As filed with the Securities and Exchange Commission on July 11, 2008

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ELEPHANT TALK COMMUNICATIONS, INC.

(Exact name of registrant as specified in charter)

California

(State or jurisdiction of incorporation or organization)

20-3766053

(I.R.S. Employer Identification No.)

Schiphol Boulevard 249,

1118 BH Schiphol, The Netherlands

31 0 20 653 5916

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

2008 Long-Term Incentive Compensation Plan

(Full titles of plan)

Willem Ackermans

Schiphol Boulevard 249,

1118 BH Schiphol, The Netherlands

31 0 20 653 5916

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Barry I. Grossman, Esq.

David Selengut, Esq.

Ellenoff Grossman & Schole LLP

150 East 42nd Street, 11th Floor

New York, New York 10017

(212) 370-1300

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per unit(2) | Proposed maximum aggregate offering price | Amount of registration fee |

| Restricted common stock, par value $0.001 per share | 325,000 shares | $1.60 | $520,000.00 | $20.44 |

| common stock, par value $0.001 per share | 4,675,000 shares | $1.60 | $7,480,000.00 | $293.96 |

| Total | 5,000,000 shares | n/a | $8,000,000.00 | $314.04 |

(1) | The aggregate amount of securities registered hereunder is 5,000,000 shares of common stock which have been granted or will be issued upon the exercise of options or upon the issuance of restricted stock awards or other awards otherwise granted hereafter pursuant to our 2008 Long-Term Incentive Compensation Plan (the “Plan”). The maximum number of shares which may be sold upon the exercise of such options or issuance of stock awards granted under the Plan are subject to adjustment in accordance with certain anti-dilution and other provisions under the Plan. Accordingly, pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended, this Registration Statement covers such indeterminate additional shares of common stock granted or otherwise issuable after the operation of such anti-dilution and other provisions. |

| | |

| (2) | The offering price has been estimated solely for the purposes of the calculation of the registration fee. The offering price has been calculated in accordance with the manner described in paragraphs (h) and (c) of Rule 457 under the Securities Act and is based upon the average of high and low prices reported by the OTC Bulletin Board on July 9, 2008, a date within five (5) business days prior to the date of the filing of this registration statement. |

(1)

Explanatory Note

This registration statement on Form S-8 of Elephant Talk Communications, Inc. (this “Registration Statement”) has been prepared in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”) to register up to 5,000,000 shares of our common stock, no par value per share (the “Common Stock”), to be issued to participants in our 2008 Long-Term Incentive Compensation Plan (the “Plan”).

This Registration Statement includes the registration for reoffer and resale of up to 4,675,000 shares of our Common Stock that may be acquired in the future under this Registration Statement by participants in the Plan who are our “affiliates” as such term is defined in Rule 405 under the Securities Act of 1933, which shares constitute “control securities” as such term is defined in General Instruction C to Form S-8. 325,000 shares of restricted stock granted under the Plan as of the date hereof may be reoffered and resold pursuant to this Registration Statement. In addition, certain unnamed non-affiliates may use this Registration Statement for the reoffer and resale of up to 1000 shares of our common stock.

The materials that follow Part I and precede Part II of this Registration Statement constitute a reoffer prospectus. The reoffer prospectus filed as part of this Registration Statement on Form S-8 has been prepared in accordance with the requirements of Part I of Form S-3 and in accordance with General Instruction C of Form S-8.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. | Plan Information.* |

| | |

| Item 2. | Registrant Information and Employee Plan Annual Information.* |

| | |

* Information required by Part I to be contained in the Section 10(a) Prospectus is omitted from the Registration Statement in accordance with Rule 428 under the Securities Act of 1933, as amended.

Reoffer Prospectus

ELEPHANT TALK COMMUNICATIONS, INC.

5,000,000 Shares

Common Stock

This prospectus is being used in connection with the offering from time to time by certain selling stockholders of our company or their successors in interest of shares of the common stock issued or to be issued, or which may be acquired upon the exercise of stock options issued or to be issued, pursuant to our 2008 Long-Term Incentive Compensation Plan, which we refer to herein as the Plan.

The common stock may be sold from time to time by the selling stockholders or by their pledgees, donees, transferees or other successors in interest. Such sales may be made in the over-the-counter market or otherwise at prices and at terms then prevailing or at prices related to the then current market price, or in negotiated transactions. The common stock may be sold by one or more of the following: (a) block trades in which the broker or dealer so gaged will attempt to sell the shares as agent but may position and resell portions of the block as principal to facilitate the transaction; (b) purchases by a broker or dealer as principal and resale by such broker or dealer for its account pursuant to this prospectus; (c) an exchange distribution in accordance with the rules of such exchange; and (d) ordinary brokerage transactions and transactions in which the broker solicits purchases. In effecting sales, brokers or dealers engaged by the selling stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from selling stockholders in amounts to be negotiated immediately prior to the sale. Such brokers or dealers and any other participating brokers or dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the Act, in connection with such sales. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. We will not receive any of the proceeds from the sale of these shares; however, we will receive proceeds from the exercise of our options. There is no guarantee that our options will be exercised, but any proceeds received therefrom will be used for general corporate purposes. We will pay the expenses of preparing this prospectus and the related registration statement.

Our common stock is quoted on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “ETAK.OB”. On July 9, 2008, the closing sales price for the common stock on the OTCBB was $1.60 per share.

Our principal executive offices are located at Schiphol Boulevard 249, 1118 BH Schiphol, The Netherlands. Our telephone number is 31 0 20 653 5916

An investment in the shares of our common stock being offered by this prospectus involves a high degree of risk. You should read the “Risk Factors” section beginning on page 14 before you decide to purchase any shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 11, 2008.

TABLE OF CONTENTS

NOTE ON FORWARD LOOKING STATEMENTS | 1 |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | 1 |

PROSPECTUS SUMMARY | 2 |

THE OFFERING | 2 |

RISK FACTORS | 14 |

USE OF PROCEEDS | 21 |

SELLING STOCKHOLDERS | 21 |

PLAN OF DISTRIBUTION | 22 |

LEGAL MATTERS | 23 |

EXPERTS | 23 |

WHERE YOU CAN FIND MORE INFORMATION | 24 |

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES LAW VIOLATIONS | 24 |

You should rely only upon the information contained in this prospectus and the registration statement of which this prospectus is a part. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus is based on information provided by us and other sources that we believe are reliable. We have summarized certain documents and other information in a manner we believe to be accurate, but we refer you to the actual documents for a more complete understanding of what we discuss in this prospectus. In making an investment decision, you must rely on your own examination of our business and the terms of the offering, including the merits and risks involved.

We obtained statistical data, market data and other industry data and forecasts used throughout, or incorporated by reference in, this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information. We have not sought the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

This prospectus contains, or incorporates by reference, trademarks, tradenames, service marks and service names of Elephant Talk Communications, Inc. and other companies.

