SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-33471

YAK COMMUNICATIONS INC.

(Exact name of registrant as specified in its charter)

| | |

| Florida | | 98-0203422 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 300 Consilium Place, Suite 500, Toronto, Ontario | | M1H 3G2 |

| (Address of principal executive offices) | | (Zip Code) |

(647) 722-2752

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| None | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filed, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated file ¨ Accelerated filer¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Non-affiliates of YAK Communications Inc. held 8,586,383 shares of Common Stock as of December 30, 2005. The fair market value of the stock held by non-affiliates is $27.0 million based on closing sale price of the shares on December 30, 2005.

As of September 19, 2006, 12,965,250 shares of Common Stock, no par value per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

Description

Part I

FORWARD-LOOKING STATEMENTS

This report contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, which are based on management’s exercise of business judgment as well as assumptions made by and information currently available to, management. When used in this document, the words “may”, “will”, “anticipate”, “believe”, “estimate”, “expect”, “intend” and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties as described in this Annual Report on Form 10-K as well as other periodic reports, filed with the Securities and Exchange Commission, and as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation, and do not intend, to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize.

PART I

Material Subsequent Events

During the fourth quarter of the fiscal 2006, the Company’s Board of Directors determined that, in light of, among other things, rising costs and expenses associated with our remaining a public reporting company as compared to our revenue base, the need for additional investment in the Voice over Internet Protocol (VoIP) and Yak Communications (America) Inc. (“Yak America”) segments, the trading value of the Company and the actual performance of our core business as compared with projections, we should explore various strategic alternatives available to us to maximize shareholder value. To oversee this process, the Board has established an Independent Committee, consisting solely of independent directors of the Board (the “Committee”). The Board’s mandate to the Committee was, among other things, to (i) review, study, explore and analyze various strategic alternatives to maximize shareholder value including, without limitation, the potential sale of all or portions of the Company’s operations, (ii) consider all legal and regulatory requirements applicable to any strategic alternative, (iii) canvas the structuring of any strategic alternative, (iv) review the implementation of any strategic alternative, if approved by the Board, and (v) review our public disclosures with respect to any strategic alternative.

1

At the June 12, 2006 meeting, the Board approved the Committee’s recommendations to the Board. Among other things, the Committee recommended that various strategic alternatives to maximize our shareholder value should be reviewed, explored and analyzed, including, without limitation, the potential sale of all or portions of the Company’s operations. On June 29, 2006, the Board engaged the investment banking firm of Orion Securities Inc. to advise the Company with regard to our various strategic alternatives.

On September 20, 2006, following a rigorous auction process managed by the Independent Committee and based upon such Committee’s recommendation to the Board, the Board approved an all cash offer to acquire all outstanding shares of Yak’s common stock made by Globalive Communications Corp. (“Globalive”). The $5.25 per share offered by Globalive represents a premium of approximately 34.6% to the $3.90 closing price of our common stock on September 20, 2006. The transaction value is approximately $68 million.

Under the definitive merger agreement executed by Yak and Globalive as of September 20, 2006 (the “Merger Agreement”), the transaction has been structured as an all cash tender offer for 100% of Yak’s outstanding shares of common stock to be followed by the merger of Yak with and into a wholly-owned subsidiary of Globalive. Yak would cease being an Exchange Act reporting company as promptly as possible following the closing of the transaction.

Globalive intends to commence the offer for all of Yak’s outstanding shares of common stock shortly. A vote of shareholders on the merger will be required only if less than 80% of our common stock shares are tendered into the offer. Under the terms of the Merger Agreement, we have granted Globalive an option to acquire up to one share more than 80% of Yak’s issued and outstanding common stock shares that would become exercisable only upon the acceptance and payment for shares of common stock in the tender offer if more than 50% of the Yak common stock shares shall have been tendered and not withdrawn. The transaction is not subject to any financing contingencies and is expected to be completed before December 31, 2006, subject to certain conditions, including the receipt of regulatory approvals, the Board’s obtaining a fairness opinion from an independent third party not involved in the bidding process to date and other customary closing conditions. The focus of the fairness opinion is to determine whether the transaction was fair from a financial standpoint to all shareholders as a class.

On September 20, 2006, the Board unanimously approved the tender offer and the merger and determined that the tender offer and the Merger Agreement maximized shareholder value and are in the best interests of our shareholders. Our Board unanimously recommended that our shareholders acceptGlobalive’s offer and tender their shares.Individual shareholders, who hold approximately 51% ownership interest in our Company, have agreed to tender their shares in the offer.

YAK STOCKHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. YAK STOCKHOLDERS WILL BE ABLE TO OBTAIN FREE COPIES OF THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS FILED BY GLOBALIVE COMMUNICATIONS CORP. OR ITS SUBSIDIARY, YAKQUISITION CORP., WITH THE SEC AT THE SEC’S WEBSITE ATWWW.SEC.GOV. IN ADDITION, DOCUMENTS FILED WITH THE SEC BY GLOBALIVE OR YAKQUISITION CORP. MAY BE OBTAINED FREE OF CHARGE FROM GLOBALIVE BY DIRECTING A REQUEST TO SUCH COMPANY AT (416) 640-1088.

Business Overview

Yak Communications Inc., through its wholly owned subsidiaries Yak Communications (Canada) Inc. (“Yak Canada”) and Yak Communications (America) Inc. (“Yak America” and collectively “Yak”, the “Company”, “we” or “us”) provides telecommunications services in Canada and the United States. Our primary service offering is discounted residential toll services in Canada provided through our Yak Canada subsidiary. Yak Canada has enjoyed success in this business and is now one of the largest independent (i.e. not affiliated with an incumbent carrier or cable operator) competitive telecommunications carriers in Canada. Yak Canada also provides a full range of telecommunications services to small and medium sized businesses in Canada through its Yak for Business division and Voice over Internet Protocol (“VoIP”) services in Canada and the United States through its WorldCity VoIP division. Contour Telecom Inc. (“Contour”), a wholly owned subsidiary of Yak Canada, provides managed telecommunications services to

2

businesses in Canada. Yak America provides discounted residential toll services to customers in the United States. As of June 30, 2006 we have approximately 827,000 recurring residential and small business customers measured by unique Automatic Number Identification (“ANIs”).

Yak is a registered reseller of telecommunications services with both the Canadian Radio-Television and Telecommunications Commission (“CRTC”) and the U.S. Federal Communications Commission (“FCC”). Yak Canada has been granted a Class A Basic International Telecommunications Services License by the CRTC.

Our head office is located in Toronto, Canada. We also have office locations in Miami, Florida and Brossard, Quebec, Canada. Most of our employees are located in our Toronto office.

