway system, there is an array of rail mass transit options including Amtrak, Metrolink (commuter rail), and Metrorail (subway & light rail). Rail freight service is provided by Burlington Northern Santa Fe and the Union Pacific. |

| |

| • | | Quality of life options in Los Angeles County range from professional sports to personal recreation at beaches, marinas, and mountain resorts. There is a growing array of fine and performing arts activities, as well as a variety of special festivals including the renowned Tournament of Roses. In the past few years, many new landmarks opened, including the Getty Center, the California Science Center and the Staples Center sports arena in downtown Los Angeles, and the Aquarium of the Pacific in Long Beach. |

| |

| • | | General Information |

| | | |

| County seat: | | Los Angeles |

| Address: | | 500 W. Temple Street |

| | | Room 358, 90012 |

| Telephone: | | 213-974-1311 |

| Internet: | | http://lacounty/info/ |

| Incorporated: | | February 18, 1850 |

| Form of government: | | Charter |

| Land area (square miles): | | 4,060.9 |

| Water area (square miles): | | 691.5 |

-13-

THE CITY

Pasadena is located 15 minutes northeast of downtown Los Angeles and 405 miles southeast of San Francisco.

SIZE

23.1 square miles

POPULATION

142,200

ALTITUDE

864 Feet (at City Hall)

CLIMATE

Dry, subtropical with a yearly mean average temperature of 69 degrees. Prevailing winds

are southwest. Yearly mean rainfall is 11.7 inches.

GOVERNMENT

Suburban community, general law, council-manager type of government. Incorporated June 19, 1886.

PROPERTY TAX RATE

All property-residential, commercial, industrial is appraised at full market value as it existed on March 1, 1975, with increases limited to 2% annually. Property created or sold since March 1, 1975 will bear full cash value as of the time creased or sold, plus the 2% annual increase. The basic tax rate is $1.00 per $100 appraised (real cash) value plus any special taxes levied to cover bonded indebtedness for county, city, school or other taxing agencies. Appraised valuations and tax rates are published annually after July.

UTILITIES

| | | |

| Electricity: | | Pasadena Water & Power Department |

| Natural Gas: | | Southern California Gas Company |

| Telephone: | | SBC formerly Pacific Bell |

| Water: | | Pasadena Water & Power |

| Cable Television: | | Cencom Cable |

SCHOOLS

11 Elementary Schools, 2 Junior High Schools, (3) Senior High Schools, (32) Private Schools and (11) Universities or Colleges, (89) Pre-Schools or Child Care Centers

-14-

THE CITY

(Continued)

BUSES

Metropolitan Transit Authority

Dial-a-Ride, City of Pasadena

Embree Bus, Inc.

Greyhound-Trailways Bus Lines

HIGHWAYS

Pasadena Freeway (California 110), Foothill Freeway (I-210), Ventura Freeway (California 134) and Long Beach Freeway (I-710).

COMMERCE

30 miles from Los Angeles-Long Beach Harbors

AIRPORTS

Pasadena is served by three airports, Burbank-Glendale-Pasadena Airport, L.A. International Airport and Ontario International Airport. Both Ontario and Burbank Airports are 15-30 minutes from Pasadena while Los Angeles International is approximately a one hour freeway drive from Pasadena.

Transportation to and from all airports is provided by many services, including bus and limousine service and door-to-door shuttles.

RECREATIONAL FACILITIES

(24) parks, (76) tennis courts, (1) YMCA, (3) golf courses (1 private), (2) public plunges and (2) riding academies.

CHURCHES AND LIBRARIES

(125) churches and (1) city library and (8) branches and (1) county library

NEWSPAPER

The Star News

The Pasadena Weekly

Plus all regional and metropolitan Los Angeles newspapers

-15-

INTRODUCTION

DEFINITION OF MARKET VALUE

Market Value means the most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

| | (1) | | buyer and seller are typically motivated; |

| |

| | (2) | | both parties are well informed or well advised, and acting in what they consider their own best interests; |

| |

| | (3) | | a reasonable time is allowed for exposure in the open market. |

| |

| | (4) | | payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and |

| |

| | (5) | | the price represents the normal consideration for the property sold unaffected by special or creative financing

or sales concessions granted by anyone associated with the sale. |

| | |

| (Source: | | Office of the Comptroller of the Currency under 12 CFR, Part 34, Subpart C-Appraisals, 34.42 Definitions (f).) |

PURPOSE AND FUNCTION OF THE APPRAISAL

The purpose of this appraisal is to provide the appraiser’s best estimate of total and individual market value of the subject real properties as of the effective date. Market value is defined by the federal financial institutions regulatory agencies as that definition is given above.

INTENDED USE AND USER OF THE APPRAISAL REPORT

The information and value conclusions contained in this report are intended strictly for use by the client and assigns for real estate and/or business purposes. The intended use of this appraisal is to assist the client in establishing market value at the effective date (October 28, 2005) of this report. The disclosure of the contents of this report to any other third party other than the client is strictly prohibited, and may render this appraisal invalid.

EFFECTIVE DATE OF VALUE

October 28, 2005

INSPECTION DATE

October 28, 2005

-16-

INTRODUCTION

(Continued)

REPORT DATE

November 21, 2005

LEGAL DESCRIPTION – PARCEL I

Lots 3, 4, 5, in Block 7 of L.J. Rose’s Subdivision of Lamanda Park, in the City of Pasadena, County of Los Angeles, State of California, as per map recorded in Book 7, Page 38 of Miscellaneous Records, in the Office of the County Recorder of said County.

