Exhibit 99(c)(4)

Preliminary Draft

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Project Ohio River

Special Committee Discussion Materials

June 20, 2005

Table of Contents

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

|

|

[LOGO]

1

Overview

• Received presentation from Buyer Group (April 27, 2005)

• Reviewed preliminary due diligence findings and valuation perspectives with Special Committee (May 4, 2005)

• Presented views on Proposal to Buyer Group financial advisors (May 11, 2005)

• Larry Smith/Comcast public statement regarding triggering dissolution (May 11, 2005)

• S&P downgrades Insight Communications and Insight Midwest bonds (June 1, 2005)

• Received response from Buyer Group financial advisors (June 15, 2005)

• Updated and refreshed due diligence

• Per Management guidance,

• 2005 projections revised

• 2006-2010 projections are substantially unchanged

2

Observations on the Offer

Documentation |

| • No Purchase Agreement has been provided by Buyer Group to date |

|

|

|

|

| • Controlling Shareholders stated that they will not agree to any other transaction involving their stake in the Company |

Process |

| • Carlyle is said to have prepared financial projections with little guidance from management |

|

| • Controlling Shareholders informed the financial advisors that they have not seen the projections prepared by Carlyle |

|

|

|

Controlling Shareholders |

| • Controlling Shareholders have 63% of vote and 15% of value ($104 mm as of 06/17/05) |

|

|

|

Timing |

| • No timetable established |

3

2. Company Information & Performance

Insight Communications vs. Cable Peer Group

Cable Revenue Growth (%) |

| Cable EBITDA Growth (%) | ||||||||||||

|

|

| ||||||||||||

A bar chart showing cable revenue growth expressed in percentages by year.

The bar chart compared Insight cable revenue growth versus a cable peer group (which included Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable). |

| Year |

| Insight/Management |

| Peer median |

| A bar chart showing cable EBITDA growth expressed in percentages by year.

The bar chart compared Insight cable EBITDA growth versus a cable peer group (which included Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable). | Year |

| Insight/Management |

| Peer median |

|

| 2005 |

| 12.2% |

| 9.3% |

| 2005 |

| 3.8% |

| 10.5% |

| ||

| 2006 |

| 8.6% |

| 8.3% |

| 2006 |

| 10.5% |

| 10.3% |

| ||

| 2007 |

| 8.6% |

| 7.5% |

| 2007 |

| 8.8% |

| 8.4% |

| ||

| 2008 |

| 7.3% |

| 6.4% |

| 2008 |

| 6.1% |

| 6.5% |

| ||

| 2009 |

| 6.1% |

| 5.6% |

| 2009 |

| 4.3% |

| 5.2% |

| ||

| 2010 |

| 4.9% |

| 4.7% |

| 2010 |

| 3.0% |

| 4.3% |

| ||

Cable EBITDA Margin (%) |

| Cable EBITDA per Subscriber ($) | ||||||||||||

|

|

| ||||||||||||

A bar chart showing cable EBITDA margin expressed in percentages by year.

The bar chart compared Insight cable EBITDA margin versus a cable peer group (which included Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable). |

| Year |

| Insight/Management |

| Peer median |

| A bar chart showing cable EBITDA per subscriber expressed in dollars by year.

The bar chart compared Insight cable EBITDA per subscriber versus a cable peer group (which included Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable). | Year |

| Insight/Management |

| Peer median |

|

| 2005 |

| 39.9% |

| 38.7% |

| 2005 |

| $350 |

| $360 |

| ||

| 2006 |

| 40.5% |

| 39.3% |

| 2006 |

| $391 |

| $402 |

| ||

| 2007 |

| 40.6% |

| 39.6% |

| 2007 |

| $432 |

| $445 |

| ||

| 2008 |

| 40.2% |

| 39.8% |

| 2008 |

| $459 |

| $483 |

| ||

| 2009 |

| 39.5% |

| 39.7% |

| 2009 |

| $479 |

| $513 |

| ||

| 2010 |

| 38.8% |

| 38.6% |

| 2010 |

| $493 |

| $524 |

| ||

Note: Peer group comprised of Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable.

Source: Wall Street Research and Insight Communications Management Projections dated 4/28/05.

4

Basic Penetration (% of Video Homes Passed) |

| Digital Penetration (% of Basic Subs) |

|

|

|

[CHART] |

| [CHART] |

Data Penetration (% of Video Homes Passed) |

| Telephony Penetration (% of Video Homes Passed) |

|

|

|

[CHART] |

| [CHART] |

Note: Peer group comprised of Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable.

Source: Wall Street Research and Insight Communications Management Projections dated 4/28/05.

5

Basic Subscriber Growth (%) |

| Data Subscriber Growth (%) |

|

|

|

[CHART] |

| [CHART] |

Digital Subscriber Growth (%) |

| Telephony Subscriber Growth (%) |

|

|

|

[CHART] |

| [CHART] |

Note: Peer group comprised of Cablevision, Charter, Comcast, Cox, Mediacom and Time Warner Cable.

Source: Wall Street Research and Insight Communications Management Projections dated 4/28/05.

6

Insight Communications Actual Performance vs. Budget

|

| 2002 |

| 2003 |

| 2004 |

| ||||||||||||||||||

|

| Budget |

| Actual |

| % Var. |

| Budget |

| Actual |

| % Var. |

| Budget |

| Actual |

| % Var. |

| ||||||

Basic Sub Revenue |

| $ | 509.7 |

| $ | 506.1 |

| (0.7 | )% | $ | 548.5 |

| $ | 537.0 |

| (2.1 | )% | $ | 581.5 |

| $ | 573.7 |

| (1.4 | )% |

Digital Revenue |

| 71.8 |

| 66.1 |

| (7.9 | ) | 95.0 |

| 83.5 |

| (12.2) |

| 101.1 |

| 98.8 |

| (2.3 | ) | ||||||

HSI Revenue |

| 56.0 |

| 59.0 |

| 5.2 |

| 89.4 |

| 93.9 |

| 5.1 |

| 133.3 |

| 132.0 |

| (0.9 | ) | ||||||

Other |

| 143.4 |

| 180.8 |

| 26.1 |

| 182.2 |

| 188.2 |

| 3.3 |

| 197.7 |

| 198.0 |

| 0.2 |

| ||||||

Total Revenue |

| $ | 780.9 |

| $ | 812.0 |

| 4.0 | % | $ | 915.1 |

| $ | 902.6 |

| (1.4 | )% | $ | 1,013.6 |

| $ | 1,002.5 |

| (1.1 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

| $ | 362.2 |

| $ | 355.5 |

| (1.9 | )% | $ | 404.1 |

| $ | 387.1 |

| (4.2 | )% | $ | 430.6 |

| $ | 432.0 |

| 0.3 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Capex |

| $ | (327.1 | ) | $ | (283.0 | ) | (13.5 | )% | $ | (220.0 | ) | $ | (196.7 | ) | (10.6 | )% | $ | (188.3 | ) | $ | (174.1 | ) | (7.6 | )% |

Homes Passed (’000) |

| 2,241 |

| 2,263 |

| 1.0 | % | 2,310 |

| 2,326 |

| 0.7 | % | 2,343 |

| 2,375 |

| 1.4 | % | ||||||

Basic Cable Subs (’000) |

| 1,302 |

| 1,289 |

| (1.0 | ) | 1,322 |

| 1,294 |

| (2.2 | ) | 1,302 |

| 1,273 |

| (2.3 | ) | ||||||

Digital Subs (’000) |

| 351 |

| 335 |

| (4.6 | ) | 412 |

| 403 |

| (2.1 | ) | 470 |

| 451 |

| (4.0 | ) | ||||||

HSI Subs (’000) |

| 137 |

| 145 |

| 5.7 |

| 211 |

| 230 |

| 9.0 |

| 324 |

| 331 |

| 2.0 |

| ||||||

Telephony Subs (’000) |

| 48 |

| 31 |

| (35.9 | ) | 80 |

| 55 |

| (30.8 | ) | 76 |

| 64 |

| (15.5 | ) | ||||||

|

| 2005 Q1 |

| 2005 YTD (a) |

| ||||||||||||

|

| Budget |

| Actual |

| % Var. |

| Budget |

| Actual |

| % Var. |

| ||||

Basic Sub Revenue |

| $ | 147.5 |

| $ | 147.6 |

| 0.1 | % | $ | 249.7 |

| $ | 249.3 |

| (0.1 | )% |

Digital Revenue |

| 24.6 |

| 26.8 |

| 8.9 |

| 43.1 |

| 45.4 |

| 5.2 |

| ||||

HSI Revenue |

| 39.6 |

| 42.1 |

| 6.4 |

| 72.3 |

| 72.8 |

| 0.8 |

| ||||

Other |

| 53.0 |

| 52.8 |

| (0.5 | ) | 89.8 |

| 90.1 |

| 0.3 |

| ||||

Total Revenue |

| $ | 264.7 |

|

| 269.3 |

| 1.7 | % | $ | 454.8 |

| $ | 457.6 |

| 0.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

| $ | 100.1 |

| $ | 107.6 |

| 7.4 | % | $ | 174.8 |

| $ | 192.0 |

| 9.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Capex |

| NA |

| $ | (38.7 | ) | NM |

| NA |

| NA |

| NM |

| |||

Homes Passed (’000) |

| 2,335 |

| 2,384 |

| 2.1 | % | NA |

| 2,393 |

| NM |

| ||||

Basic Cable Subs (’000) |

| 1,267 |

| 1,271 |

| 0.4 |

| 1,273 |

| 1,264 |

| (0.7 | ) | ||||

Digital Subs (’000) |

| 460 |

| 459 |

| (0.2 | ) | 470 |

| 459 |

| (2.3 | ) | ||||

HSI Subs (’000) |

| 361 |

| 368 |

| 1.8 |

| 373 |

| 383 |

| 2.7 |

| ||||

Telephony Subs (’000) |

| 72 |

| 69 |

| (5.0 | ) | 77 |

| 72 |

| (7.4 | ) | ||||

Source: Insight Communications budget materials as of 4/28/05 and 06/16/05, and Company filings.

(a) YTD through May 2005.

