SECURITIES & EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

COMMISSION FILE NUMBER 0-30106

PACIFIC CONTINENTAL CORPORATION

(Exact name of registrant as specified in its charter)

OREGON 93-1269184

(State of Incorporation) (IRS Employer Identification No)

111 West 7th Avenue

Eugene, Oregon 97401

(Address of principal executive offices)

(541) 686-8685

(Registrant’s telephone number)

Securities registered pursuant to 12(b) of the Act: None

Securities registered pursuant to 12(g) of the Act:

No Par Value Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes __ No X

Indicate by check mark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act Yes __ No X

Check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ___

Check if there is no disclosure of delinquent filers in response to item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this Form 10-K. ( X )

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer __ Accelerated filer X Non-accelerated filer __

Indicate by check mark whether the registrant is registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act Yes __ No X

The aggregate market value of the voting stock held by non-affiliates of the Registrant at June 30, 2006 (the last business day of the most recent second quarter) was $173,926,000 based on the closing price as quoted on the NASDAQ National Market on that date.

The number of shares outstanding of each of the registrant’s classes of common stock, as of March 9, 2007, was 10,720,384 shares of no par value Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference information from the registrant’s definitive proxy statement for the 2007 annual meeting of shareholders.

PACIFIC CONTINENTAL CORPORATION

FORM 10-K

ANNUAL REPORT

TABLE OF CONTENTS

PART 1 | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

PART II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART III | (Items 10 through 14 are incorporated by reference from Pacific Continental Corporation’s definitive proxy statement for the annual meeting of shareholders scheduled for April 24, 2007) | |

| | |

| | |

| | |

| | |

| | |

PART IV | | |

| | |

| | |

| | |

PART I

General

Pacific Continental Corporation (the “Company” or the “Registrant”) is an Oregon corporation and registered bank holding company located in Eugene, Oregon. The Company was organized on June 7, 1999, pursuant to a holding company reorganization of Pacific Continental Bank, its wholly owned subsidiary.

The Company’s principal business activities are conducted through its full-service commercial bank subsidiary, Pacific Continental Bank (the “Bank”), an Oregon state-chartered bank with deposits insured by the Federal Deposit Insurance Corporation (“FDIC”). The Bank has two subsidiaries, PCB Service Corporation (presently inactive), which holds and manages Bank property, and PCB Loan Services (presently inactive), which manages certain other real estate owned.

On November 30, 2005, the Company acquired NWB Financial Corporation (“NWBF”) for a combination of stock and cash and entered the metropolitan Seattle market in the State of Washington. Combined, the stock and cash transaction was valued at approximately $40.4 million. The acquisition was accounted for under the purchase method of accounting and, accordingly, the results of operations of NWBF have been included in the consolidated financial statements only since the date of acquisition. For more information regarding the Company’s acquisition of NWBF see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” in Items 7 and 8 of this Form 10-K.

With the acquisition of NWBF, the Bank now operates in three primary markets: Portland, Oregon / Southwest Washington market; Seattle, Washington market; and Lane County, Oregon market. The Bank opened its fifth full-service office in the Portland / Southwest Washington market in Vancouver, Washington during the second quarter 2006. At December 31, 2006, the Bank operated fourteen full-service offices and two consumer finance lending offices in seven Oregon and two Washington cities. During the fourth quarter 2006, the Bank lost the use of its office in Bellevue, Washington due to an accident at a nearby construction site, which severely damaged the Bank’s facility. The Bank expects to open a temporary office in the Bellevue market during first quarter 2007 and will use a temporary facility until the original office location is repaired, which is expected during third quarter 2007. The Bank has not lost any clients due to the temporary closure of the Bellevue office and is fully insured for any damage to its facility.

Subsequent to December 31, 2006, the Bank announced it would close its existing Tualatin, Oregon office and relocate to a new highly visible site on I-5, approximately one mile from the current office location. Construction of the new Tualatin, Oregon office is expected to be completed during the fourth quarter 2007.

Results

For the year ended December 31, 2006, the consolidated net income of the Company was $12.7 million or $1.18 per diluted share. At December 31, 2006, the consolidated equity of the Company was $95.7 million with 10.6 million shares outstanding and a book value of $8.99 per share. Total assets were $885.4 million. Loans, including loans held for sale, net of allowance for loan losses, were $761.0 million at December 31, 2006 and represented 86% of total assets. Deposits totaled $641.3 million at year-end 2006. For more information regarding the Company’s financial condition and results of operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” in sections 7 and 8 of this Form 10-K.

THE BANK

General

The Bank commenced operations on August 15, 1972. At December 31, 2006, the Bank operated fourteen banking offices and two consumer finance lending offices in Oregon and Washington. The primary business strategy of the Bank is to provide comprehensive banking and related services tailored to community-based business, not-for-profits, professional service providers and private banking services for business owners and executives. The Bank emphasizes the diversity of its product lines, high levels of personal service, and through technology, offers convenient access typically associated with larger financial institutions, while maintaining local decision-making authority and market knowledge, typical of a local community bank. More information on the Bank and its banking services can be found on its website www.therightbank.com. The Bank operates under the banking laws of the State of Oregon, State of Washington and the rules and regulations of the FDIC and the Federal Reserve Bank of San Francisco.

Primary Market Area

The Bank’s primary markets consist of the metropolitan Portland, which includes Southwest Washington, and Eugene areas in the State of Oregon and the metropolitan Seattle area in the State of Washington. The Bank has five full-service banking offices in the metropolitan Portland and Southwest Washington area, seven full-service banking offices in the metropolitan Eugene area, and two full-service offices in the metropolitan Seattle area. In addition, the Bank operates consumer finance lending offices in the Oregon cities of Eugene and Coos Bay. The Bank has its headquarters and administrative office in the city of Eugene.

Competition

Commercial banking in the state of Oregon and Washington is highly competitive with respect to providing banking services, including making loans and attracting deposits. The Bank competes with other banks, as well as with savings and loan associations, savings banks, credit unions, mortgage companies, investment banks, insurance companies, and other financial institutions. Banking in Oregon and Washington is dominated by several large banking institutions, including U.S. Bank, Wells Fargo Bank, Bank of America, and Washington Mutual Bank, which together account for a majority of the total commercial and savings bank deposits in Oregon and Washington. These competitors have significantly greater financial resources and offer a much greater number of branch locations. The Bank has attempted to offset the advantage of the larger competitors by focusing on certain market segments, providing high levels of customization and personal service, and tailoring its technology, products, and services to the specific market segments that the Bank serves.

In addition to larger institutions, numerous “community” banks or credit unions have been formed, expanded or moved into the Bank’s three primary areas and have developed a similar focus to the Bank. These institutions have further increased competition in all three of the Bank’s primary markets. This growing number of similar financial institutions and an increased focus by larger institutions in the Bank’s primary markets has led to intensified competition in all aspects of the Banks business, particularly in the area of deposits.

The adoption of the Gramm-Leach-Bliley Act of 1999 (the “GLB Act”) has led to further intensification of competition in the financial services industry. The GLB Act has eliminated many of the barriers to affiliation among providers of various types of financial services and has permitted business combinations among financial service providers such as banks, insurance companies, securities or brokerage firms, and other financial service providers. Additionally, the rapid adoption of financial services through the Internet has reduced or even eliminated many barriers to entry by financial services providers physically located outside our market area. For example, remote deposit services, partly developed in response to the recently adopted Check 21 law, allow depository companies physically located in other geographical markets to service local businesses with minimal cost of entry. Although the Bank has been able to compete effectively in the financial services business in its markets to date, there can be no assurance that it will be able to continue to do so in the future.

The financial services industry has experienced widespread consolidation over the last decade. The Company anticipates that consolidation among financial institutions in its market area will continue. The Company seeks acquisition opportunities, from time to time, in its existing markets and in new markets of strategic importance to it. However, other financial institutions aggressively compete against the Bank in the acquisition market. Some of these institutions may have greater access to capital markets, larger cash reserves, and stock for use in acquisitions that is more liquid and more highly valued by the market.

Services Provided

Lending Activities

The Bank emphasizes specific areas of lending within its primary market areas: loans to community-based businesses, including professional service providers, not-for-profit organizations and private banking services for business owners and executives.

