UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________________ to ____________________

000-30061

(Commission file No.)

ELEPHANT TALK COMMUNICATIONS, INC.

(Exact name of small business issuer as specified in its charter)

| CALIFORNIA | 95-4557538 | |

| (State or other jurisdiction of | (I.R.S. employer identification no.) | |

| incorporation or organization) |

19103 Centre Rose Boulevard

Lutz, FL 33558

United States

(Address of principal executive offices)

+ 1 813 926 8920

(Issuer's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $38 million based on the closing sale price of the Company’s common stock on such date of U.S. $1.82 per share, as reported by the OTC BB.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of March 29, 2011 there were 98,820,013 shares of common stock outstanding.

Documents incorporated by reference: None.

Elephant Talk Communications Inc.

Form 10-K

For the fiscal year ended December 31, 2010

TABLE OF CONTENTS

| Note on Forward-Looking Statement | 3 | ||

| PART I | 4 | ||

| Item 1. | Description of Business. | 4 | |

| Item 1A. | Risk Factors. | 21 | |

| Item 1B. | Unresolved Staff Comments. | 30 | |

| Item 2. | Description of Property. | 30 | |

| Item 3. | Legal Proceedings. | 30 | |

| Item 4. | Removed and Reserved. | 31 | |

| PART II | 31 | ||

| Item 5. | Market for Common Equity and Related Stockholder Matters. | 31 | |

| Item 6. | Selected Financial Data. | 33 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 34 | |

| Item 7A. | Quantative and Qualitative Disclosures about Market Risk. | 44 | |

| Item 8. | Financial Statements. | 45 | |

| Item 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure. | 73 | |

| Item 9A. | Controls and Procedures. | 73 | |

| Item 9B. | Other Information. | 74 | |

| PART III | 75 | ||

| Item 10. | Directors, Executive Officers and Control Persons. | 75 | |

| Item 11. | Executive Compensation. | 81 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters. | 85 | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 87 | |

| Item 14. | Principal Accountant Fees and Services. | 88 | |

| PART IV | 89 | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 89 | |

2

NOTE ON FORWARD LOOKING STATEMENTS

This Report, including the documents incorporated by reference in this Report, includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Our actual results may differ materially from those discussed herein, or implied by, these forward-looking statements. Forward-looking statements are generally identified by words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “project” and other similar expressions. In addition, any statements that refer to expectations or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements included in this Report or our other filings with the SEC include, but are not necessarily limited to, those relating to:

| · | risks and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future; |

| · | our possible inability to raise or generate additional funds that will be necessary to continue and expand our operations; |

| · | our potential lack of revenue growth; |

| · | our potential inability to add new products and services that will be necessary to generate increased sales; |

| · | our potential lack of cash flows; |

| · | our potential loss of key personnel; |

| · | the availability of qualified personnel; |

| · | international, national regional and local economic political changes; |

| · | general economic and market conditions; |

| · | increases in operating expenses associated with the growth of our operations; |

| · | the possibility of telecommunications rate changes and technological changes; |

| · | the potential for increased competition; and |

| · | other unanticipated factors. |

The foregoing does not represent an exhaustive list of risks. Please see “Risk Factors” for additional risks which could adversely impact our business and financial performance. Moreover, new risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Report are based on information available to us on the date of this Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Report.

3

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Our Company

Elephant Talk Communications, Inc. also referred to as “we”, “us”, “Elephant Talk” and “the Company” is an international provider of business software and services to the telecommunications and financial services industries. Elephant Talk provides global telecommunication companies, mobile network operators, banks, supermarkets, consumer product companies, media firms, and other businesses a full suite of products and services that enables them to fully provide telecom services as part of their business offerings. The company offers various dynamic products that include remote health care, credit card fraud prevention, mobile internet ID security, multi-country discounted phone services, loyalty management services, and a whole range of other emerging customized mobile services.

Converged telecommunication services – full MVNE solutions.

The Company is a niche player in the converged telecommunications market, providing traffic and network services as a licensed operator, and specializing in carrier grade mobile enabling platforms to provide outsourced solutions to the various players in the telecommunications’ value chain, including MNOs, MVNOs and non-operator companies in need of both mobile as well as specialized land-line telecommunication services. In this chain we position ourselves as a Full Mobile Virtual Network Enabler , including also customized mobile services such as our network integrated ValidSoft security and fraud prevention solutions.

ValidSoft – electronic fraud prevention

Our acquisition of ValidSoft Ltd. (“ValidSoft”) gives us a position in providing solutions to counter electronic fraud through card, internet and telephone channels. ValidSoft is a leader in this market. ValidSoft's solutions are telecommunications based and are at the cutting edge of the market, utilizing their access to the most sophisticated global telecommunications networks and expertise. The solutions are used to combat card-present and card-not-present fraud as well as electronic fraud on all channels, including the most advanced fraudulent attacks such as Man-in-the-Browser on the internet. The solutions are designed for mass markets, in a highly cost effective and secure manner, yet are easy to use, intuitive and leverage the most ubiquitous devices available. VALid-POS® was awarded the European Privacy Seal in March 2010, certifying its compliance with European Data Protection and Data Privacy legislation. ValidSoft is the only security software company in the world to be certified to European standards.

Landline network outsourcing services

Through our fixed line telecom infrastructure and our centrally operated and managed IN-CRM-Billing platform, we also provide traditional telecom services like Carrier Select and Carrier Pre-Select Services, Toll Free and Premium Rate Services to the business market.

Overview

We are an international provider of business software and services to the telecommunications and financial services industry. Elephant Talk installs its operating software at the network operating centers of mobile carrier and receives a monthly fee per cell phone subscriber on the network. Currently the subscribers are wholesale customers of Vizzavi (a subsidiary of the Vodafone group) in Spain and T-Mobile in the Netherlands. Furthermore we signed a framework hosting agreement with KPN Group Belgium NV to make use of their radio network for us to connect MVNO customers in Belgium. Just recently, the company closed a contract in the Middle East to install its mobile platform which is planned to be operational in the course of 2011. Elephant Talk typically signs a five- year exclusive with one carrier per country. Negotiations with mobile carriers are currently under way in a number of other countries. We also operate landline telephony services in nine European countries and Bahrain. Our network components, hardware, software systems, telecom switches and interconnections with other telecom operators are located in secured data-centers in eight countries.

Our ET Boss software enables mobile carriers to outsource their entire back office to Elephant Talk. By outsourcing operations the mobile carriers can reduce the number of vendor software, employees, and consultants. ET Boss reduces the number of software modules / vendors from over twenty to one. Additionally, ET Boss enables mobile virtual network operators (MVNOs) to control their pricing and product offerings with the touch of a keypad from a Windows interface. This compares with the current situation often experienced by virtual operators whereby it can take up to six month to effect a change in their product offerings.

4

Due to the large operational expenditures required to operate and maintain switches and network infrastructure, due mostly to the very high levels of complexity, mobile network operations such as Sprint have already been outsourced (to Ericsson) in an effort to reduce costs. Now Elephant Talk offers a comparable possibility of fully outsourcing the complete IT back office of any mobile operator. We believe that our software platform offers thereby not only a substantial reduction in cost, but also provides much higher service levels and flexibility. We are currently providing these services to Vodafone’s subsidiary in Spain and T-Mobile in the Netherlands, and will start to connect MVNOs in Belgium this year to the network of KPN Group in Belgium. We simply take three pipes from the mobile network operator (MNO) – voice, data, and signaling (see above) – and plug them into our ET Boss platform (see below).

