Exhibit 99.1

Business Update September—October 2005

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

Certain statements in this presentation constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of these factors, we refer you to the Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2004 and all other reports filed by the Company thereafter.

In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved.

1

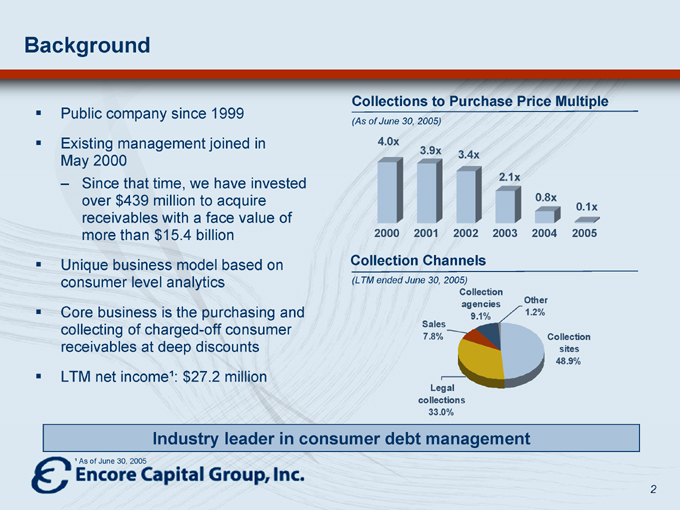

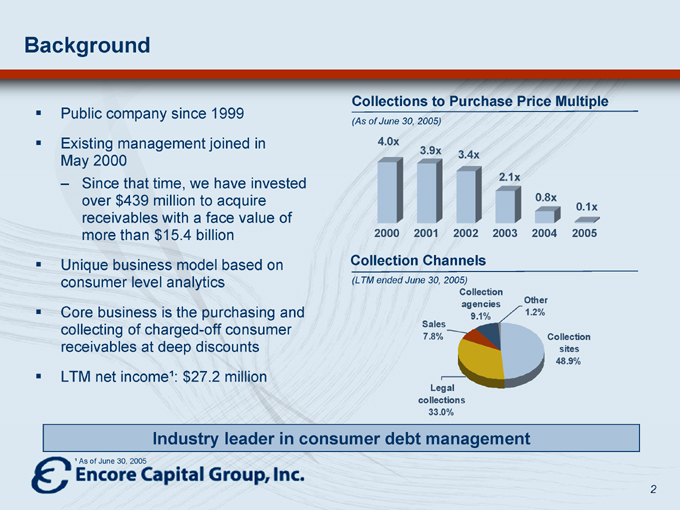

Background

Public company since 1999 Existing management joined in May 2000

– Since that time, we have invested over $439 million to acquire receivables with a face value of more than $15.4 billion Unique business model based on consumer level analytics Core business is the purchasing and collecting of charged-off consumer receivables at deep discounts LTM net income¹: $27.2 million

Collections to Purchase Price Multiple

(As of June 30, 2005)

4.0x

3.9x

3.4x

2.1x

0.8x

0.1x

2000 2001 2002 2003 2004 2005

Collection Channels

(LTM ended June 30, 2005)

Legal collections 33.0%

Sales 7.8%

Collection agencies 9.1%

Other 1.2%

Collection sites 48.9%

Industry leader in consumer debt management

¹ As of June 30, 2005

2

Strategic Vision

Leverage analytics to build the leading company in the distressed consumer space

Continue to grow the profitable core business of purchasing unsecured defaulted consumer receivables

– Acquire attractively priced portfolios (e.g., Jefferson Capital)

– Recruit top level managers to further refine business processes

– Differentiated analytical capabilities utilized for both acquiring and collecting portfolios

Build new businesses centered around the management of distressed consumers

– Strategic acquisitions (e.g., Ascension Capital)

– Organic growth (e.g., Healthcare business)

3

Investment Highlights

Recent acquisitions diversify asset base and enhance growth Attractive industry dynamics Differentiated analytical acquisition and collections approach Track record of generating superior financial returns Experienced management team

4

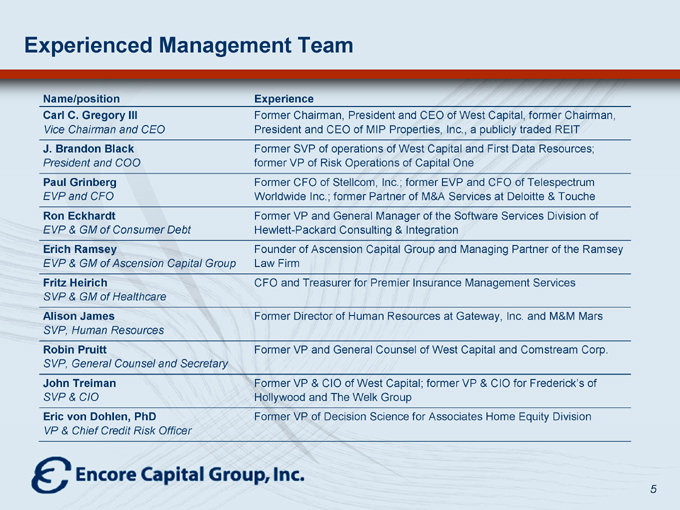

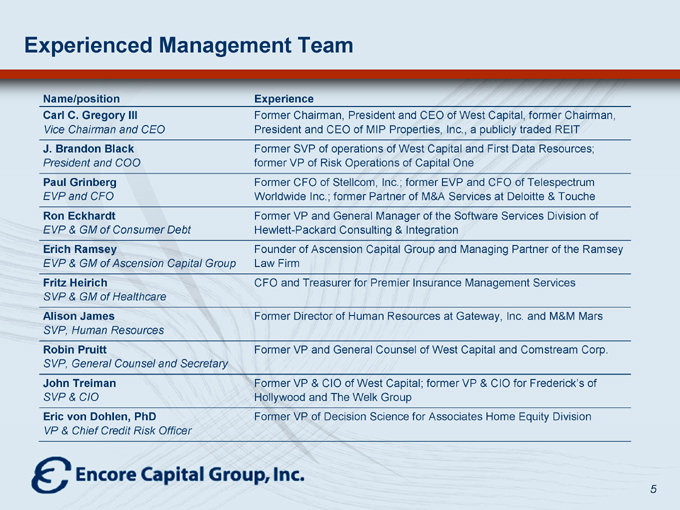

Experienced Management Team

Name/position Experience

Carl C. Gregory III Former Chairman, President and CEO of West Capital, former Chairman,