Commercial loans, secured and unsecured, are made primarily to professionals, community-based businesses, and not-for-profit organizations. These loans are available for general operating purposes, acquisition of fixed assets, purchases of equipment and machinery, financing of inventory and accounts receivable, and other business purposes. The Bank also originates Small Business Administration (“SBA”) loans and enjoys a national preferred lender status with the SBA.

Within its primary markets, the Bank also concentrates on construction loan financing for commercial facilities and for pre-sold, custom, and speculative home construction. The major thrust of residential construction lending is for the construction of single-family residences. The Bank also finances requests for multi-family residences.

Fixed-rate and variable rate residential mortgage loans are offered through the Bank’s mortgage loan department. Most residential mortgage loans originated are sold in the secondary market along with the mortgage loan servicing rights.

The Bank makes secured and unsecured loans to individuals for various purposes including purchases of automobiles, mobile homes, boats, and other recreational vehicles, home improvements, education, and personal investment.

The Bank offers credit card services to its business customers and uses an outside vendor for credit card processing. In addition, the Bank provides merchant bankcard processing services, through an outside processor, for its business customers.

The Board of Directors has approved specific lending policies and procedures for the Bank and management is responsible for implementation of the policies. The lending policies and procedures include guidelines for loan term, loan-to-value ratios, collateral appraisals, and cash flow coverage. The loan policies also vest varying levels of loan authority in management, the Bank’s Loan Committee, and the Board of Directors. Bank management monitors lending activities through management meetings, weekly loan committee meetings, monthly reporting, and periodic review of loans by third-party contractors.

The Bank has a Consumer Finance Division which operates under the business name Pacific Continental Finance. At December 31, 2006, this Division had approximately $11.1 million in outstanding loans which are primarily secured loans to individuals for various purposes including automobiles, mobile homes, boats, and home improvements or home equity loans. At December 31, 2006, approximately 84% of Consumer Finance loans were secured by real estate. A small percentage of loans made by this division are unsecured. The majority of loans made by the Consumer Finance Division are classified as sub-prime lending and have yields appropriate to the credit risk assumed.

Deposit Services

The Bank offers a full range of deposit services that are typically available in most banks and savings banks, including checking, savings, money market accounts, and time deposits. The transaction accounts and time deposits are tailored to the Bank’s primary markets and market segments at rates competitive with those offered in the area. Additional deposits are generated through national networks for institutional deposits and the State of Oregon and State of Washington for public time deposits. All deposit accounts are insured by the FDIC to the maximum amount permitted by law.

The Bank has invested continuously in image technology since 1994 for the processing of checks. The Bank was the first financial institution in Lane, Multnomah, Clackamas, and Washington Counties to offer this service. In addition, the Bank provides on-line banking services to businesses and consumers and allows 24-hour customer access to deposit and loan information via telephone and on-line cash management products.

Merchant Card Services

The Bank provides merchant card services to its clients, which includes processing of credit card transactions and issuance of business credit cards. This service is an integral part of the Bank’s business focus to market to community-based business, not-for-profits, and service providers. During 2006, the Company processed approximately $150 million in credit card transactions for its merchant clients.

Other Services

The Bank provides other traditional commercial and consumer banking services, including cash management products for businesses, on-line banking, safe deposit services, debit and ATM cards, ACH transactions, savings bonds, cashier’s checks, travelers checks, notary services and others. The Bank is a member of numerous ATM networks and utilizes an outside processor for the processing of these automated transactions.

Employees

At December 31, 2006, the Bank employed 257 full-time equivalent employees with 226 in Oregon and 31 in Washington. None of these employees are represented by labor unions, and management believes that the Company’s relationship with employees is good. The Company emphasizes a positive work environment for its employees, which is validated by recognition from independent third parties. The Bank was recognized for the fifth consecutive year by Oregon Business Magazine as one of Oregon’s Best 100 Companies for which to work. In addition, in 2004, the Bank was named as the number one small company (employees under 250) to work for in the State of Oregon by Oregon Business Magazine. Management continually strives to retain and attract top talent as well as provide career development opportunities to enhance skill levels. A number of benefit programs are available to eligible employees, including group medical plans, paid sick leave, paid vacation, group life insurance, 401(k) plans, and equity compensation plans.

Supervision and Regulation

General

The following discussion describes elements of the extensive regulatory framework applicable to the Company and the Bank. This regulatory framework is primarily designed for the protection of depositors, federal deposit insurance funds and the banking system as a whole rather than specifically for the protection of shareholders. Due to the breadth of this regulatory framework, our costs of compliance continue to increase in order to monitor and satisfy these requirements.

To the extent that this section describes statutory and regulatory provisions, it is qualified in its entirety by reference to those provisions. Those statutes and regulations, as well as related policies, are subject to change by Congress, state legislatures and federal and state regulators. Changes in statutes, regulations or regulatory policies applicable to the Company, including interpretation or implementation thereof, could have a material effect on the Company’s business or operations.

Federal Bank Holding Company Regulation

General. The Company is a bank holding company as defined in the Bank Holding Company Act of 1956, as amended (“BHCA”), and is therefore subject to regulation, supervision and examination by the Federal Reserve. In general, the BHCA limits the business of bank holding companies to owning or controlling banks and engaging in other activities closely related to banking. The Company must file reports with and provide the Federal Reserve with such additional information as it may require.

Holding Company Bank Ownership. The BHCA requires every bank holding company to obtain the prior approval of the Federal Reserve before (1) acquiring, directly or indirectly, ownership or control of any voting shares of another bank or bank holding company if, after such acquisition, it would own or control more than 5% of such shares, (2) acquiring all or substantially all of the assets of another bank or bank holding company, or (3) merging or consolidating with another bank holding company.

Holding Company Control of Nonbanks. With some exceptions, the Bank Holding Company Act also prohibits a bank holding company from acquiring or retaining direct or indirect ownership or control of more than 5% of the voting shares of any company which is not a bank or bank holding company, or from engaging directly or indirectly in activities other than those of banking, managing or controlling banks, or providing services for its subsidiaries. The principal exceptions to these prohibitions involve certain non-bank activities that, by statute or by Federal Reserve regulation or order, have been identified as activities closely related to the business of banking or of managing or controlling banks.

Transactions with Affiliates. Subsidiary banks of a bank holding company are subject to restrictions imposed by the Federal Reserve Act on extensions of credit to the holding company or its subsidiaries, on investments in their securities and on the use of their securities as collateral for loans to any borrower. These regulations and restrictions may limit the Company’s ability to obtain funds from the Bank for its cash needs, including funds for payment of dividends, interest and operational expenses.

Tying Arrangements. The Company is prohibited from engaging in certain tie-in arrangements in connection with any extension of credit, sale or lease of property or furnishing of services. For example, with certain exceptions, neither the Company nor its subsidiaries may condition an extension of credit to a customer on either (1) a requirement that the customer obtain additional services provided by us or (2) an agreement by the customer to refrain from obtaining other services from a competitor.

Support of Subsidiary Banks. Under Federal Reserve policy, the Company is expected to act as a source of financial and managerial strength to the Bank. This means that the Company is required to commit, as necessary, resources to support the Bank. Any capital loans a bank holding company makes to its subsidiary banks are subordinate to deposits and to certain other indebtedness of those subsidiary banks.

State Law Restrictions. As an Oregon corporation, the Company is subject to certain limitations and restrictions under applicable Oregon corporate law. For example, state law restrictions in Oregon include limitations and restrictions relating to lending limits related to individual borrowers, indemnification of directors, distributions to shareholders, transactions involving directors, officers or interested shareholders, maintenance of books, records, and minutes, and observance of certain corporate formalities.

Federal and State Regulation of Pacific Continental Bank

General. The Bank is an Oregon commercial bank operating in Oregon and Washington with deposits insured by the FDIC. As a result, the Bank is subject to supervision and regulation by the Oregon Department of Consumer and Business Services and the FDIC. These agencies have the authority to prohibit banks from engaging in what they believe constitute unsafe or unsound banking practices. Additionally, the Bank’s branches in Washington are subject to supervision and regulation by the Washington Department of Financial Institutions and must comply with applicable Washington laws regarding community reinvestment, consumer protection, fair lending and intrastate branching.

Community Reinvestment. The Community Reinvestment Act of 1977 requires that, in connection with examinations of financial institutions within their jurisdiction, the Federal Reserve or the FDIC evaluate the record of the financial institution in meeting the credit needs of its local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of the institution. A bank’s community reinvestment record is also considered by the applicable banking agencies in evaluating mergers, acquisitions and applications to open a branch or facility.

