UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement. |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e) (2)). |

| x | Definitive proxy statement. |

| ¨ | Definitive additional materials. |

| ¨ | Soliciting material pursuant to Rule 14a—12 |

YAK COMMUNICATIONS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

YAK COMMUNICATIONS INC.

300 Consilium Place

Suite 500

Toronto, Ontario M1H 3G2

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on December 12, 2005

Dear Shareholder:

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of Yak Communications Inc., a Florida corporation (the “Company”), to be held at 10:00 a.m., local time, on December 12, 2005, at the offices of Adorno & Yoss LLP located at 2525 Ponce de Leon Boulevard, Suite 400, Miami, Florida 33134-6012, for the following purposes:

| | 1. | To elect eight directors of the Company, each to serve a one-year term until the 2006 Annual Meeting of Shareholders. Our current Board of Directors has nominated and recommended for such election as directors the following persons: Charles Zwebner, Anthony Greenwood, Anthony Heller, Adrian Garbacz, Joseph Grunwald, Kevin Crumbo, R. Gregory Breetz, Jr. and Gary M. Clifford. |

| | 2. | To approve the appointment of our independent auditors. |

| | 3. | To transact such other business as may properly come before the Annual Meeting of Shareholders or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on October 17, 2005, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournments or postponements thereof. Such shareholders may vote in person or by proxy. The accompanying form of proxy is solicited by our Board of Directors.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE SELF-ADDRESSED ENVELOPE, ENCLOSED FOR YOUR CONVENIENCE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU CHOOSE, YOU MAY STILL VOTE IN PERSON AT THE ANNUAL MEETING EVEN THOUGH YOU PREVIOUSLY SUBMITTED A PROXY CARD.

|

| By Order of the Board of Directors, |

|

/s/ Charles Zwebner

|

| Charles Zwebner |

Chairman of the Board of Directors and Chief Executive Officer |

November 9, 2005

YAK COMMUNICATIONS INC.

300 Consilium Place

Suite 500

Toronto, Ontario M1H 3G2

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

December 12, 2005

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Yak Communications Inc., a Florida corporation (the “Company”), in connection with the Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at 10:00 a.m., local time, on December 12, 2005 at the offices of Adorno & Yoss LLP located at 2525 Ponce de Leon Boulevard, Suite 400, Miami, Florida 33134-6012 and at any adjournments or postponements thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This solicitation is made by our Board of Directors. This Proxy Statement and the accompanying Proxy Card are being mailed on or about November 23, 2005 to our shareholders of record as of October 17, 2005 (the “Record Date”).

Please complete, date and sign the accompanying Proxy Card and return it promptly to the Company in the enclosed envelope.

Shareholders Entitled to Vote. Holders of record of our common stock, no par value (the ���Common Stock”), at the close of business on the Record Date are entitled to receive Notice of the Annual Meeting and vote such shares held by them at the Annual Meeting or at any adjournments or postponements thereof. Each share of Common Stock outstanding on the Record Date entitles its holder to cast one vote (1) to elect eight directors to hold office until their successors are elected and have been duly qualified, (2) to approve our appointment of independent auditors, and (3) on any other matter that may properly come before the Annual Meeting or any adjournment thereof. As of October 17, 2005, there were 12,897,250 shares of Common Stock outstanding. We have no other shares of capital stock issued and outstanding.

The Board unanimously recommends adoption of all the matters to be submitted to the shareholders at the Annual Shareholders Meeting.

Quorum. The presence at the meeting, either in person or by proxy, of shareholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions, votes withheld and broker non-votes, i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not voting on a particular proposal, will be included in the calculation of the number of shares considered to be present at the meeting for

1

purposes of determining if a quorum exists. Abstentions will have the effect of votes against a particular proposal, and broker non-votes will have no effect on the outcome of the vote on a particular proposal. Shareholders are not entitled to cumulative voting in the election of directors. Directors are elected by the affirmative vote of a plurality of the votes of the shares entitled to vote, present in person or represented by proxy, and votes may be cast in favor of or withheld from each director nominee.

Voting.If the accompanying Proxy Card is properly signed, returned to the Company and not revoked, it will be voted as directed by the shareholder. The persons designated as proxy holders on the Proxy Card will, unless otherwise directed, vote the shares represented by such proxy IN FAVOR OF the election of all nominees for our Board of Directors named in this Proxy Statement, IN FAVOR OF the appointment of our independent auditors, and as recommended by our Board of Directors with regard to any other matters, or, if no such recommendation is given, in their own discretion.

Revocation of a Proxy. A shareholder may revoke a previously granted proxy at any time before it is exercised by filing with our Secretary a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person.

You should rely only on the information provided in this Proxy Statement. The Company has authorized no one to provide you with different information. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

CORPORATE GOVERNANCE

The following does not constitute soliciting material and should not be deemed filed or incorporated by reference in any other filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Our business and affairs are managed under the direction of our Board of Directors, except with respect to those matters reserved for our shareholders. The Board of Directors establishes our overall corporate policies, reviews the performance of senior management in executing our business strategy and managing our day-to-day operations, acts as an advisor to our senior management and reviews our long-term strategic plans. Our Board’s mission is to further the long-term interests of our shareholders. Members of the Board of Directors are kept informed of our business through discussions with our management, primarily at meetings of the Board of Directors and its committees, and through reports and analyses presented to them. The Board and each of its committees also have the authority to retain, at the Company’s expense, outside counsel, consultants or other advisors in the performance of their duties.

