Fourth Quarter 2024 Investor Presentation Encore Capital Group, Inc. February 26, 2025 Exhibit 99.1

Encore Capital Group, Inc. 2 Legal Disclaimers The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results (including portfolio purchase volumes, collections and cash generation), performance, business plans or prospects, as well as statements regarding supply, portfolio pricing, returns, run rates, tax rates, interest expense, ability to access capital markets, the consumer credit cycle, interest rates and other macroeconomic factors. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent report on Form 10-K, as it may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

Encore Capital Group, Inc. 3 Today’s Call o 2024 Highlights o Our Strategy and Market Presence o Financial Results o Priorities and Outlook for 2025

Encore Capital Group, Inc. 4 Encore’s momentum in 2024 driven by U.S. business Encore delivered significant growth in 2024 (Purchasing up 26%, Collections up 16%, Cash generation up 20%) MCM delivered strong results o U.S. market continues to be robust with revolving credit at record high and charge-off rate still growing o Deployed record $1B (up 23%), allocating vast majority of our global deployment capital to U.S. o Collections growth of 20% in 2024 Persistent Cabot issues are now behind us o Implemented multiple restructuring actions at Cabot, which impacted earnings o Expect future performance to closely align with rebased ERC o Deployed $353M in 2024 including large opportunistic spot purchases in Q4, but remain disciplined o Collections growth of 8% in 2024 Leverage ratio declined from 2.9x in 2023 to 2.6x in 2024 – near the midpoint of target range – even while achieving record portfolio purchases Expect to resume share repurchases in 2025

Encore Capital Group, Inc. 5 Our Strategy and Market Presence o Purchase NPL portfolios at attractive cash returns o Focus on the consumer and ensure the highest level of compliance o Meet or exceed collection expectations o Maintain efficient cost structure o Minimize cost of funding o Market Focus o Competitive Advantage o Balance Sheet Strength Our Business Our Strategy • Market leader in the United States • 25+ years in operation • One of the largest players in the UK (20+ years in operation) • Building strength in select European markets (France and Spain) Our Market Presence

Encore Capital Group, Inc. 6 Record global portfolio purchasing up 26% over 2023 as we continue to allocate capital to U.S. opportunities, where returns are highest Portfolio Purchases (in $M) 543 409 556 815 999 117 256 245 259 353 0 200 400 600 800 1,000 1,200 1,400 2020 2021 2022 2023 2024 United States Europe 1,352 660 665 801 1,074 26% Cabot 74% MCM +26%

Encore Capital Group, Inc. 7 After being impacted by several years of lower deployments, collections increased by 16% in 2024 Note: Global, U.S. and Europe collections in 2024 were 103%, 106% and 96% (103%, 106% and 98% in constant currency), respectively, of the Dec 31, 2023 portfolio ERC forecasts for portfolios purchased prior to Dec 31, 2023. Collections by Geography (in $M) 1,529 1,642 1,355 1,315 1,572 554 645 553 544 588 2020 2021 2022 2023 2024 United States Europe Other 1,912 2,307 2,112 2,162 1,863 +16%

Encore Capital Group, Inc. 8 Similar to collections, after being impacted by several years of lower deployments, cash generation increased by 20% in 2024 Encore Cash Generation1 (in $M) 0 200 400 600 800 1000 1200 1400 1600 2020 2021 2022 2023 2024 Adjusted EBITDA Collections applied to principal balance 1) Cash generation defined as Adjusted EBITDA + collections applied to principal balance. 2) See appendix for reconciliation of Adjusted EBITDA to GAAP net income. 2 +20%

