Business Update Annual Meeting October 2012 NYSE MKT: ETAK

This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , about Elephant Talk . Forward - looking statements are based largely on expectations and projections about events and Future trends and are subject to numerous assumptions, risks and uncertainties, which change over time . Forward - looking statements can be identified by terminology such as “anticipate,” “believe,” “could,” “could increase the likelihood,” “estimate,” “expect, “intend,” “is planned,” “may,” “should,” “will,” “will enable,” “would be expected,” “look forward," “may provide,” “would” or similar terms, variations of such terms or the negative of those terms . Elephant Talk’s actual results could differ materially from those anticipated in forward - looking statements and you should not place any undue reliance on such forward - looking statements . This presentation includes annualized revenue models and proforma financial information that is based Upon assumptions and estimates that management believes are reasonable based on currently available information ; however, management's assumptions and the Company’s future performance are subject to a wide range of business risks and uncertainties, and there is no assurance that these goals and projections can or will be met . Any number of factors could cause actual results to differ materially from expectations . Factors that could cause actual performance to differ from these forward - looking statements include the risks and uncertainties disclosed in Elephant Talk’s filings with the SEC . Elephant Talk’s filings with the SEC are accessible on the SEC’s website at (http : ///www . sec . gov) . Forward looking statements speak only as of the date they are made, and Elephant Talk assures no obligation to update, amend or clarify any forward - looking statements . Safe Harbor Statement 1

Investment Highlights Uniquely Integrated Mobile & Security Proposition ▪ Cloud - based mobile telecommunication, identity & access management, and transactions security delivery platform ▪ World - class mobile security solution – unique product positioning ▪ Only software security company in the world with two European Privacy Seals (third seal approval underway) ▪ Significant investments in our carrier grade network paying dividends; providing powerful and differentiated platform for mobile and security solutions ▪ Attractive business model – Recurring subscription and transaction - based revenue model ▪ Strong operating momentum in mobile platform managed services and transaction security in 2012 ▪ Revenue mix constantly trending toward high - margin, high - growth solutions ▪ Accomplished management team and Board 2

3 Elephant Talk ValidSoft ▪ Vodafone Enabler Spain – Recent mass migration of SIMs in Spain • Managing over 1.1 million SIMs on the platform • Unique network SIM migration solution, not requiring any hardware swap ▪ Contract in Germany (currently on hold) ▪ S elected as managed service provider to roll out mobile services across three major markets • Expected to go l i ve around year - end • Potential to add several million subscribers to the mobile platform over time ▪ Trajectory to become o perational cash flow positive by early 2013 ▪ Introduced ValidSoft SIM Swap solution, a world first, now live in production with a leading global financial institution ▪ Only Security Software Company in the world to be certified with two European Privacy Seals – 3rd Seal already underway ▪ Key partnerships; • – Leading customer risk intervention solutions provider, acquired by FICO (World leader in predictive decision analytics) • – Global leader in the Mobile Payments space • ( Spindle) – Provider of secure mobile commerce and alternative payment solutions Recent Milestones Getting Closer to Operational Cash Flow Positive

