TO OUR SHAREHOLDERS:

You are cordially invited to attend the 2006 Annual Meeting of Shareholders of Pacific Continental Corporation which will be held at 7:00 p.m. on Tuesday, April 18, 2006, at Pacific Continental Bank's Olive Street Office, 111 West 7th Avenue, Eugene, Oregon.

It is important that your shares be represented at the meeting. Whether or not you plan to attend the meeting, you are requested to complete, date, sign and return your Proxy in the envelope provided. If you do attend the meeting, you may then withdraw your proxy and vote your shares in person.

Sincerely,

| | | HAL BROWN |

| | March 17, 2006 | President and |

| | | Chief Executive Officer |

PACIFIC CONTINENTAL CORPORATION

111 West 7th Avenue Eugene, Oregon 97401 541-686-8685 | P.O. Box 10727 Eugene, Oregon 97440-2727 |

Notice of Annual Meeting of Shareholders

| | TIME | 7:00 p.m. on Tuesday, April 18, 2006 |

| | PLACE | 111 West 7th Avenue, Eugene, Oregon |

| | ITEMS OF BUSINESS | (1) To elect three directors to a three-year term. |

| | | (2) To approve the 2006 Stock Option and Equity Compensation Plan. |

| | | (3) To transact such other business as may properly come before the meeting and any adjournment thereof. |

| | RECORD DATE | You are entitled to vote at the annual meeting and at any adjournments or postponements thereof if you were a shareholder at the close of business on Friday, March 3, 2006. |

| | VOTING BY PROXY | Please submit your proxy card as soon as possible so that your shares can be voted at the annual meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions in the Proxy Statement and on your enclosed proxy form. |

By Order of the Board of Directors

HAL BROWN

President and Chief Executive Officer

This proxy statement and the accompanying proxy card are being distributed on or about

March 17, 2006

TABLE OF CONTENTS

& #160; Page

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | | |

| | | 1 | |

| | | 2 | |

| | | 2 | |

| | | 3 | |

| | | 3 | |

| | | 4 | |

| | | 6 | |

| | | 6 | |

| | | 6 | |

| | | 6 | |

| | | 8 | |

| | | 9 | |

| | | 10 | |

| | | 10 | |

| | | 11 | |

| | | 12 | |

| | | 13 | |

| | | 14 | |

| | | 14 | |

| | | 19 | |

| | | 21 | |

| | | 21 | |

| | | 21 | |

| | | 22 | |

| | | 22 | |

| | | 24 | |

| | | 25 | |

| | | 25 | |

| | | 25 | |

| | | 26 | |

| | | 28 | |

| | | 28 | |

| | | 28 | |

| | | 28 | |

| | | 28 | |

| | | 28 | |

| | | 29 | |

PROXY STATEMENT

For Annual Meeting of Shareholders

to be held on April 18, 2006

This Proxy Statement and the accompanying Proxy are furnished to the shareholders of the Company in connection with the solicitation of proxies by the Board of Directors of the Company for use at it’s Annual Meeting of Shareholders to be held on Tuesday, April 18, 2006, and any adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the accompanying Proxy and Notice of Annual Meeting were first mailed to shareholders on or about March 17, 2006.

At the Annual Meeting, shareholders will be asked to consider and vote upon:

| · | The election of Messrs. Robert Ballin, Michael E. Heijer, and John H. Rickman to serve as directors of the Company for three-year terms or until their successors have been elected and qualified. |

| · | Approve the 2006 Stock Option and Equity Compensation Plan |

Shareholders of record as of the close of business on March 3, 2006 (“Record Date”), are entitled to one vote for each share of Common Stock then held. As of the Record Date there were 10,482,860 shares of Common Stock issued and outstanding.

The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining the existence of a quorum. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares.

The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Annual Meeting. In addition to the use of the mail, proxies may be solicited by personal interview or telephone by directors, officers and employees of the Company or its bank subsidiary, Pacific Continental Bank (“Bank”). It is not expected that compensation will be paid for the solicitation of proxies.

When a Proxy card is returned properly signed and dated, the shares represented by the Proxy will be voted in accordance with the instructions on the Proxy card. Where no instructions are indicated, proxies will be voted FOR the director nominees and FOR the 2006 Stock Option and Equity Compensation Plan.

Shareholders who execute Proxies retain the right to revoke them at any time. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by filing a later Proxy prior to a vote being taken at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a Proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a previously granted Proxy.

Voting of Proxies by Shareholders of Record and by Beneficial Owners

A portion of the Company’s shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Shareholders of Record. If your shares are registered directly in your name, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent to you by the Company through its transfer agent. As the shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker on how to vote. Your broker or nominee has enclosed a voting instruction card for you to use in directing your broker or nominee as to how to vote your shares.

Voting in Person at the Annual Meeting

Shareholders of Record. Shares held directly in your name as the shareholder of record may be voted in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Beneficial Owner. Shares held in street name may by voted in person by you only if you bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on the Record Date.

Election of Directors. The nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from the directors as a group, or for each individual nominee. Votes that are withheld and broker nonvotes will have no effect on the outcome of the election because directors will be elected by a plurality of votes cast.

2006 Stock Option and Equity Compensation Plan. The proposal for the Company to adopt the 2006 Stock Option and Equity Compensation Plan requires the affirmative vote FOR of a majority of the shares present and entitled to vote at the Annual Meeting. You may vote for, against or abstain from approving the 2006 Stock Option and Equity Compensation Plan. Abstentions and broker non-votes will have no effect on the outcome of the vote. Shareholders of record will be entitled to one vote per share on this proposal.

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The Company’s Articles of Incorporation provide that the number of directors will be not less than six (6), with the number of directors to be established in accordance with the Company’s Bylaws. The Company’s Bylaws currently provide for a board of eight (8) to twelve (12) directors, with the specific number of directors to be established by board resolution. Through resolution the Board of Directors has currently established the number of directors at nine (9). The Company’s Articles of Incorporation require that the terms of the directors be staggered so that approximately one-third of the total number of directors is elected each year.

The Governance/Nominating Committee has recommended to the Board, and the Board has nominated, Robert Ballin, Michael E. Heijer, and John H. Rickman for election as directors for three-year terms to expire in the year 2009. Messrs. Ballin and Rickman have served as directors of the Company since 1999 and 2003 and directors of the Bank since 1980 and 2003, respectively. Mr. Heijer joined the Board on December 1, 2005, following the acquisition of NWB Financial Corporation. Directors Donald Bick and Ronald Taylor whose terms expire in 2006 will resign effective at the Annual Meeting, as required by the Bylaws that have a mandatory retirement age of 70.

The Board of Directors recommends that you vote FOR the nominees to be elected as directors.

If any of the nominees should refuse or be unable to serve, your Proxy will be voted for such persons as are designated by the Board of Directors to replace any such nominee. The Board of Directors presently has no knowledge that any nominee will refuse or be unable to serve. As of December 31, 2005, directors of the Company also served as directors of the Bank.

Robert Ballin, 64, has been a director of the Company and Bank since 1999 and 1980, respectively, and has served as Chairman of the Board since 2000. Mr. Ballin currently serves as Chairman of Willis, Eugene which is the largest insurance brokerage office between Portland and San Francisco. Among other professional interests, Mr. Ballin has also served on numerous community and philanthropic boards.

Michael E. Heijer, 46, joined the Board on December 1, 2005, following the acquisition of NWB Financial Corporation. Mr. Heijer was a founder of Northwest Business Bank and served on the Boards of Directors of NWB Financial Corporation and Northwest Business Bank until the Company acquired them in November 2005. He has 16 years experience in Pacific Northwest hotel and commercial real estate development and is the owner of GranCorp, Inc., a commercial real estate investment company that he formed in April 1986, with investments in the Pacific Northwest. Mr. Heijer is also a founder and part owner of American Legal Copy, a legal copying business serving the West Coast that was formed in May 1996. He holds a bachelor’s degree in economics from the University of California at Berkeley.