During the fiscal year ended June 30, 2005, there were 13 meetings of the Board of Directors. Each director attended in excess of 75% of the total number of meetings of our Board of Directors during fiscal year 2005. In addition, from time to time, the members of the Board acted by unanimous written consent pursuant to Florida law. We have no formal policy regarding

2

attendance by our directors at our annual shareholder meetings, although we encourage this attendance and most of our directors have historically attended these meetings. Our officers are elected annually by our Board of Directors and serve at the discretion of the Board. Our directors hold office until the expiration of their term or until their successors have been duly elected and qualified.

Code of Ethics

We have adopted a Code of Ethics applicable to all directors, officers and employees, including the chief executive officer, senior financial officers and other persons performing similar functions. The Code of Ethics is a statement of business practices and principles of behavior that support our commitment to conducting business while maintaining the highest standards of business conduct and ethics. Our Code of Ethics covers topics including, but not limited to, compliance resources, conflicts of interest, compliance with laws, rules and regulations, internal reporting of violations and accountability for adherence to the Code. Any amendment of the Code of Ethics or any waiver of its provisions for a director, executive officer or senior financial officer must be approved by the Board of Directors. We will publicly disclose any such waivers or amendments pursuant to applicable SEC and NASDAQ Stock Market regulations.

Communications Between Shareholders and the Board

Shareholders or other interested parties wishing to communicate with our Board of Directors should submit any communications in writing to the Board of Directors at Yak Communications Inc., 300 Consilium Place, Suite 500, Toronto, Ontario M1H 3G2. If a shareholder would like the letter to be forwarded directly to our Chairman or to one of the Chairmen of our three standing committees, he or she should so indicate. If no specific direction is indicated, the Secretary will review the letter and forward it to the appropriate Board member.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently has seven members, Charles Zwebner, Anthony Greenwood, Anthony Heller, Adrian Garbacz, Joseph Grunwald, Kevin Crumbo and R. Gregory Breetz, Jr. The terms of such directors expire at the Annual Meeting. Messrs. Zwebner, Greenwood, Heller, Garbacz, Grunwald, Crumbo, Breetz and Clifford have been nominated and recommended for election to serve as directors for a term expiring at the 2006 Annual Meeting of Shareholders. If, for any reason, at the time of election, any of the nominees named should decline or be unable to accept his nomination or election, it is intended that such proxy will be voted in favor of the election, in the nominee’s place, of a substituted nominee, who would be recommended by the Board of Directors. The Board of Directors, however, has no reason to believe that any of the nominees will be unable or unwilling to serve as a director.

3

Information Regarding Nominees

The information set forth below is submitted with respect to the nominees for election to the Board of Directors for a term expiring at the 2006 Annual Meeting of Shareholders. There are no family relationships among any of our directors.

CHARLES ZWEBNER.

Mr. Zwebner, 47, is the founder of our company, and has served as our President, Chief Executive Officer, and Chairman of our Board of Directors since our inception in December 1998. Prior to organizing our company, he served as the President of CardCaller Canada Inc. (1992-1998) and was a member of its Board of Directors. Mr. Zwebner founded CardCaller Canada in 1992, which developed the first Canadian fixed amount prepaid, multilingual telephone calling card. In June 1997, the shareholders, including Mr. Zwebner, of CardCall International Holdings, Inc. (“CIH”), the parent of CardCaller Canada, sold all of their shares in CIH to a U.S. public corporation. Mr. Zwebner continued as President and a director of CardCaller Canada until his resignation in August 1998. Prior to Mr. Zwebner’s resignation, the new owner of CIH disposed of substantially all of the assets of that company. Mr. Zwebner holds a B.A. in Computer Science and Business Administration from York University.

ANTHONY GREENWOOD

Mr. Greenwood, 47, has served as a Director of our company since December 2001. He is a Canadian attorney with Greenwoods Barristers & Solicitors. He was educated in Europe and North America, and practices law and acts as a consultant to both Canadian and U.S. private and public corporations in the area of business law, cross border financing, and dispute resolutions. He is a member of the International Law and Business Law sections of the American Bar Association and sits on several committees including the International Business Law Committee of the Section of Business Law. He is also a member of the Canadian Bar Association, the London, England-based International Bar Association, and the Tokyo-based Inter-Pacific Bar Association. Mr. Greenwood is an author of many academic articles in the areas of secured financing, corporate finance, financial service regulation, and international debt recovery & dispute resolution, and is an associate editor of the Canadian-based internationalBanking & Finance Law Review and an editor of the Australian-based international law publicationJournal of Banking and Finance, Law & Practice. Mr. Greenwood is also a part time lecturer at the Osgoode Hall Law School (Toronto, Canada).

ANTHONY HELLER.

Mr. Heller, 54, has served as a Director of our company since December 1998. He has served as the President of Plazacorp Investments Limited (a real estate development company based in Toronto, Canada) since 1994. During that period, Plazacorp has completed over $300 million worth of real estate developments principally in Canada. Mr. Heller has also been involved in venture capital financings and has consulted to both privately held and publicly traded companies in which he has invested.

4

ADRIAN GARBACZ

Mr. Garbacz, 46, has been a member of our Board of Directors since January 2003. Mr. Garbacz is currently self-employed in the real estate and development industry in New York. Previously, he was the Chief Executive Officer of The Grisdale Group of Companies in Queens, NY, which was also involved in the real estate development and finance industry. Mr. Garbacz received a B.A. in Accounting (1985) from Touro College and his certified public accountant designation in the state of New York in 1987. Mr. Garbacz is a member of the Audit Committee and Governance and Nominating Committee of our Board of Directors.