We organize our operations into five business segments, as follows:

| | • | | Yak Canada: Using a facilities-based resale network, whereby we own and operate a Class 4/5 telecommunications switch and lease transmission facilities (both inter and intra-city) from leading Canadian facilities-based telecommunications carriers, such as Bell Canada and Telus Communications Inc. (“Telus”), we provide several long distance products to residential subscribers throughout Canada. |

| | • | | Yak for Business:This segment provides a variety of voice and data products, including local lines, long distance services, data and Internet services, to small and medium-sized businesses in Canada. We purchase wholesale services from a variety of carriers and customize these services to provide customized products to our end-users. |

| | • | | Contour: This segment provides managed telecommunications services from the review and technology planning stage, to the implementation and administration stage, to the support services stage which is often needed to facilitate day-to-day activity and changes experienced by medium and large business customers located across North America. |

| | • | | Yak America:This segment provides a variety of long distance voice products to residential customers located in the United States. We are authorized to provide interstate and intrastate (in the 48 continental states) residential long distance services. |

| | • | | WorldCity VoIP:This segment provides VoIP services to residential customers located in the United States, Canada and other international locations. |

3

Segment sales and profit data that follow are consistent with our current management reporting structure. The Yak Canada and Yak America segments provide products such as 10-10-Yak®, yakLongDistance™, yakCell®, yakCallingCard™ and LooneyCall®. Our selling, general and administrative expenses and cost of revenues, excluding corporate expenses are charged to each segment based on where the expenses are incurred. The following table sets forth segment results for the periods ended June 30, 2006, 2005 and 2004:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended June 30, 2006 | |

| | | Yak

Canada | | | Yak for

Business | | | Contour | | | Yak

America | | | WorldCity

VoIP | | | Total

Segments | | | Eliminations

and other | | | Total | |

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

Net Revenue | | 68,883 | | | 13,024 | | | 4,901 | | | 5,236 | | | 353 | | | 92,397 | | | — | | | 92,397 | |

Cost of revenue (1) | | 36,430 | | | 9,282 | | | 3,741 | | | 5,423 | | | 428 | | | 55,304 | | | — | | | 55,304 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Contribution margin | | 32,453 | | | 3,742 | | | 1,160 | | | (187 | ) | | (75 | ) | | 37,093 | | | — | | | 37,093 | |

General and administrative | | 10,589 | | | 3,094 | | | 742 | | | 1,209 | | | 3,152 | | | 18,786 | | | 3,647 | | | 22,433 | |

Professional fees for related parties | | 137 | | | — | | | — | | | — | | | — | | | 137 | | | 104 | | | 241 | |

Stock-based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | 303 | | | 303 | |

Bad debts expense | | 83 | | | 95 | | | (217 | ) | | 325 | | | — | | | 286 | | | — | | | 286 | |

Sales and marketing | | 2,449 | | | 1 | | | — | | | 3,271 | | | 1,111 | | | 6,832 | | | — | | | 6,832 | |

Other expenses | | (68 | ) | | (11 | ) | | (32 | ) | | (1 | ) | | — | | | (112 | ) | | (492 | ) | | (604 | ) |

Writedown of property and equipment | | 174 | | | — | | | — | | | — | | | 3,413 | | | 3,587 | | | — | | | 3,587 | |

Depreciation and amortization | | 2,088 | | | 649 | | | 36 | | | 115 | | | 334 | | | 3,222 | | | — | | | 3,222 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Segment earnings (loss) before income taxes | | 17,001 | | | (86 | ) | | 631 | | | (5,106 | ) | | (8,085 | ) | | 4,355 | | | (3,562 | ) | | 793 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Segment assets | | 43,044 | | | 6,307 | | | 3,703 | | | 2,369 | | | 2,190 | | | 57,613 | | | (8,087 | ) | | 49,526 | |

Long-lived assets | | 9,864 | | | 2,237 | | | 567 | | | 515 | | | 1,843 | | | 15,026 | | | — | | | 15,026 | |

Purchases of property and equipment | | 3,410 | | | 89 | | | 122 | | | — | | | 642 | | | 4,263 | | | — | | | 4,263 | |

| (1) | Excludes depreciation and amortization of $2,618 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended June 30, 2005 | |

| | | Yak

Canada | | | Yak for

Business | | | Contour | | Yak

America | | | WorldCity

VoIP | | | Total

Segments | | Eliminations

and other | | | Total | |

| | | $ | | | $ | | | $ | | $ | | | $ | | | $ | | $ | | | $ | |

Net Revenue | | 72,194 | | | 11,753 | | | 5,557 | | 3,007 | | | 76 | | | 92,587 | | 113 | | | 92,700 | |

Cost of revenue (1) | | 41,899 | | | 8,416 | | | 4,085 | | 3,094 | | | 33 | | | 57,527 | | 109 | | | 57,636 | |

| | | | | | | | | | | | | | | | | | | | | | |

Contribution margin | | 30,295 | | | 3,337 | | | 1,472 | | (87 | ) | | 43 | | | 35,060 | | 4 | | | 35,064 | |

General and administrative | | 8,501 | | | 3,028 | | | 920 | | 1,380 | | | 1,216 | | | 15,045 | | 3,079 | | | 18,124 | |

Professional fees for related parties | | 171 | | | — | | | — | | — | | | — | | | 171 | | 287 | | | 458 | |

Stock-based compensation | | — | | | — | | | — | | — | | | — | | | — | | 81 | | | 81 | |

Bad debts expense | | 95 | | | (113 | ) | | 163 | | 228 | | | — | | | 373 | | — | | | 373 | |

Sales and marketing | | 1,900 | | | 8 | | | — | | 5,358 | | | — | | | 7,266 | | 27 | | | 7,293 | |

Other expenses | | (10 | ) | | 73 | | | 101 | | (126 | ) | | 390 | | | 428 | | (1,796 | ) | | (1,368 | ) |

Depreciation and amortization | | 2,077 | | | 556 | | | 17 | | 132 | | | 141 | | | 2,923 | | 20 | | | 2,943 | |

| | | | | | | | | | | | | | | | | | | | | | |

Segment earnings (loss) before income taxes | | 17,561 | | | (215 | ) | | 271 | | (7,059 | ) | | (1,704 | ) | | 8,854 | | (1,694 | ) | | 7,160 | |

| | | | | | | | | | | | | | | | | | | | | | |

Segment assets | | 34,269 | | | 7,382 | | | 2,409 | | 1,603 | | | 5,141 | | | 50,804 | | 2,434 | | | 53,238 | |

Long-lived assets | | 7,308 | | | 2,705 | | | 286 | | 629 | | | 5,139 | | | 16,067 | | — | | | 16,067 | |

Purchases of property and equipment | | 4,535 | | | 32 | | | — | | 618 | | | — | | | 6,077 | | — | | | 6,077 | |

| (1) | Excludes depreciation and amortization of $2,359 |

4

| | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended June 30, 2004 |

| | | Yak

Canada | | Yak for

Business | | | Contour | | | Yak

America | | | WorldCity

VoIP | | | Total

Segments | | Eliminations

and other | | | Total |

| | | $ | | $ | | | $ | | | $ | | | $ | | | $ | | $ | | | $ |

Net Revenue | | 62,228 | | 11,775 | | | 5,646 | | | 1,074 | | | — | | | 80,723 | | 79 | | | 80,802 |

Cost of revenue (1) | | 39,403 | | 8,647 | | | 4,018 | | | 1,048 | | | — | | | 53,116 | | 33 | | | 53,149 |

| | | | | | | | | | | | | | | | | | | | | |

Contribution margin | | 22,825 | | 3,128 | | | 1,628 | | | 26 | | | — | | | 27,607 | | 46 | | | 27,653 |

General and administrative | | 5,288 | | 2,918 | | | 964 | | | 231 | | | 172 | | | 9,573 | | 1,508 | | | 11,081 |

Professional fees for related parties | | 236 | | — | | | — | | | — | | | — | | | 236 | | — | | | 236 |

Stock-based compensation | | — | | — | | | — | | | — | | | — | | | — | | 26 | | | 26 |

Bad debts expense | | 34 | | 32 | | | — | | | 72 | | | — | | | 138 | | — | | | 138 |

Sales and marketing | | 3,571 | | 30 | | | — | | | 204 | | | — | | | 3,805 | | 89 | | | 3,894 |

Other expenses | | 2,221 | | 40 | | | (56 | ) | | (52 | ) | | — | | | 2,153 | | (1,203 | ) | | 950 |

