QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

RAE SYSTEMS INC. |

(Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies:

|

| | | 2) | | Aggregate number of securities to which transaction applies:

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | 5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

|

Amount Previously Paid:

|

| | | 2) | | Form, Schedule or Registration Statement No.:

|

| | | 3) | | Filing Party:

|

| | | 4) | | Date Filed:

|

March 23, 2004

Dear Stockholder:

The annual meeting of stockholders of RAE Systems Inc. will be held on May 5, 2004, at 2:00 p.m., local time, at the Wyndham Hotel located at 1300 Chesapeake Terrace, Sunnyvale, California.

Only stockholders who owned stock at the close of business on March 15, 2004 can vote at this meeting or any adjournments that may take place. The matters proposed to be acted upon at the meeting are described in detail in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. Also enclosed is a copy of the 2003 Annual Report on Form 10-K which includes audited financial statements and certain other information.

Our board of directors recommends that you vote in favor of the proposals outlined in the attached Proxy Statement.

At the meeting, we will also report on RAE Systems' 2003 business results and other matters of interest to stockholders.

It is important that you use this opportunity to take part in the affairs of RAE Systems by voting on the business to come before this meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. Returning the proxy does not deprive you of your right to attend the meeting and vote your shares in person.

We look forward to seeing you at the meeting.

|

|

Sincerely yours, |

|

|

|

| | | Robert I. Chen

President and Chief Executive Officer |

1339 Moffett Park Drive

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 5, 2004

TO THE STOCKHOLDERS:

Notice is hereby given that the annual meeting of the stockholders of RAE Systems Inc., a Delaware corporation, will be held on Wednesday, May 5, 2004, at 2:00 p.m. local time, at the Wyndham Hotel located at 1300 Chesapeake Terrace, Sunnyvale, California, for the following purposes:

1. To elect two Class II directors each to hold office for a three-year term and until their respective successors are duly elected and qualified.

2. To ratify the appointment of BDO Seidman, LLP as our independent auditors for the fiscal year ending December 31, 2004.

3. To transact such other business as may properly come before the meeting and any adjournment or postponement thereof.

Stockholders of record at the close of business on March 15, 2004 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement of the meeting. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 1339 Moffett Park Drive, Sunnyvale, California.

| | | By order of the Board of Directors, |

|

|

|

| | | Lea-Anne Matsuoka

Secretary |

| | | |

Sunnyvale, California

March 23, 2004 | | |

IMPORTANT: Please fill in, date, sign and promptly mail the enclosed proxy card in the accompanying postage-paid envelope to assure that your shares are represented at the meeting. If you attend the meeting, you may choose to vote in person even if you have previously sent in your proxy card.

RAE SYSTEMS INC.

1339 Moffett Park Drive

Sunnyvale, California 94089

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of RAE Systems Inc., a Delaware corporation, (hereinafter "RAE," "our," "us," and the "Company") for use at the annual meeting of stockholders to be held May 5, 2004 at 2:00 p.m., local time, or at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The annual meeting will be held at the Wyndham Hotel located at 1300 Chesapeake Terrace, Sunnyvale, California. Our telephone number is (408) 752-0723.

These proxy solicitation materials are being mailed on or about April 12, 2004 to all stockholders entitled to vote at the annual meeting.

Record Date; Outstanding Shares

Stockholders of record at the close of business on March 15, 2004 are entitled to notice of, and to vote at, the annual meeting. At the record date, approximately 55,476,122 shares of our common stock, $0.001 par value, were issued and outstanding.

Voting

The shares represented by the proxies received will be voted as you direct. If you give no direction, such shares will be voted as recommended by our board of directors. Each stockholder is entitled to one vote for each share of stock held by him or her on all matters.

Votes cast by proxy or in person will be tabulated by the inspector of elections. The inspector of elections will also determine whether or not a quorum is present. Our bylaws provide that a majority of all the shares of stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting.

Assuming a quorum is present, the nominees for election as Class II directors at the annual meeting will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the meeting. All other matters submitted to the stockholders will require the affirmative vote of a majority of shares present in person or represented by proxy at the meeting assuming a quorum is present. The inspector of elections will treat abstentions of votes as shares that are present and entitled to vote for purposes of determining the presence of a quorum and as negative votes for purposes of determining the approval of any matter submitted to the stockholders for a vote.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our Secretary a written notice of revocation or a duly executed proxy bearing a later date or by attending the annual meeting and voting in person. If you have instructed your broker to vote your shares, you must follow directions received from your broker to change those instructions.

Solicitation

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional soliciting materials sent to stockholders. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by some of our directors, officers and employees, without additional compensation, personally or by mail, telephone or facsimile.

Deadline for Receipt of Stockholder Proposals for 2005 Annual Meeting

Stockholder proposals may be included in our proxy materials for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in applicable Securities and Exchange Commission ("SEC") rules. For a stockholder proposal to be included in our proxy materials for the 2005 annual meeting, the proposal must be received at our principal executive offices, addressed to the Secretary, not later than December 1, 2004. Stockholder business that is not intended for inclusion in our proxy materials may be brought before the annual meeting so long as we receive notice of the proposal as specified by our bylaws, addressed to the Secretary at our principal executive offices, not later than December 1, 2004.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified board of directors, which as of the date of this proxy, consists of two Class II directors, two Class III directors and two Class I directors, who will serve until the annual meetings of stockholders to be held in 2004, 2005 and 2006, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates.

The terms of the Class II directors will expire on the date of the upcoming annual meeting. Accordingly, two persons are to be elected to serve as Class II directors of our board of directors at the meeting. Management's nominees for election by the stockholders to those two positions are the current Class II members of the board of directors:

1. Neil W. Flanzraich.

2. Lyle D. Feisel.

If elected, the nominees will serve as directors until our annual meeting of stockholders in 2007 and until their successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate.

2

Vote Required and Board of Directors Recommendation

If a quorum is present and voting, the two nominees for Class II director receiving the highest number of votes will be elected as Class II directors. Abstentions and broker non-votes have no effect on the vote.

The board of directors recommends a vote "FOR" the nominees named above.

Nominees and Directors

The following table sets forth, for our current directors, including the Class II nominees to be elected at this meeting, information with respect to their ages and background.

Name of Director

| | Position With RAE Systems

| | Age

| | Director

Since(1)

|

|---|

Class II directors nominated for election at the 2004 annual meeting of stockholders: |

|

|

Neil W. Flanzraich |

|

Director |

|

60 |

|

2000 |

Lyle D. Feisel |

|

Director |

|

68 |

|

2001 |

Class III directors whose terms expire at the 2005 annual meeting of stockholders: |

|

|

Robert I. Chen |

|

President, Chief Executive Officer, Director |

|

56 |

|

1991 |

Sigrun Hjelmquist |

|

Director |

|

48 |

|

2004 |

Class I directors whose terms expire at the 2006 annual meeting of stockholders: |

|

|

Peter H. Hsi |

|

Vice President, Chief Technology Officer, Director |

|

54 |

|

1991 |

Edward C. Ross |

|

Director |

|

62 |

|

2001 |

- (1)

- Years noted are years which if prior to the April 2002 reverse merger between RAE Systems Inc., a California corporation ("RAE California"), and Nettaxi.com ("Nettaxi"), such director served on the board of directors of RAE California. Upon the merger, Messrs. Flanzraich, Feisel, Chen, Hsi and Ross, each of whom was previously a director of RAE California, became our directors.