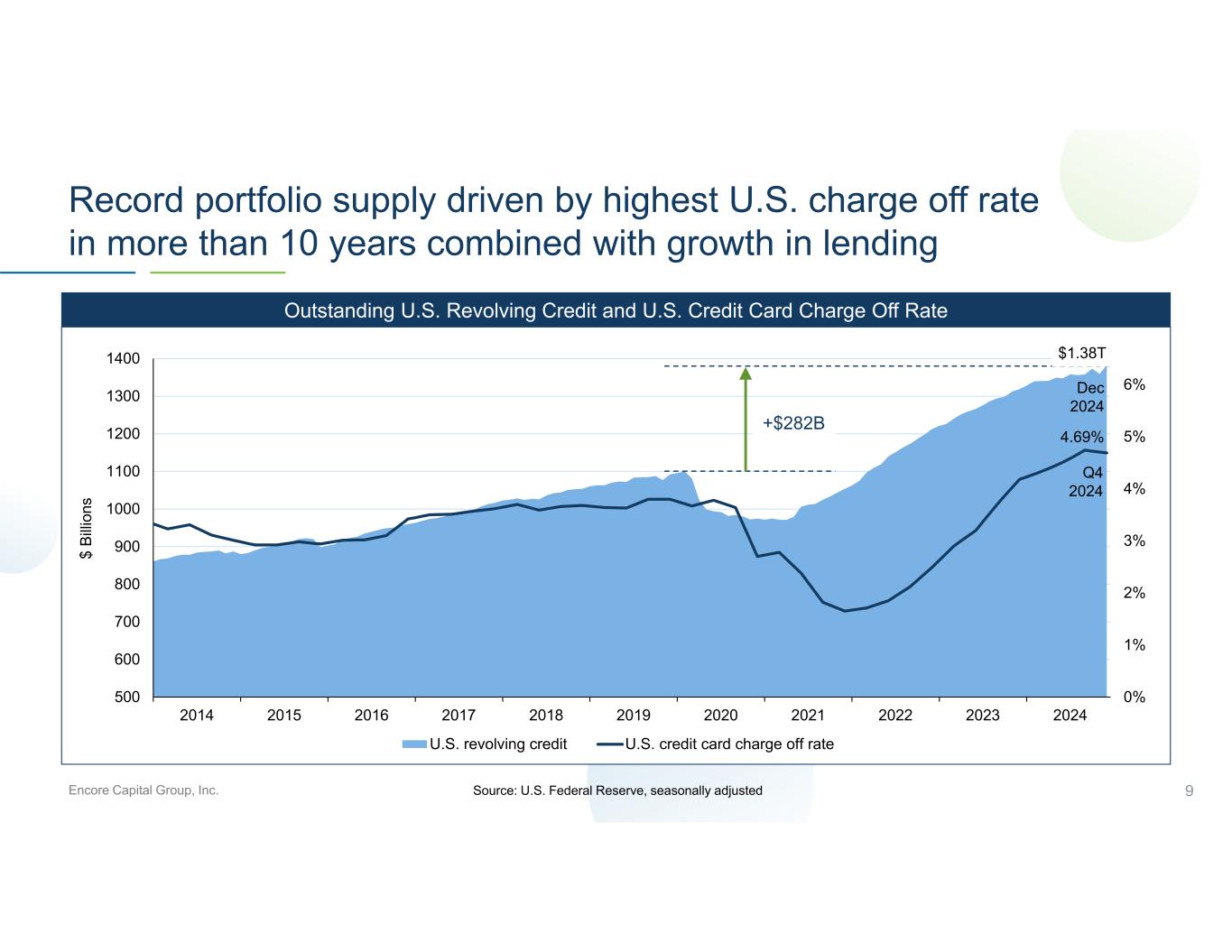

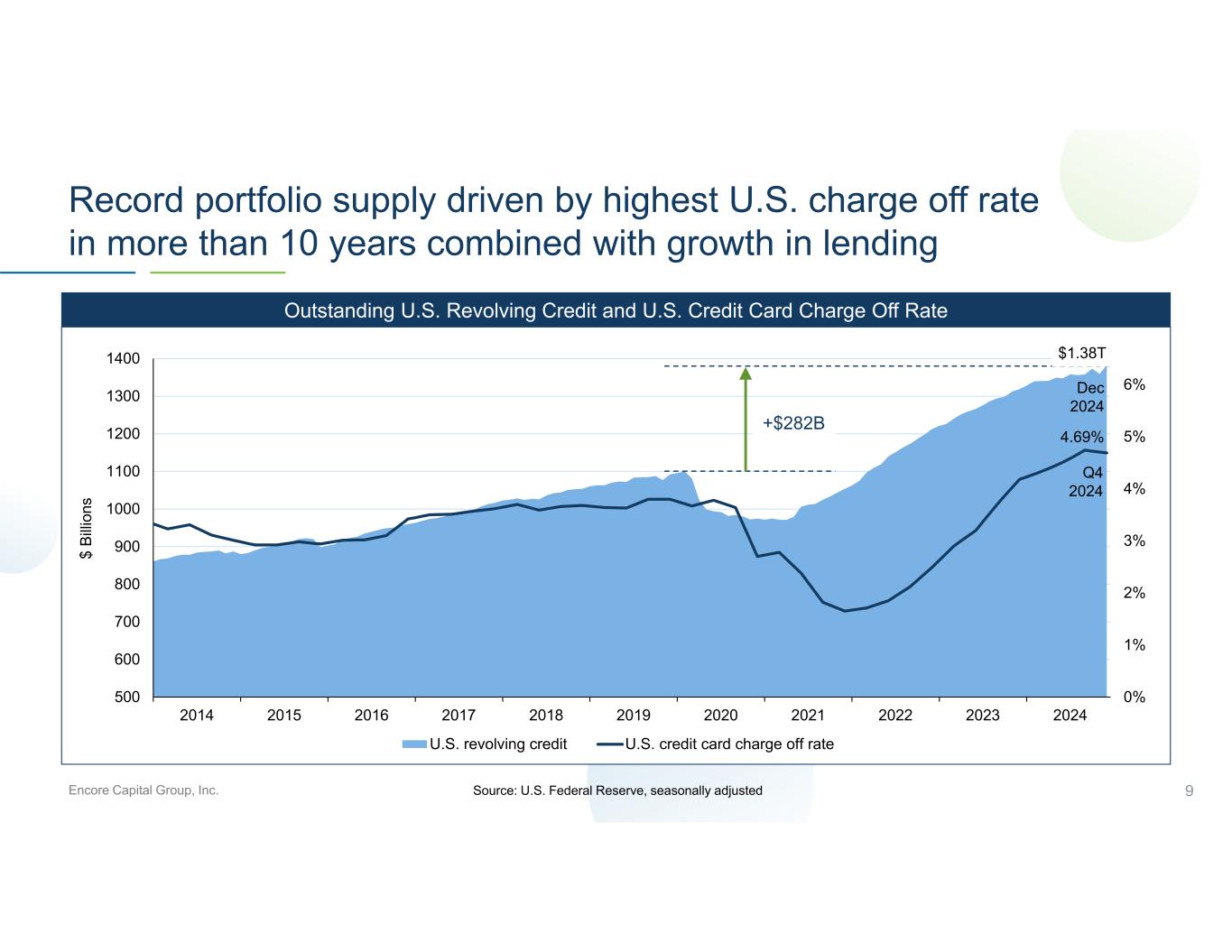

Encore Capital Group, Inc. 9 Record portfolio supply driven by highest U.S. charge off rate in more than 10 years combined with growth in lending Outstanding U.S. Revolving Credit and U.S. Credit Card Charge Off Rate Source: U.S. Federal Reserve, seasonally adjusted 0% 1% 2% 3% 4% 5% 6% 500 600 700 800 900 1000 1100 1200 1300 1400 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 U.S. revolving credit U.S. credit card charge off rate $ Bi llio ns +$282B $1.38T Dec 2024 4.69% Q4 2024

Encore Capital Group, Inc. 10 U.S. consumer credit card delinquency rates continue to rise Source: TransUnion 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 30+ Days 60+ Days 90+ Days U.S. Bankcard Balance Delinquency Rates 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 % o f B al an ce s Pa st D ue

Encore Capital Group, Inc. 11 MCM Portfolio Purchases in the U.S. (in $M) 506 562 536 638 682 543 409 556 815 999 0 200 400 600 800 1,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Pandemic impact 2024 was a record year of portfolio purchasing for our U.S. business with deployments of $1B, up 23% compared to 2023 +23%

Encore Capital Group, Inc. 12 MCM continues to deliver strong results across the board Portfolio supply in the U.S. in 2024 surged to its highest level ever Record MCM portfolio purchases of $1B in 2024 were up 23% compared to 2023, including a single quarter record $295M in Q4 MCM collections of $1.57B in 2024 increased by 20% compared to 2023 – we expect continued growth in 2025 MCM’s estimated remaining collections (ERC) exceeds $5B for the first time Consumer payment behavior remains stable MCM (U.S.)

Encore Capital Group, Inc. 13 U.K. consumer credit continues to grow slowly and charge off rate remains low U.K. Consumer Credit Outstanding Balances and U.K. Annual Charge Off Rate Sources: Bank of England Database as at end September/December 2024. UK outstanding of total (excluding the Student Loans Company) sterling net unsecured lending to individuals (in sterling billions) not seasonally adjusted. Charge off rate only considers MFI data (Credit Card and Other loans to individuals) 0% 1% 2% 3% 4% 5% 0 50 100 150 200 250 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 U.K. Consumer Credit Outstanding Balances U.K. Annual Charge Off Rate 1.6% Q3 2024 £234B Dec 2024 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 £ Bi llio ns

Encore Capital Group, Inc. 14 Cabot issues are now behind us Reductions to Cabot ERC led to negative changes in expected future recoveries of $129M, of which: o 66% relate to U.K. o 16% relate to Europe o 18% relate to market exits $6M of restructuring charges related to exit of Italian NPL market in Q4 (after exiting the Spanish Secured NPL market in Q3) $19M IT-related asset impairment $101M Goodwill impairment primarily due to ERC reduction Actions in Q4 to address persistent Cabot issues Q4 2024 EPS Impact1 Q4 2024 ImpactImpacts from Cabot Actions and other items ($5.40)($129M)Cabot changes in expected future recoveries ($4.21)($101M)Cabot goodwill impairment ($0.78)($19M)Cabot IT-related asset impairment ($0.28)($8M)Loss on extinguishment of debt ($0.25)($6M)Cabot restructuring charges ($10.92)($262M)Total 1) Basic share count was used to calculate EPS impacts.

Encore Capital Group, Inc. 15 Cabot positioned for positive, predictable trajectory Cabot collections in 2024 of $588M increased by 8% compared to 2023 Cabot portfolio purchases of $353M in 2024 were up 36% compared to 2023, driven by exceptional Q4 of $200M that included large spot-market purchases at attractive returns As U.K. market remains impacted by subdued consumer lending, low delinquencies and robust competition, we do not expect 2024 level of purchasing to continue in 2025 Cabot (Europe) Cabot (Europe) Collections (in $M) 554 645 553 544 588 2020 2021 2022 2023 2024 +8%