John H. Rickman, 64, has been a director of both the Company and Bank since 2003. Mr. Rickman retired from U.S. Bank in December of 2001, after more than 38 years of service. Prior to his retirement, Mr. Rickman served as President of U.S. Bank, Oregon and head of the bank’s Oregon commercial lending group. Mr. Rickman is involved with numerous civic and professional organizations including: the executive committee of the Portland Chamber, United Way campaign cabinet committee, member of the SOLV-Founders Circle, and Goodwill industries of Columbia-Willamette. He previously served on the board of the Oregon Business Council, the Association for Portland Progress, co-chair of the Oregon Mentoring Initiative, and the Portland Oregon Sports Authority. He is a past chairman of the Oregon Bankers Association.

Directors Retiring in 2006

Donald A. Bick, 70, has been a director of the Company and Bank since 1999, and 1972, respectively. Mr. Bick is an attorney and sole practitioner. From 1963 until 1999, Mr. Bick served as a partner at the law firm Bick & Monte, P.C. From 1971 through 1986, Mr. Bick served as Vice President of Eugene Aircraft Inc., a Piper Aircraft dealership. In addition, Mr. Bick served as a director of Black Butte Ranch, a destination resort property, serving two years as chairman.

Ronald F. Taylor, 69, has been a director of the Company and Bank since 1999, and 1973, respectively. In 1997, Mr. Taylor retired as the General Manager of Willamette Graystone Inc., a Northwest company, which produces and sells concrete and related masonry products. Mr. Taylor served as General Manager for Willamette Graystone for over 25 years.

Directors with Terms Expiring 2008

Michael S. Holcomb, 62, has been a director of the Company and Bank since 1999 and 1997, respectively. Mr. Holcomb is the Managing Partner of Berjac of Oregon, a Northwest Premium Financing Company for commercial insurance premiums. Prior to joining Berjac, Mr. Holcomb was a commissioned officer in the United States Air Force. Among other professional interests, Mr. Holcomb is involved in the Downtown Rotary and the Eugene Executive Association.

Donald G. Montgomery, 66, has been a director of the Company and Bank since 1999 and 1996, respectively, Vice Chairman of the Board since 2000 and currently serves as the chair of the Compensation Committee. Mr. Montgomery is currently a private investor. Mr. Montgomery formerly served as the Chief Operating Officer of the Timber Products Company, a privately owned wood products production and sales company. Prior to joining Timber Products, Mr. Montgomery worked for Kings Table International where he retired as Chief Operating Officer in 1985.

Donald L. Krahmer, Jr., 48, has been a director of both the Company and Bank since 2002, and currently serves as the chair of the Audit Committee. Mr. Krahmer is a Shareholder of the law firm Schwabe, Williamson and Wyatt, P.C. specializing in corporate law. Prior to joining Schwabe in 2003, Mr. Krahmer was a partner at Black Helterline, LLP and had held various management positions with Endeavour Capital, PacifiCorp Financial Services, PacifiCorp and U.S. Bancorp. Mr. Krahmer serves as a member of the board of directors of the Portland Business Alliance, and the Oregon Nanoscience and Microtechnologies Institute, which is a joint collaboration among Oregon State University, University of Oregon, Portland State University, and Battelle’s Pacific Northwest National Laboratory (PNNL). In 2005, Mr. Krahmer was appointed to serve as a technical advisor to the Oregon Innovation Council. Mr. Krahmer is a member of the American Bar Association's Business Law Section and its Corporate Governance, Venture Capital and Private Equity and Negotiated Acquisitions committees.

Directors with Terms Expiring 2007

Hal Brown, 52, was elected a director of both the Company and Bank in August 2002 following his July 2002 appointment as President and Chief Executive Officer of the Company and the Bank. Prior to his promotion, Mr. Brown served as the Executive Vice President and Chief Operating Officer of the Company and the Bank from 1999, and prior to that served as the Senior Vice President and Chief Financial Officer of the Company and the Bank from 1996. He began his career with the Bank in 1985 as Cashier. Mr. Brown currently serves on the boards of United Way of Lane County and ShelterCare, an organization serving the housing needs of homeless families and adults with severe and persistent mental disabilities.

Larry Campbell, 65, has been a director of the Company and Bank since 1999 and 1982, respectively. Mr. Campbell is the President of L.G. Campbell Co. Inc., which owns Campbell Commercial Real Estate. He is a past Board Member of the University of Oregon Alumni Association and the Eugene/Springfield Metro Partnership.

Michael D. Holzgang, 48, has been a director of both the Company and Bank since 2002 and currently serves as the chair of the Governance/Nominating Committee. Mr. Holzgang serves as Senior Vice President of Colliers International, a global real estate services firm. Prior to joining Colliers International in 2001, Mr. Holzgang worked with Cushman and Wakefield of Oregon for nearly 20 years. Among other volunteer board service, Mr. Holzgang is the past President of the Boys and Girls Clubs of Portland and currently acts as Chairman of NW Medical Teams International, an organization that coordinates the planning efforts of many voluntary organizations that respond to disasters.

DIRECTORS AND ITS COMMITTEES

The following sets forth information concerning the Board of Directors and certain Committees of the Company and the Bank for the fiscal year ended December 31, 2005.

The Company held 10 Board meetings and the Bank held 12 Board meetings in 2005. Each director attended at least 75% percent of the aggregate of (i) the total number of meetings of the Boards of Directors, and (ii) the total number of meetings held by all committees on which he served. During 2005 the Board of Directors met three times in executive session, without management present. The Company does not require, but expects the directors to attend the Annual Meeting of Shareholders, and at the 2005 Annual Meeting of Shareholders all serving directors were in attendance.

The Board has determined that each member of the Board, except for Hal Brown, who is the President and CEO of the Company, meets the applicable SEC requirements and listing standards regarding “independence” required by Nasdaq and that each such director is free of relationships that would interfere with the individual exercise of independent judgment.

The Company and the Board of Directors welcome communication from shareholders and have established a formal method for receiving such communication. The preferred method is by e-mail and can be most conveniently done by visiting the Company’s Website and clicking on the Corporate Governance link within the Investor Relations section on the Company’s home page (www.therightbank.com). By further clicking on Shareholder Communications, an e-mail dialog box will be made available for shareholder comments. The e-mail is sent to the Board Chair with a copy sent to the Company’s CEO.

For shareholders who do not have access to the Company’s Website, communications with the Board may also be made by writing to the Chairman of the Board, c/o the Corporate Secretary, Pacific Continental Corporation, P.O. Box 10727, Eugene, Oregon 97440-2727. A copy of such written communication will also be made available to the Company’s CEO.

If the Chairman and the CEO determine that such communications, whether received by e-mail or mail, are relevant to and consistent with the Company’s operations and policies, such communications will be forwarded to the entire Board for review and consideration.

The Company and Bank Boards have jointly established an Audit Committee, Compensation Committee, and a Corporate Governance/Nominating Committee. Each committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors. Committee charters are available for review on the Company’s Website by clicking on the Corporate Governance link within the Investor Relations section on the Company’s Website (www.therightbank.com).

The following table shows the membership of the various committees during the fiscal year 2005.