NEIL W. FLANZRAICH has served as a member of our board of directors since December 2000. Since May 1998, he served as Vice Chairman and President of IVAX Corporation, a pharmaceutical company. From 1995 to May 1998, Mr. Flanzraich served as Chairman of the Life Sciences Legal Practice Group of Heller Ehrman White and McAuliffe, and from 1981 to 1994, Senior Vice President and member of the corporate Operating Committee at Syntex Corporation, a pharmaceutical company. Mr. Flanzraich is a director of IVAX Diagnostics and Continucare Corporation. He also serves as Chairman of the Israel America Foundation. Mr. Flanzraich received an A.B. from Harvard College and a J.D. from Harvard Law School.

LYLE D. FEISEL has served as a member of our board of directors since March 2001. In 2001, he retired as the Dean of the Thomas J. Watson School of Engineering and Applied Science, and Professor of Electrical Engineering at the State University of New York at Binghamton. Dr. Feisel joined the faculty of SUNY Binghamton in 1983. Dr. Feisel is a Life Fellow of the Institute of Electrical and Electronics Engineers and of the American Society for Engineering Education, and is a Fellow of the National Society of Professional Engineers. He is active in the affairs of those organizations and in the development and accreditation of engineering education worldwide. Dr. Feisel received his B.S., M.S. and Ph.D. degrees in Electrical Engineering from Iowa State University.

ROBERT I. CHEN co-founded RAE Systems in 1991 and has served as President, Chief Executive Officer and a member of the board of directors since our inception. From 1981 to 1990, Mr. Chen

3

served as President and Chief Executive Officer of Applied Optoelectronic Technology Corporation, a manufacturer of computer-aided test systems, a company he founded and subsequently sold to Hewlett Packard. Mr. Chen currently serves on the board of directors for the Shanghai Ericsson Simtek Electronics Company, Limited, a telecommunications and electronics company. Mr. Chen received a B.S.E.E. from Taiwan National Cheng Kung University, a M.S.E.E. from South Dakota School of Mines and Technology, and graduated from the Harvard Owner/President program.

SIGRUN HJELMQUIST has served as a member of our board of directors since March 9, 2004 and is currently the investment manager and one of the founding partners of BrainHeart Capital, a venture capital company. From 1998 to 2000, Ms. Hjelmquist was president of Ericsson Components AB, and from 1994 to 1997, General Manager of the Microelectronics Business Unit at Ericsson Components AB. Ms. Hjelmquist currently serves on the board of directors of the Confederation of Swedish Enterprise, Sandvik AB, Svenska Handelsbanken AB, IBS AB, Sydkraft AB, and IUI, the Research Institute of Industrial Economics. Ms. Hjelmquist received a M.S. in Physical Engineering from the Royal Institute of Technology in Stockholm, Sweden.

PETER HSI co-founded RAE Systems in 1991 and has served as our Vice President, Chief Technology Officer and a member of the board of directors since our inception. Prior to co-founding RAE Systems, Dr. Hsi worked at Applied Optoelectronic Technology Corporation as the chief architect for semiconductor test systems. Dr. Hsi has filed eighteen (18) patent applications, of which eight (8) have been granted and ten (10) are pending. Dr. Hsi received a B.S.E.E. from the National Chiao-Tung University, and a M.S. and Ph.D. in Electrical Engineering from Syracuse University.

EDWARD C. ROSS has served as a member of our board of directors since March 2001, and is currently the President of TSMC North America. From 1998 to 2000, Dr. Ross served as Senior Vice President of the Professional Services Group of Synopsys, Inc., a computer-aided design company, where he was responsible for developing and executing Synopsys' consulting business practices. From 1995 to 1998, Dr. Ross was the President of the Technology and Manufacturing Group of Cirrus Logic, a semiconductor company. Dr. Ross received a B.S.E.E from Drexel University, and a M.S.E.E., M.A, and Ph.D. from Princeton University.

Board Meetings and Committees

The board of directors held five meetings during the last fiscal year. The board of directors has determined that a majority of its members do not have a material relationship with the Company that would interfere with the exercise of their independent judgment and are otherwise "independent" in accordance with the applicable listing requirements of the American Stock Exchange ("AMEX"). The board of directors has an audit committee, a compensation committee and nominating and corporate governance committee. The board of directors has adopted a charter for each of the three standing committees. You can find links to these charters on our website at:http://www.raesystems.com. The charter for the audit committee is also included in this annual report as Appendix A.

During the last fiscal year, no director attended fewer than 75% of the total number of meetings of the board of directors and all of the committees of the board of directors on which such director served held during that period.

Audit Committee. The members of the audit committee during fiscal 2003 were Messrs. Flanzraich, Ross and Feisel and Mr. Bo Andersson. The current members of the audit committee are Messrs. Flanzraich, Ross and Feisel and Ms. Hjelmquist, The board of directors has determined that each current member of the Audit Committee is "independent," as such term is defined under the applicable AMEX listing standards and the rules and regulations of the SEC. The board of directors has also determined that each member of the Audit Committee is financially literate, and that Mr. Flanzraich is a "financial expert," as such term is defined by the applicable regulations of the SEC. The functions of the audit committee include overseeing the accounting and financial

4

reporting processes of the Company and the audits of the Company's financial statements, appointing, compensating and overseeing our independent auditors including reviewing their independence and reviewing and pre-approving any audit and permissible non-audit services to be performed by them, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies, reviewing any related party transactions and preparing any report required under SEC rules. The audit committee held five meetings during the last fiscal year. The report of the audit committee is included in this annual report on page 16.

Compensation Committee. The members of the compensation committee during fiscal 2003 were Messrs. Ross, Flanzraich, Andersson and Feisel. The current members of the compensation committee are Messrs. Flanzraich, Ross and Feisel and Ms. Hjelmquist. The functions of the compensation committee include reviewing and fixing the compensation of our executive officers, including our Chief Executive Officer, reviewing director compensation, approving grants of stock options and restricted stock under the Company's 2002 Stock Option Plan to eligible employees, and preparing any report required under SEC rules. The compensation committee held one meeting during the last fiscal year. The report of the Compensation Committee is included in this annual report on page 14.

Nominating and Corporate Governance Committee. The members of the nomination committee during fiscal 2003 were Messrs. Chen, Ross, Andersson and Feisel. In 2004, we reformed the nomination committee as a nominating and corporate governance committee and our board of directors adopted a charter for such committee. The current members of the nominating and corporate governance committee are Messrs. Flanzraich, Ross and Feisel and Ms. Hjelmquist. The functions of the nominating and corporate governance committee include identifying individuals qualified to become members of the board of directors, selecting, or recommending to the board of directors director nominees for each election of directors, developing and recommending to the board of directors criteria for selecting qualified director candidates, considering committee member qualifications, appointment and removal, and, if requested by the board of directors, providing oversight in the evaluation of the board of directors and each committee. The nomination committee did not hold any meetings during the last fiscal year. The nomination committee met in March 2004 in order to, among other matters, consider nominees for the annual meeting.