5

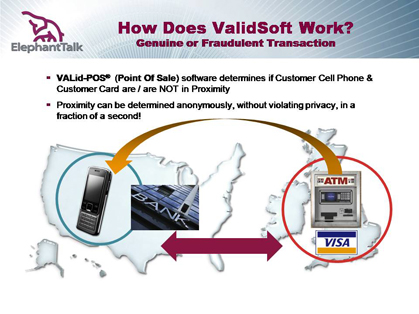

We are developing and acquiring application software to enable our virtual clients to offer various dynamic products that include remote health care monitoring on a watch or pendant, credit card fraud prevention, mobile internet ID security, multi-country discounted phone services, loyalty management services, and a whole range of other emerging customized mobile services. In line with our strategy to develop and market customized mobile solutions, we acquired ValidSoft, Ltd. on March 17, 2010. ValidSoft provides strong authentication and transaction verification capabilities that allow organizations to quickly implement solutions that protect against certain of the latest forms of credit and debit card fraud, and on-line transaction and identity theft. By correlating the relative location of a person’s credit card with the location of their mobile phone, this service can tell a bank in real-time if the transaction is likely genuine or fraudulent (see diagram below). We anticipate generating revenues on a per transaction verification fee from banks. This acquisition combines ValidSoft’s best in class proprietary software with our superior telecommunication platform to create what we believe is the best electronic fraud prevention total solution available.

In 2010 we generated almost $40 million in revenues and employed 88 employees and retained 42 independent contractors on a long-term basis. Our principal offices are located in The Netherlands, Spain, China and London. Mobile services are currently provided in Spain and The Netherlands, whereas landline telephony services are provided in nine European countries and Bahrain. Our network components, hardware, software systems, telecom switches and interconnections with other telecom operators are located in secured data-centers in eight countries.

Background of Elephant Talk Communications, Inc.

Elephant Talk Communications Inc. was formed in 2001 as a result of a merger between Staruni Corporation (USA, 1962) and Elephant Talk Limited (Hong Kong, 1994). Staruni Corporation - named Altius Corporation, Inc., until 1997 - was a web developer and Internet Service Provider since 1997 following its acquisition of Starnet Universe Internet Inc. Elephant Talk Limited (Hong Kong) began operating in 1994 as an international long distance services provider, specializing in international call termination into China. In 2006 Elephant Talk Communications, Inc., decided to abandon its strategy of focusing on international calls into China.

In 2000 Staruni Corporation became a reporting company on the OTC Bulletin Board under the symbol “SRUN”, replaced by “ETLK” following the merger with Elephant Talk Limited (Hong Kong), and in turn changed to “ETAK” pursuant to a 2008 stock-split.

In January 2007, through our acquisition of Benoit Telecom (Switzerland), we established a foothold in the European telecommunications market, particularly within the market for Service Numbers (Premium Rate Services and Toll Free Services) and to a smaller extent Carrier (Pre) Select Services. Furthermore, through the human capital, IT resources and software acquired, we obtained the experience and expertise of individuals and software deeply connected to telecom and multi-media systems, telecom regulations and European markets.

In March 2010, we acquired ValidSoft. This acquisition is in line with our strategy to develop and market customized mobile solutions. ValidSoft provides strong authentication and transaction verification capabilities that allow organizations to quickly implement solutions which protect against the latest forms of credit and debit card fraud, on-line transaction and identity theft. This acquisition combines ValidSoft’s best in class proprietary software with our superior telecommunication platform to create the best electronic fraud prevention total solution available on the market today. Further details on the above acquisitions, other (smaller) acquisitions and incorporations can be found under “legal structure of the company”.

6

Product – Service Strategy

Our corporate strategy results in the following three main types of value propositions offered to the market, each building upon our converged network and access capabilities in combination with “ET Boss”, our proprietary telecommunications Operating Support System (OSS) and Business Support System (BSS):

| · | Customized mobile services, such as our ValidSoft credit card fraud solution |

| · | Mobile Enabling Platform (ET BOSS), including our MVNE/MVNO services |

| · | Landline network outsourcing services |

Industry Developments

A number of relevant factors in the converging telecommunications industry, combined with consumers and businesses increasing adoption of mobile and wireless based applications, drive our investments and services, are as follow:

The mobile phone will become the channel of choice for consumers

We believe that the mobile phone will ultimately be the (handheld) device chosen by consumers and businesses to best bring personalized, contextual and time-wise relevant services such as:

| · | mobile banking |

| · | telemedicine |

| · | location based services |

| · | use of near field communications for cashless payments, couponing, cashless tickets, vending machine payments, grocery store payments |

| · | credit card applications |

| · | communities; social, entertainment and loyalty |

| · | customer profiling and data mining to support one-on-one marketing |

| · | security and trust sensitive applications; the mobile phone as authenticator. |

Mobile operators need to reduce total cost of ownership (TCO) and increase utilization of their assets

Mobile Network Operators typically have twenty or more vendors for their software to handle Network Management, Customer Relationship Management (CRM), billing, fulfillment, distribution and customer care. This has resulted in legacy systems that are expensive to maintain and difficult to adapt to changing market conditions. In addition, MNOs are looking for new ways to attract traffic over their networks, since the traditional mass marketing of voice and messaging focused on end-users (“retail”) shows little or no growth. MNOs are required to shift their organization from a mass marketing oriented retail focus to a wholesale focus; thereby allowing other organizations such as MVNOs to serve smaller and specifically targeted end-user groups with specialized and converged solutions in order to increase traffic (e.g. voice, text, data or media) over the operators networks.

Trust and security aspects are increasingly important in a networked and digitalized environment

The open nature of the Internet as well as exponential digitalization and globalization of society has resulted in increased (international) fraud, attention for privacy intrusions and national security concerns.

7

MVNO telecommunication markets

By Informa1

Western Europe and North America, both expected to grow in terms of MVNO subscription numbers, are not expected to see a radical shift in terms of market structure. The global MVNO market will reach 186 million subscriptions by the end of 2015 with North America and Western Europe still accounting for the vast majority. These two regions will remain the largest MVNO markets in terms of the number of subscriptions and players and will also continue to top the ranks in terms of MVNO penetration.

By Ovum2

Global mobile virtual network operator (MVNO) connections are forecast to reach 85.6 million by 2015, and revenues are expected to be $9.5 billion. Over the next five years, new MVNO markets are expected to open up in South and Central America, Asia-Pacific, and in the Middle East. However, there are still regulatory and market challenges to overcome before these markets can offer an environment that can sustain MVNO activity. Therefore, we expect the bulk of MVNO connections and revenue growth from 2010–15 will come from established MVNO markets in Western Europe, Asia-Pacific, and North America.

Established MVNO markets will drive growth

Global MVNO connections are forecast to reach 85.6 million by 2015, and revenues are expected to be $9.5 billion. The bulk of global MVNO connections growth will come from established MVNO markets in Western Europe, Asia-Pacific, and North America.

In Western Europe, the fastest-growing MVNO markets are Germany, France, Italy, Spain, and the Netherlands. Germany and the Netherlands have been the largest MVNO markets (in terms of the number of MVNOs) for many years, and this will not change over the forecast period, especially as both markets are regarded as good testing grounds for MVNOs looking to trial new business models.

