SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

PACIFIC CONTINENTAL CORPORATION

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

TO OUR SHAREHOLDERS:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders of Pacific Continental Corporation which will be held at 7:30 p.m. on Tuesday, April 23, 2002, at Pacific Continental Bank’s Olive Street Office, 111 West 7th Avenue, Eugene, Oregon.

It is important that your shares be represented at the meeting. Whether or not you plan to attend the meeting, you are requested to complete, date, sign and return your Proxy in the envelope provided.

| | | Sincerely, |

|

| | | /s/ J. Bruce Riddle

|

| March 20, 2002 | | J. BRUCE RIDDLE Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that pursuant to call of its directors, the regular Annual Meeting of the Shareholders of Pacific Continental Corporation (“Company”) will be held at 111 West 7th Avenue, Eugene, Oregon, on Tuesday, April 23, 2002, at 7:30 p.m., for the purpose of considering and voting upon the following matters:

| 1. | | ELECTION OF DIRECTORS: Electing three persons to serve as directors, each for a three-year term; and one person to serve as a director for a two year term, or until their successors are elected and qualified. |

| 2. | | WHATEVER OTHER BUSINESS may properly be brought before the meeting or any adjournment thereof. |

Only those shareholders of record at the close of business on March 1, 2002, will be entitled to notice of the meeting and to vote at the meeting.

| | By | Order of the Board of Directors |

|

Eugene, Oregon March 20, 2002 | | /s/ J. BRUCE RIDDLE

J. BRUCE RIDDLE President and Chief Executive Officer |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, WE URGE YOU TO SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE. IF YOU DO ATTEND THE MEETING, YOU MAY THEN WITHDRAW YOUR PROXY. THE PROXY MAY BE REVOKED AT ANY TIME PRIOR TO ITS EXERCISE.

1

PACIFIC CONTINENTAL CORPORATION

111 West 7th Avenue Eugene, OR 97401 | | P.O. Box 10727 Eugene, Oregon 97440-2727 |

PROXY STATEMENT

For Annual Meeting of Shareholders

to be held on April 23, 2002

INTRODUCTION

This Proxy Statement and the accompanying Proxy are furnished to the shareholders of the Company in connection with the solicitation of proxies by the Board of Directors of the Company for use at it’s Annual Meeting of Shareholders to be held on Tuesday, April 23, 2002, and any adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The date of this Proxy Statement is March 20, 2002. This Proxy Statement and the accompanying Proxy and Notice of Annual Meeting were first mailed to shareholders on or about March 20, 2002.

GENERAL INFORMATION

Purpose of the Meeting

The purpose of the meeting is to:

| | • | | Elect four persons to serve as directors of the Company. |

Record Ownership; Quorum

Shareholders of record as of the close of business on March 1, 2002, are entitled to one vote for each share of common stock of Pacific Continental Corporation (“Common Stock”) then held. As of March 1, 2002, the Company had 5,051,294 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining the existence of a quorum. Broker nonvotes will not be considered shares present and will not be included in determining whether a quorum is present.

Solicitation of Proxies

The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on the proposal to be considered at the Annual Meeting. In addition to the use of the mail, proxies may be solicited by personal interview or telephone by directors, officers and employees of the Company or its bank subsidiary, Pacific Continental Bank (“Bank”). It is not expected that compensation will be paid for the solicitation of proxies.

When a Proxy card is returned properly signed and dated, the shares represented by the Proxy will be voted in accordance with the instructions on the Proxy card. Where no instructions are indicated, proxies will be voted FOR the nominees.

1

Voting of Proxies by Record Holder

Shareholders who execute Proxies retain the right to revoke them at any time. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by filing a later Proxy prior to a vote being taken at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a Proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a prior granted Proxy.

Voting of Proxies by Beneficial Holder

If your shares are held by a bank, broker or other holder of record you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If you want to attend the shareholder meeting and vote in person, you will need to bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on the record date.

Voting for Directors

The nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from the directors as a group, or for each individual nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because directors will be elected by a plurality of votes cast.

Nominations for Directors

Nominations may be made in accordance with the prior notice provisions contained in the Company’s bylaws. These notice provisions require that a shareholder provide the Company with written notice not less than ten (10) nor more than fifty (50) days prior to any meeting of shareholders called for the election of directors (or if less than twenty-one (21) days notice is given to shareholders, within seven (7) days from the date the notice of meeting, was mailed).

2

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Company’s Articles of Incorporation provide that the number of directors will be not less than six (6), with the specific number of directors to be fixed in the Company’s Bylaws. The Company’s Bylaws currently provide for a board of ten (10) directors. The Company’s Articles of Incorporation require that the terms of the directors be staggered so that approximately one-third of the total number of directors is elected each year.