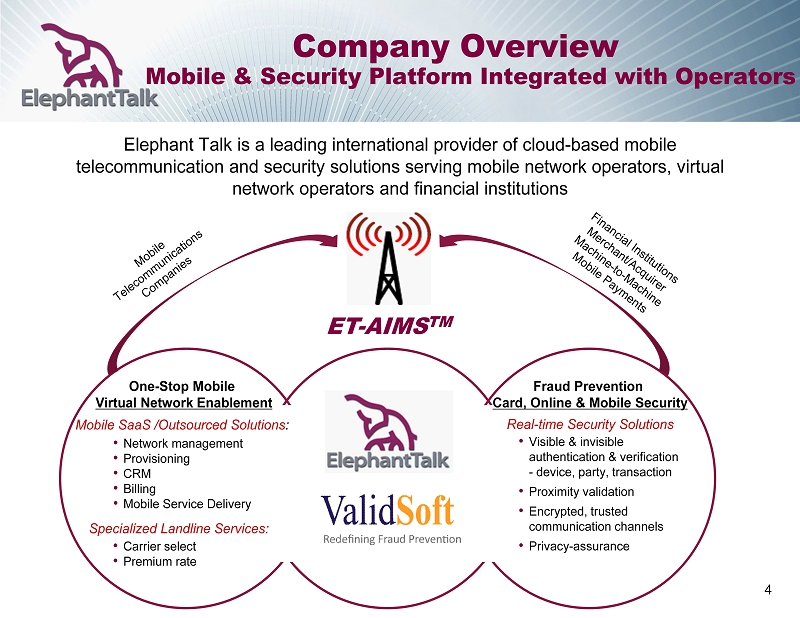

Company Overview Mobile & Security Platform Integrated with Operators 4 Elephant Talk is a leading international provider of cloud - based mobile telecommunication and security solutions serving mobile network operators, virtual network operators and financial institutions • Network management • Provisioning • CRM • Billing • Mobile Service Delivery One - Stop Mobile Virtual Network Enablement Fraud Prevention Card, Online & Mobile Security Specialized Landline Services: Mobile SaaS /Outsourced Solutions : • Carrier select • Premium rate • Visible & invisible authentication & verification - device, party, transaction • Proximity validation • Encrypted, trusted communication channels • Privacy - assurance Real - time Security Solutions ET - AIMS TM

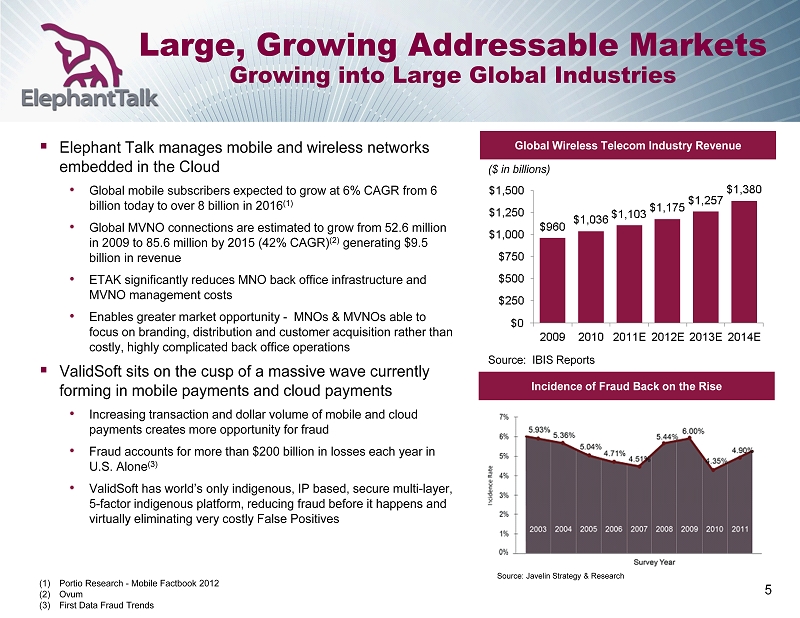

Large, Growing Addressable Markets Growing into Large Global Industries ▪ Elephant Talk manages mobile and wireless networks embedded in the Cloud • Global mobile subscribers expected to grow at 6% CAGR from 6 billion today to over 8 billion in 2016 (1) • Global MVNO connections are estimated to grow from 52.6 million in 2009 to 85.6 million by 2015 (42% CAGR) (2) generating $9.5 billion in revenue • ETAK significantly reduces MNO back office infrastructure and MVNO management costs • Enables greater market opportunity - MNOs & MVNOs able to focus on branding, distribution and customer acquisition rather than costly, highly complicated back office operations ▪ ValidSoft sits on the cusp of a massive wave currently forming in mobile payments and cloud payments • Increasing transaction and dollar volume of mobile and cloud payments creates more opportunity for fraud • Fraud accounts for more than $200 billion in losses each year in U.S. Alone (3) • ValidSoft has world’s only indigenous, IP based, secure multi - layer, 5 - factor indigenous platform, reducing fraud before it happens and virtually eliminating very costly False Positives 5 Incidence of Fraud Back on the Rise Global Wireless Telecom Industry Revenue ($ in billions) Source: IBIS Reports (1) Portio Research - Mobile Factbook 2012 (2) Ovum (3) First Data Fraud Trends Source: Javelin Strategy & Research

