UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

| | |

| Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

PACIFIC CONTINENTAL CORPORATION

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

| | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | (4) | | Date Filed: |

| | |

| | | | |

|

|

TO OUR SHAREHOLDERS:

You are cordially invited to attend the 2016 Annual Meeting of Shareholders (“Annual Meeting”) of Pacific Continental Corporation to be held at 10:00 a.m., local time, on Monday, April 25, 2016, at The Inn at the 5th, Maple Room, 1st Floor, 205 East 6th Avenue, in Eugene, Oregon.

At the meeting, you will be asked to elect as directors the 11 individuals nominated by the Pacific Continental Corporation Board of Directors for a term of one year. You will also be asked to approve an amendment to the Company’s articles of incorporation to provide for majority voting in uncontested director elections, to approve an advisory, non-binding resolution which approves the compensation of the Company’s named executive officers, and to ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. We will also transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

All of the above matters are more fully described in the Proxy Statement. You may access the Annual Report to Shareholders and Proxy Statement through the Internet at http://www.edocumentview.com/PCBK. If you would like a paper copy of the proxy materials mailed to you, you may request one athttp://www.investorvote.com/PCBK; or call1-866-641-4276; or by sending an email toinvestorvote@computershare.com with “Proxy Materials Pacific Continental Corporation” in the subject line. Include in the message your full name and address, plus the number located in the shaded bar on the reverse, and state in the email that you want a paper copy of current meeting materials.

Our Board of Directors has selected February 29, 2016, as the record date for determining shareholders entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournment or postponement thereof. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy. You may vote over the Internet, by telephone or by mail.

| | |

| | Sincerely, |

| |

| | |

| |

March 14, 2016 | | Roger S. Busse |

| | President, Chief Executive Officer |

PACIFIC CONTINENTAL CORPORATION

111 West 7th Avenue

Eugene, Oregon 97401

541-686-8685

Notice of Annual Meeting of Shareholders

| | | | |

| TIME | | 10:00 a.m., local time, on Monday, April 25, 2016 |

| |

| PLACE | | Maple Room, 1st Floor, The Inn at the 5th, 205 East 6th Avenue, Eugene, Oregon 97401 |

| | |

| ITEMS OF BUSINESS | | (1) | | To elect 11 directors to serve on the Board of Directors until our 2017 Annual Meeting of Shareholders. |

| | |

| | (2) | | To approve an amendment to the Company’s Second Amended and Restated Articles of Incorporation to provide for majority voting in uncontested director elections. |

| | |

| | (3) | | To approve an advisory (non-binding) resolution approving executive compensation. |

| | |

| | (4) | | To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

| | |

| | (5) | | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| |

| RECORD DATE | | You are entitled to vote at the Annual Meeting and at any adjournments or postponements thereof if you were a shareholder of record at the close of business on February 29, 2016. |

| |

| VOTING | | You may vote over the Internet, by telephone or by mail. For specific instructions on voting, please refer to the instructions in the accompanying Proxy Statement. |

Pursuant to Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders via the Internet. This process allows us to provide stockholders with the information they need, while at the same time lowering the cost of delivery. On or about March 14, 2016, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders containing instructions on how to access our 2016 Proxy Statement and 2015 Annual Report to Shareholders. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail. The Notice will also serve as an admission ticket for a stockholder to attend the 2016 Annual Meeting of Shareholders. Each attendee must present the Notice, or other proper form of documentation, to be admitted.

|

By Order of the Board of Directors |

|

|

|

Roger S. Busse |

President, Chief Executive Officer |

PROXY STATEMENT

Annual Meeting of Shareholders

April 25, 2016

INTERNET AVAILABILITY OF ANNUAL MEETING MATERIALS

Under Securities and Exchange Commission (“SEC”) rules, we have elected to make our proxy materials available to our stockholders over the Internet, rather than mailing paper copies of those materials to each stockholder. On or about March 14, 2016, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) directing stockholders to a web site where they can access our 2016 Proxy Statement and 2015 Annual Report to Shareholders and view instructions on how to vote via the Internet or by phone. If you received the Notice and would like to receive a paper copy of the proxy materials, please follow the instructions printed on the Notice to request that a paper copy be mailed.

Copies of this Proxy Statement and the Annual Report to Shareholders for the year ended December 31, 2015, are available in theInvestor Relations section of Pacific Continental Bank’s website atwww.therightbank.com.

INTRODUCTION

Our Board of Directors is soliciting proxies for the 2016 Annual Meeting of Shareholders (the “Annual Meeting”) of Pacific Continental Corporation (the “Company”). This Proxy Statement contains information about the items you will vote on at the Annual Meeting to be held on Monday, April 25, 2016, and any adjournments or postponements thereof.

GENERAL INFORMATION

Date, Time and Place of Annual Meeting

The Annual Meeting will be held on Monday, April 25, 2016, at 10:00 a.m., local time, at The Inn at the 5th, Maple Room, 1st Floor, located at 205 East 6th Avenue, Eugene, Oregon.

Purpose of the Meeting

At the Annual Meeting, you will be asked to:

| | ● | | Elect as directors of the Company the 11 individuals nominated by our Board of Directors to serve until our 2017 Annual Meeting or until their successors have been elected and qualified. |

| | ● | | Approve an amendment to the Company’s Second Amended and Restated Articles of Incorporation to provide for majority voting in uncontested director elections. |

| | ● | | Approve an advisory (non-binding) resolution, which approves the compensation of the Company’s named executive officers. |

| | ● | | Ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

1

Record Ownership

Shareholders of record as of the close of business on February 29, 2016 (the “Record Date”), are entitled to one vote for each share of common stock then held. As of February 29, 2016, there were 19,604,780 shares of common stock issued and outstanding.

Quorum

The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of common stock is necessary to constitute a quorum at the Annual Meeting. Both abstentions and broker non-votes (as defined below) will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining the existence of a quorum.

Solicitation of Proxies

The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on proposals being considered at the Annual Meeting. In addition to the use of the mail, proxies may be solicited in person or by telephone by directors, officers and employees of the Company or its subsidiary, Pacific Continental Bank (the “Bank”). It is not expected that compensation will be paid for the solicitation of proxies; however, in the event an outside proxy solicitation firm is engaged to render proxy solicitation services, the Company will pay a fee for such services.

Voting of Proxies

A portion of the Company’s shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially. You may vote your shares in one of several ways, depending upon how you own your shares.