Encore Capital Group, Inc. 16 Detailed Financial Discussion

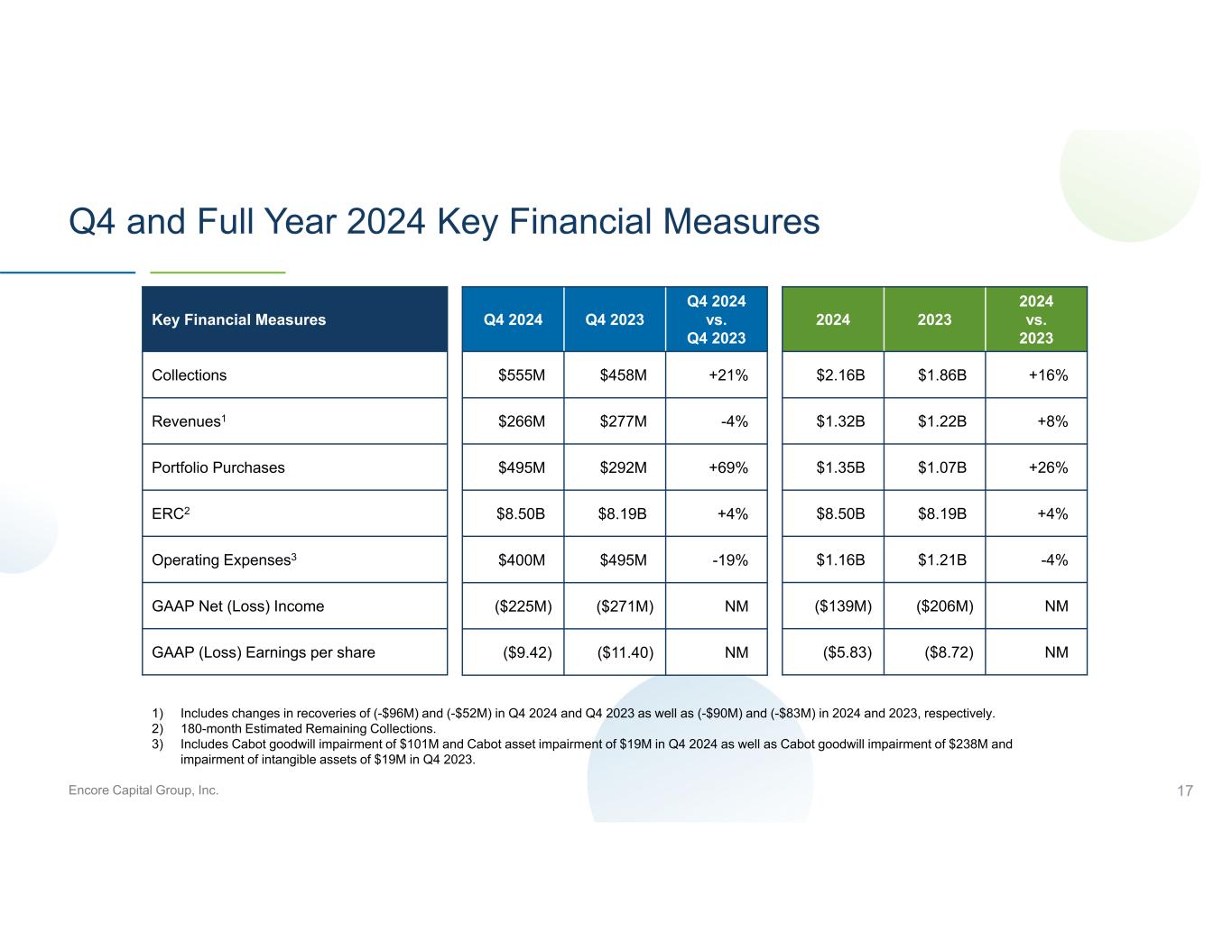

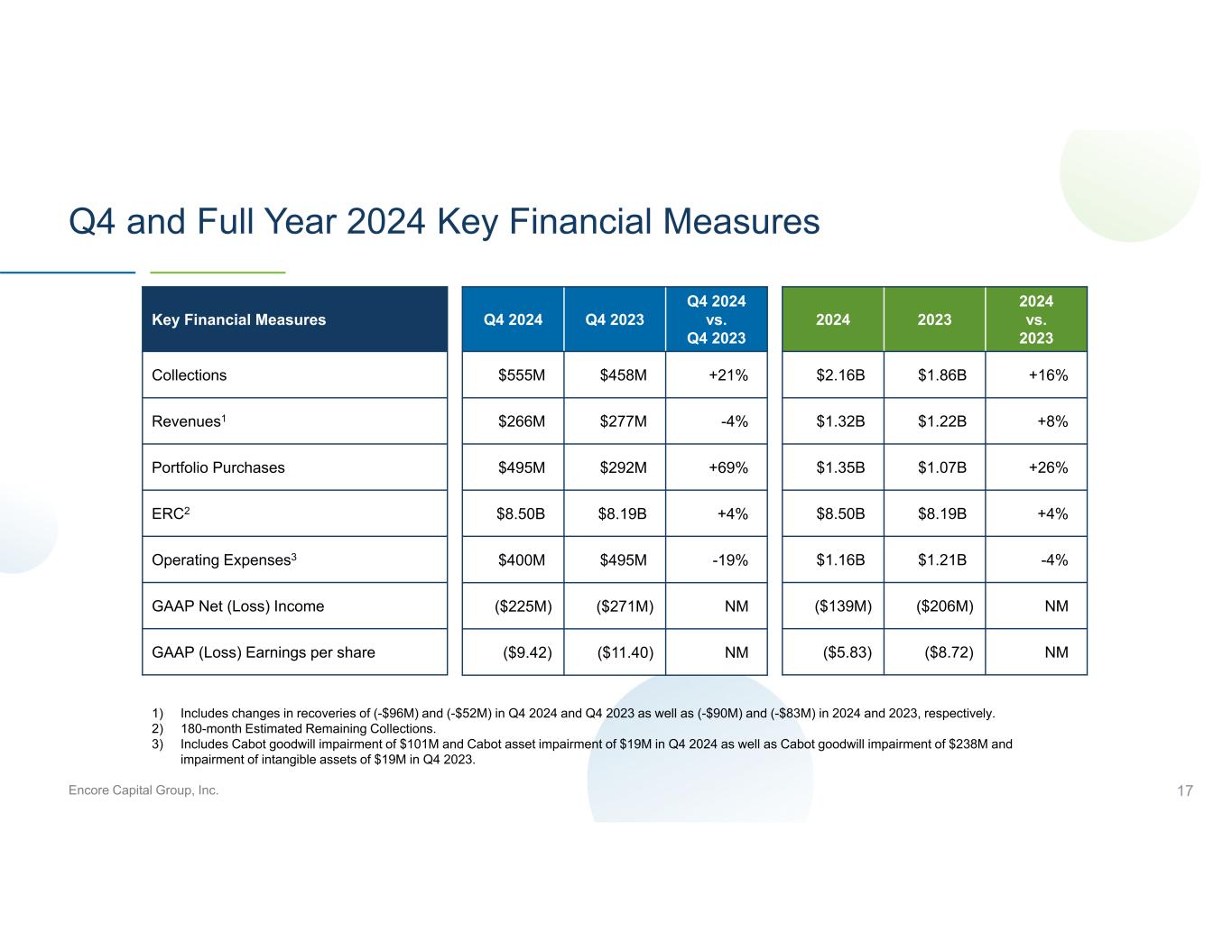

Encore Capital Group, Inc. 17 Q4 and Full Year 2024 Key Financial Measures Key Financial Measures Collections Revenues1 Portfolio Purchases ERC2 Operating Expenses3 GAAP Net (Loss) Income GAAP (Loss) Earnings per share 1) Includes changes in recoveries of (-$96M) and (-$52M) in Q4 2024 and Q4 2023 as well as (-$90M) and (-$83M) in 2024 and 2023, respectively. 2) 180-month Estimated Remaining Collections. 3) Includes Cabot goodwill impairment of $101M and Cabot asset impairment of $19M in Q4 2024 as well as Cabot goodwill impairment of $238M and impairment of intangible assets of $19M in Q4 2023. Q4 2024 vs. Q4 2023 Q4 2023Q4 2024 +21%$458M$555M -4%$277M$266M +69%$292M$495M +4%$8.19B$8.50B -19%$495M$400M NM($271M)($225M) NM($11.40)($9.42) 2024 vs. 2023 20232024 +16%$1.86B$2.16B +8%$1.22B$1.32B +26%$1.07B$1.35B +4%$8.19B$8.50B -4%$1.21B$1.16B NM($206M)($139M) NM($8.72)($5.83)

Encore Capital Group, Inc. 18 Leverage continues to decrease – even with record global portfolio purchases in 2024 2.8x 2.7x 2.4x 1.9x 2.4x 2.9x 2.6x 0.0x 1.0x 2.0x 3.0x 4.0x Q1 18 Q2 18 Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Leverage Ratio Leverage 1) Leverage Ratio utilizes non-GAAP metrics and is defined as Net Debt ÷ (LTM Adjusted EBITDA + LTM collections applied to principal balance). See appendix for calculations and a reconciliation to GAAP. 1 Target Leverage Ratio Range

Encore Capital Group, Inc. 19 Proactively managing borrowings with no significant maturities until 2028 Debt Maturity Profile1 at December 31, 2024 (in $M) 533 500 500 313 23 843 284 319 100 230 100 - 306 1,689 730 819 0 200000000 400000000 600000000 800000000 1E+09 1.2E+09 1.4E+09 1.6E+09 1.8E+09 2025 2026 2027 2028 2029 2030 As of December 31, 2024, available capacity under Encore’s Global Revolving Credit Facility (revolver) was $403M, not including non-client cash and cash equivalents of $178M. Redeemed €350M 2025 Senior Secured Notes at par in October 2024 and £300M 2026 Senior Secured Notes at par in November 2024. In October 2024, amended and extended revolver to, among other things, increase capacity by $92M to $1,295M, reduce interest margin by 0.25% and extend maturity by 1 year to September 20282. Entered into new Cabot Securitization Facility in December 2024 which matures in January 2030, replacing prior facility which was due to mature in September 2028. Bonds 50% Revolving Credit Facility 24% U.S. Facility 8% Convertible Notes 9% Securitisation Facility 9% 1) Note: Does not include other borrowings of approximately $66M. 2) Except for $22.5M, which matures in September 2027.