JOSEPH GRUNWALD

Mr. Grunwald, 42, has been a member of our Board of Directors since January 2003. Mr. Grunwald has been involved in the banking industry for over 15 years. He is currently a Senior Vice President with Safra Bank, New York, NY where he is Director of Domestic Business Development. Mr. Grunwald received a B.A. in Economics (1983) from the City University of New York and an M.B.A. from Long Island University (1986). Joseph Grunwald is a member of the Audit Committee and Governance and Nominating Committee of our Board of Directors.

KEVIN CRUMBO

Mr. Crumbo, 39, has been a member of our Board of Directors since 2004. He began his career in San Francisco at the tax practice of Coopers & Lybrand and subsequently moved into the financial analysis industry working for a Fortune 200 financial services firm. He later advanced into senior financial roles for bioscience and healthcare companies with highlights including successful turn-arounds, private placements, and various business combinations. Now leading Kraft Corporate Recovery Services, LLC, he assists clients in a variety of industries with turn-around management, corporate governance reviews, and litigation support. Telecommunications companies comprise a large portion of his consulting clients, and he has recently consulted with Yak on a variety of matters. Mr. Crumbo received a B.S. in Accounting from the University of Kentucky in 1988 and M.B.A. from Vanderbilt University in 1996. He holds certificates in public and forensic accounting. Although he does not practice as a certified public or other accountant, Mr. Crumbo has earned certificates in both public and forensic accounting. Mr. Crumbo is a member of the Compensation Committee.

R. GREGORY BREETZ, JR.

Mr. Breetz, 43, has served as a Director since 2004. He is currently an Executive-in-Residence for Dolphin Equity Partners, a New York City based venture capital fund. Dolphin Equity invests primarily in telecommunications and media companies. Prior to joining Dolphin, Mr. Breetz was with XO Communications and McCaw Cellular in various financial roles. Mr. Breetz has a BS in Accounting from the University of Kentucky and is a CPA. Mr. Breetz currently serves as the Chairman of the Audit Committee. Mr. Breetz is also a member of the Governance and Nominating Committee.

5

GARY M. CLIFFORD

Mr. Clifford, 36, has been nominated to serve on our Board of Directors. Mr. Clifford has over 17 years of business experience in various industries; over the last 10 years his time has been focused on the telecommunications, technology and broadcast industries. Mr. Clifford has recently established a private equity and consulting firm. Since 2002, Mr. Clifford was the Chief Financial Officer of Counsel Corporation, and in 2004 he also became its Executive Vice President. Mr. Clifford was also the Chief Financial Officer of C2 Global Technologies Inc. during this period. Counsel Corporation, a public company traded on the Toronto Stock Exchange, is a merchant bank focused on the value creation for shareholders in real estate, VoIP intellectual property and patent portfolio and seniors living businesses. C2 Global Technologies Inc., a public company traded on the OTC Bulletin Board, is a VoIP technology company. Effective December 15, 2005, Mr. Clifford has resigned from his positions with Counsel Corporation and C2 Global Technologies Inc. Since 2004, Mr. Clifford has served on the Board of Directors and is the Chairman of the Audit Committee of Qustream Corporation, a public company traded on the Toronto Stock Exchange. Qustream is a technology manufacturer servicing the broadcast industry. Prior to 2002, Mr. Clifford held various positions with Leitch Technology Corporation, NetStar Communications Inc. and Coopers & Lybrand. Mr. Clifford received a Bachelor of Arts in Management from the University of Toronto in 1992, is a Chartered Accountant (1996) and he has also lectured at Ryerson Polytechnic University in Toronto, Canada.

BOARD OF DIRECTORS COMMITTEES

Our Board of Directors has a standing Audit Committee, Compensation Committee and Nominating and Governance Committee.

Audit Committee

Our Board of Directors has an Audit Committee which currently consists of Messrs. Breetz, Garbacz and Grunwald. The Audit Committee assists the Board of Directors in its oversight of the quality and integrity of our accounting, auditing and reporting practices. The Audit Committee’s functions include meeting with our management and our independent auditors, reviewing and discussing our audited and unaudited financial statements with our management, recommending to the Board of Directors the engagement of our independent auditors, reviewing with such auditors the plan and results of their audit of our financial statements, determining the independence of such auditors and discussing with management and the independent auditors the quality and adequacy of our internal controls as required by Section 404 of the Sarbanes-Oxley Act of 2002.

During the fiscal year ended June 30, 2005, the Audit Committee held 16 meetings. The Audit Committee has the authority and responsibility to hire one or more independent auditors to audit our books, records and financial statements and to review our systems of accounting (including our systems of internal control), to discuss with our independent auditors the results of their audit and review, to conduct periodic independent reviews of the systems of accounting (including systems of internal control), and to make reports periodically to the Board of Directors with respect to its findings. Our Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee.

6

All of the members of the Audit Committee are independent of the Company (as defined under current Rule 4200(a)(15) of the National Association of Securities Dealers (“NASD”) listing standards). We consider Mr. Breetz a “financial expert” as defined under Item 401 of Regulation S-K.

REPORT OF THE AUDIT COMMITTEE

The Board of Directors appoints an Audit Committee each year to review the Company’s financial matters. The members of the Audit Committee are Messrs. Breetz, Garbacz and Grunwald. Each member of the Company’s Audit Committee meets the independence requirements set by the Securities and Exchange Commission (“SEC”) and the NASD. The Audit Committee operates under a written charter adopted by the Board of Directors, which was set forth as Appendix “A” to the 2004 Proxy Statement.