Site (Legal) address: 2674 E. Walnut Street, Pasadena, California

Site (Mailing) address: 2670 E. Walnut Street, Pasadena, California

Assessor’s Parcel Number: 5748-005-032

PROPERTY OWNERSHIP AND RECENT HISTORY – PARCEL I

The owner according to Public Records is Tsann Kuen, USA, Inc..

The subject property has not had a transfer of ownership since 1995 according to public records as surveyed by National Data Collective.

LEGAL DESCRIPTION – PARCEL II

Lots 1, 2 in Block 7 of L.J. Rose’s Subdivision of Lamanda Park, in the City of Pasadena, County of Los Angeles, State of California, as per map recorded in Book 7, Page 38 of Miscellaneous Records, in the Office of the County Recorder of said County.

Site (Legal) address: 89 N. San Gabriel Boulevard, Pasadena, California

Site (Mailing) address: 89 and 91 N. San Gabriel Boulevard, Pasadena, California

Assessor’s Parcel Number: 5748-005-031

PROPERTY OWNERSHIP AND RECENT HISTORY – PARCEL II

The owner according to Public Records is Tsann Kuen, USA, Inc.

The subject property has not had a transfer of ownership since 1995 according to public records as surveyed by National Data Collective.

-17-

INTRODUCTION

(Continued)

LEGAL DESCRIPTION – PARCEL III

Lot 14 and the east 25 feet of Lot 13 in Block 7 of L.J. Rose’s Subdivision of Lamanda Park, in the City of Pasadena, County of Los Angeles, State of California, as per map recorded in Book 7, Page 38 of Miscellaneous Records, in the Office of the County Recorder of said County.

Site (Legal and Mailing) address: 2675 Nina Street, Pasadena, California

Assessor’s Parcel Number: 5748-005-013

PROPERTY OWNERSHIP AND RECENT HISTORY – PARCEL III

The subject property has not had a transfer of ownership since 1995 according to public records as surveyed by National Data Collective.

ASSESSED VALUE-PARCEL I

The assessed value for Parcel I for the current tax year, (2005) as established by the Los Angeles County Assessor’s Office, was as follows:

| | | | | |

| Tax Rate Area: | | | 07500 | |

| Land: | | $ | 369,460 | |

| Improvements: | | $ | 162,440 | |

| Total: | | $ | 531,900 | |

| Property Tax: | | $ | 9,449.57 | |

ASSESSED VALUE-PARCEL II

The assessed value for Parcel II for the current tax year, (2005) as established by the Los Angeles County Assessor’s Office, was as follows:

| | | | | |

| Tax Rate Area: | | | 07500 | |

| Land: | | $ | 245,510 | |

| Improvements: | | $ | 72,935 | |

| Total: | | $ | 318,445 | |

| Property Tax: | | $ | 4,642.26 | |

-18-

INTRODUCTION

(Continued)

ASSESSED VALUE-PARCEL III

The assessed value for Parcel III for the current (2005) tax year, as established by the Los Angeles County Assessor’s Office, was as follows:

| | | | | |

| Tax Rate Area: | | | 07500 | |

| Land: | | $ | 184,729 | |

| Improvements: | | $ | 5,956 | |

| Total: | | $ | 190,685 | |

| Property Tax: | | $ | 2,661.77 | |

Property taxes in the State of California are based on a property tax rate of 1%, applied to the March 1, 1975 full cash value of the property with increases limited to 2% per year. Properties sold or constructed after March 1, 1975 are assessed at the sales price or current market value indicated by the transaction. Taxes may be increased above the 1% limit to cover bonded indebtedness authorized by voters. According to the Los Angeles County Tax Collector’s Office, taxes were current as of the valuation date.

-19-

SITE DATA-PARCEL I

LOCATION

The site of Parcel I is located along the south side of Walnut Street in Pasadena, California. The San Bernardino Freeway is situated about 2 miles south of the property and the Foothill Freeway is about 2 blocks to the north.

SIZE AND SHAPE

The site is rectangular in shape having 100 feet of frontage along Walnut Street. The area of the site is calculated at 20,656 square feet or .4742 acres.

TOPOGRAPHY AND DRAINAGE

The site is flat and level and at street grade. Drainage appears to be adequate.

HUD DESIGNATED FLOOD HAZARD

The property is not located within a HUD designated flood hazard zone.

UTILITIES

All normal utilities are immediately available at the property line.

STREET IMPROVEMENTS

Walnut Street is an east-west street that serves the subject and the Northeast Pasadena area. It has a dedicated width of 80 feet and is 2 lanes wide. All off-site improvements are existing along the subject’s street frontage. It is asphalt paved. On the subject side of the street there are concrete curbs, gutters and sidewalks. Street lighting is from overhead lamps. On the far side of street there are no curbs, gutters or sidewalks. It is an abandoned railroad right-of-way.

ZONING

Subject is in the “d1-IG” General Industrial District according to the East Pasadena Specific Plan. That plan along with permitted uses are in the addendum to this report.

EASEMENTS

No title report was furnished to the appraiser. Easements, if any, are not considered to materially affect the value.

SOILS

A soil report was not provided and it is assumed soil conditions are normal and adequate to support typical load-bearing structures.

-20-

SITE DATA-PARCEL I

(Continued)

ACCESS AND EXPOSURE

Direct access to the site is available from Walnut Street which intersects San Gabriel Boulevard. The site has good traffic exposure from Walnut Street. Freeway access to the San Bernardino Freeway is approximately a fifteen minute drive away and access to the Foothill Freeway is only minutes away.

