Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

RESOURCES CONNECTION, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

September 15, 2017

Dear Stockholder:

On behalf of the Board of Directors, you are cordially invited to attend the 2017 Annual Meeting of Stockholders of Resources Connection, Inc., to be held at 1:30 p.m. Pacific Time, on October 19, 2017, at the Company’s headquarters in Irvine, California. The formal notice of the Annual Meeting appears on the following page. The attached Notice of Annual Meeting and Proxy Statement describe the matters we expect to be acted upon at the Annual Meeting.

During the Annual Meeting, stockholders will have the opportunity to ask questions. Whether or not you plan to attend the Annual Meeting, it is important your shares be represented. Regardless of the number of shares you own, please sign and date the enclosed proxy card and promptly return it to us in the enclosed postage-prepaid envelope. Alternatively, as discussed in the Question and Answer section of the Proxy Statement, you may be eligible to vote electronically over the Internet or by telephone. If you sign and return your proxy card without specifying your choices, your shares will be voted in accordance with the recommendations of the Board of Directors contained in the Proxy Statement.

We look forward to seeing you on October 19, 2017, and urge you to return your proxy as soon as possible.

Sincerely,

Kate W. Duchene

Chief Executive Officer

Table of Contents

RESOURCES CONNECTION, INC.

17101 ARMSTRONG AVENUE

IRVINE, CALIFORNIA 92614

(714) 430-6400

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

| DATE AND TIME: | 1:30 p.m., Pacific Time, on Thursday, October 19, 2017 | |

| PLACE: | Resources Connection, Inc. 17101 Armstrong Avenue, Irvine, California 92614 | |

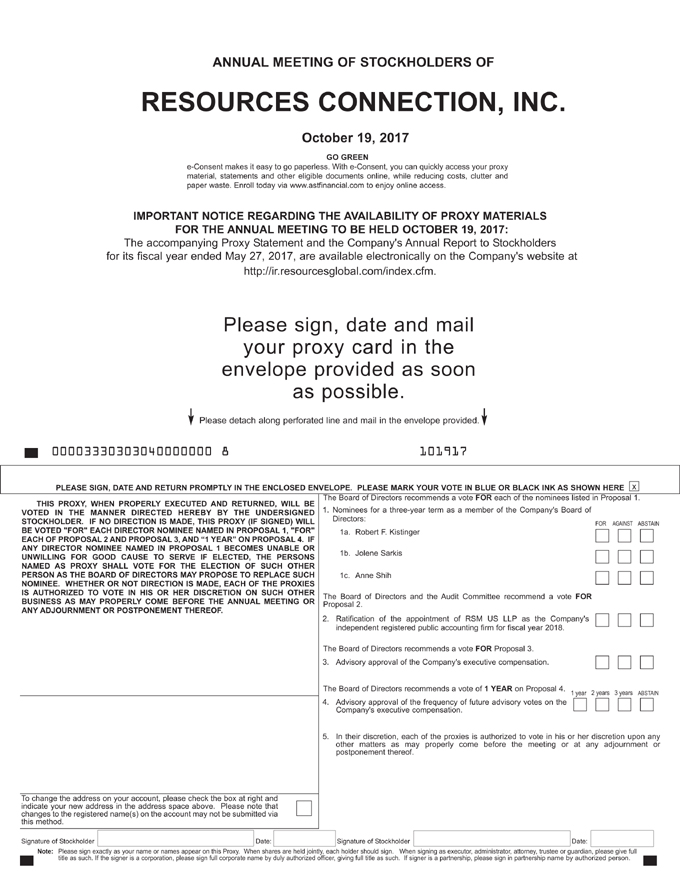

| ITEMS OF BUSINESS: | (1) To vote for the election of Robert F. Kistinger, Jolene Sarkis and Anne Shih to our Board of Directors, each for a three-year term expiring at the annual meeting in 2020 and until their respective successors are duly elected and qualified; | |

(2) To ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2018; | ||

(3) To approve on an advisory basis Resources Connection, Inc.’s executive compensation; | ||

(4) To approve on an advisory basis the frequency of future advisory votes on Resources Connection, Inc.’s executive compensation; and | ||

(5) To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. | ||

| RECORD DATE: | August 24, 2017 is the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting. | |

| PROXY VOTING: | It is important that your shares be represented and voted at the Annual Meeting. You may vote your shares by mail by completing, signing and returning the enclosed proxy card or voting instruction form, or alternatively, you may be able to vote your shares via the Internet or by telephone. Voting instructions are printed on your proxy card or voting instruction form and included with the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement. | |

Table of Contents

PROXY STATEMENT

We are sending this Proxy Statement (“Proxy Statement”) to you, the stockholders of Resources Connection, Inc. (“Resources Connection” or “the Company”), a Delaware corporation, as part of our Board of Directors’ solicitation of proxies to be voted at our 2017 Annual Meeting of Stockholders (“Annual Meeting”) to be held at the Company’s headquarters in Irvine, California, at 1:30 p.m., Pacific Time, on October 19, 2017, and at any postponements or adjournments thereof. This Proxy Statement and accompanying form of proxy were first sent to stockholders on or about September 15, 2017.

We are enclosing a copy of our 2017 Annual Report to Stockholders (“Annual Report”), which includes our fiscal 2017 financial statements. Our Annual Report is not, however, part of the proxy materials.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on October 19, 2017.

This Proxy Statement and our Annual Report are also available electronically on the Company’s website athttp://ir.rgp.com/annuals-proxies.cfm. The other information on our corporate website does not constitute part of this Proxy Statement.

1

Table of Contents

| 4 | ||||

| 10 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

Corporate Governance Guidelines and Code of Business Conduct and Ethics | 26 | |||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

Security Ownership of Certain Beneficial Owners and Management | 31 | |||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

Executive Compensation — Compensation Discussion and Analysis | 36 | |||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| 45 |

2

Table of Contents

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

Proposal 3. Advisory Vote on the Company’s Executive Compensation | 57 | |||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 59 |

3

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement. The following description is only a summary. For more complete information about these topics, please review our Annual Report, which contains our financial statements, and read the entire Proxy Statement carefully before voting.

FINANCIAL HIGHLIGHTS

| • | We achieved revenue of $583.4 million for fiscal 2017; |

| • | We generated $18.7 million in net income for fiscal 2017; |

| • | We achieved Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, and stock-based compensation expense) of $43.9 million for fiscal 20171; |

| • | We achieved an Adjusted EBITDA Margin of 7.5% for fiscal 20172; |

| • | We generated diluted earnings per share of $0.56 for fiscal 2017; and |

| • | We retained 100% of our top 50 clients from fiscal 2016 in fiscal 2017. |

Our financial position is strong with cash of approximately $62.3 million and $28.3 million of cash provided by operating activities in fiscal 2017. Our ability to continue to generate cash allows us the flexibility of returning cash to you, our stockholders, while being opportunistic on investments for our future growth. Additionally, the Company entered into a $120 million secured revolving credit facility (“Facility”) with Bank of America in October 2016. The Facility is available for working capital and general corporate purposes, including potential acquisitions and stock repurchases. On November 21, 2016, the Company completed its Dutch auction tender offer, purchasing approximately 6.5 million shares of the Company’s common stock for approximately $104.2 million, excluding transaction costs, funded partially by borrowing $58.0 million under the Facility and using $46.2 million of cash on hand. As of the end of fiscal 2017, approximately $71 million remained available for borrowing under the Facility.

