UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ARIBA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

ARIBA, INC.

807 11th Avenue

Sunnyvale, California 94089

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Ariba, Inc., which will be held at Ariba’s Atlanta office, located at 11625 Rainwater Drive, 500-600 Northwinds Center, Suite 150, Alpharetta, GA on January 18, 2011, at 8:00 a.m. Eastern Time.

Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. We encourage you to read these materials carefully.

It is important that your shares be represented and voted at the Annual Meeting. Whether you plan to attend the Annual Meeting in person or not, I hope you will vote your shares as soon as possible. I encourage you to vote electronically via the Internet or by telephone prior to the meeting or, if you request paper materials, to sign and return your proxy card, so that your shares will be represented and voted at the meeting even if you cannot attend. As discussed in the Proxy Statement, voting electronically via the Internet, by telephone or by returning the proxy or voting instruction card does not deprive you of your right to attend the Annual Meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Ariba. We look forward to seeing you at the Annual Meeting.

|

| Sincerely, |

|

ROBERT M. CALDERONI |

Chairman of the Board of Directors and Chief Executive Officer |

Sunnyvale, California

December 8, 2010

ARIBA, INC.

807 11th Avenue

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held January 18, 2011

The Annual Meeting of Stockholders of Ariba, Inc. will be held at Ariba’s Atlanta office, located at 11625 Rainwater Drive, 500-600 Northwinds Center, Suite 150, Alpharetta, GA on January 18, 2011, at 8:00 a.m. Eastern Time for the following purposes:

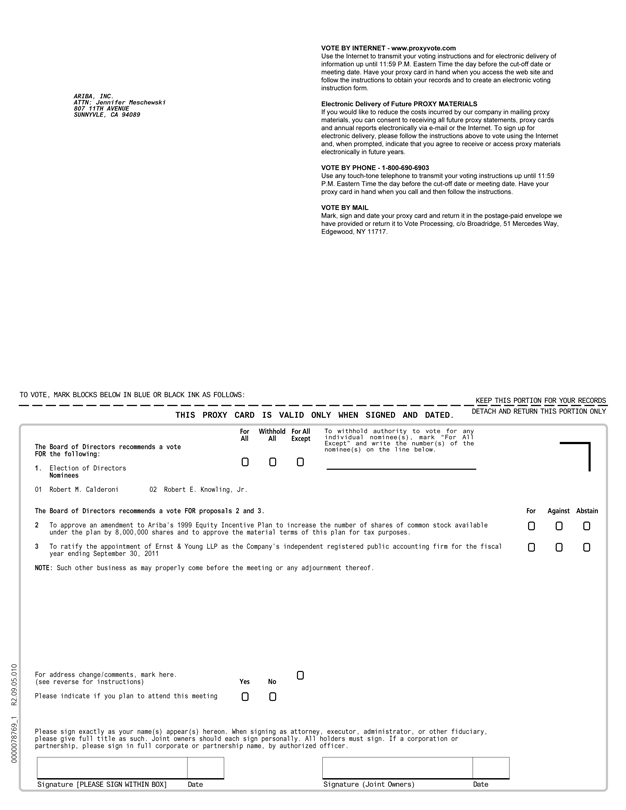

1. To elect two (2) members of the Board of Directors to serve until the 2014 annual meeting of stockholders of the Company or until such persons’ successors have been duly elected and qualified;

2. To approve an amendment to our 1999 Equity Incentive Plan to increase the number of shares of common stock available under the plan by 8,000,000 shares and to approve the material terms of this plan for tax purposes;

3. To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2011; and

4. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement.

Only stockholders of record at the close of business on December 1, 2010, the record date, are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s principal executive offices located at 807 11th Avenue, Sunnyvale, California 94089 during ordinary business hours for the ten-day period prior to the Annual Meeting.

The Company is pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. The Company believes these rules allow the Company to provide its stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting of Stockholders.

| | |

| By Order of the Board of Directors |

|

|

Ahmed Rubaie |

| Executive Vice President and Chief Financial Officer |

Sunnyvale, California

December 8, 2010

IMPORTANT

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE VOTE ELECTRONICALLY VIA THE INTERNET, BY TELEPHONE, OR, IF YOU HAVE REQUESTED A PAPER COPY OF THESE DOCUMENTS, BY PROMPTLY SIGNING, DATING AND RETURNING THE ENCLOSED PROXY IN THE PRE-ADDRESSED ENVELOPE PROVIDED. PLEASE SEE “VOTING OF SHARES” ON PAGE 2 OF THE 2011 PROXY STATEMENT FOR INFORMATION ON HOW TO VOTE YOUR SHARES AND CHANGE YOUR VOTE.

TABLE OF CONTENTS

ARIBA, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held January 18, 2011

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of Ariba, Inc., a Delaware corporation (“Ariba,” the “Company”, or “us”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at Ariba’s Atlanta office, located at 11625 Rainwater Drive, 500-600 Northwinds Center, Suite 150, Alpharetta, GA on January 18, 2011, at 8:00 a.m. Eastern Time, and at any adjournment or postponement of the Annual Meeting. These proxy materials were first distributed or made available on or about December 8, 2010 to stockholders entitled to vote at the Annual Meeting.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement (“2011 Proxy Statement”).

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s common stock, $0.002 par value (the “Common Stock”), is the only type of security entitled to vote at the Annual Meeting. On December 1, 2010, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 93,316,844 shares of Common Stock outstanding. Each stockholder of record on December 1, 2010 is entitled to one vote for each share of Common Stock held by such stockholder on December 1, 2010. Shares of Common Stock may not be voted cumulatively. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative, negative and withheld votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Common Stock issued and outstanding and entitled to vote generally in the election of directors, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal No. 1.Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted toward a nominee’s total. Stockholders may not cumulate votes in the election of directors.

Proposal No. 2.Approval of the amendment to and materials terms of the 1999 Equity Incentive Plan requires the affirmative vote of a majority of those votes present in person or by proxy and cast affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

1

Proposal No. 3.Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2011 requires the affirmative vote of a majority of those votes present in person or by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

Voting of Shares

If your shares of Common Stock are registered directly in your name with the Company’s transfer agent, ComputerShare, you are considered, with respect to those shares, the stockholder of record. In accordance with rules and regulations adopted by the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to each stockholder of record, we furnish proxy materials to our stockholders on the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) by mail, you will not receive a printed copy of these proxy materials. Instead, the Notice of Internet Availability will instruct you as to how you may access and review all of the important information contained in these proxy materials. The Notice of Internet Availability also instructs you as to how you may submit your proxy on the Internet or over the telephone. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, including a proxy card, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account.

Shares of Common Stock held in a stockholder’s name as the stockholder of record may be voted in person at the Annual Meeting. Shares of Common Stock held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by submitting a proxy electronically via the Internet, by telephone, or if you have requested a hard copy of these proxy materials, by returning the proxy or voting instruction card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee.

Whether or not you are able to attend the Annual Meeting, you are urged to complete and return your proxy or voting instructions, which are being solicited by the Company’s Board of Directors (the “Board of Directors”) and which will be voted as you direct on your proxy or voting instructions when properly completed. If you hold your shares directly as the stockholder of record and do not provide directions in your proxy, your proxy will be voted FOR the nominees for election to the Board of Directors, FOR the amendment to our 1999 Equity Incentive Plan, FOR the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2011 and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting.

If you are a beneficial owner and hold your shares in street name and do not provide the organization that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the selection of independent public accountants, but do not have discretion to vote on non-routine matters such as director elections and compensation plans.

Please note that this year the rules regarding how brokers may vote your shares have changed. We therefore encourage you to provide instructions to your broker regarding the voting of your shares.

2

Revocability of Proxies

You may revoke or change your proxy or voting instructions at any time before the Annual Meeting. To revoke your proxy, send a written notice of revocation or another signed proxy with a later date to the Chief Financial Officer of the Company at the Company’s Atlanta office at 11625 Rainwater Drive, 500-600 Northwinds Center, Suite 150, Alpharetta, GA 30009 before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. To revoke your voting instructions, submit new voting instructions to your broker, trustee or nominee; alternatively, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, you may attend the Annual Meeting and vote in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Attending the Annual Meeting

You are entitled to attend the Annual Meeting only if you were a stockholder of the Company as of the close of business on December 1, 2010 or you hold a valid proxy for the Annual Meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, your name will be verified against the list of record holders on the record date prior to your being admitted to the Annual Meeting. If you are a beneficial owner of shares held in street name, you should provide proof of beneficial ownership on the record date, such as your most recent brokerage account statement prior to December 1, 2010, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above upon request, you will not be admitted to the Annual Meeting.

3

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has determined that each of its members, other than Robert M. Calderoni, Ariba’s Chief Executive Officer, is an “independent director” as described in the listing standards of The Nasdaq Global Select Market (“Nasdaq”).

Board Leadership Structure

Currently, the Company’s Chief Executive Officer, Robert M. Calderoni, also serves as Chairman of the Board. The Board of Directors believes that the current Board leadership structure, coupled with a strong emphasis on Board independence, provides effective independent oversight of management while allowing both the Board and management to benefit from Mr. Calderoni’s crucial leadership and experience in the Company’s business. Serving as Chairman of the Board since 2003 and Chief Executive Officer since 2001, Mr. Calderoni has been the director most capable of effectively identifying strategic priorities, leading critical discussion and executing the Company’s strategy and business plans. Mr. Calderoni possesses detailed and in-depth knowledge of the issues, opportunities, and challenges facing the Company. Independent directors and management sometimes have different perspectives and roles in strategy development. The Company’s independent directors bring experience, oversight and expertise from outside the Company, while the Chief Executive Officer brings company-specific experience and expertise. The Board of Directors believes that Mr. Calderoni’s combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to its stockholders, employees and customers.

Currently, Robert E. Knowling serves as the Company’s lead independent director. The lead independent director presides over the meetings of the independent directors, serves as a liaison between the independent directors and the Chairman of the Board of Directors and Chief Executive Officer, and has such other authority as generally held by a lead independent director and as the independent directors shall determine from time to time.

Board of Directors Meetings and Committees

During the fiscal year ended September 30, 2010, the Board of Directors held nine meetings and did not act by written consent in lieu of a meeting on any occasion. For the fiscal year ended September 30, 2010, each of the current directors attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served. All of Ariba’s directors are encouraged to attend the Annual Meeting. All of Ariba’s directors were in attendance either by person or by telephone at Ariba’s 2010 annual meeting of stockholders.

During the fiscal year ended September 30, 2010, the Board of Directors had an Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Equity Incentive Committee.

The Board of Directors and other committees held a total of 18 executive sessions during the fiscal year ended September 30, 2010. Mr. Calderoni was not present at any of these executive sessions.

Audit Committee. During the fiscal year ended September 30, 2010, the Audit Committee of the Board of Directors (the “Audit Committee”) held eleven meetings and did not act by written consent in lieu of a meeting on any occasion. The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including (i) the selection of the Company’s independent auditors, (ii) the scope of the independent auditors’ service and annual audit fees to be paid to the Company’s independent auditors, (iii) the performance of the Company’s independent auditors, (iv) the accounting practices of the Company and (v) oversight of the Company’s enterprise risk management activities. The chair of the Audit

4

Committee is Mr. Monahan, and the other members of the Audit Committee are Messrs. Kashnow and Johnson and Ms. Edelman. The Board of Directors has determined that each member of the Audit Committee is independent as described in applicable Nasdaq listing standards. The Board of Directors has also determined that Mr. Monahan is an “audit committee financial expert” as described in applicable rules and regulations of the Securities and Exchange Commission. A copy of the Audit Committee’s charter is publicly available on the Company’s web site athttp://www.ariba.com/company/investor_governance.cfm.

Corporate Governance and Nominating Committee. During the fiscal year ended September 30, 2010, the Corporate Governance and Nominating Committee of the Board of Directors (the “Corporate Governance and Nominating Committee”) held two meetings and did not act by written consent in lieu of a meeting on any occasion. The Corporate Governance and Nominating Committee (i) reviews, considers developments in and makes recommendations to the Board of Directors regarding corporate governance policies and procedures for the Company, (ii) makes recommendations to the Board of Directors regarding candidates for membership in the Board of Directors and regarding the size and composition of the Board of Directors, and (iii) establishes procedures for the nomination process. The chair of the Corporate Governance and Nominating Committee is Mr. Kashnow, and the other members of the Corporate Governance and Nominating Committee are Mr. Newkirk and Ms. Edelman. A copy of the Corporate Governance and Nominating Committee’s charter is publicly available on the Company’s web site athttp://www.ariba.com/company/investor_governance.cfm.

Compensation Committee. During the fiscal year ended September 30, 2010, the Compensation Committee of the Board of Directors (the “Compensation Committee”) held twelve meetings and did not act by written consent in lieu of a meeting on any occasion. The Compensation Committee (i) administers the Company’s stock plans, (ii) reviews the performance of, and establishes compensation programs for, the executive officers of the Company and (iii) reviews the compensation programs for other key employees, including salary and cash bonus levels and option and restricted stock grants under the Company’s stock plans. The Compensation Committee has the authority to engage independent advisors, such as compensation consultants, to assist it in carrying out its responsibilities. The Compensation Committee at present engages an outside consultant on a regular basis to advise it on the Company’s compensation practices. Additional information on the roles and responsibilities of the outside compensation consultant is provided under “Executive Compensation and Related Information” beginning on page 14 of this 2011 Proxy Statement. The chair of the Compensation Committee is Mr. Wallman and the other members of the Compensation Committee are Messrs. Newkirk and Knowling. A copy of the Compensation Committee’s charter is publicly available on the Company’s web site athttp://www.ariba.com/company/investor_governance.cfm.

Compensation Committee Interlocks and Insider Participation. The Compensation Committee was formed in April 1999, and Messrs. Wallman, Newkirk and Knowling served as members during fiscal year 2010. None of these individuals was at any time during fiscal year 2010, or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Equity Incentive Committee. During the fiscal year ended September 30, 2010, the Equity Incentive Committee of the Board of Directors (the “Equity Incentive Committee”) held no meetings and acted by written consent in lieu of a meeting on 28 occasions. The Equity Incentive Committee administers the Company’s equity incentive plans with respect to persons other than directors and executive officers of the Company. With respect to each calendar quarter, its authority is limited to grants of not more than 50,000 options per person per quarter and not more than 25,000 restricted shares or restricted stock units per person per quarter. The sole member of the Equity Incentive Committee is Mr. Calderoni.

Board’s Role in Risk Oversight

Risk is inherent with every business and the Company faces a number of risks, including strategic, financial, operational, legal/compliance and reputational risks. The Company’s management is responsible for the day-to-day management of the risks that the Company faces. The Board of Directors as a whole has

5

responsibility for oversight of enterprise risk management. The Audit Committee oversees the Company’s enterprise risk management activities under direction of the Board of Directors, including reviewing policies and procedures to assess and manage exposure to enterprise risk. The role of the Board of Directors is supported by management reporting processes that are designed to provide the Board and committees visibility into the identification, assessment, and management of critical risks.

Risk Assessment of Compensation Policies and Practices

The Company has assessed the compensation policies and practices for its employees and concluded that they do not create risks that are reasonably likely to have a material adverse effect on the Company. In reaching its conclusion, the Company examined the following factors, which have been identified by the Securities and Exchange Commission as areas of potential concern for companies:

| | • | | If a business unit carries a significant portion of the company’s risk; |

| | • | | If compensation is structured in a significantly different manner among different business units; |

| | • | | If one business unit is significantly more profitable than other business units; |

| | • | | If compensation expense is a particularly significant percentage of a business unit’s revenues; and |

| | • | | If compensation policies vary significantly from the overall risk and reward structure of the company. |

The Company’s compensation plans, which are reviewed annually, are designed to be well aligned with management objectives and investor interests and to be focused on paying for individual performance and results. Compensation of executives, including named executive officers, focuses on both a short term (cash bonus) and long term (performance based equity grant) performance to reduce the risk of undue focus on short term goals at the expense of long term goals, or vice versa. The Company does not have independently operating business units and seeks to ensure that all bonus plans are directly governed by overall company performance which further aligns bonus payments with company performance. None of the concerns specifically identified by the Securities and Exchange Commission are present in the Company’s compensation plans. This analysis was presented to both the Audit Committee and the Compensation Committee.

Consideration of Director Nominees

Director Qualifications

In assessing the appropriate size and composition of the Board of Directors, the Corporate Governance and Nominating Committee considers bona fide candidates from all relevant sources, including current members of the Board of Directors, professional search firms, stockholders and other persons. The minimum qualifications and skills that each director should possess include (i) the highest professional and personal ethics and values, (ii) broad experience at the policy-making level in business, government, education, technology or public interest, (iii) a commitment to enhancing stockholder value and (iv) sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. In addition, the Corporate Governance and Nominating Committee considers (i) various and relevant career experience, (ii) relevant skills, such as an understanding of the software business, software development, technology, finance, marketing and international commerce, (iii) financial expertise and (iv) diversity. While we do not maintain a formal policy requiring the consideration of diversity in identifying nominees for director, diversity is, as noted above, one of the factors our Corporate Governance and Nominating Committee considers in conducting its assessment of director nominees.

The Corporate Governance and Nominating Committee and the Board of Directors believe that the above-mentioned attributes, along with the leadership skills and other experiences of its board members described on pages 10-13 below, provide Ariba with a diverse range of perspectives and judgment necessary to guide Ariba’s strategies and monitor their execution.

6

Stockholder Recommendations and Nominees

Stockholders may propose director candidates for consideration by the Corporate Governance and Nominating Committee. Any such recommendations should be directed to the Secretary of the Company at Ariba’s headquarters at the address set forth above. In addition, the Company’s bylaws permit stockholders to nominate directors at an annual meeting of stockholders. To nominate a director, a stockholder must (i) give timely notice thereof in writing to the Secretary of the Company in accordance with the Company’s bylaws, which require that notice be received by the Secretary of the Company within the time periods described below (see “Stockholder Proposals for 2012 Annual Meeting”) and (ii) have acted in accordance with the representations set forth in a solicitation statement required by the Company’s bylaws.

Stockholder Communications with Directors

Any stockholder wishing to send written communications to the Board of Directors or a specified individual director may do so by sending them to Ariba’s headquarters at 807 11th Avenue, Sunnyvale, California 94089, Attn: General Counsel. The Company’s General Counsel will relay all such communications to the Board of Directors, or individual members, as appropriate.

Stock Ownership Guidelines

In 2007, the Board of Directors adopted stock ownership guidelines to align the interests of Ariba’s executive officers and directors with the interests of stockholders and to promote the Company’s commitment to sound corporate governance. The stock ownership guidelines were amended and restated in 2008. The stock ownership guidelines are effective for all of the Company’s current executive officers and directors, and as of October 31, 2010, all of the Company’s executive officers and directors have met their targets. Any future executive officer or director has five years from the date of appointment or election, as applicable, to meet his or her target. The stock ownership guidelines are as follows:

| | |

| Chief Executive Officer | | 3 times salary |

| All other Executive Officers | | 1 times salary |

| Non-Management Directors | | 10,000 shares of Common Stock |

Stock ownership will be deemed to include shares owned outright by the individual or his or her immediate family members; shares held in a 401(k) account; restricted stock issued, whether or not vested; shares held in trust for the benefit of the participant or his or her immediate family; and vested or unvested performance share awards, assuming achievement of target-level performance. The definition of stock expressly includes restricted stock units and performance share awards.

Failure to meet or to show sustained progress toward meeting the stock ownership guidelines may result in a reduction in an executive officer’s or director’s future long-term incentive grants and also may result in a requirement to retain all stock acquired through Company grants of equity.

Code of Ethics

In 2005, the Company adopted a Code of Business Conduct (the “Code of Conduct”). The Company requires all directors, officers, and employees to conduct themselves according to the Code of Conduct and to seek to avoid even the appearance of improper behavior. Employees are encouraged to talk to managers or other appropriate personnel about observed illegal or unethical behavior or when in doubt about the best course of action in a particular situation. The Code of Conduct is posted on the Company’s web site, and the Company also intends to post any future amendments to, or waivers granted to our executive officers, from a provision of the Code of Conduct.

7

Corporate Governance Document Availability

The charters of the Compensation Committee, the Audit Committee and the Corporate Governance and Nominating Committee, the Corporate Governance Guidelines, the Code of Conduct, Policies and Procedures with respect to Related Person Transactions and the Stock Ownership Guidelines may be accessed on the Company’s Web sitewww.ariba.com by clicking on the “Corporate Governance” section in the “Investor Relations” section. Printed copies of these documents are available upon request by contacting the General Counsel’s office, at the address noted above.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Beneficial Ownership Table

The following table sets forth, as of October 31, 2010, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent (5%) of the Company’s outstanding shares of Common Stock, (ii) each of the Company’s directors and the executive officers named in the 2010 Summary Compensation Table on page 25 and (iii) all current directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty (60) days of the date as of which the information is provided. In computing the percentage ownership of any person, the number of shares is deemed to include the number of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

| | | | | | | | |

| | | Shares Beneficially Owned

as of October 31, 2010 | |

Beneficial Owner | | Number of

Shares(1) | | | Percentage

of Class(2) | |

FMR LLC(3) | | | 9,291,553 | | | | 9.9 | % |

82 Devonshire Street, Boston, Massachusetts 02109 | | | | | | | | |

| | |

BlackRock, Inc.(4) | | | 6,215,821 | | | | 6.6 | |

40 East 52nd Street New York, NY 10022 | | | | | | | | |

| | |

The Bank of New York Mellon Corporation(5) | | | 7,646,907 | | | | 8.1 | |

One Wall Street, 31st Floor New York, New York 10286 | | | | | | | | |

| | |

T. Rowe Price Associates, Inc.(6) | | | 4,728,053 | | | | 5.0 | |

100 East Pratt Street Baltimore, Maryland 21202 | | | | | | | | |

| | |

Robert M. Calderoni | | | 626,844 | | | | * | |

| | |

Harriet Edelman | | | 18,874 | | | | * | |

| | |

Robert D. Johnson(7) | | | 58,981 | | | | * | |

| | |

Richard A. Kashnow(8) | | | 63,300 | | | | * | |

| | |

Robert E. Knowling, Jr.(9) | | | 50,008 | | | | * | |

| | |

Thomas F. Monahan(8) | | | 96,162 | | | | * | |

| | |

Karl E. Newkirk(10) | | | 123,178 | | | | * | |

| | |

Richard F. Wallman(11) | | | 52,538 | | | | * | |

| | |

Kevin S. Costello | | | 296,988 | | | | * | |

| | |

Kent L. Parker | | | 207,827 | | | | * | |

| | |

Ahmed Rubaie | | | 139,164 | | | | * | |

| | |

All current directors and executive officers as a group (11 people) | | | 1,733,864 | | | | 1.8 | % |

9

| * | Less than 1% of the outstanding shares of Common Stock. |

| (1) | The number of shares of Common Stock deemed outstanding includes shares issuable pursuant to stock options that may be exercised within 60 days of October 31, 2010 for the purpose of computing the percentage ownership of the person holding those options, but not for the purpose of computing the percentage ownership of any other person. |

| (2) | Based on 93,939,000 shares of Common Stock outstanding as of October 31, 2010. |

| (3) | Based on a Schedule 13G filed with the Securities and Exchange Commission on January 11, 2010 by FMR LLC. FMR LLC, may be deemed to beneficially own 9,291,553 shares. FMR LLC has sole power to vote or to direct the vote of 2,077,456 shares and sole power to dispose or to direct the disposition of 9,291,553 shares. This includes 7,083,287 shares beneficially owned by Fidelity Management & Research Company, a subsidiary of FMR LLC. Edward C. Johnson 3rd, Chairman of FMR, through control of Fidelity, has power to dispose of 7,083,287 shares and as a result of certain voting arrangements, members of the family of Edward C. Johnson 3d , may be deemed to form a controlling group with respect to FMR and thus may be deemed to be beneficial owners of the shares beneficially owned by FMR. |

| (4) | Based on a Schedule 13G filed with the Securities and Exchange Commission on January 29, 2010 by BlackRock, Inc. BlackRock, Inc. may be deemed to beneficially own 6,215,821 shares. BlackRock, Inc. has sole power to vote or to direct the vote of 6,215,821 shares and sole power to dispose or to direct the disposition of 6,215,821 shares. |

| (5) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 4, 2010 by The Bank of New York Mellon Corporation, MBC Investment Corporation, Neptune LLC, Mellon International Holdings S.A.R.L., BNY Mellon International Limited, Newton Management Limited, and Newton Investment Management Limited. The Bank of New York Mellon Corporation is the beneficial owner of, and has sole voting power with respect to, 7,182,253 shares, shared voting power with respect to 276,808 shares, sole dispositive power with respect to 7,628,857 shares and shared dispositive power with respect to 10 shares. |

| (6) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 11, 2010 by T. Rowe Price Associates, Inc. T. Rowe Price Associates, Inc, may be deemed to beneficially own 4,728,053 shares. T. Rowe Price Associates, Inc. has sole voting power of 1,030,000 shares and sole dispositive power of 4,728,053 shares. |

| (7) | Includes stock options exercisable within the next 60 days totaling 25,000 shares of Ariba Common Stock. |

| (8) | Includes stock options exercisable within the next 60 days totaling 62,500 shares of Ariba Common Stock. |

| (9) | Includes stock options exercisable within the next 60 days totaling 39,165 shares of Ariba Common Stock. |

| (10) | Includes stock options exercisable within the next 60 days totaling 79,516 shares of Ariba Common Stock. |

| (11) | Includes stock options exercisable within the next 60 days totaling 40,000 shares of Ariba Common Stock. |

Equity Compensation Plan Information

The following table sets forth as of September 30, 2010 certain information regarding our equity compensation plans.

| | | | | | | | | | | | |

| | | A | | | B | | | C | |

Plan category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | | Weighted-average

exercise price of

outstanding

options, warrants

and rights | | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in Column A) | |

Equity compensation plans approved by security holders | | | 425,759 | | | $ | 10.99 | | | | 8,271,892 | (1) |

Equity compensation plans not approved by security holders | | | 98,971 | (2) | | $ | 14.27 | (2) | | | — | |

Total | | | 524,730 | | | $ | 11.61 | | | | 8,271,892 | |

| (1) | Includes 1.3 million shares available for future purchase under the Ariba, Inc. Employee Stock Purchase Plan. Securities available for future issuance under the Ariba, Inc. 1999 Equity Incentive Plan exclude unvested shares of restricted common stock as of September 30, 2010. |

| (2) | Represents shares of common stock issuable pursuant to awards outstanding under equity compensation plans assumed by us in connection with our fiscal year 2004 merger with FreeMarkets. |

10

1999 Equity Incentive Plan

The Company’s Board of Directors approved the 1999 Equity Incentive Plan (the “Incentive Plan”) on April 20, 1999 and most recently amended on December 3, 2010. Any shares not issued under the Company’s 1996 Stock Plan (the “1996 Stock Plan”) and any shares repurchased pursuant to the 1996 Stock Plan will also be available for grant under the Incentive Plan. Under the Incentive Plan, eligible employees, outside directors and consultants may be granted stock options, stock appreciation rights, restricted shares or stock units. The exercise price for incentive stock options and nonstatutory options may not be less than 100% and 85%, respectively, of the fair value of common stock at the option grant date. As of September 30, 2010, 7.0 million shares are available for grant under the Incentive Plan (including shares transferred from the 1996 Stock Plan since September 22, 1999). As of September 30, 2010, there were 349,000 shares outstanding in connection with options granted under the Incentive Plan, including shares transferred from the 1996 Stock Plan since September 22, 1999.

Employee Stock Purchase Plan

The Company’s Board of Directors adopted the Employee Stock Purchase Plan (the “Purchase Plan”) on April 20, 1999 and most recently amended on March 11, 2009. Under the Purchase Plan, eligible employees may purchase common stock in an amount not to exceed 1,000 shares per period. The purchase price per share equals 85% of the common stock’s fair value at the end of the defined purchase period. As of September 30, 2010, there have been 5.8 million shares issued under the Purchase Plan and 1.3 million shares are available for future issuance.

FreeMarkets Stock Plans

On July 1, 2004, the Company assumed the FreeMarkets, Inc. Second Amended and Restated Stock Incentive Plan and Broad Based Equity Incentive Plan (the “FreeMarkets Plans”). The FreeMarkets Plans were not approved by the Company’s stockholders. On October 11, 2007, our Compensation Committee amended and restated the Second Amended and Restated Stock Incentive Plan. This Third Amended and Restated Stock Incentive Plan provides for the grant of stock units representing the equivalent of shares of Ariba’s common stock, the grant of incentive stock options to employees at prices not less than 100% of the fair market value of the common stock on the date of grant and for the grant of nonstatutory stock options to employees, consultants, advisers and outside directors at a price determined by the Board of Directors. The Broad Based Equity Incentive Plan provides for the grant of nonstatutory stock options to employees (other than officers), consultants and advisers at a price determined by the Board of Directors. Options expire not later than ten years from the date of grant. As of September 30, 2010, there were 99,000 options outstanding in connection with options granted under the FreeMarkets Plans.

11

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company’s certificate of incorporation provides for a classified board of directors. There are three classes of directors, with each class of directors serving three-year terms that end in successive years. Ariba currently has authorized eight directors. The class of directors standing for election at the Annual Meeting consists of two directors. The two directors will be elected at the Annual Meeting to serve until the 2014 annual meeting of stockholders of Ariba or until their successors are elected and qualified.

The directors being nominated for election to the Board of Directors (each, a “Nominee”), their ages as of December 1, 2010, their positions and offices held with Ariba and certain biographical information are set forth below.

The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below unless otherwise instructed. In the event that any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the current Board of Directors to fill the vacancy. As of the date of this 2011 Proxy Statement, the Board of Directors is not aware that any Nominee is unable or will decline to serve as a director. The two Nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of Ariba. Abstentions and broker non-votes will not be counted toward an individual’s total. Proxies cannot be voted for more than two individuals.

| | | | | | | | | | |

Nominee | | Age | | | Year Term Expires | | | Positions and Offices Held with the Company |

Robert M. Calderoni | | | 50 | | | | 2014 | | | Chairman of the Board of Directors and

Chief Executive Officer |

Robert E. Knowling, Jr. | | | 55 | | | | 2014 | | | Director |

Robert M. Calderoni, has served as Chairman of the Board of Directors since July 2003 and as the Company’s Chief Executive Officer and a director since 2001. From 2001 to 2004, Mr. Calderoni also served as the Company’s President. In 2001, Mr. Calderoni served as the Company’s Executive Vice President and Chief Financial Officer. In addition to serving as a director of the Company, he is also a member of the boards of directors of Juniper Networks, Inc. and KLA-Tencor Corporation. Mr. Calderoni holds a Bachelor of Science degree in accounting and finance from Fordham University. As the Chief Executive Officer of the Company, Mr. Calderoni is able to provide the Board with an understanding of the Company’s products and technology as well as provide expert perspective on industry trends and opportunities. Mr. Calderoni’s experience with the Company offers the Board insight to the evolution of the Company, including from execution, cultural, operational, competitive and industry points of view. See also “Corporate Governance—Board Leadership Structure” on page 4.

Robert E. Knowling, Jr.has served as a director of the Company since July 2000 and currently serves as the Company’s lead independent director. Mr. Knowling is currently Chairman of Eagles Landing Partners. From June 2005 to March 2009, Mr. Knowling served as Chief Executive Officer of Telwares Communications, LLC (formerly Vercuity Solutions, Inc.), a supplier of telecom expense management services. From January 2003 to May 2005, Mr. Knowling served as Chief Executive Officer of the New York Leadership Academy at the New York City Board of Education. From 2001 to 2003, Mr. Knowling served as Chairman and Chief Executive Officer of SimDesk Technologies, a software development company. Mr. Knowling served as President and Chief Executive Officer of Covad Communications Company, a broadband service provider, from 1998 to 2000. He also served as Chairman of the Board of Directors of Covad in 1999 and 2000. In addition to serving as a director of the Company, he is also a member of the boards of directors of Heidrick & Struggles International, Inc. and Roper Industries, Inc and in the past five years has served as a member of the boards of Immune Response Corporation and Aprimo, Inc. Mr. Knowling holds a Bachelor of Arts degree in theology from Wabash

12

College and a Master of Business Administration from Northwestern University’s Kellogg Graduate School of Business. Mr. Knowling brings to the Board a broad array of institutional knowledge and historical perspective on our business. Having served in senior corporate management roles since 1996, including as a Chief Executive Officer, Mr. Knowling is able to deliver important insights to our management team and other directors on subjects ranging from executive compensation and corporate governance to procurement and technology matters.

Our Board of Directors recommends a vote “For” the Nominees listed above.

Set forth below is information regarding each of the continuing directors of Ariba, including his or her age as of December 1, 2010, the period during which he or she has served as a director, and certain information as to principal occupations and directorships held by him or her in corporations whose shares are publicly registered.

Continuing Directors—Term Ending in 2012

Harriet Edelman, age 54, has served as a director of the Company since July 2008. Ms. Edelman currently is Vice Chairman, Emigrant Bank. From 2008 to 2010, she served as I.T. Advisor to the Chairman, Emigrant Bank. From 1979 to 2008, Ms. Edelman was employed at Avon Products, Inc., a leading global beauty company with over $10 billion in annual revenue. Ms. Edelman held a number of leadership roles at Avon Products throughout her career and most recently served as Senior Vice President & Chief Information Officer. Ms. Edelman also serves as a director of Brinker International, Inc., an owner, operator and franchisor of restaurants, and as Vice President of the Board of the Police Athletic League of New York and is a director of the Girl Scouts, USA. Ms. Edelman holds a Bachelor of Music degree from Bucknell University and a Master of Business Administration from Fordham University. Ms. Edelman brings her understanding and knowledge as a senior officer in a worldwide retail company in areas of information technology and supply chain management, and experience serving as a director on public company boards. She provides a unique insight into the strategic integration of technology into a large retail company environment as well as understanding of finance and global supply chain matters.

Richard A. Kashnow,age 68, has served as a director of the Company since April 2003. Since 2003, Mr. Kashnow has been self-employed as a consultant. From 1999 until 2003, Mr. Kashnow served as President of Tyco Ventures, the venture capital unit he established for Tyco International, Inc., a diversified manufacturing and services company. From 1995 to 1999, he served as Chairman, Chief Executive Officer, and President of Raychem Corporation, a global technology materials company. He started his career as a physicist at General Electric’s Corporate Research and Development Center in 1970. During his seventeen years with GE, he progressed through a series of technical and general management assignments. He served in the U.S. Army between 1968 and 1970 and completed his active duty tour as a Captain. He also serves on the board of Electronics for Imaging, Inc. a public company specializing in printing technology and print management solutions and in the past five years has served as a member of the boards of ParkerVision, Inc., ActivCard Corp., ActivIdentity, Inc., Pillar Data Systems, and Komag, Incorporated. Mr. Kashnow received a Ph.D. in physics from Tufts University in 1968 and a BS in physics from Worcester Polytechnic Institute in 1963. Mr. Kashnow’s experience in supervising a principal financial officer as the former Chief Executive Officer of Raychem Corporation provides the Board of Directors with a perspective of an executive involved in the preparation and review of financial statements of a public company.

Robert D. Johnson, age 63, has served as a director of the Company since January 2005. From August 2006 to July 2008, Mr. Johnson served as Chief Executive Officer of Dubai Aerospace Enterprise, an aerospace, manufacturing and services corporation. From January 2005 to January 2006, Mr. Johnson was the Chairman, Aerospace of Honeywell Aerospace, a division of Honeywell Inc., a supplier of aircraft engines, equipment, systems and services. From 2000 to 2005, Mr. Johnson was the President and Chief Executive Officer of Honeywell Aerospace. In 1999 and 2000, he was President and Chief Executive Officer of AlliedSignal Aerospace, a division of AlliedSignal Inc., a supplier of aircraft engines, equipment, systems and services. From 1997 until 1999, he was President and Chief Executive Officer of Electronic and Avionics Systems, AlliedSignal

13

Aerospace. In addition to serving as a director of the Company, Mr. Johnson is also a member of the boards of directors of Spirit Aerosystems Holdings, Inc. and Roper Industries Inc and in the past five years has served as a member of the board of Phelps Dodge Corporation. Mr. Johnson holds a Bachelor of Arts degree in economics and mathematics from Miami University (Ohio). Mr. Johnson brings valuable knowledge in marketing, sales and production from his career. His management leadership skills provide the Board with guidance in compensation and management issues.

Continuing Directors—Term Ending in 2013

Thomas F. Monahan, age 61, has served as a director of the Company since July 2003. In 2003, after six years as Dean of the College of Commerce and Finance at Villanova University, he returned to the faculty in the John M. Cooney Endowed Professorship in Accounting. Mr. Monahan received his Ph.D. in Accounting from Temple University, his Master of Business Administration in Finance from Rutgers University and his Bachelor of Science degree in Economics from Hofstra University. He is a Certified Public Accountant. Mr. Monahan possesses knowledge of accounting and finance that strengthens the Board’s collective knowledge, capabilities and experience.

Karl E. Newkirk, age 69, has served as a director of the Company since July 2004. From August 2003 to July 2004, Mr. Newkirk served as a director of FreeMarkets, Inc., which the Company acquired in July 2004. From 1963 to 2001, Mr. Newkirk was employed at Accenture, Ltd (formerly known as Andersen Consulting), where he was a partner from 1972 through 2001, when Andersen Consulting became a public company. Mr. Newkirk held a number of leadership roles throughout his career at Accenture, most recently serving as the Managing Partner of the Global Enterprise Business Solutions Practice and of the Microsoft Alliance. Mr. Newkirk holds an undergraduate degree in Industrial Engineering from Case Institute of Technology and a Master of Business Administration from Case Western Reserve University. Mr. Newkirk’s historical role as a director of FreeMarkets, and his extensive experience as a consultant to companies with respect to information systems and technology, provide significant insight and expertise to our Board.

Richard F. Wallman, age 59, has served as a director of the Company since October 2002. From 1995 through 2003, Mr. Wallman served as the Senior Vice President and Chief Financial Officer of Honeywell International, Inc., a diversified technology company, and AlliedSignal, Inc. (prior to its merger with Honeywell). In addition to serving as a director of the Company, he is also a member of the boards of directors of Convergys Corporation, Roper Industries Inc. and Dana Holding Corporation and in the past five years has served as a member of the boards of Avaya, Inc., Lear Corporation, Hayes-Lemmerz International, Inc. and ExpressJet Holdings, Inc. Mr. Wallman holds a degree in electrical engineering from Vanderbilt University and a Master of Business Administration from the University of Chicago Graduate School of Business. Mr. Wallman’s leadership experience, including CFO experience and outside board experience, provide him with an informed understanding of the financial issues and risks that affect the Company.

14

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Named Executive Officers

This section and the “Executive Compensation Tables” section that follows provide information relating to our executive compensation programs and the compensation paid to or accrued for the Company’s named executive officers during fiscal year 2010. Our named executive officers are determined in accordance with Securities and Exchange Commission rules. For fiscal year 2010, our named executive officers included all of our executive officers, Robert M. Calderoni, Kevin S. Costello, Kent L. Parker and Ahmed Rubaie (collectively, the “named executive officers”).

Compensation Discussion and Analysis

Overview of Executive Compensation Program

The Compensation Committee is responsible for approving the general components of and individual arrangements under, and overseeing operation of, our compensation program for the named executive officers. The Compensation Committee’s additional responsibilities include administering the Company’s stock plans and other compensation plans and performing such other activities and functions related to executive compensation as may be assigned from time to time by the Board. See further discussion of the Compensation Committee and its members above in the section entitled “Corporate Governance—Board of Directors Meetings and Committees—Compensation Committee.”

The components of our compensation program, which are discussed in more detail below, include base salary, annual cash bonus, equity incentive awards, benefits in the event of termination of employment under certain circumstances and certain other benefits generally offered to all Company employees. In fiscal year 2010, the Company continued its practice of offering a compensation program for our named executive officers that is highly performance-based, with a significant portion of annual total compensation at risk in the event specified performance goals are not achieved or are achieved at a level below target level performance. The fiscal year 2010 performance criteria applicable to our named executive officers were designed to support the Company’s financial and operational goals for the year.

Compensation Philosophy and Objectives

The objective of the Company’s executive compensation program is to align executive compensation with the Company’s long-term and short-term business objectives and performance. Additionally, executive compensation is designed to enable the Company to attract, retain and motivate qualified executives who are able to contribute to the long-term success of the Company.

The following specific strategies are generally utilized to guide the Company’s executive compensation decisions:

| | • | | Compensate Competitively. The Company’s compensation programs should allow it to attract and retain the highly-qualified executive talent it needs to execute successfully its business strategy. |

| | • | | Risk and Reward. A significant portion of an executive’s compensation should be tied to his or her performance and contributions to the success of the Company. |

| | • | | Pay for Performance. If an executive performs above expectations, then the executive should be rewarded with a higher level of total compensation. Similarly, if performance is below expectations, then there should be a lower level of total compensation, including the possibility of no variable compensation. |

The Compensation Committee seeks to align the interests of the Company’s stockholders and management by integrating compensation with the Company’s annual and long-term corporate strategic and financial

15

objectives that are designed to grow our business and enhance stockholder value. In order to attract and retain the most qualified personnel, the Company intends to offer a total compensation package competitive with similarly situated companies in the high tech industry. The Compensation Committee also considers before finalizing individual compensation decisions the retention risk presented by the individual officer.

Compensation Consultants

As it has since September 2008, the Compensation Committee retained Mercer as its compensation consultant for fiscal years 2010 and 2011. Mercer did not undertake any work directly for the Company without the express permission of the Compensation Committee or its members. The Compensation Committee retained Mercer to ensure that it would receive independent advice on and market information relevant to compensation decisions. Mercer attended seven meetings of the Compensation Committee that were specifically focused on named executive officer compensation for fiscal year 2010 and, as of December 1, 2010, Mercer had attended 6 meetings of the Compensation Committee that were specifically focused on named executive officer compensation for fiscal year 2011.

During the course of its work in fiscal year 2010 and to date in fiscal year 2011, Mercer assisted the Compensation Committee by summarizing key trends in equity compensation among peer group companies, evaluating the Company’s total compensation package offered to executives in light of the Company’s compensation objectives and philosophy, reviewing and providing advice related to the peer group of companies against whose executive compensation programs the Company considers when evaluating its own program and supplying relevant market data upon request. Mercer also assisted the Compensation Committee with evaluating whether to include any proposals related to its equity compensation program in this 2011 Proxy Statement and worked with the Compensation Committee with the assistance of the Company personnel to prepare and present Proposal No. 2 related to an amendment to the Company’s 1999 Equity Incentive Plan to increase the number of shares available for future grants.

Peer Group Companies

Each year the Compensation Committee reviews compensation practices at the peer group companies to ensure that each component of compensation for named executive officers, when taken as a whole, is in line with market practices, supports our executive retention objectives and is internally equitable among our executives. The Compensation Committee then considers a number of other factors in setting compensation levels for named executive officers. These include (i) the relative mix between fixed and variable compensation and between short-term and long-term incentive compensation, (ii) the individual’s experience, skills, seniority and performance, (iii) market trends in compensation, (iv) the Company’s performance, and (v) internal fairness. As a result, the Compensation Committee only uses market data to provide context and considers a number of other factors when determining individual components of compensation, rather than targeting a specific percentile or range of percentiles of compensation at the peer group companies.

In order to determine the peer group for fiscal year 2010 (the “2010 Peer Group”), the Compensation Committee relied on Mercer’s peer group development process to yield selection criteria for identifying comparable companies based on two primary criteria: the Company’s business and its revenue. Ariba’s business criteria included direct peers (i.e. technology companies that provide various financial, sales and other solutions) and industry-related peers (e.g. software and internet software companies that provide financial, sales or customer relationship solutions). In general, companies with a revenue range of $125 million to $750 million were considered, although four companies, Brocade, Salesforce, Cadence and Sybase, were outside of this range, but were included to reflect the labor market from which Ariba attracts candidates.

16

Through this process, the Compensation Committee selected a 2010 Peer Group consisting of the following companies, which were the same peer group companies as Mercer had recommended to the Compensation Committee for fiscal year 2009:

| | | | |

• Actuate Corporation | | • Advent Software | | • Aspen Technology |

• Blackboard, Inc. | | • Brocade Communications Systems | | • Cadence Design Systems |

• Concur Technologies | | • Epicor Software | | • EPIQ Systems |

• JDA Software | | • Kenexa | | • Manhattan Associates |

• MicroStrategy Incorporated | | • Openwave Systems | | • Radiant Systems |

• Salesforce.com | | • Sybase | | • TIBCO Software |

The 2010 Peer Group had actual median revenue of $325 million for fiscal year 2008, which was similar to the Company’s fiscal year 2008 revenue of $328 million.

In order to determine the peer group for fiscal year 2011 (the “2011 Peer Group”), the Compensation Committee reviewed the 2010 Peer Group using Mercer’s peer group development process. Through this process, the Compensation Committee determined that it would not make any changes to the peer group constituency for fiscal year 2011. The 2011 Peer Group had actual median revenue of $344 million for fiscal year 2009, which was similar to the Company’s fiscal year 2009 revenue of $339 million.

Role of Named Executive Officers and Management in Compensation Decisions

While the Compensation Committee has overall responsibility with respect to overseeing and determining the named executive officer compensation programs, various other individuals are involved in this process. The Company’s Senior Vice President of Human Resources works directly with the chair of the Compensation Committee, management of the Company and the compensation consultant to ensure that compensation-related activities are completed according to a time and responsibility schedule. The performance criteria for the Company’s Chief Executive Officer for fiscal year 2010 were developed and evaluated by the Compensation Committee, in consultation with its compensation consultant, in support of the Company’s financial and operational goals for the year. The Compensation Committee determines the compensation of the other named executive officers in consultation with its compensation consultant and the Chief Executive Officer. As all performance criteria used for fiscal year 2010 were the same for all named executive officers and involved only corporate-level (as opposed to individual or business unit) objectives, achievement of the criteria are monitored and reported to the Committee by the Chief Executive Officer, with the support of his staff.

Compensation Components

Our named executive officer compensation programs consist of the following principal components:

| | • | | annual cash incentive bonus; |

| | • | | equity incentive awards, consisting primarily of performance-based stock units; |

| | • | | benefits in the event of termination of employment under certain circumstances; and |

| | • | | certain other benefits generally available to all salaried employees. |

The Compensation Committee uses (i) base salaries to provide a minimum, fixed level of cash compensation for the executive officers, (ii) annual cash bonuses to incentivize and reward executive officers for the Company’s achieving key shorter-term financial and operating results, (iii) equity-based incentive awards to incentivize and reward executive officers for the Company’s achieving key longer-term strategic initiatives, as well as to align their interests with those of stockholders; and (iv) employment termination-related benefits to

17

retain key executive officers, keep them focused on the Company’s business during periods when circumstances might otherwise result in their being distracted and considering other employment opportunities, and ensure that our compensation programs remain competitive. The Committee believes that the majority of the executive officers’ total compensation should consist of long-term equity incentive compensation, rather than cash, which is primarily tied to shorter-term performance.

Base Salary

Base salary represents the portion of each named executive officer’s total compensation that is fixed, or not at risk. The Compensation Committee reviews each named executive officer’s base salary annually, and it makes adjustments after considering the amount of time since the individual executive’s last salary adjustment, the named executive officer’s total compensation package, including cash incentives and equity-based incentives, the named executive officer’s contributions to the Company’s success, and other factors including competitive market factors.

The Compensation Committee reviewed executive officer base salaries for fiscal year 2010 in September 2009, including information provided by Mercer regarding the executive officers’ cash compensation history in light of the Company’s compensation philosophy and objectives. As a result of its review, the Compensation Committee determined that base salary was at an appropriate level for Messrs. Calderoni, Costello and Rubaie and annual base salary for each these officers for fiscal year 2010 remained at their same levels as for fiscal year 2009. In contrast, as a result of its September 2009 review, the Compensation Committee determined that the base salary for Mr. Parker should be adjusted given Mr. Parker’s expanded role with the Company, which had grown to include responsibility for the Research and Development organization. Accordingly, the Compensation Committee approved at that time, effective as of the beginning of fiscal year 2010, an increase in Mr. Parker’s annual base salary from $350,000 to $375,000.

With respect to fiscal year 2011, in September 2010 the Compensation Committee again reviewed with input from Mercer the executive officers’ cash compensation history in light of the compensation philosophy and objectives. As a result of this review, the Compensation Committee determined that base salary was at an appropriate level for Messrs. Calderoni, Costello and Rubaie and it made no adjustments to their base salary. The Committee decided that base salary for Mr. Parker should again be adjusted given his expanding role with the Company, as determined in the prior year, and his performance over the prior year. The Compensation Committee therefore increased Mr. Parker’s annual base salary to $400,000, effective as of the beginning of fiscal year 2011.

Bonus

The Company’s cash bonus program for executive officers is designed to allow the Company to offer cash bonus opportunities to executive officers whose individual efforts contribute to achievement of the Company’s corporate-level performance. The Compensation Committee administers this bonus program with the intent that under it an individual officer’s opportunity for a more significant bonus payment increases when both Ariba and the officer achieve higher levels of performance.

The Company’s cash bonus program for the fiscal year ended September 30, 2010, as in prior fiscal years, was administered through the Ariba Bonus Plan—Executive Officers. Under this plan, an annual target bonus amount is assigned to each participant as soon as reasonably practicable after the beginning of the fiscal year, with 50% of the actual bonus amount determined on the basis of the Company’s annual non-GAAP net income and 50% determined on the basis of the Company’s annual non-GAAP revenue. Actual payments under the bonus plan can range from 0% to 200% of the target bonus amount specified for an individual. The Ariba Bonus Plan was structured to encompass key annual targets that the Compensation Committee believes are important for measuring short-term Company performance and enhancing stockholder value. Specifically, the Compensation Committee uses non-GAAP measures of revenue and net income because it believes that these

18

metrics are used by the Board of Directors and investors in evaluating the Company’s performance. “Non-GAAP revenue” under the Bonus Plan means revenue excluding the impact of purchase accounting adjustment-deferred revenue. “Non-GAAP net income” under the Bonus Plan means after-tax income excluding (i) restructuring costs, (ii) amortization of intangible assets, (iii) litigation benefit, (iv) stock-based compensation; (v) tax accrual reversal and (vi) transaction-related costs.

Notwithstanding that the Ariba Bonus Plan is structured as a performance-based bonus plan that is intended to pay upon achievement of pre-specified financial goals, as defined, the Compensation Committee retains discretionary authority under the terms of the plan to increase or reduce any annual bonus award based on criteria other than non-GAAP revenue and/or non-GAAP net income. The Compensation Committee has from time to time exercised its discretion under the bonus plan to vary the amounts actually paid from the amounts that would have been paid based solely upon formulaic application of performance objectives to target bonus amounts. For example, in fiscal year 2008, the Compensation Committee determined that no bonus amounts would be paid under the plan in order to conserve cash, even though Company performance would have indicated a payment of approximately 91% of the target amount under the bonus plan.

For fiscal year 2010, the Compensation Committee set the performance metrics under the Ariba Bonus Plan for the non-GAAP revenue component at $339 million and at $64 million for the non-GAAP net income component, with the actual performance level required to achieve maximum pay-out under the plan (at 200% of target) at $363 million for the non-GAAP revenue component and $76 million for the non-GAAP net income component. The target bonus amounts for each of the Executive Officers for fiscal year 2010 was as follows: Mr. Calderoni: $675,000, representing 100% of his base salary; Mr. Costello: $335,000, representing 67% of his base salary; Mr. Rubaie: $200,000; representing 50% of his base salary; and Mr. Parker: $235,000, representing 63% of his base salary.

Based on the Company’s fiscal year 2010 financial results, the Compensation Committee determined that the performance metrics for the year had been achieved at a combined rate of 167% (which reflects the average achievement on both goals as follows: 192% for the non-GAAP revenue component and 141% for the non-GAAP net income component). The Company achieved for fiscal year 2010 non-GAAP revenue of $361.1 million and non-GAAP net income of $68.6 million, representing 6% growth in non-GAAP revenue and 13% growth in non-GAAP net income over the prior year’s results. Accordingly, the Compensation Committee determined that each named executive officer other than Mr. Calderoni should receive a bonus reflecting the 167% attainment level under the bonus plan, or 167% of his target bonus. With respect to Mr. Calderoni, the Compensation Committee exercised its discretionary authority under the Ariba Bonus Plan and determined that he should receive the maximum amount of bonus permitted under the plan (200% of target bonus) taking into account actual attainment level of the two specified corporate performance objectives and certain additional factors relating to Mr. Calderoni’s individual performance coupled with overall Company performance during fiscal year 2010. The Compensation Committee made this decision based on Mr. Calderoni’s superior performance over the prior 12 months in guiding the Company through the sale of its sourcing services assets, attainment of significant growth in non-GAAP revenue and non-GAAP net income levels and growth in subscription software in network revenue.

In September 2010, the Compensation Committee, aided by Mercer, reviewed the target bonus levels for the named executive officers with respect to fiscal year 2011 in light of our compensation philosophy and objectives. As a result of its review, the Compensation Committee continued the fiscal year 2010 target bonus levels for each of the named executive officers except for Mr. Costello, whose target bonus amount was adjusted from $335,000 to $375,000, which is 75% of his base salary. This adjustment was made, in part, as recognition for Mr. Costello’s contribution in effecting the sale of the Company’s sourcing services assets and his role in overseeing the Company’s commercial organization. As in fiscal year 2010, the fiscal year 2011 performance metrics under the Ariba Bonus Plan are weighted equally, non-GAAP revenue and non-GAAP net income.

19

Equity Incentive Programs

The Company relies upon equity-based awards as its primary form of long-term incentive compensation and each year as part of its annual compensation review process, the Compensation Committee considers the grant of equity awards to our named executive officers. The Compensation Committee believes that well-designed equity awards best align the interests of each named executive officer with those of our stockholders and provide added incentive for named executive officers to influence the strategic direction of the Company and to create and grow value for customers, stockholders and employees. The Committee works with Mercer to structure carefully these incentives so that they focus the executive officers on achievement of the Company’s longer-term strategic initiatives. Since 2006, when the Company generally stopped granting stock options, our executive compensation programs have included restricted shares or restricted stock units, including performance unit awards. The amount of such awards granted to any individual named executive officer is generally based on the officer’s demonstrated performance, overall corporate performance, the amount and timing of prior awards to the individual officer, and the officer’s overall compensation and equity participation in the Company. Equity awards are generally performance-based, although grants made to newly-hired executive officers generally have time (service)-based vesting conditions rather than performance-based vesting.