-21-

SITE DATA-PARCEL II

LOCATION

The site of Parcel II is located at the corner of San Gabriel Boulevard and Walnut Street in Pasadena, California. The site of Parcel II is on the southwest corner. The San Bernardino Freeway is situated about 2 miles south of the property and the Foothill Freeway is about 2 blocks to the north.

SIZE AND SHAPE

The site is rectangular in shape having 137.75 foot frontage along San Gabriel Boulevard and with a 100 foot footage along Walnut Street. The area of the site is calculated at 13,778 square feet.

TOPOGRAPHY AND DRAINAGE

The site is flat and level and at street grade. Drainage appears to be adequate.

HUD DESIGNATED FLOOD HAZARD

The property is not located within a HUD designated flood hazard zone.

UTILITIES

All normal utilities are immediately available at the property line.

STREET IMPROVEMENTS

This parcel faces San Gabriel Boulevard a major north-south street that serves the subject and the Northeast Pasadena area. It has a dedicated width of 80 feet and is 4 lanes wide. All off-site improvements are existing along the subject’s street frontage.

ZONING

Subject is in the similar zone to Parcel I. That East Pasadena Specific Plan along with permitted uses are in the addendum to this report.

EASEMENTS

No title report was furnished to the appraiser. Easements, if any, are not considered to materially affect the value.

SOILS

A soil report was not provided and it is assumed soil conditions are normal and adequate to support typical load-bearing structures.

-22-

SITE DATA-PARCEL II

(Continued)

ACCESS AND EXPOSURE

Direct access to the site is available from San Gabriel Boulevard and Walnut Street which intersects San Gabriel Boulevard. The site has good traffic exposure from San Gabriel Boulevard. Freeway access to the San Bernardino Freeway is approximately a fifteen minute drive south and access to the Foothill Freeway is only minutes away to the north.

-23-

SITE DATA-PARCEL III

LOCATION

The subject site is located along the north side of Nina Street also in Pasadena, California. The San Bernardino Freeway is situated about 2 miles south of the property and the Foothill Freeway is about 2 blocks to the north.

SIZE AND SHAPE

The site is rectangular in shape having some 75 feet of frontage along Nina Street with a depth of 137.5 feet. The area of the site is calculated at 10,328 square feet.

TOPOGRAPHY AND DRAINAGE

The site is flat and level and at street grade. Drainage appears to be adequate.

HUD DESIGNATED FLOOD HAZARD

The property is not located within a HUD designated flood hazard zone.

UTILITIES

All normal utilities are immediately available at the property line.

STREET IMPROVEMENTS

Nina Street is a side east-west street that serves the subject and additional nearby businesses. It has a dedicated width of 60 feet and is 2 lanes wide. All off-site improvements are existing.

ZONING

Zoning is similar to Parcels I and II. A copy of that Specific Plan along with permitted uses is in the addendum to this report.

EASEMENTS

No title report was furnished to the appraiser. Easements, if any, are not considered to materially affect the value.

SOILS

A soil report was not provided and it is assumed soil conditions are normal and adequate to support typical load-bearing structures.

-24-

SITE DATA-PARCEL III

(Continued)

ACCESS AND EXPOSURE

Direct access to the site is available from Nina Street which intersects San Gabriel Boulevard. Freeway access to the San Bernardino Freeway is approximately a fifteen minute drive away and access to the Foothill Freeway is only minutes away as with Parcels I and II.

It should be noted that to the tenant who leases the improved space on Parcel III which is a small building on this Parcel III is now leasing space from the landlord of an adjoining parcel. The main entrance to this tenants business was on Parcel III. The former entrance on Parcel III is now a side and minor entrance.

-25-

HIGHEST AND BEST USE

The primary consideration in estimating the market value of a property is the highest and best use of the property. The term highest and best use, as used herein, is defined as follows:

*“The reasonable and probable use that supports the highest present value, as defined, as of the date of the appraisal.

Alternately,

“The use, from among reasonable, probable and legal alternative uses, found to be physically possible, appropriately supported, financially feasible, and that results in the highest present land value”.

The market value of a property, whether vacant or improved, is based upon the assumption that potential buyers will pay prices that reflect the most profitable use of that property. The existing improvements on a site may or may not represent the highest and best use of the site. It becomes necessary, therefore, with an improved property, to consider the highest and best use of the site.

1) as vacant

2) as improved

The determination of highest and best use is based not only on an analysis of the property in question, but also on an analysis of the overall community its history and trends, zoning, and market conditions as well as the basic principles of land utilization. As indicated in the second definition above, there are four elements in highest and best use analysis that must be considered. The highest and best use of a property is that use, among alternate uses, that is physically possible, legally permissible, financially feasible and maximally productive.

AS VACANT LAND

The site of Parcels I, II and III are level and of an adequate size and shape to accommodate a variety of uses. The soil conditions appear adequate and public utilities available in the area for development of the site. If vacant, the site could accommodate a range of general industrial uses within the applicable zoning of 1d-IG. All three parcels have the same zoning.

The range of possible uses is limited by the City through zoning ordinance. The site is zoned “d1-IG”, general industrial. This zoning permits a number of uses. A survey of the neighborhood revealed the majority of similarly zoned land is improved with small single or multiple tenant one and two story light industrial, commercial, marketing and service tenancies.

| | |

| * | | The Appraisal of Real Estate, eighth edition |

-26-

HIGHEST AND BEST USE

(Continued)

AS VACANT LAND

For a use to be financially feasible, it must generate a positive net income or rate of return. Potential uses of the subject site, as if vacant, have been narrowed to industrial or combination use. This appears financially feasible as evident by the success of similar properties in the market area.