7

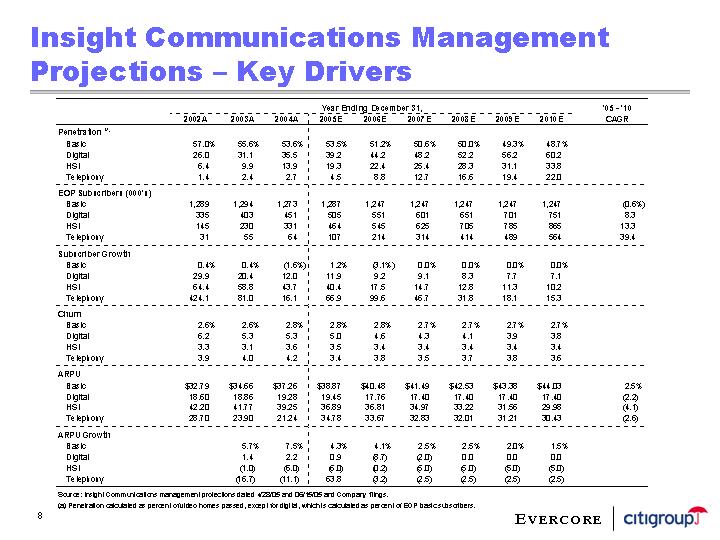

Insight Communications Management Projections – Key Drivers

|

| Year Ending December 31, |

| ’05 - ’10 |

| |||||||||||||||||||||||||

|

| 2002A |

| 2003A |

| 2004A |

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| CAGR |

| |||||||||

Penetration (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

| 57.0 | % | 55.6 | % | 53.6 | % | 53.5 | % | 51.2 | % | 50.6 | % | 50.0 | % | 49.3 | % | 48.7 | % |

|

| |||||||||

Digital |

| 26.0 |

| 31.1 |

| 35.5 |

| 39.2 |

| 44.2 |

| 48.2 |

| 52.2 |

| 56.2 |

| 60.2 |

|

|

| |||||||||

HSI |

| 6.4 |

| 9.9 |

| 13.9 |

| 19.3 |

| 22.4 |

| 25.4 |

| 28.3 |

| 31.1 |

| 33.8 |

|

|

| |||||||||

Telephony |

| 1.4 |

| 2.4 |

| 2.7 |

| 4.5 |

| 8.8 |

| 12.7 |

| 16.6 |

| 19.4 |

| 22.0 |

|

|

| |||||||||

EOP Subscribers (000’s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

| 1,289 |

| 1,294 |

| 1,273 |

| 1,287 |

| 1,247 |

| 1,247 |

| 1,247 |

| 1,247 |

| 1,247 |

| (0.6 | )% | |||||||||

Digital |

| 335 |

| 403 |

| 451 |

| 505 |

| 551 |

| 601 |

| 651 |

| 701 |

| 751 |

| 8.3 |

| |||||||||

HSI |

| 145 |

| 230 |

| 331 |

| 464 |

| 545 |

| 625 |

| 705 |

| 785 |

| 865 |

| 13.3 |

| |||||||||

Telephony |

| 31 |

| 55 |

| 64 |

| 107 |

| 214 |

| 314 |

| 414 |

| 489 |

| 564 |

| 39.4 |

| |||||||||

Subscriber Growth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

| 0.4 | % | 0.4 | % | (1.6 | )% | 1.2 | % | (3.1 | )% | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % |

|

| |||||||||

Digital |

| 29.9 |

| 20.4 |

| 12.0 |

| 11.9 |

| 9.2 |

| 9.1 |

| 8.3 |

| 7.7 |

| 7.1 |

|

|

| |||||||||

HSI |

| 64.4 |

| 58.8 |

| 43.7 |

| 40.4 |

| 17.5 |

| 14.7 |

| 12.8 |

| 11.3 |

| 10.2 |

|

|

| |||||||||

Telephony |

| 424.1 |

| 81.0 |

| 16.1 |

| 66.9 |

| 99.6 |

| 46.7 |

| 31.8 |

| 18.1 |

| 15.3 |

|

|

| |||||||||

Churn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

| 2.6 | % | 2.6 | % | 2.8 | % | 2.8 | % | 2.8 | % | 2.7 | % | 2.7 | % | 2.7 | % | 2.7 | % |

|

| |||||||||

Digital |

| 6.2 |

| 5.3 |

| 5.3 |

| 5.0 |

| 4.6 |

| 4.3 |

| 4.1 |

| 3.9 |

| 3.8 |

|

|

| |||||||||

HSI |

| 3.3 |

| 3.1 |

| 3.6 |

| 3.5 |

| 3.4 |

| 3.4 |

| 3.4 |

| 3.4 |

| 3.4 |

|

|

| |||||||||

Telephony |

| 3.9 |

| 4.0 |

| 4.2 |

| 3.4 |

| 3.8 |

| 3.5 |

| 3.7 |

| 3.8 |

| 3.6 |

|

|

| |||||||||

ARPU |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

| $ | 32.79 |

| $ | 34.66 |

| $ | 37.26 |

| $ | 38.87 |

| $ | 40.48 |

| $ | 41.49 |

| $ | 42.53 |

| $ | 43.38 |

| $ | 44.03 |

| 2.5 | % |

Digital |

| 18.60 |

| 18.86 |

| 19.28 |

| 19.45 |

| 17.76 |

| 17.40 |

| 17.40 |

| 17.40 |

| 17.40 |

| (2.2 | ) | |||||||||

HSI |

| 42.20 |

| 41.77 |

| 39.25 |

| 36.89 |

| 36.81 |

| 34.97 |

| 33.22 |

| 31.56 |

| 29.98 |

| (4.1 | ) | |||||||||

Telephony |

| 28.70 |

| 23.90 |

| 21.24 |

| 34.78 |

| 33.67 |

| 32.83 |

| 32.01 |

| 31.21 |

| 30.43 |

| (2.6 | ) | |||||||||

ARPU Growth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Basic |

|

|

| 5.7 | % | 7.5 | % | 4.3 | % | 4.1 | % | 2.5 | % | 2.5 | % | 2.0 | % | 1.5 | % |

|

| |||||||||

Digital |

|

|

| 1.4 |

| 2.2 |

| 0.9 |

| (8.7 | ) | (2.0 | ) | 0.0 |

| 0.0 |

| 0.0 |

|

|

| |||||||||

HSI |

|

|

| (1.0 | ) | (6.0 | ) | (6.0 | ) | (0.2 | ) | (5.0 | ) | (5.0 | ) | (5.0 | ) | (5.0 | ) |

|

| |||||||||

Telephony |

|

|

| (16.7 | ) | (11.1 | ) | 63.8 |

| (3.2 | ) | (2.5 | ) | (2.5 | ) | (2.5 | ) | (2.5 | ) |

|

| |||||||||

Source: Insight Communications management projections dated 4/28/05 and 06/15/05 and Company filings.

(a) Penetration calculated as percent of video homes passed, except for digital, which is calculated as percent of EOP basic subscribers.

8

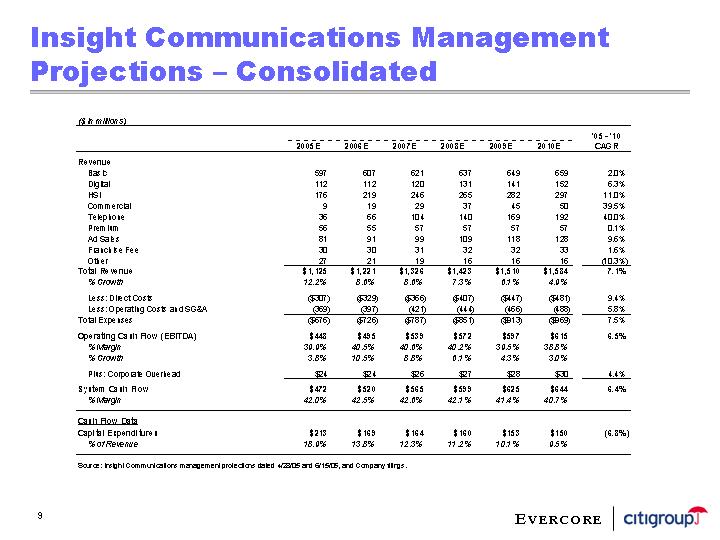

Insight Communications Management Projections – Consolidated

($ in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| ’05 - ’10 |

| ||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| CAGR |

| ||||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Basic |

| 597 |

| 607 |

| 621 |

| 637 |

| 649 |

| 659 |

| 2.0 | % | ||||||

Digital |

| 112 |

| 112 |

| 120 |

| 131 |

| 141 |

| 152 |

| 6.3 | % | ||||||

HSI |

| 176 |

| 219 |

| 246 |

| 265 |

| 282 |

| 297 |

| 11.0 | % | ||||||

Commercial |

| 9 |

| 19 |

| 29 |

| 37 |

| 45 |

| 50 |

| 39.5 | % | ||||||

Telephone |

| 36 |

| 66 |

| 104 |

| 140 |

| 169 |

| 192 |

| 40.0 | % | ||||||

Premium |

| 56 |

| 55 |

| 57 |

| 57 |

| 57 |

| 57 |

| 0.1 | % | ||||||

Ad Sales |

| 81 |

| 91 |

| 99 |

| 109 |

| 118 |

| 128 |

| 9.6 | % | ||||||

Franchise Fee |

| 30 |

| 30 |

| 31 |

| 32 |

| 32 |

| 33 |

| 1.6 | % | ||||||

Other |

| 27 |

| 21 |

| 19 |

| 16 |

| 16 |

| 16 |

| (10.3 | )% | ||||||

Total Revenue |

| $ | 1,125 |

| $ | 1,221 |

| $ | 1,326 |

| $ | 1,423 |

| $ | 1,510 |

| $ | 1,584 |

| 7.1 | % |

% Growth |

| 12.2 | % | 8.6 | % | 8.6 | % | 7.3 | % | 6.1 | % | 4.9 | % |

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Less: Direct Costs |

| $ | (307 | ) | $ | (329 | ) | $ | (366 | ) | $ | (407 | ) | $ | (447 | ) | $ | (481 | ) | 9.4 | % |

Less: Operating Costs and SG&A |

| (369 | ) | (397 | ) | (421 | ) | (444 | ) | (466 | ) | (488 | ) | 5.8 | % | ||||||

Total Expenses |

| $ | (676 | ) | $ | (726 | ) | $ | (787 | ) | $ | (851 | ) | $ | (913 | ) | $ | (969 | ) | 7.5 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Operating Cash Flow (EBITDA) |

| $ | 448 |

| $ | 495 |

| $ | 539 |

| $ | 572 |

| $ | 597 |

| $ | 615 |

| 6.5 | % |

% Margin |

| 39.9 | % | 40.5 | % | 40.6 | % | 40.2 | % | 39.5 | % | 38.8 | % |

|

| ||||||

% Growth |

| 3.8 | % | 10.5 | % | 8.8 | % | 6.1 | % | 4.3 | % | 3.0 | % |

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Plus: Corporate Overhead |

| $ | 24 |

| $ | 24 |

| $ | 26 |

| $ | 27 |

| $ | 28 |

| $ | 30 |

| 4.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

System Cash Flow |

| $ | 472 |

| $ | 520 |

| $ | 565 |

| $ | 599 |

| $ | 625 |

| $ | 644 |

| 6.4 | % |

% Margin |

| 42.0 | % | 42.5 | % | 42.6 | % | 42.1 | % | 41.4 | % | 40.7 | % |

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Capital Expenditures |

| $ | 213 |

| $ | 169 |

| $ | 164 |

| $ | 160 |

| $ | 153 |

| $ | 150 |

| (6.8 | )% |

% of Revenue |

| 18.9 | % | 13.8 | % | 12.3 | % | 11.2 | % | 10.1 | % | 9.5 | % |

|

| ||||||

Source: Insight Communications management projections dated 4/28/05 and 6/15/05, and Company filings.