The Sarbanes-Oxley Act of 2002 and the committee’s charter require that all services provided to us by Horwath Orenstein LLP (“Horwath”), our independent auditors for the fiscal year ended June 30, 2005, be subject to pre-approval by the Audit Committee. The Audit Committee has established policies and procedures contemplated by these rules.

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its responsibility to oversee the Company’s financial reporting activities. The Audit Committee meets with the Company’s independent auditors and reviews the scope of their audit, report and recommendations. The Audit Committee also recommends to the Board of Directors the selection of the Company’s independent auditors. The Audit Committee members reviewed and discussed the audited financial statements for the fiscal year ending June 30, 2005 with management. The Audit Committee also discussed all the matters required to be discussed by Statement of Auditing Standard No. 61, “Communications with Audit Committees,” with Horwath, the Company’s independent auditors for the fiscal year ending June 30, 2005. The Audit Committee received the written disclosures and the letter from Horwath as required by Independence Standards Board Standard No. 1 and has discussed the independence of Horwath with representatives of such firm.

Without management present, the Audit Committee met separately with Horwath to review the results of their examinations, their evaluation of the Company’s internal controls, and the overall quality of the Company’s accounting and financial reporting. In addition, the Audit Committee reviewed initiatives and programs aimed at strengthening the effectiveness of our internal control structure. As part of this process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal procedures and controls.

Based on their review and the discussions described above, and subject to the limitations on its role and responsibilities, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements for the fiscal year ended June 30, 2005, be included in the Company’s Annual Report on Form 10-K filed with the SEC.

7

|

| Respectfully submitted, |

|

| Audit Committee of the Company’s Board of Directors |

|

| R. Gregory Breetz, Jr. |

| Adrian Garbacz |

| Joseph Grunwald |

Governance and Nominating Committee

The Governance and Nominating Committee consists of Messrs. Garbacz, Grunwald and Breetz, all of whom meet the independence requirements prescribed by the Marketplace Rules of the NASD. The committee is responsible for recommending candidates for election to the Board of Directors for approval and nomination by the Board of Directors. The committee is also responsible for making recommendations to the Board of Directors or otherwise acting with respect to corporate governance matters, including board size and membership qualifications, new director orientation, committee structure and membership, communications with shareholders, and board and committee self-evaluations. The Governance and Nominating Committee operates under a written charter adopted by the Board of Directors, which was set forth as Appendix “B” to the 2004 Proxy Statement.

The Committee will consider director candidates recommended by shareholders. In considering candidates submitted by shareholders, the Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Committee may also take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held. To have a candidate considered by the Committee, a shareholder must submit the recommendation in writing and must include: (i) the name of the shareholder and evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and (ii) the name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director and the person’s consent to be named as a director if nominated by the Committee.

The shareholder recommendation and information described above must be sent to our corporate secretary at 300 Consilium Place, Suite 500, Toronto, Ontario M1H 3G2, and must be received by the corporate secretary not less than 90 nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting of shareholders; provided, however, that in the event that the annual meeting is called for a date that is not within 25 days before or after such anniversary date, notice by the shareholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made, whichever first occurs.

The Committee believes that the minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of our business and affairs

8

and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. In addition, the Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. We also seek to have the Board represent a diversity of backgrounds, and experience.

The Committee identifies potential nominees by asking current directors and executive officers to notify the Committee if they become aware of persons, meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the Board. The Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by shareholders.

Once a person has been identified by the Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Committee chairperson contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Committee requests information from the candidate, reviews the person’s accomplishments and qualifications, including in light of any other candidates that the Committee might be considering, and conducts one or more interviews with the candidate. Members of the Committee may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a shareholder, although, as stated above, the Committee may take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held.

Compensation Committee

The Compensation Committee consists of Messrs. Crumbo and Grunwald, both of whom meet the independence requirements prescribed by the Marketplace Rules of the NASD. The committee is responsible for reviewing and approving, on behalf of our Board of Directors, management recommendations regarding all forms of compensation to be provided to our executive officers and directors, including stock compensation, and all bonus and stock compensation to all employees. The Compensation Committee operates under a written charter adopted by our Board of Directors. During fiscal 2005, the Compensation Committee held two meetings.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is now or ever was an officer or an employee of ours. None of our executive officers serves as a member of the compensation committee of any entity in which one or more of its executive officers serves as a member of our Board of Directors or Compensation Committee. There were no Compensation Committee interlocks during fiscal 2005.

9

Principal Shareholders

The following table sets forth the beneficial ownership of shares of our common stock by (i) each person who is known to us to be the beneficial owner of more than 5% of our common stock; (ii) each director and named executive officer (defined above) individually; and (iii) all directors and executive officers as a group. Beneficial ownership of common stock has been determined for this purpose in accordance with Rules 13d-3 and 13d-5 of the Securities and Exchange Commission, under the Securities Exchange Act of 1934, as amended, which provide, among other things, that a person is deemed to be the beneficial owner of common stock if such person, directly or indirectly, has or shares voting power or investment power with respect to the common stock or has the right to acquire such ownership within sixty days after the date of this proxy statement. Unless otherwise indicated, the address of each person listed is c/o Yak Communications Inc., 300 Consilium Place, Suite 500, Toronto, Ontario M1H 3G2.

