Encore Capital Group, Inc. Q3 2016 EARNINGS CALL Exhibit 99.1

2 CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results, earnings per share, and growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent reports on Form 10-K and Form 10-Q, as they may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

3 ENCORE UPDATE

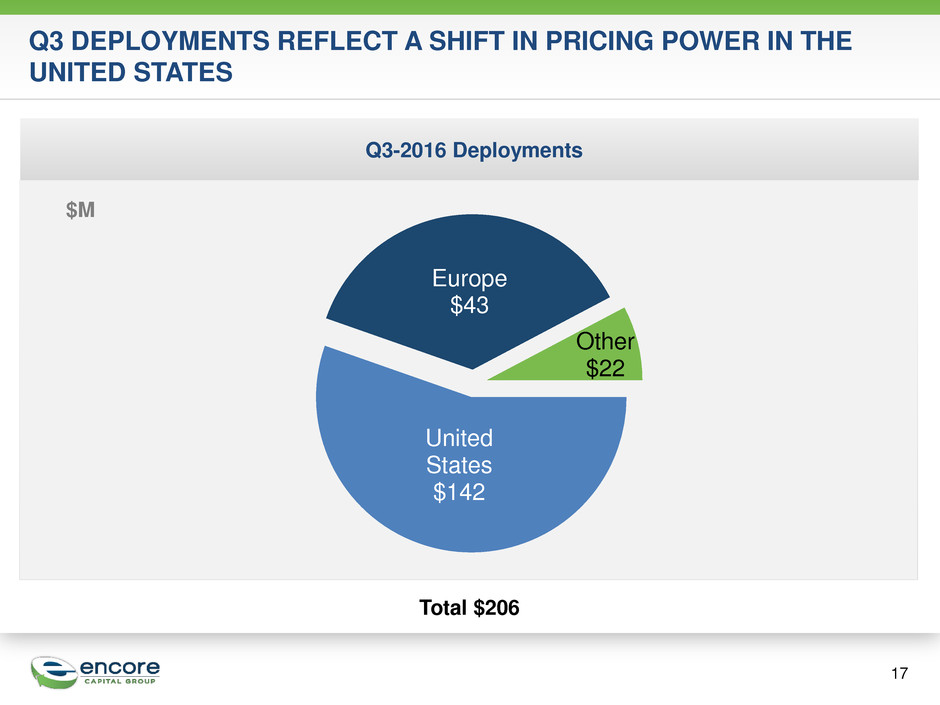

4 U.S. MARKET CONTINUES TO DEMONSTRATE PRICING DISCIPLINE WHILE SUPPLY BEGINS TO IMPROVE We continue to book business at higher returns than last year driven by improved supply and market pricing discipline Supply in the U.S. is on track to rise 15% in 2016 Pricing has meaningfully declined from 2015 Consumer-centric programs continue to improve both liquidations and consumer satisfaction We are purchasing newly committed 2017 forward flows at higher returns than for 2016, which in turn were purchased at higher returns than for 2015 89% of Encore shareholder capital deployed in Q3 was invested in the U.S. market opportunity Encore is favorably positioned in the U.S. market as attractive returns are driven by pricing declines and liquidation improvement programs

5 LEGAL COLLECTIONS EXPECTED TO RAMP UP WHILE STRATEGIC COST MANAGEMENT INITIATIVES REDUCE OPERATING EXPENSES Issuers have caught up with fulfilment of documentation requirements after re-engineering their internal processes Both collections and expenses had been delayed Ramping to normal legal collections run rate as we enter 2017 Revenue recognition remains intact Strategic cost management initiatives continue to reduce operating expenses $23 million lower in Q3 with $5 million related to documentation delay $53 million lower YTD with $8 million related to documentation delay U.S. cost-to-collect of 41.0% in Q3 down 200 basis points compared to Q3 last year

SEVERAL RECENT INDICATORS POINT TO SUPPLY FURTHER INCREASING IN THE FUTURE AS A RESULT OF CREDIT GROWTH • Consumers are taking on a higher debt load at a high rate • Bank CEO’s are explicitly commenting that delinquencies will rise • Outstandings have grown to pre- recession levels • Average household credit card debt has also grown to pre-recession levels We expect supply will continue to increase 6

CABOT CREDIT MANAGEMENT IS A LEADING EUROPEAN DEBT PURCHASING COMPANY Largest debt purchaser in Europe as measured by ERC 22 years of experience and over 1400 unique portfolios Leading servicing and purchasing player in UK & Ireland Entered Spain, France and Portugal in last 12 months, 3 new markets which offer attractive returns Long curves and low, affordable payments provide sustainable and growing ERC as well as long-term revenue streams Cabot has sufficient liquidity for future growth Cabot redeemed £265 million Senior Secured Notes at 10.375% and replaced with £350 million Senior Secured Notes at 7.5% Cabot extended and amended revolving credit facility to £250 million at reduced interest margin 7

8 PORTFOLIO ALLOWANCE CHARGE TAKEN IN Q3 EXPECTED TO COMPREHENSIVELY CONCLUDE EUROPEAN POOL GROUP REVIEW After thorough review, Encore incurred allowance charge in Q3 Cost basis of European pool groups has been reduced by a non-cash charge: $94 million gross consolidated portfolio allowance Adjusting for ownership stake = $43 million Encore share of allowance Applying tax = $37 million Encore share of allowance after tax 1) We had increased our expectations and raised IRR’s under U.S. GAAP based on collections overperformance and expected uplift from operational initiatives 2) These uplifts were delayed and tempered primarily due to revised regulatory requirements and operational initiatives which did not fully materialize European pool group review has also resulted in an overall increase in ERC Root Causes

9 DUE TO REGULATORY CHANGES AND OPERATIONAL CONSTRAINTS, EXPECTED UPLIFTS WERE IMPACTED Regulatory changes drove significant changes in business practices at Cabot, but collection performance did not immediately change Revised business practices were largely implemented by 2014 Post-charge-off interest Income/expense-based means testing to document affordability Refined and extended call framework Heightened requirements to litigate on consumer accounts The cumulative impact of regulatory expectations dampened the upside we were anticipating in the near-term In addition, some near-term improvement initiatives were either delayed or delivered lower results due to operational and regulatory constraints Collections continue to follow a trajectory consistent with the longer and flatter curves we’ve been anticipating – but with only a portion of the uplift we expected

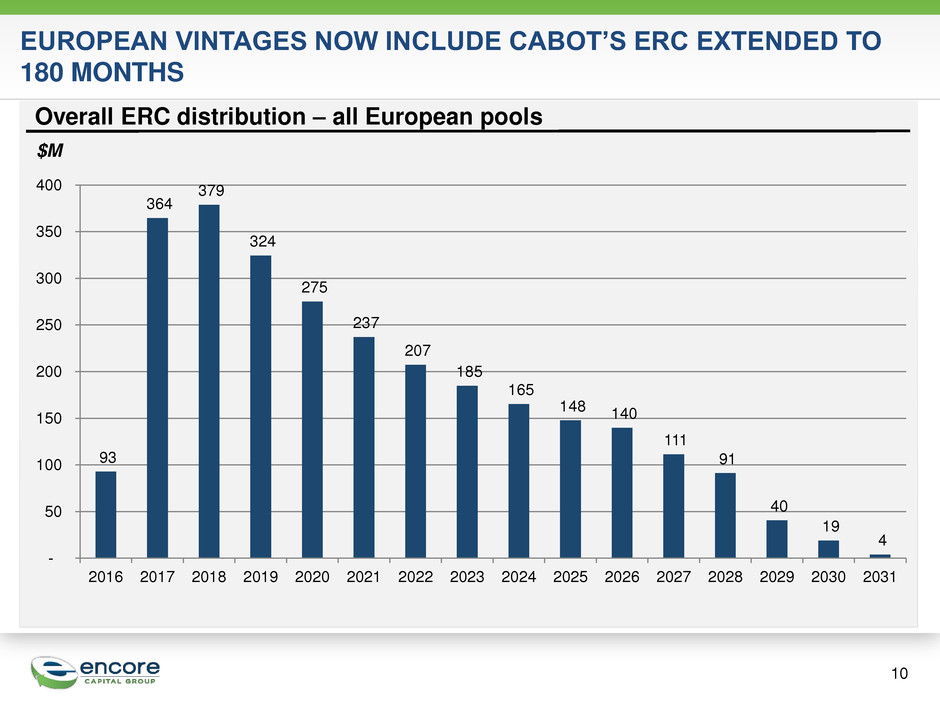

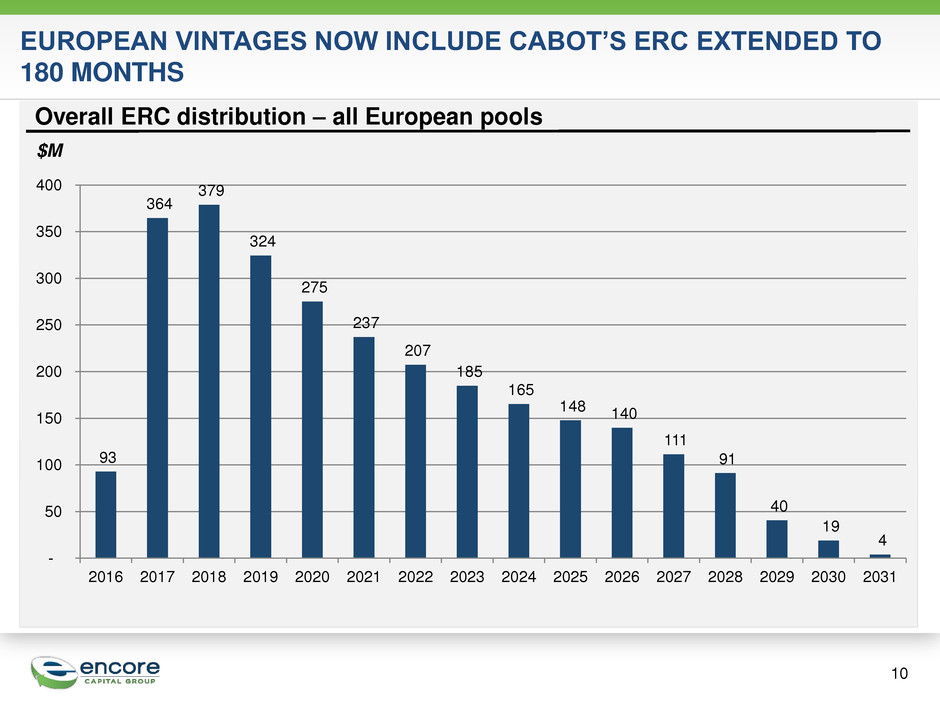

10 EUROPEAN VINTAGES NOW INCLUDE CABOT’S ERC EXTENDED TO 180 MONTHS 93 364 379 324 275 237 207 185 165 148 140 111 91 40 19 4 - 50 100 150 200 250 300 350 400 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Overall ERC distribution – all European pools $M