When considering the nomination of directors for election at an annual meeting, the nominating and corporate governance committee will review annually the results of an evaluation performed by the board of directors and each committee, and the needs of the board of directors for various skills, background, experience and expected contributions and the qualification standards established from time to time by the nominating and corporate governance committee. When reviewing potential nominees for election as director, including incumbents whose term is expiring, the nominating and corporate governance committee will consider the perceived needs of the board of directors, the candidate's relevant background, experience and skills, such as an understanding of manufacturing, technology, finance and marketing, international background and expected contribution to the board of directors and the following factors:

- •

- the appropriate size of the Company's board of directors and its committees;

- •

- the perceived needs of the board of directors for particular skills, background and business experience;

- •

- the skills, background, reputation, and business experience of nominees compared to the skills, background, reputation, and business experience already possessed by other members of the board of directors;

- •

- nominees' independence from management;

- •

- nominees' experience with accounting rules and practices;

5

- •

- nominees' background with regard to executive compensation;

- •

- applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance;

- •

- the benefits of a constructive working relationship among directors; and

- •

- the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members.

The nominating and corporate governance committee's goal is to assemble a board of directors that brings to the Company a diversity of experience at policy-making levels in business, government, education and technology, and in areas that are relevant to the Company's global activities. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our stockholders. They must have an inquisitive and objective perspective and mature judgment. Director candidates must have sufficient time available in the judgment of the nominating and corporate governance committee to perform all board of directors and committee responsibilities. They must also have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Members of the board of directors are expected to rigorously prepare for, attend, and participate in all board of directors and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in the best interests of the Company and its stockholders. The nominating and corporate governance committee believes that it is preferable that at least one member of the board of directors meet the criteria for an audit committee "financial expert" as defined by SEC rules. Under applicable AMEX listing requirements, at least a majority of the members of the board of directors must meet the definition of "independent director" set forth in such listing requirements. The nominating and corporate governance committee also believes it appropriate for one or more key members of the Company's management to participate as members of the board of directors.

The nominating and corporate governance committee will consider candidates for directors proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the nominating and corporate governance committee believes that the board of directors requires additional candidates for nomination, the nominating and corporate governance committee will engage, as appropriate, a third party search firm to assist in identifying qualified candidates. All incumbent directors and nominees will be required to submit a completed form of directors' and officers' questionnaire as part of the nominating process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the nominating and corporate governance committee.

The nominating and corporate governance committee will also consider candidates for directors recommended by a stockholder, provided that any such recommendation is sent in writing to the Corporate Secretary, RAE Systems Inc., 1339 Moffett Park Drive, Sunnyvale, California 94089, at least 120 days prior to the anniversary of the date proxy statements were mailed to stockholders in connection with the prior year's annual meeting of stockholders and contains the following information:

- •

- the candidate's name, age, contact information and present principal occupation or employment; and

- •

- a description of the candidate's qualifications, skills, background, and business experience during, at a minimum, the last five years, including his or her principal occupation and employment and the name and principal business of any corporation or other organization in which the candidate was employed or served as a director.

6

The nominating and corporate governance committee will evaluate any candidates recommended by stockholders pursuant to the above procedures against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Stockholders may also nominate directors for election at an annual meeting, provided the advance notice requirements set forth in the Company's Bylaws have been met.

Attendance at the Stockholders Meeting

The Company will make every effort to schedule its annual meeting of stockholders at a time and date to maximize attendance by directors taking into account the directors' schedules. All directors are expected to make reasonable efforts to attend the Company's annual meeting of stockholders. At our last annual meeting, which was held on April 25, 2003, two of our current directors were in attendance.

Code of Business Conduct and Ethics

The board of directors has adopted a code of business conduct and ethics that applies to all RAE Systems employees, including employees of RAE Systems' subsidiaries, and each member of the Company's board of directors. The code of business conduct and ethics is available at the Company's website athttp://www.raesystems.com. The Company intends to disclose future amendments to the Code of Business Conduct and Ethics on our website and any waivers thereof for executive officers and directors within five days of such action in a Form 8-K filed with the SEC.

Communications Between Stockholders and Directors

Stockholders and other interested parties may communicate with any and all members of the board of directors, by mail addressed to the intended recipient c/o Corporate Secretary, RAE Systems Inc., 1339 Moffett Park Drive, Sunnyvale, California 94089, by facsimile to (408) 585-3568 or by email toCorporateSecretary@raesystems.com. The Corporate Secretary will maintain a log of such communications and transmit them promptly to the identified recipient, unless there are safety or security concerns that mitigate against further transmission. The intended recipient shall be advised of any communication withheld for safety or security reasons as soon as practicable.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The audit committee has approved the engagement of BDO Seidman, LLP as independent auditors to audit our consolidated financial statements for the fiscal year ending December 31, 2004. BDO Seidman, LLP has acted in such capacity since its appointment in fiscal year 2000. A representative of BDO Seidman, LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

7

The following table sets forth the aggregate fees billed to us for fiscal years ended December 31, 2003 and 2002 by BDO Seidman, LLP:

| | 2003

| | 2002

|

|---|

| | Audit Fees(1) | | $ | 139,399 | | $ | 315,036 |

| | Non-Audit Fees: | | | | | | |

| | |

Audit Related Fees(2) |

|

$ |

0 |

|

$ |

0 |

| | | Tax Fees(3) | | $ | 101,450 | | $ | 9,500 |

| | | All Other Fees(4) | | $ | 0 | | $ | 0 |

| TOTAL FEES PAID TO AUDITOR | | $ | 240,849 | | $ | 324,536 |

- (1)

- Audit Fees consist of fees billed for professional services rendered for the audit of the Company's consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by BDO Seidman LLP in connection with statutory and regulatory filings or engagements.

- (2)

- Audit-Related Fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company's consolidated financial statements and are not reported under "Audit Fees."

- (3)

- Tax Fees consist of fees billed for professional services rendered for tax compliance, tax advice and tax planning (domestic and international). These services include assistance regarding federal, state and international tax compliance, acquisitions and international tax planning.

- (4)

- All Other Fees consist of fees for products and services other than the services reported above.

The audit committee has considered the role of BDO Seidman, LLP in providing certain tax services and other non-audit services to RAE Systems and has concluded that such services are compatible with BDO Seidman, LLP's independence as our auditors. In addition, since the effective date of the SEC rules stating that an auditor is not independent of an audit client if the services it provides to the client are not appropriately approved, the Audit Committee has and will continue to pre-approve all audit and permissible non-audit services provided by the independent auditors.