Insider Credit Transactions. Banks are also subject to certain restrictions imposed by the Federal Reserve Act on extensions of credit to executive officers, directors, principal shareholders or any related interests of such persons. Extensions of credit (1) must be made on substantially the same terms, including interest rates and collateral, and follow credit underwriting procedures that are at least as stringent, as those prevailing at the time for comparable transactions with persons not covered above and who are not employees; and (2) must not involve more than the normal risk of repayment or present other unfavorable features. Banks are also subject to certain lending limits and restrictions on overdrafts to insiders. A violation of these restrictions may result in the assessment of substantial civil monetary penalties, the imposition of a cease and desist order, and other regulatory sanctions.

Regulation of Management. Federal law (1) sets forth circumstances under which officers or directors of a bank may be removed by the institution's federal supervisory agency; (2) places restraints on lending by a bank to its executive officers, directors, principal shareholders, and their related interests; and (3) prohibits management personnel of a bank from serving as a director or in other management positions of another financial institution whose assets exceed a specified amount or which has an office within a specified geographic area.

Safety and Soundness Standards. Federal law imposes certain non-capital safety and soundness standards upon banks. These standards cover internal controls, information systems and internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth, compensation, fees and benefits, such other operational and managerial standards as the agency determines to be appropriate, and standards for asset quality, earnings and stock valuation. An institution that fails to meet these standards must develop a plan acceptable to its regulators, specifying the steps that the institution will take to meet the standards. Failure to submit or implement such a plan may subject the institution to regulatory sanctions.

Interstate Banking And Branching

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 ("Interstate Act") permits nationwide interstate banking and branching under certain circumstances. This legislation generally authorizes interstate branching and relaxes prior interstate branching restrictions under federal law. Generally, bank holding companies may purchase banks in any state, and states may not prohibit these purchases. Additionally, banks are permitted to merge with banks in other states, as long as the home state of neither merging bank has opted out under the legislation. The Interstate Act requires regulators to consult with community organizations before permitting an interstate institution to close a branch in a low-income area. Federal banking agency regulations prohibit banks from using their interstate branches primarily for deposit production and they have each implemented a loan-to-deposit ratio screen to ensure compliance with this prohibition.

Oregon and Washington have both enacted “opting in” legislation in accordance with the Interstate Act provisions allowing banks to engage in interstate merger transactions, subject to certain “aging” requirements. Oregon restricts an out-of-state bank from opening de novo branches. However, once an out-of-state bank has acquired a bank within Oregon, either through merger or acquisition of all or substantially all of the bank's assets, the out-of-state bank may open additional branches within Oregon. Under Washington law, an out-of-state bank may, subject to Department of Financial Institutions’ approval, open de novo branches in Washington or acquire an in-state branch so long as the home state of the out-of-state bank has reciprocal laws with respect to de novo branching or branch acquisitions.

Deposit Insurance

In February 2006, the President signed federal deposit insurance reform legislation. The legislation (i) required the FDIC to merge the Bank Insurance Fund and the Savings Association Insurance Fund into a newly created Deposit Insurance Fund, which was completed in 2006; (ii) increases the amount of deposit insurance coverage for retirement accounts; (iii) allows for deposit insurance coverage on individual accounts to be indexed for inflation starting in 2010; (iv) provides the FDIC more flexibility in setting and imposing deposit insurance assessments; and (v) provides eligible institutions, such as the Company’s banking subsidiaries, credits on future assessments.

The Bank’s deposits are currently insured to a maximum of $100,000 per depositor through the Deposit Insurance Fund. The Bank is required to pay deposit insurance premiums, which are assessed and paid regularly. The premium amount is based upon a risk classification system established by the FDIC. Banks with higher levels of capital and a low degree of supervisory concern are assessed lower premiums than banks with lower levels of capital or a higher degree of supervisory concern.

Dividends

The principal source of the Company’s cash reserves is dividends received from the Bank and the payment of these dividends is subject to government regulation. Regulatory authorities may prohibit banks and bank holding companies from paying dividends in a manner that would constitute an unsafe or unsound banking practice. In addition, a bank may not pay cash dividends if doing so would reduce the amount of its capital below that necessary to meet minimum applicable regulatory capital requirements. State laws also limit a bank's ability to pay dividends.

Capital Adequacy

Regulatory Capital Guidelines. Federal bank regulatory agencies use capital adequacy guidelines in the examination and regulation of bank holding companies and banks. The guidelines are “risk-based,” meaning that they are designed to make capital requirements more sensitive to differences in risk profiles among banks and bank holding companies.

Tier I and Tier II Capital. Under the guidelines, an institution’s capital is divided into two broad categories, Tier I capital and Tier II capital. Tier I capital generally consists of common stockholders’ equity, surplus and undivided profits. Tier II capital generally consists of the allowance for loan losses, hybrid capital instruments, and subordinated debt. The sum of Tier I capital and Tier II capital represents an institution’s total capital. The guidelines require that at least 50% of an institution’s total capital consist of Tier I capital.

Risk-based Capital Ratios. The adequacy of an institution’s capital is gauged primarily with reference to the institution’s risk-weighted assets. The guidelines assign risk weightings to an institution’s assets in an effort to quantify the relative risk of each asset and to determine the minimum capital required to support that risk. An institution’s risk-weighted assets are then compared with its Tier I capital and total capital to arrive at a Tier I risk-based ratio and a total risk-based ratio, respectively. The guidelines provide that an institution must have a minimum Tier I risk-based ratio of 4% and a minimum total risk-based ratio of 8%.

Leverage Ratio. The guidelines also employ a leverage ratio, which is Tier I capital as a percentage of average total assets, less intangibles. The principal objective of the leverage ratio is to constrain the maximum degree to which a bank holding company may leverage its equity capital base. The minimum leverage ratio is 3%; however, for all but the most highly rated bank holding companies and for bank holding companies seeking to expand, regulators expect an additional cushion of at least 1% to 2%.

Prompt Corrective Action. Under the guidelines, an institution is assigned to one of five capital categories depending on its total risk-based capital ratio, Tier I risk-based capital ratio, and leverage ratio, together with certain subjective factors. The categories range from “well capitalized” to “critically undercapitalized.” Institutions that are "undercapitalized" or lower are subject to certain mandatory supervisory corrective actions.

In 2006, the federal banking agencies, including the FDIC and the Federal Reserve, provided notice of proposed rulemaking that would change the existing risk-based capital framework by enhancing its risk sensitivity. Whether such revisions are implemented or what effect they might have on the Company or the Bank cannot be predicted at this time, but we do not expect our operations to be significantly impacted.

Corporate Governance and Accounting Legislation

Sarbanes-Oxley Act of 2002. The Sarbanes-Oxley Act of 2002 (the “Act”) addresses, among other things, corporate governance, auditing and accounting, enhanced and timely disclosure of corporate information, and penalties for non-compliance. Generally, the Act (i) requires chief executive officers and chief financial officers to certify to the accuracy of periodic reports filed with the Securities and Exchange Commission (the “SEC”); (ii) imposes specific and enhanced corporate disclosure requirements; (iii) accelerates the time frame for reporting of insider transactions and periodic disclosures by public companies; (iv) requires companies to adopt and disclose information about corporate governance practices, including whether or not they have adopted a code of ethics for senior financial officers and whether the audit committee includes at least one “audit committee financial expert;” and (v) requires the SEC, based on certain enumerated factors, to regularly and systematically review corporate filings.

To deter wrongdoing, the Act: (i) subjects bonuses issued to top executives to disgorgement if a restatement of a company's financial statements was due to corporate misconduct; (ii) prohibits an officer or director misleading or coercing an auditor; (iii) prohibits insider trades during pension fund “blackout periods”; (iv) imposes new criminal penalties for fraud and other wrongful acts; and (v) extends the period during which certain securities fraud lawsuits can be brought against a company or its officers.

As a publicly reporting company, we are subject to the requirements of the Act and related rules and regulations issued by the SEC and NASDAQ. After enactment, we updated our policies and procedures to comply with the Act’s requirements and have found that such compliance, including compliance with Section 404 of the Act relating to management control over financial reporting, has resulted in significant additional expense for the Company. We anticipate that we will continue to incur such additional expense in our ongoing compliance.