Committee Membership

Name | Audit | Compensation | Corporate Governance/ Nominating |

| Robert Ballin | £ | £ | þ |

| Donald Bick | þ | £ | £ |

| Michael Holcomb | þ | þ | £ |

| Michael Holzgang | þ | £ | þ * |

| Donald Krahmer, Jr. | þ * | £ | þ |

| Donald Montgomery | £ | þ * | þ |

| John Rickman | £ | þ | þ |

| Ronald Taylor | þ | þ | £ |

*Chairman

Audit Committee. The Audit Committee is currently comprised of five directors, each of who is considered “independent” (as defined by the Nasdaq listing standards). The committee operates under a formal written charter, a copy of which is attached as Appendix A. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the outside auditors performing or issuing an audit report, and approves the engagement and fees for all audit and non-audit functions, with the independent auditors reporting directly to the Audit Committee. The responsibilities of the Audit Committee include overseeing (i) the integrity of the Company’s financial statements, which includes reviewing the scope and results of the annual audit by the independent auditors, any recommendations of the independent auditors and management’s response to such recommendations, and the accounting principles being applied by the Company in financial reporting; (ii) the establishment of procedures for the receipt, retention and treatment of accounting controls; (iii) the reports of bank regulatory authorities and reporting its conclusions to the Board; (iv) the procedures with respect to the records and business practices of the Company and Bank, (v) the adequacy and implementation of the internal auditing, accounting and financial controls; (vi) the independent auditor’s qualifications and independence; and (vii) the compliance with the Company’s legal and regulatory requirements.

The Audit Committee oversees and evaluates the adequacy of the Company’s internal and disclosure controls, but management is responsible for developing and implementing the internal controls and the financial reporting process. The independent accountants are responsible for performing an audit of the consolidated financial statements in accordance with generally accepted auditing standards; then issues a report thereon. The committee’s responsibility is to monitor and oversee this process. The Committee held thirteen meetings during the year. The Board of Directors has determined that director Krahmer meets the definition of “audit committee financial expert” as defined in rules adopted by the Securities and Exchange Commission (SEC) under the Sarbanes Oxley Act of 2002 (the “Sarbanes Act”).

Compensation Committee. The Compensation Committee is currently comprised of four directors, each of whom is considered “independent” (as defined by the Nasdaq listing standards). The Compensation Committee reviews and approves the Company’s retirement and benefit plans, determines the salary and incentive compensation for Mr. Brown and certain other executive officers, and establishes compensation for directors. The Committee held four meetings during the year.

Corporate Governance/Nominating Committee. The Corporate Governance/Nominating Committee is currently comprised of five directors, each of whom is considered “independent” (as defined by the Nasdaq listing standards). The committee reviews and considers various corporate governance standards as suggested or required by SEC, Nasdaq and other regulatory agencies. These standards may include Company code of ethics, defining board member expectations, and review of Company committee charters. In addition, the committee recommends to the full Board a slate of director nominees for election at the Company’s annual meeting. The Committee held four meetings during the year.

The Corporate Governance/Nominating Committee will consider nominees recommended by shareholders, provided that the recommendations are made in accordance with the procedures described in this Proxy Statement under “Information Concerning Shareholder Proposals and Director Nominations.” The committee evaluates all candidates, including shareholder-proposed candidates, using generally the same methods and criteria, although those methods and criteria are not standardized and may vary from time to time. The committee is authorized to establish guidelines for the qualification, evaluation and selection of new directors to serve on the Board. We do not anticipate that the committee will adopt specific minimum qualifications for committee-recommended nominees, but that the committee will instead evaluate each nominee on a case-by-case basis, including assessment of each nominee’s business experience, involvement in the communities served by the Company, and special skills. The Corporate Governance/Nominating Committee will also evaluate whether the nominee’s skills are complimentary to existing Board members’ skills, and the Board’s need for operational, management, financial, technological or other expertise, as well as geographical representation of the Company's market areas.

Director Fees. For the year 2005 and as authorized by the Company’s Bylaws and approved by board resolution, the Company has established a program for director compensation in which each director of the Company receives $1,900 for each regularly scheduled meeting. The Chairman of the Board receives $2,100 for each regularly scheduled meeting. Board members serving on the Audit committee receive $150 for in-person attendance at committee meetings and $100 per scheduled telephone meetings. Board members of other committees receive $100 for meeting attendance. The Chairmen of the Audit, ALCO, Compensation, and Governance/Nominating committees each receive a quarterly retainer of $500. The Chairman of the Executive Committee does not receive a quarterly retainer.

Directors’ Stock Option Plan. The Company maintains a director stock option plan for the benefit of non-employee directors. The plan authorizes the non-employee directors of the Board to administer the plan and to grant nonqualified stock options to non-employee directors of the Company. The plan provides that the exercise price of options granted must be not less than the greater of (i) 100% of the fair market value; or (ii) the net book value of such stock on the date of the grant. All options granted under the plan expire not more than ten years from the date of grant and may be fully vested at the time of the grant.

In 1999, the Board adopted and the shareholders approved the current Director Stock Option Plan ("1999 DSOP"), providing for the grant of up to 100,000, (183,333 split-adjusted), shares of the Company’s Common Stock. At the 2003 Annual Meeting, the shareholders approved an amendment to the 1999 Director Stock Option Plan to increase the number of shares available under the plan by an additional 100,000, (166,667 split-adjusted), shares. At December 31, 2005, 151,000 shares remain available for issuance. At the 2006 Annual Meeting, shareholders will vote to approve a new equity compensation plan. If Proposal No. 2 is approved by the requisite vote of the shareholders, the 1999 DSOP will be frozen, no additional options under the 1999 DSOP will be granted, and any remaining shares available for grant will be deregistered.

Directors’ Stock Option Grants. In April 2005, the non-employee directors were awarded, in the aggregate, stock options to acquire 22,500 shares of Company common stock at a per share exercise price of $15.74. The options expire five years from the date of grant and vest over a three year period, with the first 34% vesting on the date of grant, and the remaining vesting at 33% each year thereafter.

BENEFICIAL OWNERS AND MANAGEMENT

The table on the following page shows, as of December 31, 2005, the amount of Common Stock beneficially owned by (a) each director and director nominee; (b) the executive officers named in the compensation table (“named executive officers”); (c) all persons who are beneficial owners of five percent or more of the Company’s Common Stock; and (d) all of the Company’s directors and executive officers as a group. Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a director or executive officer can vote or transfer and stock options that are exercisable currently or become exercisable within 60 days. Except as noted below, each holder has sole voting and investment power for all shares shown as beneficially owned. Where beneficial ownership was less than one percent of all outstanding shares, the percentage is not reflected in the table.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

Name | Position with Company | Number of Shares (1)(2) | Percentage of Shares |

| | | | |

Executive Officers and Directors | | |

| Hal M. Brown | Director, President and Chief Executive Officer | 220,298 | 2.14% |

Roger Busse | Executive Vice President, Chief Operating Officer | 10,521 | * |

| Mitchell J. Hagstrom | Executive Vice President, Director of Lane County Operations | 48,076 (3) | * |

Daniel J. Hempy | Executive Vice President, Director of Portland Operations | 49,679 | * |