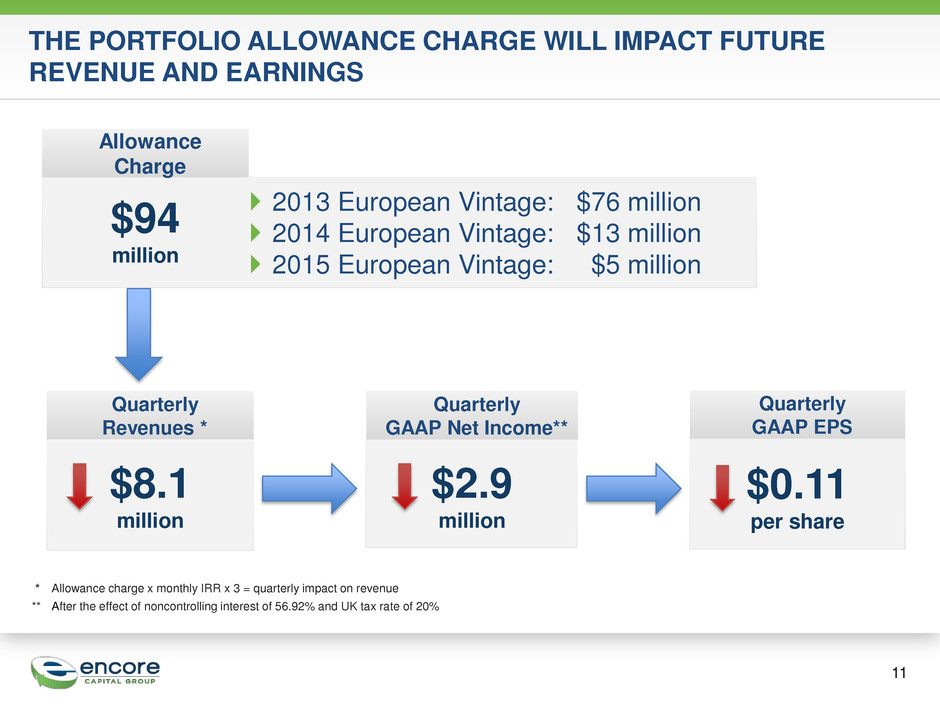

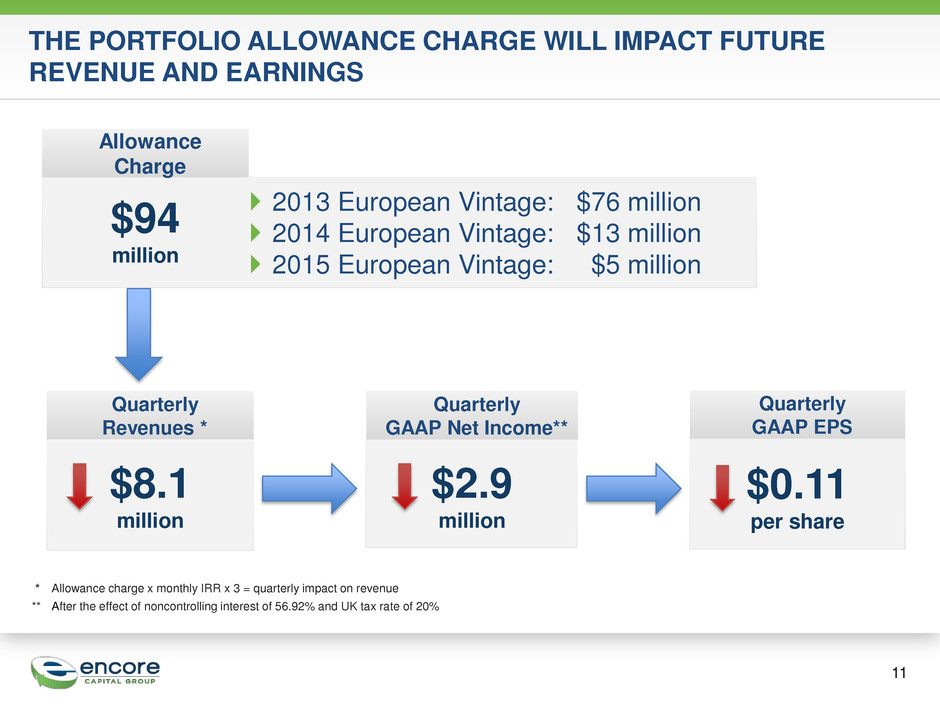

THE PORTFOLIO ALLOWANCE CHARGE WILL IMPACT FUTURE REVENUE AND EARNINGS 11 $94 million Allowance Charge Quarterly Revenues * $8.1 million Quarterly GAAP EPS $0.11 per share Quarterly GAAP Net Income** $2.9 million * Allowance charge x monthly IRR x 3 = quarterly impact on revenue ** After the effect of noncontrolling interest of 56.92% and UK tax rate of 20% 2013 European Vintage: $76 million 2014 European Vintage: $13 million 2015 European Vintage: $5 million

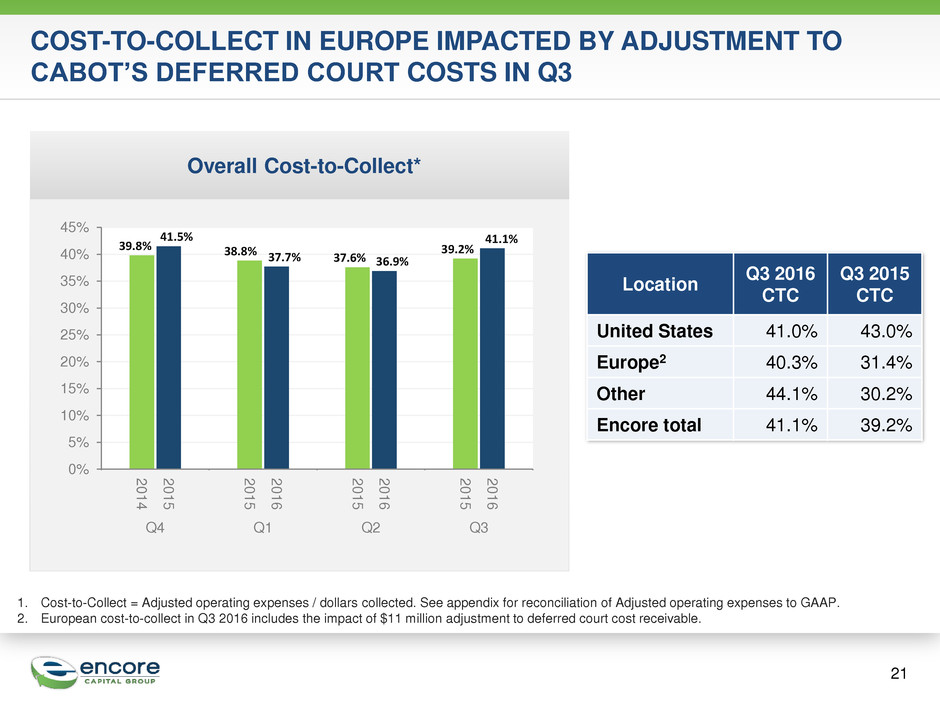

12 ALSO IN Q3, ENCORE HAS MADE AN ADJUSTMENT TO CABOT’S DEFERRED COURT COSTS For successful litigation, court costs incurred are recoverable from the consumer Recoverable costs are capitalized based on the percentage of court costs expected to be recovered in the future We have adjusted our expectations for recovering Cabot-related court costs due to the cumulative impact of regulatory changes on our recoveries and the change in the mix of assets purchased by Cabot After accounting for noncontrolling interest, the non-cash deferred court cost adjustment was $4 million after tax

13 CFPB’S OUTLINE OF PROPOSED NEW INDUSTRY RULES ALIGNS WELL WITH ENCORE’S CURRENT PRACTICES We’re pleased that many of the proposed rules in the outline are consistent with our own recommendations or our current practices Because of this, actual rule implementation for Encore will be greatly advanced compared to others in the industry The new rules will create a more level playing field, provide needed clarity and remove uncertainty that has been over-hanging our company and the industry We continue to have thoughtful dialogue with the CFPB on areas where unintended consumer consequences may occur Based on our understanding of the rule-making process, we expect final CFPB rules will be in place and effective sometime in early 2018

14 Detailed Financial Discussion

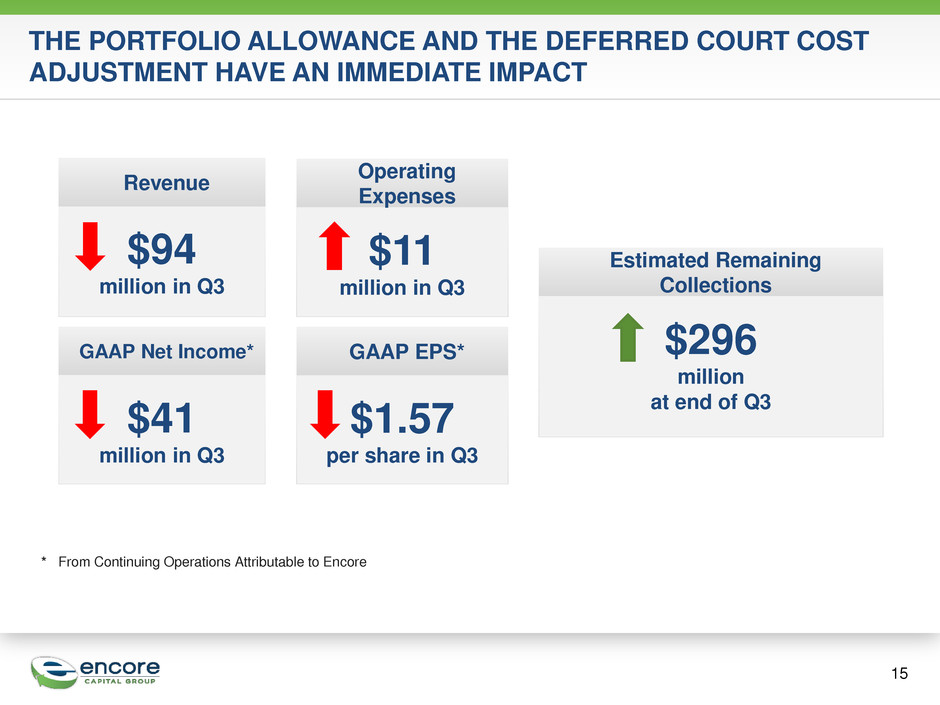

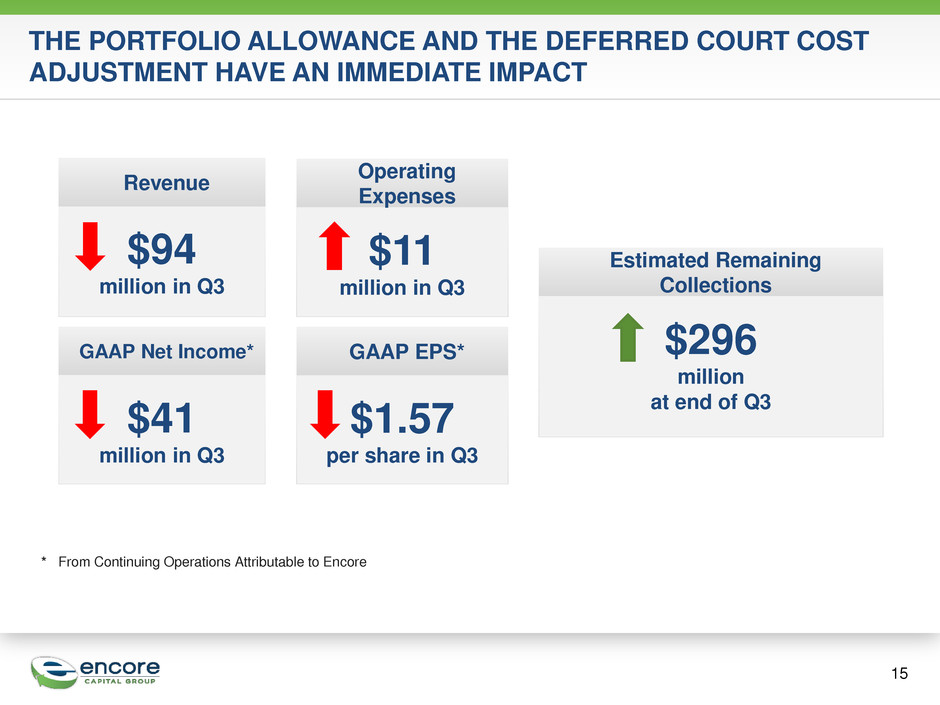

15 THE PORTFOLIO ALLOWANCE AND THE DEFERRED COURT COST ADJUSTMENT HAVE AN IMMEDIATE IMPACT Operating Expenses $11 million in Q3 Revenue $94 million in Q3 GAAP Net Income* $41 million in Q3 $1.57 per share in Q3 GAAP EPS* * From Continuing Operations Attributable to Encore Estimated Remaining Collections $296 million at end of Q3

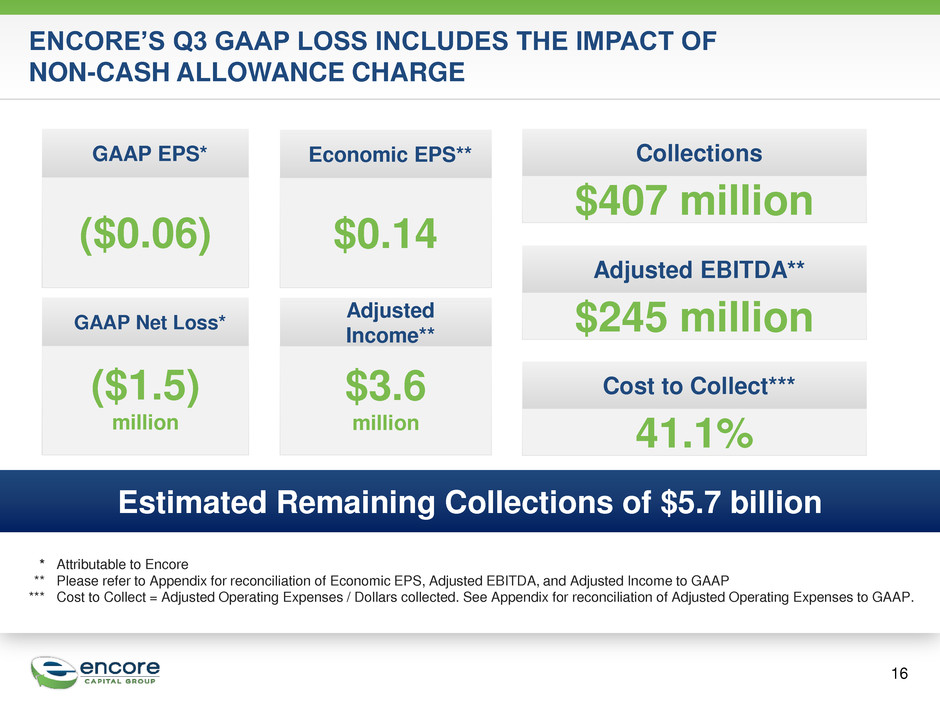

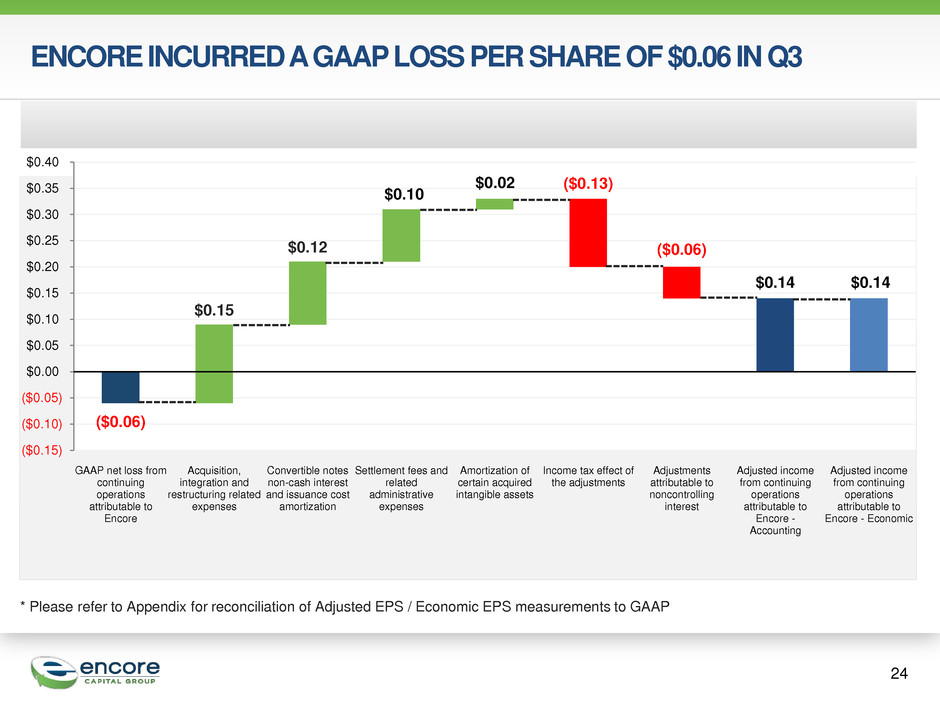

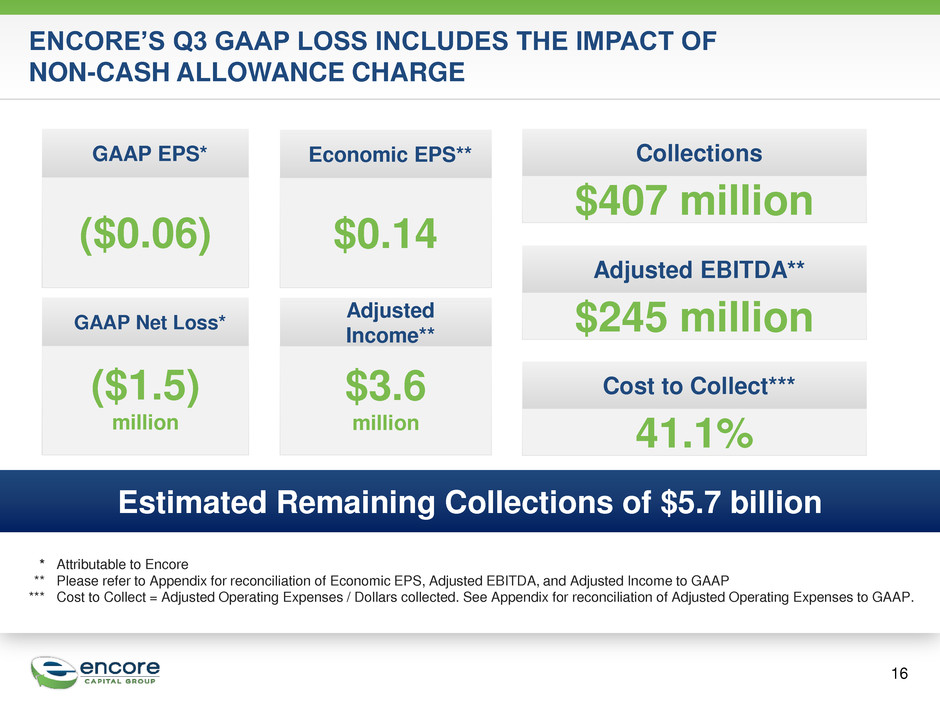

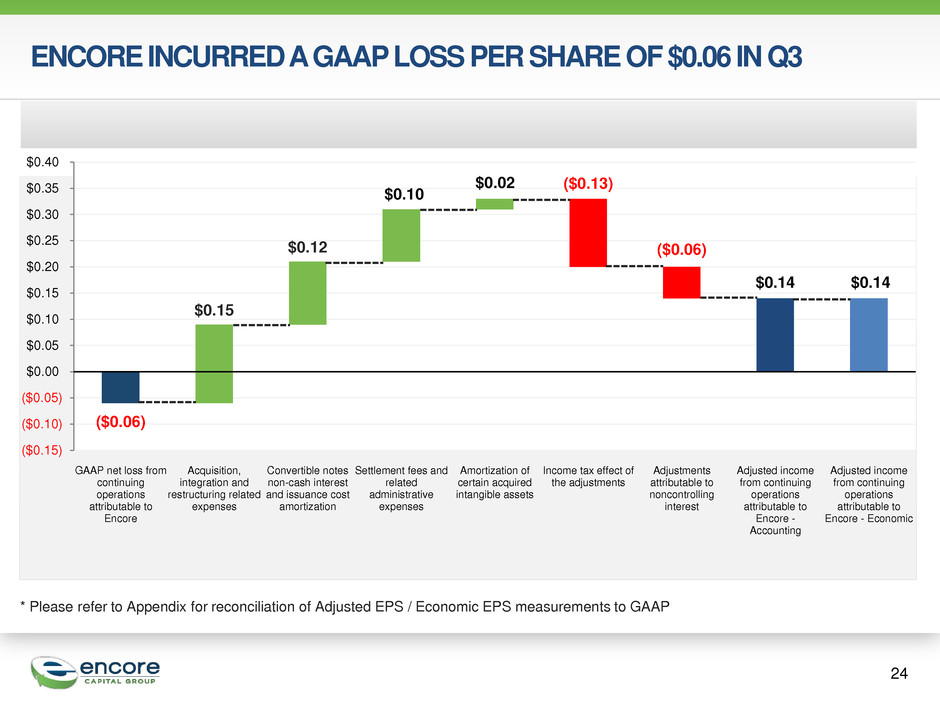

16 ENCORE’S Q3 GAAP LOSS INCLUDES THE IMPACT OF NON-CASH ALLOWANCE CHARGE $0.14 Economic EPS** GAAP EPS* ($0.06) GAAP Net Loss* ($1.5) million Adjusted Income** $3.6 million Estimated Remaining Collections of $5.7 billion * Attributable to Encore ** Please refer to Appendix for reconciliation of Economic EPS, Adjusted EBITDA, and Adjusted Income to GAAP *** Cost to Collect = Adjusted Operating Expenses / Dollars collected. See Appendix for reconciliation of Adjusted Operating Expenses to GAAP. Adjusted EBITDA** $245 million Collections $407 million Cost to Collect*** 41.1%

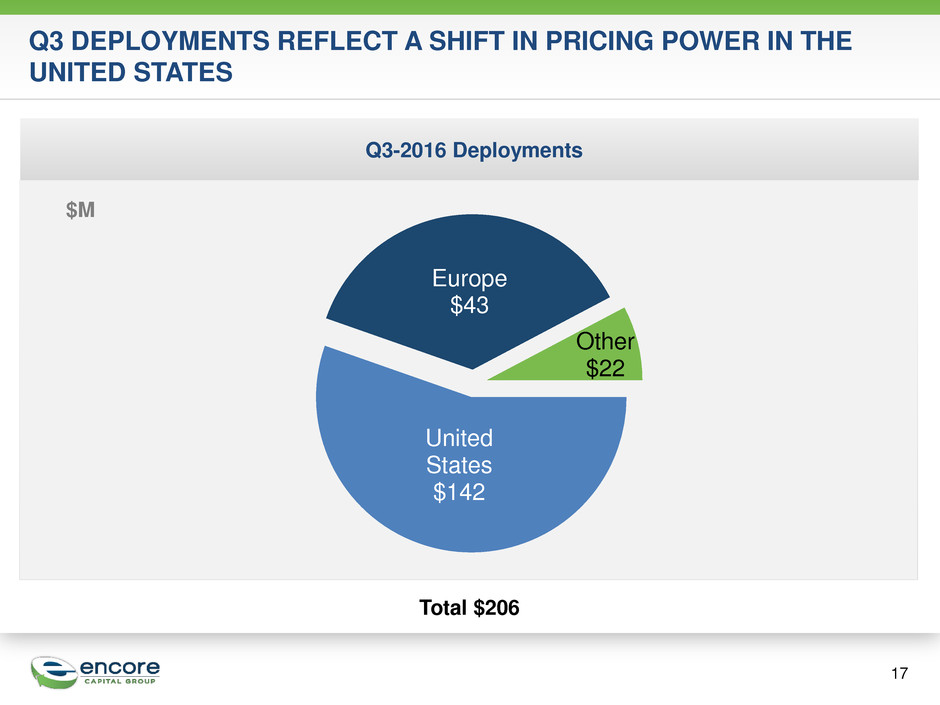

17 Q3 DEPLOYMENTS REFLECT A SHIFT IN PRICING POWER IN THE UNITED STATES Q3-2016 Deployments $M United States $142 Europe $43 Other $22 Total $206

