SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under Rule 14a-12

ARIBA, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

ARIBA, INC.

807 11th Avenue

Sunnyvale, California 94089

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Ariba, Inc., which will be held at the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, March 18, 2002, at 8:00 a.m.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the Annual Meeting.WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE.Returning the proxy does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the Annual Meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Ariba. We look forward to seeing you at the Annual Meeting.

| | Dir | ector, President and Chief Executive Officer |

Sunnyvale, California

February 4, 2002

ARIBA, INC.

807 11th Avenue

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 18, 2002

To the Stockholders:

The annual meeting of stockholders (the “Annual Meeting”) of Ariba, Inc. (the “Company”) will be held at the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, March 18, 2002, at 8:00 a.m. for the following purposes:

1. To elect two (2) members of the Board of Directors to serve until the 2005 annual meeting of stockholders of the Company or until their successors have been duly elected and qualified;

2. To ratify the appointment of KPMG LLP as the Company’s independent public accountants for the fiscal year ending September 30, 2002; and

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement. Only stockholders of record at the close of business on January 17, 2002, the record date, are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 807 11th Avenue, Sunnyvale, California, during ordinary business hours for the ten-day period prior to the Annual Meeting.

| | By | Order of the Board of Directors, |

Sunnyvale, California

February 4, 2002

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE ANNUAL MEETING.

ARIBA, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 18, 2002

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of Ariba, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the San Mateo Marriott located at 1770 S. Amphlett Boulevard, San Mateo, California, on Monday, March 18, 2002, at 8:00 a.m., and at any adjournment or postponement of the Annual Meeting. These proxy materials were first mailed to stockholders on or about February 4, 2002.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement (“Proxy Statement”).

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s Common Stock (the “Common Stock”) is the only type of security entitled to vote at the Annual Meeting. On January 17, 2002, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 262,619,080 shares of Common Stock outstanding. Each stockholder of record on January 17, 2002 is entitled to one vote for each share of Common Stock held by such stockholder on January 17, 2002. Shares of Common Stock may not be voted cumulatively. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Common Stock issued and outstanding and entitled to vote generally in the election of directors, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal No. 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The two (2) nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted toward a nominee’s total. Stockholders may not cumulate votes in the election of directors.

Proposal No. 2. Ratification of the appointment of KPMG LLP as the Company’s independent public accountants for the fiscal year ending September 30, 2002 requires the affirmative vote of a majority of those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

Proxies

Whether or not you are able to attend the Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors (the “Board of Directors”) and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the nominees for election to the Board of Directors (as set forth in Proposal No. 1), FOR Proposal No. 2 and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting. You may also revoke or change your proxy at any time before the Annual Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive offices before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram, or other means by directors, officers, employees or agents of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Certificate of Incorporation of the Company provides for a classified board of directors, with the terms of office of each class of directors ending in successive years. The Company currently has authorized seven directors, with one class of directors consisting of three directors and two classes of directors each consisting of two directors. Each class of directors serves a three year term. At the Annual Meeting, two directors are to be elected to serve until the 2005 annual meeting of stockholders of the Company or until their successors are elected and qualified. The directors who are being nominated for election to the Board of Directors (the “Nominees”), their ages as of December 31, 2001, their positions and offices held with the Company and certain biographical information are set forth below. The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below unless otherwise instructed. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the current Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware of any Nominee who is unable or will decline to serve as a director. The two (2) Nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company. Abstentions and broker non-votes will not be counted toward a Nominee’s total. Proxies cannot be voted for more than two (2) individuals.

Nominees

| | Age

| | Year Term Expires

| | Positions and Offices Held with the Company

|

| Robert M. Calderoni(1) | | 42 | | 2002 | | Director, President and Chief Executive Officer |

| Robert E. Knowling, Jr.(2)(3) | | 46 | | 2002 | | Director |

| (1) | | Member of Stock Option Committee. |

| (2) | | Member of Audit Committee. |

| (3) | | Member of Compensation Committee. |

2

Robert M. Calderoni, age 42, has served as the Company’s President and Chief Executive Officer and a director since October 2001. From October 2001 to December 2001, Mr. Calderoni also served as the Company’s Interim Chief Financial Officer. From January 2001 to October 2001, Mr. Calderoni served as the Company’s Executive Vice President and Chief Financial Officer. Mr. Calderoni was also an employee of the Company from November 2000 to January 2001. From November 1997 to November 2000, he served as Chief Financial Officer at Avery Dennison Corporation, a manufacturer of pressure-sensitive materials and office products. From June 1996 to November 1997, Mr. Calderoni served as Senior Vice President of Finance at Apple Computer. Prior to that time, Mr. Calderoni held various positions with IBM, most recently as Vice President of Finance of IBM Storage Systems Division. Mr. Calderoni holds a Bachelor of Science degree from Fordham University.

Robert E. Knowling, Jr., age 46, has served as a director of the Company since July 2000. Since February 2001, Mr. Knowling has served as Chairman and Chief Executive Officer of Internet Access Technologies, a software development company. Mr. Knowling served as Chairman of the Board of Directors, President and Chief Executive Officer of Covad Communications Group from July 1998 to October 2000. Prior to joining Covad, he served as Executive Vice President of Operations and Technologies from October 1997 to July 1998 and as Vice President of Network Operations from March 1996 to September 1997 at US West Communications. Prior to joining US West, Mr. Knowling served as Vice President of Network Operations for Ameritech Corporation from November 1994 to March 1996. In addition to serving as a director of the Company, he is also a member of the boards of directors of Hewlett-Packard Company, Broadmedia, Heidrick and Struggles International, the YMCA of Metropolitan Chicago, and the Juvenile Diabetes Research Foundation International. Mr. Knowling holds a Bachelor of Arts degree from Wabash College, and a Master of Business Administration from Northwestern University’s Kellogg Graduate School of Business.