9

Insight Communications Management Projections – Proportionate Summary

($ in millions)

|

| Year End December 31, |

| ’05 - ’10 |

| ||||||||||||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| CAGR |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

50% of Insight Midwest EBITDA |

| $ | 219 |

| $ | 241 |

| $ | 262 |

| $ | 277 |

| $ | 289 |

| $ | 298 |

| 6.4 | % |

ICCI HoldCo EBITDA |

| 11 |

| 14 |

| 16 |

| 17 |

| 18 |

| 19 |

| 12.2 | % | ||||||

Proportionate EBITDA |

| $ | 230 |

| $ | 254 |

| $ | 277 |

| $ | 295 |

| $ | 308 |

| $ | 317 |

| 6.7 | % |

% Growth |

| 7.7 | % | 10.9 | % | 9.0 | % | 6.2 | % | 4.4 | % | 3.0 | % |

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Less: Depreciation & Amortization |

| (145 | ) | (152 | ) | (135 | ) | (129 | ) | (122 | ) | (120 | ) | (3.8 | )% | ||||||

Proportionate EBIT |

| $ | 84 |

| $ | 102 |

| $ | 142 |

| $ | 166 |

| $ | 186 |

| $ | 197 |

| 18.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Proportionate EBITDA |

| $ | 230 |

| $ | 254 |

| $ | 277 |

| $ | 295 |

| $ | 308 |

| $ | 317 |

| 6.7 | % |

Less: Capital Expenditures |

| (107 | ) | (85 | ) | (82 | ) | (80 | ) | (77 | ) | (76 | ) | (6.7 | )% | ||||||

Plus: Decrease in Working Capital |

| 7 |

| 2 |

| 5 |

| 6 |

| 6 |

| 6 |

| (3.1 | )% | ||||||

Less: Cash Interest Expense |

| (93 | ) | (118 | ) | (136 | ) | (129 | ) | (128 | ) | (117 | ) | 4.7 | % | ||||||

Less: Cash Taxes |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| NM |

| ||||||

Proportionate Free Cash Flow |

| $ | 36 |

| $ | 54 |

| $ | 64 |

| $ | 91 |

| $ | 109 |

| $ | 130 |

| 29.1 | % |

% Growth |

|

|

| 48.9 | % | 19.2 | % | 42.3 | % | 19.2 | % | 19.4 | % |

|

| ||||||

Source: Insight Communications management projections dated 4/28/05 and 6/15/05.

Note: Represents proportionate income statement and cash flows (50% of Insight Midwest and 100% of ICCI HoldCo).

10

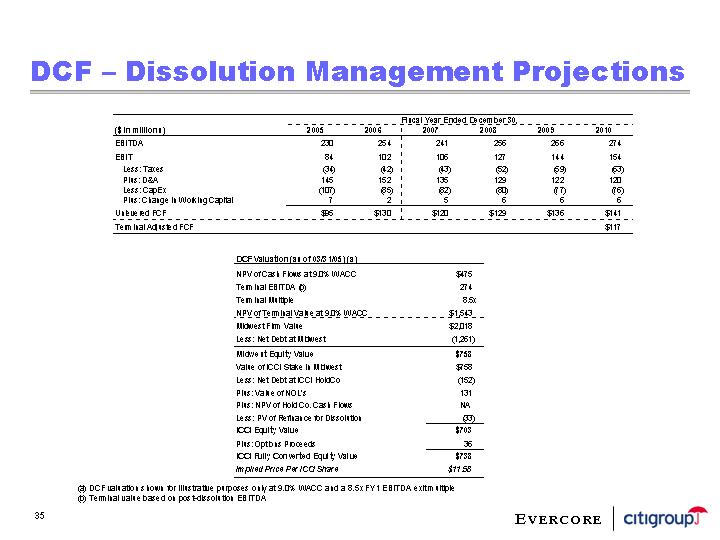

Dissolution Management Projections

• Assumptions in the event of a dissolution as provided by CompanyManagement

• Dissolution process assumed to be concluded on 12/31/06

• Insight Midwest assets and liabilities assumed to be split 50/50 (no assumption made regarding the asset split)

• Management fee, Interactive and 20% of corporate overhead are eliminated in dissolution

• Programming expenses increase by 300bp

($ in millions)

|

| Year Ending December 31, |

| ||||||||||||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Status Quo |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Midwest Revenue |

| $ | 1,125 |

| $ | 1,221 |

| $ | 1,326 |

| $ | 1,423 |

| $ | 1,510 |

| $ | 1,584 |

|

Midwest EBITDA |

| $ | 438 |

| $ | 481 |

| $ | 523 |

| $ | 555 |

| $ | 578 |

| $ | 595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

HoldCo EBITDA Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Midwest EBITDA (50%) |

| 219 |

| 241 |

| 262 |

| 277 |

| 289 |

| 298 |

| ||||||

Plus: HoldCo Management Fee Income |

| 34 |

| 37 |

| 40 |

| 43 |

| 45 |

| 48 |

| ||||||

Less: HoldCo Corporate Overhead |

| (24 | ) | (24 | ) | (26 | ) | (27 | ) | (28 | ) | (30 | ) | ||||||

Plus: HoldCo Interactive EBITDA Contribution |

| 1 |

| 2 |

| 1 |

| 1 |

| 1 |

| 1 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Status Quo Proportionate EBITDA |

| $ | 230 |

| $ | 254 |

| $ | 277 |

| $ | 295 |

| $ | 308 |

| $ | 317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Pro Forma for Dissolution |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Pro Forma Midwest Revenue (50%) |

| $ | 562 |

| $ | 611 |

| $ | 663 |

| $ | 711 |

| $ | 755 |

| $ | 792 |

|

Midwest Level EBITDA Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Status Quo Midwest EBITDA |

| 438 |

| 481 |

| 523 |

| 555 |

| 578 |

| 595 |

| ||||||

Add back: Midwest Management Fee Expense |

| 34 |

| 37 |

| 40 |

| 43 |

| 45 |

| 48 |

| ||||||

Add back: Interactive “Expense” to Midwest |

| 3 |

| 4 |

| 4 |

| 4 |

| 4 |

| 4 |

| ||||||

Deduct: Midwest Additional Programming Expense |

| (34 | ) | (37 | ) | (40 | ) | (43 | ) | (45 | ) | (48 | ) | ||||||

Adjusted Midwest EBITDA |

| 441 |

| 485 |

| 527 |

| 558 |

| 582 |

| 599 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

HoldCo EBITDA Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Post-Dissolution Share of Adjusted Midwest EBITDA (50%) |

| 220 |

| 242 |

| 263 |

| 279 |

| 291 |

| 299 |

| ||||||

Less: HoldCo Corporate Overhead (80% of status quo) |

| (19 | ) | (20 | ) | (21 | ) | (22 | ) | (23 | ) | (24 | ) | ||||||

Less: Interactive Costs |

| (2 | ) | (2 | ) | (2 | ) | (2 | ) | (2 | ) | (2 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Pro Forma Proportionate EBITDA |

| $ | 199 |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

% Growth |

| 6.7 | % | 11.0 | % | 9.0 | % | 6.1 | % | 4.2 | % | 2.7 | % | ||||||

% Change vs. Status Quo |

| (13.3 | )% | (13.2 | )% | (13.1 | )% | (13.3 | )% | (13.5 | )% | (13.7 | )% | ||||||

Note: Potential tax liability to Comcast in the event of a dissolution prior to 1/1/08 could be as high as approximately $230 million.

11

3. Stock Price Performance & Shareholder Dynamics

ICCI Price Performance Since IPO

[CHART]

(a) One-year averages starting from IPO date (7/23/99).

12

Valuation & Trading Trends

Cable Has Trended up Since July 2004 |

|

[CHART] |

|

ICCI vs. Cable Sector Peers Since July 2004 through 3/4/05 |

|

[CHART] |

|

Still, Values Are Near Historical Lows |

|

[CHART] |

Note: Current bars reflect balance sheet financials as of 12/31/04 (with exception of Comcast and Insight Communications which are as of 3/31/05); share prices as of 6/17/05, and ending Subs as of 12/31/04.

13

Historical Cable Trading Ranges

Cable Sector (a) FV / EBITDA Multiple

[CHART]

Source: Wall Street research.

Note: LTM data based on actual quarterly data. Forward information based on projected quarterly data. FTM and LTM EBITDA for 6/17/2005 reflect financials as of 3/31/05.

(a) Universe comprised of Cablevision, Charter, Comcast, Cox (through 2Q ’04), Insight and Mediacom .