The Board has nominated Michael S. Holcomb, Donald G. Montgomery and Donald L. Krahmer, Jr. for election as directors for three-year terms to expire in the year 2005, and Michael D. Holzgang for election as a director for a two-year term to expire 2004. Messrs. Holcomb and Montgomery have served as directors of the Company since 1997 and 1996, respectively. Messrs. Holzgang and Krahmer are directors appointed to the Board of Directors on February 14, 2002. James W. Putney, a director of the Company since 1989, informed the board that he will resign his position effective with the annual meeting of shareholders. Mr. Holzgang has been nominated for election to serve the remainder of Mr. Putney’s term.

The Board of Directors recommends that you voteFOR the nominees to be elected as directors.

If any of the nominees should refuse or be unable to serve, your Proxy will be voted for such persons as are designated by the Board of Directors to replace any such nominee. The Board of Directors presently has no knowledge that any nominee will refuse or be unable to serve.

Nominees and Continuing Directors

The following tables set forth certain information with respect to the director nominees (Messrs. Holcomb, Holzgang, Krahmer and Montgomery) and the continuing directors, including the number of shares beneficially held by each. Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a director or executive officer can vote or transfer and stock options that are exercisable currently or become exercisable within 60 days. Except as noted below, each holder has sole voting and investment power for all shares shown as beneficially owned. Where beneficial ownership was less than one percent of all outstanding shares, the percentage is not reflected in the table. As of December 31, 2001, directors of the Company, with the exception of Messrs. Holzgang and Krahmenr, also served as directors of the Bank.

3

Name, Age and Tenure as Director

| | Principal Occupation

of Director During

Last Five Years

| | Shares and Percentage of Common Stock Beneficially Owned as of December 31, 2001

| |

| | | | | (1) (2) (3) | |

Nominee for Director for Two-Year Term Expiring 2004 |

Michael D. Holzgang, 44

Since 2002

| | Senior Vice President, Colliers International; Senior Director, Cushman and Wakefield of Oregon | | 0 | |

Nominees for Director for Three-Year Term Expiring 2005 |

Michael S. Holcomb, 58

Since 1997

| | Manager and Owner, Berjac of Oregon; Partner Berjac Portland and Denver | | 78,137 (1.54 | (4) %) |

Donald G. Montgomery, 62

Since 1996 | | Private Investor; Executive Vice President, Timber Products, Co. | | 17,648 | |

Donald L. Krahmer, Jr., 44

Since 2002 | | Partner, Attorney at Law, Black Helterline, LLP | | 0 | |

Continuing Directors with Term Expiring 2003 |

Robert A. Ballin, 60

Since 1980 | | Chairman of Willis Corporation of Eugene | | 247,560 (4.88 | %) |

Donald A Bick, 66

Since 1972 | | Attorney, Bick & Monte, Attorneys | | 45,213 | (5) |

Ronald F. Taylor, 65

Since 1973 | | General Manager, Willamette Graystone, Inc. | | 22,221 | (6) |

Continuing Directors with Term Expiring 2004 |

Larry G. Campbell, 61

Since 1982 | | President, L.G. Campbell Company; Inc. Campbell Commercial Real Estate | | 42,335 | |

James W. Putney, 62

Since 1989 | | Private Investor; VP and GM of KVAL Television | | 39,151 | (7) |

J. Bruce Riddle, 57

Since 1980 | | President and CEO of Pacific Continental Bank | | 210,640 (4.15 | %) |

| 1. | | Shares held directly with sole voting and sole investment power, unless otherwise indicated. |

| 2. | | Includes shares that could be acquired within 60 days by the exercise of stock options as follows: Ballin 6,600 shares; Bick 6,600 shares, Campbell 6,600 shares; Holcomb 6,600 shares; Montgomery 6,600 shares; Putney 6,600 shares; Riddle 12,100 shares; and Taylor 6,600 shares. |

| 3. | | Shares amounts have been adjusted to reflect the 10% stock dividend paid in September 2001. |

| 4. | | Includes 9,122 shares held jointly with adult sons. |

| 5. | | Includes 5,004 shares held as custodian for grandchildren and 466 shares owned by spouse. |

| 6. | | Includes 5,764 shares held by spouse. |

| 7. | | Includes 1,320 shares held as custodian for grandchildren. Mr. Putney will resign from the board at the annual meeting of shareholders. |

4

INFORMATION REGARDING THE BOARD OF

DIRECTORS AND ITS COMMITTEES

The following sets forth information concerning the Board of Directors and Committees of the Company and the Bank for the fiscal year ended December 31, 2001.