| | | | | |

Name of Beneficial Owner

| | Number of Shares

| | | Percent of Class (1)

|

| Directors and Executive Officers | | | | | |

Charles Zwebner | | 3,229,734 | (2) | | 25.0 |

Anthony Heller | | 944,800 | (3) | | 7.3 |

Anthony Greenwood | | 15,000 | | | * |

Adrian Garbacz | | 4,000 | | | * |

Joseph Grunwald | | 4,000 | | | * |

Kevin Crumbo | | 0 | | | * |

R. Gregory Breetz | | 0 | | | * |

Gary M. Clifford | | 10,000 | | | * |

David B. Hurwitz | | 130,000 | | | 1.0 |

Valerie Ferraro | | 50,000 | | | * |

All Directors and Executive Officers as a Group (10 persons) | | 4,397,534 | | | 34.1 |

10

| (1) | Based on 12,897,250 shares of common stock outstanding as of the Record Date. |

| (2) | Includes 1,523,800 shares of common stock currently held in the name of 1231912 Ontario, Inc., a corporation controlled by Charles Zwebner. |

| (3) | Includes 400,000 shares of common stock currently held in the name of 1054311 Ontario Limited and 254,000 shares of common stock held in the name of Helmsbridge Holdings, Ltd., corporations controlled by Anthony Heller. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who beneficially own more than ten percent (10%) of a registered class of our equity securities (collectively “Reporting Persons”), to file reports of ownership and changes in ownership with the Securities and Exchange Commission. In addition, under Section 16(a), trusts for which a Reporting Person is a trustee and a beneficiary (or for which a member of his immediate family is a beneficiary) may have a separate reporting obligation with regard to ownership of the Common Stock and other of our equity securities. Such Reporting Persons are required by rules of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) reports they file. Based solely upon a review of the copies of such forms furnished to us and written representations from the Reporting Persons, we believe that during the fiscal year ended June 30, 2005, all persons subject to the reporting requirements of Section 16(a) filed the required reports on a timely basis.

Certain Relationships and Related Transactions

We paid professional fees for consulting and executive search services for the current year of $173,000 to Kraft Corporate Recovery Services, LLC (“Kraft”) and Kraft Search Associates, LLC. Mr. Crumbo, a member of our Board of Directors, is a principal and employee of Kraft. This director became a related party in October 2004 and as of June 30, 2005 there was a balance of $136,000 owing. These services were provided pursuant to written agreements, copies of which are included in our Form 8-K filed on April 6, 2005. These agreements were approved by our Audit Committee.

We paid professional fees for legal services for the years ending June 30, 2005, 2004 and 2003 of $171,000, $160,000 and $109,000, respectively, to Greenwoods Barristers and Solicitors, of which Anthony Greenwood is a director and minority shareholder. These legal services were provided pursuant to a standard engagement agreement between us and Greenwoods Barristers and Solicitors. This engagement agreement was approved by our Audit Committee. For the fiscal years ended June 30, 2005, 2004 and 2003 there was no balance owing.

We paid $18,000 of marketing and design fees for the year ending June 30, 2005 to Mitchell Shore, a former officer and minority shareholder. This former officer ceased to be a related party as of June 30, 2004. In the years ended June 30, 2004 and 2003, $142,000 and $122,000 was paid respectively to a corporation controlled by Mr. Shore as a related party transaction.

On November 12, 2002, the Company entered into a Commercial Services and Marketing Agreement with Digital Way, S.A., a Peruvian corporation (“Digital Way”). In addition, Yak

11

Communications (Canada), Inc., a subsidiary of the Company, entered into a Telecommunications Services and Disbursement Agreement with Digital Way. Pursuant to these agreements, the Company was providing certain telecommunication services to Digital Way. The operations of this joint venture are expected to be wound down by the end of the first fiscal quarter of 2006. As of July 31, 2005 the agreement between the two above mentioned companies was terminated. Digital Way is partly-owned by Universal Communications Systems, Inc., a public company whose chairman and principal shareholder is Michael Zwebner. Michael Zwebner is also a director of Digital Way. Michael Zwebner and Charles Zwebner are brothers.

Management

A brief description of our non-director management is as follows:

VALERIE FERRARO

Ms. Ferraro, 53, joined Yak Communications in 2004 following a 30-year career with Bell Canada. She has extensive experience leading multi-discipline organizations in the small/medium and enterprise-level business markets, and has directed sales, engineering and project management organizations in voice, data and Internet based technologies. A multi-year member of Bell Canada’s “President’s Club,” she pioneered the development of the company’s wholesale division – the Carrier Services Group (CSG). As the Senior Director of CSG, Ms. Ferraro held primary responsibility for the organizational design, marketing and sales strategy, regulatory compliance, customer and employee satisfaction, revenue growth and financial controls of the organization. Under her leadership, CSG experienced four digit increases in revenue growth and profitability increases, as the group mandate expanded to include National Canadian Wholesale, as well as United States and international markets. Ms. Ferraro holds a BA and has completed numerous professional management and financial courses at the various Canadian universities.

DAVID HURWITZ

Mr. Hurwitz, 41, became President of the VoIP Initiative in November 2003. He has over 18 years experience in the competitive telecommunications industry, encompassing business development, general management, strategic sales and marketing initiatives, and mergers and acquisitions. Prior to joining Yak, Mr. Hurwitz founded InTandem Communications, Inc., a telecommunications reseller acquired by Cognigen Networks in September of 2003. Prior to that, for over eight years Mr. Hurwitz served as COO and, subsequently, President and CEO of Capsule Communications, Inc., a publicly traded long distance carrier that was acquired by Covista Communications, Inc. in February of 2002. Mr. Hurwitz has also held management-level positions with RCN Corporation, InterNet Communications Services, Inc. and FiberNet, Inc.

