SUBJECT TO COMPLETION, DATED October 22, 2021

PRELIMINARY PRICING SUPPLEMENT

(to Prospectus dated February 1, 2019)

$

Jefferies Group LLC

Senior Floating Rate Notes due

October 29, 2071

Linked to Compounded SOFR

As further described below, interest will accrue and be payable quarterly, in arrears, from the Original Issue Date to, but excluding, the stated maturity date (October 29, 2071), at a variable rate per annum equal to SOFR (compounded daily during the relevant Interest Payment Period, which we refer to as “Compounded SOFR”) minus the Spread, subject to the Minimum Interest Rate of 0.00% per annum. You may request that we repurchase your Notes on a semi-annual basis (i.e., once every six months) beginning approximately two years after the Original Issue Date, subject to your compliance with the Minimum Repurchase Amount, the procedural requirements and the other limitations set forth under “Summary of Terms” below and in “Annex A—Supplemental Terms of the Notes—Early Repurchase” of this pricing supplement. You will receive less than your principal amount if you request that we repurchase your notes on any Repurchase Date prior to October 29, 2046.

| SUMMARY OF TERMS |

|

| Issuers: | Jefferies Group LLC and Jefferies Group Capital Finance Inc., its wholly owned subsidiary. |

| Title of the Notes: | Senior Floating Rate Notes due October 29, 2071 Linked to Compounded SOFR |

| Aggregate Principal Amount: | $ . We may increase the Aggregate Principal Amount prior to the Original Issue Date but are not required to do so. |

| Issue Price: | At variable prices. The Notes will be offered at a price equal to 100% of the Stated Principal Amount per Note until the initial pricing date, which is , 2021. Thereafter, the Notes will be offered from time to time in one or more negotiated transactions at varying prices to be determined at the time of each sale, which may be at market prices prevailing, at prices related to such prevailing prices or at negotiated prices, subject to a maximum price of 100% of the Stated Principal Amount per Note. |

| Stated Principal Amount | $1,000 per note |

| Pricing Date: | |

| Original Issue Date: | October 29, 2021( Business Days after the Pricing Date) |

| Maturity Date: | |

| Interest Accrual Date: | |

| Payment at Maturity | The Payment at Maturity per Note will be the Stated Principal Amount plus accrued and unpaid interest, if any. |

| SOFR (compounded daily during the relevant Interest Payment Period). Please see “Determination of Compounded SOFR” below. |

| Interest Rate | From and including the Original Issue Date to, but excluding, October 29, 2071: a variable rate per annum equal to Compounded SOFR minus the Spread, subject to the Minimum Interest Rate. |

| Interest for each Interest Payment Period is subject to the Minimum Interest Rate of 0.00% per annum. It is possible that you could receive no interest on the Notes. |

| Quarterly (from and including the 29th day of each January, April, July and October to, but excluding, the 29th day of the month occurring three months following such month (each such date, an “Interest Payment Period End Date”), beginning October 29, 2021), provided that SOFR for each calendar day from, and including, the Rate Cut-Off Date for each Interest Payment Period to, but excluding, the Interest Payment Period End Date for such Interest Payment Period will equal SOFR in respect of the Rate Cut-Off Date. For the avoidance of doubt, to the extent the Notes are repurchased on any applicable Repurchase Date, such Repurchase Date will serve as the Interest Payment Period End Date for such Interest Payment Period. |

| Rate Cut-Off Date | For each Interest Payment Period, the fourth U.S. Government Securities Business Day immediately preceding the Interest Payment Period End Date for such Interest Payment Period. |

| Interest Payment Dates | The 29th day of each January, April, July and October, beginning January 29, 2022. For the avoidance of doubt, to the extent the Notes are repurchased on any applicable Repurchase Date, such Repurchase Date will serve as the Interest Payment Date for such Interest Payment Period. |

| Interest Payment Period End Dates | Unadjusted |

| Early Repurchase | You may request that we repurchase all or any portion of your Notes on any Repurchase Date on or after October 29, 2023 (the “Initial Repurchase Date”) by following the procedures described under “Annex A—Supplemental Terms of the Notes—Early Repurchase,” which will include us receiving a Repurchase Notice by no later than 4:00 p.m., New York City time, fifteen Business Days prior to the relevant Repurchase Date. If you fail to comply with these procedures, your notice will be deemed ineffective. To exercise the Early Repurchase right, you must submit Notes for repurchase having an aggregate Stated Principal Amount equal to the minimum repurchase amount of $100,000 or an integral multiple of $1,000 in excess thereof (the “Minimum Repurchase Amount”). |

| Repurchase Dates | The 29th day of each April and October, beginning on October 29, 2023 and ending on April 29, 2071. |

| Repurchase Amount | Upon Early Repurchase, you will receive for each $1,000 Stated Principal Amount of the Notes, on the applicable Repurchase Date, a cash “Repurchase Amount” equal to the following amount, as applicable, plus any accrued and unpaid interest: From and including October 29, 2023, to, but excluding, October 29, 2031: $980.00 From and including October 29, 2031 to, but excluding, October 29, 2046: $990.00 From and including October 29, 2046 to, but excluding, April 29, 2071: $1,000.00 You will receive less than your stated principal amount per note if you request that we repurchase your notes on any repurchase date prior to October 29, 2046. Depending on market conditions, including changes in interest rates, it is possible that the value of the Notes in the secondary market at any time may be greater than the Repurchase Amount. Accordingly, prior to exercising the Early Repurchase right described above, you should contact the broker or other entity through which the Notes are held to determine whether a sale of the Notes in the secondary market may result in greater proceeds than the Repurchase Amount. |