Elephant Talk Implementation Case Study 6 Challenge ▪ Vodafone Enabler Spain was seeking a flexible turn - key mobile platform provider ▪ Customer demanded an integrated platform that could grow along with customer demands ▪ Competition included Ericsson and Huawei, among others Solution ▪ Elephant Talk alone fit three key criteria: ▪ Robustness – Solution architecture & design ▪ Flexibility – Solution design & adaptability ▪ Innovation – Elephant Talk organization & company culture Customer Benefit ▪ Spanish platform is currently sized to support up to 3 million subscribers ▪ Vodafone Enabler Spain has publicized the tremendous success of the partnership ▪ Over 1.1 million SIMs currently on our platform in Spain

7 Card, Online & Mobile Financial Services Fraud Detection & Prevention

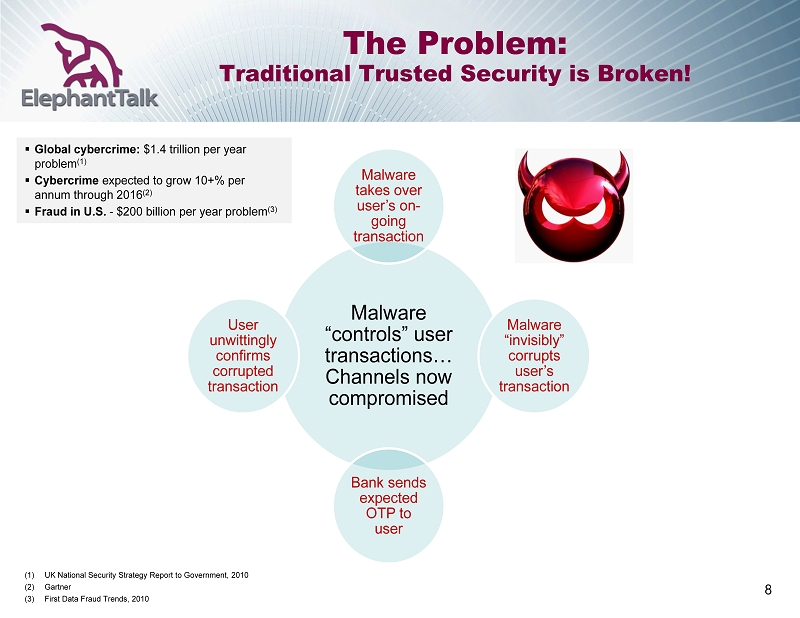

The Problem: Traditional Trusted Security is Broken! 8 Malware “controls” user transactions… Channels now compromised Malware takes over user’s on - going transaction Malware “invisibly” corrupts user’s transaction Bank sends expected OTP to user User unwittingly confirms corrupted transaction ▪ Global cybercrime: $1.4 trillion per year problem (1) ▪ Cybercrime expected to grow 10+% per annum through 2016 (2) ▪ Fraud in U.S. - $200 billion per year problem (3) (1) UK National Security Strategy Report to Government, 2010 (2) Gartner (3) First Data Fraud Trends, 2010

ValidSoft Redefining Fraud Prevention 9 ▪ Emerging global leader in Telecommunication - based multi - layer, multi - factor mutual, invisible & visible Authentication; Identity and Transaction verification for all electronic transaction channels ▪ Fraud prevention solutions cover Card Present transactions, Card Not Present, ecommerce, Internet/Telephone Banking, Mobile Financial Services (m - banking, m - wallet, m - payments, m - commerce), Enterprise security ▪ Significant investment in Intellectual Property: Extensive patent portfolio, trademarks, copyrights ▪ Solutions ideal for Mass Consumer Deployment: Cost effective, intuitive, secure, disability enabled, pervasive solutions – applicability in: Financial Services; Healthcare; Retail; Gaming ▪ Industry Thought Leaders in countering electronic fraud: See recent live demonstration at Finovate Fall 2012 in NYC: http://www.finovate.com/fall12vid/validsoft.html ▪ Gartner views mobile fraud detection as a “high benefit” solution and lists ValidSoft among top solutions . • “Mobile fraud detection … will become a ‘must have’ technology, as enterprises and service providers roll out context - enriched services” (1) ▪ Only security software company with Two EU Data Privacy Seals ▪ Security Model reviewed by Royal Holloway University of London ▪ Partnerships (global emerging leaders/disruptive technologies): ADEPTRA, UTIBA, SPINDLE, SOCURE (1) Gartner, “Hype Cycle for Application Security, July 2012

ValidSoft Partner Access to Large Addressable Markets 10 500M – 1BN transactions 1BN – 5BN transactions 5BN + transactions Increased Volume Incremental Transaction Risk Eg Visa Europe, TSYS, RSA Eg First Data, BofA , NOVA, Global Payments, etc. Eg ISIS, Monitise , mPesa , Google, Visa, Mastercard , etc. Top Banks Merchant Acquirers / Machine - to - Machine Mobile Payments (Mobile banking, Mobile Commerce, P2P) • Customers • Transaction Volume • Partnership Relevance (target) Spindle

ValidSoft Implementation Case Study Challenge ▪ Leading global bank has been facing escalating security threats ▪ Increasingly sophisticated fraud involves complex interception of communications over what are thought to be trusted channels of communication ▪ ValidSoft has unique, patent pending technology to combat SIM swap fraud Solution ▪ Implemented world’s first SIM swap fraud detection and prevention solution into bank’s core processing systems in April 2012 ▪ Solution handled through Adeptra platform to ensure minimal banking resources required for implementation, and generic industry applicability ▪ Eliminates potential channel for several million dollars of fraud each year ▪ Product went live 8 weeks after contract signed – rapid implementation reduced fraud ▪ Integration of systems allows for rapid implementation of additional ValidSoft products via Adeptra platform, including Card Fraud/False Positive prevention & Man - in - the - Browser protection Customer Benefit 11

Financial Discussion 12

Recurring Revenue Business Model Driven by the Needs of our Customers ▪ Elephant Talk and ValidSoft are focused on recurring revenue models, following a trend among customers: • From Capex to Opex , freeing up resources • From Fixed to Variable Cost ; “pay as you go” model • From Complicated, Point Solutions to One - Stop Shop Solutions 13 Solution Segment Revenue Model Average Pricing Gross Margin Managed Services • Subscription - based • $1.00 / month / subscriber 90+% Managed Services + Airtime (Bundled Offering) • Subscription - based • $10.00 - $20.00 / month / subscriber 20+% Transaction Verification • Transaction - based • Subscription - based • $0.20 - 0.01 / verification • $0.30 - $0.50 / month / subscriber 60+%

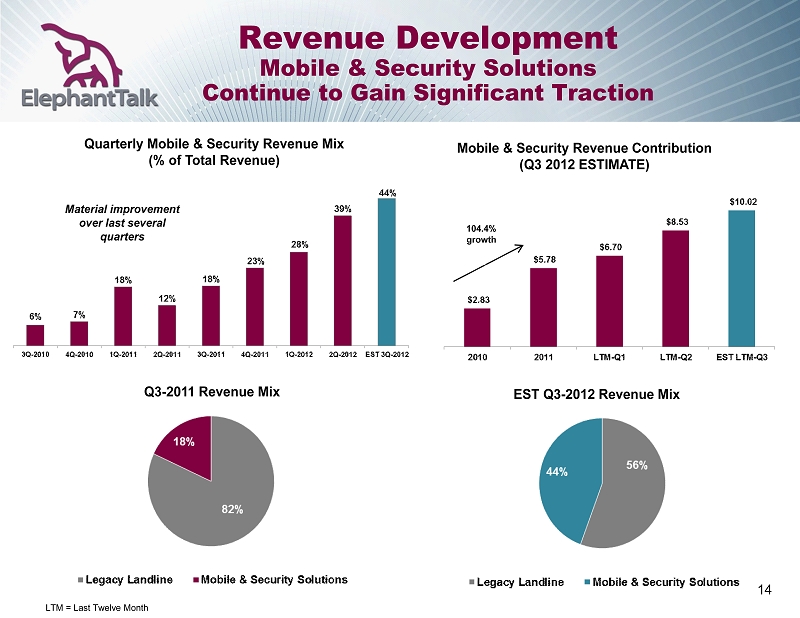

Revenue Development Mobile & Security Solutions Continue to Gain Significant Traction 14 Q3 - 2011 Revenue Mix EST Q3 - 2012 Revenue Mix Quarterly Mobile & Security Revenue Mix (% of Total Revenue) Mobile & Security Revenue Contribution (Q3 2012 ESTIMATE) 104.4% growth Material improvement over last several quarters LTM = Last Twelve Month

Positive Margin Development Driven by Growth of Mobile & Security Results 15 LTM = Last Twelve Month Yearly Gross Margin (%) Yearly Gross Margin ($m) Quarterly Gross Margin (%) Quarterly Gross Margin ($m) Over the past several quarters, margin has been trending upward as we began our transition to high - growth, high - margin business lines

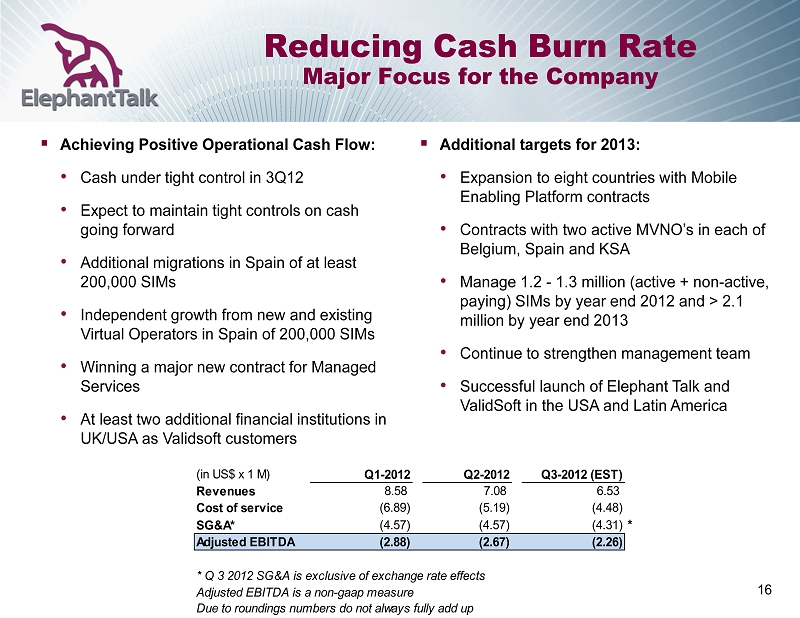

Reducing Cash Burn Rate Major Focus for the Company ▪ Achieving Positive Operational Cash Flow: • Cash under tight control in 3Q12 • Expect to maintain tight controls on cash going forward • Additional migrations in Spain of at least 200,000 SIMs • Independent growth from new and existing Virtual Operators in Spain of 200,000 SIMs • Winning a major new contract for Managed Services • At least two additional financial institutions in UK/USA as Validsoft customers 16 ▪ Additional targets for 2013: • Expansion to eight countries with Mobile Enabling Platform contracts • Contracts with two active MVNO’s in each of Belgium, Spain and KSA • Manage 1.2 - 1.3 million (active + non - active, paying) SIMs by year end 2012 and > 2.1 million by year end 2013 • Continue to strengthen management team • Successful launch of Elephant Talk and ValidSoft in the USA and Latin America (in US$ x 1 M) Q1-2012 Q2-2012 Q3-2012 (EST) Revenues 8.58 7.08 6.53 Cost of service (6.89) (5.19) (4.48) SG&A* (4.57) (4.57) (4.31) * Adjusted EBITDA (2.88) (2.67) (2.26) * Q 3 2012 SG&A is exclusive of exchange rate effects Adjusted EBITDA is a non-gaap measure Due to roundings numbers do not always fully add up

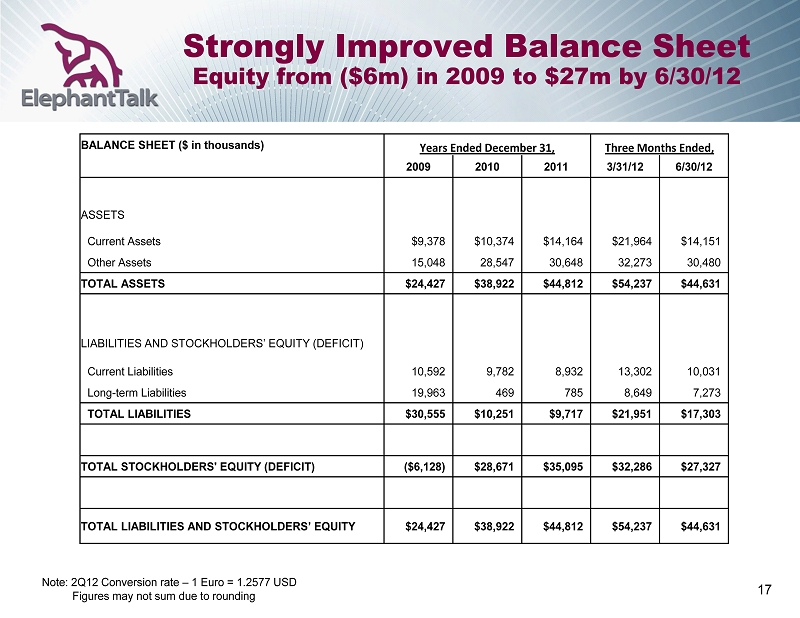

Strongly Improved Balance Sheet Equity from ($6m) in 2009 to $27m by 6/30/12 17 Note: 2Q12 Conversion rate – 1 Euro = 1.2577 USD Figures may not sum due to rounding BALANCE SHEET ($ in thousands) Years Ended December 31, Three Months Ended, 2009 2010 2011 3/31/12 6/30/12 ASSETS Current Assets $9,378 $10,374 $14,164 $21,964 $14,151 Other Assets 15,048 28,547 30,648 32,273 30,480 TOTAL ASSETS $24,427 $38,922 $44,812 $54,237 $44,631 LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) Current Liabilities 10,592 9,782 8,932 13,302 10,031 Long - term Liabilities 19,963 469 785 8,649 7,273 TOTAL LIABILITIES $30,555 $10,251 $9,717 $21,951 $17,303 TOTAL STOCKHOLDERS' EQUITY (DEFICIT) ($6,128) $28,671 $35,095 $32,286 $27,327 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $24,427 $38,922 $44,812 $54,237 $44,631

Investment Summary OVERVIEW ▪ World - Class Mobile Cloud Management & Security Delivery Platform ▪ World - Class Mobile S ecurity Solution – unique product positioning ▪ Only security software company accredited with two European Privacy Seals ▪ World’s first SIM swap fraud solution FINANCIAL HIGHLIGHTS ▪ 3Q12 Mobile and Security r evenue accounted for an estimated 44% of total quarterly revenue vs. 18% a year earlier ▪ Mobile and Security revenue has more than doubled Y/Y in 3Q12 to approximately $2.9 million, up from $ 1.4 million for 3Q11 ▪ 3Q12 Gross Margin of ~$2.1 million or ~31% of revenue vs . $ 0.8 million and 10% of revenue in 3Q11 ▪ On track to achieve first month of Positive Operational Cash Flow by early 2013 , excluding non - cash expenses and capital expenditures 18

19 Contact Us Corporate Headquarters ▪ Schiphol Boulevard 249 1118 BH Schiphol The Netherlands www.elephanttalk.com Investor Relations ▪ Steve Gersten steve.gersten@elephanttalk.com Phone: (813)926 - 8920 ▪ Peter Salkowski peter@blueshirtgroup.com Phone: (415)489 - 2184