12

Executive Compensation

The following table sets forth information about the compensation paid or accrued by us to our chief executive officer and the three most highly compensated executive officers, for the last three completed fiscal years:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | |

Name and Principal Position

| | Annual Compensation

| | Awards

| |

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options

| | Other

Compensation

| |

Charles Zwebner – President, and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 320,000

210,000

120,000 | | $

$

$ | 150,000

67,000

175,000 | | —

—

— | |

$

| —

12,815,000

— |

(1)

|

| | | | | |

David Hurwitz – Chief Operating Officer (2) | | 2005

2004

2003 | | $

$

| 222,000

102,000

— | | $

| 40,000

—

— | | —

130,000

— | |

| —

—

— |

|

| | | | | |

Valerie Ferraro – President – Yak Communications (Canada) Inc. (3) | | 2005

2004

2003 | | $

| 194,000

—

— | | $

| 76,000

—

— | | —

—

— | |

| —

—

— |

|

| (1) | On December 31, 2003, the Company issued 2,260,934 shares of its common stock to Mr. Zwebner in connection with the exchange of an option to purchase 2,568,000 shares held by Mr. Zwebner. Such shares of common stock were valued at an aggregate of $12,815,000, or 2,260,934 shares of common stock assuming a discounted market price of $5.67 per share as of November 30, 2003. |

| (2) | David Hurwitz joined the Company in November, 2003. |

| (3) | Valerie Ferraro joined the Company in February, 2004. |

Compensation of Directors

The compensation plan for each independent director is as follows: (i) $3,000 per quarter; and (ii) $6,000 per annum (in addition to items (i) and (iii) hereof); and (iii) $3,000 for attendance at the Company’s annual meeting of shareholders, along with travel expenses related thereto; and (iv) issuance of 2,000 shares of the common stock of the Company per annum for continued service on the Board of Directors.

In addition to the foregoing, the members of our Audit Committee received additional compensation for their extraordinary services in connection with the restatement of certain of our historical financial statements. The members of the Audit Committee received fees of $17,000 each and the chairman received fees of $50,000. These amounts were reviewed by the Compensation Committee and recommended to the full Board of Directors which approved the amounts and payment of the fees. The fees were based on an hourly rate of $200.

13

STOCK OPTION PLAN

In June 1999, we established a Stock Option Plan for key employees which covers up to 640,000 shares of our common stock. There are currently two officers with outstanding options as follows:

| | | | | | | | | | |

Employee

| | Option Grant Date

| | Vesting

Period

| | # of

Options

| | Grant

Price

| | Options

Vested at June 30,

2005

|

Valerie Ferraro | | May 11, 2004 | | 5 Years | | 50,000 | | 6.57 | | 10,000 |

David Hurwitz | | November 17, 2003 | | 4 Years | | 130,000 | | 6.50 | | 32,500 |

STOCK AWARD PLAN

We have authorized a one-time Stock Award Plan whereby we may issue up to an aggregate of 40,000 shares of our Common Stock to certain of our employees as the Board of Directors may determine in its discretion. As of December 28, 2001, all 40,000 shares were issued under this Plan.

Employment Contracts, Terminations of Employment and Change in Control Arrangements

On January 1, 2005, the Company and our Canadian subsidiary entered into an Employment Agreement with Charles Zwebner, our President and Chief Executive Officer, which provides him an annual base salary of $300,000. The Employment Agreement expires on December 31, 2006, unless terminated earlier in accordance with the provisions of the agreement. Mr. Zwebner’s employment agreement also provides for annual salary increases and bonuses as determined by our Board of Directors.

Indemnification of Officers and Directors

Our Articles of Incorporation and Bylaws designate the relative duties and responsibilities of our officers, establish procedures for actions by directors and shareholders and other items. Our Articles of Incorporation and Bylaws also contain indemnification provisions that permit us to indemnify our officers and directors to the maximum extent provided by Florida law.

We have entered into indemnification agreements with all of our directors to provide them with the maximum indemnification allowed under our Bylaws and applicable law, including indemnification for all judgments and expenses incurred as the result of any lawsuit in which such person is named as a defendant by reason of being our director, to the extent indemnification is permitted by the laws of Florida. We believe that the limitation of liability provisions in our Articles of Incorporation and the indemnification agreements will enhance our ability to continue to attract and retain qualified individuals to serve as directors and officers.

14

Directors and Officers Liability Insurance

We have obtained directors’ and officers’ liability insurance with an aggregate liability for the policy year, inclusive of costs of defense, in the amount of $10,000,000. This policy expires June 18, 2006.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following Report on Executive Compensation and the performance graph included elsewhere in this Proxy Statement do not constitute soliciting material and should not be deemed filed or incorporated by reference in any other filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this report or the performance graph by reference therein.

The policy of the Board of Directors is to maintain executive compensation at competitive levels that will permit us to attract, motivate and retain individuals with superior managerial abilities. The levels of compensation are intended to reward individual initiative and achievement, while motivating our executives to increase shareholder value by improving our performance and profitability.

The Compensation Committee reviews the base salaries of our executive officers annually, as well as all bonus and stock compensation for all employees, considering factors such as corporate progress toward achieving objectives (without reference to any specific performance-related targets) and individual performance experience and expertise. In determining our employees’ overall compensation, the Compensation Committee also reviews certain compensation levels at other companies. Additional factors reviewed by the Compensation Committee in determining appropriate compensation levels include subjective factors related to corporate and individual performance.