STOCKHOLDER RETURN

We returned approximately $133.1 million to stockholders during fiscal 2017 through our share repurchase and dividend programs, as well as the repurchase of shares in the modified Dutch tender offer. In the past three fiscal years, we have returned a cumulative total of almost $213.3 million to our stockholders through our share repurchase and dividend programs and the repurchase of shares in the modified Dutch tender offer.

We believe that the payment of a regular dividend, along with the continuance of our stock repurchase plan, gives us the ability to return cash to our stockholders with consistency.

Issuance of Quarterly Dividend:

In July 2010, our Board of Directors authorized the establishment of a regular quarterly dividend, subject to quarterly Board approval. This dividend has been increased each year since its introduction. In July 2017, our Board of Directors approved a 9% increase in the quarterly dividend to $0.12 per share.

Share Repurchase:

In July 2015, our Board of Directors approved a new share repurchase program, authorizing the purchase, at the discretion of the Company’s senior executives, of our common stock with an aggregate dollar limit not to

| 1 | See page 40 of Resources Connection, Inc.’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on July 24, 2017, for a discussion of the adjustments made and a reconciliation of those adjustments to net income, the most directly comparable GAAP financial measure, to compute Adjusted EBITDA. |

| 2 | Adjusted EBITDA Margin consists of Adjusted EBITDA divided by revenue. |

4

Table of Contents

exceed $150 million. The program commenced in February 2016, upon exhaustion of the previous stock repurchase program of $150 million, which was approved by the Company’s Board of Directors in April 2011. As of May 27, 2017, approximately $125.1 million remains available for future repurchases of our common stock under the 2015 repurchase program.

MANAGEMENT HIGHLIGHTS

Fiscal 2017 was a year of change for the Company. Our Chief Executive Officer and our Chief Financial Officer retired. We formed a new executive team with redefined functional roles to drive a refined strategic vision for the Company, and developed an execution plan for the next five years. We completed a reduction in force with a goal to take approximately $7.0 million of cost out of our SG&A per year, affecting approximately 50 management employees. The following are the most significant changes to the management team in order of occurrence:

Change in the Chief Financial Officer

Nathan Franke, our Executive Vice President & Chief Financial Officer since 2007, retired effective August 26, 2016. Effective August 29, 2016, Herbert M. Mueller was promoted to the position of Executive Vice President and Chief Financial Officer to replace Mr. Franke. Mr. Mueller joined the Company in 2012 and previously served as Managing Director of our Atlanta, Georgia office with full oversight and operations responsibility for that practice office.

Appointment of a Chief Accounting Officer

On August 17, 2016, the Company announced the promotion of John D. Bower to the newly-created position of Chief Accounting Officer. Mr. Bower reports to the Chief Financial Officer. Since 2005, Mr. Bower served the Company as Senior Vice President, Finance. In that role, Mr. Bower was the senior finance leader responsible for the Company’s financial reporting and financial operations.

Change in the Chief Executive Officer

On October 7, 2016, Anthony C. Cherbak, President and Chief Executive Officer retired from the Company due to health issues. Mr. Cherbak has and will continue to serve the Company as a member of the Board of Directors. Consistent with the Company’s Emergency Succession Plan, the Board of Directors appointed Kate W. Duchene to the role of Interim Chief Executive Officer.

On December 16, 2016, following a search process led by a Search Committee of the Board of Directors, the Board appointed Kate W. Duchene to serve as President and Chief Executive Officer of the Company. Prior to her appointment, Ms. Duchene held the role of Chief Legal Officer, Executive Vice President, Human Resources & Secretary, for the Company, positions she held since 2000.

Resignation of the Executive Vice-President — International Operations and Procurement & Supply Chain Management

On November 16, 2016, Tracy Stephens announced his decision to leave his position as Executive Vice-President — International Operations and Procurement & Supply Chain Management of the Company and his memberships on the Boards of Directors of the Company’s international subsidiaries or affiliates. Mr. Stephens left the Company effective as of December 31, 2016.

5

Table of Contents

ANNUAL MEETING

Date and Time: | 1:30 p.m., Pacific Time, on Thursday, October 19, 2017 |

Place: | Resources Connection, Inc. |

17101 Armstrong Avenue, Irvine, California 92614

Record Date: | August 24, 2017 |

Voting: | Stockholders as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals. |

Meeting Agenda

1. Election of three directors, each for a three-year term expiring at the Company’s annual meeting in 2020 and until their respective successors are duly elected and qualified;

2. Ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2018;

3. Approval on an advisory basis of the Company’s executive compensation;

4. Approval on an advisory basis of the frequency of future advisory votes on the Company’s executive compensation; and

5. Transaction of such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

Voting Matters

| Detailed Information | ||

Proposal 1 — Election of Three Directors for a Three-Year Term | page 14 |

The following table provides summary information about each director nominee. More detailed information may be found in the section entitled “Proposal 1. Election of Directors.”

Committee | ||||||||||||||||

Name | Age | Director | Background | Experience/ Qualification | Ind. | Comp | Audit | Nom/ Govern | ||||||||

Robert F. Kistinger | 64 | 2006 | Mr. Kistinger was the Chief Operating Officer of Bonita Banana Company from 2009 to 2014 and now continues to serve as an Executive Advisor to the company. He was formerly President and Chief Operating Officer of the Fresh Group of Chiquita Brands International, Inc. (“Chiquita”). Mr. Kistinger was employed at Chiquita for more than 27 years and held numerous senior management positions in accounting, financial analysis and strategic planning roles. Prior to joining Chiquita, Mr. Kistinger was with the accounting firm of Arthur | Mr. Kistinger has held leadership positions in large multinational companies with operations in Latin America, developing critical financial and international operations expertise. Mr. Kistinger’s knowledge, insight and experience are invaluable to the Company and to the Board as we continue to provide services and solutions to our clients around the world. | X | X | X | |||||||||

6

Table of Contents

Committee | ||||||||||||||||

Name | Age | Director | Background | Experience/ Qualification | Ind. | Comp | Audit | Nom/ Govern | ||||||||

| Young & Company for six years and is a certified public accountant and a member of the American Institute of Certified Public Accountants | ||||||||||||||||

Jolene Sarkis | 67 | 2002 | Ms. Sarkis has been a private marketing and advertising consultant since 2001. Ms. Sarkis held various positions of responsibility for Time Inc. from 1985 to 2001 in sales and marketing, primarily for Time Inc.’s leading publications which include Time, People, Sports Illustrated, Fortune and Money. Ms. Sarkis served as Publisher of Fortune from 1996 to 2001 and, additionally, as President of Fortune from 1999 to 2001. She is currently Executive Vice President of CFS Restaurant Group, Inc., a position she has held since 2011. | Ms. Sarkis’ business experience in operations management and business development brings a unique skill set to the Board and to the Company in the critical areas of leadership and strategic planning, as well as marketing and human resources.. | X | X | ||||||||||

Anne Shih | 70 | 2007 | Ms. Shih is actively involved in many philanthropic endeavors, including her twenty years with the Bowers Museum in Santa Ana, California, where she currently serves as Chairwoman of the Board of Governors, a position she has held since 2010. Ms. Shih is an honorary president of the Chinese Cultural Arts Association, a position she has held since 2003 and was also Deputy Secretary of the Chinese Women’s League Los Angeles Chapter. In 2008, Ms. Shih was awarded a Certificate of Special Congressional Recognition from the U.S. Congress for her outstanding and invaluable service to the community. In 2010, Ms. Shih was made the first Official World Ambassador of Cultural Heritage for Shaanxi Province, China. | Ms. Shih’s strong business and personal relationships in Greater China are important to the Company and the Board as we expand our international footprint in Asia. | X | X | ||||||||||

Board Recommendation — FOR each of the Board’s Director Nominees

Detailed Information | ||

Proposal 2 — Ratification of the appointment of RSM US LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 2018 | page 34 |

7

Table of Contents

For more detailed information on the appointment of RSM US LLP, please refer to the detailed information in “Proposal 2. Ratification of Appointment of Independent Registered Public Accounting Firm for Fiscal Year 2018.”