14

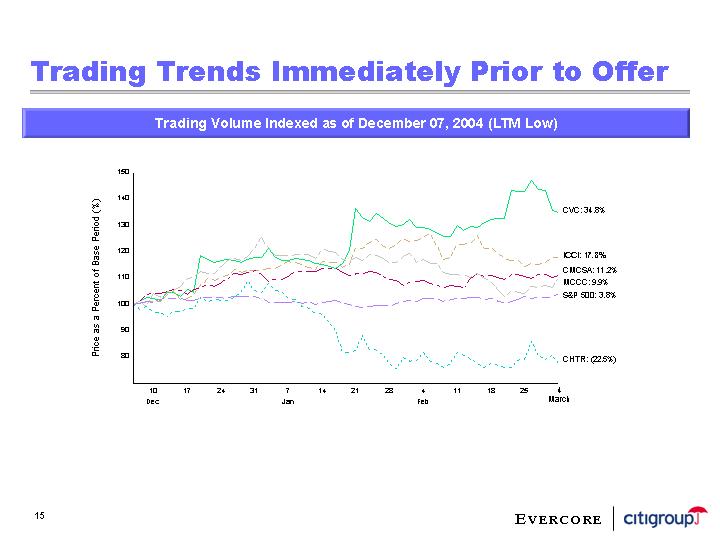

Trading Trends Immediately Prior to Offer

Trading Volume Indexed as of December 07, 2004 (LTM Low)

A line graph showing trading volume indexed as of December 7, 2004 (LTM low) expressed as price as a percent of base period |

| As of March 4, 2005 |

|

| ||

|

|

|

| |||

| CVC |

| 34.8% |

|

| |

| ICCI |

| 17.8% |

|

| |

| CMCSA |

| 11.2% |

|

| |

| MCCC |

| 9.9% |

|

| |

| S&P 500 |

| 3.8% |

|

| |

| CH |

| 22.5% |

|

| |

15

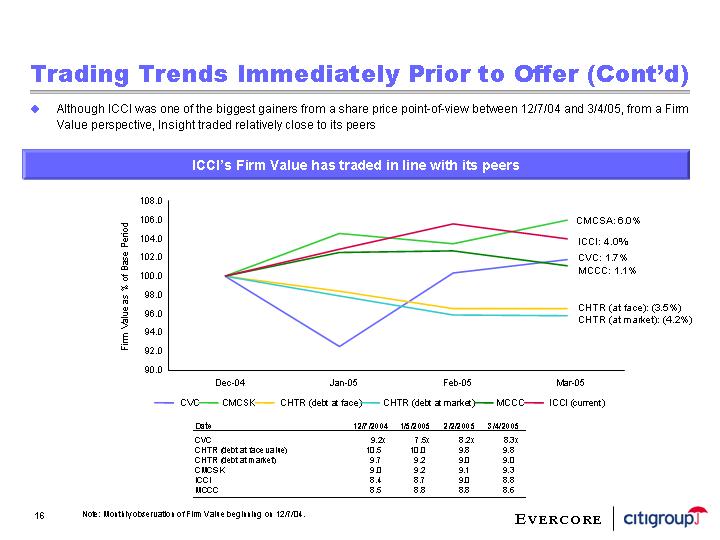

• Although ICCI was one of the biggest gainers from a share price point-of-view between 12/7/04 and 3/4/05, from a Firm Value perspective, Insight traded relatively close to its peers

ICCI’s Firm Value has traded in line with its peers

[CHART]

Date |

| 12/7/2004 |

| 1/5/2005 |

| 2/2/2005 |

| 3/4/2005 |

|

CVC |

| 9.2 | x | 7.5 | x | 8.2 | x | 8.3 | x |

CHTR (debt at face value) |

| 10.5 |

| 10.0 |

| 9.8 |

| 9.8 |

|

CHTR (debt at market) |

| 9.7 |

| 9.2 |

| 9.0 |

| 9.0 |

|

CMCSK |

| 9.0 |

| 9.2 |

| 9.1 |

| 9.3 |

|

ICCI |

| 8.4 |

| 8.7 |

| 9.0 |

| 8.8 |

|

MCCC |

| 8.5 |

| 8.8 |

| 8.8 |

| 8.6 |

|

Note: Monthly observation of Firm Value beginning on 12/7/04.

16

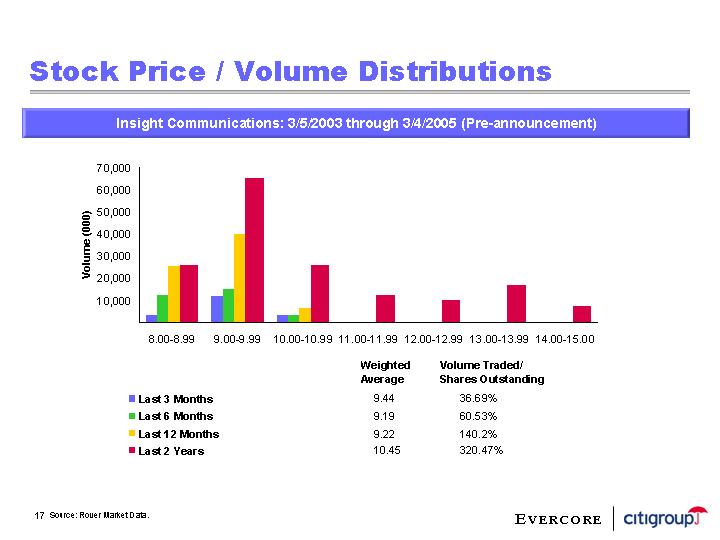

Stock Price / Volume Distributions

Insight Communications: 3/5/2003 through 3/4/2005 (Pre-announcement)

[CHART]

|

|

| Weighted |

| Volume Traded/ |

|

• | Last 3 Months |

| 9.44 |

| 36.69 | % |

• | Last 6 Months |

| 9.19 |

| 60.53 | % |

• | Last 12 Months |

| 9.22 |

| 140.2 | % |

• | Last 2 Years |

| 10.45 |

| 320.47 | % |

Source: Rover Market Data.

17

Top 25 Shareholders (12/31/04)

• Based on public disclosure, prior to the Offer, 86.7% of shares held by top 25 institutional investors appear to have an estimated average purchase price greater than the current offer price

• Collectively, the top 25 institutional investors account for 88.6% of total Class A shares outstanding (75.9% of total basic shares outstanding)

Top 25 Institutional Investors:

|

|

|

|

|

|

|

| Last 6 Months |

| ||||

Rank |

| Institutional Investor |

| Position as of |

| % Total |

| % Change |

| Avg. Transaction |

| ||

1 |

| Wallace R. Weitz & Co. |

| 8,512 |

| 16.7 | % | (1.9 | )% | $ | 8.78 |

| |

2 |

| Eubel Brady & Suttman Asset Management, Inc. |

| 6,590 |

| 13.0 |

| 1.9 |

| 8.78 |

| ||

3 |

| Westport Asset Management, Inc. |

| 4,895 |

| 9.6 |

| (11.2 | ) | 8.79 |

| ||

4 |

| Dimensional Fund Advisors, Inc. |

| 3,466 |

| 6.8 |

| 32.9 |

| 8.77 |

| ||

5 |

| Barclays Global Investors, N.A. |

| 3,460 |

| 6.8 |

| 4.3 |

| 8.78 |

| ||

6 |

| Columbia Wanger Asset Management LP |

| 2,980 |

| 5.9 |

| 0.0 |

| NA |

| ||

7 |

| Royce & Associates LLC |

| 1,712 |

| 3.4 |

| 2.0 |

| 8.78 |

| ||

8 |

| Granahan Investment Management, Inc. |

| 1,256 |

| 2.5 |

| (28.4 | ) | 8.80 |

| ||

9 |

| Capital Guardian Trust Co. |

| 1,133 |

| 2.2 |

| (225.1 | ) | 8.78 |

| ||

10 |

| Jennison Associates LLC |

| 1,101 |

| 2.2 |

| 7.6 |

| 8.80 |

| ||

11 |

| Dalton, Greiner, Hartman, Maher & Co. |

| 991 |

| 1.9 |

| 20.4 |

| 8.77 |

| ||

12 |

| SSgA Funds Management |

| 882 |

| 1.7 |

| 15.8 |

| 8.80 |

| ||

13 |

| Loeb Partners Corp. |

| 825 |

| 1.6 |

| (32.1 | ) | 8.80 |

| ||

14 |

| F&C Asset Management |

| 792 |

| 1.6 |

| 0.0 |

| NA |

| ||

15 |

| Citadel Investment Group LLC |

| 747 |

| 1.5 |

| 19.6 |

| 8.79 |

| ||

16 |

| Vanguard Group, Inc. |

| 731 |

| 1.4 |

| (0.6 | ) | 8.78 |

| ||

17 |

| Skyline Asset Management LP |

| 698 |

| 1.4 |

| 0.0 |

| NA |

| ||

18 |

| State Teachers Retirement System of Ohio |

| 645 |

| 1.3 |

| 92.3 |

| 8.80 |

| ||

19 |

| Gannett, Welsh & Kotler, Inc. |

| 602 |

| 1.2 |

| 6.6 |

| 8.79 |

| ||

20 |

| Kirr, Marbach & Co. LLC |

| 601 |

| 1.2 |

| 26.6 |

| 8.80 |

| ||

21 |

| Steadfast Advisors LLC |

| 592 |

| 1.2 |

| 7.1 |

| 8.76 |

| ||

22 |

| New Jersey Division of Investment |

| 540 |

| 1.1 |

| 0.0 |

| NA |

| ||

23 |

| John A. Levin & Co., Inc. |

| 454 |

| 0.9 |

| (4.4 | ) | 8.76 |

| ||

24 |

| JPMorgan Investment Advisors, Inc. |

| 429 |

| 0.8 |

| (9.8 | ) | NA |

| ||

25 |

| Northern Trust Global Investments |

| 418 |

| 0.8 |

| (2.8 | ) | 8.76 |

| ||

Total |

|

|

| 45,050 |

| 88.6 | % |

|

| $ | 8.78 |

| |

|

|

|

| Last 12 Months |

| Est. Avg. Purchase |

| |||||

Rank |

| Institutional Investor |

| % Change in |

| Avg. Transaction |

| Price of |

| |||

1 |

| Wallace R. Weitz & Co. |

| 2.8 | % | $ | 9.14 |

| $ | 17.31 |

| |

2 |

| Eubel Brady & Suttman Asset Management, Inc. |

| 17.6 |

| 9.64 |

| 11.11 |

| |||

3 |

| Westport Asset Management, Inc. |

| (18.4 | ) | 9.01 |

| 18.04 |

| |||

4 |

| Dimensional Fund Advisors, Inc. |

| 52.5 |

| 9.08 |

| 10.73 |

| |||

5 |

| Barclays Global Investors, N.A. |

| 17.1 |

| 9.25 |

| 12.22 |

| |||

6 |

| Columbia Wanger Asset Management LP |

| 36.2 |

| 9.35 |

| 12.65 |

| |||

7 |

| Royce & Associates LLC |

| 17.2 |

| 9.38 |

| 10.43 |

| |||

8 |

| Granahan Investment Management, Inc. |

| 19.4 |

| 9.63 |

| 16.18 |

| |||

9 |

| Capital Guardian Trust Co. |

| (324.3 | ) | 9.05 |

| 19.06 |

| |||

10 |

| Jennison Associates LLC |

| 7.4 |

| 8.81 |

| 16.80 |

| |||

11 |

| Dalton, Greiner, Hartman, Maher & Co. |

| 5.5 |

| 9.00 |

| 12.33 |

| |||

12 |

| SSgA Funds Management |

| 15.7 |

| 9.06 |

| 13.34 |

| |||

13 |

| Loeb Partners Corp. |

| (27.5 | ) | 8.90 |

| 13.36 |

| |||

14 |

| F&C Asset Management |

| 25.3 |

| 10.14 |

| 9.88 |

| |||

15 |

| Citadel Investment Group LLC |

| 69.9 |

| 9.65 |

| 10.17 |

| |||

16 |

| Vanguard Group, Inc. |

| 3.6 |

| 9.42 |

| 14.12 |

| |||

17 |

| Skyline Asset Management LP |

| 2.6 |

| 9.28 |

| 18.86 |

| |||

18 |

| State Teachers Retirement System of Ohio |

| 91.7 |

| 8.80 |

| 9.03 |

| |||

19 |

| Gannett, Welsh & Kotler, Inc. |

| 11.5 |

| 9.25 |

| 18.67 |

| |||

20 |

| Kirr, Marbach & Co. LLC |

| 100.0 |

| 9.61 |

| 9.61 |

| |||

21 |

| Steadfast Advisors LLC |

| 100.0 |

| 9.99 |

| 9.99 |

| |||

22 |

| New Jersey Division of Investment |

| 5.6 |

| 9.85 |

| 20.87 |

| |||

23 |

| John A. Levin & Co., Inc. |

| (4.4 | ) | 8.76 |

| 9.80 |

| |||

24 |

| JPMorgan Investment Advisors, Inc. |

| 42.4 |

| 9.52 |

| 10.65 |

| |||

25 |

| Northern Trust Global Investments |

| (4.9 | ) | 9.55 |

| 13.40 |

| |||

Total |

|

|

|

|

| $ | 9.33 |

| $ | 13.54 |

| |

Denotes institutional investors with average purchase price greater than offer price.

(1) Based on total basic Class A shares outstanding as of 3/31/05 per company filings.

(2) Change expressed as percentage of current position.

(3) Estimates based on quarterly volume weighted average price with quarterly position changes.

(4) Estimates based on quarterly volume weighted average price with quarterly position changes since 9/30/1999, assuming average price of position at 9/30/1999 is $24.50 (IPO price on 7/20/99).

Source: FactSet. Data available as of 4/29/05.

18

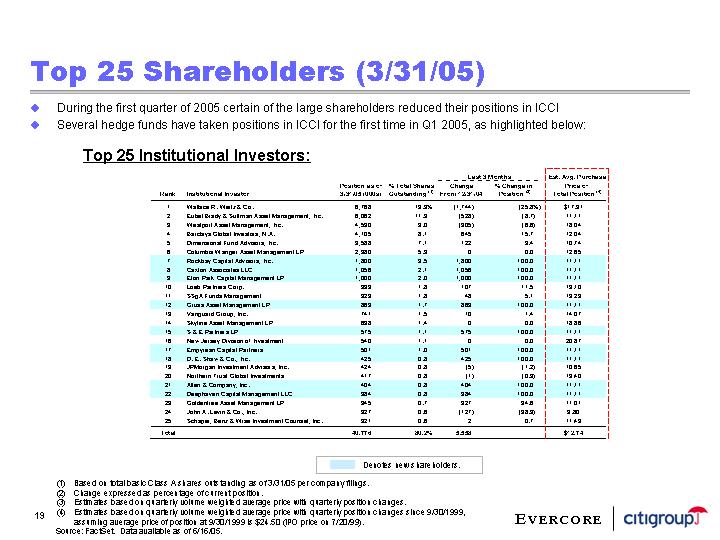

Top 25 Shareholders (3/31/05)

• During the first quarter of 2005 certain of the large shareholders reduced their positions in ICCI

• Several hedge funds have taken positions in ICCI for the first time in Q1 2005, as highlighted below:

Top 25 Institutional Investors:

|

|

|

|

|

|

|

| Last 3 Months |

| Est. Avg. Purchase |

| |||

Rank |

| Institutional Investor |

| Position as of |

| % Total Shares |

| Change |

| % Change in |

| Price of |

| |

1 |

| Wallace R. Weitz & Co. |

| 6,768 |

| 13.3 | % | (1,744 | ) | (25.8 | )% | $ | 17.31 |

|

2 |

| Eubel Brady & Suttman Asset Management, Inc. |

| 6,062 |

| 11.9 |

| (528 | ) | (8.7 | ) | 11.11 |

| |

3 |

| Westport Asset Management, Inc. |

| 4,590 |

| 9.0 |

| (305 | ) | (6.6 | ) | 18.04 |

| |

4 |

| Barclays Global Investors, N.A. |

| 4,105 |

| 8.1 |

| 645 |

| 15.7 |

| 12.04 |

| |

5 |

| Dimensional Fund Advisors, Inc. |

| 3,588 |

| 7.1 |

| 122 |

| 3.4 |

| 10.74 |

| |

6 |

| Columbia Wanger Asset Management LP |

| 2,980 |

| 5.9 |

| 0 |

| 0.0 |

| 12.65 |

| |

7 |

| Rockbay Capital Advisors, Inc. |

| 1,800 |

| 3.5 |

| 1,800 |

| 100.0 |

| 11.11 |

| |

8 |

| Caxton Associates LLC |

| 1,056 |

| 2.1 |

| 1,056 |

| 100.0 |

| 11.11 |

| |

9 |

| Eton Park Capital Management LP |

| 1,000 |

| 2.0 |

| 1,000 |

| 100.0 |

| 11.11 |

| |

10 |

| Loeb Partners Corp. |

| 933 |

| 1.8 |

| 107 |

| 11.5 |

| 13.10 |

| |

11 |

| SSgA Funds Management |

| 929 |

| 1.8 |

| 48 |

| 5.1 |

| 13.23 |

| |

12 |

| Gruss Asset Management LP |

| 863 |

| 1.7 |

| 863 |

| 100.0 |

| 11.11 |

| |

13 |

| Vanguard Group, Inc. |

| 741 |

| 1.5 |

| 10 |

| 1.4 |

| 14.07 |

| |

14 |

| Skyline Asset Management LP |

| 698 |

| 1.4 |

| 0 |

| 0.0 |

| 18.86 |

| |

15 |

| S & E Partners LP |

| 575 |

| 1.1 |

| 575 |

| 100.0 |

| 11.11 |

| |

16 |

| New Jersey Division of Investment |

| 540 |

| 1.1 |

| 0 |

| 0.0 |

| 20.87 |

| |

17 |

| Empyrean Capital Partners |

| 501 |

| 1.0 |

| 501 |

| 100.0 |

| 11.11 |

| |

18 |

| D. E. Shaw & Co., Inc. |

| 425 |

| 0.8 |

| 425 |

| 100.0 |

| 11.11 |

| |

19 |

| JPMorgan Investment Advisors, Inc. |

| 424 |

| 0.8 |

| (5 | ) | (1.2 | ) | 10.65 |

| |

20 |

| Northern Trust Global Investments |

| 417 |

| 0.8 |

| (1 | ) | (0.3 | ) | 13.40 |

| |

21 |

| Allen & Company, Inc. |

| 404 |

| 0.8 |

| 404 |

| 100.0 |

| 11.11 |

| |

22 |

| Deephaven Capital Management LLC |

| 384 |

| 0.8 |

| 384 |

| 100.0 |

| 11.11 |

| |

23 |

| Goldentree Asset Management LP |

| 345 |

| 0.7 |

| 327 |

| 94.6 |

| 11.01 |

| |

24 |

| John A. Levin & Co., Inc. |

| 327 |

| 0.6 |

| (127 | ) | (38.9 | ) | 9.80 |

| |

25 |

| Schaper, Benz & Wise Investment Counsel, Inc. |

| 321 |

| 0.6 |

| 2 |

| 0.7 |

| 11.49 |

| |

Total |

|

|

| 40,776 |

| 80.2 | % | 5,558 |

|

|

| $ | 12.74 |

|

Denotes new shareholders.

(1) Based on total basic Class A shares outstanding as of 3/31/05 per company filings.

(2) Change expressed as percentage of current position.

(3) Estimates based on quarterly volume weighted average price with quarterly position changes.

(4) Estimates based on quarterly volume weighted average price with quarterly position changes since 9/30/1999, assuming average price of position at 9/30/1999 is $24.50 (IPO price on 7/20/99).

Source: FactSet. Data available as of 6/16/05.

19

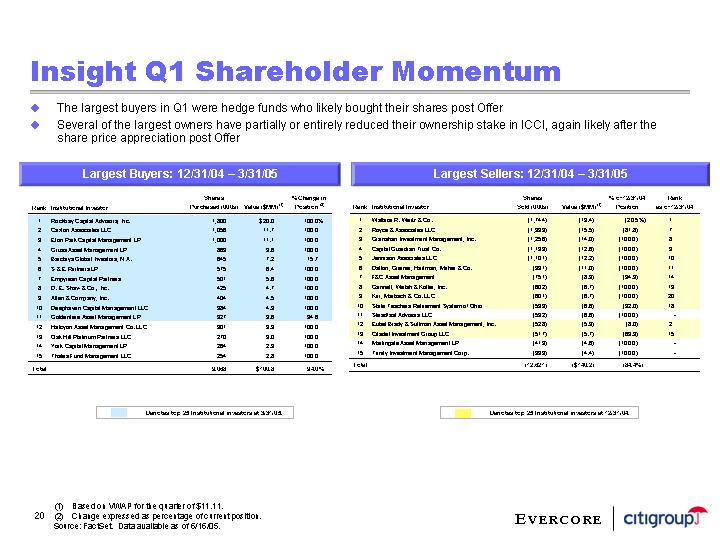

Insight Q1 Shareholder Momentum

• The largest buyers in Q1 were hedge funds who likely bought their shares post Offer

• Several of the largest owners have partially or entirely reduced their ownership stake in ICCI, again likely after the share price appreciation post Offer

Largest Buyers: 12/31/04 – 3/31/05

Rank |

| Institutional Investor |

| Shares |

| Value ($MM) (1) |

| % Change in |

| |

1 |

| Rockbay Capital Advisors, Inc. |

| 1,800 |

| $ | 20.0 |

| 100.0 | % |

2 |

| Caxton Associates LLC |

| 1,056 |

| 11.7 |

| 100.0 |

| |

3 |

| Eton Park Capital Management LP |

| 1,000 |

| 11.1 |

| 100.0 |

| |

4 |

| Gruss Asset Management LP |

| 863 |

| 9.6 |

| 100.0 |

| |

5 |

| Barclays Global Investors, N.A. |

| 645 |

| 7.2 |

| 15.7 |

| |

6 |

| S & E Partners LP |

| 575 |

| 6.4 |

| 100.0 |

| |

7 |

| Empyrean Capital Partners |

| 501 |

| 5.6 |

| 100.0 |

| |

8 |

| D. E. Shaw & Co., Inc. |

| 425 |

| 4.7 |

| 100.0 |

| |

9 |

| Allen & Company, Inc. |

| 404 |

| 4.5 |

| 100.0 |

| |

10 |

| Deephaven Capital Management LLC |

| 384 |

| 4.3 |

| 100.0 |

| |

11 |

| Goldentree Asset Management LP |

| 327 |

| 3.6 |

| 94.6 |

| |

12 |

| Halcyon Asset Management Co. LLC |

| 301 |

| 3.3 |

| 100.0 |

| |

13 |

| Oak Hill Platinum Partners LLC |

| 270 |

| 3.0 |

| 100.0 |

| |

14 |

| York Capital Management LP |

| 264 |

| 2.9 |

| 100.0 |

| |

15 |

| Thales Fund Management LLC |

| 254 |

| 2.8 |

| 100.0 |

| |

|

|

|

|

|

|

|

|

|

| |

Total |

|

|

| 9,068 |

| $ | 100.8 |

| 94.0 | % |

Denotes top 25 Institutional investors at 3/31/05.