| Repurchase Notice | A repurchase notice substantially in the form of the repurchase notice set forth in Annex B to this pricing supplement. |

| Minimum Interest Rate | |

| Spread | |

| Day-count Convention: | Please see “Determination of Interest Payments” below. |

| Specified Currency: | U.S. dollars |

Redemption: | Not applicable |

| CUSIP/ISIN: | |

| Book-entry or Certificated Note: | Book-entry |

| Business Day: | New York. If any Interest Payment Date, Repurchase Date or the Maturity Date occurs on a day that is not a Business Day, any payment owed on such date will be postponed as described in “The Notes” below. |

| Agent: | Jefferies LLC, a wholly-owned subsidiary of Jefferies Group LLC and an affiliate of Jefferies Group Capital Finance Inc. See “Supplemental Plan of Distribution.” |

| Calculation Agent: | Jefferies Financial Services Inc., a wholly owned subsidiary of Jefferies Group LLC and an affiliate of Jefferies Group Capital Finance Inc. |

| Trustee: | The Bank of New York Mellon |

| Use of Proceeds: | General corporate purposes |

| Listing: | None |

| Conflict of Interest: | Jefferies LLC, the broker-dealer subsidiary of Jefferies Group LLC, is a member of FINRA and will participate in the distribution of the notes being offered hereby. Accordingly, the offering is subject to the provisions of FINRA Rule 5121 relating to conflicts of interest and will be conducted in accordance with the requirements of Rule 5121. See “Conflict of Interest.” |

The Notes will be our senior unsecured obligations and will rank equally with our other senior unsecured indebtedness.

Investing in the Notes involves risks that are described in the “

Risk Factors” section beginning on page PS-5 of this pricing supplement.

| | PER NOTE

| | | TOTAL | |

| Public Offering Price | | At variable prices | | | At variable prices | |

| Underwriting Discounts and Commissions | | $ | | | | $ | | |

| Proceeds to Jefferies Group LLC (Before Expenses) | | $ | | | | $ | | |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this pricing supplement or the accompanying prospectus or either prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We will deliver the Notes in book-entry form only through The Depository Trust Company on or about October 29, 2021 against payment in immediately available funds.

Jefferies

Pricing supplement dated , 2021.

You should read this document together with the related prospectus and prospectus supplement,

each of which can be accessed via the hyperlinks below, before you decide to invest.

|

| PAGE |

|

|

| PRICING SUPPLEMENT |

|

|

| PS-ii |

| PS-1 |

| PS-4 |

| PS-5 |

| PS-8 |

| PS-9 |

| PS-11 |

| PS-13 |

| PS-14 |

| PS-15 |

|

You should rely only on the information contained in or incorporated by reference in this pricing supplement and the accompanying prospectus and prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this pricing supplement or the accompanying prospectus or prospectus supplement is accurate as of any date later than the date on the front of this pricing supplement.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This pricing supplement and the accompanying product supplement, prospectus and prospectus supplement contain or incorporate by reference “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are not statements of historical fact and represent only our belief as of the date such statements are made. There are a variety of factors, many of which are beyond our control, which affect our operations, performance, business strategy and results and could cause actual reported results and performance to differ materially from the performance and expectations expressed in these forward-looking statements. These factors include, but are not limited to, financial market volatility, actions and initiatives by current and future competitors, general economic conditions, controls and procedures relating to the close of the quarter, the effects of current, pending and future legislation or rulemaking by regulatory or self-regulatory bodies, regulatory actions, and the other risks and uncertainties that are outlined in our Annual Report on Form 10-K for the fiscal year ended November 30, 2020 filed with the U.S. Securities and Exchange Commission, or the SEC, on January 29, 2021 (the “Annual Report on Form 10-K”) and in our Quarterly Reports on Form 10-Q for the quarterly periods ended February 28, 2021, May 31, 2021 and August 31, 2021 filed with the SEC on April 8, 2021, July 9, 2021 and October 8, 2021, respectively. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date of the forward-looking statements.

The Notes are joint and several obligations of Jefferies Group LLC and Jefferies Group Capital Finance Inc., its wholly- owned subsidiary. The Aggregate Principal Amount of the Notes is $ . The Notes will mature on October 29, 2071. From and including the Original Issue Date to, but excluding, the Maturity Date, the Notes will bear interest at a per annum floating rate equal to Compounded SOFR minus the Spread, subject to the Minimum Interest Rate of 0.00% per annum. Interest on the Notes will be payable on a quarterly basis on the Interest Payment Dates set forth in the “Summary of Terms” on the cover page of this pricing supplement. You may request that we repurchase your Notes on a semi-annual basis (i.e., once every six months) beginning approximately two years after the Original Issue Date, subject to your compliance with the Minimum Repurchase Amount, the procedural requirements and the other limitations set forth under “Summary of Terms” on the cover page of this pricing supplement and in “Annex A— Supplemental Terms of the Notes—Early Repurchase” of this pricing supplement. You will receive less than your principal amount if you request that we repurchase your notes on any Repurchase Date prior to October 29, 2046. We describe the basic features of these Notes in the sections of the accompanying prospectus called “Description of Securities We May Offer—Debt Securities” and the prospectus supplement called “Description of Notes”, subject to and as modified by any provisions described below and in the “Summary of Terms” on the cover page of this pricing supplement. All payments on the Notes are subject to our credit risk.

If any Interest Payment Date, Repurchase Date or the Maturity Date occurs on a day that is not a Business Day, then the payment owed on such date will be postponed until the next succeeding Business Day. No additional interest will accrue on the Notes as a result of such postponement, and no adjustment will be made to the length of the relevant Interest Payment Period.