Depreciation and amortization | | 2,372 | | 472 | | | 60 | | | 62 | | | — | | | 2,966 | | 14 | | | 2,980 |

| | | | | | | | | | | | | | | | | | | | | |

Segment earnings (loss) before income taxes | | 9,103 | | (364 | ) | | 660 | | | (491 | ) | | (172 | ) | | 8,736 | | (388 | ) | | 8,348 |

| | | | | | | | | | | | | | | | | | | | | |

Segment assets | | 29,891 | | 3,923 | | | 2,984 | | | 1,023 | | | 3,187 | | | 41,008 | | 12,642 | | | 53,650 |

Long-lived assets | | 5,323 | | 2,255 | | | 296 | | | 474 | | | 3,187 | | | 11,535 | | 102 | | | 11,637 |

Purchases of property and equipment | | 4,520 | | 396 | | | 3 | | | 9 | | | 566 | | | 5,494 | | 118 | | | 5,612 |

| (1) | Excludes depreciation and amortization of $2,767 |

5

| | | | | | | | | |

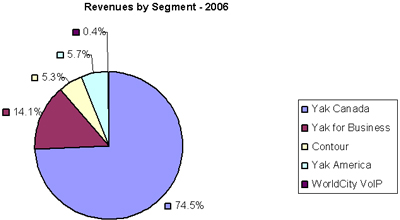

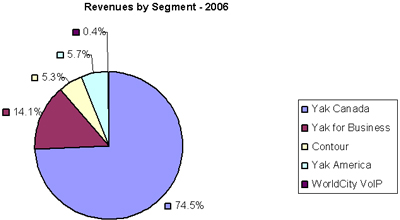

Revenues by Segment | | 2006 | | | 2005 | | | 2004 | |

Yak Canada | | 74.5 | % | | 78.0 | % | | 77.0 | % |

Yak for Business | | 14.1 | % | | 12.7 | % | | 14.6 | % |

Contour | | 5.3 | % | | 6.0 | % | | 7.0 | % |

Yak America | | 5.7 | % | | 3.2 | % | | 1.4 | % |

WorldCity VoIP | | 0.4 | % | | 0.1 | % | | — | |

Yak Canada

Yak Canada is our most established and successful business segment and generates approximately 74.5% of our total consolidated revenues. Yak Canada began operations in Toronto in July 1999. Since then, Yak Canada has expanded its scope of operations and provides service in all major urban centers in Canada.

Yak Canada’s primary product offering is 10-10-Yak®, a variable dial-around long distance product (also known as “casual calling”). Casual calling allows subscribers to place domestic and international long distance calls using Yak’s network by dialing around the subscriber’s existing long-distance carrier. Rather than dialing “1” plus the destination telephone number, subscribers dial 10-10-925 and their call is routed over Yak’s network. Our dial-around service offers very competitive per minute long distance rates, especially for international destinations. The CRTC mandates that local exchange carriers (“LECs”) must provide equal access to competitive long distance carriers such as Yak, including the support of dial-around services. The CRTC also requires LECs to offer billing and collection services to dial-around providers. As such, our dial-around subscribers do not have to pre-subscribe to use our service, rather our charges appear on the customer’s local phone bill. We have entered into billing and collection agreements with the major incumbent LECs (“ILECs”), Videotron Ltd. and Rogers Home Phone Inc. (formerly Call-Net Communications Inc.).

Yak Canada also provides the following product offerings:

| | • | | yakLongDistance: a “1+” pre-subscribed long distance service. Subscribers to this service select Yak as their pre-subscribed long distance carrier and all “1+” long distance calls they make are delivered over Yak’s network; |

| | • | | yakCell: a pre-subscribed two stage dialing service for cell-phone users. yakCell customers dial a local access number to have their long distance telephone calls routed over Yak’s long distance network rather than their cellular provider’s toll network; |

6

| | • | | yakCallingCard: a post-paid phone card service for travelers; and |

| | • | | LooneyCall: a flat-rate long distance dial-around service. aimed at customers who make long duration long distance calls. LooneyCall enables customers to purchase 60 minutes of long distance time for $1 (CAD) per call to anywhere in Canada, the U.S., China, and Hong Kong. |

In addition, to meet the changing demands of the telecommunications customer, we are continually striving to develop new products and services.

The CRTC’s 2006 Telecom Monitoring Report describes the size of the long distance market in Canada to be approximately $5.1 billion (CAD) for 2005, with the residential long distance market estimated at $2.68 billion (CAD), the business market estimated at $1.57 billion (CAD) and the long distance wholesale market approximately $0.858 billion (CAD). Competitors, such as Yak, have approximately 28% market share of the residential long distance market in Canada. Yak has approximately 10% market share of the 28% residential long distance market attributed to competitors. Almost 87% of Yak Canada’s revenues are generated by our 10-10-Yak dial-around product. At present, we estimate that Yak Canada has the largest market share in the dial-around segment in Canada, with about 75% market share. Nevertheless, we believe there is opportunity to gain further market share in the residential long distance market. Yak’s goal is to expand the size of the addressable Canadian marketplace by marketing our products to new urban centers and non-urban locations where we have not traditionally focused our efforts. Traditionally, we have focused our marketing efforts on ethnic communities who make a large proportion of international calls. However, more recently we have found that, as our brand recognition in Canada has increased, our services are attractive to a wide segment of the Canadian population. Further, over the past year we have placed more focus on cross-selling our other long distance products (yakLongDistance, yakCell and yakCallingCard) and have re-priced our domestic (i.e., calls to Canada and the U.S.) per minute rate at CAD 3.5 cents for pre-subscribed services. Our domestic and international rates are among the lowest of all Canadian long distance providers, however, due to decreased underlying carrier costs and improved processes and systems implemented by Yak to reduce network costs, Yak Canada’s products continue to be profitable.

Operational accomplishments and highlights of our 2006 fiscal year include:

| | • | | Commencing an advertising campaign on pre-subscription products to the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario and Quebec. The campaign began in the late second quarter. In total, we have increased our number of yakLongDistance customers by more than 38,000 or 458% as compared to fiscal year 2005; |

| | • | | Introduction of a new value-added feature which allows customers to view their account details online. Components of this new feature include account updates, invoice downloading and the status of any new services ordered; |

| | • | | Expansion of our local access footprint so that we will have more local access telephone numbers throughout Canada. This will enable us to more effectively offer our yakCell and yakCallingCard products on a wider geographic basis; |

| | • | | Due to increased competition and decreased marketing in the province of Ontario, revenues and minutes usage for our dial-around products have decreased; and |

| | • | | Addition of vital employees to the Company by making key management hires including the Chief Accounting Officer, Director of Audit and Financial Reporting, Vice President Network Operations and Engineering, Chief Architect, Director of Human Resources and Director of Marketing. |

Yak for Business

The Yak for Business segment provides a variety of voice and data products, including local lines, long distance services, and data and Internet services to small and medium-sized businesses in Canada. In July 2003, we acquired Argos Telecom Inc. (subsequently renamed Yak for Business). This segment purchases

7

wholesale services from a variety of underlying carriers and in turn customizes these services to provide customized products to our end-users.

Operational accomplishments and highlights of our 2006 fiscal year include making operational procedures more efficient in order to improve segment earnings before income tax. The number of billing cycles for voice products has been significantly reduced by 58%. Further, there have been efforts to migrate data customers without term commitments to one or three year contracts.

Contour

Contour Telecom Inc. was purchased from AT&T Canada in July, 2003 (in conjunction with Yak for Business (see above)) to sell telecommunications management services to medium and large enterprises across North America.

Contour provides outsourced telecom management services at all levels: planning, administration and support. Contour effectively becomes its client’s telecom department thereby allowing its clients to focus on their core business activity. Contour focuses on cost reduction, containment and consolidated billing processes, while striving to improve service levels via its support services which facilitate day-to-day activity and change. The result is active and objective management that saves its clients money through a centralized telecom operation.