Board of Directors

The Company held 10 Board meetings and the Bank held 12 Board meetings in 2001. Each director attended at least 75% percent of the aggregate of (i) the total number of meetings of the Boards of Directors, and (ii) the total number of meetings held by all committees on which he served, except Mr. Putney who attended 73% of his aggregate meetings.

Certain Committees of the Board of Directors

The Bank Board has established an Audit Committee, a Compensation Committee and an Executive Committee. When the need arises the full Board serves as the Nominating Committee. The committees of the Bank also act as the committees for the Company.

Audit Committee. The Audit Committee is composed of independent directors (as defined by the Nasdaq listing standards) and operates under a formal written charter adopted by the Board of Directors. The function of the Audit Committee includes reviewing the plan, scope, and audit results of the independent auditors, as well as reviewing and approving the services of the independent auditors. The Audit Committee reviews or causes to be reviewed the reports of bank regulatory authorities and reports its conclusions to the Board. The Audit Committee also reviews procedures with respect to the records and business practices of the Company and Bank, and reviews the adequacy and implementation of the internal auditing, accounting and financial controls. Management is responsible for internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards and issues a report thereon. The committee’s responsibility is to monitor and oversee this process. The Committee held four meetings during the year. For 2001, members of the Audit Committee consisted of Messrs. Bick (Chairman), Holcomb, Montgomery, and Taylor.

Compensation Committee. The Compensation Committee met twice to review and approve the retirement and benefit plans, and to determine the salary and incentive compensation for Mr. Riddle and certain other executive officers. For 2001, members of the Compensation Committee consisted of Messrs. Montgomery (Chairman), Holcomb, Riddle, and Taylor. However, Mr. Riddle, who is the President and CEO of the Bank, did not participate in the Committee’s or Board’s action on his compensation.

Executive Committee. The Executive Committee functions as a subcommittee of the full Board of Directors. It meets when directed by the Board and considers matters for later report to the Board of Directors. Matters to be considered by the committee may include new office locations, real estate purchases and lease negotiations, merger and acquisition opportunities, and strategic planning. The committee did not meet during the year. For 2001, members of the Executive Committee consisted of Messrs. Ballin (Chairman), Montgomery, Putney and Riddle.

Compensation of Directors

Director Fees. Pursuant to the Bank’s Bylaws, the Bank has an established program for director compensation in which each director of the Bank receives a fee of $1,150 for the first regularly scheduled

5

meeting and $75 for each committee meeting attended. The Chairman of the Board receives $1,265 for the first regularly scheduled meeting and $100 for each committee meeting attended.

In addition to their directors’ fees, directors participate in an incentive bonus program. The program provides that directors may receive an annual bonus of between $1,000 and $9,000, determined by the Bank’s return on average assets. For 2001, the bonus program resulted in payments of $3,000 to each director, a total expenditure of $24,000.

Directors’ Stock Option Plan. The Company maintains a director stock option plan for the benefit of non-employee directors. The plan authorizes the non-employee directors of the Board to administer the plan and to grant nonqualified stock options to non-employee directors of the Company. The plan provides that the exercise price of options granted must be not less than the greater of (i) 100% of the fair market value; or (ii) the net book value of such stock on the date of the grant. All options granted under the plan expire not more than ten years from the date of grant and may be fully vested at the time of the grant.

From time to time, the plan is amended or a new plan is adopted to provide for additional shares. In 1999, the Board adopted and the shareholders approved a new Director Stock Option Plan (“1999 DSOP”), providing for the grant of up to 100,000 shares of the Company’s Common Stock. At December 31, 2001, 63,800 shares remained available for issuance under the 1999 DSOP, subject to appropriate adjustments for any stock splits, stock dividends, or other changes in the capitalization of the Company. No shares remain available for grant under any of the other existing plans.

Directors’ Stock Option Grants. In September 2001, individual grants to purchase 3,330 shares (as adjusted for the 10% stock dividend paid in September 2001) was awarded to all non-employee directors at an adjusted per share exercise price of $12.76. The options are fully vested at the time of grant and expire in 2006.

6

EXECUTIVE COMPENSATION

The following table sets forth the compensation received by the Chief Executive Officer and the four most highly compensated principal officers of the Company, whose total compensation during the last fiscal year exceeded $100,000 during the last three fiscal years. The Bank pays all compensation of the executive officers.