AS IMPROVED LAND

Theoretically, an improved property is often the best use of a site as long as the improvements contribute an additional dollar value over and above the value of the land as unimproved. It is your appraiser’s opinion the present improvements appear to meet the definition of highest and best use for the site on Parcels I and II.

The improvements on Parcel III do not contribute additional dollar value and the overall value is as unimproved vacant industrial/commercial land.

-27-

METHOD OF APPRAISAL

All three classic approaches to value were used in the appraisal of the subject property. Each of the three approaches are briefly described:

| A. | | Cost Approach: This method involves three distinct estimates: 1) estimate land value based on the highest and best use of the property as a vacant site; 2) estimate the current reproduction or replacement cost of all improvements; and 3) estimate accrued depreciation or loss in value for any cause. As the latter 2 require substantial assumptions and there is a lack of vacant land sales in the immediate area this approach is not valid and would not provide a sound approach to value. The approach was not used for Parcels I, II and III. |

| |

| B. | | Income Approach: This method is also commonly referred to as a capitalization approach. This method also involves three distinct estimates: 1) estimating stabilized gross income; 2) estimating all necessary real estate expenses required for the continuation of the income stream; and 3) estimating the proper capitalization rate (O.A.R.) attributable to the income stream. The stabilized income approach value or capitalized value is mathematically arrived at by dividing net income by the overall capitalization rate (O.A.R.). Again this approach is used with regard to Parcels I and II only. |

| |

| C. | | Market Approach: This method is also commonly referred to as a direct sales comparison approach. It involves researching, verifying and analyzing the best comparable market data known to the appraiser. For reliance, this approach depends on a representative number of reasonably comparable properties. This approach is used with regard to Parcels I, II and III. The “Market Approach” employed for each Parcel utilizes comparables which are similar in use to the current uses of Parcel I and II and “Highest and Best Use” of Parcel III. |

The result of the three approaches, if all three are applicable, provides a band of value. These values are then correlated into the final value estimate, considering all factors involved as they relate to the subject property.

-28-

SUMMARY DESCRIPTION OF IMPROVEMENTS – PARCEL I*

| | | |

| Design: | | Conforming office building. Traditional style. |

| | | |

EXTERIOR | | |

| | | |

| Walls: | | Glass, cinder block and steel frame, two story. |

| | | |

| Foundation: | | Concrete slab, perimeter footings. |

| | | |

| Roof: | | Flat wood framed, composition cover; surface drains. (Not inspected) |

| | | |

| Windows: | | Fixed glass, fixed frames. |

| | | |

| Parking: | | Open asphalt paved surface, general and handicapped spaces. |

| | | |

| Other: | | A permanent patio/seating area is in front. |

| | | |

INTERIOR | | |

| | | |

| Floor Plan: | | First Floor: (1) reception area, stairway to 2nd floor, (.75) bathroom, (4) bedrooms (dormitory style), (1) living room and (2) general rooms. (The living room, dormitory style bedrooms and general purpose rooms are used by traveling executives.) |

| | | |

| | | Second Floor: (1) reception area, (1) conference room, (2)1/2 restrooms, (2) work area-office space, (2) offices, (1) “gourmet” kitchen and product display area and (1) photo/dark room. |

| | | |

| Walls: | | Drywall, drywall dividers; sealed and painted. |

| | | |

| Ceiling: | | Wood beam and acoustic paneled, fluorescent lighting |

| | | |

| Floors: | | Carpeted and tile with vinyl linoleum in bathroom. |

| | | |

| Heat: | | Central systems, gas fired. (not inspected) |

| | | |

| Air Conditioning: | | Central systems, roof mounted. (not inspected) |

| | | |

| Electrical: | | Standard service and ceiling mounted commercial grade fluorescent fixtures. |

| | | |

| Bathrooms: | | American Standard type toilets, wall mounted wash basin, linoelum floors. |

| | |

| * | | There are no improvements on Parcel III. There will be no “Summary Description of Improvements for Parcel III. |

-29-

SUMMARY DESCRIPTION OF IMPROVEMENTS – PARCEL I

(Continued)

| | | |

| Special Note: | | A portion of the building is sublet to a tenant known as “The Plant Peddler”. That space is one story (with a mezzanine). |

| | | |

Floor Plan:

(Plant Peddler) | | (1) work area, (2) full bathrooms, (1) office (on mezzanine). |

| | | |

Walls:

(Plant Peddler) | | Cinder block and drywall with corrugated metal. |

| | | |

Ceiling:

(Plant Peddler) | | Unfinished |

| | | |

Floors:

(Plant Peddler) | | Sealed concrete |

-30-

SUMMARY DESCRIPTION OF IMPROVEMENTS – PARCEL II*

| | | |

| Design: | | Conforming light industrial-warehouse building. Traditional style. |

| | | |

EXTERIOR | | |

| | | |

| Walls: | | Wood frame and stucco, painted, one story. |

| | | |

| Foundation: | | Concrete slab, perimeter footings. |

| | | |

| Roof: | | Arched wood framed, composition cover. (Not inspected) |

| | | |

| Windows: | | Fixed glass, fixed frames in front only. |

| | | |

| Parking: | | None on site. Parcel II uses parking in loading dock area and space on Parcel I. |

| | | |

| Other: | | Attached to rear of improvements in a former residence (1 story) and it is described on the next page. |

| | | |

INTERIOR | | |

| | | |

| Floor Plan: | | (1) office used by tenant (Schlasser) along front of building, (1) showroom (also used by tenant), (1) warehouse (used by property owner). |

| | | |

| Loading: | | (2) manual garage type manual loading doors with truck well and loading dock. Opens to San Gabriel Boulevard. (1) grade level garage type loading door without truck well and opening to Walnut Street. |

| | | |

| Walls: | | Open wood framed, drywall dividers; sealed and painted. |

| | | |

| Ceiling: | | Wood beam and acoustic panel in office and showroom and unfinished in warehouse. |

| | | |

| Floors: | | Carpet in office and showroom and sealed concrete in warehouse and loading area. |

| | | |

| Heat: | | Central systems, gas fired. (not inspected) office and showroom only. |

| | | |

| Air Conditioning: | | Central systems, roof mounted. (not inspected) office and showroom only. |

| | | |

| Electrical: | | Standard service, ceiling mounted commercial grade fluorescent fixtures in entire building. |

| | |

| * | | There are no improvements on Parcel III. There will be no “Summary Description of Improvements for Parcel III. |

-31-

SUMMARY DESCRIPTION OF IMPROVEMENTS – PARCEL II

(Continued)

| | | |

| Former Residence: | | Attached to building is a former residence building with a living room, (2) bedrooms and a3/4 bathroom. There is no kitchen. The exterior is brick (wood frame) and there is a composite shingle roof. The former home features carpeted and linoleum floors, wood wainscoting, wall heat, window air conditioner and sliding aluminum windows. The home is now vacant and has not been used for several years according to a local spokesperson. |

-32-

PARCEL I

MARKET DATA APPROACH

This valuation method is a process of analyzing sales of similar properties in order to derive an indication of the most probable sale price of the property being appraised. Additional information was gathered and evaluated from real estate brokers, leasing agents, developers and lenders within this market.

In determining an estimate of market value for the subject property using the Market Data Approach (also known as Sales Comparison Approach) numerous sales were analyzed. The schedules set forth on the following pages summarize a selected number of closed sales. These comparable properties reflect similar markets and are considered similar properties that could be found in this office building market. The major differences are the size of the lots, improvements, location and condition. Primary emphasis was placed on those sales in most similar to subject. Particular attention was given to the location as compared to subject. Closed sales were selected measuring unadjusted sales prices from $193.91 per square foot to $220.50 per square foot.

Adjustments reflected specific market elements including features relating to location, size of building/lot, age, utility and condition of improvements. The comparables reflect the basic areas, construction and features of their original design. On an adjusted basis, we developed a square foot price range from $198.15 to $212.65. The subject property reflects aspects of the mid range, i.e. quality of construction, overall utility, size, condition and location supporting a square foot value of $205.00 per square foot.

On this basis, we estimate the market value of subject property on an “as-is” basis on the effective date of the appraisal to have been:

$205.00 x 17,808 Square Feet =$3,650,640.00

Rounded to:

$3,651,000

-33-

PARCEL I

MARKET DATA APPROACH

(Continued)

SUMMARY OF IMPROVED SALES

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | BLDG. | | | | | | | | |

| | | | | SALE | | LOT | | | | | | FULL | | ADJUSTED % |

| | | | | DATE | | BLDG. | | YEAR | | PRICE | | PRICE |

| NO. | | LOCATION | | DOC.# | | SQ.FT. | | BUILT | | SQ. FT. | | SQ. FT. |

| 1. | | 959 E. Walnut Street | | 10/04/05 | | | 36,322 | | | | 1978 | | | $ | 7,576,000 | | | | (-)5 | % |

| | | Pasadena | | #2384657 | | | 60,984 | | | | | | | $ | 208.58 | | | $ | 198.15 | |

| | | | | | | | | | | | | | | | | | | | | |

| 2. | | 48 S. Chester Avenue | | 10/15/04 | | | 14,747 | | | | 1959 | | | $ | 3,200,000 | | | | (-)2 | % |

| | | Pasadena | | #2652658 | | | 19,891 | | | | | | | $ | 216.99 | | | $ | 212.65 | |

| | | | | | | | | | | | | | | | | | | | | |

| 3. | | 33 S. Catalina Avenue | | 08/09/05 | | | 11,563 | | | | 1982 | | | $ | 2,265,000 | | | Balanced |

| | | Pasadena | | #1893109 | | | 17,762 | | | | | | | $ | 195.88 | | | $ | 195.88 | |

| | | | | | | | | | | | | | | | | | | | | |

| 4. | | 975 E. Green Street | | 06/09/04 | | | 8,556 | | | | 1929 | | | $ | 1,835,000 | | | | (-)2 | % |

| | | Pasadena | | #1475493 | | | 14,374 | | | | | | | $ | 214.47 | | | $ | 210.18 | |

| | | | | | | | | | | | | | | | | | | | | |

| 5. | | 110 S. Rosemead Blvd. | | 01/20/05 | | | 8,019 | | | | 1968 | | | $ | 1,555,000 | | | | (+)3 | % |

| | | Pasadena | | #0143544 | | | 20,473 | | | | | | | $ | 193.91 | | | $ | 199.73 | |

| | | | | | | | | | | | | | | | | | | | | |

| 6. | | 474 S. Raymond Avenue | | 01/11/05 | | | 26,000 | | | | 1970 | | | $ | 5,773,000 | | | | (-)8 | |

| | | Pasadena | | #0071771 | | | 37,500 | | | | | | | $ | 220.50 | | | $ | 202.86 | |

Sales reported by the Comps Inc. (a real-estate database) have been confirmed individually using local public records and/or the appraiser’s files.

NOTE: Additional details regarding Improved Sales is maintained in Appraiser’s file.