The Compensation Committee adopted a policy which places executive compensation under an annual review, pursuant to which bonuses and additional option grants, as well as increases to salary, will be based on performance goals as established by the committee and the individual executives at the commencement of each year of employment.

Members of the Compensation Committee

Kevin Crumbo

Joseph Grunwald

The Board of Directors recommends a vote IN FAVOR OF Proposal 1 to elect the eight nominees listed above. If no instructions are given on a properly executed and returned proxy, the shares of Common Stock represented thereby will be voted IN FAVOR OF Messrs. Zwebner, Greenwood, Heller, Garbacz, Grunwald, Crumbo, Breetz and Clifford.

15

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT AUDITORS

Our Board of Directors, upon recommendation of the Audit Committee, has appointed the firm of Ernst & Young LLP to serve as our independent auditors for the fiscal year ending June 30, 2006, subject to the ratification of this appointment by our shareholders.

The Board of Directors recommends that you vote FOR this Appointment of Independent Auditors.

Information Concerning Auditors

The appointment of Ernst & Young LLP was made by our Audit Committee and was ratified by the Board. As required by the Sarbanes-Oxley Act of 2002, the Audit Committee will be directly responsible for the appointment, compensation and oversight of any work of the independent auditors for the fiscal year ending June 30, 2006. Representatives of Ernst & Young LLP are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Principal Accountant Fees and Services.

During the fiscal year ended June 30, 2005, Horwath Orenstein LLP served as our independent auditors. Aggregate fees billed to us for the fiscal years ended June 30, 2005 and 2004 by Horwath Orenstein LLP, and its affiliates, were as follows:

| | | | | | |

| Principal Accountant Fees and Services |

| | |

| | | 2005

| | 2004

|

Audit Fees (a) | | $ | 168,000 | | $ | 100,000 |

Audit-Related Fees (b) | | | 84,000 | | | 30,000 |

Tax Fees (c) | | | 16,000 | | | 12,000 |

All Other Fees (d) | | | 22,000 | | | 93,000 |

| | |

|

| |

|

|

Total | | $ | 290,000 | | $ | 235,000 |

| | |

|

| |

|

|

| (a) | Audit Fees include the aggregate fees billed by our auditors for professional services rendered for the audit of the Company’s annual financial statement, along with fees for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q during that fiscal year. |

| (b) | Audit Related Fees include the aggregate of fees billed for services related to the Company’s SEC and Nasdaq filings and applications and preparation of special audit reports filed with the CRTC. |

| (c) | Tax Fees include the aggregate fees billed by our auditors for taxation compliance related services. |

| (d) | All Other Fees include the aggregate fees billed by our auditors for services rendered to the Company, other than the services covered in “Audit Fees”. These fees primarily related to non-audit acquisition services relating to the Company’s due diligence review and other due diligence engagements. |

The Audit Committee believes that the services provided to the Company for such fees noted above were compatible with maintaining such principal auditor’s independence.

16

Pre-Approval Policy

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of service and is subject to a specific budget. The Audit Committee requires the independent auditors and management to report on the actual fees charged for each category of service at Audit Committee meetings throughout the year.

During the year, circumstances may arise when it may become necessary to engage the independent auditors for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires specific pre-approval before engaging the independent auditors. The Audit Committee has delegated pre-approval authority to the Chair of the Audit Committee for those instances when pre-approval is needed prior to a scheduled Audit Committee meeting. The Chair of the Audit Committee must report on such approvals at the next scheduled Audit Committee meeting.

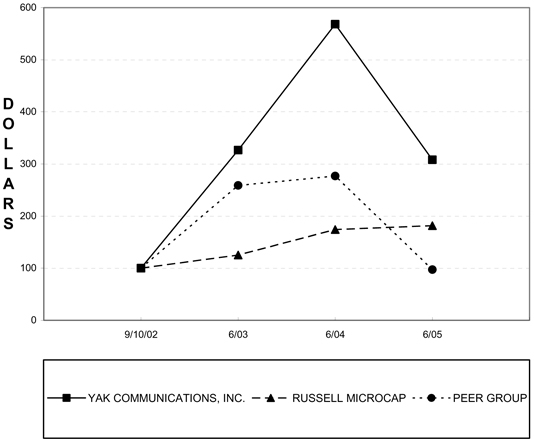

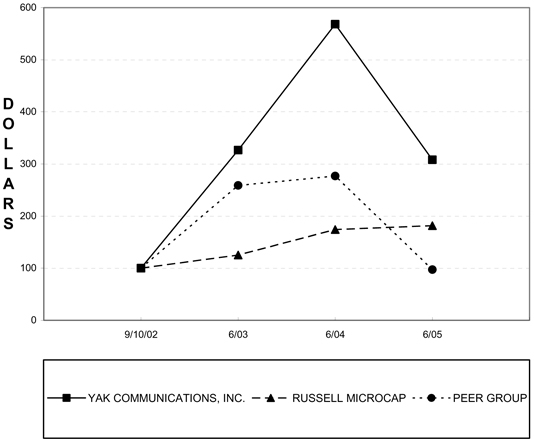

PERFORMANCE GRAPH

The following graph presents the performance of our common stock for the period September 10, 2002 (the first day our common stock was quoted on the OTC Bulletin Board) to June 30, 2005. Our common stock is compared to the Russell Microcap Index and a peer group. The peer group is comprised of the following companies: Boston Communications Group Inc., Impsat Fiber Networks, Inc., ITC Deltacom, Inc., LCC International, Inc., Lynch Interactive Corp., Moscow Cablecom Corp., Multiband Corporation, PAC-West Telecom, Inc., Primus Telecommunications Group, Inc. and US LEC Corp. The graph assumes that the value of the investment in our common stock and of each of the named indices was $100 at September 10, 2002 and that all dividends were reinvested. The information contained in this graph is not necessarily indicative of our future performance.