Michael Reynolds | Executive Vice President, Chief Financial officer | 24,942 (4) | * |

| Robert A. Ballin | Chairman of the Board | 432,727 | 4.22% |

| Donald A. Bick | Director | 49,107 | * |

| Larry G. Campbell | Director | 80,560 | * |

| Michael E. Heijer | Director | 47,371(5) | * |

| Michael S. Holcomb | Director | 147,880 (6) | 1.44% |

| Michael D. Holzgang | Director | 10,835 | * |

| Donald L. Krahmer, Jr. | Director | 12,801 | * |

| Donald G. Montgomery | Vice Chairman of the Board | 28,415 | * |

| John H. Rickman | Director | 15,000 | * |

| Ronald F. Taylor | Director | 48,255 (7) | * |

| Directors and executive officers as a group (19 persons) | | 1,403,135 (8) | 13.24% |

| * Represents less than 1% of the Company’s outstanding Common Stock |

|

| 1. | Share amounts include options to acquire shares that are exercisable within 60 days as follows: Ballin 15,501 shares; Bick 10,001 shares; Brown 37,438 shares; Busse 10,521 shares; Campbell 15,501 shares; Hagstrom 20,638 shares; Heijer 10,019 shares; Hempy 41,345 shares; Holcomb 15,501 shares; Holzgang 10,001 shares; Krahmer 10,001 shares; Montgomery 10,001 shares; Reynolds 10,168 shares; Rickman 10,000 shares and Taylor 15,501 shares. |

| 2. | Share amounts include shares of Company common stock “jointly with spouse” as follows: Ballin 161,131 shares; Brown 182,860 shares; Hagstrom 27,054 shares; Heijer 34,469 shares; Hempy 8,334 shares; Holcomb 110,202 shares; Holzgang 834 shares; Reynolds 10,331 shares; and Rickman 5,000 shares. |

| 3. | Includes 384 shares held as custodian for child. |

| 4. | Includes 255 shares held by spouse. |

| 5. | Includes 2,883 shares held as custodian for child. |

| 6. | Includes 15,198 shares held jointly with children. |

| 7. | Includes 12,188 shares held by spouse. |

| 8. | Includes 360,132 shares subject to options that could be exercised within 60 days. |

5% Shareholder | | | |

Five M Investments, LLC 2100 Kimberly Circle Eugene, OR 97405 | | 558,417 | 5.46% |

The following table sets forth information with respect to the executive officers that are not director nominees or directors of the Bank, including employment history for the last five years.

Name | Age | Position with Bank and Five Year Employment History | Tenure as an Officer of the Bank |

| Carol Batchelor | 44 | Senior Vice President and Director of Human Resources since 2002 | 1995 |

| Roger Busse | 50 | Executive Vice President and Chief Operating Officer of Bank since 2005 (1) | 2003 |

| Mitchell J. Hagstrom | 49 | Executive Vice President and Director of Lane County Operations since 2004 | 1988 |

| Patricia Haxby | 55 | Senior Vice President and Chief Information Officer since 2002 | 1985 |

| Daniel J. Hempy | 46 | Executive Vice President, Director of Portland Operations since 2004 (2) | 2002 |

| Casey Hogan | 47 | Executive Vice President and Chief Credit Officer since 2005 | 1995 |

| Michael Reynolds | 54 | Executive Vice President and Chief Financial Officer of Company and Bank since 2004. | 1998 |

| Basant Singh | 49 | Executive Vice President and Director of Seattle Operations since 2005 (3) | 2005 |

(1) Mr. Busse previously worked for US Bank for 25 years serving in a variety of credit administration and commercial lending positions.

(2) Mr. Hempy previously worked at US Bank and was employed by US Bank since 1978.

(3) Mr. Singh previously served as President and CEO of NWB Financial Corporation and its subsidiary, Northwest Business Bank until being acquired by the Company in November of 2005.

The following table sets forth the last three fiscal years compensation received by the Chief Executive Officer and the four most highly compensated principal officers of the Company, whose total compensation during the last fiscal year exceeded $100,000. The Bank pays all compensation of the executive officers.

SUMMARY COMPENSATION TABLE

| | | | | | Long Term Compensation | |

| | Annual Compensation | Awards | Payouts | |

Name and Principal Position | Year | Salary | Bonus (1) | Other Annual Compensation (2) | Restricted Stock Awards | Securities Underlying Options/ SARs(#)(3) | LTIP Payouts | All Other Compensation (4)(5) |

Hal M. Brown President and Chief Executive Officer | 2005 2004 2003 | $215,490 $203,035 $198,715 | $118,800 $105,970 $ 87,000 | $0 $0 $0 | $0 $0 $0 | 0 12,000 9,375 | $0 $0 $0 | $ 30,437 $ 26,685 $ 25,505 |

Roger Busse, Executive Vice President, Chief Operating Officer | 2005 2004 2003 | $141,629 $124,827 $100,160 | $ 70,000 $ 50,200 $ 55,000 | $0 $0 $0 | $0 $0 $0 | 0 10,000 36,104 | $0 $0 $0 | $ 26,777 $ 15,987 $ 6,596 |

Mitchell J. Hagstrom, Executive Vice President, Director of Lane Cnty Operations | 2005 2004 2003 | $115,534 $103,157 $ 99,202 | $ 50,250 $ 41,300 $ 38,000 | $0 $0 $0 | $0 $0 $0 | 0 10,000 9,375 | $0 $0 $0 | $ 24,299 $ 19,716 $ 18,260 |

Daniel J. Hempy Executive Vice President, Director of Portland Operations | 2005 2004 2003 | $162,754 $161,140 $157,923 | $ 67,350 $ 62,900 $ 42,000 | $0 $0 $0 | $0 $0 $0 | 0 10,000 10,929 | $0 $0 $0 | $ 29,173 $ 25,471 $ 16,604 |

Michael Reynolds Executive Vice President, Chief Financial Officer | 2005 2004 2003 | $110,339 $ 99,624 $ 96,266 | $ 51,800 $ 39,000 $ 37,000 | $0 $0 $0 | $0 $0 $0 | 0 10,000 7,500 | $0 $0 $0 | $ 15,580 $ 14,885 $ 15,558 |

| 1. | Bonus accrued during the 2005 fiscal year and paid in 2006. |

| 2. | Does not include amounts attributable to miscellaneous benefits received by executive officers, including the use of company-owned automobiles and the payment of certain club dues. In the opinion of management, the costs to the Bank of providing such benefits to any individual executive officer during the year ended December 31, 2005 did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for the individual. |

| 3. | Adjusted to reflect the September 2004 5-for-4 and September 2003 4-for-3 stock splits and 10% stock dividends paid in 2004 and 2003. |

| 4. | Includes contributions accrued by the Bank during 2005 for the benefit of Messrs. Brown, Busse, Hagstrom, Hempy, and Reynolds in the amounts of $21,042, $14,175, $11,560, $16,626 and $11,040, respectively, pursuant to the Bank’s 401(k) Profit Sharing Plan. |

| 5. | Includes insurance premiums paid by the Bank during 2005 on behalf of Messrs. Brown, Busse, Hagstrom, Hempy and Reynolds in the amounts of $9,395, $12,602, $12,738, $12,547, and $4,540, respectively. |

Stock Option Grants. There were no individual grants of stock options under the stock option plans awarded to the named executive officers during the year ended December 31, 2005.

Stock Option Exercises. The table on the following page sets forth certain information concerning exercises of stock options pursuant to the Company’s stock option plans by the named executive officers during the year ended December 31, 2005 and stock options held at year-end.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND YEAR END OPTION VALUES |

Name | Shares Acquired on Exercise (1) | Value Realized | Number of Unexercised Options at Year End | Value of Unexercised Options at Year End (2) |

| | | | Exercisable | Unexercisable | Exercisable | Unexercisable |

| Hal M. Brown | 18,333 | $199,660 | 37,438 | 19,938 | $ 258,147 | $ 68,597 |

| Roger Busse | 0 | 0 | 10,521 | 18,854 | 41,766 | 64,430 |

| Mitchell J. Hagstrom | 6,383 | 56,667 | 20,638 | 14,271 | 125,741 | 34,889 |

| Daniel J. Hempy | 0 | 0 | 41,344 | 12,916 | 340,765 | 60,357 |

| Michael Reynolds | 4,166 | 31,953 | 10,168 | 13,333 | 46,169 | 31,069 |

| 1. | As adjusted for subsequent stock splits. |

| 2. | On December 31, 2005, the closing market price of the Common Stock was $ 15.89. For purposes of the foregoing table, stock options with an exercise price less than that amount are considered to be "in-the-money" and are considered to have a value equal to the difference between the estimated market price and the exercise price of the stock option multiplied by the number of stock option shares. |

Below are summaries of certain agreements between executive officers listed in the compensation table and the Company or the Bank. These summaries are qualified in their entirety by the individual agreements.