Anti-terrorism Legislation

USA Patriot Act of 2001. The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, intended to combat terrorism, was renewed with certain amendments in 2006 (the “Patriot Act”). Certain provisions of the Patriot Act were made permanent and other sections are now subject to extended “sunset” provisions. The Patriot Act, in relevant part, (1) prohibits banks from providing correspondent accounts directly to foreign shell banks; (2) imposes due diligence requirements on banks opening or holding accounts for foreign financial institutions or wealthy foreign individuals (3) requires financial institutions to establish an anti-money-laundering compliance program, and (4) eliminates civil liability for persons who file suspicious activity reports. The Act also includes provisions providing the government with power to investigate terrorism, including expanded government access to bank account records. While the Patriot Act has had minimal affect on our record keeping and reporting expenses, we do not believe that the renewal and amendment will have a material adverse effect on our business or operations.

Financial Services Modernization

Gramm-Leach-Bliley Act of 1999. The Gramm-Leach-Bliley Financial Services Modernization Act of 1999 brought about significant changes to the laws affecting banks and bank holding companies. Generally, the Act (i) repeals the historical restrictions on preventing banks from affiliating with securities firms, (ii) provides a uniform framework for the activities of banks, savings institutions and their holding companies, (iii) broadens the activities that may be conducted by national banks and banking subsidiaries of bank holding companies, (iv) provides an enhanced framework for protecting the privacy of consumer information and requires notification to consumers of bank privacy policies and (v) addresses a variety of other legal and regulatory issues affecting both day-to-day operations and long-term activities of financial institutions. Bank holding companies that qualify and elect to become financial holding companies can engage in a wider variety of financial activities than permitted under previous law, particularly with respect to insurance and securities underwriting activities.

Recent Legislation

Financial Services Regulator Relief Act of 2006. In October 2006, the President signed the Financial Services Regulatory Relief Act of 2006 into law (the “Relief Act”). The Relief Act amends several existing banking laws and regulations. It eliminates some unnecessary and overly burdensome regulations of depository institutions and clarifies several existing regulations. The Relief Act, among other things, (i) authorizes the Federal Reserve Board to set reserve ratios; (ii) amends national bank regulations relating to shareholder voting and granting of dividends; (iii) amends several provisions relating to such issues as loans to insiders, regulatory applications, privacy notices, and golden parachute payments; and (iv) expands and clarifies the enforcement authority of federal banking regulators. It is too early to predict the impact this legislation may have on us, but we do not expect our business, expenses, or operations will be significantly impacted.

Effects Of Government Monetary Policy

Our earnings and growth are affected not only by general economic conditions, but also by the fiscal and monetary policies of the federal government, particularly the Federal Reserve. The Federal Reserve implements national monetary policy for such purposes as curbing inflation and combating recession, but its open market operations in U.S. government securities, control of the discount rate applicable to borrowings from the Federal Reserve, and establishment of reserve requirements against certain deposits, influence the growth of bank loans, investments and deposits, and also affect interest rates charged on loans or paid on deposits. The nature and impact of future changes in monetary policies and their impact on us cannot be predicted with certainty.

Statistical Information

Selected Quarterly Information

The following chart contains data for the last eight quarters ending December 31, 2006. All data, except per share data, is in thousands of dollars.

YEAR | | | | | | 2006 | | | | | | 2005 | | | | | |

QUARTER | | Fourth | | Third | | Second | | First | | Fourth | | Third | | Second | | First | |

| Interest income | | $ | 16,743 | | $ | 16,062 | | $ | 15,165 | | $ | 14,002 | | $ | 11,697 | | $ | 9,791 | | $ | 9,432 | | $ | 8,673 | |

| Interest expense | | | 6,139 | | | 5,865 | | | 5,269 | | | 4,642 | | | 3,150 | | | 2,323 | | | 2,111 | | | 1,769 | |

| Net interest income | | | 10,604 | | | 10,197 | | | 9,896 | | | 9,360 | | | 8,547 | | | 7,468 | | | 7,321 | | | 6,904 | |

| Provision for loan loss | | | - | | | 150 | | | 200 | | | 250 | | | 300 | | | 250 | | | 325 | | | 225 | |

| Noninterest income | | | 1,033 | | | 1,354 | | | 1,056 | | | 957 | | | 970 | | | 1,050 | | | 1,091 | | | 972 | |

| Noninterest expense | | | 6,590 | | | 6,109 | | | 5,704 | | | 5,389 | | | 5,191 | | | 4,253 | | | 4,360 | | | 4,330 | |

| Net income | | | 3,093 | | | 3,441 | | | 3,188 | | | 2,932 | | | 2,754 | | | 2,469 | | | 2,305 | | | 2,050 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PER COMMON | | | | | | | | | | | | | | | | | | | | | | | | | |

| SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (basic) | | $ | 0.29 | | $ | 0.32 | | $ | 0.30 | | $ | 0.28 | | $ | 0.30 | | $ | 0.28 | | $ | 0.26 | | $ | 0.24 | |

| Net income (diluted) | | $ | 0.29 | | $ | 0.32 | | $ | 0.30 | | $ | 0.28 | | $ | 0.29 | | $ | 0.27 | | $ | 0.26 | | $ | 0.23 | |

| Cash dividends | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 | | $ | 0.07 | | $ | 0.07 | | $ | 0.07 | | $ | 0.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 10,630,313 | | | 10,592,960 | | | 10,525,387 | | | 10,379,908 | | | 9,307,691 | | | 8,782,476 | | | 8,747,028 | | | 8,697,517 | |

| Diluted | | | 10,833,801 | | | 10,703,864 | | | 10,710,295 | | | 10,566,140 | | | 9,591,642 | | | 9,002,313 | | | 8,990,960 | | | 8,955,573 | |

Investment Portfolio

The following chart contains information regarding the Company’s investment portfolio. All of the Company’s investment securities are accounted for as available-for-sale and are reported at estimated fair value. The difference between estimated fair value and amortized cost, net of deferred taxes, is recorded as a separate component of stockholders’ equity.

INVESTMENT PORTFOLIO

ESTIMATED FAIR VALUE

(dollars in thousands)

| | | | | | | December 31, | | | | |

| | | | 2006 | | | 2005 | | | 2004 | |

| US Treasury, US Government agencies and corporations, and | | | | | | | | | | |

| agency mortgagebacked securities | | $ | 14,501 | | $ | 16,757 | | $ | 6,390 | |

| Obligations of states and political subdivisions | | | 5,596 | | | 4,820 | | | 3,059 | |

| Other mortgage-backed securities | | | 18,686 | | | 17,768 | | | 18,109 | |

| Total | | $ | 38,783 | | $ | 39,345 | | $ | 27,558 | |

| | | | | | | | | | | |

The following chart presents the fair value of each investment category by maturity date and includes a weighted average yield for each period. Mortgage-backed securities have been classified based on their December 31, 2006 projected average life.

SECURITIES AVAILABLE-FOR-SALE

(dollars in thousands)

| | Within One Year | | | | After One Year But Within five Years | | | | After Five Years But Within Ten Years | | | | After Ten Years | | | |

| | | | Amount | | | Yield | | | Amount | | | Yield | | | Amount | | | Yield | | | Amount | | | Yield | |

| US Treasury, US Government | | | | | | | | | | | | | | | | | | | | | | | | | |

| agencies and agency mortgage- | | | | | | | | | | | | | | | | | | | | | | | | | |

| backed securities | | $ | 4,593 | | | 5.27 | % | $ | 26,072 | | | 5.25 | % | $ | 497 | | | 5.29 | % | $ | 2,026 | | | 5.49 | % |

| Obligations of states and political | | | | | | | | | | | | | | | | | | | | | | | | | |

| subdivisions | | | 476 | | | 5.43 | % | | 997 | | | 5.20 | % | | 3,225 | | | 4.04 | % | | 897 | | | 3.93 | % |

| Total | | $ | 5,069 | | | 5.29 | % | $ | 27,069 | | | 5.25 | % | $ | 3,722 | | | 4.20 | % | $ | 2,923 | | | 5.01 | % |

Loan Portfolio

Loans represent a significant portion of the Company’s total assets. Average balance and average rates paid by category of loan is included in Table I, “Average Balance Analysis of Net Interest Earnings”, on page 29 of the Company’s “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included later in this report. The following tables contain information related to the Company’s loan portfolio, including loans held for sale, for the five-year period ended December 31, 2006.