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | Long Term Compensation | | |

| | | |

|

| | |

| | | Annual Compensation | | Awards | | Payouts | | |

| |

|

|

|

|

|

| | |

Name and Principal Position | | Year | | Salary (1) | | Bonus (2) | | Other Annual Compensation (3) | | Restricted Stock Awards | | Securities Underlying Options/ SARs(#)(4) | | LTIP Payouts | | All Other Compensation (5)(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| J. Bruce Riddle, President and CEO | | 2001 2000 1999 | | $ $ $ | 237,125 237,650 236,150 | | $ $ $ | 225,000 214,272 229,000 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | 8,250 11,000 0 | | $ $ $ | 0 0 0 | | $ $ $ | 24,536 24,382 24,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hal M. Brown Executive Vice President, Chief Operating Officer | | 2001 2000 1999 | | $ $ $ | 134,529 130,209 111,834 | | $ $ $ | 70,000 64,000 74,000 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | 6,600 11,000 0 | | $ $ $ | 0 0 0 | | $ $ $ | 23,071 21,994 20,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| John M. Gydé, Executive Vice President, Chief Credit Officer | | 2001 2000 1999 | | $ $ $ | 103,069 101,287 98,938 | | $ $ $ | 41,000 49,000 58,000 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | 6,600 6,600 0 | | $ $ $ | 0 0 0 | | $ $ $ | 17,052 16,426 16,578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mitchell J. Hagstrom, Senior Vice President, Manager of Client Services | | 2001 2000 1999 | | $ $ $ | 85,475 77,785 70,825 | | $ $ $ | 33,000 35,000 37,000 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | 6,600 6,600 0 | | $ $ $ | 0 0 0 | | $ $ $ | 17,605 16,138 15,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Judy A. Thompson, Senior Vice President, Manager | | 2001 2000 1999 | | $ $ $ | 96,242 94,860 86,474 | | $ $ $ | 29,000 28,000 45,000 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | 6,600 6,600 0 | | $ $ $ | 0 0 0 | | $ $ $ | 16,755 16,167 15,529 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. | | Includes director and committee fees paid to Mr. Riddle and Mr. Gydé during 2001, 2000, and 1999. |

| 2. | | Includes accrued director bonuses earned by Mr. Riddle. |

| 3. | | Does not include amounts attributable to miscellaneous benefits received by executive officers, including the use of company-owned automobiles and the payment of certain club dues. In the opinion of management, the costs to the Bank of providing such benefits to any individual executive officer during the year ended December 31, 2001 did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for the individual. |

| 4. | | Adjusted to reflect the 10% stock dividend paid in September 2001. |

| 5. | | Includes contributions accrued by the Bank during 2001 for the benefit of Messrs. Riddle, Brown, Gydé, and Hagstrom and Ms. Thompson in the amounts of $18,095, $14,319, $10,524, $9,098, and $10,237, respectively, pursuant to the Bank’s 401(k) Profit Sharing Plan. |

| 6. | | Includes insurance premiums paid by the Bank during 2001 on behalf of Messrs. Riddle, Brown, Gydé and Hagstrom and Ms. Thompson in the amounts of $6,441, $8,752, $6,528, $8,507 and $6,518, respectively. |

7

Stock Option Plans

The Company maintains an Incentive Stock Option Plan for the benefit of employees of the Bank. A committee of non-employee directors of the Board administers the plan. Under the terms of the plan, the committee may grant employees of the Bank options in the form of “incentive” or “non-qualified” stock options to purchase shares of the Company’s Common Stock at a purchase price of not less than the greater of (i) 100% of the fair market value; or (ii) the net book value of such stock on the date of the grant (in the case of an incentive stock option, the price may not be less than the fair market value). The options have a term not exceeding ten years from the date the option is granted.

From time to time, the Plan is amended or a new plan is adopted to provide for additional shares. In 1999, the Board adopted and the shareholders approved a new Incentive Stock Option Plan (“1999 Plan”). The 1999 Plan provides for the grant of up to 500,000 shares of the Company’s Common Stock. At December 31, 2001, 197,670 shares remained available for issuance under the 1999 Plan, subject to appropriate adjustments for any stock splits, stock dividends, or other changes in the capitalization of the Company. No shares remain available for grant under any of the other existing plans.

Stock Option Grants. The following table sets forth certain information concerning individual grants of stock options under the stock option plans awarded to the named officers during the year ended December 31, 2001.