Hal Brown Employment Agreement. During 2002, the Bank and Company entered into an Employment Agreement (“Agreement”) with Hal Brown, who was elected to the Board of Directors and appointed President and Chief Executive Officer in 2002. The initial Agreement was for a term of three years, expiring on April 30, 2005. Annually, unless action is taken by the board otherwise, the term of the Agreement is extended for an additional one-year period, reestablishing a term of three years. The board took no such action during 2005, resulting in an extension of the original expiration date to April 30, 2008. Mr. Brown’s salary under his current agreement is $216,000, with a cash bonus opportunity. In the event Mr. Brown is terminated before the term ends for “good reason” or by the Company or the Bank, without “cause,” Mr. Brown will be entitled to receive compensation (including any bonus earned) and benefits in the amounts that they would have received had they been employed, for a period of 12 months from the date of termination. In addition, the Agreements provide for severance payments in the event employment is terminated (i) voluntarily or involuntarily within one year after a change in control (as defined); or (ii) involuntarily within one year prior to the occurrence of a change of control. In the event of a change in control, executive will be eligible to receive a lump sum payment equal to a multiple of two and one half times of the executive’s highest compensation received during any of the most recent three calendar years prior to or simultaneous with the change in control; and in the case of an involuntary termination following a change of control, the continuation of certain benefits, including portions of medical and dental insurance premiums, for a period of one year. Solely for purposes of illustration, the change in control severance benefit available to Mr. Brown under his employment agreement would be approximately $837,000 if a change in control occurs by the end of 2006 and if his employment terminates immediately before or after the change in control. Payments made under Mr. Brown’s agreement are limited to the provisions of Section 280G(b)(2)(A) of the Internal Revenue Code.

Executive Severance Agreements. During 2005, the Bank entered into Severance/Salary Continuation Severance Agreements with executive officers Messrs. Busse, Hagstrom, Hempy, and Reynolds. Under these agreements, Messrs. Busse and Reynolds are entitled to receive a Change in Control Payment in the event (i) they remain employed with the Company and the Bank through the closing of a Change in Control or (ii) the Company or the Bank terminates Messrs. Busse or Reynolds without cause or Messrs. Busse or Reynolds resign for good reason before a Change in Control, and, within twelve months thereafter, the Company or the Bank enters into an agreement or an announcement is made regarding a Change in Control. The single cash payment is equal to one times Messrs. Busse or Reynolds’ executive compensation. In case of a termination event after a Change in Control, Messrs. Busse and Reynolds are also entitled to a salary continuation payment, payable in a lump sum, equal to twelve months of Messrs. Busse or Reynolds’ Post Change in Control Salary (as defined). Messrs. Hagstrom and Hempy are entitled to receive a Change in Control Payment in the event (i) they remain employed with the Company and the Bank through the closing of a Change in Control or (ii) the Company or the Bank terminates Messrs. Hagstrom or Hempy without cause or Messrs. Hagstrom or Hempy resign for good reason before a Change in Control and within twelve months thereafter the Company or the Bank enters into an agreement or an announcement is made regarding a Change in Control. The single cash payment is equal to one-half times their respective compensation. In case of a termination event after a Change in Control, Messrs. Hagstrom and Hempy are also entitled to a salary continuation payment, payable in a lump sum, equal to eighteen months of Messrs. Hagstrom or Hempys’ Post Change in Control Salary. Payments made under Messrs. Busse, Reynolds, Hagstrom and Hempys’ respective agreements are limited to the provisions of Section 280G(b)(2)(A) of the Internal Revenue Code.

Solely for purposes of illustration, the maximum change in control severance benefit available to Messrs. Busse, Hagstrom, Hempy, and Reynolds under their respective agreements would be approximately $420,000, $336,000, $456,019, and $327,600 if a change in control occurs by the end of 2006 and if their employment terminates immediately before or after the change in control.

The Company maintains an Incentive Stock Option Plan for the benefit of employees of the Bank that is administered by the Company’s Compensation Committee. The 1999 Plan, which has a term of ten years, provides for granting to employees of the Bank options that qualify as “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986, and nonqualified stock options. In 1999, the Board adopted and the shareholders approved the current 1999 Employee Stock Option Plan ("1999 Plan") providing for the grant of up to 500,000 (916,667 split-adjusted), shares of the Company’s Common Stock. At the 2003 Annual Meeting the shareholders approved an amendment to the 1999 Plan to increase the number of shares available under the plan by an additional 500,000, (833,333 split-adjusted), shares. At December 31, 2005, 570,671 shares remain available for future issuance.

At the 2006 Annual Meeting shareholders will vote to approve a new equity based compensation plan. If Proposal No. 2 is approved by the requisite vote of the shareholders, the 1999 Plan will be frozen, no additional options under the 1999 Plan will be granted, and any remaining shares available for grant will be deregistered.

In connection with the acquisition of NWB Financial Corporation (“NWB Acquisition”) the company adopted NWB Financial Corporation’s Employee Stock Option Plan and Director Stock Option Plan (collectively, the “NWB Plans”). No further grants will be made under the NWB Plans.

The following table summarizes information regarding the Company’s equity compensation plans.

Equity Compensation Plan Information

| | Year Ended December 31, 2005 |

Plan Category | Number of Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (1)(2) (a) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (2) (b) | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding securities reflected in column (a)) (3) (c) |

Equity compensation plans approved by security holders | 1,114,232 | $ 10.82 | 721,671 |

Equity compensation plans not approved by security holders | 0 | $0 | 0 |

1. As adjusted to reflect subsequent stock splits and stock dividends.

��

2. Includes 219,599 shares reserved for issuance under the NWB Plans that were assumed by the Company in connection with the NWB Acquisition. No additional shares are available for future issuance under these plans.

3. The material terms of the Company’s equity compensation plans are described above.

The Bank has a 401(k) Profit Sharing Plan ("401(k) Plan") covering substantially all employees. An employee must be at least 18 years of age and have one year of service with the Bank to be eligible for the 401(k) Plan ("Effective Date"). Under the 401(k) Plan, participants may defer a percentage of their compensation, the dollar amount of which may not exceed the limit as governed by law. At the discretion of the Board, the Bank may also elect to pay a discretionary matching contribution equal to a percentage of the amount of the salary deferral made by the participant. The 401(k) Plan provides that contributions made are 100% vested immediately upon the participant’s Effective Date. During 2005, the amount accrued by the Bank for the benefit of employees under the 401(k) Plan totaled $534,862. The Bank acts as the Plan Administrator of the 401(k) Plan. The 401(k) Plan’s trustees determine general investment options. The 401(k) Plan participants make specific investment decisions.

Compensation Committee Report

The Compensation Committee of the Board of Directors makes the following report, which notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, will not be incorporated by reference into any such filings and will not otherwise be deemed to be proxy soliciting materials or to be filed under such Acts.