Operational accomplishments and highlights for our 2006 fiscal year include an increase in net profit margins due to reductions in operational costs (primarily salaries) and a bad debt recovery. Overall, revenues decreased by $0.656 million or 11.8%. Long distance rates were reduced in order to stay competitive in the marketplace and, although we were successful in the renewal of significant contracts, we experienced some client turnover. The launch of our new billing system to 20% of our client base increased our expenses at the end of the fiscal year. We believe the launch of our new scalable billing and support system gives us a competitive advantage in the marketplace offering effective cost management controls, inventory management and on-line reporting. Further, this launch positions us to grow our business by eliminating manual business processes and driving efficiency gains for Contour.

Yak America

Through Yak America, we provide residential long distance services throughout the United States. We offer a similar product suite as Yak Canada, including 10-10-Yak, yakLongDistance, yakCell and yakCallingCard. We are authorized by the FCC to provide interstate and international services and have PUC licenses or authorizations to provide intra-state toll services in 48 states.

We continue to promote our dial around services in the United States, relying on our core strategy of niche marketing to ethnic communities to grow market share. However, we are also focusing on converting recurring dial-around subscribers to our 1+ service. We have an ongoing targeted marketing campaign to Hispanic markets in South Florida and Los Angeles. We have continued our relationship with a Hispanic celebrity spokesperson and we utilize print and outdoor media to attract customers. We maintain an office in Miami, Florida to support our strategic focus in the United States. We believe that through the implementation of our strategically focused approach an opportunity to grow this market exists.

To support our dial-around products in the United States, we have entered into an agreement with Billing Concepts, Inc., which specializes in inter-carrier clearinghouse operations, for handling, transporting and delivery of our billing records to the LEC for invoicing and collection purposes. This billing and collection arrangement is similar to those arrangements we have established in Canada, however, this agreement does not apply to most of the Competitive Local Exchange Carriers (“CLECs”) in the U.S. As a result, we do not process calls which originate from certain alternative local line carriers in the United States. We have developed software on our switching systems to block customers of CLECs for which we do not have billing and collection agreements in place. Unlike in Canada, CLECs represent a larger market share of calls originating in the U.S.

8

Operational highlights of our 2006 fiscal year include:

| | • | | The commencement of a telemarketing campaign to convert dial-around customers to the Yak Long Distance product (1+ service); and |

| | • | | Minutes for the fiscal year ended June 30, 2006 increased by 81%, as compared to the previous fiscal year. |

WorldCity VoIP

Internet-enabled voice services represent an important emerging market opportunity in the telecommunications industry. VoIP technology enables voice communications over broadband IP networks, including, but not limited to, the public Internet, instead of the traditional telephone network. When VoIP is used, a voice communication traverses at least a portion of its communications path in an IP packet format using IP technology and IP networks. Since VoIP providers bypass traditional circuit-switched networks, and in the case of many providers including Yak utilize the public Internet, they have the potential to significantly reduce voice communications costs for end-users. In addition, since VoIP service is IP-based there is a great potential to provide a wide array of value-added features. Currently, we own and operate the network, infrastructure and software to support a number of retail VoIP product offerings.

As part of our strategy to leverage our recurring cash flow from our dial-around business to transition into high growth and emerging markets, we launched our VoIP service in September 2004. Services are currently provided to residential customers in both the United States and Canada through the WorldCity VoIP segment. We believe that we have developed a compelling value proposition for retail consumers looking to maximize the benefits of their IP communications by offering a product that enables them to make a large amount of long distance calls – both domestic and international – at rates lower than traditional wireline long distance prices. Significant marketing efforts began in January 2005 and have continued throughout our 2006 fiscal year. We have increasingly focused our efforts on developing a robust and innovative software end user device enabled (softphone) peer-to-peer VoIP service, which bypasses the Public Switched Telephone Network (“PSTN”) entirely. yakForFree™ is a VoIP service which allows users to make free voice and video calls using the Internet to any other yakForFree subscriber.

We encourage our yakForFree subscribers to upgrade to one or more of our two paying services:

| | • | | yakToAnyone™, a prepaid VoIP service which allows users to make PC to PSTN Internet phone calls over a high-speed connection. yakToAnyone also supports video capabilities; and |

| | • | | yakUnlimited™, a pre-subscribed VoIP service which allows users to make 3,500 minutes of North American Internet phone calls for one monthly fee. yakUnlimited, a residential first line replacement or second line service, is available in certain locations in Canada and the United States (where E911 service is supported). yakUnlimited is a “nomadic” VoIP service (i.e., the subscriber can utilize the service wherever he/she has access to a broadband Internet connection and the service is not limited to a fixed location). We believe subscribers will see value in using both a softphone and phone adapter tied to a single account. The product offering also includes a competitive number of bundled local and North American long distance minutes and market-acceptable feature functionality. |

To support our VoIP products, we have entered into strategic arrangements with a number of innovative technology companies. These include Kayote Networks, Inc. (“Kayote”) and CounterPath Solutions, Inc. (“CounterPath”). Kayote provides recognized industry expertise to help define VoIP technology solutions and overcome typical interoperability issues that have previously inhibited the widespread acceptance of Internet based services. CounterPath provides softphones that allow customers to make and receive phone calls or video phone calls directly on their personal computer without the need of a regular analogue phone line. In January 2006, we re-launched our yakUnlimited service. Certain necessary back-office systems for the yakUnlimited service were outsourced to CommPartners Inc. of Las Vegas, NV.

9

Operational highlights of fiscal year 2006 include the launch of yakForFree and yakToAnyone in the second quarter, the re-launch of the yakUnlimited product in January 2006 and the roll-out of yakUnlimited to international customers. IT developmental programs to support web-based marketing initiatives also continued throughout fiscal year 2006.

In the fourth quarter, we discontinued our Yak Basic product, recording a write-down of the assets associated with that product totaling $3,413. Additionally, we reduced the size of the IT and product developments team based upon the completion of our VoIP platform and the President of VoIP Initiatives was terminated, his responsibilities were assumed by our Chief Executive Officer. During the fourth quarter, we signed a Software License and Distribution Agreement with Intel Corporation. Under this agreement, Yak is offering its WorldCity VoIP product suite in conjunction with the roll out of the Intel 600SM PCI Phone Adapter.

THE INDUSTRY AND COMPETITION

In both Canada and the U.S. there are several other residential long distance, including “dial-around”, companies competing against Yak in the marketplace. The VoIP marketplace is in its initial stages and is characterized by significant new entry.

Canada

Long Distance Services

Meaningful competition in long distance services in Canada has existed since the 1990s. Recognizing that the market had achieved sustainable competition, in 1997 the CRTC de-regulated the incumbent carriers’ (such as Bell Canada and Telus) retail long distance service offerings. New entries in the marketplace and the increased competition in the telecommunications industry has resulted from decreased termination costs and a proliferation of call routing options. Five very large providers of long distance services currently dominate the Canadian market: Bell Canada, Telus, Rogers Home Phone, MTS-Allstream and Primus Telecommunications Canada Inc. In addition, there are a variety of small long distance resellers with annual revenues of less than $10 million (CAD). Further, Canada’s major cable companies such as Videotron Ltd. and Shaw Communications Inc. have entered the residential telecommunications market and currently offer both local and long distance products. The cable companies are able to leverage their existing customer base and are currently offering bundled discounts across all lines of their communications base. In addition, pure VoIP carriers, such as Vonage Canada, have started offering bundled local/long distance services. Finally, we will increasingly face competition from mobile wireless service providers as wireless substitution grows. Statistics Canada recently reported, as of December 2005, that 4.8 percent of Canadian households had replaced their wireline services with wireless services.

