Exhibit 99.1

NASDAQ: ECPG

JPMorgan

Small Cap Conference

March 10, 2005

1

CAUTIONARY NOTE A BOUT FORWARD - -LOOKING STATEMENTS

Certain Statements in This Presentation Constitute “Forward-looking Statements” Within the

Meaning of the Private Securities Litigation Reform Act of 1995. Such Statements Involve

Risks, Uncertainties and Other Factors Which May Cause Actual Results, Performance or

Achievements of the Company and Its Subsidiaries to Be Materially Different From Any Future

Results, Performance or Achievements Expressed or Implied by Such Forward-looking

Statements. For a Discussion of These Factors, We Refer You to the Company’s Annual

Report on Form 10-K As of and for the Year Ended December 31, 2004.

In Light of the Significant Uncertainties Inherent in the Forward-looking Statements Included

Herein, the Inclusion of Such Information Should Not Be Regarded As a Representation by the

Company or by Any Other Person or Entity That the Objectives and Plans of the Company Will

Be Achieved.

2

ENCORE CAPITAL

50 year old purchaser and manager of consumer receivables portfolios

Unique business model

Excellent financial and operating results

Strong drivers for growth

3

INVESTMENT HIGHLIGHTS

Growth Industry

No barriers to entry - high barriers to long-term success

Demonstrated ability to buy right and collect well

Process company focused on debt collection

Innovations and analysis

Multiple collection channels reduces need to acquire new portfolios & increase

outbound collection staff

New lower cost financing

Significant catalyst for pretax margin expansion and earnings growth

Highly seasoned and respected management team

4

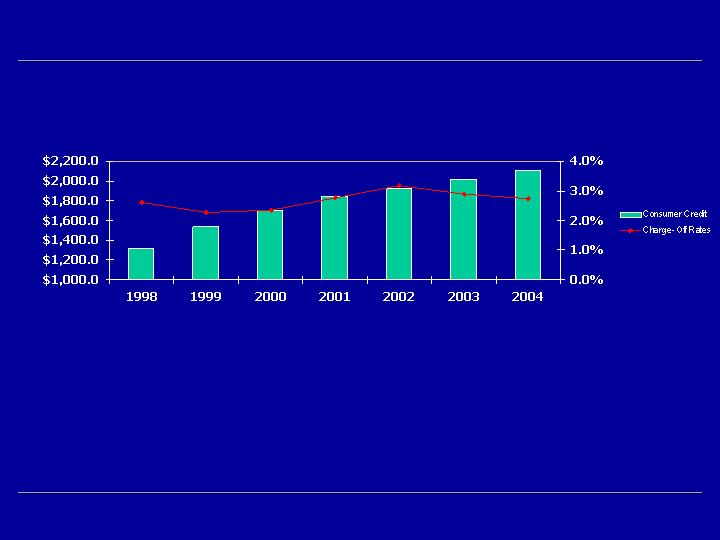

COMPELLING FUNDAMENTALS

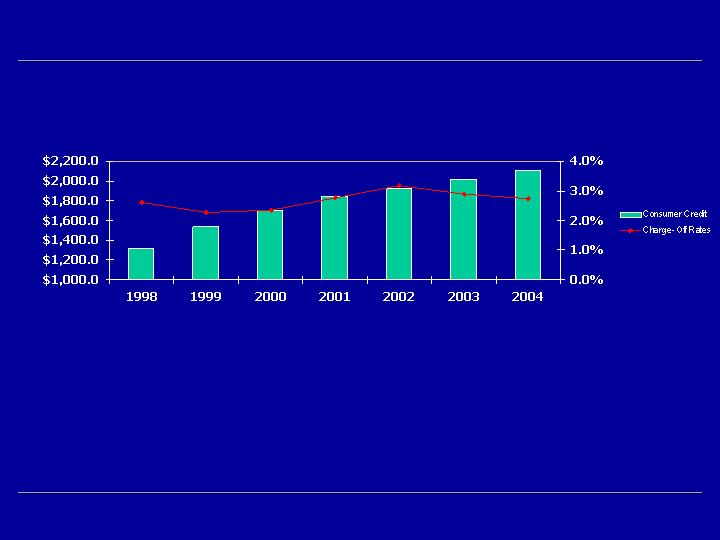

Source: Federal Reserve Board, February 7, 2005 for Consumer Credit

Federal Reserve Board, February 23, 2005 for Charge-Off Rates

$ in billions

Non-mortgage consumer debt and charge-off rates

Traditional consumer debt continues to grow

Other types of consumer receivables are beginning to be sold

Automobile deficiencies Telecom

Utilities Medical

Health Club

5

BUSINESS DRIVERS

Buy Right

Collect Well

Manage Expenses

Challenge Everything

Demand Professional and Ethical Behavior

6

Encore’s COMPETITIVE ADVANTAGES

Consumer level analytics

Multiple collection strategies

Proprietary and dynamic account management

software

7

Account level valuation provides several competitive advantages

Buy Right

Note: All purchases since mid-2000 through 12/31/04.

Provides ability to create

positively selected deals

Expands universe of sources to

include our competition

Applies to alternative paper types

Increases our flexibility to buy throughout

the universe of defaulted receivables

8

Month Since

Charge

-

off

Face Value

($ in Billions)

% of Total

Face Purch.