COMPARISON OF 33 MONTH CUMULATIVE TOTAL RETURN*

AMONG YAK COMMUNICATIONS, INC., THE RUSSELL MICROCAP INDEX

AND A PEER GROUP

| * | $100 invested on 9/10/02 in stock or index- |

including reinvestment of dividends.

Fiscal year ending June 30.

YAK Communications -NASNM

| | | | | | | | |

| | | Cumulative Total Return

|

| | | 9/10/02

| | 6/03

| | 6/04

| | 6/05

|

YAK COMMUNICATIONS, INC. | | 100.00 | | 326.67 | | 568.25 | | 307.94 |

RUSSELL MICROCAP | | 100.00 | | 125.35 | | 174.20 | | 181.48 |

PEER GROUP | | 100.00 | | 258.90 | | 276.76 | | 97.10 |

Deadline for Submission of Shareholder Proposals

Shareholders interested in presenting a proposal to be considered for inclusion in the Proxy Statement for presentation at the 2006 annual meeting of shareholders may do so by following the procedures prescribed in Securities and Exchange Commission Rule 14a-8. To be eligible for inclusion, shareholder proposals must be received by us on or before July 5, 2006, at our principal executive offices, 300 Consilium Place, Suite 500, Toronto, Ontario, Canada M1H 3G2.

After the July 5, 2006 deadline, shareholders interested in presenting a proposal for consideration at the 2006 annual meeting of shareholders may submit the proposal and present it at the 2006 annual meeting, but we are not obligated to include the proposal in our proxy materials. Rule 14a-4 of the Securities and Exchange Commission’s proxy rules allows a

17

company to use discretionary voting authority to vote on matters coming before an annual meeting of shareholders, if the company does not have notice of the matter at least 45 days before the date corresponding to the date on which the company first mailed its proxy materials for the prior year’s annual meeting of shareholders or the date specified by an overriding advance notice provision in the company’s bylaws.

OTHER INFORMATION

Proxy Solicitation

All costs of solicitation of proxies will be borne by us. In addition to solicitation by mail, our officers and regular employees may solicit proxies personally or by telephone.

Other Business

The Board knows of no other matter to be presented at the meeting. If any additional matter should properly come before the meeting, it is the intention of the persons named in the enclosed Proxy to vote such Proxy in accordance with their judgment on any such matters.

Additional Information

Accompanying this Proxy Statement is a copy of our Annual Report on Form 10-K for the year ended June 30, 2005. The Annual Report on Form 10-K constitutes our Annual Report to Shareholders for purposes of Rule 14a-3 under the Securities Exchange Act of 1934.

Shareholders who have questions in regard to any aspect of the matters discussed in this Proxy Statement should contact Charles Zwebner, our Chief Executive Officer, at (647) 722-2752.

|

| By Order of the Board of Directors |

|

Charles Zwebner, Chairman of the Board, President and Chief Executive Officer |

18

YAK COMMUNICATIONS INC.

300 CONSILIUM PLACE, SUITE 500

TORONTO, ONTARIO, CANADA M1H 3G2

(647) 722-2752

PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS

SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints Charles Zwebner and Anthony Heller, and each of them, each with the power to appoint his substitute, and hereby authorizes each of them to represent and to vote, as designated on the reverse side, all shares of common stock of Yak Communications Inc. (the “Company”) held of record by the undersigned on October 17, 2005 at the Annual Meeting of Stockholders to be held on December 12, 2005, and any adjournments thereof.

This Proxy When Properly Executed Will Be Voted As Directed. If No Direction Is Given With Respect To A Particular Proposal, This Proxy Will Be Voted For Such Proposal.

PLEASE MARK, DATE, SIGN AND RETURN THIS PROXY CARD PROMPTLY, USING THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

The Board of Directors recommends a vote “FOR” Proposals 1 and 2.

x Please mark votes as in this example.

| | | | | |

| Proposal 1. Election of Directors | | FOR

| | WITHHOLD AUTHORITY

|

Nominee: Charles Zwebner | | ¨ | | ¨ | |

Nominee: Anthony Greenwood | | ¨ | | ¨ | |

Nominee: Anthony Heller | | ¨ | | ¨ | |

Nominee: Adrian Garbacz | | ¨ | | ¨ | |

Nominee: Joseph Grunwald | | ¨ | | ¨ | |

Nominee: Kevin Crumbo | | ¨ | | ¨ | |

Nominee: R. Gregory Breetz, Jr. | | ¨ | | ¨ | |

Nominee: Gary M. Clifford | | ¨ | | ¨ | |

Proposal 2. Approval of the Company’s Independent Auditors.

¨ FOR ¨ AGAINST ¨ ABSTAIN

In their discretion, the proxies are authorized to vote upon any other business that may properly come before the meeting.

If you wish to vote in accordance with the Board of Directors’ recommendations, just sign below. You need not mark any boxes.

Mark Here for Address Change¨ and Note new address in space provided

Signature

Date

Signature

Date

NOTE: When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If the person named on the stock certificate has died, please submit evidence of your authority. If a corporation, please sign in full corporate name by the President or authorized officer and indicate the signer’s office. If a partnership, please sign in the partnership name by an authorized person.