Encore Capital Group, Inc. Q2 2016 EARNINGS CALL Exhibit 99.1

PROPRIETARY 2 CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results, earnings per share, and growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent reports on Form 10-K and Form 10-Q, as they may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

PROPRIETARY 3 ENCORE UPDATE

PROPRIETARY 4 DISCIPLINED PRICING, STABLE SUPPLY CHARACTERIZE U.S. MARKET Debt buyers continue to exhibit pricing discipline – booking business at higher returns than last year Consumer-centric liquidation programs performing above expectations as liquidations and consumer satisfaction increase Strategic cost management initiatives gather traction as domestic debt recovery recurring expenses reduced $18 million in Q2 and $30 million YTD from prior year Earnings are supported by cost reductions, which offset declines in revenue Issuers now compete for debt buyer capital, effectively lowering prices

PROPRIETARY 5 OUR EUROPEAN BUSINESS CONTINUES TO SEE HIGHER IRR’s AND MORE GROWTH OPPORTUNITIES IN SPAIN As reported, Cabot is the first large debt buyer to achieve Financial Conduct Authority (FCA) authorization Approval carries new expectations which are reshaping and extending already lengthy liquidation curves Management is working through consumer-centric initiatives to increase collections in both the short and long term In addition to the U.K., deployed capital in Spain and - for the first time - in Portugal Similar to our U.S. business, Cabot implementing strategic cost management activities to counter higher pricing and improve future returns

PROPRIETARY 6 GROWTH OF OUR BUSINESS IN LATIN AMERICA WILL BE DEPENDENT UPON PERFORMANCE AND COMFORT LEVEL We remain optimistic about our prospects in Latin America, although we have now prioritized Mexico over Brazil In Colombia, Refinancia’s returns are meeting expectations – market supply expected to improve in the second half Long term, we expect Latin America will move corporate returns higher as a result of its favorable ROIC characteristics of higher IRR’s and lower effective tax rates

PROPRIETARY 7 FUTURE PLATFORM INITIATIVES Encore Asset Reconstruction Company (EARC) continues to prepare for business launch, subject to Reserve Bank of India license approval Indian NPL market continues to grow at a 28% CAGR Few meaningful players in the market Banking regulations encouraging recognition and sale of non- performing assets Baycorp in early stages of business transformation Deployments will exceed prior year Installing U.S.-based operating improvements and metrics to improve performance

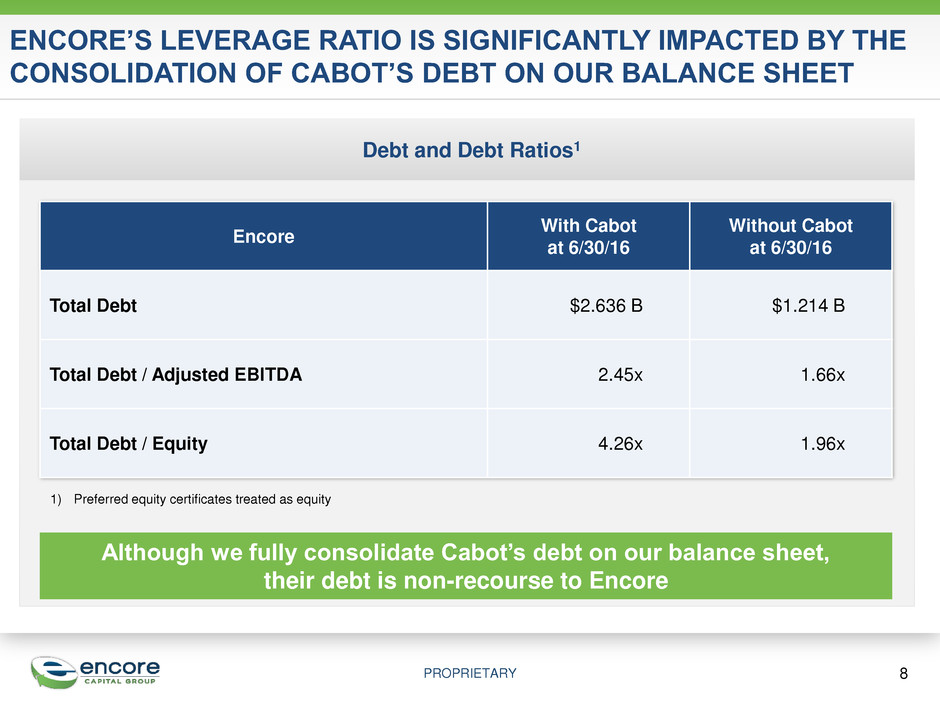

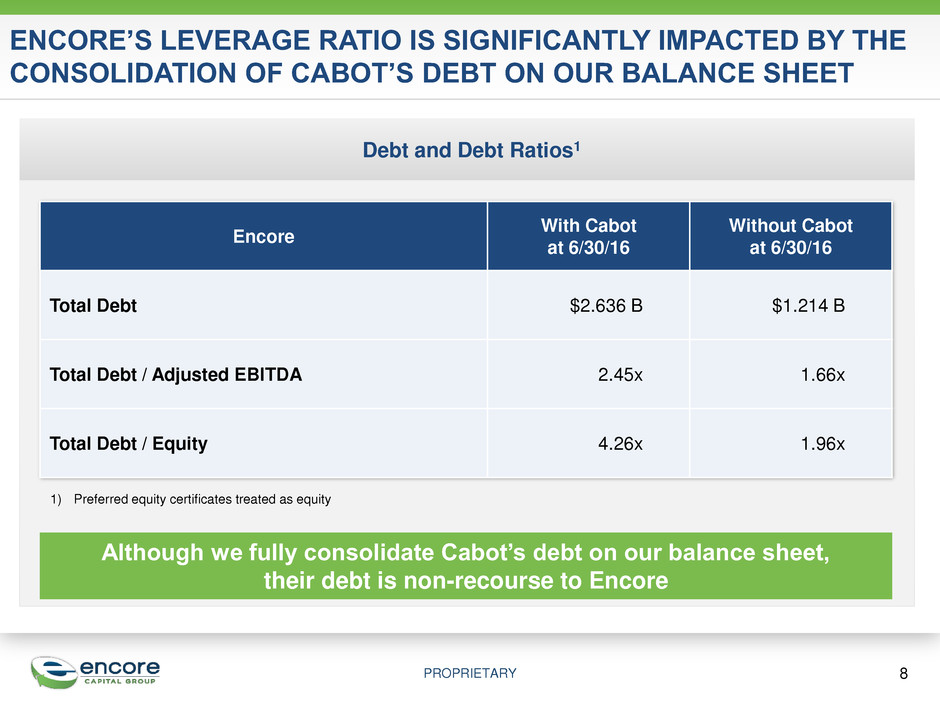

PROPRIETARY 8 ENCORE’S LEVERAGE RATIO IS SIGNIFICANTLY IMPACTED BY THE CONSOLIDATION OF CABOT’S DEBT ON OUR BALANCE SHEET Debt and Debt Ratios1 Although we fully consolidate Cabot’s debt on our balance sheet, their debt is non-recourse to Encore Encore With Cabot at 6/30/16 Without Cabot at 6/30/16 Total Debt $2.636 B $1.214 B Total Debt / Adjusted EBITDA 2.45x 1.66x Total Debt / Equity 4.26x 1.96x 1) Preferred equity certificates treated as equity

PROPRIETARY 9 CFPB PUBLISHES OUTLINE OF PROPOSED NEW INDUSTRY RULES IN PREPARATION FOR UPCOMING SMALL BUSINESS PANEL Outline of proposed new rules provides clarity and removes uncertainty that was over-hanging the company and industry We’ll continue to evaluate the proposed new rules as they are further refined to identify precisely what we’ll need to do to implement those items that require action We’re pleased that a number of the proposed new rules were derived from our own recommendations and existing best practices Overall, we believe the new rules will help create a more level playing field for all companies in the industry, large and small