0

-

6

$

2.2

18%

7

-

12

$

1.0

9%

13

-

18

$

2.1

19%

19

-

24

$

0.8

8%

25

-

36

$

2.7

25%

37+

$

2.3

21%

Total

$

11.1

100%

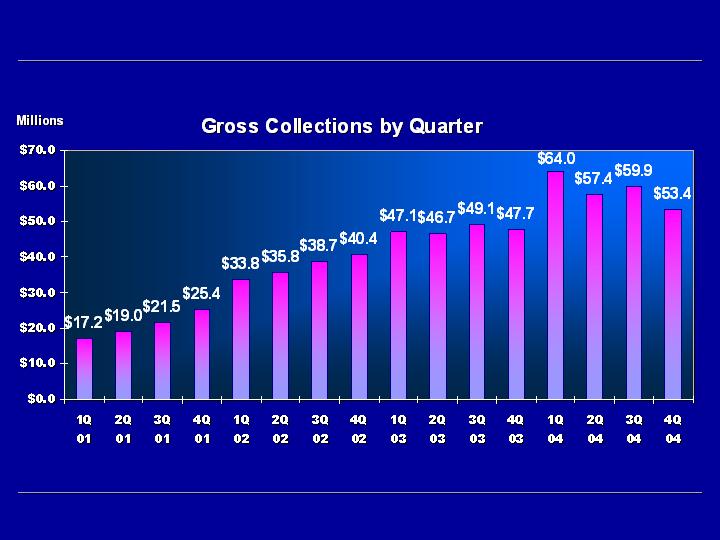

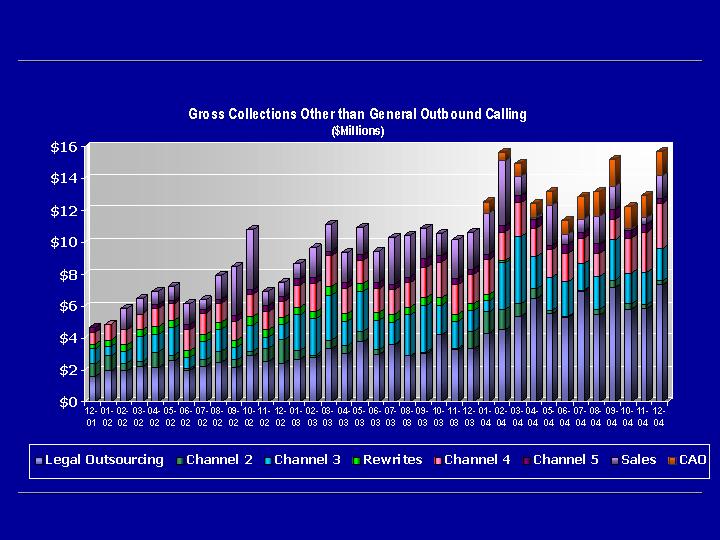

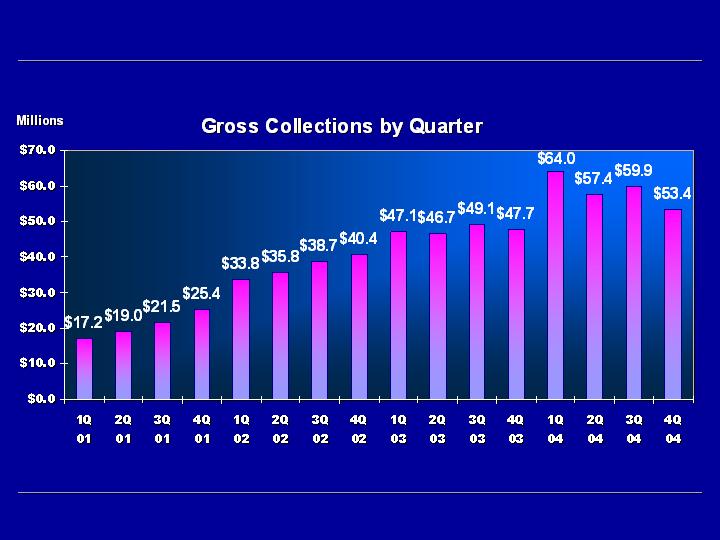

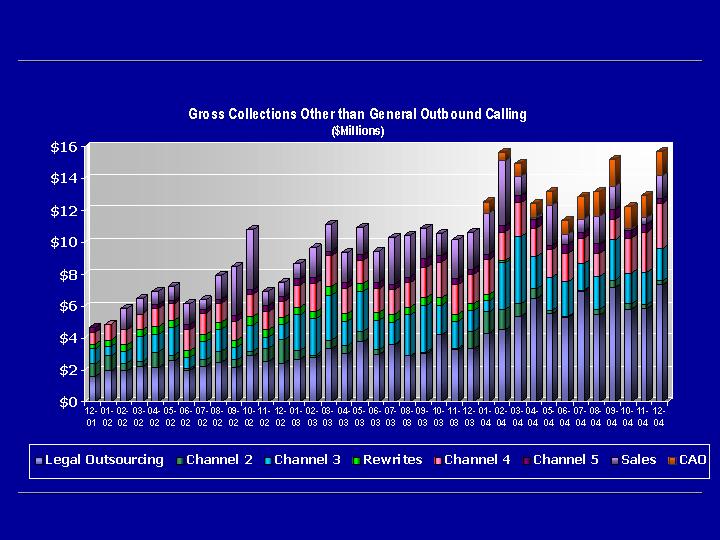

Strong Collection Growth

* 1Q ’04 total includes $4 million sale of rewrite business

9

COLLECT WELL - UNIQUE LIQUIDATION STRATEGIES

Continuous innovation is driving our collection growth

10

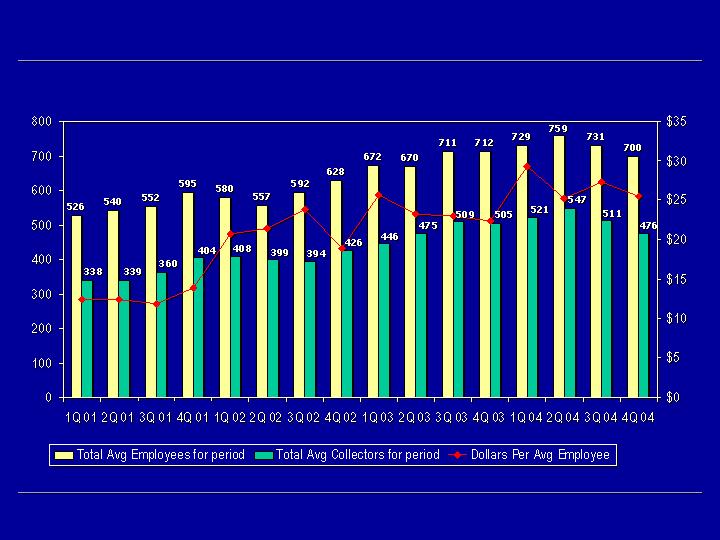

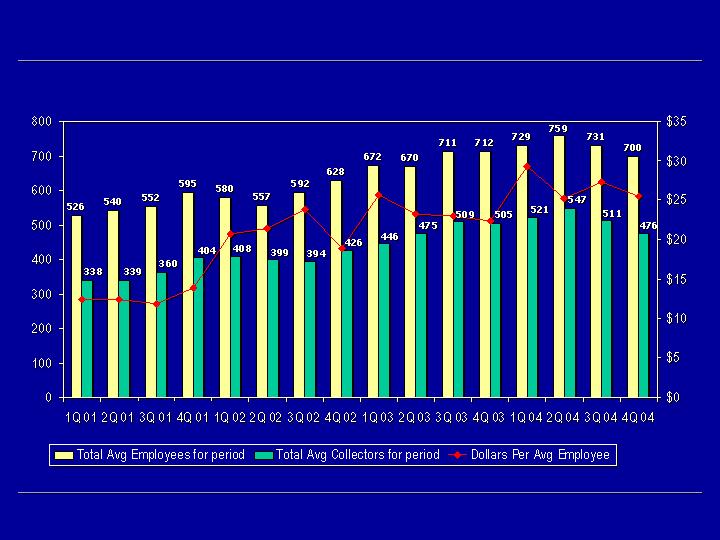

COLLECT WELL - RESULTS

Collection innovation drives our performance improvement

($ in Thousands)

(Employees)

11

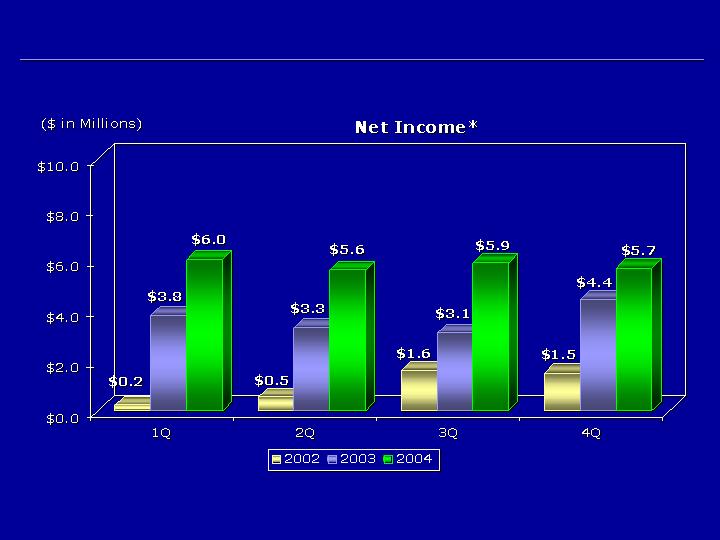

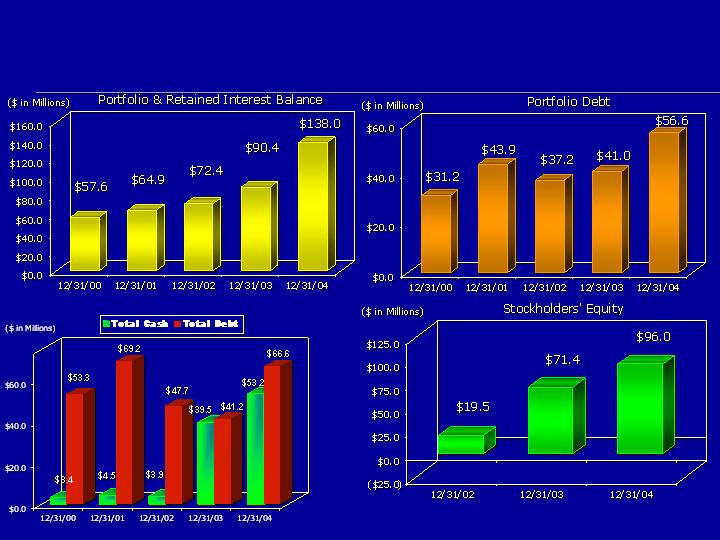

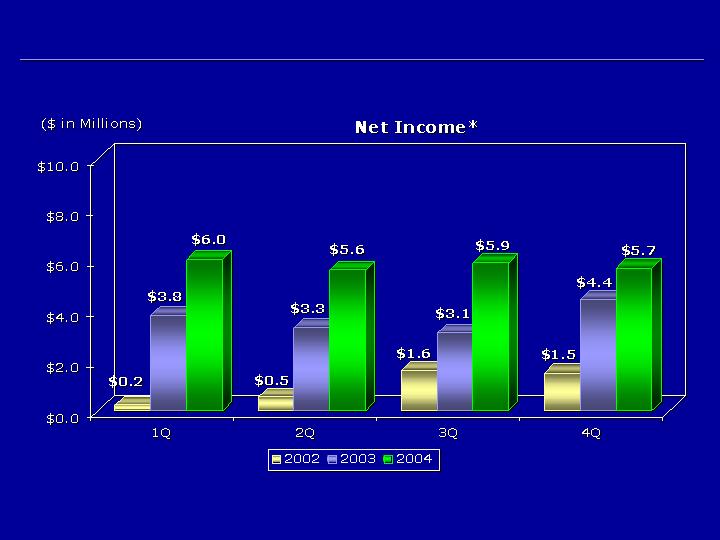

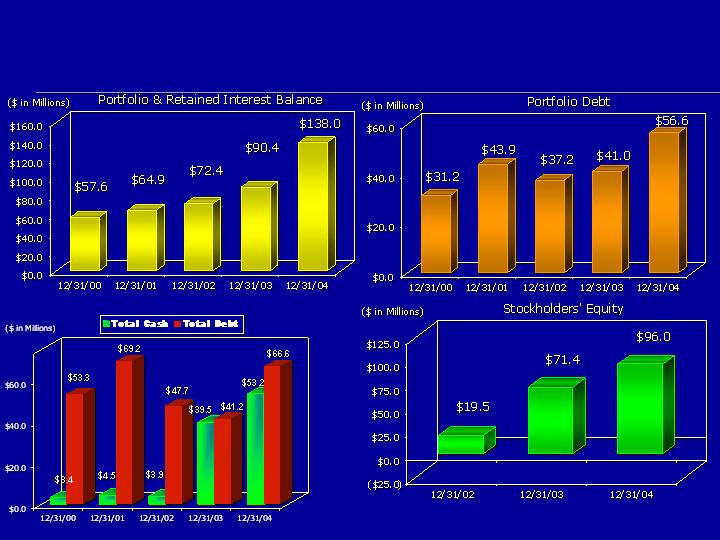

STRONG FINANCIAL R ESULTS & MOMENTUM

*Excludes one-time items.

12

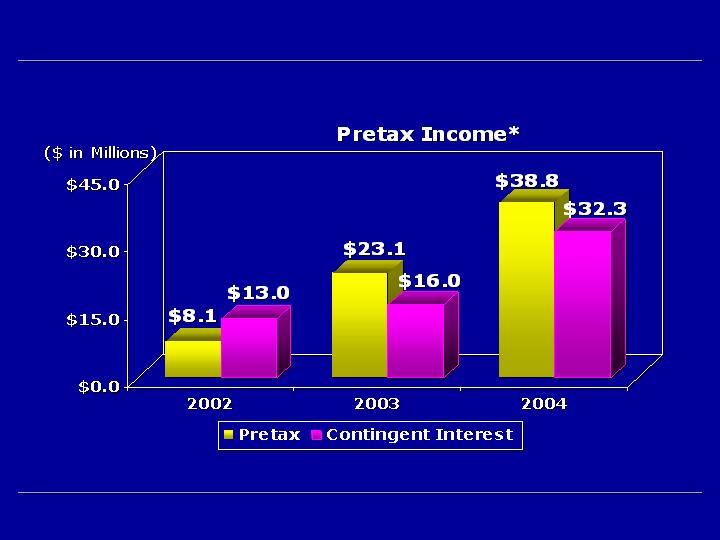

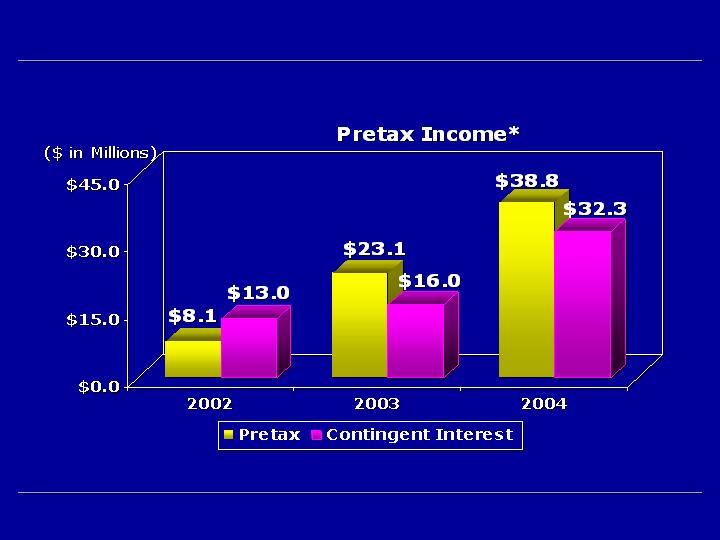

*Pretax Income excludes one-time benefit and charges.

STRONG FINANCIAL R ESULTS & MOMENTUM

The real earnings power not yet realized

13

STRONG FINANCIAL RESULTS & MOMENTUM -

BALANCE SHEET IMPROVEMENT

14

ACTUAL RESULTS

Our returns are consistently strong.

36 months

24 months

12 months

6 months

106

$4.3 Billion

$1.9 Billion

$7.6 Billion

$ 9.7 Billion

Total Face Value

57

189

226

# of Portfolios

0.8x

1.4x

2.5x

3.4x

15

Our Average Monthly Collections per Employee are very favorable.

ECPG1

$26,863

Monthly Collections

per Avg. Total

Employees

$234,676

2004 YTD Gross

Collections (in thousands)

728

Average # of

Total Employees

Key Metric

1 Data from 10-K filing for the period ending December 31, 2004 (12-month period).

16

Strong Collections and Judicious Portfolio Buys Create Strong Turnover

ECPG1

1.21

Annualized Portfolio

Turnover

$234,676

Annualized Gross

Collections (in thousands)

$193,741

Total Inventory

(in thousands)

$103,374

Annualized Purchases

(in thousands)

$90,367

Portfolio BOY

(in thousands)

Key Metric

1 Data from 10-K filing for the period ending December 31, 2004 (12-month period).

17

$376,500

Implied Gross Collections to

Realize Book Value

(in thousands)

$19,556

Avg. Monthly Collections 2004

(in thousands)

ECPG1

19.3

Months Remaining to Amortize

Book

24%

YTD Amortization Rate

$90,367

Portfolio January 1, 2004

(in thousands)

Key Metric

1 Data from 10-K filing for the period ending December 31, 2004 (12-month period).

We Are Amortizing Our Portfolio Quickly

18

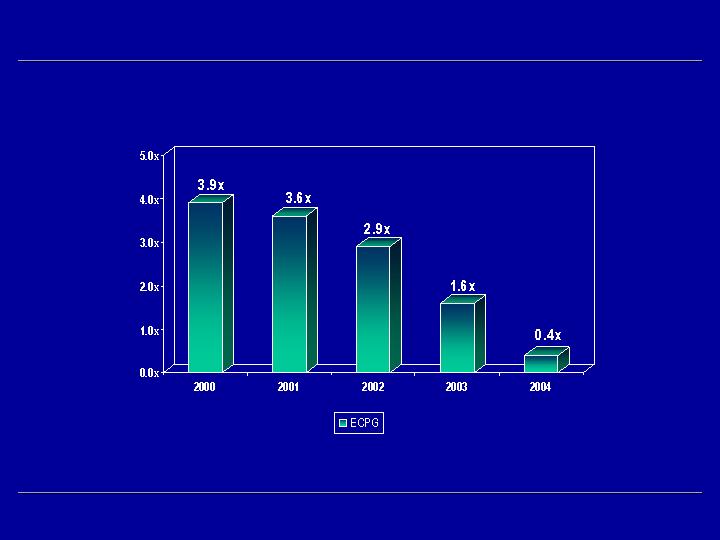

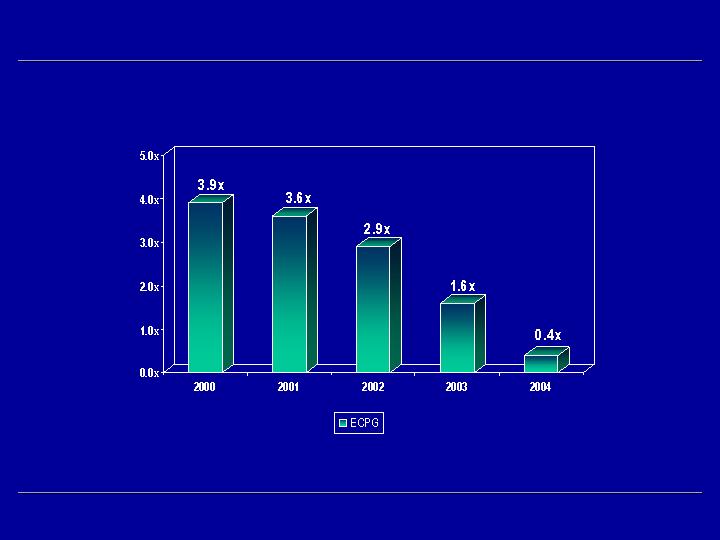

COMPETITIVE COMPARISON

Recent Vintages Are Consistently Strong

Ratio of Total Collections to Purchase Price by Year of Origin

1 Data from 10-K filings for the period ending December 31, 2004 (12-month period).

19

EXPERIENCED MANAGEMENT TEAM

Former CFO of Stellcom, Inc.; Former EVP and CFO of Telespectrum Worldwide Inc.; Former Partner

of M&A Services at Deloitte and Touche

Paul Grinberg

SVP Finance

Former Director of Service Strategy at Gateway, Inc.

Anna Hansen

SVP Collection Operations

Former VP of Decision Science for Associates Home Equity Division

Eric Von Dohlen

VP & Chief Credit Risk Officer

Former VP & CIO of West Capital; Former VP & CIO for Frederick’s of Hollywood and The Welk Group

John Treiman

SVP & CIO

Former VP and General Counsel of West Capital and Comstream Corp.

Robin R. Pruitt

SVP, General Counsel and Secretary

Former Director of Human Resources at Gateway, Inc.

Alison James

SVP, Human Resources

Former SVP of Operations of West Capital and First Data Resources; Former VP/Risk Operations of

Capital One

J. Brandon Black

President & COO

Former CFO of West Capital; Former CFO and Board Member of Bank One, Texas, N.A; Former

Controller of Great Western Financial Corp.

Barry R. Barkley

EVP & CFO

Former Chairman, President and CEO of West Capital; Former Chairman, President and CEO of MIP

Properties, Inc., a publicly traded REIT

Carl C. Gregory, III

Vice Chairman & CEO

Experience

Name/Position

20

Future Prospects

Growth Opportunities

Innovations and analysis

Significant reduction in effective

interest rate driven by new financing

Continued penetration of alternative

asset classes

Ample liquidity for complementary

acquisitions.

Challenges

Higher prices for purchased

receivables

Implementation of SOP 2003-03

Managing SOX 404 requirements

21

NASDAQ: ECPG

JP Morgan

Small Cap Conference

March 10, 2005

22