OPTION GRANTS IN LAST FISCAL YEAR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Grants | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

|

|

|

Name | | Options Granted (1)(2) | | % of Total Options Granted to Employees | | | Exercise Price (2) | | Expiration Date | | 5% | | 10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| J. Bruce Riddle | | 8,250 | | 4.5 | % | | $ | 12.76 | | 8-14-06 | | $ | 29,084 | | $ | 64,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hal M. Brown | | 6,600 | | 3.6 | % | | $ | 12.76 | | 8-14-06 | | $ | 23,267 | | $ | 51,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| John M. Gydé | | 6,600 | | 3.6 | % | | $ | 12.76 | | 8-14-06 | | $ | 23,267 | | $ | 51,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mitchell J. Hagstrom | | 6,600 | | 3.6 | % | | $ | 12.76 | | 8-14-06 | | $ | 23,267 | | $ | 51,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Judy A. Thompson | | 6,600 | | 3.6 | % | | $ | 12.76 | | 8-14-06 | | $ | 23,267 | | $ | 51,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. | | Options granted under the employee stock option plans vest over a four-year period, with 20% of the shares vested on the grant date. The remaining shares vest 20% on each of the first, second, third, and fourth anniversaries of the grant date. |

| 2. | | Options granted and the option price have been adjusted to reflect the 10% stock dividend paid in September 2001. |

8

Stock Option Exercises. The following table sets forth certain information concerning exercises of stock options pursuant to the Company’s stock option plans by the named executive officers during the year ended December 31, 2001 and stock options held at year-end.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND YEAR END OPTION VALUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name | | Shares Acquired on Exercise (1) | | Value Realized | | Number of Unexercised Options at Year End (1) | | Value of Unexercised Options at Year End (2) |

| | | | | |

|

|

|

|

|

|

|

|

| | | | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

|

|

|

|

|

|

|

|

|

|

|

|

|

| J. Bruce Riddle | | 6,806 | | $ | 7,301 | | 12,100 | | 13,200 | | $ | 38,280 | | $ | 28,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hal M. Brown | | 6,806 | | $ | 7,301 | | 11,770 | | 11,880 | | $ | 38,280 | | $ | 28,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| John M. Gydé | | 6,806 | | $ | 7,301 | | 10,010 | | 9,240 | | $ | 30,730 | | $ | 16,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mitchell J. Hagstrom | | 6,806 | | $ | 6,682 | | 11,110 | | 9,240 | | $ | 30,730 | | $ | 16,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Judy A. Thompson | | 6,806 | | $ | 7,301 | | 10,010 | | 9,240 | | $ | 30,730 | | $ | 16,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. | | The number of shares acquired on exercise and the number of unexercised options at year-end have been adjusted to reflect the 10% stock dividend paid in September 2001. |

| 2. | | On December 31, 2001, the estimated market price of the Common Stock was $ 12.70. For purposes of the foregoing table, stock options with an exercise price less than that amount are considered to be “in-the-money” and are considered to have a value equal to the difference between the estimated market price and the exercise price of the stock option multiplied by the number of stock option shares. |

Executive Severance Agreements

The Bank maintains Executive Severance Agreements with certain of its executive officers. Under these agreements, the executive is entitled to receive severance payments in the event his or her employment is terminated (i) voluntarily or involuntarily within three years after a change in control (as defined); or (ii) involuntarily within two years prior to the occurrence of a change in control. Under the terms of these agreements, Mr. Hagstrom and Ms. Thompson would be eligible to receive a lump sum payment equal to the executive’s highest compensation received during any of the most recent three calendar years prior to or simultaneous with, the change in control; and Mr. Gydé would be eligible to receive an amount equal to one and one-half times the executive’s highest compensation received during any of the most recent three calendar years prior to or simultaneous with, the change in control.

During 2001, the Bank and Company entered into Employment Agreements (“Agreements”) with executive officers Bruce Riddle and Hal Brown. The Agreements are for a term of three years, expiring on April 24, 2004. Under the terms of the respective Agreements, Messrs. Riddle and Brown receive initial annual salaries in the amounts of $222,500 and $131,250, respectively, and a cash bonus opportunity based on the Bank’s 401(k)/bonus formula in effect at that time. In the event either of Messrs. Riddle or Brown are terminated before the term ends for “good reason” or by the Company or the Bank, without “cause,” Messrs. Riddle and Brown will be entitled to receive compensation (including any bonus earned) and benefits in the amounts that they would have received had they been employed, for a period of 12 months from the date of termination. In addition, the Agreements provide for severance payments in the event employment is terminated (i) voluntarily or involuntarily within one year after a change in control (as defined); or (ii) involuntarily within one year prior to the occurrence of a change of control. In the event of a change in control, executive will be eligible to receive a lump sum

9

payment equal to a multiple (two and one half times for Mr. Riddle and two times for Mr. Brown) of the executive’s highest compensation received during any of the most recent three calendar years prior to or simultaneous with the change in control; and in the case of an involuntary termination following a change of control, the continuation of certain benefits at no cost to the executive for a period of one year.