Shares registered directly in your name through our transfer agent. If your shares are registered directly in your name, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent to you by the Company through its transfer agent. As the shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.

| | ● | | Via Internet: Go tohttp://www.investorvote.com/PCBK and follow the instructions. You will need to enter the control number printed on the proxy card you received, and you should follow the instructions provided with your proxy materials and on your proxy card. |

| | ● | | By Telephone: Call toll-free (800) 652-VOTE (8683) and follow the instructions. You will need to enter the control number printed on the proxy card you received, and you should follow the instructions provided with your proxy materials and on your proxy card. |

| | ● | | In Writing: If you wish to vote by mail, complete, sign, date and return the proxy card in the envelope that was provided to you, or, if you wish to vote in person at the Annual Meeting, provide it or a ballot distributed at the Annual Meeting directly to the Inspector of Election when instructed. |

2

Shares held in “street” or “nominee” name (through a bank, broker or other nominee). If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and your broker or other nominee is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker or other nominee on how to vote.

| | ● | | You may receive the proxy card or a separate voting instruction form from your bank, broker or other nominee holding your shares. You should follow the instructions on the proxy card or voting instruction form provided by your broker or nominee in order to instruct your broker or nominee on how to vote your shares. The availability of telephone or Internet voting will depend on the voting process of the broker or nominee. To vote in person at the Annual Meeting, you must obtain a proxy, executed in your favor, from the holder of record. |

| | ● | | If you own shares in “street name” through a broker or other nominee and do not instruct your broker or nominee how to vote, your broker or nominee may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this Proxy Statement, the proposal to ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016, is considered to be “routine.” Each of the other proposals is considered to be a “non-routine” matter. Therefore, if you do not provide your bank, broker or other nominee holding your shares in “street name” with voting instructions, those shares will count for quorum purposes, but will not be counted as shares present and entitled to vote on the election of directors, the amendment of the Company’s articles of incorporation to provide for majority voting in uncontested director elections, or the other proposals included in this Proxy Statement. Therefore, it is important that you provide voting instructions to your bank, broker or other nominee. |

Regardless of how you own your shares, if you are a shareholder of record, you may vote by attending the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or the Internet so that your vote will be counted if you later decide not to attend the meeting.

If you vote via the Internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the Internet and telephone voting facilities to vote your shares will vote:

| | ● | | FOR each director nominee. |

| | ● | | FOR approval of an amendment to the Company’s Second Amended and Restated Articles of Incorporation to provide for majority voting in uncontested director elections. |

| | ● | | FOR approval of the advisory and non-binding resolution, which approves the compensation of the Company’s named executive officers. |

| | ● | | FOR the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. |

Proxy Revocation

Shareholders who execute Proxies retain the right to revoke them at any time prior to the vote on a given matter at the Annual Meeting. Proxies may be revoked by written notice delivered in person or mailed to the Corporate Secretary of the Company or by filing a later Proxy prior to a vote being taken at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a Proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a previously granted Proxy. You may revoke your Proxy by telephone by calling 1-800-652-VOTE (8683) and following the instructions or via the Internet by going tohttp://www.investorvote.com/PCBK and following the instructions.

3

Voting on the Matters Presented

Election of Directors.The nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast FOR or WITHHELD from the directors as a group, or for each or any individual nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the proposal because directors will be elected by a plurality of votes cast.

Vote to Approve an Amendment to the Second Amended and Restated Articles of Incorporation. The proposal to approve an amendment to the Company’s Second Amended and Restated Articles of Incorporation to require a majority vote for the election of directors in uncontested elections will be adopted if a majority of the shares present in person or by proxy voting on this matter are cast FOR the proposal. You may vote FOR, AGAINST or ABSTAIN from approving the proposal. Abstentions and broker non-votes will have no effect on the outcome of the proposal. If the amendment is approved by shareholders at the Annual Meeting, the majority voting standard will be effective commencing with our 2017 annual meeting of shareholders. If shareholders do not approve the proposed amendment, directors will continue to be elected by plurality vote.

Advisory (Non-Binding) Vote to Approve Executive Compensation.The vote presented in Proposal 2 is an advisory vote and, therefore, is not binding on the Company, our Compensation Committee or our Board of Directors. We value the opinions of our shareholders, however, and the Compensation Committee will, as it did with respect to last year’s named executive officer compensation vote, take into account the result of the advisory vote when determining future executive compensation. In accordance with the vote of the shareholders at the 2011 Annual Meeting, and concurrence of our Board of Directors, the Company will provide shareholders with such a vote on an annual basis. The affirmative vote FOR by a majority of those shares present in person or by proxy and voting on this matter is required to approve the advisory (non-binding) resolution to approve the compensation of the Company’s named executive officers. You may vote FOR, AGAINST or ABSTAIN from approving this resolution. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

Ratification of the Appointment of the Independent Registered Public Accounting Firm.The proposal to ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016, will be adopted if a majority of the shares present in person or by proxy voting on this matter are cast FOR the proposal. You may vote FOR, AGAINST or ABSTAIN from approving the proposal. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

Other Matters Presented at the Annual Meeting

We do not expect any matters, other than those included in the Proxy Statement, to be presented at the Annual Meeting. If other matters are presented, the individuals named as proxies will have discretionary authority to vote your shares on those matters.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the Annual Meeting. We will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. After the Form 8-K is filed, you may obtain a copy by visiting our website atwww.therightbank.com, or the SEC’s website atwww.sec.gov, or by writing the Company’s Corporate Secretary at the Company’s main office.

4

CORPORATE GOVERNANCE

The Board of Directors is committed to good business practices, transparency in financial reporting and high standards of corporate governance. The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct, and assuring compliance with such responsibilities and standards. The Board periodically reviews the Company’s governance policies and practices against those suggested by various groups or authorities active in corporate governance and the practices of other companies, as well as the requirements of applicable securities laws and the listing standards of The NASDAQ Stock Market (“NASDAQ”).

Code of Ethics and Corporate Governance Documents

We have adopted a Conflicts of Interest/Code of Ethics/Confidentiality Policy (the “Ethics Policy”), which provides ethical standards and corporate policies that apply to all of our directors, officers and employees. Our Ethics Policy requires, among other things that our directors, officers and employees act in a responsible and ethical manner, comply with laws and regulations, avoid conflicts of interest, and otherwise conduct themselves in a manner deserving of the public trust and confidence. We have also adopted a Code of Ethics for Senior Financial Officers that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, and any persons performing similar functions, and provides for accurate, complete and fair financial reporting.

In addition, each of our committees operates under formal written charters approved by the applicable committee and adopted by our Board of Directors. You may access the current charters and policies, including the Code of Ethics for Senior Financial Officers, Ethics Policy, Articles of Incorporation, Bylaws, and the Audit, Compensation and Corporate Governance and Nominating Committee (“Governance/Nominating Committee”) charters, by visiting the Company’s website and clicking on theGovernance Documentslink within theInvestor Relationssection atwww.therightbank.com.

Board Authority for Risk Oversight

The Board has ultimate authority and responsibility for overseeing risk management of the Company. Some aspects of risk oversight are fulfilled at the full Board level. For example, periodically the Board receives from management various risk management reports, including an Enterprise Risk Management dashboard. Additionally, the Board, or a committee of the Board, receives specific periodic reports from executive management on credit risk, liquidity risk, interest rate risk, capital risk, operational risk and economic risk. Our Board’s standing committees also support the Board by regularly addressing various issues within their respective areas of oversight. The Audit Committee oversees financial, accounting and internal control risk management. The head of the Company’s internal audit function and the independent registered public accounting firm report directly to the Audit Committee. The Compensation Committee oversees the management of risks that may be posed by the Company’s compensation practices and programs. The Governance/Nominating Committee assists our Board in fulfilling its risk management oversight responsibilities associated with risks related to corporate governance structures and processes. Each of the committee chairs, as appropriate, reports to the full Board at regular meetings concerning the activities of their respective committee, the significant issues it has discussed and the actions taken by the committee.

5

Board Composition and Attendance at Meetings

Our Board of Directors is currently composed of eleven (11) members. The Company’s Articles of Incorporation provide that the number of directors will be not less than six (6), with the number of directors to be established in accordance with the Company’s Bylaws. The Company’s Bylaws currently provide for a board of six (6) to fifteen (15) directors, with the specific number of directors to be established by board resolution. The Articles of Incorporation provide that directors are elected annually for one-year terms.