Set forth below is information regarding each of the continuing directors of the Company, including his age as of December 31, 2001, the period during which he has served as a director, and information furnished by him as to principal occupations and directorships held by him in corporations whose shares are publicly registered.

Continuing Directors—Term Ending in 2003

Keith J. Krach, age 44, a co-founder of the Company, has served as Chairman of the Board of Directors since the Company’s inception in September 1996. Mr. Krach also served as Interim Chief Executive Officer from July 2001 to October 2001 and Chief Executive Officer from September 1996 to April 2001. From March 1996 to September 1996, Mr. Krach served as an Entrepreneur in Residence at Benchmark Capital. From October 1988 to August 1995, Mr. Krach served as Chief Operating Officer of Rasna Corporation, a mechanical computer–aided design automation software company. Prior to joining Rasna, Mr. Krach held various positions with General Motors, including General Manager and Vice President of GMF Robotics. Mr. Krach holds a Bachelor of Science degree from Purdue University and a Master of Business Administration from Harvard Business School.

Robert C. Kagle, age 46, has served as a director of the Company since the Company’s inception in September 1996. Mr. Kagle has been a Managing Member of the general partner of Benchmark Capital Partners since May 1995. Mr. Kagle also has been a General Partner of Technology Venture Investors since January 1984. Mr. Kagle currently serves as a director of eBay and E-Loan and is currently a Trustee of Kettering University, formerly known as the General Motors Institute. Mr. Kagle holds a Bachelor of Science degree from Kettering University and a Master of Business Administration from the Stanford Graduate School of Business.

Continuing Directors—Term Ending in 2004

Paul Hegarty, age 37, a co-founder of the Company, has served as a director of the Company since October 1998. Mr. Hegarty also served as Vice President of Engineering from the Company’s inception in September

3

1996 to August 1997, and as Chief Technical Officer from the Company’s inception to October 1998. From June 1996 to September 1996, Mr. Hegarty served as an Entrepreneur in Residence at Benchmark Capital. From February 1988 to May 1996, Mr. Hegarty served in various engineering capacities at NeXT Software, including Vice President of Engineering. Mr. Hegarty holds Bachelor of Science and Master of Science degrees from Stanford University.

Board of Directors Meetings and Committees

During the fiscal year ended September 30, 2001, the Board of Directors held 15 meetings and acted by written consent in lieu of a meeting on two occasions. For the fiscal year, each of the current directors during the term of their tenure attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. The Board of Directors has three standing committees: the Audit Committee; the Compensation Committee; and the Stock Option Committee.

Audit Committee. During the fiscal year ended September 30, 2001, the Audit Committee of the Board of Directors (the “Audit Committee”) held five meetings and did not act by written consent in lieu of a meeting. The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s accountants, the scope of the annual audits, fees to be paid to the Company’s accountants, the performance of the Company’s accountants and the accounting practices of the Company. The members of the Audit Committee are Messrs. Hegarty, Kagle and Knowling.

Compensation Committee. During the fiscal year ended September 30, 2001, the Compensation Committee of the Board of Directors (the “Compensation Committee”) held one meeting and acted by written consent in lieu of a meeting on six occasions. The Compensation Committee reviews the performance of the executive officers of the Company, establishes compensation programs for the officers, and reviews the compensation programs for other key employees, including salary and cash bonus levels and option grants under the 1999 Equity Incentive Plan. The members of the Compensation Committee are Messrs. Kagle and Knowling.

Stock Option Committee. ��The Stock Option Committee of the Board of Directors (the “Stock Option Committee”) has the authority to administer the Company’s 1999 Equity Incentive Plan with respect to persons other than directors and officers of the Company, and with respect to options to purchase not more than 150,000 shares. Options to purchase more than 150,000 shares must be approved by the Compensation Committee. The Stock Option Committee acted by written consent in lieu of a meeting on 23 occasions to authorize grants of stock options in the fiscal year ended September 30, 2001. The sole member of the Stock Option Committee is Mr. Calderoni.

Director Compensation

Except for grants of stock options, directors of the Company do not receive compensation for services provided as a director. The Company also does not pay compensation for committee participation or special assignments.

Non-employee directors are eligible for option grants pursuant to the provisions of the 1999 Directors’ Stock Option Plan. Under the 1999 Directors’ Stock Option Plan, as amended, each individual who first becomes a non-employee director after the date of the Company’s initial public offering will be granted an option to purchase 25,000 shares on the date such individual joins the Board of Directors, provided such individual has not been in the prior employ of the Company. In addition, at each annual meeting, each individual who will continue serving as a director thereafter will receive an additional option grant to purchase 10,000 shares of Common Stock, whether or not such individual has been in the prior employ of the Company. The option price for each option grant under the 1999 Directors’ Stock Option Plan will be equal to the fair market value per share of Common Stock on the automatic grant date. Each initial grant will become exercisable for 50% of the shares at

4

the automatic grant date and the remaining 50% of the shares after 12 months of service on the Company’s Board of Directors. The initial grants become exercisable for all shares if the Company is subject to a change in control. Each annual option grant is fully exercisable on the grant date. Pursuant to the 1999 Directors’ Stock Option Plan, each of Messrs. Hegarty, Kagle and Knowling were granted options to purchase 10,000 shares of Common Stock on February 26, 2001 and will be granted options to purchase 10,000 shares of Common Stock on the date of the Annual Meeting.

Directors are eligible to receive options and be issued shares of Common Stock directly under the Company’s 1999 Equity Incentive Plan. Directors who are also employees of the Company are eligible to participate in the Company’s Employee Stock Purchase Plan (unless such employee owns 5% or more of the Company’s outstanding shares), and directors who are also executive officers of the Company are eligible to participate in the 2001 Executive Bonus Program. On October 4, 2001, Mr. Knowling was granted a fully vested option to purchase 50,000 shares of Common Stock under the 1999 Equity Incentive Plan at an exercise price of $2.00 per share.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED HEREIN.

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT ACCOUNTANTS

The Company is asking the stockholders to ratify the appointment of KPMG LLP as the Company’s independent public accountants for the fiscal year ending September 30, 2002. The affirmative vote of the holders of a majority of shares present in person, or represented by proxy, and voting at the Annual Meeting will be required to ratify the appointment of KPMG LLP. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

In the event the stockholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the appointment is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent accounting firm at any time during the fiscal year if the Board of Directors feels that such a change would be in the best interest of the Company and its stockholders.

KPMG LLP has audited the Company’s financial statements since 1997. Its representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Audit Fees

In the past fiscal year, $350,000 in aggregate fees were billed by KPMG LLP for professional services rendered for the audit of the registrant’s annual financial statements for the most recent fiscal year and the reviews of the financial statements included in the registrant’s Forms 10-Q.

Financial Information Systems Design and Implementation Fees

In the past fiscal year, there were no fees billed by KPMG LLP for professional services related to financial information systems design and implementation.

All Other Fees

In the past fiscal year, $2,139,000 in fees were billed by KPMG for professional services unrelated to those services captioned above under “Audit Fees” and “Financial Information Systems Design and Implementation Fees.” The services rendered consisted primarily of tax services, Webtrust certification services, and various accounting assistance services on matters including filings with the Securities and Exchange Commission and mergers and acquisitions.

5

The Audit Committee received confirmations from management with respect to internal audit and other non-audit services provided by the auditors, and considered whether the provision of such non-audit services by the independent auditors to the Company is compatible with maintaining the auditor’s independence.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF KPMG LLP TO SERVE AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2002.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of December 31, 2001, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent (5%) of the Company’s outstanding shares of Common Stock, (ii) each of the Company’s directors and the executive officers named in the Summary Compensation Table below and (iii) all current directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty (60) days of the date as of which the information is provided. In computing the percentage ownership of any person, the number of shares is deemed to include the number of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

| | | Shares Beneficially Owned as of December 31, 2001(1)

| |

Beneficial Owner**(2)

| | Number of Shares

| | Percentage of Class

| |

| Keith J. Krach(3) | | 17,078,664 | | 6.5 | % |

| Paul Hegarty(4) | | 2,230,757 | | * | |

| Robert C. Kagle(5) | | 1,098,572 | | * | |

| Robert E. Knowling, Jr.(6) | | 85,000 | | * | |

| Robert M. Calderoni(7) | | 2,063,170 | | * | |

| Eileen J. McPartland(8) | | 917,223 | | * | |

| Michael Schmitt(9) | | 485,416 | | * | |

| James Steele(10) | | 503,646 | | * | |

| All current directors and executive officers as a group (9 persons)(11) | | 24,462,448 | | 9.2 | % |

| * | | Less than 1% of the outstanding shares of Common Stock. |

| ** | | These beneficial owners can be reached at Ariba, Inc., 807 11th Avenue, Sunnyvale, California 94089. |

| (1) | | The number of shares of Common Stock deemed outstanding includes shares issuable pursuant to stock options that may be exercised within 60 days after December 31, 2001. |

| (2) | | As of October 26, 2001, after transactions relating to his severance agreement, Lawrence A. Mueller beneficially owned 2,000,615 shares of Common Stock. The Company is unable to determine the number of shares of Common Stock beneficially owned by Mr. Mueller as of December 31, 2001. |

6

| (3) | | Includes 307,500 shares held by The Krach Family Foundation. |

| (4) | | Includes options exercisable for 81,667 shares of Common Stock within 60 days of December 31, 2001. |

| (5) | | Includes options exercisable for 20,000 shares of Common Stock within 60 days of December 31, 2001. |

| (6) | | Includes options exercisable for 85,000 shares of Common Stock within 60 days of December 31, 2001. |

| (7) | | Includes options exercisable for 2,062,500 shares of Common Stock within 60 days of December 31, 2001. |

| (8) | | Includes options exercisable for 533,890 shares of Common Stock within 60 days of December 31, 2001. Also includes an aggregate of 383,333 shares subject to a repurchase right in favor of the Company, as of December 31, 2001, upon cessation of Ms. McPartland’s service to the Company. |

| (9) | | Includes options exercisable for 385,416 shares of Common Stock within 60 days of December 31, 2001. Also includes an aggregate of 100,000 shares subject to a repurchase right in favor of the Company, as of December 31, 2001, upon cessation of Mr. Schmitt’s service to the Company. |

| (10) | | Includes options exercisable for 403,646 shares of Common Stock within 60 days of December 31, 2001. Also includes an aggregate of 100,000 shares subject to a repurchase right in favor of the Company, as of December 31, 2001, upon cessation of Mr. Steele’s service to the Company. |

| (11) | | Includes options exercisable for an aggregate of 3,572,119 shares of Common Stock within 60 days of December 31, 2001. Also includes an aggregate of 583,333 shares subject to a repurchase right in favor of the Company, as of December 31, 2001. |

7

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

The members of the Board of Directors, the executive officers of the Company and persons who hold more than 10% of the Company’s outstanding Common Stock are subject to the reporting requirements of Section 16(a) of the Exchange Act (“Section 16(a)”), which require them to file reports with respect to their ownership of Common Stock and their transactions in Common Stock. Based upon (i) the copies of Section 16(a) reports that the Company received from such persons for their fiscal year 2001 transactions in the Common Stock and their Common Stock holdings and (ii) the written representations received from one or more of such persons that no annual Form 5 reports were required to be filed by them for the fiscal year 2001, the Company believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its executive officers, members of the its Board of Directors and greater than ten-percent stockholders.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The following Summary Compensation Table sets forth the compensation earned by each individual who served as the Company’s Chief Executive Officer during fiscal year 2001 and the four other most highly compensated executive officers who were serving as such as of September 30, 2001 (collectively, the “Named Officers”), each of whose aggregate compensation for fiscal year 2001 exceeded $100,000 for services rendered in all capacities to the Company and its subsidiaries for that fiscal year.

Summary Compensation Table

| | | | | | | | | | Long-Term Compensation Awards

| | | |

| | | Fiscal | | Annual Compensation

| | | Restricted Stock | | Securities Underlying | | All Other | |

Name and Principal Position

| | Year

| | Salary(1)

| | Bonus

| | | Awards($)(2)

| | Options(#)

| | Compensation

| |

Keith J. Krach(3) | | 2001 | | $ | 200,000 | | $ | 80,716 | (4) | | $ | 0 | | 0 | | $ | 0 | |

| Chairman of the Board and | | 2000 | | | 200,000 | | | 52,808 | | | | 0 | | 0 | | | 0 | |

| Former President and Chief | | 1999 | | | 119,583 | | | 47,400 | | | | 0 | | 1,600,000 | | | 0 | |

| Executive Officer | | | | | | | | | | | | | | |

|

Lawrence A. Mueller(5) | | 2001 | | | 240,625 | | | 79,707 | | | | 7,760,000 | | 5,000,000 | | | 28,313 | (6) |

| Former Director, Chief | | 2000 | | | 229,167 | | | 155,971 | | | | 0 | | 1,400,000 | | | 0 | |

| Executive Officer, President | | 1999 | | | 0 | | | 0 | | | | 0 | | 2,000,000 | | | 0 | |

| and Chief Operating Officer | | | | | | | | | | | | | | |

|

Robert M. Calderoni(7) | | 2001 | | | 270,455 | | | 2,266,250 | | | | 0 | | 2,500,000 | | | 0 | |

| Director, President and Chief | | 2000 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

| Executive Officer, Former | | 1999 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

| Executive Vice President | | | | | | | | | | | | | | |

| and Chief Financial Officer | | | | | | | | | | | | | | |

|

Eileen J. McPartland | | 2001 | | | 243,750 | | | 147,388 | | | | 2,995,750 | | 600,000 | | | 0 | |

| Executive Vice President | | 2000 | | | 164,131 | | | 36,696 | | | | 0 | | 211,386 | | | 0 | |

| | | 1999 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

|

Michael Schmitt(8) | | 2001 | | | 165,972 | | | 93,089 | | | | 481,250 | | 875,000 | | | 0 | |

| Executive Vice President | | 2000 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

| | | 1999 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

|

James W. Steele(9) | | 2001 | | | 210,227 | | | 2,108,750 | | | | 481,250 | | 875,000 | | | 0 | |

| Executive Vice President | | 2000 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

| | | 1999 | | | 0 | | | 0 | | | | 0 | | 0 | | | 0 | |

| (1) | | Salary includes amounts deferred under the Company’s 401(k) Plan. |

8

| (2) | | On September 30, 2001, Mr. Mueller held 1,000,000 restricted shares of Common Stock with a value of $1,860,000, Ms. McPartland held 500,000 shares with a value of $930,000, Mr. Schmitt held 100,000 shares with a value of $186,000, and Mr. Steele also held 100,000 shares with a value of $186,000. (The value of restricted stock holdings is based on the closing price of Common Stock on the Nasdaq Stock Market on September 28, 2001, which was $1.86 per share.) No part of Mr. Mueller’s restricted stock grant vested before it expired in October 2001. Ms. McPartland received a grant of 200,000 shares that vests in three equal installments in May 2001, July 2002 and July 2003. She also received a separate grant of 300,000 shares. After the end of the fiscal year, Ms. McPartland’s 300,000 share grant and each of the 100,000 share grants of Messrs. Schmitt and Steele were exchanged for new shares of restricted stock on a share-for-share basis. As a result, Ms. McPartland’s 300,000 share grant vests with respect to 50,000 shares in December 2001, 50,000 shares in June 2002, 100,000 shares in June 2002 and 100,000 shares in June 2004, and the grants of Messrs. Schmitt and Steele vest with respect to 16,667 shares in February 2002, 16,667 shares in June 2002, 33,333 shares in June 2003 and 33,333 shares in June 2004. In addition, this exchange had the effect of removing vesting requirements based on performance and/or minimum price, with the result that the restricted shares vest solely on the basis of time of service. The holders of all shares of restricted stock have the same dividend rights as the holders of other shares of Common Stock. |

| (3) | | Mr. Krach resigned as Chief Executive Officer in April 2001 and served as Interim Chief Executive Officer from July 2001 to October 2001. |

| (4) | | Includes $7,200 paid to Mr. Krach for President’s Club achievement. |

| (5) | | Mr. Mueller ceased serving as Chief Executive Officer, President and Chief Operating Officer in July 2001. |

| (6) | | Includes payments to Mr. Mueller in the amount of $28,313 for Flexible Time Off payout. |

| (7) | | Mr. Calderoni was elected President and Chief Executive Officer in October 2001. |

| (8) | | Mr. Schmitt was elected as Executive Vice President in June 2001. |

| (9) | | Mr. Steele was elected as Executive Vice President in June 2001. |

The following table contains information concerning the stock option grants made to each of the Named Officers for the fiscal year ended September 30, 2001. No stock appreciation rights were granted during such year.

Option Grants in Last Fiscal Year

| | | Individual Grants(1)

| | |

| | | Number of Securities Underlying Options | | % of Total Options Granted to Employees | | | Exercise Price Per | | Expiration | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

Name

| | Granted

| | in 2001(2)

| | | Share

| | Date

| | 5%

| | 10%

|

| Keith J. Krach | | 0 | | n/a | | | | n/a | | n/a | | | n/a | | | n/a |

| Lawrence A. Mueller | | 5,000,000 | | 21.7 | % | | $ | 4.8125 | | 4/3/11 | | $ | 15,132,777 | | $ | 38,349,428 |

| Robert M. Calderoni(4) | | 2,500,000 | | 10.9 | | | | 4.8125 | | 4/3/11 | | | 7,566,389 | | | 19,174,714 |

| Eileen J. McPartland(5) | | 100,000 | | 0.4 | | | | 29.0000 | | 2/6/11 | | | 1,823,794 | | | 4,621,853 |

| | | 500,000 | | 2.2 | | | | 4.8125 | | 4/3/11 | | | 1,513,278 | | | 3,834,943 |

| Michael Schmitt(5) | | 875,000 | | 3.8 | | | | 4.8125 | | 4/3/11 | | | 2,648,236 | | | 6,711,150 |

| James Steele(5) | | 875,000 | | 3.8 | | | | 4.8125 | | 4/3/11 | | | 2,648,236 | | | 6,711,150 |

| (1) | | The exercise price for each option may be paid in cash, in shares of Common Stock valued at fair market value on the exercise date or through a procedure involving a same-day sale of the purchased shares. The Company may also finance the option exercise by loaning the optionee sufficient funds to pay the exercise price for the purchased shares, together with any federal and state income tax liability incurred by the optionee in connection with such exercise. The plan administrator has the discretionary authority to reprice the options through the cancellation of those options and the grant of replacement options with an exercise |

9

| | price based on the fair market value of the option shares on the regrant date. The options have a maximum term of 10 years measured from the option grant date, subject to earlier termination in the event of the optionee’s cessation of service with the Company. The options listed in the table are exercisable as the options vest, which is (i) 25% after one year of service from the grant date and 1/48th of the option per month thereafter with respect to options granted to Messrs. Calderoni, Schmitt and Steele, (ii) 25% on the grant date and 1/36th of the option per month thereafter with respect to the option granted to Mr. Mueller and the 500,000 share option granted to Ms. McPartland and (iii) 1/48th of the option per month from the vesting commencement date with respect to the 100,000 share option granted to Ms. McPartland. Under each of the options, the option shares will vest upon an acquisition of the Company by merger or asset sale, unless the acquiring company assumes the options. In addition, if a change in control occurs within 12 months after the optionee’s vesting start date, then the option will vest as to an additional number of shares as if the optionee had been in service 12 additional months. If a change in control occurs more than 12 months after the optionee’s vesting start date, then the option will vest as to the lesser of: (i) 50% of the then remaining unvested portion of the option; or (ii) the excess of 75% of the total number of shares originally subject to the option over the number of shares that had already vested. Each option shall fully vest if, within 12 months after a change in control, the optionee’s employment or service is terminated without cause or the optionee resigns after he or she is subject to the following without his or her consent: a material reduction in responsibility, a reduction in level of compensation or a relocation of place of employment by more than 50 miles. |

| (2) | | Based on an aggregate of 23,034,662 options granted in the fiscal year. |

| (3) | | The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission. There can be no assurance provided to any executive officer or any other holder of the Company’s securities that the actual stock price appreciation over the 10-year option term will be at the assumed 5% and 10% levels or at any other defined level. Unless the market price of the Common Stock appreciates over the option term, no value will be realized from the option grants made to the executive officers. |

| (4) | | On October 16, 2001, the Company granted Mr. Calderoni an option for 7,000,000 shares of Common Stock at an exercise price of $3.00 per share. |

| (5) | | On October 4, 2001, the Company granted the individual an option for 1,500,000 shares of Common Stock at an exercise price of $2.00 per share. |

The following table sets forth information concerning option exercises in fiscal year 2001 and option holdings as of September 30, 2001 with respect to each of the Named Officers. No stock appreciation rights were outstanding at the end of that year.

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | Shares Acquired on | | Value Realized (Market Price at Exercise Less | | Number of Securities Underlying Unexercised Options at September 30, 2001

| | Value of Unexercised

In-the-Money Options at September 30, 2001(1)

|

Name

| | Exercise

| | Exercise Price)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Keith J. Krach | | 0 | | | n/a | | 0 | | 0 | | n/a | | n/a |

| Lawrence A. Mueller | | 75,000 | | $ | 7,370,625 | | 0 | | 0 | | n/a | | n/a |

| Robert M. Calderoni | | 0 | | | n/a | | 0 | | 2,500,000 | | n/a | | $0 |

| Eileen J. McPartland | | 0 | | | n/a | | 323,409 | | 487,977 | | $0 | | 0 |

| Michael Schmitt | | 0 | | | n/a | | 0 | | 875,000 | | n/a | | 0 |

| James Steele | | 0 | | | n/a | | 0 | | 875,000 | | n/a | | 0 |

| (1) | | Based on the fair market value of the Company’s Common Stock at September 28, 2001 ($1.86 per share) less the exercise price payable for such shares. |

10

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Certificate of Incorporation of the Company limits the liability of the Company’s directors for monetary damages arising from a breach of their fiduciary duty as directors, except to the extent otherwise required by the Delaware General Corporation Law. Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission.

The Company’s bylaws provide that the Company shall indemnify its directors and officers to the fullest extent permitted by Delaware law, including in circumstances in which indemnification is otherwise discretionary under Delaware law. The Company has entered into indemnification agreements with its officers and directors containing provisions that may require the Company, among other things, to indemnify such officers and directors against certain liabilities that may arise by reason of their status or service as directors or officers and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified.

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND

CHANGE IN CONTROL ARRANGEMENTS

The Compensation Committee, as administrator of the 1999 Equity Incentive Plan, can provide for accelerated vesting of the shares of Common Stock subject to outstanding options held by any executive officer or director of the Company in connection with certain changes in control of the Company. The accelerated vesting may be conditioned on the termination of the individual’s employment following the change in control event. Except for Mr. Calderoni, none of the Company’s executive officers have employment agreements with the Company, and they may resign and their employment may be terminated at any time.

The Company has entered into an agreement with Robert M. Calderoni, its President and Chief Executive Officer, under which he is entitled to receive annual cash bonuses from the Company during the years 2001 through 2004. The amount of each bonus will be calculated to make Mr. Calderoni whole for the income taxes that he will incur as the result of the forgiveness of certain indebtedness to a third party. The aggregate amount of such indebtedness is $4,000,000, and it is expected that the amount forgiven each year will be $1,000,000 plus accrued interest conditioned upon his continued employment with the Company. The entire amount of the indebtedness will be forgiven if the Company is subject to a change in control, if Mr. Calderoni’s employment is terminated by the Company without cause, if his employment terminates because of his death or disability or if he resigns after the Company, without his consent, has materially reduced his responsibility, has reduced his base salary or target bonus or has relocated his place of employment by more than 25 miles. If the forgiveness of indebtedness is accelerated, the payment of the Company’s bonuses will be accelerated as well. The Company has also entered into a severance agreement with Mr. Calderoni that provides for a continuation of his cash compensation (base salary plus most recent bonus) for 12 months if the Company terminates his employment for a reason other than cause or disability or if, within 12 months after the Company is subject to a change in control, he resigns because the Company, without his consent, has materially reduced his responsibility, has reduced his compensation or has relocated his place of employment by more than 50 miles. In addition, the severance agreement provides that Mr. Calderoni receives an additional 12 months of service credit for purposes of determining the vested portion of his options and restricted shares if the Company terminates his employment for a reason other than cause or disability. Any benefits under the severance agreement are contingent on Mr. Calderoni’s executing a general release of all claims and complying with certain restrictive covenants.

The Company has entered into an agreement with Lawrence A. Mueller, its former President, Chief Executive Officer and Chief Operating Officer, in October 2001 relating to the termination of his employment with the Company. The agreement provides that Mr. Mueller will (i) receive severance benefits consisting of a lump sum cash payment of $2,005,575, payment of COBRA premiums for a period ending not later than February 1, 2003 and 2,000,000 fully vested shares of Common Stock, (ii) receive reimbursement of past

11

business expenses and other payments of at least $163,380, (iii) cancel outstanding options to purchase 8,400,000 shares of Common Stock at various exercise prices and (iv) acknowledge that a prior restricted stock grant for 1,000,000 shares of Common Stock will never vest. The agreement also contains certain restrictive covenants, mutual releases and other customary terms and conditions.

COMPENSATION COMMITTEE REPORT

The Compensation Committee (the “Committee”) has the authority to establish the level of base salary payable to the Chief Executive Officer (the “CEO”) and the other executive officers of the Company and to administer the Company’s 1999 Equity Incentive Plan and Employee Stock Purchase Plan. In addition, the Committee has the responsibility for approving the individual bonus programs to be in effect for the CEO and the other executive officers. The Committee is comprised of non-employee directors and acts periodically to evaluate the effectiveness of the compensation program in linking Company performance and executive pay. Additionally, the Committee or the Board of Directors is routinely consulted to approve the compensation package of a newly hired executive or of an executive whose scope of responsibility has changed significantly.

For the fiscal year ended September 30, 2001, the process utilized by the Committee in determining executive officer compensation levels was based on the subjective judgment of the Committee members. Among the factors considered by the Committee were the recommendations of the CEO with respect to the compensation of the Company’s key executive officers. However, the Committee made the final compensation decisions concerning such officers.

General Compensation Policy. The objective of the Company’s executive compensation program is to align executive compensation with the Company’s long-term and short-term business objectives and performance. Additionally, executive compensation is designed to enable the Company to attract, retain, and motivate qualified executives who are able to contribute to the long-term success of the Company. The following specific strategies are utilized to guide the Company’s executive compensation decisions:

| | • | | Risk and Reward. A significant portion of an executive’s compensation should be tied to his or her performance and contributions to the success of the Company. |

| | • | | Pay for Performance. If an executive performs above expectations, then the executive should be rewarded with a higher level of compensation. Similarly, if performance is below expectations, then there should be a lower level of compensation or there may be no variable compensation. |

| | • | | Compensate Competitively. The Company’s compensation programs should be comparable to those of other companies in similar industries and should be designed to attract and retain highly qualified and experienced executive leadership. |

During fiscal year 2001, the Company’s executive compensation program included these key elements:

| | • | | Base Salary. The Company establishes the base salaries of its executives based on competitive market practices. Additionally, each executive’s base pay is considered relative to the total compensation package, including cash incentives and equity-based incentives. |

| | • | | Cash-Based Incentives. During fiscal year 2001, six executives of the Company participated in a cash incentive program under which payment was based upon the achievement of goals pertaining to individual performance, Company financial performance and customer satisfaction. Specifically, target incentives were established for each executive at the beginning of each quarter based on Company financial performance, individual non-financial business objectives, and customer satisfaction. The weight given to each metric varied by quarter and by executive. During fiscal year 2001, the Company met certain of its goals related to financial performance and/or customer satisfaction, and the executives generally met their quarterly goals based on non-financial business objectives. As a result, the bonuses paid |

12

to the CEO and other executives were 55.7% of the aggregate target. Each year, the annual incentive plan is reevaluated and new performance metrics are established, reflecting the Company’s business plan and financial goals.

| | • | | Equity-Based Incentives. Stock options and restricted stock awards are designed to align the interests of each executive with those of the stockholders. Each year, the Committee considers the grant of stock option awards to executives. The Committee believes that stock options provide added incentive for executives to influence the strategic direction of the Company and to create and grow value for customers, stockholders and employees. Options typically are granted at fair market value and have vesting periods of three years or more, contingent upon the executive’s continued employment with the Company. The number of stock option shares that are granted to individual executives is based on demonstrated performance, existing equity levels and other factors. In fiscal year 2001, the Committee also considered and granted restricted stock awards to executive officers. These awards were designed to provide equity incentives to retain executive officers in light of significant changes to the Company’s business in fiscal year 2001. |

CEO Compensation. The annual base salary for Mr. Krach, the Company’s CEO at the beginning of fiscal year 2001 and acting CEO at the end of fiscal year 2001, was $200,000. The annual base salary for Mr. Mueller, the Company’s former CEO, was increased during fiscal year 2001 from $300,000 to $500,000 in connection with his promotion to CEO. Mr. Mueller was also granted 1,000,000 restricted shares of Common Stock in April 2001 as part of restricted stock awards to executive officers of the Company. The remaining components of Mr. Krach’s and Mr. Mueller’s fiscal year 2001 compensation were dependent upon the Company’s performance as well as individual performance objectives and provided no dollar guarantees. The bonuses paid to Mr. Krach and Mr. Mueller for the fiscal year were based on the same incentive plan as the other executives.

Limitation on Tax Deductions. Under the federal tax laws, a publicly held company may not claim a federal income tax deduction for compensation paid to certain executive officers to the extent that the compensation exceeds $1 million per officer in any year. To qualify for an exemption from the $1 million deduction limitation, the stockholders were asked to approve a limitation under the 1999 Equity Incentive Plan on the maximum number of shares for which a participant may be granted stock options in any calendar year.

Because this limitation was adopted, any compensation deemed paid to an executive officer when he or she exercises an option under the 1999 Equity Incentive Plan with an exercise price equal to the fair market value of the option shares on the grant date should qualify as performance-based compensation that will not be subject to the $1 million limitation. Since it is not expected that the cash compensation to be paid to the Company’s executive officers for the fiscal year ending September 30, 2002, will exceed the $1 million limit per officer, the Committee will defer any decision on whether to limit the dollar amount of all other compensation payable to executive officers to $1 million.

| | Su | bmitted by the Compensation Committee of the Board of Directors: |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee was formed in April 1999, and the members of the Compensation Committee are Messrs. Kagle and Knowling. Neither of these individuals was at any time during fiscal year 2001, or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

13

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the Board of Directors, the Audit Committee assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. A copy of the charter is attached as Exhibit B to the Company’s proxy statement for its 2001 Annual Meeting of Stockholders. The Audit Committee recommends to the Board of Directors, subject to stockholder approval, the selection of the Company’s independent accountants.

Management is responsible for the Company’s internal controls. The Company’s independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee has general oversight responsibility with respect to the Company’s financial reporting, and reviews the results and scope of the audit and other services provided by the Company’s independent auditors.

In this context, the Audit Committee has met and held discussions with management and the Company’s independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the Company’s independent auditors. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company’s independent auditors provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors’ their independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Company’s auditors are in fact “independent”.

Based on the Audit Committee’s discussion with management and the independent auditors and the Audit Committee’s review of the representations of management and the report of the independent auditors to the Audit Committee, the Audit Committee recommended to the Board of Directors of the Company, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2001, filed with the Securities and Exchange Commission. The Audit Committee and the Board of Directors also have recommended, subject to stockholder approval, the selection of KPMG LLP, as the Company’s independent auditors.

Each of the members of the Audit Committee is independent as defined under the listing standards of the Nasdaq Stock Market.

| | Su | bmitted by the Audit Committee of the Board of Directors: |

14

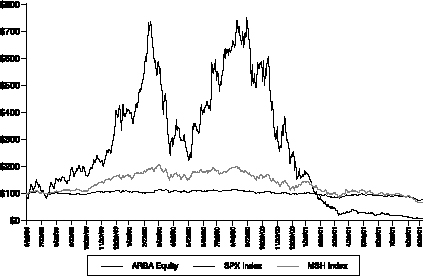

STOCK PERFORMANCE GRAPH

The graph set forth below compares the cumulative total stockholder return on the Company’s Common Stock between June 23, 1999 (the date the Common Stock commenced public trading) and September 30, 2001, with the cumulative total return of (i) the Morgan Stanley High Tech Index (the “MSH Index”) and (ii) the Standard and Poor’s 500 Index (the “S&P Index”), over the same period. This graph assumes the investment of $100.00 on June 23, 1999 in the Common Stock, the MSH Index and the S&P Index, and assumes the reinvestment of dividends, if any.

The comparisons shown in the graph below are based upon historical data. The stock price performance shown in the graph below is not necessarily indicative of, nor intended to forecast, the potential future performance of the Common Stock. Information used in the graph was obtained from Bloomberg, a source believed to be reliable, but the Company is not responsible for any errors or omissions in such information.

Note: S&P performance does not include reinvested dividends.

The Company effected its initial public offering of Common Stock on June 23, 1999 at a price of $5.75 per share (as adjusted to reflect the stock splits in 1999 and 2000). The graph above, however, commences with the closing price of $22.50 per share (as adjusted to reflect these stock splits) on June 23, 1999—the date the Company’s Common Stock commenced public trading.

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Exchange Act, that might incorporate this Proxy Statement or future filings made by the Company under those statutes, the Compensation Committee Report and Stock Performance Graph shall not be deemed filed with the Securities and Exchange Commission and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by the Company under those statutes.

15

FORM 10-K

THE COMPANY WILL MAIL WITHOUT CHARGE, UPON WRITTEN REQUEST, A COPY OF THE COMPANY’S FORM 10-K REPORT FOR FISCAL YEAR ENDED SEPTEMBER 30, 2001, INCLUDING THE FINANCIAL STATEMENTS. REQUESTS SHOULD BE SENT TO ARIBA, INC., 807 11th AVENUE, SUNNYVALE, CALIFORNIA 94089, ATTN: INVESTOR RELATIONS.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Stockholders who intend to have a proposal considered for inclusion in the Company’s proxy materials for presentation at the Company’s 2003 annual meeting of stockholders pursuant to Rule 14a-8 under the Exchange Act must submit the proposal to the Company at its offices at 807 11th Avenue, Sunnyvale, California 94089, Attn: Craig M. Schmitz, not later than October 7, 2002. Stockholders who intend to present a proposal at such meeting without inclusion of such proposal in the Company’s proxy materials pursuant to Rule 14a-8 under the Exchange Act are required to provide advance notice of such proposal to the Company at the aforementioned address not earlier than November 21, 2002 and not later than December 21, 2002. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions established by the Securities and Exchange Commission.

OTHER MATTERS

The Board of Directors knows of no other matters to be presented for stockholder action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting or any adjournments or postponements thereof, the Board of Directors intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

| | By | Order Of The Board Of Directors |

Sunnyvale, California

February 4, 2002

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE ANNUAL MEETING.

THANK YOU FOR YOUR ATTENTION TO THIS MATTER. YOUR PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE ANNUAL MEETING.

16

807 11th Avenue, Sunnyvale, CA 94089

This Proxy is Solicited on Behalf of the Board of Directors of Ariba, Inc.

for the Annual Meeting of Stockholders to be held March 18, 2002

The undersigned holder of Common Stock, par value $.002, of Ariba, Inc. (the “Company”) hereby appoints Robert M. Calderoni and Craig M. Schmitz, or either of them, proxies for the undersigned, each with full power of substitution, to represent and to vote as specified in this Proxy all Common Stock of the Company that the undersigned stockholder would be entitled to vote if personally present at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Monday, March 18, 2002 at 8:00 a.m. local time, at the San Mateo Marriott, 1770 S. Amphlett Boulevard, San Mateo, California, and at any adjournments or postponements of the Annual Meeting. The undersigned stockholder hereby revokes any proxy or proxies heretofore executed for such matters.

This proxy, when properly executed, will be voted in the manner as directed herein by the undersigned stockholder. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS LISTED IN PROPOSAL NO. 1, FOR PROPOSAL NO. 2, AND IN THE DISCRETION OF THE PROXIES AS TO ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING. The undersigned stockholder may revoke this proxy at any time before it is voted by delivering to the Corporate Secretary of the Company either a written revocation of the proxy or a duly executed proxy bearing a later date, or by appearing at the Annual Meeting and voting in person.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSAL NO. 2.

PLEASE MARK, SIGN, DATE AND RETURN THIS CARD PROMPTLY USING THE ENCLOSED RETURN ENVELOPE. If you receive more than one proxy card, please sign and return ALL cards in the enclosed envelope.

(Do you have any questions for Ariba to address at the Annual Meeting?)

(If you have written in the above space, please mark the corresponding box on the reverse side of this card)

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

(Reverse)

ARIBA, INC.

x Please | | mark votes as in this example. |

| 1. | | To elect the following directors to serve for a term ending upon the 2005 Annual Meeting of Stockholders or until their successors are elected and qualified: |

Nominees :(1) Robert M. Calderoni and (2) Robert E. Knowling, Jr.

FOR ¨ WITHHELD ¨

MARK HERE IF YOU PLAN TO ATTEND THE MEETING ¨

¨

For all nominees except as noted above

MARK HERE FOR ADDRESS CHANGE AND NOTE BELOW ¨

| 2. | | To ratify the appointment of KPMG LLP as the Company’s independent accountants for the fiscal year ending September 30, 2002. |

FOR ¨ WITHHELD ¨ ABSTAIN ¨

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting.

MARK HERE IF YOU DO NOT WANT TO RECEIVE FURTHER COMPANY REPORTS. ¨

MARK HERE IF YOU HAVE ANY QUESTIONS FOR ARIBA TO ADDRESS AT THE ANNUAL MEETING (AND WRITE ON REVERSE) ¨

The undersigned acknowledges receipt of the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Please date and sign exactly as your name(s) is (are) shown on the share certificate(s) to which the Proxy applies. When shares are held as joint-tenants, both should sign. When signing as an executor, administrator, trustee, guardian, attorney-in-fact or other fiduciary, please give full title as such. When signing as a corporation, please sign in full corporate name by President or other authorized officer. When signing as a partnership, please sign in partnership name by an authorized person.

Signature: Date:

Signature: Date: