Exhibit 99(c)(5)

Draft

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Project Ohio River

Special Committee Discussion Materials

July 28, 2005

Table of Contents

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

|

|

[LOGO]

1

1. Overview

Transaction Summary

• On March 7, 2005, Sidney Knafel (Chairman) and Michael Willner (President & CEO) along with certain other members of the management team (‘Management Group’), and The Carlyle Group (together ‘Buyer Group’), made an offer to purchase shares not owned by the Management Group for $10.70 per share in cash

• The Management Group owns 14% of the economic interest in Insight and 62% of the voting interest

• On July 27, 2005, subsequent to negotiations with the Special Committee of the Board of Directors of Insight and its advisors, Evercore Partners, Citigroup and Skadden Arps Meagher and Flom, the Buyer Group presented a revised offer of $11.75 per share in cash

|

|

|

| Proposal |

|

|

| ||

|

|

|

| $11.75 |

|

|

| ||

Premium/(Discount) to |

|

|

|

|

|

|

| ||

1 Day Prior to Initial Offer |

| $ | 9.68 |

| 21.4 | % |

|

| |

10 Trading Day Avg. |

| 9.61 |

| 22.3 |

|

|

| ||

1 Month Average |

| 9.84 |

| 19.4 |

|

|

| ||

3 Month Average |

| 9.45 |

| 24.3 |

|

|

| ||

6 Month Average |

| 9.13 |

| 28.7 |

|

|

| ||

Equity Value (a) |

|

|

| $ | 714 |

|

|

| |

of Shares to be Purchased (b) |

|

|

| 614 |

|

|

| ||

Proportionate Net Debt |

|

|

| 1,430 |

|

|

| ||

Firm Value |

|

|

| 2,143 |

|

|

| ||

TEV/Basic Subscribers |

|

|

|

|

|

|

| ||

2004A |

|

|

| $ | 3,368 |

|

|

| |

2005E |

|

|

| 3,407 |

|

|

| ||

|

|

|

| Status Quo |

| PF for Dissolution (c) |

| ||

TEV/EBITDA |

|

|

|

|

|

|

| ||

LTM |

|

|

| 9.9 | x | 11.2 | x | ||

NTM (Q2 ’05 to Q1 ’06) |

|

|

| 9.0 |

| 10.3 |

| ||

NTM (Q3 ’05 to Q2 ’06) |

|

|

| 8.8 |

| 10.1 |

| ||

|

|

|

|

|

|

|

| ||

2005E |

|

|

| 9.2 | x | 10.6 | x | ||

2006E |

|

|

| 8.4 |

| 9.7 |

| ||

Note: Insight capitalization is on a proportionate basis that includes 50% of Insight Midwest’s net debt and earnings and 100% of ICCI HoldCo’s net debt and earnings.

(a) Equity Value based on shares outstanding, plus restricted stock and in-the-money stock options, net of options proceeds.

(b) Net of option proceeds. Assumes 63.8 mm shares outstanding after option exercise, of which 9.1 mm are owned by management and affiliates and 8.5 mm are to be rolled over.

(c) Pro forma EBITDA statistics reflect the impact of dissolution as if dissolution were to occur on January 1, 2005. See page 37 for additional information on methodology used to arrive at pro forma statistics.

2

Chronology

Date (2005) |

|

|

| Event |

|

|

|

|

|

March 7 |

| • |

| Buyer Group initial offer of $10.70 per share |

March 14 |

| • |

| Evercore and Citigroup engaged by Special Committee as financial advisors |

April 13 |

| • |

| Receipt of management projections by Special Committee and financial advisors |

April 27 |

| • |

| Received presentation from Buyer Group |

May 4 |

| • |

| Special Committee discussed preliminary due diligence findings and valuation perspectives with its advisors |

May 10 |

| • |

| Larry Smith/Comcast public statement regarding triggering dissolution (a) |

May 11 |

| • |

| Responded to the Buyer Group’s Proposal |

June 1 |

| • |

| S&P downgraded Insight Communications and Insight Midwest bonds |

June 15 |

| • |

| Received response from Buyer Group financial advisors |

June 21 |

| • |

| Revised offer of $11.20 per share communicated to Special Committee |

June 27 |

| • |

| Insight announced proposed debt refinancing |

July 5 |

| • |

| Revised offer of $11.50 per share communicated to Special Committee |

July 14 |

| • |

| Special Committee indicated it was unlikely to accept the Revised Offer |

July 16 |

| • |

| Revised offer of $11.60 per share communicated to Special Committee, including certain contract concessions; Special Committee indicated it was unlikely to accept Revised Offer |

July 22 |

| • |

| Insight completed debt refinancing |

July 27 |

| • |

| Revised offer of $11.75 per share communicated to Special Committee |

(a) Larry Smith stated the following at Comcast’s analyst day on May 10, 2005: “[Insight] is on track to be broken up at the end of the year... We can pull the trigger Dec. 31, 2005. We’ve made it clear, as of now, that certainly, that is our intent.”

3

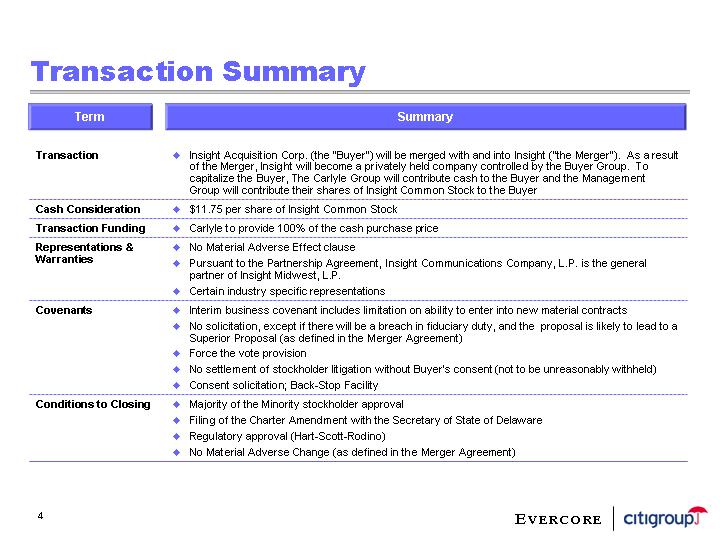

Transaction Summary

Term |

|

|

| Summary |

|

|

|

|

|

Transaction |

| • |

| Insight Acquisition Corp. (the “Buyer”) will be merged with and into Insight (“the Merger”). As a result of the Merger, Insight will become a privately held company controlled by the Buyer Group. To capitalize the Buyer, The Carlyle Group will contribute cash to the Buyer and the Management Group will contribute their shares of Insight Common Stock to the Buyer |

Cash Consideration |

| • |

| $11.75 per share of Insight Common Stock |

Transaction Funding |

| • |

| Carlyle to provide 100% of the cash purchase price |

Representations & |

| • |

| No Material Adverse Effect clause |

Warranties |

| • |

| Pursuant to the Partnership Agreement, Insight Communications Company, L.P. is the general partner of Insight Midwest, L.P. |

|

| • |

| Certain industry specific representations |

Covenants |

| • |

| Interim business covenant includes limitation on ability to enter into new material contracts |

|

| • |

| No solicitation, except if there will be a breach in fiduciary duty, and the proposal is likely to lead to a Superior Proposal (as defined in the Merger Agreement) |

|

| • |

| Force the vote provision |

|

| • |

| No settlement of stockholder litigation without Buyer’s consent (not to be unreasonably withheld) |

|

| • |

| Consent solicitation; Back-Stop Facility |

Conditions to Closing |

| • |

| Majority of the Minority stockholder approval |

|

| • |

| Filing of the Charter Amendment with the Secretary of State of Delaware |

|

| • |

| Regulatory approval (Hart-Scott-Rodino) |

|

| • |

| No Material Adverse Change (as defined in the Merger Agreement) |

4

Term |

|

|

| Summary |

Termination |

| • |

| By either the Buyer or the Company if: |

|

|

|

| • The Merger shall not have been consummated by February 15, 2006 |

|

|

|

| • There is final order or injunction precluding the merger |

|

|

|

| • There is a failure to receive Company stockholder approval |

|

| • |

| By Buyer if: |

|

|

|

| • Incurable breach by Company of its representations, warranties or covenants |

|

|

|

| • Material violation of no shop |

|

|

|

| • Failure to solicit proxies or hold stockholder meeting |

|

|

|

| • Change of recommendation (Buyer may terminate only within first 5 business days following the change) |

Termination Fees |

| • |

| $10mm fee (less expenses) and $4mm expense reimbursement policy payable by Company immediately following termination in certain circumstances |

|

| • |

| Fee may not be shared with Knafel or Willner (other than for their out-of-pocket expenses) |

Ancillary Agreements |

| • |

| Voting Agreement, Exchange Agreement, Carlyle Guarantee |

Comcast Partnership |

| • |

| Prior to the effective time of the Merger, Insight will not deliver an exit notice pursuant to its partnership agreement with Comcast, and if Comcast delivers such an exit notice to Insight, Insight will elect to postpone for a period of 6 months |

5

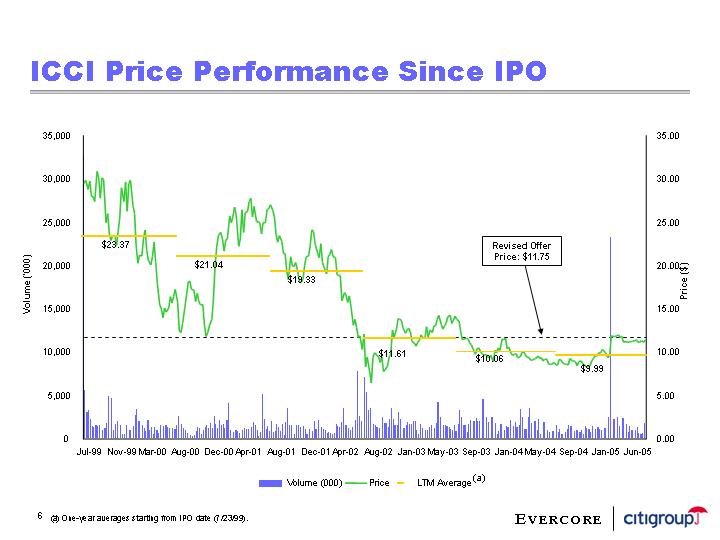

ICCI Price Performance Since IPO

[CHART]

(a) One-year averages starting from IPO date (7/23/99).