Largest Sellers: 12/31/04 – 3/31/05

Rank |

| Institutional Investor |

| Shares |

| Value ($MM) (1) |

| % of 12/31/04 |

| Rank |

| |

1 |

| Wallace R. Weitz & Co. |

| (1,744 | ) | (19.4 | ) | (20.5 | )% | 1 |

| |

2 |

| Royce & Associates LLC |

| (1,399 | ) | (15.5 | ) | (81.8 | ) | 7 |

| |

3 |

| Granahan Investment Management, Inc. |

| (1,256 | ) | (14.0 | ) | (100.0 | ) | 8 |

| |

4 |

| Capital Guardian Trust Co. |

| (1,133 | ) | (12.6 | ) | (100.0 | ) | 9 |

| |

5 |

| Jennison Associates LLC |

| (1,101 | ) | (12.2 | ) | (100.0 | ) | 10 |

| |

6 |

| Dalton, Greiner, Hartman, Maher & Co. |

| (991 | ) | (11.0 | ) | (100.0 | ) | 11 |

| |

7 |

| F&C Asset Management |

| (751 | ) | (8.3 | ) | (94.9 | ) | 14 |

| |

8 |

| Gannett, Welsh & Kotler, Inc. |

| (602 | ) | (6.7 | ) | (100.0 | ) | 19 |

| |

9 |

| Kirr, Marbach & Co. LLC |

| (601 | ) | (6.7 | ) | (100.0 | ) | 20 |

| |

10 |

| State Teachers Retirement System of Ohio |

| (593 | ) | (6.6 | ) | (92.0 | ) | 18 |

| |

11 |

| Steadfast Advisors LLC |

| (592 | ) | (6.6 | ) | (100.0 | ) | — |

| |

12 |

| Eubel Brady & Suttman Asset Management, Inc. |

| (528 | ) | (5.9 | ) | (8.0 | ) | 2 |

| |

13 |

| Citadel Investment Group LLC |

| (517 | ) | (5.7 | ) | (69.3 | ) | 15 |

| |

14 |

| Martingale Asset Management LP |

| (413 | ) | (4.6 | ) | (100.0 | ) | — |

| |

15 |

| Trinity Investment Management Corp. |

| (399 | ) | (4.4 | ) | (100.0 | ) | — |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

|

|

| (12,621 | ) | $ | (140.2 | ) | (84.4 | )% |

|

|

Denotes top 25 Institutional investors at 12/31/04.

(1) Based on VWAP for the quarter of $11.11.

(2) Change expressed as percentage of current position.

Source: FactSet. Data available as of 6/16/05.

20

Q1 Stock Price / Trading Volume

• Trading volumes in Q1 2005 suggest that the selling from certain large shareholders, as well as the buying by several hedge funds both occurred post Offer at a price higher than the Offer Price

Insight Communications: First Quarter Trading Volume

[CHART]

69% of ICCI share volume in 1Q 2005 traded above the offer price of $10.70.

Source: Rover Market Data.

21

Wall Street Views on Insight

|

| Pre Announcement |

| Post Announcement |

| |||||||||||

Research Firm |

| Date |

| Target Price |

| PV (1) |

| Date |

| Recommendation |

| Target Price |

| |||

Banc of America |

| 02/24/05 |

| $ | 11.00 |

| $ | 9.86 |

| 06/14/05 |

| Neutral |

| $ | 12.00 |

|

Calyon Securities (USA) Inc |

| 02/25/05 |

| 9.50 |

| 8.51 |

| 03/07/05 |

| Neutral |

| 10.70 |

| |||

CIBC World Markets |

| 02/24/05 |

| 13.00 |

| 11.65 |

| 03/21/05 |

| Sector Perform |

| NA |

| |||

Citigroup |

| 02/22/05 |

| 10.00 |

| 8.96 |

| 04/19/05 |

| Hold |

| 12.00 |

| |||

Credit Suisse First Boston |

| 12/21/04 |

| 11.00 |

| 10.06 |

| 03/07/05 |

| Neutral |

| 11.00 |

| |||

Friedman, Billings, Ramsey & Co |

| 02/25/05 |

| 10.00 |

| 8.93 |

| 04/29/05 |

| Market Perform |

| 10.00 |

| |||

Jefferies & Co |

| 02/25/05 |

| 12.00 |

| 10.75 |

| 04/28/05 |

| Hold |

| 12.00 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

RBC Capital Markets |

| 02/25/05 |

| 11.00 |

| 9.85 |

| 05/17/05 |

| Underperform |

| 12.00 |

| |||

Stifel Nicolaus |

| 02/25/05 |

| 16.00 |

| 14.33 |

| 05/03/05 |

| Market Perform |

| NA |

| |||

The Buckingham Research Group |

| 11/01/04 |

| 8.00 |

| 7.29 |

| 03/07/05 |

| Neutral |

| 11.00 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Tradition Asiel Securities Inc. |

| 02/25/05 |

| 13.00 |

| 11.64 |

| 03/07/05 |

| Buy |

| 13.00 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Wachovia Securities |

| 02/24/05 |

| 10.00 |

| 8.96 |

| 03/07/05 |

| Market Perform |

| 11.50 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Mean |

|

|

| $ | 11.21 |

| $ | 10.07 |

|

|

|

|

| $ | 11.52 |

|

Median |

|

|

| 11.00 |

| 9.85 |

|

|

|

|

| 11.75 |

| |||

Maximum |

|

|

| 16.00 |

| 14.33 |

|

|

|

|

| 13.00 |

| |||

Minimum |

|

|

| 8.00 |

| 7.29 |

|

|

|

|

| 10.00 |

| |||

|

| Change in |

|

|

|

Research Firm |

| Target Price (2) |

| Transaction Commentary |

|

Banc of America |

| 21.8 | % | Precedents suggest the bidders may need to raise the offer |

|

Calyon Securities (USA) Inc |

| 25.8 | % | NA |

|

CIBC World Markets |

| NA |

|

|

|

Citigroup |

| 33.9 | % | Second bid is likely |

|

Credit Suisse First Boston |

| 9.4 | % | Bid likely to go higher |

|

Friedman, Billings, Ramsey & Co |

| 12.0 | % | We expect the offer to be completed near current levels |

|

Jefferies & Co |

| 11.7 | % | We view the tender price as “a little light” |

|

|

|

|

|

|

|

RBC Capital Markets |

| 21.8 | % | NA |

|

Stifel Nicolaus |

| NA |

| Offer will likely be sweetened |

|

The Buckingham Research Group |

| 50.9 | % | Strong possibility board will ask for offer above $11 |

|

|

|

|

|

|

|

Tradition Asiel Securities Inc. |

| 11.7 | % | Clear upside to the contemplated $10.70 offer |

|

|

|

|

|

|

|

Wachovia Securities |

| 28.4 | % | Likely that the deal will close at a higher price than $10.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mean |

| 22.7 | % |

|

|

Median |

| 21.8 | % |

|

|

Maximum |

| 50.9 | % |

|

|

Minimum |

| 9.4 | % |

|

|

Source: Bloomberg, I/B/E/S, Nelson.

|

| Cost of Equity |

| ||||

Change in Target Price |

| 11.0% |

| 12.0% |

| 13.0% |

|

Mean |

| 21.7 | % | 22.7 | % | 23.7 | % |

Median |

| 20.7 |

| 21.8 |

| 22.8 |

|

Source: Bloomberg, I/B/E/S, Nelson

(1) Present value of 12 month forward price target discounted to 03/07/05 at an illustrative 12.0% equity cost of capital, with the exception of Buckingham price target, which is discounted from 12/31/05 to 03/07/05.

(2) Calculated as Post Announcement Target Price over Pre Announcement Target Price PV.

22

4. Dissolution Leverage Analysis

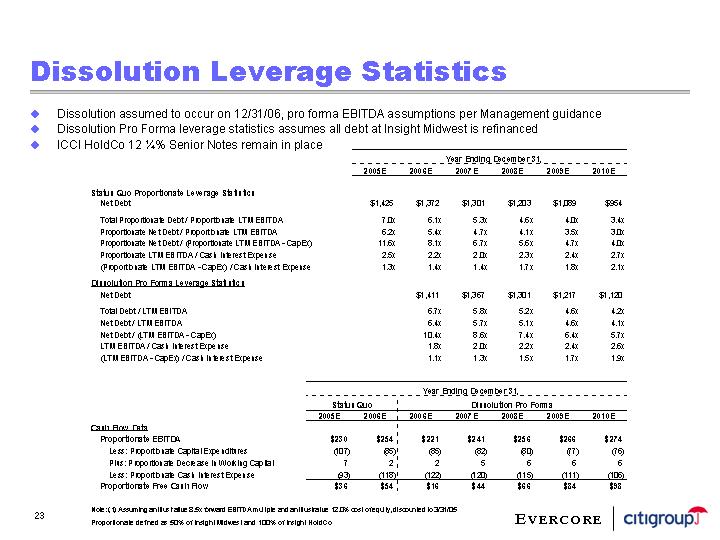

Dissolution Leverage Statistics

• Dissolution assumed to occur on 12/31/06, pro forma EBITDA assumptions per Management guidance

• Dissolution Pro Forma leverage statistics assumes all debt at Insight Midwest is refinanced

