UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

| | |

| Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

PACIFIC CONTINENTAL CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

| | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | (4) | | Date Filed: |

| | |

| | | | |

|

|

Explanatory Note:

We are filing this amendment to our definitive proxy statement, originally filed with the Securities and Exchange Commission on March 14, 2014, to correct typographical errors contained in tables on pages 23, 31 and 35. These errors occurred as a result of the EDGAR translation process. All data distributed to shareholders contained correct tabular information. No other changes have been made from the previously filed definitive proxy statement.

TO OUR SHAREHOLDERS:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders (“Annual Meeting”) of Pacific Continental Corporation to be held at 10:00 a.m., local time, on Monday, April 28, 2014, in the Vistas I Room, 12th Floor, Hilton Eugene and Conference Center, 66 East 6th Avenue, in Eugene, Oregon.

At the meeting, you will be asked to elect as directors the nine individuals nominated by the Pacific Continental Corporation Board of Directors for a term of one year. You will also be asked to approve an advisory, non-binding resolution which approves the compensation of the Company’s named executive officers, and to ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. We will also transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

All of the above matters are more fully described in the Proxy Statement. You may access the Annual Report to Stockholders and Proxy Statement through the internet athttp://www.cfpproxy.com/5782. If you would like a paper copy of the proxy materials mailed to you, you may request one at the website listed above or by calling (800) 951-2405 or by sending an email tofulfillment@rtco.com. You will need your Stockholder Control Number to make this request.

Our Board of Directors has selected March 3, 2014, as the record date for determining shareholders entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournment or postponement thereof. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy. You may vote over the internet, by telephone or by mail.

| | |

| | Sincerely, |

| |

| |

|

| |

March 17, 2014 | | HAL BROWN |

| | Chief Executive Officer |

PACIFIC CONTINENTAL CORPORATION

111 West 7th Avenue

Eugene, Oregon 97401

541-686-8685

Notice of Annual Meeting of Shareholders

| | | | |

| TIME | | 10:00 a.m., local time, on Monday, April 28, 2014 |

| |

| PLACE | | Vistas I Room, 12th Floor, Hilton Eugene and Conference Center, 66 East 6th Avenue, Eugene, Oregon |

| | |

| ITEMS OF BUSINESS | | (1) | | To elect nine directors to serve on the Board of Directors until our 2015 Annual Meeting of Shareholders. |

| | |

| | (2) | | To approve an advisory (non-binding) resolution approving executive compensation. |

| | |

| | (3) | | To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

| | |

| | (4) | | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| |

| RECORD DATE | | You are entitled to vote at the Annual Meeting and at any adjournments or postponements thereof if you were a shareholder of record at the close of business on March 3, 2014. |

| |

| VOTING | | You may vote over the Internet, by telephone or by mail. For specific instructions on voting, please refer to the instructions in the accompanying Proxy Statement. |

Pursuant to Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the internet, we have elected to deliver our proxy materials to our stockholders via the internet. This process allows us to provide stockholders with the information they need, while at the same time lowering the cost of delivery. On or about March 18, 2014, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders containing instructions on how to access our 2014 Proxy Statement and 2013 Annual Report to Stockholders. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail. The Notice will also serve as an admission ticket for a stockholder to attend the 2014 Annual Meeting of Stockholders. Each attendee must present the Notice, or other proper form of documentation, to be admitted.

|

By Order of the Board of Directors |

|

|

|

HAL BROWN |

Chief Executive Officer |

PROXY STATEMENT

Annual Meeting of Shareholders

April 28, 2014

INTERNET AVAILABILITY OF ANNUAL MEETING MATERIALS

Under Securities and Exchange Commission (“SEC”) rules, we have elected to make our proxy materials available to our stockholders over the internet, rather than mailing paper copies of those materials to each stockholder. On or about March 17, 2014, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) directing stockholders to a web site where they can access our 2014 Proxy Statement and 2013 Annual Report to Stockholders and view instructions on how to vote via the internet or by phone. If you received the Notice and would like to receive a paper copy of the proxy materials, please follow the instructions printed on the Notice to request that a paper copy be mailed.

Copies of this Proxy Statement and the Annual Report to Shareholders for the year ended December 31, 2013, are available in theInvestor Relations section of Pacific Continental Bank’s website atwww.therightbank.com.

INTRODUCTION

Our Board of Directors is soliciting proxies for the 2014 Annual Meeting of Shareholders (the “Annual Meeting”) of Pacific Continental Corporation (the “Company”). This Proxy Statement contains information about the items you will vote on at the Annual Meeting to be held on Monday, April 28, 2014, and any adjournments or postponements thereof.

GENERAL INFORMATION

Date, Time and Place of Annual Meeting

The Annual Meeting will be held on Monday, April 28, 2014, at 10:00 a.m., local time, in the Vistas I Room, 12th Floor, at the Hilton Eugene and Conference Center located at 66 East 6th Avenue, Eugene, Oregon.

Purpose of the Meeting

At the Annual Meeting, you will be asked to:

| | — | | Elect as directors of the Company the nine individuals nominated by our Board of Directors to serve until our 2015 Annual Meeting or until their successors have been elected and qualified. |

| | — | | Approve an advisory (non-binding) resolution, which approves the compensation of the Company’s named executive officers. |

| | — | | Ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

1

Record Ownership

Shareholders of record as of the close of business on March 3, 2014 (the “Record Date”) are entitled to one vote for each share of common stock then held. As of February 28, 2014, there were 17,895,114 shares of common stock issued and outstanding.

Quorum

The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of common stock is necessary to constitute a quorum at the Annual Meeting. Both abstentions and broker non-votes (as defined below) will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining the existence of a quorum.

Solicitation of Proxies

The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on proposals being considered at the Annual Meeting. In addition to the use of the mail, proxies may be solicited in person or by telephone by directors, officers and employees of the Company or its subsidiary, Pacific Continental Bank (the “Bank”). It is not expected that compensation will be paid for the solicitation of proxies; however, in the event an outside proxy solicitation firm is engaged to render proxy solicitation services, the Company will pay a fee for such services.

Voting of Proxies

A portion of the Company’s shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially. You may vote your shares in one of several ways, depending upon how you own your shares.

Shares registered directly in your name through our transfer agent. If your shares are registered directly in your name, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent to you by the Company through its transfer agent. As the shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.

| | — | | Via Internet: Go to http://www.cfpproxy.com/5782 and follow the instructions. You will need to enter the control number printed on the proxy card you received and should follow the instructions provided with your proxy materials and on your proxy card. |

| | — | | By Telephone: Call toll-free (855)564-1328 and follow the instructions. You will need to enter the control number printed on the proxy card you received and should follow the instructions provided with your proxy materials and on your proxy card. |

| | — | | In Writing: If you wish to vote by mail, complete, sign, date, and return the proxy card in the envelope that was provided to you, or provide it or a ballot distributed at the Annual Meeting directly to the Inspector of Election at the Annual Meeting when instructed. |

Shares held in “street” or “nominee” name (through a bank, broker or other nominee). If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and your broker or other nominee is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker or other nominee on how to vote.

2

| | — | | You may receive the proxy card or a separate voting instruction form from your bank, broker or other nominee holding your shares. You should follow the instructions on the proxy card or voting instruction form provided by your broker or nominee in order to instruct your broker or other nominee on how to vote your shares. The availability of telephone or internet voting will depend on the voting process of the broker or nominee. To vote in person at the Annual Meeting, you must obtain a proxy, executed in your favor, from the holder of record. |

| | — | | If you own shares in “street name” through a broker or other nominee and do not instruct your broker or nominee how to vote, your broker or nominee may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this Proxy Statement, the proposal to ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 is considered to be “routine.” Each of the other proposals is considered to be a “non-routine” matter. Therefore, if you do not provide your bank, broker or other nominee holding your shares in “street name” with voting instructions, those shares will count for quorum purposes, but will not be counted as shares present and entitled to vote on the election of directors or the other proposals included in this Proxy Statement. Therefore, it is important that you provide voting instructions to your bank, broker or other nominee. |

Regardless of how you own your shares, if you are a shareholder of record, you may vote by attending the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or the Internet so that your vote will be counted if you later decide not to attend the meeting.

If you vote via the internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the internet and telephone voting facilities to vote your shares will vote:

| | — | | FOR each director nominee. |

| | — | | FOR approval of the advisory and non-binding resolution, which approves the compensation of the Company’s named executive officers. |

| | — | | FOR the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

Proxy Revocation

Shareholders who execute Proxies retain the right to revoke them at any time prior to the vote on a given matter at the Annual Meeting. Proxies may be revoked by written notice delivered in person or mailed to the Corporate Secretary of the Company or by filing a later Proxy prior to a vote being taken at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a Proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a previously granted Proxy. You may revoke your Proxy by telephone by calling 1-800-951-2405 and following the instructions or via the internet by going to http://www.cfpproxy.com/5782 and following the instructions.

Voting on the Matters Presented

Election of Directors. The nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. Shareholders are not permitted to cumulate their

3

votes for the election of directors. Votes may be cast FOR or WITHHELD from the directors as a group, or for each or any individual nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the proposal because directors will be elected by a plurality of votes cast.

Advisory (Non-Binding) Vote to Approve Executive Compensation. The vote presented in Proposal 2 is an advisory vote and, therefore, is not binding on the Company, our Compensation Committee or our Board of Directors. We value, however, the opinions of our shareholders, and the Compensation Committee will, as it did with respect to last year’s named executive officer compensation vote, take into account the result of the advisory vote when determining future executive compensation. In accordance with the vote of the shareholders at the 2011 Annual Meeting, and concurrence of our Board of Directors, the Company will provide shareholders with such a vote on an annual basis. The affirmative vote FOR by a majority of those shares present in person or by proxy and voting on this matter is required to approve the advisory (non-binding) resolution to approve the compensation of the Company’s named executive officers. You may vote FOR, AGAINST or ABSTAIN from approving this resolution. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

Ratification of the Appointment of the Independent Registered Public Accounting Firm. The proposal to ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, will be adopted if a majority of the shares present in person or by proxy voting on this matter are cast FOR the proposal. You may vote FOR, AGAINST or ABSTAIN from approving the proposal. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

Other Matters Presented at the Annual Meeting

We do not expect any matters, other than those included in the Proxy Statement, to be presented at the Annual Meeting. If other matters are presented, the individuals named as proxies will have discretionary authority to vote your shares on those matters.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the Annual Meeting. We will publish final results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting. After the Form 8-K is filed, you may obtain a copy by visiting our website atwww.therightbank.com, the SEC’s website atwww.sec.gov, or by writing the Company’s Corporate Secretary at the Company’s main office.

4

CORPORATE GOVERNANCE

The Board of Directors is committed to good business practices, transparency in financial reporting, and high standards of corporate governance. The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct, and assuring compliance with such responsibilities and standards. The Board periodically reviews the Company’s governance policies and practices against those suggested by various groups or authorities active in corporate governance and the practices of other companies, as well as the requirements of applicable securities laws and the listing standards of The NASDAQ Stock Market (“NASDAQ”).

Code of Ethics and Corporate Governance Documents

We have adopted a Conflicts of Interest/Code of Ethics/Confidentiality Policy, (the “Ethics Policy”), which provides ethical standards and corporate policies that apply to all of our directors, officers and employees. Our Ethics Policy requires, among other things that our directors, officers and employees act in a responsible and ethical manner, comply with laws and regulations, avoid conflicts of interest, and otherwise conduct themselves in a manner deserving of the public trust and confidence. We have also adopted a Code of Ethics for Senior Financial Officers that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, and any persons performing similar functions, and provides for accurate, complete and fair financial reporting.

In addition, each of our committees operates under formal written charters approved by the applicable committee and adopted by our Board of Directors. You may access the current charters and policies, including the Code of Ethics for Senior Financial Officers, Ethics Policy, Articles of Incorporation, Bylaws, and the Audit, Compensation and Corporate Governance and Nominating Committee (“Governance/Nominating Committee”) charters, by visiting the Company’s website and clicking on theGovernance Documentslink within theInvestor Relationssection at www.therightbank.com.

Board Authority for Risk Oversight

The Board has ultimate authority and responsibility for overseeing risk management of the Company. Some aspects of risk oversight are fulfilled at the full Board level. For example, quarterly the Board receives from management a comprehensive Enterprise Risk Management Report. Additionally, the Board, or a committee of the Board, receives specific periodic reports from executive management on credit risk, liquidity risk, interest rate risk, capital risk, operational risk and economic risk. Our Board’s standing committees also support the Board by regularly addressing various issues within their respective areas of oversight. The Audit Committee oversees financial, accounting and internal control risk management. The head of the Company’s internal audit function and the independent registered public accounting firm report directly to the Audit Committee. The Compensation Committee oversees the management of risks that may be posed by the Company’s compensation practices and programs. The Governance/Nominating Committee assists our Board in fulfilling its risk management oversight responsibilities associated with risks related to corporate governance structures and processes. Each of the committee chairs, as appropriate, reports to the full Board at regular meetings concerning the activities of their respective committee, the significant issues it has discussed and the actions taken by the committee.

5

Board Composition and Attendance at Meetings

Our Board of Directors is currently composed of nine (9) members. The Company’s Articles of Incorporation provide that the number of directors will be not less than six (6), with the number of directors to be established in accordance with the Company’s Bylaws. The Company’s Bylaws currently provide for a board of six (6) to fifteen (15) directors, with the specific number of directors to be established by board resolution. The Articles of Incorporation provide that directors are elected annually for one-year terms.

The Company held ten (10) Board meetings in 2013. The Bank held eleven (11) Board meetings in 2013. Each director attended at least 75 percent of the aggregate of (i) the total number of meetings of the Board of Directors, and (ii) the total number of meetings held by all committees on which he or she served. During 2013, the Board of Directors met five (5) times in executive session, without management present. The Company does not require, but expects, the directors to attend the Annual Meeting. At the 2013 Annual Meeting, all directors of the Company nominated for re-election were in attendance.

Director Qualifications

The Board of Directors believes that each of the Company’s directors should bring a rich mix of qualities and skills to the Board. All of our directors bring to our Board a wealth of leadership experience derived from their service in a variety of professional and executive positions and extensive board experience.

The Governance/Nominating Committee is responsible for the oversight and nomination process for director nominees. The Committee has not adopted formal “director qualification standards” for Committee-recommended nominees. However, the Committee annually reviews the experience, qualifications, attributes and skills of each director and nominee as part of its evaluation of whether these are the right individuals to serve on the Company’s Board to help the Company successfully meet its strategic plans. Because each director of the Company must be re-elected annually, the Committee has an annual opportunity to assess these factors and, if appropriate, determine not to re-nominate any director. A more detailed discussion regarding the considerations given by the Committee when considering director nominees is set forth below in the section entitled“Certain Committees of the Board of Directors – Governance/Nominating Committee.”

The director biographical information set forth below summarizes the experience, qualifications, attributes and skills that the Company believes qualify each director to serve on the Board. The Governance/Nominating Committee and the Board believe that each respective director’s professional and business acumen and board experience and the total mix of all directors’ experience and skills are beneficial to the Company and the Board.

Director Independence

The Board of Directors is committed to maintaining an independent Board, and for many years our Board, excluding the Chief Executive Officer, has been comprised of independent directors. It has further been the Company’s practice to separate the duties of Chairman and Chief Executive Officer. In keeping with good corporate governance practices, at this time, the Board believes that the separation of the duties of Chairman and Chief Executive Officer eliminates any inherent conflict of interest that may arise when the roles are combined, and that an independent director who has not served as an executive of the Company can best provide the necessary leadership and objectivity required as Chairman.

6

With the assistance of legal counsel to the Company, the Governance/Nominating Committee has reviewed the applicable legal standards for Board and Board committee member independence and the criteria applied to determine “audit committee financial expert” status. The Committee has also reviewed a summary of the answers to annual questionnaires completed by each of the directors, which also included any potential director-affiliated transactions.

The Governance/Nominating Committee analyzed the independence of each director and nominee and has determined that all directors, except Mr. Hal M. Brown, who serves as the Company’s Chief Executive Officer, meet the applicable laws and listing standards regarding “independence” as defined by the NASDAQ listing standards, and that each such director or nominee is free of relationships that would interfere with the individual’s exercise of independent judgment. In determining the independence of each director or nominee, the Committee considered many factors, including any lending arrangements with the directors, each of which (i) were made in the ordinary course of business, (ii) were substantially made on the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Company or the Bank, and (iii) did not involve more than the normal risk of collectability or present other unfavorable features. Such arrangements are discussed in detail below in the section entitled“Additional Information – Certain Relationships and Related Transactions.”

Certain Committees of the Board of Directors

The Company and Bank Boards have jointly established, among others, an Audit Committee, Compensation Committee, and a Governance/Nominating Committee. Each committee operates under a formal written charter approved by the respective Committee and adopted by the Board of Directors. You may access copies of these respective charters by visiting the Company’s website and clicking on theGovernance Documentslink within theInvestor Relationssection at www.therightbank.com.

The following table shows the membership of the various Board committees as of the date of this proxy statement.

Committee Membership

| | | | | | |

| | | Audit | | Compensation | | Governance/ Nominating |

Robert A. Ballin | | ¨ | | ¨ | | þ |

Michael E. Heijer | | þ | | ¨ | | þ |

Michael D. Holzgang | | ¨ | | þ | | þ* |

Judith A. Johansen | | þ | | ¨ | | ¨ |

Donald L. Krahmer, Jr. | | þ* | | ¨ | | þ |

Donald G. Montgomery | | ¨ | | þ* | | þ |

Jeffrey D. Pinneo | | ¨ | | þ | | ¨ |

John H. Rickman | | þ | | þ | | þ |

Total Meetings in 2013 | | [12] | | [6] | | [4] |

*Committee Chair

7

Audit Committee. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the outside auditors performing or issuing an audit report, and approves the engagement and fees for all audit and non-audit functions, with the independent auditors reporting directly to the Audit Committee. The responsibilities of the Audit Committee include overseeing (i) the integrity of the Company’s financial statements, which includes reviewing the scope and results of the annual audit by the independent auditors, any recommendations of the independent auditors and management’s response to such recommendations, and the accounting principles being applied by the Company in financial reporting, (ii) the establishment of procedures for the receipt, retention and treatment of accounting controls, (iii) the reports of bank regulatory authorities and reporting its conclusions to the Board, (iv) the procedures with respect to the records and business practices of the Company and the Bank, (v) the adequacy and implementation of the internal auditing, accounting and financial controls, (vi) the independent auditor’s qualifications and independence, and (vii) compliance with the Company’s legal and regulatory requirements.

The Audit Committee oversees and evaluates the adequacy of the Company’s internal and disclosure controls; however, management is responsible for developing and implementing the internal controls and the financial reporting process. The independent accountants are responsible for performing an audit of the consolidated financial statements in accordance with generally accepted auditing standards and then issuing a report thereon. The Committee’s responsibility is to monitor and oversee this process. In connection with its ongoing responsibility of risk oversight, the Audit Committee also has responsibility for overseeing and refining the Company’s comprehensive Enterprise Risk Management (ERM) evaluative process.

Compensation Committee. The Compensation Committee reviews and approves the Company’s retirement and benefit plans, and determines the salary and incentive compensation for the Chief Executive Officer. For other executive officers, the Committee reviews recommendations from the Chief Executive Officer, President/Chief Operating Officer and the Human Resources Director. The Committee also approves, in total, the compensation levels for all other Bank officers, and establishes the annual overall salary budget for the Bank. The Committee also establishes compensation for directors, which includes Board retainer fees and committee meeting fees as well as retainer fees for certain committee chairs. In addition to cash compensation, the Committee considers equity grant awards for directors and employees. The Committee may engage outside consultants to assist the members in making peer comparisons and determining industry “best practices.” The Committee is directly responsible and has full authority for the appointment, compensation and oversight of compensation consultants, legal counsel and any other advisors retained by the Committee. The Chair of the Committee reports to the full Board the actions of the Committee.

Additional information regarding executive and director compensation is discussed below under “Compensation Discussion and Analysis,” “Executive Compensation,” and “Director Compensation.”

Governance/Nominating Committee. The Governance/Nominating Committee reviews and considers various corporate governance standards as suggested by evolving best practices, the needs of the Company and its shareholders, or as required by SEC, NASDAQ and other regulatory agencies, and makes recommendations to the full Board as it deems appropriate. The Committee is responsible for reviewing the Company Code of Ethics and committee charters, defining Board member expectations and independence, reviewing and approving related party transactions, and overseeing Board and committee self-evaluations. In addition, the Committee recommends to the full Board a slate of director nominees for election at the Company’s annual meeting of shareholders.

In deciding whether to recommend incumbent directors for re-nomination, the Governance/Nominating Committee evaluates the Company’s evolving needs and assesses the

8

effectiveness and contributions of its existing directors. The Governance/Nominating Committee is authorized to establish guidelines for the qualification, evaluation and selection of new directors to serve on the Board. The Governance/Nominating Committee has not adopted specific minimum qualifications for Committee-recommended nominees, nor has the Governance/Nominating Committee adopted a formal policy relating to Board diversity, although the Committee and the Board value a diversity of backgrounds, professional experience and skills among directors. The Governance/Nominating Committee instead evaluates each nominee on a case-by-case basis, including assessment of each nominee’s business experience, involvement in the communities served by the Company, independence and special skills. The Governance/Nominating Committee also evaluates whether the nominee’s skills are complementary to existing Board members’ skills, and the Board’s need for operational, management, financial, technological or other expertise, as well as geographical representation within the Company’s market areas.

The Governance/Nominating Committee will also consider nominees recommended by shareholders provided that the recommendations are made in accordance with the procedures described below under “Additional Information – Information Concerning Shareholder Proposals and Director Nominations.” The Governance/Nominating Committee evaluates all candidates, including shareholder-proposed candidates, using generally the same methods and criteria, although those methods and criteria are not standardized and may vary from time to time.

Compensation Committee Interlocks and Insider Participation

During 2013, the Compensation Committee consisted of Mr. Montgomery (Chair), and Messrs. Holzgang, Pinneo and Rickman. During 2013, none of our executive officers served on the compensation committee (or equivalent body) or board of directors of another entity whose executive officer served on the Compensation Committee.

Shareholder Communication with the Board of Directors

The Company and the Board of Directors welcome communication from shareholders and have established a formal method for receiving such communication. The preferred method is by email and can be most conveniently done by visiting the Company’s website (www.therightbank.com) and clicking on theShareholder Communicationslink within the Investor Relations section. By clicking onShareholder Tools, and thenShareholder Communications, an email dialog box will be made available for shareholder comments. The email is sent to the Chairman of the Board of Directors.

For shareholders who do not have access to the Company’s website, communications with the Board may also be made by writing to the Chairman of the Board, c/o the Corporate Secretary, Pacific Continental Corporation, P.O. Box 10727, Eugene, Oregon 97440-2727.

If the Chairman determines that a communication, whether received by email or postal mail, is relevant to the Company’s operations and policies, such communication will be presented to the appropriate committee or entire Board for review and consideration.

Directors; Nominees for Director

Set forth below are the names and ages of our nine directors as of the date of this Proxy Statement, the year each of them became a director, each director’s principal occupation or employment for at least the past five years, and other public company directorships held by each director during the past five years. The Governance/Nominating Committee has recommended to the Board, and the Board has nominated for election to the Board, the nine persons listed below to serve for one-year terms or until

9

their successors are elected and qualified. Unless authority is withheld, the persons named as proxies in the voting materials made available to you or in the accompanying proxy will vote “FOR” the election of the nine nominees listed below. If any of the nominees should refuse or become unavailable to serve, the persons named as proxies will have discretionary authority to vote for a substitute nominee, and your proxy will be voted for such persons as are designated by the Board of Directors to replace any such nominee. The Board of Directors presently has no knowledge that any nominee will refuse or be unavailable to serve. As of the date of this Proxy Statement, the nine incumbent directors of the Company also served as directors of the Bank.

Robert A. Ballin, 72, has been a director of the Company and the Bank since 1999 and 1980, respectively, and served as Chairman of the Board since 2000. Mr. Ballin has had a 49-year career in the insurance industry and is currently part-owner of Ward Insurance in Eugene. His special expertise is the providing of insurance and surety for the wood products industry throughout the Western half of the United States. Mr. Ballin has also served on numerous community, philanthropic, and corporate boards in varying capacities. As a long-time Northwest businessman, his experience in all economic cycles is particularly valuable. Mr. Ballin’s experience in the wood products industry provides insight and knowledge in an industry of significant importance to the Northwest, and his experience in surety underwriting helps provide Board oversight of the Bank’s credit underwriting practices.

Hal M. Brown, 60, has served as the Chief Executive Officer of the Company and the Bank since 2002. He was elected a director of both the Company and the Bank in August 2002 following his July 2002 appointment as President and Chief Executive Officer of the Company and the Bank. In 2006 and 2007, respectively, Mr. Brown relinquished his position as President of the Bank and the Company to the current President, Mr. Roger Busse. Prior to 2002, Mr. Brown served as the Executive Vice President and Chief Operating Officer of the Company and the Bank from 1999, and prior to that served as the Senior Vice President and Chief Financial Officer of the Company and the Bank from 1996. He began his career with the Bank in 1985 as Cashier. Mr. Brown currently serves on the board and chairs the audit committee of Pacific Source Health Plans. He is also a member of the Pacific Source Health Plans executive committee with responsibility for executive compensation. Mr. Brown also serves on the board of Angle, LLC, a software company developing mobile device applications for the sight impaired that provide access to periodicals and other printed materials through speech recognition and text-to-speech technologies. Mr. Brown formerly served on the boards of the United Way of Lane County and ShelterCare, an organization serving the housing needs of homeless families and adults with severe and persistent mental disabilities. The Board believes the Chief Executive Officer should be a director serving as the primary liaison between the Board and management and as the executive with overall responsibility for executing the Company’s strategic plan.

Michael E. Heijer, 54, has been a director of both the Company and the Bank since 2005, following the acquisition of NWB Financial Corporation. Mr. Heijer was a founder of Northwest Business Bank and served on the boards of directors of NWB Financial Corporation and Northwest Business Bank until their acquisition by the Company in November 2005. He has more than 20 years’ experience in Pacific Northwest hotel and commercial real estate development and is the owner of GranCorp, Inc., a commercial real estate investment company with investments in the Pacific Northwest, which he formed in April 1986. Mr. Heijer was the founder and part-owner of Teris LLC, formerly American Legal Copy, a litigation support services company serving the West Coast that was formed in 1996, and sold in September 2013. He holds a bachelor’s degree in economics from the University of California at Berkeley. Mr. Heijer is a long-time Puget Sound resident and provides an important perspective with regard to the greater Seattle market, one of the Company’s three primary markets. Mr. Heijer’s real estate and entrepreneurial business experiences in the Portland and Seattle markets are particularly beneficial to the Board.

10

Michael D. Holzgang, 56, has been a director of both the Company and the Bank since 2002. He currently serves as the chair of the Governance/Nominating Committee. Mr. Holzgang has been in the commercial real estate business for 35 years, currently serving as Senior Vice President with Colliers International, a global real estate services company since 2001. Prior to joining Colliers, Mr. Holzgang was a Senior Director at Cushman & Wakefield of Oregon where he worked for 20 years. Prior to that, Mr. Holzgang started his real estate career in Eugene following his graduation from the University of Oregon business school in finance. In addition to the breadth and depth of his knowledge of real estate in all three markets served by the Bank, Mr. Holzgang has served on volunteer boards for a collective period of 35 years. Most recently he served as chairman of the board of directors for Medical Teams International, an international humanitarian disaster relief agency, the second largest non-profit in the State of Oregon. Prior to that, Mr. Holzgang served as board President of the Boys and Girls Club of Portland. Mr. Holzgang is a native Oregonian and has spent most of his life and career residing in Portland, one of the Bank’s three primary markets. His extensive nonprofit and real estate experience and leadership provide a valuable perspective both to the Bank and the Company.

Judith A. Johansen, 55, recently retired from Marylhurst University where she served as President since 2008. Prior to her university service, Ms. Johansen was president and CEO of PacifiCorp where she was responsible for the company’s mining operations, regulated power generation facilities, wholesale energy services, transmission and distribution and concurrently served as a board member of Scottish Power, PLC. Additionally, Ms. Johansen served as CEO and administrator for Bonneville Power Administration from 1998 to 2000. Ms. Johansen currently serves on the board of Schnitzer Steel, Idaho Power, Kaiser Permanente Health Plans and Hospitals and Roseburg Forest Group. She is also a senior fellow of the American Leadership Forum of Oregon and chairs the Board of Trustees for the Oregon Chapter of the Nature Conservancy. Ms. Johansen is a former director for the Portland branch of the Federal Reserve Bank of San Francisco, the Oregon Business Council, and Bank of the Cascades and was a Trustee of Law at Lewis and Clark College. Additionally Ms. Johansen served as an Oregon governor’s appointee to the Port of Portland Commission and is a former chair and trustee for Lewis and Clark College. Ms. Johansen’s extensive and varied business experience and her knowledge of public company practice is of particular value to the Company and the Bank.

Donald L. Krahmer, Jr., 56, has been a director of both the Company and the Bank since 2002, and currently serves as the chair of the Audit Committee. Mr. Krahmer serves as a shareholder of the law firm of Schwabe Williamson & Wyatt, PC, where he chairs the firm’s Technology and Business Practice. He has expertise in corporate law, mergers and acquisitions, corporate governance, and complex business issues. Prior to joining Schwabe as a shareholder in 2002, Mr. Krahmer was a partner at Black Helterline, LLP, and held various management positions with Endeavour Capital, PacifiCorp Financial Services, PacifiCorp and U.S. Bancorp. Mr. Krahmer serves as a member of the community board of directors of Regence Blue Cross Blue Shield of Oregon and serves as a member of the board of directors of the Portland Business Alliance. He serves as a technical advisor to the Oregon Innovation Council, which brings together leaders from private businesses, higher education and the public sector to drive innovation strategy. Mr. Krahmer serves as a mentor of the Community Investment Initiative, a private sector board supported by METRO to explore long term infrastructure needs in the greater Portland metropolitan region. Mr. Krahmer is a member of the American Bar Association’s Business Law Section and its Mergers and Acquisitions, Middle Market and Small Business, and Venture and Private Equity Finance committees. Mr. Krahmer is a long-time Pacific Northwest resident who has spent time in the Bank’s three primary markets of Portland, Eugene and Seattle, and provides important perspective in all of these marketplaces. Mr. Krahmer’s extensive network of business and personal contacts within these markets provides valuable assistance in the Company’s business development efforts. Mr. Krahmer’s board, strategic and financial experience qualifies him with the expertise needed for his service to the Board as well as his position of Audit Committee chair. Additionally, his background as an advisor to many Pacific Northwest businesses, entrepreneurs, executives and corporate boards provides a unique perspective to the Board.

11

Donald G. Montgomery, 74, has been a director of the Company and the Bank since 1999 and 1996, respectively, and Vice Chair of the Board since 2000, and currently serves as the chair of the Compensation Committee. Mr. Montgomery is a private investor and formerly served for 17 years as the Chief Operating Officer of Timber Products Company, a privately-owned wood products production and sales company, prior to his retirement in 2002. Prior to joining Timber Products, Mr. Montgomery worked for Kings Table International as Chief Operating Officer. Mr. Montgomery is a long-time Eugene resident and provides an important perspective with regard to the greater Eugene market, one of the Bank’s three primary markets. Mr. Montgomery’s experience as a public company executive brings strong operational and financial expertise to the Board and contributes greatly in developing the Company’s investor relations strategy. His many years of compensation policy and human resource management experience provide the Board with a good overall perspective on compensation, social and governance issues.

Jeffrey D. Pinneo, 57, is the former CEO and president of Horizon Air. Mr. Pinneo retired in June 2010 after nearly 29 years with Alaska Air Group companies Alaska Airlines and Horizon Air. During his tenure, Mr. Pinneo helped Horizon Air expand markets and revenues and extend the reach and preference of the Horizon and Alaska brands. Under his leadership, Horizon Air was named Regional Airline of the Year by Air Transport World in 2007. While Mr. Pinneo is best known for his professional work in the airline industry, he has devoted a great deal of his time to charitable organizations, including Medical Teams International, where he has served on the board since 2008 and as CEO since 2012. Mr. Pinneo has volunteered with the agency since 2006. Through decades of service to the world’s most vulnerable, Medical Teams International has established itself as a leader in global relief and development and a regional point of pride as one of the largest non-profits in the Northwest. Mr. Pinneo has also served on the advisory boards of Seattle Pacific University Center for Integrity in Business, Washington State University College of Business, and Point Loma Nazarene University. Mr. Pinneo’s geographic, nonprofit and public company experience align well with and support the Bank’s strategic plan.

John H. Rickman, 72, has been a director of both the Company and the Bank since 2003 and currently serves as the chair of the Company’s Asset and Liability Committee. Mr. Rickman worked for U.S. Bank for 38 years, serving as head of the bank’s Oregon commercial lending group, and, until his retirement in 2001, was the State President of U.S. Bank, Oregon. Mr. Rickman has been involved with numerous civic and professional organizations, including the executive committee of the Portland Chamber, United Way campaign cabinet committee, member of the SOLV-Founders Circle, and Goodwill Industries of Columbia-Willamette. He previously served on the board of the Oregon Business Council, the Association for Portland Progress, co-chair of the Oregon Mentoring Initiative, and the Portland Oregon Sports Authority. He is a past chairman of the Oregon Bankers Association. Mr. Rickman is a long-time Portland resident and provides an important perspective with regard to the greater Portland market, one of the Bank’s three primary markets. Mr. Rickman’s large-bank experience in asset and liability management, credit underwriting, loan portfolio and personnel management is of particular benefit to the Board, and his marketing and business development experience is a valuable resource to Company personnel.

The Board of Directors unanimously recommends that you vote FORthe election of each of the nominees for director identified above.

12

COMMITTEE REPORTS

Audit Committee Report

The following is a report of the Audit Committee of the Board of Directors, which is responsible for establishing and administering the Company’s internal controls.

During the fiscal year ended December 31, 2013, the Audit Committee was comprised of four directors, each of whom is considered “independent” as defined by the NASDAQ listing standards and applicable SEC rules. The Board of Directors has determined that Mr. Krahmer is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee has met and held discussions with management and the Company’s independent accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Audit Committee has also discussed with the independent accountants matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The independent accountants provided to the Audit Committee the written disclosures and the letter from the independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent accountants that firm’s independence.

Based on the Audit Committee’s review of the audited consolidated financial statements and the various discussions with management and the independent accountants noted above, the Audit Committee determined to include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC (“2013 Annual Report on Form 10-K”).

The Director of Internal Audit reports directly to the Audit Committee of the Board of Directors. During 2013, the Director of Internal Audit worked under the direction of the Audit Committee to assist in managing all aspects of the auditing function including management of the internal audit department and coordination of all outsourced external auditors and consultants retained by the Audit Committee. The Audit Committee is directly responsible for setting the compensation of the Director of Internal Audit, review and approval of a budget for the Internal Audit department, review and approval of an annual audit plan for the Bank and the Company, and review and approval of all audits completed by the Internal Audit department, outside auditors and contractors.

Audit Committee

Donald L. Krahmer, Jr. (Chair)

Michael E. Heijer

John H. Rickman

Judith A. Johansen

13

Compensation Committee Report

During the fiscal year ended December 31, 2013, the Compensation Committee was comprised of four directors, each of whom satisfies the independence criteria under the NASDAQ listing standards and applicable rules of the SEC and the Internal Revenue Service.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis (“CD&A”) set forth in this Proxy Statement with management, and based on that review and discussions, the Compensation Committee recommended to the Board that the CD&A be included as part of this Proxy Statement and incorporated by reference into the 2013 Annual Report on Form 10-K.

Compensation Committee

Donald G. Montgomery (Chair)

Michael D. Holzgang

Jeffrey D. Pinneo

John H. Rickman

Corporate Governance and Nominating Committee Report

The following is a report of the Governance/Nominating Committee of the Board of Directors, which is responsible for the Company’s review and consideration of corporate governance standards, related person transactions and for selecting the annual slate of director nominees.

The Governance/Nominating Committee is currently comprised of six directors, each of whom is considered “independent” as defined by the NASDAQ listing standards.

The Governance/Nominating Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics that Board members should possess, as well as the composition of the Board as a whole. This review includes an assessment of the absence or presence of material relationships with the Company which might impact independence, as well as consideration of diversity, skills, experience, time available and the number of other boards the member serves in the context of the needs of the Board and the Company and such other criteria as the Governance/Nominating Committee shall determine to be relevant at the time. The Governance/Nominating Committee recommends nominees and number of directorships to the Board in accordance with the foregoing and the policies and principles in its charter.

The Governance/Nominating Committee recommends to the Board the number of director nominees required for the forthcoming year. When considering director nominations, the Governance/Nominating Committee will give equal consideration to director candidates nominated by shareholders and the Governance/Nominating Committee’s own candidates, provided that the shareholder recommendations are made in accordance with the procedures described in this Proxy Statement under “Additional Information—Information Concerning Shareholder Proposals and Director Nominations.” Candidates will be interviewed by the Governance/Nominating Committee (any expenses are the responsibility of the candidate) to evaluate the candidate’s competencies, business acumen, community visibility, Company share ownership and such other criteria as the Governance/Nominating Committee shall determine to be relevant at the time. Current directors standing for re-election are not required to participate in an interview process.

During 2013, the Governance/Nominating Committee recommended that the board expand the number of directors to nine. The Committee identified and recommended to the full board the appointment of Judith Johansen. Ms. Johansen began her board service in December 2013. Further the Governance/Nominating Committee recommended to the full Board the nine current directors for nomination for election at the Annual Meeting.

14

Corporate Governance/Nominating Committee

Michael D. Holzgang (Chair)

Robert A. Ballin

Michael E. Heijer

Donald L. Krahmer, Jr.

Donald G. Montgomery

John H. Rickman

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table shows the amount of common stock beneficially owned by (a) the executive officers named in the Summary Compensation Table (“named executive officers”), (b) each director, (c) all of the Company’s directors and executive officers as a group, and (d) all persons who are known to the Company to be beneficial owners of 5 percent or more of the Company’s common stock. Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. Except for our 5% holders, the table shows beneficial ownership as of December 31, 2013. The number of shares reported is based on data provided to us by the beneficial owners of the shares. The percentage ownership data is based on 17,891,687 shares of our common stock outstanding as of December 31, 2013. Under SEC rules, beneficial ownership includes any shares over which the person or entity exercises voting or investment power and also any shares that the person or entity has the right to acquire within 60 days of December 31, 2013. Except as noted below, each holder has sole voting and investment power for all shares shown as beneficially owned. Where beneficial ownership was less than 1 percent of all outstanding shares, the percentage is not reflected in the table. Unless otherwise noted below, the address of each beneficial owner listed in the table is: c/o Pacific Continental Corporation, 111 West 7th Avenue, Eugene, Oregon 97401.

The Company has adopted a policy prohibiting employees or directors from engaging in transactions that hedge the economic risks of ownership of the Company’s common stock, including trading in publicly traded options, puts, calls or other derivative instruments related to Company stock. In addition, the Company has adopted stock ownership and hold guidelines that require directors and executive officers to retain a certain ownership level of Company stock. A complete description of these ownership and retention guidelines is set forth in“Compensation Discussion and Analysis – Key Compensation Policies – Executive Stock Ownership and Hold Guidelines.”

Security Ownership of Certain Beneficial Owners and Management

| | | | | | | | | | | | |

| Name | | Position with Company | | Number of Shares (1)(2) | | | Percentage of Shares | | | |

Executive Officers and Directors | | | | | | | | | | |

Hal Brown | | Director, Chief Executive Officer | | | 302,978 | (3) | | | 1.686 | % | | |

Roger Busse | | President/Chief Operating Officer | | | 82,459 | | | | * | | | |

Michael Reynolds | | Executive Vice President, Chief Financial Officer | | | 46,425 | (4) | | | * | | | |

Mitchell Hagstrom | | Executive Vice President , Chief Banking Officer | | | 72,486 | (5) | | | * | | | |

15

| | | | | | | | | | | | |

| Name | | Position with Company | | Number of Shares (1)(2) | | | Percentage of Shares | | | |

Casey Hogan | | Executive Vice President, Chief Credit Officer | | | 52,885 | (6)* | | | | | | |

Robert A. Ballin | | Chair of the Board | | | 407,613 | (7) | | | 2.278 | % | | |

Michael E. Heijer | | Director | | | 58,944 | (8) | | | * | | | |

Michael D. Holzgang | | Director | | | 13,190 | | | | * | | | |

Judith A. Johansen | | Director | | | 7,926 | | | | * | | | |

Donald L. Krahmer, Jr. | | Director | | | 8,792 | | | | * | | | |

Donald G. Montgomery | | Vice Chair of the Board | | | 51,976 | | | | * | | | |

Jeffrey D. Pinneo | | Director | | | 1,851 | | | | | | | |

John H. Rickman | | Director | | | 34,374 | | | | * | | | |

Directors and executive officers as a group (13 persons) | | | | | 1,141,899 | (9) | | | 6.298 | % | | |

| | | | | | | | | | | | |

| | *Represents less than 1% of the Company’s outstanding common stock | | | | |

| | (1) | | Share amounts include options to acquire shares that are exercisable within 60 days as follows: Brown 81,977; Busse 70,733; Reynolds 28,441; Hagstrom 30,245; Hogan 28,120; and Heijer 1,102. | | | | |

| | (2) | | Share amounts include shares of Company common stock owned “jointly with spouse” as follows: Busse 11,726; Reynolds 8,670; Hagstrom 39,436; Hogan, 22,652; Ballin 153,352; Heijer 46,508; Holzgang 13,190; Johansen 7,926 and Rickman 34,374. | | | | |

| | (3) | | Includes 110,501 shares held by spouse. | | | | |

| | (4) | | Includes 247 shares held by spouse and 330 held by minor child. | | | | |

| | (5) | | Includes 384 shares held as custodian for children. | | | | |

| | (6) | | Includes 20,131 pledged as security for a line of credit. | | | | |

| | (7) | | Includes 1,425 shares held in trust for grandchildren; 90,812 pledged as security for a line of credit and 62,540 in a margin account. | | | | |

| | (8) | | Includes 3,171 shares held as custodian for children and 5,288 shares held by GranCorp Holdings, LLC and 2,875 shares held by GranCorp Inc. of which Mr. Heijer and his spouse are the owners and principals and 46,508 pledged as security for a line of credit. | | | | |

| | (9) | | Includes 240,618 shares subject to options that could be exercised within 60 days. | | | | |

5% Shareholders

| | | | | | | | |

| Name | | Number of Shares (1)(2) | | | Percentage of Shares | |

| | |

Banc Fund(1) 20 North Wacker Drive, Suite 3300 Chicago, IL 60606 | | | 1,379,137 | | | | 7.7 | % |

BlackRock Fund Advisors(2) 40 East 52nd Street New York, NY 10022 | | | 1,333,407 | | | | 7.5 | % |

16

| (1) | Based on an amended Schedule 13G filed under the Exchange Act on February 14, 2014. The securities are beneficially owned by Banc Fund VI L.P. and certain of its affiliates. |

| (2) | Based on an amended Schedule 13G filed under the Securities Exchange Act of 1934 (the “Exchange Act”) on January 30, 2014. The securities are beneficially owned by BlackRock, Inc. and certain of its affiliates. |

MANAGEMENT

Executive Officers who are not Directors

The following table sets forth information with respect to the current executive officers who are not director nominees or directors of the Company, including their employment history.

| | | | | | | | | | |

| Name | | Age | | | Position with Bank and Employment History | | Tenure as an Officer of the Company and the Bank | |

| | | |

Roger Busse | | | 58 | | | President and Chief Operating Officer of the Company since 2007 and of the Bank since 2006(1) | | | 2003 | |

| | | |

Mitchell Hagstrom | | | 57 | | | Executive Vice President, Chief Banking Officer since 2012(2) | | | 1988 | |

| | | |

Casey Hogan | | | 55 | | | Executive Vice President, Chief Credit Officer since 2006(3) | | | 1995 | |

| | | |

Michael Reynolds | | | 62 | | | Executive Vice President, Chief Financial Officer of the Company and the Bank since 2004(4) | | | 1998 | |

| | (1) | Mr. Busse was promoted to President of the Company in April 2007; he has served as President and Chief Operating Officer of the Bank since 2006. Mr. Busse previously worked for U.S. Bank for 25 years serving in a variety of credit administration and commercial lending positions. |

| | (2) | In 2012, Mr. Hagstrom was named Executive Vice President, Chief Banking Officer, responsible for market activities in all three primary markets of the Bank. He concurrently served as Market President, Greater Eugene Market, a role he had from 2008 until September 2012. Prior to his appointment in 2004 to Executive Vice President and Director of Greater Eugene Operations, Mr. Hagstrom was responsible for deposit and loan growth throughout the Lane County market, serving in a market leadership role since he joined the Bank in 1988. |

| | (3) | Prior to his appointment in 2006, Mr. Hogan served in various capacities with the Bank, including commercial lending and credit administration. He joined the Bank in 1995 after serving as a lender for Idaho First National Bank for 18 years. |

| | (4) | Mr. Reynolds joined the Company and the Bank in 1998 and has served as the Chief Financial Officer since that time. Prior to joining the Company and the Bank, Mr. Reynolds spent 17 years in the corporate finance divisions of First Interstate Bank and U.S. Bank. |

COMPENSATION DISCUSSION AND ANALYSIS

Pacific Continental’s executive compensation programs are designed to support shareholder and Company objectives by providing competitive base salaries along with short-term and long-term rewards focused on balancing risk and performance. The Company’s Board of Directors has established a Compensation Committee (“Committee”) which is responsible for establishing and administering the Company’s executive and director compensation programs. The Committee consists only of independent non-employee directors and operates under a formal written charter approved by the Committee and adopted by the Board of Directors.

17

This Compensation Discussion and Analysis discusses our 2013 compensation program for the following named executive officers:

| | |

Name | | Executive Officer Position |

| |

Hal Brown | | Chief Executive Officer |

Roger Busse | | President /Chief Operating Officer |

Michael Reynolds | | Executive Vice President & Chief Financial Officer |

Mitchell Hagstrom | | Executive Vice President & Chief Banking Officer |

Casey Hogan | | Executive Vice President & Chief Credit Officer |

Executive Compensation Philosophy and Objectives

The Committee strives to design compensation programs that attract and retain the best available talent while efficiently utilizing available resources and appropriately managing risk. The Committee seeks to compensate employees with a pay and benefits package that is competitive in the marketplace, appropriately reflects varying levels of responsibility within the Company, and is aligned with the interests of shareholders and sound risk management principles. The process for establishing executive compensation consists of targeting overall compensation and then allocating that compensation between base salary and short- and long-term incentive compensation (provided through annual cash incentive opportunity and long-term equity incentive compensation, respectively) thus driving behavior toward objectives that are aligned with shareholder interests.

The Committee believes there should be a strong link between executive pay and Company performance. Although a competitive compensation package must be provided in order to retain top talent, incentive compensation should mirror changes in the Company’s financial performance. As is described in detail below, our executive compensation program has three core components: a competitive base salary, an annual cash incentive opportunity, and a long-term equity incentive opportunity. The Committee has established financial performance and risk identification thresholds for determining incentive compensation pay levels. As the Company’s performance changes, so does the executive’s compensation. In 2013, total compensation for the Chief Executive Officer remained close to 2012 compensation in direct relationship to the performance of the Bank. Though Mr. Brown’s base pay increased between 2012 and 2013, his equity incentive decreased slightly due to a lower performance award.

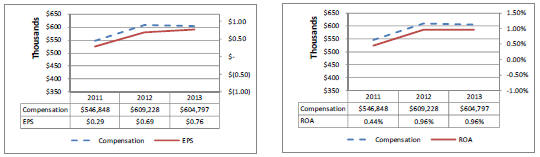

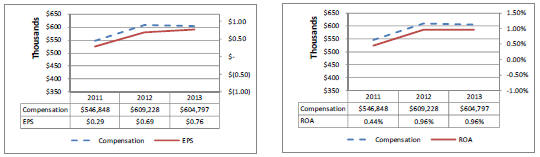

To illustrate the connection between Company performance and executive compensation, the charts and tables below show the Chief Executive Officer’s total compensation from the Summary Compensation Table for the three years ended December 31, 2013, and the Company’s performance for those same years expressed as earnings per share (“EPS”) and return on assets (“ROA”).

18

Role of Compensation Committee and Management

The Compensation Committee of the Board has overall responsibility for advising the independent members of our Board on the compensation of our named executive officers. Members of the Committee are appointed by our Board. The Committee makes its compensation recommendations utilizing the judgment of its members based on their tenure, experience and after receiving input from our Chief Executive Officer and other members of management. The independent members of our Board, taking into account the recommendations of the Committee, have the ultimate responsibility for evaluating and determining the compensation of our named executive officers, including the compensation of our Chief Executive Officer.

The Committee also has risk oversight responsibility for the Company’s compensation programs. In establishing incentive compensation arrangements for the Company’s executive officers, the Committee has made reasonable efforts to ensure that such arrangements do not encourage executive officers or other employees to take unnecessary and excessive risks that could threaten the value of the Company, either in the short- or long-term. The Committee assessed all Company compensation practices and policies for risk and concluded that none of them create risks that are reasonably likely to result in a material adverse effect on the Company. Key factors in reaching this conclusion were (i) the shift in 2011 toward greater base salary and equity awards, and lower annual cash incentive opportunities, for executive officers, (ii) the implementation in 2011 of the “clawback” policy, (iii) the significant weighting of risk management goals in the annual cash incentive program, (iv) the implementation in 2011 of stock ownership guidelines and long-term hold requirements for shares acquired through equity incentive awards, and in early 2012 the doubling of the Chief Executive Officer’s level of required stock ownership to six times average base salary over the past three years, and (v) providing that all executive change in control benefits are “double-trigger,” requiring both a termination of employment and a change in control. The Committee performed the compensation risk assessment by directing management, with the assistance of Pearl Meyer & Partners, an independent third party compensation advisor, to identify and report back to the Committee on the risk elements in each compensation program, making a threshold determination whether risks arising from any program create a reasonable likelihood of material adverse effect on the Company, and then implementing additional risk mitigation to compensation programs where appropriate.

Key Compensation Policies

Policy for the Recovery of Incentive Compensation (“Clawback” Policy). In January 2011, the Company adopted a policy for the recovery of incentive compensation under certain circumstances. Under this policy, the Company will recover incentive compensation awarded to current or former executive officers (during the preceding three years) if the Company restates its financial results due to material noncompliance with any financial reporting requirement under the securities laws, to the extent the original awards exceeded the amounts that would have been paid under the restated results.

Executive Stock Ownership and Hold Guidelines. In order to enhance the link between the interests of executive officers and shareholders, in January 2011, the Compensation Committee implemented stock ownership guidelines pursuant to which executives are expected to establish and maintain a significant level of direct ownership of Pacific Continental stock. As noted above, the guidelines were amended in January 2012 to increase the level of required ownership for the Chief Executive Officer. Our guidelines now require that the Chief Executive Officer hold shares with a value of six times his average annual base salary over the prior three years before he may sell any net shares acquired from equity awards. Mr. Brown’s ownership at December 31, 2013, exceeded six times his three-year average base salary. The other executive officers must hold shares with a value equal to their base salary before they may sell any net shares acquired from equity awards. The Committee set the

19

levels at six times and equal to base salary, respectively, to balance our objective for significant executive stock ownership with a concern that more stringent requirements could create succession planning and retention risks. Once these share ownership guidelines are attained, the executive must retain 75 percent of net shares acquired from equity awards for a period of two years. Messrs. Reynolds, Hagstrom and Hogan have acquired the applicable target level of stock while Messrs. Busse continues to work toward acquiring the target level of stock.

Competitive Market Data and Role of Compensation Consultant

The Committee undertakes an annual comprehensive evaluation of total compensation based on the principle that a meaningful portion of the executive’s pay should be in the form of incentive compensation that is tied to the short- and long-term best interests of the Company and its shareholders. To assist the Committee in establishing targeted aggregate levels of compensation, in 2012, the Committee engaged Pearl Meyer & Partners, an independent compensation consulting firm, to advise on executive compensation. Pearl Meyer & Partners compiled a peer group of banks against which to assess the three key components comprising our named executive officers’ compensation: base salary, annual incentive or cash bonus, and long-term incentives (stock options, restricted stock, and other equity-based awards). The peer group was selected based on banks in California, Colorado, Idaho, Oregon or Washington which had total assets ranging from $800 million to $2.6 billion. Some publicly-held banks were excluded due to a lack of public compensation information, financial performance, or targeted customer base. This peer group consisted of the following publicly-traded companies:

| | | | |

Bank of Commerce Holdings | | First California Financial Group, Inc. | | Pacific Mercantile Bancorp |

Bank of Marin Bancorp | | First PacTrust Bancorp, Inc. | | Pacific Premier Bancorp |

Bridge Capital Holdings | | Heritage Commerce Corp. | | Provident Financial Holdings |

Cascade Bancorp | | Heritage Financial Corp. | | Sierra Bancorp |

Cobiz Financial Inc. | | Home Federal Bancorp | | Washington Banking Co. |

CU Bancorp | | HomeStreet, Inc. | | West Coast Bancorp |

Farmers & Merchants Bancorp | | North Valley Bancorp | | |

Peer group data was compiled from the 2011 proxy statements filed with the SEC then aged at an annual rate of 3% to reflect general market movement in executive compensation. In general, the Company’s performance fell within the 50thpercentile of the custom peer group of 20 peers. Total compensation for the 20 peers was compared to compensation for the Company’s named executive officers. In aggregate, the actual and target total direct compensation was at the 50th percentile of peer banks, while total remuneration was between the 25th and 50th percentiles of peer banks.

Since the time of this study, several of the banks listed in this peer group have ceased to be viable comparables. The Committee continues to believe the Company’s total compensation philosophy appropriately rewards management performance in line with the regional and national information provided, thus meeting objectives to attract and retain quality executive management. A new study may be conducted in the near future to verify this understanding.

Elements of Compensation

Total compensation is comprised of salary, annual cash incentive or bonus, long-term incentives (stock options, restricted stock, and other equity-based awards), all other compensation, and retirement benefits.

20

Total Compensation; Allocation among Components.

The mix of base salary, annual cash incentive opportunity, and long-term equity incentive compensation varies depending upon the employment level, the degree to which the position can influence short- and long-term performance and the degree to which the executive has authority to expose the Company to incremental risk. In allocating compensation among these components, the Committee believes that a relatively greater proportion of the total compensation opportunity of its named executive officers, the levels of management having the greatest ability to influence the Company’s performance, should be performance-based and variable (which for equity compensation includes appreciation or depreciation in the market price of the Company’s common stock). At other levels of management and staff, the Committee and management establish incentive compensation that includes both cash and equity awards that recognize the achievement of specific individual and departmental/regional performance goals in areas under the control of the employee. Company-wide performance, however, represents a portion of all officer incentive programs.

When reviewing the component allocations, the Committee considers the percentage of compensation at risk and to what degree the incentive compensation programs might encourage executives to take undue risk, with a view toward ensuring they do not.

For 2013, the cash incentive and equity opportunities as a percent of base salary were as shown in the table below.

| | | | | | | | | | | | |

| | | Base Salary | | Cash Bonus

Opportunity Percent of Base Salary | | Amount in $ | | Equity Opportunity Percent of Base Salary | | Amount in $ | | Total

Compensation

Opportunity |

Hal Brown, Chief Executive Officer | | $372,654 | | 25% | | $93,164 | | 40% | | $149,062 | | $614,880 |

Roger Busse, President & Chief Operating Officer | | $330,860 | | 20% | | $66,172 | | 40% | | $132,344 | | $529,376 |

Michael Reynolds, Executive Vice President & Chief Financial Officer | | $221,020 | | 15% | | $33,153 | | 20% | | $44,204 | | $298,377 |

Mitchell Hagstrom, Executive Vice President & Chief Banking Officer | | $232,728 | | 20% | | $46,546 | | 40% | | $93,091 | | $372,365 |