The Audit Committee has adopted a policy for the pre-approval of services provided by the independent auditors, pursuant to which it may pre-approve any service consistent with applicable law, rules and regulations. Under the policy, the Audit Committee may also delegate authority to pre-approve certain specified audit or permissible non-audit services to one or more of its members, including the chairman. A member to whom pre-approval authority has been delegated must report its pre-approval decisions, if any, to the Audit Committee at its next meeting, and any such pre-approvals must specify clearly in writing the services and fees approved. Unless the Audit Committee determines otherwise, the term for any service pre-approved by a member to whom pre-approval authority has been delegated is twelve months.

Vote Required and Board of Directors Recommendation

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote at the meeting, as well as the presence of a quorum. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

The board of directors believes that the ratification of the engagement of BDO Seidman, LLP is in the best interests of the Company and our stockholders.Therefore, the board of directors unanimously recommends a vote "FOR" the appointment of BDO Seidman, LLP as our independent auditors for the fiscal year ending December 31, 2004.

8

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 2, 2004, certain information with respect to the beneficial ownership of our common stock by (i) each stockholder known by us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors and director-nominees, (iii) each executive officer named in the Summary Compensation Table below, and (iv) all our directors and executive officers as a group.

Except where otherwise indicated, the address for each of the persons listed the following table is c/o RAE Systems Inc., 1339 Moffett Park Drive, Sunnyvale, CA 94089.

Name of Beneficial Owner(1)

| | Number of Shares

Beneficially

Owned(2)

| | Percent(3)

| |

|---|

| 5% Holders | | | | | |

Michael Gardner(4)

40 Wall Street

c/o the Baytree Capital Associates, LLC

Suite 58, New York, NY 10005 |

|

3,086,596 |

|

5.6 |

% |

Directors and Director-Nominees |

|

|

|

|

|

Robert I. Chen(5) |

|

16,239,905 |

|

29.4 |

% |

Peter Hsi |

|

3,991,332 |

|

7.2 |

% |

Neil W. Flanzraich(6) |

|

578,638 |

|

1.0 |

% |

Lyle D. Feisel(7) |

|

179,031 |

|

* |

|

Edward C. Ross(8) |

|

114,031 |

|

* |

|

Sigrun Hjelmquist(9) |

|

0 |

|

* |

|

Non-Director Executive Officers |

|

|

|

|

|

Joseph Ng(10) |

|

219,974 |

|

* |

|

Hong Tao Sun(11) |

|

318,266 |

|

* |

|

Directors and executive officers as a group (8 persons)(12) |

|

21,641,178 |

|

39.0 |

% |

- *

- Less than 1%.

- (1)

- Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table.

- (2)

- Under the rules of the SEC, a person is deemed to be the beneficial owner of shares that can be acquired by such person within 60 days upon the exercise of options. Except as otherwise noted, options granted under our 1993 and 2002 Stock Option Plans are immediately exercisable, subject our right to repurchase unvested shares upon termination of employment or other service at a price equal to the option exercise price.

- (3)

- Calculated on the basis of 55,476,122 shares of common stock outstanding as of March 2, 2004, provided that any additional shares of common stock that a stockholder has the right to acquire within 60 days after March 2, 2004 are deemed to be outstanding for the purpose of calculating that stockholder's percentage beneficial ownership.

9

- (4)

- Based on a Schedule 13D filed by Michael Gardner with the SEC on September 3, 2003.

- (5)

- Based on a Schedule 13G filed by Robert I. Chen with the SEC on February 4, 2004. Includes 3,097,380 shares of common stock held by Mr. Chen's spouse, Lien Q.C. Chen, of which he disclaims beneficial ownership, and 10,045,145 shares of common stock held jointly between Robert I. and Lien Q.C. Chen, and by Robert I. Chen as trustee of the Robert I. Chen 2001 Living Trust and held by Lien Q.C. Chen as trustee of the Lien Q.C. Chen 2001 Living Trust.

- (6)

- Includes 52,083 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (7)

- Includes 52,083 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (8)

- Includes 52,083 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (9)

- Includes 0 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (10)

- Includes 122,605 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (11)

- Includes 226,318 shares subject to options that may be exercised within 60 days after March 2, 2004.

- (12)

- Includes 593,089 shares subject to options that may be exercised within 60 days after March 2, 2004.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater-than-10% beneficial owners are required by SEC regulation to furnish us with copies of all reports they file under Section 16(a).

To our knowledge, based solely on our review of the copies of reports filed under Section 16(a) furnished to us and written representations that no other reports were required, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with during the year ended December 31, 2003, except that Lyle Feisel and Peter Hsi each filed one late report covering one transaction.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table sets forth information concerning the compensation received for services rendered to us during the years ended December 31, 2001, 2002 and 2003 by our chief executive officer and our three other most highly compensated executive officers whose total salary and bonus for such fiscal year exceeded $100,000. We do not have any additional executive officers other than the four listed.

10

SUMMARY COMPENSATION TABLE

| |

| |

| |

| | Long Term Compensation

|

|---|

| | Annual Compensation

| | Awards

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus(1)

| | Restricted

Stock

| | Securities Underlying

Options/SARs (#)

|

|---|

Robert I. Chen,

President and

Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 245,000

245,002

244,039 | | | —

—

— | | | —

—

— | | —

—

— |

Joseph Ng,

Vice President of

Business Development and

Chief Financial Officer |

|

2003

2002

2001 |

|

$

$

$ |

180,000

181,178

180,615 |

|

$ |

—

—

75,000 |

|

$ |

—

—

0 |

(2) |

—

—

309,738 |

Peter Hsi,

Vice President of

Technology and Chief

Technology Officer |

|

2003

2002

2001 |

|

$

$

$ |

165,000

165,000

164,327 |

|

|

—

—

— |

|

|

—

—

— |

|

—

—

— |

Hong Tao Sun,

Vice President of

Engineering |

|

2003

2002

2001 |

|

$

$

$ |

150,000

150,151

138,846 |

|

|

—

—

— |

|

|

—

—

— |

|

—

100,000

154,870 |

- (1)

- Bonuses are based on performance. See "Report of the Compensation Committee on Executive Compensation."

- (2)

- Mr. Ng was granted 309,738 shares of restricted stock on December 8, 2001 at a purchase price of $0.0807 per share, the fair market value on the date of the grant, as determined by our board of directors. These shares vested immediately upon the consummation of the merger transaction between RAE Systems and Nettaxi.com.

Stock Options Granted in Fiscal Year 2003

There were no grants of options to purchase our common stock made during the last fiscal year to the persons named in the Summary Compensation Table.

Option Exercises and Fiscal 2003 Year-End Values

The following table provides the specified information concerning exercises of options to purchase our common stock in the last fiscal year, and unexercised options held as of December 31, 2003, by the persons named in the Summary Compensation Table above. A portion of the shares subject to these options are not yet vested, and thus would be subject to repurchase by us at a price equal to the option exercise price, if the corresponding options were exercised before those shares had vested.