The Company held thirteen (13) Board meetings in 2015. The Bank held eleven (11) Board meetings in 2015. Each individual who served as a director attended at least 75 percent of the aggregate of (i) the total number of meetings of the Board of Directors (held during the period for which each individual served as a director), and (ii) the total number of meetings held by all committees on which he or she served (during the periods that he or she served) with the exception of Mr. Pinneo who attended 73% of Board meetings and 91% of the committee meetings on which he served. During 2015, the Board of Directors met five (5) times in executive session, without management present. The Company does not require, but expects, the directors to attend the Annual Meeting. At the 2015 Annual Meeting, all directors of the Company nominated for re-election were in attendance.

Director Qualifications

The Board of Directors believes that each of the Company’s directors should bring a rich mix of qualities and skills to the Board. All of our directors bring to our Board a wealth of leadership experience derived from their service in a variety of professional and executive positions and extensive board experience.

The Governance/Nominating Committee is responsible for the oversight and nomination process for director nominees. The Committee has not adopted formal “director qualification standards” for Committee-recommended nominees. However, the Committee annually reviews the experience, qualifications, attributes and skills of each director and nominee as part of its evaluation of whether these are the right individuals to serve on the Company’s Board to help the Company successfully meet its strategic plans. Because each director of the Company must be re-elected annually, the Committee has an annual opportunity to assess these factors and, if appropriate, determine not to re-nominate any director. A more detailed discussion regarding the considerations given by the Committee when considering director nominees is set forth below in the section entitled“Certain Committees of the Board of Directors—Governance/Nominating Committee.”

The director biographical information set forth below summarizes the experience, qualifications, attributes and skills that the Company believes qualify each director to serve on the Board. The Governance/Nominating Committee and the Board believe that each respective director’s professional and business acumen and board experience and the total mix of all directors’ experience and skills are beneficial to the Company and the Board.

6

Director Independence

The Board of Directors is committed to maintaining an independent Board, and for many years our Board, excluding the Chief Executive Officer, has been comprised of independent directors. It has further been the Company’s practice to separate the duties of Chairman and Chief Executive Officer. In keeping with good corporate governance practices, at this time, the Board believes that the separation of the duties of Chairman and Chief Executive Officer eliminates any inherent conflict of interest that may arise when the roles are combined, and that an independent director who has not served as an executive of the Company can best provide the necessary leadership and objectivity required as Chairman.

With the assistance of legal counsel to the Company, the Governance/Nominating Committee has reviewed the applicable legal standards for Board and Board committee member independence and the criteria applied to determine “audit committee financial expert” status. The Committee has also reviewed a summary of the answers to annual questionnaires completed by each of the directors, which also included any potential director-affiliated transactions.

The Governance/Nominating Committee analyzed the independence of each director and nominee and has determined that all directors met the applicable laws and listing standards regarding “independence” as defined by the NASDAQ listing standards, and that each such director or nominee is free of relationships that would interfere with the individual’s exercise of independent judgment. In determining the independence of each director or nominee, the Committee considered many factors, including any lending arrangements with the directors, each of which (i) were made in the ordinary course of business, (ii) were substantially made on the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Company or the Bank, and (iii) did not involve more than the normal risk of collectability or present other unfavorable features. Such arrangements are discussed in detail below in the section entitled “Additional Information – Certain Relationships and Related Transactions.”

Certain Committees of the Board of Directors

The Company and Bank Boards have jointly established, among others, an Audit Committee, a Compensation Committee and a Governance/Nominating Committee. Each committee operates under a formal written charter approved by the respective Committee and adopted by the Board of Directors. You may access copies of these respective charters by visiting the Company’s website and clicking on theGovernance Documentslink within theInvestor Relationssection atwww.therightbank.com.

The following table shows the membership of the various Board committees as of the date of this proxy statement.

Committee Membership

| | | | | | |

| | | Audit | | Compensation | | Governance/ Nominating |

Robert A. Ballin | | ¨ | | ¨ | | þ |

Eric S. Forrest | | þ | | þ | | ¨ |

Michael E. Heijer | | þ | | ¨ | | þ |

Michael D. Holzgang | | ¨ | | þ | | þ* |

Judith A. Johansen | | þ | | ¨ | | ¨ |

Donald L. Krahmer, Jr. | | þ* | | ¨ | | þ |

Donald G. Montgomery | | ¨ | | þ* | | þ |

Jeffrey D. Pinneo | | ¨ | | þ | | ¨ |

John H. Rickman | | þ | | þ | | þ |

Karen L. Whitman | | ¨ | | þ | | ¨ |

Total Meetings in 2015 | | [15] | | [7] | | [3] |

*Committee Chair

7

Audit Committee. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the outside auditors performing or issuing an audit report, and approves the engagement and fees for all audit and non-audit functions, with the independent auditors reporting directly to the Audit Committee. The responsibilities of the Audit Committee include overseeing (i) the integrity of the Company’s financial statements, which includes reviewing the scope and results of the annual audit by the independent auditors, any recommendations of the independent auditors and management’s response to such recommendations, and the accounting principles being applied by the Company in financial reporting, (ii) the establishment of procedures for the receipt, retention and treatment of accounting controls, (iii) the reports of bank regulatory authorities and reporting its conclusions to the Board, (iv) the procedures with respect to the records and business practices of the Company and the Bank, (v) the adequacy and implementation of the internal auditing, accounting and financial controls, (vi) the independent auditor’s qualifications and independence, and (vii) compliance with the Company’s legal and regulatory requirements.

The Audit Committee oversees and evaluates the adequacy of the Company’s internal and disclosure controls; however, management is responsible for developing and implementing the internal controls and the financial reporting process. The independent accountants are responsible for performing an audit of the consolidated financial statements in accordance with generally accepted auditing standards and then issuing a report thereon. The Committee’s responsibility is to monitor and oversee this process. In connection with its ongoing responsibility of risk oversight, the Audit Committee also has responsibility for overseeing and refining the Company’s comprehensive Enterprise Risk Management (ERM) evaluative process.

Compensation Committee. The Compensation Committee reviews and approves the Company’s retirement and benefit plans, and determines the salary and incentive compensation for the Chief Executive Officer. For other executive officers, the Committee reviews recommendations from the President/Chief Executive Officer, Chief Operating Officer and the EVP/Chief Administrative Officer. The Committee also reviews and approves total compensation levels for all other Bank officers, and reviews the Company’s annual budget for total compensation and benefits expense. The Committee also establishes compensation for directors, which includes Board retainer fees and committee meeting fees as well as retainer fees for certain committee chairs. In addition to cash compensation, the Committee considers equity grant awards for directors and employees. The Committee may engage outside consultants to assist the members in making peer comparisons and determining industry “best practices.” The Committee is directly responsible and has full authority for the appointment, compensation and oversight of compensation consultants, legal counsel and any other advisors retained by the Committee. The Chair of the Committee reports to the full Board the actions of the Committee.

8

Additional information regarding executive and director compensation is discussed below under “Compensation Discussion and Analysis,” “Executive Compensation,” and “Director Compensation.”

