|

Exhibit 99.2

|

Pacific Continental Corporation to Acquire Capital Pacific Bancorp

Two Pacific Northwest Community?Focused Business Banks Agree to Merge in a Strategic Combination

Investor Presentation November 19, 2014

Pacific Continental Corporation Capital Pacific Bancorp

(NASDAQ: PCBK)(OTCQB: CPBO)

Hal M. Brown Mark C. Stevenson

Chief Executive Officer President & Chief Executive Officer

Roger S. Busse

President & Chief Operating Officer

Forward-Looking Statements Safe Harbor

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). Such forward-looking statements include but are not limited to statements about the benefits of the business combination transaction involving Pacific Continental and Capital Pacific, including future financial and operating results, the combined company’s plans, objectives, market share, expectations and intentions, expectations regarding the timing of the closing of the transaction and its impact on Pacific Continental’s earnings, expectations regarding pro forma combined assets, loans and deposits and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Pacific Continental Corporation and Capital Pacific operate; the abilitytopromptlyand effectivelyintegrate thebusinessesofPacific Continental Bank and Capital Pacific Bank; the reaction to the transaction of the companies’ customers, employees, and counterparties; and the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Pacific Continental Corporation undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this presentation. This statement is included for the express purpose of invoking PSLRA’s safe harbor provisions.

2

Merger Rationale

Strong familiarity between the two organizations with similar cultures and shared philosophies on business banking, community service and employee engagement

Business models which we believe are more closely aligned than any other banks in the Pacific Northwest

Combination will significantly increase PCBK’s presence in the Portland market

Improving operational scale in Portland – pro forma company will have $483.9 million of deposits and $591.1 million of loans in the Portland-Vancouver-Hillsboro MSA

Combination benefits from Portland’s attractive long-term demographics and improved economy

Similar to PCBK, Capital Pacific focuses on business banking and shares similar niche expertise

Capital Pacific expertise with non-profit organizations, healthcare and educational services

Enhances PCBK’s scarcity value as a bank with assets of $1.7 billion which is located in 3 of the Pacific Northwest’s largest metropolitan markets of Eugene, Portland and Seattle

Well positioned for continued growth

Effective use of capital will enhance returns and shareholder value for the combined company

Increased return on average tangible common equity for pro forma company

3

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bancorp earnings release, as of 9/30/2014

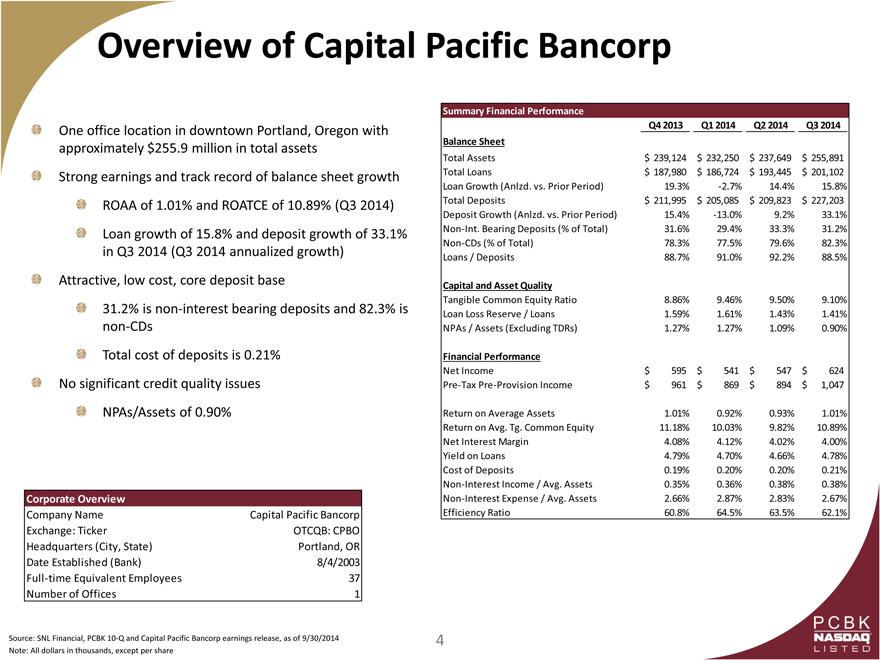

Overview of Capital Pacific Bancorp

One office location in downtown Portland, Oregon with approximately $255.9 million in total assets

Strong earnings and track record of balance sheet growth

ROAA of 1.01% and ROATCE of 10.89% (Q3 2014)

Loan growth of 15.8% and deposit growth of 33.1% in Q3 2014 (Q3 2014 annualized growth)

Attractive, low cost, core deposit base

31.2% is non-interest bearing deposits and 82.3% is non-CDs

Total cost of deposits is 0.21% No significant credit quality issues NPAs/Assets of 0.90%

Summary Financial Performance

Q4 2013 Q1 2014 Q2 2014 Q3 2014

Balance Sheet

Total Assets $ 239,124 $ 232,250 $ 237,649 $ 255,891

Total Loans $ 187,980 $ 186,724 $ 193,445 $ 201,102

Loan Growth (Anlzd. vs. Prior Period) 19.3% -2.7% 14.4% 15.8%

Total Deposits $ 211,995 $ 205,085 $ 209,823 $ 227,203

Deposit Growth (Anlzd. vs. Prior Period) 15.4% -13.0% 9.2% 33.1%

Non-Int. Bearing Deposits (% of Total) 31.6% 29.4% 33.3% 31.2%

Non-CDs (% of Total) 78.3% 77.5% 79.6% 82.3%

Loans / Deposits 88.7% 91.0% 92.2% 88.5%

Capital and Asset Quality

Tangible Common Equity Ratio 8.86% 9.46% 9.50% 9.10%

Loan Loss Reserve / Loans 1.59% 1.61% 1.43% 1.41%

NPAs / Assets (Excluding TDRs) 1.27% 1.27% 1.09% 0.90%

Financial Performance

Net Income $ 595 $ 541 $ 547 $ 624

Pre-Tax Pre-Provision Income $ 961 $ 869 $ 894 $ 1,047

Return on Average Assets 1.01% 0.92% 0.93% 1.01%

Return on Avg. Tg. Common Equity 11.18% 10.03% 9.82% 10.89%

Net Interest Margin 4.08% 4.12% 4.02% 4.00%

Yield on Loans 4.79% 4.70% 4.66% 4.78%

Cost of Deposits 0.19% 0.20% 0.20% 0.21%

Non-Interest Income / Avg. Assets 0.35% 0.36% 0.38% 0.38%

Non-Interest Expense / Avg. Assets 2.66% 2.87% 2.83% 2.67%

Efficiency Ratio 60.8% 64.5% 63.5% 62.1%

Corporate Overview

Company Name Capital Pacific Bancorp

Exchange: Ticker OTCQB: CPBO

Headquarters (City, State) Portland, OR

Date Established (Bank) 8/4/2003

Full-time Equivalent Employees 37

Number of Offices 1

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bancorp earnings release, as of 9/30/2014 Note: All dollars in thousands, except per share

4

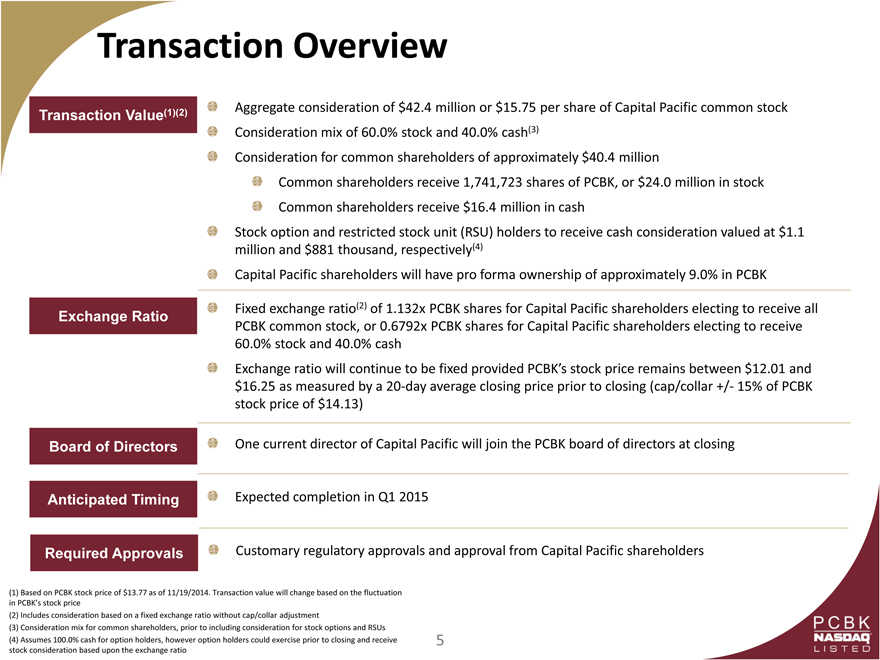

Transaction Overview

Transaction Value(1)(2) Aggregate consideration of $42.4 million or $15.75 per share of Capital Pacific common stock

Consideration mix of 60.0% stock and 40.0% cash(3)

Consideration for common shareholders of approximately $40.4 million

Common shareholders receive 1,741,723 shares of PCBK, or $24.0 million in stock

Common shareholders receive $16.4 million in cash

Stock option and restricted stock unit (RSU) holders to receive cash consideration valued at $1.1

million and $881 thousand, respectively(4)

Capital Pacific shareholders will have pro forma ownership of approximately 9.0% in PCBK

Exchange Ratio Fixed exchange ratio(2) of 1.132x PCBK shares for Capital Pacific shareholders electing to receive all

PCBK common stock, or 0.6792x PCBK shares for Capital Pacific shareholders electing to receive

60.0% stock and 40.0% cash

Exchange ratio will continue to be fixed provided PCBK’s stock price remains between $12.01 and

$16.25 as measured by a 20-day average closing price prior to closing (cap/collar +/- 15% of PCBK

stock price of $14.13)

Board of Directors One current director of Capital Pacific will join the PCBK board of directors at closing

Anticipated Timing Expected completion in Q1 2015

Required Approvals Customary regulatory approvals and approval from Capital Pacific shareholders

(1) Based on PCBK stock price of $13.77 as of 11/19/2014. Transaction value will change based on the fluctuation in PCBK’s stock price (2) Includes consideration based on a fixed exchange ratio without cap/collar adjustment (3) Consideration mix for common shareholders, prior to including consideration for stock options and RSUs (4) Assumes 100.0% cash for option holders, however option holders could exercise prior to closing and receive stock consideration based upon the exchange ratio

5

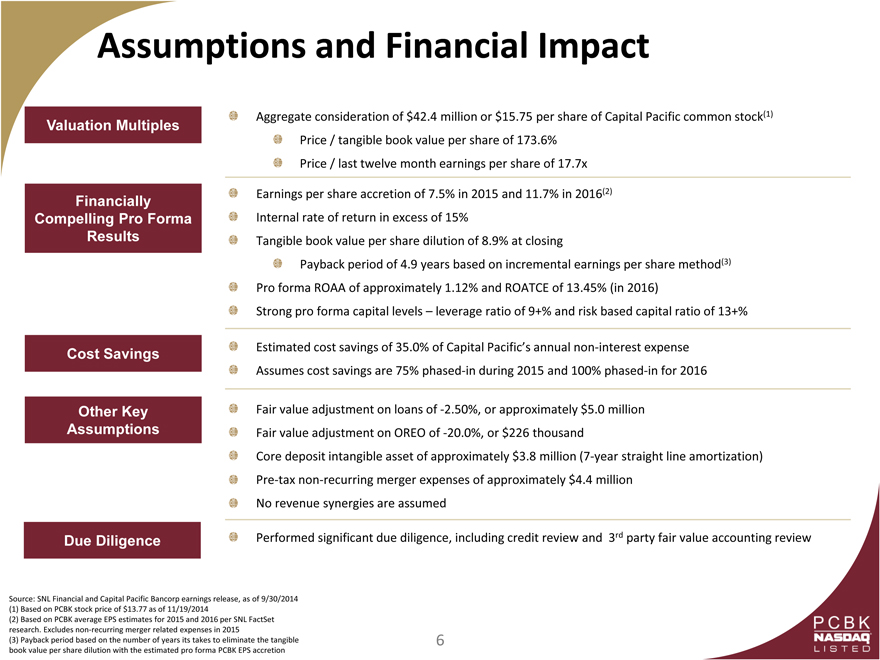

Assumptions and Financial Impact

Valuation Multiples

Aggregate consideration of $42.4 million or $15.75 per share of Capital Pacific common stock(1)

Price / tangible book value per share of 173.6%

Price / last twelve month earnings per share of 17.7x

Financially

Earnings per share accretion of 7.5% in 2015 and 11.7% in 2016(2)

Compelling Pro Forma

Internal rate of return in excess of 15%

Results

Tangible book value per share dilution of 8.9% at closing

Payback period of 4.9 years based on incremental earnings per share method(3)

Pro forma ROAA of approximately 1.12% and ROATCE of 13.45% (in 2016)

Strong pro forma capital levels – leverage ratio of 9+% and risk based capital ratio of 13+%

Cost Savings

Estimated cost savings of 35.0% of Capital Pacific’s annual non-interest expense

Assumes cost savings are 75% phased-in during 2015 and 100% phased-in for 2016

Other Key

Fair value adjustment on loans of -2.50%, or approximately $5.0 million

Assumptions

Fair value adjustment on OREO of -20.0%, or $226 thousand

Core deposit intangible asset of approximately $3.8 million (7-year straight line amortization)

Pre-tax non-recurring merger expenses of approximately $4.4 million

No revenue synergies are assumed

Due Diligence

Performed significant due diligence, including credit review and 3rd party fair value accounting review

Source: SNL Financial and Capital Pacific Bancorp earnings release, as of 9/30/2014 (1) Based on PCBK stock price of $13.77 as of 11/19/2014 (2) Based on PCBK average EPS estimates for 2015 and 2016 per SNL FactSet research. Excludes non-recurring merger related expenses in 2015 (3) Payback period based on the number of years its takes to eliminate the tangible book value per share dilution with the estimated pro forma PCBK EPS accretion

6

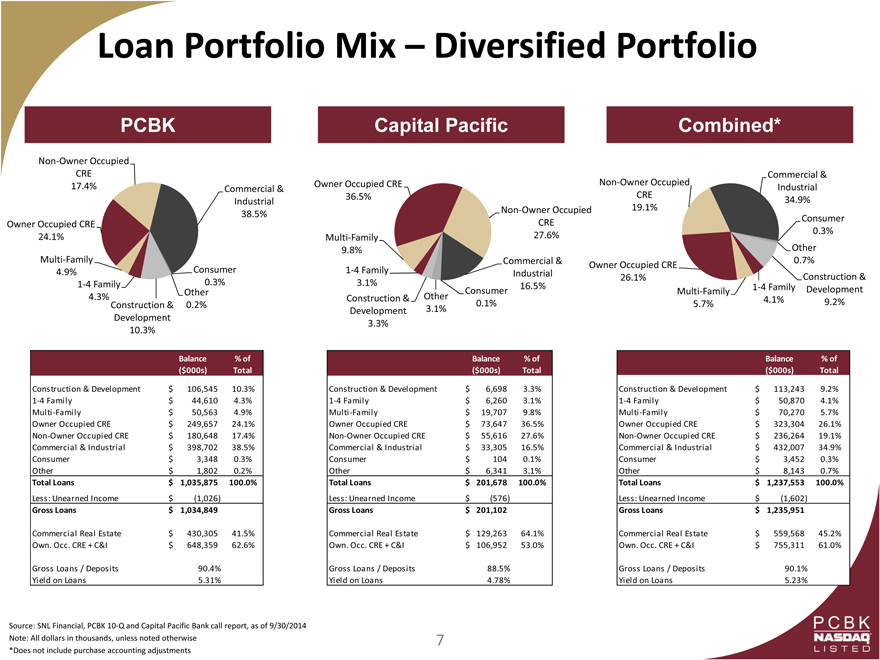

Loan Portfolio Mix – Diversified Portfolio

PCBK

Non-Owner Occupied

CRE

17.4% Commercial &

Industrial

38.5%

Owner Occupied CRE

24.1%

Multi-Family

4.9% Consumer

1-4 Family 0.3%

4.3% Other

Construction & 0.2%

Development

10.3%

Capital Pacific

Owner Occupied CRE

36.5%

Non-Owner Occupied

CRE

Multi-Family 27.6%

9.8%

Commercial &

1-4 Family Industrial

3.1% 16.5%

Consumer

Construction & Other 0.1%

Development 3.1%

3.3%

Combined*

Commercial &

Non-Owner Occupied Industrial

CRE 34.9%

19.1%

Consumer

0.3%

Other

Owner Occupied CRE 0.7%

26.1% Construction &

Multi-Family 1-4 Family Development

5.7% 4.1% 9.2%

Balance% of

($000s) Total

Construction & Development $ 106,545 10.3%

1-4 Family $ 44,610 4.3%

Multi -Family $ 50,563 4.9%

Owner Occupied CRE $ 249,657 24.1%

Non-Owner Occupied CRE $ 180,648 17.4%

Commercial & Industrial $ 398,702 38.5%

Consumer $ 3,348 0.3%

Other $ 1,802 0.2%

Total Loans $ 1,035,875 100.0%

Less: Unearned Income $ (1,026)

Gross Loans $ 1,034,849

Commercial Real Estate $ 430,305 41.5%

Own. Occ. CRE + C&I $ 648,359 62.6%

Gross Loans / Deposits 90.4%

Yield on Loans 5.31%

Balance% of

($000s) Total

Construction & Development $ 6,698 3.3%

1-4 Family $ 6,260 3.1%

Multi-Family $ 19,707 9.8%

Owner Occupied CRE $ 73,647 36.5%

Non-Owner Occupied CRE $ 55,616 27.6%

Commercial & Industrial $ 33,305 16.5%

Consumer $ 104 0.1%

Other $ 6,341 3.1%

Total Loans $ 201,678 100.0%

Less: Unearned Income $ (576)

Gross Loans $ 201,102

Commercial Real Estate $ 129,263 64.1%

Own. Occ. CRE + C&I $ 106,952 53.0%

Gross Loans / Deposits 88.5%

Yield on Loans 4.78%

Balance% of

($000s) Total

Construction & Development $ 113,243 9.2%

1-4 Family $ 50,870 4.1%

Multi-Family $ 70,270 5.7%

Owner Occupied CRE $ 323,304 26.1%

Non-Owner Occupied CRE $ 236,264 19.1%

Commercial & Industrial $ 432,007 34.9%

Consumer $ 3,452 0.3%

Other $ 8,143 0.7%

Total Loans $ 1,237,553 100.0%

Less: Unearned Income $ (1,602)

Gross Loans $ 1,235,951

Commercial Real Estate $ 559,568 45.2%

Own. Occ. CRE + C&I $ 755,311 61.0%

Gross Loans / Deposits 90.1%

Yield on Loans 5.23%

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bank call report, as of 9/30/2014 Note: All dollars in thousands, unless noted otherwise *Does not include purchase accounting adjustments

7

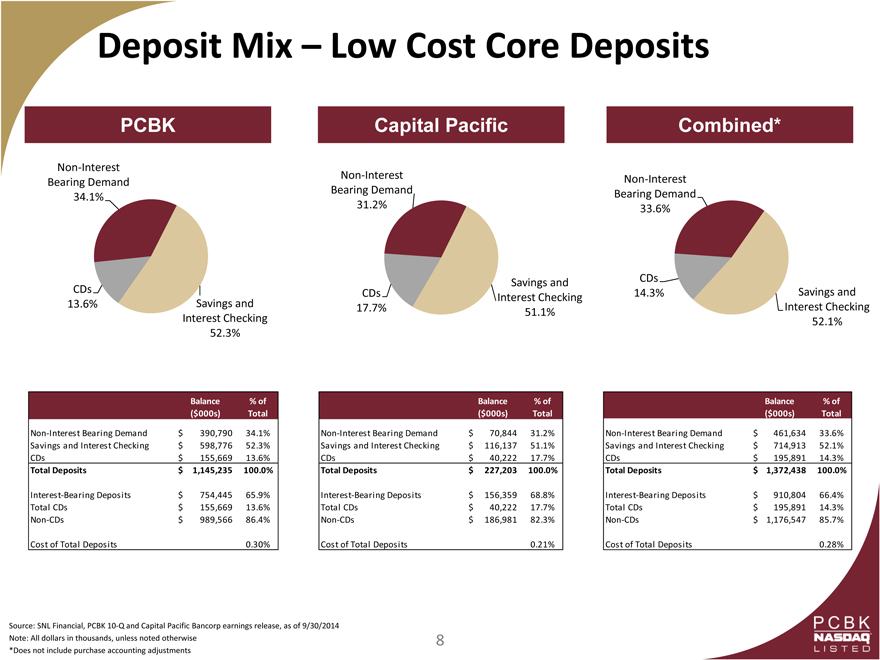

Deposit Mix – Low Cost Core Deposits

PCBK

Non-Interest

Bearing Demand

34.1%

CDs

13.6% Savings and

Interest Checking

52.3%

Capital Pacific

Non-Interest

Bearing Demand

31.2%

Savings and

CDs Interest Checking

17.7% 51.1%

Combined*

Non-Interest

Bearing Demand

33.6%

CDs

14.3% Savings and

Interest Checking

52.1%

Balance% of

($000s) Total

Non-Interest Bearing Demand $ 390,790 34.1%

Savings and Interest Checking $ 598,776 52.3%

CDs $ 155,669 13.6%

Total Deposits $ 1,145,235 100.0%

Interest-Bearing Deposits $ 754,445 65.9%

Total CDs $ 155,669 13.6%

Non-CDs $ 989,566 86.4%

Cost of Total Deposits 0.30%

Balance% of

($ 000s) Total

Non-Interest Bearing Demand $ 70,844 31.2%

Savings and Interest Checking $ 116,137 51.1%

CDs $ 40,222 17.7%

Total Deposits $ 227,203 100.0%

Interest-Bearing Deposits $ 156,359 68.8%

Total CDs $ 40,222 17.7%

Non-CDs $ 186,981 82.3%

Cost of Total Deposits 0.21%

Balance% of

($000s) Total

Non-Interest Bearing Demand $ 461,634 33.6%

Savings and Interest Checking $ 714,913 52.1%

CDs $ 195,891 14.3%

Total Deposits $ 1,372,438 100.0%

Interest-Bearing Deposits $ 910,804 66.4%

Total CDs $ 195,891 14.3%

Non-CDs $ 1,176,547 85.7%

Cost of Total Deposits 0.28%

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bancorp earnings release, as of 9/30/2014 Note: All dollars in thousands, unless noted otherwise *Does not include purchase accounting adjustments

8

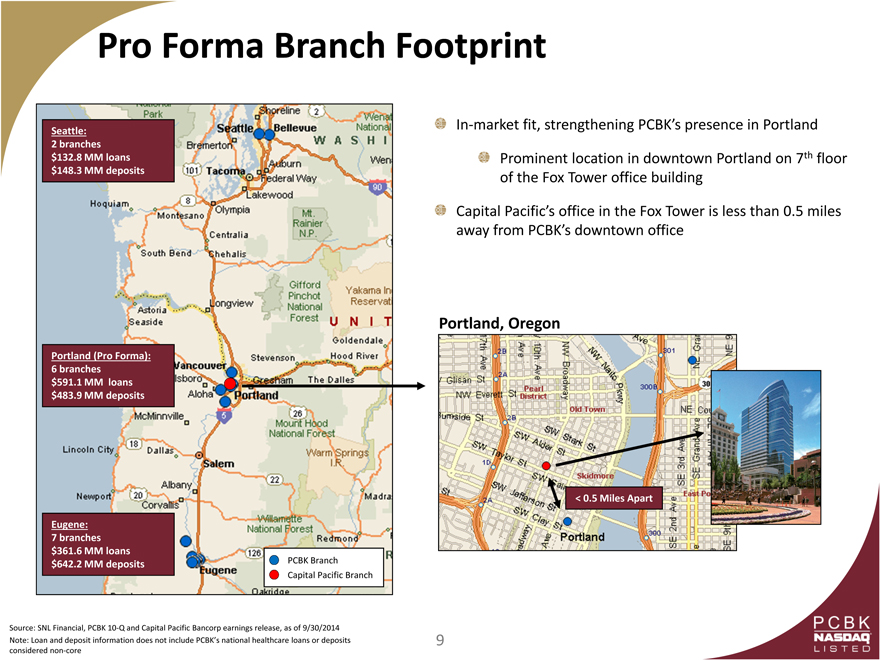

Pro Forma Branch Footprint

In-market fit, strengthening PCBK’s presence in Portland

Prominent location in downtown Portland on 7th floor of the Fox Tower office building

Capital Pacific’s office in the Fox Tower is less than 0.5 miles away from PCBK’s downtown office

Seattle:

2 branches

$132.8 MM loans

$148.3 MM deposits

Portland (Pro Forma):

6 branches

$591.1 MM loans

$483.9 MM deposits

Eugene:

7 branches

$361.6 MM loans

$642.2 MM deposits PCBK Branch

Capital Pacific Branch

Portland, Oregon

< 0.5 Miles Apart

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bancorp earnings release, as of 9/30/2014 Note: Loan and deposit information does not include PCBK’s national healthcare loans or deposits considered non-core

9

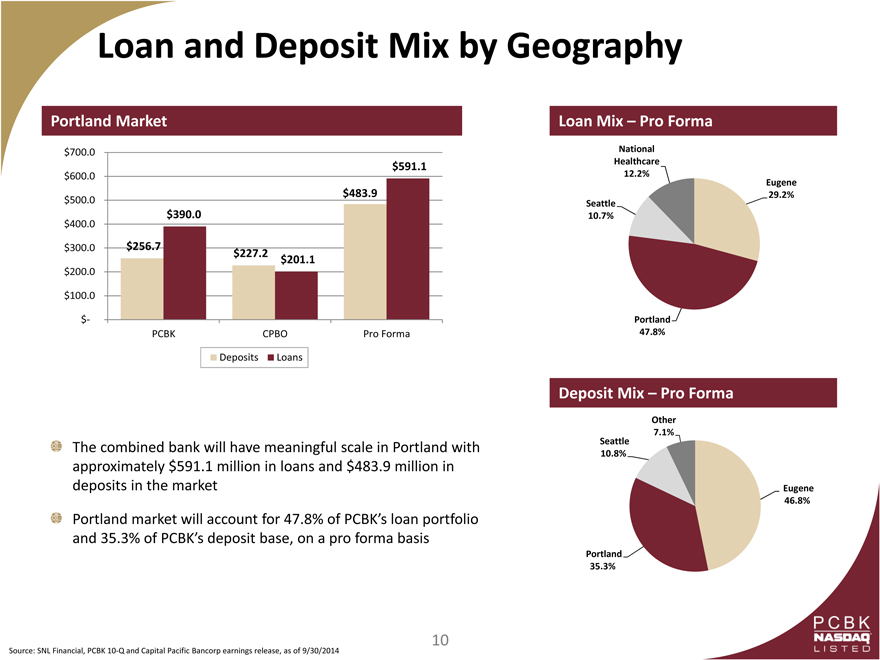

Loan and Deposit Mix by Geography

Portland Market

$ 700.0

$ 591.1

$ 600.0

$ 483.9

$ 500.0

$ 390.0

$ 400.0

$ 300.0 $ 256.7 $ 227.2

$ 201.1

$ 200.0

$ 100.0

$ -

PCBK CPBO Pro Forma

Deposits Loans

Loan Mix – Pro Forma

National

Healthcare

12.2%

Eugene

29.2%

Seattle

10.7%

Portland

47.8%

The combined bank will have meaningful scale in Portland with approximately $591.1 million in loans and $483.9 million in deposits in the market

Portland market will account for 47.8% of PCBK’s loan portfolio and 35.3% of PCBK’s deposit base, on a pro forma basis

Deposit Mix – Pro Forma

Other

7.1%

Seattle

10.8%

Eugene

46.8%

Portland

35.3%

Source: SNL Financial, PCBK 10-Q and Capital Pacific Bancorp earnings release, as of 9/30/2014

10

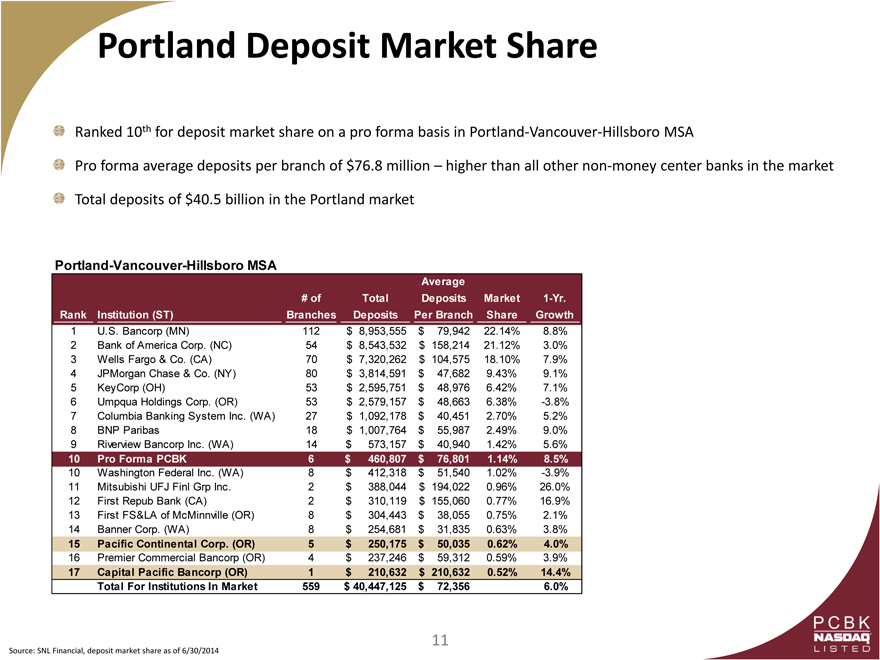

Portland Deposit Market Share

Ranked 10th for deposit market share on a pro forma basis in Portland-Vancouver-Hillsboro MSA

Pro forma average deposits per branch of $76.8 million – higher than all other non-money center banks in the market

Total deposits of $40.5 billion in the Portland market

Portland-Vancouver-Hillsboro MSA

Average

# of Total Deposits Market 1-Yr.

Rank Institution (ST) Branches Deposits Per Branch Share Growth

1 U.S. Bancorp (MN) 112 $ 8,953,555 $ 79,942 22.14% 8.8%

2 Bank of America Corp. (NC) 54 $ 8,543,532 $ 158,214 21.12% 3.0%

3 Wells Fargo & Co. (CA) 70 $ 7,320,262 $ 104,575 18.10% 7.9%

4 JPMorgan Chase & Co. (NY) 80 $ 3,814,591 $ 47,682 9.43% 9.1%

5 KeyCorp (OH) 53 $ 2,595,751 $ 48,976 6.42% 7.1%

6 Umpqua Holdings Corp. (OR) 53 $ 2,579,157 $ 48,663 6.38% -3.8%

7 Columbia Banking System Inc. (WA) 27 $ 1,092,178 $ 40,451 2.70% 5.2%

8 BNP Paribas 18 $ 1,007,764 $ 55,987 2.49% 9.0%

9 Riverview Bancorp Inc. (WA) 14 $ 573,157 $ 40,940 1.42% 5.6%

10 Pro Forma PCBK 6 $ 460,807 $ 76,801 1.14% 8.5%

10 Washington Federal Inc. (WA) 8 $ 412,318 $ 51,540 1.02% -3.9%

11 Mitsubishi UFJ Finl Grp Inc. 2 $ 388,044 $ 194,022 0.96% 26.0%

12 First Repub Bank (CA) 2 $ 310,119 $ 155,060 0.77% 16.9%

13 First FS&LA of McMinnville (OR) 8 $ 304,443 $ 38,055 0.75% 2.1%

14 Banner Corp. (WA) 8 $ 254,681 $ 31,835 0.63% 3.8%

15 Pacific Continental Corp. (OR) 5 $ 250,175 $ 50,035 0.62% 4.0%

16 Premier Commercial Bancorp (OR) 4 $ 237,246 $ 59,312 0.59% 3.9%

17 Capital Pacific Bancorp (OR) 1 $ 210,632 $ 210,632 0.52% 14.4%

Total For Institutions In Market 559 $ 40,447,125 $ 72,356 6.0%

Source: SNL Financial, deposit market share as of 6/30/2014

11

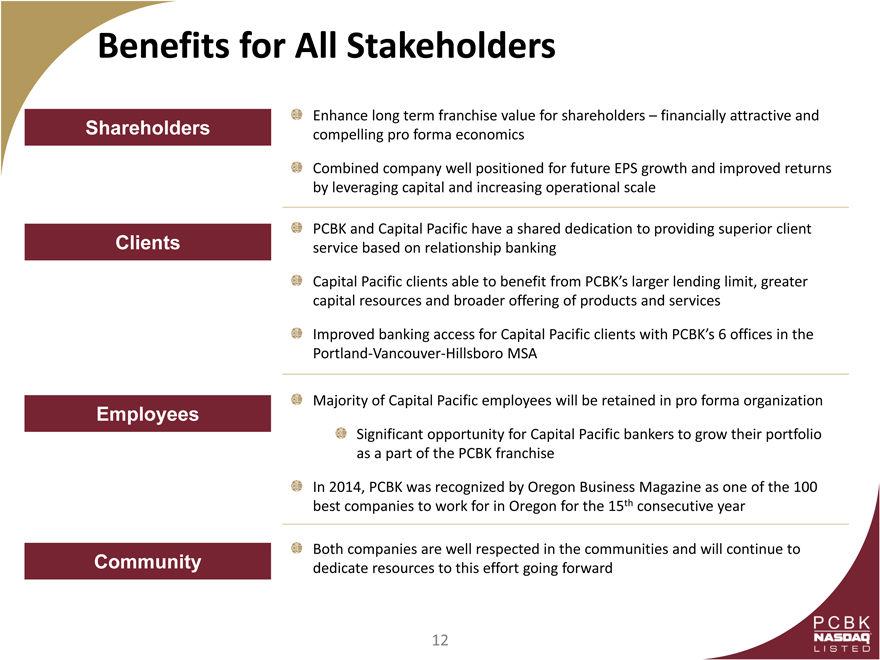

Benefits for All Stakeholders

Enhance long term franchise value for shareholders – financially attractive and

Shareholders compelling pro forma economics

Combined company well positioned for future EPS growth and improved returns

by leveraging capital and increasing operational scale

PCBK and Capital Pacific have a shared dedication to providing superior client

Clients service based on relationship banking

Capital Pacific clients able to benefit from PCBK’s larger lending limit, greater

capital resources and broader offering of products and services

Improved banking access for Capital Pacific clients with PCBK’s 6 offices in the

Portland-Vancouver-Hillsboro MSA

Majority of Capital Pacific employees will be retained in pro forma organization

Employees

Significant opportunity for Capital Pacific bankers to grow their portfolio

as a part of the PCBK franchise

In 2014, PCBK was recognized by Oregon Business Magazine as one of the 100

best companies to work for in Oregon for the 15th consecutive year

Both companies are well respected in the communities and will continue to

Community dedicate resources to this effort going forward

12

Concluding Thoughts

Ideal fit – geographically, strategically and financially attractive

Combined organization with enhanced presence in Portland and well-positioned for future growth

Improving operational scale in Portland Effective use of capital resources Enhancing returns and profitability

Attractive, low cost, core deposit base and diversified loan portfolio mix 3rd largest bank headquartered in Oregon, with $1.7 billion in total assets In-line with PCBK’s merger criteria and strategic growth plan Benefits all stakeholders – shareholders, clients, employees and the community

13