10 Detailed Financial Discussion

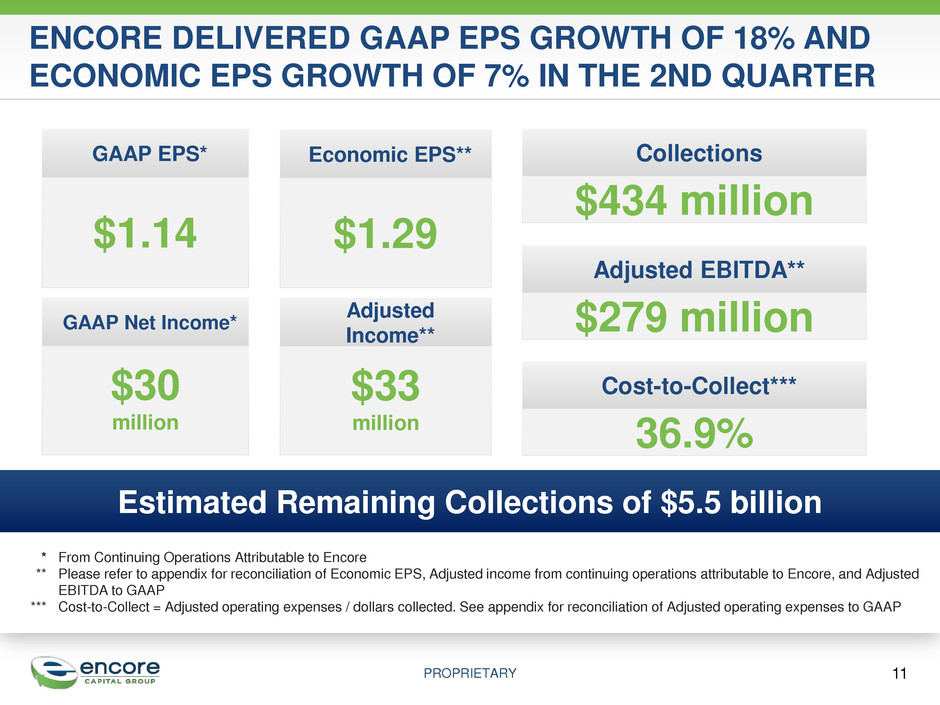

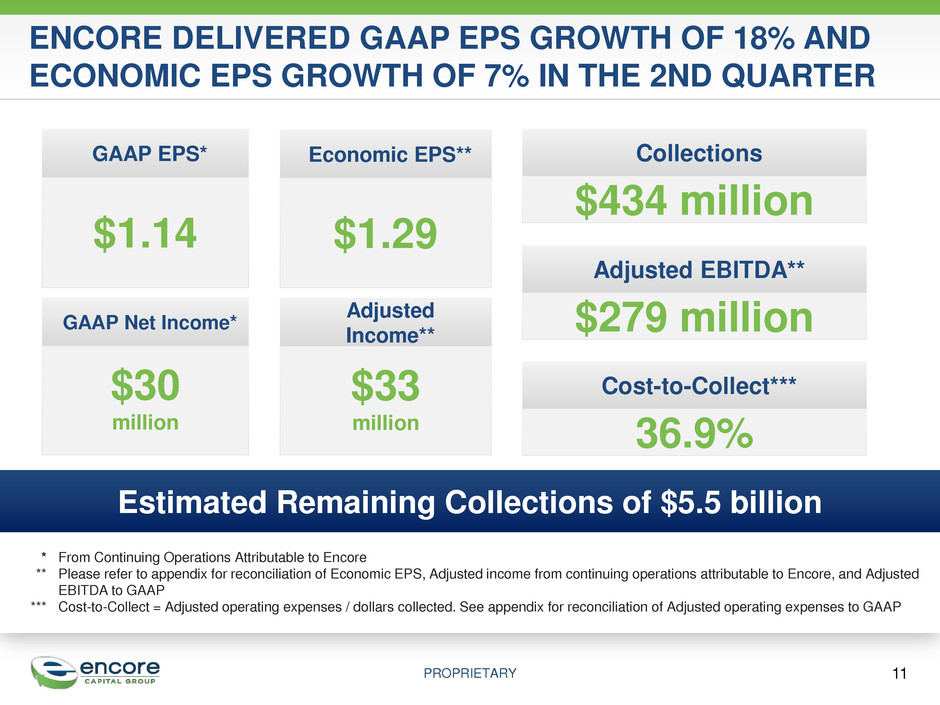

PROPRIETARY 11 ENCORE DELIVERED GAAP EPS GROWTH OF 18% AND ECONOMIC EPS GROWTH OF 7% IN THE 2ND QUARTER Economic EPS** $1.29 GAAP EPS* $1.14 GAAP Net Income* $30 million Adjusted Income** $33 million Estimated Remaining Collections of $5.5 billion * From Continuing Operations Attributable to Encore ** Please refer to appendix for reconciliation of Economic EPS, Adjusted income from continuing operations attributable to Encore, and Adjusted EBITDA to GAAP *** Cost-to-Collect = Adjusted operating expenses / dollars collected. See appendix for reconciliation of Adjusted operating expenses to GAAP Adjusted EBITDA** $279 million Collections $434 million Cost-to-Collect*** 36.9%

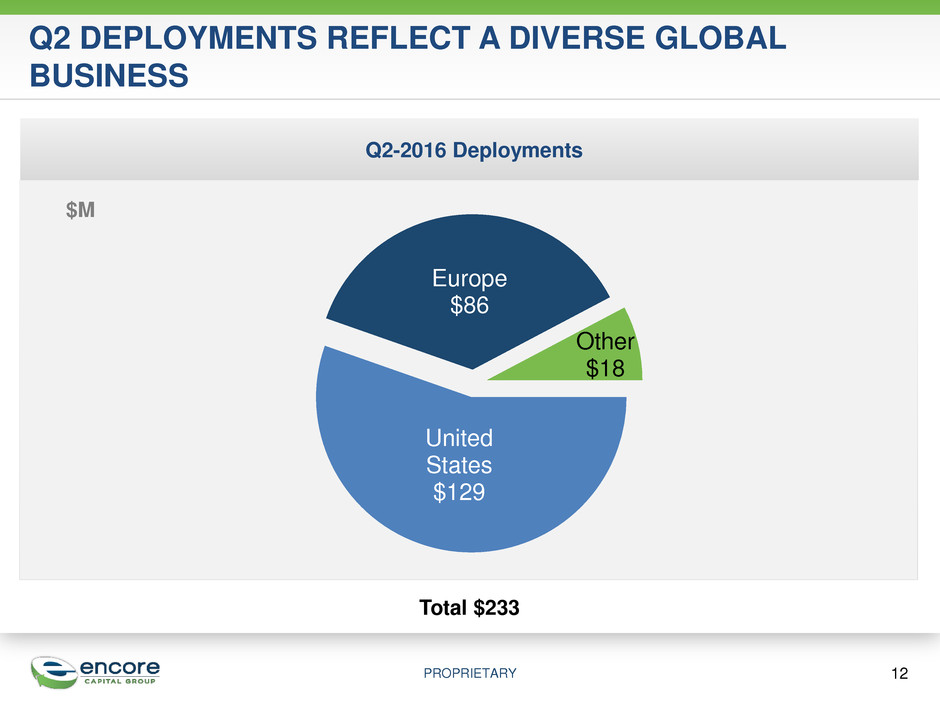

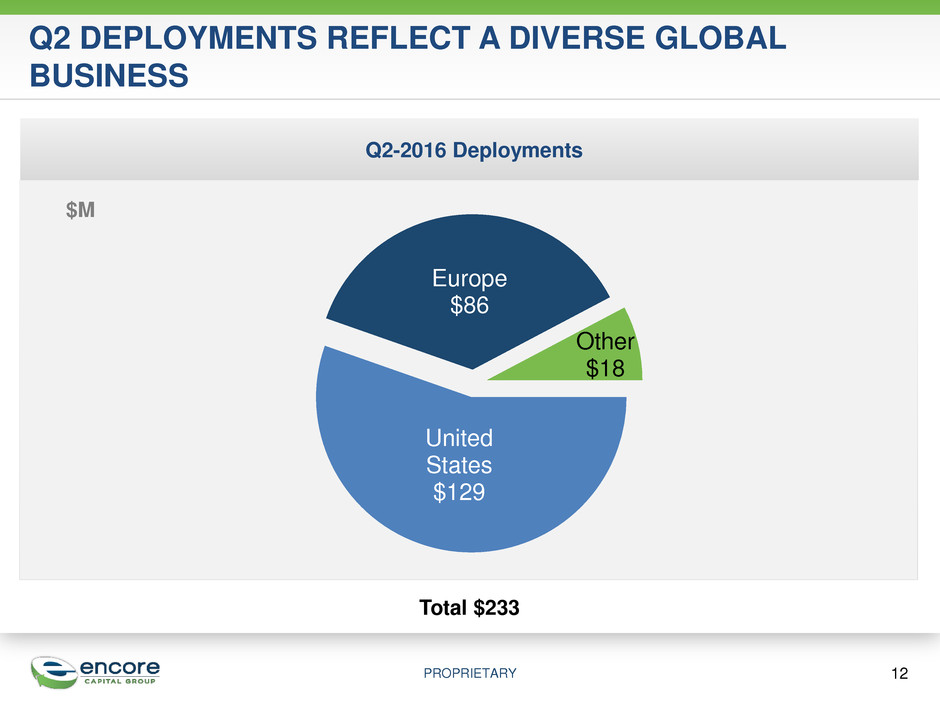

PROPRIETARY 12 Q2 DEPLOYMENTS REFLECT A DIVERSE GLOBAL BUSINESS Q2-2016 Deployments $M United States $129 Europe $86 Other $18 Total $233