Governance/Nominating Committee. The Governance/Nominating Committee reviews and considers various corporate governance standards as suggested by evolving best practices, the needs of the Company and its shareholders, or as required by the SEC, NASDAQ and other regulatory agencies, and makes recommendations to the full Board as it deems appropriate. The Committee is responsible for reviewing the Ethics Policy and committee charters, defining Board member expectations and independence, reviewing and approving related party transactions, and overseeing Board and committee self-evaluations. In addition, the Committee recommends to the full Board a slate of director nominees for election at the Company’s annual meeting of shareholders.

In deciding whether to recommend incumbent directors for re-nomination, the Governance/Nominating Committee evaluates the Company’s evolving needs and assesses the effectiveness and contributions of its existing directors. The Governance/Nominating Committee is authorized to establish guidelines for the qualification, evaluation and selection of new directors to serve on the Board. The Governance/Nominating Committee has not adopted specific minimum qualifications for Committee-recommended nominees, nor has the Governance/Nominating Committee adopted a formal policy relating to Board diversity, although the Committee and the Board value a diversity of backgrounds, professional experience and skills among directors. The Governance/Nominating Committee instead evaluates each nominee on a case-by-case basis, including assessment of each nominee’s business experience, involvement in the communities served by the Company, independence and special skills. The Governance/Nominating Committee also evaluates whether the nominee’s skills are complementary to existing Board members’ skills, and the Board’s need for operational, management, financial, technological or other expertise, as well as geographical representation within the Company’s market areas.

The Governance/Nominating Committee will also consider nominees recommended by shareholders provided that the recommendations are made in accordance with the procedures described below under “Additional Information - Information Concerning Shareholder Proposals and Director Nominations.” The Governance/Nominating Committee evaluates all candidates, including shareholder-proposed candidates, using generally the same methods and criteria, although those methods and criteria are not standardized and may vary from time to time.

Compensation Committee Interlocks and Insider Participation

During 2015, the Compensation Committee consisted of Mr. Montgomery (Chair), and Messrs. Forrest, Holzgang, Pinneo, and Rickman and Ms. Whitman. During 2015, none of our executive officers served on the compensation committee (or equivalent body) or board of directors of another entity whose executive officer served on the Compensation Committee.

9

Shareholder Communication with the Board of Directors

The Company and the Board of Directors welcome communication from shareholders and have established a formal method for receiving such communication. The preferred method is by email and can be most conveniently done by visiting the Company’s website (www.therightbank.com) and clicking on theShareholder Communicationslink within the Investor Relations section. By clicking onShareholder Tools, and thenShareholder Communications, an email dialog box will be made available for shareholder comments. Any email submitted in this manner is sent to the Chairman of the Board of Directors.

For shareholders who do not have access to the Company’s website, communications with the Board may also be made by writing to the Chairman of the Board, c/o the Corporate Secretary, Pacific Continental Corporation, P.O. Box 10727, Eugene, Oregon 97440-2727.

If the Chairman determines that a communication, whether received by email or postal mail, is relevant to the Company’s operations and policies, such communication will be presented to the appropriate committee or entire Board for review and consideration.

Directors; Nominees for Director

Set forth below are the names and ages of our 11 director nominees as of the date of this Proxy Statement, the year each of them became a director, each director’s principal occupation or employment for at least the past five years, and other public company directorships held by each director during the past five years. The Governance/Nominating Committee has recommended to the Board, and the Board has nominated for election to the Board, the 11 persons listed below to serve for one-year terms or until their successors are elected and qualified. Unless authority is withheld, the persons named as proxies in the voting materials made available to you or in the accompanying proxy will vote “FOR” the election of the 11 nominees listed below. If any of the nominees should refuse or become unavailable to serve, the persons named as proxies will have discretionary authority to vote for a substitute nominee, and your proxy will be voted for such persons as are designated by the Board of Directors to replace any such nominee. The Board of Directors presently has no knowledge that any nominee will refuse or be unavailable to serve. As of the date of this Proxy Statement, the 11 incumbent directors of the Company also served as directors of the Bank.

Robert A. Ballin, 74, has been a director of the Company and the Bank since 1999 and 1980, respectively, and served as Chairman of the Board since 2000. Mr. Ballin has had a 50-year career in the insurance industry and is currently part-owner of Ward Insurance in Eugene. His special expertise is the providing of insurance and surety for the wood products industry throughout the Western half of the United States. Mr. Ballin has also served on numerous community, philanthropic and corporate boards in varying capacities. As a long-time Northwest businessman, his experience in all economic cycles is particularly valuable. Mr. Ballin’s experience in the wood products industry provides insight and knowledge in an industry of significant importance to the Northwest, and his experience in surety underwriting helps provide Board oversight of the Bank’s credit underwriting practices.

Roger S. Busse, 60, an accredited banking veteran with more than 39 years of industry experience, became president and chief executive officer in January of 2015. Recently, Mr. Busse was named to the FDIC Advisory Committee on Community Banking. Mr. Busse joined Pacific Continental Bank in 2003 after a 25-year career with U.S. Bank. Mr. Busse’s first role with PCB was as executive vice president and chief credit officer. In 2006, Mr. Busse was promoted to executive vice president and chief operating officer; and in 2007, he was promoted to president and chief operating officer. A certified management consultant, Mr. Busse holds a bachelor’s degree from Reed College, has earned a master’s degree from

10

Harvard University and is a graduate of the Harvard/MIT executive negotiation curriculum. Mr. Busse is on the board of Synergy by Association – an affiliate organization of the Oregon Bankers Association and was the past board chair of a nonprofit organization in Portland. An accomplished presenter, Mr. Busse is a frequent guest speaker at various executive forums, business-related symposiums and university-sponsored events that focus on ethics and business management. Mr. Busse has recently spoken before professional and student audiences at Harvard, Reed College, University of Oregon, Warner Pacific College, the Oregon Banker’s Association and Moss Adams LLP. Mr. Busse is an avid community volunteer and has assisted organizations such as Food for Lane County and Habitat for Humanity.

Eric S. Forrest, 48, was elected a director of the Company and the Bank in June 2014. Mr. Forrest is the co-president of Eugene-based Bigfoot Beverages and currently serves on the Pepsi Northwest Bottlers board of directors, chairs the Oregon Beverage Recycling board and past chair of the Pepsi-Cola Bottlers Association. A native Oregonian, Mr. Forrest has served on the Board of Directors of Eugene School District 4J, chaired the Eugene Chamber of Commerce executive committee and served on the City of Eugene’s budget committee. Prior to leading Bigfoot Beverages, he was co-founder and principal of Fast Track Car Wash/Joe to Go and served as president of Riversdale Ranch Properties. Mr. Forrest’s strong management experience and entrepreneurial drive provides a significant benefit to the Bank. He received a master’s degree in business administration from Willamette University and bachelor’s degree from Oregon State University.

Michael E. Heijer, 56, has been a director of both the Company and the Bank since 2005, following the acquisition of NWB Financial Corporation. Mr. Heijer was a founder of Northwest Business Bank and served on the boards of directors of NWB Financial Corporation and Northwest Business Bank until their acquisition by the Company in November 2005. He has more than 20 years’ experience in Pacific Northwest hotel and commercial real estate development and is the owner of GranCorp, Inc., a commercial real estate investment company with investments in the Pacific Northwest, which he formed in April 1986. Mr. Heijer was the founder and part-owner of Teris LLC, formerly American Legal Copy, a litigation support services company serving the West Coast that was formed in 1996, and sold in September 2013. He holds a bachelor’s degree in economics from the University of California at Berkeley. Mr. Heijer is a long-time Puget Sound resident and provides an important perspective with regard to the greater Seattle market, one of the Company’s three primary markets. Mr. Heijer’s real estate and entrepreneurial business experiences in the Portland and Seattle markets are particularly beneficial to the Board.

