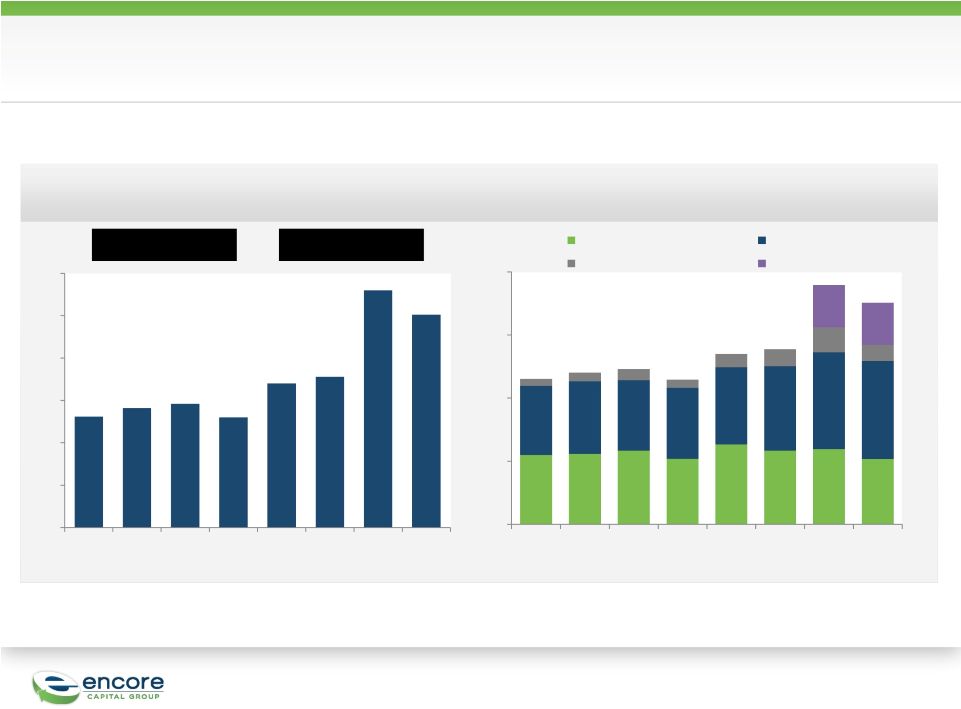

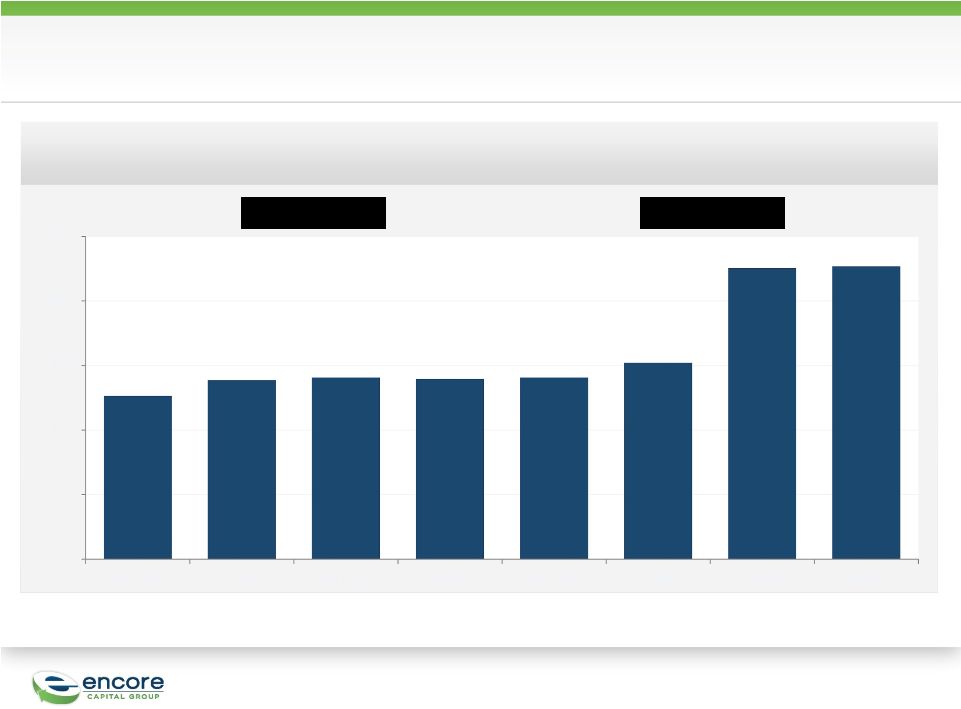

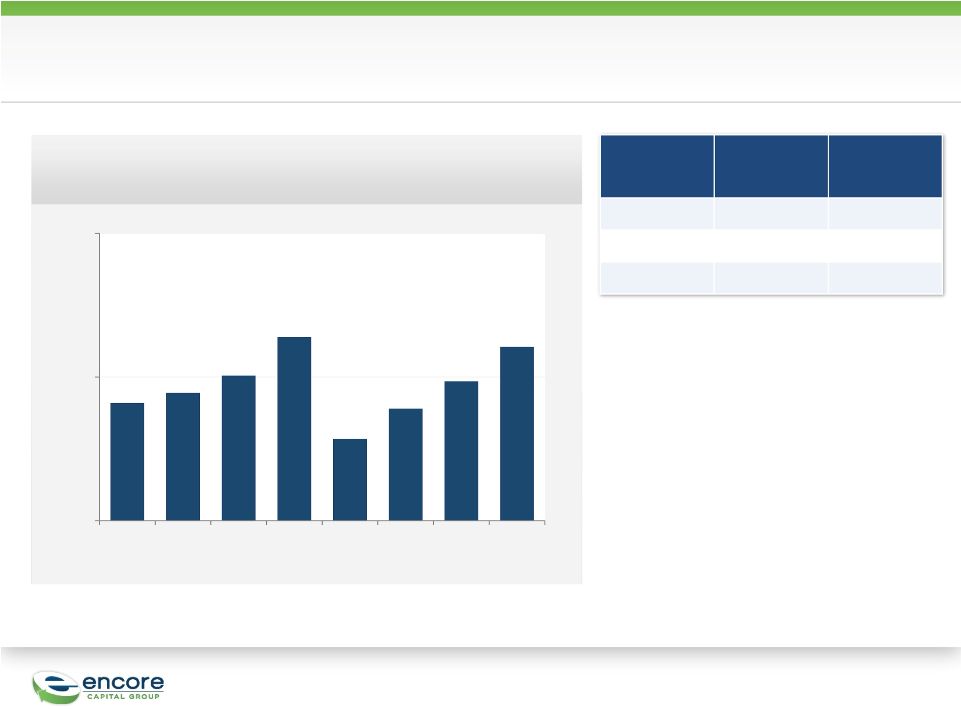

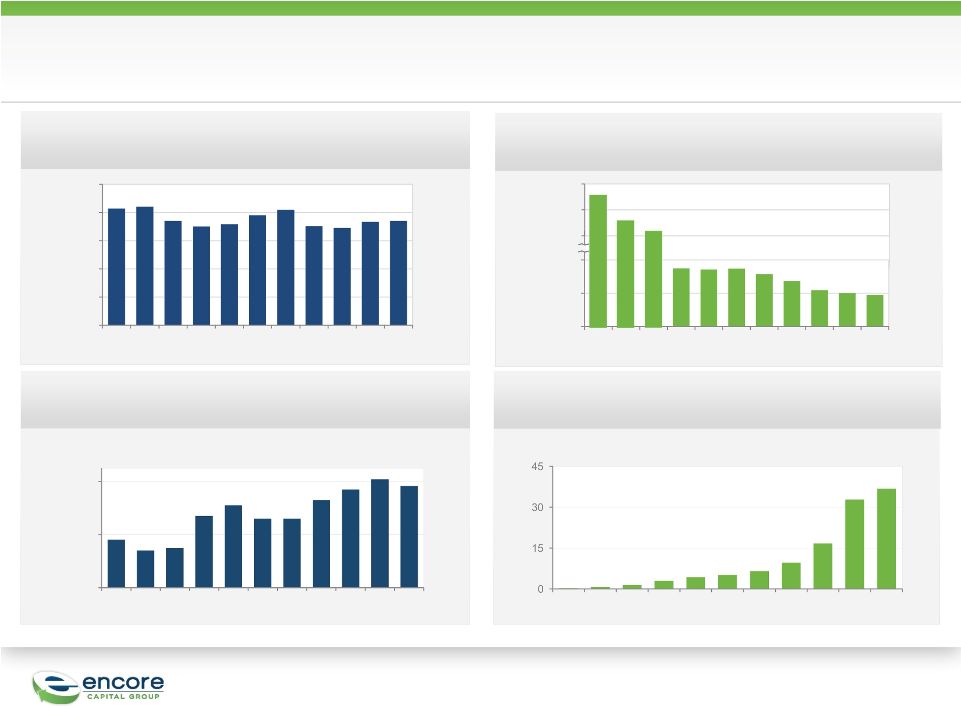

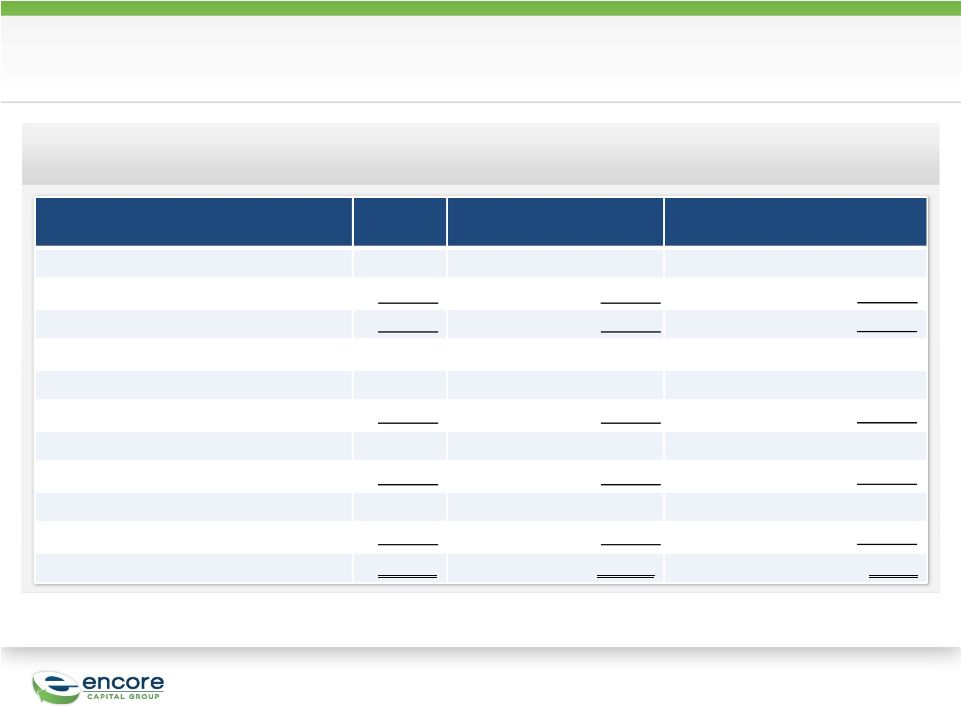

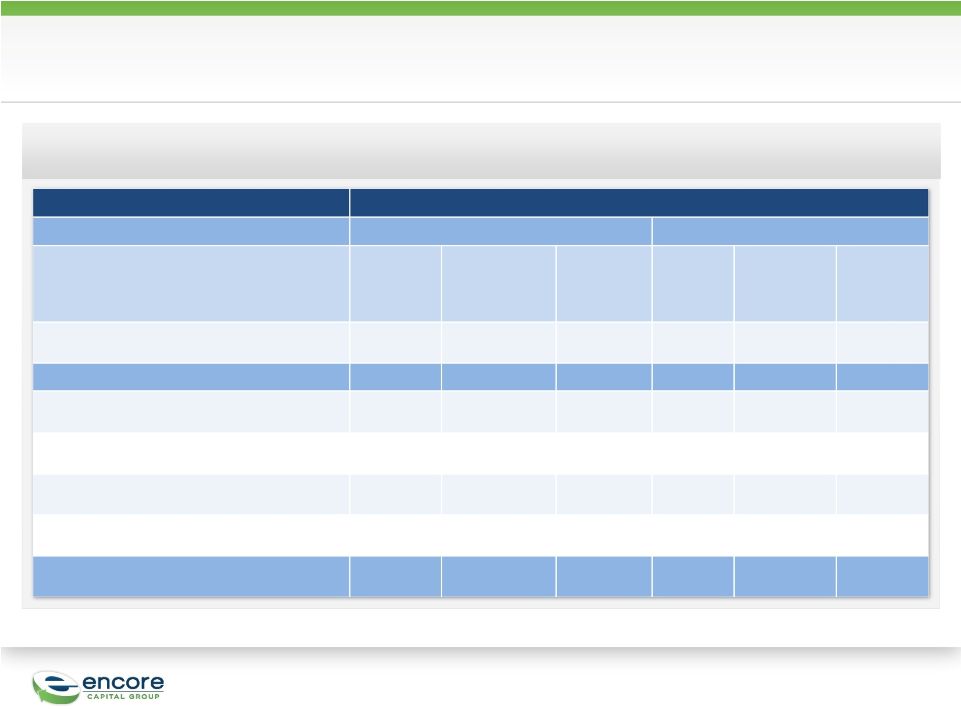

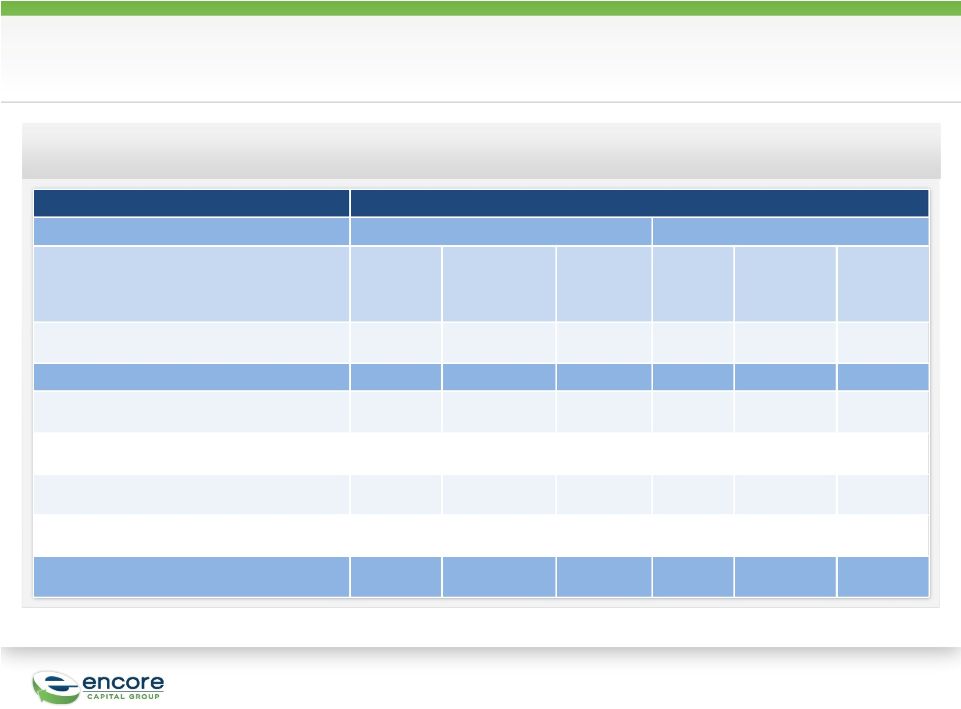

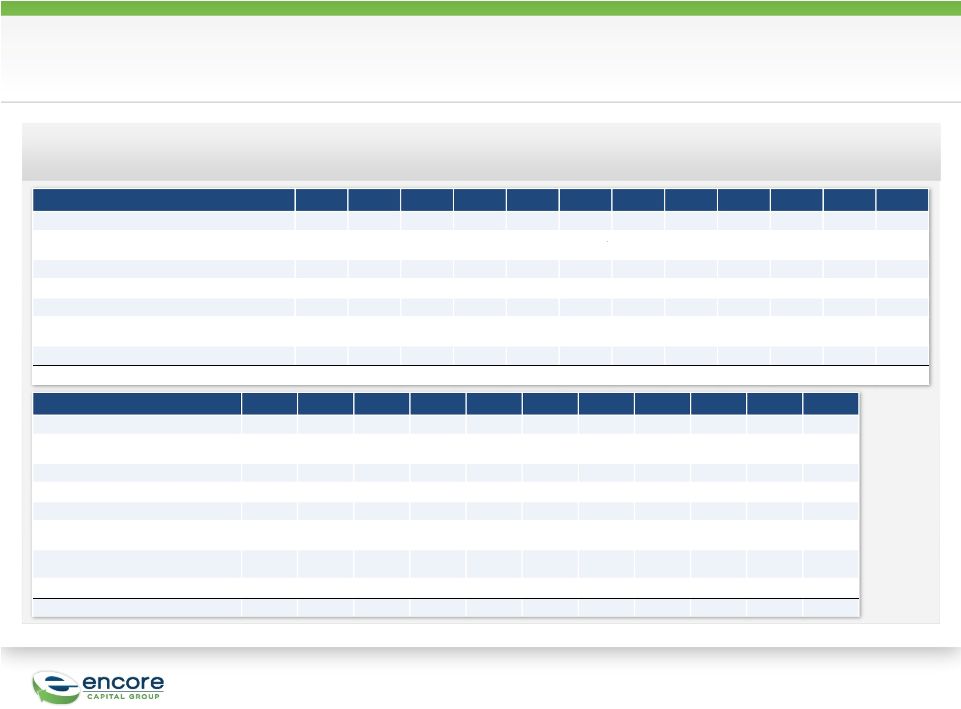

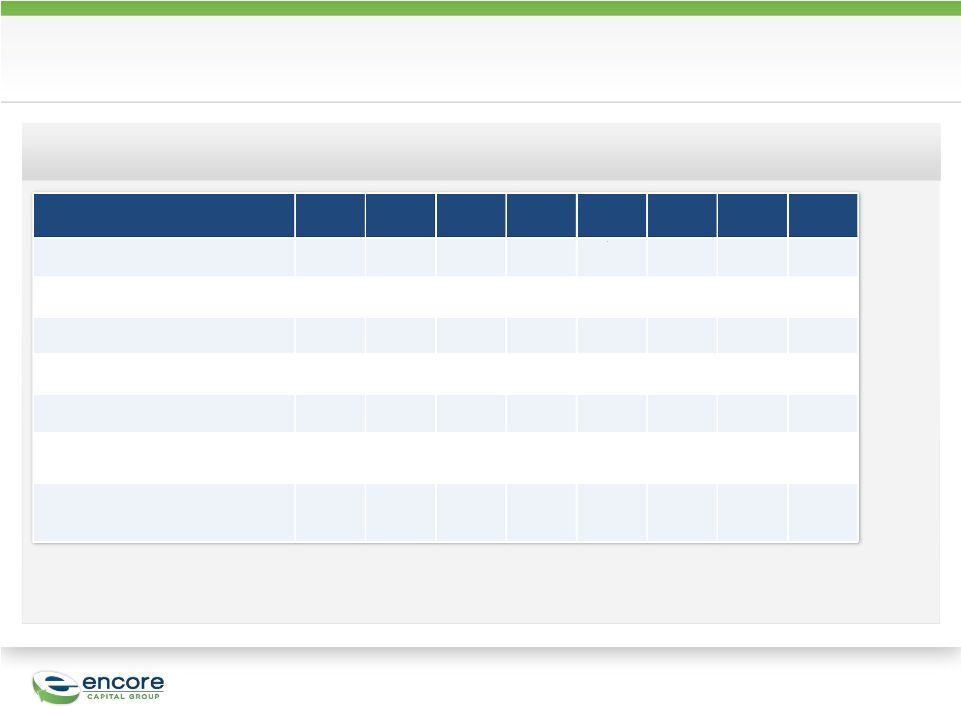

Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In Thousands) Three Months Ended 6/30/08 9/30/08 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 6/30/10 9/30/10 12/31/10 3/31/11 GAAP net income, as reported 6,162 3,028 (2,095) 8,997 6,641 9,004 8,405 10,861 11,730 12,290 14,171 13,679 (Gain) loss from discontinued operations, net of tax (89) 46 (483) (457) (365) (410) (901) (687) (684) (315) 28 (397) Interest expense 4,831 5,140 5,401 4,273 3,958 3,970 3,959 4,538 4,880 4,928 5,003 5,593 Provision for income taxes 4,161 2,429 (1,781) 5,670 3,936 5,676 4,078 6,080 6,356 6,474 9,057 8,349 Depreciation and amortization 482 396 391 410 402 443 516 522 591 650 789 904 Amount applied to principal on receivable portfolios 35,785 35,140 46,364 42,851 48,303 49,188 47,384 58,265 64,901 63,507 53,427 85,709 Stock-based compensation expense 1,288 860 382 1,080 994 1,261 1,049 1,761 1,446 1,549 1,254 1,765 Adjusted EBITDA 52,560 47,039 48,179 62,824 63,869 69,132 64,490 81,340 89,220 89,083 83,729 115,602 35 6/30/11 9/30/11 12/31/11 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 GAAP net income, as reported 14,775 15,370 17,134 11,406 16,596 21,308 20,167 19,448 11,012 21,064 22,216 (Gain) loss from discontinued operations, net of tax (9) (60) 101 6,702 2,392 - - - - 308 1,432 Interest expense 5,369 5,175 4,979 5,515 6,497 7,012 6,540 6,854 7,482 29,186 29,747 Provision for income taxes 9,475 9,834 10,418 11,660 12,846 13,887 13,361 12,571 7,267 10,272 15,278 Depreciation and amortization 958 1,054 1,165 1,240 1,420 1,533 1,647 1,846 2,158 4,523 5,020 Amount applied to principal on receivable portfolios 83,939 73,187 69,462 104,603 101,813 105,283 90,895 128,481 127,370 154,283 124,520 Severance and Stock-based compensation expense 1,810 2,405 1,729 2,266 2,539 1,905 2,084 3,001 5,364 3,983 3,486 Acquisition related expense - - - 489 3,774 - - 1,276 12,848 7,752 4,260 Adjusted EBITDA 116,317 106,965 104,988 143,881 147,877 150,928 134,694 173,477 173,501 231,371 205,959 RECONCILIATION OF ADJUSTED EBITDA PROPRIETARY Note: The periods 6/30/08 through 12/31/08 have been adjusted to reflect the retrospective application of ASC 470-20. All periods have been adjusted to show discontinued ACG operations. |