401(k) Profit Sharing Plan

The Bank has a 401(k) Profit Sharing Plan (“401(k) Plan”) covering substantially all employees. An employee must be at least 18 years of age and have one year of service with the Bank to be eligible for the 401(k) Plan (“Effective Date”). Under the 401(k) Plan, participants may defer a percentage of their compensation, the dollar amount of which may not exceed the limit as governed by law. At the discretion of the Board, the Bank may also elect to pay a discretionary matching contribution equal to a percentage of the amount of the salary deferral made by the participant. The 401(k) Plan provides that contributions made are 100% vested immediately upon the participant’s Effective Date. During 2001, the amount accrued by the Bank for the benefit of employees under the 401(k) Plan totaled $384,299. The Bank acts as the Plan Administrator of the 401(k) Plan. The 401(k) Plan’s trustees determine general investment options. The 401(k) Plan participants make specific investment decisions.

Stock Repurchase Program

On October 9, 2001, the Board approved a stock repurchase program that allows for the repurchase of up to 200,000 shares through open market transactions, block purchases, or through privately negotiated transactions. The plan repurchases are limited by the anticipated timing of stock option exercises, as well as by other factors. At March 1, 2002, a total of 30,100 shares have been repurchased under this program.

Compensation Committee Report

The following is a report of the Compensation Committee of the Board of Directors who are responsible for establishing and administering the Company’s Executive Compensation Program. The following report includes specific matters relating to compensation during the year 2001.

Compensation Philosophy and Objectives. The philosophy underlying the development and administration of the Company’s annual and long-term compensation plans is the alignment of the interests of executive management with those of the shareholders. Key elements of this philosophy are:

| | • | | Establish compensation plans which deliver pay commensurate with the Company’s performance, as measured by operating, financial and strategic objectives, |

| | • | | Provide significant equity-based incentives for executives to ensure that they are motivated over the long-term to respond to the Company’s business challenges and opportunities as owners, rather than just as employees, |

| | • | | Reward executives if shareholders receive an above-average return on their investment over the long-term. |

The objective for computing executive base salaries is to structure salaries that are competitive within the marketplace. An incentive bonus is the vehicle by which executives can earn additional compensation depending on individual and Company performance relative to certain annual objectives. The Company objectives are a combination of operating, financial and strategic goals (such as loan and deposit levels, asset quality, earnings per share, operating income, etc.) that are considered to be critical to the Company’s goal of building long-term shareholder value.

The incentive bonus program is administered by the Compensation Committee and approved by

10

the Board of Directors. Dollars for the bonus program are accumulated based on the earnings of the Company. Return on average assets is the ratio used for the calculation. Bonus pool dollars are allocated between the employer’s contribution to the Company’s 401(k)/Profit Sharing Plan and the incentive bonus.

The Company’s current long-term incentive program consists of the 1999 Stock Option Plan. Grants are considered at the then value of the Company’s Common Stock, thereby providing an additional incentive for executives to build shareholder value. Executives receive value from these grants if the Company’s Common Stock appreciates over the long-term.

Bank Performance and Compensation. During 2001 the Bank achieved operating and financial goals exceeding those of its national peers. Specific measurements include asset quality, return on average assets, return on average equity, operating income, and earnings per share. Considering these accomplishments, which were not specifically weighted, the Board awarded the Bank’s President and Chief Executive, J. Bruce Riddle, an incentive bonus payment in the amount of $222,000.

Compensation Committee Interlocks and Insider Participation. Mr. J. Bruce Riddle, the President and CEO of the Bank during 2001, served as a member of the Compensation Committee. Mr. Riddle did not vote on any matter affecting compensation paid or awarded to him.

Executive Compensation Committee

Donald G. Montgomery (Chairman)

Michael S. Holcomb

J. Bruce Riddle (President and CEO)

Ronald F. Taylor

Audit Committee Report

The Audit Committee has met and held discussions with management and the Company’s independent accountants. Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Our independent accountants also provided to the Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Committee discussed with the independent accountants that firm’s independence.

Based on the Committee’s review of the audited consolidated financial statements and the various discussions with management and the independent accountants noted above, the Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2001, filed with the Securities and Exchange Commission.

Audit Committee Members – Fiscal 2001

Donald A. Bick (Chairman)

Michael S. Holcomb

Donald G. Montgomery

Ronald F. Taylor

11

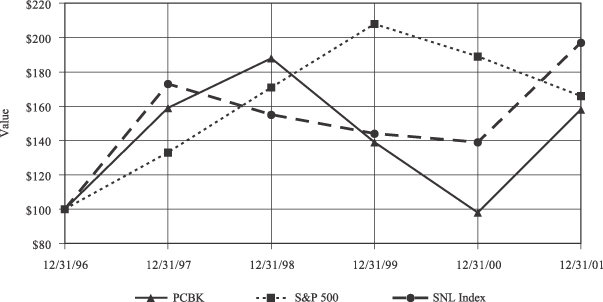

STOCK PERFORMANCE GRAPH

The following line graph and table compares the total cumulative shareholder return on the Company’s Common Stock, based on reinvestment of all dividends, to the cumulative total returns of the Standard & Poor’s S&P Composite 500 Index, and SNL Securities $250 to $500 Million Bank Asset Size Index (“SNL Index”). The graph assumes $100 invested on December 31, 1996, in the Company’s Common Stock and each of the indices.

| December 31 |

|

| | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| PCB (PCBK) | | 100 | | 159 | | 188 | | 139 | | 98 | | 158 |

| S&P 500 | | 100 | | 133 | | 171 | | 208 | | 189 | | 166 |

| SNL Index | | 100 | | 173 | | 155 | | 144 | | 139 | | 197 |

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to executive officers who are not directors or nominees for directors. All executive officers are elected annually and serve at the discretion of the Board of Directors. At December 31, 2001, the Company was not aware of any persons who beneficially owned more than 5% of the Company’s Common Stock. The table indicates the number of shares of Common Stock beneficially owned by each individual on December 31, 2001, and the percentage of Common Stock outstanding on that date that the person’s holdings represented. However, where beneficial ownership was less than one percent of all outstanding shares, the percentage is not reflected in the table.

12

|

|

|

|

|

|

Name, Address and Age | | Current Position with the Bank and Prior Five Year Experience | | Shares and Percentage of Common Stock Beneficially Owned (1) |

|

|

|

|

|

| Hal M. Brown, 48 | | Executive Vice President and Chief Operating Officer; Senior Vice President and Chief Financial Officer | | 145,904 (2.87%) |

|

|

|

|

|

| John M. Gydé, 59 | | Executive Vice President and Chief Credit Officer | | 79,246(2) (1.56%) |

|

|

|

|

|

| T. Dean Hansen, 55 | | Senior Vice President and Office Manager | | 44,534(3) |

|

|

|

|

|

| Michael Reynolds, 50 | | Vice President and Chief Financial Officer: Vice President and Controller; U.S. Bank Senior Vice President | | 6,380 |

|

|

|

|

|

| (Mitchell J. Hagstrom, 45 | | Senior Vice President and Manager of Client Services: Vice President and Manager of Client Services | | 38,141(4) |

|

|

|

|

|

| Judy A. Thompson, 55 | | Senior Vice President and Office Manager | | 38,566 |

|

|

|

|

|

| All directors and named executive officers as a group (16 persons) | | | | 1,055,676 (20.39%) |

|

|

|

|

|

| 1. | | Share amounts include options to acquire shares that are exercisable within 60 days as follows: Messrs. Brown 11,770 shares, Gydé 10,010 shares; Hagstrom 11,110 shares; Hansen 6,060; Reynolds 3,850; and Ms. Thompson 10,010 shares. |

| 2. | | Includes 212 shares held by spouse. |

| 3. | | Includes 833 shares owned by adult child living at home. |

| 4. | | Includes 15,686 shares held in a charitable remainder trust and 232 shares held as custodian for minor children |

TRANSACTIONS WITH MANAGEMENT

The Bank has had, and expects to have in the future, banking transactions, including loans, in the ordinary course of business with directors, executive officers, and their associates, on substantially the same terms, including interest rates and collateral, as those prevailing at the same time for comparable transactions with other persons, which transactions do not involve more than the normal risk of collection or present other unfavorable features. All such loans were made in the ordinary course of the Bank’s business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other customers and in the opinion of management, do not involve any undue credit risk to the Bank.

COMPLIANCE WITH SECTION 16(a) FILING REQUIREMENTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, (“Section 16(a)”) requires

13

that all executive officers and directors of the Bank and all persons who beneficially own more than 10 percent of the Company’s Common Stock file reports with the Securities and Exchange Commission with respect to beneficial ownership of the Company’s Securities. The Company has adopted procedures to assist its directors and executive officers in complying with the Section 16(a) filings.

Based solely upon the Company’s review of the copies of the filings which it received with respect to the fiscal year ended December 31, 2001, or written representations from certain reporting persons, the Company believes that all reporting persons made all filings required by Section 16(a) on a timely basis.

AUDITORS

Zirkle Long & Trigueiro LLC, Certified Public Accountants, performed the audit of the consolidated financial statements for the Company for the year ended December 31, 2001. Representatives of Zirkle Long & Trigueiro LLC will be present at the Annual Meeting, and will have the opportunity to make a statement if they so desire. They also will be available to respond to appropriate questions.

At a future meeting, the Board will appoint independent auditors to audit the Company’s financial statements for 2002. The Board will review the scope of any such audit and other assignments given to the auditors to determine whether such assignments would affect their independence.

Fees Paid to Independent Auditors

During the fiscal year ended December 31, 2001, fees billed to the Company by Zirkle Long & Trigueiro LLC consisted of the following:

Audit Fees. Audit fees billed to the Company by Zirkle Long & Trigueiro LLC during the 2001 fiscal year for audit of the annual financial statements and review of those financial statements included in the quarterly reports on Form 10-Q totaled $65,925.

Financial Information Systems Design and Implementation Fees. The Company did not engage Zirkle Long & Trigueiro LLC to provide advice regarding financial information systems design and implementation during the fiscal year ended December 31, 2001.

All other Fees. Fees billed to the Company by Zirkle Long & Trigueiro LLC during the 2001 fiscal year for all other non-audit services rendered, including tax related services, totaled $14,456.

For the fiscal year 2001 the Audit Committee and Board considered and deemed the services provided by Zirkle Long & Trigueiro LLC was compatible with maintaining the principal accountant’s independence.

14

OTHER BUSINESS

The Board of Directors knows of no other matters to be brought before the shareholders at the Annual Meeting. In the event other matters are presented for a vote at the Meeting, the Proxy holders will vote shares represented by properly executed Proxies in their discretion in accordance with their judgment on such matters.

At the Meeting, management will report on the Company’s business and shareholders will have the opportunity to ask questions.

INFORMATION CONCERNING SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the 2003 Annual Shareholders’ Meeting must be received by the Secretary of the Company prior to November 21, 2002, for inclusion in the 2003 Proxy Statement and form of proxy. In addition, if the Company receives notice of a shareholder proposal after February 3, 2003, the persons named as proxies in such proxy statement will have discretionary authority to vote on such shareholder proposal.

AVAILABLE INFORMATION

The Company currently files periodic reports and other information with the SEC. Such information and reports may be read and copied at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, D. C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Reports and information filed by the Company electronically are available on the SEC Internet site at http://www.sec.gov.

REPORTS TO SHAREHOLDERS

A copy of the 2001 Annual Report to Shareholders accompanies this Proxy Statement.Any shareholder may obtain from the Company, without charge, a copy of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934 for the year ended December 31, 2001. Written requests for the Form 10-K should be addressed to Michael Reynolds, Vice President and Chief Financial Officer of Pacific Continental Bank, at P.O. Box 10727, Eugene, Oregon 97440-2727.

| | | By Order of the Board of Directors |

|

Eugene, Oregon March 20, 2002 | | /s/ Hal Brown

HAL BROWN Corporate Secretary |

15

PROXY

PACIFIC CONTINENTAL CORPORATION

PLEASE SIGN AND RETURN IMMEDIATELY

This | | Proxy Is Solicited on Behalf of the Board of Directors |

The undersigned hereby appoints Robert A. Ballin and J. Bruce Riddle, and each of them (with full power to act alone), my Proxy, with full power of substitution as Proxy, and hereby authorize Messrs. Ballin or Riddle to represent and to vote, as designated below, all the shares of common stock of Pacific Continental Corporation, held of record by the undersigned on March 1, 2002, at the Annual Meeting of Shareholders to be held on April 23, 2002 (“Meeting”), or any adjournment of such Meeting.

1. | | ELECTION OF DIRECTORS. A vote to elect the following nominees. |

| | A. | | I voteFOR all nominees listed below.r |

| | B. | | IWITHHOLD AUTHORITY to vote for all nominees in the list below.r |

| Michael S. Holcomb | | Donald G. Montgomery |

| Donald L. Krahmer, Jr. | | Michael D. Holzgang |

| | C. | | IWITHHOLD AUTHORITY to vote for any individual whose name I have struck a line through in the list above.r |

2. | | WHATEVER OTHER BUSINESS may properly be brought before the Meeting or any adjournment thereof. |

THIS PROXY CONFERS AUTHORITY TO VOTE “FOR” AND WILL BE VOTED “FOR” THE PROPOSAL LISTED UNLESS AUTHORITY IS WITHHELD OR A VOTE AGAINST OR AN ABSTENTION IS SPECIFIED, IN WHICH CASE THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATION SO MADE.

Management knows of no other matters that may properly be, or which are likely to be, brought before the Meeting. However, if any other matters are properly presented at the Meeting, this Proxy will be voted in accordance with the recommendations of management.

The Board of Directors recommends a voteFOR the listed directors.

, 2002 (Date signed) | | | | SIGN BELOW: |

|

| | | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | | | WHEN SIGNING AS ATTORNEY, EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE. IF MORE THAN ONE TRUSTEE, ALL SHOULD SIGN. ALL JOINT OWNERS MUST SIGN. |