The CRTC 2006 Telecom Monitoring Report estimated the size of the residential long distance market in Canada at approximately $2.68 billion (CAD) for 2005. Although the overall revenues in this market have decreased over the past years, the size of the market controlled by non-ILECs, such as Yak, has marginally increased. From 2004 to 2005, competitors’ revenues increased to $753 million from $721 million and the market share has increased to 23% from 16%, while ILECs revenues decreased to $1.92 billion from $2.14 billion and their market share decreased to 72% from 75%. Currently, non-ILECs have 28% of the residential long distance market share (23% resellers and 5% facilities-based). Of this 28% market share, Yak has approximately 10% market share. In the dial-around segment, our main competitor is Telehop Communications Inc.

One of the ways in which we differentiate ourself from competitors is that we do not offer multiple plans with potentially confusing time of day, weekday/weekend restrictions. Our product offerings combine a single domestic per-minute long distance rate that applies for anytime or any day and, unlike other long distance providers, we do not charge a network access fee nor do we charge minimum monthly

10

fees (with the exception of our VoIP product offerings). In our opinion, we offer a compelling value proposition for customers who desire simple, cost-effective long-distance plans.

United States

In the United States the communications industry is highly competitive. The deregulation of the United States telecommunications industry and the implementation of the Telecommunications Act of 1996 (the “Telecommunications Act”), has led to an overall increase in competition for local and long distance telecommunications services. Further, new technologies that imitate traditional telephony calling services have increased the number of participants in the communications industry, and have increased the market competition for local, long distance, calling card, and VoIP customers. Our competitors in these markets include the national ILECs (i.e., AT&T, Qwest, Verizon), established competitive carriers (i.e., Choice One, Level 3, US LEC), as well as a variety of small long distance resellers. Recently, major cable companies in the United States have entered the residential telecommunications market and offer local, long distance, broadband, and VoIP products (i.e., Comcast and Time Warner Cable). Further, pure VoIP providers that do not bundle broadband Internet access facilities with their VoIP offering but instead rely on the facilities of third parties(i.e, Lingo, SunRocket, Vonage), have also recently entered the market, and have provided products aimed at the traditional long distance telephony market through fixed service fee calling plans.

We believe the principal competitive factors affecting the communications industry in the United States are the quality and reliability of services, innovation, customer service and price. Our continued ability to compete effectively in this market will depend upon our capability to offer innovative, high-quality, market-driven services at prices generally equal to or below those charged by our competitors. Many of our current and potential competitors have an abundance of resources which may provide them with a competitive advantage. We anticipate competition to remain intense in all of our U.S. market segments, thus, limiting our ability to achieve significantly greater market share for any of our services.

Yak also offers calling card services. We believe that our success in providing these services is based on our ability to provide low rates and reliable service and to efficiently distribute our calling cards. The calling card industry is notable for its relative lack of regulation and ease of market entry. As a result, our competitors for this service include not only established interexchange and local exchange carriers, but also thousands of small, regional companies. As rates continue to decrease and competition increases, profitability for these services is likely to decrease and we may be forced to rely on our service quality and distribution efficiencies to remain competitive.

VoIP

Competition from traditional telecommunication companies and non-traditional start-ups entering the broadband VoIP telephony market is at a relatively early stage and, as such, no market models have emerged to properly gauge competition. Despite the start up nature of this market, several relatively small companies have begun to market innovative Internet telephone calling services including Primus Canada and a variety of U.S.-based companies, such as Vonage, 8x8, Inc., and SunRocket. There are numerous VoIP providers like Skype (recently acquired by eBay), Yahoo, Google, MSN and Gizmo that do not consider voice communications as their core business, but do consider it a part of their entire communications package.

STRATEGY

The core of our vision has been and remains to provide high quality and affordable communication services for our customers. We strive to accomplish this vision by providing our customers with simple, low risk and easy to use products and communications solutions. We distinguish ourselves from the competition by offering a single domestic per-minute long distance rate that applies to any time of the day, any day of the week. Unlike other long distance providers, we do not charge a network access fee nor do

11

we charge minimum monthly fees (with the exception of our VoIP product offerings). We aspire to provide exceptional and personalized customer service to all of our customers.

Over the past two years our strategy has been to leverage our revenues, positive net income and strong cash flow from our core Canadian dial-around business (10-10-Yak) to fund our growth of residential toll services in the United States and the expansion of our VoIP product offering. We have focused our advertising budget on these new products and geographic markets while decreasing our advertising budget in our Canadian markets. As a result, our brand strength and awareness in Canada has somewhat decreased and the revenues from our 10-10-Yak product have declined.

To address these challenges, in the fourth quarter of our 2006 fiscal year, we renewed our strategy which includes the following elements:

| | • | | re-connecting to our “Yak” brand in the Canadian residential long distance market – our most successful and profitable operating segment; |

| | • | | devoting the appropriate resources to regain lost market share and revenues with respect to our core product offering, 10-10-Yak in the Canadian market, while continuing to expand our other Canadian long distance products (e.g. yakLongDistance, LooneyCall, yakCallingCard and yakCell); and |

| | • | | developing new complimentary products and investigating the expansion into complimentary telecommunications markets where we can exploit our Yak brand to achieve market share and increased revenues. |

In light of the foregoing strategy renewal, we have rededicated greater marketing and advertising resources to our core Canadian markets. We have recently hired a Director of Marketing, based in Toronto, Canada, whose mandate is consistent with the above objectives. Operational resources will also be directed to new product and market development initiatives. These initiatives will be our key priorities throughout fiscal 2007.

Although the majority of our efforts will be re-focused on the Canadian market, we will continue marketing our products offered by our Yak America and VoIP WorldCity segments and will continue to investigate areas in which we can reduce costs in these segments. We will continue to maintain our Miami, FL office to support these initiatives.

NETWORK

Over the past five years, we have established and expanded our own private, leased line network throughout most of Canada. Currently, this coast-to-coast network delivers most of our voice telephony traffic. We have continued to expand the addressable market in Canada by interconnecting with CLEC’s and independent telephone companies and these initiatives will continue into fiscal 2007. In September 2003, we acquired a “state of the art” Tekelec/Santera switch and installed it in our network premises in Toronto. Subsequently, we have migrated our network traffic to this switch from our legacy switches. To support our network growth, we have continued to expand the Tekelec/Santera switch to 40,000 ports. The switch is expandable to 200,000 ports and, as such, we anticipate having significant switching capacity in the foreseeable future.

Our Tekelec/SanteraOne switch has positioned us to more efficiently accommodate the expansion of our customer base. The switch will act as a gateway to both traditional PSTN networks and IP networks. This switch is connected through leased lines to the Local Exchange Carriers’ (“LECs”) tandem and central offices by long haul diverse fiber, and also to interexchange carriers’ (“IXCs”) networks providing customers access to true “coast to coast” networks. Dedicated fiber transport is contracted from different carriers to provide us with the most competitive pricing. We have made an effort during the past year to utilize the IP portion of our switching platform and have connected to several IP network providers for a portion of our international traffic. Our primary concern when choosing interconnection partners is to

12

maintain optimal quality and the IP networks we use meet or exceed the standards of the traditional Time Division Multiplex (“TDM”) network providers we employ.

Our coast-to-coast leased line network in Canada allows us to originate and terminate the majority of our traffic on our own network, thereby reducing our overall switching costs. For calls that terminate outside of Canada, we have agreements with other “off net” International and cross border carriers, which are selected by running real time least cost routing algorithms. Our Carrier Relations team has made significant gains in renegotiating our bandwidth and switched minute agreements over the past year and have contributed to increasing our profit margins.