-34-

PARCEL I

INCOME APPROACH

INCOME

The Income Approach is based on the assumption that a relationship exists between the value of a property and the income which it is capable of producing. It is in effect, the capitalization of expected future income into present worth. “An investor who purchases income-producing real estate is essentially trading a sum of present dollars for the right to receive future dollars. The income capitalization approach to value consists of methods, techniques, and mathematical procedures that an appraiser uses when analyzing a property’s capacity to generate monetary benefits and then converting the benefits into an indication of present value.”1

INCOME APPROACH TO VALUE

The following basic steps are required to arrive at the anticipated income generating capabilities of a property:

| | 1. | | Estimate Potential Gross Income. This could be the current lease rent roll, if at market, or the market rental of all rentable space based on 100% occupancy (when appraising fair market value). |

| |

| | 2. | | Estimate rate of vacancy and collection loss. This rate is based on market observations of similar properties as compared to the subject. |

| |

| | 3. | | Estimate Operating Expenses. The operating expenses estimated are based on assumptions made in the estimate of potential gross income in step one. Consideration is given concerning whether tenant or landlord is paying certain items of expenses, i.e., utilities, insurance, etc. |

| |

| | 4. | | The resultant net income, before debt service, is then capitalized into a value indication by the capitalization techniques. The capitalization technique used by the appraiser reflects the stability of the income stream produced by the property, the quality of this income (tenant financial ability to pay), and the risks inherent in the property type being appraised. |

METHOD OF CAPITALIZATION

There are two methods of capitalization available to the appraiser. They are yield capitalization and direct capitalization. “Yield capitalization uses the discounting procedure to convert future benefits to present value on the premise of a required level of profit or rate of return on invested capital.”2 Yield capitalization is profit oriented, and tries to stimulate a typical investor’s investment assumptions according to a presumed requirement for profit or yield. Although yield capitalization can become very complex, when properly used it will provide a very reliable estimate of market value.

-35-

PARCEL I

INCOME APPROACH

(Continued)

METHOD OF CAPITALIZATION (Continued)

“Direct capitalization is used to convert an estimate of a single year’s income expectancy into an indication of value in one direct step.”3 Direct capitalization is simple and easily understood. The estimated income is divided by an appropriate rate or multiplied by an appropriate factor to arrive at an indication of value. For this appraisal, only direct capitalization with the use of an overall rate has been used. The income selected to be capitalized is the estimated net income. The rate, most commonly used for this type of analysis, is referred to as an overall capitalization rate. The formula for this method of capitalization is expressed as follows:

| | | | | | | |

| | | Net Operating Income

Overall Capitalization Rate | | = | | Value |

| | |

| 1 | | American Institute of Real Estate Appraisal,The Appraisal of Real Estate, Eight Edition, (American Institution of Real Estate Appraiser, U.S.A., 1983),

Page 333 |

| |

| 2 | | Ibid, Page 342 |

| |

| 3 | | Ibid, Page 341 |

ANALYSIS OF RENTAL DATA

The appropriate unit of comparison for analyzing the rental data is the rate per square foot building area.

The subject is an adequately maintained two story office building with net floor area of approximately 17,808 Square Feet. As the building is now configured there is two tenants.

A market survey was developed within the market area to determine a fair rental value for the subject property at the valuation date and so applied for the value estimate. The basic lease rate appears to be well supported in that market.

A partial list of rental comparables has been summarized on the following page covering commercial units within the same or similar market areas.

We explored rentals on a gross as well as a net basis. The majority of office buildings are leased on a modified gross basis when they are multiple tenancies. When occupied by a single tenant, we found many to be “owner occupied” and no financial information was available. For this reason our area of possible comparables was widened beyond the immediate Pasadena area. However, sufficient data was obtained to establish a basis for rent on a modified gross basis.

As a result, we estimate the fair rents per square foot as follows:

| | | | | | | | | |

| Gross Rents | | Leasable | | Monthly Gross |

| $2.06 Square Feet | | 17,808 Square Feet | | $36,684.48 | | |

The subject building reflects a modified gross rental in the mid range reflecting size, age, parking, quality of construction, utility, design and location.

-36-

PARCEL I

INCOME APPROACH/RENTAL COMPARABLE

BUILDING DESCRIPTIONS

(Continued)

| | | | | |

| | | COMP #1 | | COMP #2 |

| Address | | 975 E. Green Street | | 275 E. California Boulevard |

| | | Pasadena | | Pasadena |

| | | | | |

| Proximity | | Southwest | | Southwest |

| | | | | |

| Map Reference | | 566-A5 | | 565-J6 |

| | | | | |

| Year Built | | 1924 | | 1905 |

| | | | | |

| Number of Stories | | 1/2 Stories | | 1 |

| | | | | |

| Use/Zoning | | CD6 | | CD8 |

| | | Pasadena | | Pasadena |

| | | | | |

| Construction Type | | Structural Brick | | Frame/Wood |

| | | | | |

| Construction Quality | | Average | | Average |

| | | | | |

| Date of Rent Survey | | 2005 | | 2005 |

| | | | | |

| Rent Per SF/Month | | $1.85 Sq. Ft./Mo. | | $2.68 Sq. Ft./Mo. |

| | | | | |

| Rent Form/Term | | Modified Gross | | Modified Gross |

| | | | | |

| Property Description | | Multi-tenant office building average condition. There are (29) off-street spaces for customer parking. | | Multi- tenant office building. There are (10) off-street parking spaces in a lot at rear. |

| | | | | |

| Adjusted Rent for S/P | | $1.77 Sq. Ft./Mo. | | $1.93 Sq. Ft./Mo. |

| | | | | |

| Comments | | MG lease. Selling broker reported income. Located southwest of subject in a in similar market area. | | MG lease. There are two tenants. Building size is smaller as is lot size. |