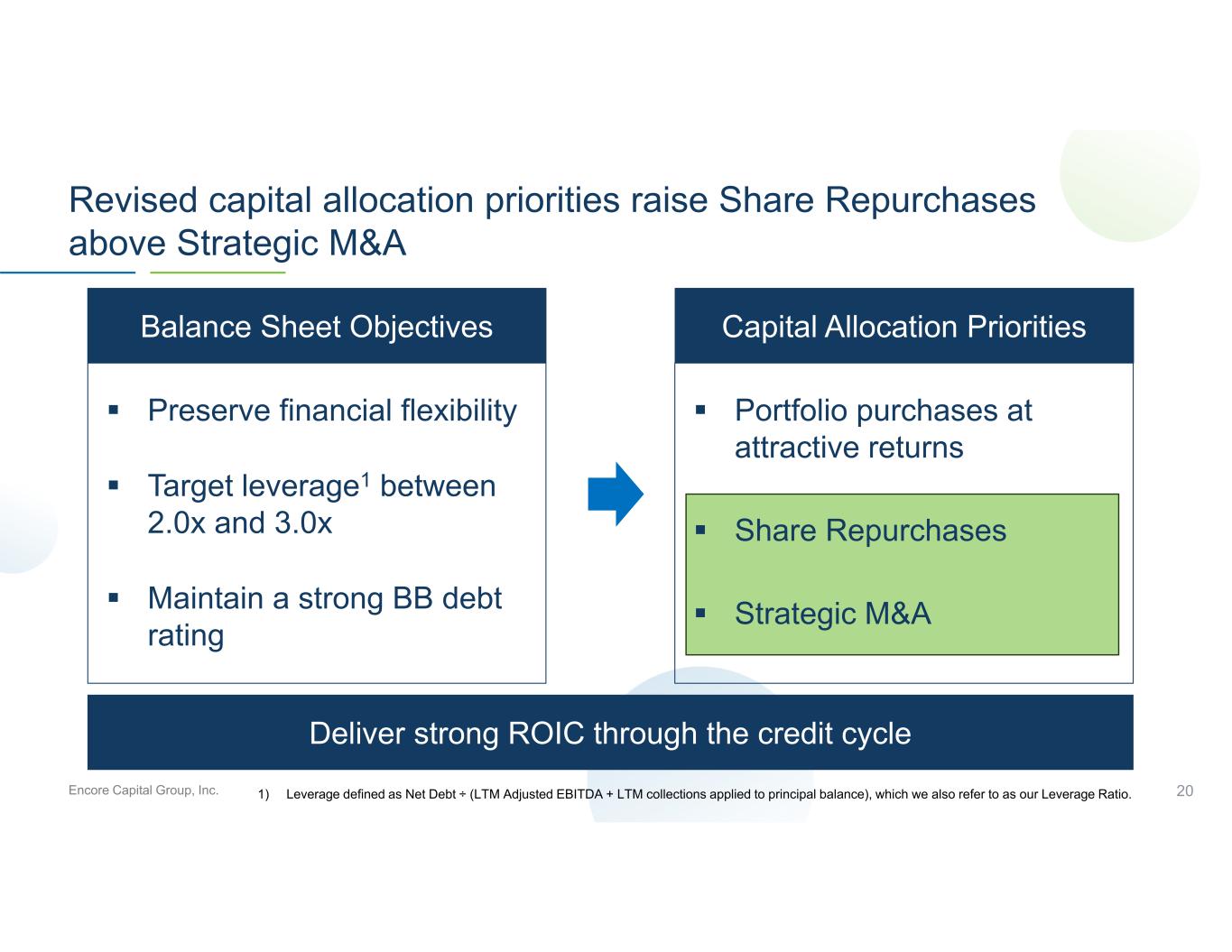

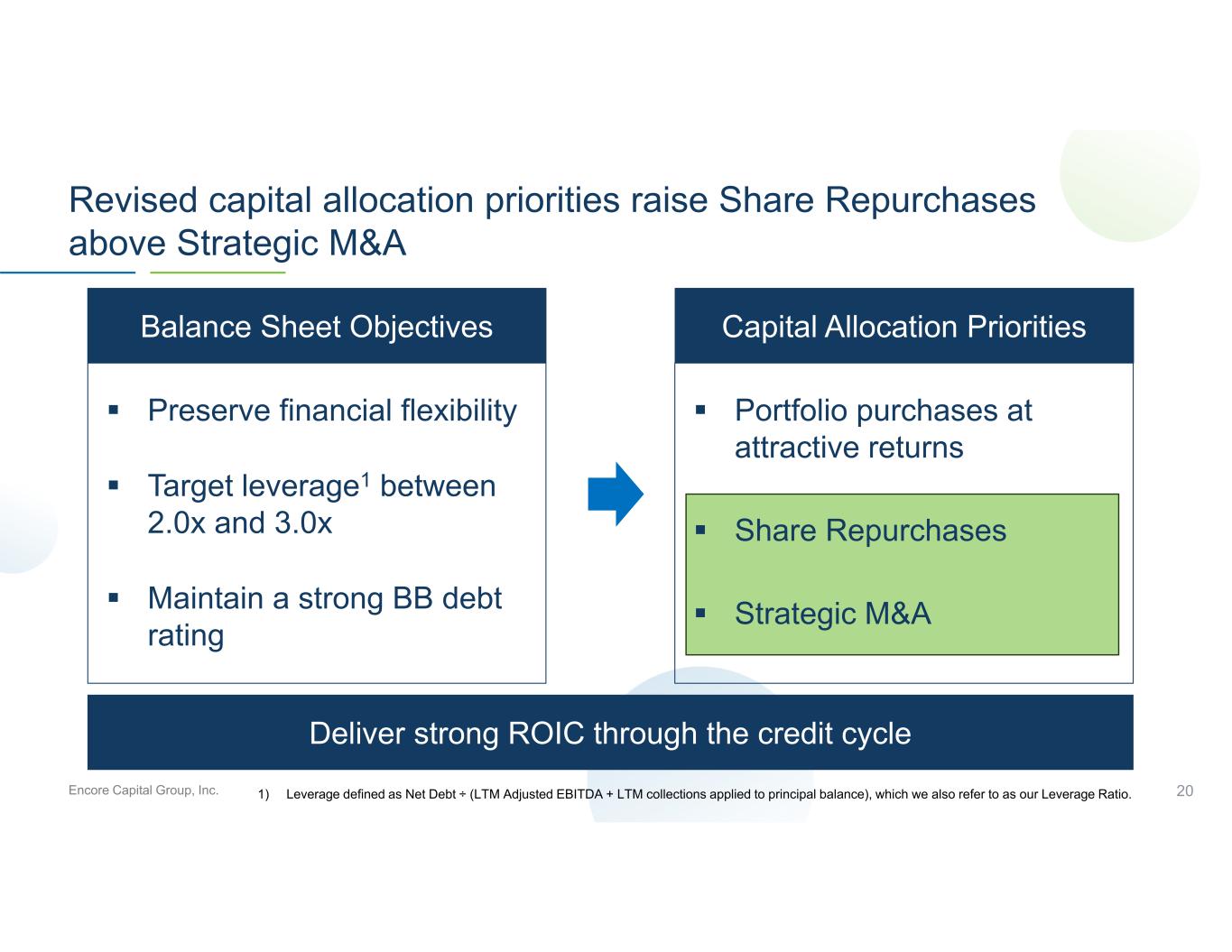

Encore Capital Group, Inc. 20 Revised capital allocation priorities raise Share Repurchases above Strategic M&A Preserve financial flexibility Target leverage1 between 2.0x and 3.0x Maintain a strong BB debt rating Portfolio purchases at attractive returns Share Repurchases Strategic M&A Deliver strong ROIC through the credit cycle Balance Sheet Objectives Capital Allocation Priorities 1) Leverage defined as Net Debt ÷ (LTM Adjusted EBITDA + LTM collections applied to principal balance), which we also refer to as our Leverage Ratio.