“U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Determination of Interest Payments

On each Interest Payment Date, the amount of each interest payment will equal the Stated Principal Amount of the Notes multiplied by the sum of the Interest Factors calculated for each day during such Interest Payment Period; provided that in no event will the interest payment be less than zero. The “Interest Factor” for each such day will be computed by dividing the interest rate applicable to that day by 360. The interest rate applicable to each such day will be equal to Compounded SOFR (as defined under “Determination of Compounded SOFR” below) minus the Spread.

Determination of Compounded SOFR

For the purposes of calculating Compounded SOFR with respect to any Interest Payment Period:

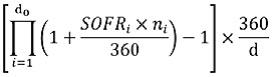

“Compounded SOFR” means the result of the following formula:

where:

“d0”, for any Interest Payment Period, is the number of U.S. Government Securities Business Days in the relevant Interest Payment Period.

“i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Interest Payment Period.

“SOFRi”, for any day “i” in the relevant Interest Payment Period, is a reference rate equal to SOFR in respect of that day.

“ni”, for any day “i” in the relevant Interest Payment Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day.

“d” is the number of calendar days in the relevant Interest Payment Period.

“SOFR” means, with respect to any day, the rate determined by the Calculation Agent in accordance with the following provisions:

| | (1) | the Secured Overnight Financing Rate for trades made on such day that appears at approximately 3:00 p.m. (New York City time) on the NY Federal Reserve’s website on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day; or |

| | (2) | if the rate specified in (1) above does not so appear, unless a Benchmark Transition Event and its related Benchmark Replacement Date have occurred as described in (3) below, the Secured Overnight Financing Rate published on the NY Federal Reserve’s website for the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the NY Federal Reserve’s website; or |

| | (3) | if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the relevant Interest Payment Period End Date, the Calculation Agent will use the Benchmark Replacement to determine the rate and for all other purposes relating to the Notes. |

In connection with the SOFR definition above, the following definitions apply:

“Benchmark” means, initially, SOFR; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by us (or one of our affiliates) as of the Benchmark Replacement Date:

| | (1) | the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable corresponding tenor and (b) the Benchmark Replacement Adjustment; or |

| | (2) | the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or |

| | (3) | the sum of: (a) the alternate rate of interest that has been selected by us (or one of our affiliates) as the replacement for the then-current Benchmark for the applicable corresponding tenor giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment. |

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by us (or one of our affiliates) as of the Benchmark Replacement Date:

| | (1) | the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement; |

| | (2) | if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment; |

| | (3) | the spread adjustment (which may be a positive or negative value or zero) that has been selected by us (or one of our affiliates) giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time. |

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes that we (or one of our affiliates) decide may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if we (or such affiliate) decide that adoption of any portion of such market practice is not administratively feasible or if we (or such affiliate) determine that no market practice for use of the Benchmark Replacement exists, in such other manner as we (or such affiliate) determine is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

| | (1) | in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or |

| | (2) | in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein. |

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

| | (1) | a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; |

| | (2) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or |

| | (3) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative. |

“Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding business day adjustment) as the applicable tenor for the then-current Benchmark.

“ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“NY Federal Reserve” means the Federal Reserve Bank of New York.

“NY Federal Reserve’s Website” means the website of the NY Federal Reserve, currently at http://www.newyorkfed.org, or any successor website of the NY Federal Reserve or the website of any successor administrator of the Secured Overnight Financing Rate.

“Reference Time” with respect to any determination of the Benchmark means the time determined by us (or one of our affiliates) in accordance with the Benchmark Replacement Conforming Changes.

“Relevant Governmental Body” means the Federal Reserve Board and/or the NY Federal Reserve, or a committee officially endorsed or convened by the Federal Reserve Board and/or the NY Federal Reserve or any successor thereto.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

Valuation of the Notes

For an initial period following the issuance of the Notes (the “Temporary Adjustment Period”), the value that will be indicated for the Notes on any brokerage account statements prepared by Jefferies LLC or its affiliates (which value Jefferies LLC may also publish through one or more financial information vendors) will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents amounts which may include, but are not limited to, profits, fees, underwriting discounts and commissions and hedging and other costs expected to be paid or realized by Jefferies LLC or its affiliates, or other unaffiliated brokers or dealers, over the term of the Notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the Temporary Adjustment Period.

SOFR is published by the NY Federal Reserve and is intended to be a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The NY Federal Reserve reports that SOFR includes all trades in the Broad General Collateral Rate, plus bilateral Treasury repurchase agreement (“repo”) transactions cleared through the delivery-versus-payment service offered by the Fixed Income Clearing Corporation (the “FICC”), a subsidiary of The Depository Trust & Clearing Corporation (“DTCC”). SOFR is filtered by the NY Federal Reserve to remove a portion of the foregoing transactions considered to be “specials”. According to the NY Federal Reserve, “specials” are repos for specific-issue collateral which take place at cash-lending rates below those for general collateral repos because cash providers are willing to accept a lesser return on their cash in order to obtain a particular security.

The NY Federal Reserve reports that SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from The Bank of New York Mellon, which currently acts as the clearing bank for the tri-party repo market, as well as General Collateral Finance Repo transaction data and data on bilateral Treasury repo transactions cleared through the FICC’s delivery-versus-payment service. The NY Federal Reserve notes that it obtains information from DTCC Solutions LLC, an affiliate of DTCC.

The NY Federal Reserve currently publishes SOFR daily on its website. The NY Federal Reserve states on its publication page for SOFR that use of SOFR is subject to important disclaimers, limitations and indemnification obligations, including that the NY Federal Reserve may alter the methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time without notice. Information contained in the publication page for SOFR is not incorporated by reference in, and should not be considered part of, this pricing supplement.

In this pricing supplement, when we refer to SOFR, we mean the rate as it appears on the NY Federal Reserve’s website. On any relevant date, if SOFR cannot be determined by reference to the NY Federal Reserve’s website (or any successor page), then the Calculation Agent will determine SOFR in accordance with the procedures set forth above.

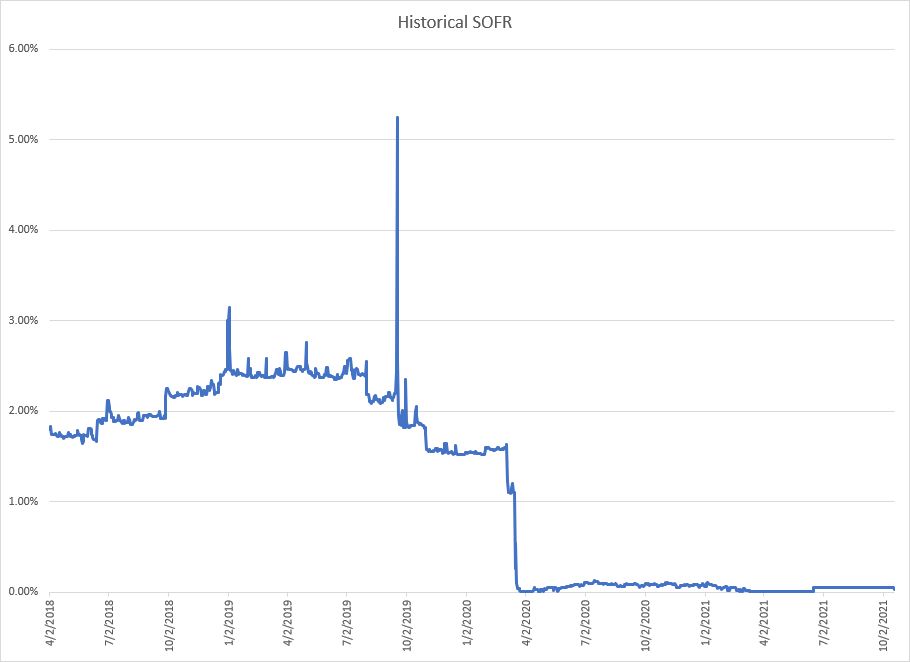

The level of SOFR has fluctuated in the past and may, in the future, experience significant fluctuations. Any historical upward or downward trend in the level of SOFR during any period shown below is not an indication that SOFR is more or less likely to increase or decrease at any time during the life of your Notes.

You should not take the historical levels of SOFR as an indication of future levels of SOFR. We cannot give you any assurance that the future levels of SOFR will result in your receiving a return on your Notes that is greater than the return you would have realized if you invested in a debt security of comparable maturity that bears interest at a prevailing market rate.

Neither we nor any of our affiliates make any representation to you as to the performance of SOFR during the term of the Notes. The actual levels of SOFR during the term of the Notes may bear little relation to the historical levels of SOFR shown below.

The graph below shows the historical performance of SOFR from April 2, 2018 through October 19, 2021. We obtained the information in the graph below from Bloomberg, without independent verification. The rates displayed in the graph below are for illustrative purposes only.

The historical performance of SOFR in the graph below does not reflect the daily compounding method used to calculate the floating rate at which interest will be payable on the Notes.

In addition to the other information contained and incorporated by reference in this pricing supplement and the accompanying prospectus and prospectus supplement including the section entitled “Risk Factors” in our Annual Report, you should consider carefully the following factors before deciding to purchase the Notes.

Structure-related Risks

The amount of interest payable on the Notes is uncertain and could be zero.

The amount of interest payable on the Notes in any Interest Payment Period will be dependent on Compounded SOFR, calculated as described in “Determination of Compounded SOFR” above. If Compounded SOFR for any Interest Payment Period is not greater than the Spread, the rate of interest payable for the related Interest Payment Period will be 0.00%. As a result, the effective yield on the Notes may be less than what would be payable on conventional, fixed-rate redeemable notes of the issuer of comparable maturity. The interest payments on the Notes and return of only the principal amount at maturity may not compensate you for the effects of inflation and other factors relating to the value of money over time.

If you request that we repurchase your Notes on any Repurchase Date prior to October 29, 2046, you will receive less than the Stated Principal Amount of your Notes.

The Repurchase Amount for any Repurchase Date from and including October 29, 2023 to, but excluding, October 29, 2031 is equal to $980.00 for each $1,000 Stated Principal Amount of Notes, and the Repurchase Amount for any Repurchase Date from and including October 29, 2031 to, but excluding, October 29, 2046 is equal to $990.00 for each $1,000 Stated Principal Amount of Notes, in each case plus any accrued and unpaid interest. As a result, if you request that we repurchase your Notes on any Repurchase Date prior to October 29, 2046, you will receive less than the Stated Principal Amount of your Notes upon an early repurchase.

There are restrictions on your ability to request that we repurchase your Notes.

To request that we repurchase your Notes, you must submit at least the Minimum Repurchase Amount of $100,000 in Stated Principal Amount of your Notes. You may not exercise the Early Repurchase right prior to October 29, 2023, and thereafter you may exercise the Early Repurchase right only once every six months. In addition, if you elect to exercise your Early Repurchase right, your request that we repurchase your Notes is only valid if we receive your Repurchase Notice by no later than 4:00 p.m., New York City time, fifteen business days prior to the relevant Repurchase Date and if you follow the procedures described under “Annex A—Supplemental Terms of the Notes—Early Repurchase” and we or our affiliates acknowledge receipt of the Repurchase Notice that same day. If we do not receive that Repurchase Notice or we or our affiliates do not acknowledge receipt of that notice, your repurchase request will not be effective and we will not be required to repurchase your Notes on the corresponding Repurchase Date. Because of the timing requirements of the Repurchase Notice, settlement of the repurchase will be prolonged when compared to a sale and settlement in a secondary market sale transaction. As your request that we repurchase your Notes is irrevocable, this will subject you to market risk in the event the market fluctuates after we receive your request.

Valuation- and Market-related Risks

The price at which the Notes may be resold prior to maturity will depend on a number of factors and may be substantially less than the amount for which they were originally purchased.

Some of these factors include, but are not limited to: (i) changes in the level of SOFR, (ii) volatility of SOFR, (iii) changes in interest and yield rates, (iv) any actual or anticipated changes in our credit ratings or credit spreads and (v) time remaining to maturity. Generally, the longer the time remaining to maturity and the more tailored the exposure, the more the market price of the Notes will be affected by the other factors described in the preceding sentence. Each of these factors can lead to significant adverse changes in the market price of securities like the Notes.

We may sell an additional aggregate face amount of the Notes at a different issue price.

At our sole option, we may decide to sell additional aggregate face amounts of the Notes subsequently to the date of this pricing supplement. The issue price of the Notes in the subsequent sale may differ substantially (higher or lower) from the Issue Price you paid. There is no stated limit on of the additional face amounts of the Notes we may sell.

Conflict-related Risks

Our trading and hedging activities may create conflicts of interest with you.

We or one or more of our affiliates, including Jefferies LLC, may engage in trading activities related to the Notes that are not for your account or on your behalf. We may enter into arrangements to hedge the market risks associated with our obligation to pay the amounts due under the Notes. We may seek competitive terms in entering into the hedging arrangements for the Notes, but are not required to do so, and we may enter into such hedging arrangements with one of our subsidiaries or affiliates. This hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, but which could also result in a loss for the hedging counterparty. These trading and hedging activities may present a conflict of interest between your interest as a holder of the Notes and the interests we and our affiliates may have in our proprietary accounts, in facilitating transactions for our customers, and in accounts under our management.

Underlying-related Risks

You must rely on your own evaluation of the merits of an investment linked to SOFR.

In the ordinary course of their businesses, we or our affiliates may have expressed views on expected movements in SOFR and related interest rates, and may do so in the future. These views or reports may be communicated to our clients and clients of our affiliates. However, these views are subject to change from time to time. Moreover, other professionals who deal in markets relating to SOFR may at any time have views that are significantly different from ours or those of our affiliates. For these reasons, you should consult information about SOFR and related interest rates from multiple sources, and you should not rely on the views expressed by us or our affiliates.

Neither the offering of the Notes nor any views which we or our affiliates from time to time may express in the ordinary course of their businesses constitutes a recommendation as to the merits of an investment in the Notes.

SOFR is a relatively new market index and as the related market continues to develop, there may be an adverse effect on the return on or value of the Notes.

The Federal Reserve Bank of New York (the “NY Federal Reserve”) began to publish SOFR in April 2018. Although the NY Federal Reserve has also begun publishing historical indicative SOFR going back to 2014, such prepublication historical data inherently involves assumptions, estimates and approximations. You should not rely on any historical changes or trends in SOFR as an indicator of the future performance of SOFR. Since the initial publication of SOFR, daily changes in the rate have, on occasion, been more volatile than daily changes in comparable benchmark or market rates. As a result, the return on the Notes may fluctuate more than floating rate securities that are linked to less volatile rates.

The Notes likely will have no established trading market when issued, and an established trading market may never develop or may not be very liquid. Market terms for securities indexed to SOFR, such as the spread over the index reflected in interest rate provisions, may evolve over time, and the value of the Notes may be lower than those of later-issued SOFR-linked securities as a result. Similarly, if SOFR does not prove to be widely used in securities like the Notes, the value of the Notes may be lower than those of securities linked to rates that are more widely used. You may not be able to sell the Notes at all or may not be able to sell the Notes at prices that will provide a yield comparable to similar investments that have a developed secondary market, and may consequently suffer from increased pricing volatility and market risk.

The NY Federal Reserve notes on its publication page for SOFR that use of SOFR is subject to important limitations, indemnification obligations and disclaimers, including that the NY Federal Reserve may alter the methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time without notice. There can be no guarantee that SOFR will not be discontinued or fundamentally altered in a manner that is materially adverse to the interests of investors in the Notes. If the manner in which SOFR is calculated is changed or if SOFR is discontinued, that change or discontinuance may result in a reduction or elimination of the amount of interest payable on the Notes and a reduction in the value of the Notes.

The formula used to determine the Interest Rate on the Notes is relatively new in the market, and as the related market continues to develop there may be an adverse effect on return on or value of the Notes.

The Interest Rate on the Notes is based on a formula used to calculate a daily compounded SOFR rate, which is relatively new in the market. For each Interest Payment Period, the Interest Rate on the Notes is based on Compounded SOFR, calculated using the formula described in “Determination of Compounded SOFR” above. This Interest Rate will not be the SOFR rate published on or for a particular day during such Interest Payment Period or an average of SOFR rates during such period nor will it be the same as the interest rate on other SOFR-linked notes that use an alternative formula to determine the interest rate. Also, if the SOFR rate for a particular day during an Interest Payment Period is negative, inclusion of that rate in the calculation will reduce the Interest Rate for such Interest Payment Period; provided that in no event will the interest payable on the Notes be less than zero.

Additionally, market terms for notes linked to SOFR may evolve over time, and the value of the Notes may be lower than those of later-issued SOFR-linked securities as a result. Similarly, if the formula to calculate daily compounded SOFR for the Notes does not prove to be widely used in other securities like the Notes, the trading price of the Notes may be lower than those of securities having a formula more widely used. You may not be able to sell the Notes at all or may not be able to sell the Notes at prices that will provide a yield comparable to similar investments that have a developed secondary market, and may consequently suffer from increased pricing volatility and market risk.

The NY Federal Reserve (or a successor), as administrator of SOFR, may also make methodological or other changes that could change the value of SOFR, including changes related to the method by which SOFR is calculated, eligibility criteria applicable to the transactions used to calculate SOFR, or timing related to the publication of SOFR. In addition, the administrator may alter, discontinue or suspend calculation or dissemination of SOFR (in which case a fallback method of determining interest rates on the notes will apply). The administrator has no obligation to consider the interests of holders of Notes when calculating, adjusting, converting, revising or discontinuing SOFR.

The Interest Rate on the Notes will be determined using alternative methods if SOFR is no longer available, and that may have an adverse effect on the return on and value of the Notes.

The terms of the Notes provide that if a Benchmark Transition Event and its related Benchmark Replacement Date occur with respect to SOFR, the Interest Rate payable on the Notes will be determined using the next-available Benchmark Replacement. As described above, these replacement rates and spreads may be selected or formulated by (i) the Relevant Governmental Body (such as the Alternative Reference Rates Committee of the NY Federal Reserve) (ii) the International Swaps and Derivatives Association, Inc. or (iii) in certain circumstances, us (or one of our affiliates). In addition, the terms of the Notes expressly authorize us (or one of our affiliates) to make Benchmark Replacement Conforming Changes with respect to, among other things, the determination of Interest Payment Periods and the timing and frequency of determining rates and making payments of interest. The interests of us (or our affiliate) in making the determinations described above may be adverse to your interests as a holder of the Notes.

The application of a Benchmark Replacement and Benchmark Replacement Adjustment, and any implementation of Benchmark Replacement Conforming Changes, or any implementation of a substitute, successor or alternative reference rate could result in adverse consequences to the Interest Rate payable on the Notes, which could adversely affect the return on, value of and market for the Notes. Further, there is no assurance that the characteristics of any substitute, successor or alternative reference rate or Benchmark Replacement will be similar to SOFR or the then-current Benchmark that it is replacing, or that any Benchmark Replacement will produce the economic equivalent of SOFR or the then-current Benchmark that it is replacing.

Tax-related Risks

The Notes will be treated as Variable Rate Debt Instruments for U.S. Federal Income Tax Purposes

The Notes will be treated as variable rate debt instruments for U.S. federal income tax purposes. Please see “Material United States Federal Income Tax Consequences” below for a more detailed discussion. Please also consult your tax advisor concerning the U.S. federal income tax and any other applicable tax consequences to you of owning your Notes in your particular circumstances.

In order to meet our payment obligations on the Notes, at the time we issue the Notes, we may choose to enter into certain hedging arrangements with one or more of our affiliates. The terms of these hedging arrangements are determined based upon terms provided by our affiliates, and take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of SOFR, the tenor of the Notes and the hedging arrangements. The economic terms of the Notes depend in part on the terms of these hedging arrangements.

The hedging arrangements may include hedging related charges, reflecting the costs associated with, and our affiliates’ profit earned from, these hedging arrangements. Since hedging entails risk and may be influenced by unpredictable market forces, actual profits or losses from these hedging transactions may be more or less than this amount.

For further information, see “Risk Factors” beginning on page PS-5 of this pricing supplement.

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES

The following is a general discussion of the material United States federal income tax consequences of purchasing, owning and disposing of the Notes and is based upon the advice of Sidley Austin LLP, our tax counsel. The following discussion supplements, and to the extent inconsistent supersedes, the discussions under “Material United States Federal Income Tax Consequences” in the accompanying prospectus and under “United States Federal Taxation” in the accompanying prospectus supplement, and is not exhaustive of all possible tax considerations that may be relevant to a holder of Notes. This summary is based upon the Internal Revenue Code of 1986, as amended (the “Code”), regulations promulgated under the Code by the U.S. Treasury Department (“Treasury”) (including proposed and temporary regulations), rulings, current administrative interpretations and official pronouncements of the Internal Revenue Service (“IRS”), and judicial decisions, all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below. We have not sought a ruling from the IRS regarding any of the tax consequences described below. This summary does not include any description of federal non-income tax laws, the tax laws of any state or local governments, or of any foreign government, that may be applicable to a particular holder of Notes.

This summary is directed solely to U.S. Holders (as defined in the accompanying prospectus supplement) that, except as otherwise specifically noted, will acquire the Notes upon original issuance and will hold the Notes as capital assets, within the meaning of Section 1221 of the Code, which generally means property held for investment, and that are not excluded from the discussion under “United States Federal Taxation” in the accompanying prospectus supplement. This summary assumes that the issue price of the Notes, as determined for U.S. federal income tax purposes, equals the principal amount thereof.

In the opinion of our tax counsel, Sidley Austin LLP, your Notes will be treated as variable rate debt instruments for U.S. federal income tax purposes. In particular, as described under “United States Federal Taxation—U.S. Holders—Floating Rate Notes—Floating Rate Notes that Provide for a Single Variable Rate” in the accompanying prospectus supplement, the Notes provide for stated interest at a single qualified floating rate. Accordingly, we intend to treat the Notes as variable rate debt instruments for U.S. federal income tax purposes and, in the opinion of Sidley Austin LLP, our tax counsel, the Notes will be treated as variable rate debt instruments for such purposes.