11

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END VALUES

| |

| |

| | Number of Shares

Underlying Unexercised

Options at Fiscal Year End(1)

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End(2)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable(3)

| | Unexercisable

| | Exercisable(3)

| | Unexercisable

|

|---|

| Robert I. Chen | | — | | | — | | — | | — | | | — | | | — |

| Joseph Ng | | — | | | — | | 109,699 | | 45,170 | | $ | 364,123 | | $ | 149,933 |

| Peter Hsi | | — | | | — | | — | | — | | | — | | | — |

| Hong Tao Sun | | 91,948 | | $ | 309,205 | | 197,181 | | 120,611 | | $ | 611,877 | | $ | 345,530 |

- (1)

- Represents options granted under our 1993 and 2002 Stock Option Plans.

- (2)

- Based on a market value of $3.40 per share, the closing price of our common stock on December 31, 2003, as reported on the AMEX.

- (3)

- Stock options granted under the 1993 and 2002 Stock Option Plans are generally immediately exercisable at the date of grant, but shares received upon exercise of unvested options are subject to repurchase by us. The options listed below become exercisable1/4 after one year and an additional1/48 per month thereafter.

Compensation of Directors

Our non-employee directors receive $1,000 for each meeting of the board of directors they attend and previously received reasonable compensation for each liaison role, and board and committee meeting they attend. Non-employee directors are also eligible to receive stock options or restricted stock awards.

In November 2003, our board of directors authorized the issuance of non-qualified options to purchase 10,000 shares of common stock to Lyle D. Feisel for additional liaison services required between our advisory board and our board of directors. These options are immediately exercisable and vested immediately on the date of issuance.

In August 2003, our board of directors authorized the issuance of non-qualified options to purchase 10,000 shares of common stock to Lyle D. Feisel for additional liaison services required between our advisory board and our board of directors. These options are immediately exercisable and vested immediately on the date of issuance.

In May 2003, our board of directors authorized the issuance of non-qualified options to purchase 10,000 shares of common stock to Lyle D. Feisel for additional liaison services required between our advisory board and our board of directors. These options are immediately exercisable and vested immediately on the date of issuance.

In May 2003, our board of directors authorized the issuance of non-qualified options to purchase 50,000 shares of common stock to Bo Andersson for additional liaison services required between our European operations in Denmark and our board of directors. The options are immediately exercisable and vest at a rate of1/4 after one year and1/48 each month thereafter.

In April 2003, our board of directors authorized the issuance of non-qualified options to purchase 10,000 shares of common stock to Lyle D. Feisel for additional liaison services required between our advisory board and our board of directors. These options are immediately exercisable and vested immediately on the date of issuance.

Our directors who are also employees of RAE Systems did not receive any compensation for their services as members of the board of directors.

12

EQUITY COMPENSATION PLAN INFORMATION

We currently maintain two compensation plans that provide for the issuance of our common stock to officers and other employees, directors and consultants. These consist of our 1993 and 2002 Stock Option Plans. The following table sets forth information regarding outstanding options and shares reserved for future issuance under the foregoing plans as of December 31, 2003:

Plan Category

| | Number of shares to be issued upon exercise of outstanding options, warrants and rights

(a)

| | Weighted average exercise price of outstanding options, warrants and rights

(b)

| | Number of shares remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders(1) | | 4,046,683 | | $ | 1.184 | | 2,201,756 |

| Equity compensation plans not approved by security holders(2) | | 5,649,857 | | $ | 12.359 | | 0 |

| Total | | 9,696,540 | | $ | 7.695 | | 2,201,756 |

- (1)

- Includes options issued pursuant to RAE's 1993 and 2002 Stock Option Plans.

- (2)

- Includes Warrants issued (i) by Nettaxi.com in conjunction with a Private Placement, (ii) by the Company to Michael Gardner for financial advice and investor relations strategies, and (iii) by the Company in conjunction with services rendered by a financial advisor and an investor relations firm. Also includes Non-plan options issued to our board of directors (Messrs. Flanzraich, Andersson, Feisel, and Ross).

Material Features of the 2002 Stock Option Plan

The 2002 Stock Option Plan was adopted by the board of directors on May 7, 2002. We are authorized to issue up to 5,000,000 shares of common stock under this plan. The plan allows grants of incentive stock options, within the meaning of Section 422 of the Code, to employees, including officers and employee directors. In addition, it allows grants of nonstatutory options to employees, non-employee directors and consultants. The plan expires in April 2012, but may be terminated sooner by the board of directors. The exercise price of incentive stock options granted under the 2002 Stock Option Plan must not be less than the fair market value of a share of the common stock on the date of grant. In the case of nonstatutory stock options, the exercise price must not be less than 85% of the fair market value of a share of the common stock on the date of grant. With respect to an incentive stock option granted to any optionee who owns stock representing more than 10% of the voting power of all classes of our outstanding capital stock, the exercise price of the option must be equal to at least 110% of the fair market value of a share of the common stock on the date of grant, and the term of the option may not exceed five years. The terms of all other options may not exceed ten years. The aggregate fair market value (determined as of the date of option grant) of the common stock for which incentive stock options may become exercisable for the first time by any optionee may not exceed $100,000 in any calendar year. The compensation committee has the discretion to determine vesting schedules and exercise requirements, if any, of all options granted under the plan. The plan provides that in connection with a change in control, if the acquiring corporation fails to assume the plan's outstanding options or replace them with substantially equivalent new options, the options will terminate. Additionally, the compensation committee, in its discretion, may provide for the acceleration of the exercisability and vesting of any and all outstanding options or may provide for the cash out of any or all outstanding options in connection with a change in control. Five million shares of common stock have been reserved for issuance under the 2002 Stock Option Plan. As of December 31, 2003, 2,201,756 options remain available for future issuance.

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There were no related transactions in 2003 other than those described in the Compensation of Directors section.

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

Compensation Philosophy

The goals of our compensation policy are to attract, retain and reward executive officers who contribute to our overall success by offering compensation that is competitive in our industry, to motivate executives to achieve our business objectives and to align the interests of officers with the long-term interests of stockholders. We currently use salary, bonuses and stock options to meet these goals.

Forms of Compensation

We provide our executive officers with a compensation package consisting of base salary, incentive bonuses and participation in benefit plans generally available to other employees. In setting total compensation, the compensation committee considers individual performance, as well as market information regarding compensation paid by other similar companies.

Base Salary. Salaries for our executive officers are initially set based on negotiation with individual executive officers at the time of recruitment and with reference to salaries for comparable positions in our industry for individuals of similar education and background to the executive officers being recruited. We also give consideration to the individual's experience, reputation in his or her industry and expected contributions to our company. Salaries are generally reviewed annually by the compensation committee and are subject to increases based on (i) the compensation committee's determination that the individual's level of contribution to our company has increased since his or her salary had last been reviewed and (ii) increases in competitive pay levels.

Bonuses. It is our policy that a component of each officer's potential annual compensation takes the form of a performance-based bonus. Bonus payments to officers other than the chief executive officer are determined by the compensation committee, in consultation with the chief executive officer, based on our financial performance and the achievement of the officer's individual performance objectives. The chief executive officer's bonus is determined by the compensation committee, without participation by the chief executive officer, based on the same factors.

