Encore Capital Group, Inc. Q1 2017 EARNINGS CALL Exhibit 99.1

2 CAUTIONARY NOTE ABOUT FORWARD- LOOKING STATEMENTS The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results, earnings per share, and growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent reports on Form 10-K and Form 10-Q, as they may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

3 ENCORE UPDATE

4 U.S. MARKET CONTINUES TO DEMONSTRATE FAVORABLE DYNAMICS FOR OUR BUSINESS Supply continues to improve Federal Reserve reports another quarter of continued growth in credit card debt in Q1, which now exceeds pre-recession levels Banks are forecasting increasing levels of loan losses Pricing declined approximately 15% in 2016 and another 15% in Q1 of 2017 As supply continues to rise, we expect pricing to remain favorable Better returns yield more ERC per dollar deployed Year-to-date commitments for 2017 total more than $350 million First quarter purchase price multiple for U.S. core business at 2.0x for first time in 4 years

5 THE 5 C’S WILL DRIVE SUCCESS IN OUR BUSINESS As volume rises, those with available capacity will garner better pricing Capital Capacity Confidence Cost Commitment We now have nearly $300 million of deployable capital Substantial existing capacity as incremental build-out continues, also preparing legal channel for more volume We are confident in our ability to liquidate First year liquidations are 50% higher than 4 years ago Our cost structure is a competitive differentiator affording us unmatched compliance and customer support We honor commitments to issuers Deeply committed to the people of Encore, our investors and our consumers

6 SPENDING AND STAFFING OBJECTIVES INTRODUCED LAST QUARTER ARE ON TRACK Incremental purchasing in late 2016 at high IRR’s – including investments in lower balance portfolios – resulted in higher account volumes As mentioned last quarter, Account Manager hiring, additional lettering, and incremental legal expenses will add approximately $20 million in total to 2017 expenses Approximately $10 million for call center and lettering Approximately $10 million for legal expenses/court costs $5 million of these additional legal expenses to be incurred in Q2 Q2 earnings expected to be low water mark for the year No change to our full year 2017 outlook Our focus on IRR’s drives additional near-term expense while maximizing profitability longer term

7 OUR INTERNATIONAL BUSINESSES PROVIDE ENCORE WITH ADDITIONAL OPPORTUNITY TO DEPLOY CAPITAL Cabot had a strong purchasing quarter in the U.K. Cabot’s liquidation initiatives continue to drive collections improvement Preparation for a potential Cabot IPO continues on track, advisors have been chosen Encore’s Asset Reconstruction Company (EARC) is now operational and recently made its first small purchases in India

8 COMPLIANCE INVESTMENTS CREATE A COMPETITIVE ADVANTAGE Investments in compliance and risk management over a multi-year period are generating significant value The legal collection delays from last year are behind us We expect delayed collections from 2016 will be mostly recouped in 2017 with a smaller portion to be collected in 2018 We continue to successfully drive the numbers of disputes and complaints to lower levels Our best-in-class compliance engine has become a distinct competitive advantage

9 Detailed Financial Discussion

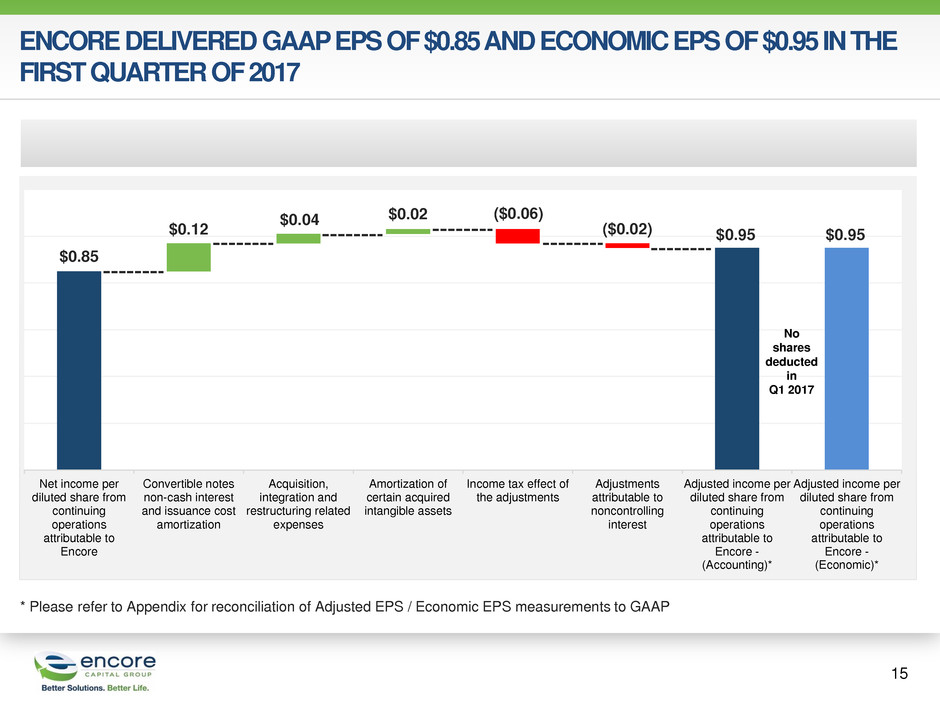

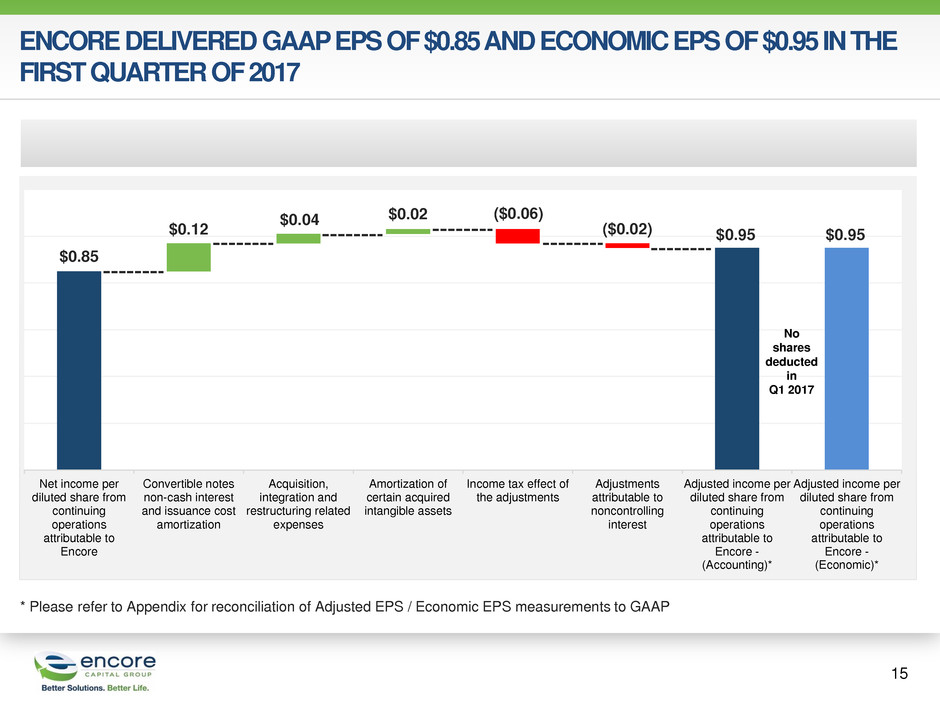

10 ENCORE’S FIRST QUARTER 2017 GAAP EPS WAS $0.85 $0.95 Economic EPS2 GAAP EPS1 $0.85 GAAP Net Income1 $22.3 million Adjusted Income2 $24.8 million Estimated Remaining Collections of $5.8 billion 1) From continuing operations attributable to Encore 2) Please refer to Appendix for reconciliation of Economic EPS and Adjusted Income to GAAP Collections $441 million

11 Q1 DEPLOYMENTS REFLECT OUR DISCIPLINED APPROACH TO PURCHASING Q1-2017 Deployments $M United States $123 Europe $85 Other $11 Total $219

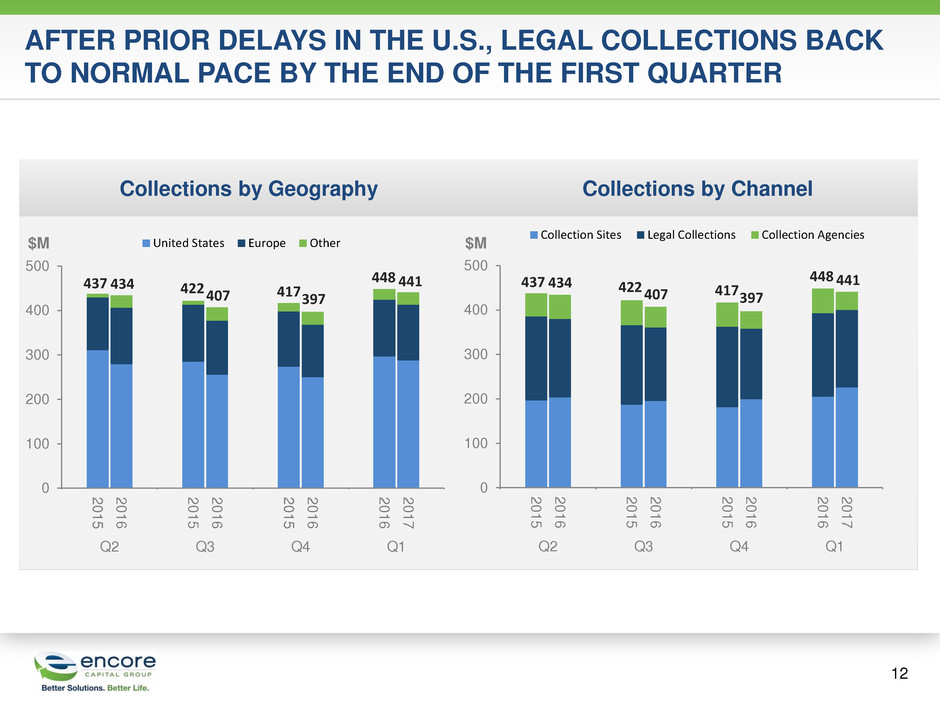

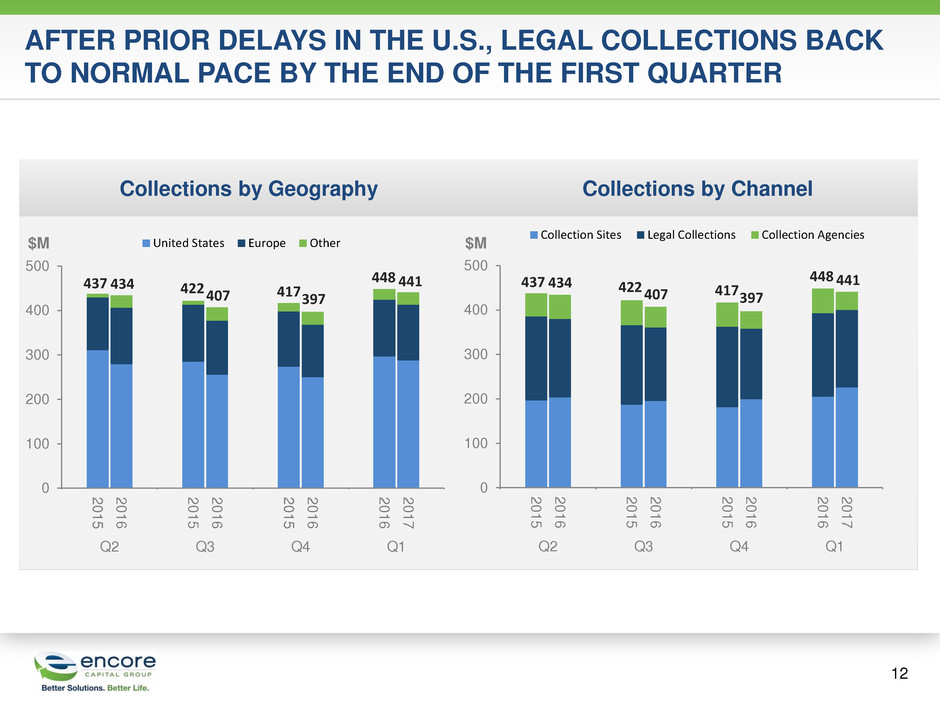

12 AFTER PRIOR DELAYS IN THE U.S., LEGAL COLLECTIONS BACK TO NORMAL PACE BY THE END OF THE FIRST QUARTER Collections by Geography 0 100 200 300 400 500 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 6 2 0 1 7 Q2 Q3 Q4 Q1 Collection Sites Legal Collections Collection Agencies $M 0 100 200 300 400 500 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 6 2 0 1 7 Q2 Q3 Q4 Q1 United States Europe Other 417 441 437 422 397 448 434 407 $M Collections by Channel 417 441 437 422 397 448 434 407

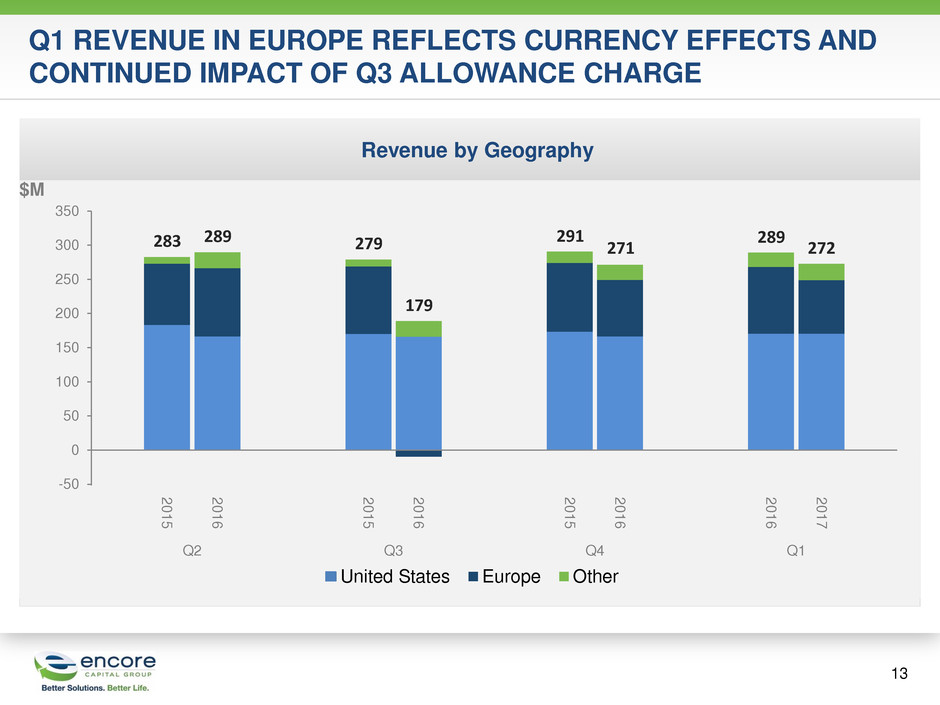

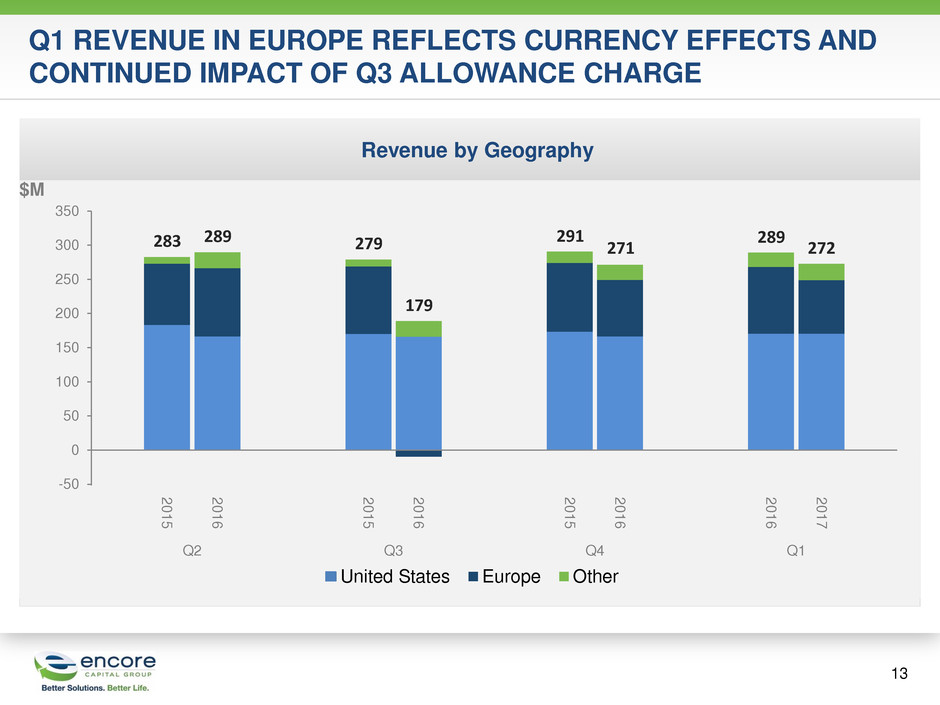

Q1 REVENUE IN EUROPE REFLECTS CURRENCY EFFECTS AND CONTINUED IMPACT OF Q3 ALLOWANCE CHARGE Revenue by Geography 13 -50 0 50 100 150 200 250 300 350 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 6 2 0 1 7 Q2 Q3 Q4 Q1 United States Europe Other $M 289 283 279 291 272 289 179 271

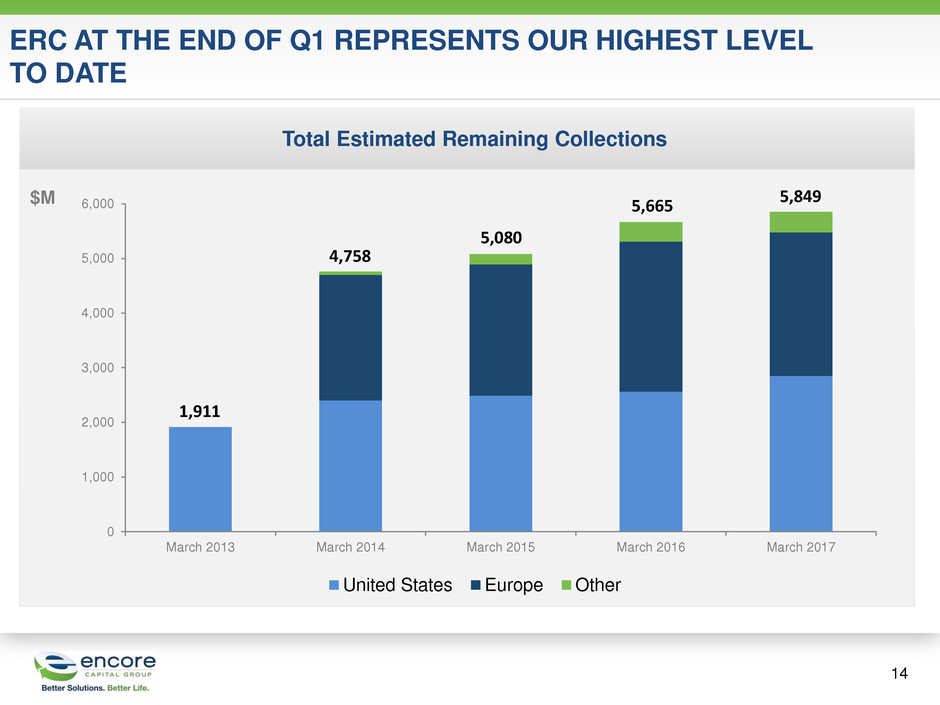

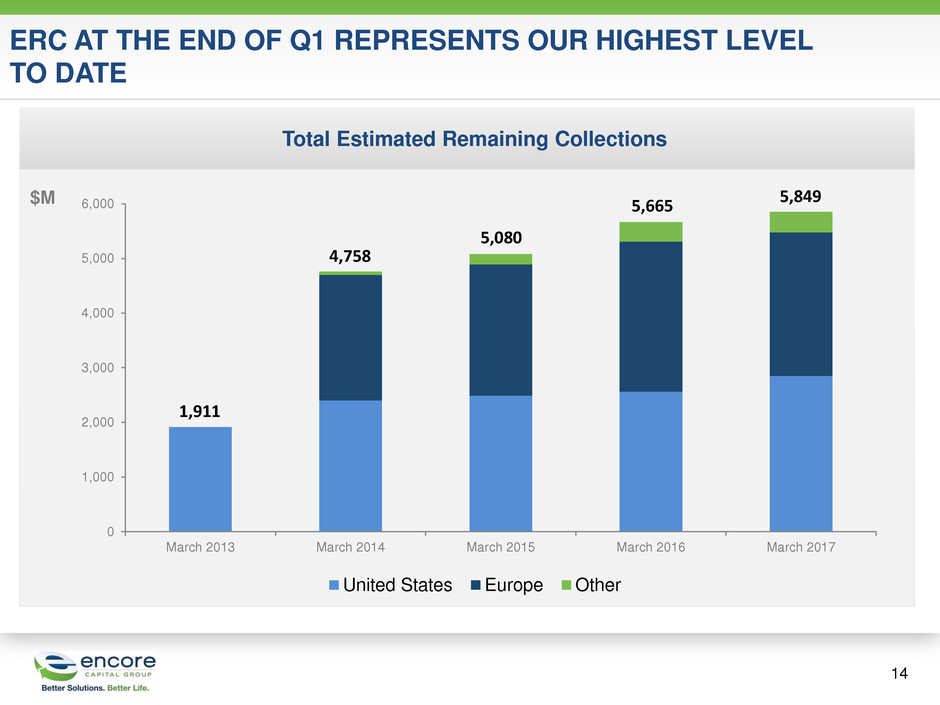

14 ERC AT THE END OF Q1 REPRESENTS OUR HIGHEST LEVEL TO DATE Total Estimated Remaining Collections 0 1,000 2,000 3,000 4,000 5,000 6,000 March 2013 March 2014 March 2015 March 2016 March 2017 United States Europe Other 1,911 4,758 5,080 $M 5,665 5,849

ENCORE DELIVERED GAAP EPS OF $0.85 AND ECONOMIC EPS OF $0.95 IN THE FIRST QUARTER OF 2017 15 * Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP $0.85 $0.02 ($0.06) ($0.02) $0.95 $0.95 $0.12 $0.04 Net income per diluted share from continuing operations attributable to Encore Convertible notes non-cash interest and issuance cost amortization Acquisition, integration and restructuring related expenses Amortization of certain acquired intangible assets Income tax effect of the adjustments Adjustments attributable to noncontrolling interest Adjusted income per diluted share from continuing operations attributable to Encore - (Accounting)* Adjusted income per diluted share from continuing operations attributable to Encore - (Economic)* No shares deducted in Q1 2017

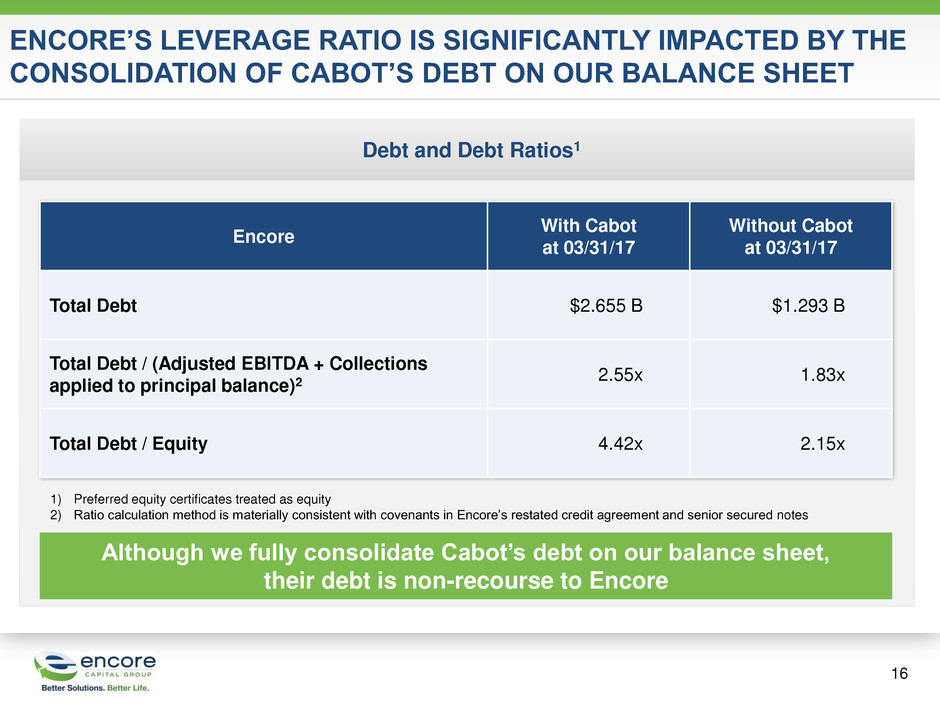

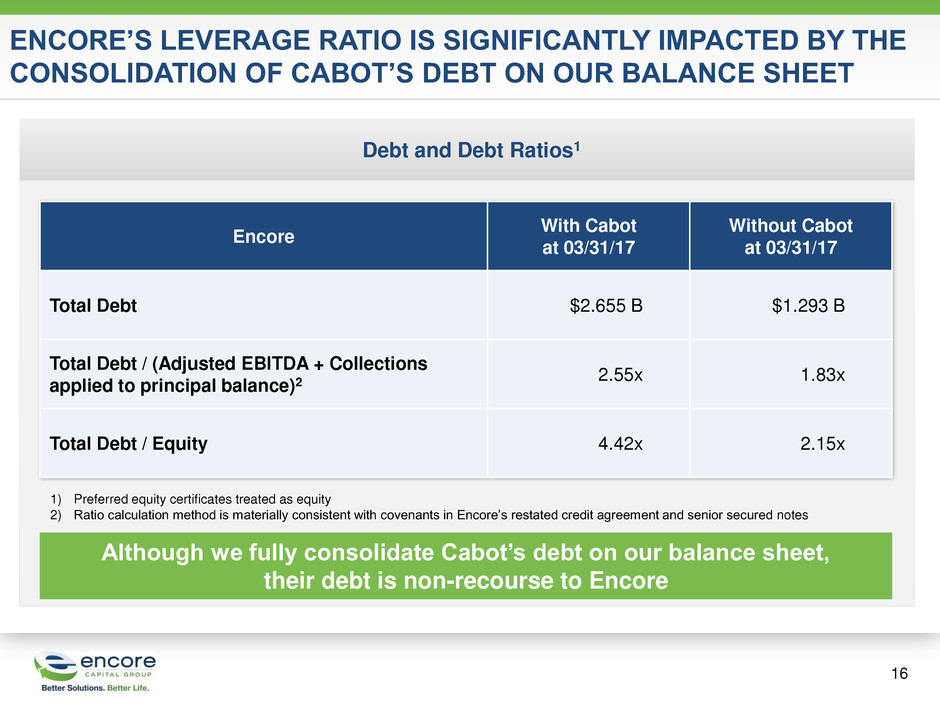

16 ENCORE’S LEVERAGE RATIO IS SIGNIFICANTLY IMPACTED BY THE CONSOLIDATION OF CABOT’S DEBT ON OUR BALANCE SHEET Debt and Debt Ratios1 Although we fully consolidate Cabot’s debt on our balance sheet, their debt is non-recourse to Encore Encore With Cabot at 03/31/17 Without Cabot at 03/31/17 Total Debt $2.655 B $1.293 B Total Debt / (Adjusted EBITDA + Collections applied to principal balance)2 2.55x 1.83x Total Debt / Equity 4.42x 2.15x 1) Preferred equity certificates treated as equity 2) Ratio calculation method is materially consistent with covenants in Encore’s restated credit agreement and senior secured notes

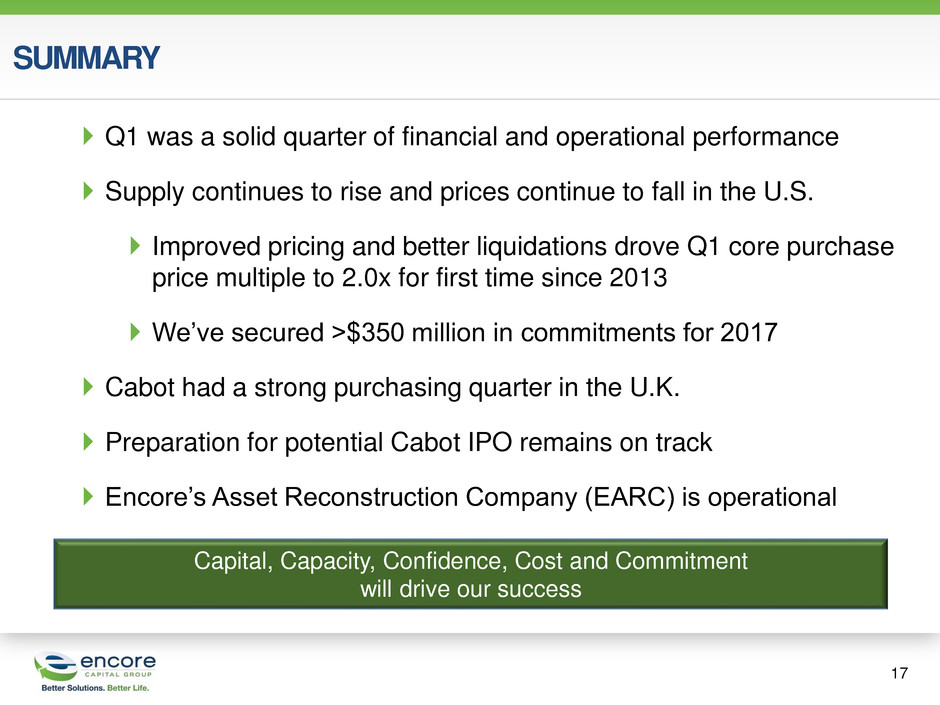

SUMMARY 17 Q1 was a solid quarter of financial and operational performance Supply continues to rise and prices continue to fall in the U.S. Improved pricing and better liquidations drove Q1 core purchase price multiple to 2.0x for first time since 2013 We’ve secured >$350 million in commitments for 2017 Cabot had a strong purchasing quarter in the U.K. Preparation for potential Cabot IPO remains on track Encore’s Asset Reconstruction Company (EARC) is operational Capital, Capacity, Confidence, Cost and Commitment will drive our success

18 Q&A

19 Appendix

20 NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order to highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore, Adjusted Income Attributable to Encore per Share/Economic EPS, and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

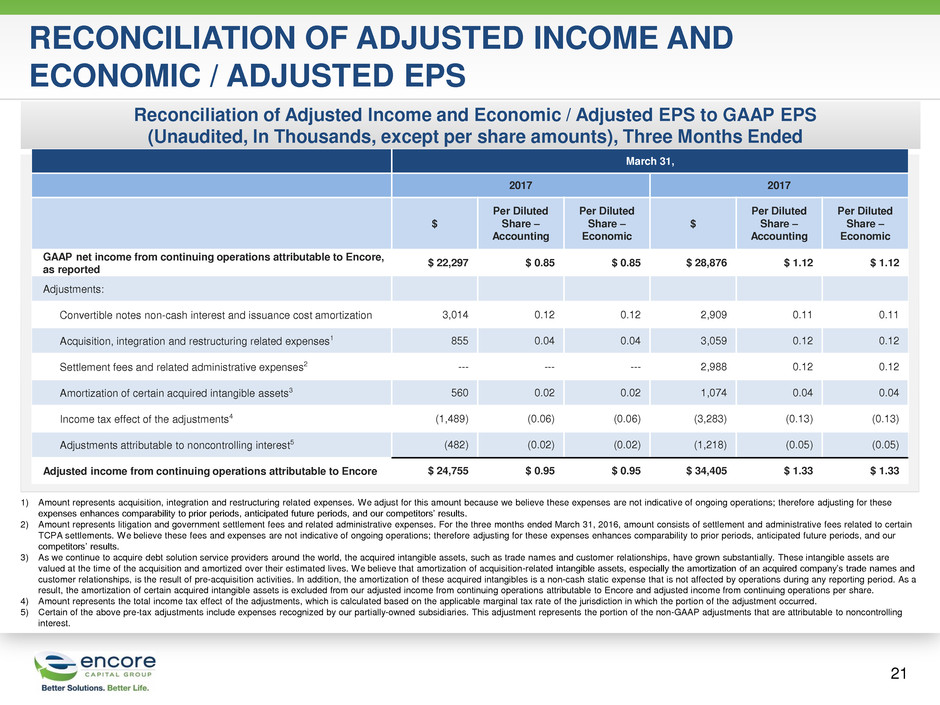

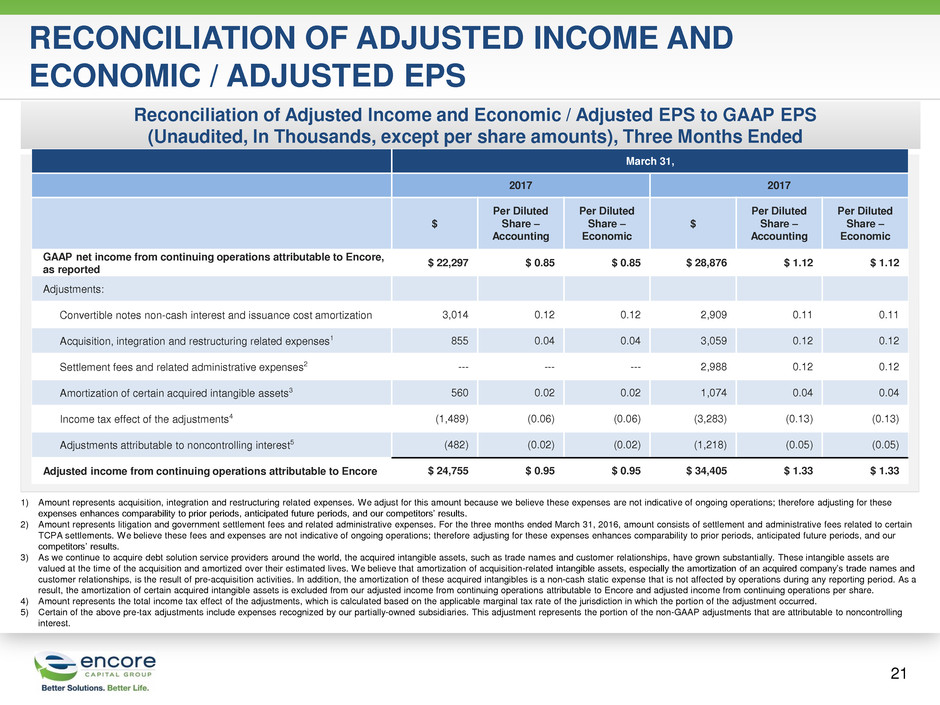

21 RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended March 31, 2017 2017 $ Per Diluted Share – Accounting Per Diluted Share – Economic $ Per Diluted Share – Accounting Per Diluted Share – Economic GAAP net income from continuing operations attributable to Encore, as reported $ 22,297 $ 0.85 $ 0.85 $ 28,876 $ 1.12 $ 1.12 Adjustments: Convertible notes non-cash interest and issuance cost amortization 3,014 0.12 0.12 2,909 0.11 0.11 Acquisition, integration and restructuring related expenses1 855 0.04 0.04 3,059 0.12 0.12 Settlement fees and related administrative expenses2 --- --- --- 2,988 0.12 0.12 Amortization of certain acquired intangible assets3 560 0.02 0.02 1,074 0.04 0.04 Income tax effect of the adjustments4 (1,489) (0.06) (0.06) (3,283) (0.13) (0.13) Adjustments attributable to noncontrolling interest5 (482) (0.02) (0.02) (1,218) (0.05) (0.05) Adjusted income from continuing operations attributable to Encore $ 24,755 $ 0.95 $ 0.95 $ 34,405 $ 1.33 $ 1.33 1) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 2) Amount represents litigation and government settlement fees and related administrative expenses. For the three months ended March 31, 2016, amount consists of settlement and administrative fees related to certain TCPA settlements. We believe these fees and expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) As we continue to acquire debt solution service providers around the world, the acquired intangible assets, such as trade names and customer relationships, have grown substantially. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the amortization of these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. As a result, the amortization of certain acquired intangible assets is excluded from our adjusted income from continuing operations attributable to Encore and adjusted income from continuing operations per share. 4) Amount represents the total income tax effect of the adjustments, which is calculated based on the applicable marginal tax rate of the jurisdiction in which the portion of the adjustment occurred. 5) Certain of the above pre-tax adjustments include expenses recognized by our partially-owned subsidiaries. This adjustment represents the portion of the non-GAAP adjustments that are attributable to noncontrolling interest.

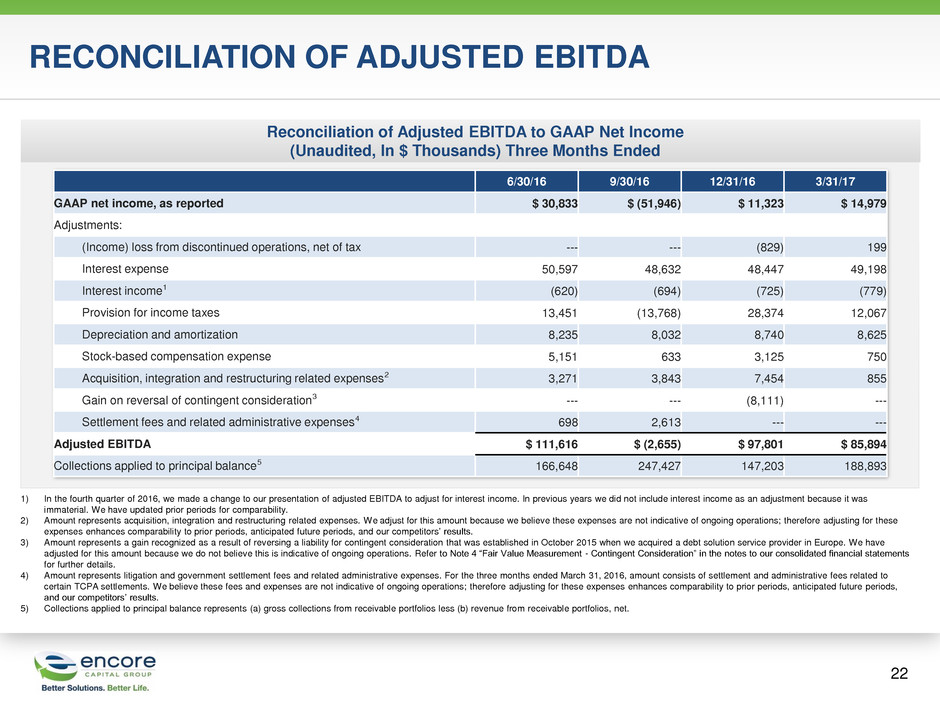

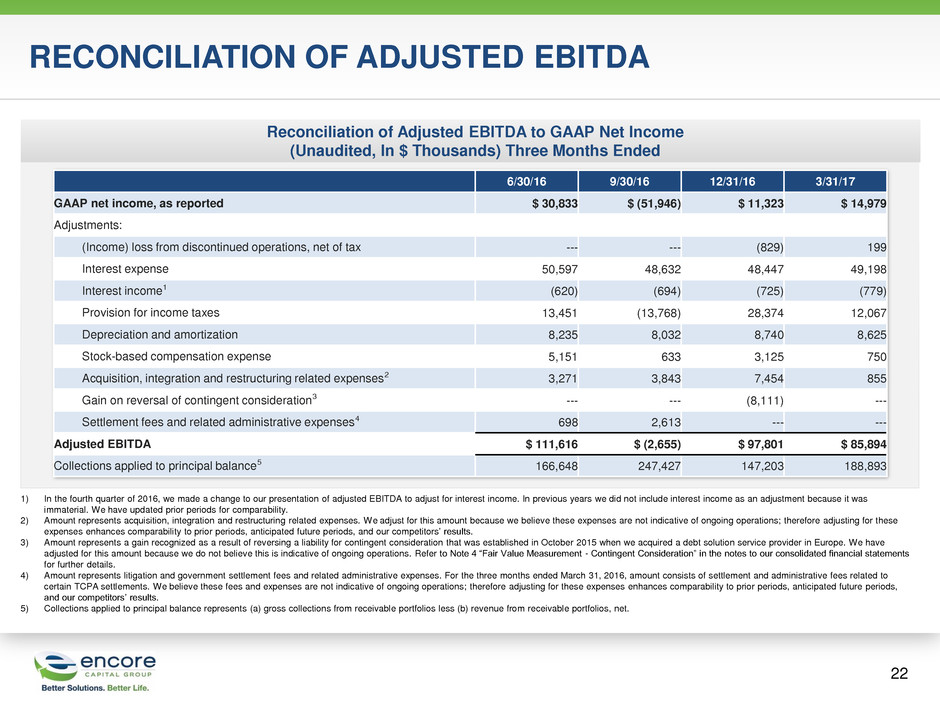

Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 6/30/16 9/30/16 12/31/16 3/31/17 GAAP net income, as reported $ 30,833 $ (51,946) $ 11,323 $ 14,979 Adjustments: (Income) loss from discontinued operations, net of tax --- --- (829) 199 Interest expense 50,597 48,632 48,447 49,198 Interest income1 (620) (694) (725) (779) Provision for income taxes 13,451 (13,768) 28,374 12,067 Depreciation and amortization 8,235 8,032 8,740 8,625 Stock-based compensation expense 5,151 633 3,125 750 Acquisition, integration and restructuring related expenses2 3,271 3,843 7,454 855 Gain on reversal of contingent consideration3 --- --- (8,111) --- Settlement fees and related administrative expenses4 698 2,613 --- --- Adjusted EBITDA $ 111,616 $ (2,655) $ 97,801 $ 85,894 Collections applied to principal balance5 166,648 247,427 147,203 188,893 RECONCILIATION OF ADJUSTED EBITDA 22 1) In the fourth quarter of 2016, we made a change to our presentation of adjusted EBITDA to adjust for interest income. In previous years we did not include interest income as an adjustment because it was immaterial. We have updated prior periods for comparability. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amount represents a gain recognized as a result of reversing a liability for contingent consideration that was established in October 2015 when we acquired a debt solution service provider in Europe. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. Refer to Note 4 “Fair Value Measurement - Contingent Consideration” in the notes to our consolidated financial statements for further details. 4) Amount represents litigation and government settlement fees and related administrative expenses. For the three months ended March 31, 2016, amount consists of settlement and administrative fees related to certain TCPA settlements. We believe these fees and expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Collections applied to principal balance represents (a) gross collections from receivable portfolios less (b) revenue from receivable portfolios, net.

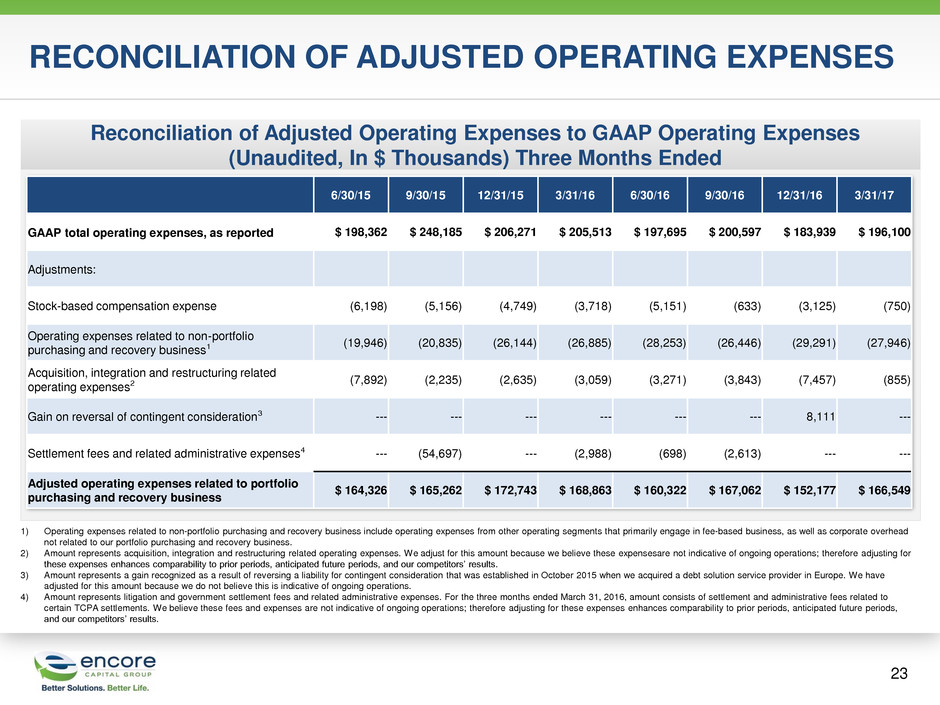

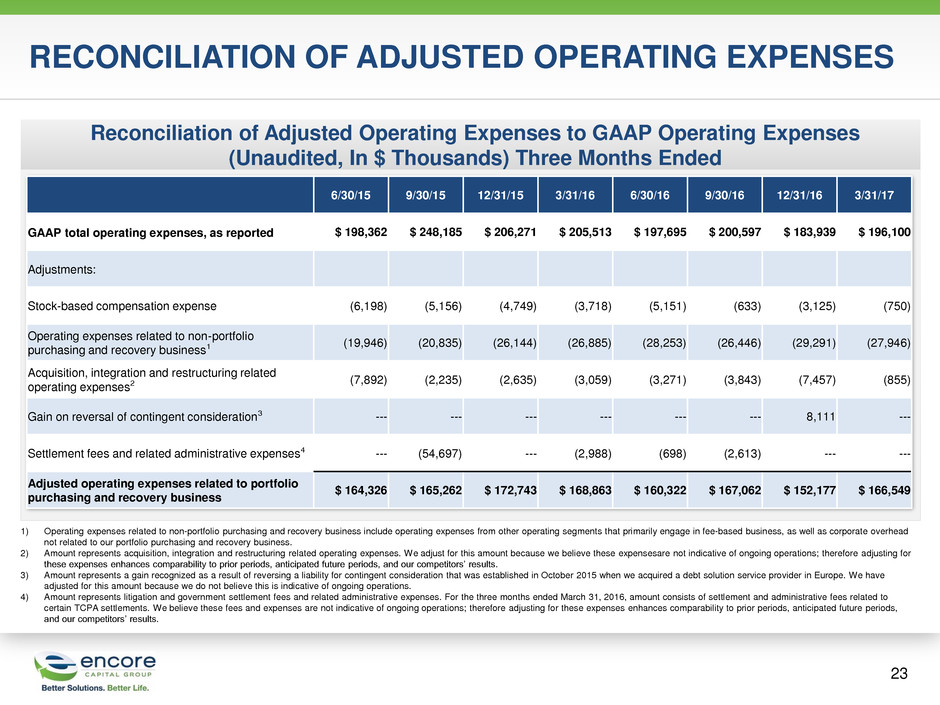

Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended RECONCILIATION OF ADJUSTED OPERATING EXPENSES 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 9/30/16 12/31/16 3/31/17 GAAP total operating expenses, as reported $ 198,362 $ 248,185 $ 206,271 $ 205,513 $ 197,695 $ 200,597 $ 183,939 $ 196,100 Adjustments: Stock-based compensation expense (6,198) (5,156) (4,749) (3,718) (5,151) (633) (3,125) (750) Operating expenses related to non-portfolio purchasing and recovery business1 (19,946) (20,835) (26,144) (26,885) (28,253) (26,446) (29,291) (27,946) Acquisition, integration and restructuring related operating expenses2 (7,892) (2,235) (2,635) (3,059) (3,271) (3,843) (7,457) (855) Gain on reversal of contingent consideration3 --- --- --- --- --- --- 8,111 --- Settlement fees and related administrative expenses4 --- (54,697) --- (2,988) (698) (2,613) --- --- Adjusted operating expenses related to portfolio purchasing and recovery business $ 164,326 $ 165,262 $ 172,743 $ 168,863 $ 160,322 $ 167,062 $ 152,177 $ 166,549 23 1) Operating expenses related to non-portfolio purchasing and recovery business include operating expenses from other operating segments that primarily engage in fee-based business, as well as corporate overhead not related to our portfolio purchasing and recovery business. 2) Amount represents acquisition, integration and restructuring related operating expenses. We adjust for this amount because we believe these expensesare not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amount represents a gain recognized as a result of reversing a liability for contingent consideration that was established in October 2015 when we acquired a debt solution service provider in Europe. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. 4) Amount represents litigation and government settlement fees and related administrative expenses. For the three months ended March 31, 2016, amount consists of settlement and administrative fees related to certain TCPA settlements. We believe these fees and expenses are not indicative of ongoing operations; therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results.

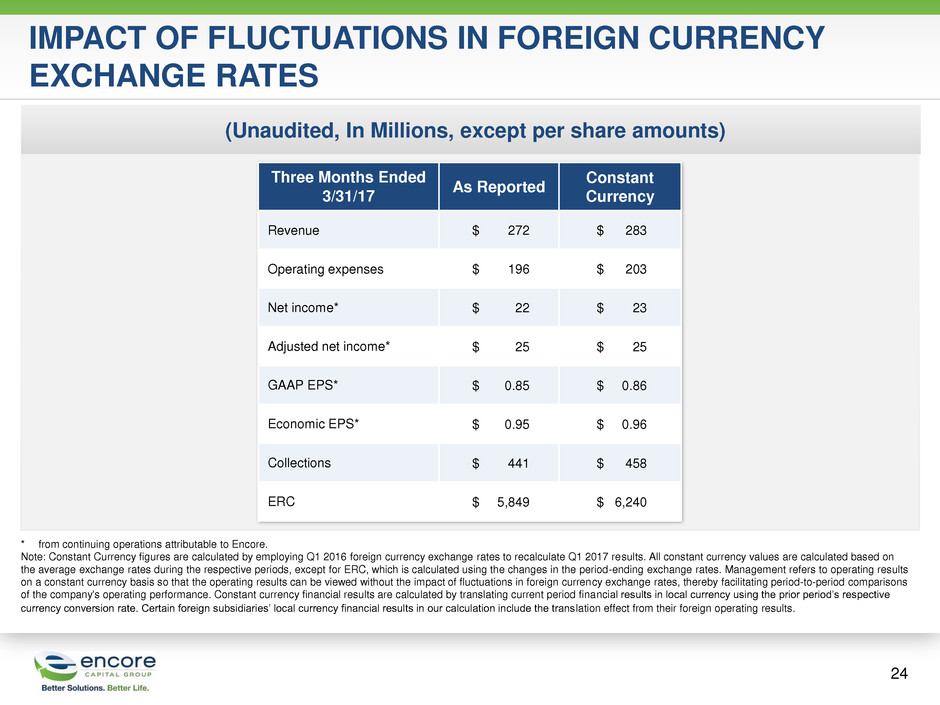

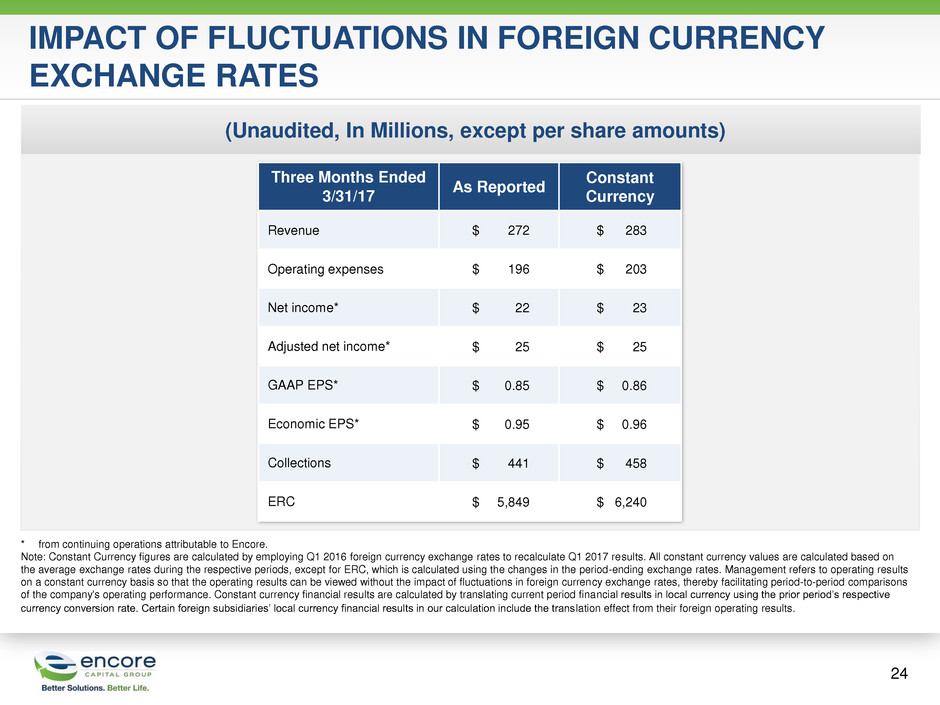

(Unaudited, In Millions, except per share amounts) IMPACT OF FLUCTUATIONS IN FOREIGN CURRENCY EXCHANGE RATES Three Months Ended 3/31/17 As Reported Constant Currency Revenue $ 272 $ 283 Operating expenses $ 196 $ 203 Net income* $ 22 $ 23 Adjusted net income* $ 25 $ 25 GAAP EPS* $ 0.85 $ 0.86 Economic EPS* $ 0.95 $ 0.96 Collections $ 441 $ 458 ERC $ 5,849 $ 6,240 24 * from continuing operations attributable to Encore. Note: Constant Currency figures are calculated by employing Q1 2016 foreign currency exchange rates to recalculate Q1 2017 results. All constant currency values are calculated based on the average exchange rates during the respective periods, except for ERC, which is calculated using the changes in the period-ending exchange rates. Management refers to operating results on a constant currency basis so that the operating results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company's operating performance. Constant currency financial results are calculated by translating current period financial results in local currency using the prior period’s respective currency conversion rate. Certain foreign subsidiaries’ local currency financial results in our calculation include the translation effect from their foreign operating results.

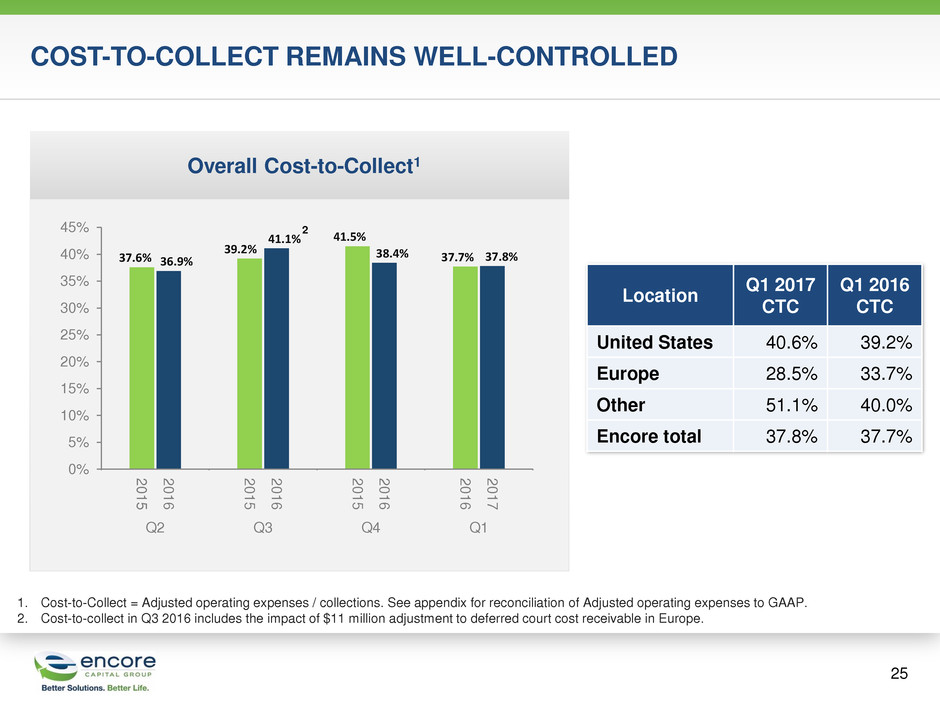

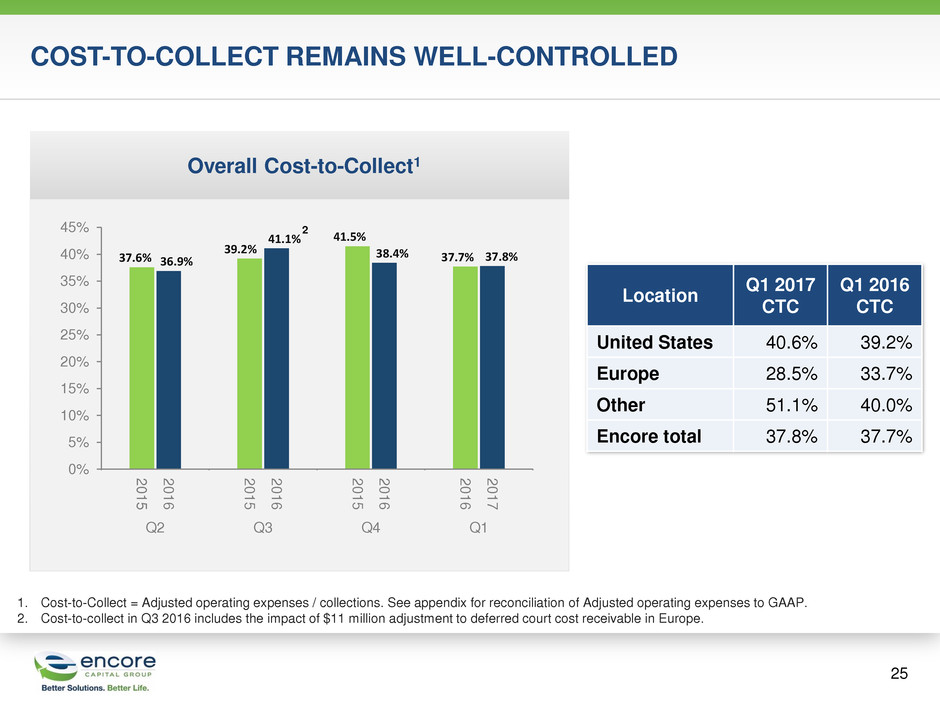

COST-TO-COLLECT REMAINS WELL-CONTROLLED 25 Overall Cost-to-Collect1 37.6% 36.9% 39.2% 41.1% 41.5% 38.4% 37.7% 37.8% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 5 2 0 1 6 2 0 1 6 2 0 1 7 Q2 Q3 Q4 Q1 1. Cost-to-Collect = Adjusted operating expenses / collections. See appendix for reconciliation of Adjusted operating expenses to GAAP. 2. Cost-to-collect in Q3 2016 includes the impact of $11 million adjustment to deferred court cost receivable in Europe. Location Q1 2017 CTC Q1 2016 CTC United States 40.6% 39.2% Europe 28.5% 33.7% Other 51.1% 40.0% Encore total 37.8% 37.7% 2