-37-

PARCEL I

INCOME APPROACH/RENTAL COMPARABLE

BUILDING DESCRIPTIONS

(Continued)

| | | | | |

| | | COMP #3 | | COMP #4 |

| Address | | 20 E. Foothill Blvd. | | 200 E. Del Mar Avenue |

| | | Arcadia | | Pasadena |

| | | | | |

| Proximity | | East | | Southwest |

| | | | | |

| Map Reference | | 567-D4 | | 565-J5 |

| | | | | |

| Year Built | | 1980 | | 1981 |

| | | | | |

| Number of Stories | | 2 | | +3 |

| | | | | |

| Use/Zoning | | C2 | | RD7A |

| | | Arcadia | | Pasadena |

| | | | | |

| Construction Type | | Concrete block | | Frame/Wood |

| | | | | |

| Construction Quality | | Average | | Average |

| | | | | |

| Parking | | 95 | | 140 |

| | | | | |

| Date of Rent Survey | | 2005 | | 2005 |

| | | | | |

| Rent Per SF/Month | | $1.70 Sq. Ft./Mo. | | $2.00 Sq. Ft./Mo. |

| | | | | |

| Rent Form/Term | | Modified Gross | | Modified Gross |

| | | | | |

| Property Description | | Multi-tenant low rise office | | Multi tenant office building. |

| | | building located on a mid | | Located in the same city as |

| | | block parcel. Parking | | subject. Open paved parking |

| | | in rear. | | spaces for (140) patients in adjacent |

| | | | | lot. |

| | | | | |

| Adjusted Rent for S/P | | $2.25 Sq. Ft./Mo. | | $2.05 Sq. Ft./Mo. |

| | | | | |

| Comments | | MG lease. Larger building | | MG lease. Superior appeal, age |

| | | area and lot. Similar | | and location. Greater land |

| | | condition. Located in | | area and building square feet. |

| | | similar market area. | | Superior condition, similar |

| | | | | market area. |

-38-

PARCEL I

INCOME APPROACH TO VALUE

(Continued)

INCOME AND EXPENSE ANALYSIS

In consideration of the facilities offered, it is our opinion that a modified gross rental analysis will be the most reliable basis for an estimate of value by the Income Approach. The application of this method is summarized as follows:

| | | | | |

| ESTIMATED ANNUAL INCOME (Rounded) | | | | |

| Gross Monthly Income: | | $ | 36,684 | |

| Estimated Gross Annual Income: | | $ | 440,214 | |

| Allowance for vacancy & collection losses (3%): | ( | $ | 13,206 | ) |

| Effective Gross Income: | | $ | 427,007 | |

| | | | | |

| ESTIMATED ANNUAL EXPENSES | | | | |

| Total Expenses: | | $ | 123,832 | |

| | | | |

| NET ANNUAL INCOME: (before debt service) | | $ | 303,175 | |

| | | | |

| |

| The estimated overall capitalization rate is estimated at 9.5%. The indicated value is computed as follows: |

| |

| Net Annual Income: | | $ | 303,175 | |

| Net Annual Income divided by: 9.5% | | | 0.095 | |

| Indicated Value by the Income Approach: | | $ | 3,191,315 | |

Rounded to:

$3,191,000

-39-

PARCEL II

MARKET DATA APPROACH

This valuation method is a process of analyzing sales of similar properties in order to derive an indication of the most probable sale price of the property being appraised. Additional information was gathered and evaluated from real estate brokers, leasing agents, developers and lenders within this market.

In determining an estimate of market value for the subject property using the Market Data Approach (also known as Sales Comparison Approach) numerous sales were analyzed. The schedules set forth on the following pages summarize a selected number of closed sales. These comparable properties reflect similar markets and are considered similar properties that could be found in this industrial/warehouse market. The major differences are the size of the lots, improvements, location and condition. Primary emphasis was placed on those sales in most similar to subject. Particular attention was given to the location as compared to subject. Closed sales were selected measuring unadjusted sales prices from $142.86 per square foot to $270.83 per square foot.

Adjustments reflected specific market elements including features relating to location, size of building/lot, age, utility and condition of improvements. The comparables reflect the basic areas, construction and features of their original design. On an adjusted basis, we developed a square foot price range from $200.00 to $248.05. The subject property reflects aspects of the mid range, i.e. quality of construction, overall utility, size, condition and location supporting a square foot value of $240.00 per square foot.

On this basis, we estimate the market value of subject property on an “as-is” basis on the effective date of the appraisal to have been:

$240.00 x 10,717 Square Feet =$2,572,080.00

Rounded to:

$2,572,000

-40-

PARCEL II

MARKET DATA APPROACH

(Continued)

SUMMARY OF IMPROVED SALES

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | BLDG. | | | | | | | | |

| | | | | SALE | | LOT | | | | | | FULL | | ADJUSTED % |

| | | | | DATE | | BLDG. | | YEAR | | PRICE | | PRICE |

| NO. | | LOCATION | | DOC.# | | SQ.FT. | | BUILT | | SQ. FT. | | SQ. FT. |

| 1. | | 1940 E. Walnut Street | | 01/13/05 | | | 2,400 | | | | 1947 | | | $ | 650,000 | | | | (-)15 | % |

| | | Pasadena | | #0093241 | | | 5,497 | | | | | | | $ | 270.83 | | | $ | 230.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| 2. | | 59 Palmetto Drive | | 07/28/05 | | | 6,000 | | | | 2004 | | | $ | 1,550,000 | | | | (-)7 | % |

| | | Pasadena | | #1789945 | | | 7,100 | | | | | | | $ | 258.33 | | | $ | 240.24 | |