Vice Chairman and CEO President and CEO of MIP Properties, Inc., a publicly traded REIT

J. Brandon Black Former SVP of operations of West Capital and First Data Resources;

President and COO former VP of Risk Operations of Capital One

Paul Grinberg Former CFO of Stellcom, Inc.; former EVP and CFO of Telespectrum

EVP and CFO Worldwide Inc.; former Partner of M&A Services at Deloitte & Touche

Ron Eckhardt Former VP and General Manager of the Software Services Division of

EVP & GM of Consumer Debt Hewlett-Packard Consulting & Integration

Erich Ramsey Founder of Ascension Capital Group and Managing Partner of the Ramsey

EVP & GM of Ascension Capital Group Law Firm

Fritz Heirich CFO and Treasurer for Premier Insurance Management Services

SVP & GM of Healthcare

Alison James Former Director of Human Resources at Gateway, Inc. and M&M Mars

SVP, Human Resources

Robin Pruitt Former VP and General Counsel of West Capital and Comstream Corp.

SVP, General Counsel and Secretary

John Treiman Former VP & CIO of West Capital; former VP & CIO for Frederick’s of

SVP & CIO Hollywood and The Welk Group

Eric von Dohlen, PhD Former VP of Decision Science for Associates Home Equity Division

VP & Chief Credit Risk Officer

5

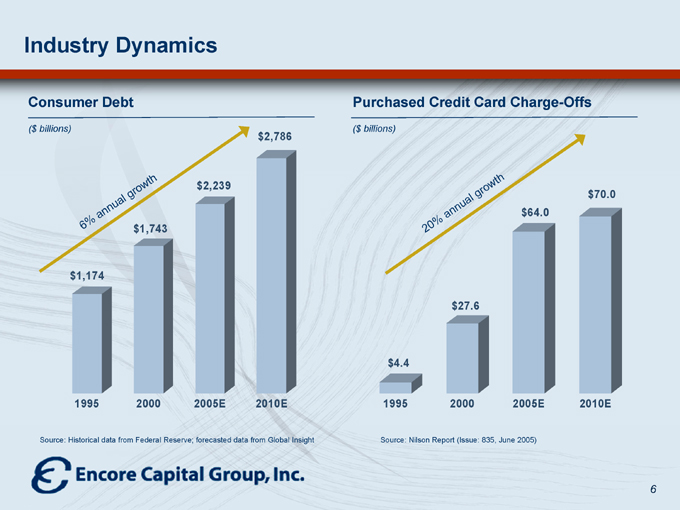

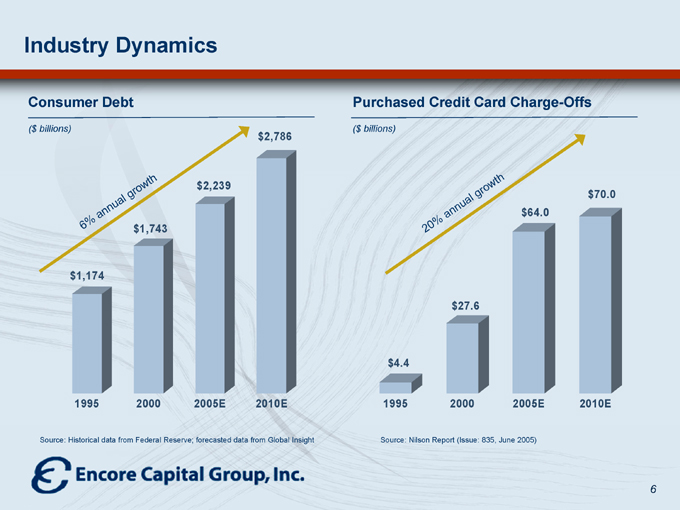

Industry Dynamics

Consumer Debt

($ billions) $1,174 $1,743 $2,239 $2,786

1995 2000 2005E 2010E

6% annual growth

Source: Historical data from Federal Reserve; forecasted data from Global Insight

Purchased Credit Card Charge-Offs

($ billions)

20% annual growth

$4.4 $27.6 $64.0 $70.0

1995 2000 2005E 2010E

Source: Nilson Report (Issue: 835, June 2005)

6

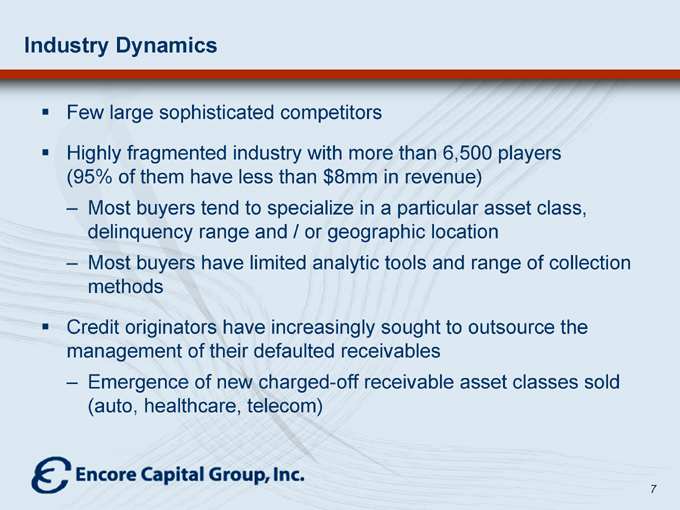

Industry Dynamics

Few large sophisticated competitors

Highly fragmented industry with more than 6,500 players (95% of them have less than $8mm in revenue)

– Most buyers tend to specialize in a particular asset class, delinquency range and / or geographic location

– Most buyers have limited analytic tools and range of collection methods

Credit originators have increasingly sought to outsource the management of their defaulted receivables

– Emergence of new charged-off receivable asset classes sold (auto, healthcare, telecom)