Michael D. Holzgang, 58, has been a director of both the Company and the Bank since 2002. He currently serves as the chair of the Governance/Nominating Committee. Mr. Holzgang has been in the commercial real estate business for over 35 years, currently serving as senior vice president with Colliers International, a global real estate services company since 2001. Prior to joining Colliers, Mr. Holzgang was a senior director at Cushman & Wakefield of Oregon where he worked for 20 years. Prior to that, Mr. Holzgang started his real estate career in Eugene following his graduation from the University of Oregon business school in finance. In addition to the breadth and depth of his knowledge of real estate in all three markets served by the Bank, Mr. Holzgang has served on volunteer boards for a collective period of 35 years. Most recently he served as chairman of the board of directors for Medical Teams International, an international humanitarian disaster relief agency, the second largest nonprofit in the state of Oregon. Prior to that, Mr. Holzgang served as board president of the Boys and Girls Clubs of Portland. Mr. Holzgang is a native Oregonian and has spent most of his life and career residing in Portland, one of the Bank’s three primary markets. His extensive nonprofit and real estate experience and leadership provide a valuable perspective both to the Bank and the Company.

11

Judith A. Johansen, 57, has been a director of both the Company and the Bank since 2013. Ms. Johansen recently retired from Marylhurst University where she served as president since 2008. Prior to her university service, Ms. Johansen was president and CEO of PacifiCorp where she was responsible for the company’s mining operations, regulated power generation facilities, wholesale energy services, transmission and distribution and concurrently served as a board member of Scottish Power, PLC. Additionally, Ms. Johansen served as CEO and administrator for Bonneville Power Administration from 1998 to 2000. Ms. Johansen currently serves on the board of Schnitzer Steel, Idaho Power, Kaiser Permanente Health Plans and Hospitals, Roseburg Forest Group and Hood River Distillers. She is also a senior fellow of the American Leadership Forum of Oregon and chairs the Board of Trustees for the Oregon Chapter of the Nature Conservancy. Ms. Johansen is a former director for the Portland branch of the Federal Reserve Bank of San Francisco, the Oregon Business Council and Bank of the Cascades, and was a Trustee of Law at Lewis and Clark College. Additionally, Ms. Johansen served as an Oregon governor’s appointee to the Port of Portland Commission and is a former chair and trustee for Lewis and Clark College. Ms. Johansen’s extensive and varied business experience and her knowledge of public company practice is of particular value to the Company and the Bank.

Donald L. Krahmer, Jr., 58, has been a director of both the Company and the Bank since 2002, and currently serves as the chair of the Audit Committee. Mr. Krahmer serves as a shareholder of the law firm of Schwabe Williamson & Wyatt, PC, where he chairs the firm’s Technology and Business Practice. He has expertise in corporate law, mergers and acquisitions, corporate governance, and complex business issues. Prior to joining Schwabe as a shareholder in 2002, Mr. Krahmer was a partner at Black Helterline, LLP, and held various management positions with Endeavour Capital, PacifiCorp Financial Services, PacifiCorp and U.S. Bancorp. Mr. Krahmer serves as a member of the community board of directors of Regence Blue Cross Blue Shield of Oregon and serves as a member of the board of directors and executive committee of the Portland Business Alliance. He serves as a technical advisor to the Oregon Innovation Council, which brings together leaders from private businesses, higher education and the public sector to drive innovation strategy. Mr. Krahmer is a member of the American Bar Association’s Business Law Section and its Mergers and Acquisitions, Middle Market and Small Business, and Venture and Private Equity Finance committees. Mr. Krahmer is a long-time Pacific Northwest resident who has spent time in the Bank’s three primary markets of Portland, Eugene and Seattle, and provides important perspective in all of these marketplaces. Mr. Krahmer’s extensive network of business and personal contacts within these markets provides valuable assistance in the Company’s business development efforts. Mr. Krahmer’s board, strategic and financial experience qualifies him with the expertise needed for his service to the Board as well as his position of Audit Committee chair. Additionally, his background as an advisor to many Pacific Northwest businesses, entrepreneurs, executives and corporate boards provides a unique perspective to the Board.

Donald G. Montgomery, 76, has been a director of the Company and the Bank since 1999 and 1996, respectively, and vice chair of the Board since 2000, and currently serves as the chair of the Compensation Committee. Mr. Montgomery is a private investor and formerly served for 17 years as the chief operating officer of Timber Products Company, a privately-owned wood products production and sales company, prior to his retirement in 2002. Prior to joining Timber Products, Mr. Montgomery worked for Kings Table International as chief operating officer. Mr. Montgomery is a long-time Eugene resident and provides an important perspective with regard to the greater Eugene market, one of the Bank’s three primary markets. Mr. Montgomery’s experience as a public company executive brings strong operational and financial expertise to the Board and contributes greatly in developing the Company’s investor relations strategy. His many years of compensation policy and human resource management experience provide the Board with a good overall perspective on compensation, social and governance issues.

12

Jeffrey D. Pinneo, 59, has been a director of both the Company and the Bank since 2013. While Mr. Pinneo is best known for his professional work in the airline industry, he has devoted a great deal of his time to charitable organizations, including Medical Teams International, where he has served on the board since 2008 and as CEO since 2012. Mr. Pinneo has volunteered with the agency since 2006. Through decades of service to the world’s most vulnerable, Medical Teams International has established itself as a leader in global relief and development and a regional point of pride as one of the largest non-profits in the Northwest. Mr. Pinneo is the former CEO and president of Horizon Air. Mr. Pinneo retired in June 2010 after nearly 29 years with Alaska Air Group companies Alaska Airlines and Horizon Air. During his tenure, Mr. Pinneo helped Horizon Air expand markets and revenues and extend the reach and presence of the Horizon and Alaska brands. Under his leadership, Horizon Air was named Regional Airline of the Year by Air Transport World in 2007. Mr. Pinneo has also served on the advisory boards of Seattle Pacific University Center for Integrity in Business, Washington State University College of Business and Point Loma Nazarene University. Mr. Pinneo’s geographic, nonprofit and public company experience align well with and support the Bank’s strategic plan.

John H. Rickman, 74, has been a director of both the Company and the Bank since 2003 and currently serves as the chair of the Company’s Asset and Liability Committee. Mr. Rickman worked for U.S. Bank for 38 years, serving as head of the bank’s Oregon commercial lending group, and, until his retirement in 2001, was the State President of U.S. Bank, Oregon. Mr. Rickman has been involved with numerous civic and professional organizations, including the executive committee of the Portland Chamber, United Way campaign cabinet committee, member of the SOLV-Founders Circle and Goodwill Industries of Columbia-Willamette. He previously served on the board of the Oregon Business Council, the Association for Portland Progress, co-chair of the Oregon Mentoring Initiative, and the Portland Oregon Sports Authority. He is a past chairman of the Oregon Bankers Association and was elected to the Oregon Bankers Hall of Fame in 2003. Mr. Rickman is a long-time Portland resident and provides an important perspective with regard to the greater Portland market, one of the Bank’s three primary markets. Mr. Rickman’s large-bank experience in asset and liability management, credit underwriting, loan portfolio and personnel management is of particular benefit to the Board, and his marketing and business development experience is a valuable resource to Company personnel.

Karen L. Whitman, 74, was appointed a director of the Company and the Bank in March 2015. Ms. Whitman is the president of Karen Whitman Projects and has extensive background in marketing and communication strategy with 35 years of experience advising business, political leaders, nonprofits, art and cultural institutions and economic development organizations. Ms. Whitman was a founding director of Capital Pacific Bancorp and Capital Pacific Bank, which were formed in 2003 and acquired by the Company in March 2015. Ms. Whitman served as board chair for both Capital Pacific Bancorp and Capital Pacific Bank. Ms. Whitman is the past chair of the Oregon Sports Authority and TravelPortland. She is a founder of the ArtQuake Festival, Association for Portland Progress (now Portland Business Alliance) and Sunset Corridor Association (now Westside Economic Alliance). Ms. Whitman is the past president of Portland Schools Foundation (now All Hands Raised) and was named trustee emeritus in 2010. Ms. Whitman is currently a board member of the Friends of Astoria Column, Inc., Museum of the City, Open School and founder director of Converge 45.

The Board of Directors unanimously recommends that you vote FORthe election of each of the nominees for director identified above.

13

COMMITTEE REPORTS

Audit Committee Report

The following is a report of the Audit Committee of the Board of Directors, which is responsible for establishing and administering the Company’s internal controls.

During the fiscal year ended December 31, 2015, the Audit Committee was comprised of five directors, each of whom is considered “independent” as defined by the NASDAQ listing standards and applicable SEC rules. The Board of Directors has determined that Mr. Krahmer is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee has met and held discussions with management and the Company’s independent accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Audit Committee has also discussed with the independent accountants matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The independent accountants provided to the Audit Committee the written disclosures and the letter from the independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent accountants that firm’s independence.

Based on the Audit Committee’s review of the audited consolidated financial statements and the various discussions with management and the independent accountants noted above, the Audit Committee included the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC (“2015 Annual Report on Form 10-K”).

The Director of Internal Audit reports directly to the Audit Committee of the Board of Directors. During 2015, the Director of Internal Audit worked under the direction of the Audit Committee to assist in managing all aspects of the auditing function including management of the internal audit department and coordination of all outsourced external auditors and consultants retained by the Audit Committee. The Audit Committee is directly responsible for setting the compensation of the Director of Internal Audit, review and approval of a budget for the Internal Audit department, review and approval of an annual audit plan for the Bank and the Company, and review and approval of all audits completed by the Internal Audit department, outside auditors and contractors.

Audit Committee

Donald L. Krahmer, Jr. (Chair)

Eric S. Forrest

Michael E. Heijer

Judith A. Johansen

John H. Rickman

14

Compensation Committee Report

During the fiscal year ended December 31, 2015, the Compensation Committee was comprised of six directors, each of whom satisfies the independence criteria under the NASDAQ listing standards and applicable rules of the SEC and the criteria of an outside director under the applicable rules of the Internal Revenue Service.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis (“CD&A”) set forth in this Proxy Statement with management, and based on that review and those discussions, the Compensation Committee recommended to the Board that the CD&A be included as part of this Proxy Statement and incorporated by reference into the 2015 Annual Report on Form 10-K.

Compensation Committee

Donald G. Montgomery (Chair)

Eric S. Forrest

Michael D. Holzgang

Jeffrey D. Pinneo

John H. Rickman

Karen L. Whitman

Corporate Governance and Nominating Committee Report

The following is a report of the Governance/Nominating Committee of the Board of Directors, which is responsible for the Company’s review and consideration of corporate governance standards, related person transactions and for selecting the annual slate of director nominees.

The Governance/Nominating Committee is currently comprised of six directors, each of whom is considered “independent” as defined by the NASDAQ listing standards.

The Governance/Nominating Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics that Board members should possess, as well as the composition of the Board as a whole. This review includes an assessment of the absence or presence of material relationships with the Company which might impact independence, as well as consideration of diversity, skills, experience, time available and the number of other boards the member serves in the context of the needs of the Board and the Company and such other criteria as the Governance/Nominating Committee shall determine to be relevant at the time. The Governance/Nominating Committee recommends nominees and number of directorships to the Board in accordance with the foregoing and the policies and principles in its charter.

The Governance/Nominating Committee recommends to the Board the number of director nominees required for the forthcoming year. When considering director nominations, the Governance/Nominating Committee will give equal consideration to director candidates nominated by shareholders and the Governance/Nominating Committee’s own candidates, provided that the shareholder recommendations are made in accordance with the procedures described in this Proxy Statement under “Additional Information - Information Concerning Shareholder Proposals and Director Nominations.” Candidates will be interviewed by the Governance/Nominating Committee (any expenses are the responsibility of the candidate) to evaluate the candidate’s competencies, business acumen, community visibility, Company share ownership and such other criteria as the Governance/Nominating Committee shall determine to be relevant at the time. Current directors standing for re-election are not required to participate in an interview process.

15

During 2015, the Governance/Nominating Committee recommended to the full Board the 11 current directors for nomination for election at the Annual Meeting.

Corporate Governance/Nominating Committee

Michael D. Holzgang (Chair)

Robert A. Ballin

Michael E. Heijer

Donald L. Krahmer, Jr.

Donald G. Montgomery

John H. Rickman

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table shows the amount of common stock beneficially owned by (a) the executive officers named in the Summary Compensation Table (“named executive officers”), (b) each director, (c) all of the Company’s directors and executive officers as a group, and (d) all persons who are known to the Company to be beneficial owners of five percent or more of the Company’s common stock. Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. Except for our five percent holders, the table shows beneficial ownership as of December 31, 2015. The number of shares reported is based on data provided to us by the beneficial owners of the shares. The percentage ownership data is based on 19,604,192 shares of our common stock outstanding as of December 31, 2015. Under SEC rules, beneficial ownership includes any shares over which the person or entity exercises voting or investment power and also any shares that the person or entity has the right to acquire within 60 days of December 31, 2015. Except as noted below, each holder has sole voting and investment power for all shares shown as beneficially owned. Where beneficial ownership was less than one percent of all outstanding shares, the percentage is not reflected in the table. Unless otherwise noted below, the address of each beneficial owner listed in the table is: c/o Pacific Continental Corporation, 111 West 7th Avenue, Eugene, Oregon 97401.

The Company has adopted a policy prohibiting employees or directors from engaging in transactions that hedge the economic risks of ownership of the Company’s common stock, including trading in publicly traded options, puts, calls or other derivative instruments related to Company stock. In addition, the Company has adopted stock ownership and hold guidelines that require directors and executive officers to retain a certain ownership level of Company stock. A complete description of these ownership and retention guidelines is set forth in“Compensation Discussion and Analysis – Key Compensation Policies – Executive Stock Ownership and Hold Guidelines.”

Security Ownership of Certain Beneficial Owners and Management

| | | | | | | | | | |

| Name | | Position with Company | | Number of

Shares (1)(2) | | | Percentage

of Shares | | |

Executive Officers and Directors | | | | | | | | |

Roger S. Busse | | President/Chief Executive Officer | | | 98,845 | (3) | | * | | |

Michael A. Reynolds** | | Executive Vice President, Chief Financial Officer | | | 51,270 | (3) | | * | | |

Richard R. Sawyer*** | | Executive Vice President, Chief Financial Officer | | | 3,000 | (4) | | * | | |

16

| | | | | | | | | | | | |

Mitchell J. Hagstrom | | Executive Vice President, Chief Banking Officer | | | 79,715 | (5) | | | * | | | |

Casey R. Hogan | | Executive Vice President, Chief Operating Officer | | | 58,939 | | | | * | | | |

Rachel L. Ulrich | | Executive Vice President, Chief Administrative Office | | | 14,323 | | | | * | | | |

Robert A. Ballin | | Chairman of the Board | | | 404,690 | (6) | | | 2.064 | % | | |

Eric S. Forrest | | Director | | | 5,254 | | | | | | | |

Michael E. Heijer | | Director | | | 72,563 | (7) | | | * | | | |

Michael D. Holzgang | | Director | | | 16,442 | | | | * | | | |

Judith A. Johansen | | Director | | | 13,642 | | | | * | | | |

Donald L. Krahmer, Jr. | | Director | | | 12,044 | | | | * | | | |

Donald G. Montgomery | | Vice Chairman of the Board | | | 60,728 | | | | * | | | |

Jeffrey D. Pinneo | | Director | | | 5,868 | | | | | | | |

John H. Rickman | | Director | | | 37,626 | (8) | | | * | | | |

Karen L. Whitman | | Director | | | 14,038 | | | | * | | | |

Directors and executive officers as a group (16 persons) | | | | | 949,847 | (9) | | | 4.801 | % | | |

| | | | | | | | | | | | |

| | *Represents less than 1% of the Company’s outstanding common stock. | | | | |

| | **Mr. Reynolds retired from his position as chief financial officer, effective August 31,2015. | | | | |

| | *** Mr. Sawyer was appointed chief financial officer of the Company effective August 24, 2015. | | | | |

| | (1) | | Share amounts include options to acquire shares that are exercisable within 60 days as follows: Busse 73,709; Reynolds 29,578; Hagstrom 31,587; Hogan 29,219; and Ulrich 10,225 | | | | |

| | (2) | | Share amounts include shares of Company common stock owned “jointly with spouse” as follows: Busse 25,136; Reynolds 21,445; Sawyer 1,000; Hagstrom 47,744; Hogan 29,720; Ulrich 4,098; Ballin 156,604; Forrest 5,254; Heijer 61,229; Holzgang 16,442; Johansen 13,642; Krahmer 12,044; Pinneo 5,868; and Rickman 37,626. | | | | |

| | (3) | | Includes 247 shares held by spouse | | | | |

| | (4) | | Includes 500 shares held by spouse. | | | | |

| | (5) | | Includes 384 shares held as custodian for children. | | | | |

| | (6) | | Includes 2,250 shares held in trust for grandchildren; 90,812 pledged as security for a line of credit; and 62,540 in a margin account. | | | | |

| | (7) | | Includes 3,171 shares held as custodian for children; 5,288 shares held by GranCorp Holdings, LLC, 2,875 shares held by GranCorp Inc., of which Mr. Heijer and his spouse are the owners and principals, and 46,508 pledged as security for a line of credit. | | | | |

| | (8) | | All shares held in the Rickman Family Trust. | | | | |

| | (9) | | Includes 174,318 shares subject to options that could be exercised within 60 days. | | | | |

17

5% Shareholders

| | | | | | | | |

| Name | | Number of

Shares (1)(2) | | | Percentage

of Shares | |

| | |

Banc Fund (1) 20 North Wacker Drive, Suite 3300 Chicago, IL 60606 | | | 1,691,652 | | | | 8.63 | % |

Basswood Capital Management (2) 645 Medison Avenue,10th Floor New York, NY 10022 | | | 1,340,460 | | | | 6.84 | % |

BlackRock Fund Advisors (3) 40 East 52nd Street New York, NY 10022 | | | 1,296,441 | | | | 6.61 | % |

| (1) | Based on Schedule 13G filed under the Securities Exchange Act of 1934 (the “Exchange Act”) on February 5, 2016. The securities are beneficially owned by Banc Fund Co. LLC and certain of its affiliates. |

| (2) | Based on Schedule 13F Form filed under the Exchange Act on December 31, 2015. The securities are beneficially owned by Basswood Capital Management and certain of its affiliates. |

| (3) | Based on Schedule 13F Combined filed under the Exchange Act on December 31 2015. The securities are beneficially owned by BlackRock Fund Advisors and certain of its affiliates. |

MANAGEMENT

Executive Officers who are not Directors

The following table sets forth information with respect to the current executive officers who are not director nominees or directors of the Company, including their employment history.

| | | | | | | | | | |

| Name | | Age | | | Position with the Company or the Bank and Employment History | | Tenure as an Officer of the Company and

the Bank | |

| | | |

Harlan D. Barcus | | | 56 | | | Executive Vice President, Chief Lending Officer (1) | | | 2003 | |

| | | |

Scott A. Beard | | | 49 | | | Executive Vice President, Director of Healthcare Lending (2) | | | 2001 | |

| | | |

Denise L. Ghazal | | | 53 | | | Executive Vice President, Greater Eugene Market President (3) | | | 1990 | |

| | | |

Mitchell J. Hagstrom | | | 59 | | | Executive Vice President, Chief Banking Officer (4) | | | 1988 | |

| | | |

Robert C. Harding | | | 47 | | | Executive Vice President, Greater Portland Market President (5) | | | 2000 | |

| | | |

Casey R. Hogan | | | 57 | | | Executive Vice President, Chief Operating Officer (6) | | | 1995 | |

| | | |

Nazim N. Karmali | | | 50 | | | Executive Vice President, Greater Seattle Market President (7) | | | 2013 | |

18

| | | | | | | | | | |

| | | |

Scott P. McGillivray | | | 47 | | | Executive Vice President, Chief Information Officer (8) | | | 2014 | |

| | | |

Michael A. Reynolds | | | 64 | | | Executive Vice President, Chief Financial Officer(9) | | | 1998 | |

| | | |

Damon R. Rose | | | 48 | | | Executive Vice President, Chief Credit Officer (10) | | | 1999 | |

| | | |

Richard R. Sawyer | | | 50 | | | Executive Vice President, Chief Financial Officer (11) | | | 2015 | |

| | | |

Mark C. Stevenson | | | 55 | | | Executive Vice President, Chief Nonprofit & Sustainability Officer (12) | | | 2005 | |

| | | |

Rachel L. Ulrich | | | 50 | | | Executive Vice President, Chief Administrative Officer (13) | | | 2008 | |

| | (1) | Mr. Barcus joined the Bank in March, 2015 as part of the Capital Pacific Bank acquisition and serves as executive vice president and chief lending officer. Mr. Barcus brings 35 years of credit administration and banking experience to his role, including several years in the 1980s as senior bank examiner for the Federal Deposit Insurance Corporation. |

| | (2) | Mr. Beard joined the Bank in 2001, and leads the Company’s health care banking team as executive vice president and director of health care lending. Mr. Beard has over 20 years of commercial lending experience in the health care market, including more than 14 years in dental practice lending |

| | (3) | Ms. Ghazal joined the Bank in 1990 and soon became involved in the commercial lending arena. Prior to her 2012 promotion to executive vice president and market president Ms. Ghazal spent several years as a commercial banking manager and team leader where she supervised a large staff of commercial lenders and support teams |