Long-Term Incentives. Longer-term incentives are provided through the 2002 Stock Option Plan, which rewards executives and other employees through the growth in value of our stock. The compensation committee believes that employee equity ownership is highly motivating, provides a major incentive for employees to build stockholder value and serves to align the interests of employees with those of stockholders. Grants of stock options to executive officers are based upon each officer's relative position, responsibilities, historical and expected contributions to our company, and the officer's existing stock ownership and previous option grants, with primary weight given to the executive officers' relative rank and responsibilities. Initial stock option grants designed to recruit an executive officer to join us may be based on negotiations with the officer and with reference to historical option grants to existing officers. Stock options are granted at an exercise price equal to the market price of our common stock on the date of grant and will provide value to the executive officers only when the price of our common stock increases over the exercise price.

14

2003 Compensation

Compensation for the chief executive officer and other executive officers for 2003 was set according to our established compensation policy described above. As of the end of fiscal 2003, we did not pay any bonuses to our executive officers. However, bonuses have been accrued for disbursement in 2004 and 2005 in accordance with the approved management incentive plan for the year ended December 31, 2003.

| | | COMPENSATION COMMITTEE |

| | | |

| | | Edward C. Ross

Lyle D. Feisel

Neil W. Flanzraich

Sigrun Hjelmquist |

15

REPORT OF THE AUDIT COMMITTEE

The audit committee oversees our financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process, including internal control systems. BDO Seidman, LLP is responsible for expressing an opinion as to the conformity of our audited financial statements with generally accepted accounting principles.

The audit committee consists of four directors each of whom, in the judgment of the board of directors, is an "independent director," as such term is defined by applicable SEC and AMEX rules and regulations.The audit committee acts pursuant to a written charter that has been adopted by the board of directors. A copy of this charter is attached to this proxy statement as Appendix A.

The audit committee has discussed and reviewed with the auditors all matters required to be discussed pursuant to the Statement on Auditing Standards No. 61 (Communication with Audit Committees). The committee has met with BDO Seidman, LLP, with and without management present, to discuss the overall scope of BDO Seidman, LLP audit, the results of its examinations, its evaluations of our internal controls and the overall quality of its financial reporting. The audit committee has reviewed and discussed the audited financial statements with management.

The audit committee has received from the auditors a formal written statement describing all relationships between the auditors and us that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors' independence.

Based on the review and discussions referred to above, the committee recommended to the board of directors that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

| | | AUDIT COMMITTEE |

| | | |

| | | Lyle D. Feisel

Neil W. Flanzraich

Edward C. Ross

Sigrun Hjelmquist |

16

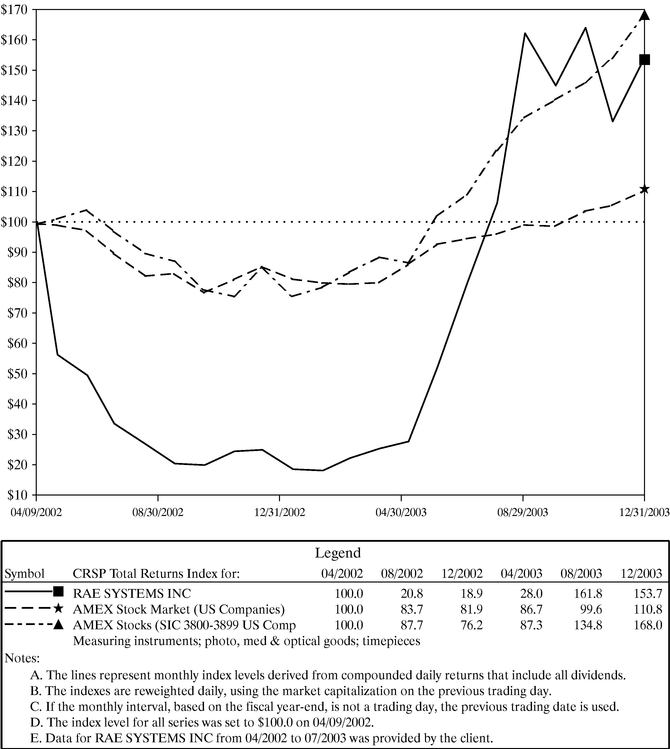

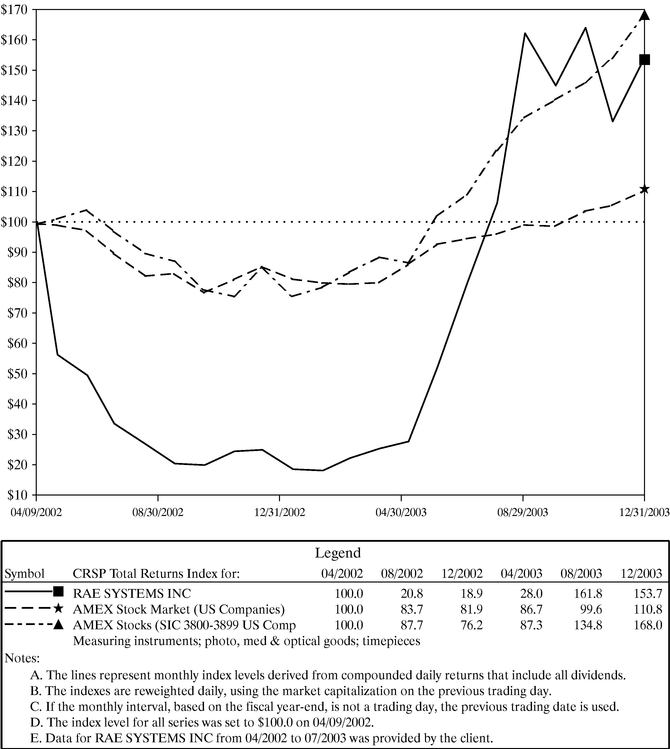

COMPARISON OF STOCKHOLDER RETURN

Set forth below is a graph indicating cumulative total return on $100 invested, alternatively, in our common stock, the CRSP Total Return Index for the AMEX and for a peer group of AMEX stocks for SIC codes 3800 - 3899, for the period from April 9, 2002 through December 31, 2003, before which period we were a privately-held company.

Performance Graph for

RAE SYSTEMS INC.

Comparison of Cumulative Total Returns

from April 9, 2002 through December 31, 2003

17

TRANSACTION OF OTHER BUSINESS

At the date of this Proxy Statement, the board of directors knows of no other business that will be conducted at the 2004 annual meeting other than as described in this Proxy Statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

| | | By order of the Board of Directors, |

|

|

|

| | | Lea-Anne Matsuoka

Secretary |

March 23, 2004

18

APPENDIX A

RAE SYSTEMS INC.

CHARTER OF THE AUDIT COMMITTEE OF THE

BOARD OF DIRECTORS

I. STATEMENT OF POLICY

This Charter specifies the scope of the responsibilities of the Audit Committee of the Board of Directors of RAE Systems Inc. (the "Company"), and how the Committee shall carry out those responsibilities, including the Committee's structure, processes, and membership requirements.