Shareholder ratification of the appointment of RSM US LLP as our independent registered public accounting firm is not required by our Bylaws or otherwise. However, the Board is submitting the appointment of RSM US LLP to the stockholders for ratifications as a matter of good corporate governance. If the stockholders fail to ratify the appointment, the Audit Committee may reconsider whether or not to retain RSM US LLP. Even if the appointment is ratified, the Audit Committee, in its discretion, may appoint a different independent auditor at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and our stockholders.

Set forth below is summary information with respect to RSM US LLP’s fees for services provided to the Company in fiscal 2017 and fiscal 2016.

| 2017 | 2016 | |||||||

Audit Fees | $ | 736,500 | $ | 689,400 | ||||

Audit Related Fees | — | — | ||||||

Tax Fees | $ | 9,500 | — | |||||

All Other Fees | — | — | ||||||

Board Recommendation — FOR ratification of the appointment of RSM US LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 2018

Detailed Information | ||

Proposal 3 — Advisory Vote on the Company’s Executive Compensation | page 57 |

We are asking stockholders to approve, on an advisory basis, the Company’s executive compensation as disclosed pursuant to the SEC’s executive compensation disclosure rules and set forth in this Proxy Statement (including in the compensation tables and narratives accompanying those tables as well as the Compensation Discussion and Analysis). The Board of Directors recommends aFOR vote because it believes that the Company’s executive compensation programs use appropriate structures and sound pay practices that are effective in achieving the Company’s core objectives of providing competitive pay, pay for performance, and alignment of management’s interests with the interests of long-term stockholders. In addition to reviewing the information in “Proposal 3. Advisory Vote on the Company’s Executive Compensation” and the executive compensation tables and corresponding narratives in this Proxy Statement, stockholders are encouraged to read the “Compensation Discussion and Analysis” section of this Proxy Statement for a more detailed discussion of how our compensation programs reflect our core objectives. Further, the Board believes our executive compensation programs are reasonable in relation to comparable public and private companies in our industry.

Pay for Performance Orientation

| • | Base Salaries. As discussed below, the fiscal 2017 base salaries for our named executive officers (“NEOs”) identified in the Summary Compensation Table – Fiscal Years 2015-2017 included herein were adjusted in connection with the changes in the positions of our NEOs. |

| • | Annual Incentives. Our Executive Incentive Plan (“EIP”) reflects a pay for performance culture. The EIP for fiscal 2017 includes quantitative and qualitative measures. No incentive compensation is earned under the EIP unless the Company achieves a threshold level of financial performance. For fiscal year 2017, the threshold level of financial performance under the EIP was the achievement of 6.5% Adjusted EBITDA performance, which the Company achieved. In fiscal year 2017, the Company achieved 92.6% and 67.8% of our revenue and Adjusted EBITDA Margin goals, respectively, under the EIP. No bonus was payable under the EIP for fiscal year 2017 based on performance against the Adjusted EBITDA Margin goal. Based on performance against the revenue goal and the Compensation Committee’s assessment of their |

8

Table of Contents

overall performance, especially in light of the significant changes to the executive team and changes to the focus of our business in fiscal 2017, which made it an unusually difficult year to measure, the Compensation Committee awarded the EIP participants annual cash incentives for fiscal 2017 as follows: |

| • | Ms. Duchene was awarded a total annual incentive of $438,685, representing 33% of her maximum award opportunity or 75% of her target annual incentive opportunity; and |

| • | Mr. Mueller was awarded a total annual incentive of $251,904, representing 45% of his maximum award opportunity or 90% of his target annual incentive opportunity. |

| • | Messrs. Cherbak and Franke were not eligible to receive a bonus under the EIP for fiscal 2017 because they both retired during fiscal 2017. Mr. Bower did not participate in the EIP for fiscal 2017 because the EIP for fiscal 2017 was approved prior to his appointment as Chief Accounting Officer. Mr. Bower was awarded a discretionary bonus of $175,000 for fiscal 2017. |

| • | Long-Term Incentives. In fiscal 2017, the Compensation Committee approved equity incentives, in the form of stock options, to Ms. Duchene, and Messrs. Mueller, Bower and Cherbak under our 2014 Performance Incentive Plan (“2014 Plan”). These awards vest over a four-year period. Stock options have value only if our stock price increases after the date the option is granted, thereby further aligning the interest of participating NEOs with those of our stockholders. Mr. Franke did not receive equity awards from the Company in fiscal 2017 as he had retired prior to the date the Compensation Committee approved the equity awards for fiscal 2017. Mr. Mueller also received an award of restricted stock units under our 2014 Plan in connection with his appointment as Chief Financial Officer. |

The Company’s current policy is to provide stockholders with an opportunity to approve, on an advisory basis, the compensation of our NEOs each year at the annual meeting of stockholders. We have included in this Proxy Statement a proposal to approve the frequency of future advisory votes on the Company’s executive compensation and our Board of Directors recommends that we continue with the current policy of holding such a vote every year. Accordingly, it is expected that the next such vote will occur at the 2018 annual meeting of stockholders.

Board Recommendation — FOR approval of the Company’s Executive Compensation

Detailed Information | ||

Proposal 4 — Advisory Vote on the Frequency of Future Advisory Votes on the Company’s Executive Compensation | page 59 |

As set forth in Proposal 4, our stockholders are being provided the opportunity to cast an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers. The Board recommends that our stockholders vote for an advisory vote on the Company’s executive compensation annually. While we believe a vote every year is the best choice for us, you are not voting to approve or disapprove the Board’s recommendation, but rather to make your own choice to have future advisory votes on executive compensation every year, every two years or every three years. You may also abstain from voting. Our Board values the opinions that our stockholders express in their votes and will take into account the outcome of the vote when determining the frequency of future advisory votes on the Company’s executive compensation.

Board Recommendation — 1 YEAR for the frequency of future advisory votes on the Company’s executive compensation

9

Table of Contents

What am I voting on?

At the Annual Meeting, our stockholders will be voting on the following proposals:

1. the election of three director nominees (Robert F. Kistinger, Jolene Sarkis and Anne Shih) to our Board of Directors, each for a three-year term expiring at the annual meeting in 2020 and until his or her respective successor is duly elected and qualified;

2. the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2018;

3. the approval, on an advisory basis, of the Company’s executive compensation; and

4. the approval, on an advisory basis, of the frequency of future advisory votes on the Company’s executive compensation.

Our stockholders will also consider any other business properly raised at the Annual Meeting or any postponement or adjournment thereof.

How does the Board of Directors recommend I vote on each of the proposals?

Our Board of Directors recommends you voteFORelection to our Board of Directors of each of the three nominees for director named in Proposal 1 of this Proxy Statement;FORthe ratification of the appointment of RSM US LLP as our independent registered public accounting firm for fiscal 2018, as outlined in Proposal 2 of this Proxy Statement;FORthe approval, on an advisory basis, of the Company’s executive compensation, as outlined in Proposal 3 of this Proxy Statement; and1 YEAR with respect to the approval, on an advisory basis, of the frequency of future advisory votes on the Company’s executive compensation, as outlined in Proposal 4 of this Proxy Statement.