• ICCI HoldCo 12 ¼% Senior Notes remain in place

|

| Year Ending December 31, |

| ||||||||||||||||

|

| 2005E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Status Quo Proportionate Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net Debt |

| $ | 1,425 |

| $ | 1,372 |

| $ | 1,301 |

| $ | 1,203 |

| $ | 1,089 |

| $ | 954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total Proportionate Debt / Proportionate LTM EBITDA |

| 7.0 | x | 6.1 | x | 5.3 | x | 4.6 | x | 4.0 | x | 3.4 | x | ||||||

Proportionate Net Debt / Proportionate LTM EBITDA |

| 6.2 | x | 5.4 | x | 4.7 | x | 4.1 | x | 3.5 | x | 3.0 | x | ||||||

Proportionate Net Debt / (Proportionate LTM EBITDA - CapEx) |

| 11.6 | x | 8.1 | x | 6.7 | x | 5.6 | x | 4.7 | x | 4.0 | x | ||||||

Proportionate LTM EBITDA / Cash Interest Expense |

| 2.5 | x | 2.2 | x | 2.0 | x | 2.3 | x | 2.4 | x | 2.7 | x | ||||||

(Proportionate LTM EBITDA - CapEx) / Cash Interest Expense |

| 1.3 | x | 1.4 | x | 1.4 | x | 1.7 | x | 1.8 | x | 2.1 | x | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Dissolution Pro Forma Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net Debt |

|

|

| $ | 1,411 |

| $ | 1,367 |

| $ | 1,301 |

| $ | 1,217 |

| $ | 1,120 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total Debt / LTM EBITDA |

|

|

| 6.7 | x | 5.8 | x | 5.2 | x | 4.6 | x | 4.2 | x | ||||||

Net Debt / LTM EBITDA |

|

|

| 6.4 | x | 5.7 | x | 5.1 | x | 4.6 | x | 4.1 | x | ||||||

Net Debt / (LTM EBITDA - CapEx) |

|

|

| 10.4 | x | 8.6 | x | 7.4 | x | 6.4 | x | 5.7 | x | ||||||

LTM EBITDA / Cash Interest Expense |

|

|

| 1.8 | x | 2.0 | x | 2.2 | x | 2.4 | x | 2.6 | x | ||||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

|

|

| 1.1 | x | 1.3 | x | 1.5 | x | 1.7 | x | 1.9 | x | ||||||

|

| Year Ending December 31, |

| |||||||||||||||||||

|

| Status Quo |

| Dissolution Pro Forma |

| |||||||||||||||||

|

| 2005E |

| 2006E |

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| |||||||

Cash Flow Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Proportionate EBITDA |

| $ | 230 |

| $ | 254 |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

Less: Proportionate Capital Expenditures |

| (107 | ) | (85 | ) | (85 | ) | (82 | ) | (80 | ) | (77 | ) | (76 | ) | |||||||

Plus: Proportionate Decrease in Working Capital |

| 7 |

| 2 |

| 2 |

| 5 |

| 6 |

| 6 |

| 6 |

| |||||||

Less: Proportionate Cash Interest Expense |

| (93 | ) | (118 | ) | (122 | ) | (120 | ) | (115 | ) | (111 | ) | (106 | ) | |||||||

Proportionate Free Cash Flow |

| $ | 36 |

| $ | 54 |

| $ | 16 |

| $ | 44 |

| $ | 66 |

| $ | 84 |

| $ | 98 |

|

Note: (1) Assuming an illustrative 8.5x forward EBITDA multiple and an illustrative 12.0% cost of equity, discounted to 3/31/05

Proportionate defined as 50% of Insight Midwest and 100% of Insight HoldCo

23

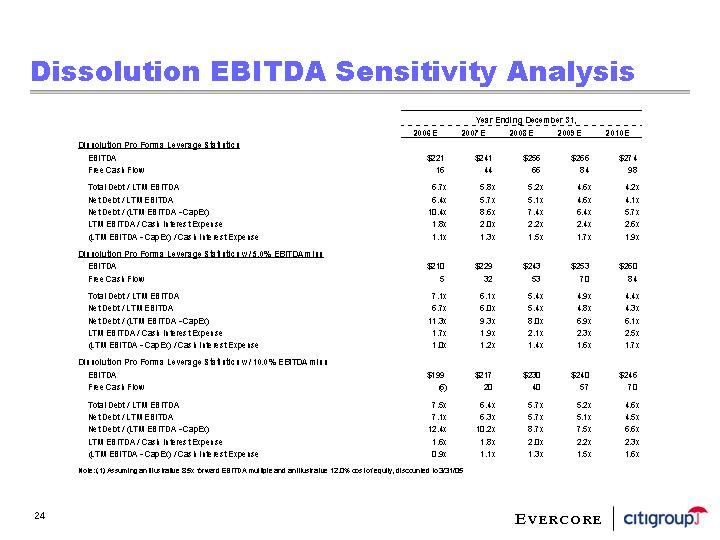

Dissolution EBITDA Sensitivity Analysis

|

| Year Ending December 31, |

| |||||||||||||

|

| 2006E |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| |||||

Dissolution Pro Forma Leverage Statistics |

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | 221 |

| $ | 241 |

| $ | 256 |

| $ | 266 |

| $ | 274 |

|

Free Cash Flow |

| 16 |

| 44 |

| 66 |

| 84 |

| 98 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Total Debt / LTM EBITDA |

| 6.7 | x | 5.8 | x | 5.2 | x | 4.6 | x | 4.2 | x | |||||

Net Debt / LTM EBITDA |

| 6.4 | x | 5.7 | x | 5.1 | x | 4.6 | x | 4.1 | x | |||||

Net Debt / (LTM EBITDA - CapEx) |

| 10.4 | x | 8.6 | x | 7.4 | x | 6.4 | x | 5.7 | x | |||||

LTM EBITDA / Cash Interest Expense |

| 1.8 | x | 2.0 | x | 2.2 | x | 2.4 | x | 2.6 | x | |||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

| 1.1 | x | 1.3 | x | 1.5 | x | 1.7 | x | 1.9 | x | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Dissolution Pro Forma Leverage Statistics w/ 5.0% EBITDA miss |

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | 210 |

| $ | 229 |

| $ | 243 |

| $ | 253 |

| $ | 260 |

|

Free Cash Flow |

| 5 |

| 32 |

| 53 |

| 70 |

| 84 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Total Debt / LTM EBITDA |

| 7.1 | x | 6.1 | x | 5.4 | x | 4.9 | x | 4.4 | x | |||||

Net Debt / LTM EBITDA |

| 6.7 | x | 6.0 | x | 5.4 | x | 4.8 | x | 4.3 | x | |||||

Net Debt / (LTM EBITDA - CapEx) |

| 11.3 | x | 9.3 | x | 8.0 | x | 6.9 | x | 6.1 | x | |||||

LTM EBITDA / Cash Interest Expense |

| 1.7 | x | 1.9 | x | 2.1 | x | 2.3 | x | 2.5 | x | |||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

| 1.0 | x | 1.2 | x | 1.4 | x | 1.6 | x | 1.7 | x | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Dissolution Pro Forma Leverage Statistics w/ 10.0% EBITDA miss |

|

|

|

|

|

|

|

|

|

|

| |||||

EBITDA |

| $ | 199 |

| $ | 217 |

| $ | 230 |

| $ | 240 |

| $ | 246 |

|

Free Cash Flow |

| (6 | ) | 20 |

| 40 |

| 57 |

| 70 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Total Debt / LTM EBITDA |

| 7.5 | x | 6.4 | x | 5.7 | x | 5.2 | x | 4.6 | x | |||||

Net Debt / LTM EBITDA |

| 7.1 | x | 6.3 | x | 5.7 | x | 5.1 | x | 4.5 | x | |||||

Net Debt / (LTM EBITDA - CapEx) |

| 12.4 | x | 10.2 | x | 8.7 | x | 7.5 | x | 6.6 | x | |||||

LTM EBITDA / Cash Interest Expense |

| 1.6 | x | 1.8 | x | 2.0 | x | 2.2 | x | 2.3 | x | |||||

(LTM EBITDA - CapEx) / Cash Interest Expense |

| 0.9 | x | 1.1 | x | 1.3 | x | 1.5 | x | 1.6 | x | |||||

Note: (1) Assuming an illustrative 8.5x forward EBITDA multiple and an illustrative 12.0% cost of equity, discounted to 3/31/05

24

Present Value of Future Stock Prices

• The following prices assume valuations of 8x – 9x the respective years EBITDA discounted to 6/30/05 at a 12% cost of equity

Status Quo

[CHART]

Early Dissolution – 5% EBITDA Miss

[CHART]

Early Dissolution

[CHART]

Early Dissolution – 10% EBITDA Miss

[CHART]

25

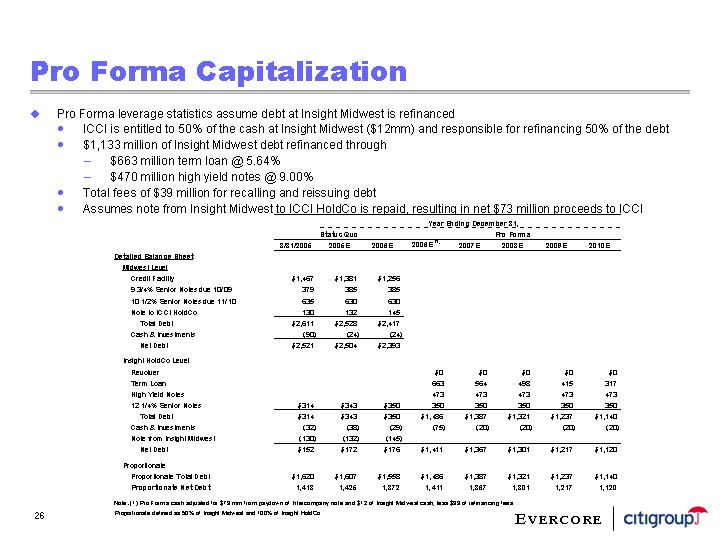

Pro Forma Capitalization

• Pro Forma leverage statistics assume debt at Insight Midwest is refinanced

• ICCI is entitled to 50% of the cash at Insight Midwest ($12mm) and responsible for refinancing 50% of the debt

• $1,133 million of Insight Midwest debt refinanced through

• $663 million term loan @ 5.64%

• $470 million high yield notes @ 9.00%

• Total fees of $39 million for recalling and reissuing debt

• Assumes note from Insight Midwest to ICCI HoldCo is repaid, resulting in net $73 million proceeds to ICCI

|

| Year Ending December 31, |

| ||||||||||||||||||||||||

|

| Status Quo |

| Pro Forma |

| ||||||||||||||||||||||

|

| 3/31/2005 |

| 2005E |

| 2006E |

| 2006E (1) |

| 2007E |

| 2008E |

| 2009E |

| 2010E |

| ||||||||||

Detailed Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Midwest Level |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Credit Facility |

| $ | 1,467 |

| $ | 1,381 |

| $ | 1,256 |

|

|

|

|

|

|

|

|

|

|

| |||||||

9 3/4% Senior Notes due 10/09 |

| 379 |

| 385 |

| 385 |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

10 1/2% Senior Notes due 11/10 |

| 635 |

| 630 |

| 630 |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Note to ICCI HoldCo |

| 130 |

| 132 |

| 145 |

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Total Debt |

| $ | 2,611 |

| $ | 2,528 |

| $ | 2,417 |

|

|

|

|

|

|

|

|

|

|

| |||||||

Cash & Investments |

| (90 | ) | (24 | ) | (24 | ) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Net Debt |

| $ | 2,521 |

| $ | 2,504 |

| $ | 2,393 |

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Insight HoldCo Level |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Revolver |

|

|

|

|

|

|

|

|

|

| $ | 0 |

|

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| |

Term Loan |

|

|

|

|

|

|

| 663 |

| 564 |

| 498 |

| 415 |

| 317 |

| ||||||||||

High Yield Notes |

|

|

|

|

|

|

| 473 |

| 473 |

| 473 |

| 473 |

| 473 |

| ||||||||||

12 1/4% Senior Notes |

| $ | 314 |

| $ | 343 |

| $ | 350 |

| 350 |

| 350 |

| 350 |

| 350 |

| 350 |

| |||||||

Total Debt |

| $ | 314 |

| $ | 343 |

| $ | 350 |

| $ | 1,486 |

| $ | 1,387 |

| $ | 1,321 |

| $ | 1,237 |

| $ | 1,140 |

| ||

Cash & Investments |

| (32 | ) | (38 | ) | (29 | ) | (75 | ) | (20 | ) | (20 | ) | (20 | ) | (20 | ) | ||||||||||

Note from Insight Midwest |

| (130 | ) | (132 | ) | (145 | ) |

|

|

|

|

|

|

|

|

|

| ||||||||||

Net Debt |

| $ | 152 |

| $ | 172 |

| $ | 176 |

| $ | 1,411 |

| $ | 1,367 |

| $ | 1,301 |

| $ | 1,217 |

| $ | 1,120 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Proportionate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Proportionate Total Debt |

| $ | 1,620 |

| $ | 1,607 |

| $ | 1,558 |

| $ | 1,486 |

| $ | 1,387 |

| $ | 1,321 |

| $ | 1,237 |

| $ | 1,140 |

| ||

Proportionate Net Debt |

| 1,413 |

| 1,425 |

| 1,372 |

| 1,411 |

| 1,367 |

| 1,301 |

| 1,217 |

| 1,120 |

| ||||||||||

Note: (1) Pro Forma cash adjusted for $73 mm from paydown of Intercompany note and $12 of Insight Midwest cash, less $39 of refinancing fees Proportionate defined as 50% of Insight Midwest and 100% of Insight HoldCo

26

Midwest Refinancing Assumptions

2006 Status Quo EBITDA (50%) |

| 254 |

|

2006 Pro Forma EBITDA (50%) |

| 221 |

|

|

| Debt Outstanding |

| Current |

| Attributable |

|

|

|

|

| Refinance |

| Call |

| Call |

|

|

| ||

|

| at 3/31/2005 |

| at 12/31/2006 |

| Yield |

| to ICCI |

| Leverage |

| Refinance? |

| Amt |

| Premium |

| Date |

| Total Exp. |

|

Midwest Holdings Term Loan A |

| $356 |

| $165 |

| 4.94 | % | $83 |

| 0.3 | x | Yes |

| $83 |

| 0.00 | % | NA |

| 0.0 |

|

Midwest Holdings Term Loan B |

| 1,111 |

| 1,091 |

| 5.74 |

| 546 |

| 2.1 |

| Yes |

| 546 |

| 0.00 |

| NA |

| 0.0 |

|

Midwest 9.75% Notes |

| 385 |

| 385 |

| 6.82 |

| 193 |

| 0.8 |

| Yes |

| 193 |

| 1.63 |

| 10/1/2006 |

| 3.1 |

|

Midwest 10.5% Notes |

| 630 |

| 630 |

| 7.32 |

| 315 |

| 1.2 |

| Yes |

| 315 |

| 3.50 |

| 11/1/2006 |

| 11.0 |

|

ICCI HoldCo 12.25% Notes |

| 350 |

| 350 |

| 8.69 |

| 350 |

| 1.4 |

| No |

| 0 |

| 4.08 |

| 2/15/2006 |

| 0.0 |

|

Total |

| $2,832 |

| $2,621 |

|

|

| $1,486 |

| 5.8 | x |

|

|

|

|

|

|

|

| $14.2 |

|

New Capital Structure |

| Leverage |

| Amount |

| Fee (%) |

| Fee ($) |

| Interest |

|

|

|

Revolver |

| 0.0 |

| x |

| $0 |

| 1.75 | % | $0 |

| 0.00 | % |

Term Loan B |

| 3.0 |

| 663 |

| 1.75 | % | 12 |

| 5.64 | % |

|

|

High Yield Notes |

| 2.1 |

| 473 |

| 2.75 | % | 13 |

| 9.00 | % |

|

|

ICCI HoldCo 12.25% Notes |

| 1.6 |

| 350 |

| 0.00 | % | 0 |

| 12.25 | % |

|

|

Total |

| 6.7 |

| x |

| $1,486 |

| $25 |

|

|

|

|

|

Sources and Uses |

|

|

| |

Sources: |

|

|

| |

Total Debt Raised in Refinancing |

| $ | 1,136 |

|

Cash from Intercompany Note |

| 73 |

| |

Cash & Investments from Midwest |

| 12 |

| |

Total Sources |

| $ | 1,220 |

|

|

|

|

| |

Uses: |

|

|

| |

Repayment of Existing Debt |

| $ | 1,136 |

|

Tender Premium / Fees |

| 14 |

| |

Fees from New Issuance |

| 25 |

| |

Cash to Balance Sheet |

| 46 |

| |

Total Uses |

| $ | 1,220 |

|

27

5. Preliminary Valuation Analyses

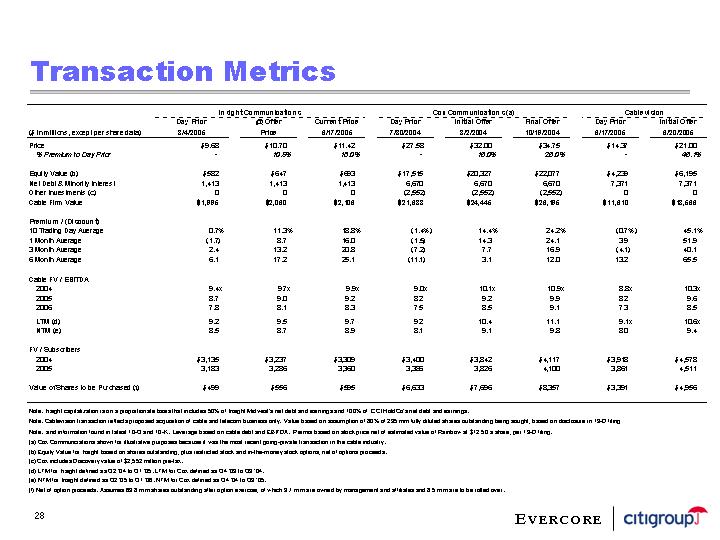

Transaction Metrics

|

| Insight Communications |

| Cox Communications (a) |

| Cablevision |

| ||||||||||||||||||

($ in millions, except per share data) |

| Day Prior |

| @ Offer |

| Current Price |

| Day Prior |

| Initial Offer |

| Final Offer |

| Day Prior |

| Initial Offer |

| ||||||||

Price |

| $ | 9.68 |

| $ | 10.70 |

| $ | 11.42 |

| $ | 27.58 |

| $ | 32.00 |

| $ | 34.75 |

| $ | 14.37 |

| $ | 21.00 |

|

% Premium to Day Prior |

| — |

| 10.5 | % | 18.0 | % | — |

| 16.0 | % | 26.0 | % | — |

| 46.1 | % | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Equity Value (b) |

| $ | 582 |

| $ | 647 |

| $ | 693 |

| $ | 17,515 |

| $ | 20,327 |

| $ | 22,077 |

| $ | 4,239 |

| $ | 6,195 |

|

Net Debt & Minority Interest |

| 1,413 |

| 1,413 |

| 1,413 |

| 6,670 |

| 6,670 |

| 6,670 |

| 7,371 |

| 7,371 |

| ||||||||

Other Investments (c) |

| 0 |

| 0 |

| 0 |

| (2,552 | ) | (2,552 | ) | (2,552 | ) | 0 |

| 0 |

| ||||||||

Cable Firm Value |

| $ | 1,995 |

| $ | 2,060 |

| $ | 2,106 |

| $ | 21,633 |

| $ | 24,445 |

| $ | 26,195 |

| $ | 11,610 |

| $ | 13,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Premium / (Discount) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

10 Trading Day Average |

| 0.7 | % | 11.3 | % | 18.8 | % | (1.4 | )% | 14.4 | % | 24.2 | % | (0.7 | )% | 45.1 | % | ||||||||

1 Month Average |

| (1.7 | ) | 8.7 |

| 16.0 |

| (1.5 | ) | 14.3 |

| 24.1 |

| 3.9 |

| 51.9 |

| ||||||||

3 Month Average |

| 2.4 |

| 13.2 |

| 20.8 |

| (7.2 | ) | 7.7 |

| 16.9 |

| (4.1 | ) | 40.1 |

| ||||||||

6 Month Average |

| 6.1 |

| 17.2 |

| 25.1 |

| (11.1 | ) | 3.1 |

| 12.0 |

| 13.2 |

| 65.5 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cable FV / EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

2004 |

| 9.4 | x | 9.7 | x | 9.9 | x | 9.0 | x | 10.1 | x | 10.9 | x | 8.8 | x | 10.3 | x | ||||||||

2005 |

| 8.7 |

| 9.0 |

| 9.2 |

| 8.2 |

| 9.2 |

| 9.9 |

| 8.2 |

| 9.6 |

| ||||||||

2006 |

| 7.8 |

| 8.1 |

| 8.3 |