6

Cable Sector Share Price Performance

• Since ICCI’s IPO, stock prices for cable providers have declined by an average of 51%

• Over the same time period, the S&P 500 has declined 9%

[CHART]

7

Historical Cable Trading Ranges

Cable Sector (a) FV / EBITDA Multiple

[CHART]

Source: Wall Street research.

Note: LTM data based on actual quarterly data. Forward information based on projected quarterly data. FTM and LTM EBITDA for 7/27/2005 reflect financials as of 3/31/05.

(a) Universe comprised of Cablevision, Charter, Comcast, Cox (through 2Q ’04), Insight and Mediacom.

8

ICCI Price Performance Since Initial Offer Date

[CHART]

9

Transaction Metrics

|

| Insight Communications |

| Cox Communications (a) |

| Cablevision (a) |

| |||||||||||||||||||||

|

| Day Prior |

| @ Original |

| @ Revised |

| Revised Offer PF |

| Day Prior |

| Initial Offer |

| Final Offer |

| Day Prior |

| Initial Offer |

| |||||||||

($ in millions, except per share data) |

| 3/4/2005 |

| Offer Price |

| Offer Price |

| Dissolution Case (g) |

| 7/30/2004 |

| 8/2/2004 |

| 10/19/2004 |

| 6/17/2005 |

| 6/20/2005 |

| |||||||||

Price |

| $ | 9.68 |

| $ | 10.70 |

| $ | 11.75 |

| $ | 11.75 |

| $ | 27.58 |

| $ | 32.00 |

| $ | 34.75 |

| $ | 14.37 |

| $ | 21.00 |

|

% Premium to Day Prior |

| — |

| 10.5 | % | 21.4 | % | 21.4 | % | — |

| 16.0 | % | 26.0 | % | NM |

| NM |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Equity Value (b) |

| $ | 582 |

| $ | 647 |

| $ | 714 |

| $ | 714 |

| $ | 17,515 |

| $ | 20,327 |

| $ | 22,077 |

| $ | 4,239 |

| $ | 6,195 |

|

Net Debt & Minority Interest |

| 1,430 |

| 1,430 |

| 1,430 |

| 1,430 |

| 6,670 |

| 6,670 |

| 6,670 |

| 7,371 |

| 7,371 |

| |||||||||

Other Investments (c) |

| 0 |

| 0 |

| 0 |

| 0 |

| (2,552 | ) | (2,552 | ) | (2,552 | ) | 0 |

| 0 |

| |||||||||

Cable Firm Value |

| $ | 2,011 |

| $ | 2,076 |

| $ | 2,143 |

| $ | 2,143 |

| $ | 21,633 |

| $ | 24,445 |

| $ | 26,195 |

| $ | 11,610 |

| $ | 13,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Premium / (Discount) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

10 Trading Day Average |

| 0.7 | % | 11.3 | % | 22.3 | % | 22.3 | % | (1.4 | )% | 14.4 | % | 24.2 | % | NM |

| NM |

| |||||||||

1 Month Average |

| (1.7 | ) | 8.7 |

| 19.4 |

| 19.4 |

| (1.5 | ) | 14.3 |

| 24.1 |

| NM |

| NM |

| |||||||||

3 Month Average |

| 2.4 |

| 13.2 |

| 24.3 |

| 24.3 |

| (7.2 | ) | 7.7 |

| 16.9 |

| NM |

| NM |

| |||||||||

6 Month Average |

| 6.1 |

| 17.2 |

| 28.7 |

| 28.7 |

| (11.1 | ) | 3.1 |

| 12.0 |

| NM |

| NM |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Cable FV / EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

2004 |

| 9.4 | x | 9.7 | x | 10.1 | x | 11.5 | x | 9.0 | x | 10.1 | x | 10.9 | x | 8.8 | x | 10.3 | x | |||||||||

2005 |

| 8.6 |

| 8.9 |

| 9.2 |

| 10.6 |

| 8.2 |

| 9.2 |

| 9.9 |

| 8.2 |

| 9.6 |

| |||||||||

2006 |

| 7.9 |

| 8.2 |

| 8.4 |

| 9.7 |

| 7.5 |

| 8.5 |

| 9.1 |

| 7.3 |

| 8.5 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

LTM (d) |

| 9.3 |

| 9.6 |

| 9.9 |

| 11.2 |

| 9.2 |

| 10.4 |

| 11.1 |

| 9.1 |

| 10.6 |

| |||||||||

NTM (e) |

| 8.4 |

| 8.7 |

| 9.0 |

| 10.3 |

| 8.1 |

| 9.1 |

| 9.8 |

| 8.0 |

| 9.4 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

FV / Subscribers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

2004 |

| $ | 3,161 |

| $ | 3,263 |

| $ | 3,368 |

| $ | 3,368 |

| $ | 3,400 |

| $ | 3,842 |

| $ | 4,117 |

| $ | 3,918 |

| $ | 4,578 |

|

2005 |

| 3,197 |

| 3,300 |

| 3,407 |

| 3,407 |

| 3,386 |

| 3,826 |

| 4,100 |

| 3,861 |

| 4,511 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Value of Shares to be Purchased (f) |

| $ | 499 |

| $ | 556 |

| $ | 614 |

| $ | 614 |

| $ | 6,633 |

| $ | 7,696 |

| $ | 8,357 |

| $ | 3,391 |

| $ | 4,956 |

|

Note: Insight capitalization is on a proportionate basis that includes 50% of Insight Midwest’s net debt and earnings and 100% of ICCI HoldCo’s net debt and earnings.

(a) Cox Communciations shown for illustrative purposes because it is the most recent completed going-private transaction in the cable industry. Cablevision is the most recent announced going private transaction in the industry.

(b) Equity Value for Insight based on shares outstanding, plus restricted stock and in-the-money stock options, net of options proceeds.

(c) Cox includes Discovery value of $2,552 million pre-tax.

(d) LTM for Insight defined as Q2 ’04 to Q1 ’05. LTM for Cox defined as Q4 ’03 to Q3 ’04.

(e) NTM for Insight defined as Q2 ’05 to Q1 ’06. NTM for Cox defined as Q4 ’04 to Q3 ’05.

(f) Net of option proceeds. For Insight, assumes 63.8 mm shares outstanding after option exercise, of which 9.1 mm are owned by management and affiliates and 8.5 mm are to be rolled over.

(g) Pro forma EBITDA statistics reflect the impact of dissolution as if dissolution were to occur on January 1, 2005. See page 37 for additional information on methodology used to arrive at pro forma statistics.

10

Stock Price Premium Analysis

(Dollars in Millions, Except per Share Data and Multiples)

|

|

|

| Day Prior |

| Initial Offer |

| Interim Proposals |

| Revised Offer |

| Market (a) |

| ||||||||||||

|

|

|

| $9.68 |

| $10.70 |

| $11.20 |

| $11.50 |

| $11.60 |

| $11.75 |

| $11.38 |

| ||||||||

Price |

|

|

| Premium / (Discount) to |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

1 Day Prior |

| $ | 9.68 |

| 0.0 | % | 10.5 | % | 15.7 | % | 18.8 | % | 19.8 | % | 21.4 | % | 17.6 | % | |||||||

10 Trading Day Avg. |

| 9.61 |

| 0.7 |

| 11.3 |

| 16.6 |

| 19.7 |

| 20.7 |

| 22.3 |

| 18.4 |

| ||||||||

1 Month Average |

| 9.84 |

| (1.7 | ) | 8.7 |

| 13.8 |

| 16.8 |

| 17.8 |

| 19.4 |

| 15.6 |

| ||||||||

3 Month Average |

| 9.45 |

| 2.4 |

| 13.2 |

| 18.5 |

| 21.7 |

| 22.7 |

| 24.3 |

| 20.4 |

| ||||||||

6 Month Average |

| 9.13 |

| 6.1 |

| 17.2 |

| 22.7 |

| 26.0 |

| 27.1 |

| 28.7 |

| 24.7 |

| ||||||||

Equity Value (b) |

|

|

| $ | 582 |

| $ | 647 |

| $ | 679 |

| $ | 698 |

| $ | 704 |

| $ | 714 |

| $ | 690 |

| |

of Shares to be Purchased (c) |

|

|

| 499 |

| 556 |

| 583 |

| 600 |

| 605 |

| 614 |

| 593 |

| ||||||||

Proportionate Net Debt |

|

|

| 1,430 |

| 1,430 |

| 1,430 |

| 1,430 |

| 1,430 |

| 1,430 |

| 1,430 |

| ||||||||

Firm Value |

|

|

| 2,011 |

| 2,076 |

| 2,108 |

| 2,127 |

| 2,134 |

| 2,143 |

| 2,120 |

| ||||||||

Basic Subscribers |

|

|

| Firm Value / |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

2004A |

| 636 |

| $ | 3,161 |

| $ | 3,263 |

| $ | 3,313 |

| $ | 3,343 |

| $ | 3,353 |

| $ | 3,368 |

| $ | 3,331 |

| |

2005E |

| 629 |

| 3,197 |

| 3,300 |

| 3,351 |

| 3,382 |

| 3,392 |

| 3,407 |

| 3,369 |

| ||||||||

EBITDA |

|

|

| Firm Value / |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

LTM |

| $ | 217 |

| 9.3 | x | 9.6 | x | 9.7 | x | 9.8 | x | 9.8 | x | 9.9 | x | 9.7 | x | |||||||

NTM (Q2 ’05 to Q1 ’06) |

| 238 |

| 8.4 |

| 8.7 |

| 8.8 |

| 8.9 |

| 9.0 |

| 9.0 |

| 8.9 |

| ||||||||

NTM (Q3 ’05 to Q2 ’06) |

| 244 |

| 8.3 |

| 8.5 |

| 8.6 |

| 8.7 |

| 8.8 |

| 8.8 |

| 8.7 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

2005E |

| $ | 233 |

| 8.6 | x | 8.9 | x | 9.0 | x | 9.1 | x | 9.2 | x | 9.2 | x | 9.1 | x | |||||||

2006E |

| 254 |

| 7.9 |

| 8.2 |

| 8.3 |

| 8.4 |

| 8.4 |

| 8.4 |

| 8.3 |

| ||||||||

EBITDA (PF for Dissolution) (d) |

|

|

| Firm Value / |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

LTM |

| $ | 191 |

| 10.6 | x | 10.9 | x | 11.1 | x | 11.2 | x | 11.2 | x | 11.2 | x | 11.1 | x | |||||||