In the United States, we have achieved comparable network breadth by interconnecting with Wiltel Communications LLC (“Wiltel”), a major U.S. wholesale carrier (Wiltel was acquired by Level 3 Communications Inc. on December 23, 2005). Our Carrier Identification Codes (“CIC”) are programmed into Wiltel switches and therefore we take advantage of Wiltel’s extensive network access arrangements with the Regional Bell Operating Companies (“RBOC”s) and most major LECs. U.S. originated calls are hauled to our switch in Toronto and terminated on our Canadian network or routed “off net” if the calls terminate outside of Canada. Further, redundancy has been built in this U.S. network by connecting our switch to two independent major switching centers in New York City.

During the quarter ended December 31, 2005, a second switch was installed in the NAP of the Americas in Miami, FL and became fully operational in the quarter ended March 31, 2006. The system consists of a redundant Tekelec/Santera switch with 16,000 ports and a complete billing and fraud system. The system handles the daily overflow traffic from Canada and is capable of handling 70% of Yak’s traffic in the event of a catastrophic failure of the switch in Toronto.

We also own and operate several routers to support our VoIP network. The routers allow Yak to receive VoIP calls that are originated by our subscribers and routed over the public Internet, so that we may terminate these calls on the PSTN. Currently, we utilize our VoIP network facilities to support our yakForFree and yaktoAnyone products.

EMPLOYEES

As of June 30, 2006, we had a total of 161 employees. Our workforce included 98 employees employed in our Yak Canada segment, 23 employees in the Yak for Business segment, 16 employees in the Contour segment, 3 employees in the Yak America segment and 21 employees in the VoIP segment. Some of our employees employed in the Yak Canada segment perform management and administration duties and provide services to all our business segments.

We consider our relations with our employees to be excellent, and none of our employees are covered by a collective bargaining agreement.

GOVERNMENTAL REGULATION

As an international communications company providing telecommunications services in Canada and the United States, we are subject to varying degrees of regulation in each of the jurisdictions in which we provide services. Laws and regulations applicable to the provision of telecommunications services, and the interpretation of such laws and regulations, differ significantly among the jurisdictions in which we operate. The summary below describes the primary regulatory developments in the U.S. and Canada that may have a material adverse effect on our business.

In general, the regulation of the telecommunications industry continues to change rapidly both domestically and globally. In both the U.S. and Canada, telecommunications regulations are from time to time subject to judicial and administrative proceedings, as well as legislative and administrative hearings, in which proposals are made that, if adopted, could change the manner in which our industry operates. We cannot predict the outcome of these proceedings or their impact on us. There can be no assurance that future regulatory, judicial and legislative changes will not have a material adverse effect on us, or that domestic or international regulations or third parties will not raise material issues with adverse effect on us.

13

Canada

Yak is registered with the CRTC as a reseller of telecommunications services in Canada. This is a requirement that has been imposed by the CRTC on all persons that resell telecommunications services in Canada. Registration with the CRTC is the only requirement necessary to have the authorization to resell telecommunications services in Canada. The provision of certain services, however, requires additional licensing by the CRTC or is subject to certain rules and regulations, regardless of whether the services are provided on a resale or a facilities basis.

All persons who provide basic international telecommunications services (voice or data) must obtain a license from the CRTC for the provision of such services. Resellers who provide basic international telecommunications services must also obtain an international services license.

The international services licensing regime was established in part because of concerns relating to the potential for anti-competitive behavior involving foreign monopolists acting in conjunction with a resale affiliate based in Canada. The CRTC also wished to exercise some supervision over Canadian service providers, especially resale affiliates in Canada.

Yak Canada is required to, and holds, a Class A license from the CRTC as it operates telecommunications equipment that converts basic international traffic from circuit switched traffic to data. The CRTC issues international telecommunications service provider licenses for a period of ten years. Licensees who maintain their licenses in good standing may expect to have them renewed by the CRTC. Currently, there is no fee payable in order to obtain a basic international telecommunications services license.

A Class A licensee is required to advise the CRTC of any changes to the information about the licensee that has been previously filed with the CRTC. Licensees are also obliged to comply with the requirements of the Canadian contribution regime (see below) and file with the CRTC information pertaining to the telecommunications industry data collection process requirements. Yak Canada is currently in full compliance with all filing requirements of its Class A license.

As of June 30, 2006 the CRTC has not had any concerns regarding anti-competitive behavior on the part of the Company and since we do not provide services on a monopoly basis and we are not a resale affiliate, it is unlikely that the CRTC will have concerns in the future. In addition, because Yak does not own or operate the underlying transmission facilities used to provide telecommunications services to the public, it is not classified as a Canadian carrier. As such, Yak is not subject to the Canadian ownership and control requirements that apply to the facilities-based Canadian carriers.

Contribution Requirements

The CRTC has established a “contribution” regime (a universal access-type regime) which requires that a contribution be paid to the CRTC on the revenue from the widest possible range of services and service providers regulated by the CRTC. Thus, ILECs, long distance operators, CLEC’s, cellular operators, resellers such as Yak and others must all make contribution payments based on their Canadian telecommunications service revenues.

The calendar year interim contribution rate is 1.03%. This rate may be adjusted by the CRTC in the fourth quarter of calendar year 2006. For fiscal years 2005 and 2004, the contribution charge was 1.1% of “contribution-eligible” revenues.The rate is expected to remain stable or slightly decline in future years. Although Yak cannot predict whether the CRTC will change its method of contribution assessment and collection in the future, if the current approach remains unchanged and the overall contribution requirement declines as expected, the Company does not anticipate that its total contribution payments will become material in future years.

14

VoIP Regulation - Canada

The current position of the CRTC is that VoIP services that provide subscribers with access to and/or from the PSTN and the ability to make and/or receive local telephone calls are to be regulated as local exchange services. Therefore, existing regulatory requirements would apply depending on the class of service provider, i.e., ILECs, CLECs and resellers. This approach allows Yak to offer VoIP services as a local reseller with minimal regulatory requirements and Yak’s competitors in Canada, particularly the incumbent carriers, will be regulated to a much greater degree (e.g., ILECs are required to file tariffs and not price their service below cost). In addition, the CRTC enunciated that underlying broadband access providers should not discriminate against independent VoIP providers, such as Yak. Although Yak views this decision as positive, we were required to develop and implement local service features (such as basic 911) and network-based privacy obligations. The CRTC has directed the industry to identify methods to provide enhanced 911 for nomadic and non-native VoIP services, such as Yak. (Fixed native VoIP providers are currently required to provide enhanced 911 services.) In response to the CRTC directive an industry group will be working on developing one or more potential solutions in 2007.

The ILECs have appealed the CRTC’s ruling with respect to VoIP and a decision is pending. The ILECs argued that VoIP services are fundamentally different from current local voice services and it should be unregulated.