NOTE ON FORWARD LOOKING STATEMENTS

Certain statements contained in this prospectus constitute “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and releases issued by the SEC and within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan” and other expressions which are predictions of or indicate future events and trends and which do not relate to historical matters identify forward-looking statements. Reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to: (a) our projected revenues and profitability, (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital.

The foregoing does not represent an exhaustive list of risks. Please see “Risk Factors” for additional risks which could adversely impact our business and financial performance. Moreover, new risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents, heretofore filed by us with the U.S. Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, are hereby incorporated by reference, except as superseded or modified herein:

1. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2007, filed on Aril 15, 2008;

2. Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2008, filed on May 15, 2008;

3. Our Current Reports on Form 8-K, filed on May 19, 2008, June 5, 2008, June 12, 2008, and June 13, 2008;

4. Our Proxy Statement On Schedule 14A, filed on December 21, 2007; and

5. The description of our common stock contained in our Form 10-SB12G/A filed on May 12, 2000.

All reports and other documents filed by the Registrant after the date hereof pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be part hereof from the date of filing of such reports and documents.

We will provide without charge to each person to whom a copy of this prospectus is delivered, upon the written or oral request of any such person, a copy of any document described above (other than exhibits). Requests for such copies should be directed to Elephant Talk Communications, Inc., Schiphol Boulevard 249, 1118 BH Schiphol, The Netherlands; Attention: Willem Ackermans.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone else to provide you with different information. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front page of those documents.

The following summary highlights selected information contained in this prospectus. This summary does not contain all of the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the risk factors section as well as the financial statements and the notes to the financial statements incorporated herein by reference. In this prospectus and any amendment or supplement hereto, unless otherwise indicated, the terms “Elephant Talk”, “ETAK”, the “Company”, “we”, “us”, and “our” refer and relate to Elephant Talk Communications, Inc. and its consolidated subsidiaries. On June 11, 2008, we effected a 1:25 reverse stock split of our outstanding common stock. Unless otherwise indicated, the information contained herein reflects the reverse split.

The Offering

Outstanding Common Stock Prior to the Offering | 43,292,424 shares of our common stock issued and outstanding as of June 26, 2008 (1) |

| | |

Common Stock issuable under the Plan or upon the exercise or Options issuable under the Plan and Reoffered hereby | Up to 5,000,000 shares. |

| | |

| Use of Proceeds | We will not receive any proceeds from the sale of our common stock by the selling stockholders. We would, however, receive proceeds upon the exercise of options received under the Plan. Any cash proceeds will be used by us for general corporate purposes. |

| | |

| Risk Factors | The securities offered hereby involve a high degree of risk. See “Risk Factors”. |

| | |

| OTCBB Symbol | ETAK.OB |

(1) Does not include common stock issuable upon the exercise of options or warrants outstanding on the date hereof.

[remainder of page intentionally left blank]

The Company

Elephant Talk Communications, Inc. is an international telecom operator and enabler/systems integrator to the multi-media industry. ETAK, until recently, was engaged in the long distance telephone business in China and the Special Administrative Region Hong Kong. In 2006 the Company adopted the strategy to re-position itself by facilitating the distribution of all forms of content and telecommunications services to various international customers. The Company provides traditional telecom services, media streaming and distribution services primarily to the business-to-business community within the telecommunications market where it has a presence. Elephant Talk operates in over a dozen markets in Europe, Asia Pacific and the Middle East. Through intelligent design and organizational structure the Company pursues this strategy by building a worldwide network based on both clear and IP bandwidth that is managed centrally by its self-developed In House Customer Relations Management (IN-CRM)-Billing platform.

In January 2007, through the acquisition of various assets in Europe, the Company established a foothold in the European Telecommunications Market, particularly in the market of Service Numbers like Toll Free and Premium Rate Services and to a smaller extent Carrier (Pre) Select Services. Furthermore, through the human and IT resources acquired, the Company obtained the expertise of telecom and multi-media systems, telecom regulations and European markets.

The Company currently operates a switch-based telecom network with national licenses and direct fixed line interconnects with the Incumbents/National Telecom Operators in eight (8) European countries, one (1) in the Middle East (Bahrain), licenses in Hong Kong and the U.S.A., partnerships with telecom operators in France, Germany, Scandinavia, Poland and Hong Kong. Codec and media streaming servers are currently located in six centers geographically spread around the world. Together with the centrally operated and managed Intelligent Network Customer Relations Management (IN-CRM)-Billing platform, the Company offers geographical, premium rate, toll free, personal, nomadic and Voice over Internet Protocol (VoIP) numbers. Services are primarily provided to the business market and include traditional telecom services, VoIP, media streaming and distribution including the necessary billing and collection. Through its European and Chinese development centers, ETAK develops in-house telecom and media related systems and software.

Background of Elephant Talk Communications, Inc.

Elephant Talk Communications Inc. was formed in 2001 as a result of a merger between the Staruni Corporation and Elephant Talk Limited (Hong Kong). Elephant Talk Limited (Hong Kong) originally started its operation in 1994 as an international long distance services provider, specializing in international call termination into China. Its operating hubs in Hong Kong and the USA provided a gateway to both the North American and Worldwide Carrier Networks. However, due to the extremely competitive nature of this market, the Company chose to abandon this strategy a few years ago.

Elephant Talk is now primarily engaged in long distance and premium rate telephone services and is actively seeking to position itself as a broader telecommunications services provider and a multimedia distribution company. It is the Company’s goal to further develop and exploit a highly flexible, fully standardized and integrated global telecommunications network on the basis of national licenses & interconnects which are owned or accessed through partnerships. Through an integrated platform around this network it is ETAK’s intention to offer its clients a turnkey solution for basic, commoditized (voice) telecommunication services, toll free, shared cost and premium rate services, content & payment provisioning, and mobile services. Eventually covering the full range of services from (IP based) telecommunications services to content delivery and billing and operating its own global communications network, ETAK hopes to be able to bring these communications services and content to its customers, collect payments, and allocate those payments to all parties involved in the distribution chain.

ETAK is creating a managed global network that, it believes, enables ETAK’s customers to distribute all their information in a fully managed and secured environment compared to the internet. Together with a fully integrated back office system, ET opens up this network to every Business-to-Business (B2B) customer and enables these customers to manage and control their business, as well as to collect payment, from their own premises and to run ETAK’s network as if it is their own. The feature allows ETAK’s B2B customers to see mobile, fixed, internet, WIFI, and local, regional or multi-country, as just one integrated network, with the advantages of one single network interface, centralized customer recognition and one set of financial controls.

attempting to position itself as the preferred telecom outsourcing partner to all of its B2B customers. These long term business partners include larger marketing organizations and/or content providers who are in need of telecommunications services as a key (or merely a supporting but important) feature in their overall product/market and distribution offering. In addition other telecom companies could partner with ETAK to expand their geographical footprint or services offered. As such ETAK positions its partners as if they are a fully networked telecommunications company themselves by providing them all the tools and resources to manage their businesses, particularly the telecommunications part, as an integrated element of their overall offering.

ETAK believes its B2B customers will be able to create their own business environment, and be able, with the support of ETAK’s back office and CRM (Customer Relationship Management) systems, to recognize and serve their own clients, employees or partners wherever they are, whatever device they use and at any time. ETAK’s vision is that all access to its network will be steered by its worldwide central data and information base. This data base will facilitate ETAK’s customers to define worldwide access authorization so their clients will get access to the services through their own familiar interface and/or workplace and in the format and language of their preference.

The key to ETAK’s business plan is the fully automated capturing and recording of any event on its global network through standard Call Data Records. These so called CDR’s are globally recognized and accepted by all of ETAK’s suppliers and customers because of their high quality, reliability and consistency. As a result, on a real time/on-line basis, ETAK believes its billing engine provides trustworthy inter-company payment overviews.

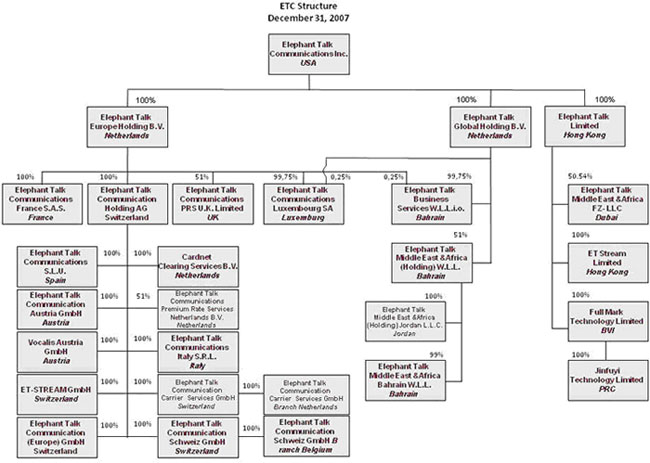

The following chart illustrates the Company’s structure as of December 31, 2007.

In 2007 the ETAK group grew as a result of the acquisition, effective January 1, 2007, of Elephant Talk Communication Holding AG (formerly known as “Benoit Telecom Holding AG”) by Elephant Talk Europe Holding B.V.(the “Benoit Acquisition”). Please see Historical background “Benoit Acquisition”, for an overview of this transaction. In addition to the Benoit Acquisition, on June 1, 2007 ETAK acquired a French entity: 3U Telecom SrL, from 3U Telecom AG, a German company. The name of this entity was subsequently changed to Elephant Talk Communications France S.A.S. (“ET France”). As a result of this transaction and the Benoit Acquisition, the operations and corporate structure of ETAK significantly expanded.

In addition to the aforementioned acquisitions, in 2007 we incorporated three new companies in the ETAK group. On May 24, 2007 we established Elephant Talk Global Holding B.V (“ET Global”), a 100% Dutch subsidiary of ETAK. We created ET Global to act as the holding company for several of our worldwide subsidiaries. We incorporated Elephant Talk Business Services W.L.L. (“ET Business Services”), a Bahrain based company, on October 21, 2007, to act as an intra-group service provider outside Europe. Elephant Talk Communication Carrier Services GmbH performs this activity within Europe. We also formed Elephant Talk Communications Luxembourg S.A. (ET Luxembourg) on December 27, 2007, to initially focus on providing payment collection services for other group companies.

Historical background “Benoit Acquisition”

On January 17, 2005, the Company entered into a Memorandum of Understanding with Beltrust AG, a corporation organized and existing under the laws of Switzerland (“Beltrust”), to acquire all of the issued and outstanding shares of Benoit Telecom Holding AG, a corporation organized and existing under the laws of Switzerland (“Benoit Telecom”). Benoit Telecom is a European-based telecom company. On November 17, 2006, the Company executed an Agreement of Purchase and Sale (the “Agreement”), with Beltrust and Elephant Talk Europe Holding B.V. (“ET Europe”), a corporation organized and existing under the laws of The Netherlands, and a wholly owned subsidiary of the Company, providing for the purchase and sale of all of the issued and outstanding shares of Benoit Telecom by ET Europe.

Pursuant to the Agreement, ET Europe agreed to purchase from Beltrust all of the 100,000 issued and outstanding shares of Benoit Telecom, in exchange for a) cash payment of $6,643,080 and b) 40,000,000 shares of the Company’s common stock. The parties acknowledged that $6,043,080 (equivalent to approximately Euros 4,625,000) had been previously paid by the Company on behalf of ET Europe to an escrow agent as an earnest deposit. In addition, the parties agreed that the remaining balance of the consideration consisting of $600,000 of cash payment and 40,000,000 shares of common stock of the Company shall be transferred to Beltrust within 30 days of the closing. The 100,000 shares of Benoit were transferred to ET Europe as of the closing pursuant to the Agreement.

Technology Infrastructure

ETAK has built a worldwide footprint through intelligent network and content management systems, supported by its organizational structure. The company provides clear communication and IP bandwidth centrally managed by its proprietary sophisticated IN (Intelligent Network)-CRM (Customer Relationship Management)-Billing platform. ETAK is able to eliminate the usual limitations caused by national borders, networks, devices or media and therefore enables its Business-to-Business customers to operate as independent telecom and multimedia distribution organizations. Moreover, the Company is a system integrator and developer for telecom and digital media distribution activities as well as a circuit and package based telecom operator. ETAK believes it has positioned itself as the premier outsourcing partner for national and global multimedia companies.

To maintain flexibility and to allow growth, ETAK has chosen to develop its own proprietary software and systems including: 1) a fully integrated rating, mediation, provisioning, CRM and billing system for multi-country and multi-media use and applications; 2) an advanced Infitel IN platform; and 3) a streaming technology. ETAK’s development activities are located in Gerona, Spain, while the actual development and testing is carried out by ETAK’s own software engineering staff in Guangzhou (China). Also ETAK’s global 24/7 Network Operating Center is located in Guangzhou.

ETAK’s in-house CRM/billing system is the backbone for all of the Company’s operations. It ensures proper support for all of ETAK’s services and its reliable data are the basis for customer satisfaction. We believe the Company’s network and system platforms are able to handle the extremely high demands of national incumbents and other telecom operators on ETAK’s globally interconnected network.

By combining fixed line, mobile and wireless access services through contractual arrangements with an unrestricted number of first/last mile telecom providers, ETAK offers a wide range of content, media streaming and more traditional telecom services. All traffic is supported by ETAK’s own CRM and CDR (Call Data Records) systems for complete customer identification, billing and collection purposes. Consequently, ETAK enables its B2B customers to operate as global telecom & multi media distribution organizations themselves. Supporting business processes such as fulfillment, logistics, and live customer care agents can be provided through third party suppliers with which ETAK cooperates.