Emerging markets warming to MVNOs

While currently there are very few MVNOs in emerging markets, more markets are expected to introduce MVNOs over the forecast period. MVNOs are expected to move into markets in Brazil and Chile in South and Central America; Turkey in the Middle East; and India, Pakistan, and Vietnam in Asia-Pacific. Markets such as Brazil and India present an attractive opportunity for MVNOs, but there are still a number of obstacles impacting MVNO development in these markets including a lack of cooperation from mobile network operators (MNOs) and a lack of regulation to facilitate new MVNO entrants. Therefore, we expect the majority of new MVNO markets to remain relatively small and have minimal impact on global MVNO connections and revenues.

MVNO revenues to remain steady

Global revenues are forecast to remain steady over the next five years. Currently, Western Europe and the US account for over 84% of global MVNO revenues, and by 2015 we forecast that this figure will fall marginally to 80%. MVNO markets in South and Central America and the Middle East are expected to make up a greater share of global MVNO revenues over the forecast period. In 2009, South and Central America and the Middle East contributed approximately 1% to global MVNO revenues, and we forecast that this will increase to 6% by 2015.

MVNOs have explored numerous segments

MVNOs have been in operation for over a decade, and in this time it has become clear which business models have been successful and which have been failures. “Tried and tested” MVNO business models include targeting low-spending customers by offering no-frills domestic and international mobile services, and targeting businesses and households by offering mobile and fixed service bundles. MVNOs have also had success in other niche segments, such as focusing on the wealthy, charities, or offering gender-specific services. All of these models have proven lucrative for MVNOs and have presented them with good opportunities in most markets. However, while targeting the right segment is extremely important for MVNOs, their success is also dependent on market conditions, competition, and execution.

1 Extract Global MVNO Forecast to 2015, © 2011 Informa Telecom & Media, Publication Date 22 March 2011

2 Reference Code: OVUM052659, Publication Date: 31 August 2010

8

Electronic and card fraud markets

The solutions from Validsoft are targeted to combat electronic fraud across card, internet and the telephone channels. Card fraud in the US is estimated to be $100 billion p.a. and $330 billion p.a. globally with the other channels accounting for additional fraud of $50billion p.a and $150 billion p.a. respectively. The total addressable market is $450 billion p.a whereby a recent report from the U.K. government on National Security Strategy even estimates cybercrime numbers of $1,000 billion. Through the ValidSoft technology the extent of this endemic problem can be reduced through reducing the direct impact of fraud, reducing operating costs and improving the customer experience. These solutions also provide an environment which allows banks and other institutions to automate manual process safely and securely.

Summary Services and Solutions

ValidSoft: customized mobile solution for credit card fraud prevention

ValidSoft provides strong authentication and transaction verification capabilities, which allow organizations to quickly implement solutions that protect against the latest forms of credit and debit card fraud, on-line transaction and identity theft. ValidSoft’s advanced proprietary software combined with what we believe is a superior telecommunication platform to create a leading electronic fraud prevention total solution.

We believe the ValidSoft solution can have large cost reduction potential for financial institutions around the world that have losses associated with fraud losses, false positives and administration in connection with credit and debit card fraud. ValidSoft has successfully completed trials with four major commercial banks, has entered into an agreement with Visa Europe and is in advanced discussions with other leading global payment processors, international banks and credit card providers. ValidSoft was recently awarded the European Privacy Seal from EuroPrise3, underscoring the prudent set-up of its systems as to privacy matters.

MVNE/MVNO

Since 2006, significant investments have been made in mobile enabling services and platforms. We invest and operate as a full Mobile Virtual Network Enabler (MVNE), offering MNOs various parts of the back office network including core network, messaging platforms, data platforms and billing solutions. As a result, we are positioning ourselves as the MVNE partner of choice for the larger, global MNOs, and a one-stop convergent solutions provider for specialized MVNO customers.

The first revenues from these mobile services began during the fourth quarter of 2008 with T-Mobile in the Netherlands and with Vizzavi (a subsidiary of Vodafone group) in Spain during 2009. Currently we have 8 MVNOs running on our platforms in The Netherlands and Spain, and are expanding our geographic service areas. Following a recent closing of a contract in the Middle East we will be operational in the Middle East in the course of 2011 and we have planned an operational start in Belgium this year.

Currently we are negotiating agreements with various MNOs and MVNOs in numerous countries in order to realize our strong growth objectives, both in revenues and margin improvement.

Landline Outsourced solutions

At the base of our advanced mobile services, and currently still the largest revenue contributor4, is our landline services, which we offer in nine European countries and Bahrain. These services are provided by operating a switch-based telecom network with national licenses and direct land line interconnects with the Incumbents/National Telecom Operators. Together with our centrally operated and managed IN-CRM platform, we offer geographical, premium rate, toll free, personal, nomadic and Voice over Internet Protocol (“VoIP”) services to our primarily business customers. We position our customers as if they are a fully networked telecommunications company themselves by providing them with the tools and resources necessary to manage their businesses, particularly the telecommunications segment, as an integrated component of their overall offering.

3 EuroPriSe is an initiative led by the Unabhaengiges Landeszentrum fuer Datenschutz (“ULD”, Independent Centre for Privacy Protection), Germany. EuroPriSe was funded with 1.3 million Euro by the European Commission's eTEN program. The EuroPriSe project consortium led by ULD included partners from eight European countries: the data protection authorities from Madrid (Agencia deProteccion de Datos de la Communidad de Madrid, APDCM), and France (Commission Nationale de l'Informatique et de Libertes, CNIL), the Austrian Academy of Science, London Metropolitan University from the UK, Borking Consultancy from the Netherlands, Ernst and Young AB from Sweden, TUeV Informationstechnik GmbH from Germany, and VaF s.r.o. from Slovakia. http://www.european-privacy-seal.eu/

4 but not the largest margin contributor as a result of the low margins of landline services.

9

Network

Landline and Mobile Network

Our network is based on landline and MVNO telecommunications licenses, mobile access agreements and network interconnections. Our geographical cross-border footprint, established through existing relationships with national telecom incumbents, is well positioned for international traffic because we have established our own facilities-based infrastructure on two continents. Currently, as a fully licensed carrier, we are interconnected with incumbents in the Netherlands (KPN), Spain (Telefonica), Austria (Telekom Austria), Belgium (Belgacom), Switzerland (Swisscom), Italy (Telecom Italia), the United Kingdom (BT) and Bahrain (Batelco). Through partners, we have access to interconnections in France, Germany, Poland, Finland, Sweden, Norway and Ireland. For our premium rate services we added to our national interconnect with KPN a direct connection in the Netherlands with the mobile operators Vodafone and T-Mobile.

For our mobile services we need, in addition to the landline interconnections and switch facilities, mobile access coverage. In 2008 we entered into our first MVNE agreement with T-Mobile/Orange in the Netherlands where in 2010 we were servicing six of our own MVNOs. In 2009 we were awarded an MVNE agreement with Vizzavi (a subsidiary of the Vodafone group) of Spain, and provide managed services for their MVNO portfolio, to be followed by the hosting of our own MVNOs. In 2010 we signed an MVNE framework hosting agreement with KPN Group Belgium NV with a planned start of service this year.