Encore Capital Group, Inc. 21 Well-positioned to capitalize on opportunities ahead Guidance Resume share repurchases in 2025 We also expect: − Interest expense in 2025 of $285M − Effective tax rate in 2025 to be in the mid-20’s % 1) In constant currency 2025 Guidance12024 Actual2023 Actual Exceed $1.35B+26% to $1.35B$1.07BPortfolio Purchases +11% to $2.4B+16% to $2.16B$1.86BCollections

Encore Capital Group, Inc. 22 Appendix

Encore Capital Group, Inc. 23 Non-GAAP Financial Measures This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information in the evaluation of its operations and believes that this measure, when added to collections applied to principal balance, is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included Pre-Tax ROIC as management uses this measure to monitor and evaluate operating performance relative to our invested capital and because the Company believes it is a useful measure for investors to evaluate effective use of capital. The Company has included Net Debt and Leverage Ratio as management uses these measures to monitor and evaluate its ability to incur and service debt. The Company has included Adjusted Operating Expenses in order to calculate Cash Efficiency Margin, which can be used as a measure of expense efficiency. The Company has included impacts from foreign currency exchange rates to facilitate a comparison of operating metrics that are unburdened by variations in foreign currency exchange rates over time. Adjusted EBITDA, Adjusted Income from Operations (used in Pre-Tax ROIC), Net Debt, Leverage Ratio, Adjusted Operating Expenses (used in Cash Efficiency Margin) and impacts from foreign currency exchange rates have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, income from operations, or operating expenses as indicators of the Company’s operating performance or liquidity. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Encore Capital Group, Inc. 24 Reconciliation of Adjusted EBITDA to GAAP Net Income 20242023202220212020(Unaudited, in $ thousands) ($ 139,244)($ 206,492)$ 194,564 $ 351,201 $ 212,524 GAAP net income (loss), as reported 252,545201,877153,308169,647209,356Interest expense 7,832------9,30040,951Loss on extinguishment of debt (7,008)(4,746)(1,774)(1,738)(2,397)Interest income 43,02926,228116,42585,34070,374Provision for income taxes 32,43441,737 46,419 50,079 42,780 Depreciation and amortization (267)(3,170)---------Net gain on derivative instruments1 ------------15,009CFPB settlement fees2 14,01213,85415,40218,33016,560Stock-based compensation expense 10,4517,4011,21320,5594,962Acquisition, integration and restructuring related expenses3 100,600238,200---------Goodwill impairment4 18,54418,7264,075------Impairment of assets4 $ 332,928$ 333,615$ 529,632$ 702,718$ 610,119 Adjusted EBITDA $ 1,004,230$ 776,280 $ 635,262 $ 843,087 $ 740,350 Collections applied to principal balance5 1) Amount represents gain or loss recognized on derivative instruments that are not designated as hedging instruments or gain or loss recognized on derivative instruments upon dedesignation of hedge relationships. We adjust for this amount because we believe the gain or loss on derivative contracts is not indicative of ongoing operations. 2) Amount represents a charge resulting from the Stipulated Judgment with the CFPB. We have adjusted for this amount because we believe it is not indicative of ongoing operations; therefore, adjusting for it enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 4) During the years ended December 31, 2024, and 2023, we recorded a non-cash goodwill impairment charge of $100.6 million and $238.2 million, respectively. We recorded a non-cash impairment of long-lived assets of $18.5 million and a non- cash impairment of intangible assets of $18.7 million during the years ended December 31, 2024, and 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) Amount represents (a) gross collections from receivable portfolios less (b) debt purchasing revenue, plus (c) proceeds applied to basis from sales of real estate owned (“REO”) assets and exit activities.

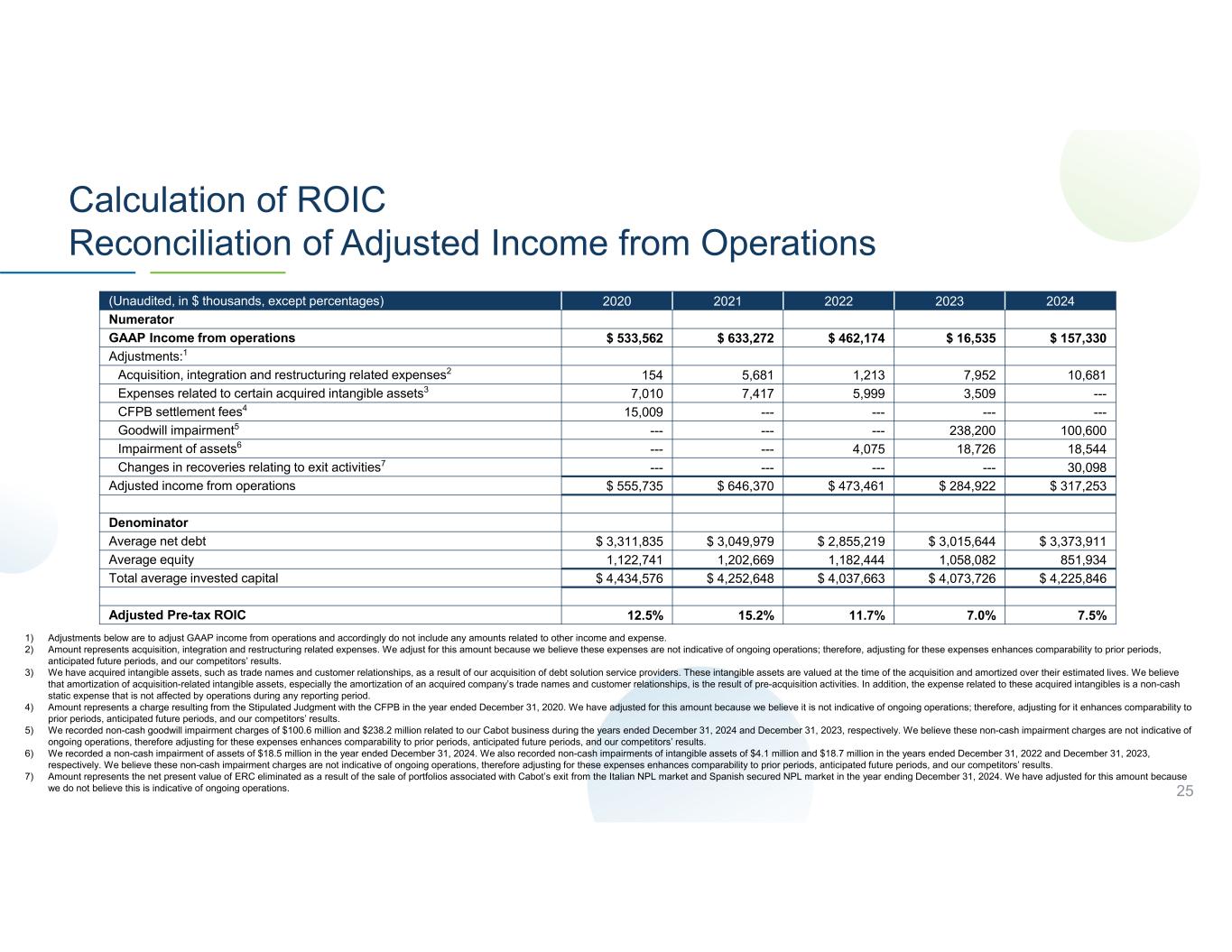

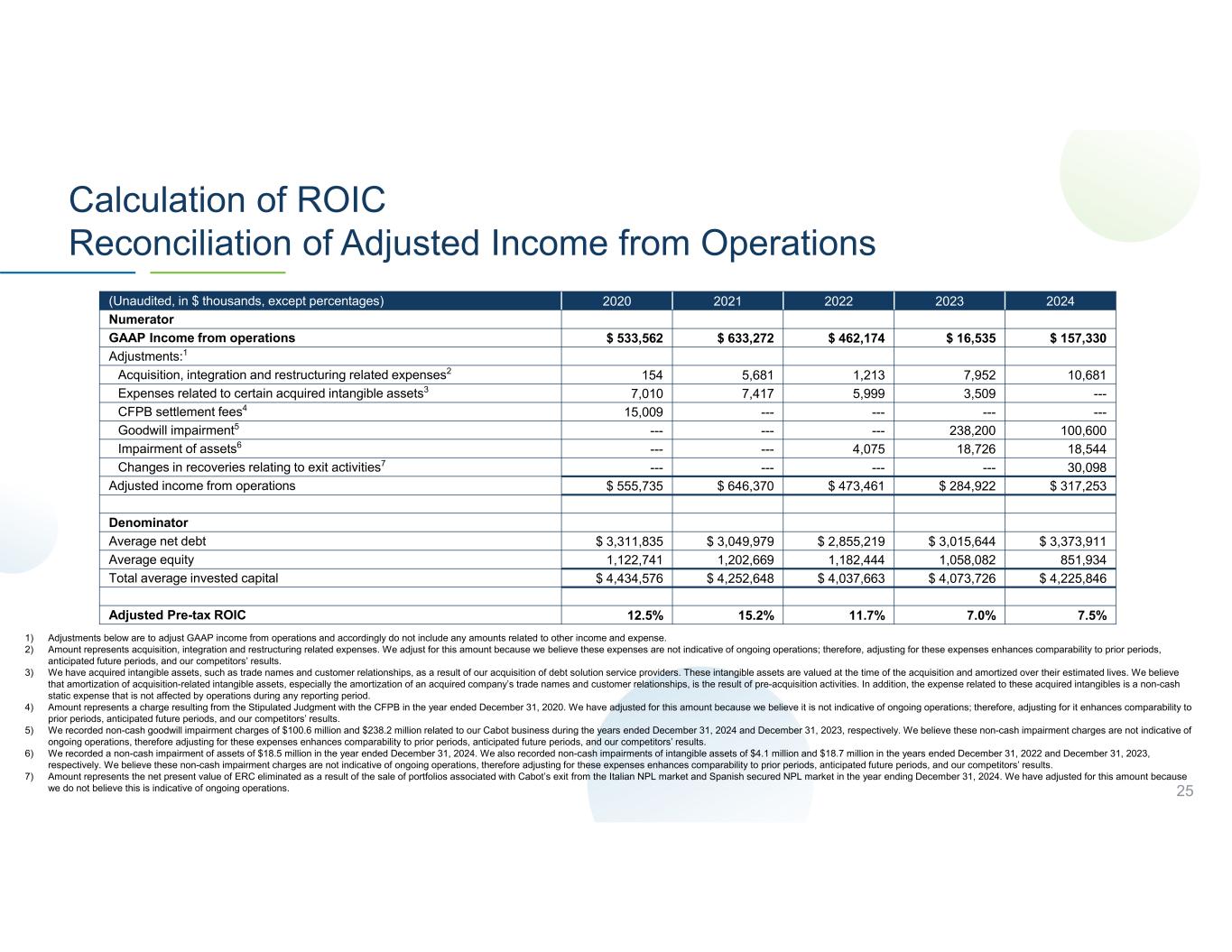

Encore Capital Group, Inc. 25 Calculation of ROIC Reconciliation of Adjusted Income from Operations 20242023202220212020(Unaudited, in $ thousands, except percentages) Numerator $ 157,330$ 16,535$ 462,174$ 633,272$ 533,562GAAP Income from operations Adjustments:1 10,6817,9521,2135,681154Acquisition, integration and restructuring related expenses2 ---3,5095,999 7,417 7,010 Expenses related to certain acquired intangible assets3 ------------15,009CFPB settlement fees4 100,600238,200---------Goodwill impairment5 18,54418,7264,075------Impairment of assets6 30,098------------Changes in recoveries relating to exit activities7 $ 317,253$ 284,922$ 473,461$ 646,370 $ 555,735 Adjusted income from operations Denominator $ 3,373,911$ 3,015,644$ 2,855,219$ 3,049,979$ 3,311,835Average net debt 851,934 1,058,082 1,182,444 1,202,669 1,122,741 Average equity $ 4,225,846$ 4,073,726$ 4,037,663$ 4,252,648 $ 4,434,576 Total average invested capital 7.5%7.0%11.7%15.2%12.5%Adjusted Pre-tax ROIC 1) Adjustments below are to adjust GAAP income from operations and accordingly do not include any amounts related to other income and expense. 2) Amount represents acquisition, integration and restructuring related expenses. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) We have acquired intangible assets, such as trade names and customer relationships, as a result of our acquisition of debt solution service providers. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the expense related to these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. 4) Amount represents a charge resulting from the Stipulated Judgment with the CFPB in the year ended December 31, 2020. We have adjusted for this amount because we believe it is not indicative of ongoing operations; therefore, adjusting for it enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) We recorded non-cash goodwill impairment charges of $100.6 million and $238.2 million related to our Cabot business during the years ended December 31, 2024 and December 31, 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 6) We recorded a non-cash impairment of assets of $18.5 million in the year ended December 31, 2024. We also recorded non-cash impairments of intangible assets of $4.1 million and $18.7 million in the years ended December 31, 2022 and December 31, 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 7) Amount represents the net present value of ERC eliminated as a result of the sale of portfolios associated with Cabot’s exit from the Italian NPL market and Spanish secured NPL market in the year ending December 31, 2024. We have adjusted for this amount because we do not believe this is indicative of ongoing operations.

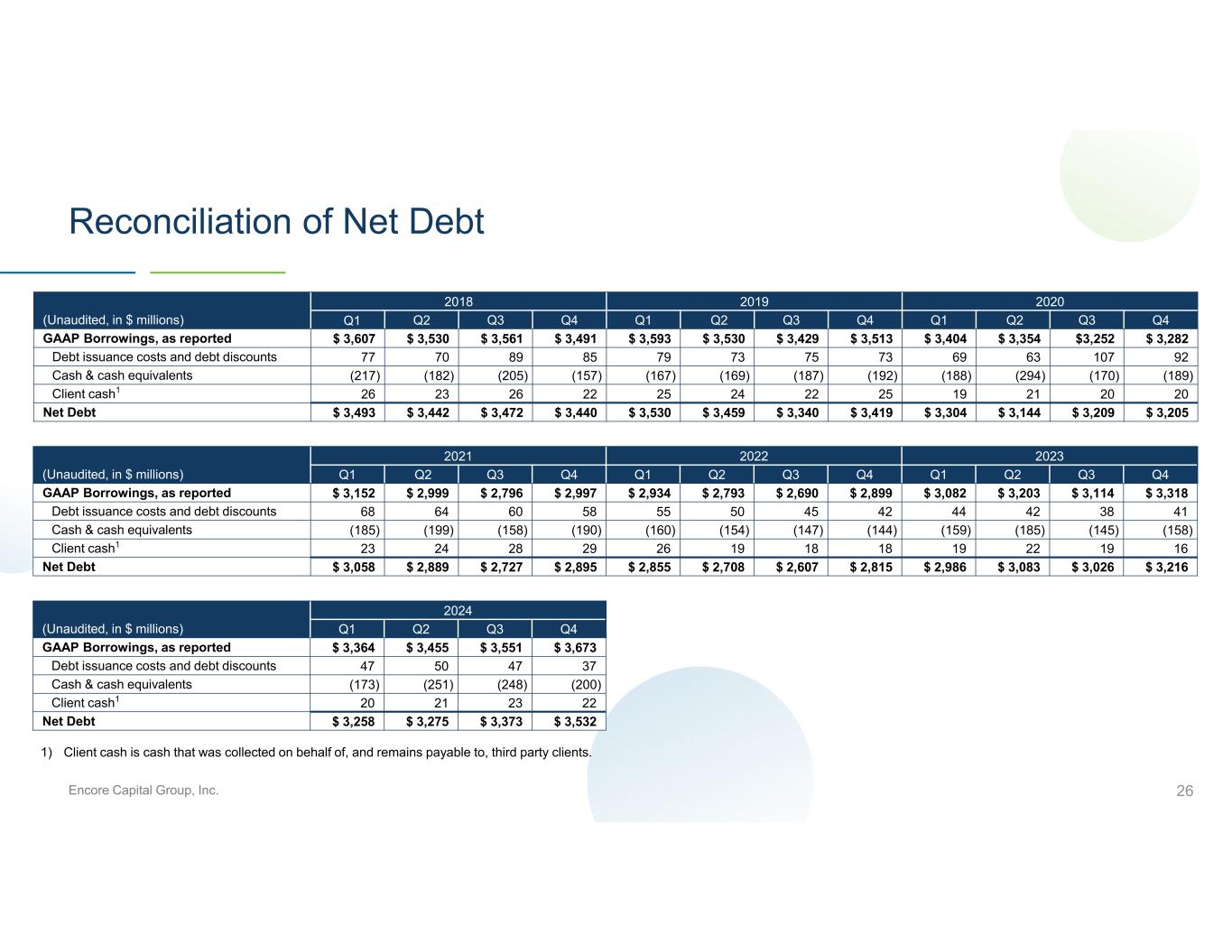

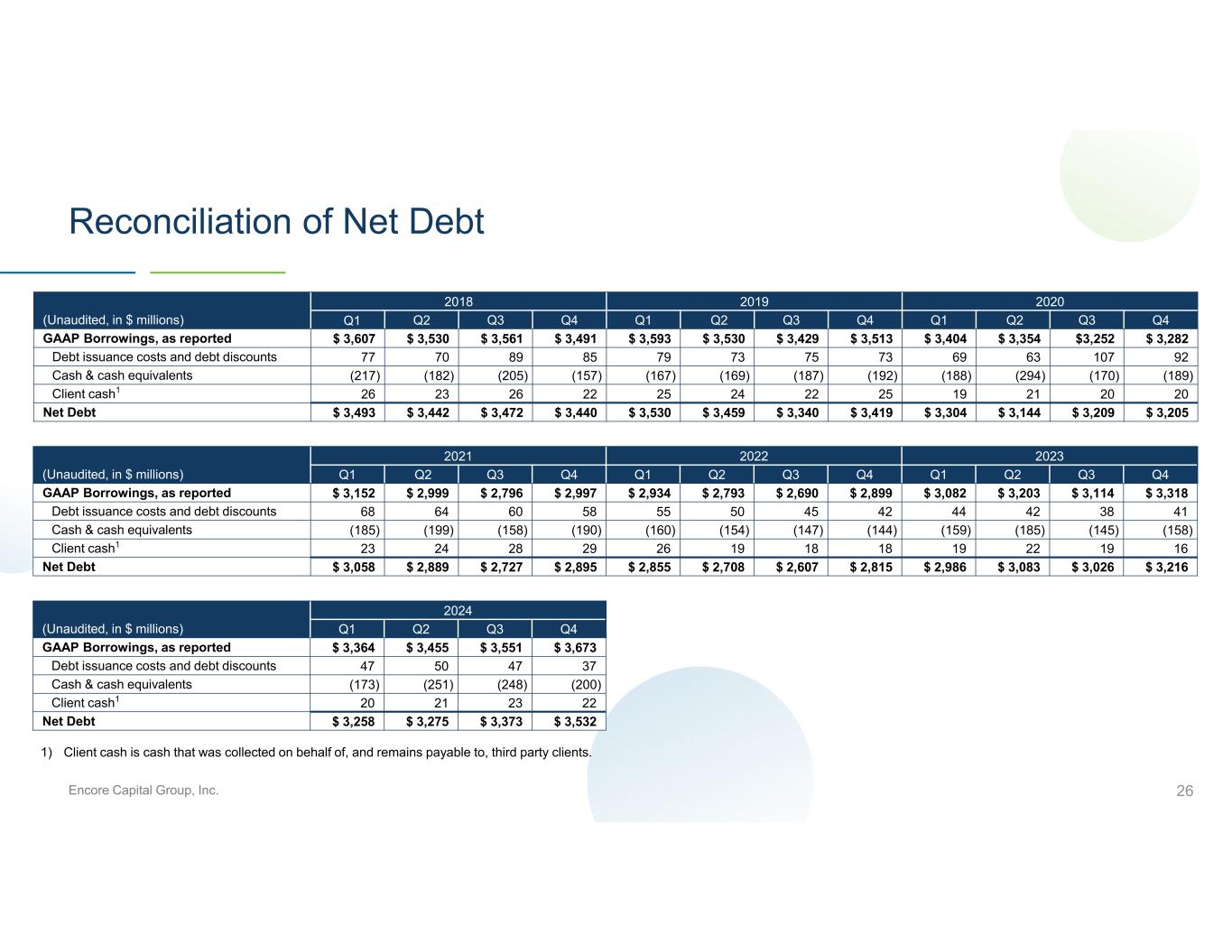

Encore Capital Group, Inc. 26 Reconciliation of Net Debt 202020192018 Q4Q3Q2Q1Q4Q3Q2Q1Q4Q3Q2Q1(Unaudited, in $ millions) $ 3,282$3,252$ 3,354 $ 3,404$ 3,513$ 3,429 $ 3,530 $ 3,593 $ 3,491 $ 3,561$ 3,530 $ 3,607 GAAP Borrowings, as reported 9210763 697375 73 79 8589 70 77 Debt issuance costs and debt discounts (189)(170)(294)(188)(192)(187)(169)(167)(157)(205)(182)(217)Cash & cash equivalents 202021 192522242522 2623 26 Client cash1 $ 3,205$ 3,209$ 3,144 $ 3,304$ 3,419$ 3,340$ 3,459$ 3,530 $ 3,440$ 3,472$ 3,442 $ 3,493Net Debt 1) Client cash is cash that was collected on behalf of, and remains payable to, third party clients. 202320222021 Q4Q3Q2Q1Q4Q3Q2Q1Q4Q3Q2Q1(Unaudited, in $ millions) $ 3,318$ 3,114$ 3,203$ 3,082$ 2,899$ 2,690$ 2,793$ 2,934$ 2,997$ 2,796$ 2,999$ 3,152GAAP Borrowings, as reported 413842444245505558606468Debt issuance costs and debt discounts (158)(145)(185)(159)(144)(147)(154)(160)(190)(158)(199)(185)Cash & cash equivalents 161922191818192629282423Client cash1 $ 3,216$ 3,026$ 3,083$ 2,986$ 2,815$ 2,607$ 2,708$ 2,855$ 2,895$ 2,727$ 2,889$ 3,058Net Debt 2024 Q4Q3Q2Q1(Unaudited, in $ millions) $ 3,673$ 3,551$ 3,455$ 3,364GAAP Borrowings, as reported 37475047Debt issuance costs and debt discounts (200)(248)(251)(173)Cash & cash equivalents 22232120Client cash1 $ 3,532$ 3,373$ 3,275$ 3,258Net Debt

Encore Capital Group, Inc. 27 Debt/Equity and Leverage Ratio 202320222021 Q4Q3Q2Q1Q4Q3Q2Q1Q4Q3Q2Q1 3.5x2.6x2.6x2.6x2.5x2.3x2.3x2.4x2.5x2.0x2.2x2.5xDebt / Equity1 2.9x2.8x2.8x2.7x2.4x2.1x2.0x1.9x1.9x1.8x1.9x2.1xLeverage Ratio2 1) GAAP Borrowings ÷ Total Encore Capital Group, Inc. stockholders’ equity 2) Leverage Ratio defined as Net Debt ÷ (LTM Adjusted EBITDA + LTM collections applied to principal balance). See appendix for reconciliation of Net Debt to GAAP Borrowings and Adjusted EBITDA to GAAP net income. 202020192018 Q4Q3Q2Q1Q4Q3Q2Q1Q4Q3Q2Q1 2.7x2.9x3.2x3.8x3.4x3.7x3.9x4.1x4.3x4.6x5.7x5.9xDebt / Equity1 2.4x2.4x2.4x2.6x2.7x2.7x2.7x2.8x2.8x2.9x3.0x3.2xLeverage Ratio2 2024 Q4Q3Q2Q1 4.8x3.4x3.5x3.5xDebt / Equity1 2.6x2.7x2.7x2.8xLeverage Ratio2

Encore Capital Group, Inc. 28 Impact of Fluctuations in Foreign Currency Exchange Rates Note: Constant Currency figures are calculated by employing Q4 2023 foreign currency exchange rates to recalculate Q4 2024 results and FY2023 foreign currency exchange rates to recalculate FY2024 results. All constant currency values are calculated based on the average exchange rates during the respective periods, except for ERC and debt, which are calculated using the changes in the period-ending exchange rates. Management refers to operating results on a constant currency basis so that the operating results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of the company's operating performance. Constant currency financial results are calculated by translating current period financial results in local currency using the prior period’s respective currency conversion rate. Certain foreign subsidiaries’ local currency financial results in our calculation include the translation effect from their foreign operating results. (Unaudited, in $ millions, except per share amounts) Constant CurrencyAs ReportedThree Months Ended 12/31/24 $ 552$ 555 Collections $ 266$ 266Revenues $ 397$ 400Operating Expenses $ (222)$ (225)GAAP Net Loss $ (9.30)$ (9.42)GAAP Loss per share 1) At December 31, 2024 Constant CurrencyAs ReportedTwelve Months Ended 12/31/24 $ 2,152$ 2,162 Collections $ 1,310 $ 1,316Revenues $ 8,619$ 8,501ERC1 $ 1,152$ 1,159Operating Expenses $ (137)$ (139)GAAP Net Loss $ (5.77)$ (5.83)GAAP Loss per share $ 3,724$ 3,673Borrowings1

Encore Capital Group, Inc. 29 Cash Efficiency Margin 2,227 2,428 2,006 1,946 2,247 57.5% 60.1% 53.9% 51.8% 54.2% 2020 2021 2022 2023 2024 Cash Receipts Cash Efficiency Margin Cash Efficiency Margin and Cash Receipts (in $M) Note: Cash Efficiency Margin defined as (Cash receipts – Adjusted operating expenses) ÷ Cash receipts, where Cash receipts = Collections + Servicing revenue. See calculations on following page.

Encore Capital Group, Inc. 30 Calculation of Cash Efficiency Margin1 1) Cash Efficiency Margin defined as (Cash receipts – Adjusted Operating expenses) ÷ Cash receipts, where Cash receipts = Collections + Servicing revenue Note: Beginning with the investor presentation covering the period ending December 31, 2024, we modified the adjustments to operating expenses used in the calculation of cash efficiency margin to enhance the comparability to prior periods, anticipated future periods, and our competitors’ results. We have updated prior periods for comparability. 2) During the years ended December 31, 2024, and 2023, we recorded a non-cash goodwill impairment charge of $100.6 million and $238.2 million, respectively. We recorded a non-cash impairment of long-lived assets of $18.5 million and a non-cash impairment of intangible assets of $18.7 million during the years ended December 31, 2024, and 2023, respectively. We believe these non-cash impairment charges are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 3) We have acquired intangible assets, such as trade names and customer relationships, as a result of our acquisition of debt solution service providers. These intangible assets are valued at the time of the acquisition and amortized over their estimated lives. We believe that amortization of acquisition-related intangible assets, especially the amortization of an acquired company’s trade names and customer relationships, is the result of pre-acquisition activities. In addition, the expense related to these acquired intangibles is a non-cash static expense that is not affected by operations during any reporting period. 4) Amount represents a charge resulting from the Stipulated Judgment with the CFPB in the year ended December 31, 2020. We have adjusted for this amount because we believe it is not indicative of ongoing operations; therefore, adjusting for it enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 20242023202220212020(Unaudited, in $ thousands, except percentages) $ 2,162,478$ 1,862,567$ 1,911,537$ 2,307,359$ 2,111,848Collections 84,78383,13694,922120,778115,118Servicing revenue $ 2,247,262$ 1,945,703$ 2,006,459$ 2,428,137$ 2,226,966Cash receipts (A) 1,159,0311,206,145936,173981,227967,838Operating expenses (10,681)(7,952)(1,213)(5,681)(154)Acquisition, integration, and restructuring related expenses (100,600)(238,200)---------Goodwill impairment2 (18,544)(18,726)(4,075)------Impairment of assets2 ---(3,509)(5,999)(7,417)(7,010)Amortization of certain acquired intangible assets3 ------------(15,009)Settlement fees and admin expenses4 $ 1,029,206$ 937,759$ 924,886 $ 968,129$ 945,665Adjusted operating expenses (B) 54.2%51.8%53.9%60.1%57.5%Cash Efficiency Margin (A-B)/A

Encore Capital Group, Inc. 31 2024 Cash Collections and Revenue Reconciliation 2,084 2,162 1,303 +78 -860 0 500 1000 1500 2000 Expected Cash Collections Recoveries Above Forecast (Over Performance) Cash Collections Portfolio Amortization Revenue from Receivable Portfolios 2024 Collections and Revenue Reconciliation (in $M) $2,084M Expected Cash Collections, equal to the sum of 2023 ERC plus expected collections from portfolios purchased in 2024 $78M Recoveries Above Forecast, cash collections above Expected Cash Collections for 2024 $2,162M Cash Collections from debt purchasing business in 2024 $860M Portfolio Amortization $1,303M Revenue from Receivable Portfolios (further detailed on the next slide) A A C CB D E B D E Notes: For simplicity, amounts reported above do not include the immaterial impacts of put-backs and recalls, which were ~$16M for the twelve months ended December 31, 2024. References within our reporting to Collections Applied to Principal primarily reflects the aggregate of Changes in Future Recoveries plus Portfolio Amortization.

Encore Capital Group, Inc. 32 Components of Debt Purchasing Revenue in 2024 1,303 1,213 +78 -168 0 200 400 600 800 1000 1200 1400 Revenue from Receivable Portfolios Recoveries Above Forecast (Over Performance) Changes in Expected Future Recoveries Debt Purchasing Revenue 2024 Debt Purchasing Revenue (in $M) 1. Revenue from Receivable Portfolios is revenue from expected collections and is a formulaic calculation based on the investment in receivable balance and an effective interest rate (EIR) that is established at the time of the purchase of each portfolio. 2. Changes in Recoveries is the sum of B + G 3. Recoveries Above/Below Forecast is the amount collected as compared to forecast for the period and represents over/under performance for the period. Colloquially referred to as “cash-overs” or “cash-unders”. 4. Changes in Expected Future Recoveries1 is the present value of changes to future ERC, which generally consists of: o Collections “pulled forward from” or “pushed out to” future periods (amounts either collected early or expected to be collected later); and o Magnitude and timing changes to estimates of expected future collections (which can be increases or decreases) 5. Debt Purchasing Revenue is the sum of E + F -90 Changes in Recoveries E B G H E B G H Note: References within our reporting to Collections Applied to Principal primarily reflects the aggregate of Changes in Future Recoveries plus Portfolio Amortization. F F Debt Purchasing Revenue in the Financial Statements