ETAK’s network is based on fixed-line telecommunications licenses, mobile access agreements and network interconnections. ETAK’s geographical cross-border footprint, established through existing relationships with national telecom incumbents, is, in the Company’s opinion, especially well-positioned for international traffic. ET has established its own facilities-based infrastructure on four continents. Currently, as a fully licensed carrier, ETAK is interconnected with incumbents in the Netherlands (KPN), Spain (Telefonica), Austria (Telekom Austria), Belgium (Belgacom), Switzerland (Swisscom), Italy (Telecom Italia), the United Kingdom (BT) and Bahrain (Batelco). Through partners, Elephant Talk has access to interconnections in France, Germany, Poland, Finland, Sweden, Norway and Ireland. To complement its international capabilities, ETAK has facilities in Hong Kong and Los Angeles.

ETAK’s distribution of third party content such as movies, ring tones and sports is centrally managed and integrated through a network of content management platforms strategically located in data centers around the world in places like Hong Kong, Amsterdam, Hannover, Barcelona, Bahrain and Curaçao.

As mobile and wireless access increasingly play a vital role in communication success, ETAK continues to expand its mobile access on top of its fixed line access. In June 2007 a MVNE (Mobile Virtual Network Enabler) agreement was signed between T-Mobile/Orange in the Netherlands and ETAK.

Products & Markets

Carrier (Pre) Select (CS/CPS)

ETAK’s traditional fixed line network-based services include CS and CPS services to end-users. In addition the Company offers the service to retailers/resellers as a “white label” (third party branded) product with the use of ETAK’s fully integrated management tools. ETAK’s CS and CPS services route calls over its network at competitive rates. By dialing a specific ETAK assigned access code each time a long distance call is made (Carrier Select) or by having such code pre-installed at the subscription providing carrier (Carrier PreSelect), clients can route calls via the ETAK network. Clients can join ETAK easily as ETAK takes care of administrative work including number porting, the process of transporting their number to ETAK’s carrier service. ETAK does not charge fixed costs for using its CS or CPS services, clients are billed on a per usage base only. Our detailed invoices, sent by email or accessible on-line, provide complete call records and statistics. CS and CPS services are presently being offered in The Netherlands, Italy, France and Austria. To support its customers ETAK has a multilingual helpdesk available.

Service Numbers / Premium Rate (PRS) & Toll Free Services

ETAK’s Premium Rate Service offers an easy payment solution for paid content such as data services and interactive & value added services over fixed and mobile networks as well as over the internet. The calling party pays a premium on top of the normal call charges. Both charges are normally collected by the subscription providing carrier, usually the local incumbent, through the regular phone bill. PRS numbers implemented with ETAK are directly delivered to ETAK’s switches, while the premium (after deduction of mostly regulated collecting charges) is being paid to ETAK. ETAK offers such PRS services on either a domestic or cross border basis in over 10 European countries with the added benefit of a centrally located management and billing system. If required, ETAK can provide PRS numbers in other countries as well. In order to meet the new demands as a result of the increasing integration of telecommunication and media broadcasting, ETAK is adding Video Calling solutions to its PRS platform capabilities.

Toll Free numbers are usually marketed by companies that want to increase the number of customers calling their sales, service and customer support centers. Based on ETAK’s interconnected global network, ETAK is positioned to cater to this market, especially focusing on high quality, low cost cross border toll free traffic.

Two Stage Dialing

ETAK’s Two-Stage Dialing facility offers a low rate international call service and is a white label third party branded product. Two-stage dialing means the end user has to dial twice - once to reach a second dial tone, and again to reach the final destination. In other words, a call traversing from a public switched telephone network (PSTN) to VoIP or VoIP to PSTN must go through two dialing stages to reach the intended recipient. Access to the service can be gained by dialing a premium-rate or shared-cost number from as little as $0.05/min. up to a maximum of around $0.63/min. subject to the international destination. Once connected to the service a dial tone prompts callers to dial the number at their desired international destination subsequent to which ETAK routs the call through its international carrier network. The main benefits of this concept are: a) total price transparency for the end-user, b) no separate billing, callers are charged on their regular phone bill, c) no registration or contracts for callers, d) service can be used from any phone, including mobiles, at any time. The continuously decreasing termination costs have worked in favor of the profit margin between the revenues ETAK receives from the premium-rate and shared-cost numbers, and the international call routing costs. The service is currently used in Germany, Spain, The Netherlands, Austria, Switzerland, Poland and the UK. Interconnects in these countries allow the service to be centrally managed and ETAK’s CRM billing system enables the company’s customers to monitor constantly updated call statistics online. The Two-Stage Dialing services have predominantly been marketed through profit sharing Media Partners among which some of the largest media groups in Europe including IP Media (RTL, Switzerland), ORF Television (Austria), Metro, STER (Dutch national television), and various leading local TV channels and newspapers. Call statistics have revealed that the service is particularly popular among the expanding European immigrant population. Poland, for instance, is one of the top five most frequented destinations of all countries where Two-Stage dialing has been marketed. Over the years the Two-Stage dialing service has clearly encountered more competition from VoIP call services such as Skype but also from lower international call charges by incumbents and other telecommunication companies in general. However, immigrant user groups tend to have only limited access to these alternative international call facilities and often depend on a mobile device only. Consequently, Two-Stage Dialing continues to be essential for its niche market group users and the call volume of this service has been only marginally affected by competing services.

Streaming, Media & Content Services

Streaming

ETAK provides high quality streaming of video and audio for the internet and mobile phones. ETAK has developed a new technology for the digitalization of ‘running video’ based on a military pattern recognition technology. This compression technology is applied specifically for encoding and transmitting video via any standard mobile telephone communication protocol, such as GSM, GPRS, EDGE, UMTS, HSDPA, CDMA, WCDMA with a capacity of 22 Kbps and higher: 16 Kbps for video, 6 Kbps for audio. In addition, ETAK also has live streaming facilities for analogue modems, ISDN, double ISDN, cable, xDSL, Wifi, Wimax and LAN. This streaming technology thus allows ETAK’s customers to not only offer services to broadband users, but to reach the vast market of low bandwidth end-users as well.

Media Phone

ETAK’s platform facilitates the distribution of content driven services to end-users via PC, laptop, fixed telephone or mobile handset using a proprietary software interface called Media Phone. This interface provides end-users access to content (music, videos and games), to use VoIP communication services, and for example also Fax and SMS services via ETAK’s network. By making use of the ETAK’s CRM/billing system, ETAK’s B2B customers are also able to offer revenue sharing business models to their own clients. Contrary to regular soft phone interfaces, all Media Phone traffic is channeled through ETAK’s switches (not peer-to-peer), thus making sure communication is of the highest quality. Users are automatically directed to the nearest VoIP/Media Gateway, located around the globe, to further ensure the highest quality of service. As the VoIP facility of the Media Phone can set up all regular national and international calls via ETAK’s own network, users can be assured of very competitive call charges. The platform has recently become operational, though to date it has not generated any traffic.