| | | | | | | | | | | | | | | | | | | | | |

| 3. | | 309 S. Raymond Avenue | | 08/26/04 | | | 16,800 | | | | 1940 | | | $ | 4,500,000 | | | | (-)5 | % |

| | | Pasadena | | #2202695 | | | 30,575 | | | | | | | $ | 267.86 | | | $ | 254.47 | |

| | | | | | | | | | | | | | | | | | | | | |

| 4. | | 361-379 S. Fair Oaks Ave. | | 01/07/04 | | | 12,735 | | | | 1993 | | | $ | 2,925,000 | | | | (+)8 | % |

| | | Pasadena | | #0038420 | | | 24,412 | | | | | | | $ | 229.68 | | | $ | 248.05 | |

| | | | | | | | | | | | | | | | | | | | | |

| 5. | | 504-508 N. Fair Oaks Ave. | | 03/02/04 | | | 4,200 | | | | 1984 | | | $ | 600,000 | | | | (+)40 | % |

| | | Pasadena | | #0488813 | | | 9,780 | | | | | | | $ | 142.86 | | | $ | 200.00 | |

Sales reported by the Comps Inc. (a real-estate database) have been confirmed individually by using local public records and/or the appraiser’s files.

NOTE: Additional details regarding Improved Sales is maintained in Appraiser’s file.

-41-

PARCEL II

INCOME APPROACH

INCOME

The Income Approach is based on the assumption that a relationship exists between the value of a property and the income which it is capable of producing. It is in effect, the capitalization of expected future income into present worth. “An investor who purchases income-producing real estate is essentially trading a sum of present dollars for the right to receive future dollars. The income capitalization approach to value consists of methods, techniques, and mathematical procedures that an appraiser uses when analyzing a property’s capacity to generate monetary benefits and then converting the benefits into an indication of present value.”1

INCOME APPROACH TO VALUE

The following basic steps are required to arrive at the anticipated income generating capabilities of a property:

| | 1. | | Estimate Potential Gross Income. This could be the current lease rent roll, if at market, or the market rental of all rentable space based on 100% occupancy (when appraising fair market value). |

| |

| | 2. | | Estimate rate of vacancy and collection loss. This rate is based on market observations of similar properties as compared to the subject. |

| |

| | 3. | | Estimate Operating Expenses. The operating expenses estimated are based on assumptions made in the estimate of potential gross income in step one. Consideration is given concerning whether tenant or landlord is paying certain items of expenses, i.e., utilities, insurance, etc. |

| |

| | 4. | | The resultant net income, before debt service, is then capitalized into a value indication by the capitalization techniques. The capitalization technique used by the appraiser reflects the stability of the income stream produced by the property, the quality of this income (tenant financial ability to pay), and the risks inherent in the property type being appraised. |

METHOD OF CAPITALIZATION

There are two methods of capitalization available to the appraiser. They are yield capitalization and direct capitalization. “Yield capitalization uses the discounting procedure to convert future benefits to present value on the premise of a required level of profit or rate of return on invested capital.”2 Yield capitalization is profit oriented, and tries to stimulate a typical investor’s investment assumptions according to a presumed requirement for profit or yield. Although yield capitalization can become very complex, when properly used it will provide a very reliable estimate of market value.

-42-

PARCEL II

INCOME APPROACH

(Continued)

METHOD OF CAPITALIZATION (Continued)

“Direct capitalization is used to convert an estimate of a single year’s income expectancy into an indication of value in one direct step.”3 Direct capitalization is simple and easily understood. The estimated income is divided by an appropriate rate or multiplied by an appropriate factor to arrive at an indication of value. For this appraisal, only direct capitalization with the use of an overall rate has been used. The income selected to be capitalized is the estimated net income. The rate, most commonly used for this type of analysis, is referred to as an overall capitalization rate. The formula for this method of capitalization is expressed as follows:

| | | | | | | |

| | | Net Operating Income

Overall Capitalization Rate | | = | | Value |

| | |

| 1 | | American Institute of Real Estate Appraisal,The Appraisal of Real Estate, Eight Edition, (American Institution of Real Estate Appraiser, U.S.A., 1983), Page 333 |

| |

| 2 | | Ibid, Page 342 |

| |

| 3 | | Ibid, Page 341 |

ANALYSIS OF RENTAL DATA

The appropriate unit of comparison for analyzing the rental data is the rate per square foot building area.

The subject is an adequately maintained one story industrial/commercial building with net floor area of approximately 10,717 Square Feet. As the building is now configured there is one tenant with the balance being used by the owner.

A market survey was developed within the market area to determine a fair rental value for the subject property at the valuation date and so applied for the value estimate. The basic lease rate appears to be well supported in that market.

A partial list of rental comparables has been summarized on the following page covering commercial units within the same or similar market areas.

We explored rentals on a gross as well as a net basis. The majority of commercial buildings are leased on a modified gross basis when they are multiple tenancies. When occupied by a single tenant, we found many to be “owner occupied” and no financial information was available. For this reason our area of possible comparables was widened beyond the immediate Pasadena area. However, sufficient data was obtained to establish a basis for rent on a modified gross basis.

As a result, we estimate the fair rents per square foot as follows:

| | | | | | | | | |

| Gross Rents | | Leasable | | | Monthly Gross | |

| $0.88 Square Feet | | 10,717 Square Feet | | $9,430.96 | | |

The subject building reflects a modified gross rental in the mid range reflecting size, age, parking, quality of construction, utility, design and location.

-43-

PARCEL II

INCOME APPROACH/RENTAL COMPARABLE

BUILDING DESCRIPTIONS

(Continued)

| | | | | |

| | | COMP #1 | | COMP #2 |