NTM (Q2 ’05 to Q1 ’06) |

| 207 |

| 9.7 |

| 10.0 |

| 10.2 |

| 10.3 |

| 10.3 |

| 10.3 |

| 10.2 |

| ||||||||

NTM (Q3 ’05 to Q2 ’06) |

| 212 |

| 9.5 |

| 9.8 |

| 9.9 |

| 10.0 |

| 10.1 |

| 10.1 |

| 10.0 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

2005E |

| $ | 203 |

| 9.9 | x | 10.2 | x | 10.4 | x | 10.5 | x | 10.5 | x | 10.6 | x | 10.5 | x | |||||||

2006E |

| 221 |

| 9.1 | x | 9.4 |

| 9.5 |

| 9.6 |

| 9.7 |

| 9.7 |

| 9.6 |

| ||||||||

Note: Insight capitalization is on a proportionate basis that includes 50% of Insight Midwest’s net debt and earnings and 100% of ICCI HoldCo’s net debt and earnings.

(a) Market price as of July 27, 2005.

(b) Equity Value based on shares outstanding, plus restricted stock and in-the-money stock options, net of options proceeds.

(c) Net of option proceeds. Assumes 63.8 mm shares outstanding after option exercise, of which 9.1 mm are owned by management and affiliates and 8.5 mm are to be rolled over.

(d) Pro forma EBITDA statistics assume dissolution were to take place on January 1, 2005. See page 37 for additional information on methodology used to arrive at pro forma statistics.

11

2. Valuation Analyses

Summary Valuation Analyses

[CHART]

Note: Underlying numbers are from Management Projections for each of Status Quo and Dissolution scenarios.

(a) Targeting an IRR of approximately 20%, assumes dissolution 12/31/06, and sale to strategic in 2009.

(b) Targeting an IRR of approximately 20%, assumes dissolution 12/31/06, and IPO in 2009.

12

Squeeze Outs Analysis – 100% Cash Transactions

• Data below is for 100% cash transactions in which acquirers sought 20% or greater of target equity

Precedent All Cash Transactions

Date |

| Date |

|

|

|

|

|

|

| Target’s |

| Transaction Value ($ mm) (b) |

| Price |

| Initial Premium (c) |

| Final Premium (c) |

| |||||||||||

|

| Target |

| Acquiror |

| % Sought |

| Leverage(a) |

| at Announcement |

| at Execution |

| Initial |

| Final |

| 1 - Day |

| 30 - Day |

| 1 - Day |

| 30 - Day |

| |||||

20-Jun-05 |

| Not Closed |

| Cablevision Systems |

| Dolan Family |

| 80.0 | % | 5.0 | x | $ | 4,956 |

| — |

| $ | 21.00 |

| — |

| NM |

| NM |

| — |

| — |

| |

21-Feb-05 |

| Not Closed |

| Eon Labs |

| Novartis |

| 34.6 |

| NM |

| 989 |

| — |

| 31.00 |

| — |

| 11.0 |

| 18.2 |

| — |

| — |

| |||

02-Aug-04 |

| 02-Dec-04 |

| Cox Communications |

| Cox Enterprises |

| 38.0 |

| 2.9 |

| 7,857 |

| 8,532 |

| 32.00 |

| $ | 34.75 |

| 16.0 |

| 13.6 |

| 26.0 | % | 23.4 | % | ||

22-Jul-04 |

| 23-Dec-04 |

| AMC Entertainment |

| Investor Group |

| 50.1 |

| 2.8 |

| N/A |

| 834 |

| N/A |

| 19.50 |

| N/A |

| N/A |

| 13.6 |

| 28.5 |

| |||

19-Feb-02 |

| 11-Apr-02 |

| Travelocity.com Inc |

| Sabre Holdings Corp. |

| 30.0 |

| 0.1 |

| 403 |

| 491 |

| 23.00 |

| 28.00 |

| 19.8 |

| 1.0 |

| 45.8 |

| 23.0 |

| |||

21-Sep-01 |

| 08-Nov-01 |

| Prodigy Communications Corp. |

| SBC Communications |

| 58.3 |

| 4.4 |

| 409 |

| 496 |

| 5.45 |

| 6.60 |

| 54.0 |

| 2.3 |

| 86.4 |

| 23.9 |

| |||

15-Feb-01 |

| 01-Oct-01 |

| Westfield America Inc |

| Westfield America Trust |

| 22.5 |

| 0.0 |

| 262 |

| 268 |

| 15.88 |

| 16.25 |

| 9.9 |

| 9.9 |

| 12.5 |

| 12.5 |

| |||

25-Jan-01 |

| 20-Jun-01 |

| SodexhoMarriott Services |

| Sodexho Alliance |

| 52.0 |

| 3.2 |

| 989 |

| 1,173 |

| 27.00 |

| 32.00 |

| 8.5 |

| 23.0 |

| 28.6 |

| 45.8 |

| |||

27-Oct-00 |

| 16-Mar-01 |

| AzurixCorp. |

| Enron Corp. |

| 33.0 |

| 6.8 |

| 276 |

| 330 |

| 7.00 |

| 8.38 |

| 96.5 |

| 73.5 |

| 135.1 |

| 107.6 |

| |||

15-Aug-00 |

| 01-Mar-01 |

| Avis Group Holdings |

| Cendant |

| 82.0 |

| 1.6 |

| 823 |

| 937 |

| 29.00 |

| 33.00 |

| 13.7 |

| 29.4 |

| 29.4 |

| 47.3 |

| |||

24-Jul-00 |

| 11-Jan-01 |

| Phoenix Investment Partners |

| Phoenix Home Life Mutual |

| 40.5 |

| 1.9 |

| 344 |

| 434 |

| 12.50 |

| 15.75 |

| 15.6 |

| 19.8 |

| 45.7 |

| 50.9 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mean: |

| 29.4 | % | 22.6 | % | 47.0 | % | 40.3 | % | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Median: |

| 15.8 |

| 19.0 |

| 29.4 |

| 28.5 |

| |||

Note: Data is for 100% cash transactions in which acquirors sought 20% or greater of target equity, and where transaction value was greater than $200 mm in past 5 years.

Cablevision transaction reflects proposed acquisition of cable and telecom business only. Value based on assumption of 80% of 295 mm fully diluted shares outstanding being sought, based on disclosure in 13-D filing and information found in latest 10-Q and 10-K. Leverage based on cable debt and EBITDA. Premia based on stock price net of estimated value of Rainbow at $12.50 a share, per 13-D filing.

In cases where deals were pre-negotiated, initial offer price based company filings.

(a) Leverage defined as Total Debt & Preferred / LTM EBITDA.

(b) Represents equity value of the minority shareholders’ stake, which the acquiror proposed to acquire in the transaction.

(c) One-day premium measured relative to target’s closing stock price on last trading day prior to annoucement date; 30-day premium measured relative to target’s average closing stock price during the 30-day trading period prior to announcement date.

Implied ICCI Stock Prices

|

|

|

| Final Premium Paid (a) |

| Implied Stock Price |

| |||||||

|

| Stock Price |

| Low |

| High |

| Low |

| High |

| |||

One Day Prior |

| $ | 9.68 |

| 25.0 | % | 30.0 | % | $ | 12.10 |

| $ | 12.58 |

|

30 Day Average Prior (b) |

| 9.93 |

| 25.0 |

| 30.0 |

| 12.42 |

| 12.91 |

| |||

(a) Based on median data from precedent squeeze out analysis.

(b) Average of 30 trading days prior to announcement date.

13

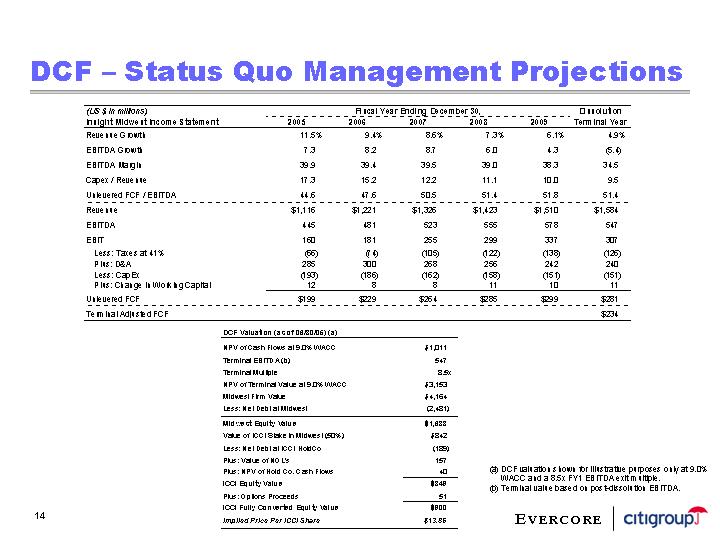

DCF – Status Quo Management Projections

(US $ in millions) |

| Fiscal Year Ending December 30, |

| Dissolution |

| ||||||||||||||

Insight Midwest Income Statement |

| 2005 |

| 2006 |

| 2007 |

| 2008 |

| 2009 |

| Terminal Year |

| ||||||

Revenue Growth |

| 11.5 | % | 9.4 | % | 8.6 | % | 7.3 | % | 6.1 | % | 4.9 | % | ||||||

EBITDA Growth |

| 7.3 |

| 8.2 |

| 8.7 |

| 6.0 |

| 4.3 |

| (5.4 | ) | ||||||

EBITDA Margin |

| 39.9 |

| 39.4 |

| 39.5 |

| 39.0 |

| 38.3 |

| 34.5 |

| ||||||

Capex / Revenue |

| 17.3 |

| 15.2 |

| 12.2 |

| 11.1 |

| 10.0 |

| 9.5 |

| ||||||

Unlevered FCF / EBITDA |

| 44.6 |

| 47.6 |

| 50.5 |

| 51.4 |

| 51.8 |

| 51.4 |

| ||||||

Revenue |

| $ | 1,116 |

| $ | 1,221 |

| $ | 1,326 |

| $ | 1,423 |

| $ | 1,510 |

| $ | 1,584 |

|

EBITDA |

| 445 |

| 481 |

| 523 |

| 555 |

| 578 |

| 547 |

| ||||||

EBIT |

| 160 |

| 181 |

| 255 |

| 299 |

| 337 |

| 307 |

| ||||||

Less: Taxes at 41% |

| (66 | ) | (74 | ) | (105 | ) | (122 | ) | (138 | ) | (126 | ) | ||||||

Plus: D&A |

| 285 |

| 300 |

| 268 |

| 256 |

| 242 |

| 240 |

| ||||||

Less: CapEx |

| (193 | ) | (186 | ) | (162 | ) | (158 | ) | (151 | ) | (151 | ) | ||||||

Plus: Change in Working Capital |

| 12 |

| 8 |

| 8 |

| 11 |

| 10 |

| 11 |

| ||||||

Unlevered FCF |

| $ | 199 |

| $ | 229 |

| $ | 264 |

| $ | 285 |

| $ | 299 |

| $ | 281 |

|

Terminal Adjusted FCF |

|

|

|

|

|

|

|

|

|

|

| $ | 234 |

| |||||

DCF Valuation (as of 06/30/05) (a) |

|

|

| |

NPV of Cash Flows at 9.0% WACC |

| $ | 1,011 |

|

Terminal EBITDA (b) |

| 547 |

| |

Terminal Multiple |

| 8.5 | x | |

NPV of Terminal Value at 9.0% WACC |

| $ | 3,153 |

|

Midwest Firm Value |

| $ | 4,164 |

|

Less: Net Debt at Midwest |

| (2,481 | ) | |

Midwest Equity Value |

| $ | 1,683 |

|

Value of ICCI Stake in Midwest (50%) |

| $ | 842 |

|

Less: Net Debt at ICCI HoldCo |

| (189 | ) | |

Plus: Value of NOL’s |

| 157 |

| |

Plus: NPV of Hold Co. Cash Flows |

| 40 |

| |

ICCI Equity Value |

| $ | 849 |

|

Plus: Options Proceeds |

| 51 |

| |

ICCI Fully Converted Equity Value |

| $ | 900 |

|

Implied Price Per ICCI Share |

| $ | 13.86 |

|

(a) DCF valuation shown for illustrative purposes only at 9.0% WACC and a 8.5x FY1 EBITDA exit multiple.

(b) Terminal value based on post-dissolution EBITDA.

14

Implied Value per Share

|

| Terminal EBITDA Multiple |

| |||||||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

| |||||

8.0 | % | $ | 12.05 |

| $ | 13.56 |

| $ | 15.05 |

| $ | 16.54 |

| $ | 18.03 |

|

8.5 | % | 11.50 |

| 12.99 |

| 14.45 |

| 15.91 |

| 17.37 |

| |||||

9.0 | % | 10.96 |

| 12.42 |

| 13.86 |

| 15.29 |

| 16.72 |

| |||||

9.5 | % | 10.44 |

| 11.87 |

| 13.29 |

| 14.69 |

| 16.09 |

| |||||

10.0 | % | 9.93 |

| 11.32 |

| 12.72 |

| 14.10 |

| 15.47 |

| |||||

ICCI Equity Value as of 6/30/05

|

| Terminal EBITDA Multiple |

| |||||||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

| |||||

8.0 | % | $ | 733 |

| $ | 830 |

| $ | 926 |

| $ | 1,023 |

| $ | 1,120 |

|

8.5 | % | 698 |

| 792 |

| 887 |

| 982 |

| 1,077 |

| |||||

9.0 | % | 664 |

| 756 |

| 849 |

| 942 |

| 1,035 |

| |||||

9.5 | % | 630 |

| 721 |

| 812 |

| 903 |

| 994 |

| |||||

10.0 | % | 598 |

| 687 |

| 776 |

| 865 |

| 954 |

| |||||

Implied FV Multiple of 2005E EBITDA

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 8.8 | x | 9.3 | x | 9.7 | x | 10.1 | x | 10.6 | x |

8.5 | % | 8.7 |

| 9.1 |

| 9.5 |

| 10.0 |

| 10.4 |

|

9.0 | % | 8.5 |

| 8.9 |

| 9.4 |

| 9.8 |

| 10.2 |

|

9.5 | % | 8.4 |

| 8.8 |

| 9.2 |

| 9.6 |

| 10.0 |

|

10.0 | % | 8.2 |

| 8.6 |

| 9.0 |

| 9.4 |

| 9.8 |

|

Corresponding Premium to Pre-Offer Price Per Share

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 24.5 | % | 40.1 | % | 55.5 | % | 70.9 | % | 86.3 | % |

8.5 | % | 18.8 |

| 34.2 |

| 49.3 |

| 64.3 |

| 79.4 |

|

9.0 | % | 13.3 |

| 28.3 |

| 43.2 |

| 58.0 |

| 72.7 |

|

9.5 | % | 7.9 |

| 22.6 |

| 37.3 |

| 51.7 |

| 66.2 |

|

10.0 | % | 2.6 |

| 17.0 |

| 31.4 |

| 45.7 |

| 59.8 |

|

Implied Perpetuity Growth Rate

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 2.1 | % | 2.5 | % | 2.8 | % | 3.1 | % | 3.3 | % |

8.5 | % | 2.6 |

| 2.9 |

| 3.3 |

| 3.6 |

| 3.8 |

|

9.0 | % | 3.1 |

| 3.4 |

| 3.8 |

| 4.0 |

| 4.3 |

|

9.5 | % | 3.5 |

| 3.9 |

| 4.2 |

| 4.5 |

| 4.8 |

|

10.0 | % | 4.0 |

| 4.4 |

| 4.7 |

| 5.0 |

| 5.3 |

|

Implied FV Multiple of 2006E EBITDA

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 8.2 | x | 8.6 | x | 9.0 | x | 9.4 | x | 9.8 | x |

8.5 | % | 8.0 |

| 8.4 |

| 8.8 |

| 9.2 |

| 9.6 |

|

9.0 | % | 7.9 |

| 8.3 |

| 8.6 |

| 9.0 |

| 9.4 |

|

9.5 | % | 7.7 |

| 8.1 |

| 8.5 |

| 8.9 |

| 9.2 |

|

10.0 | % | 7.6 |

| 8.0 |

| 8.3 |

| 8.7 |

| 9.1 |

|

15

DCF – Dissolution Management Projections

|

| Fiscal Year Ended December 30, |

| ||||||||||||||||

($ in millions) |

| 2005 |

| 2006 |

| 2007 |

| 2008 |

| 2009 |

| 2010 |

| ||||||

EBITDA |

| 233 |

| 254 |

| 241 |

| 256 |

| 266 |

| 274 |

| ||||||

EBIT |

| 89 |

| 103 |

| 105 |

| 126 |

| 144 |

| 154 |

| ||||||

Less: Taxes |

| (36 | ) | (42 | ) | (43 | ) | (52 | ) | (59 | ) | (63 | ) | ||||||

Plus: D&A |

| 144 |

| 151 |

| 135 |

| 129 |

| 122 |

| 120 |

| ||||||

Less: CapEx |

| (98 | ) | (94 | ) | (82 | ) | (80 | ) | (77 | ) | (76 | ) | ||||||

Plus: Change in Working Capital |

| 5 |

| 4 |

| 4 |

| 6 |

| 6 |

| 6 |

| ||||||

Unlevered FCF |

| $ | 104 |

| $ | 122 |

| $ | 120 |

| $ | 129 |

| $ | 136 |

| $ | 141 |

|

Terminal Adjusted FCF |

|

|

|

|

|

|

|

|

|

|

| $ | 117 |

| |||||

DCF Valuation (as of 06/30/05) (a) |

|

|

| |

NPV of Cash Flows at 9.0% WACC |

| $ | 485 |

|

Terminal EBITDA (b) |

| 274 |

| |

Terminal Multiple |

| 8.5 | x | |

NPV of Terminal Value at 9.0% WACC |

| $ | 1,577 |

|

Midwest Firm Value |

| $ | 2,061 |

|

Less: Net Debt at Midwest |

| (1,240 | ) | |

Midwest Equity Value |

| $ | 821 |

|

Value of ICCI Stake in Midwest |

| $ | 821 |

|

Less: Net Debt at ICCI HoldCo |

| (189 | ) | |

Plus: Value of NOL’s |

| 135 |

| |

Plus: NPV of Hold Co. Cash Flows |

| NA |

| |

Less: PV of Refinance for Dissolution |

| (34 | ) | |

ICCI Equity Value |

| $ | 733 |

|

Plus: Options Proceeds |

| 36 |

| |

ICCI Fully Converted Equity Value |

| $ | 769 |

|

Implied Price Per ICCI Share |

| $ | 12.06 |

|

(a) DCF valuation shown for illustrative purposes only at 9.0% WACC and a 8.5x FY1 EBITDA exit multiple

(b) Terminal value based on post-dissolution EBITDA

16

Implied Value per Share

|

| Terminal EBITDA Multiple |

| |||||||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

| |||||

8.0 | % | $ | 10.22 |

| $ | 11.73 |

| $ | 13.25 |

| $ | 14.74 |

| $ | 16.23 |

|

8.5 | % | 9.68 |

| 11.16 |

| 12.65 |

| 14.12 |

| 15.58 |

| |||||

9.0 | % | 9.15 |

| 10.60 |

| 12.06 |

| 13.51 |

| 14.94 |

| |||||

9.5 | % | 8.60 |

| 10.06 |

| 11.49 |

| 12.91 |

| 14.32 |

| |||||

10.0 | % | 8.07 |

| 9.53 |

| 10.93 |

| 12.32 |

| 13.71 |

| |||||

ICCI Equity Value as of 6/30/05

|

| Terminal EBITDA Multiple |

| |||||||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

| |||||

8.0 | % | $ | 616 |

| $ | 713 |

| $ | 809 |

| $ | 906 |

| $ | 1,003 |

|

8.5 | % | 581 |

| 676 |

| 771 |

| 866 |

| 960 |

| |||||

9.0 | % | 548 |

| 641 |

| 733 |

| 826 |

| 919 |

| |||||

9.5 | % | 515 |

| 606 |

| 697 |

| 788 |

| 879 |

| |||||

10.0 | % | 483 |

| 572 |

| 661 |

| 750 |

| 839 |

| |||||

Implied FV Multiple of 2005E EBITDA

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 8.3 | x | 8.8 | x | 9.2 | x | 9.6 | x | 10.0 | x |

8.5 | % | 8.2 |

| 8.6 |

| 9.0 |

| 9.4 |

| 9.8 |

|

9.0 | % | 8.1 |

| 8.4 |

| 8.8 |

| 9.2 |

| 9.6 |

|

9.5 | % | 7.9 |

| 8.3 |

| 8.7 |

| 9.1 |

| 9.5 |

|

10.0 | % | 7.8 |

| 8.2 |

| 8.5 |

| 8.9 |

| 9.3 |

|

Corresponding Premium to Pre-Offer Price Per Share

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 5.5 | % | 21.2 | % | 36.9 | % | 52.3 | % | 67.7 | % |

8.5 | % | (0.0 | ) | 15.3 |

| 30.7 |

| 45.8 |

| 60.9 |

|

9.0 | % | (5.5 | ) | 9.6 |

| 24.6 |

| 39.6 |

| 54.3 |

|

9.5 | % | (11.1 | ) | 3.9 |

| 18.7 |

| 33.4 |

| 47.9 |

|

10.0 | % | (16.7 | ) | (1.5 | ) | 12.9 |

| 27.3 |

| 41.6 |

|

Implied Perpetuity Growth Rate

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 2.1 | % | 2.5 | % | 2.8 | % | 3.1 | % | 3.3 | % |

8.5 | % | 2.6 |

| 2.9 |

| 3.3 |

| 3.6 |

| 3.8 |

|

9.0 | % | 3.1 |

| 3.4 |

| 3.8 |

| 4.0 |

| 4.3 |

|

9.5 | % | 3.5 |

| 3.9 |

| 4.2 |

| 4.5 |

| 4.8 |

|

10.0 | % | 4.0 |

| 4.4 |

| 4.7 |

| 5.0 |

| 5.3 |

|

Implied FV Multiple of 2006E EBITDA

|

| Terminal EBITDA Multiple |

| ||||||||

WACC |

| 7.5 x |

| 8.0 x |

| 8.5 x |

| 9.0 x |

| 9.5 x |

|

8.0 | % | 7.6 | x | 8.0 | x | 8.4 | x | 8.8 | x | 9.2 | x |

8.5 | % | 7.5 |

| 7.9 |

| 8.2 |

| 8.6 |

| 9.0 |

|

9.0 | % | 7.4 |

| 7.7 |

| 8.1 |

| 8.5 |

| 8.8 |

|

9.5 | % | 7.2 |

| 7.6 |

| 8.0 |

| 8.3 |

| 8.7 |

|

10.0 | % | 7.1 |

| 7.5 |

| 7.8 |

| 8.2 |

| 8.5 |

|

17

Multiples Analysis – Status Quo

Public Market Multiples

($ in millions, Except per Share Data)

|

|

|

| Multiple Range |

| Implied Firm Value |

| Implied Equity Value (a) |

| Implied Equity |

| |||||||||||||||||

Metric |

| Data |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| |||||||||

2004A EBITDA |

| $ | 213 |

| 9.0 | x | 10.0 | x | $ | 1,919 |

| $ | 2,132 |

| $ | 489 |

| $ | 702 |

| $ | 8.17 |

| $ | 11.57 |

| ||

2005E EBITDA |

| 233 |

| 8.5 |

| 9.5 |

| 1,980 |

| 2,213 |

| 551 |

| 784 |

| 9.20 |

| 12.85 |

| |||||||||

2006E EBITDA |

| 254 |

| 8.0 |

| 9.0 |

| 2,036 |

| 2,290 |

| 606 |

| 861 |

| 10.06 |

| 14.04 |

| |||||||||

2004 Subscribers |

| 636 |

| $ | 3,000 |

| $ | 3,500 |

| $ | 1,909 |

| $ | 2,227 |

| $ | 479 |

| $ | 797 |

| $ | 8.00 |

| $ | 13.06 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Max |

| $ | 10.06 |

| $ | 14.04 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mean |

| 8.86 |

| 12.88 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Median |

| 8.68 |

| 12.96 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Low |

| 8.00 |

| 11.57 |

| |||||||||

(a) Equity Value = Firm Value - Proportionate Net Debt

(b) Shares outstanding fluctuate based on fully converted share count for the implied equity value per share.

Precedent Transactions

($ in millions, Except per Share Data)

|

|

|

| Multiple Range |

| Implied Firm Value |

| Implied Equity Value (a) |

| Implied Equity |

| |||||||||||||||||

Metric |

| Data |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| |||||||||

2005E EBITDA |

| $ | 233 |

| 9.5 | x | 11.5 | x | $ | 2,213 |

| $ | 2,679 |

| $ | 784 |

| $ | 1,250 |

| $ | 12.85 |

| $ | 20.04 |

| ||

2004 Subscribers |

| 636 |

| $ | 3,250 |

| $ | 3,750 |

| $ | 2,068 |

| $ | 2,386 |

| $ | 638 |

| $ | 956 |

| $ | 10.57 |

| $ | 15.52 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mean |

| $ | 11.71 |

| $ | 17.78 |

| |||||||

(a) Equity Value = Firm Value - Proportionate Net Debt

(b) Shares outstanding fluctuate based on fully converted share count for the implied equity value per share.

18

Multiples Analysis – Dissolution

Public Market Multiples

($ in millions, Except per Share Data)

|

|

|

| Multiple Range |

| Implied Firm Value |

| Implied Equity Value (a) |

| Implied Equity |

| |||||||||||||||||

Metric |

| Data |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| |||||||||

2004A EBITDA |

| $ | 187 |

| 9.0 | x | 10.0 | x | $ | 1,679 |

| $ | 1,866 |

| $ | 250 |

| $ | 436 |

| $ | 4.17 |

| $ | 7.28 |

| ||

2005E EBITDA |

| 203 |

| 8.5 |

| 9.5 |

| 1,724 |

| 1,926 |

| 294 |

| 497 |

| 4.91 |

| 8.30 |

| |||||||||

2006E EBITDA |

| 221 |

| 8.0 |

| 9.0 |

| 1,768 |

| 1,989 |

| 338 |

| 559 |

| 5.65 |

| 9.33 |

| |||||||||

2004 Subscribers |

| 636 |

| $ | 3,000 |

| $ | 3,500 |

| $ | 1,909 |

| $ | 2,227 |

| $ | 479 |

| $ | 797 |

| $ | 8.00 |

| $ | 13.06 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Max |

| $ | 8.00 |

| $ | 13.06 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mean |

| 5.68 |

| 9.49 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Median |

| 5.28 |

| 8.81 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Low |

| 4.17 |

| 7.28 |

| |||||||||

(a) Equity Value = Firm Value - Proportionate Net Debt

(b) Shares outstanding fluctuate based on fully converted share count for the implied equity value per share.

Precedent Transactions

($ in millions, Except per Share Data)

|

|

|

| Multiple Range |

| Implied Firm Value |

| Implied Equity Value (a) |

| Implied Equity |

| |||||||||||||||||

Metric |

| Data |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| Low |

| High |

| |||||||||

2005E EBITDA |

| $ | 203 |

| 9.5 | x | 11.5 | x | $ | 1,926 |

| $ | 2,332 |

| $ | 497 |

| $ | 903 |

| $ | 8.30 |

| $ | 14.69 |

| ||

2004 Subscribers |

| 636 |

| $ | 3,250 |

| $ | 3,750 |

| $ | 2,068 |

| $ | 2,386 |

| $ | 638 |

| $ | 956 |

| $ | 10.57 |

| $ | 15.52 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mean |

| $ | 9.43 |

| $ | 15.10 |

| |||||||

(a) Equity Value = Firm Value - Proportionate Net Debt

(b) Shares outstanding fluctuate based on fully converted share count for the implied equity value per share.

19

Cable Change of Control Transactions

(Dollars in Millions, Subscribers in Thousands)

Date of |

| Acquiring |

| Seller/Acquired |

| Firm |

| Total |

| Adjusted |

| Forward |

| ||

Apr-05 |

| Time Warner and Comcast |

| Adelphia |

| $ | 18,100 |

| 5,300 |

| $ | 3,415 |

| 13.9 | x |

Sep-03 |

| Atlantic Broadband LLC |

| Charter Communications |

| 765 |

| 235 |

| 3,255 |

| 10.6 |

| ||

Jul-03 |

| Susquehanna Communications |

| RCN Corp |

| 120 |

| 30 |

| 4,027 |

| 9.4 |

| ||

Feb-03 |

| Cequel III |

| Shaw Communications |

| 85 |

| 27 |

| 3,148 |

| 11.9 |

| ||

Feb-03 |

| Advance / Newhouse |

| Shaw Communications |

| 112 |

| 44 |

| 2,545 |

| 10.1 |

| ||

Dec-02 |

| G-Force LLC |

| Northland Cable |

| 46 |

| 17 |

| 2,756 |

| 11.6 |

| ||

Aug-02 |

| Patriot Media (Spectrum and Steve Simmons) |

| RCN Corp |

| 245 |

| 80 |

| 3,063 |

| 11.3 |

| ||

Apr-02 |

| Bresnan Communications |

| Comcast / AT&T Broadband |

| 675 |

| 317 |

| 2,129 |

| 10.1 |

| ||

Dec-01 |

| Comcast Corp |

| AT&T Broadband |

| 56,560 |

| 13,357 |

| 4,235 |

| 22.9 |

| ||

May-01 |

| Comcast |

| AT&T Baltimore Cable |

| 500 |

| 110 |

| 4,545 |

| NA |

| ||

Apr-01 |

| Comcast |

| AT&T |

| 2,696 |

| 595 |

| 4,531 |

| NA |

| ||

Apr-01 |

| Adelphia Communications |

| AT&T “PONY” |

| 300 |

| 115 |

| 2,609 |

| NA |

| ||

Feb-01 |

| Mediacom |

| AT&T Broadband |

| 2,215 |

| 840 |

| 2,637 |

| 11.8 |

| ||

Jun-00 |

| Adelphia Communications |

| GS Communications |

| 826 |

| 155 |

| 5,329 |

| 27.5 |

| ||

Apr-00 |

| Cablevision |

| AT&T Westchester Cable |

| 628 |

| 126 |

| 5,000 |

| NA |

| ||

Apr-00 |

| AT&T Broadband |

| Cablevision Boston Cable |

| 1,790 |

| 358 |

| 5,001 |

| NA |

| ||

Mar-00 |

| Sandler Capital |

| James Cable |

| 160 |

| 72 |

| 2,226 |

| 11.6 |

| ||

Mar-00 |

| Charter Communications |

| Cablevision of Michigan |

| 173 |

| 49 |

| 3,557 |

| 18.7 |

| ||

May-99 |

| Cox Communications Inc |

| TCA Cable TV Inc |

| 3,634 |

| 883 |

| 4,115 |

| 19.6 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| High |

| $ | 5,329 |

| 27.5 | x | |

|

|

|

|

|

|

|

| Median |

| 3,486 |

| 11.6 |

| ||

|

|

|

|

|

|

|

| Mean |

| 3,615 |

| 14.1 |

| ||

|

|

|

|

|

|

|

| Low |

| 2,129 |

| 9.4 |

| ||

20

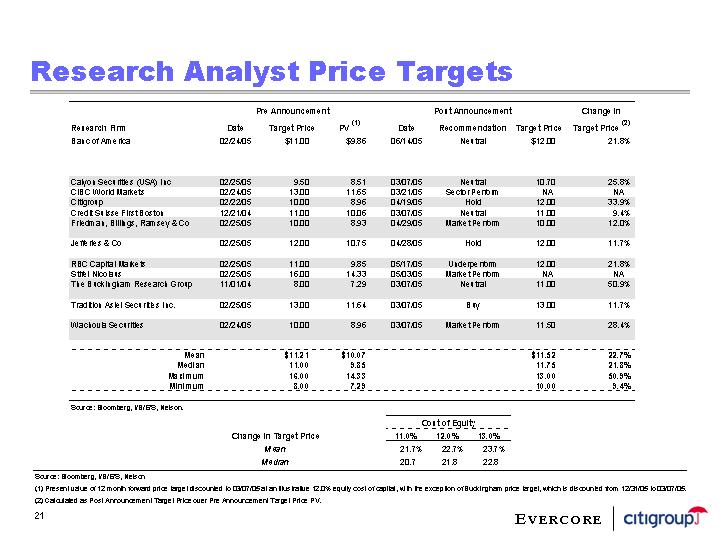

Research Analyst Price Targets

|

| Pre Announcement |

| Post Announcement |

| Change in |

| |||||||||||

Research Firm |

| Date |

| Target Price |

| PV (1) |

| Date |

| Recommendation |

| Target Price |

| Target Price (2) |

| |||

Banc of America |

| 02/24/05 |

| $ | 11.00 |

| $ | 9.86 |

| 06/14/05 |

| Neutral |

| $ | 12.00 |

| 21.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Calyon Securities (USA) Inc |

| 02/25/05 |

| 9.50 |

| 8.51 |

| 03/07/05 |

| Neutral |

| 10.70 |

| 25.8 | % | |||

CIBC World Markets |

| 02/24/05 |

| 13.00 |

| 11.65 |

| 03/21/05 |

| Sector Perform |

| NA |

| NA |

| |||

Citigroup |

| 02/22/05 |

| 10.00 |

| 8.96 |

| 04/19/05 |

| Hold |

| 12.00 |

| 33.9 | % | |||

Credit Suisse First Boston |

| 12/21/04 |

| 11.00 |

| 10.06 |

| 03/07/05 |

| Neutral |

| 11.00 |

| 9.4 | % | |||

Friedman, Billings, Ramsey & Co |

| 02/25/05 |

| 10.00 |

| 8.93 |

| 04/29/05 |

| Market Perform |

| 10.00 |

| 12.0 | % | |||

Jefferies & Co |

| 02/25/05 |

| 12.00 |

| 10.75 |

| 04/28/05 |

| Hold |

| 12.00 |

| 11.7 | % | |||

RBC Capital Markets |

| 02/25/05 |

| 11.00 |

| 9.85 |

| 05/17/05 |

| Underperform |

| 12.00 |

| 21.8 | % | |||

Stifel Nicolaus |

| 02/25/05 |

| 16.00 |

| 14.33 |

| 05/03/05 |

| Market Perform |

| NA |

| NA |

| |||

The Buckingham Research Group |

| 11/01/04 |

| 8.00 |

| 7.29 |

| 03/07/05 |

| Neutral |

| 11.00 |

| 50.9 | % | |||

Tradition Asiel Securities Inc. |

| 02/25/05 |

| 13.00 |

| 11.64 |

| 03/07/05 |

| Buy |

| 13.00 |

| 11.7 | % | |||

Wachovia Securities |

| 02/24/05 |

| 10.00 |

| 8.96 |

| 03/07/05 |

| Market Perform |

| 11.50 |

| 28.4 | % | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Mean |

|

|

| $ | 11.21 |

| $ | 10.07 |

|

|

|

|

| $ | 11.52 |

| 22.7 | % |

Median |

|

|

| 11.00 |

| 9.85 |

|

|

|

|

| 11.75 |

| 21.8 | % | |||

Maximum |

|

|

| 16.00 |

| 14.33 |

|

|

|

|

| 13.00 |

| 50.9 | % | |||

Minimum |

|

|

| 8.00 |

| 7.29 |

|

|

|

|

| 10.00 |

| 9.4 | % | |||

Source: Bloomberg, I/B/E/S, Nelson.

|

| Cost of Equity |

| ||||

Change in Target Price |

| 11.0% |

| 12.0% |

| 13.0% |

|

Mean |

| 21.7 | % | 22.7 | % | 23.7 | % |

Median |

| 20.7 |

| 21.8 |

| 22.8 |

|

Source: Bloomberg, I/B/E/S, Nelson

(1) Present value of 12 month forward price target discounted to 03/07/05 at an illustrative 12.0% equity cost of capital, with the exception of Buckingham price target, which is discounted from 12/31/05 to 03/07/05.

(2) Calculated as Post Announcement Target Price over Pre Announcement Target Price PV.

21

LBO Analysis – Sale to Strategic

(post-Dissolution)

LBO Summary

(Dollars in Millions)

Purchase Price |

| $ | 11.75 |

|

|

|

|

| |

ICCI Equity Value |

| $ | 714 |

|

Plus: Proportionate Net Debt (3/31/05) |

| 1,430 |

| |

Enterprise Value |

| $ | 2,143 |

|

|

|

|

| |

2005E Proportionate Dissolution EBITDA Multiple |

| 10.6 | x | |

Proportionate Debt / 2005E Dissolution EBITDA |

| 7.0 | x | |

|

|

|

| |

Exit Multiple |

| 9.0 | x | |

2010E EBITDA (1) |

| $ | 317 |

|

Value of Midwest |

| $ | 2,851 |

|

Less: Proportionate Net Debt (12/31/09) |

| (1,203 | ) | |

Less: Promote Profits Interest |

| (42 | ) | |

Implied Equity Value (Midwest) |

| $ | 1,605 |

|

Implied Value per ICCI Share |

| $ | 25.73 |

|

|

|

|

| |

IRR |

| 19.7 | % | |

(1) Assumes sale to strategic post-dissolution.

IRR Sensitivity Analysis

At 7.0x Proportionate Debt / 2005E Dissolution EBITDA

|

| Share Price Paid |

| ||||||||||||

|

| $9.00 |

| $10.00 |

| $10.70 |

| $11.75 |

| $12.00 |

| $13.00 |

| $14.00 |

|

Exit Multiple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.5 | x | 24.0 | % | 21.3 | % | 19.6 | % | 17.3 | % | 16.7 | % | 14.8 | % | 12.9 | % |

9.0 | x | 26.4 | % | 23.8 | % | 22.0 | % | 19.7 | % | 19.2 | % | 17.1 | % | 15.3 | % |

9.5 | x | 28.5 | % | 25.9 | % | 24.3 | % | 21.9 | % | 21.4 | % | 19.4 | % | 17.5 | % |

10.0 | x | 30.4 | % | 27.8 | % | 26.2 | % | 23.9 | % | 23.4 | % | 21.4 | % | 19.5 | % |

10.5 | x | 32.3 | % | 29.6 | % | 28.0 | % | 25.7 | % | 25.2 | % | 23.2 | % | 21.4 | % |

At 8.0x Proportionate Debt / 2005E Dissolution EBITDA

|

| Share Price Paid |

| ||||||||||||

|

| $9.00 |

| $10.00 |

| $10.70 |

| $11.75 |

| $12.00 |

| $13.00 |

| $14.00 |

|

Exit Multiple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.5 | x | 29.4 | % | 25.4 | % | 22.9 | % | 19.5 | % | 18.8 | % | 16.0 | % | 13.6 | % |

9.0 | x | 32.4 | % | 28.3 | % | 25.9 | % | 22.5 | % | 21.8 | % | 19.1 | % | 16.6 | % |

9.5 | x | 35.3 | % | 30.9 | % | 28.4 | % | 25.3 | % | 24.5 | % | 21.8 | % | 19.3 | % |

10.0 | x | 37.9 | % | 33.4 | % | 30.8 | % | 27.5 | % | 26.8 | % | 24.2 | % | 21.7 | % |

10.5 | x | 40.4 | % | 35.7 | % | 33.1 | % | 29.7 | % | 28.9 | % | 26.3 | % | 23.9 | % |

22

LBO Analysis – IPO

(Post-Dissolution)

LBO Summary

(Dollars in Millions)

Purchase Price |

| $ | 11.75 |

|

|

|

|

| |

ICCI Equity Value |

| $ | 714 |

|

Plus: Proportionate Net Debt (3/31/05) |

| 1,430 |

| |

Enterprise Value |

| $ | 2,143 |

|

|

|

|

| |

2005E Proportionate Dissolution EBITDA Multiple |

| 10.6 | x | |

Proportionate Debt / 2005E Dissolution EBITDA |

| 7.0 | x | |

|

|

|

| |

Exit Multiple |

| 8.0 | x | |

2010E EBITDA (1) |

| $ | 274 |

|

Value of Midwest |

| $ | 2,188 |

|

Less: Proportionate Net Debt (12/31/09) |

| (1,203 | ) | |

Less: Promote Profits Interest |

| 0 |

| |

Implied Equity Value (Midwest) |

| $ | 985 |

|

Implied Value per ICCI Share |

| $ | 16.01 |

|

|

|

|

| |

IRR |

| 7.4 | % | |

(1) Assumes IPO on 12/31/09

IRR Sensitivity Analysis

At 7.0x Proportionate Debt / 2005E Dissolution EBITDA

|

| Share Price Paid |

| ||||||||||||

|

| $6.00 |

| $7.00 |

| $8.00 |

| $9.00 |

| $10.00 |

| $10.70 |

| $11.75 |

|

Exit Multiple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.0 | x | 24.7 | % | 20.6 | % | 17.1 | % | 14.1 | % | 11.5 | % | 9.8 | % | 7.4 | % |

8.5 | x | 27.6 | % | 23.7 | % | 20.3 | % | 17.2 | % | 14.6 | % | 12.9 | % | 10.5 | % |

9.0 | x | 30.3 | % | 26.4 | % | 23.0 | % | 20.0 | % | 17.3 | % | 15.6 | % | 13.3 | % |

9.5 | x | 32.8 | % | 28.8 | % | 25.5 | % | 22.5 | % | 19.8 | % | 18.1 | % | 15.7 | % |

10.0 | x | 35.2 | % | 31.0 | % | 27.6 | % | 24.7 | % | 22.0 | % | 20.3 | % | 17.9 | % |

At 8.0x Proportionate Debt / 2005E Dissolution EBITDA

|

| Share Price Paid |

| ||||||||||||

|

| $6.00 |

| $7.00 |

| $8.00 |

| $9.00 |

| $10.00 |

| $10.70 |

| $11.75 |

|

Exit Multiple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.0 | x | 36.3 | % | 27.4 | % | 21.1 | % | 16.1 | % | 11.9 | % | 9.4 | % | 6.1 | % |

8.5 | x | 41.3 | % | 31.8 | % | 25.6 | % | 20.6 | % | 16.4 | % | 13.9 | % | 10.5 | % |

9.0 | x | 45.8 | % | 35.7 | % | 29.2 | % | 24.3 | % | 20.2 | % | 17.6 | % | 14.3 | % |

9.5 | x | 49.8 | % | 39.3 | % | 32.4 | % | 27.4 | % | 23.4 | % | 20.9 | % | 17.5 | % |

10.0 | x | 53.4 | % | 42.6 | % | 35.4 | % | 30.2 | % | 26.2 | % | 23.7 | % | 20.4 | % |

23

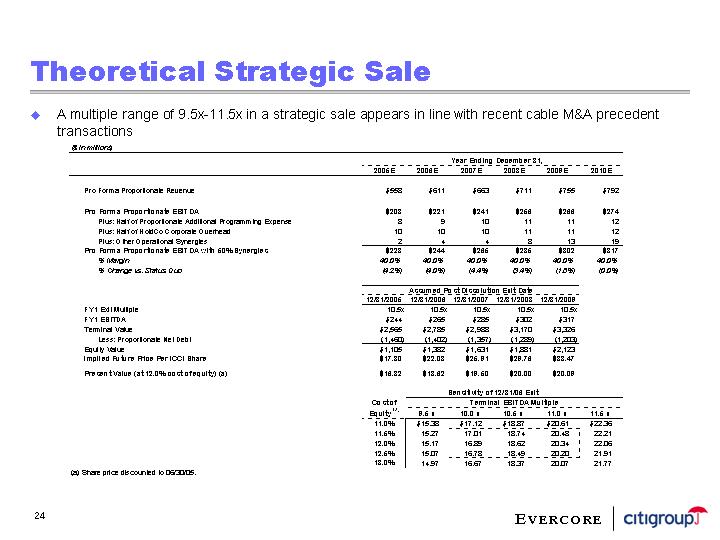

Theoretical Strategic Sale

• A multiple range of 9.5x-11.5x in a strategic sale appears in line with recent cable M&A precedent transactions

($ in millions)

|

| Year Ending December 31, |

| ||||||||||||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Pro Forma Proportionate Revenue |

| $ | 558 |

| $ | 611 |

| $ | 663 |

| $ | 711 |

| $ | 755 |

| $ | 792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Pro Forma Proportionate EBITDA |

| $ | 203 |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

Plus: Half of Proportionate Additional Programming Expense |

| 8 |

| 9 |

| 10 |

| 11 |

| 11 |

| 12 |

| ||||||

Plus: Half of HoldCo Corporate Overhead |

| 10 |

| 10 |

| 10 |

| 11 |

| 11 |

| 12 |

| ||||||

Plus: Other Operational Synergies |

| 2 |

| 4 |

| 4 |

| 8 |

| 13 |

| 19 |

| ||||||

Pro Forma Proportionate EBITDA with 50% Synergies |

| $ | 223 |

| $ | 244 |

| $ | 265 |

| $ | 285 |

| $ | 302 |

| $ | 317 |

|

% Margin |

| 40.0 | % | 40.0 | % | 40.0 | % | 40.0 | % | 40.0 | % | 40.0 | % | ||||||

% Change vs. Status Quo |

| (4.2 | )% | (4.0 | )% | (4.4 | )% | (3.4 | )% | (1.8 | )% | (0.0 | )% | ||||||

|

| Assumed Post Dissolution Exit Date |

|

|

| |||||||||||||

|

| 12/31/2005 |

| 12/31/2006 |

| 12/31/2007 |

| 12/31/2008 |

| 12/31/2009 |

|

|

| |||||

FY1 Exit Multiple |

| 10.5 | x | 10.5 | x | 10.5 | x | 10.5 | x | 10.5 | x |

|

| |||||

FY1 EBITDA |

| $ | 244 |

| $ | 265 |

| $ | 285 |

| $ | 302 |

| $ | 317 |

|

|

|

Terminal Value |

| $ | 2,565 |

| $ | 2,785 |

| $ | 2,988 |

| $ | 3,170 |

| $ | 3,326 |

|

|

|

Less: Proportionate Net Debt |

| (1,460 | ) | (1,402 | ) | (1,357 | ) | (1,289 | ) | (1,203 | ) |

|

| |||||

Equity Value |

| $ | 1,105 |

| $ | 1,382 |

| $ | 1,631 |

| $ | 1,881 |

| $ | 2,123 |

|

|

|

Implied Future Price Per ICCI Share |

| $ | 17.80 |

| $ | 22.08 |

| $ | 25.91 |

| $ | 29.76 |

| $ | 33.47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Value (at 12.0% cost of equity) (a) |

| $ | 16.82 |

| $ | 18.62 |

| $ | 19.50 |

| $ | 20.00 |

| $ | 20.09 |

|

|

|

|

|

|

| Sensitivity of 12/31/06 Exit |

| |||||||||||||

|

| Cost of |

| Terminal EBITDA Multiple |

| |||||||||||||

|

| Equity (a) |

| 9.5 x |

| 10.0 x |

| 10.5 x |

| 11.0 x |

| 11.5 x |

| |||||

|

| 11.0 | % | $ | 15.38 |

| $ | 17.12 |

| $ | 18.87 |

| $ | 20.61 |

| $ | 22.36 |

|

|

| 11.5 | % | 15.27 |

| 17.01 |

| 18.74 |

| 20.48 |

| 22.21 |

| |||||

|

| 12.0 | % | 15.17 |

| 16.89 |

| 18.62 |

| 20.34 |

| 22.06 |

| |||||

|

| 12.5 | % | 15.07 |

| 16.78 |

| 18.49 |

| 20.20 |

| 21.91 |

| |||||

|

| 13.0 | % | 14.97 |

| 16.67 |

| 18.37 |

| 20.07 |

| 21.77 |

| |||||

(a) Share price discounted to 06/30/05.

24

Potential Outcomes of a Future Sale

Dissolution with Synergies

12/31/05 Exit

|

| Multiple of 2006E EBITDA |

| |||||||||||||

|

| 9.5x |

| 10.0x |

| 10.5x |

| 11.0x |

| 11.5x |

| |||||

Annual EBITDA Performance vs. Plan |

|

|

|

|

|

|

|

|

|

|

| |||||

10 | % | $ | 16.64 |

| $ | 18.59 |

| $ | 20.55 |

| $ | 22.50 |

| $ | 24.45 |

|

5 | % | 14.95 |

| 16.82 |

| 18.68 |

| 20.55 |

| 22.41 |

| |||||

0 | % | 13.26 |

| 15.04 |

| 16.82 |

| 18.59 |

| 20.37 |

| |||||

(5 | )% | 11.56 |

| 13.26 |

| 14.95 |

| 16.64 |

| 18.33 |

| |||||

(10 | )% | 9.84 |

| 11.47 |

| 13.08 |

| 14.68 |

| 16.28 |

| |||||

12/31/06 Exit

|

| Multiple of 2007E EBITDA |

| |||||||||||||

|

| 9.5x |

| 10.0x |

| 10.5x |

| 11.0x |

| 11.5x |

| |||||

Annual EBITDA Performance vs. Plan |

|

|

|

|

|

|

|

|

|

|

| |||||

10 | % | $ | 18.44 |

| $ | 20.34 |

| $ | 22.23 |

| $ | 24.12 |

| $ | 26.02 |

|

5 | % | 16.81 |

| 18.62 |

| 20.42 |

| 22.23 |

| 24.04 |

| |||||

0 | % | 15.17 |

| 16.89 |

| 18.62 |

| 20.34 |

| 22.06 |

| |||||

(5 | )% | 13.53 |

| 15.17 |

| 16.81 |

| 18.44 |

| 20.08 |

| |||||

(10 | )% | 11.90 |

| 13.45 |

| 15.00 |

| 16.55 |

| 18.10 |

| |||||

Dissolution without Synergies

12/31/05 Exit

|

| Multiple of 2006E EBITDA |

| |||||||||||||

|

| 9.5x |

| 10.0x |

| 10.5x |

| 11.0x |

| 11.5x |

| |||||

Annual EBITDA Performance vs. Plan |

|

|

|

|

|

|

|

|

|

|

| |||||

10.0 | % | $ | 13.10 |

| $ | 14.87 |

| $ | 16.63 |

| $ | 18.40 |

| $ | 20.17 |

|

5.0 | % | 11.55 |

| 13.26 |

| 14.95 |

| 16.63 |

| 18.32 |

| |||||

0.0 | % | 10.00 |

| 11.63 |

| 13.26 |

| 14.87 |

| 16.47 |

| |||||

(5.0 | )% | 8.43 |

| 10.00 |

| 11.55 |

| 13.10 |

| 14.62 |

| |||||

(10.0 | )% | 6.77 |

| 8.34 |

| 9.83 |

| 11.31 |

| 12.78 |

| |||||

12/31/06 Exit

|

| Multiple of 2007E EBITDA |

| |||||||||||||

|

| 9.5x |

| 10.0x |

| 10.5x |

| 11.0x |

| 11.5x |

| |||||

Annual EBITDA Performance vs. Plan |

|

|

|

|

|

|

|

|

|

|

| |||||

10.0 | % | $ | 15.14 |

| $ | 16.86 |

| $ | 18.59 |

| $ | 20.31 |

| $ | 22.03 |

|

5.0 | % | 13.66 |

| 15.30 |

| 16.94 |

| 18.59 |

| 20.23 |

| |||||

0.0 | % | 12.17 |

| 13.74 |

| 15.30 |

| 16.86 |

| 18.43 |

| |||||

(5.0 | )% | 10.67 |

| 12.17 |

| 13.66 |

| 15.14 |

| 16.63 |

| |||||

(10.0 | )% | 9.16 |

| 10.60 |

| 12.01 |

| 13.42 |

| 14.83 |

| |||||

Note: Present value of future stock prices analysis assumes 12% cost of equity.

25

3. Dissolution Leverage Analysis

25

Dissolution Leverage Statistics

• Dissolution assumed to occur on 12/31/06, pro forma EBITDA assumptions per Management guidance

• Dissolution Pro Forma leverage statistics assumes all debt at Insight Midwest is refinanced

• ICCI HoldCo 12 ¼% Senior Notes remain in place

|

| Year Ending December 31, |

| ||||||||||||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Status Quo Proportionate Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net Debt |

| $ | 1,412 |

| $ | 1,364 |

| $ | 1,292 |

| $ | 1,192 |

| $ | 1,076 |

| $ | 941 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total Proportionate Debt / Proportionate LTM EBITDA |

| 6.8 | x | 6.1 | x | 5.3 | x | 4.6 | x | 4.0 | x | 3.4 | x | ||||||

Proportionate Net Debt / Proportionate LTM EBITDA |

| 6.1 | x | 5.4 | x | 4.7 | x | 4.0 | x | 3.5 | x | 3.0 | x | ||||||

Proportionate Net Debt / (Proportionate LTM EBITDA - CapEx) |

| 10.5 | x | 8.5 | x | 6.6 | x | 5.6 | x | 4.7 | x | 3.9 | x | ||||||

Proportionate LTM EBITDA / Cash Interest Expense |

| 2.5 | x | 2.2 | x | 2.1 | x | 2.3 | x | 2.4 | x | 2.7 | x | ||||||

(Proportionate LTM EBITDA - CapEx) / Cash Interest Expense |

| 1.5 | x | 1.4 | x | 1.5 | x | 1.7 | x | 1.8 | x | 2.1 | x | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Dissolution Pro Forma Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net Debt |

|

|

| $ | 1,402 |

| $ | 1,357 |

| $ | 1,289 |

| $ | 1,203 |

| $ | 1,103 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total Debt / LTM EBITDA |

|

|

| 6.7 | x | 5.7 | x | 5.1 | x | 4.6 | x | 4.1 | x | ||||||

Net Debt / LTM EBITDA |

|

|

| 6.3 |

| 5.6 |

| 5.0 |

| 4.5 |

| 4.0 |

| ||||||

Net Debt / (LTM EBITDA - CapEx) |

|

|

| 11.0 |

| 8.6 |

| 7.4 |

| 6.4 |

| 5.6 |

| ||||||

LTM EBITDA / Cash Interest Expense |

|

|

| 1.8 |

| 2.1 |

| 2.3 |

| 2.4 |

| 2.6 |

| ||||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

|

|

| 1.1 |

| 1.4 |

| 1.5 |

| 1.7 |

| 1.9 |

| ||||||

|

| Year Ending December 31, |

| |||||||||||||||||||

|

| Status Quo |

| Dissolution Pro Forma |

| |||||||||||||||||

|

| 2005E |

| 2006E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| |||||||

Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Proportionate EBITDA |

| $ | 233 |

| $ | 254 |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

Less: Proportionate Capital Expenditures |

| (98 | ) | (94 | ) | (94 | ) | (82 | ) | (80 | ) | (77 | ) | (76 | ) | |||||||

Plus: Proportionate Decrease in Working Capital |

| 5 |

| 4 |

| 4 |

| 4 |

| 6 |

| 6 |

| 6 |

| |||||||

Less: Proportionate Cash Interest Expense |

| (92 | ) | (115 | ) | (120 | ) | (117 | ) | (113 | ) | (109 | ) | (104 | ) | |||||||

Proportionate Free Cash Flow |

| $ | 49 |

| $ | 49 |

| $ | 11 |

| $ | 45 |

| $ | 68 |

| $ | 86 |

| $ | 100 |

|

Note: Proportionate defined as 50% of Insight Midwest and 100% of Insight HoldCo

26

Dissolution EBITDA Sensitivity Analysis

|

| Year Ending December 31, |

| |||||||||||||

|

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| |||||

Dissolution Pro Forma Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

Free Cash Flow |

| 11 |

| 45 |

| 68 |

| 86 |

| 100 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Total Debt / LTM EBITDA |

| 6.7 | x | 5.7 | x | 5.1 | x | 4.6 | x | 4.1 | x | |||||

Net Debt / LTM EBITDA |

| 6.3 | x | 5.6 | x | 5.0 | x | 4.5 | x | 4.0 | x | |||||

Net Debt / (LTM EBITDA - CapEx) |

| 11.0 | x | 8.6 | x | 7.4 | x | 6.4 | x | 5.6 | x | |||||

LTM EBITDA / Cash Interest Expense |

| 1.8 | x | 2.1 | x | 2.3 | x | 2.4 | x | 2.6 | x | |||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

| 1.1 | x | 1.4 | x | 1.5 | x | 1.7 | x | 1.9 | x | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Dissolution Pro Forma Leverage Statistics w/ 5.0% EBITDA miss |

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | 210 |

| $ | 229 |

| $ | 243 |

| $ | 253 |

| $ | 260 |

|

Free Cash Flow |

| 0 |

| 33 |

| 55 |

| 73 |

| 86 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Total Debt / LTM EBITDA |

| 7.0 | x | 6.0 | x | 5.4 | x | 4.8 | x | 4.3 | x | |||||