7

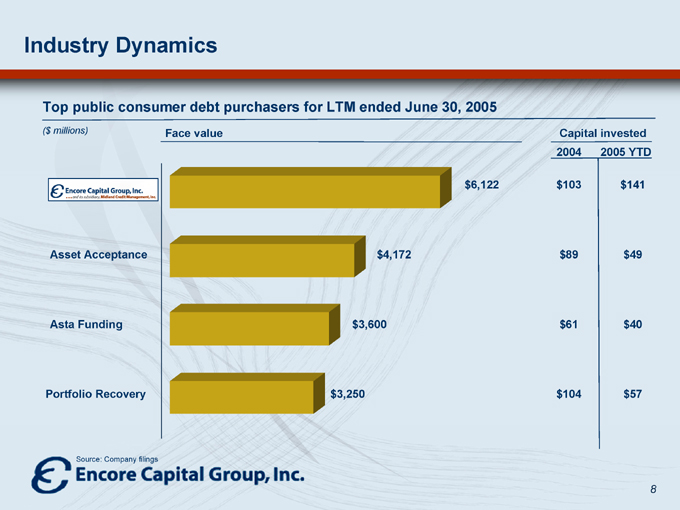

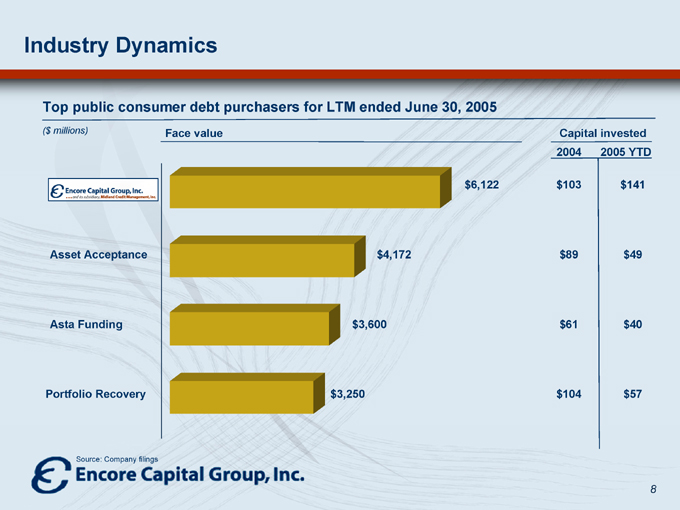

Industry Dynamics

Top public consumer debt purchasers for LTM ended June 30, 2005

($ millions)

