Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

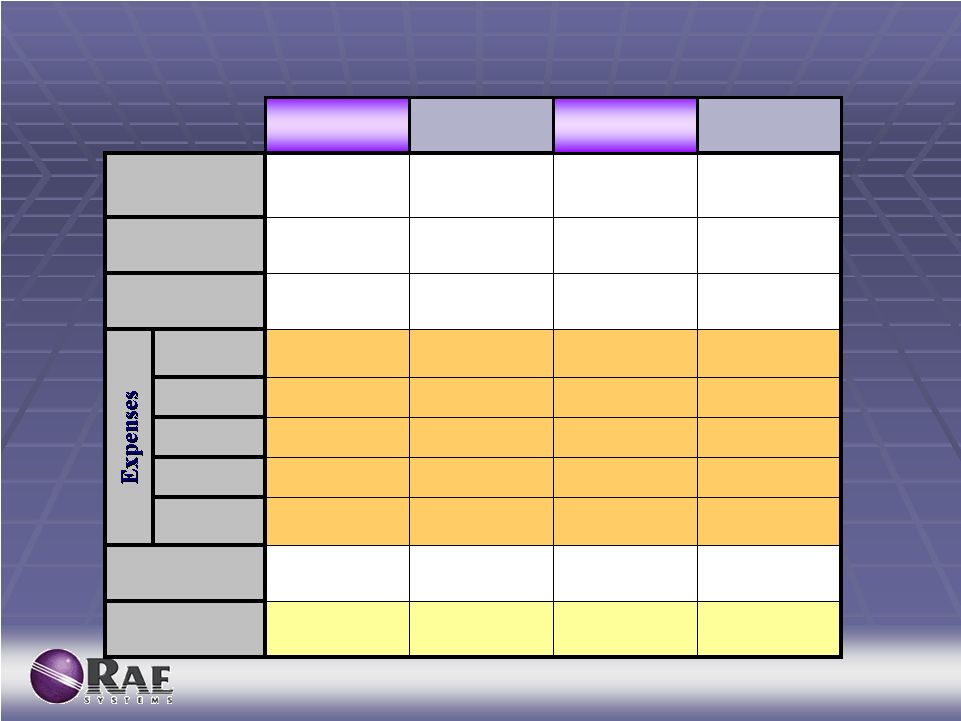

Filing tables

RAE similar filings

- 10 May 06 RAE Systems Reports First Quarter 2006 Results

- 9 May 06 RAE Systems Reports First Quarter 2006 Results

- 3 Apr 06 Entry into a Material Definitive Agreement

- 1 Mar 06 Regulation FD Disclosure

- 15 Feb 06 RAE Systems Reports Fourth Quarter and Year-end 2005 Results

- 7 Feb 06 Regulation FD Disclosure

- 12 Jan 06 Departure of Directors or Principal Officers

Filing view

External links