Who can attend the Annual Meeting?

All stockholders of the Company as of the close of business on August 24, 2017, the record date, can attend the Annual Meeting. If your shares are held through a broker, bank or nominee (that is, in “street name”), you are considered the beneficial holder of such shares and if you would like to attend the Annual Meeting, you must either (1) write Alice J. Washington, our General Counsel, at 17101 Armstrong Avenue, Irvine, CA 92614; or (2) bring to the meeting a copy of your brokerage account statement or a “legal proxy” (which you can obtain from the broker, bank or nominee that holds your shares). Please note, however, that beneficial owners whose shares are held in “street name” by a broker, bank or nominee may vote their shares at the Annual Meeting only as described below under “Who is entitled to vote at the meeting?”

Who is entitled to vote at the meeting?

Stockholders of record, as of the close of business on August 24, 2017, the record date, are entitled to vote at the Annual Meeting. If you are the beneficial owner of shares held in “street name” through a broker, bank or nominee and held such shares as of the close of business on the record date, the proxy materials are being forwarded to you by your broker, bank or nominee together with a voting instruction form. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote the shares at the meeting. Even if you plan to attend the Annual Meeting, we recommend you submit your proxy or voting instructions in advance of the Annual Meeting so your vote will be counted if you later decide not to attend the Annual Meeting.

How do I vote?

You can vote on matters that properly come before the meeting in one of two ways: (1) by submitting a proxy or voting instructions via the Internet, telephone or by mail, or (2) by voting in person at the meeting.

10

Table of Contents

If your shares are registered in the name of a broker, bank or other nominee, you will receive a voting instruction form from your broker, bank or other nominee that can be used to instruct how your shares will be voted at the Annual Meeting. You may also be eligible to submit voting instructions electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the Broadridge Financial Solutions, Inc. (“Broadridge”) online program. If your bank or brokerage firm is participating in Broadridge’s program, your voting instruction form will provide instructions for such alternative methods of voting. If you submit your voting instructions via the Internet or by telephone, you do not have to return your voting instruction form by mail.

If your proxy card or voting instruction form does not reference Internet or telephone information, please complete and return the paper proxy card or voting instruction form. Sign and date each proxy card or voting instruction form you receive and return it in the postage-paid envelope.

If you return your signed proxy card or voting instruction form but do not mark the boxes showing how you wish to vote, your shares will be votedFORelection to our Board of Directors of each of the three nominees for director named in Proposal 1 of this Proxy Statement;FORthe ratification of the appointment of RSM US LLP as our independent registered public accounting firm for fiscal 2018, as outlined in Proposal 2 of this Proxy Statement;FORthe approval, on an advisory basis, of the Company’s executive compensation, as outlined in Proposal 3 of this Proxy Statement; and1 YEARwith respect to the approval, on an advisory basis, of the frequency of future advisory votes on the Company’s executive compensation, as outlined in Proposal 4 of this Proxy Statement.

You have the right to revoke your proxy or voting instruction form at any time before your shares are voted at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy by:

| • | notifying our corporate Secretary (Michelle Gouvion) in writing; |

| • | signing and returning a later-dated proxy card; |

| • | submitting a new proxy electronically via the Internet or by telephone; or |

| • | voting in person at the Annual Meeting. |

If you are the beneficial owner of shares held in “street name” by a broker, bank or nominee, you may change your vote by submitting new voting instructions to your broker, bank or nominee, or, if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares at the Annual Meeting, by attending the Annual Meeting and voting in person.

Please note that attendance at the Annual Meeting will not by itself constitute revocation of a proxy.

What is the deadline for voting my shares?

If you are a stockholder of record, please mark, sign, date and return the enclosed proxy card, which must be received before the polls close at the Annual Meeting in order for your shares to be voted at the meeting. If you are a beneficial stockholder, please follow the voting instructions provided by the bank, broker or other nominee who holds your shares.

How will voting on any other business be conducted?

Other than the proposals described in this Proxy Statement, we know of no other business to be considered at the Annual Meeting. However, if any other matters are properly presented at the meeting or any postponement or adjournment thereof, your proxy, if properly submitted, authorizes Kate W. Duchene, our President and Chief Executive Officer, or Herbert M. Mueller, our Executive Vice President and Chief Financial Officer, to vote in their discretion on those matters.

Who will count the votes?

American Stock Transfer and Trust Company will count the votes.

11

Table of Contents

Who will bear the cost of soliciting votes?

The solicitation of proxies will be conducted by mail, and the Company will bear all attendant costs. These costs include the expense of preparing and mailing proxy solicitation materials and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation materials to beneficial owners of the Company’s common stock. The Company may conduct further solicitation personally, telephonically, through the Internet or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with the solicitation. At this time, the Company does not anticipate engaging the services of a proxy solicitor. The Company may incur other expenses in connection with the solicitation of proxies.

What does it mean if I receive more than one proxy card or voting instruction form?

It probably means your shares are registered differently and are in more than one account. Please sign and return each proxy card or voting instruction form you receive or, if available, submit your proxy or voting instructions electronically via the Internet or by telephone by following the instructions set forth on each proxy card or voting instruction form, to ensure all your shares are voted.

How many shares can vote?

As of the close of business on the record date, 29,899,426 shares of our common stock, including unvested shares of restricted stock, were outstanding. Each share of our common stock outstanding and each unvested share of restricted stock with voting rights on the record date is entitled to one vote on each of the three director nominees and one vote on each other matter that may be presented for consideration and action by the stockholders at the Annual Meeting.

What is the voting requirement for each of the above matters?

Proposal 1. Election of Directors. Once a quorum has been established, under our Third Amended and Restated Bylaws (our “Bylaws”), each director nominee must receive the affirmative vote of a majority of the votes cast in order to be elected to our Board of Directors (that is, the number of shares voted “FOR” the director nominee must exceed the number of votes cast “AGAINST” that director nominee). Each stockholder will be entitled to vote the number of shares of common stock held as of the close of business on the record date by that stockholder for each director position to be filled. Stockholders will not be allowed to cumulate their votes in the election of directors.

If any of the director nominees named in Proposal 1, each of whom is currently serving as a director, is not elected at the Annual Meeting by the requisite majority of votes cast, under Delaware law, the director would continue to serve on the Board of Directors as a “holdover director.” However, under our Bylaws, any incumbent director who fails to receive a majority of the votes cast must tender his or her resignation to the Secretary of the Company promptly following certification of the election results. In such circumstances, the Board of Directors, taking into account the recommendation of the Corporate Governance and Nominating Committee of the Board of Directors, must decide whether to accept or reject the resignation and publicly disclose its decision, including the rationale behind any decision to reject the tendered resignation, within 90 days following certification of the election results.

Other Proposals. Once a quorum has been established, under our Bylaws, approval of Proposals 2, 3 and 4 requires the affirmative vote of stockholders holding a majority of those shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Notwithstanding the above, please be advised that each of Proposals 2, 3 and 4 is advisory only and not binding on the Company or our Board of Directors. Our Board of Directors will consider the outcome of the vote on each of these items in considering what actions, if any, should be taken in response to the advisory votes by stockholders. In addition, with respect to Proposal 4, if no frequency option receives the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote on the matter, our Board of Directors will consider the option receiving the highest number of votes cast as the preferred frequency option of our stockholders.

12

Table of Contents

What constitutes a quorum?

In order to transact business at the Annual Meeting, a quorum must be present. Under Delaware law and our Bylaws, a quorum is present if a majority of the shares of our common stock outstanding on the record date are present, in person or by proxy, and entitled to vote at the Annual Meeting. Because there were 29,899,426 shares outstanding as of the close of business on the record date, holders of at least 14,949,713 shares of our common stock will need to be present in person or by proxy at the Annual Meeting for a quorum to exist to transact business at the Annual Meeting.

What happens if my shares are held by a broker?

If you are the beneficial owner of shares held in “street name” by a broker, the broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker, the broker will nevertheless be entitled to vote the shares with respect to “routine” matters but will not be permitted to vote the shares with respect to “non-routine” matters. The ratification of the appointment of the Company’s independent registered public accounting firm in Proposal 2 is considered a routine matter and may be voted upon by your broker if you do not give instructions. However, brokers do not have discretionary authority to vote your shares on your behalf for any of the other items to be submitted for a vote of stockholders at the Annual Meeting (the election of directors, the advisory vote on the Company’s executive compensation and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation). Accordingly, if you are a beneficial owner that has not submitted voting instructions to your broker and your broker exercises its discretion to vote your shares on Proposal 2, your shares will be treated as broker non-votes with respect to Proposals 1, 3 and 4 (the election of directors, the advisory vote on the Company’s executive compensation and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation). There will not be any broker non-votes on Proposal 2 (ratification of the appointment of the Company’s independent registered public accounting firm for fiscal year 2018).

How will “broker non-votes” and abstentions be treated?

Broker non-votes with respect to Proposals 1, 3 and 4 (the election of directors, the advisory vote on the Company’s executive compensation and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation) are counted for the purposes of calculating a quorum. However, when the broker notes on the proxy card that it lacks discretionary authority with respect to these matters and has not received voting instructions from the beneficial owner, those shares are not deemed to be entitled to vote for the purpose of determining whether stockholders have approved the matter and, therefore, will not be counted in determining the outcome of the matter.

A properly executed proxy marked “ABSTAIN” with respect to the election of one or more director nominees in Proposal 1 will not be voted with respect to the director or director nominees indicated and, therefore, will not be counted in determining the outcome of the director nominee’s election to the Board of Directors. For the remaining Proposals, a properly executed proxy marked “ABSTAIN” with respect to the proposal has the same effect as a vote “AGAINST” the matter or, in the case of Proposal 4, a vote not in favor of any of the proposed frequency options. In all cases, a properly executed proxy marked “ABSTAIN” will be counted for purposes of determining whether a quorum is present.

When must notice of business to be brought before an annual meeting be given and when are stockholder proposals and director nominations due for the 2018 annual meeting?

Advance Notice Procedures. Under our Bylaws, business, including director nominations, may be brought before an annual meeting if it is specified in the notice of the meeting or is otherwise brought before the meeting by or at the discretion of our Board of Directors or by a stockholder entitled to vote who has delivered notice to our corporate secretary (containing certain information specified in our Bylaws) not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding year’s annual meeting (for next year’s annual meeting, no earlier than the close of business on June 21, 2018, and no later than the close of business on July 21, 2018). These requirements are separate from

13

Table of Contents

and in addition to the requirements of the SEC that a stockholder must meet in order to have a stockholder proposal included in next year’s proxy statement.

Stockholder Proposals for the 2018 Annual Meeting. Written notice of stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2018 annual meeting of stockholders must be received no later than May 18, 2018. In addition, all proposals will need to comply with Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials.

How do I obtain a copy of the Annual Report on Form 10-K that Resources Connection filed with the SEC?

A copy of the Company’s most recent Annual Report has been included with this Proxy Statement. If you desire another copy of our Annual Report or would like a copy of our Annual Report on Form 10-K filed with the SEC (including the financial statements and the financial statement schedules),we will provide one to you free of charge upon your written request to our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or from our Investor Relations website athttp://ir.rgp.com.

How may I obtain a separate set of proxy materials?

If you share an address with another stockholder, you may receive only one set of proxy materials (including this Proxy Statement and our Annual Report) unless you have provided contrary instructions. If you wish to receive a separate set of proxy materials, please request the additional copies by contacting our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or by telephone at 714-430-6400. A separate set of proxy materials will be sent promptly following receipt of your request.

If you are a stockholder of record and wish to receive a separate set of proxy materials in the future, or if you are a stockholder at a shared address to which we delivered multiple copies of this Proxy Statement or the Annual Report and you desire to receive one copy in the future, please contact our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or by telephone at 714-430-6400.

If you hold shares beneficially in street name, please contact your broker, bank or nominee directly if you have questions, require additional copies of this Proxy Statement or our Annual Report, or wish to receive multiple reports by revoking your consent to house holding.

PROPOSAL 1. ELECTION OF DIRECTORS

Our Board of Directors consists of nine directors. Our Amended and Restated Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors, each serving staggered three-year terms. At this year’s Annual Meeting, we will be electing three directors, each to serve a term of three years expiring at our 2020 Annual Meeting and until his or her successor is duly elected and qualified.

Each of the nominees, Robert F. Kistinger, Jolene Sarkis and Anne Shih, is presently a member of our Board of Directors, having served on the Company’s Board since 2006, 2002 and 2007, respectively. The Board of Directors, acting upon the recommendation of the Corporate Governance and Nominating Committee, recommends the stockholders vote in favor of the election of the nominees named in this Proxy Statement to serve as members of our Board of Directors. (See “Director Nominees” below).

In recommending director nominees for selection by the Board, the Corporate Governance and Nominating Committee considers a number of factors, which are described in more detail below under “Board of Directors —Corporate Governance and Nominating Committee.” In considering these factors, the Corporate Governance and Nominating Committee and the Board consider the fit of each individual’s qualifications and skills with those of the Company’s other directors in order to build a Board of Directors that, as a whole, is effective, collegial and responsive to the Company and its stockholders.

The six directors whose terms do not expire in 2017 are expected to continue to serve after the Annual Meeting until such time as their respective terms of office expire and their respective successors are duly elected and qualified. (See “Continuing Directors” below.)

14

Table of Contents

If at the time of the Annual Meeting any of the nominees should be unable or unwilling for good cause to serve if elected, the persons named as proxy on the proxy card will vote for such substitute nominee or nominees, if any, as our Board of Directors recommends or, if no substitute nominee is recommended by our Board of Directors, for the remaining nominees, leaving a vacancy, unless our Board of Directors chooses to reduce the number of directors serving on the Board. Each of the nominees has consented to be named in this Proxy Statement and to serve if elected.

Following is biographical information about each nominee and each director. This description includes the principal occupation of and directorships held by each director for at least the past five years, as well as the specific experience, qualifications, attributes and skills that led to the Board’s conclusion that each nominee and director should serve as a member of the Company’s Board of Directors.