The primary purpose of the Committee is to oversee the accounting and financial reporting processes of the Company and the audits of the Company's financial statements. The Committee shall also review the qualifications, independence and performance, and approve the terms of engagement of the Company's independent auditor, and prepare any reports required of the Committee under rules of the Securities and Exchange Commission ("SEC").

Management of the Company is responsible for the preparation, presentation and integrity of the Company's financial statements. Management is responsible for maintaining appropriate accounting and financial reporting principles, policies, internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent accountants are responsible for planning and carrying out proper audits and reviews, including reviews of the Company's financial statements prior to the filing of reports with the SEC and other procedures. In fulfilling their responsibilities hereunder, it is recognized that members of the Committee are not full-time employees of the Company and are not, and do not represent themselves to be, accountants or auditors by profession or experts in the fields of accounting and auditing. It is not the duty or responsibility of the Committee or its members to conduct any type of auditing or accounting review or procedure, and each member of the Committee shall be entitled to rely on (i) the integrity of those persons and organizations within and outside the Company that it receives information from and (ii) the accuracy of the financial and other information provided to the Committee by such persons or organizations, absent actual knowledge to the contrary (which shall be promptly reported to the Board).

The Company shall provide appropriate funding, as determined by the Committee, to permit the Committee to perform its duties under this Charter, to compensate its advisors and to compensate any registered public accounting firm engaged for the purpose of rendering or issuing an audit report or related work or performing other audit, review or attest services for the Company. The Committee, at its discretion, has the authority to initiate investigations, and hire legal, accounting or other outside advisors or experts to assist the Committee, as it deems necessary to fulfill its duties under this Charter. The Committee may also perform such other activities consistent with this Charter, the Company's Bylaws and governing law, as the Committee or the Board deems necessary or appropriate.

II. ORGANIZATION AND MEMBERSHIP REQUIREMENTS

The Committee shall be comprised of three or more directors selected by the Board, each of whom shall satisfy the independence requirements of the SEC and the American Stock Exchange ("Amex");providedthat one director who does not meet the independence criteria of Amex and is not a current officer or employee or an immediate family member of such person, may, subject to the approval of the Board, serve on the Committee pursuant to, and subject to the limitations under, the "exceptional and limited circumstances" exception as provided under the rules of AMEX.

All members of the Committee must be able to read and understand fundamental financial statements, including a balance sheet, income statement, and cash flow statement. In addition, at least

A-1

one member must have past employment experience in finance or accounting, professional certification in accounting, or other comparable experience or background resulting in the individual's financial sophistication, including being or having been a chief executive, chief financial, or other senior officer with financial oversight responsibilities.

The members of the Committee shall be appointed by the Board and shall serve until their successors are duly elected and qualified or until their earlier resignation or removal. Any member of the Committee may be replaced by the Board. Unless a chairman is elected by the full Board, the members of the Committee may designate a chairman by majority vote of the full Committee membership.

III. MEETINGS

The Committee shall meet as often as it determines, but not less than quarterly. A majority of the members shall represent a quorum of the Committee, and, if a quorum is present, any action approved by at least a majority of the members present shall represent the valid action of the Committee. The Committee may form and delegate authority to subcommittees, or to one or more members of the Committee, when appropriate. The Committee shall meet at least as often as necessary, but not less than annually, with each of management and the independent auditor in separate executive sessions to discuss any matters that the Committee or each of these groups believe should be discussed privately. In addition, the Committee should meet with the independent auditors and management on a quarterly basis to review the Company's financial statements and reports consistent with Section IV.A.5. below. The Committee shall maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

IV. PROCESSES

To fulfill its responsibilities and duties the Committee shall:

A. Documents/Reports to Review

1. Review and reassess the Charter's adequacy periodically, and at least annually, as conditions dictate.

2. Review the Company's annual audited financial statements, including a discussion of the matters required to be discussed by Statement of Auditing Standards No. 61, as amended, and any reports or other financial information submitted to any governmental body, or the public, including any certification, report, opinion, or review rendered by the independent auditors.

3. Review the regular Management Letter to management prepared by the independent auditors and management's response.

4. Review any related party transactions for potential conflicts of interests.

5. Review the interim financial statements with financial management and the independent auditors prior to the filing of the Company's Form 10-Ks and Form 10-Qs, including a discussion of the matters required to be discussed by Statement of Auditing Standards No. 61, as amended.

6. Review and discuss with management and the independent auditor the Company's disclosure under "Management's Discussion and Analysis of Financial Condition and Results of Operations" appearing in the Company's periodic reports.

7. Based on the review and discussions referred to in Sections IV.A.2, IV.A.5 and IV.B.4, determine whether to recommend to the Board that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the last fiscal year for filing with the SEC.

A-2

8. Review and discuss earnings press releases and other information provided to securities analysts and rating agencies, including any "pro forma" or adjusted financial information.

B. Independent Auditors

1. Be directly and solely responsible for the appointment, compensation, retention, oversight (including resolution of disagreements between management and the independent auditor regarding financial reporting) and, if necessary, termination and replacement of any independent auditor engaged by the Company, with any such independent auditor reporting directly to the Committee.

2. Approve in advance the engagement of the independent auditor, including fees and other terms of any such engagement, for all audit services and non-audit services in accordance with applicable law, provided, however, that the Committee may establish pre-approval policies and procedures for any engagement to render such services and delegate to one or more members of the Committee the authority to grant pre-approvals for such services, provided that such policies, procedures and delegation are in accordance with applicable law (including SEC and Amex rules).

3. Evaluate at least annually the qualifications and performance of the independent auditor, and report to the Board on its conclusions, together with any recommendations for additional action.

4. Obtain from the independent auditors, on a periodic basis, a formal written statement consistent with Independence Standards Board Standard No. 1, as amended ("Standard No. 1"), delineating all relationships between the auditor and the Company, including without limitation, descriptions of (x) all relationships between the auditor and the Company, (y) any disclosed relationships or services that may impact the independent auditor's objectivity and independence and (z) whether any of the Company's senior finance personnel were recently employed by the independent auditor. Discuss with the auditor any disclosed relationships or services that may impact auditor objectivity and independence consistent with Standard No. 1.

5. Take, or recommend that the Board take, appropriate action to oversee the independence of the outside auditor, including an annual review of the outside auditor's independence.

6. Consult with the independent auditor to assure the rotation of the lead audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit every five years.

7. Establish policies for the hiring of employees or former employees of the independent auditor who participated in any capacity in the audit of the Company, taking into account the impact of such policies on auditor independence.

C. Financial Reporting Processes

1. Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit.

2. Review with management its assessment of the effectiveness, integrity and adequacy of the Company's internal control structure and procedures for financial reporting ("Internal Controls") and, when relevant SEC rules are in effect, review annually with the independent auditor the attestation to and report on the assessment made by management

3. To the extent that the Committee deems appropriate, review with management its evaluation of the Company's procedures and controls designed to assure that information required to be disclosed in its periodic public reports is recorded, processed, summarized and reported in such reports within the time periods specified by the SEC for the filing of such reports

A-3

("Disclosure Controls"), and consider whether any changes are appropriate in light of management's evaluation of the effectiveness of such Disclosure Controls.

