The Notes are not secured debt, are riskier than ordinary debt securities and, unlike ordinary debt securities, the Notes do not pay interest or generally guarantee the return of principal at maturity. This section describes the most significant risks relating to the Notes. You should carefully consider whether the Notes are suited to your particular circumstances before you decide to purchase them. You should consider carefully the following discussion of risks, as well as the discussion of risks included in the accompanying prospectus supplement, prospectus and the applicable pricing supplement, before you decide that an investment in the Notes is suitable for you.

Structure-related Risks

The Notes do not pay interest or generally guarantee return of principal.

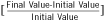

The terms of the Notes differ from those of ordinary debt securities in that we do not guarantee to pay you the principal amount of the Notes at maturity and do not pay you interest on the Notes. Instead, at maturity you will receive for each Note that you hold an amount in cash based on the Final Value, or Final Average Value, if applicable, of the Underlying. If the Final Value or Final Average Value of the Underlying is less than its Initial Value, in the case of Bull Notes, or is greater than its Initial Value, in the case of Bear Notes, you will lose some or all of your investment.

Notwithstanding the above, the applicable pricing supplement may indicate that the particular issue of Notes has a buffer. If so indicated, the buffer will offer limited protection against the loss of principal for a limited decline in the Underlying (or, in the case of Bear Notes, an increase in the Underlying). For these Notes you will lose some and may lose all of your investment if the decline in the Underlying is greater than the protection represented by the buffer. The applicable pricing supplement may also indicate that the particular issue of Notes has a minimum payment at maturity. If the Notes are subject to a minimum payment at maturity, the Payment at Maturity will not be less than the minimum payment at maturity. For these Notes, you will lose some and may lose a significant portion of your investment if the Final Value or Final Average Value of the Underlying is less than its Initial Value.

If the Notes are subject to a Maximum Payment at Maturity, your appreciation potential is limited.

If specified in the applicable pricing supplement, the appreciation potential of the Notes will be limited by the Maximum Payment at Maturity. In this case the Payment at Maturity will never exceed the Maximum Payment at Maturity, which will be a fixed percentage over the original public offering price per Note.

The Notes are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the Notes.

You are dependent on our ability to pay all amounts due on the Notes at maturity, and, therefore, you are subject to our credit risk. If we default on our obligations under the Notes, your investment would be at risk and you could lose some or all of your investment. As a result, the market value of the Notes prior to maturity will be affected by changes in the market’s view of our creditworthiness. Any actual or anticipated decline in our credit ratings or increase in the credit spreads charged by the market for taking our credit risk is likely to adversely affect the market value of the Notes.

The Notes may not be listed on any securities exchange and secondary trading may be limited.

Unless we specify otherwise in the applicable pricing supplement, the Notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the Notes. Our affiliate, Jefferies LLC, may, but is not obligated to, make a market in the Notes and, if it once chooses to make a market, may cease doing so at any time. When it does make a market, it will generally do so for transactions of routine secondary market size at prices based on its estimate of the current value of the Notes, taking into account its bid/offer spread, our credit spreads, market volatility, the notional size of the proposed sale, the cost of unwinding any related hedging positions, the time remaining to maturity and the likelihood that it will be able to resell the Notes. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Since other broker-dealers may not participate significantly in the secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Jefferies LLC is willing to transact. If, at any time, Jefferies LLC were to cease making a market in the Notes, it is likely that there would be no secondary market for the Notes. Accordingly, you should be willing to hold your Notes to maturity.

Changes in the value of one or more of the Basket Components may offset each other.

For Notes linked to a Basket, price movements in the Basket Components may not correlate with each other. At a time when the value of one or more of the Basket Components increases, the value of one or more of the other Basket