The individuals standing for election are:

Robert F. Kistinger

Age 64

Director since August 2006

| Mr. Kistinger was the Chief Operating Officer of Bonita Banana Company from 2009 to 2014 and now continues to serve as an Executive Advisor to the company. He was formerly President and Chief Operating Officer of the Fresh Group of Chiquita Brands International, Inc. (“Chiquita”). Mr. Kistinger was employed at Chiquita for more than 27 years and held numerous senior management positions in accounting, financial analysis and strategic planning roles. Prior to joining Chiquita, Mr. Kistinger was with the accounting firm of Arthur Young & Company for six years and is a certified public accountant and a member of the American Institute of Certified Public Accountants | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Kistinger has held leadership positions in large multinational companies with operations in Latin America, developing critical financial and international operations expertise. Mr. Kistinger’s knowledge, insight and experience are invaluable to the Company and to the Board as we continue to provide services and solutions to our clients around the world. | ||

Jolene Sarkis

Age 67

Director since April 2002 | Ms. Sarkis has been a private marketing and advertising consultant since 2001. Ms. Sarkis held various positions of responsibility for Time Inc. from 1985 to 2001 in sales and marketing, primarily for Time Inc.’s leading publications which include Time, People, Sports Illustrated, Fortune and Money. Ms. Sarkis served as Publisher of Fortune from 1996 to 2001 and, additionally, as President of Fortune from 1999 to 2001. She is currently Executive Vice President of CFS Restaurant Group, Inc., a position she has held since 2011. | |

| Key experience, qualifications, attributes and skills: | ||

| Ms. Sarkis’ business experience in operations management and business development brings a unique skill set to the Board and to the Company in the critical areas of leadership and strategic planning, as well as marketing and human resources. | ||

15

Table of Contents

Anne Shih

Age 70

Director since October 2007 | Ms. Shih is actively involved in many philanthropic endeavors, including her 25 years with the Bowers Museum in Santa Ana, California, where she currently serves as Chairwoman of the Board of Governors, a position she has held since 2010. Ms. Shih is an honorary president of the Chinese Cultural Arts Association, a position she has held since 2003 and was also Deputy Secretary of the Chinese Women’s League Los Angeles Chapter. In 2008, Ms. Shih was awarded a Certificate of Special Congressional Recognition from the U.S. Congress for her outstanding and invaluable service to the community. In 2010, Ms. Shih was made the first Official World Ambassador of Cultural Heritage for Shaanxi Province, China. | |

| Key experience, qualifications, attributes and skills: | ||

| Ms. Shih’s strong business and personal relationships in Greater China are important to the Company and the Board as we continue to expand our international operations in Asia. | ||

The Board of Directors unanimously recommends that stockholders vote FOR each of the nominees set forth above.

The following persons are the members of our Board of Directors whose terms of office do not expire until after the Annual Meeting and who are therefore not standing for re-election at the Annual Meeting:

Anthony Cherbak

Age 63

Director since August 2009

Mr. Cherbak’s term of office as one of our directors expires at the Annual Meeting in 2019. | In October 2016, Mr. Cherbak retired from the Company as Chief Executive Officer but has continued to serve as a member of the Board of Directors, a position he has held since 2009. Mr. Cherbak served as the Company’s Chief Executive Officer and President from 2013 to 2016 and was the Company’s President and Chief Operating Officer from 2009 to 2013. He previously held the positions of Executive Vice President of Operations from July 2005 to August 2009 and President of International Operations from November 2008 to August 2009. He joined the Company in July 2005 from Deloitte & Touche LLP, a professional services firm, where he spent the majority of his career as an audit partner in the Orange County, California office. While with Deloitte & Touche LLP, Mr. Cherbak led the firm’s consumer business practice for its Pacific Southwest region and most recently served as the Partner in Charge of the Orange County audit practice. | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Cherbak brings to the Board over 35 years of professional services, operations and financial management experience. This experience uniquely qualifies him to advise the Company in its growth strategy and containment of costs. Mr. Cherbak’s former service as an Executive Officer of the Company allows him to bring to the Board insight into the operations of the Company, its challenges and opportunities for growth. | ||

16

Table of Contents

Susan J. Crawford

Age 70

Director since May 2009

Ms. Crawford’s term of office as one of our directors expires at the Annual Meeting in 2018. | Ms. Crawford currently serves as a Senior Judge on the United States Court of Appeals for the Armed Forces, a position she has held since September 2006. A veteran lawyer of more than 30 years, Ms. Crawford served as a member of the court of appeals bench from 1991 to 2006 and also served as General Counsel of the Army, special counsel to the Secretary of Defense, and Inspector General of the Department of Defense. In February 2007, Ms. Crawford was appointed by the Secretary of Defense to serve a three-year term as the convening authority in charge of the Office of Military Commissions, during which time she oversaw the military process and procedures at Guantanamo Bay. After serving as the Chairperson of the Board of Trustees of Bucknell University from 2003 to 2009, Ms. Crawford currently serves on the Finance and Academic Affairs and Campus Life Committees, having served in prior years on the Trusteeship, Human Resources and Compensation Committees. Ms. Crawford is also a member of the New England Law School Board of Trustees. | |

| Key experience, qualifications, attributes and skills: | ||

| Ms. Crawford’s credentials and years of legal experience in private practice and the public sector make her a trusted advisor as the Company continues to expand our legal services practice. In addition, her ongoing board service at Bucknell University brings valuable experience related to matters of ethics and corporate governance. | ||

Neil F. Dimick

Age 68

Director since November 2003

Mr. Dimick’s term of office as one of our directors expires at the Annual Meeting in 2019. | Prior to joining the Board, Mr. Dimick served as Executive Vice President and Chief Financial Officer of AmerisourceBergen Corporation, a pharmaceutical services provider, from August 2001 to May 2002. He served as Senior Executive Vice President and Chief Financial Officer of Bergen Brunswig Corporation, as well as a director and a member of the Bergen Board’s Finance, Investment and Retirement Committees, for more than five years prior to its merger with AmeriSource Health in 2001. Mr. Dimick began his professional career as a corporate auditor with Deloitte & Touche LLP, a professional services firm. He was a partner with the firm for eight years and served for two years as the National Director of the firm’s Real Estate Industry Division. Mr. Dimick currently serves on the Board of Directors of WebMD Health Corp., where he serves as a member of the Executive and Audit Committees and as Chairman of the Nominating and Governance Committees; Mylan, Inc., where he serves as Chairperson of the Audit and member of the Executive, Finance and Compensation Committees; and Alliance HealthCare Services, Inc., where he serves as Chairperson of the Audit Committee and member of the Strategic Planning and Finance and Nominating and Corporate Governance Committees. Mr. Dimick formerly served on the board of Thoratec Corporation, where he was Chairman of the Board and a member of the Audit and Corporate Governance and Nominating Committees. | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Dimick brings to the Board and the Audit Committee he chairs, 20 years of public accounting experience, including eight years as a partner at Deloitte & Touche LLP, experience as a Chief Financial Officer for a large-cap publicly traded international company and continued involvement with public company boards and board committees, | ||

17

Table of Contents

| all of which provide our Board with in-depth knowledge of the many critical financial and risk-related issues facing public companies today. | ||

Donald B. Murray

Age 70

Director since April 1999

Mr. Murray’s term of office as one of our directors expires at the Annual Meeting in 2018. | Mr. Murray founded Resources Connection in June 1996 and served as our Managing Director from inception until April 1999. From April 1999 through May 2008, Mr. Murray served as our Chief Executive Officer and President and as our Chairman of the Board. On June 1, 2008, Mr. Murray resigned as President and Chief Executive Officer, but remained as Executive Chairman of the Board of Directors. Mr. Murray reassumed the position of Chief Executive Officer on July 22, 2009. On August 31, 2015, Mr. Murray retired as an employee of the Company. At the request of the Board, Mr. Murray agreed to remain in service to the Company as a non-employee director and Chairman of the Board.

Prior to founding Resources Connection, Mr. Murray was Partner in Charge of Accounting and Assurance Services for the Orange County, California office of Deloitte & Touche LLP, a professional services firm, from 1988 to 1996. From 1984 to 1987, Mr. Murray was the Partner in Charge of the Woodland Hills office of Touche Ross & Co., a predecessor firm to Deloitte & Touche LLP, an office he founded in 1984. Mr. Murray currently serves on the Board of Directors for two non-profit organizations, the University of Southern California’s Marshall School of Business and the USC Center for Innovation. | |

| Key experience, qualifications, attributes and skills: | ||

| In addition to his career credentials as a partner with Deloitte & Touche LLP, as the Company’s founder, he developed the Company’s business model and vision. Mr. Murray brings to the Board an intimate, first-hand knowledge of the Company’s operations, culture and people. | ||

A. Robert Pisano

Age 74

Director since November 2002

Mr. Pisano’s term of office as one of our directors expires at the Annual Meeting in 2018. | Mr. Pisano has served as our Lead Independent Director since 2004. Mr. Pisano is a business consultant, an activity he began in September 2011, and served as a Strategic Advisor to IMAX Corporation, a leading entertainment technology company until December 2015. Mr. Pisano was the President and Chief Operating Officer of the Motion Picture Association of America from October 2005 until September 2011, and was the interim Chief Executive Officer from January 2010 until March 2011. He served as the National Executive Director and Chief Executive Officer of the Screen Actors Guild from September 2001 to April 2005. From August 1993 to August 2001, he was Executive Vice President, then Vice Chairman and Consultant to Metro-Goldwyn-Mayer, Inc. (“MGM”). Prior to joining MGM, Mr. Pisano was Executive Vice President of Paramount Pictures from May 1985 to June 1991, serving as General Counsel and a member of the Office of the Chairman. From 1969 to 1985, Mr. Pisano was an associate and then a partner with the law firm O’Melveny & Myers LLP. Mr. Pisano was formerly a director of StateNet, a legislative and regulatory reporting service, and was until June 30, 2016, Chairman of the Board for the Motion Picture and Television Fund. Effective July 31, 2012, Mr. Pisano was elected to the Boards of FPA Paramount Fund and FPA Perennial Fund. He previously served on the Boards of the FPA Group of Funds, including Paramount, Perennial, New Income, Crescent and Capital, where he sat on the audit committees from 2002 | |

18

Table of Contents

| to 2008, and as a director of Netflix, Inc. until October 2005. He was since elected to the Boards of FPA Capital, New Income and International Funds, as well as Source Capital and Crescent Funds, all FPA funds. | ||

| Key experience, qualifications, attributes and skills: | ||

| Mr. Pisano’s 20 years of experience as a partner specializing in business litigation while at O’Melveny & Myers LLP, followed by his hands-on management of international business operations, marketing and business development while employed by the leaders in the entertainment industry provide a wealth of experience, especially in the areas of acquisitions and legislative and regulatory affairs, to the Board and to the Company. | ||

Michael H. Wargotz

Age 59

Director since May 2009

Mr. Wargotz’s term of office as one of our directors expires at the Annual Meeting in 2018. | Mr. Wargotz is currently the Chairman of Axcess Ventures, an affiliate of Axcess Worldwide, a partnership development company, a position he has held since July 2011. Previously, he served as the Chief Financial Officer of The Milestone Aviation Group, LLC from August 2010 through June 2011, Co-Chairman of Axcess Luxury and Lifestyle, from August 2009 through July 2010, and Chief Financial Advisor of NetJets, Inc., a leading provider of private aviation services from December 2006 through August 2009. From June 2004 until November 2006, he was a vice president of NetJets. Mr. Wargotz currently serves on the Board of Directors of Wyndham Worldwide Corporation as Chair of its Audit Committee and a member of its Executive Committee. | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Wargotz brings to the Board more than 30 years of experience as a financial professional and advisor in leadership roles for both public and private companies and is an experienced public company board member. | ||

The Board of Directors unanimously recommends a vote FOR election to the Board of Directors of each of the three director nominees named in this Proxy Statement.

The following table sets forth information about our current executive officers. Each of our executive officers serves at the pleasure of the Board of Directors:

Name | Age | Position | ||||

Kate W. Duchene | 54 | Chief Executive Officer and President | ||||

Herbert M. Mueller | 60 | Chief Financial Officer and Executive Vice President | ||||

John D. Bower | 56 | Chief Accounting Officer | ||||

Kate W. Duchene. Effective December 14, 2016, Ms. Duchene was named our Chief Executive Officer and President. Between 1999 and 2016, Ms. Duchene was our Chief Legal Officer, and since 2000, Ms. Duchene held the positions of corporate Secretary and Executive Vice President of Human Resources. Prior to joining Resources Connection, Ms. Duchene practiced law with O’Melveny & Myers LLP, an international law firm, in Los Angeles, California, specializing in labor and employment matters. Ms. Duchene was with O’Melveny & Myers LLP from October 1990 through December 1999.

Herbert M. Mueller. Effective August 29, 2016, Herbert M. Mueller was named our Executive Vice President and Chief Financial Officer. Prior to his appointment as the Executive Vice President and Chief

19

Table of Contents

Financial Officer, Mr. Mueller served as the Company’s Managing Director in the Atlanta practice from November 2013 to August 2016 and as a Director of Client Service from January 2012 to November 2013. Prior to joining the Company, Mr. Mueller served as Senior Vice President and Chief Financial Officer of TAA Partners, Inc. and Chief Financial Officer of Delta Apparel.

John D. Bower. Effective August 17, 2016, Mr. Bower was appointed as our Chief Accounting Officer. Prior to his appointment as Chief Accounting Officer, Mr. Bower served as our Senior Vice President of Finance from 2005 to 2016 and controller from 1998 to 2005. Prior to joining the Company, Mr. Bower spent nine years with Deloitte and served as the Director of SEC Reporting at FHP International for five years.

The Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman of the Board and Chief Executive Officer of the Company in any way that is in the best interests of the Company and its stockholders at a given point in time. The Board believes that the decision as to who should serve as Chairman of the Board and Chief Executive Officer, and whether these offices should be combined or separate, should be assessed periodically by the Board, and that the Board should not be constrained by a rigid policy mandating that such positions be separate. The Company currently separates the roles of Chief Executive Officer and Chairman of the Board, with Mr. Murray currently serving as Chairman of the Board. Ms. Duchene serves as our Chief Executive Officer and is the individual with primary responsibility for managing the Company’s day-to-day operations with in-depth knowledge and understanding of the Company. Ms. Duchene does not currently serve as a member of our Board of Directors. This leadership structure permits Mr. Murray, our Chairman of the Board, to focus on providing guidance to our Chief Executive Officer and sets the agenda for, and presides over, meetings of the Board of Directors. By having a separate Chairman of the Board, the Company maintains an independent perspective on the Company’s business affairs. Mr. Murray, our Company’s founder, has served as Chairman of the Board in a non-employee director status since his retirement as an employee and executive officer of the Company in August 2015. Because Mr. Murray served in an executive officer position during his tenure as Executive Chairman, he is not deemed independent pursuant to NASDAQ Listing Rules. Therefore, the Board has designated A. Robert Pisano to serve as Lead Independent Director, with responsibilities that are similar to those typically performed by an independent chairman. Coupled with a Lead Independent Director who is appointed annually by the Board, this combined structure provides independent oversight while avoiding unnecessary confusion regarding the Board’s oversight responsibilities and the day-to-day management of business operations.

The responsibilities of our Chairman and our Lead Independent Director are summarized in the table below.

Chairman | Lead Independent Director | |

| Calls meetings of the Board and stockholders | Calls meetings of the independent directors | |

| Chairs meetings of the Board and the annual meeting of stockholders | Sets agenda and chairs executive sessions of the independent directors | |

| Establishes Board meeting schedules and agendas | Available to chair meetings of the Board when there is a potential conflict of interest with the Chairman on issues to be discussed or the Chairman is absent | |

| Ensures that information provided to the Board is sufficient for the Board to fulfill its primary responsibilities | Provides input to the Chairman on the scope, quality, quantity and timeliness of the information provided to the Board | |

| Communicates with all directors on key issues and concerns outside of Board meetings | Serves as a conduit to the Chairman of views and concerns of the independent directors | |

| With the Lead Independent Director, jointly recommends Committee Chair positions to full Board and the Corporate Governance and Nominating Committee | Collaborates with the Corporate Governance and Nominating Committee on questions of possible conflicts of interest or breaches of the Company’s governance principles by other directors, including the Chairman |

20

Table of Contents

Chairman | Lead Independent Director | |

| Provides suggestions to the Corporate Governance and Nominating Committee with respect to the composition and structure of the Board and Board recruitment efforts | Oversees the process of hiring or firing a Chief Executive Officer, including any compensation arrangements | |

| Leads the Board review of management succession and development plans | Recommends to the Board the retention of outside advisors who report directly to the Board | |

| Represents the Company to, and interacts with, external stockholders and employees | Participates with the Compensation Committee Chair in communicating performance feedback and compensation decisions to the Chief Executive Officer |

The Board believes the Company’s corporate governance measures ensure that strong, independent directors continue to oversee effectively the Company’s management and key issues related to executive compensation, evaluation of our Chief Executive Officer and succession planning, strategy, risk, and integrity.

As required by the Company’s Corporate Governance Guidelines and Committee Charters, our Board of Directors has determined that each of Ms. Crawford, Mr. Dimick, Mr. Kistinger, Mr. Pisano, Ms. Sarkis, Ms. Shih and Mr. Wargotz is an “independent director” under the NASDAQ Listing Rules. Mr. Murray was employed as an executive officer until August 31, 2015, and Mr. Cherbak is currently employed as an Executive Advisor to the Company and, accordingly, neither qualifies as an “independent director” under the NASDAQ Listing Rules. There were no transactions, relationships or arrangements engaged in by these directors which the Board considered in making its independence determination.

Committees of the Board of Directors

The Company’s standing Board committees consist of (1) an Audit Committee, (2) a Compensation Committee, and (3) a Corporate Governance and Nominating Committee. Each committee of the Board is comprised entirely of independent directors under the NASDAQ Listing Rules and, for members of the Audit Committee, the applicable rules of the SEC. As referenced above, the Board of Directors also designates a Lead Independent Director to serve as a representative for the independent directors and to facilitate communications among the independent directors and management. The following identifies the members of each of the Company’s standing Board committees and indicates the number of meetings held by each committee during fiscal 2017:

| Audit | Compensation | Corporate Governance and Nominating | Board of Directors | |||||

A. Robert Pisano, Lead Independent Director | Member | Chair | Independent | |||||

Susan Crawford | Member | Independent | ||||||

Neil Dimick | Chair | Member | Independent | |||||

Robert Kistinger | Member | Member | Independent | |||||

Jolene Sarkis | Chair | Independent | ||||||

Anne Shih | Member | Independent | ||||||

Michael Wargotz | Member | Member | Independent | |||||

Number of Fiscal Year 2017 Meetings Held | 8 | 7 | 4 | 8 |

Our Board of Directors met eight times during fiscal 2017. All directors attended at least 75% of the aggregate of Board of Directors meetings and meetings of the committees upon which he or she serves. The Company’s policy is that directors should make themselves available to attend the Company’s annual meeting of stockholders. All members of our Board attended our 2016 annual meeting either in person or telephonically.

21

Table of Contents

The Board of Directors annually reviews and approves the charter of each of the committees. The Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee Charters were reviewed and approved on July 27, 2017 and are available on the Investor Relations — Corporate Governance section of the Company’s website atwww.rgp.com.

Corporate Governance and Nominating Committee

The current members of the Corporate Governance and Nominating Committee are Mr. Pisano (Chairperson), Ms. Crawford, Mr. Kistinger and Ms. Shih. The Corporate Governance and Nominating Committee met four times during fiscal 2017.

Governance-Related Duties. The Corporate Governance and Nominating Committee is responsible for overseeing the corporate governance principles applicable to the Company, and the Company’s Code of Business Conduct and Ethics, which is reviewed by the entire Board of Directors annually. See “Corporate Governance Guidelines and Code of Business Conduct and Ethics” below. In addition, the Corporate Governance and Nominating Committee annually reviews the Company’s compliance with the NASDAQ Listing Rules and reports the conclusions of such review to the Board.

Nominating-Related Duties. The Corporate Governance and Nominating Committee is also responsible for overseeing the process of nominating individuals to stand for election or re-election as directors. In doing so, the Corporate Governance and Nominating Committee reviews and makes recommendations to the Board with respect to the composition of the Board, tenure of Board members, and qualifications, skills and attributes for new directors. The Corporate Governance and Nominating Committee may also retain a professional executive search firm, on an as-needed basis, to assist in the identification and recruitment of independent Board candidates. The Company did not retain a professional executive search firm during fiscal 2017 for Board member recruitment activities. While the Corporate Governance and Nominating Committee normally is able to identify an ample number of qualified candidates from its own resources and from candidates identified by a professional executive search firm, it will consider stockholder suggestions of persons to be considered as nominees, as further described below. Any director candidates recommended by the Company’s stockholders in accordance with the Company’s policy regarding such recommendations will be given consideration by the Corporate Governance and Nominating Committee, consistent with the process used for all candidates and in accordance with the Company’s policy regarding such recommendations.

Selection of Director Candidates. The Corporate Governance and Nominating Committee’s process for identifying and evaluating new director candidates is as follows. If determined appropriate, the Corporate Governance and Nominating Committee may retain a professional executive search firm to assist the Corporate Governance and Nominating Committee in managing the overall process, including the identification of new director candidates who meet certain criteria set from time to time by the Corporate Governance and Nominating Committee. All potential new director candidates, whether identified by the search firm, stockholders or Board members, are then reviewed by the Corporate Governance and Nominating Committee, our executive officers, and at times by the search firm. In the course of this review, some candidates are eliminated from further consideration because of conflicts of interest, unavailability to attend Board or committee meetings or other relevant reasons. The Corporate Governance and Nominating Committee then decides which of the remaining candidates most closely match the established criteria, described in the subsequent paragraph, and are therefore deserving of further consideration. The Corporate Governance and Nominating Committee then discusses these new director candidates, decides which of them, if any, should be pursued, gathers additional information if desired, conducts interviews and decides whether to recommend one or more of the candidates to the Board of Directors for nomination. In connection with this review, the Corporate Governance and Nominating Committee also reviews and considers each of the incumbent directors for continuing Board membership after his or her term expires. The Board discusses the Corporate Governance and Nominating Committee’s recommended candidates, decides if any additional interviews or further background information is desirable and, if not, decides whether to nominate one or more candidates. Those nominees are named in the proxy statement for election by the stockholders at the annual meeting (or, if between annual meetings, the nominees may be elected by the Board itself to fill any vacancies on the Board).

22

Table of Contents