Asset Acceptance

Asta Funding

Portfolio Recovery

Face value $6,122 $4,172 $3,600 $3,250

Capital invested

2004 2005 YTD

$103 $141

$89 $49

$61 $40

$104 $57

Source: Company filings

8

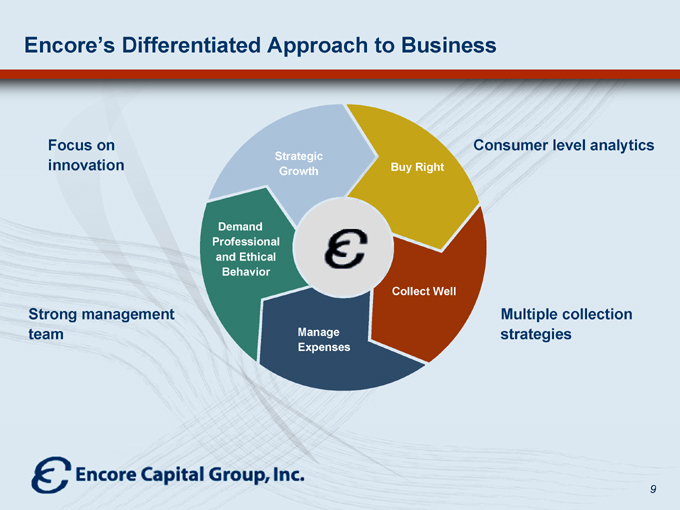

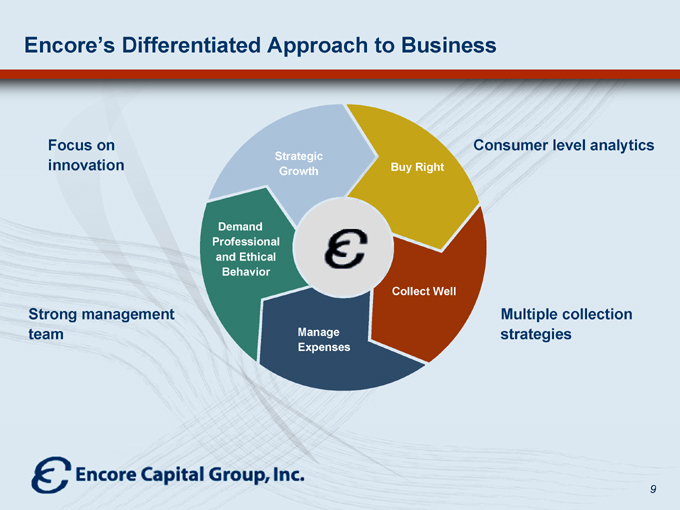

Encore’s Differentiated Approach to Business

Focus on innovation

Strong management team

Consumer level analytics

Multiple collection strategies

Strategic Growth

Buy Right

Collect Well

Manage Expenses

Demand Professional and Ethical Behavior

9

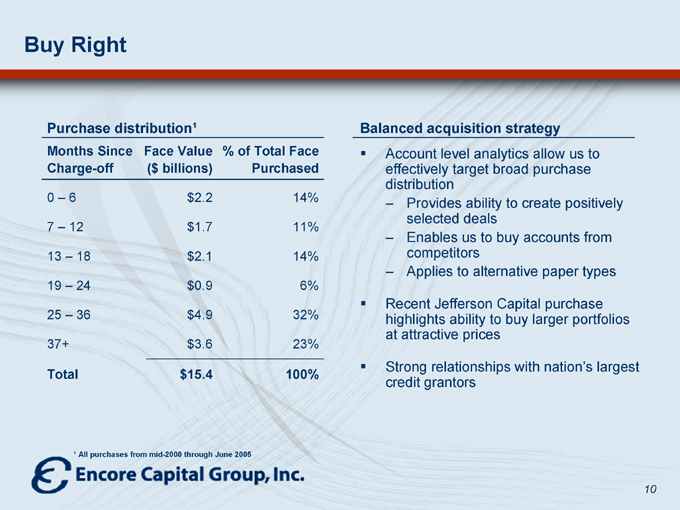

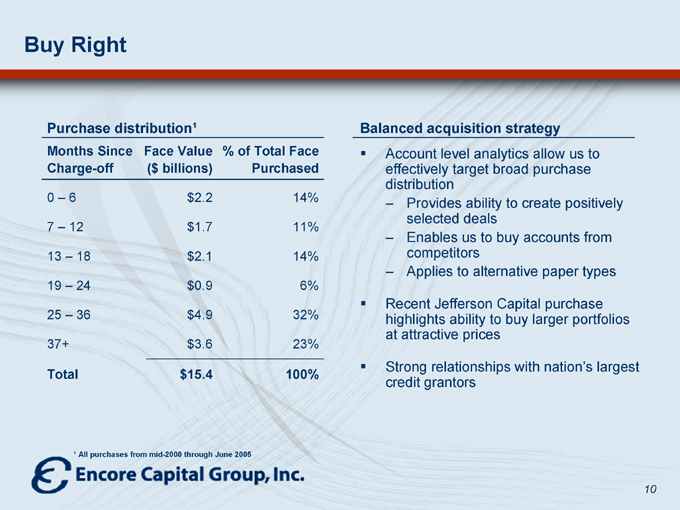

Buy Right

Purchase distribution¹

Months Since Charge-off Face Value ($ billions) % of Total Face Purchased

0 – 6 $2.2 14%

7 – 12 $1.7 11%

13 – 18 $2.1 14%

19 – 24 $0.9 6%

25 – 36 $4.9 32%

37+ $3.6 23%

Total $15.4 100%

Balanced acquisition strategy

Account level analytics allow us to effectively target broad purchase distribution

– Provides ability to create positively selected deals

– Enables us to buy accounts from competitors

– Applies to alternative paper types

Recent Jefferson Capital purchase highlights ability to buy larger portfolios at attractive prices

Strong relationships with nation’s largest credit grantors

¹ All purchases from mid-2000 through June 2005

10

Recent Jefferson Capital Portfolio Acquisition

Deal Overview

Purchased charged-off consumer credit card debt from Jefferson Capital, a subsidiary of CompuCredit

Purchase price of $142.9mm

– Initial portfolio with face value of $2.8bn, as well as:

– 5-year forward flow agreement to purchase additional $3.25bn in face value at a fixed price

– New collection site in St. Cloud, MN with approximately 120 employees

Concurrently entered into an expanded 3-year $200mm revolving credit facility with JPMorgan

Benefits

Secures large, profitable forward flow portfolio

Essentially fulfills purchase requirements for the duration of 2005

– Allows for selectivity in future purchases this year

Increases earnings potential while maintaining purchasing discipline

Allows the company to focus more on recovery of existing portfolio and strategic objectives

11

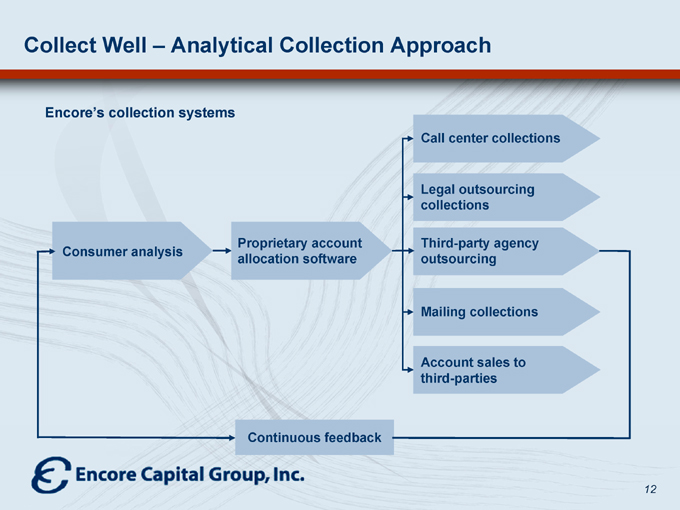

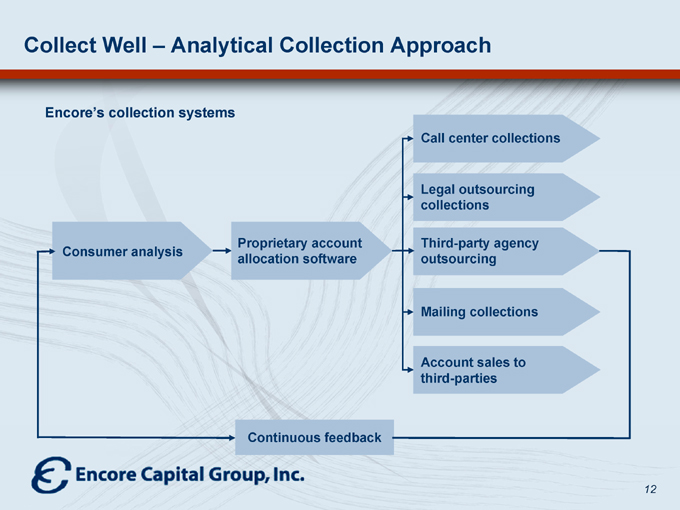

Collect Well – Analytical Collection Approach

Encore’s collection systems

Consumer analysis

Proprietary account allocation software

Call center collections

Legal outsourcing collections

Third-party agency outsourcing

Mailing collections

Account sales to third-parties

Continuous feedback

12

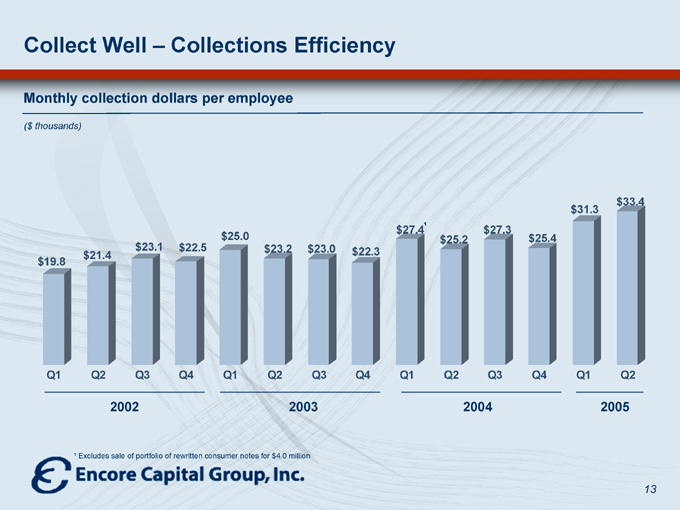

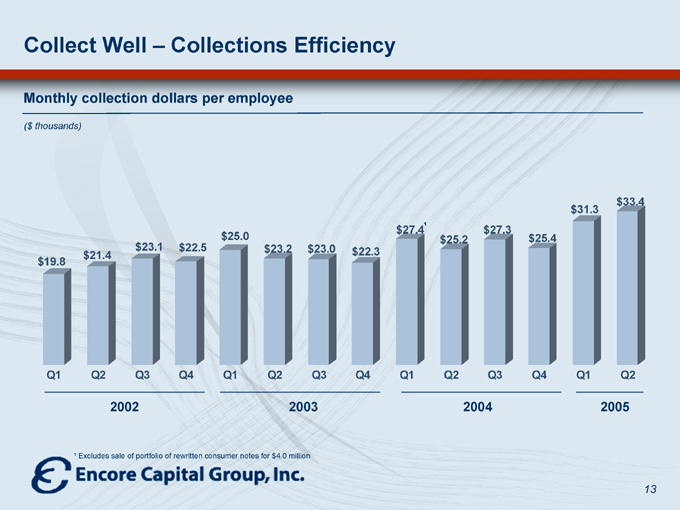

Collect Well – Collections Efficiency

Monthly collection dollars per employee

($ thousands) $19.8 $21.4 $23.1 $22.5 $25.0 $23.2 $23.0 $22.3 $27.4¹ $25.2 $27.3 $25.4 $31.3 $33.4

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2002 2003 2004 2005

¹ Excludes sale of portfolio of rewritten consumer notes for $4.0 million

13

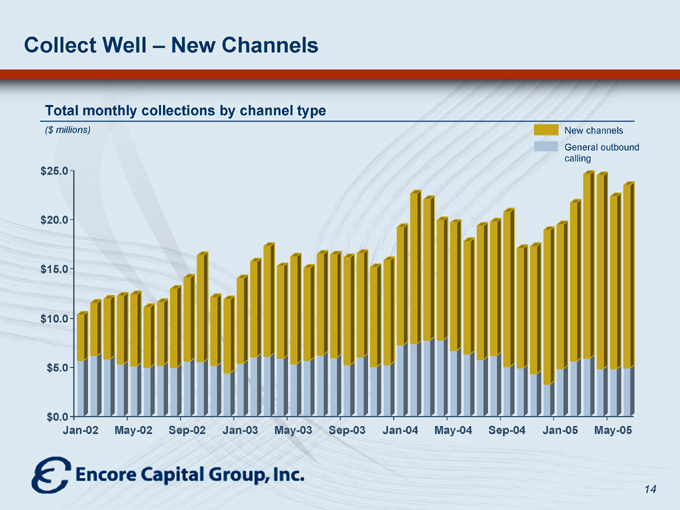

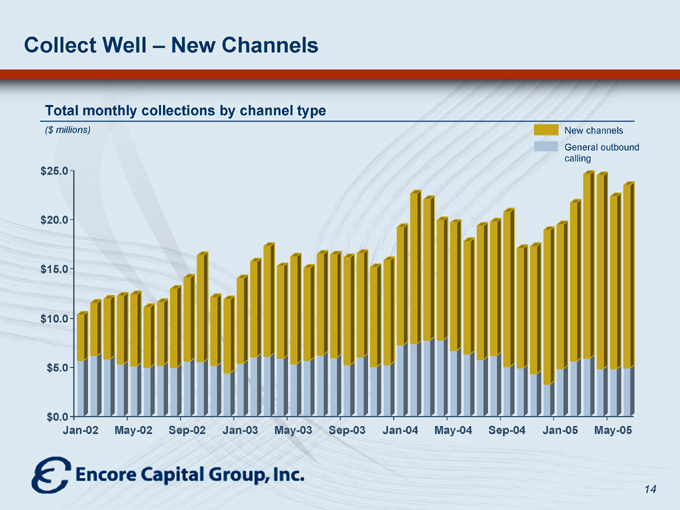

Collect Well – New Channels

Total monthly collections by channel type

($ millions) $25.0 $20.0 $15.0 $10.0 $5.0 $0.0

Jan-02 May-02 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 May-05

New channels General outbound calling

14

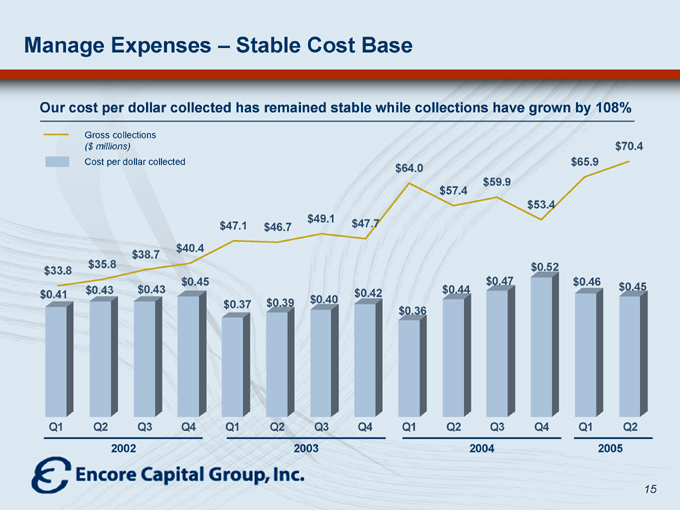

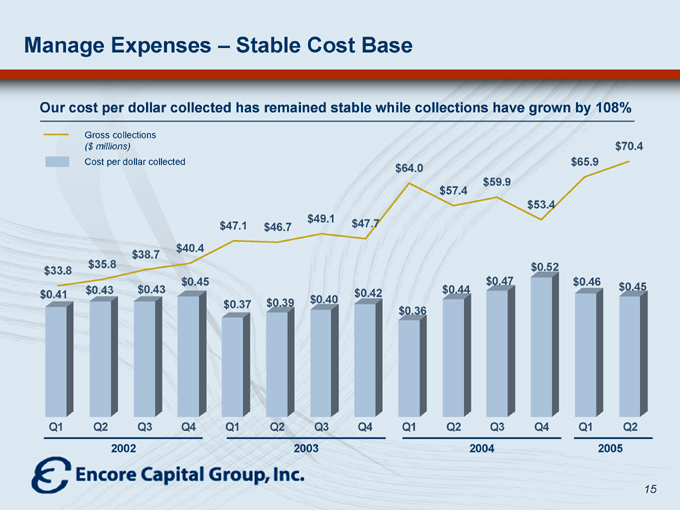

Manage Expenses – Stable Cost Base

Our cost per dollar collected has remained stable while collections have grown by 108%

Gross collections

($ millions)

Cost per dollar collected $33.8 $35.8 $38.7 $40.4 $47.1 $46.7 $49.1 $47.7 $64.0 $57.4 $59.9 $53.4 $65.9 $70.4 $0.41 $0.43 $0.43 $0.45 $0.37 $0.39 $0.40 $0.42 $0.36 $0.44 $0.47 $0.52 $0.46 $0.45

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2002 2003 2004 2005

15

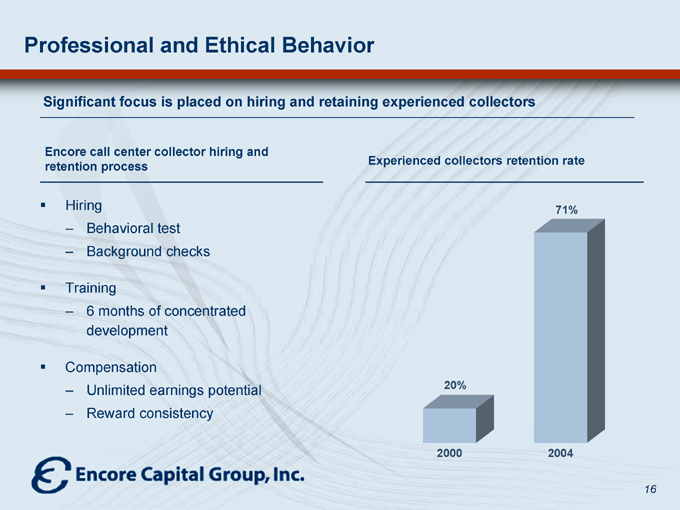

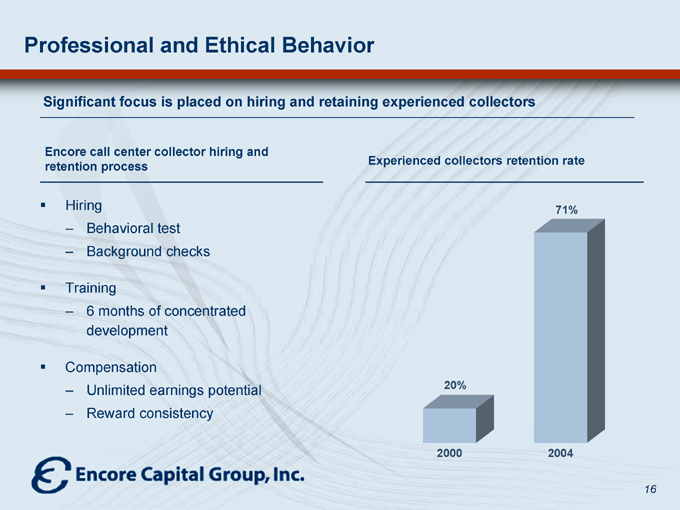

Professional and Ethical Behavior

Significant focus is placed on hiring and retaining experienced collectors

Encore call center collector hiring and retention process

Hiring

– Behavioral test

– Background checks

Training

– 6 months of concentrated development

Compensation

– Unlimited earnings potential

– Reward consistency

Experienced collectors retention rate

20%

71%

2000

2004

16

Strategic Growth

Active Approach to Broaden Business

Penetration into secured bankruptcy servicing through Ascension acquisition

Organic expansion into medical receivables

Strategic Rationale

Builds upon core credit card charge-off business by expanding into higher growth areas

Allows entry into growing niches within the consumer debt recovery business

Affords significant cross-selling opportunities

Future Areas of Opportunity

Auto Telecom Utilities Student loans Secured loans

Other asset classes / consumer types

17

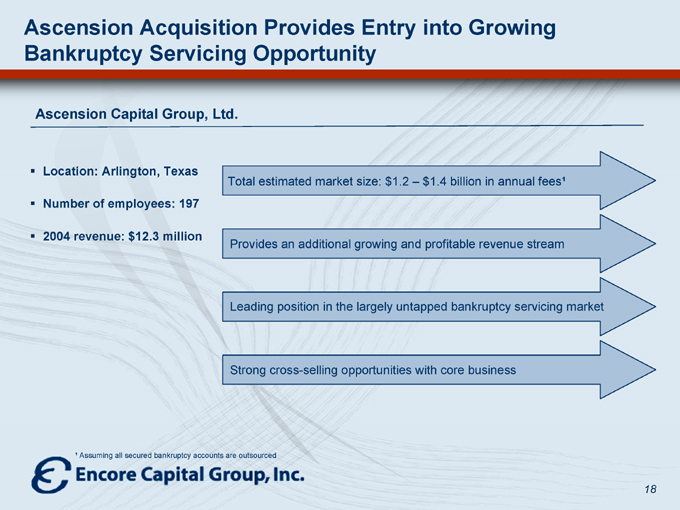

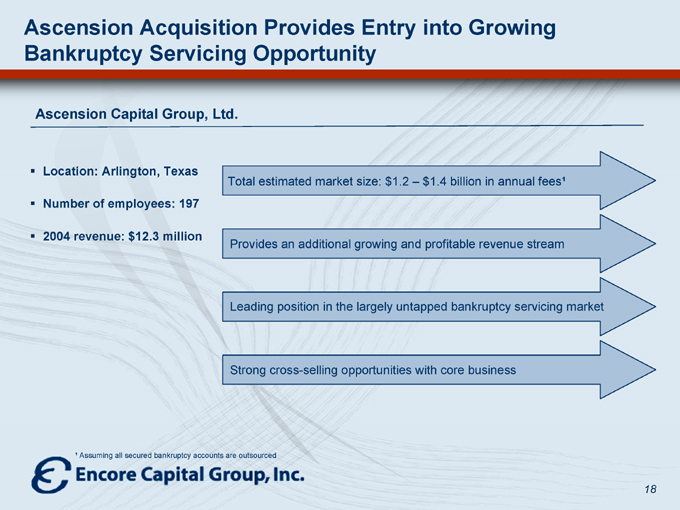

Ascension Acquisition Provides Entry into Growing Bankruptcy Servicing Opportunity

Ascension Capital Group, Ltd.

Location: Arlington, Texas Number of employees: 197 2004 revenue: $12.3 million

Total estimated market size: $1.2 – $1.4 billion in annual fees¹

Provides an additional growing and profitable revenue stream

Leading position in the largely untapped bankruptcy servicing market

Strong cross-selling opportunities with core business

¹ Assuming all secured bankruptcy accounts are outsourced

18

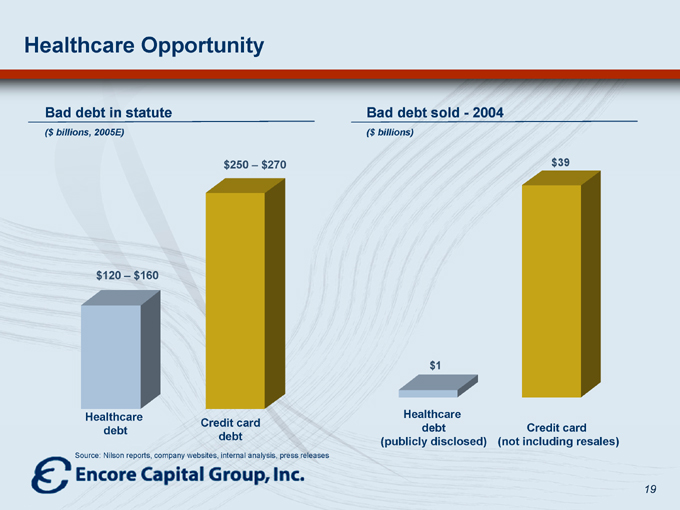

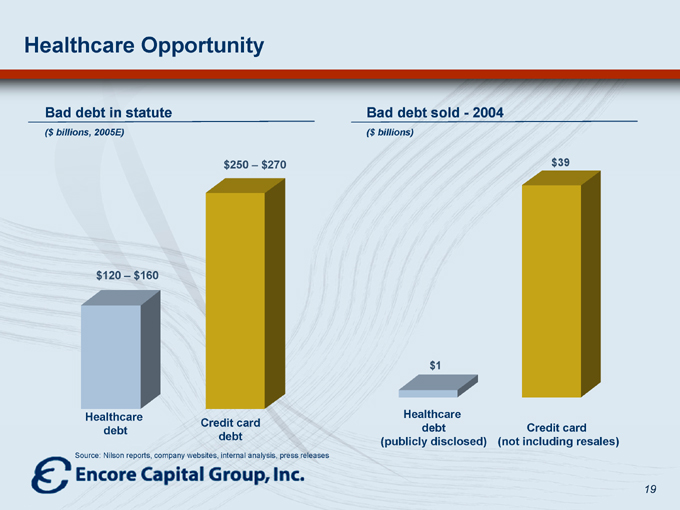

Healthcare Opportunity

Bad debt in statute

($ billions, 2005E) $120 – $160 $250 – $270

Healthcare debt

Credit card debt

Bad debt sold—2004

($ billions) $1 $39

Healthcare debt (publicly disclosed)

Credit card (not including resales)

Source: Nilson reports, company websites, internal analysis, press releases

19

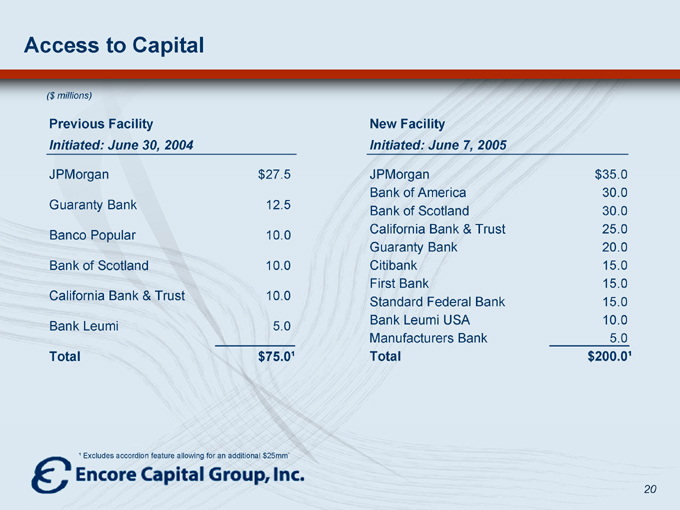

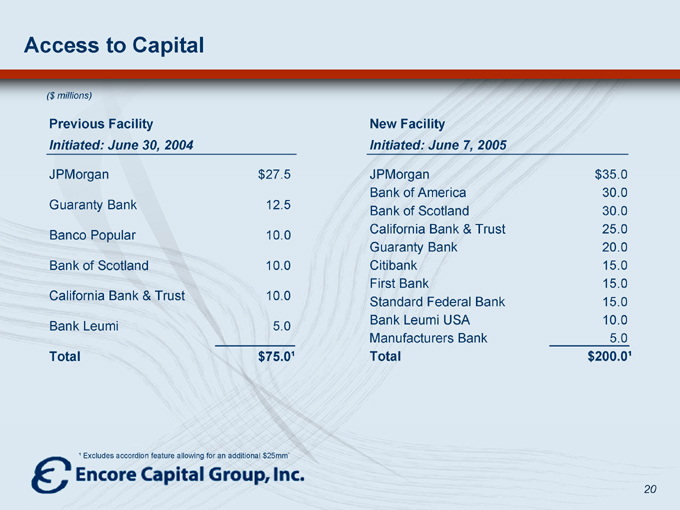

Access to Capital

($ millions)

Previous Facility

Initiated: June 30, 2004

JPMorgan $27.5

Guaranty Bank 12.5

Banco Popular 10.0

Bank of Scotland 10.0

California Bank & Trust 10.0

Bank Leumi 5.0

Total $75.0¹

New Facility

Initiated: June 7, 2005

JPMorgan $35.0

Bank of America 30.0

Bank of Scotland 30.0

California Bank & Trust 25.0

Guaranty Bank 20.0

Citibank 15.0

First Bank 15.0

Standard Federal Bank 15.0

Bank Leumi USA 10.0

Manufacturers Bank 5.0

Total $200.0¹

¹ Excludes accordion feature allowing for an additional $25mm`

20

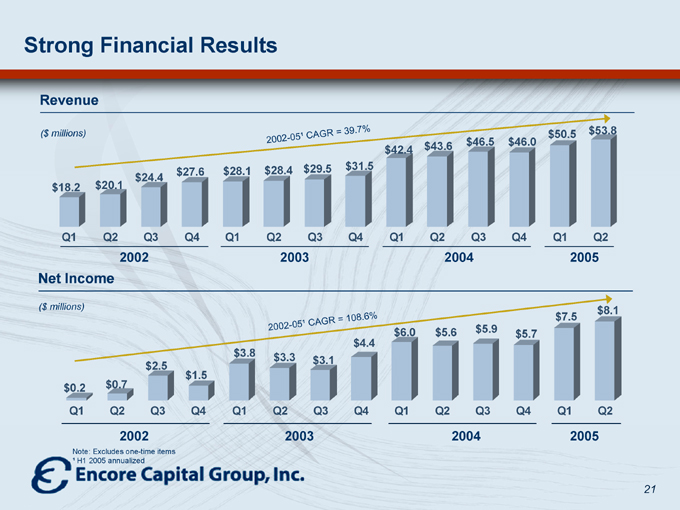

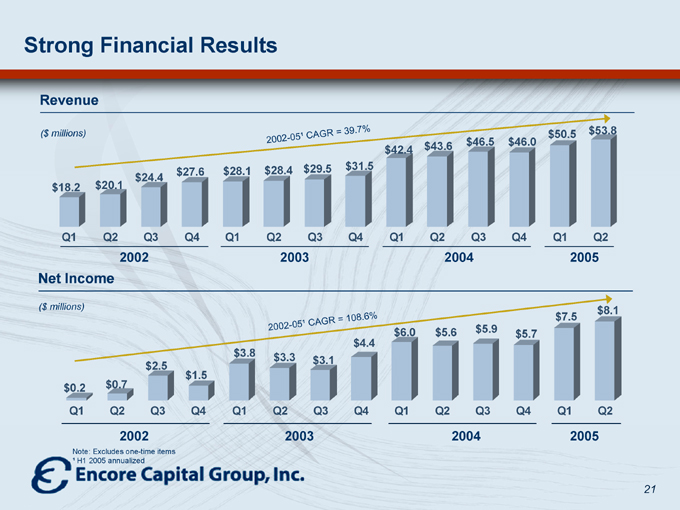

Strong Financial Results

Revenue

($ millions)

2002-05¹ CAGR = 39.7%

$18.2 $20.1 $24.4 $27.6 $28.1 $28.4 $29.5 $31.5 $42.4 $43.6 $46.5 $46.0 $50.5 $53.8

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2002 2003 2004 2005

Net Income

($ millions)

2002-05¹ CAGR = 108.6%

$0.2 $0.7 $2.5 $1.5 $3.8 $3.3 $3.1 $4.4 $6.0 $5.6 $5.9 $5.7 $7.5 $8.1

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2002 2003 2004 2005

Note: Excludes one-time items

¹ H1 2005 annualized

21

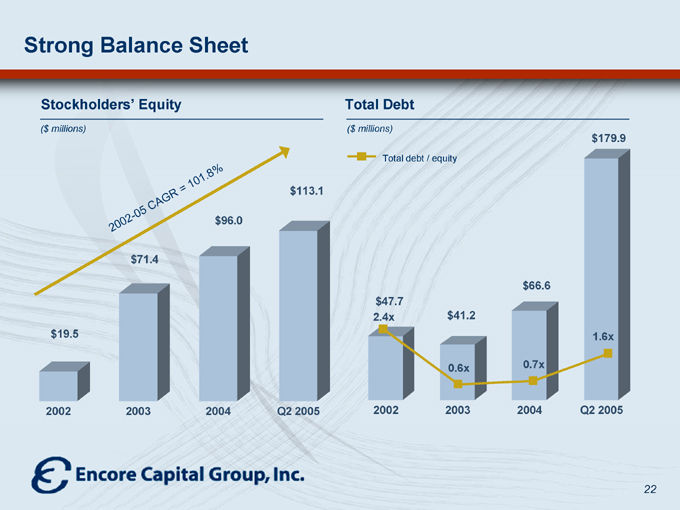

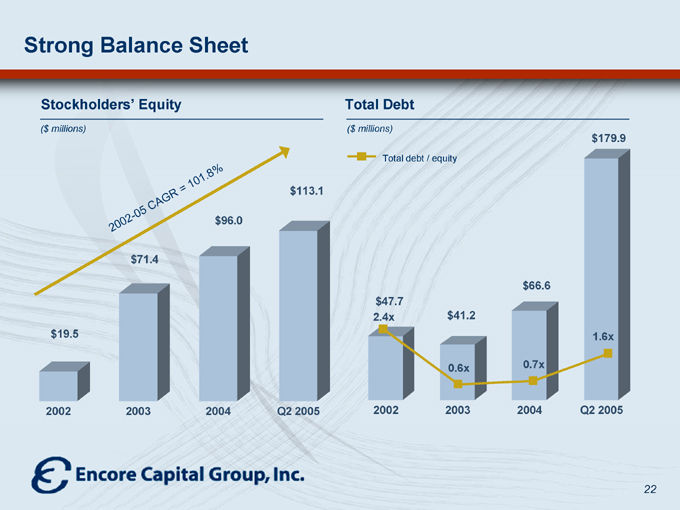

Strong Balance Sheet

Stockholders’ Equity

($ millions)

2002-05 CAGR = 101.8%

$19.5 $71.4 $96.0 $113.1

2002 2003 2004 Q2 2005

Total Debt

($ millions)

Total debt / equity $47.7 2.4x $41.2

0.6x $66.6

0.7x $179.9

1.6x

2002 2003 2004 Q2 2005

22

Investment Highlights

Recent acquisitions diversify asset base and enhance growth Attractive industry dynamics Differentiated analytical acquisition and collections approach Track record of generating superior financial returns Experienced management team

23