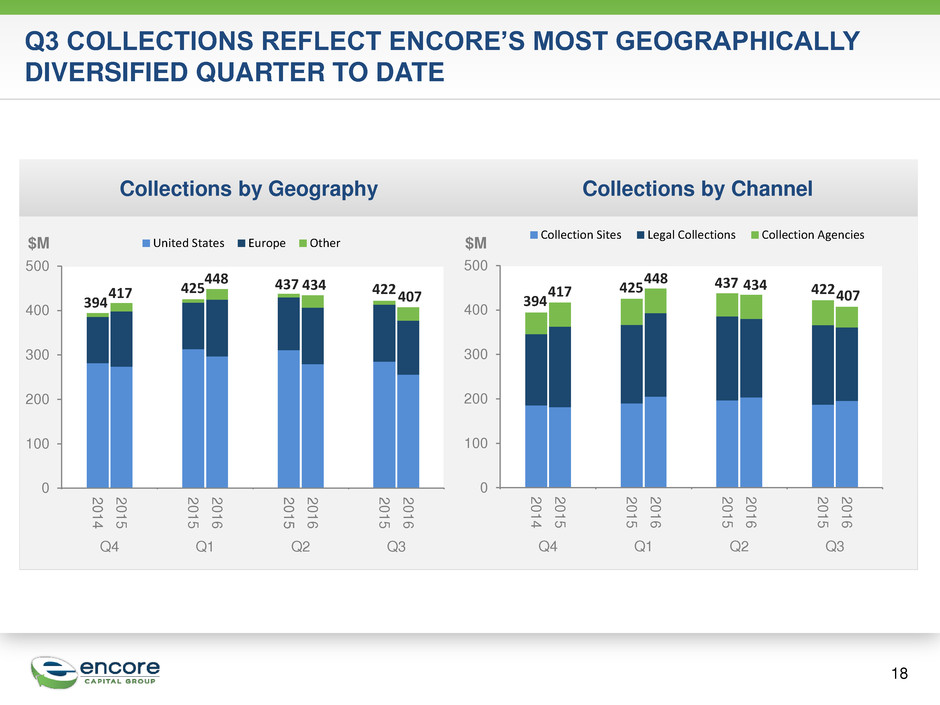

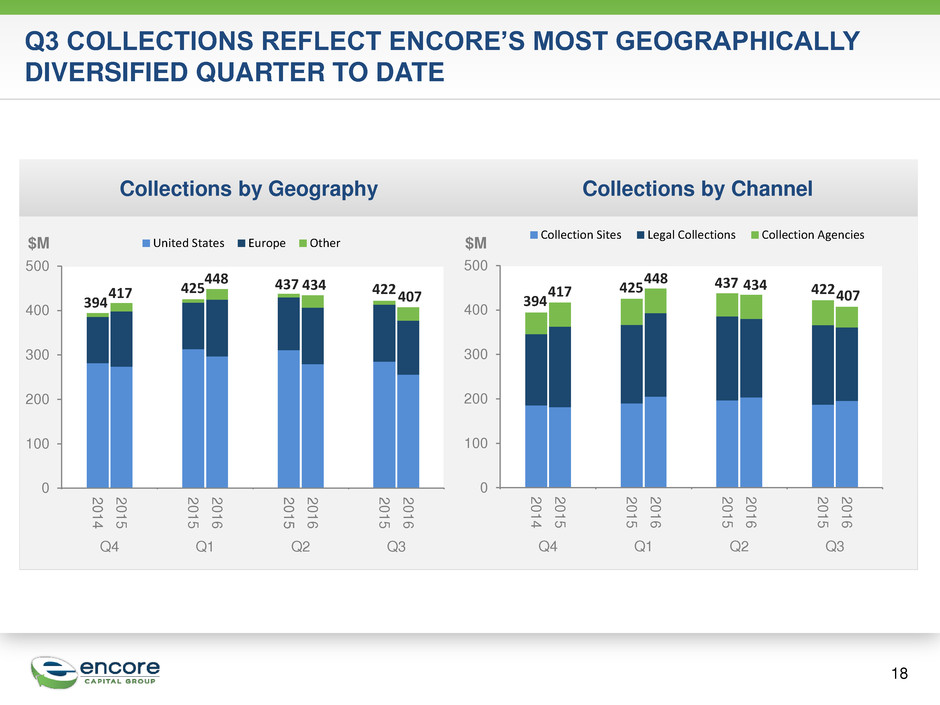

18 Q3 COLLECTIONS REFLECT ENCORE’S MOST GEOGRAPHICALLY DIVERSIFIED QUARTER TO DATE Collections by Geography 0 100 200 300 400 500 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q4 Q1 Q2 Q3 Collection Sites Legal Collections Collection Agencies $M 0 100 200 300 400 500 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q4 Q1 Q2 Q3 United States Europe Other 417 425 437 422 394 448 434 407 $M Collections by Channel 417 425 437 422 394 448 434 407

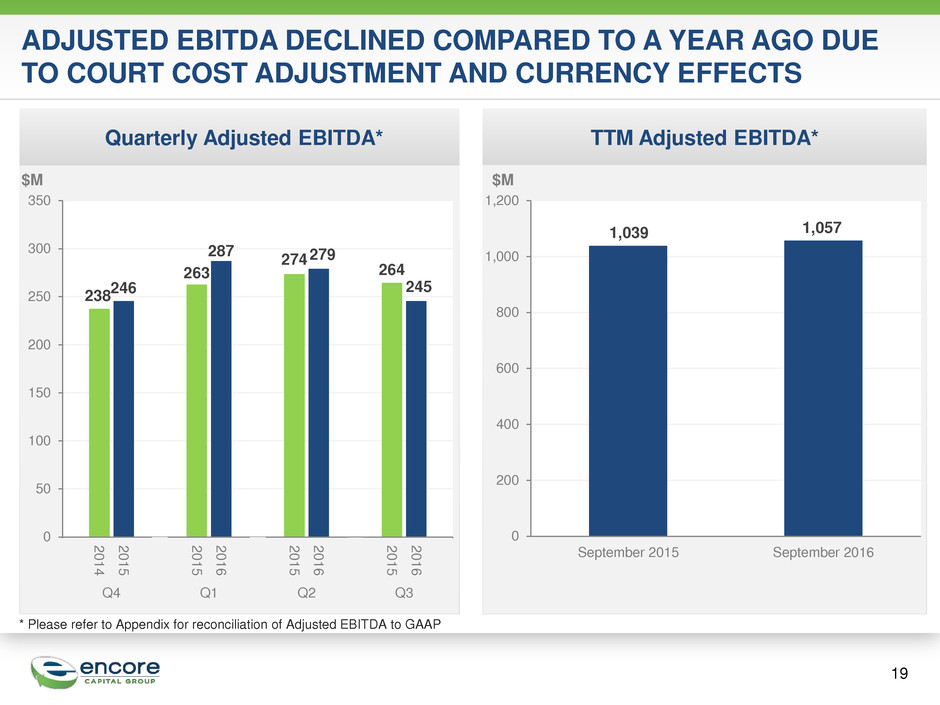

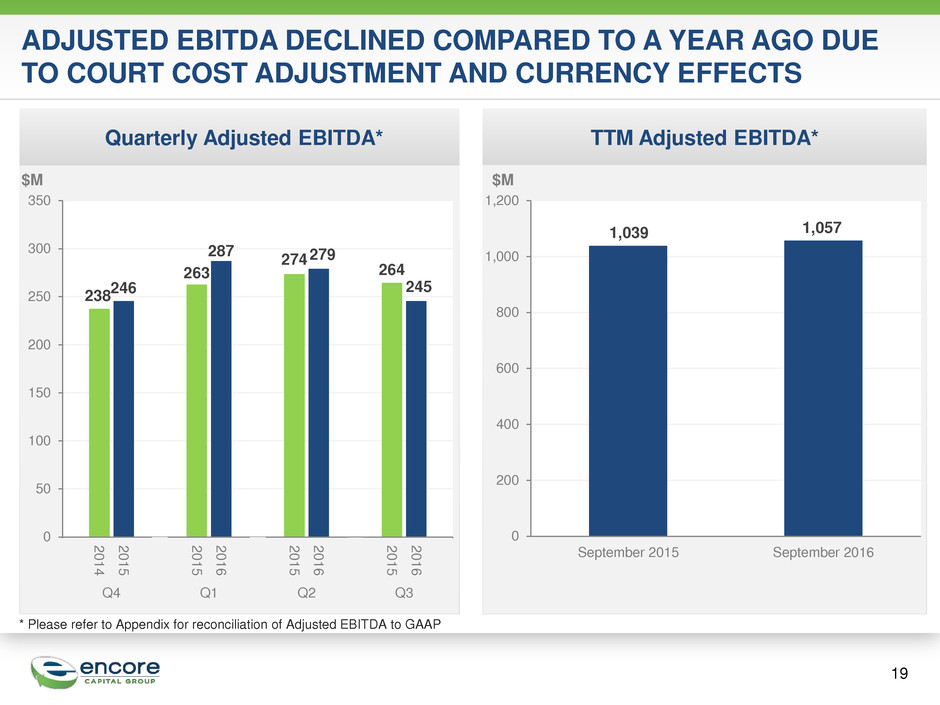

ADJUSTED EBITDA DECLINED COMPARED TO A YEAR AGO DUE TO COURT COST ADJUSTMENT AND CURRENCY EFFECTS 19 * Please refer to Appendix for reconciliation of Adjusted EBITDA to GAAP $M Quarterly Adjusted EBITDA* TTM Adjusted EBITDA* 238 246 263 287 274 279 264 245 0 50 100 150 200 250 300 350 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q4 Q1 Q2 Q3 1,039 1,057 0 200 400 600 800 1,000 1,200 September 2015 September 2016 $M $M

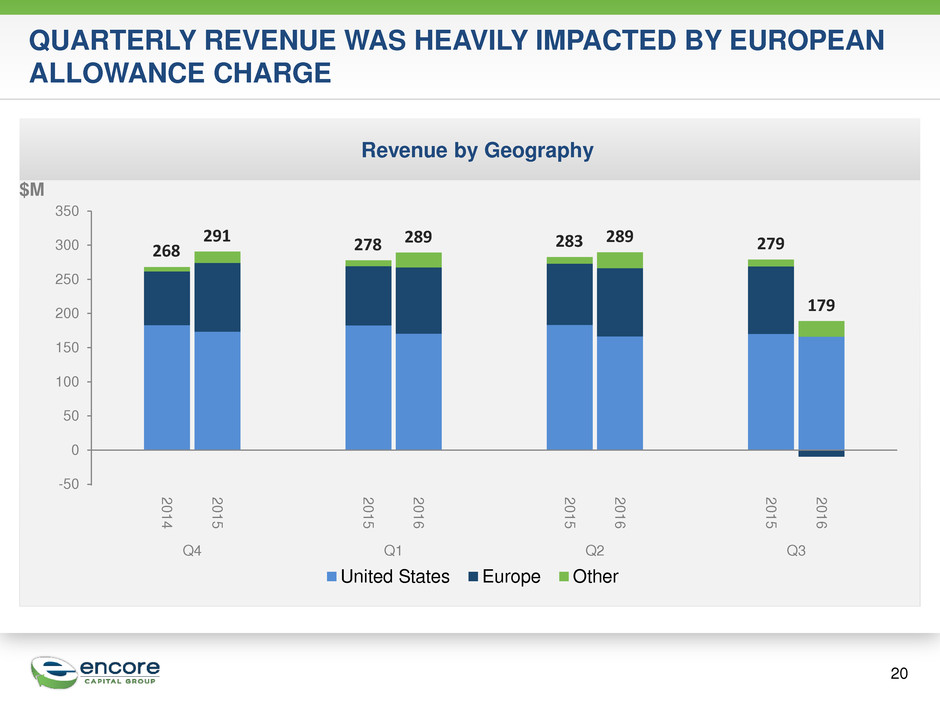

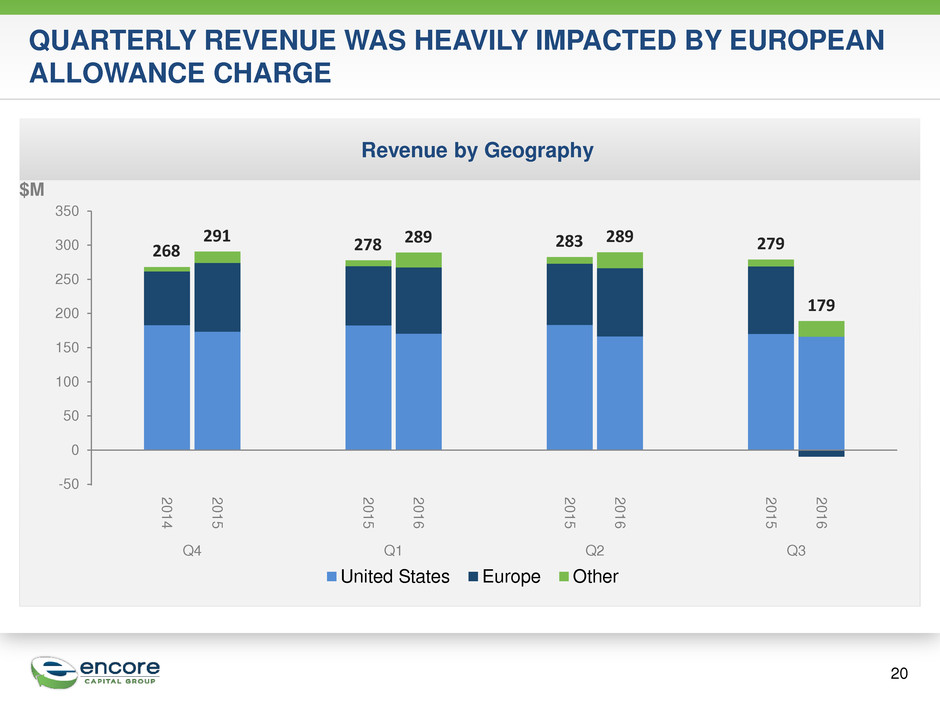

QUARTERLY REVENUE WAS HEAVILY IMPACTED BY EUROPEAN ALLOWANCE CHARGE Revenue by Geography 20 -50 0 50 100 150 200 250 300 350 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q4 Q1 Q2 Q3 United States Europe Other $M 289 283 279 291 278 289 179 268

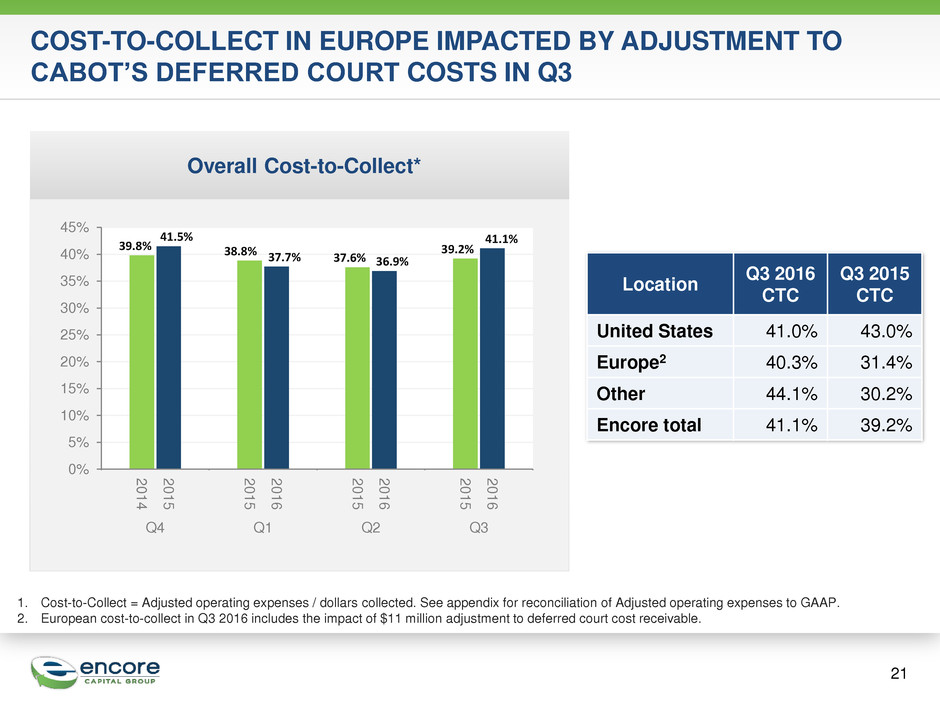

COST-TO-COLLECT IN EUROPE IMPACTED BY ADJUSTMENT TO CABOT’S DEFERRED COURT COSTS IN Q3 21 Overall Cost-to-Collect* 39.8% 41.5% 38.8% 37.7% 37.6% 36.9% 39.2% 41.1% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2 0 1 4 2 0 1 5 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 Q4 Q1 Q2 Q3 1. Cost-to-Collect = Adjusted operating expenses / dollars collected. See appendix for reconciliation of Adjusted operating expenses to GAAP. 2. European cost-to-collect in Q3 2016 includes the impact of $11 million adjustment to deferred court cost receivable. Location Q3 2016 CTC Q3 2015 CTC United States 41.0% 43.0% Europe2 40.3% 31.4% Other 44.1% 30.2% Encore total 41.1% 39.2%

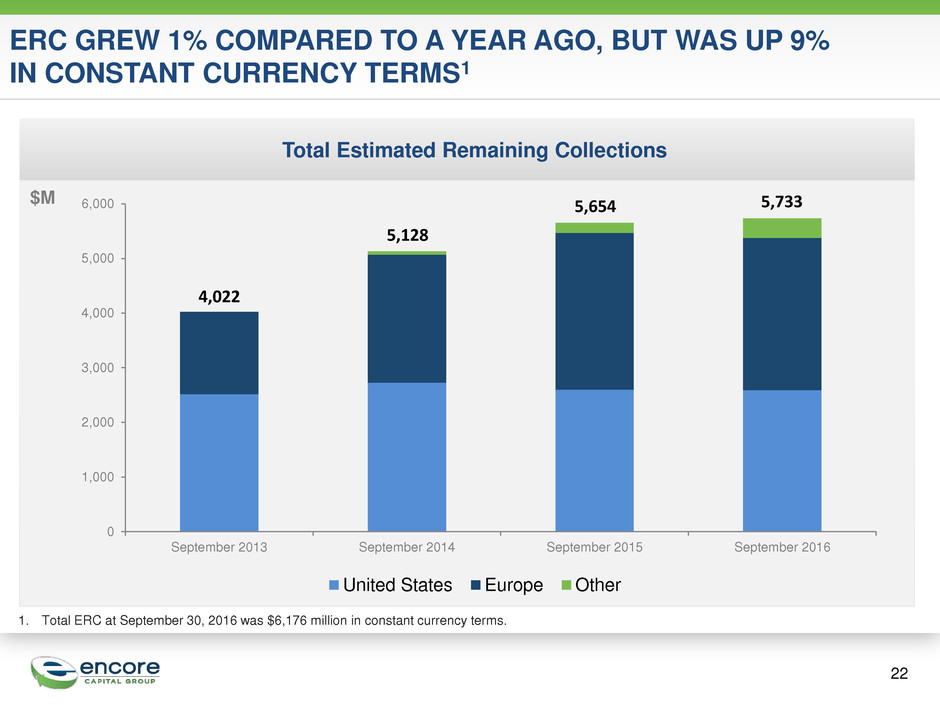

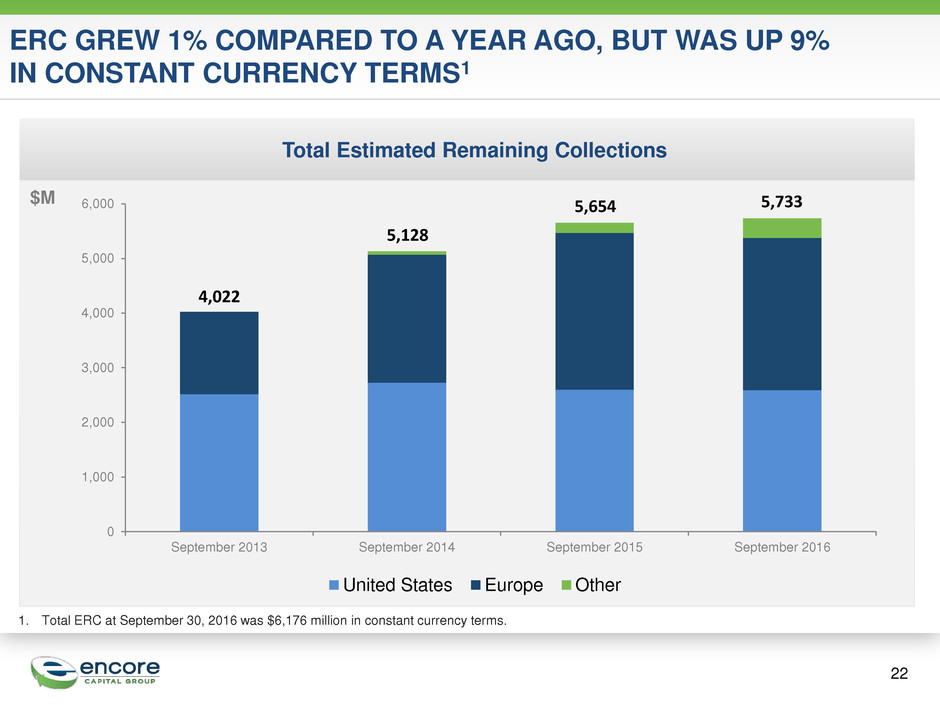

22 ERC GREW 1% COMPARED TO A YEAR AGO, BUT WAS UP 9% IN CONSTANT CURRENCY TERMS1 Total Estimated Remaining Collections 0 1,000 2,000 3,000 4,000 5,000 6,000 September 2013 September 2014 September 2015 September 2016 United States Europe Other 4,022 5,128 5,654 $M 5,733 1. Total ERC at September 30, 2016 was $6,176 million in constant currency terms.

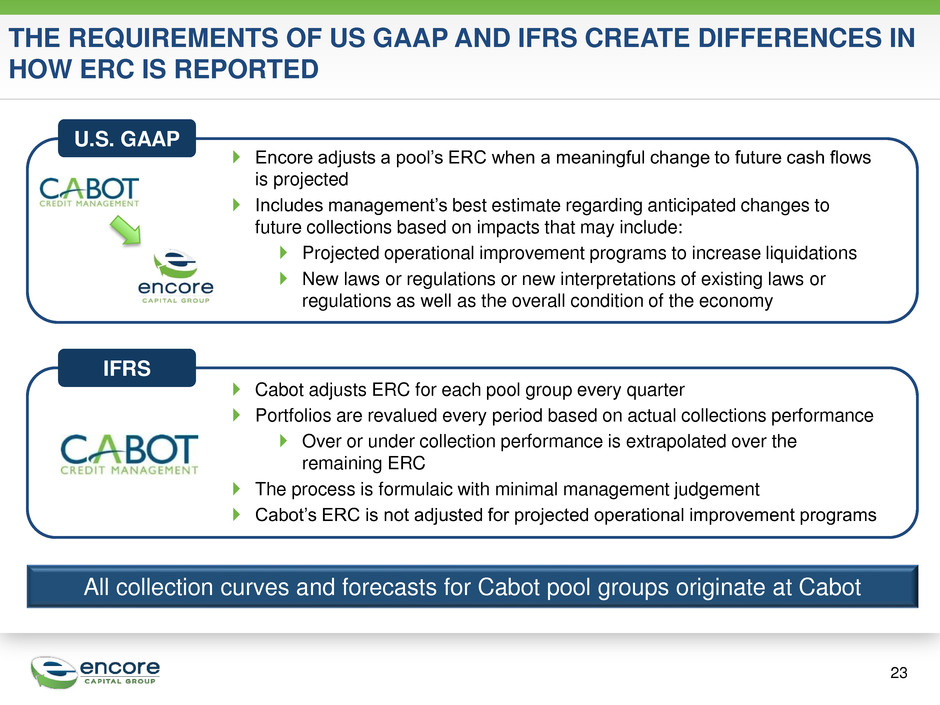

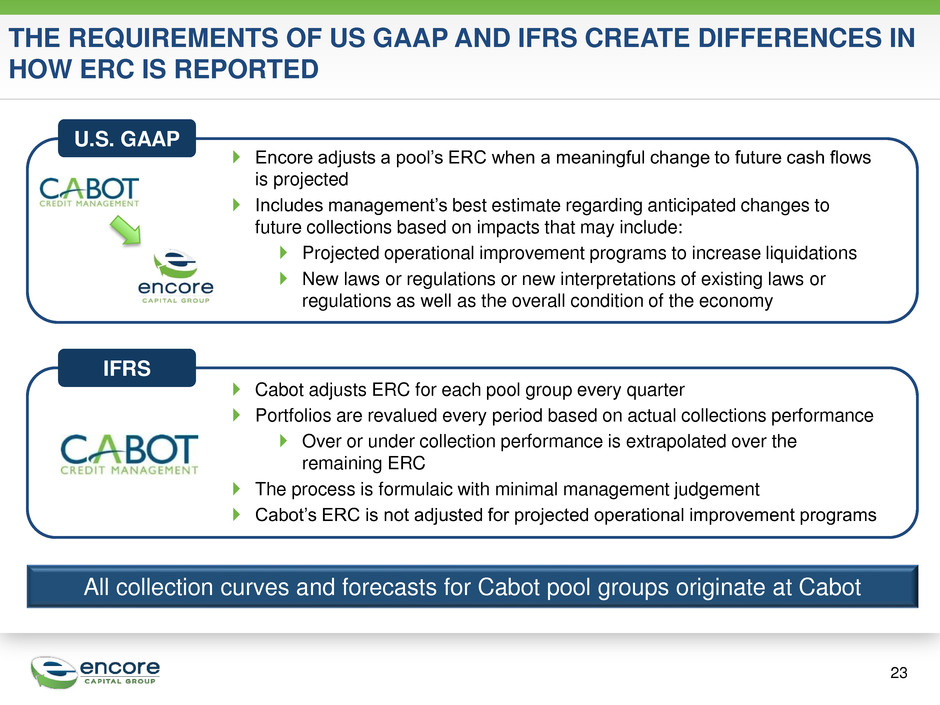

THE REQUIREMENTS OF US GAAP AND IFRS CREATE DIFFERENCES IN HOW ERC IS REPORTED 23 U.S. GAAP Encore adjusts a pool’s ERC when a meaningful change to future cash flows is projected Includes management’s best estimate regarding anticipated changes to future collections based on impacts that may include: Projected operational improvement programs to increase liquidations New laws or regulations or new interpretations of existing laws or regulations as well as the overall condition of the economy Cabot adjusts ERC for each pool group every quarter Portfolios are revalued every period based on actual collections performance Over or under collection performance is extrapolated over the remaining ERC The process is formulaic with minimal management judgement Cabot’s ERC is not adjusted for projected operational improvement programs IFRS All collection curves and forecasts for Cabot pool groups originate at Cabot

ENCORE INCURRED A GAAP LOSS PER SHARE OF $0.06 IN Q3 24 * Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP ($0.06) $0.02 $0.10 ($0.13) ($0.06) $0.14 $0.14 $0.15 $0.12 ($0.15) ($0.10) ($0.05) $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 GAAP net loss from continuing operations attributable to Encore Acquisition, integration and restructuring related expenses Convertible notes non-cash interest and issuance cost amortization Settlement fees and related administrative expenses Amortization of certain acquired intangible assets Income tax effect of the adjustments Adjustments attributable to noncontrolling interest Adjusted income from continuing operations attributable to Encore - Accounting Adjusted income from continuing operations attributable to Encore - Economic

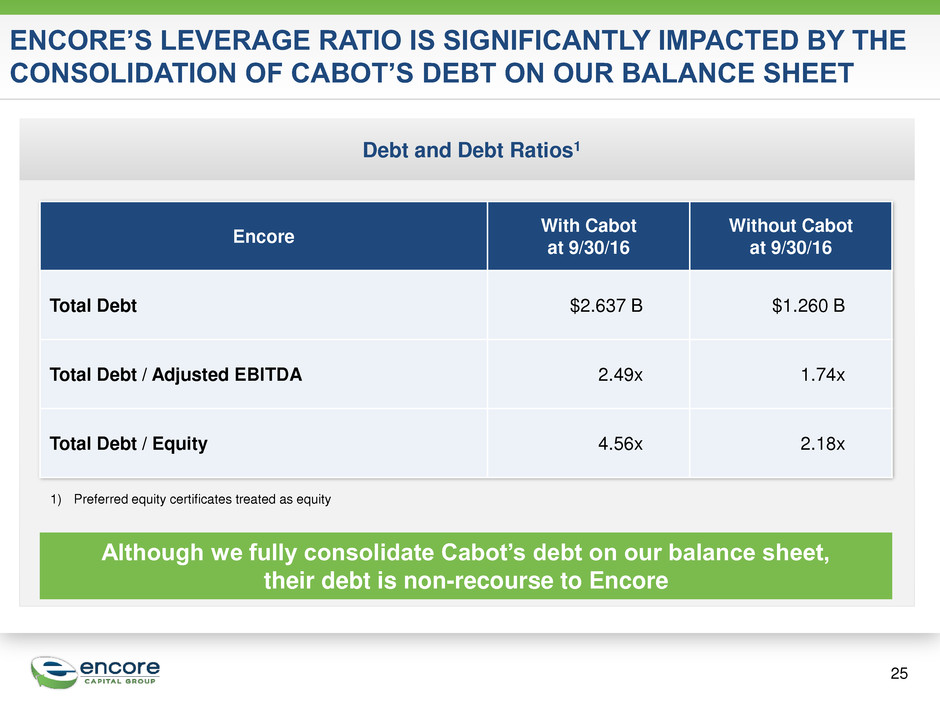

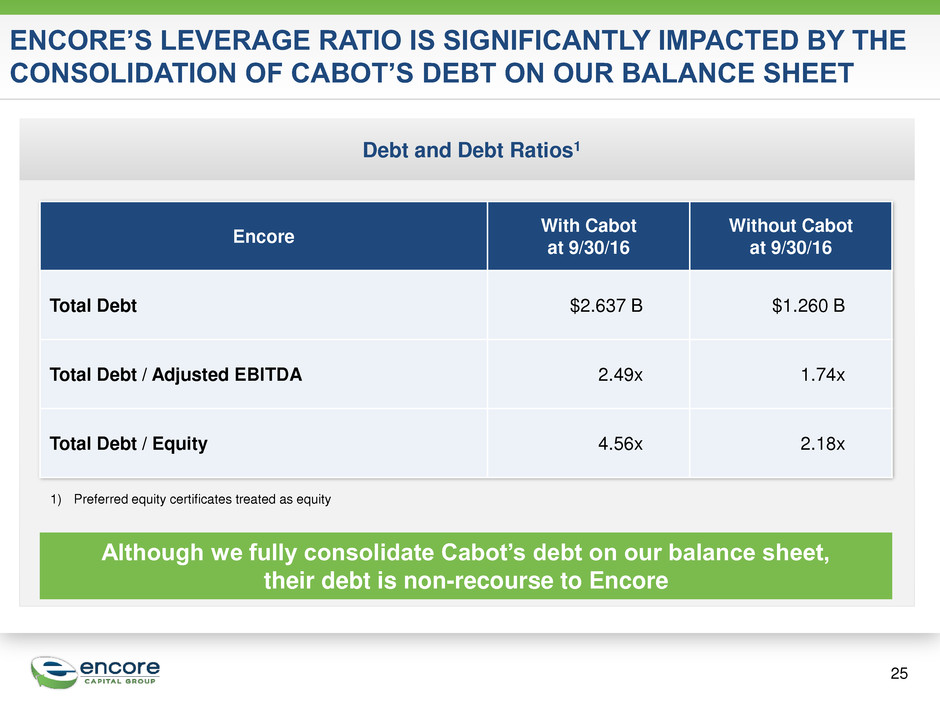

25 ENCORE’S LEVERAGE RATIO IS SIGNIFICANTLY IMPACTED BY THE CONSOLIDATION OF CABOT’S DEBT ON OUR BALANCE SHEET Debt and Debt Ratios1 Although we fully consolidate Cabot’s debt on our balance sheet, their debt is non-recourse to Encore Encore With Cabot at 9/30/16 Without Cabot at 9/30/16 Total Debt $2.637 B $1.260 B Total Debt / Adjusted EBITDA 2.49x 1.74x Total Debt / Equity 4.56x 2.18x 1) Preferred equity certificates treated as equity

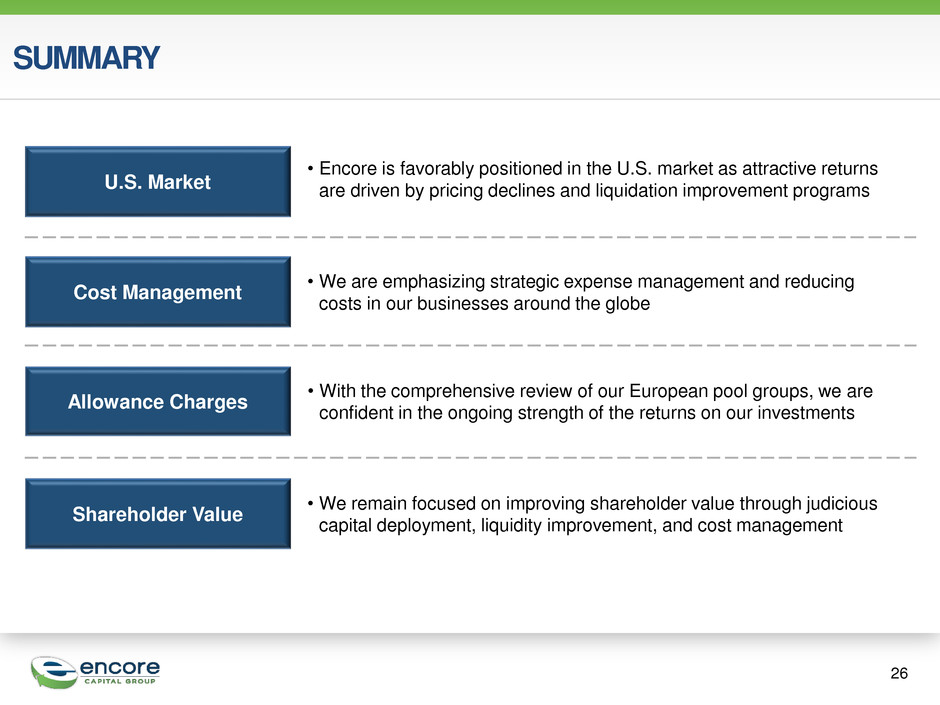

SUMMARY Cost Management • We are emphasizing strategic expense management and reducing costs in our businesses around the globe Allowance Charges • With the comprehensive review of our European pool groups, we are confident in the ongoing strength of the returns on our investments Shareholder Value • We remain focused on improving shareholder value through judicious capital deployment, liquidity improvement, and cost management 26 U.S. Market • Encore is favorably positioned in the U.S. market as attractive returns are driven by pricing declines and liquidation improvement programs

27 Q&A

28 Appendix

29 NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information, which is materially similar in calculation to a financial measure contained in covenants used in the Company's revolving credit facility, in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order to highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore, Adjusted Income Attributable to Encore per Share/Economic EPS, and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

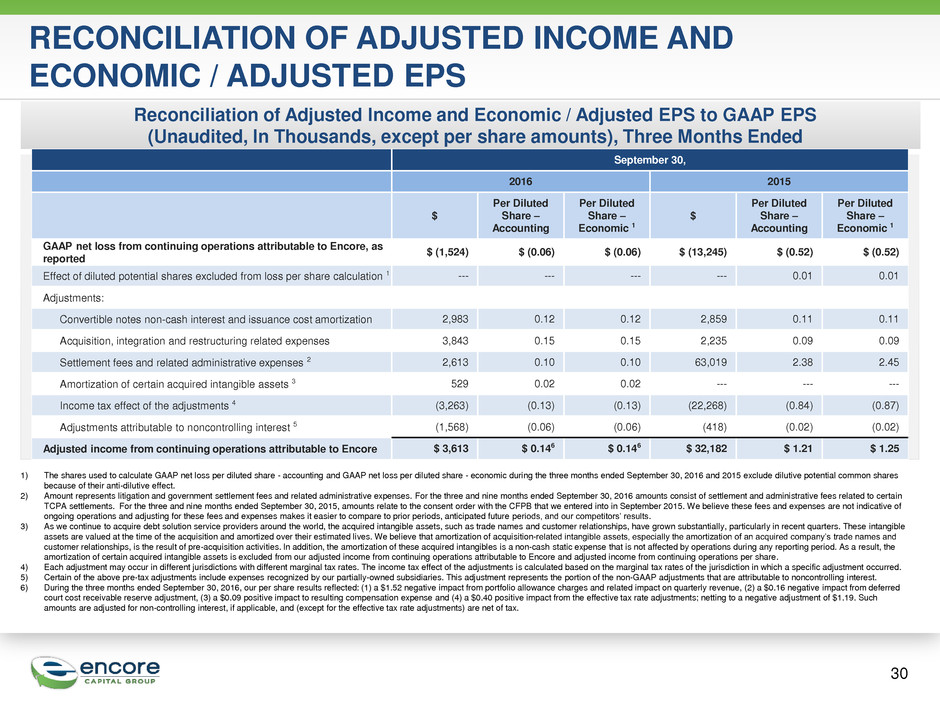

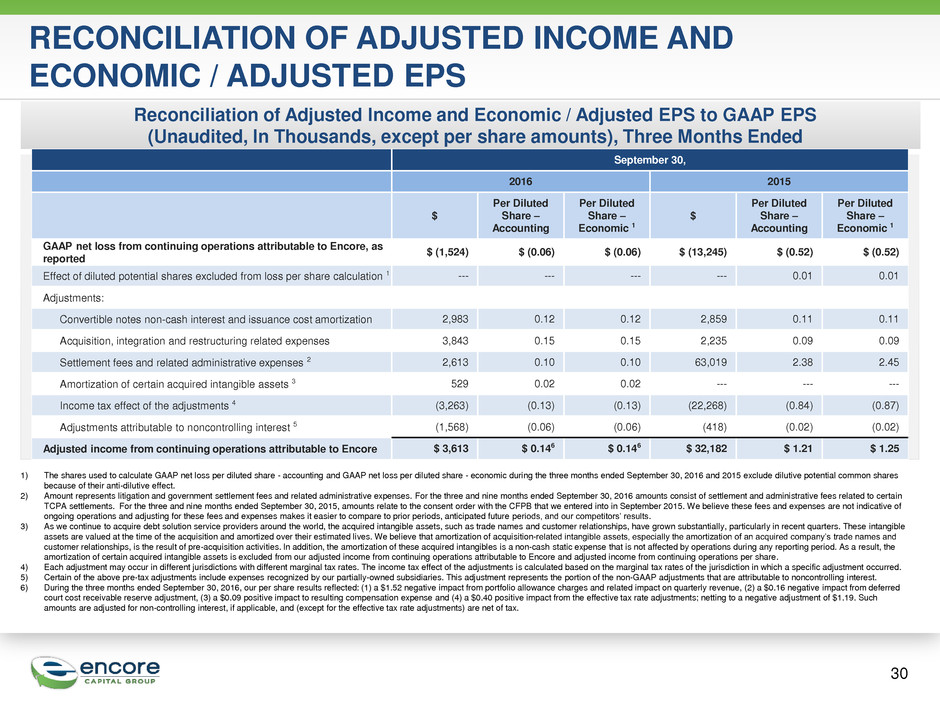

30 RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended September 30, 2016 2015 $ Per Diluted Share – Accounting Per Diluted Share – Economic 1 $ Per Diluted Share – Accounting Per Diluted Share – Economic 1 GAAP net loss from continuing operations attributable to Encore, as reported $ (1,524) $ (0.06) $ (0.06) $ (13,245) $ (0.52) $ (0.52) Effect of diluted potential shares excluded from loss per share calculation 1 --- --- --- --- 0.01 0.01 Adjustments: Convertible notes non-cash interest and issuance cost amortization 2,983 0.12 0.12 2,859 0.11 0.11 Acquisition, integration and restructuring related expenses 3,843 0.15 0.15 2,235 0.09 0.09 Settlement fees and related administrative expenses 2 2,613 0.10 0.10 63,019 2.38 2.45 Amortization of certain acquired intangible assets 3 529 0.02 0.02 --- --- --- Income tax effect of the adjustments 4 (3,263) (0.13) (0.13) (22,268) (0.84) (0.87) Adjustments attributable to noncontrolling interest 5 (1,568) (0.06) (0.06) (418) (0.02) (0.02) Adjusted income from continuing operations attributable to Encore $ 3,613 $ 0.146 $ 0.146 $ 32,182 $ 1.21 $ 1.25 1) The shares used to calculate GAAP net loss per diluted share - accounting and GAAP net loss per diluted share - economic during the three months ended September 30, 2016 and 2015 exclude dilutive potential common shares because of their anti-dilutive effect. 2) Amount represents litigation and government settlement fees and related administrative expenses. For the three and nine months ended September 30, 2016 amounts consist of settlement and administrative fees related to certain TCPA settlements. For the three and nine months ended September 30, 2015, amounts relate to the consent order with the CFPB that we entered into in September 2015. We believe these fees and expenses are not indicative of ongoing operations and adjusting for these fees and expenses makes it easier to compare to prior periods, anticipated future periods, and our competitors’ results. 3) As we continue to acquire debt solution service providers around the world, the acquired intangible assets, such as trade names and customer relationships, have grown substantially, particularly in recent quarters. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the amortization of these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. As a result, the amortization of certain acquired intangible assets is excluded from our adjusted income from continuing operations attributable to Encore and adjusted income from continuing operations per share. 4) Each adjustment may occur in different jurisdictions with different marginal tax rates. The income tax effect of the adjustments is calculated based on the marginal tax rates of the jurisdiction in which a specific adjustment occurred. 5) Certain of the above pre-tax adjustments include expenses recognized by our partially-owned subsidiaries. This adjustment represents the portion of the non-GAAP adjustments that are attributable to noncontrolling interest. 6) During the three months ended September 30, 2016, our per share results reflected: (1) a $1.52 negative impact from portfolio allowance charges and related impact on quarterly revenue, (2) a $0.16 negative impact from deferred court cost receivable reserve adjustment, (3) a $0.09 positive impact to resulting compensation expense and (4) a $0.40 positive impact from the effective tax rate adjustments; netting to a negative adjustment of $1.19. Such amounts are adjusted for non-controlling interest, if applicable, and (except for the effective tax rate adjustments) are net of tax.

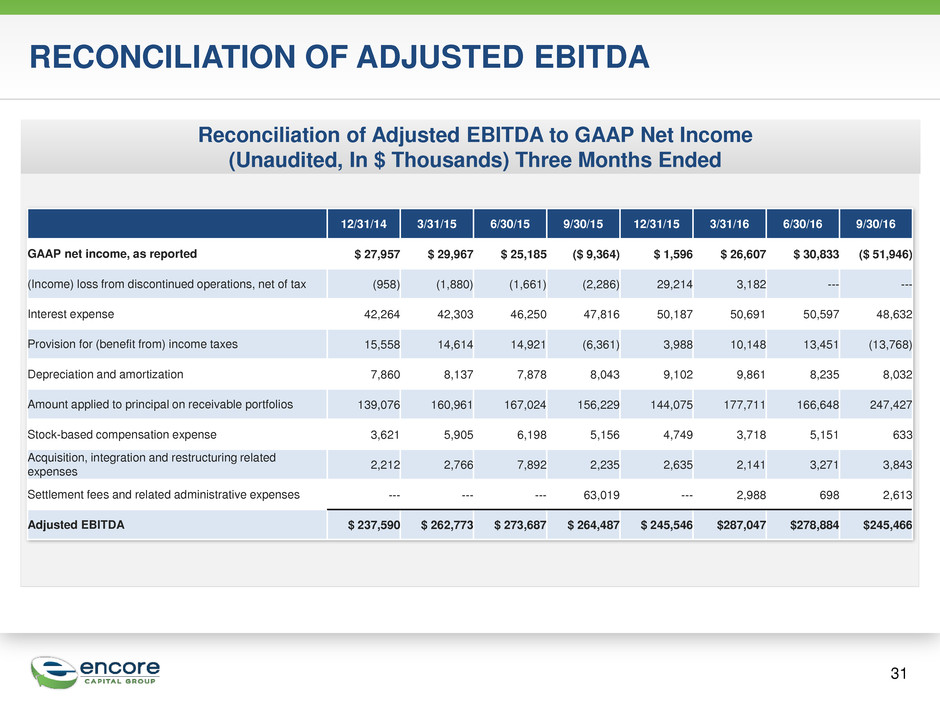

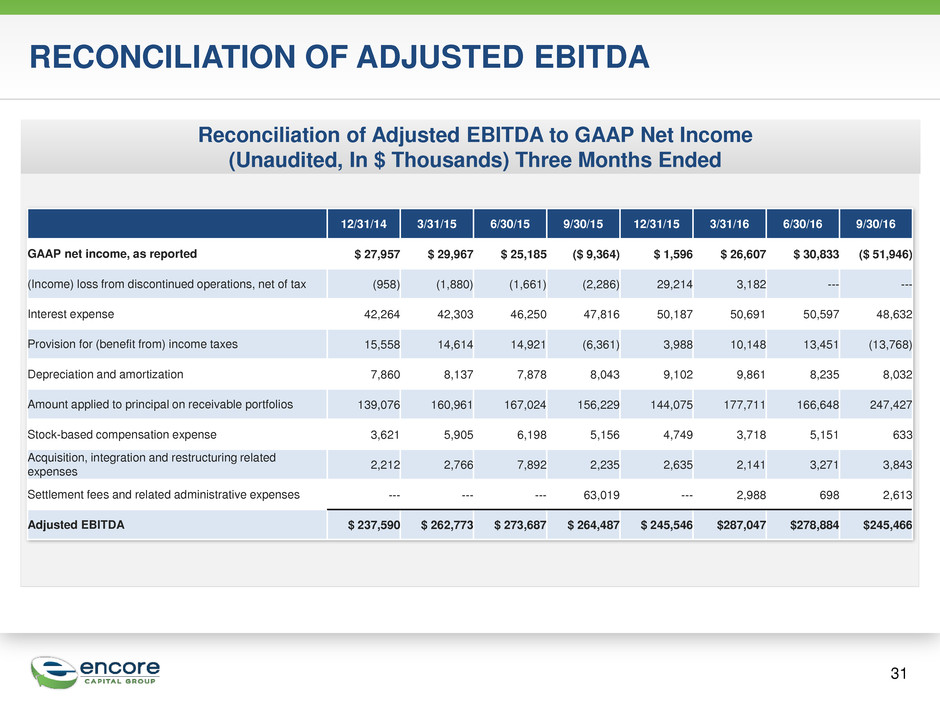

Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 9/30/16 GAAP net income, as reported $ 27,957 $ 29,967 $ 25,185 ($ 9,364) $ 1,596 $ 26,607 $ 30,833 ($ 51,946) (Income) loss from discontinued operations, net of tax (958) (1,880) (1,661) (2,286) 29,214 3,182 --- --- Interest expense 42,264 42,303 46,250 47,816 50,187 50,691 50,597 48,632 Provision for (benefit from) income taxes 15,558 14,614 14,921 (6,361) 3,988 10,148 13,451 (13,768) Depreciation and amortization 7,860 8,137 7,878 8,043 9,102 9,861 8,235 8,032 Amount applied to principal on receivable portfolios 139,076 160,961 167,024 156,229 144,075 177,711 166,648 247,427 Stock-based compensation expense 3,621 5,905 6,198 5,156 4,749 3,718 5,151 633 Acquisition, integration and restructuring related expenses 2,212 2,766 7,892 2,235 2,635 2,141 3,271 3,843 Settlement fees and related administrative expenses --- --- --- 63,019 --- 2,988 698 2,613 Adjusted EBITDA $ 237,590 $ 262,773 $ 273,687 $ 264,487 $ 245,546 $287,047 $278,884 $245,466 RECONCILIATION OF ADJUSTED EBITDA 31

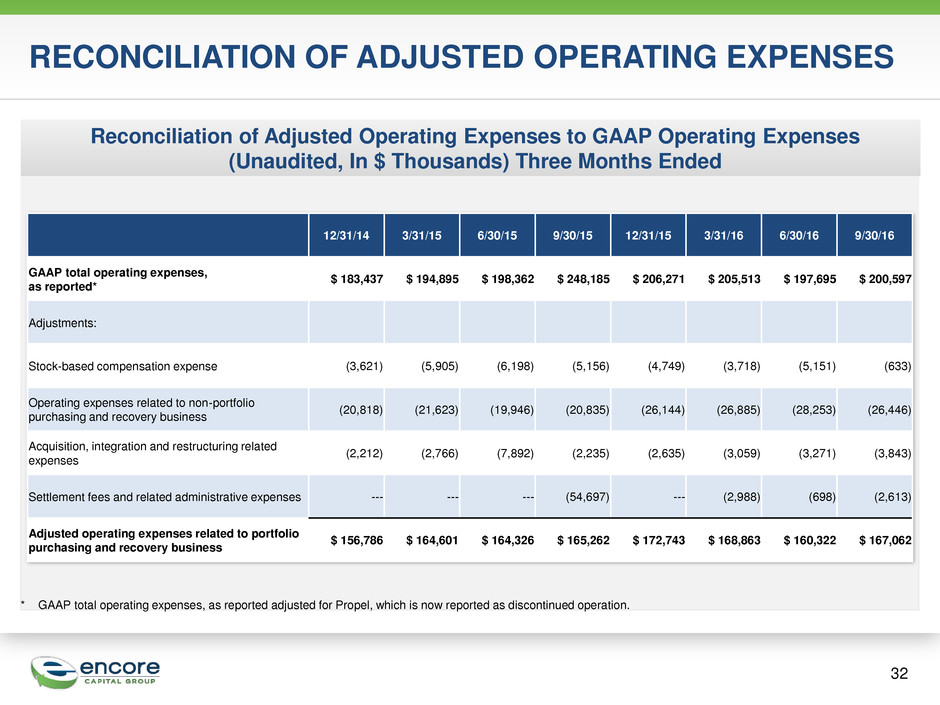

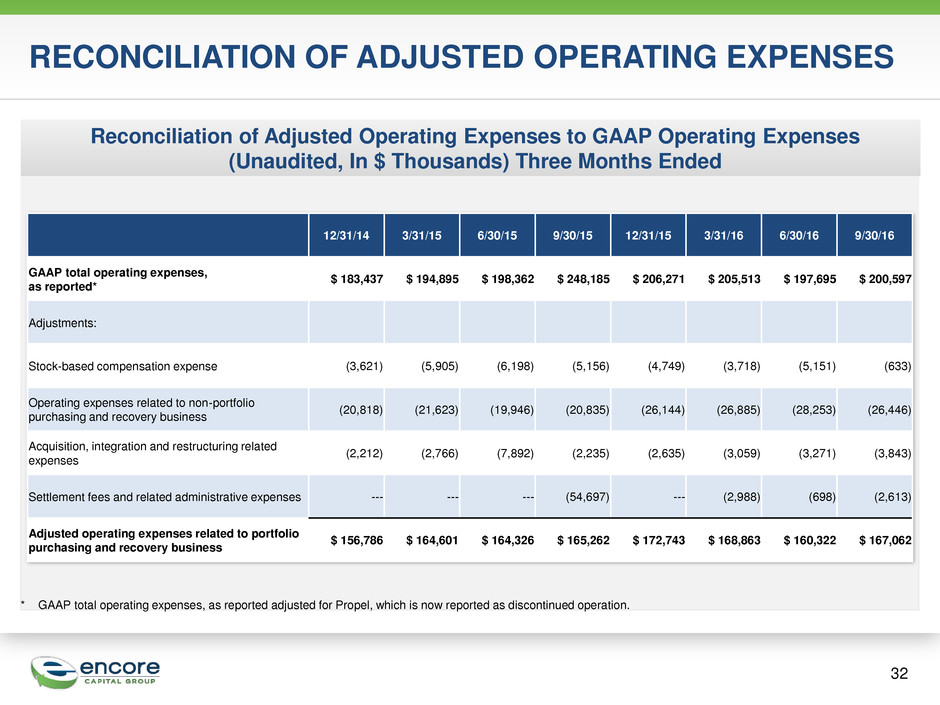

Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended RECONCILIATION OF ADJUSTED OPERATING EXPENSES 12/31/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 9/30/16 GAAP total operating expenses, as reported* $ 183,437 $ 194,895 $ 198,362 $ 248,185 $ 206,271 $ 205,513 $ 197,695 $ 200,597 Adjustments: Stock-based compensation expense (3,621) (5,905) (6,198) (5,156) (4,749) (3,718) (5,151) (633) Operating expenses related to non-portfolio purchasing and recovery business (20,818) (21,623) (19,946) (20,835) (26,144) (26,885) (28,253) (26,446) Acquisition, integration and restructuring related expenses (2,212) (2,766) (7,892) (2,235) (2,635) (3,059) (3,271) (3,843) Settlement fees and related administrative expenses --- --- --- (54,697) --- (2,988) (698) (2,613) Adjusted operating expenses related to portfolio purchasing and recovery business $ 156,786 $ 164,601 $ 164,326 $ 165,262 $ 172,743 $ 168,863 $ 160,322 $ 167,062 32 * GAAP total operating expenses, as reported adjusted for Propel, which is now reported as discontinued operation.

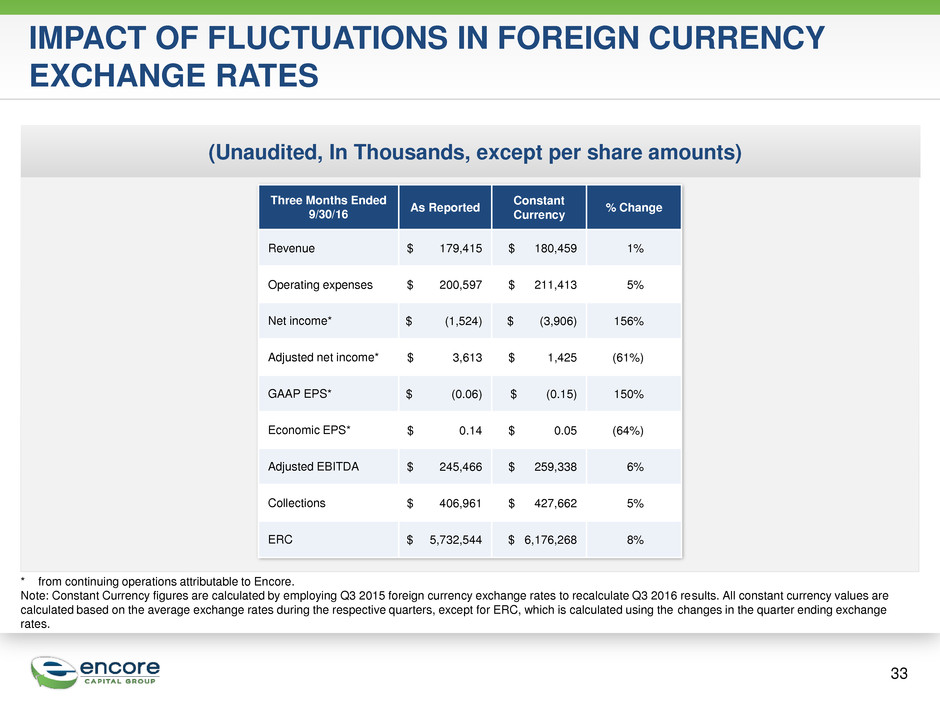

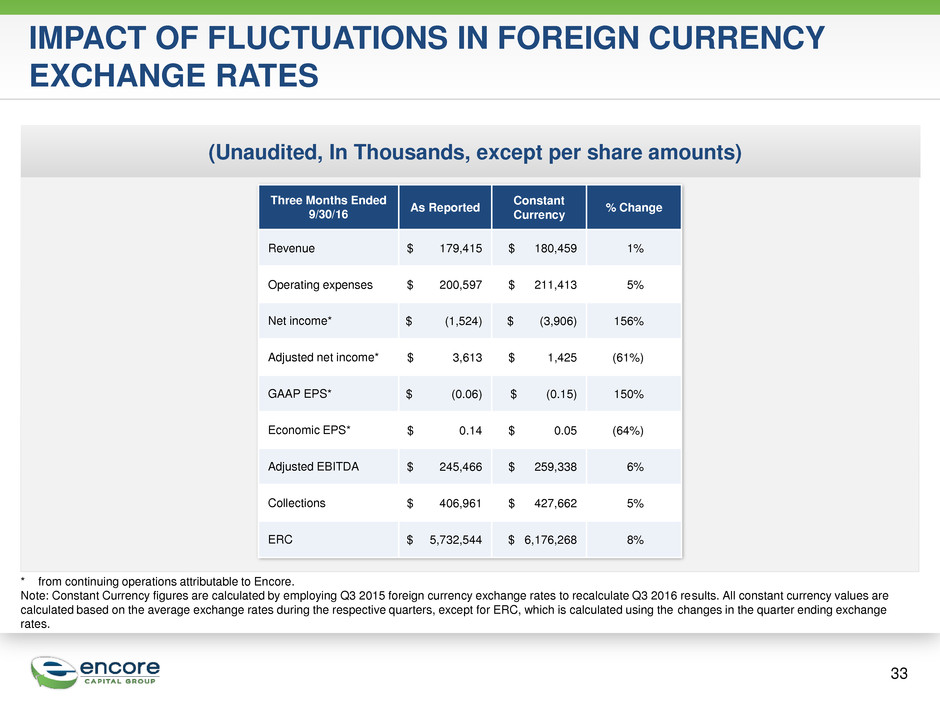

(Unaudited, In Thousands, except per share amounts) IMPACT OF FLUCTUATIONS IN FOREIGN CURRENCY EXCHANGE RATES Three Months Ended 9/30/16 As Reported Constant Currency % Change Revenue $ 179,415 $ 180,459 1% Operating expenses $ 200,597 $ 211,413 5% Net income* $ (1,524) $ (3,906) 156% Adjusted net income* $ 3,613 $ 1,425 (61%) GAAP EPS* $ (0.06) $ (0.15) 150% Economic EPS* $ 0.14 $ 0.05 (64%) Adjusted EBITDA $ 245,466 $ 259,338 6% Collections $ 406,961 $ 427,662 5% ERC $ 5,732,544 $ 6,176,268 8% 33 * from continuing operations attributable to Encore. Note: Constant Currency figures are calculated by employing Q3 2015 foreign currency exchange rates to recalculate Q3 2016 results. All constant currency values are calculated based on the average exchange rates during the respective quarters, except for ERC, which is calculated using the changes in the quarter ending exchange rates.