Digital Content

ETAK has recently acquired distribution rights from third parties for the widest range of content including movies, videos, music, mobile content, and games. ETAK’s facilities will offer access to this content base, and also enable ETAK’s B2B customers to distribute their content efficiently. To avoid unauthorized usage, security solutions have been developed using the latest techniques, including Microsoft DRM licenses 9, 10 and 11, that offer a highly secure environment in combination with ETAK’s CRM/billing modules.

Mobile Services

ETAK is a full MVNE (Mobile Virtual Network Enabler) with its own integrated platforms, switches and network for back-office and customer interaction solutions. The back-office services will range from provisioning and administration to OSS (Operation Service Support) and BSS (Business Service Support) running on ETAK’s IN/CRM/Billing platform. ETAK’s CRM system is designed to facilitate both MNO’s (Mobile Network Operators) to profitably target specific, often niche market segments and/or specific market requirements as well as MVNO’s (Mobile Virtual Network Operators) to run their operations effortlessly without the technical and financial burden of an own mobile network. We anticipate these services to be fully operational in the second quarter of 2008.

For companies that wish to enter the mobile telephone market, the MVNO business model is most attractive because it eliminates the expense of establishing and managing a mobile network of their own. The initial capital expenditure is therefore very low and so are the corresponding operational costs. Traditionally MNO-MVNO propositions required high capital and operational expenditure and attention to multiple technical components for both the MNO as well as the MVNO. ETAK’s business model offers a solution for MVNO’s allowing them to concentrate on sales and marketing, and for MNO’s to be able to cater to often smaller, niche market MVNO’s without burdening legacy systems and other resources, usually not designed to efficiently service such wholesale customers.

Next to more traditional voice and SMS services, ETAK’s MVNE platform is focusing on wireless data services, content, applications and e-commerce. Traditional voice service of MVNO’s will probably be marginalized over time, following similar price erosion patterns as in fixed telecom services, and therefore cannot compete on the long run without value-added services. Moreover, the emerging market of 3G/3.5G mobile services, including WIMAX and WIFI, create great opportunities to attract new subscribers.

Mobile devices are an effective medium to communicate commercial messages to subscribers, especially if supported by proper customer profiling tools in combination with ETAK’s CRM/billing platform. Mobile messages can be personalized per subscriber, segmented within the client base or just be used as a mass communication means. As a mobile device is one of the most personal communication tools to connect with, and stimulate customers, MVNO’s might offer excellent opportunities to a variety of companies with a non-telecommunication core business, like fast moving consumer goods companies looking to expand and broaden their markets, while at the same time creating focused marketing communication channels with their existing customer bases.

Business Strategy for 2008 and Beyond

Growth Strategy, in general

In their efforts to continue to reposition the Company, management has been actively seeking additional business opportunities to steer the Company away from the extremely competitive and low margin market of international call termination to the more profitable Carrier (Pre)Select, Premium Rate, Toll Free, Content Distribution and Mobile Services global market.

In this respect the Company concluded its acquisition of Benoit Telecom Holding (BT) on January 1, 2007, giving Europe access to the European market. In addition, on June 1, 2007, the Company concluded its acquisition of 3U’s French operation, mainly active in Carrier (Pre)Select.

After obtaining all required licenses, the Company obtained its own interconnections in the UK with BT and in Bahrain with Batelco operational in the third quarter of 2007, thereby adding an additional footprint. Management hopes to substantially increase ECTI’s presence over the next couple of years in Europe, Middle East & Africa, The Far East and in the Americas, thereby increasing its fixed line origination and termination capabilities.

An important part of ETAK’s strategy will be to grow and operate its presence both at a lower original investment cost as well as a structurally lower operational cost by managing its global infrastructure as if it is one simple national network, i.e. with one overhead instead of many different operational overheads.

All ETAK’s network elements, wherever located, are managed, monitored, diagnosed and updated remotely. As all systems are designed redundantly and build up from similar, uniform components, no continuous on-site support is required. On a rotating basis, proactive maintenance takes place to promote 100% uptime. As a consequence, ETAK can run all of its systems with one dedicated, relatively small team of high level hardware, software and telecom engineers from locations in Spain, China and the Netherlands. Using this single, relatively low overhead to run all of its global applications, gives what ETAK believes is a low cost structure and which is, in management’s belief, absolutely required for ETAK to gain a preferred market positioning.

Another part of ETAK’s strategy will be to build access to mobile networks on top of its global fixed line infrastructure. This is achieved through negotiating full Mobile Virtual Network Operator/Enabler (MVNO/MVNE) contracts with mobile network operators in countries where ETAK already is in the possession of a full fixed telecom license.

By building mobile access capabilities on top of its fixed network infrastructure, and using primarily the same overheads to run this, ETAK can add these MVNE capabilities at a lower investment cost than usual for these activities at a corresponding lower operational cost, thus creating a competitive advantage. In this respect ETAK concluded in 2007 its first MVNE contract in the Netherlands, which operation is expected to start in the second quarter of 2008. During the next couple of years management expects to be able to add 2 to 3 national MVNE operations each year.

The Company intends to continue on this path of expansion by further acquisition of a controlling stake in profitable companies in the year 2008 and beyond.

The Company also hopes to grow its presence in China. We believe that a business position in China eventually will be beneficial to the Company as the telecommunications industry in China experiences continuous growth along with the development and modernizations of its economy. The accession to World Trade Organization makes the demand for international calling services even bigger and will eventually open China’s telecommunications market to companies like ETAK. Therefore we expect an increasingly transparent regulatory environment in China through its regulatory system, and its gradual opening up of the domestic market to foreign participation which should create opportunities that facilitate progress toward an improved operating environment.

Development Strategy

The Management of the Company believes that reliable and flexible billing, information management, monitoring and control are critical to the Company’s success. Accordingly, ETAK will continue to invest substantial resources to further develop and implement a sophisticated real-time management information system. Key features of this system will include:

· | Reliability |

· | Remote Management |

· | Compatibility to all current and future payment methods |

· | A global reach |

· | Fully compliant with the legal framework in each market |

· | Standardized technology |

· | Rapid deployment of services |

We hope to execute this strategy at a lower cost and lower investment than is normally required through the application of a small organizational structure, the remote control of switches in each country in which ETAK is operational, the use of company-owned innovative technology, and the continuous search for optimal balance between quality of services and operational costs.

Product Strategy

ETAK is planning to ultimately offer a complete range of retail and wholesale products and services for telecommunications and multimedia content distribution, including:

| | · | Smart POTS (Plain Old Telephony Services), creating cheaper access through the application of smart access technology: |

| | o | Carrier Select |

| | o | Carrier PreSelect |

| | o | 2-stage dialing through third party Shared Cost/Premium Rate billing; pre paid calling cards |

| | o | 2-stage dialing through direct pre/post paid billing; pre/post paid value/calling cards |

| | o | Dial around access plans |

| | o | VoIP through desktop/laptop client |

| | o | VoIP using normal phone set through ADSL/Cable/Wifi connected VoIP box |

| | · | Originating & Terminating Services |

| | o | Toll Free Originating Services |

| | o | Shared Cost Originating Services |

| | o | Premium Rate Originating Services |

| | o | Revenue Shared Terminating Services |

| | o | LCR Global Terminating Services |

| | · | Mobile Access Services |

| | o | Mobile Virtual Network Enabling Services, based on 3rd party mobile networks |

| | o | Wireless ET Network Services, based on ET WIFI and/or WIMAX networks |

| | o | Roaming services |

| | · | Supporting Services |

| | o | Content |

| | o | Streaming |

| | o | Codec |

| | o | MediaPhone |

| | o | Billing-CRM-Payment Transaction Services |

| | o | Inteligent Network Platform Services |

It is the Company’s intention to offer these products either separately or as a bundled package starting in 2008.

The Company believes that adding market presence combined with a more in-depth products and services offering, will position ETAK to find more marketing and distribution partners, thereby enabling ETAK to rapidly grow the company with a lower than proportional growth in overhead cost.

Partners

As a result of the converging of IT and telecom solutions the amount of engagement between ETAK and its various partners has increased. On the supply side ET works closely together with dozens of other carriers to either originate or terminate ET’s traffic around the globe and with a broad range of content providers. On the client side, resellers have evolved from indirect channels to true partners bringing specialist market knowledge, customer focus and a geographical reach to its activities.

As a key element of our low-cost and fast deployment strategy, ETAK makes use of partners in all layers of our Multimedia distribution platform. ETAK’s partners with entities in the following particular areas:

Fixed Network Interconnect Partners . As a fully licensed telecommunications carrier, ETAK is entitled to be interconnected with a variety of incumbent operators and cable companies as well as more recently established telecom providers in over a dozen countries that provide both network origination and termination, mostly at regulated costs.

Network Exchange Partners. ETAK’s Network Exchange Partners secure mutual network access and interconnection on a country by country and mutually voluntary basis. Through this cooperation, ETAK is able to leverage its own network of regulated interconnections by exchanging these interconnections with network access in countries were ETAK is not present. Thereby ETAK is capable to rapidly enlarge its network without the associated capital expenditures.

Content Partners. These partners can be a supplier as well as a marketing client at the same time. On one hand they provide a broad array of content available for distribution through ETAK’s network, to be marketed by a variety of ETAK’s marketing partners. On the other hand ETAK provides these partners with all the tools they may require to exploit and market their content and generate revenue from them.

LCR Wholesale Origination/Termination Partners ETAK’s network is connected to over a dozen Wholesale Partners that work together on a commercial basis to provide each with Least Cost Routing capabilities, to globally originate and terminate calls at the best possible cost/quality levels.

Payment Partners. Through their clearing houses and platforms ETAK is able to charge and collect monies due from end-customers, using any form of payment and transfer said funds accordingly to any of its marketing, content and carrier partners around the globe.

Management & Personnel

During 2007 ETAK strengthened its organization in order to prepare itself for its current growth strategy by hiring a new CFO, a Corporate Controller, a General Manager for the Middle East & Africa, a manager for Mobile Operations, engineers and software developers to expand ETAK’s VoIP, Intelligent Network Platform, and Billing-CRM capabilities, and sales managers in Europe. In January 2008 ETAK retained the services of a Chief Marketing Officer whose main task will be to streamline all of ETAK’s commercial activities and prepare the company for accelerated growth in revenues.

In addition to our corporate management staff, as of March 31, 2008 ETAK employed 24 full time and 3 part time employees. The Company has retained on a long term basis the services of 16 independent consultants. We consider relations with our employees and consultants to be good. Each of our current employees and consultants has entered into confidentiality and non-competition agreements with the Company.

At the same time the Company is pursuing the aforementioned opportunities, Management is attempting to improve the internal structuring of the organization and to realize a fully integrated organization. This will have to be achieved not only on a corporate level but also in the financial, technical and operational departments of the Company in order to implement new services, connectivity in new countries and extra capacity.

Competition

The Company experiences fierce competition in each of the market segments in which it operates.

Carrier (Pre) Select (CS/CPS)

By far the biggest competition still comes from each of the incumbent telecom operators like France Telecom, KPN, Telecom Italia and Telekom Austria. Originally they started with virtually 100% market shares, and although certainly market share has been lost, they usually still have a dominant position. Other competitors are either specialized Pan European telecom retail providers like for example Tele2. The strongest price competition usually comes from smaller, locally established players.

Service Numbers / Premium Rate (PRS) & Toll Free Services

Also here traditional incumbents are strong competitors if customers solely need domestic oriented services, as they also here started originally out with around 100% market shares. In certain countries also some of the Cable Companies have established larger market shares, while some other markets see strong competition from either succesfull foreign incumbents, like British Telecom in the Netherlands, or highly specialized local services companies, like DTMS in Germany. As ETAK combines traffic originating from a dozen European markets into one single network, ETAK is in a more favourable competitive position if customers are for a substantial part also looking at such cross border traffic.

Domestic Toll Free traffic is again dominated by the various incumbent carriers in the various countries ET operates in. However also for these kind of services, ETAK’s single network approach for traffic from over a dozen European markets, creates a unique selling point for ETAK to service for example major Pan European call centres. In this cross border segment companies like COLT Telecom pose serious competition.

Two Stage Dialing

Over the years the Two-Stage dialing service has encountered more competition from VoIP call services such as Skype but also from lower international call charges by incumbents and other telecommunication companies in general. However, immigrant user groups tend to have only limited access to these alternative international call facilities and often depend on a mobile device only. Consequently, Two-Stage Dialing continuous to be essential for its niche market group users and the call volume of this service has only been little affected by its competition.

Streaming, Media & Content Services

The internet as such is by far the strongest competition for all kind of content distribution and streaming services. However more and more content distributors and content owners start to question the long term healthyness of the sometimes free for all distribution capabilities via internet. A free content model whereby revenue is solely driven by ad expenditures, based on unique traffic to one’s website might simply not be suitable for any content party. ET provides tools to deliver electronic content in a more controlled fashion and either receive payments for specific usage, or provide valuable customer profiling from specific customers allowed to see the content, or a combination of both.

Mobile Services

Even though ETAK as a Mobile Virtual Network Provider, will keep on creating excellent opportunities for MNO’s to increase the addressable market that can service profitably, at some moment in time such MNO’s may be considering to not only take on larger MVNO’s directly, but to again start servicing such smaller MVNO’s directly. This may especially be true if new technologies make it easier for these MNO’s to service such smaller non-retail customers directly. Also other MVNE’s may possibly create strong competition, especially if such new MVNE’s will be created by MNO’s as a consequence of ETAK’s success in profitably cooperating with various other MNO’s that already have a succesfull MVNE relation with ETAK.

So far there are very few truly MVNE’s, running all the required network elements to offer an integrated platform with a flexible, user-friendly services, currently operating, although this may change in the near future.

Employees

In addition to our corporate management staff, as of March 31, 2008 ETAK employed 24 full time and 3 part time employees. We believe that our relations with our employees are good. None of our employees are represented by a union or any collective bargaining agreement.

Corporate Information

Our principal executive offices are located at Schiphol Boulevard 249, 1118 BH Schiphol, The Netherlands. Our telephone number is 31 0 20 653 5916. Our corporate website is http://www.elephanttalk.com.com. The information on our website is not incorporated by reference into this Registration Statement.

We file reports and other information with the SEC. The SEC maintains an internet site that contains reports, proxy, information statements and other information at http://www.sec.gov.

An investment in our company is extremely risky. You should carefully consider the following risks, in addition to the other information presented in this prospectus before deciding to buy or exercise our securities. If any of the following risks actually materialize, our business and prospects could be seriously harmed, the price and value of our securities could decline and you could lose all or part of your investment.

Risks related to our company

Our substantial and continuing losses, coupled with significant ongoing operating expenses, raise doubt about our ability to continue as a going concern.

We have sustained substantial losses. Such losses continue due to ongoing operating expenses and a lack of revenues sufficient to offset operating expenses. We have raised capital to fund ongoing operations by private sales of our securities, some of which sales have been highly dilutive and involve considerable expense. In our present circumstances, there is substantial doubt about our ability to continue as a going concern absent significant sales of our products and telecommunication services, substantial revenues from new licensing or co-development contracts, or the sale of our securities.

We incurred net losses of $12,057,732 and $4,829,665 for the years ended December 31, 2007 and 2006, respectively, and $2,575,988 and $1,396,167 for the periods ending March 31, 2008 and 2007, respectively. As of December 31, 2007, we had an accumulated deficit of $29,019,832, derivative liabilities of $18,255,065 related to the obligations to issue 613,492,498 shares of our common stock, accounts payable of $4,857,229 and current portion of notes payable of $6,484,063. As of March 31, 2008, we had an accumulated deficit of $31,595,820.

We expect to continue to spend significant amounts to acquire businesses and to expand our current technology. As a result, we will need to raise additional capital until we generate significant additional revenue to achieve profitability. There is no guarantee that such capital will be available, or that it will be available on favorable terms.

We have recently shifted our business strategy, and we may not prove successful in our new focus.

In 2007, the Company began to shift its focus from market of international call termination to the Carrier (Pre) Select, Premium Rate, Toll Free, Content Distribution and Mobile Services global markets. We have limited experience in these areas, and there is no guarantee that we will be able to enter and compete in these markets, or achieve profitability.

We may not be able to integrate new technologies and provide new services in a cost-efficient manner.

The telecommunications industry is subject to rapid and significant changes in technology, frequent new service introductions and evolving industry standards. We cannot predict the effect of these changes on our competitive position, our profitability or the industry generally. Technological developments may reduce the competitiveness of our networks and require additional capital expenditures or the procurement of additional products that could be expensive and time consuming. In addition, new products and services arising out of technological developments may reduce the attractiveness of our services. If we fail to adapt successfully to technological advances or fail to obtain access to new technologies, we could lose customers and be limited in our ability to attract new customers and/or sell new services to our existing customers. In addition, delivery of new services in a cost-efficient manner depends upon many factors, and we may not generate anticipated revenue from such services.

Disruptions in our networks and infrastructure may cause us to lose customers and incur additional expenses.

To be successful, we will need to continue to provide our customers with reliable and timely service over our networks. We face the following risks to our networks and infrastructure:

| | · | our territory can have significant weather events which physically damage access lines; |

| | · | power surges and outages, computer viruses or hacking, and software or hardware defects which are beyond our control; and |

| | · | unusual spikes in demand or capacity limitations in our or our suppliers’ networks. |

Disruptions may cause interruptions in service or reduced capacity for customers, either of which could cause us to lose customers and/or incur expenses, and thereby adversely affect our business, revenue and cash flow.

Integration of acquisitions ultimately may not provide the benefits originally anticipated by management and may distract the attention of our personnel from the operation of our business.

We strive to increase the volume of voice and data traffic that we carry over our existing global network in order to reduce transmission costs and other operating costs as a percentage of net revenue, improve margins, improve service quality and enhance our ability to introduce new products and services. We may pursue acquisitions in the future to further our strategic objectives. Acquisitions of businesses and customer lists, a key element of our historical growth strategy, involve operational risks, including the possibility that an acquisition does not ultimately provide the benefits originally anticipated by management. Moreover, there can be no assurance that we will be successful in identifying attractive acquisition candidates, completing and financing additional acquisitions on favorable terms, or integrating the acquired business or assets into our own. There may be difficulty in migrating the customer base and in integrating the service offerings, distribution channels and networks gained through acquisitions with our own. Successful integration of operations and technologies requires the dedication of management and other personnel, which may distract their attention from the day-to-day business, the development or acquisition of new technologies, and the pursuit of other business acquisition opportunities, and there can be no assurance that successful integration will occur in light of these factors.

Uncertainties and risks associated with international markets could adversely impact our international operations.

We have significant international operations in Europe, the Middle East and the Far East. In international markets, we are smaller than the principal or incumbent telecommunications carrier that operates in each of the foreign jurisdictions where we operate. In these markets, incumbent carriers are likely to control access to, and the pricing of, the local networks; enjoy better brand recognition and brand and customer loyalty; generally offer a wider range of product and services; and have significant operational economies of scale, including a larger backbone network and more correspondent agreements. Moreover, the incumbent carrier may take many months to allow competitors, including us, to interconnect to our switches within our territory, and we are dependent upon their cooperation in migrating customers onto our network. There can be no assurance that we will be able to obtain the permits and operating licenses required for us to operate; obtain access to local transmission facilities on economically acceptable terms; or market services in international markets. In addition, operating in international markets generally involves additional risks, including unexpected changes in regulatory requirements, taxes, tariffs, customs, duties and other trade barriers, difficulties in staffing and managing foreign operations, problems in collecting accounts receivable, political risks, fluctuations in currency exchange rates, restrictions associated with the repatriation of funds, technology export and import restrictions, and seasonal reductions in business activity. Our ability to operate and grow our international operations successfully could be adversely impacted by these risks.

Because a significant portion of our business is conducted outside the United States, fluctuations in foreign currency exchange rates could adversely affect our results of operations.

A significant portion of our net revenue is derived from sales and operations outside the United States. The reporting currency for our consolidated financial statements is the United States dollar (USD). The local currency of each country is the functional currency for each of our respective entities operating in that country. In the future, we expect to continue to derive a significant portion of our net revenue and incur a significant portion of our operating costs outside the United States, and changes in exchange rates have had and may have a significant, and potentially adverse, effect on our results of operations. Our primary risk of loss regarding foreign currency exchange rate risk is caused by fluctuations in the following exchange rates: USD/EUR, USD/CHF, USD/HKD, USD/CNY and USD/BHD. Due to the large percentage of our operations conducted outside of the United States, strengthening or weakening of the USD relative to one or more of the foregoing currencies could have an adverse impact on future results of operations. We historically have not engaged in hedging transactions and do not currently contemplate engaging in hedging transactions to mitigate foreign exchange risks. In addition, the operations of affiliates and subsidiaries in foreign countries have been funded with investments and other advances denominated in foreign currencies. Historically, such investments and advances have been long-term in nature, and we accounted for any adjustments resulting from currency translation as a charge or credit to accumulated other comprehensive loss within the stockholders’ deficit section of our consolidated balance sheets.

We are substantially smaller than our major competitors, whose marketing and pricing decisions, and relative size advantage, could adversely affect our ability to attract and retain customers and are likely to continue to cause significant pricing pressures that could adversely affect our net revenues, results of operations and financial condition.

The long distance telecommunications, Internet, broadband, DSL, data and wireless industry is significantly influenced by the marketing and pricing decisions of the larger long distance, Internet access, broadband, DSL and wireless business participants. Prices in the long distance industry have continued to decline in recent years, and as competition continues to increase within each of our service segments and each of our product lines, we believe that prices are likely to continue to decrease. Customers frequently change long distance, wireless and broadband providers, and ISPs in response to the offering of lower rates or promotional incentives, increasingly as a result of bundling of various services by competitors. Moreover, competitors’ VOIP and broadband product rollouts have added further customer choice and pricing pressure. As a result, generally, customers can switch carriers and service offerings at any time. Competition in all of our markets is likely to remain intense, or even increase in intensity and, as deregulatory influences are experienced in markets outside the United States, competition in non-United States markets is becoming similar to the intense competition in the United States. Many of our competitors are significantly larger than us and have substantially greater financial, technical and marketing resources, larger networks, a broader portfolio of service offerings, greater control over network and transmission lines, stronger name recognition and customer loyalty, long-standing relationships with our target customers, and lower debt leverage ratios. As a result, our ability to attract and retain customers may be adversely affected. Many of our competitors enjoy economies of scale that result in low cost structures for transmission and related costs that could cause significant pricing pressures within the industry. We compete on the basis of price, particularly with respect to our sales to other carriers, and also on the basis of customer service and our ability to provide a variety of telecommunications products and services. If such price pressures and bundling strategies intensify, we may not be able to compete successfully in the future, may face quarterly revenue and operating results variability, and may have heightened difficulty in estimating future revenues or results.

Our positioning in the marketplace as a smaller provider places a significant strain on our resources, and if not managed effectively, could result in operational inefficiencies and other difficulties.

Our positioning in the marketplace may place a significant strain on our management, operational and financial resources, and increase demand on our systems and controls. To manage this position effectively, we must continue to implement and improve our operational and financial systems and controls, invest in critical network infrastructure to maintain or improve our service quality levels, purchase and utilize other transmission facilities, and train and manage our employee base. If we inaccurately forecast the movement of traffic onto our network, we could have insufficient or excessive transmission facilities and disproportionate fixed expenses. As we proceed with our development, operational difficulties could arise from additional demand placed on customer provisioning and support, billing and management information systems, product delivery and fulfillment, on our support, sales and marketing and administrative resources and on our network infrastructure. For instance, we may encounter delays or cost-overruns or suffer other adverse consequences in implementing new systems when required. In addition, our operating and financial control systems and infrastructure could be inadequate to ensure timely and accurate financial reporting.

We are subject to the economic risks inherent in the Asian and European economies.

An economic crisis in Asia or Europe where a substantial portion of our client base is and will be located could result in a decrease in our revenues. Several countries in Asia have experienced currency devaluation and/or difficulties in financing short-term obligations. We cannot assure you that the effect of an economic crisis on our customers will not impact operations, or that the effect on our customers in that region will not adversely affect both the demand for our services and the collection of receivables.

We could suffer adverse tax and other financial consequences if U.S. or foreign taxing authorities do not agree with our interpretation of applicable tax laws.

Our corporate structure is based, in part, on assumptions about the various tax laws, including withholding tax, and other relevant laws of applicable non-U.S. jurisdictions. We cannot assure you that foreign taxing authorities will agree with our interpretations or that they will reach the same conclusions. Our interpretations are not binding on any taxing authority and, if these foreign jurisdictions were to change or to modify the relevant laws, we could suffer adverse tax and other financial consequences or have the anticipated benefits of our corporate structure materially impaired.

We must attract and retain skilled personnel. If we are unable to hire and retain technical, sales and marketing and operational employees, our business could be harmed.

Our ability to manage our growth will be particularly dependent on our ability to develop and retain an effective sales force and qualified technical and managerial personnel. We intend to hire additional employees, including software engineers, sales and marketing employees and operational employees. The competition for qualified sales, technical, and managerial personnel in the communications industry is intense, and we may not be able to hire and retain sufficient qualified personnel. In addition, we may not be able to maintain the quality of our operations, control our costs, maintain compliance with all applicable regulations, and expand our internal management, technical, information and accounting systems in order to support our desired growth, which could have an adverse impact on our operations.

If we are not able to use and protect our intellectual property domestically and internationally, it could have a material adverse effect on our business.

Our ability to compete depends, in part, on our ability to use intellectual property in the United States and internationally. We rely on a combination of trade secrets, trademarks and licenses to protect our intellectual property. We are also subject to the risks of claims and litigation alleging infringement of the intellectual property rights of others. The telecommunications industry is subject to frequent litigation regarding patent and other intellectual property rights. We rely upon certain technology, including hardware and software, licensed from third parties. There can be no assurance that the technology licensed by us will continue to provide competitive features and functionality or that licenses for technology currently used by us or other technology that we may seek to license in the future will be available to us on commercially reasonable terms or at all.

Risks related to our industry

Changes in the regulation of the telecommunications industry could adversely affect our business, revenue or cash flow.

We operate in a heavily regulated industry. The majority of our revenue has been generally supported by and subject to regulation at the federal, state and local level. Certain foreign, federal, and state regulations and local franchise requirements have been, are currently, and may in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals. Such proceedings may relate to, among other things, the rates we may charge for our local, network access and other services, the manner in which we offer and bundle our services, the terms and conditions of interconnection, unbundled network elements and resale rates, and could change the manner in which telecommunications companies operate. We cannot predict the outcome of these proceedings or the impact they will have on our business, revenue and cash flow.

If competitive pressures continue or intensify and/or the success of our new products is not adequate in amount or timing to offset the decline in results from our legacy businesses, we may not be able to service our debt or other obligations.

There are substantial risks and uncertainties in our future operating results, particularly as aggressive pricing and bundling strategies by certain incumbent carriers and incumbent local exchange carriers have intensified competitive pressures in the markets where we operate, and/or if we have insufficient financial resources to market our services. The aggregate anticipated margin contribution from our new products may not be adequate in amount or timing to offset the declines in margin from our legacy long distance voice and dial-up ISP business.

We experience intense domestic and international competition which may adversely affect our results of operations and financial condition.