The following is a report of the Compensation Committee of the Board of Directors, which is responsible for establishing and administering the Company’s Executive and Director Compensation Programs. The Board of Directors has determined that all of the members of the Compensation Committee meet the independence requirements as defined under the Nasdaq listing standards. The Committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors, and the charter is available for review on the Company’s Website by clicking on the Corporate Governance link within the Investor Relations section on the Company’s home page (www.therightbank.com). The following report includes specific matters relating to compensation during the year 2005.

Compensation Philosophy and Objectives. The philosophy underlying the development and administration of the Company’s annual and long-term compensation plans align the interests of the shareholders with those of executive management. The key elements of this philosophy are designed to enhance overall shareholder value and to:

| | * | Attract and retain highly qualified executive officers; |

| | * | Establish compensation plans which deliver salary and incentive based compensation proportionate to the Company’s performance, as measured by operating, financial and strategic objectives and which are competitive in the marketplace; and |

| | * | Provide significant equity-based incentives for executives to ensure that they are motivated over the long-term to respond to the Company’s business challenges and opportunities as owners. |

Components of Executive Compensation. The Company structures executive base salaries to be competitive within the marketplace, both for similarly sized financial institutions and similarly complex organizations regardless of industry. Additional incentive based compensation is provided to recognize and reward individual and Company performance relative to certain Company objectives. The Company goals are a combination of operating, financial and strategic objectives that are considered to be critical to the Company’s goal of building long-term shareholder value. Specific measurements include loan and deposit growth, asset quality, return on average assets, return on average equity, revenue increases, expense control, growth in earnings per share and regulatory ratings. Other factors considered in making executive compensation determinations include customer satisfaction, new business creation, total stockholder return, the development of employees and the fostering of teamwork and other Company values.

Incentive based compensation programs include annual performance based bonus opportunities, stock option grants, and employer contributions to the 401(k)/Profit Sharing Plan. The Company’s incentive bonus program is administered by the Compensation Committee. Dollars for the bonus program are accumulated based on the earnings of the Company. For the year 2005, annual bonus opportunities were accrued as a percent of the executive’s base salary and awarded depending on individual performance and the Company’s results related to the accomplishment of specific strategic goals.

The Company’s current long-term incentive program consists of the amended 1999 Stock Option Plan and is administered by the Compensation Committee. The Committee believes executives who own shares of the Company’s Common Stock are more closely aligned with the long-term objectives of all shareholders. Stock option grants are established at the then fair market value of the Company’s Common Stock, thereby providing an incentive for executives to build shareholder value. Executives receive value from these grants if the Company’s Common Stock appreciates over the term of the grant. When granting stock options the Committee considers the dilutive effect such grants have on existing shareholder ownership. Factors such as overhang ratios and run rates are evaluated against other public companies of comparable size and/or industry.

The Company’s 401(k)/Profit Sharing Plan provides additional performance incentive. Company employer matches are discretionary and are administered by the Compensation Committee. Eligible employees may contribute a portion of their salary as a 401(k) contribution. Annually the Committee determines the degree to which eligible contributions are matched. The Committee has historically tied the employer match percentage to bank performance, specifically to the return on average assets.

The Company does not currently offer any deferred compensation plans or defined retirement benefits.

In determining executive salaries, including the Chief Executive Officer, the Committee reviews all components of compensation, including salary, bonus, equity and long-term incentive compensation, accumulated realized and unrealized stock option gains, the dollar value to the executive and cost to the Company of all perquisites and other personal benefits, and the actual projected payout obligations under several potential severance and change-in-control scenarios.

Compensation for the Chief Executive Officer. Hal Brown has served as President, Chief Executive Officer and a Director of the Company since July 2002. In establishing Mr. Brown’s compensation for 2005, the Compensation Committee used the executive compensation components described above in the same manner as they were applied to other executives. Prior to 2005, in addition to his compensation as President and Chief Executive Officer, Mr. Brown received compensation as a director. The Committee concluded that beginning in 2005, only outside directors are eligible to participate in director compensation plans. Therefore, beginning in 2005, Mr. Brown no longer received compensation as a director. The Committee considered the Company’s operating, financial and strategic goals, including loan and deposit growth, asset quality, return on average assets and average equity, revenue increases, expense controls, growth in earnings per share, regulatory ratings and the efforts associated with the successful acquisition of NWB Financial Corporation. Considering all of these factors, which were not specifically weighted, during 2005 the Committee recommended, and the Board approved, an increase in Mr. Brown’s salary to $216,000 and awarded a 2005 performance bonus of $118,800 (expensed in 2005, but paid in 2006.) For the year 2005 Mr. Brown’s cash compensation (salary and bonus) totaled $332,690 a 7.7% increase when compared to 2004 total cash compensation of $309,005.

Compensation for Outside Directors. During 2005 the Committee adjusted director compensation. The Committee evaluated “best practices” of other public reporting companies and adopted several changes effective January 1, 2005. Most significant was the elimination of a director incentive bonus. Also in recognition of the extra preparation and time requirements, committee chairs receive a $500 quarterly chair retainer. Additionally, board and committee meeting fees were increased. Directors receive $1,900 ($2,100 for the board chairman) for attending board meetings and fees of $100 to $150 for attending assigned committee meetings.

Compensation Committee

Donald G. Montgomery (Chairman)

Michael S. Holcomb

John Rickman

Ronald F. Taylor

Audit Committee Report

The Audit Committee of the Board of Directors makes the following report, which notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, will not be incorporated by reference into any such filings and will not otherwise be deemed to be proxy soliciting materials or to be filed under such

The following is a report of the Audit Committee of the Board of Directors, which is responsible for establishing and administering the Company’s internal controls. The Board of Directors has determined that all of the members of the Audit Committee meet the independence requirements as defined under the Nasdaq listing standards and reaffirmed that each member has no material relationship with the Company that would jeopardize the director’s ability to exercise independent judgment. The Board of Directors has determined that director Krahmer meets the definition of “audit committee financial expert” as defined by Item 401 of Regulation S-K. The Committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors, and the charter is attached as Appendix A to the 2006 Proxy Statement, and is also available for review on the Company’s Website by clicking on the Corporate Governance link within the Investor Relations section on the Company’s home page (www.therightbank.com).

The Audit Committee has met and held discussions with management and the Company’s independent accountants. Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Committee has also discussed with the independent accountants matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The independent accountants also provided to the Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Committee discussed with the independent accountants that firm’s independence.

Based on the Committee’s review of the audited consolidated financial statements and the various discussions with management and the independent accountants noted above, the Committee determined to include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, filed with the Securities and Exchange Commission.

During 2005, the Audit Committee approved a proposal for the creation of a Director of Internal Audit position within the Bank. The new Director of Internal Audit will be managing the overall operations of auditing within the bank as well as coordinating any external auditing functions for the Bank. The Director of Internal Audit reports directly to the Audit Committee of the Bank’s board of directors.

Audit Committee

Donald L. Krahmer, Jr., (Chairman)

Donald A. Bick

Michael S. Holcomb

Michael Holzgang

Ronald F. Taylor

Corporate Governance/Nominating Committee Report

The Compensation Committee of the Board of Directors makes the following report, which notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, will not be incorporated by reference into any such filings and will not otherwise be deemed to be proxy soliciting materials or to be filed under such Acts.

The following is a report of the Corporate Governance/Nominating Committee of the Board of Directors, which is responsible for the Company’s review and consideration of corporate governance standards and for establishing the annual ballot for director nominees. The Board of Directors has determined that all of the members of the Corporate Governance/Nominating Committee meet the independence requirements as defined under the Nasdaq listing standards. The Committee operates under a formal written charter approved by the Committee and adopted by the Board of Directors, and the charter is available for review on the Company’s Website by clicking on the Corporate Governance link within the Investor Relations section on the Company’s home page (www.therightbank.com).

The Corporate Governance/Nominating Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics new Board members should possess as well as the composition of the Board as a whole. This review includes an assessment of the absence or presence of material relationships with the Company which might impact independence, as well as consideration of diversity, skills, experience, time available and the number of other boards the member sits on in the context of the needs of the Board and the Company, and such other criteria as the Committee shall determine to be relevant at the time. The Corporate Governance/Nominating Committee recommends nominees for directorships to the Board in accordance with the foregoing and the policies and principles in its charter.

Philosophy and Responsibilities. The key elements of the philosophy underlying director responsibilities are:

| · | The Board will have a majority of outside directors. |

| · | All outside directors will, in the business judgment by the Board, meet the criteria for independence required by Nasdaq for continued listing and all other applicable legal requirements. |

| · | The Board believes in the separation of the offices of Chairman and the Chief Executive Officer. |

| · | The basic responsibility of the directors is to exercise their business judgment to act in what they reasonably believe to be in the best interests of the Company. In discharging that obligation, directors are entitled to rely on the honesty and integrity of the Company's senior executives and its outside advisors and auditors. |

| · | Directors are expected to attend Board meetings, the Annual Meeting of Shareholders, and meetings of committees on which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. |

Director Candidates: The Committee will recommend to the board the number of director positions required for the forthcoming year. When considering director nominations the Corporate Governance/Nominating Committee will give equal consideration to director candidates nominated by shareholders and the Committee’s own candidates, provided that the shareholder recommendations are made in accordance with the procedures described in this Proxy Statement under “INFORMATION CONCERNING SHAREHOLDER PROPOSALS AND DIRECTOR NOMINATIONS.” Candidates will be interviewed by the Committee (any expenses are the responsibility of the candidate) to evaluate the candidate’s competencies, business acumen, community visibility, Company share ownership, and such other criteria as the Committee shall determine to be relevant at the time. Current directors standing for reelection are not required to participate in an interview process.

Nominees for Director. In considering the director slate to be recommended to shareholders at the 2006 Annual Meeting of Shareholders, the Committee recommended establishing the current number of directors at nine. Four director terms expire in 2006. Current directors Ballin and Rickman have expressed a desire to continue service while current directors Bick and Taylor will retire as required by the Company’s bylaws. The Committee has recommended to the board that Messrs. Ballin and Rickman be nominated for reelection with three-year terms to expire in 2009.

Director Heijer. Director Heijer was appointed to the board of both the Company and the Bank at the regular board meetings of December 20, 2005. Mr. Heijer was formerly the chairman of the board for NWB Financial and Northwest Business Bank that were acquired by Pacific Continental Corporation on November 30, 2005. During negotiations the Committee offered, and Mr. Heijer accepted, the directorship appointment and the Committee’s commitment to nominate Mr. Heijer for election with a three-year term to expire in 2009.

Directors Bick and Taylor. Directors Bick and Taylor have served on the board since 1972 and 1973, respectively. At the 2006 Annual Meeting of Shareholders, and in accordance with the Company’s director retirement bylaws, Messrs. Bick and Taylor will retire from the board. The board and management wish to express their sincerest appreciation for the years of faithful service provided the Bank and Company.

Corporate Governance/Nominating Committee

Michael Holzgang (Chairman)

Donald L. Krahmer, Jr.

Robert A. Ballin

Donald G. Montgomery

John Rickman

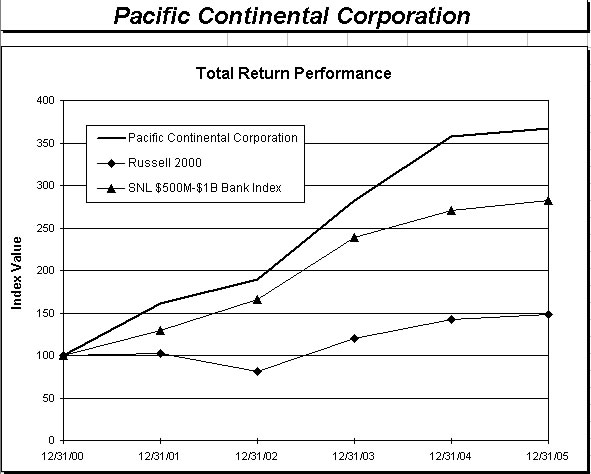

The above graph and following table compares the total cumulative shareholder return on the Company’s Common Stock, based on reinvestment of all dividends, to the cumulative total returns of the Russell 2000 Index and SNL Securities $500 to $1 Billion Bank Asset Size Index. The graph assumes $100 invested on December 31, 2000, in the Company’s Common Stock and each of the indices.

| | | December 31, | |

Index | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

| Pacific Continental Corporation | 100.00 | 161.64 | 189.39 | 282.88 | 357.31 | 366.85 |

| Russell 2000 | 100.00 | 102.49 | 81.49 | 120.00 | 142.00 | 148.46 |

| SNL $500M-$1B Bank Index | 100.00 | 129.74 | 165.63 | 238.84 | 270.66 | 282.26 |

The Board of Directors adopted the Pacific Continental Corporation 2006 Stock Option and Equity Compensation Plan (the “2006 Plan”) on February 21, 2006. The 2006 Plan is subject to shareholder approval at this Annual Meeting. Below is a summary of the principal provisions of the 2006 Plan and its operation. A copy of the 2006 Plan is set forth in full in Appendix B to this Proxy Statement, and the following description of the 2006 Plan is qualified in its entirety by reference to the full text of the plan.

The Board of Directors has adopted the 2006 Plan as the preferred vehicle for making future awards of equity-based incentive compensation to eligible employees and directors of the Company and its affiliates. The Company’s shareholders are being asked to approve the 2006 Plan as a successor to the Company’s 1999 Plan and the 1999 DSOP. If the 2006 Plan receives shareholder approval, the Company will register with the SEC, on Form S-8 Registration Statement, 500,000 shares of Company common stock (“Shares”) that would be subject to issue under the 2006 Plan, which as of the Record Date represent approximately 4.8% of the issued and outstanding shares of the Company. In view of the number of employees of the Company and its subsidiary, its recent acquisition and the fact that the Company may, in the future, make further acquisitions resulting in the hiring of additional employees, the Board of Directors recognizes the need for this number of Shares which may be issued pursuant to the 2006 Plan.

Further, if the 2006 Plan receives shareholder approval, the Company intends to freeze both the 1999 Plan and the 1999 DSOP and deregister, before the plans expire, the remaining shares that could have been issued under the respective 1999 plans. As of the Record Date, options to acquire an aggregate of 721,671 shares remain available for future grant under the two plans: 570,671 and 151,000 for the 1999 Plan and the 1999 DSOP, respectively.

The 2006 Plan’s principal difference from the 1999 plans relates to the greater flexibility that the 2006 Plan will provide with respect to the types of awards that could be made. The 1999 plans focused on stock options, while the 2006 Plan would allow grants not only in the form of stock options, but also in the form of stock appreciation rights, restricted stock, and restricted stock units. These types of awards are described below and are referred to collectively as “awards”.

The Board of Directors believes that the approval of the 2006 Plan is a critical factor in attracting, retaining and motivating employees and directors of the Company and its affiliates. The Board believes that the Company needs the flexibility both to have shares available for future equity-based awards, and to make future awards in a form other than stock options. Before granting any awards, the Company will carefully consider the effect of newly adopted financial accounting standards that relate to the financial expense arising from awards. One of the purposes in adopting the 2006 Plan is to provide the Company with the flexibility to be competitive in its marketplaces and best address changing accounting treatment of equity-based compensation.

The affirmative vote of the holders of a majority of the shares of Company common stock present in person or by proxy at the Annual Meeting and voting on this proposal is required to approve the proposal.

The Board of Directors unanimously recommends that the Company’s shareholders vote “FOR” approval of the 2006 Plan.

General. The 2006 Plan provides for the issuance of options that qualify as “incentive stock options,” within the meaning of Section 422 of the Internal Revenue Code of 1986, nonqualified stock options, stock appreciation rights, restricted stock and restricted stock units. Under the 2006 Plan, an “Award” will mean the grant of a stock option, restricted share, stock appreciation right or restricted stock unit. Directors, officers, and employees of the Company and its affiliates may be granted Awards, though only employees may receive stock options classified as “incentive stock options.”

Administration of 2006 Plan. The 2006 Plan will be administered by a committee of at least three Directors (the “Committee”), each of whom shall be a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Committee will have authority, subject to the terms of the 2006 Plan, to determine when and to whom to make grants under the plan, the type of award, and the number of shares to be covered by the grants, the fair market value of shares, the terms of the grants, which includes the exercise price of the shares of common stock covered by options, any applicable vesting provisions, and conditions under which awards may be terminated, expired, cancelled, renewed or replaced, and to construe and interpret the terms of the 2006 Plan and awards. Subject to applicable law, the Committee may delegate administrative functions to officers or other designated employees of the Company or its affiliates.

Options. Options granted under the 2006 Plan provide participants with the right to purchase shares at a predetermined exercise price. The Committee may grant incentive stock options (“ISOs”) and non-qualified stock options (“NQSOs”); provided that ISO treatment is not available for options that become first exercisable in any calendar year for shares that have a value exceeding $100,000 (based upon the fair market value of the shares on the option grant date).

All options granted under the 2006 Plan provide that the option exercise price is equal to the fair market value of the shares subject to the option at the time of grant and expire at such time as determined by the Committee; provided, however, that incentive stock options will expire no later than 10 years from the date of grant. The option exercise price is payable in cash or other consideration, including Company common stock. In the event of a Shareholder-Employee (defined as an employee owning 10% or more of the outstanding shares of the Company), the ISO exercise price will be at least 110% of the fair market value of the common stock on the date of grant, and will expire five years from the date of grant.

Restricted Stock Award. Restricted Stock Award means a share of common stock issued to an employee or director under the 2006 Plan that is subject to restrictions and conditions. The Restricted Stock Award will be evidenced by a written agreement that shall contain terms and conditions consistent with those of the 2006 Plan. Certificates representing the award may be held in escrow. Shares of common stock that are part of an award will vest upon satisfying such conditions as the Committee may determine, including, for example, completing a specified number of years of service and/or attaining performance goals. For example, the Committee may determine that such shares will vest over a period of four years from the date of grant (with 25% vesting on the first anniversary of the grant and 25% on each subsequent anniversary), provided the grantee is employed by the Company on each of such anniversary dates. The Committee may also determine that none of such shares will vest until the grantee has been employed by the Company for four years, at which time 100% of such shares will vest. The Committee may determine to use a shorter or longer vesting period than four years. An Employee holding a Restricted Stock Award (both vested and unvested) will have the rights of a shareholder (including voting, dividend and liquidation rights) with respect to the shares subject to the award.

Restricted Stock Unit. A Restricted Stock Unit means the right to receive a payment in cash or common stock in an amount equal to the fair market value of the common stock on the date of exercise of the right to receive payments under the Restricted Stock Unit. A Restricted Stock Unit will be evidenced by a written agreement that shall contain terms and conditions consistent with those of the 2006 Plan. Restricted Stock Units will vest upon satisfying such conditions as the Committee may determine, including, for example, completing a specified number of years of service or attaining performance goals similar to those described in the section under Restricted Stock Award. An employee or director holding a Restricted Stock Unit will have none of the rights of a shareholder (including the payment of cash dividends) until such time as shares, if any, are actually issued. Upon termination of employment, any unvested portion of a Restricted Stock Unit will be forfeited.

Stock Appreciation Right. A Stock Appreciation Right means the right to receive payment in cash or common stock in an amount equal to the excess of the fair market value of the common stock on the date of exercise of the right to receive payments under the Stock Appreciation Right and the fair market value of the common stock at the time of grant. The Stock Appreciation Right will be evidenced by a written agreement that shall contain terms and conditions consistent with those of the Amended Plan. Stock Appreciation Rights will vest upon satisfying such conditions as the Committee may determine, including, for example, completing a specified number of years of service or attaining performance goals similar to those described in the section under Restricted Shares. An employee or director holding a Stock Appreciation Right will have none of the rights of a shareholder (including the payment of cash dividends) until such time as shares, if any, are actually issued. Upon termination of employment, any unvested portion of a Stock Appreciation Right will be forfeited.

Repricing of Stock Options. The 2006 Plan does not allow for the exercise price of outstanding options to be changed, except (i) with the approval of shareholders; or (ii) as may be required under the terms of the 2006 Plan in connection with a change in the capital structure of the Company, such as a stock split or stock dividend, subdivision or consolidation, or other increase or decrease in the number of shares effected without receipt of consideration by the Company.

Transferability. Awards may not be sold, pledged, assigned, hypothecated, transferred, or disposed of other than by will or the laws of descent or distribution if specifically permitted by the plan.

Certain Corporate Transactions. Subject to any required action by the shareholders, the number of shares of common stock subject to awards, the number of shares of common stock available for grants under additional awards, the exercise price for shares of common stock specified in each outstanding Option, and the value of common stock used to determine amounts required to be paid under Restricted Stock Units and Stock Appreciation rights shall be proportionately adjusted for any increase or decrease in the number of issued shares of common stock resulting from a stock split or other subdivision or consolidation of shares, the payment of any stock dividend (but only on the common stock) or any other increase or decrease in the number of such shares of common stock effected without receipt of consideration by the Company. In the event of a merger or other reorganization whereby the Company is not the surviving entity, all awards shall immediately vest as of the date of the closing of such transaction, unless the Committee elects to vest the awards as of an earlier date. Notwithstanding the immediately preceding sentence, if the surviving, successor or acquiring corporation in the transaction (or its parent) agrees to replace awards with rights to its shares that confer substantially the same benefits as those represented by the awards, as determined by the Committee, then the awards shall not vest but shall be so replaced. The Committee shall notify each grantee in writing of any action to vest or replace awards hereunder not less than sixty (60) days prior to the expected closing date of the transaction that prompts such action.

Term of the 2006 Plan; Amendments or Termination. The Plan has an unlimited duration; provided, however, that the Board of Directors has the authority to terminate the Plan at any time and incentive stock options may not be granted more than 10 years after the earlier of the date the Plan is adopted or approved by the shareholders. The Plan may be amended by the Board of Directors without shareholder approval, except that no such amendment may (i) increase the number of shares that may be issued pursuant to the Plan, or (ii) modify the Plan in a manner that would require shareholder approval under any applicable laws or regulations. All granted but unexercised options under the existing Plan will remain outstanding for their respective terms.

Income Tax Withholding. As a condition for the issuance of shares pursuant to Awards, the 2006 Plan requires satisfaction of any applicable federal, state, local, or foreign withholding tax obligations that may arise in connection with the award or the issuance of shares.

Incentive Stock Options. Holders of incentive stock options incur no federal income tax (other than potential alternative minimum tax) on the grant or exercise of such options. When stock received upon exercise of an incentive stock option is sold at a gain, the holder incurs tax at capital gain rates, provided the stock is treated in its hands as a capital asset. The Company will generally not be entitled to a deduction for any amount relating to stock issued under an incentive stock option. The exercise price of incentive stock options may be no less than the fair market value of the common stock of Pacific at the time of grant.