A U.S. Holder will be required to include qualified stated interest payments in income in accordance with the U.S. Holder’s method of accounting for U.S. federal income tax purposes. Please see the discussion under “United States Federal Taxation—U.S. Holders—Floating Rate Notes” in the accompanying prospectus supplement for more detailed information regarding the U.S. federal income tax treatment of your Notes as variable rate debt instruments and the U.S. federal income tax consequences of the purchase, ownership and disposition of the Notes.

Qualified Replacement Property. Prospective investors seeking to treat the Notes as “qualified replacement property” for purposes of Section 1042 of the Code should be aware that Section 1042 of the Code requires the issuer to meet certain requirements in order for the Notes to constitute qualified replacement property. In general, qualified replacement property is a security issued by a domestic operating corporation that did not, for the taxable year preceding the taxable year in which such security was purchased, have “passive investment income” in excess of 25 percent of the gross receipts of such corporation for such preceding taxable year (the “passive income test”). For purposes of the passive income test, where the issuing corporation is in control of one or more corporations or such issuing corporation is controlled by one or more other corporations, all such corporations are treated as one corporation (the “affiliated group”) when computing the amount of passive investment income under Section 1042 of the Code.

We believe that less than 25 percent of our affiliated group’s gross receipts is passive investment income for the taxable year ending November 30, 2020. Accordingly, we believe that the Notes should qualify as “qualified replacement property”. In making this determination, we have made certain assumptions and used procedures which we believe are reasonable. We cannot give any assurance as to whether our affiliated group will continue to meet the relevant tests and requirements necessary for the Notes to qualify as “qualified replacement property”. It is, in addition, possible that the IRS may disagree with the manner in which we have calculated the affiliated group’s gross receipts (including the characterization thereof) and passive investment income and the conclusions reached herein.

SUPPLEMENTAL PLAN OF DISTRIBUTION

Jefferies LLC, the broker-dealer subsidiary of Jefferies Group LLC and an affiliate of Jefferies Group Capital Finance Inc., will act as our Agent in connection with the offering of the Notes. Subject to the terms and conditions contained in a distribution agreement between us and Jefferies LLC, the Agent has agreed to use its reasonable efforts to solicit purchases of the Notes. We have the right to accept offers to purchase Notes and may reject any proposed purchase of the Notes. The Agent may also reject any offer to purchase Notes. We or Jefferies LLC will pay various discounts and commissions to dealers of per Note depending on market conditions.

We may also sell Notes to the Agent who will purchase the Notes as principal for its own account. In that case, the Agent will purchase the Notes at a price equal to the issue price specified on the cover page of this pricing supplement, less a discount. The discount will equal the applicable commission on an agency sale of the Notes.

The Agent may resell any Notes it purchases as principal to other brokers or dealers at a discount, which may include all or part of the discount the Agent received from us. If all the Notes are not sold at the initial offering price, the Agent may change the offering price and the other selling terms.

The Agent will sell any unsold allotment pursuant to this pricing supplement from time to time in one or more transactions in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of time of sale, prices relating to the prevailing market prices or negotiated prices.

We may also sell Notes directly to investors. We will not pay commissions on Notes we sell directly.

The Agent, whether acting as agent or principal, may be deemed to be an “underwriter” within the meaning of the Securities Act. We have agreed to indemnify the Agent against certain liabilities, including liabilities under the Securities Act.

If the Agent sells Notes to dealers who resell to investors and the Agent pays the dealers all or part of the discount or commission it receives from us, those dealers may also be deemed to be “underwriters” within the meaning of the Securities Act.

The Agent is offering the Notes, subject to prior sale, when, as and if issued to and accepted by it, subject to approval of legal matters by its counsel, including the validity of the Notes, and other conditions contained in the distribution agreement, such as the receipt by the Agent of officers’ certificates and legal opinions. The Agent reserves the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

The Agent is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, the offering of the notes will conform to the requirements of FINRA Rule 5121. See “Conflict of Interest” below.

The Agent is not acting as your fiduciary or advisor solely as a result of the offering of the Notes, and you should not rely upon any communication from the Agent in connection with the Notes as investment advice or a recommendation to purchase the Notes. You should make your own investment decision regarding the Notes after consulting with your legal, tax, and other advisors.

We expect to deliver the Notes against payment therefor in New York, New York on October 29, 2021, which will be the scheduled business day following the initial pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the Notes occurs more than two business days from a pricing date, purchasers who wish to trade the Notes more than two business days prior to the Original Issue Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The Notes will be offered at a price equal to 100% of the Stated Principal Amount per Note until the initial pricing date. Thereafter, the Notes will be offered from time to time in one or more negotiated transactions at varying prices to be determined at the time of each sale, which may be at market prices prevailing, at prices related to such prevailing prices or at negotiated prices, subject to a maximum price of 100% of the Stated Principal Amount per Note.

Jefferies LLC and any of our other broker-dealer affiliates may use this pricing supplement, the prospectus and the prospectus supplements for offers and sales in secondary market transactions and market-making transactions in the Notes. However, they are not obligated to engage in such secondary market transactions and/or market-making transactions. Our affiliates may act as principal or agent in these transactions, and any such sales will be made at prices related to prevailing market prices at the time of the sale.

None of this pricing supplement or the accompanying product supplement, prospectus or the prospectus supplement is a prospectus for the purposes of the Prospectus Directive (as defined below).

Prohibition of Sales to EEA and United Kingdom Retail Investors—The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”) or in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 014/65/EU, as amended (“MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the Prospectus Regulation. Consequently no key information document required by Regulation (EU) No 1286/2014, as amended (the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA or in the United Kingdom has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA or in the United Kingdom may be unlawful under the PRIIPs Regulation.

This pricing supplement, the accompanying prospectus and the prospectus supplement have been prepared on the basis that any offer of Notes in any Member State of the EEA or in the United Kingdom will only be made to a legal entity which is a qualified investor under the Prospectus Regulation (“Qualified Investors”). Accordingly any person making or intending to make an offer in that Member State of Notes which are the subject of the offering contemplated in this pricing supplement, the accompanying prospectus and the prospectus supplement may only do so with respect to Qualified Investors. Neither the issuers nor the Agent have authorized, nor do they authorize, the making of any offer of Notes other than to Qualified Investors. The expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

Jefferies LLC, the broker-dealer subsidiary of Jefferies Group LLC, is a member of FINRA and will participate in the distribution of the Notes. Accordingly, the offering is subject to the provisions of FINRA Rule 5121 relating to conflicts of interests and will be conducted in accordance with the requirements of Rule 5121. Jefferies LLC will not confirm sales of the Notes to any account over which it exercises discretionary authority without the prior written specific approval of the customer.

The validity of the Notes is being passed on for us by Sidley Austin LLP, New York, New York.

The consolidated financial statements, and the related financial statement schedules, of Jefferies Group LLC and subsidiaries incorporated herein by reference to the Annual Report on Form 10-K, and the effectiveness of Jefferies Group LLC and subsidiaries’ internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial statements and financial statement schedules have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

$

Jefferies Group LLC

Senior Floating Rate Notes due

October 29, 2071

Linked to

Compounded SOFR

PRICING SUPPLEMENT

Annex A

Supplemental Terms of the Notes

Early Repurchase

You may submit a request to have us repurchase all or any portion of your Notes on any Repurchase Date during the term of the Notes on or after the Initial Repurchase Date, subject to the procedures and terms set forth below. Any repurchase request that we accept in accordance with the procedures and terms set forth below will be irrevocable. To exercise the Early Repurchase Right, you must submit Notes for repurchase having an aggregate Stated Principal Amount equal to the Minimum Repurchase Amount of $100,000 or an integral multiple of $1,000 in excess thereof.

To request that we repurchase your Notes, you must instruct your broker or other person through which you hold your Notes to take the following steps:

| | • | Send a notice of repurchase, substantially in the form attached as Annex B to this pricing supplement (a “Repurchase Notice”), to us via email at PuttableBondNotification@Jefferies.com, with “Floating Rate Notes Due October 29, 2071, CUSIP No. 47233JGV4” as the subject line, by no later than 4:00 p.m., New York City time, fifteen business days prior to the relevant Repurchase Date. We or our affiliate must acknowledge receipt of the Repurchase Notice on the same business day for it to be effective, which acknowledgment will be deemed to evidence our acceptance of your repurchase request; |

| | • | Instruct your DTC custodian to book a delivery versus payment trade with respect to your Notes on the relevant Repurchase Date at a price equal to the Repurchase Amount payable upon early repurchase of the Notes; and |

| | • | Cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the day on which the Notes will be repurchased. |

Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your interest in the Notes in respect of those deadlines. If we do not receive your repurchase notice by 4:00 p.m., New York City time, fifteen business days prior to the relevant Repurchase Date or we (or our affiliates) do not acknowledge receipt of the Repurchase Notice on the same day, your Repurchase Notice will not be effective, and we will not repurchase your Notes. Once given, a Repurchase Notice may not be revoked.

The Calculation Agent will, in its sole discretion, resolve any questions that may arise as to the validity of a Repurchase Notice and the timing of receipt of a Repurchase Notice or as to whether and when the required deliveries have been made. Questions about the repurchase requirements should be directed to PuttableBondNotification@Jefferies.com.

Annex B

Form of Repurchase Notice

To: Jefferies Group LLC and Jefferies Group Capital Finance Inc. – Middle Office

Subject: Floating Rate Notes Due October 29, 2071, CUSIP No. 47233JGV4

Ladies and Gentlemen:

The undersigned holder of Jefferies Group LLC and Jefferies Group Capital Finance Inc.’s Floating Rate Notes Due October 29, 2071, CUSIP No. 47233JGV4 (the “Notes”), hereby irrevocably elects to exercise, with respect to the number of the Notes indicated below, as of the date hereof, the right to have you repurchase such Notes on the Repurchase Date specified below as described in the pricing supplement dated [•] relating to the Notes (collectively, the “Supplement”). Terms not defined herein have the meanings given to such terms in the Supplement.

The undersigned certifies to you that it will (i) instruct its DTC custodian with respect to the Notes (specified below) to book a delivery versus payment trade on the relevant Repurchase Date with respect to the number of Notes specified below at a price per $1,000 Stated Principal Amount of Notes determined in the manner described in the Supplement, facing DTC 0019 and (ii) cause the DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m. New York City time on the Repurchase Date.

Very truly yours,

[NAME OF HOLDER]

Name:

Title:

Telephone:

Fax:

Email:

Number of Notes surrendered for repurchase (minimum of $100,000 Stated Principal Amount):

Applicable repurchase date: _________________, 20__*

DTC # (and any relevant sub-account):

Contact Name:

Telephone:

Acknowledgment: I acknowledge that the Notes specified above will not be repurchased unless all of the requirements specified in the Supplement are satisfied, including the acknowledgment by you or your affiliate of the receipt of this notice on the date hereof.

Questions regarding the repurchase requirements of your Notes should be directed to PuttableBondNotification@Jefferies.com.

*Subject to adjustment as described in the Supplement.