LOAN PORTFOLIO

(dollars in thousands)

| | | | | | | December 31, | | | | | |

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| Commercial Loans | | $ | 169,566 | | $ | 160,988 | | $ | 107,538 | | $ | 89,127 | | $ | 94,345 | |

| Real Estate Loans | | | 590,855 | | | 507,479 | | | 341,111 | | | 255,150 | | | 222,727 | |

| Loans held for sale | | | 2,140 | | | 642 | | | 2,072 | | | 1,958 | | | 5,546 | |

| Consumer Loans | | | 9,168 | | | 12,463 | | | 10,380 | | | 11,424 | | | 9,579 | |

| | | | 771,729 | | | 681,572 | | | 461,101 | | | 357,659 | | | 332,197 | |

| Deferred loan origination fees | | | (2,489 | ) | | (2,609 | ) | | (2,061 | ) | | (1,582 | ) | | (1,394 | ) |

| | | | 769,240 | | | 678,963 | | | 459,040 | | | 356,077 | | | 330,803 | |

| Allowance for loan losses | | | (8,284 | ) | | (7,792 | ) | | (5,224 | ) | | (5,225 | ) | | (4,403 | ) |

| | | $ | 760,956 | | $ | 671,171 | | $ | 453,816 | | $ | 350,852 | | $ | 326,400 | |

| | | | | | | | | | | | | | | | | |

The following table presents loan portfolio information by loan category related to maturity and repricing sensitivity. Variable rate loans are included in the time frame in which the interest rate on the loan could be first adjusted. Loans held for sale of $2,140 are included in the Real Estate category.

MATURITY AND REPRICING DATA FOR LOANS

(dollars in thousands)

| | | Commercial | | Real Estate | | Consumer | | Total | |

| Three months or less | | $ | 101,367 | | $ | 261,139 | | $ | 5,748 | | $ | 368,254 | |

| Over three months through 12 months | | | 8,273 | | | 38,618 | | | 478 | | | 47,369 | |

| Over 1 year through 3 years | | | 13,474 | | | 114,851 | | | 1,023 | | | 129,348 | |

| Over 3 years through 5 years | | | 32,167 | | | 119,039 | | | 852 | | | 152,058 | |

| Over 5 years through 15 years | | | 14,285 | | | 59,348 | | | 1,067 | | | 74,700 | |

| Total loans | | $ | 169,566 | | $ | 592,995 | | $ | 9,168 | | $ | 771,729 | |

Loan Concentrations

At December 31, 2006, residential construction loans totaled $100,996 and represented 13.1% of outstanding loans. In addition, at December 31, 2006, unfunded loan commitments for residential construction totaled approximately $59,642. At year end there were no nonaccrual loans and no impaired loans in this industry. No other single industry group represents more than 10% of outstanding loans. Approximately 77% of the Bank’s loans are secured by real estate. The granular nature of the portfolio, both from industry mix and loan size, continues to disburse risk concentration.

Within the loan portfolio, loans in the hotel/motel industry account for 3.3% of the total loan portfolio at December 31, 2006. There were no foreclosed or non-accrual hotel/motel properties as of year end December 31, 2006. All hotel/motel loans are performing according to their contractual terms. In view of the uncertainties in this industry, the Company continues to carefully monitor loans made by the Bank in this industry.

NONPERFORMING ASSETS

(dollars in thousands)

| | | | | | | | | | December 31, | | | | | | | |

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| Nonaccrual loans | | $ | - | | $ | 180 | | $ | 1,004 | | $ | 1,506 | | $ | 6,176 | |

| 90 or more days past due and still accruing | | | - | | | - | | | 213 | | | 545 | | | 359 | |

| Total nonperforming loans | | | - | | | 180 | | | 1,217 | | | 2,051 | | | 6,535 | |

| Government guarantees | | | - | | | (28 | ) | | (101 | ) | | (233 | ) | | (1,563 | ) |

| Net nonperforming loans | | | - | | | 152 | | | 1,116 | | | 1,818 | | | 4,972 | |

| Foreclosed assets | | | - | | | 131 | | | 262 | | | 411 | | | 864 | |

| Total nonperforming assets | | $ | - | | $ | 283 | | $ | 1,378 | | $ | 2,229 | | $ | 5,836 | |

| | | | | | | | | | | | | | | | | |

| Nonperforming assets as a percentage of | | | | | | | | | | | | | | | | |

| of total assets | | | 0.00 | % | | 0.04 | % | | 0.27 | % | | 0.52 | % | | 1.54 | % |

| | | | | | | | | | | | | | | | | |

If interest on nonaccrual loans had been accrued, such income would have been approximately $14, $89, and $98, respectively, for years 2006, 2005 and 2004.

Allowance for Loan Loss

The following chart presents information about the Company’s allowances for loan losses. Management evaluates the allowance monthly and considers the amount to be adequate to absorb possible loan losses.

ALLOWANCE FOR LOAN LOSS

(dollars in thousands)

| | | | | | | | | | December 31, | | | | | | | |

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| Balance at beginning of year | | $ | 7,792 | | $ | 5,224 | | $ | 5,225 | | $ | 4,403 | | $ | 3,418 | |

| Charges to the allowance | | | | | | | | | | | | | | | | |

| Real estate loans | | | - | | | (214 | ) | | (79 | ) | | (843 | ) | | (4,138 | ) |

| Consumer loans | | | (71 | ) | | (106 | ) | | (269 | ) | | (104 | ) | | (123 | ) |

| Commercial | | | (152 | ) | | (316 | ) | | (168 | ) | | (238 | ) | | (542 | ) |

| Total charges to the allowance | | | (223 | ) | | (636 | ) | | (516 | ) | | (1,185 | ) | | (4,803 | ) |

| Recoveries against the allowance | | | | | | | | | | | | | | | | |

| Real estate loans | | | 4 | | | 37 | | | 73 | | | 799 | | | 49 | |

| Consumer loans | | | 20 | | | 56 | | | 54 | | | 15 | | | 10 | |

| Commercial | | | 91 | | | 31 | | | 70 | | | 103 | | | 69 | |

| Total recoveries against the allowance | | | 115 | | | 124 | | | 197 | | | 917 | | | 128 | |

| | | | | | | | | | | | | | | | | |

| Acquisition | | | - | | | 2,014 | | | - | | | 190 | | | - | |

| Provisions | | | 600 | | | 1,100 | | | 500 | | | 900 | | | 5,660 | |

| Unfunded commitments * | | | - | | | (34 | ) | | (182 | ) | | - | | | - | |

| Balance at end of the year | | $ | 8,284 | | $ | 7,792 | | $ | 5,224 | | $ | 5,225 | | $ | 4,403 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net charge offs as a percentage of total | | | | | | | | | | | | | | | | |

| average loans | | | 0.01 | % | | 0.10 | % | | 0.08 | % | | 0.08 | % | | 1.62 | % |

| | | | | | | | | | | | | | | | | |

* Allowance for unfunded commitments is presented as part of the other liabilities in the balance sheet.

The following table sets forth the allowance for loan losses allocated by loan type at December 31, 2006:

| Real estate loans | | $ | 5,749 | |

| Consumer loans | | | 149 | |

| Commercial | | | 2,306 | |

| Unallocated | | | 80 | |

| | | | | |

| Allowance for loan losses | | $ | 8,284 | |

| | | | | |

During 2006, the Bank recorded a provision for loan losses of $600 compared to $1,100 for the year 2005. The decrease in the loan loss provision reflected improvement in credit quality throughout the year 2006 and is reflective of the fact that at December 31, 2006, the Bank has no nonperforming loans or assets. At December 31, 2006, the recorded investment in certain loans totaling $496 was considered impaired. Impaired loans at December 31, 2006 consist of two loans to a single borrower totaling $496 that are performing under revised terms. A specific reserve of $109 is provided for these loans and is included in the $8,284 allowance for loan losses at December 31, 2006.

Deposits

Deposits represent a significant portion of the Company’s liabilities. Average balance and average rates paid by category of deposit is included in Table I, “Average Balance Analysis of Net Interest Earnings”, within the Company’s “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included on page 30 of this report. The chart below details the Company’s time deposits at December 31, 2006. The Company does not have any foreign deposits. Variable rate deposits are listed by first repricing opportunity.

TIME DEPOSITS

(dollars in thousands)

| | | Time Deposits | | Time Deposits | | | |

| | of $100,000 | | of less than | | Total | |

| | Or more | | $100,000 | | Time Deposits | |

| Three months or less | | $ | 24,782 | | $ | 23,909 | | $ | 48,691 | |

| Over three months through twelve months | | | 17,281 | | | 20,446 | | | 37,727 | |

| Over one year through three years | | | 6,365 | | | 3,904 | | | 10,269 | |

| Over three years | | | 448 | | | 440 | | | 888 | |

| | | $ | 48,876 | | $ | 48,699 | | $ | 97,575 | |

Short-term Borrowings

The Company uses short-term borrowings to fund fluctuations in deposits and loan demand. The Company’s only subsidiary, Pacific Continental Bank, has access to both secured and unsecured overnight borrowing lines. At December 31, 2006, the Bank had unsecured and secured borrowing lines totaling approximately $370,000. At December 31, 2006, available unsecured borrowing lines with various correspondent banks and a secured line with the Federal Reserve Bank of San Francisco was approximately $104,000. The Federal Home Loan Bank of Seattle (FHLB) also provides a secured borrowing line using a blanket pledge of commercial real estate loans. The Bank’s FHLB borrowing limit at December 31, 2006 was 30% of assets or $266,000, subject to sufficient collateral and stock investment.

SHORT-TERM BORROWINGS

(dollars in thousands)

| | | | 2006 | | | 2005 | | | 2004 | |

| Federal Funds Purchased, FHLB CMA & Short Term Advances | | | | | | | | | | |

| Average interest rate | | | | | | | | | | |

| At year end | | | 5.55 | % | | 4.33 | % | | 2.75 | % |

| For the year | | | 5.31 | % | | 3.35 | % | | 2.46 | % |

| Average amount outstanding for the year | | $ | 73,171 | | $ | 17,693 | | $ | 12,596 | |

| Maximum amount outstanding at any month end | | $ | 99,410 | | $ | 34,825 | | $ | 31,790 | |

| Amount outstanding at year end | | $ | 99,410 | | $ | 24,000 | | $ | 31,790 | |

| | | | | | | | | | | |

In addition to these borrowings at December 31, 2006, the Bank had other FHLB borrowings in the amount of $36,804 with a weighted average remaining maturity of 2 years.

Long-term Borrowings

The Company acquired $8,248 in junior subordinated debentures on November 28, 2005, due on January 7, 2036, to help fund the acquisition of NWBF. These debentures are priced at 6.265% for five years and then convert to a floating rate instrument at 135 basis points over the 3-month LIBOR.

Our business exposes us to certain risks. The following is a discussion of the most significant risks and uncertainties that may affect our business, financial condition and future results.

Fluctuating interest rates can adversely affect our profitability

Our profitability is dependent to a large extent upon net interest income, which is the difference (or “spread”) between the interest earned on loans, securities and other interest-earning assets and interest paid on deposits, borrowings, and other interest-bearing liabilities. Because of the differences in maturities and repricing characteristics of our interest-earning assets and interest-bearing liabilities, changes in interest rates do not produce equivalent changes in interest income earned on interest-earning assets and interest paid on interest-bearing liabilities. Accordingly, fluctuations in interest rates could adversely affect our interest rate spread, and, in turn, our profitability. Because our Company is asset sensitive, we seek to manage our interest rate risk within well established guidelines. Generally, the Company seeks an asset and liability structure that insulates net interest income from large deviations attributable to changes in market rates.

Our allowance for loan losses may not be adequate to cover actual loan losses, which could adversely affect our earnings

We maintain an allowance for loan losses in an amount that we believe is adequate to provide for losses inherent in the portfolio. While we strive to carefully manage and monitor credit quality and to identify loans that may become nonperforming, at any time there are loans included in the portfolio that will result in losses, but that have not been identified as nonperforming or potential problem loans. By managing our credit quality, we attempt to identify deteriorating loans before they become nonperforming assets and adjust the loan loss reserve accordingly. However, because future events are uncertain, there may be loans that deteriorate to a nonperforming status in a relatively short time frame. As a result of these types of situations, future additions to the allowance may be necessary. Because the loan portfolio contains a significant number of commercial and commercial real estate loans with relatively large balances, the deterioration of one or a few of these loans may cause a significant increase in nonperforming loans, requiring an increase to the loan loss allowance. Additionally, future additions to the allowance may be required based on changes in the loans comprising the portfolio and changes in the financial condition of borrowers, such as may result from changes in economic conditions, or as a result of incorrect assumptions by management in determining the allowance. Additionally, federal banking regulators, as an integral part of their supervisory function, periodically review our allowance for loan losses. These regulatory agencies may require us to recognize further loan loss provisions or charge-offs based upon their judgments, which may be different from ours. Any increase in the allowance for loan losses could have a negative effect on our financial condition and results of operation.

An economic downturn in the market areas we serve may cause us to have lower earnings and could increase our credit risk associated with our loan portfolio

The inability of borrowers to repay loans can erode our earnings. Substantially all of our loans are to businesses and individuals in Oregon and Washington, and any decline in the economy of these market areas could impact us adversely. As a lender, we are exposed to the risk that our customers will be unable to repay their loans in accordance with their terms, and that any collateral securing the payment of their loans may not be sufficient to assure repayment.

None

The principal properties of the registrant are comprised of the banking facilities owned by the Bank. The Bank operates fourteen full service facilities and two consumer finance offices. The Bank owns a total of seven buildings and, with the exception of one building, owns the land on which these buildings are situated. Significant properties owned by the Bank are as follows:

| 1) | Three-story building and land with approximately 30,000 square feet located on Olive Street in Eugene, Oregon. |

| 2) | Building with approximately 4,000 square feet located on West 11th Avenue in Eugene, Oregon. The building is on leased land. |

| 3) | Building and land with approximately 8,000 square feet located on High Street in Eugene, Oregon. |

| 4) | Three-story building and land with approximately 31,000 square feet located in the Gateway area of Springfield, Oregon. The Bank occupies approximately 5,500 square feet of the first floor and approximately 5,900 square feet on the second floor and leases out, or is seeking to lease out, the remaining space. |

| 5) | Building and land with approximately 3,500 square feet located in Beaverton, Oregon. |

| 6) | Building and land with approximately 2,000 square feet located in Junction City, Oregon. |

| 7) | Building and land with approximately 5,000 square feet located in Portland, Oregon. |

The Bank leases facilities for branch offices in Seattle, Washington, Bellevue, Washington, Portland, Oregon, Vancouver, Washington, and Tualatin, Oregon; two branch offices and one consumer finance lending office located in Eugene, Oregon and one consumer finance office in Coos Bay, Oregon. In addition, the Bank leases a portion of an adjoining building to the High Street office for administrative and training functions. Management considers all owned and leased facilities adequate for current use. The Bank is presently investigating additional space in Eugene, Oregon to house various Bank administrative departments.

During the fourth quarter 2006, the Bank lost the use of its office in Bellevue, Washington due to an accident at a nearby construction site, which severely damaged the Bank’s facility. The Bank expects to open a temporary office in the Bellevue market during first quarter 2007 and will use the temporary facility until the original office location is repaired, which is expected during third quarter 2007. The Bank has not lost any clients due to the temporary closure of the Bellevue office and is fully insured for any damage to its facility.

Subsequent to December 31, 2006, the Bank announced it would close its existing Tualatin, Oregon office and relocate to a new highly visible site on I-5, approximately one mile from the current office location. Construction of the new Tualatin, Oregon office is expected to be completed during the fourth quarter 2007.

As of the date of this report, neither the Company nor the Bank or any of its subsidiaries is party to any material pending legal proceedings, including proceedings of governmental authorities, other than ordinary routine litigation incidental to the business of the Bank.

There were no matters submitted to a vote of security holders during the fourth quarter of 2006.

PART II

Issuer Purchases of Securities

The Company did not repurchase any shares of its common stock during the fourth quarter of 2006. The Company had no sales of securities during the past three years, other than those issued pursuant to its stock option plans.

Dividends

The Company pays cash dividends on a quarterly basis, typically in March, June, September and December of each year. The Board of Directors considers the dividend amount quarterly and takes a broad perspective in its dividend deliberations including a review of recent operating performance, capital levels, and growth projections. The Board also considers dividend payout ratios, dividend yield, and other financial metrics in setting the quarterly dividend. The Company declared and paid cash dividends of $0.32 per share for the year 2006. That compares to cash dividends of $0.28 per share paid for the year 2005.

Equity Compensation Plan Information

| | Year Ended December 31, 2006 |

| | Number of Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (2)(3) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (3) | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (2) |

Equity compensation plans approved by security holders(1) | 780,932 | $ 13.56 | 404,950 |

| | | | |

Equity compensation plans not approved by security holders | 0 | $0 | 0 |

| (1) | Under the Company’s respective equity compensation plans, the Company may grant incentive stock options and non-qualified stock options, restricted stock, restricted stock units and stock appreciation rights to its employees and directors, however only employees may receive incentive stock options. |

| (2) | All amounts have been adjusted to reflect subsequent stock splits and stock dividends. |

| (3) | Includes 21,140 shares reserved for issuance under the NWBF Plans that were assumed by the Company in |

connection with the acquisition of NWB Financial Corporation in November 2005. No additional shares are available for future issuance under these plans.

Market Information

The Company’s common stock trades on the NASDAQ Global Market under the symbol PCBK. At March 9, 2007, the Company had 10,720,384 shares of common stock outstanding held by approximately 669 shareholders.

The high, low and closing sales prices (based on daily closing price) for the last eight quarters are shown in the table below.

YEAR | | 2006 | | | | | 2005 | | |

QUARTER | Fourth | Third | Second | First | | Fourth | Third | Second | First |

| Market value: | | | | | | | | | |

| High | $19.60 | $18.25 | $17.35 | $17.50 | | $16.20 | $16.30 | $16.25 | $16.25 |

| Low | 18.08 | 15.75 | 16.01 | 15.50 | | 15.10 | 13.75 | 15.00 | 15.45 |

| Close | 19.45 | 18.24 | 16.50 | 16.70 | | 15.89 | 15.75 | 15.20 | 15.75 |

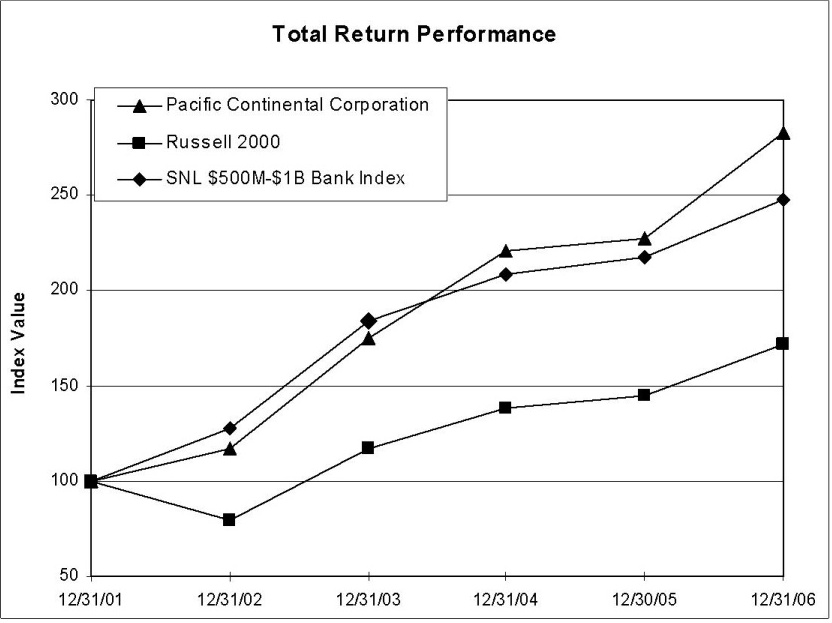

The information contained in the following chart entitled “Total Return Performance” is not considered to be “soliciting material”, or “filed”, or incorporated by reference in any past or future filing by the Company under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that the Company specifically incorporates it by reference.

STOCK PERFORMANCE GRAPH

The above graph and following table compares the total cumulative shareholder return on the Company’s Common Stock, based on reinvestment of all dividends, to the cumulative total returns of the Russell 2000 Index and SNL Securities $500 to $1 Billion Bank Asset Size Index. The graph assumes $100 invested on December 31, 2001, in the Company’s Common Stock and each of the indices.

| | | | | | | Period Ending | | | | | | | |

| Index | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/30/05 | | 12/31/06 | |

| Pacific Continental Corporation | | | 100.00 | | | 117.16 | | | 175.00 | | | 221.05 | | | 226.95 | | | 282.91 | |

| Russell 2000 | | | 100.00 | | | 79.52 | | | 117.09 | | | 138.55 | | | 144.86 | | | 171.47 | |

| SNL $500M-$1B Bank Index | | | 100.00 | | | 127.67 | | | 184.09 | | | 208.62 | | | 217.57 | | | 247.44 | |

| | | | | | | | | | | | | | | | | | | | |

Selected financial data for the past five years is shown in the table below.

($ in thousands, except for per share data)

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| For the year | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 40,057 | | $ | 30,240 | | $ | 24,952 | | $ | 22,220 | | $ | 19,689 | |

| Provision for loan losses | | $ | 600 | | $ | 1,100 | | $ | 500 | | $ | 900 | | $ | 5,660 | |

| Noninterest income | | $ | 4,401 | | $ | 4,083 | | $ | 4,463 | | $ | 4,946 | | $ | 4,200 | |

| Noninterest expense | | $ | 23,791 | | $ | 18,134 | | $ | 16,041 | | $ | 15,202 | | $ | 12,594 | |

| Income taxes | | $ | 7,412 | | $ | 5,510 | | $ | 4,925 | | $ | 4,233 | | $ | 2,181 | |

| Net income | | $ | 12,655 | | $ | 9,578 | | $ | 7,948 | | $ | 6,831 | | $ | 3,454 | |

| Cash dividends | | $ | 3,381 | | $ | 2,556 | | $ | 2,164 | | $ | 1,841 | | $ | 1,610 | |

| | | | | | | | | | | | | | | | | |

| Per common share data (1) | | | | | | | | | | | | | | | | |

| Net income: | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.20 | | $ | 1.08 | | $ | 0.93 | | $ | 0.81 | | $ | 0.41 | |

| Diluted | | $ | 1.18 | | $ | 1.05 | | $ | 0.90 | | $ | 0.79 | | $ | 0.41 | |

| Cash dividends | | $ | 0.32 | | $ | 0.28 | | $ | 0.25 | | $ | 0.22 | | $ | 0.19 | |

| Market value, end of year | | $ | 19.45 | | $ | 15.89 | | $ | 15.75 | | $ | 12.71 | | $ | 8.70 | |

| | | | | | | | | | | | | | | | | |

| At year end | | | | | | | | | | | | | | | | |

| Assets | | $ | 885,351 | | $ | 791,794 | | $ | 516,630 | | $ | 425,799 | | $ | 379,846 | |

| Loans, less allowance for loan loss (2) | | $ | 760,957 | | $ | 671,171 | | $ | 453,817 | | $ | 350,852 | | $ | 326,400 | |

| Deposits | | $ | 641,272 | | $ | 604,271 | | $ | 403,791 | | $ | 356,099 | | $ | 309,909 | |

| Shareholders' equity | | $ | 95,735 | | $ | 81,412 | | $ | 49,392 | | $ | 42,234 | | $ | 36,698 | |

| | | | | | | | | | | | | | | | | |

| Average for the year | | | | | | | | | | | | | | | | |

| Assets | | $ | 825,671 | | $ | 573,717 | | $ | 463,509 | | $ | 402,195 | | $ | 337,258 | |

| Earning assets | | $ | 755,680 | | $ | 533,930 | | $ | 431,374 | | $ | 369,574 | | $ | 305,763 | |

| Loans, less allowance for loan losses | | $ | 712,563 | | $ | 501,541 | | $ | 398,739 | | $ | 342,192 | | $ | 284,614 | |

| Deposits | | $ | 605,814 | | $ | 461,013 | | $ | 379,618 | | $ | 329,157 | | $ | 271,765 | |

| Interest-paying liabilities | | $ | 567,708 | | $ | 372,880 | | $ | 290,569 | | $ | 256,441 | | $ | 211,745 | |

| Shareholders' equity | | $ | 90,238 | | $ | 54,528 | | $ | 46,043 | | $ | 39,758 | | $ | 36,117 | |

| | | | | | | | | | | | | | | | | |

| Financial ratios | | | | | | | | | | | | | | | | |

| Return on average: | | | | | | | | | | | | | | | | |

| Assets | | | 1.53 | % | | 1.67 | % | | 1.71 | % | | 1.70 | % | | 1.02 | % |

| Equity | | | 14.02 | % | | 17.57 | % | | 17.26 | % | | 17.18 | % | | 9.56 | % |

| Avg shareholders' equity / avg assets | | | 10.93 | % | | 9.50 | % | | 9.93 | % | | 9.89 | % | | 10.71 | % |

| Dividend payout ratio | | | 26.72 | % | | 26.69 | % | | 27.23 | % | | 26.95 | % | | 46.61 | % |

| Risk-based capital: | | | | | | | | | | | | | | | | |

| Tier I capital | | | 9.93 | % | | 9.32 | % | | 10.19 | % | | 10.95 | % | | 10.23 | % |

| Tier II capital | | | 10.98 | % | | 10.48 | % | | 11.29 | % | | 12.20 | % | | 11.47 | % |

| | | | | | | | | | | | | | | | | |

(1) Per common share data is retroactively adjusted to reflect the 5-for-4 stock split, and 4-for-3 stock split of 2004 and 2003, respectively. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (2) Outstanding loans include loans held for sale. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The following discussion is intended to provide a more comprehensive review of the Company’s operating results and financial condition than can be obtained from reading the Consolidated Financial Statements alone. The discussion should be read in conjunction with the audited financial statements and the notes included later in this report. All numbers, except per share data, are expressed in thousands of dollars.

In addition to historical information, this report contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). Such forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the concentration of loans of the company's banking subsidiary, particularly with respect to commercial and residential real estate lending; changes in the regulatory environment and increases in associated costs, particularly ongoing compliance expenses and resource allocation needs in response to the Sarbanes-Oxley Act and related rules and regulations; vendor quality and efficiency; employee recruitment and retention, specifically in the Bank's Portland and Seattle markets; the company's ability to control risks associated with rapidly changing technology both from an internal perspective as well as for external providers; increased competition among financial institutions; fluctuating interest rate environments; and similar matters. Regarding the acquisition of Northwest Business Bank, completed on November 30, 2005, the combined company may fail to realize the projected cost savings, revenue enhancement, and accretive earnings. Readers are cautioned not to place undue reliance on the forward-looking statements. Pacific Continental Corporation undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this release. Readers should carefully review any risk factors described in Pacific Continental’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents, including any Current Reports on Form 8-K furnished to or filed from time to time with the Securities Exchange Commission. This statement is included for the express purpose of invoking PSLRA's safe harbor provisions.

HIGHLIGHTS

| | | 2006 (2) | | 2005 (2) | | % Change 2006 vs. 2005 | | 2004 | | % Change 2005 vs. 2004 | |

Operating revenue (1) | | $ | 44,458 | | $ | 34,323 | | | 30 | % | $ | 29,415 | | | 17 | % |

| Net income | | $ | 12,655 | | $ | 9,578 | | | 32 | % | $ | 7,948 | | | 21 | % |

| | | | | | | | | | | | | | | | | |

Earnings per share (3) | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.20 | | $ | 1.08 | | | 11 | % | $ | 0.93 | | | 16 | % |

| Diluted | | $ | 1.18 | | $ | 1.05 | | | 12 | % | $ | 0.90 | | | 17 | % |

| Assets, period-end | | $ | 885,351 | | $ | 791,794 | | | 12 | % | $ | 516,630 | | | 53 | % |

| Deposits, period-end | | $ | 641,272 | | $ | 604,271 | | | 6 | % | $ | 403,791 | | | 50 | % |

| | | | | | | | | | | | | | | | | |

| Return on assets | | | 1.53 | % | | 1.67 | % | | | | | 1.71 | % | | | |

| Return on equity | | | 14.02 | % | | 17.57 | % | | | | | 17.26 | % | | | |

Return on tangible equity (4) | | | 19.12 | % | | 18.25 | % | | | | | 17.26 | % | | | |

| (1) | Operating income is defined as net interest income plus noninterest income. |

| (2) | On November 30, 2005, the Company acquired NWBF for a combination of stock and cash. Combined, the stock and cash transaction was valued at approximately $40,434. The acquisition was accounted for under the purchase method of accounting and accordingly, the results of operations of NWBF have been included in the consolidated financial statement only since the date of acquisition. |

| (3) | Per share data for 2004 was retroactively adjusted to reflect the 5-for 4 stock split declared in September 2004. |

| (4) | Tangible equity excludes goodwill and core deposit intangible related to acquisitions. |

The Company earned $12,655 in 2006 compared to $9,578 in 2005. Growth in operating revenue, which consists of net interest income plus noninterest income was primarily responsible for the increased earnings in 2006 over 2005. Operating revenues were $44,458 in 2006, up $10,135 or 30% over 2005. Operating revenue growth was driven by a 42% increase in average earning assets resulting in a $9,817 increase in net interest income. Growth in earning assets was due to the full year effect of assets acquired in the NWBF transactions and organic growth.

When comparing 2006 and 2005 results, it is also fair to consider the effects of several unusual transactions and the adoption of new accounting standards. Effective January 1, 2006, the Company implemented FAS 123(R),” Share-Based Payment,” which requires the expensing of stock-based compensation. The Company elected to implement FAS 123(R) using the modified prospective method, meaning there was no restatement of prior periods. For the year ended December 31, 2006, the Company recognized $586 in stock-based compensation expense within the income statement. Had the accounting principle been effective in 2005, the Company would have recognized $515 in stock-based compensation expense which would have reduced full year 2005 diluted earnings per share by $0.06. Also during 2005 the Oregon legislature, as required in the Oregon Constitution, refunded to the Company a state income tax “kicker” reducing 2005 state income taxes by $241 which was recognized by the Company in the fourth quarter, increasing diluted earnings per share for the year 2005 by $0.02.

During the third quarter 2006, the Company sold two rental properties that the Bank had purchased in 1988 and held for possible office expansion. The sale resulted in a pretax non-interest income gain of $335. In addition, during the third quarter 2006, the Bank expensed the remaining unamortized loan premium of $101 from its 2003 purchase of the Coos Bay consumer finance office. The net after-tax gain associated with these two unusual transactions resulted in a $0.01 per diluted share contribution to full year 2006 earnings.

The Company earned $9,578 in 2005 compared to $7,948 in 2004. Growth in operating revenue was primarily responsible for the increased earnings in 2005 over 2004. Operating revenues in 2005 grew by $4,908 or 17% over 2004. Operating revenue growth was driven by a 24% increase in average earning assets resulting in a 21% increase in net interest income. The increase in net interest income was partially offset by a 9% decline in noninterest income due to lower service charges on deposit accounts, other deposit related service fees, and income from the origination of residential mortgages.

Period-end assets at December 31, 2006 were $885,351, compared to $791,794 at December 31, 2005. Core deposits, which are defined as demand deposits, interest checking, money market accounts, and local time deposits (including local time deposits over $100 thousand) constitute 90% of December 31, 2006 outstanding deposits. Demand deposits were $187,834 or 29% of total deposits at year-end December 31, 2006.

During 2007, the Company believes the following factors could impact reported financial results:

| § | A flat or inverted yield curve that would reduce spreads between the Bank’s yield on fixed rate loans and the Bank’s short-term borrowing costs and costs of core deposits, which could negatively affect the net interest margin and revenue growth. |

| § | The ability to manage noninterest expense growth in light of expected slow revenue growth. |

| § | The ability to grow core deposits, to fund expected loan growth during 2007. |

| § | The local and regional economies and their effect on loan demand, the credit quality of existing clients with lending relationships, and vacancy rates of commercial real estate properties, since a significant portion of our loan portfolio is secured by real estate. |

| § | Increases in long-term interest rates and their impact on residential construction, residential mortgage lending, and refinancing activities of existing homeowners. |

| § | Increased expenses related to personnel costs and the rising costs of providing employee benefits, plus staffing, consulting, audit fees, and other expenses related to internal auditing and ongoing compliance with Section 404 of the Sarbanes-Oxley Act. |

| § | The ability to attract and retain qualified and experienced commercial bankers in all markets. |

| § | The performance of new and relocated offices in the metropolitan Portland area. |

| § | The performance and growth of loans and deposits in the metropolitan Seattle area. |

SUMMARY OF CRITICAL ACCOUNTING POLICIES