Other Regulatory Developments

On March 22, 2006, the Telecommunications Policy Review Panel (“Panel”) released its comprehensive report with recommendations to modify and amend Canada’s telecommunications policy. The Panel was established by the Canadian Ministry of Industry on April 11, 2005, to conduct a review of Canada’s telecommunications policy and regulatory framework. Among its over 120 recommendations, the Panel concluded that the scope of mandated wholesale access currently required by the CRTC is too broad and that it undermines incentives for competitive entry, investment and innovation. The Panel recommends that mandated access be restricted to essential facilities – as defined by Competition Law tests – and interconnection services (e.g. equal access). Yak’s network has been built through leasing facilities from other carriers, including the ILECs, and some of these facilities are obtained through CRTC mandated access requirements. As well, should mandated wholesale access be removed, opportunities to develop new services through resale (e.g. high-speed Internet resale) may be curtailed. The Panel also made some recommendations that would support competitive entry by removing barriers to entry, such as mandated access to multi-unit buildings. The Panel’s recommendations are being studied by the Ministry of Industry and recently the Ministry tabled a Policy Direction to the CRTC requiring the CRTC to rely on market forces to the maximum extent feasible and regulate, where there is still a need to do so, in a manner that interferes with market forces to the minimum extent necessary. The proposed Policy Direction is open for public comment and is not yet in force. We cannot predict whether these recommendations will be adopted by the government in whole or in part. Many competitive carriers are in the same position as Yak. Nonetheless, many industry players will be monitoring these developments closely and will attempt to influence the Canadian government to act (or not act) on some or all of the Panel’s recommendations. We will continue to consider the Panel’s recommendations and how they affect the operation of our business.

On April 27, 2006 the CRTC set the final switching and aggregation (“S&A”) rates. The final rates are effective May 30, 2002 with respect to Access Tandem rates and December 17, 2003 with respect to Direct Connect Rates. The final rates are approximately 10-20% lower than the interim rates. S&A charges are interconnect charges that an interexchange carrier (“IXC”) pays to the local exchange carrier (“LEC”) for each minute of traffic originated by the LEC and/or terminated by the LEC that is carried over the IXC’s network. The S&A charges relate to all associated switching, transport and signaling functions performed by the LEC at the originating or terminating end of a long-distance call. As of March, 2006, Yak typically paid $443,000 per month to the LECs for switching and aggregation. As of June 5, 2006, the Company requested that each applicable LEC provide it with its entitled rebate and sufficient information about the calculation of the rebate. While the Company acknowledges that LECs should eventually pay on account of S&A credits owed, the Company’s past experience indicates that measurement of the credits is likely to

15

be contested and timely repayments of the credits may not be assured, thereby creating uncertainty in the Company’s ability to reliably estimate the credit that will be realized. Additionally, timely repayment of the credits may not be assured. The Company therefore did not recognize an asset for the S&A receivable at June 30, 2006.

United States

Increasingly complex federal and state regulation in the United States also affects Yak’s business. In the United States, our long distance telecommunications services are subject to federal regulation under the Telecommunications Act and Federal Communications Commission (FCC) regulations and state regulation under applicable laws and regulations of the various states and state regulatory commissions. At the FCC, we are considered a non-dominant domestic interstate telecommunications carrier and we are authorized by Section 214 of the Act to operate as a non-dominant international carrier. We also hold certificates of public convenience and necessity from multiple state regulatory commissions authorizing us to provide intrastate telecommunications services or operate on an intrastate basis pursuant to tariff, registration or on a deregulated basis.

The degree of FCC regulation depends on the amount of market power a particular provider possesses. The FCC imposes less regulation on non-dominant telecommunications carriers like Yak. As a non-dominant interstate telecommunications carrier, we are not required to obtain FCC authority to initiate or expand our domestic interstate operations but we are required to obtain prior FCC approval to transfer legal or actual control or discontinue service. Our telecommunications services are subject to common carrier telecommunications requirements set forth in the Act and the FCC’s rules, including the requirement to offer service on a nondiscriminatory basis at just and reasonable rates. Further, we are subject to requirements regarding unauthorized changes in a customers’ preferred carrier (i.e., “anti-slamming” provisions), the FCC’s Do Not Call telemarketing rules, and various consumer information privacy requirements. As a common carrier of telecommunications services, we must abide by the Communications Assistance for Law Enforcement Act (“CALEA”) and certain FCC regulations which require carriers to modify their networks and institute procedures to enable law enforcement authorities to perform electronic surveillance. According to the FCC, the Act’s requirement that common carrier practices shall be “just and reasonable” require carriers like Yak providing dial-around, calling card and other long distance services to ensure that its marketing practices are not unfair and deceptive. In administering these requirements, the FCC imposes truth-in-advertising principles regarding disclosure of material information and restrictions, clear and conspicuous language, etc. We are also required to file various reports and pay various fees, including annual FCC regulatory fees and Universal Service Fund contribution.

In addition, we are subject to the FCC’s common carrier complaint jurisdiction which enables consumers to file complaints against us at the FCC for alleged violations of the Act or the FCC’s rules. The FCC has broad authority to commence investigations and to impose monetary and other penalties and conditions on us for violations of regulatory requirements.

Our intrastate telecommunications offerings are subject to state regulation under applicable laws and rules promulgated by state regulatory commissions. We are certified to provide intrastate residential toll services in 48 states. We are required to maintain in most jurisdictions, certification and to file tariffs. Some states also require us to file periodic reports, pay various fees and surcharges, and to comply with service standards and consumer protection rules. States often require prior approval or notification for certain stock or asset transfers or, in several states, for the issuance of securities, debt or for name changes. As a certificated carrier, consumers may file complaints against us at the public service commission and state agencies have the authority to impose a range of penalties on us for regulatory noncompliance. Yak’s marketing practices for its long-distance services are also subject to various state laws regarding marketing disclosures.

The FCC and state commissions may develop rules, and federal and state legislators may pass laws that change the regulatory requirements applicable to our services in a way that significantly raises our costs, makes compliance more burdensome, or otherwise adversely affects our telecommunications business.

16

Our costs for providing long distance services depends on the rates imposed on us by other local carriers for the termination and origination of traffic over local facilities. The rates that competitive and incumbent local carriers can charge for the use of local facilities is capped by the FCC and, in some instances, the relevant state regulatory authority. The FCC has been granting local carriers greater flexibility and relaxing regulations in markets where there are multiple providers of local origination and termination services. Depending on the number of competitors in a particular market and the trend to deregulate traditional monopoly providers of local telecommunications services, we could be subject to an increase in our termination and origination costs reducing our profitability or our ability to offer competitive rates for service.

VoIP Regulation – United States

We are a provider of “interconnected VoIP services” as that term is defined by the FCC. Laws, regulations and legal liability issues regarding VoIP services are evolving at a rapid pace. Measures under consideration by the FCC, Congress, the courts and/or other federal and state agencies include, without limitation, new laws and regulations, or the interpretation of existing laws and regulations, regarding access to telephone numbers, taxes, consumer protection rules, intercarrier compensation arrangements, consumer privacy, assistance to law enforcement, and the provision of E-911 services. Some or all of these measures, if adopted and determined to be applicable to our VoIP services, could make it significantly more expensive to operate our VoIP services and could cause us to cease operating or enhancing some or all of our VoIP services.

As a provider of interconnected VoIP services, Yak must offer E-911 services to all of its customers. We currently offer E911 services in the United States through a third-party vendor. That vendor, however, only offers E911 in limited areas in the United States. As such, to comply with the FCC’s E911 obligations, Yak was compelled to suspend marketing its VoIP service to new customers, and to modify its VoIP offering by making it available only to new customers in areas of the United States where Yak’s vendor is capable of providing VoIP E911 coverage. We expect our vendor to increase its E911 coverage area in the coming months, but cannot guarantee when full implementation of a comprehensive nationwide E911 solution will be in place. Along with a number of other VoIP providers, we have sought a waiver, of the FCC’s VoIP E-911 rules to provide Yak more time in which to implement E911 for its VoIP services. The FCC has not yet ruled on these requests and we cannot predict whether we will be subject to FCC enforcement actions concerning the offering of our VoIP service. Further, Yak cannot predict when it will be able to offer its VoIP products in the United States on a nationwide basis.

The FCC has also determined that interconnected VoIP providers are subject to CALEA which requires providers of communications services to modify their facilities in order to assist law enforcement agencies in conducting lawfully authorized electronic surveillance. Yak and other interconnected VoIP providers must comply with CALEA by May 17, 2007. As much of the standards work for CALEA is still ongoing, we cannot predict whether we will be able to meet this compliance deadline. On June 27, 2006, the FCC released an order requiring interconnected VoIP providers to contribute to the Universal Service Fund (“USF”). Interconnected VoIP providers are expected to submit their first filing on August 1, 2006, with USF contributions effective for the fourth quarter 2006. VoIP providers may rely on a “safe harbor” in reporting their interstate revenues which are used to calculate the amount due to the USF. The FCC established a safe harbor of 64.9% for interconnected VoIP providers (i.e. 64.9% of VoIP revenues can be considered interstate). Moreover, the VoIP USF order specifically states that any underlying telecommunications carrier who provides telecommunications components to a non-certificated interconnected VoIP provider, like Yak, must continue to pay USF on the sales to that VoIP provider through the first quarter 2007, for a total of two quarters, even if the VoIP carrier is themselves contributing to the USF directly. The FCC acknowledged that this may result in double payment by interconnected VoIP providers on an interim basis. Accordingly, Yak may have to pass through the fees imposed on the Company to its customers that would result in higher bills potentially making our service less competitive

17

with other communications service providers. Alternatively, we may choose to absorb the cost which would reduce the profitability associated with our VoIP service. We cannot predict whether VoIP providers in a similar situation will be subject to double collection for more than two quarters.

OTHER DEVELOPMENTS

Previously Reported Restatements

On May 31, 2005, we restated our financial statements for the fiscal years ended June 30, 2003 and 2004. Further, on September 27, 2005, we completed further adjustments to the above described restatement to correct for an error in the initial restatements. At that time, we made further amendments to our June 30, 2003 and 2004 annual reports. As a result of these corrections, we also amended our Annual Report filed on Form 10-K for the year ended June 30, 2005 to correct the amounts previously reported in our financial statements for fiscal years 2003 and 2004, as well as each of the quarters in fiscal year 2004 and for the first three quarters of fiscal year 2005.

On April 21, 2006, we filed Amendment No. 2 to our Annual Report on Form 10-K for the year ended June 30, 2005 and two amendments to our Quarterly Reports on Form 10-Q for the first and second quarters of our fiscal year 2006 ended September 30 and December 31, 2005, respectively, to correct for certain accounting errors and disclosure deficiencies in its previously issued public filings. We restated our previously issued financial statements to correct for the errors and deficiencies described below:

| | A. | To correct for the misapplication of SFAS 133, SFAS 150 and EITF 00-19 related to the 2004 issuance of detachable warrants (the “Warrants”); |

| | B. | To correct for segment disclosure deficiencies under SFAS 131; |

| | C. | To correct for errors in our Cash Flow Statements; and |

| | D. | To correct for the fiscal 2005 misclassification of financing expenses related to assignment of accounts receivable. |

The nature and details of the restatements are more fully disclosed in Note 5 to the financial statements included in our Form 10K/A Amendment No.2 filed on April 21, 2006.

On May 4, 2006, the SEC advised the Company that it completed its review of our restated filings and, at that time, did not have any further comments.

Additional Information About the Company

For further information about our Company, you may read the materials we have filed with the SEC without charge at the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 100 F Street, NE, Washington, D.C. 20549. You can also obtain copies of these materials at prescribed rates from the Public Reference Section of the SEC in Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms.

Our SEC filings and the registration statement can also be reviewed by accessing the SEC’s internet site at http://www.sec.gov, which contains reports, proxy and information statements and other information regarding registrants that are filed electronically with the SEC.

Our internet address is www.yak.ca. We maintain an external link on the “Investor Relations” section of our website which takes users directly to our filings with the SEC. All such filings are available free of charge.

18

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and all other information contained in our public filings before making an investment decision about our common stock. While the risks described below are the ones we believe are most important for you to consider, these risks are not the only ones that we face. If any of the following risks actually occurs, our business, operating results or financial condition could suffer, the market value of our common stock could decline and you could lose all or part of your investment.

Industry trends and specific risks may affect our future business and results. The matters discussed below could cause our future results to differ from past results or those described in forward-looking statements and could have a material adverse effect on our business, financial condition, results of operations and stock price.

Changes or new developments in the telecommunications regulatory environment in Canada and/or the United States may negatively impact our business.

Our retail services in Canada have been largely deregulated by the CRTC, however, our major competitors, the ILECs remain subject to CRTC regulation with respect to many of their services, including the requirement to provide certain access and wholesale services to competitors, like Yak, at cost-based prices. How the ILECs comply with regulation as well as how the CRTC enforces its regulation against the ILECs could impact our operations and financial condition. In addition, as noted above, in “Other Developments – Telecom Policy Review (Canada)”, the Panel is recommending that the CRTC limit mandated access requirements to essential facilities and interconnection services. If this recommendation is implemented it could negatively impact the range of current (in the case of Yak for Business) and potential services we are able to provide and increase our network facility costs. Any change in Canadian governmental or CRTC policy, regulations or interpretations could have a material adverse effect on our operations and financial condition and operating results.

Increasingly complex federal and state regulation in the United States also affects our business. In the United States, our long distance and local telecommunications services are subject to federal regulation and state regulation under applicable laws and regulations of the various states and state regulatory commissions. Our telecommunications services are subject to various specific common carrier telecommunications requirements set forth in the FCC’s rules, including operating, reporting and fee requirements. Both federal and state regulatory agencies have broad authority to commence investigations and impose monetary and other penalties on us for violations of regulatory requirements. The FCC and state commissions may develop rules, and federal and state legislators may pass laws that change the regulatory requirements applicable to our services in a way that significantly raises our costs, makes compliance more burdensome, or otherwise adversely affects our telecommunications business.

Existing regulatory requirements in Canada allow us to offer VoIP services as a local reseller with minimal regulatory requirements. Although this is a positive environment in which we can currently provide these services, we still are required to develop and implement local service features (such as basic 911 and privacy obligations) that will increase our costs to provide VoIP services.

In the United States most VoIP services are considered to be unregulated “information services” rather than “telecommunications services” under the Communications Act of 1934, as amended. However, the FCC has not made a final determination on this issue, and is currently conducting a rulemaking proceeding to consider whether to classify VoIP services as information or telecommunications services, and what federal regulatory requirements, if any, should be imposed on providers of such services. If the FCC determines that VoIP should be classified as a telecommunications service, additional regulatory requirements, fees, access charges, surcharges and/or required contribution to state and federal universal service funds may apply to our VoIP services. Such a decision could significantly raises our costs, make compliance more burdensome, or otherwise adversely affect our broadband business. Further, state legislators and/or regulators could determine that VoIP or VoIP service providers, such as Yak, are subject to local regulation, certification, fees, or other requirements which could impose material regulatory burdens and increased costs on Yak.

19

While the FCC has been considering whether to impose regulatory requirements on VoIP, it has taken steps to deregulate and promote broadband deployment. These actions may increase the ability of ILECs and cable TV companies to compete with Yak for the provision of broadband and IP-enabled services, such as VoIP.

Additionally, our ability to offer VoIP services outside North America is subject to the local regulatory environment, which may be unknown, complicated and often uncertain. Regulatory treatment of VoIP telephony outside North America varies from country to country. There is no assurance that we will immediately be in compliance with the applicable laws and regulations of the markets we have identified as promising for our VoIP services. Some countries may assert that we are required to register as a telecommunications service provider. Please refer to Item 1. Business—“Governmental Regulation” for further details.

Fluctuations in foreign currency exchange rates could adversely affect our results of operations.