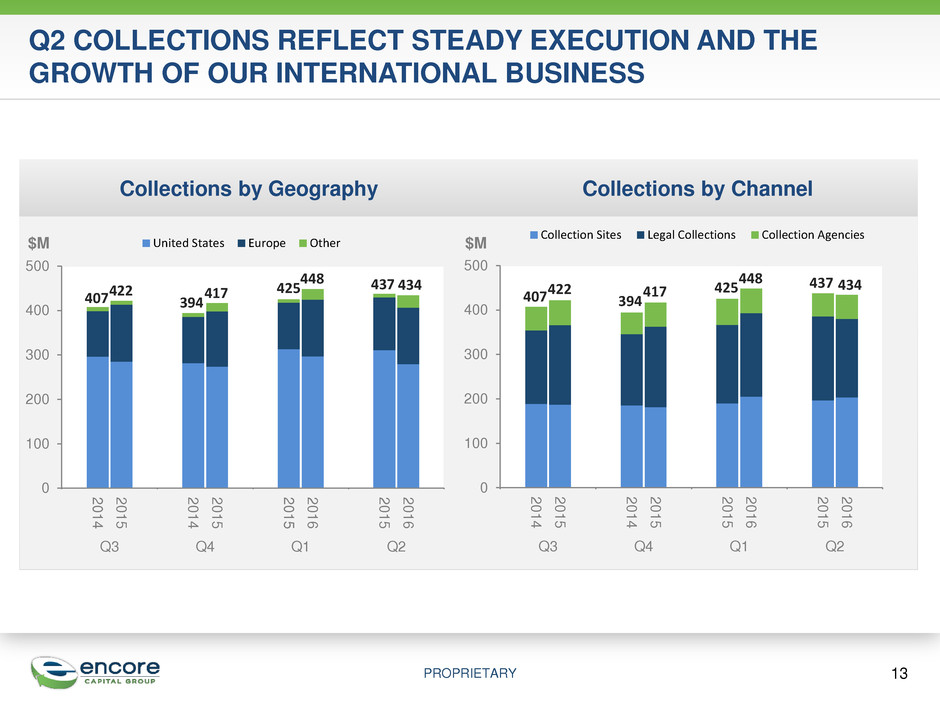

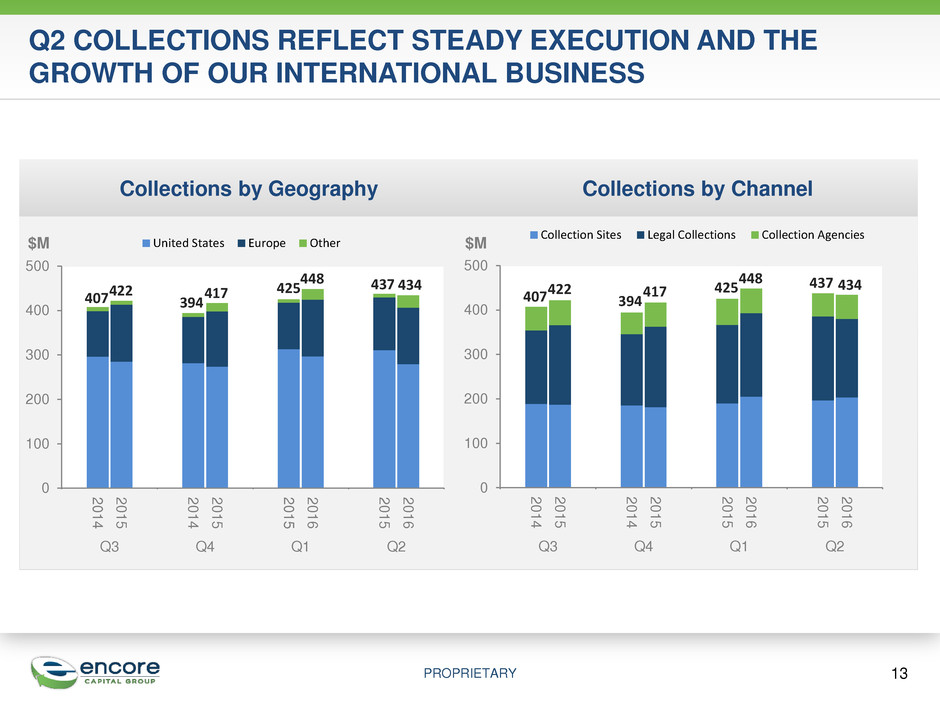

PROPRIETARY 13 Q2 COLLECTIONS REFLECT STEADY EXECUTION AND THE GROWTH OF OUR INTERNATIONAL BUSINESS Collections by Geography 0 100 200 300 400 500 2 0 1 4 2 0 1 5 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q3 Q4 Q1 Q2 Collection Sites Legal Collections Collection Agencies $M 0 100 200 300 400 500 2 0 1 4 2 0 1 5 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q3 Q4 Q1 Q2 United States Europe Other 417 425 437 422 394 448 434 407 $M Collections by Channel 417 425 437 422 394 448 434 407

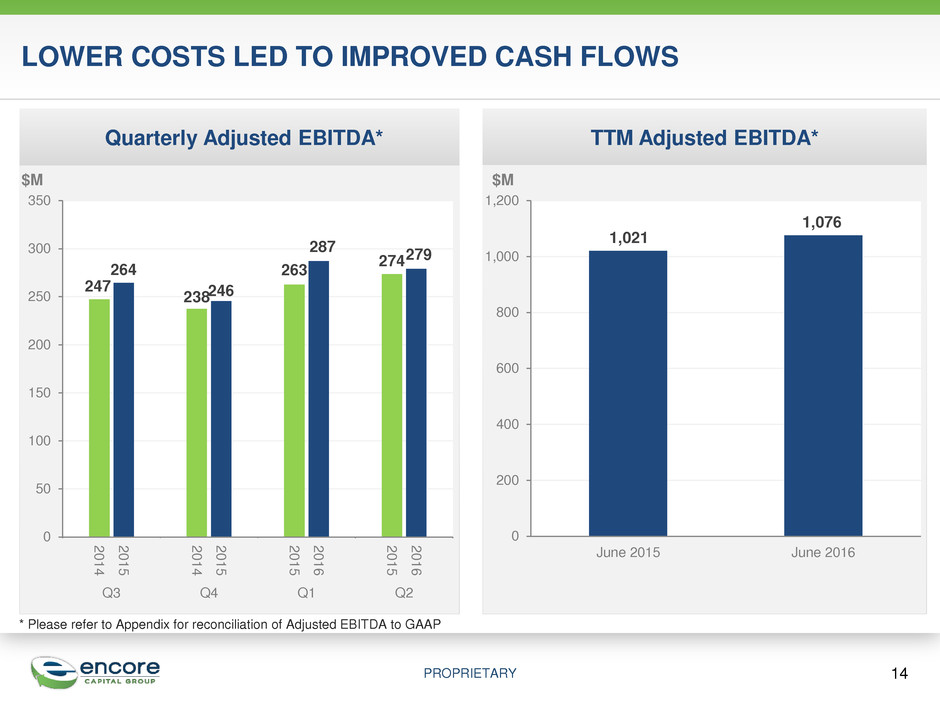

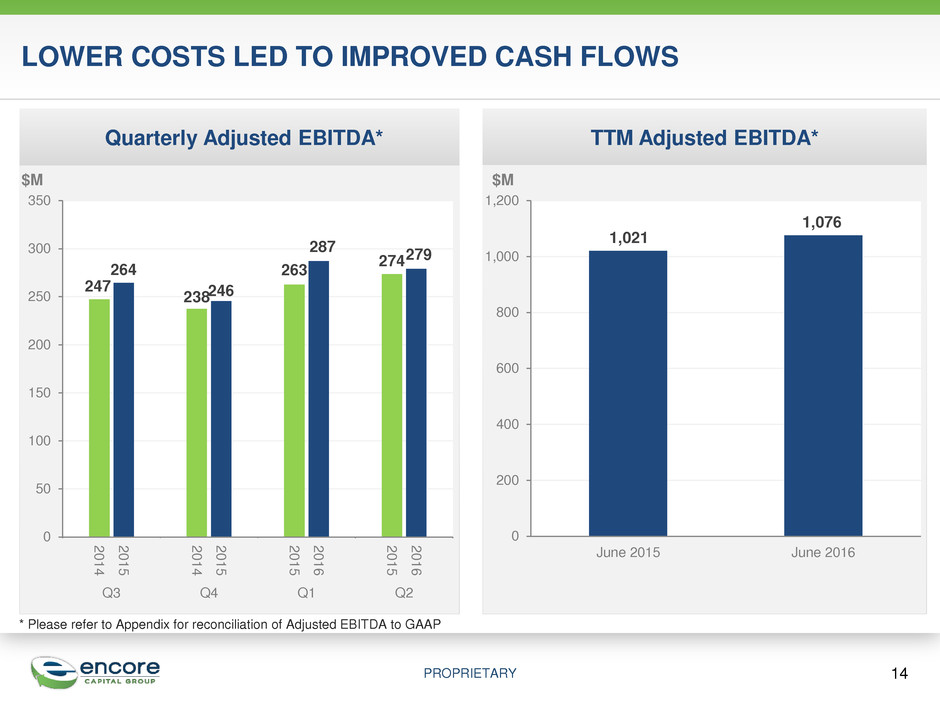

PROPRIETARY LOWER COSTS LED TO IMPROVED CASH FLOWS 14 * Please refer to Appendix for reconciliation of Adjusted EBITDA to GAAP $M Quarterly Adjusted EBITDA* TTM Adjusted EBITDA* 247 264 238 246 263 287 274 279 0 50 100 150 200 250 300 350 2 0 1 4 2 0 1 5 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q3 Q4 Q1 Q2 1,021 1,076 0 200 400 600 800 1,000 1,200 June 2015 June 2016 $M $M

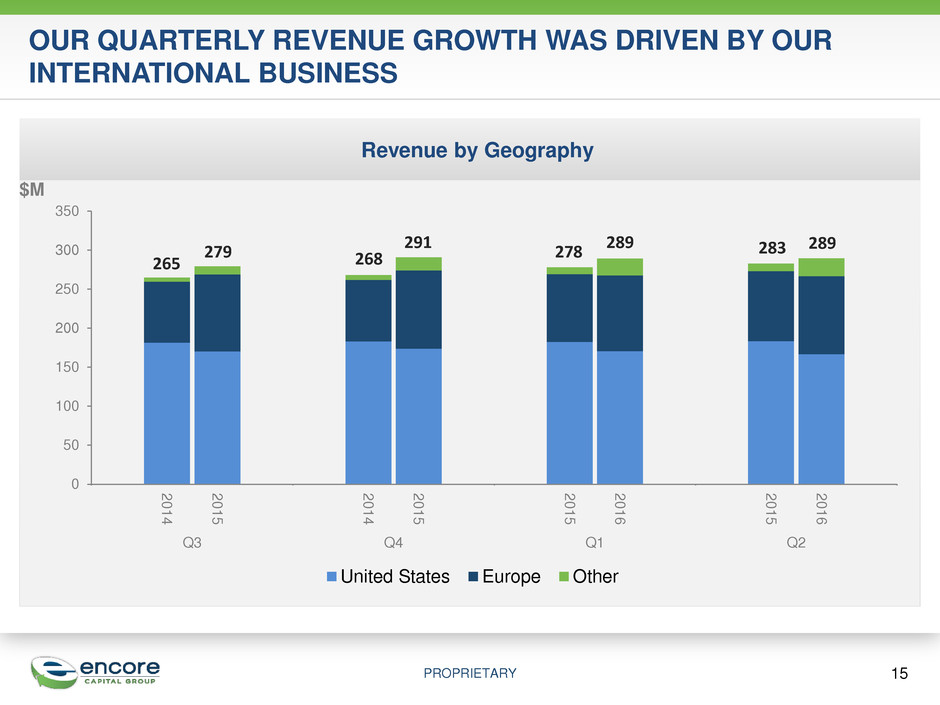

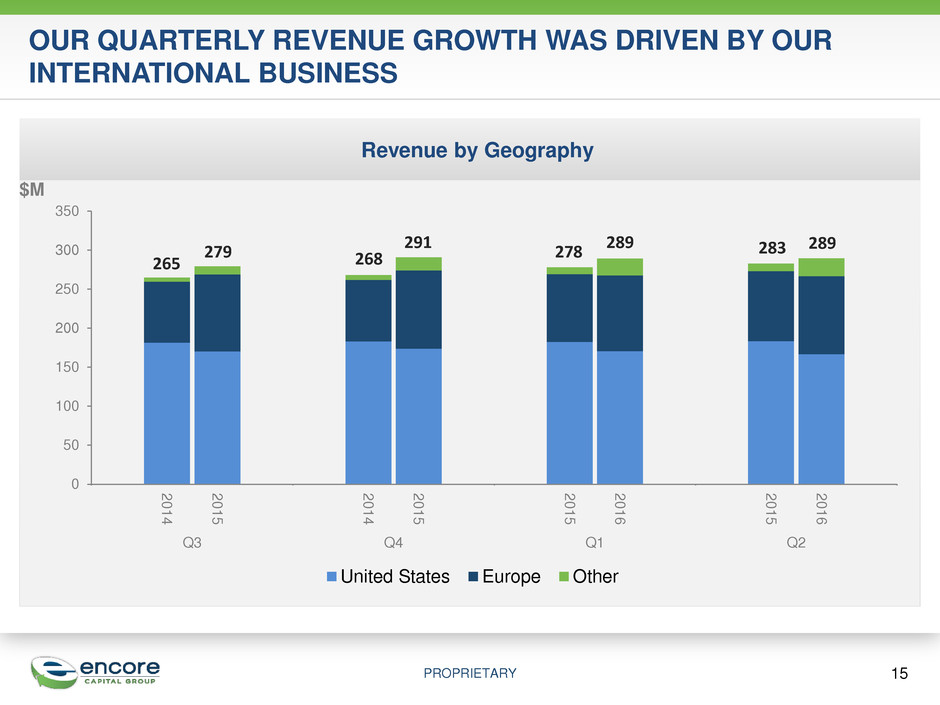

PROPRIETARY OUR QUARTERLY REVENUE GROWTH WAS DRIVEN BY OUR INTERNATIONAL BUSINESS Revenue by Geography 15 0 50 100 150 200 250 300 350 2 0 1 4 2 0 1 5 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q3 Q4 Q1 Q2 United States Europe Other $M 289 283 279 291 278 289 265 268

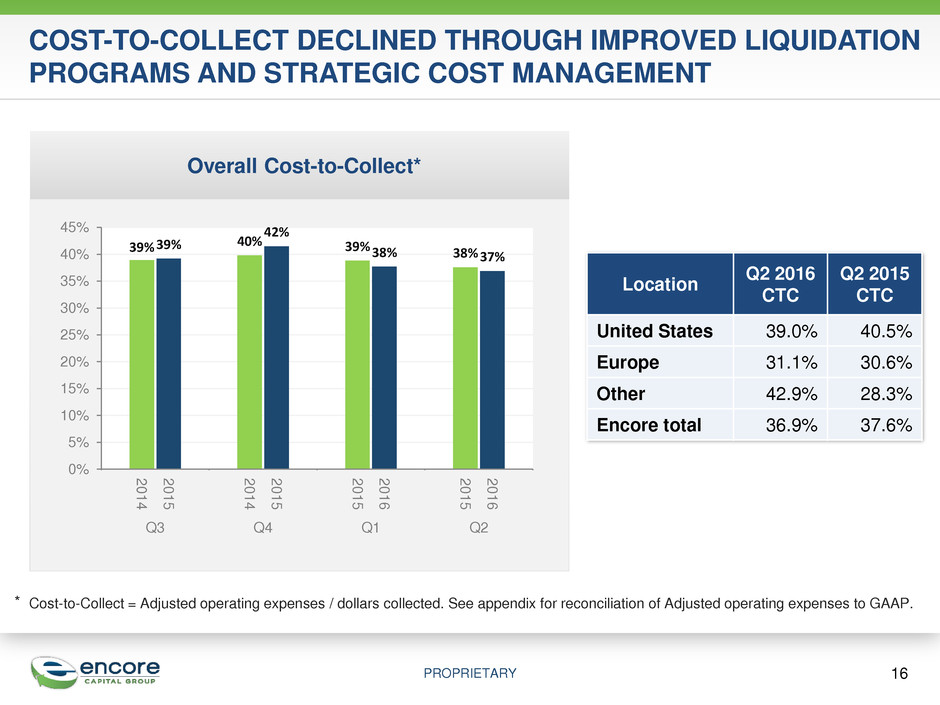

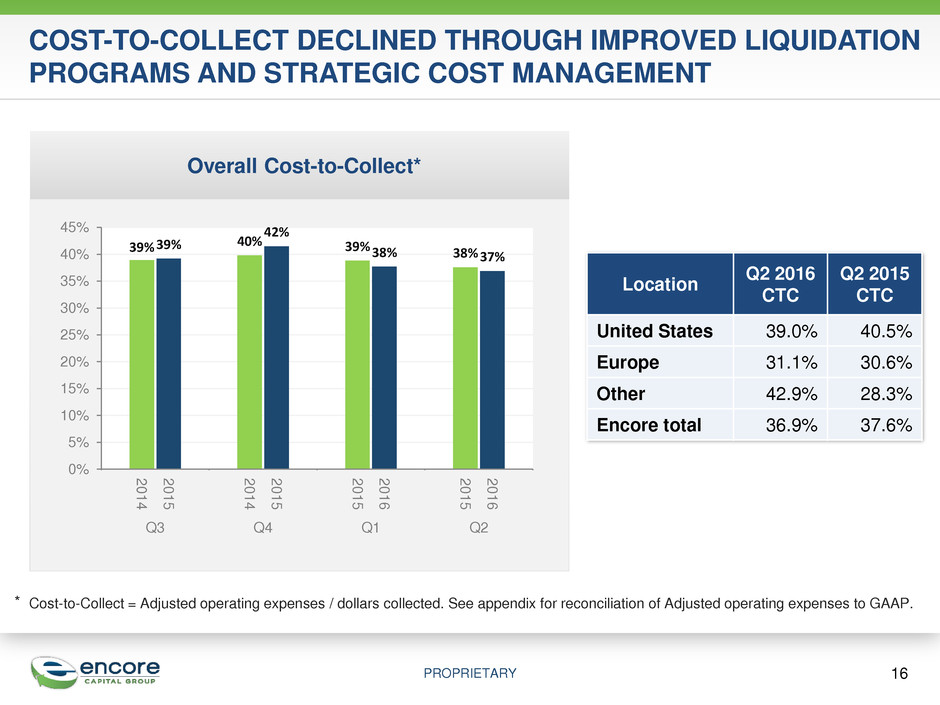

PROPRIETARY COST-TO-COLLECT DECLINED THROUGH IMPROVED LIQUIDATION PROGRAMS AND STRATEGIC COST MANAGEMENT 16 Overall Cost-to-Collect* 39% 39% 40% 42% 39% 38% 38% 37% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2 0 1 4 2 0 1 5 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q3 Q4 Q1 Q2 ⃰ Cost-to-Collect = Adjusted operating expenses / dollars collected. See appendix for reconciliation of Adjusted operating expenses to GAAP. Location Q2 2016 CTC Q2 2015 CTC United States 39.0% 40.5% Europe 31.1% 30.6% Other 42.9% 28.3% Encore total 36.9% 37.6%

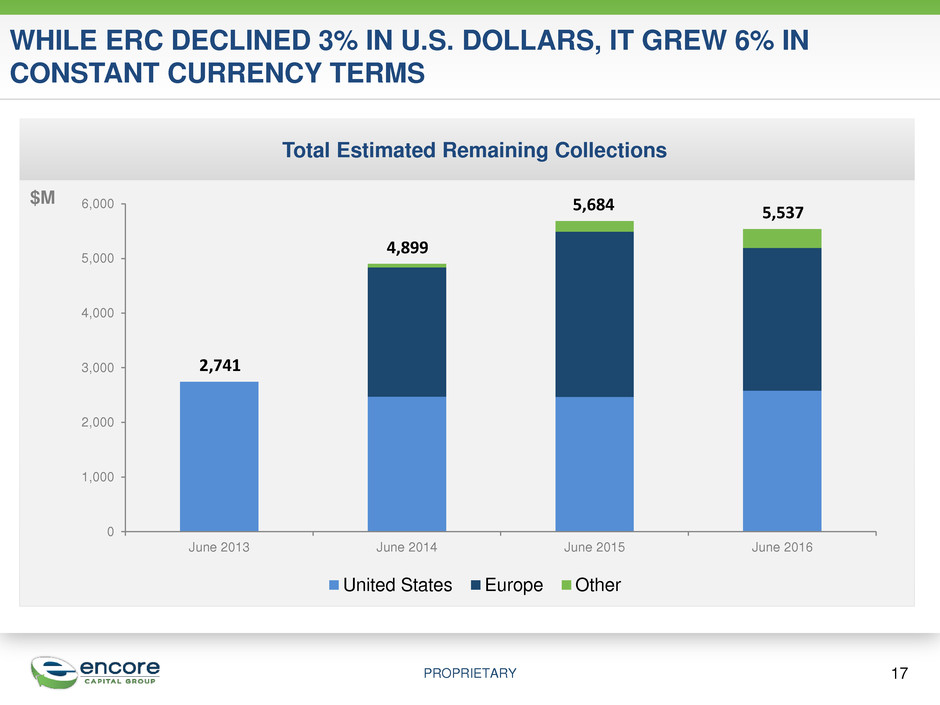

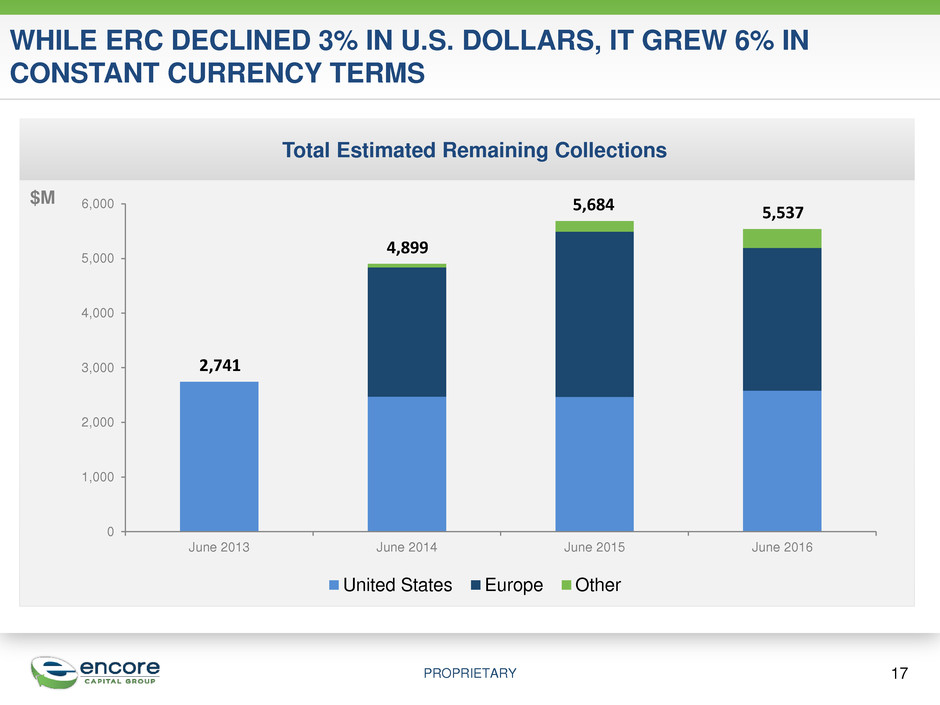

PROPRIETARY 17 WHILE ERC DECLINED 3% IN U.S. DOLLARS, IT GREW 6% IN CONSTANT CURRENCY TERMS Total Estimated Remaining Collections 0 1,000 2,000 3,000 4,000 5,000 6,000 June 2013 June 2014 June 2015 June 2016 United States Europe Other 2,741 4,899 5,684 $M 5,537

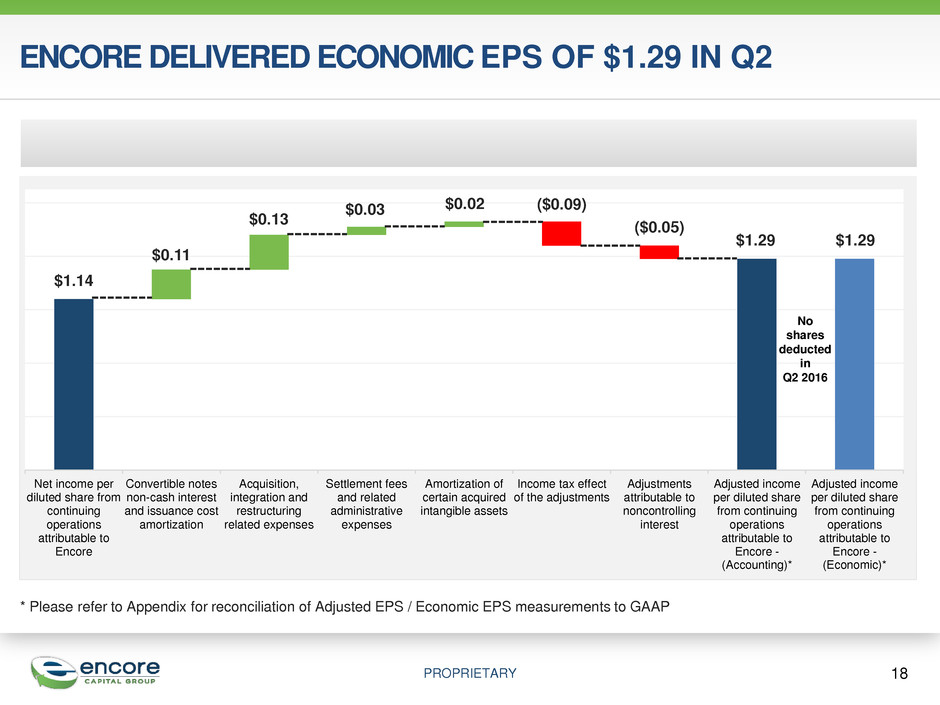

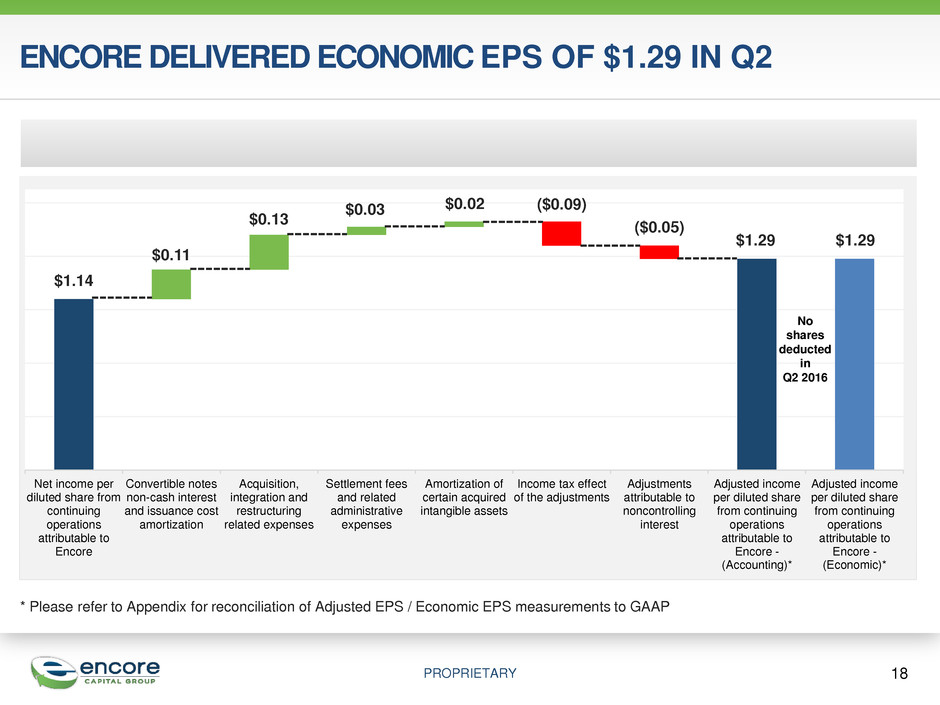

PROPRIETARY ENCORE DELIVERED ECONOMIC EPS OF $1.29 IN Q2 18 * Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP $1.14 $0.03 $0.02 ($0.09) ($0.05) $1.29 $1.29 $0.11 $0.13 Net income per diluted share from continuing operations attributable to Encore Convertible notes non-cash interest and issuance cost amortization Acquisition, integration and restructuring related expenses Settlement fees and related administrative expenses Amortization of certain acquired intangible assets Income tax effect of the adjustments Adjustments attributable to noncontrolling interest Adjusted income per diluted share from continuing operations attributable to Encore - (Accounting)* Adjusted income per diluted share from continuing operations attributable to Encore - (Economic)* No shares deducted in Q2 2016

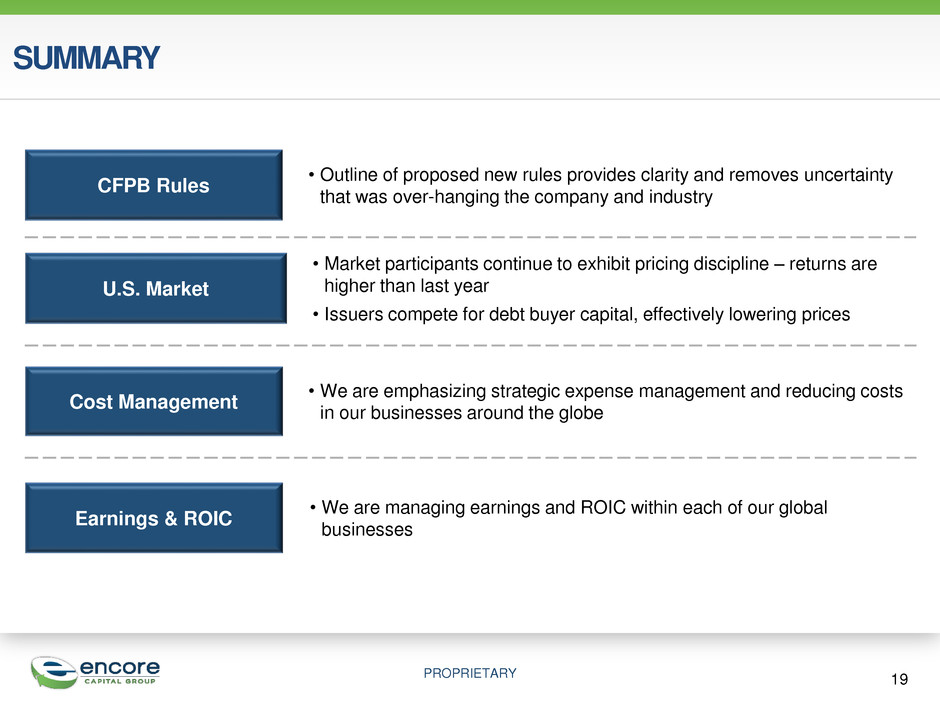

PROPRIETARY SUMMARY U.S. Market • Market participants continue to exhibit pricing discipline – returns are higher than last year • Issuers compete for debt buyer capital, effectively lowering prices Cost Management • We are emphasizing strategic expense management and reducing costs in our businesses around the globe Earnings & ROIC • We are managing earnings and ROIC within each of our global businesses 19 CFPB Rules • Outline of proposed new rules provides clarity and removes uncertainty that was over-hanging the company and industry

20 Q&A

21 Appendix

PROPRIETARY 22 NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information, which is materially similar in calculation to a financial measure contained in covenants used in the Company's revolving credit facility, in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order to highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore, Adjusted Income Attributable to Encore per Share/Economic EPS, and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

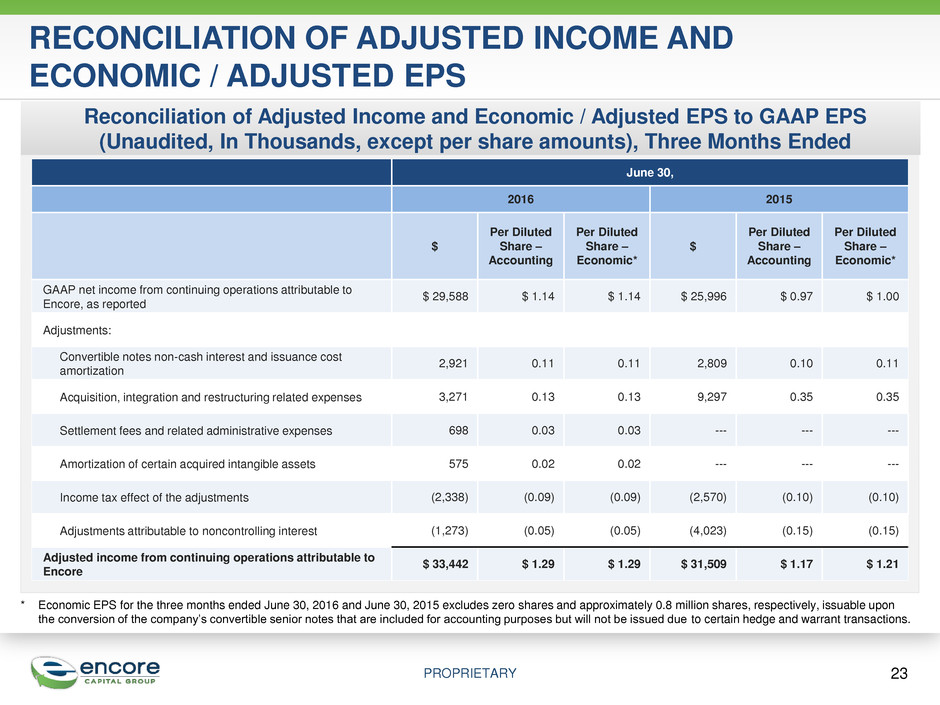

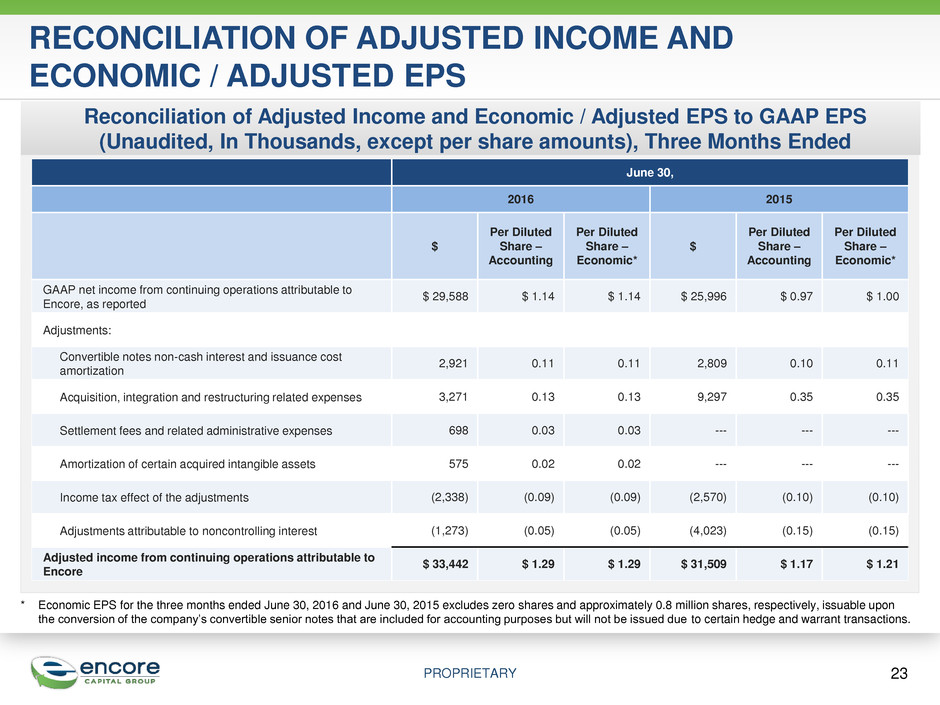

PROPRIETARY 23 RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended June 30, 2016 2015 $ Per Diluted Share – Accounting Per Diluted Share – Economic* $ Per Diluted Share – Accounting Per Diluted Share – Economic* GAAP net income from continuing operations attributable to Encore, as reported $ 29,588 $ 1.14 $ 1.14 $ 25,996 $ 0.97 $ 1.00 Adjustments: Convertible notes non-cash interest and issuance cost amortization 2,921 0.11 0.11 2,809 0.10 0.11 Acquisition, integration and restructuring related expenses 3,271 0.13 0.13 9,297 0.35 0.35 Settlement fees and related administrative expenses 698 0.03 0.03 --- --- --- Amortization of certain acquired intangible assets 575 0.02 0.02 --- --- --- Income tax effect of the adjustments (2,338) (0.09) (0.09) (2,570) (0.10) (0.10) Adjustments attributable to noncontrolling interest (1,273) (0.05) (0.05) (4,023) (0.15) (0.15) Adjusted income from continuing operations attributable to Encore $ 33,442 $ 1.29 $ 1.29 $ 31,509 $ 1.17 $ 1.21 * Economic EPS for the three months ended June 30, 2016 and June 30, 2015 excludes zero shares and approximately 0.8 million shares, respectively, issuable upon the conversion of the company’s convertible senior notes that are included for accounting purposes but will not be issued due to certain hedge and warrant transactions.

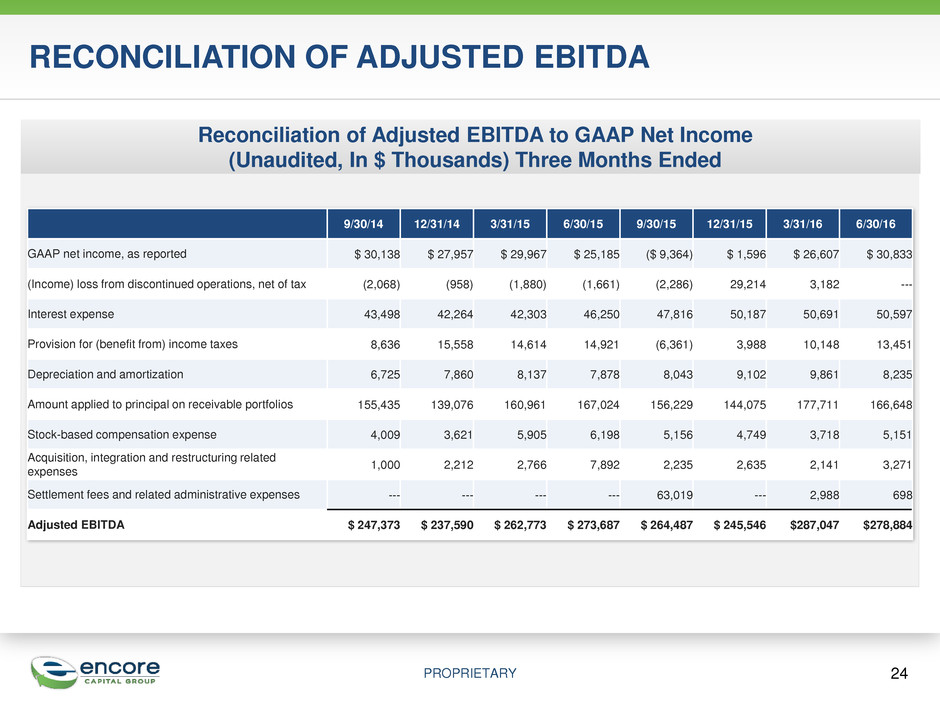

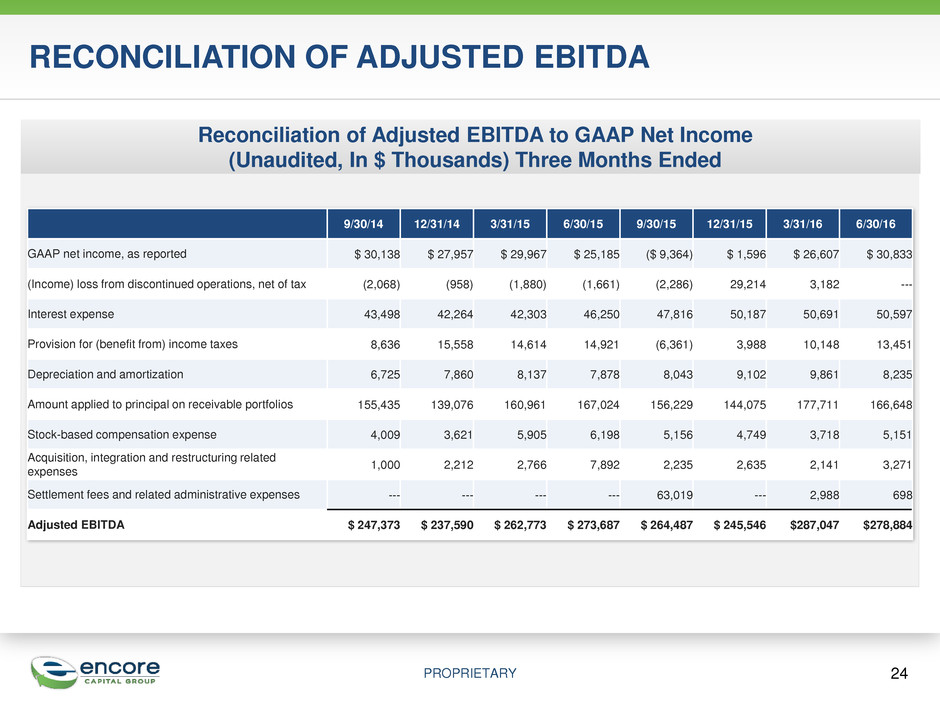

PROPRIETARY Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 GAAP net income, as reported $ 30,138 $ 27,957 $ 29,967 $ 25,185 ($ 9,364) $ 1,596 $ 26,607 $ 30,833 (Income) loss from discontinued operations, net of tax (2,068) (958) (1,880) (1,661) (2,286) 29,214 3,182 --- Interest expense 43,498 42,264 42,303 46,250 47,816 50,187 50,691 50,597 Provision for (benefit from) income taxes 8,636 15,558 14,614 14,921 (6,361) 3,988 10,148 13,451 Depreciation and amortization 6,725 7,860 8,137 7,878 8,043 9,102 9,861 8,235 Amount applied to principal on receivable portfolios 155,435 139,076 160,961 167,024 156,229 144,075 177,711 166,648 Stock-based compensation expense 4,009 3,621 5,905 6,198 5,156 4,749 3,718 5,151 Acquisition, integration and restructuring related expenses 1,000 2,212 2,766 7,892 2,235 2,635 2,141 3,271 Settlement fees and related administrative expenses --- --- --- --- 63,019 --- 2,988 698 Adjusted EBITDA $ 247,373 $ 237,590 $ 262,773 $ 273,687 $ 264,487 $ 245,546 $287,047 $278,884 RECONCILIATION OF ADJUSTED EBITDA 24

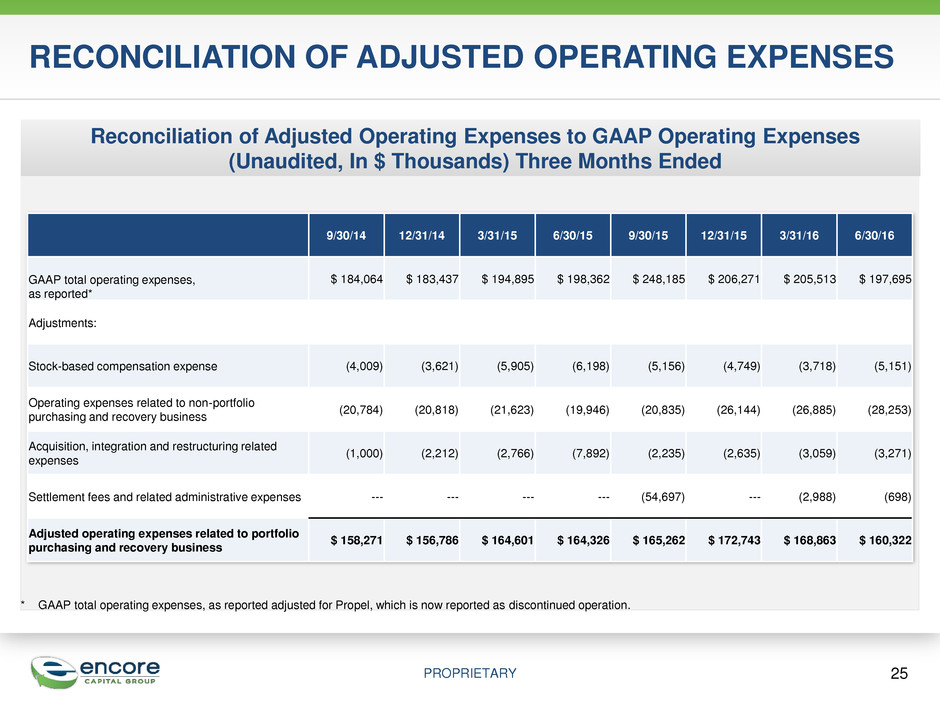

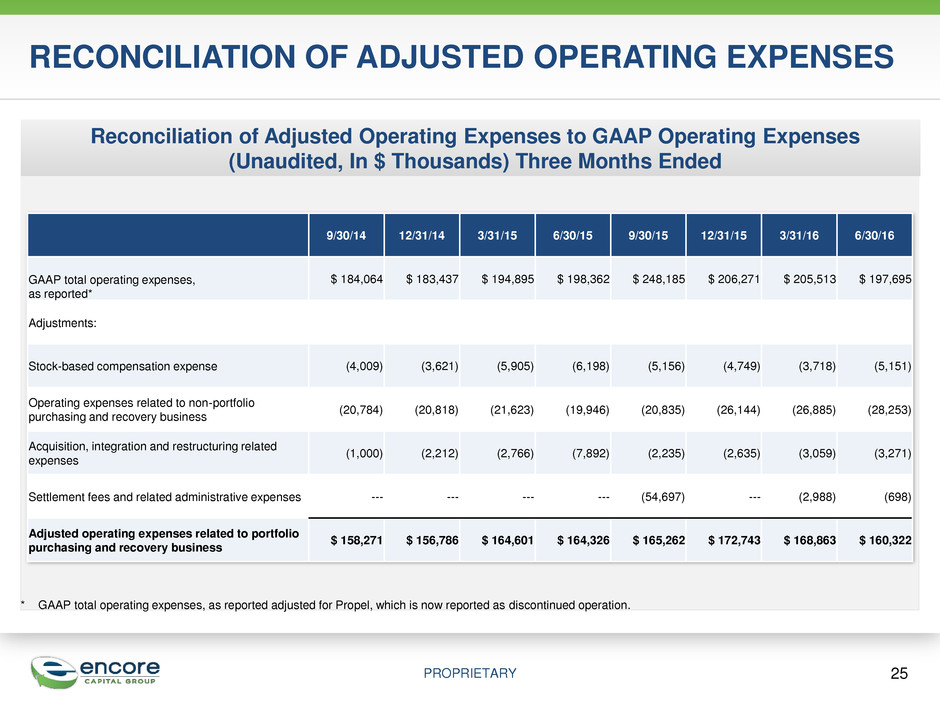

PROPRIETARY Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended RECONCILIATION OF ADJUSTED OPERATING EXPENSES 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 GAAP total operating expenses, as reported* $ 184,064 $ 183,437 $ 194,895 $ 198,362 $ 248,185 $ 206,271 $ 205,513 $ 197,695 Adjustments: Stock-based compensation expense (4,009) (3,621) (5,905) (6,198) (5,156) (4,749) (3,718) (5,151) Operating expenses related to non-portfolio purchasing and recovery business (20,784) (20,818) (21,623) (19,946) (20,835) (26,144) (26,885) (28,253) Acquisition, integration and restructuring related expenses (1,000) (2,212) (2,766) (7,892) (2,235) (2,635) (3,059) (3,271) Settlement fees and related administrative expenses --- --- --- --- (54,697) --- (2,988) (698) Adjusted operating expenses related to portfolio purchasing and recovery business $ 158,271 $ 156,786 $ 164,601 $ 164,326 $ 165,262 $ 172,743 $ 168,863 $ 160,322 25 * GAAP total operating expenses, as reported adjusted for Propel, which is now reported as discontinued operation.

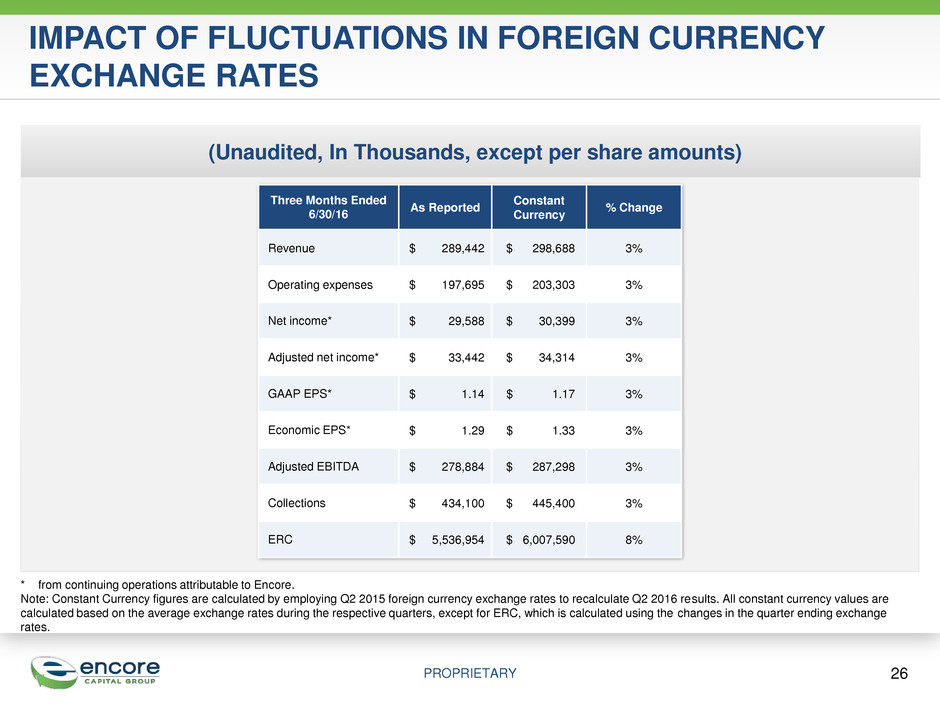

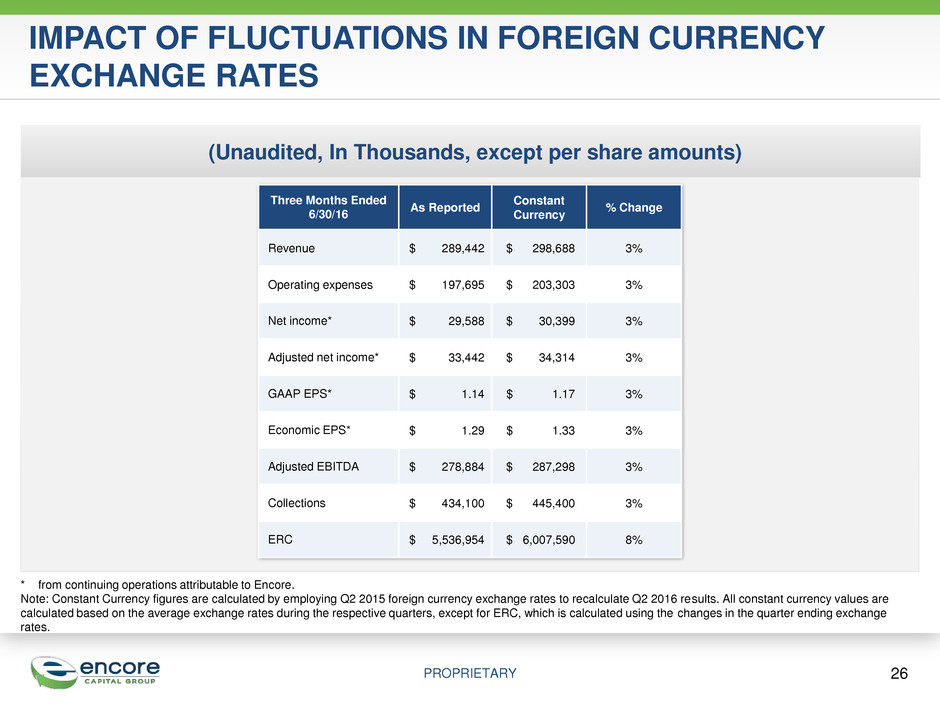

PROPRIETARY (Unaudited, In Thousands, except per share amounts) IMPACT OF FLUCTUATIONS IN FOREIGN CURRENCY EXCHANGE RATES Three Months Ended 6/30/16 As Reported Constant Currency % Change Revenue $ 289,442 $ 298,688 3% Operating expenses $ 197,695 $ 203,303 3% Net income* $ 29,588 $ 30,399 3% Adjusted net income* $ 33,442 $ 34,314 3% GAAP EPS* $ 1.14 $ 1.17 3% Economic EPS* $ 1.29 $ 1.33 3% Adjusted EBITDA $ 278,884 $ 287,298 3% Collections $ 434,100 $ 445,400 3% ERC $ 5,536,954 $ 6,007,590 8% 26 * from continuing operations attributable to Encore. Note: Constant Currency figures are calculated by employing Q2 2015 foreign currency exchange rates to recalculate Q2 2016 results. All constant currency values are calculated based on the average exchange rates during the respective quarters, except for ERC, which is calculated using the changes in the quarter ending exchange rates.