4. Review with management and the independent auditors any significant judgments made in management's preparation of the financial statements and the view of each as to appropriateness of such judgments.

5. Review with management and the independent auditor the effect of any regulatory and accounting initiatives on the financial statements. Review any major issues regarding accounting principles and financial statement presentations, including any significant changes in selection of an application of accounting principles.

6. Review any analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including the effects of alternative GAAP methods on the financial statements.

7. Review and discuss with management and the independent auditor any off-balance sheet transactions or structures and their effect on the Company's financial results and operations, as well as the disclosure regarding such transactions and structures in the Company's public filings.

8. Consider and approve, if appropriate, changes to the Company's auditing and accounting principles and practices as suggested by the independent auditors or management.

D. Process Improvement

1. Review with the independent auditor the critical accounting policies and practices used by the Company, including the auditor's assessment of the quality, not just acceptability, of the accounting principles, all alternative treatments of financial information within generally accepted accounting principles ("GAAP") that the independent auditor has discussed with management, the ramifications of the use of such alternative disclosures and treatments and the treatment preferred by the independent auditor.

2. Regularly review with the independent auditor any significant difficulties encountered during the course of the annual audit, any restrictions on the scope of work or access to required information and any significant disagreement among management and the independent auditor in connection with the preparation of the financial statements. Review with the independent auditor any accounting adjustments that were noted or proposed by the auditor but that were "passed" (as immaterial or otherwise), any "management" or "internal control" letter or schedule of unadjusted differences issued, or proposed to be issued, by the auditor to the Company, or any other material written communication provided by the independent auditor to the Company's management.

3. Review with the chief executive and chief financial officer of the Company as well as the independent auditors any report on significant deficiencies in the design or operation of the Internal Controls that could adversely affect the Company's ability to record, process summarize or report financial data, any material weaknesses in Internal Controls identified to the independent auditors, and any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's Internal Controls.

4. Periodically consult with the independent auditors out of the presence of management about Internal Controls and the fullness and accuracy of the Company's financial statements.

5. Review any special audit steps adopted in light of any material control deficiencies. Review with the independent auditor and management the extent to which changes or improvements in financial or accounting practices, as approved by the Committee, have been implemented.

A-4

6. Provide oversight and review the Company's asset management policies, including an annual review of the Company's investment policies and performance for cash and short-term investments.

E. Ethical and Legal Compliance

1. Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

2. Consider and adopt a Code of Business Conduct and Ethics ("Code of Conduct") applicable to all employees and directors which meets the requirements of the SEC and Amex, including the adoption of procedures for monitoring and enforcing compliance with such Code of Conduct.

3. As requested by the Board, review and investigate conduct alleged by the Board to be in violation of the Code of Conduct, and adopt as necessary or appropriate, remedial, disciplinary, or other measures with respect to such conduct.

4. Review management's monitoring of compliance with the Foreign Corrupt Practices Act.

5. Review, with the Company's counsel, legal compliance matters including corporate securities trading policies.

6. Prepare the report required by the rules of the SEC to be included in the Company's annual proxy statement.

7. Review, with the Company's counsel, any legal matter that could have a significant impact on the Company's financial statements.

8. Regularly report to the Board on the Committee's activities, recommendations and conclusions.

A-5

RAE SYSTEMS INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

SOLICITED BY THE BOARD OF DIRECTORS

The undersigned, revoking all prior proxies, hereby appoints Robert I. Chen and Joseph Ng, or either of them, with full power of substitution, as proxies to represent and vote as designated in this proxy any and all of the shares of stock of RAE Systems Inc., held or owned by or standing in the name of the undersigned on the company's books on March 15, 2004 at the Annual Meeting of Stockholders of the company to be held at the Wyndham Hotel located at 1300 Chesapeake Terrace, Sunnyvale California at 2:00 p.m. on May 5, 2004, and any continuation or adjournment thereof, with all powers the undersigned would possess if personally present at the meeting.

The undersigned hereby directs and authorizes said proxies, and each of them, or their substitute or substitutes, to vote as specified with respect to the proposals listed on the reverse side, or, if no specification is made, to vote in favor thereof.

The undersigned hereby further confers upon said proxies, and each of them, or their substitute or substitutes, discretionary authority to vote with respect to all other matters, which may properly come before the meeting or any continuation or adjournment thereof.

The undersigned hereby acknowledges receipt of: (a) a Notice of Annual Meeting of Stockholders of the Company, (b) an accompanying Proxy Statement, and (c) an Annual Report to Stockholders for the fiscal year ended December 31, 2003.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR AND FOR THE RATIFICATION OF THE APPOINTMENT OF BDO SEIDMAN, LLP AS OUR INDEPENDENT AUDITORS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. | | To elect the following two persons as Class II directors to hold office for a three-year term and until their successors are elected and qualified: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | Nominee: Neil W. Flanzraich |

| | | o | | FOR | | o | | WITHHELD | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | Nominee: Lyle D. Feisel |

| | | o | | FOR | | o | | WITHHELD | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (TO BE SIGNED ON REVERSE SIDE) |

| 2. | | To ratify the appointment of BDO Seidman, LLP as our independent auditors for the fiscal year ending December 31, 2004. |

| | | o | | FOR | | o | | AGAINST | | o | | ABSTAIN |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU ARE URGED TO SIGN AND PROMPTLY MAIL THIS PROXY IN THE RETURN ENVELOPE SO THAT YOUR STOCK MAY BE REPRESENTED AT THE MEETING.

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT o

| | | Signature: | |

| | Date: | |

|

|

|

|

|

|

|

|

|

|

| | | Signature: | |

| | Date: | |

|

|

|

|

|

|

|

|

|

|

| | | Note: | | Sign exactly as your name(s) appears on your stock certificate. If shares of stock are held in the name of two or more persons or in the name of husband and wife, either as joint tenants or otherwise, both or all of such persons should sign the above Proxy. If shares of stock are held by a corporation, the Proxy should be executed by the President or Vice President and the Secretary or Assistant Secretary. Executors or administrators or other fiduciaries who execute the above Proxy for a deceased stockholder should give their full title. Please date the Proxy. |

QuickLinks

PROPOSAL NO. 1 ELECTION OF DIRECTORSPROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSSTOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTSection 16(a) Beneficial Ownership Reporting ComplianceEXECUTIVE COMPENSATION AND OTHER MATTERSSUMMARY COMPENSATION TABLEAGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END VALUESEQUITY COMPENSATION PLAN INFORMATIONCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSREPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATIONREPORT OF THE AUDIT COMMITTEECOMPARISON OF STOCKHOLDER RETURNPerformance Graph for RAE SYSTEMS INC. Comparison of Cumulative Total Returns from April 9, 2002 through December 31, 2003TRANSACTION OF OTHER BUSINESSAPPENDIX A RAE SYSTEMS INC. CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS