UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________

Form 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 29, 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-32113

________________________

RESOURCES CONNECTION, INC.

(Exact Name of Registrant as Specified in Its Charter)

________________________

Delaware |

| 33-0832424 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

17101 Armstrong Avenue, Irvine, California 92614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (714) 430-6400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered |

Common Stock, par value $0.01 per share | RGP | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None (Title of Class)

________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ |

|

|

| Accelerated Filer ☒ | ||

Non-accelerated Filer ☐ |

|

| Smaller Reporting Company ☐ | |||

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

As of November 27, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter), the approximate aggregate market value of common stock held by non-affiliates of the registrant was $382,157,000 (based upon the closing price for shares of the registrant’s common stock as reported by The Nasdaq Global Select Market). As of July 14, 2021, there were approximately 32,888,182 shares of common stock, $.01 par value, outstanding.

________________________

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s definitive proxy statement for the 2021 Annual Meeting of Stockholders is incorporated by reference in Part III of this Form 10-K to the extent stated herein.

RESOURCES CONNECTION, INC.

TABLE OF CONTENTS

Page No. | ||

PART I | ||

ITEM 1. | 3 | |

ITEM 1A. | 10 | |

ITEM 1B. | 19 | |

ITEM 2. | 20 | |

ITEM 3. | 20 | |

ITEM 4. | 20 | |

PART II | ||

ITEM 5. | 21 | |

ITEM 6. | 23 | |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 23 |

ITEM 7A. | 38 | |

ITEM 8. | 40 | |

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 69 |

ITEM 9A. | 69 | |

ITEM 9B. | 71 | |

ITEM 9C. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 71 |

PART III | ||

ITEM 10. | 71 | |

ITEM 11. | 71 | |

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 71 |

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 72 |

ITEM 14. | 72 | |

PART IV | ||

ITEM 15. | 73 | |

ITEM 16. | 76 | |

77 |

In this Annual Report on Form 10-K, “Resources Global Professionals,” “Company,” “we,” “us” and “our” refer to the business of Resources Connection, Inc. and its subsidiaries. References in this Annual Report on Form 10-K to “fiscal,” “year” or “fiscal year” refer to our fiscal year that consists of the 52- or 53-week period ending on the Saturday in May closest to May 31. The fiscal years ended May 29, 2021 and May 25, 2019 both consisted of 52 weeks. The fiscal year ended May 30, 2020 consisted of 53 weeks.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K, including information incorporated herein by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to expectations concerning matters that are not historical facts. For example, statements discussing, among other things, expected savings, business strategies, growth strategies and initiatives, acquisition strategies, future revenues and future performance, are forward-looking statements. Such forward-looking statements may be identified by words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should” or “will” or the negative of these terms or other comparable terminology.

These statements and all phases of our operations are subject to known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievements and those of our industry to differ materially from those expressed or implied by these forward-looking statements. The disclosures we make concerning risks, uncertainties and other factors that may affect our business or operating results, including those identified in Item 1A “Risk Factors” of this Annual Report on Form 10-K, as well as our other reports filed with the Securities and Exchange Commission (“SEC”) should be reviewed carefully. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business or operating results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We do not intend, and undertake no obligation, to update the forward-looking statements in this filing to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events, unless required by law to do so.

PART I

ITEM 1. BUSINESS.

Overview

Resources Global Professionals is a global consulting firm helping clients match the right professional talent needed to tackle transformation, change and compliance challenges. As a next-generation human capital partner for our clients, we specialize in solving today’s most pressing business problems across the enterprise in the areas of transactions, regulations, and transformations. Our engagements are designed to leverage human connection and collaboration to deliver practical solutions and more impactful results that power our clients’, consultants’ and partners’ success.

Disrupting the professional services industry since Resources Global Professionals was founded in 1996, we are the “now of work” – and are focused on attracting the best talent in an increasingly fluid gig-oriented environment. Based in Irvine, California, with offices worldwide, our agile human capital model attracts top-caliber professionals with in-demand skillsets who seek a workplace environment that embraces flexibility, collaboration and human connection. Our agile professional services model quickly aligns the right resources for the work at hand with speed and efficiency. Our approach to workforce strategy uniquely positions us to help our clients transform their businesses and workplaces. Our approximately 5,000 professionals collectively engaged with over 2,100 clients around the world in fiscal 2021, including over 85% of the Fortune 100 as of July 2021.

Business Segments

We operate in three business segments, including:

RGP – a global business consulting practice which operates primarily under the RGP brand and focuses on project consulting and professional staffing services in areas such as finance and accounting, business strategy and transformation, risk and compliance, and technology and digital;

taskforce – a German professional services firm that operates under the taskforce brand. It utilizes a distinct independent contractor/partner business model and infrastructure and focuses on providing senior interim management and project management services to middle market clients in the German market; and

Sitrick – a crisis communications and public relations firm which operates under the Sitrick brand, providing corporate, financial, transactional and crisis communication and management services.

Each of these three segments reports through a separate management team to our Chief Executive Officer, who is the Chief Operating Decision Maker for segment reporting purposes. RGP is our only reportable segment. taskforce and Sitrick do not individually meet the quantitative thresholds to qualify as reportable segments. Therefore, they are combined and disclosed as Other Segments.

RGP accounts for more than 90% of our consolidated revenue and segment total adjusted EBITDA and, therefore, represents our dominant segment. The discussions in this section apply to both our entire business and RGP.

Industry Background and Trends

Changing Market for Project- or Initiative-Based Professional Services

Our services respond to what we believe is a growing marketplace trend: namely, organizations are increasingly choosing to address their workforce needs in more flexible ways. We believe this growing shift in workforce strategy towards a project-based orientation was also accelerated by the COVID-19 pandemic (the “Pandemic”) with an enhanced emphasis on business agility. Permanent professional personnel positions are being reduced as organizations engage agile talent for project initiatives and transformation work.

Organizations use a mix of alternative resources to execute on projects. Some companies rely solely on their own employees who may lack the requisite time, experience or skills for specific projects. Other companies may outsource entire projects to consulting firms, which provides them access to the expertise of the firm but often entails significant cost and less management control of the project. As a more cost-efficient alternative, companies sometimes use temporary employees from traditional and Internet-based staffing firms, although these employees may be less experienced or less qualified than employees from professional services firms. Finally, companies can supplement their internal resources with employees from agile consulting or other traditional professional services firms, like Resources Global Professionals. The use of project consultants as a viable alternative to traditional accounting, consulting and law firms allows companies to:

Strategically access specialized skills and expertise for projects of set duration;

Access the very best talent across regions and geographies;

Be nimble and mobilize quickly;

Blend independent and fresh points of view;

Effectively supplement internal resources;

Increase labor flexibility; and

Reduce overall hiring, training and termination costs.

Supply of Project Consultants

Based on discussions with our consultants, we believe the number of professionals seeking to work on an agile basis has been increasing due to a desire for:

More flexible hours and work arrangements, including working from home options, coupled with an evolving professional culture that offers competitive wages and benefits;

The ability to learn and contribute in different environments and collaborate with diverse team members;

Challenging engagements that advance their careers, develop their skills and add to their experience base;

A work environment that provides a diversity of, and more control over, client engagements; and

Alternate employment opportunities throughout the world.

The employment alternatives available to professionals may fulfill some, but not all, of an individual’s career objectives. A professional working for a Big Four firm or a consulting firm may receive challenging assignments and training; however, he or she may encounter a career path with less choice and less flexible hours, extensive travel and limited control over work engagements. On the other hand, a professional who works as an independent contractor faces the ongoing task of sourcing assignments and significant administrative burdens, including potential tax and legal issues.

Resources Global Professionals’ Solution

We believe Resources Global Professionals is ideally positioned to capitalize on the confluence of the industry shifts described above. We believe, based on discussions with our clients, that Resources Global Professionals provides the agility companies desire in today’s highly competitive and quickly evolving business environment. Our solution offers the following elements:

A relationship-oriented and collaborative approach to client service;

A dedicated talent acquisition and management team adept at developing, managing and deploying a project-based workforce;

Deep functional and/or technical experts who can assess clients’ project needs and customize solutions to meet those needs;

Highly qualified and pedigreed consultants with the requisite expertise, experience and points of view;

Competitive rates on an hourly, rather than project, basis; and

Significant client control of their projects with effective knowledge transfer and change management.

Resources Global Professionals’ Strategic Priorities

Our Business Strategy

We are dedicated to serving our clients with highly qualified and experienced talent in support of projects and initiatives in a broad array of functional areas, including:

Transactions Integration and divestitures Bankruptcy/restructuring Going public readiness and support Financial process optimization System implementation | Regulations Accounting regulations Internal audit and compliance Data privacy and security Healthcare compliance Regulatory compliance |

Transformations Finance transformation Digital transformation Supply chain management Cloud migration Data design and analytics |

|

Our objective is to build and maintain Resources Global Professionals’ reputation as the premier provider of agile human capital solutions for companies facing transformation, change and compliance challenges. We have developed the following business strategies to achieve our objectives:

Hire and retain highly qualified, experienced consultants. We believe our highly qualified, experienced consultants provide us with a distinct competitive advantage. Therefore, one of our priorities is to continue to attract and retain high-caliber consultants who are committed to serving clients and solving their problems. We believe we have been successful in attracting and retaining qualified professionals by providing challenging work assignments, competitive compensation and benefits, and continuing professional development and learning opportunities as well as membership to an exclusive community of likeminded professionals, while offering flexible work schedules and more control over choosing client engagements.

Maintain our distinctive culture. Our corporate culture is the foundation of our business strategy and we believe it has been a significant component of our success. See “Human Capital Management” below for further discussions about our culture.

Establish consultative relationships with clients. We emphasize a relationship-oriented approach to business rather than a transaction-oriented or assignment-oriented approach. We believe the professional services experience of our management and consultants enables us to understand the needs of our clients and deliver an integrated, relationship-based approach to meeting those needs. Client relationships and needs are addressed from a client centric, not geographic, perspective. Our revenue team regularly meets with our existing and prospective clients to understand their business issues and help them define their project needs. Our talent team then identifies consultants with the appropriate skills and experience from our global talent pool to meet the client’s objectives. We believe that by establishing relationships with our clients to solve their professional service needs, we are more likely to identify new opportunities to serve them. The strength and depth of our client relationships is demonstrated by the approximately 74% retention rate of our top 100 clients over the last five years.

Build the RGP brand. We want to be the preferred provider in the “now of work,” providing the best talent in an increasingly fluid gig-oriented environment. Our primary means of building our brand continues to be the consistent and reliable delivery of high-quality, value-added services to our clients. We have also built a significant referral network through our 2,902 consultants and 851 management and administrative employees as of May 29, 2021. In addition, we have invested in global, regional and local marketing and brand activation efforts that reinforce our brand. We rely on trademark registrations and common law trademark rights to protect the distinctiveness of our brand.

Our Growth Strategy

Since inception, our growth has been primarily organic with certain strategic acquisitions along the way that augmented our physical presence or solution offerings. We believe we have significant opportunity for continued organic growth in our core business while also growing opportunistically through strategic and highly targeted acquisitions as the global economy recovers from the Pandemic and our clients continue to accelerate their digital and workforce paradigm transformations. In both our core and acquired businesses, key elements of our growth strategy include:

Increase penetration of existing client base. A principal component of our strategy is to secure additional work from the clients we have served. Based on discussions with our clients, we believe that the amount of revenue we currently generate from many of our clients represents a relatively small percentage of the total amount that they spend on professional services. Consistent with current industry trends, we believe our clients may also continue to increase that spend as the global economy recovers and as businesses adopt a more agile workforce strategy. We believe that by continuing to deliver high-quality services and by furthering our relationships with our clients, we can capture a significantly larger share of our clients’ professional services budgets. We maintain our Strategic Client Account Program to serve a number of our largest clients with dedicated global account teams. We have and will continue to expand the Strategic Client Account Program by adding additional clients and taking a more client centric and borderless approach to serving these clients. We believe this focus enhances our opportunities to develop in-depth knowledge of these clients’ needs and the ability to increase the scope and size of projects with those clients. The Strategic Client Account Program has been one of our key drivers for revenue and business growth.

Grow our client base. We continue to focus on attracting new clients. We strive to develop new client relationships primarily by leveraging the significant contact networks of our management and consultants and through referrals from existing clients. We believe we can continue to attract new clients by building our brand identity and reputation, supplemented by our global, regional and local marketing efforts. We anticipate our growth efforts will continue to pivot on identifying strategic target accounts especially in the large and middle market client segments and within certain focus industries, such as healthcare, technology and financial services.

Diversify service offerings. We continue to develop and consider entry into new professional service offerings. Since our founding, we have diversified our professional service offerings from a primary focus on accounting and finance to other areas in which our clients have significant needs such as integration and divestitures, financial process optimization, accounting regulations, internal audit and compliance, healthcare compliance, finance transformation, digital transformation, and data design and analytics. We continuously identify project opportunities we can market at a broader level with our talent, tools and methodologies and commercialize projects into solution offerings. When evaluating new solution offerings to market to current and prospective clients, we consider (among other things) cultural fit, growth potential, profitability, cross-marketing opportunities and competition.

Engage in strategic acquisitions. Our acquisition strategy is to engage in targeted M&A efforts that are designed to complement our core service offerings and enhance our consulting capabilities that are in line with market demands and trends. In fiscal 2020, we acquired Veracity Consulting Group, LLC (“Veracity”). The acquisition of Veracity accelerated our digital capabilities and our ability to offer comprehensive digital innovation services.

Human Capital Management

Our internal employees and consultants represent our greatest asset and operate together to provide the highest quality of service to our clients. As of May 29, 2021, we had 3,753 employees, including 851 management and administrative employees and 2,902 consultants. Our employees are not covered by any collective bargaining agreements.

Our Culture and Values

Our company culture is the cornerstone of all our human capital programs. Our senior management team, the majority of whom are Big Four, management consulting and/or Fortune 500 alumni, has created a culture that combines the commitment to quality and the client service focus of a Big Four firm with the entrepreneurial energy of an innovative, high-growth company. Our culture is built upon our shared, core values of Loyalty, Integrity, Focus, Enthusiasm, Accountability and Talent, and we believe this is a key reason for our success.

Along with our core values, we act in accordance with our Code of Business Conduct and Ethics (“Code of Conduct”), which sets forth the standards our employees and board members must adhere to at all times in the execution of their duties. Our Code of Conduct covers topics such as honest and candid conduct, conflicts of interest, protecting confidential information, anti-corruption, compliance with laws, rules and regulations, fair dealing, equal opportunities and non-harassment, maintaining a safe workplace, and the reporting of violations. The Code of Conduct reflects our commitment to operating in a fair, honest, responsible and ethical manner and also provides direction for reporting complaints in the event of alleged violations of our policies (including through an anonymous hotline).

Diversity, Equity & Inclusion

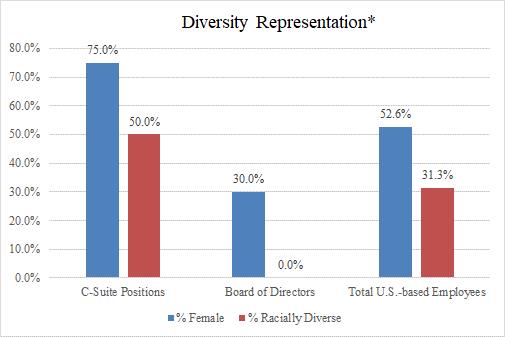

Diversity, equity and inclusion (DE&I) are critical underpinnings of our shared values and guide our conduct in our interactions with both clients and each other. As a human-first company, we recognize diversity as a strength that is cultivated through our culture, our people, our business, and our clients. We are a Paradigm for Parity Coalition company and a 2020 Women on Boards “W” Winning Company. Our gender and racial diversity representation in the C-suite positions (i.e., our “Chief” level positions), board of directors and U.S.-based workforce is presented in the following table:

* -- Data for our C-suite and board of directors is as of May 29, 2021 and our total U.S.-based employees is as of November 2020.

In fiscal 2021, we established a Diversity Council and a Diversity Ambassador program, consisting of team members across North America from various functions. The Diversity Council serves an important role in working closely with senior leaders to facilitate alignment between our DE&I efforts and overall business strategy of promoting human capital practices that support and accelerate our DE&I goals. Our Diversity Council hosts periodic town hall meetings that are accessible to our global workforce. In these meetings, our council discusses the current year’s DE&I initiatives and strategy for execution on those initiatives, as well as updates to our DE&I resources. For example, our fiscal 2021 DE&I initiatives focused on increasing DE&I awareness, education and involvement among our workforce, increasing diversity in our workforce, and promoting diversity in our Go-to-Market activities. In fiscal 2021, we also established a Social Justice Charitable Matching Fund, which has allowed us to help raise DE&I awareness internally across our organization by matching employees’ contributions to charitable organizations that promote social justice. As of May 29, 2021, we achieved our goal of matching $100,000 in contributions during fiscal 2021.

Employee Wellbeing and Resilience

Employee safety and wellbeing is of paramount importance to us in any year and was of particular focus in our fiscal years 2020 and 2021 in light of the Pandemic. To further this focus, we formed a Global Business Continuity Team to improve our disaster preparedness plans and implement strategies to manage the health and security of our employees, business continuity, client confidence, and excellent customer service. In response to the Pandemic, we introduced a work-from-home policy, critical safety and hygiene protocols and a limited business travel directive. We continue to monitor changing government rules and regulations in countries where we operate and have begun to reopen our offices in accordance with local health department guidelines. Our goal is to help every human in our workforce maintain a positive, productive and connected work experience. We provide productivity and collaboration tools and resources for employees working remotely, and during 2020 and 2021, we enhanced and promoted programs to support our employees’ physical and mental wellbeing, including the offering of virtual fitness and education classes, and the institution of the RGP Kids Academy that offers academic and enrichment classes for children and families of our employees. We also offer all U.S.-based employees participation in our Employee Assistance Program, which provides our employees with mental health support and resources.

Building Strong Leaders and Talent Management

Strong leadership is critical to fostering employee engagement and positioning employees to perform at their best. For these reasons, we invest in the ongoing professional development of our employees through curated programs that are designed to promote personal, functional and leadership growth. Successful talent development starts with hiring the right people. We seek to recruit and hire candidates that demonstrate skills and competencies that align with our core values and that have an aptitude to further develop those strengths. After onboarding, we remain dedicated to providing employees with training and development opportunities to allow our employees to progress in their careers.

Compensation and Benefits

We provide a competitive compensation and benefits program to attract and reward our employees. In addition to salaries, our eligible employees, including our consultants, are offered participation in a comprehensive benefits program including: paid time off and holidays, group medical and dental programs, a basic term life insurance program, health savings accounts, flexible spending accounts, a 401(k) retirement plan with employer matching contributions, a 2019 Employee Stock Purchase Plan (“ESPP”), which enables employees to purchase shares of our stock at a discount, and an employee assistance program. In addition, eligible management and administrative employees may participate in annual cash incentive programs or receive stock-based awards. We also allow eligible consultants to maintain continuation of benefits for 90 days following the completion of a consulting project. Internationally, our consultants are a blend of employees and independent contractors. Independent contractor arrangements are more common abroad than in the U.S. due to worker preferences, applicable laws and regulations and customs in the market.

During fiscal 2021, we introduced our Pay for Success Total Rewards Philosophy that promotes more consistent and transparent practices for rewarding and incentivizing our employees and the alignment of pay practices with Company success. The Total Rewards Philosophy is comprised of three main components: base pay, designed to reflect an individual’s value given knowledge, skills, and value driven through job performance; short term incentives, awarded to employees based on results delivered during the applicable fiscal year and determined by quantitative metrics, qualitative contributions, individual goals, and demonstration of company values; and long-term incentives, granted to reward and retain employees who have strategic impact on the long-term success of the Company.

During fiscal 2021, we also launched our “You Matter” digital global employee recognition and appreciation program. You Matter includes service awards to acknowledge key milestones, including employment anniversaries and hours of service. This program provides all employees with the ability to both give and receive recognition, contributing to our culture of gratitude and excellence.

Clients

We provide our services and solutions to a diverse client base in a broad range of industries. In fiscal 2021, we served over 2,100 clients in 42 countries. Our revenues are not concentrated with any particular client. No single customer accounted for more than 10% of revenue for the 2021, 2020 or 2019 fiscal years. In fiscal 2021, our 10 largest clients accounted for approximately 21% of our revenues.

Operations

We generally provide our professional services to clients at a local level, with the oversight of our market or account leaders and consultation with our corporate management team. The market or account leaders and client development directors in each market are responsible for initiating client relationships, ensuring client satisfaction throughout engagements, coordinating services for clients on a national and international platform and maintaining client relationships post-engagement. Market or account revenue leadership and their teams identify, develop and close new and existing client opportunities, often working in a coordinated effort with other markets on multi-national/multi-location proposals.

Market or account level leadership works closely with our regionalized talent management team, who are responsible for identifying, hiring and cultivating a sustainable relationship with seasoned professionals fitting the RGP profile of client needs. Our consultant recruiting efforts are regionally and nationally based, depending upon the skill set required; talent management handles both the identification and hiring of consultants specifically skilled to perform client projects as well as monitoring the satisfaction of consultants during and post-completion of assignments. The talent teams focus on getting the right talent in the right place at the right time. In fiscal 2020, we launched our Borderless Talent initiative in response to the Pandemic to evolve towards and facilitate a virtual operating model. With this initiative, we seek to provide borderless solutions, anytime, anywhere, bringing the best talent to meet our clients’ business needs, based on workload, not zip code.

We believe a substantial portion of the buying decisions made by our clients are made on a local or regional basis and our offices most often compete with other professional services providers on a local or regional basis. We continue to believe our local market or account leaders are well-positioned to understand the local and regional outsourced professional services market. Additionally, the complexity of relationships with many of our multinational clients also dictates that in some circumstances a hybrid model, bringing

the best of both locally driven relationships as well as global focus and delivery, is important for employee and client satisfaction. Through our Strategic Client Account Program, we aim to be the service provider that can partner with our multinational clients on a global basis by organizing the concerted effort and talent team to deliver through one integrated service platform. Additionally, team members in our Advisory and Project Services group are individuals with requisite depth of expertise and tools to work with clients on projects requiring intimate knowledge and thought leadership on particular client concerns.

We believe our ability to deliver professional services successfully to clients is dependent on our leaders in the field working together as a collegial and collaborative team. To build a sense of team spirit and increase camaraderie among our leaders, we have a program for field personnel that awards annual incentives based on specific agreed-upon goals focused on the performance of the individual and performance of the Company. We also share across the Company the best and most effective practices of our highest achieving offices and accounts and use this as an introductory tool with new revenue team members. New leadership also spends time in other markets or otherwise partners with experienced sales and recruiting personnel in those markets to understand how best to serve current clients, expand our presence with prospects and identify and recruit highly qualified consultants, among many other important skills. This allows the veteran leadership to share their success stories, foster our culture with new team members and review specific client and consultant development programs. We believe these team-based practices enable us to better serve clients who prefer a centrally organized service approach.

From our corporate headquarters in Irvine, California, we provide centralized administrative, marketing, finance, human resources (“HR”), information technology (“IT”), legal and real estate support. We also have a business support operations center in our Utrecht, Netherlands office to provide centralized finance, HR, IT, payroll and legal support to our European offices. These centralized functions minimize the administrative burdens on our front office market leaders and enables operational efficiency and scalability throughout the enterprise.

Business Development

Our business development initiatives are composed of:

local and global initiatives focused on existing clients and target companies;

national and international targeting efforts focused on multinational companies;

brand marketing activities; and

national and local advertising and direct mail programs.

Our business development efforts are driven by the networking and sales efforts of our management, with our worldwide Salesforce software platform providing a common database of opportunities and clients and enhancing our local and global business development efforts. While local senior management focus on market-related activities, they are also part of the regional, national and international sales efforts, especially when the client is part of a multinational entity. In certain markets, sales efforts are also enhanced by management professionals focused solely on business development efforts on a market and national basis based on firm-wide and industry-focused initiatives. These business development professionals, teamed with the vice-presidents and client service teams, are responsible for initiating and fostering relationships with the senior management and decision makers of our targeted client companies.

We believe our national marketing efforts have effectively generated incremental revenues from existing clients and developed new client relationships. Our brand marketing initiatives help bolster Resources Global Professionals’ reputation in the markets we serve. Our brand is reinforced by our professionally designed website, print, and online advertising, direct marketing, seminars, initiative-oriented brochures, social media and public relations efforts. We believe our branding initiatives, coupled with our high-quality client service, help to differentiate us from our competitors and to establish Resources Global Professionals as a credible and reputable global professional services firm.

Competition

We operate in a competitive, fragmented market and compete for clients and consultants with a variety of organizations that offer similar services. Our principal competitors include:

consulting firms;

local, regional, national and international accounting and other traditional professional services firms;

independent contractors;

traditional and Internet-based staffing firms; and

the in-house or former in-house resources of our clients.

We compete for clients based on the quality of professionals we bring to our clients, the knowledge base they possess, our ability to mobilize the right talent quickly, the scope and price of services, and the geographic reach of services. We believe our attractive value proposition, consisting of our highly qualified consultants, relationship-oriented approach and professional culture, enables us to compete effectively in the marketplace.

Regulatory Environment

Our operations are subject to regulations by federal, state, local and professional governing bodies and laws and regulations in various foreign countries, including, but not limited to, (a) licensing and registration requirements and (b) regulation of the employer/employee relationship, such as worker classification regulations, wage and hour regulations, tax withholding and reporting, immigration/H-1B visa regulations, social security and other retirement, antidiscrimination, and employee benefits and workers’ compensation regulations. Our operations could be impacted by legislative changes by these bodies, particularly with respect to provisions relating to payroll and benefits, tax and accounting, employment, worker classification and data privacy. Due to the complex regulatory environment that we operate in, we remain focused on the compliance with governmental and professional organizations regulations. For more discussion of the potential impact that the regulatory environment could have on our financial results, refer to Item 1A “Risk Factors”.

Available Information

Our principal executive offices are located at 17101 Armstrong Avenue, Irvine, California 92614. Our telephone number is (714) 430-6400 and our website address is https://www.rgp.com. The information set forth in our website does not constitute part of this Annual Report on Form 10-K. We file our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 with the SEC electronically. These reports are maintained on the SEC’s website at http://www.sec.gov.

A copy of our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and amendments to those reports may also be obtained free of charge on the Investor Relations page of our website at https://ir.rgp.com as soon as reasonably practicable after we file such reports with the SEC.

ITEM 1A. RISK FACTORS.

The risks described below should be considered carefully before a decision to buy shares of our common stock is made. The order of the risks is not an indication of their relative weight or importance. The risks and uncertainties described below are not the only ones facing us but do represent those risks and uncertainties we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely impact and impair our business. If any of the following risks actually occur, our business could be harmed. In that case, the trading price of our common stock could decline, and all or part of the investment in our common stock might be lost. When determining whether to buy our common stock, other information in this Annual Report on Form 10-K, including our financial statements and the related notes should also be reviewed.

Risks Related to the Business Environment

Our business is subject to risks arising from epidemic diseases, such as the ongoing COVID-19 pandemic.

A pandemic, including COVID-19, or other public health epidemic poses the risk that we or our employees and partners may be prevented from conducting business activities at full capacity for an indefinite period of time, including due to the spread of the virus or due to shutdowns that are requested or mandated by governmental authorities. The current Pandemic and governmental measures intended to reduce its spread have affected, and may continue to affect, how we operate, including, among other things, by reducing demand for or delaying client decisions to procure our services, or resulting in cancellations of existing projects. We may also experience a decline in productivity, adversely impacting our ability to continue to serve our clients efficiently. The Pandemic may also have impacted, and may continue to impact, the overall financial condition of some of our clients and their ability to pay outstanding receivables owed to us.

We have followed government mandatory stay-at-home orders when required, and limited all non-essential travel worldwide for our employees, which have negatively impacted, and could continue to negatively affect our business, especially in certain regions with continued high rates of infection of COVID-19. Although our operations have started to stabilize in a majority of the markets in which we operate, the lingering adverse effects of the Pandemic could continue into fiscal 2022. The full extent to which the Pandemic impacts our business and financial results will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact, the impacts of new variants of the virus, and the timing, distribution, efficacy and public acceptance of vaccines and other treatments for COVID-19.

Economic conditions or changes in the use of outsourced professional services consultants could adversely affect our business.

The Pandemic has caused disruptions in the U.S. and global economy, and uncertainty regarding general economic conditions within some regions and countries in which we operate has led to reluctance on the part of some companies to spend on discretionary projects. This has partially contributed to a decrease in hours worked and the number of professional services consultants at Resources Global Professionals from fiscal 2020 to 2021. Deterioration of or prolonged uncertainty related to the global economy or tightening credit markets could further reduce the demand for our services and adversely affect our business in the future. In addition, the use of professional services consultants on a project-by-project basis could decline for non-economic reasons, including due to clients utilizing their own internal employees, due to competitive reasons, due to a lack of qualified consultants and for the other reasons described elsewhere in this Item 1A. In the event of a reduction in the demand for our consultants, our financial results would suffer.

Economic deterioration at one or more of our clients may also affect our allowance for doubtful accounts. Our estimate of losses resulting from our clients’ failure to make required payments for services rendered has historically been within our expectations and the provisions established. While our overall receivable collections have not been severely impacted by the Pandemic, we cannot guarantee we will continue to experience the same credit loss rates we have in the past. A significant change in the liquidity or financial position of our clients could cause unfavorable trends in receivable collections and cash flows and additional allowances may be required. These additional allowances could materially affect our future financial results.

In addition, we are required periodically, and at least annually, to assess the recoverability of certain assets, including deferred tax assets, long-lived assets and goodwill. Downturns in the U.S. and international economies could adversely affect our evaluation of the recoverability of deferred tax assets, long-lived assets and goodwill. Although the additional tax valuation allowances and the impairment of long-lived assets and goodwill are non-cash expenses, they could materially affect our future financial results and financial condition.

The market for professional services is highly competitive, and if we are unable to compete effectively against our competitors, our business and operating results could be adversely affected.

We operate in a competitive, fragmented market, and we compete for clients and consultants with a variety of organizations that offer similar services. Our principal competitors include: consulting firms; local, regional, national and international accounting and other traditional professional services firms; independent contractors; traditional and Internet-based staffing firms; and the in-house or former in-house resources of our clients. The competition is likely to increase in the future due to the expected growth of the market and the relatively few barriers to entry.

We cannot provide assurance that we will be able to compete effectively against existing or future competitors. Many of our competitors have significantly greater financial resources, greater revenues and greater name recognition, which may afford them an advantage in attracting and retaining clients and consultants and in offering pricing concessions. Some of our competitors in certain markets do not provide medical and other benefits to their consultants, thereby allowing them to potentially charge lower rates to clients. In addition, our competitors may be able to respond more quickly to changes in companies’ needs and developments in the professional services industry.

Risks Related to Human Capital Resources

We must provide our clients with highly qualified and experienced consultants, and the loss of a significant number of our consultants, or an inability to attract and retain new consultants, could adversely affect our business and operating results.

Our business involves the delivery of professional services, and our success depends on our ability to provide our clients with highly qualified and experienced consultants who possess the skills and experience necessary to satisfy their needs. At various times, such professionals can be in great demand, particularly in certain geographic areas or if they have specific skill sets. Our ability to attract and retain consultants with the requisite experience and skills depends on several factors including, but not limited to, our ability to:

provide our consultants with either full-time or flexible-time employment;

obtain the type of challenging and high-quality projects that our consultants seek;

provide competitive compensation and benefits; and

provide our consultants with flexibility as to hours worked and assignment of client engagements.

There can be no assurance we will be successful in accomplishing any of these factors and, even if we are, we cannot assure we will be successful in attracting and retaining the number of highly qualified and experienced consultants necessary to maintain and grow our business.

Our business could suffer if we lose the services of one or more key members of our senior management.

Our future success depends upon the continued employment of our senior management team. The unforeseen departure of one or more key members of our senior management team could significantly disrupt our operations if we are unable to successfully manage the transition. The replacement of members of senior management can involve significant time and expense and create uncertainties that could delay, prevent the achievement of, or make it more difficult for us to pursue and execute on our business opportunities, which could have an adverse effect on our business, financial condition and operating results.

Further, due to legal restrictions prohibiting non-compete agreements in certain jurisdictions, we generally do not have non-compete agreements with our employees, including our senior management team, and, therefore, they could terminate their employment with us at any time. Our ability to retain the services of members of our senior management and other key employees could be impacted by a number of factors, including competitors’ hiring practices or the effectiveness of our compensation programs. If members of our senior management or other key employees leave us for any reason, they could pursue other employment opportunities with our competitors or otherwise compete with us. If we are unable to retain the services of these key personnel or attract and retain other qualified and experienced personnel on acceptable terms, our business, financial condition and operating results could be adversely affected.

Significant increases in wages or payroll-related costs could have a material adverse effect on our financial results.

We are required to pay a number of federal, state and local payroll related costs for our employees and consultants, including providing certain benefits such as medical insurance, paid time off and sick leave, and paying unemployment taxes, workers’ compensation insurance premiums and claims, and FICA and Medicare taxes. These costs could be increased by changes to local laws and regulations. Costs could also increase as a result of health care reforms or the possible imposition of additional requirements and restrictions related to the placement of personnel. We may not be able to increase the fees charged to our clients in a timely manner or in a sufficient amount to cover these potential cost increases.

Risks Related to Our Business Operations and Initiatives

Our business depends upon our ability to secure new projects from clients and renew expired contracts, and we could be adversely affected if we fail to do so.

We generally do not have long-term agreements with our clients for the provision of services and our clients may terminate engagements with us at any time. The success of our business is dependent on our ability to secure new projects from clients or to renew expired contracts with clients. For example, our business is likely to be materially adversely affected if we are unable to secure new client projects because of improvements in our competitors’ service offerings, because of a change in government regulatory requirements, because of an economic downturn decreasing the demand for outsourced professional services, or for other reasons. New impediments to our ability to secure projects from clients may develop over time, such as the increasing use by large clients of in-house procurement groups that manage their relationship with service providers.

If we are not able to replace the revenue from our expired client contracts, either through follow-on contracts or new contracts for those requirements or for other requirements, our revenue and operating results may be adversely affected. On the expiration of a contract, we typically seek a new contract or subcontractor role relating to that client to replace the revenue generated by the expired contract. There can be no assurance that those expiring contracts we are servicing will continue after their expiration, that the client will re-procure those requirements, that any such re-procurement will not be restricted in a way that would eliminate us from the competition, or that we will be successful in any such re-procurements or in obtaining subcontractor roles. Any factor that diminishes client relationships and/or our professional reputation could make it substantially more difficult for us to compete successfully for new engagements and qualified consultants. To the extent our client relationships and/or professional reputation deteriorate, our revenue and operating results could be adversely affected.

Our financial results could suffer if we are unable to achieve or maintain a suitable pay/bill ratio.

Our consultant cost structure is primarily variable in nature, and our profitability depends to a large extent on the level of pay/bill ratio achieved. Our failure to maintain or increase the hourly rates we charge our clients for our services or to pay an adequate and competitive rate to our consultants in order to maintain a suitable pay/bill ratio could compress our gross margin and adversely impact our profitability.

The pay rates of our consultants are affected by a number of factors, including:

the skill sets and qualifications our consultants possess;

the competition for talent; and

current labor market and economic conditions.

The billing rates of our consultants are affected by a number of factors, including:

our clients’ perception of our ability to add value through our services;

the market demand for the services we provide;

introduction of new services by us or our competitors;

our competition and the pricing policies of our competitors; and

current economic conditions.

If we are unable to achieve a desirable pay/bill ratio, our financial results could materially suffer. In addition, a limited number of clients are requesting certain engagements be a fixed fee rather than our traditional hourly time and materials approach, thus shifting a portion of the burden of financial risk and monitoring to us.

We derive significant revenue and profits from contracts awarded through a competitive bidding process, which can impose substantial costs on us, and we will lose revenue and profits if we fail to compete effectively.

We derive significant revenue and profits from contracts that are awarded through a competitive bidding process. Competitive bidding imposes substantial costs and presents a number of risks, including the:

Substantial cost and managerial time and effort that we spend to prepare bids and proposals;

Need to estimate accurately the resources and costs that will be required to service any contracts we are awarded, sometimes in advance of the final determination of their full scope; and

Opportunity cost of not bidding on and winning other contracts we may have otherwise pursued.

To the extent we engage in competitive bidding and are unable to win particular contracts, we not only incur substantial costs in the bidding process that negatively affect our operating results, but we may lose the opportunity to operate in the market for the services provided under those contracts for a number of years. Even if we win a particular contract through competitive bidding, our profit margins may be depressed, or we may even suffer losses as a result of the costs incurred through the bidding process and the need to lower our prices to overcome competition.

Our contracts may contain provisions that are unfavorable to us and permit our clients to, among other things, terminate our contracts partially or completely at any time prior to completion.

Our contracts typically contain provisions that allow our clients to terminate or modify these contracts at their convenience on short notice. If a client terminates one of our contracts for convenience, we generally can only bill the client for work completed prior to the termination, plus any commitments and settlement expenses the client agrees to pay, but not for any work not yet performed. If a client were to terminate, decline to exercise options under, or curtail further performance under one or more of our major contracts, our revenue and operating results could be adversely affected.

We may be unable to realize the level of benefit that we expect from our restructuring initiatives, which may adversely impact our business and results of operations.

We may be unable to realize some or all of the anticipated benefits of restructuring initiatives we have undertaken, which may adversely impact our business and results of operations. In response to changes in industry and market conditions, we have undertaken in the past, and may undertake in the future, restructuring, reorganization, or other strategic initiatives and business transformation plans to realign our resources with our growth strategies, operate more efficiently and control costs. For example, we initiated a global restructuring and business transformation plan in North America and Asia Pacific (the “North America and APAC Plan”) in March 2020 and in Europe (the “European Plan”) in September 2020. The successful implementation of our restructuring activities may from time to time require us to effect business and asset dispositions, workforce reductions, management restructurings, decisions to limit investments in or otherwise exit businesses, office consolidations and closures, and other actions, each of which may depend on a number of factors that may not be within our control.

Any such effort to realign or streamline our organization may result in the recording of restructuring or other charges, such as asset impairment charges, contract and lease termination costs, exit costs, termination benefits, and other restructuring costs. Further, as

a result of restructuring initiatives, we may experience a loss of continuity, loss of accumulated knowledge and/or inefficiency, adverse effects on employee morale, loss of key employees and/or other retention issues during transitional periods. Reorganization and restructuring can impact a significant amount of management and other employees’ time and focus, which may divert attention from operating and growing our business. Further, upon completion of any restructuring initiatives, our business may not be more efficient or effective than prior to the implementation of the plan and we may be unable to achieve anticipated operating enhancements or cost reductions, which would adversely affect our business, competitive position, operating results and financial condition.

Our recent digital expansion and technology transformation efforts may not be successful, which could adversely impact our growth and profitability.

One of our primary areas of focus for fiscal 2021 and fiscal 2022 is digital expansion, which includes the development and launch of our human cloud platform aimed at introducing a new way for clients and talent alike to engage with us and expanding go-to-market penetration for the business we acquired from Veracity. We are also making investments in the transformation of our technology systems to keep up with technological changes that impact the needs of our clients, the delivery of our services and the efficiency of our back-office operations. These investments require significant capital expenditures. If we are unable to execute these initiatives successfully, we may not realize our anticipated return on investment and may not be able to realize the benefits expected, which could adversely impact our growth and profitability.

We may not be able to build an efficient support structure as our business continues to grow and transform.

As our business continues to grow and transform, we may not be able to build an efficient support structure. For example, in fiscal 2020 we launched our Borderless Talent initiative in response to the Pandemic to evolve towards and facilitate a virtual operating model. With this initiative, we seek to provide borderless solutions, anytime, anywhere, bringing the best talent to meet our clients’ business needs, based on workload, not zip code. The successful implementation of such initiatives requires adjusting and strengthening of our business operations, financial and talent management systems, procedures and controls and compliance, which may increase our total operating costs and adversely impact our profitability and growth.

New business strategies and initiatives, such as these, can be time consuming for our management team and disruptive to our operations. New business initiatives could also involve significant unanticipated challenges and risks including not advancing our business strategy, not realizing our anticipated return on investment, experiencing difficulty in implementing initiatives, or diverting management’s attention from our other businesses. These events could cause material harm to our business, operating results or financial condition.

We may not be able to grow our business, manage our growth or sustain our current business.

Historically, we have grown by opening new offices and by increasing the volume of services provided through existing offices. Beginning late in fiscal 2017, we embarked on several new strategic initiatives, including the implementation of a new operating model to be more center led instead of geographically focused, to drive growth and scale. As noted above, we undertook the North America and APAC Plan in March 2020 and the European Plan in September 2020 to analyze our physical geographic footprint and real estate spend in those areas. We have worked to focus investment dollars in high growth core markets for greater impact and to shift to a virtual operating model in certain other markets. There can be no assurance we will be able to maintain or expand our market presence in our current locations, successfully enter other markets or locations or successfully operate our business virtually without a physical presence in all our markets. Our ability to continue to grow our business will depend upon an improving global economy and a number of factors, including our ability to:

grow new client base and penetrate our existing client base;

expand profitably into new geographies;

drive growth in core markets, key industry verticals and solution offerings such as digital transformation services;

provide additional professional service offerings;

hire qualified and experienced consultants;

maintain margins in the face of pricing pressure; and

manage costs

Even if we are able to resume more rapid growth in our revenue, the growth will result in new and increased responsibilities for our management as well as increased demands on our internal systems, procedures and controls, and our administrative, financial, marketing and other resources. Failure to adequately respond to these new responsibilities and demands may adversely affect our business, financial condition and results of operations.

Our ability to serve clients internationally is integral to our strategy and our international activities expose us to additional operational challenges we might not otherwise face.

Our international activities require us to confront and manage several risks and expenses we would not face if we conducted our operations solely in the U.S. Any of these risks or expenses could cause a material negative effect on our operating results. These risks and expenses include:

difficulties in staffing and managing foreign offices as a result of, among other things, distance, language and cultural differences;

exposure to labor laws and regulations in foreign countries;

expenses associated with customizing our professional services for clients in foreign countries;

foreign currency exchange rate fluctuations when we sell our professional services in denominations other than U.S. dollars;

protectionist laws and business practices that favor local companies;

political and economic instability in some international markets;

multiple, conflicting and changing government laws and regulations;

trade barriers;

compliance with stringent and varying privacy laws in the markets in which we operate;

compliance with regulations on international business, including the Foreign Corrupt Practices Act, the United Kingdom Bribery Act of 2010 and the anti-bribery laws of other countries;

reduced protection for intellectual property rights in some countries;

potentially adverse tax consequences; and

restrictions on the ability to repatriate profits to the U.S. or otherwise move funds.

We have acquired, and may continue to acquire, companies, and these acquisitions could disrupt our business.

We have acquired several companies, including two in each of fiscal 2020 and fiscal 2018, and we may continue to acquire companies in the future. Entering into an acquisition entails many risks, any of which could harm our business, including:

diversion of management’s attention from other business concerns;

failure to integrate the acquired company with our existing business;

failure to motivate, or loss of, key employees from either our existing business or the acquired business;

failure to identify certain risks or liabilities during the due diligence process;

potential impairment of relationships with our existing employees and clients;

additional operating expenses not offset by additional revenue;

incurrence of significant non-recurring charges;

incurrence of additional debt with restrictive covenants or other limitations;

addition of significant amounts of intangible assets, including goodwill, that are subject to periodic assessment of impairment, with such non-cash impairment potentially resulting in a material impact on our future financial results and financial condition;

dilution of our stock as a result of issuing equity securities; and

assumption of liabilities of the acquired company.

Our failure to be successful in addressing these risks or other problems encountered in connection with our past or future acquisitions could cause us to fail to realize the anticipated benefits of such acquisitions, incur unanticipated liabilities and harm our business generally.

Our recent rebranding efforts may not be successful. In addition, we may be unable to adequately protect our intellectual property rights, including our brand name.

We believe establishing, maintaining and enhancing the RGP and Resources Global Professionals brand names are important to our business. We rely on trademark registrations and common law trademark rights to protect the distinctiveness of our brand. In fiscal 2020, we launched a significant global rebranding initiative. However, there can be no assurance that our rebranding initiative will result in a positive return on investment. In addition, there can be no assurance that the actions we have taken to establish and protect our trademarks will be adequate to prevent use of our trademarks by others. Further, not all of our trademarks were successfully registered in all of our desired countries. Accordingly, we may not be able to claim or assert trademark or unfair competition claims against third parties for any number of reasons. For example, a judge, jury or other adjudicative body may find that the conduct of competitors does not infringe or violate our trademark rights. In addition, third parties may claim that the use of our trademarks and branding infringe, dilute or otherwise violate the common law or registered marks of that party, or that our marketing efforts constitute unfair competition. Such claims could result in injunctive relief prohibiting the use of our marks, branding and marketing activities as well as significant damages, fees and costs. If such a claim was made and we were required to change our name or any of our marks, the value of our brand may diminish and our results of operations and financial condition could be adversely affected.

Risks Related to Information Technology, Cybersecurity and Data Protection

Our computer hardware and software and telecommunications systems are susceptible to damage, breach or interruption.

The management of our business is aided by the uninterrupted operation of our computer and telecommunication systems. These systems are vulnerable to security breaches, natural disasters or other catastrophic events, computer viruses, ransomware attacks, or other interruptions or damage stemming from power outages, equipment failure or unintended or unauthorized usage by employees. In addition, we rely on information technology systems to process, transmit and store electronic information and to communicate among our locations around the world and with our clients, partners and consultants. The breadth and complexity of this infrastructure increases the potential risk of security breaches. Security breaches, including ransomware attacks, cyber-attacks or cyber-intrusions by computer hackers, foreign governments, cyber terrorists or others with grievances against the industry in which we operate or us in particular, may disable or damage the proper functioning of our networks and systems and result in a significant disruption of our business and potentially significant payments to restore the networks and systems. We review and update our systems and have implemented processes and procedures to protect against security breaches and unauthorized access to our data. Despite our implementation of security controls, our systems and networks are vulnerable to computer viruses, malware, worms, hackers and other security issues, including physical and electronic break-ins, router disruption, sabotage or espionage, disruptions from unauthorized access and tampering (including through social engineering such as phishing attacks), impersonation of authorized users and coordinated denial-of-service attacks. For example, in the past we have experienced cyber security incidents resulting from unauthorized access to our systems, which to date have not had a material impact on our business or results of operations; however, there is no assurance that such impacts will not be material in the future. In addition, our transition of certain of our employees to remote working during the Pandemic could also increase our vulnerability to risks related to our hardware and software systems, including risks of phishing and other cybersecurity attacks. Our systems may be subject to additional risk introduced by software that we license from third parties. This licensed software may introduce vulnerabilities within our own operations as it is integrated with our systems, or as we provide client services through partnership agreements.

It is also possible our security controls over personal and other data may not prevent unauthorized access to, or destruction, loss, theft, misappropriation or release of personally identifiable or other proprietary, confidential, sensitive or valuable information of ours or others; this access could lead to potential unauthorized disclosure of confidential personal, Company or client information that others could use to compete against us or for other disruptive, destructive or harmful purposes and outcomes. Any such disclosure or damage to our networks and systems could subject us to third party claims against us and reputational harm, including statutory damages under California law, regulatory penalties and significant costs of breach investigation, remediation and notification. If these events occur, our ability to attract new clients may be impaired or we may be subjected to damages or penalties. In addition, system-wide or local failures of these information technology systems could have a material adverse effect on our business, financial condition, results of operations or cash flows.

Legal and Regulatory Risks

Failure to comply with data privacy laws and regulations could have a materially adverse effect on our reputation, results of operations or financial condition, or have other adverse consequences.

Our employees may have access or exposure to personally identifiable or otherwise confidential information and customer data and systems, the misuse of which could result in legal liability. The collection, hosting, transfer, disclosure, use, storage and security of personal information required to provide our services is subject to federal, state and foreign data privacy laws. These laws, which are not uniform, do one or more of the following: regulate the collection, transfer (including in some cases, the transfer outside the country of collection), processing, storage, use and disclosure of personal information, and require notice to individuals of privacy practices;

give individuals certain access, correction and deletion rights with respect to their personal information; and prevent the use or disclosure of personal information for secondary purposes such as marketing. Under certain circumstances, some of these laws require us to provide notification to affected individuals, data protection authorities and/or other regulators in the event of a data breach.

In many cases, these laws apply not only to third-party transactions, but also to transfers of information among us and our subsidiaries. Under the European General Data Protection Regulation (the “GDPR”), data transfers from the European Union to the United States are generally prohibited unless certain measures are followed. Significantly, the Court of Justice of the European Union issued a decision in 2020 in the Schrems II case that invalidated one of the mechanisms, the Privacy Shield, and called into question another mechanism, the Standard Contractual Clauses (“SCC”). The European Commission recently adopted a new set of SCCs. Complying with the enhanced obligations imposed by the GDPR may result in additional costs to our business and require us to amend certain of our business practices.

Laws and regulations in this area are evolving and generally becoming more stringent. For example, the New York State Department of Financial Services has issued cybersecurity regulations that outline a variety of required security measures for protection of data. Other U.S. states, including California and South Carolina, have also recently enacted cybersecurity laws requiring certain security measures of regulated entities that are broadly similar to GDPR requirements, and we expect other states will follow suit. As these laws continue to evolve, we may be required to make changes to our systems, services, solutions and/or products to enable us and/or our clients to meet the new legal requirements, including by taking on more onerous obligations in our contracts, limiting our storage, transfer and processing of data and, in some cases, limiting our service and/or solution offerings in certain locations. Changes in these laws, or the interpretation and application thereof, may also increase our potential exposure through significantly higher potential penalties for non-compliance. The costs of compliance with, and other burdens imposed by, such laws and regulations and client demand in this area may limit the use of, or demand for, our services, solutions and/or products, make it more difficult and costly to meet client expectations, or lead to significant fines, penalties or liabilities for noncompliance, any of which could adversely affect our business, financial condition, and results of operations.

Failure to comply with governmental, regulatory and legal requirements or with our company-wide Code of Business Conduct and Ethics, Compliance Policy for Anti-Bribery and Anti-Corruption Laws, Insider Trading Policy, and other policies could lead to governmental or legal proceedings that could expose us to significant liabilities and damage our reputation.

We are subject to governmental, regulatory and legal requirements in each jurisdiction in which we operate. While we seek to remain in compliance with such legal and regulatory requirements, there may be changes to regulatory schemes in jurisdictions in which we operate that are outside our control and our efforts to remain in compliance with such changes may adversely affect our business and operating results.