In order to reduce the investments required for our MVNOs, as well as increase our flexibility and depth of mobile service offerings to MVNOs and MNOs, we operate as a full MVNE; meaning that we procure, integrate and operate the relevant mobile components, including core network, application platform, subscriber management and MVNO billing and CRM.

Network Operations Center (NOC)

Our global 24/7 Network Operations Center is located in Guangzhou, China and remotely monitors the quality of all landline, data and mobile services throughout our global clear bandwidth and IP network. Our datacenters, network and network nodes are primarily located in Europe.

Proprietary Software Technology

ET’s Business Operating Support System (“ET BOSS”)

| § | To maintain flexibility and allow for growth, we have chosen to develop our own proprietary software and systems including: 1) a fully integrated rating, mediation, and provisioning CRM and billing system for multi-country and multimedia use, and applications, and 2) an advanced Infitel IN platform. |

| § | Our internally developed customer provisioning, rating and billing system, also known as “ET BOSS”, ensures proper support for all of our services. We believe our network and system platforms are able to handle the high demands of national incumbents and other telecom operators on our globally interconnected network. The key component of our business strategy is the fully automated capturing and recording of any event on our global network through a standard Call Data Record, or CDR. CDRs are globally recognized and accepted by all of our suppliers and customers because of their high quality, reliability and consistency. As a result, on a real time/on-line basis, we believe our billing engine provides reliable inter-company payment overviews, and will continue to do so as we develop and implement our global network. |

| § | The core modules have been designed to address all of our major business processes, and those of our partners in such a manner that the state of the art flexibility, level of integration and dynamic feature set ensures rapid and low-cost deployments. The core modules and their sub-modules include amongst others: |

| § | Billing; (dynamic) rating management, bill mediation, invoicing and automatic payment script generation |

10

| § | Payment; credit card, direct debit, Paypal etc. enabled functionalities |

| § | Provisioning; switches, HLR, porting |

| § | Self Care; mobile, carrier(pre)select, premium rate & toll free services |

| § | CRM ; trouble ticketing, customer management, provisioning |

| § | Sales & Marketing; prospect management, sales management, analysis tools |

| § | Revenue Collection Assurance; end-user credit management, credit control, fraud management, routing analysis |

| § | Control; dashboard overview, reporting, quality analysis, quality control |

The sub-modules are unique and tailored to local situations.

Infitel Suite - IN Platform

In order to achieve real time session control, rating and charging, telecom value added applications as well as improved enrichment of data generated in and passing through our networks, we have acquired the carrier grade next generation IN (Intelligent Network) platform “Infitel”, including the source code and trademark. We own and develop this platform, thereby ensuring the flexibility and integration we strive for in and between all our software and network components.

Inficore is the core of the IN platform, defines the framework, administrative modules and SLP (Service Logic Processor) that runs the scripts (call flows) created with Infiscript.

Infiscript is the SCE (Service Creation Environment) this is a graphical suite with which the call flows and business logic can be developed and compiled to be distributed to running Inficore environments.

Infitel Suite comprises the applications and call-flows that are running on top of Inficore and that have been created with Infiscript, customized SIBs (C++ core code) and stored procedures.

The Infitel Suite comprises amongst others the following value added services:

Intelligent Call Routing, Service Numbers

| § | Universal Prepaid (Residential, Phoneshop, Reseller) |

| § | Flexible Number Portability |

| § | EasyVote (Televoting) |

| § | VPN/CUG |

| § | Advanced Call Completion |

| § | NJoy-Dial |

| § | Personal Call Manager |

| § | Advanced Business Communication |

| § | Zonal Call Manager |

ValidSoft - Fraud Prevention and Security Software Solutions

In 2009, we began investing and developing the integration of our systems into those of (at that time still) joint venture partner ValidSoft, in order to be able to offer a full fledged security solution over mobile networks. These investments in development were part of our overall strategy to becoming a leading player in the area of “Customized Mobile Solutions”.

ValidSoft, as a software engineering company, has made significant investments in intellectual property in processes and software pertaining to Intelligent Identity & Transaction Verification, and is considered to have developed thought leadership in countering electronic fraud. The essence of the ValidSoft product suite is in providing Card-(not) Present fraud prevention, on-line Banking fraud prevention, Strong Mutual Authentication (multi-channel), Transaction Verification (Out of Band – OOB), Identity Verification and Non-Repudiation.

11

The main components of the VALid® product suite are:

| · | VALid-IVR is the Real-Time Interactive Voice Response (IVR) Internet, Phone Banking and Call Center mutual authentication and transaction verification solution providing a holistic multi-channel approach to fraud prevention. VALid-IVR provides outbound and inbound telephony all with configurable Transaction Verification. VALid-IVR integrates with Text-To-Speech (TTS), Speech Recognition and Voice Biometrics functionality, providing a seamless and intuitive customer experience while delivering the most secure and functionally rich authentication capability available. |

| · | VALid-SMS is the Store-and-Forward based protocol that provides Standard, Premium and Flash based messages, all with configurable Transaction Verification. Though SMS does not provide the multi-channel capability and real-time conversational functionality of voice services, it is a simple delivery mechanism for alerts, OTP’s (One Time Passcodes) and lower priority messages, and provides a migration path strategy for organizations wishing to extend their existing SMS based solutions. |

| · | VALid-SVP stands for Speaker Verification Platform and is the biometric voice verification capability of the VALid® platform. The VALid-SVP solution is based on a completely modular, plug-in based architecture that allows organizations to integrate their existing or preferred biometric engines into the VALid® framework. VALid-SVP supports text-dependent, text-independent and conversational voice verification models, all deliverable over multiple electronic channels. ValidSoft’s own biometric voice verification engine is based on Alize, a state-of-the-art speaker verification platform developed in the European Union. |

| · | VALid-TDS is the Transaction Data Signing capability of VALid®, crucial in the provision of Non-Repudiation for Internet based financial transactions. VALid-TDS cryptographically ties the One Time Passcode (OTP) to the underlying transaction, as distinct to a randomly generated OTP. This enables the underlying transaction detail to be determined through the code, critical in proving or disproving transaction repudiation. VALid-TDS also interoperates with external tamper evident stores, storing the encrypted transaction data, authentication details and real-time call recording for further use in Non-Repudiation. |

| · | VALid-POS® is the Card-Present fraud prevention solution from ValidSoft. VALid-POS® targets one of the fastest growing fraud threats; card skimming. VALid-POS® combines the functionality of VALid’s real-time Out-of-Band transaction verification capability with proximity based mathematical models that assists banks in determining whether the genuine customer is conducting the card-based transaction. Where in doubt, VALid® can contact the customer and resolve the potential threat in real-time, providing massive advantages to bank and their customers alike. |

| · | VALid-ARM stands for Advanced Risk Management and provides organizations with a suite of tools to enhance their fraud prevention capability and increase the effectiveness of their risk management function. Included within VALid-ARM is the Risk Adjusted Rules Engine (RARE), real-time alerting, Panic-PIN, advanced voice analysis techniques such as voice pattern analysis and VALid’s proximity correlation tool VALid-POS. |

| · | VALid-TTS - The pluggable Text-to-Speech option that can run in parallel with a WAV based voice service or replace it completely. VALid-TTS enables organizations to apply Transaction Integrity Verification (TIV) to totally dynamic data such as individual or company names and address information. A classic example of a manual transaction that could be enabled for the web is an Address Change, where VALid-TTS would be used to perform the TIV function on the actual address detail. |

| · | VALid-VPN - The Virtual Private Network client that allows users to gain secure remote access to an organization’s protected network. Remote network access is becoming a greater issue for many organizations through the growth of home working, remote workers, extended enterprise and disaster recovery and business disruption planning. VALid-VPN supports most of the major remote access solution providers, including Citrix, Juniper, Checkpoint and Cisco. The VALid-VPN solution has been designing as a generic solution enabling simple, low-cost integration into additional remote access technologies and providers, should this be necessary. |

12

| · | VALid-ISA - VALid’s ISA integration provides secure access to applications accessed through ISA, e.g. Microsoft OWA. Currently many companies disallow remote access to ISA hosted applications (e.g. OWA) due to security concerns. VALid-ISA solves this problem and, through its zero client-footprint model, enables instant wide scale distribution. VALid-ISA also enables one secure point of access to any number of web based application sitting behind ISA. |

Products

Full MVNE

We are positioning ourselves as a complete MVNE with our own integrated platforms, switches and network capabilities for back-office and customer interaction solutions. The back-office services range from provisioning and administration to Operations Support Systems (“OSS”) and Business Support Systems (“BSS”) running on our global IN/CRM/Billing platform “ET BOSS”. Our “ET BOSS” platform is designed to provide an all-in-one solution for both the traditional MNOs: (i) the operators of large antenna networks and (ii) managers of wireless spectrum granted through licenses by national governments, as well as for MVNOs. MVNOs are generally fast-moving sales and marketing companies reselling refocused, re-priced, re-bundled and repackaged mobile telecom services. We partner with MNOs to bypass their legacy systems to profitably accommodate these wholesale MVNO customers with service levels and applications that satisfy the instant service flexibility, and pricing capability that MVNOs require to specifically address their niche markets. At the same time, we can offer additional market share to MNOs by marketing and contracting our own range of MVNOs that look for the very specific capabilities that our mobile service delivery platforms may offer. Bundled together with attractively priced wholesale airtime packages provided by our MNO partners, our MVNOs are positioned to run their operations effortlessly without the technical and financial burden associated with the development, maintenance and ownership of their own mobile network, while at the same time focusing on sales, marketing and distribution and the application of all elements required to be successful in these rapidly evolving consumer markets.

These in-depth MVNE platform services are now fully operational in The Netherlands as of the end of 2008 and since June 2009 in Spain with a planned operational start in Belgium this year. Following a recent closing of a contract in the Middle East we will be operational in the Middle East in the course of 2011.

For companies that aspire to enter the mobile telephone market, the MVNO business model is attractive because it eliminates the expenses associated with establishing and managing a mobile network of their own. The initial capital expenditures required to enter the field are very low, as are the corresponding operational costs. Traditionally MNO and MVNO propositions required substantial capital and operational expenditures and attention to multiple technical components. Our business model offers a solution for MVNOs, which allows them to concentrate on sales and marketing, and which allows MNOs to cater to often smaller, niche market MVNOs without the cumbersome burden of their legacy systems and other resources, which are not designed to efficiently service such wholesale customers.

In addition to the more traditional voice and SMS services, we are focusing our MVNE platform on wireless data services, content, applications and E-commerce. The traditional voice services of MVNOs are likely to be marginalized over time and will follow a similar price erosion pattern as landline telecom services. Therefore, it is unlikely MVNOs will be able to effectively compete over time without value-added services. Moreover, the emerging market of 3G/3.5/4G mobile services, including WIFI, WIMAX and LTE, create great opportunities to attract new subscribers with new and improved business models. Mobile devices are an effective medium to communicate commercial messages to subscribers, especially if supported by legitimate customer profiling tools in combination with our IN/CRM/Billing platform “ET BOSS”. Mobile messages can be personalized per subscriber becoming contextually relevant, and thereby migrate from being perceived as intruding advertising to meaningful information, segmented within the client base or just to be used as a mass communication means. A mobile device is one of the most personal communication tools to connect with and stimulate customers, thus an MVNO channel might offer excellent opportunities to a variety of companies with a non-telecommunication core business, such as fast moving consumer goods companies (“FMCGs”) looking to expand and broaden their markets, while at the same time creating focused marketing communication channels with their existing customer bases, providing these contextual services that, we believe, will be perceived as adding value to communications. We are well positioned to provide such market entrants with a one stop, full service and instantly available platform to effectively cater to these markets, and thereby support any application that might help our customers to quickly offer a truly differentiating service into the marketplace. We believe that many new business models, especially within security, logistics, heath care and banking, will become viable through a networked environment, thereby helping such businesses to enter such models without having to go through yearlong learning cycles to understand, master and manage all the relevant technologies. We are positioning ourselves as the enabling technology partner for these new entrants, covering all technology elements and deliver all the tools these future business partners require to drive these new business models successfully.

13

Through an integrated platform built around our network we offer our customers a turnkey solution for both pre-paid and post-paid mobile services, as well as more traditional landline telecommunication services like toll free, shared cost and premium rate services, supported by content & payment provisioning systems.

Our global network enables our customers to distribute all their information in a fully managed environment that we believe is more secure than the Internet. Together with a fully integrated back office system, we are opening up these networked platforms to our B2B customers, providing them with an efficient and effective tool designed to substantially improve their productivity. Additionally, through a customer friendly, web-based interface, our customers may run these networked delivery platforms as if they were their own. This feature will allow our B2B customers to see mobile, landline, Internet, WiFi, WiMax and local, regional or multi-country, as just one integrated network, with all of the advantages of one single network interface, centralized customer recognition and financial controls.

With the support of our back office system combined with our integrated “ET BOSS” system, we believe our B2B customers have all the necessary tools to create their own virtual telecom business environment; thereby enabling our customers to recognize and serve their own clients, employees, partners or affiliates through any device, at any place and at any time. Our vision is that access to our global network will revolve around our central data and information base, which will allow our customers to provide their clients with worldwide access authorization to our services through a familiar interface and/or workplace, preferred format and language.

Customized Mobile Solutions – ValidSoft Fraud prevention and security solutions

The essence of the ValidSoft product suite is in providing:

§ Card-Present fraud prevention and resolution – Card Skimming is one of the fastest growing fraud threats. In the US alone, this type of fraud in 2008 was reported as costing the Financial Services Industry over fifty billion $US, and a leading research company is predicting that the cost of plastic card fraud will rise three-fold over the next 3 to 5 years. VALid-POS combines the functionality of VALid’s real-time Out-of-Band transaction verification capability with proximity based mathematical models that assists Issuing Banks in determining whether the genuine customer is conducting the card-based transaction. Where in doubt, VALid® can contact the customer and resolve the potential threat in real-time.

§ Card-not-Present fraud prevention and resolution – Card-not-Present fraud, i.e. fraud associated with online retailing, is a significant problem worldwide. The vast majority of this type of fraud involves the use of card details that have been fraudulently obtained through methods such as skimming, data hacking or through unsolicited emails or telephone calls. The card details are then used to make fraudulent card-not-present transactions, most commonly via the Internet. As the number of Internet retailers has grown, fraudsters have increasingly targeted the online shopping environment. In the US alone, this type of fraud in 2008 was reported as costing the Financial Services Industry over fifty five billion $US, and a leading research company is predicting that the cost of card-not-present fraud will rise three-fold over the next 3 to 5 years. VALid-POS combines the functionality of VALid’s real-time Out-of-Band transaction verification capability with proximity based mathematical models that assists retail providers in determining whether the genuine customer is conducting the online transaction. Where in doubt, VALid® can contact the customer and resolve the potential threat in real-time.

14

§ Online Banking fraud prevention – Online banking fraud is a significant threat to the take-up of online banking worldwide. Fears concerning the safety of this type of banking transactions prevent banks from realizing the massive cost savings provided by self-service online banking. Globally less than 50% of internet users bank online and security fears remain the primary inhibitor of take-up. VALid’s real-time Out-of-Band strong mutual authentication and real-time transaction verification enables the bank to apply a real-time dynamic rules engine to identify anomalies and to contact the customer and verify the transaction in real-time.

§ Strong Mutual Authentication (multi-channel) – the need for the customer to know that the bank is genuine is just as important as the need for the bank to know that it is transacting with the genuine customer - this is essential in terms of fostering consumer confidence, the lack of which is the single most significant deterrent in terms of the adoption of online commerce. This is termed “Mutual Authentication” and VALid® has one of the most intuitive and strongest forms of Mutual Authentication available;

§ Transaction Verification (Out-of-Band – OOB) – even if both parties to a transaction are genuine there is no guarantee that the transaction will not be corrupted. A “Man-in-the-Middle” or “Man-in-the-Browser” attack will succeed no matter how strong the authentication process. Therefore banks need Transaction Verification. Most banks monitor transactions to identify anomalies. When an exception is detected, banks for the most part rely on a manual process of contacting the customer by phone to verify the legitimacy of the transaction – this is expensive and also prone to security risk itself as the customer is forced to reveal security credentials to unknown third parties. VALid® addresses this issue since it has the ability to verify the integrity of transactions in real-time and in a totally automated manner over a separate telecommunications channel. Real-time OOB Transaction Verification is regarded by Gartner as the only effective way to protect the integrity of a transaction carried out on the Internet.

§ Identity Verification – In mass market and extranet situations, service providers are struggling to find a solution that does not require the distribution of hardware devices yet provides strong authentication and transaction verification in a cost effective and convenient manner. It is likely that going forward service providers will be expected to comply with increasing regulation in this area. ValidSoft, through its telephony based architecture enables service providers to implement the strongest form of mutual authentication and transaction verification available. Designed specifically for mass markets and extranet situations, VALid® combines ease-of-use, cost effectiveness and strong security, from challenge response up to and including conversational voice biometrics, to ensure that service providers can verify to non-repudiation level if required, the verification of identity of both internal employees, external contractors and customers who may have access to sensitive material and also conduct transactions electronically.

§ Non-Repudiation – PKI (Digital Certificates), long regarded as a form of Non-Repudiation is now vulnerable to Man-in-the-Browser attacks. This means that PKI can no longer guarantee the integrity of transactions and therefore can be challenged in a Court of Law where PKI is presented as a case for Non-Repudiation. VALid® has been designed to address the issue of Non-Repudiation through its multi-layered approach, which includes elements such as: Transaction Verification; Transaction Data Signing (cryptographically linking a One Time Passcode to the underlying transaction); Voice Biometrics (or OOB challenge/response); Customer Authorization (Voice Recording) and Geometric Transaction Analysis, to achieve the highest level of non-repudiation capability, presented to the customer in an intuitive and easy-to-use manner.

§ Business Enabling – financial institutions cannot leverage the full power and cost effectiveness of the Internet as a Business Enabling/Self-Service medium because of security concerns. Certain transactions requiring branch or telephone banking, or the completion of paper-based forms with signatures (e.g. Address change), are considered too high risk for Internet deployment, and as a consequence these transactions continue to be processed manually resulting in high cost, inefficiencies, poor quality data and customer inconvenience. VALid®, through the combination of OOB Strong Mutual Authentication and Transaction Verification, provides the capability to securely automate today’s manual processes resulting in: dramatic cost savings; customer empowerment; increasing the consistency, accuracy, timeliness and security of transactions; and creating competitive advantage through market differentiation.

Landline network outsourcing services

Even though the majority of our investments in the past years have been in (mobile) software development, mobile related acquisitions and implementing MNOs and MVNOs, our largest revenue stream is currently still generated by our traditional telecom services like Carrier Select and Carrier Pre-Select Services, and Toll Free and Premium Rate Services. These services formed the basis and gave us decade-long experience as an outsourcing partner in the field of telecommunications services managed by our propriety Intelligent Network/Customer Provisioning Management/Billing platform. This platform has always been designed to put our customers, who purposely chose to outsource their telecommunication requirements to a specialized company like us, in control: our customers can work with our technology and our delivery platforms as if these are their own. We empower and likewise facilitate our customers to harness, to manage and to fully apply the power of some of the most powerful mobile/landline delivery systems in the world through a web-based self care user friendly interface, without the need to initiate, install, fund, operate and support those global systems on a 24/7 basis.

15

Growth Strategy

Elephant Talk is actively seeking additional MNO partners that understand the symbioses between a mobile network operator and an applications-focused enabler that brings the right services in the right format through a secure delivery platform within reach of all business customers that may require such services as part of their overall market and product strategy. We believe that over the next couple of years MNOs will proactively seek partners like our company, as it will be the preferred way to successfully expand from retail focused markets to wholesale markets, thereby more effectively using the capacity of their core antenna networks and spectrum capabilities.

Especially in markets where direct retail customer penetration reaches 80% plus levels, MVNOs can enhance bring market penetration and network usage levels. However, only if these MVNOs are capable of bringing significantly differentiated service bundles into the market place - reflecting the specific requirements of individualized communities - will they be less vulnerable to what has been undermining the MNOs basic business models: churn. Most important to an operator’s success is to understand that a uniquely serviced community far outweighs the pricing alone of any basic underlying service.

The growing importance of converging services is an area where we see excellent possibilities to combine our decade long in-depth experience in landline services with our sophisticated mobile delivery platform. This will support both our MNO as well as our MVNO customers to bring newly bundled services into the marketplace through a single device that is capable of using landline, IP, mobile, and wireless connectivity for any voice, data and multi-media application. All this will be provisioned and managed through one single customer account and one integrated bill that is supported by any relevant payment mechanism.

We see opportunities in customized mobile service, combining the individual profile of a mobile customer and his or her exact location, with the “always-on” secured connectivity of a mobile network, supported by our powerful mobile delivery platforms. We believe these elements will create completely new business models for MNOs and MVNOs alike, bringing personalized, contextual and time-wise relevant services to billions of customers worldwide. One can easily think of new applications in the areas of security, protection and logistics of people, goods and services, remotely monitoring and escalating medical care, individualized and contextual marketing communications for broad ranges of goods and services, and supporting secure financial transactions.

Most of these new business models, driven by customized mobile services, will be created and operated by independent third party application providers that may be directly or indirectly connected to mobile service delivery platforms like our MVNE platform. In areas we see attractive opportunities to create, operate and market such services ourselves, we may actively invest in such developments or may acquire other companies that already have developed such applications. A good example of such a service is the fraud prevention application that ValidSoft offers, the company recently acquired by us.

Growth in Partnerships

As a result of the convergence of information technology and telecommunications solutions, our involvement with various partners has increased. On the supply side, we work with dozens of other carriers and content providers to either originate or terminate our traffic around the globe. On the customer side, resellers have evolved from indirect channels to true partners bringing specialized market knowledge, customer focus and a geographical reach to its activities.

As a key element of our low-cost and fast deployment strategy, we make use of partners in all layers of our distribution platform. Our partners typically come from the following disciplines:

16

Landline Network Interconnect Partners

As a fully licensed telecommunications carrier, we are entitled to be interconnected with a variety of incumbent operators and cable companies as well as more recently established telecom providers in over a dozen countries that provide both network origination and termination, mostly at regulated costs.

Mobile Network Partners

As a provider of full Mobile Virtual Network Enabling platforms, we partner with Mobile Network Operators to strongly support them in better addressing the specific needs of Mobile Virtual Network Operators, the sales, marketing and distribution organizations that (re)package, (re)bundle and (re)position mobile telecommunications as part of their overall service offering. Likewise, we help our partner MNOs to improve the usage of their networks by also directly contracting additional MVNOs for which we attractively bundle our systems capabilities with the partner MNOs airtime.

Content & Customized Mobile Services Partners

These partners can have a dual purpose whereby they are both a supplier as well as a marketing client. Essentially Content and Customized Mobile Services Partners provide a broad array of content and services available for distribution through our mobile and landline networks which are then promoted and sold by a variety of our marketing partners. However, at the same time we may also generate revenue from such Content and Customized Mobile Services Partners by providing them with all of the tools required to exploit and promote their content and services through our delivery platforms.

Roaming & LCR Wholesale Origination/Termination Partners

Our network is connected to over a dozen wholesale partners that work together on a commercial basis to provide each other with “Least Cost Routing” and roaming capabilities to globally originate and terminate landline and mobile calls at the best possible cost/quality levels.

Competition

We experience fierce competition in each of the market segments in which we operate.

Traditional Telecom Services

In all segments where we offer traditional telecom services like carrier (pre) select/dial around/2-stage dialing services, premium rate and toll free services, we encounter heavy competition. Our stiffest competition comes from each of the incumbent telecom operators such as BT, France Telecom, KPN, Telefonica, Telecom Italia and Telekom Austria. The strongest price competition usually comes from smaller, locally established and/or regional players, although newer Pan-European carriers like Colt Telecom position themselves as aggressively priced competition.

Mobile Services

We face competition from other MVNE’s, as well as from the traditional MNOs. An average MNO may have a few dozen technology suppliers; each may deliver a part of the overall network, switching, control and administrative systems comprising a mobile carrier’s infrastructure to service millions of retail customers. Likewise, many companies are aiming to become a vendor/partner of a MNO in order to assist the MNO to better service their wholesale business towards MVNOs. Some companies try to achieve this by selling various core components as a more traditional vendor: stand alone switching systems, billing systems, CRM systems, Intelligent Network systems, etc. Examples of our competition in this market are companies like Highdeal, Comverse, Geneva, Amdocs and Artilium. In such cases the MNO often contracts with a system integrator like Cap Gemini or Atos Origin to help them to integrate all these components into effectively working systems. Recently, more and more of these system integrators not only position themselves anymore as onetime integrators, but they are also looking to assume the role as an on-going service providers, keeping (part of) the system up and running on behalf of the MNO; examples are Cap Gemini, Atos Origin, EDS, Accenture, and IBM. Likewise, various vendors themselves assumed such roles of managing and operating the systems they supplied. As such, we also face competition from traditional telecom infrastructure companies like Nokia-Siemens, Ericsson and Alcatel.

17

As a consequence of these purchasing and outsourcing policies, many MNOs have over the years assembled large teams, sometimes as large as a dozen or more vendors/integrators/service providers, whereby each of them delivers a crucial part of the overall required capabilities. Not only have such larger teams, usually involving hundreds of full time consultants, been requiring very intense vendor management attention from the MNO to coordinate them, the result was often a very complex operational structure and work environment for both the MNO as well as the MVNO to work with. Instead of bringing superior, flexible services at affordable cost levels that were supposed to better position the MNO to easily go after MVNO business, the MNO is often struck with a whole range of hard to manage, inflexible and expensive (and sometimes even incompatible) platforms, that actually undermine the capability of the MNO to successfully and profitably compete for MVNO business. Existing MVNOs threaten to migrate to another network provider, while new prospect are lost to other MNOs that do provide more flexible and affordable service.

Being positioned for many years as an outsourcing partner for other businesses that require telecoms as a part of their overall service offering, we believe we can assist MNOs to simplify and streamline these outsourced system requirements. One of the key elements in our offering in landline telecommunications has always been that all network, switching, control and administrative elements would function within one system, and that our B2B customer would be able to self-manage such system through an easy to use web based interface. In designing its MVNE platform, our company has kept the same philosophy in place. As a result, a MNO would only require one managed service provider to fully offer any possible service requirement any type of MVNO may have. We therefore believe that we not only eliminate an intense and costly vendor management role, but at the same time offer flexible, superior service levels at a much lower operational cost.

Other companies that have positioned themselves as a MVNE platform provider, aiming to assume the same role of a one stop solution provider to MNOs, and as such are direct competitors of us, include Aspider, primarily active in the Netherlands, Vistream/Materna, primarily active in Germany, Effortel, primarily active in Belgium and Italy, Transatel, primarily active in France, Telcordia, primarily active in North America, Virtel, primarily active in Australia and the combination Artilium/Atos Origin, active throughout Europe. However, none of them cover the same depth and width of platform capabilities as Elephant Talk provides. On top of that, on the supplier/vendor side we believe we compete favorably with all the earlier mentioned telecom system vendors and integrators. Even though we believe our company has a very good offering at a competitive pricing level, many of our competitors may develop a comparable, fully integrated MVNE platform in the near future. As many of these competitors are much larger companies than ours, with much higher profiles, it may very well be that these competitors will successfully sell their higher priced, less capable solutions than comparable Elephant Talk systems.

Although we believe we will continue to create excellent opportunities for MNOs to increase the addressable market they can service profitably, many MNOs may still prefer to compete directly with us, not only for the business of larger MVNOs, but also in servicing the many smaller MVNOs. This situation may become more likely if new technologies make it easier for the MNOs to service both larger and smaller non-retail customers directly on a lower cost basis. Also, other MVNEs may create strong competition, especially if such new MVNEs will be created by competing MNOs as a consequence of our success in profitably cooperating with other MNOs that already have a successful MVNE relationship with us.

Fraud Prediction & Prevention Services

Our current (ValidSoft) Fraud Prediction & Prevention Services face competition from Authentify, Strikeforce, Finsphere, Tricipher for Out-of-Band (OBB), RSA, VASCO and others for Tokens, and Verisign and others for Digital Certificates.

ValidSoft’s products combined with the Elephant Talk’s advanced telecommunications platform we believe combine the complementary strengths which results in a state of the art and currently one of a kind in terms of being a total solution for payment card (debit and credit) fraud prevention.

18

More in particular for the ValidSoft part, VALid® combines strong authentication and transaction verification to counter not only the more traditional attacks, but also the latest in session hijacking (Man-in-the-Middle, Man-in-the-Browser) through its Transaction Integrity Verification (TIV) model. Alternative two factor authentication solutions such as hardware tokens are vulnerable to these types of threats. These vulnerabilities exist due to a number of issues and weaknesses. VALid® provides flexibility in allowing banks to authenticate at both the session and transaction level, with the device, protocol and even authentication behavior completely configurable. Use of the customers’ existing telephony devices, ensures complete interoperability between multiple banks, while providing the necessary branding through the use of the individual bank’s voice scripts. As VALid® supports remote access in a number of ways it operates in exactly the same manner for internal enterprise access. Managing conventional Two Factor authentication systems that use physical tokens carry significant overheads, such as the end user token distribution process (including retrieval and replacement), synchronization issues and time sequencing problems. Managing these tokens is also cumbersome as in some cases a master token must be used before an administrator can de-activate a token. VALid® does not have these issues and provides banks with the added benefit of a significant lower Total Cost of Ownership whilst dramatically improving security levels. A user can be added to the system using an intuitive web based system resulting in near real time for activation or deactivation

Intellectual Property

We have a significant investment in our intellectual property, including:

| · | VALid® Patent Protected – ValidSoft own the UK Patent for authenticating a user access request to a secured service utilizing both a primary and secondary channel |

| · | VALid-POS® - Patent Pending (CFPP System) – ValidSoft are in a Patent Pending process for a Patent concerning a method where mathematically derived probability data determined from transaction feeds and telemetry services is used to identify a false positive transaction |

| · | VALid-POS® - Patent Pending (ACS System) – ValidSoft are in a Patent Pending process for a Patent concerning a method where data determined from transaction feeds and telemetry services is used to anonymously identify a fraudulent or false positive transaction |

| · | Two additional Patent submissions underway leading to Patents Pending relating to Card-Not-Present transactions, i.e. transactions carried out over the web - awaiting Patent Filing references |

| · | Significant investment in our own software, including: VALid-IVR; VALid-SMS; VALid-SVP; VALid-TDS; VALid-POS; VALid-ARM; VALid-TTS; VALid-VPN; VALid-ISA; VALid-FOB |

| · | Registered Trademarks VALid® and Trademarks VALid-POS® |

Government Regulation

We operate in a heavily regulated industry. As a multinational telecommunications company or provider of services to carriers and operators, we are directly and indirectly subject to varying degrees of regulation in each of the jurisdictions in which we provide our services. Local laws and regulations, and the interpretation of such laws and regulations, differ significantly among the jurisdictions in which we operate. Enforcement and interpretations of these laws and regulations can be unpredictable and are often subject to the informal views of government officials. Certain European, foreign, federal, and state regulations and local franchise requirements have been, are currently, and may in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals. Such proceedings may relate to, among other things, the rates we may charge for our local, network access and other services, the manner in which we offer and bundle our services, the terms and conditions of interconnection, unbundled network elements and resale rates, and could change the manner in which telecommunications companies operate. We cannot predict the outcome of these proceedings or the impact they will have on our business, revenue and cash flow.

Employees

As of December 31, 2010 we employed 88 people and retained on a long term basis, the services of 42 independent contractors. We consider relations with our employees and contractors to be good. Each of our current employees and contractors has entered into confidentiality and non-competition agreements with us. There are no collective bargaining contracts covering any of our employees.

19

Legal structure of the company

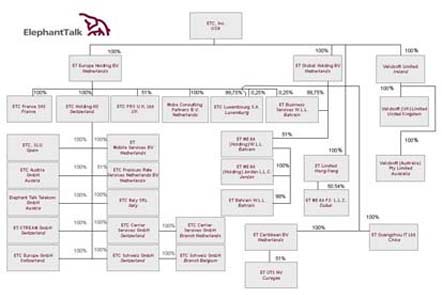

The following chart illustrates our company’s corporate structure as of December 31, 2010.

In 2007, our company grew as a result of the acquisition, effective January 1, 2007, of Elephant Talk Communication Holding AG (formerly known as “Benoit Telecom Holding AG”) by Elephant Talk Europe Holding B.V. In addition to the Benoit Acquisition, on June 1, 2007, we acquired a French entity: 3U Telecom SrL, from 3U Telecom AG, a German company. The name of this entity was subsequently changed to Elephant Talk Communications France S.A.S. (“ET France”). As a result of the preceding acquisitions, our corporate structure and breadth of operations significantly expanded.

In addition to the aforementioned acquisitions, we incorporated three new companies in 2007. On May 24, 2007 we established Elephant Talk Global Holding B.V (“ET Global”), a 100% Dutch subsidiary of ETCI. We created ET Global to act as the holding company for several of our worldwide subsidiaries. On October 21, 2007 we incorporated Elephant Talk Business Services W.L.L. (“ET Business Services”), a Bahrain based company, to act as an intra-group service provider outside Europe (Elephant Talk Communication Carrier Services GmbH performs this activity within Europe). On December 27, 2007 we formed Elephant Talk Communications Luxembourg S.A. (“ET Luxembourg”) to initially focus on providing payment collection services for other group companies. On March 20, 2008 Elephant Talk Caribbean BV was incorporated in the Netherlands as a 100% subsidiary of Elephant Talk Global Holding B.V. The purpose of this subsidiary is to act as the joint venture partner of United Telecommunication Services N.V. in the entity ET-UTS NV. ET-UTS NV was incorporated in Curacao, the Netherland Antilles, on April 9, 2008 as a 51% subsidiary of Elephant Talk Caribbean B.V. with the remaining 49% owned by our joint venture partner United Telecommunication Services N.V. The total issued capital amounts to one hundred thousand dollars ($100,000.00). The purpose of ET-UTS NV is to design, install, maintain and exploit WIFI and WIMAX networks in the Caribbean area and Surinam.

On August 14, 2008 we changed the name of Cardnet Clearing Services BV, a wholly-owned affiliate of Elephant Talk Europe Holding BV, to Elephant Talk Mobile Services BV. This company’s primary objective is to act as our vehicle to contract Mobile Virtual Network Operators in the Netherlands. On August 20, 2008 Elephant Talk Europe Holding BV signed an agreement for the acquisition of 100% of Moba Consulting Services BV. The effective date of the transaction was September 1, 2008 at an acquisition price of €1.00 plus 50,000 of our stock options. We acquired Moba Consulting Services BV to obtain expertise and manpower for certain aspects of the implementation of the Mobile Virtual Network Operators on our platform

20

ValidSoft Acquisition

On March 17, 2010, we entered into two Sale and Purchase Agreements (each an “SPA” and, collectively, the “SPAs”) with the shareholders of ValidSoft Limited (“ValidSoft”), a company organized under the laws of the Republic of Ireland. The entry into the SPAs follows the parties’ execution of a Heads of Terms on November 2, 2009. Two SPAs were entered into because one SPA, entered into with shareholder Enterprise Ireland, an Irish agency, is to be governed by Irish law. The remaining shareholders entered into the other SPA, governed by New York law.

Pursuant to the SPAs, we acquired the outstanding securities of ValidSoft for consideration consisting of 20% of our issued and outstanding common stock as of February 1, 2009 and warrants to purchase our common stock equal to the sum of: (i) 20% of our issued and outstanding warrants as of February 1, 2009; and (ii) 20% of our issued and outstanding options as of February 1, 2009. Twenty-five percent of the foregoing consideration was placed into escrow and is subject to forfeiture and cancellation in the event certain revenue milestones are not achieved.