| | (4) | In 2012, Mr. Hagstrom was named executive vice president, chief banking officer, responsible for market activities in all three primary markets of the Bank. He concurrently served as market president, Greater Eugene Market, a role he had from 2008 until September 2012. Prior to his appointment in 2004 to executive vice president and director of Greater Eugene operations, Mr. Hagstrom was responsible for deposit and loan growth throughout the Eugene market, serving in a market leadership role since he joined the Bank in 1988. |

| | (5) | Mr. Harding joined the Bank’s leadership team in 2010 as executive vice president and market president. Mr. Harding previously served as the Bank’s senior vice president and relationship banking team leader in the Portland metropolitan market. Before joining Pacific Continental Bank in 2000, Mr. Harding worked for Bank of America for seven years. |

| | (6) | Prior to his appointment as chief operating officer of the Company in 2015, Mr. Hogan served as executive vice president and chief credit officer of the Bank. Prior to his appointment as executive vice president and chief credit officer of the Bank in 2006, Mr. Hogan served in various capacities with the Bank, including commercial lending and credit administration. He joined the Bank in 1995 after serving as a lender for Idaho First National Bank for 18 years. |

| | (7) | Mr. Karmali joined the Bank in April, 2013 as a senior vice president and commercial banking manager. Mr. Karmali was promoted to executive vice president and president of the Greater Seattle market in September, 2013. Prior to joining the Bank, Mr. Karmali worked in a variety of banking positions including lending and management roles with Toronto Dominion Bank and Opus Bank. |

| | (8) | Mr. McGillivray joined the Bank in 2014 as senior vice president and chief information officer and was promoted to executive vice president and chief information officer in 2015. Mr. McGillivray has more than 20 years of technology leadership experience, including 10 years in the financial services industry. Mr. McGillivray has held a number of IT management roles in industries such as transportation, chemical manufacturing, high tech and the public sector. |

| | (9) | Mr. Reynolds joined the Company and the Bank in 1998 and has served as the chief financial officer until his retirement effective August 31, 2015. Prior to joining the Company and the Bank, Mr. Reynolds spent 17 years in the corporate finance divisions of First Interstate Bank and U.S. Bank. |

| | (10) | Mr. Rose began his banking career at the commercial banking division of Siuslaw Valley Bank in 1992, where he worked in all aspects of commercial banking. Mr. Rose joined the Bank as a commercial lender working with small business professionals, becoming well versed in SBA lending. In 2006, Mr. Rose was promoted to the position of senior vice president and senior credit officer. In 2015 Mr. Rose was promoted to executive vice president and chief credit officer. |

19

| | (11) | Mr. Sawyer was named executive vice president and chief financial officer for Pacific Continental Bank in Augustr, 2015. Mr. Sawyer possesses strong experience within the community banking industry and also provides great insight and counsel related to one of PCB’s key business niches – the nonprofit sector. Mr. Sawyer was the executive vice president and chief financial officer for Tower Financial Corporation, a publicly held community bank also headquartered in Fort Wayne. Mr. Sawyer succeeded Michael A. Reynolds as chief financial officer upon Mr. Reynolds’s retirement effective August 31, 2015. |

| | (12) | Mr. Stevenson joined the Bank in March, 2015 as part of the Capital Pacific Bank acquisition and serves as executive vice president and chief nonprofit & sustainability officer. Mr. Stevenson served as president and CEO of Capital Pacific Bank and has more than 30 years of experience in commercial banking, credit management and corporate finance at financial institutions such as U.S. Bank and Security Pacific Bank. |

| | (13) | Ms. Ulrich was appointed as chief administrative officer of the Company in January 2015. Prior to her appointment, Ms. Ulrich served as senior vice president and human resources director since joining the Company in 2008; later that same year she was promoted to executive vice president. Prior to joining the Company Ms. Ulrich served 12 years as executive vice president and director of human resources for First Defiance Financial Corporation. |

COMPENSATION DISCUSSION AND ANALYSIS

Pacific Continental’s executive compensation programs are designed to support shareholder and Company objectives by providing competitive base salaries along with short-term and long-term rewards focused on balancing risk and performance. The Company’s Board of Directors has established a Compensation Committee (“Committee”) which is responsible for establishing and administering the Company’s executive and director compensation programs. The Committee consists only of independent non-employee directors and operates under a formal written charter approved by the Committee and adopted by the Board of Directors.

This Compensation Discussion and Analysis discusses our 2015 compensation program for the following named executive officers:

| | |

Name | | Executive Officer Position |

| |

Roger S. Busse | | President & Chief Executive Officer |

Michael A. Reynolds | | Executive Vice President & Chief Financial Officer (1) |

Richard R. Sawyer | | Executive Vice President & Chief Financial Officer (2) |

Mitchell J. Hagstrom | | Executive Vice President & Chief Banking Officer |

Rachel L Ulrich | | Executive Vice President & Chief Administrative Officer |

Casey R. Hogan | | Executive Vice President & Chief Operating Officer |

| (1) | Mr. Reynolds retired from his position of chief financial officer effective August 31, 2015. |

| (2) | Mr. Sawyer was appointed chief financial officer of the Company on August 24, 2015. |

Executive Compensation Philosophy and Objectives

The Committee strives to design compensation programs that attract and retain the best available talent while efficiently utilizing available resources and appropriately managing risk. The Committee seeks to compensate employees with a pay and benefits package that is competitive in the marketplace, appropriately reflects varying levels of responsibility within the Company, and is aligned with the interests of shareholders and sound risk management principles. The process for establishing executive compensation consists of targeting overall compensation and then allocating that compensation between base salary, short-term and long-term incentive compensation (provided through annual cash incentive opportunity and long-term equity incentive compensation, respectively) thus driving behavior toward objectives that are aligned with shareholder interests.

20

The Committee believes there should be a strong link between executive pay and Company performance. Although a competitive compensation package must be provided in order to retain top talent, incentive compensation should mirror changes in the Company’s financial performance. As is described in detail below, our executive compensation program has three core components: a competitive base salary, an annual cash incentive opportunity and a long-term equity incentive opportunity. The Committee has established financial performance and risk identification thresholds for determining incentive compensation pay levels. As the Company’s performance changes, so does the executive’s compensation. In 2015, total compensation for the Chief Executive Officer remained in direct relationship to the performance of the Bank.

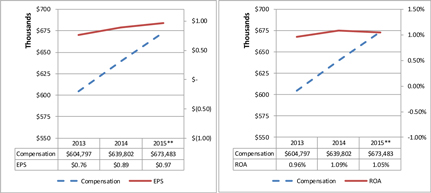

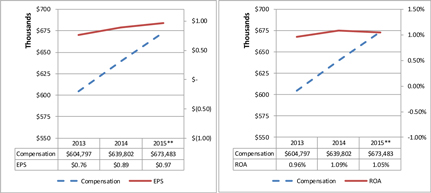

To illustrate the connection between Company performance and executive compensation, the charts and tables below show the Chief Executive Officer’s total compensation from the Summary Compensation Table for the three years ended December 31, 2015 and the Company’s performance for those same years expressed as earnings per share (“EPS”) and return on assets (“ROA”).

**excludes one-time expenses related to relocation

Role of Compensation Committee and Management