Exhibit 99.1 Encore Capital Group, Inc. Investor Presentation September 2020 Proprietary and Confidential

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS This presentation has been prepared by Encore Capital Group, Inc. (“Encore” or the “Company") and the market price of the notes, could be materially adversely affected. You should not place solely for informational purposes. For the purposes of this disclaimer, the presentation that follows undue reliance on these forward-looking statements. All subsequent written and oral forward- shall mean and include the slides that follow, the oral presentation of the slides by the Company or looking statements attributable to the Company or any person acting on its behalf are expressly any person on its behalf, any question-and-answer session that follows the oral presentation, hard qualified in their entirety by the cautionary statements referenced above. Forward-looking copies of this document and any materials distributed in connection with the presentation. statements speak only as of the date on which such statements are made. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward- The Company has included non-GAAP financial measures in this presentation. These looking statement to reflect events or circumstances after the date on which such statement is measurements may not be comparable to those of other companies. Reference to these non- made, or to reflect the occurrence of unanticipated events. GAAP financial measures should be considered in addition to GAAP financial measures, but should not be considered а substitute for results that are presented in accordance with GAAP. The The presentation does not constitute or form part of, and should not be construed as, an offer to information contained in this presentation has not been subject to any independent audit or review. sell or issue, or the solicitation of an offer to purchase, subscribe to or acquire the Company or the No representation, warranty or undertaking, express or implied, is made to, and no reliance should Company's securities, or an inducement to enter into investment activity. No part of this be placed on, the fairness, accuracy, completeness or correctness of the information or opinions presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection herein. No responsibility or liability (including in respect of direct, indirect or consequential loss or with, any contract or commitment or investment decision whatsoever. This presentation is not for damage) is assumed by any person for such information or opinions or for any errors or omissions. publication, release or distribution. А significant portion of the information contained in this document, including all market data and trend information, is based on estimates or expectations of the Company, and there can be no assurance that these estimates or expectations are or will prove to be accurate. Our internal estimates have not been verified by an external expert, and we cannot guarantee that a third party using different methods to assemble, analyze or compute market information and data would obtain or generate the same results. We have not verified the accuracy of such information, data or predictions contained in this report that were taken or derived from industry publications, public documents of our competitors or other external sources. Further, our competitors may define our and their markets differently than we do. In addition, past performance of the Company is not indicative of future performance. The future performance of the Company will depend on numerous factors which are subject to uncertainty. Certain statements contained in this document that are not statements of historical fact, including, without limitation, any statements preceded by, followed by or including the words "targets," "believes," "expects," "aims," "intends," "may," "anticipates," "would," "could" or similar expressions or the negative thereof, constitute forward-looking statements, notwithstanding that such statements are not specifically identified. In addition, certain statements may be contained in press releases, and in oral and written statements made by or with the approval of the Company that are not statements of historical fact and constitute forward- looking statements. Examples of forward-looking statements include, but are not limited to: (i) statements about future financial and operating results; (ii) statements of strategic objectives, business prospects, future financial condition, budgets, potential synergies to be derived from acquisitions, projected levels of production, projected costs and projected levels of revenues and profits of the Company or its management or board of directors, (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict and outside of the control of the management of the Company. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. We have based these assumptions on information currently available to us, if any one or more of these assumptions turn out to be incorrect, actual market results may differ from those predicted. While we do not know what impact any such differences may have on our business, if there are such differences, our future results of operations and financial condition, 2 Proprietary and Confidential

TODAY’S PRESENTERS President & CEO, CEO, Cabot Encore Ashish Masih Craig Buick 30 11 31 4 EVP & CFO, Encore Jonathan Clark 34 5 Managing VP, Managing VP, Corporate Global Treasury & Development & Corporate Treasury, Encore Development Scott Goverman Tomas Hernanz 34 9 19 4 Years of experience Years at Encore / Cabot 3 Proprietary and Confidential

EXECUTIVE SUMMARY ` We are excited to present to you today our strategy and value proposition for the combined business of Encore Capital Group, Inc. and Cabot Credit Management ` Encore has been in the business of purchasing debt for over 25 years, the Company operates internationally with approximately 7,600 employees(1) and owns c.120 million accounts representing c.64 million unique consumers in the U.S. and U.K. ` On July 24, 2018, Encore acquired the remaining equity interest in Cabot from existing shareholders and formalized the union of Encore’s leadership position in two of the world’s most valuable credit markets (U.S. and the U.K.) ` While the acquisition provided benefits such as the ability to rationalize European operations and simplifying financial reporting, today the two balance sheets remain legally separate and non-recourse to one another ` We are now pursuing a joint financing strategy to combine the two balance sheets, which we believe will result in an enhanced credit profile for both existing and prospective Encore and Cabot lenders and investors: ` Fully leverage the combined size of Encore and Cabot to create the Global leader in the debt purchasing sector ` Significantly enhance geographic reach to create a highly diversified footprint across the most mature markets ` Maximize financial flexibility to leverage global borrowing base and enhance access to capital markets ` Allows Encore to satisfy financial reporting requirements with its quarterly and annual SEC filings ` Allows allocation of capital to the markets with the best returns so as to maximize overall Encore returns and take advantage of varying market cycles impacting pricing and supply across the globe 1) Number of employees as of Q1 2020, as not publicly disclosed in Q2 2020. 4 Proprietary and Confidential

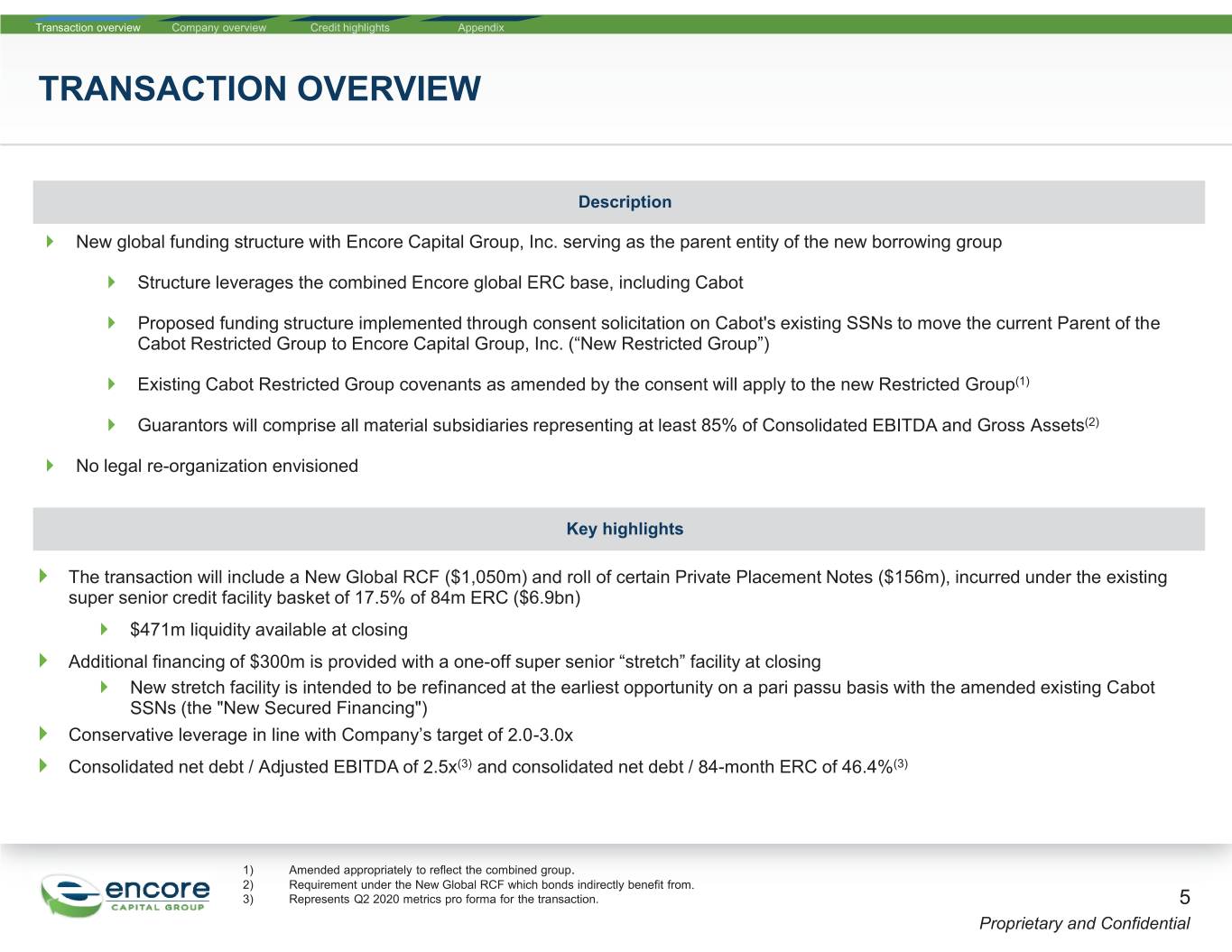

Transaction overview Company overview Credit highlights Appendix TRANSACTION OVERVIEW Description ` New global funding structure with Encore Capital Group, Inc. serving as the parent entity of the new borrowing group ` Structure leverages the combined Encore global ERC base, including Cabot ` Proposed funding structure implemented through consent solicitation on Cabot's existing SSNs to move the current Parent of the Cabot Restricted Group to Encore Capital Group, Inc. (“New Restricted Group”) ` Existing Cabot Restricted Group covenants as amended by the consent will apply to the new Restricted Group(1) ` Guarantors will comprise all material subsidiaries representing at least 85% of Consolidated EBITDA and Gross Assets(2) ` No legal re-organization envisioned Key highlights ` The transaction will include a New Global RCF ($1,050m) and roll of certain Private Placement Notes ($156m), incurred under the existing super senior credit facility basket of 17.5% of 84m ERC ($6.9bn) ` $471m liquidity available at closing ` Additional financing of $300m is provided with a one-off super senior “stretch” facility at closing ` New stretch facility is intended to be refinanced at the earliest opportunity on a pari passu basis with the amended existing Cabot SSNs (the "New Secured Financing") ` Conservative leverage in line with Company’s target of 2.0-3.0x ` Consolidated net debt / Adjusted EBITDA of 2.5x(3) and consolidated net debt / 84-month ERC of 46.4%(3) 1) Amended appropriately to reflect the combined group. 2) Requirement under the New Global RCF which bonds indirectly benefit from. 3) Represents Q2 2020 metrics pro forma for the transaction. 5 Proprietary and Confidential

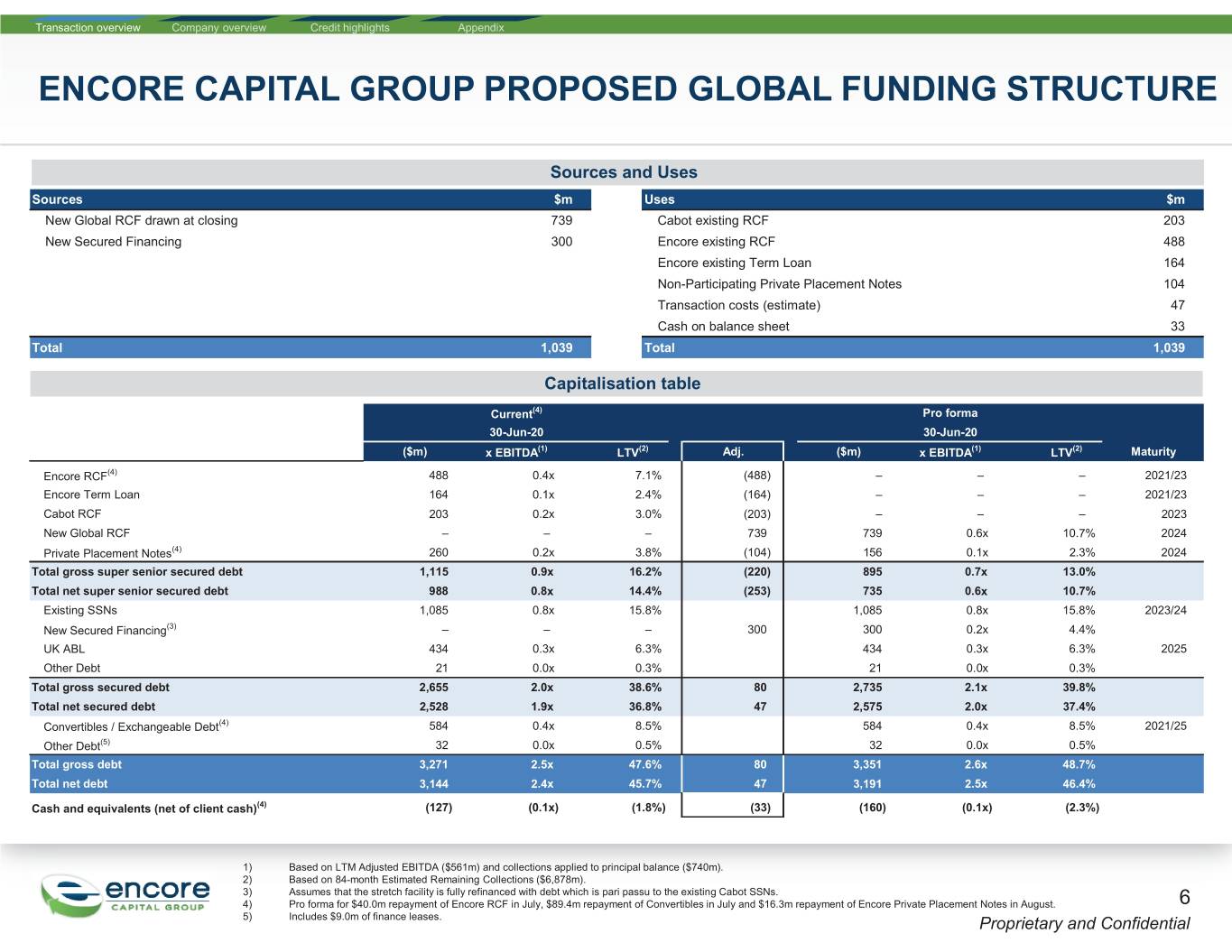

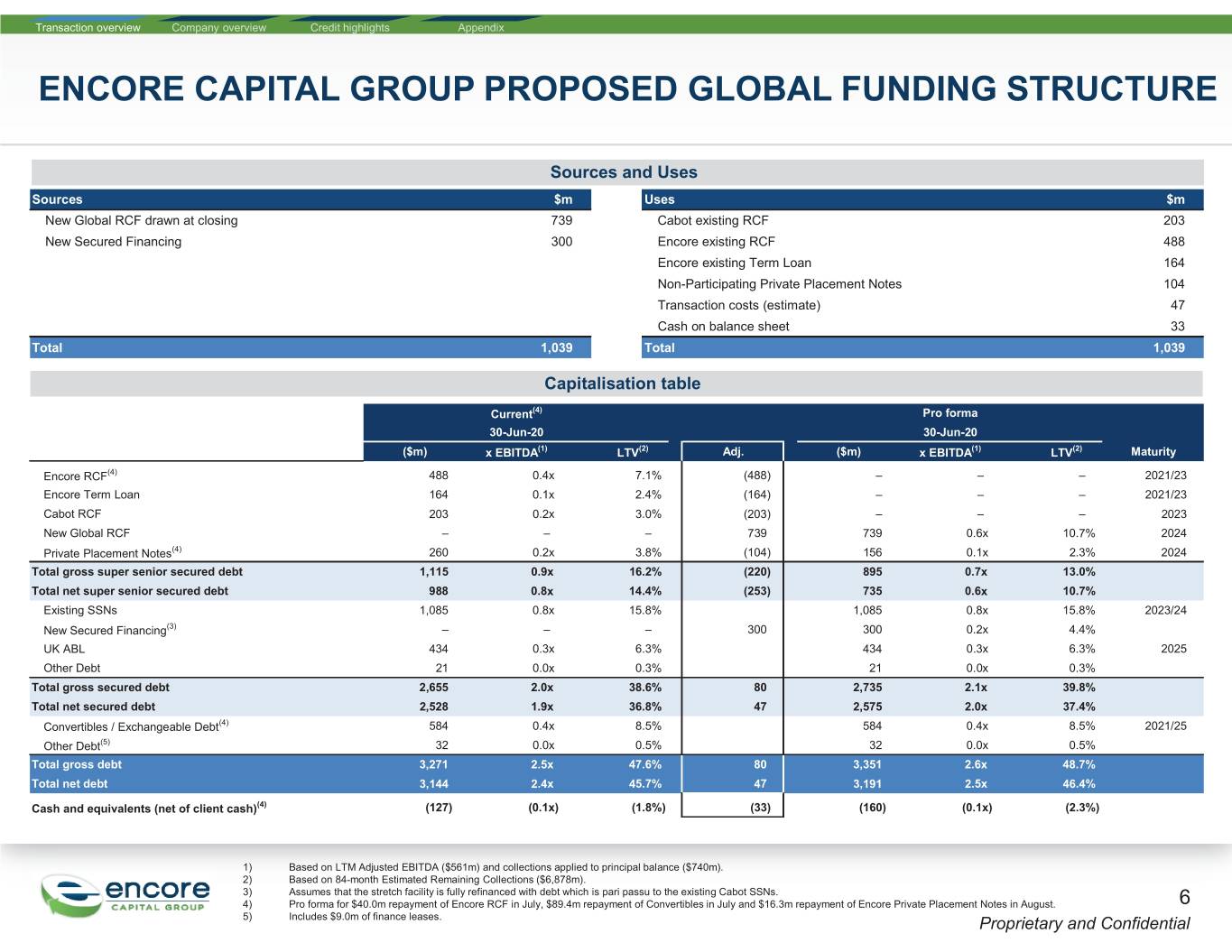

Transaction overview Company overview Credit highlights Appendix ENCORE CAPITAL GROUP PROPOSED GLOBAL FUNDING STRUCTURE Sources and Uses Sources $m Uses $m New Global RCF drawn at closing 739 Cabot existing RCF 203 New Secured Financing 300 Encore existing RCF 488 Encore existing Term Loan 164 Non-Participating Private Placement Notes 104 Transaction costs (estimate) 47 Cash on balance sheet 33 Total 1,039 Total 1,039 Capitalisation table Current(4) Pro forma 30-Jun-20 30-Jun-20 ($m) x EBITDA(1) LTV(2) Adj. ($m) x EBITDA(1) LTV(2) Maturity Encore RCF(4) 488 0.4x 7.1% (488) –––2021/23 Encore Term Loan 164 0.1x 2.4% (164) –––2021/23 Cabot RCF 203 0.2x 3.0% (203) –––2023 New Global RCF –––739 739 0.6x 10.7% 2024 Private Placement Notes(4) 260 0.2x 3.8% (104) 156 0.1x 2.3% 2024 Total gross super senior secured debt 1,115 0.9x 16.2% (220) 895 0.7x 13.0% Total net super senior secured debt 988 0.8x 14.4% (253) 735 0.6x 10.7% Existing SSNs 1,085 0.8x 15.8% 1,085 0.8x 15.8% 2023/24 New Secured Financing(3) –––300 300 0.2x 4.4% UK ABL 434 0.3x 6.3% 434 0.3x 6.3% 2025 Other Debt 21 0.0x 0.3% 21 0.0x 0.3% Total gross secured debt 2,655 2.0x 38.6% 80 2,735 2.1x 39.8% Total net secured debt 2,528 1.9x 36.8% 47 2,575 2.0x 37.4% Convertibles / Exchangeable Debt(4) 584 0.4x 8.5% 584 0.4x 8.5% 2021/25 Other Debt(5) 32 0.0x 0.5% 32 0.0x 0.5% Total gross debt 3,271 2.5x 47.6% 80 3,351 2.6x 48.7% Total net debt 3,144 2.4x 45.7% 47 3,191 2.5x 46.4% Cash and equivalents (net of client cash)(4) (127) (0.1x) (1.8%) (33) (160) (0.1x) (2.3%) 1) Based on LTM Adjusted EBITDA ($561m) and collections applied to principal balance ($740m). 2) Based on 84-month Estimated Remaining Collections ($6,878m). 3) Assumes that the stretch facility is fully refinanced with debt which is pari passu to the existing Cabot SSNs. 4) Pro forma for $40.0m repayment of Encore RCF in July, $89.4m repayment of Convertibles in July and $16.3m repayment of Encore Private Placement Notes in August. 6 5) Includes $9.0m of finance leases. Proprietary and Confidential

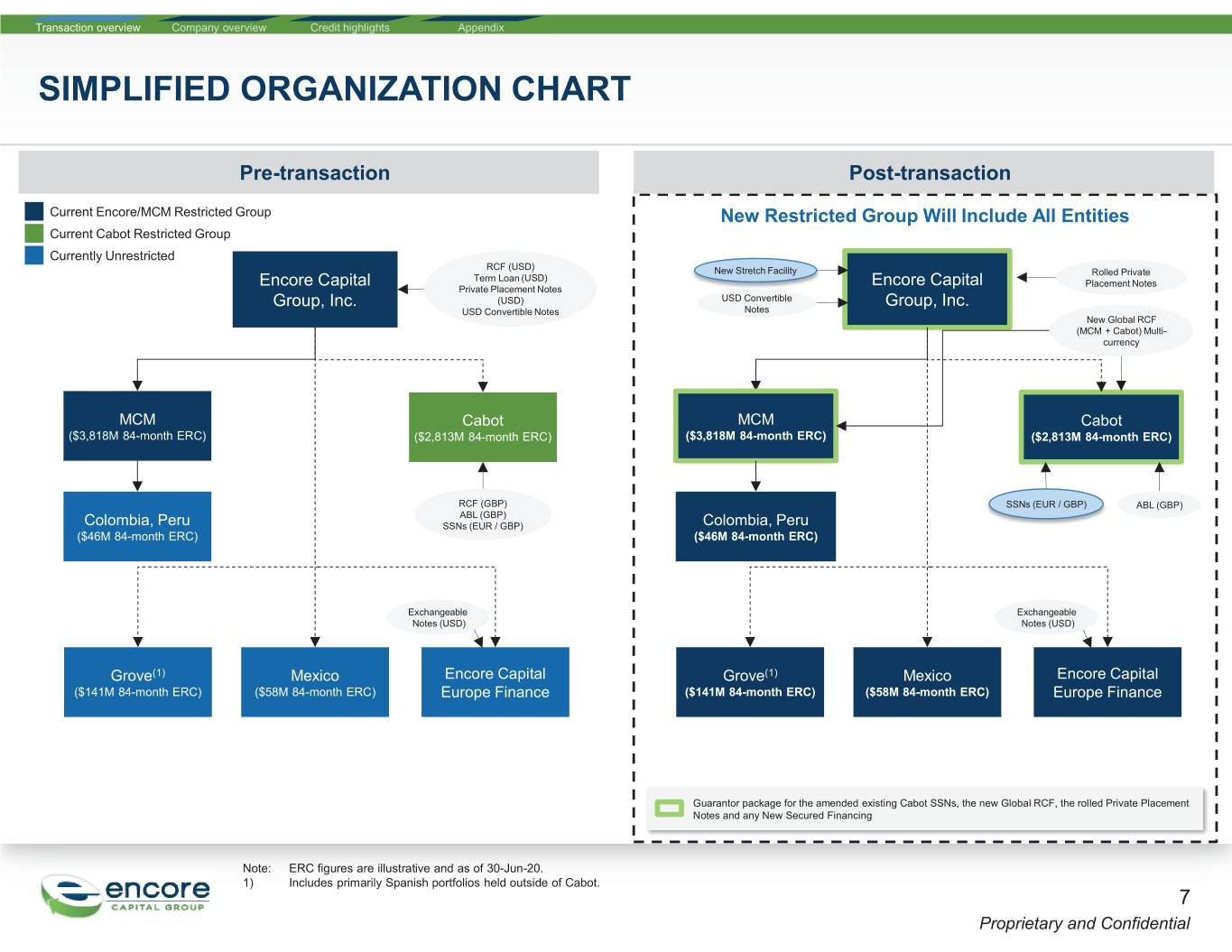

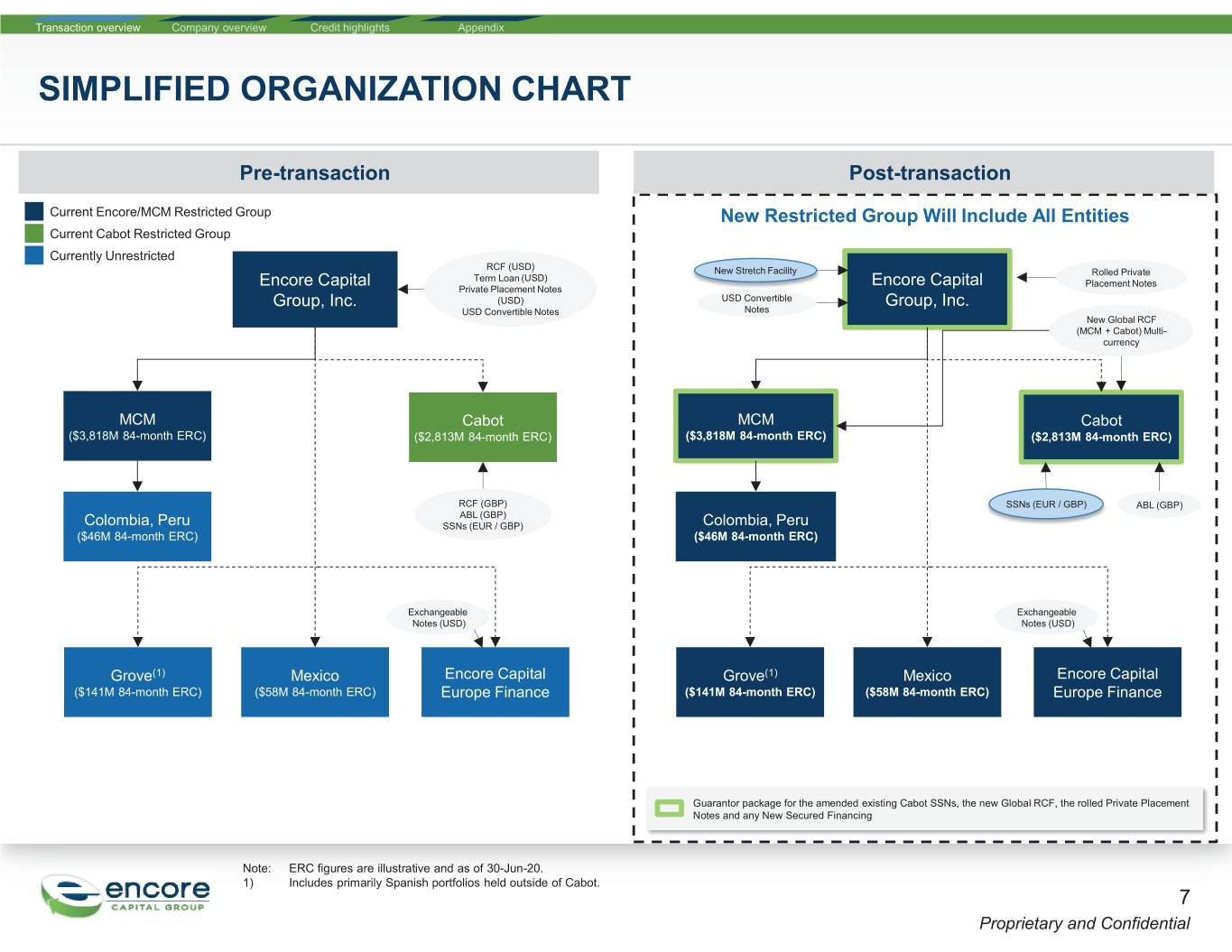

Transaction overview Company overview Credit highlights Appendix SIMPLIFIED ORGANIZATION CHART Pre-transaction Post-transaction Current Encore/MCM Restricted Group New Restricted Group Will Include All Entities Current Cabot Restricted Group Currently Unrestricted RCF (USD) New Stretch Facility Rolled Private Term Loan (USD) Encore Capital Encore Capital Placement Notes Private Placement Notes Group, Inc. (USD) USD Convertible Group, Inc. USD Convertible Notes Notes New Global RCF (MCM + Cabot) Multi- currency MCM Cabot MCM Cabot ($3,818M 84-month ERC) ($2,813M 84-month ERC) ($3,818M 84-month ERC) ($2,813M 84-month ERC) RCF (GBP) SSNs (EUR / GBP) ABL (GBP) ABL (GBP) Colombia, Peru SSNs (EUR / GBP) Colombia, Peru ($46M 84-month ERC) ($46M 84-month ERC) Exchangeable Exchangeable Notes (USD) Notes (USD) Grove(1) Mexico Encore Capital Grove(1) Mexico Encore Capital ($141M 84-month ERC) ($58M 84-month ERC) Europe Finance ($141M 84-month ERC) ($58M 84-month ERC) Europe Finance Guarantor package for the amended existing Cabot SSNs, the new Global RCF, the rolled Private Placement Notes and any New Secured Financing Note: ERC figures are illustrative and as of 30-Jun-20. 1) Includes primarily Spanish portfolios held outside of Cabot. 7 Proprietary and Confidential

2. Company overview and update 8 Proprietary and Confidential

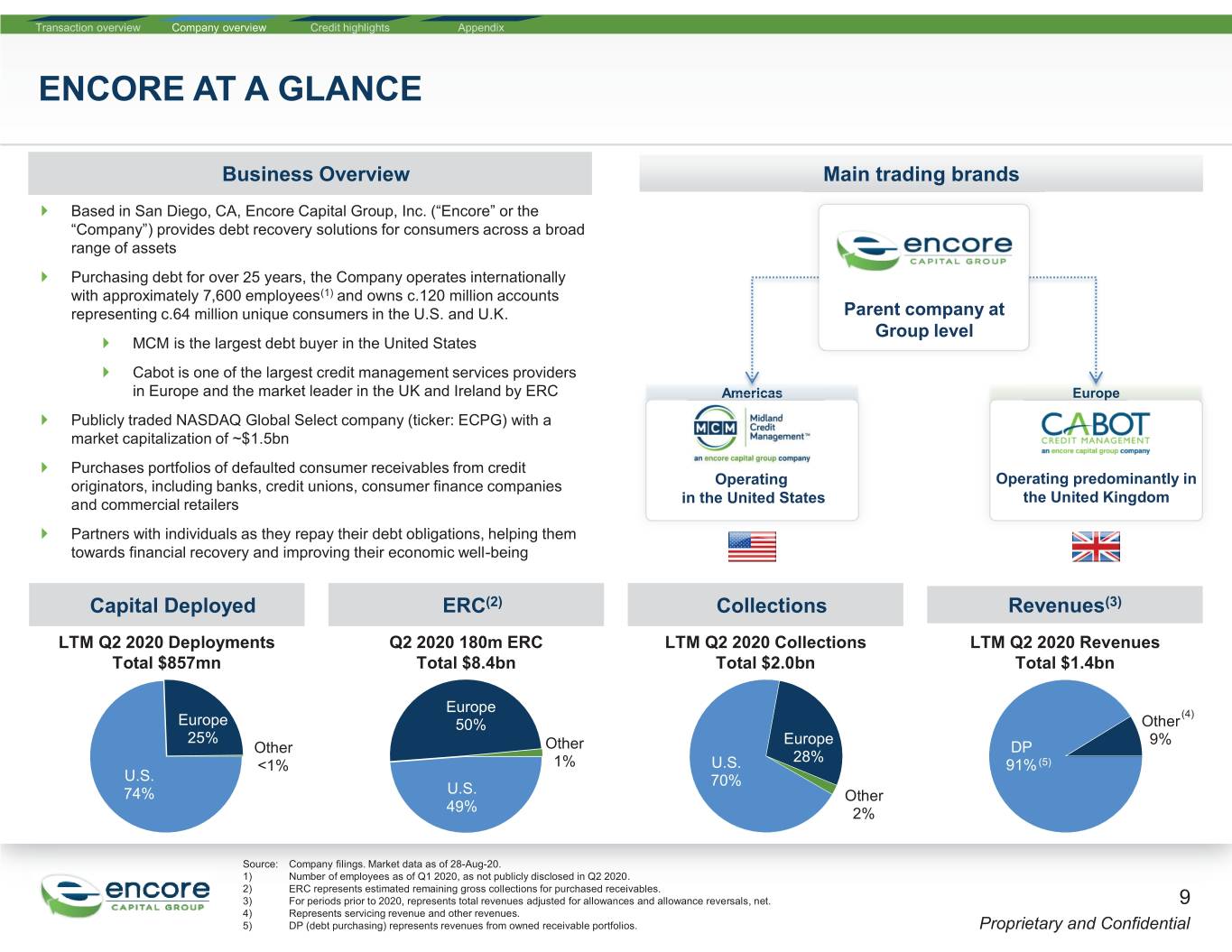

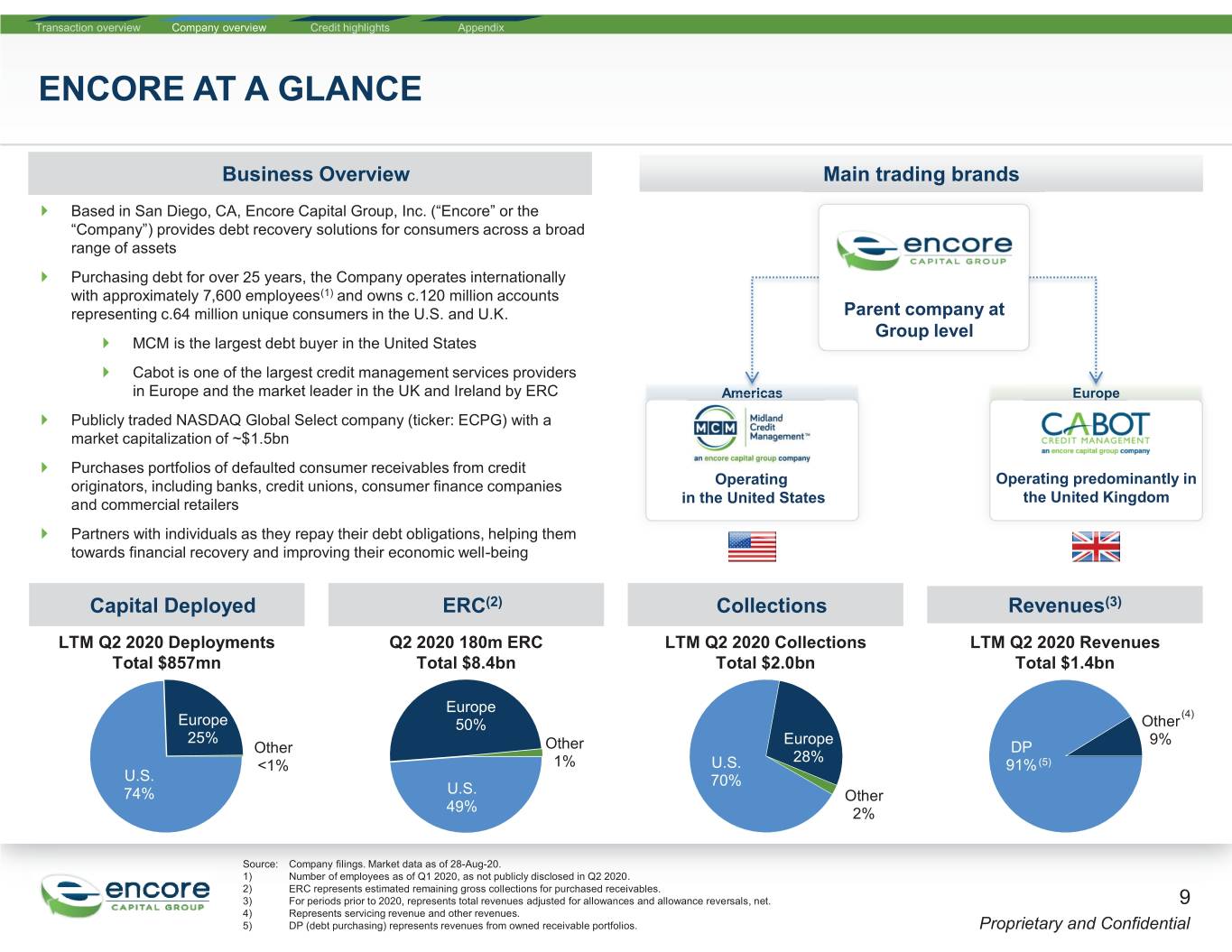

Transaction overview Company overview Credit highlights Appendix ENCORE AT A GLANCE Business Overview Main trading brands ` Based in San Diego, CA, Encore Capital Group, Inc. (“Encore” or the “Company”) provides debt recovery solutions for consumers across a broad range of assets ` Purchasing debt for over 25 years, the Company operates internationally with approximately 7,600 employees(1) and owns c.120 million accounts representing c.64 million unique consumers in the U.S. and U.K. Parent company at Group level ` MCM is the largest debt buyer in the United States ` Cabot is one of the largest credit management services providers in Europe and the market leader in the UK and Ireland by ERC Americasmmericasericas EuropeEurop ` Publicly traded NASDAQ Global Select company (ticker: ECPG) with a market capitalization of ~$1.5bn ` Purchases portfolios of defaulted consumer receivables from credit originators, including banks, credit unions, consumer finance companies Operating Operating predominantly in and commercial retailers in the United States the United Kingdom ` Partners with individuals as they repay their debt obligations, helping them towards financial recovery and improving their economic well-being Capital Deployed ERC(2) Collections Revenues(3) LTM Q2 2020 Deployments Q2 2020 180m ERC LTM Q2 2020 Collections LTM Q2 2020 Revenues Total $857mn Total $8.4bn Total $2.0bn Total $1.4bn Europe (4) Europe 50% Other 25% Europe 9% Other Other DP 28% <1% 1% U.S. 91% (5) U.S. 70% 74% U.S. Other 49% 2% Source: Company filings. Market data as of 28-Aug-20. 1) Number of employees as of Q1 2020, as not publicly disclosed in Q2 2020. 2) ERC represents estimated remaining gross collections for purchased receivables. 3) For periods prior to 2020, represents total revenues adjusted for allowances and allowance reversals, net. 9 4) Represents servicing revenue and other revenues. 5) DP (debt purchasing) represents revenues from owned receivable portfolios. Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix ENCORE IS A LEADER IN THE GLOBAL DEBT PURCHASING & RECOVERY SECTOR Peers(1) In USDm (2) ERC 1 8,382 6,942 6,352 5,089 2,622 2,177 (180m) (Total ERC) (Total ERC) (180m) (180m) (120m) (3) 1% Revenue mix 9% 4% 17% 7% 9% 25% Servicing Purchasing (4) 37% Other 59% 91% 75% 99% 83% 83% ERC ERC ERC ERC ERC ERC Other Geographical Nordics Ireland diversification 1% Other Nordics SE Europe 2% 22% Northern Italy 23% 24% 14% Europe Europe 19% UK 43% 38% W Europe 37% 12% US 49% Southern Americas DACH Europe DACH & UK UK Central Netherlands Europe 57% 16% Poland 50% 21% 60% Europe 14% Portugal 34% 15% 21% 28% LTM Collections 1 2,034 1,162 1,914 954 573 559 LTM Adj. EBITDA(5) 1 5615 + 740 1,207 1,225 632 405 376 LTM Portfolio 2 857 808 1,176 434 286 224 Purchases Net Debt / 2.5x(6) 4.4x 2.0x 4.8x 3.1x 4.1x LTM Adj. EBITDA(5) LTM Adj. EBITDA(5) / 6.1x 6.7x 8.5x 2.2x 4.9x 5.5x Interest Note: Data as of latest reported quarter; Encore, Arrow Global, B2Holding, Intrum, Lowell and PRA Group as of Q2 2020. Net debt represents debt less unrestricted cash and cash equivalents excluding client cash. See Appendix for a reconciliation of Net Debt to GAAP Debt. 1) Peers leverage sourced from public filings. 2) Includes $79.8m of real estate-owned assets in Q2 2020. Prior year reported ERC figures did not include real estate-owned assets. 3) Represents servicing revenue and other revenues. 10 4) Arrow debt purchasing revenue based on pre-impairment income from investment business. 5) Adjusted EBITDA includes collections applied to principal balance. See appendix for a reconciliation of Adjusted EBITDA to GAAP net income. 6) Represents Q2 2020 metrics pro forma for the transaction. Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix WE ARE MAKING STEADY PROGRESS ON THREE STRATEGIC PRIORITIES Market Concentrating on the U.S. and the 1 U.K. markets, where we have the Focus highest risk-adjusted returns 2 Competitive Innovating to continually enhance Advantage our competitive advantages 3 Balance Sheet Strengthening our balance sheet Strength while delivering strong results 11 Proprietary and Confidential

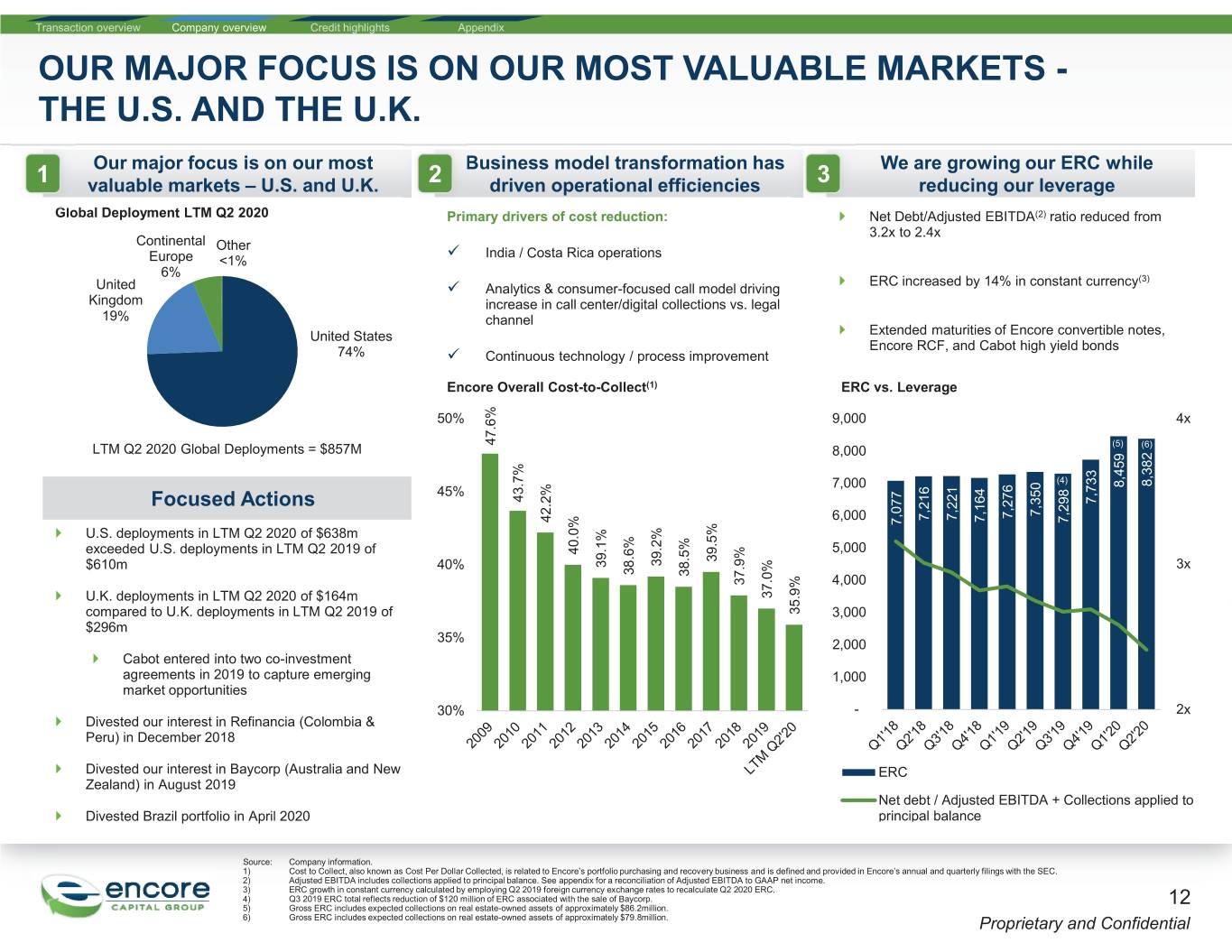

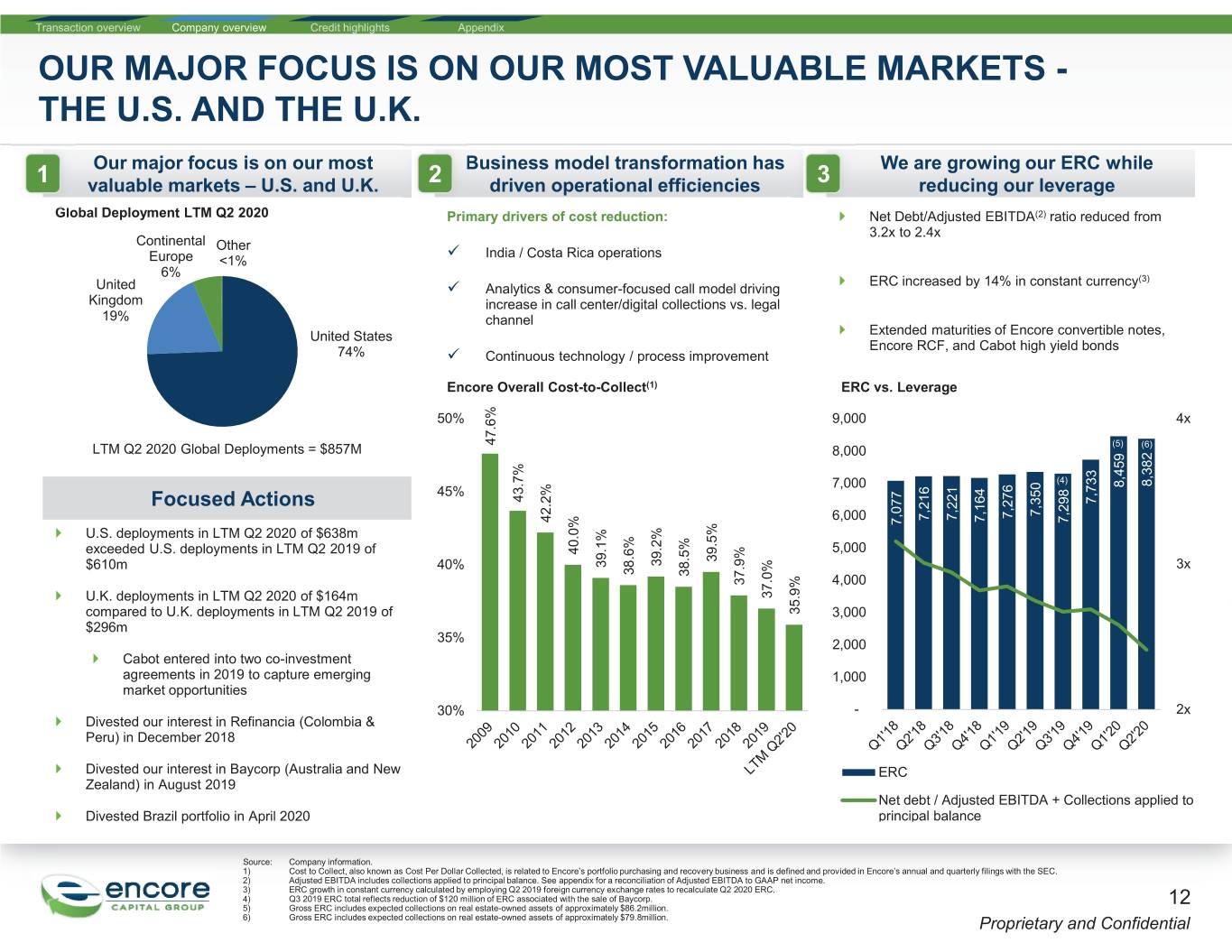

Transaction overview Company overview Credit highlights Appendix OUR MAJOR FOCUS IS ON OUR MOST VALUABLE MARKETS - THE U.S. AND THE U.K. Our major focus is on our most BusinessB model transformation has We are growing our ERC while 1 valuable markets – U.S. and U.K. 2 driven operational efficiencies 3 reducing our leverage GlobalGl Deployment LTM Q2 2020 Primary drivers of cost reduction: ` Net Debt/Adjusted EBITDA(2) ratio reduced from 3.2x to 2.4x Continental Other 9 India / Costa Rica operations Europe <1% 6% ` ERC increased by 14% in constant currency(3) United 9 Analytics & consumer-focused call model driving Kingdom increase in call center/digital collections vs. legal 19% channel United States ` Extended maturities of Encore convertible notes, Encore RCF, and Cabot high yield bonds 74% 9 Continuous technology / process improvement Encore Overall Cost-to-Collect(1) ERC vs. Leverage 50% 9,000 4x 47.6% (5) LTM Q2 2020 Global Deployments = $857M 8,000 (4) (5) (6) 7,000 (4) 8,382 8,382 45% 8,459 43.7% Focused Actions 7,733 7,350 7,350 42.2% 6,000 7,276 7,276 7,221 7,221 7,216 7,216 7,164 7,164 7,298 7,298 ` U.S. deployments in LTM Q2 2020 of $638m 7,077 exceeded U.S. deployments in LTM Q2 2019 of 40.0% 5,000 39.5% 39.2% $610m 40% 39.1% 3x 38.6% 38.5% 37.9% 4,000 ` U.K. deployments in LTM Q2 2020 of $164m 37.0% compared to U.K. deployments in LTM Q2 2019 of 35.9% 3,000 $296m 35% 2,000 ` Cabot entered into two co-investment agreements in 2019 to capture emerging 1,000 market opportunities 30% - 2x ` Divested our interest in Refinancia (Colombia & Peru) in December 2018 ` Divested our interest in Baycorp (Australia and New ERC Zealand) in August 2019 Net debt / Adjusted EBITDA + Collections applied to ` Divested Brazil portfolio in April 2020 principal balance Source: Company information. 1) Cost to Collect, also known as Cost Per Dollar Collected, is related to Encore’s portfolio purchasing and recovery business and is defined and provided in Encore’s annual and quarterly filings with the SEC. 2) Adjusted EBITDA includes collections applied to principal balance. See appendix for a reconciliation of Adjusted EBITDA to GAAP net income. 3) ERC growth in constant currency calculated by employing Q2 2019 foreign currency exchange rates to recalculate Q2 2020 ERC. 4) Q3 2019 ERC total reflects reduction of $120 million of ERC associated with the sale of Baycorp. 12 5) Gross ERC includes expected collections on real estate-owned assets of approximately $86.2million. 6) Gross ERC includes expected collections on real estate-owned assets of approximately $79.8million. Proprietary and Confidential

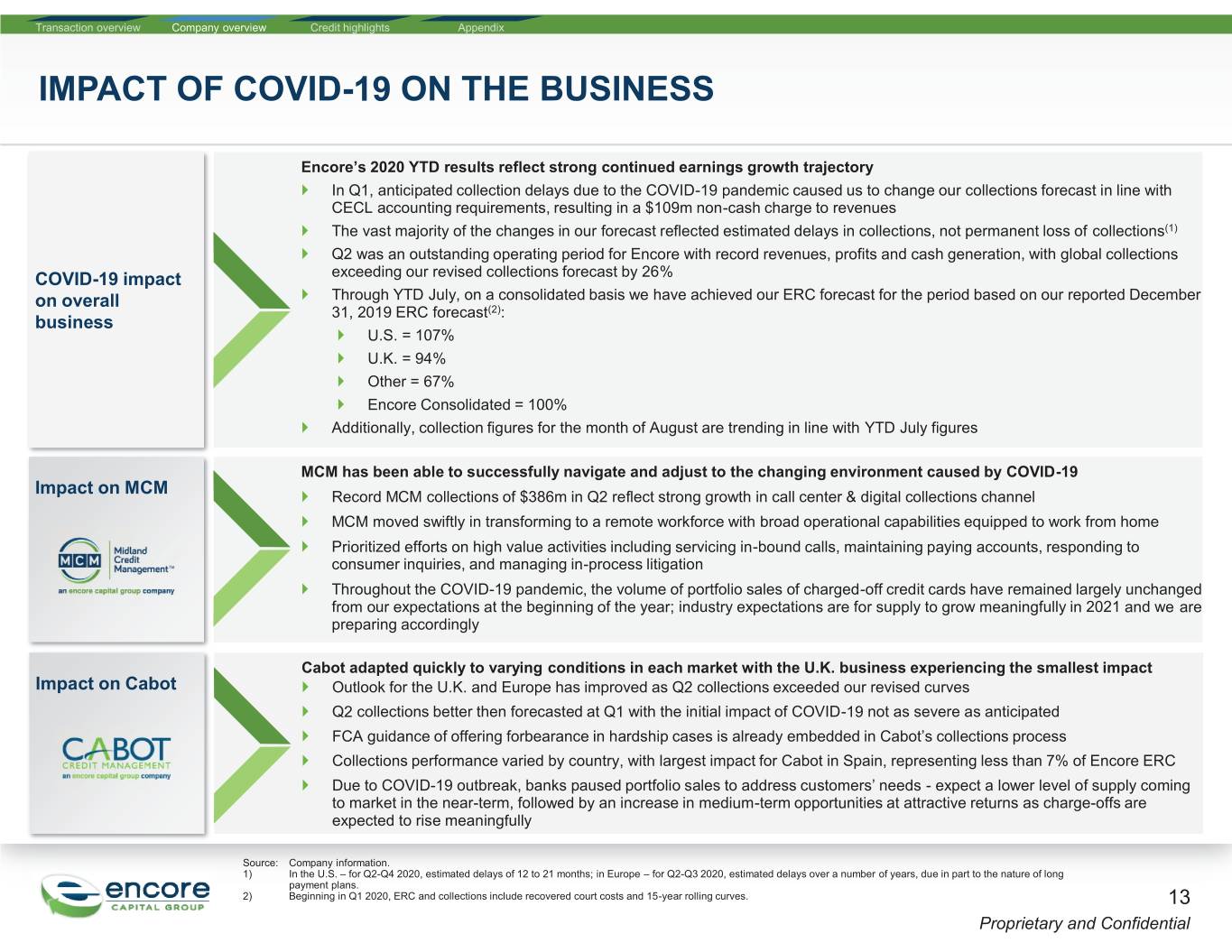

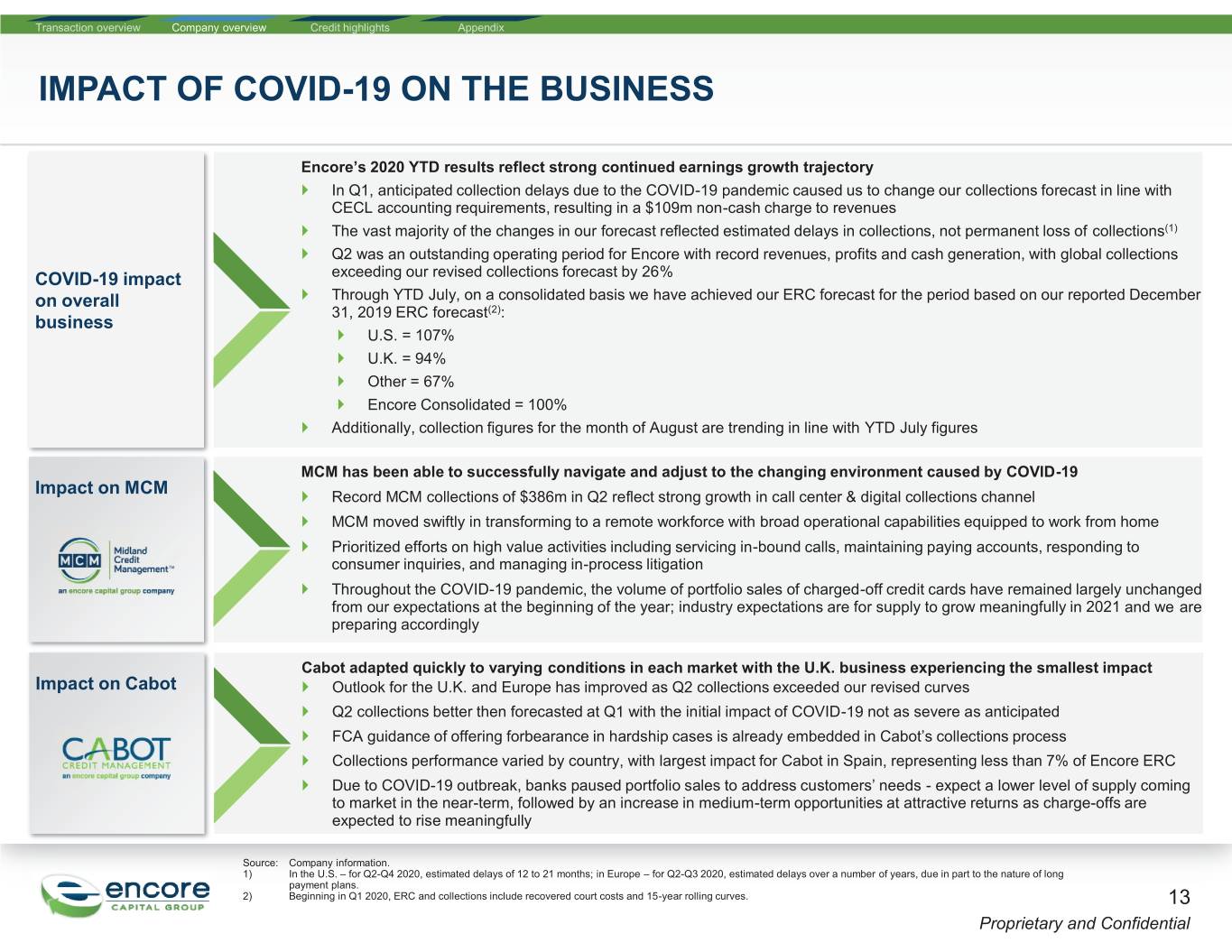

Transaction overview Company overview Credit highlights Appendix IMPACT OF COVID-19 ON THE BUSINESS Encore’s 2020 YTD results reflect strong continued earnings growth trajectory ` In Q1, anticipated collection delays due to the COVID-19 pandemic caused us to change our collections forecast in line with CECL accounting requirements, resulting in a $109m non-cash charge to revenues ` The vast majority of the changes in our forecast reflected estimated delays in collections, not permanent loss of collections(1) ` Q2 was an outstanding operating period for Encore with record revenues, profits and cash generation, with global collections COVID-19 impact exceeding our revised collections forecast by 26% on overall ` Through YTD July, on a consolidated basis we have achieved our ERC forecast for the period based on our reported December 31, 2019 ERC forecast(2): business ` U.S. = 107% ` U.K. = 94% ` Other = 67% ` Encore Consolidated = 100% ` Additionally, collection figures for the month of August are trending in line with YTD July figures MCM has been able to successfully navigate and adjust to the changing environment caused by COVID-19 Impact on MCM ` Record MCM collections of $386m in Q2 reflect strong growth in call center & digital collections channel ` MCM moved swiftly in transforming to a remote workforce with broad operational capabilities equipped to work from home ` Prioritized efforts on high value activities including servicing in-bound calls, maintaining paying accounts, responding to consumer inquiries, and managing in-process litigation ` Throughout the COVID-19 pandemic, the volume of portfolio sales of charged-off credit cards have remained largely unchanged from our expectations at the beginning of the year; industry expectations are for supply to grow meaningfully in 2021 and we are preparing accordingly Cabot adapted quickly to varying conditions in each market with the U.K. business experiencing the smallest impact Impact on Cabot ` Outlook for the U.K. and Europe has improved as Q2 collections exceeded our revised curves ` Q2 collections better then forecasted at Q1 with the initial impact of COVID-19 not as severe as anticipated ` FCA guidance of offering forbearance in hardship cases is already embedded in Cabot’s collections process ` Collections performance varied by country, with largest impact for Cabot in Spain, representing less than 7% of Encore ERC ` Due to COVID-19 outbreak, banks paused portfolio sales to address customers’ needs - expect a lower level of supply coming to market in the near-term, followed by an increase in medium-term opportunities at attractive returns as charge-offs are expected to rise meaningfully Source: Company information. 1) In the U.S. – for Q2-Q4 2020, estimated delays of 12 to 21 months; in Europe – for Q2-Q3 2020, estimated delays over a number of years, due in part to the nature of long payment plans. 2) Beginning in Q1 2020, ERC and collections include recovered court costs and 15-year rolling curves. 13 Proprietary and Confidential

3. Credit highlights 14 Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix ENCORE – A HIGHLY ATTRACTIVE CREDIT STORY Encore attributes Regulatory & Disciplined Scale & Consumer Data and analytical compliance capital efficiency focus leadership excellence allocation Large market size These factors make Encore what it is today ... High degree of market sophistication A.A We are a leading operator in our core U.S. and U.K. markets with attractive long term growth prospects and strong competitive advantages Consistency of front-book B.B Our scale, operational differentiation and compliance excellence drive strong risk opportunities adjusted returns Granular, diversified C.C 20+ years of experience have created a large, diversified back-book generating resilient portfolios cash flows D.D Strong operating performance and capital allocation discipline support Encore’s healthy Back-book Unsecured consumer finance market attributes consumer finance Unsecured market financial profile resilience 15 Proprietary and Confidential

A. A leading operator in our core U.S. and U.K. markets with attractive long term growth prospects & strong competitive advantages 16 Proprietary and Confidential

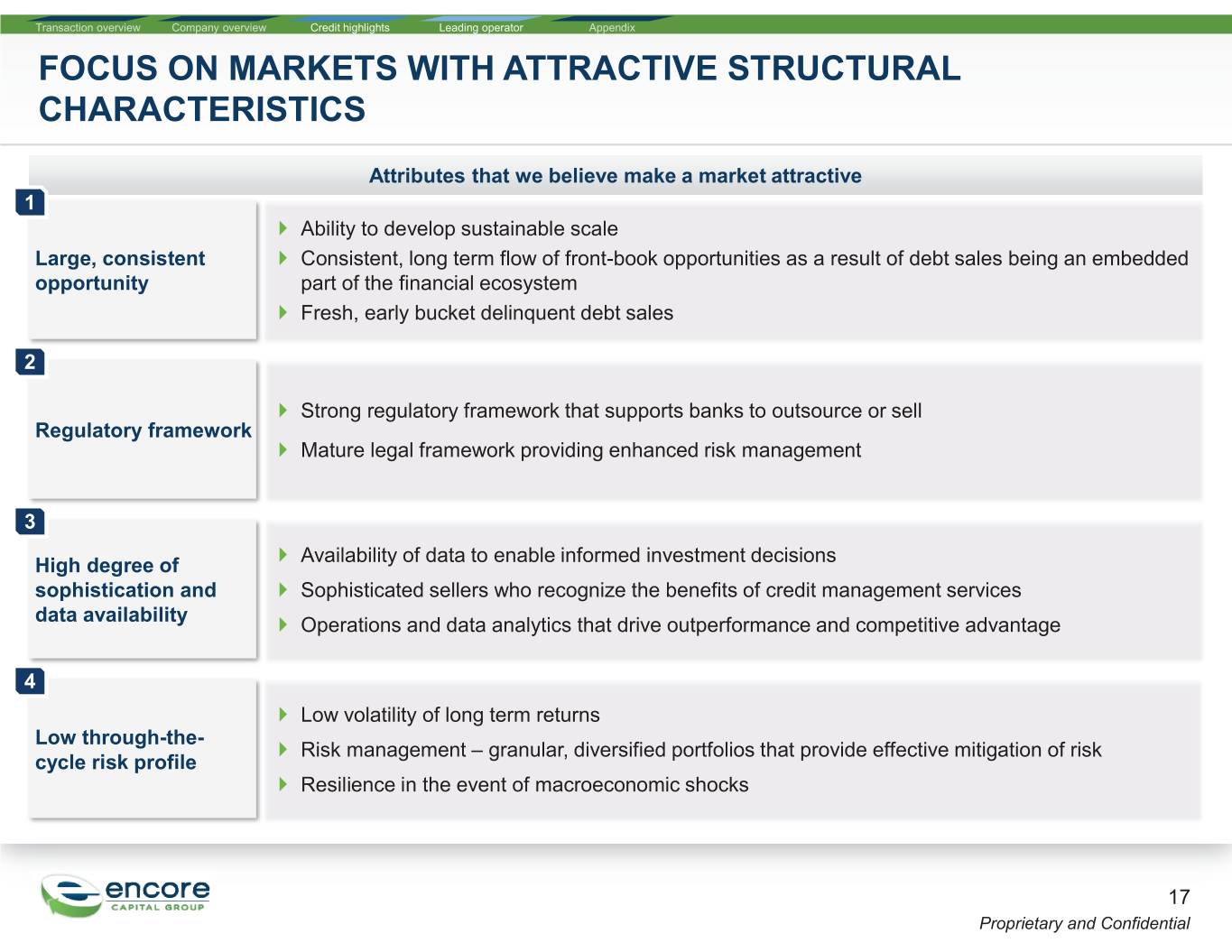

Transaction overview Company overview Credit highlights Leading operator Appendix FOCUS ON MARKETS WITH ATTRACTIVE STRUCTURAL CHARACTERISTICS Attributes that we believe make a market attractive 1 ` Ability to develop sustainable scale Large, consistent ` Consistent, long term flow of front-book opportunities as a result of debt sales being an embedded opportunity part of the financial ecosystem ` Fresh, early bucket delinquent debt sales 2 ` Strong regulatory framework that supports banks to outsource or sell Regulatory framework ` Mature legal framework providing enhanced risk management 3 ` Availability of data to enable informed investment decisions High degree of sophistication and ` Sophisticated sellers who recognize the benefits of credit management services data availability ` Operations and data analytics that drive outperformance and competitive advantage 4 ` Low volatility of long term returns Low through-the- ` Risk management – granular, diversified portfolios that provide effective mitigation of risk cycle risk profile ` Resilience in the event of macroeconomic shocks 17 Proprietary and Confidential

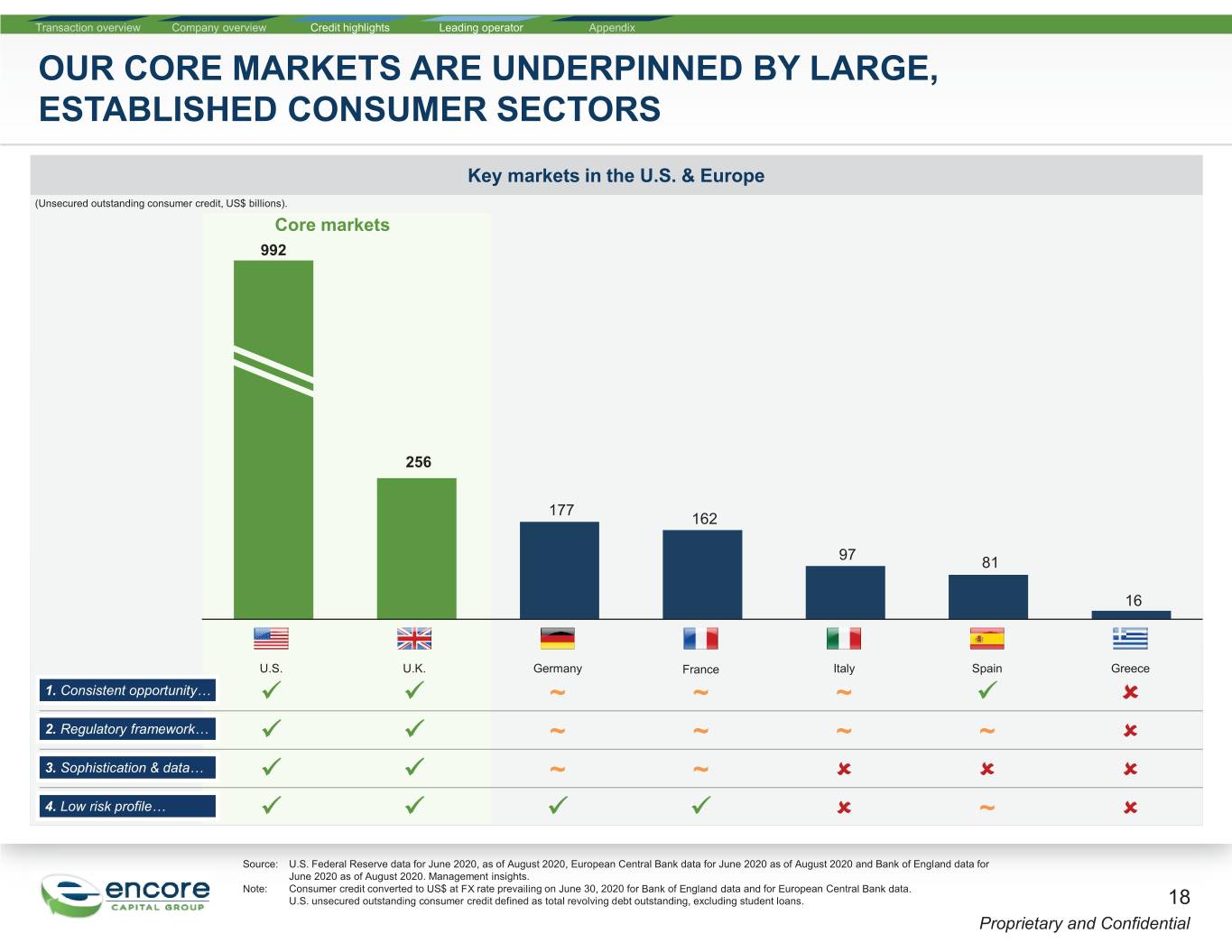

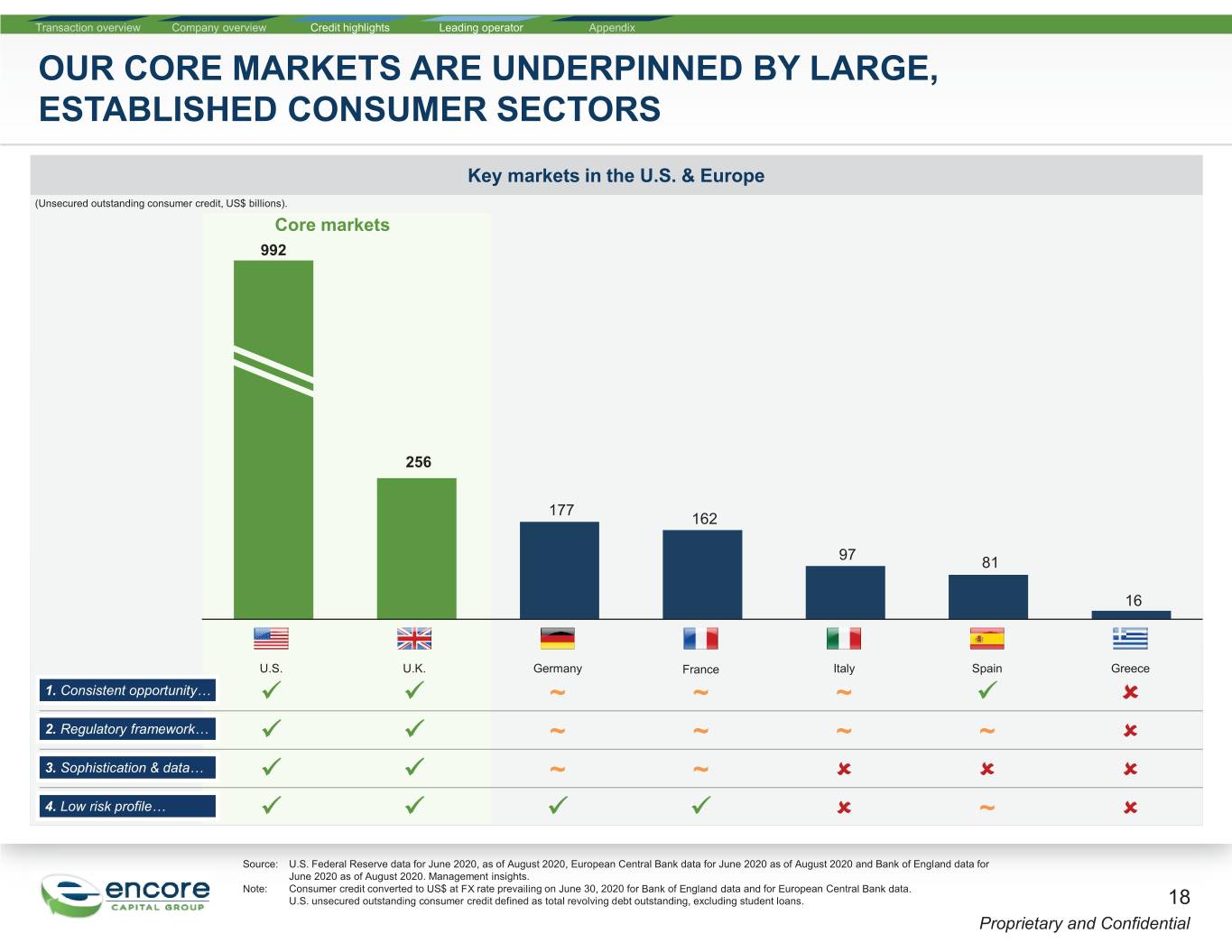

Transaction overview Company overview Credit highlights Leading operator Appendix OUR CORE MARKETS ARE UNDERPINNED BY LARGE, ESTABLISHED CONSUMER SECTORS Key markets in the U.S. & Europe (Unsecured outstanding consumer credit, US$ billions). Core markets 992 256 177 162 97 81 16 U.S. U.K. Germany France Italy Spain Greece 1. Consistent opportunity… 9 9 ~ ~ ~ 9 8 2. Regulatory framework… 9 9 ~ ~ ~ ~ 8 3. Sophistication & data… 9 9 ~ ~ 8 8 8 4. Low risk profile… 9 9 9 9 8 ~ 8 Source: U.S. Federal Reserve data for June 2020, as of August 2020, European Central Bank data for June 2020 as of August 2020 and Bank of England data for June 2020 as of August 2020. Management insights. Note: Consumer credit converted to US$ at FX rate prevailing on June 30, 2020 for Bank of England data and for European Central Bank data. U.S. unsecured outstanding consumer credit defined as total revolving debt outstanding, excluding student loans. 18 Proprietary and Confidential

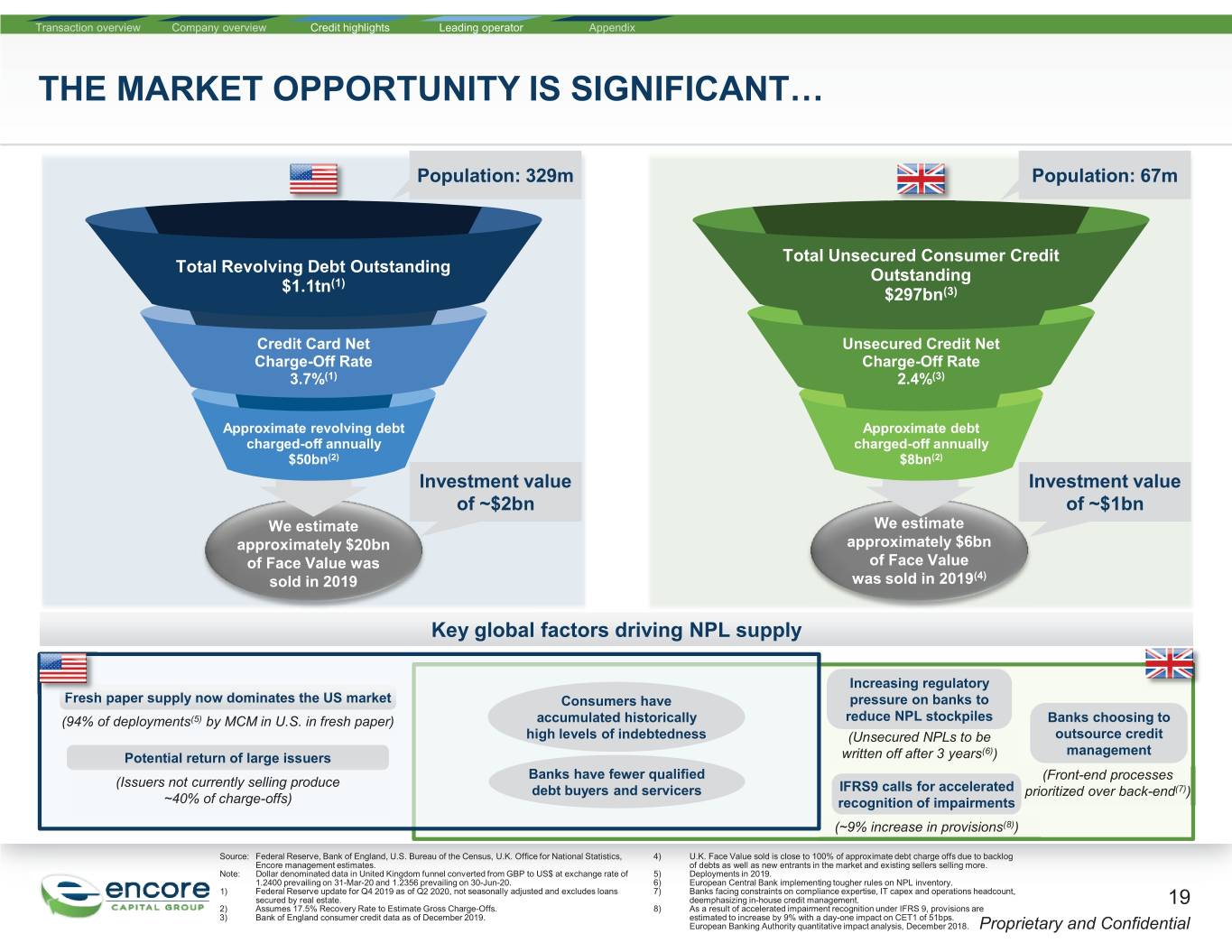

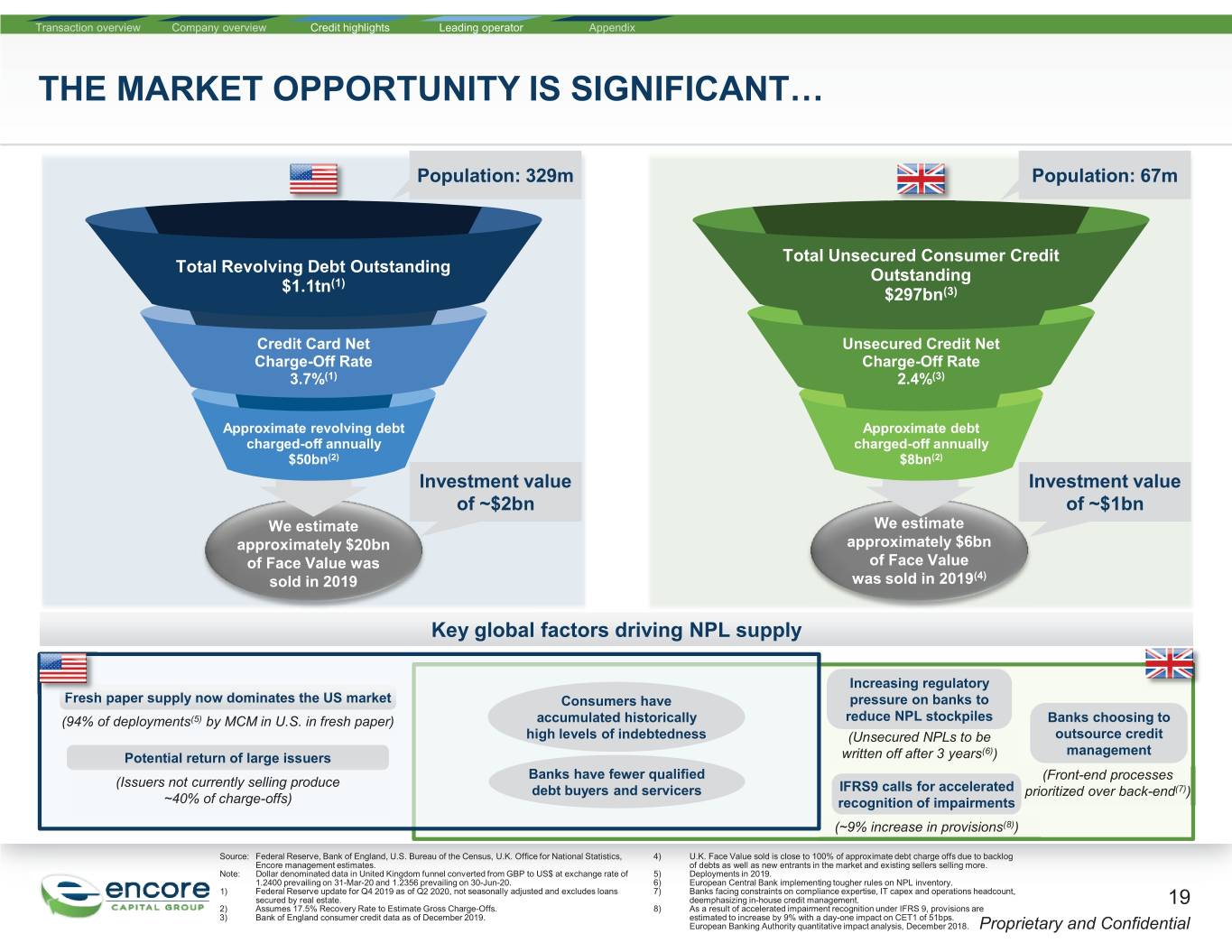

Transaction overview Company overview Credit highlights Leading operator Appendix THE MARKET OPPORTUNITY IS SIGNIFICANT… Population: 329m Population: 67m Total Unsecured Consumer Credit Total Revolving Debt Outstanding (1) Outstanding $1.1tn $297bn(3) Credit Card Net Unsecured Credit Net Charge-Off Rate Charge-Off Rate 3.7%(1) 2.4%(3) Approximate revolving debt Approximate debt charged-off annually charged-off annually $50bn(2) $8bn(2) Investment value Investment value of ~$2bn of ~$1bn We estimate We estimate approximately $20bn approximately $6bn of Face Value was of Face Value sold in 2019 was sold in 2019(4) Key global factors driving NPL supply Increasing regulatory FreshFh paper supply now dominates the US market Consumers have pressure on banks to (94% of deployments(5) by MCM in U.S. in fresh paper) accumulated historically reduce NPL stockpiles Banks choosing to high levels of indebtedness (Unsecured NPLs to be outsource credit (6) management Potential return of large issuers written off after 3 years ) Banks have fewer qualified (Front-end processes (Issuers not currently selling produce debt buyers and servicers IFRS9 calls for accelerated prioritized over back-end(7)) ~40% of charge-offs) recognition of impairments (~9% increase in provisions(8)) Source: Federal Reserve, Bank of England, U.S. Bureau of the Census, U.K. Office for National Statistics, 4) U.K. Face Value sold is close to 100% of approximate debt charge offs due to backlog Encore management estimates. of debts as well as new entrants in the market and existing sellers selling more. Note: Dollar denominated data in United Kingdom funnel converted from GBP to US$ at exchange rate of 5) Deployments in 2019. 1.2400 prevailing on 31-Mar-20 and 1.2356 prevailing on 30-Jun-20. 6) European Central Bank implementing tougher rules on NPL inventory. 1) Federal Reserve update for Q4 2019 as of Q2 2020, not seasonally adjusted and excludes loans 7) Banks facing constraints on compliance expertise, IT capex and operations headcount, secured by real estate. deemphasizing in-house credit management. 19 2) Assumes 17.5% Recovery Rate to Estimate Gross Charge-Offs. 8) As a result of accelerated impairment recognition under IFRS 9, provisions are 3) Bank of England consumer credit data as of December 2019. estimated to increase by 9% with a day-one impact on CET1 of 51bps. European Banking Authority quantitative impact analysis, December 2018. Proprietary and Confidential

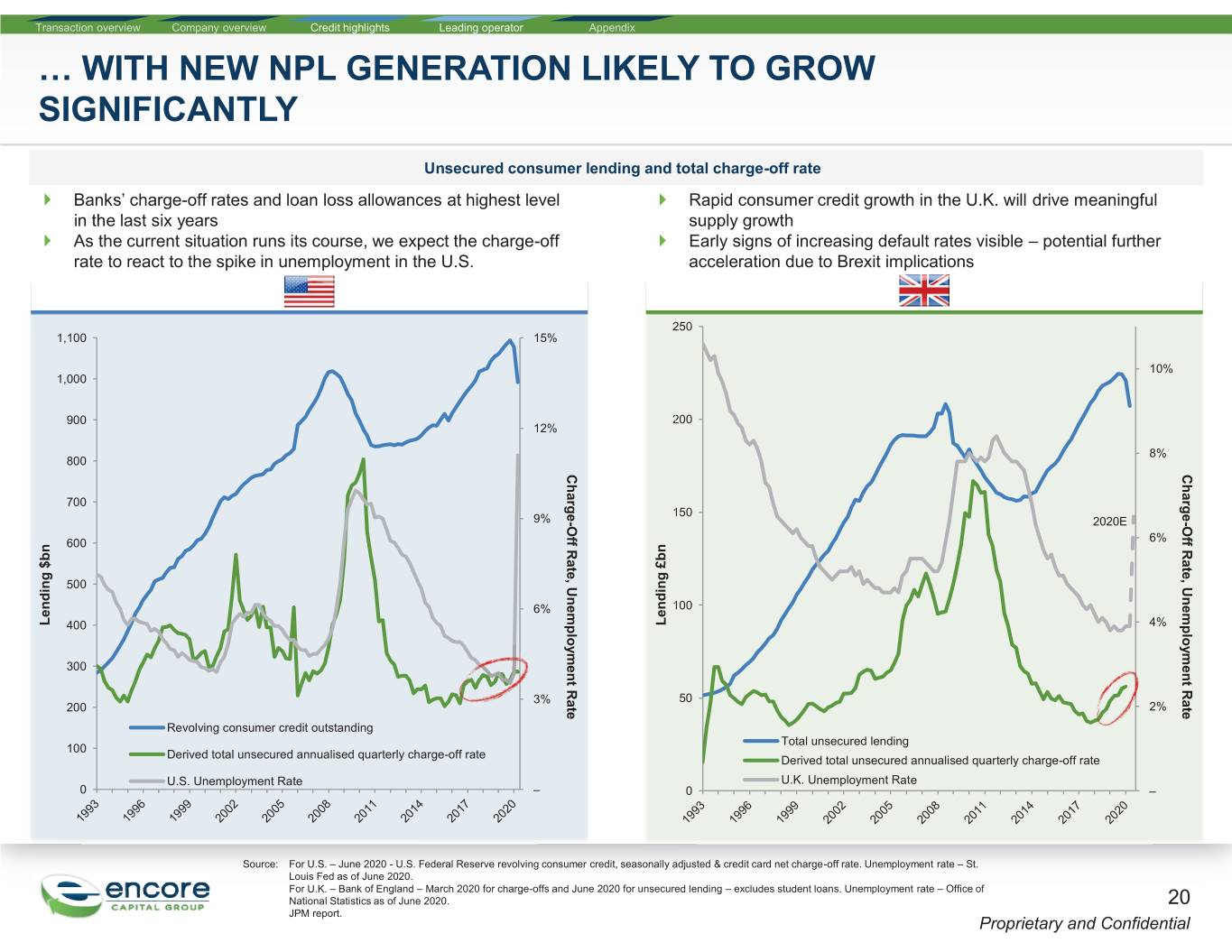

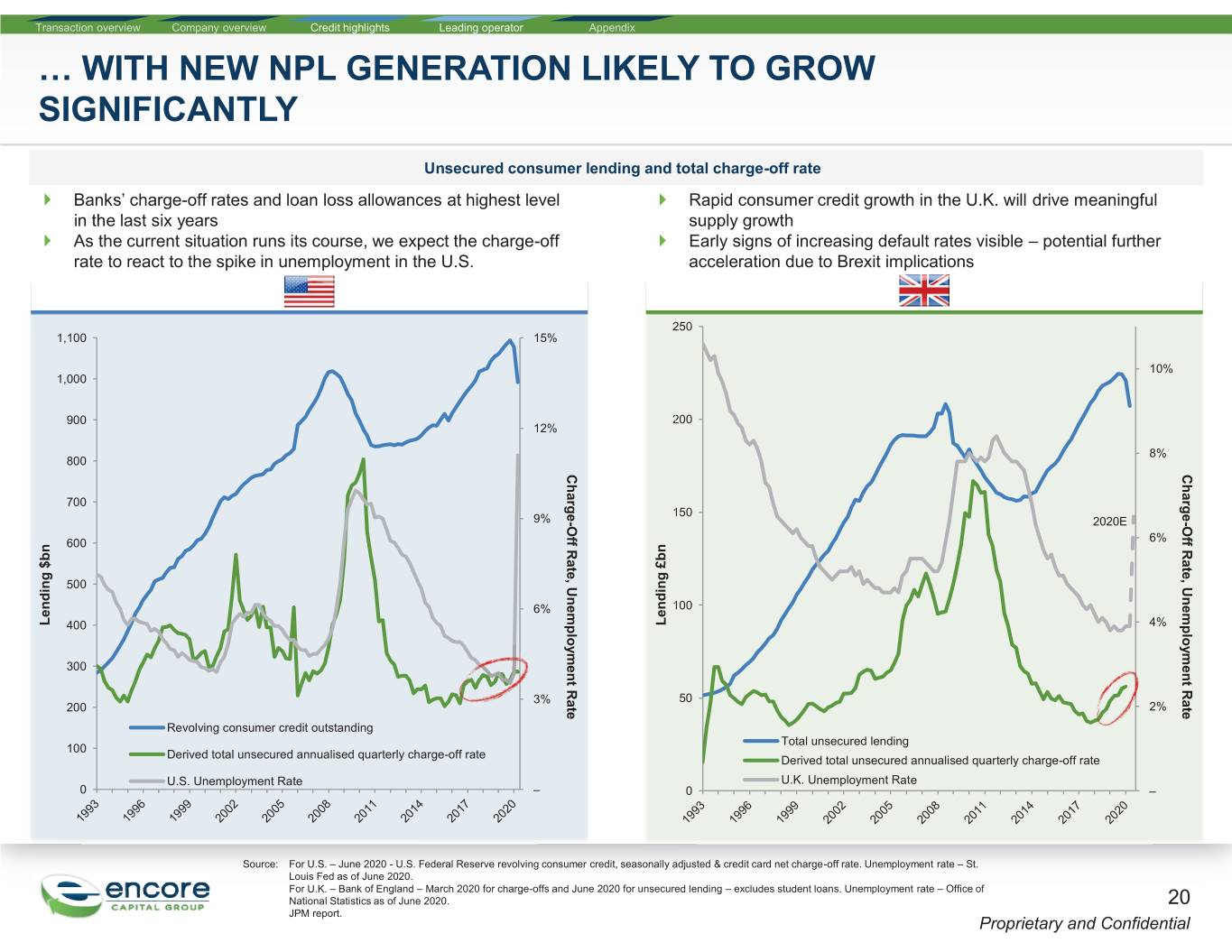

Transaction overview Company overview Credit highlights Leading operator Appendix … WITH NEW NPL GENERATION LIKELY TO GROW SIGNIFICANTLY Unsecured consumer lending and total charge-off rate ` Banks’ charge-off rates and loan loss allowances at highest level ` Rapid consumer credit growth in the U.K. will drive meaningful in the last six years supply growth ` As the current situation runs its course, we expect the charge-off ` Early signs of increasing default rates visible – potential further rate to react to the spike in unemployment in the U.S. acceleration due to Brexit implications 250 11,100 15% 10% 1,0001 900 2200 12% 8% 800 Charge-Off Rate, Unemployment Rate Rate Unemployment Rate, Charge-Off Charge-Off Rate, Unemployment Rate Rate Unemployment Rate, Charge-Off 700 1150 9% 2020E 600 6% 500 6% 1100 Lending $bn Lending 400 Lending £bn 4% 300 3% 50 200 2% Revolving consumer credit outstanding Total unsecured lending 100 Derived total unsecured annualised quarterly charge-off rate Derived total unsecured annualised quarterly charge-off rate U.S. Unemployment Rate U.K. Unemployment Rate 0 – 0 – Source: For U.S. – June 2020 - U.S. Federal Reserve revolving consumer credit, seasonally adjusted & credit card net charge-off rate. Unemployment rate – St. Louis Fed as of June 2020. For U.K. – Bank of England – March 2020 for charge-offs and June 2020 for unsecured lending – excludes student loans. Unemployment rate – Office of National Statistics as of June 2020. 20 JPM report. Proprietary and Confidential

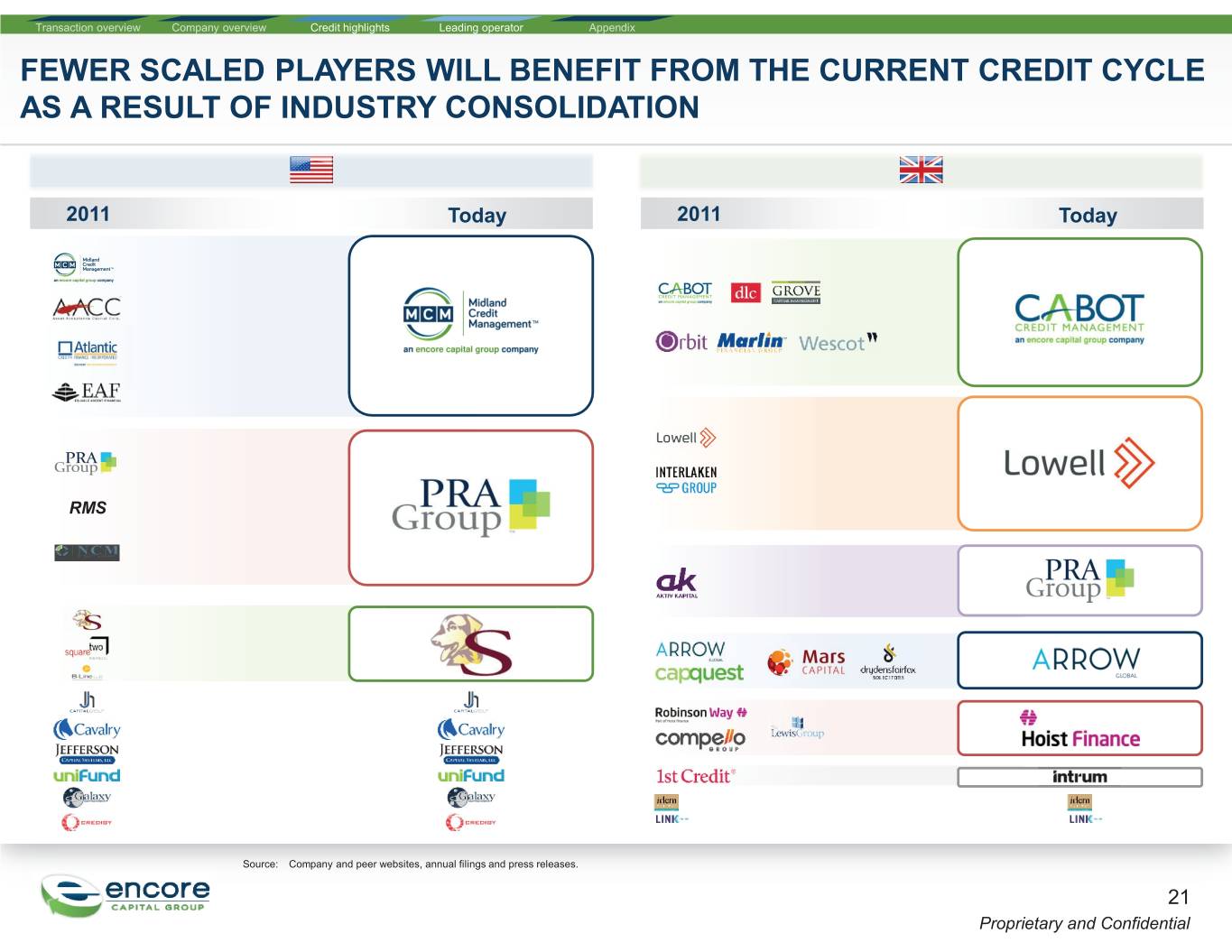

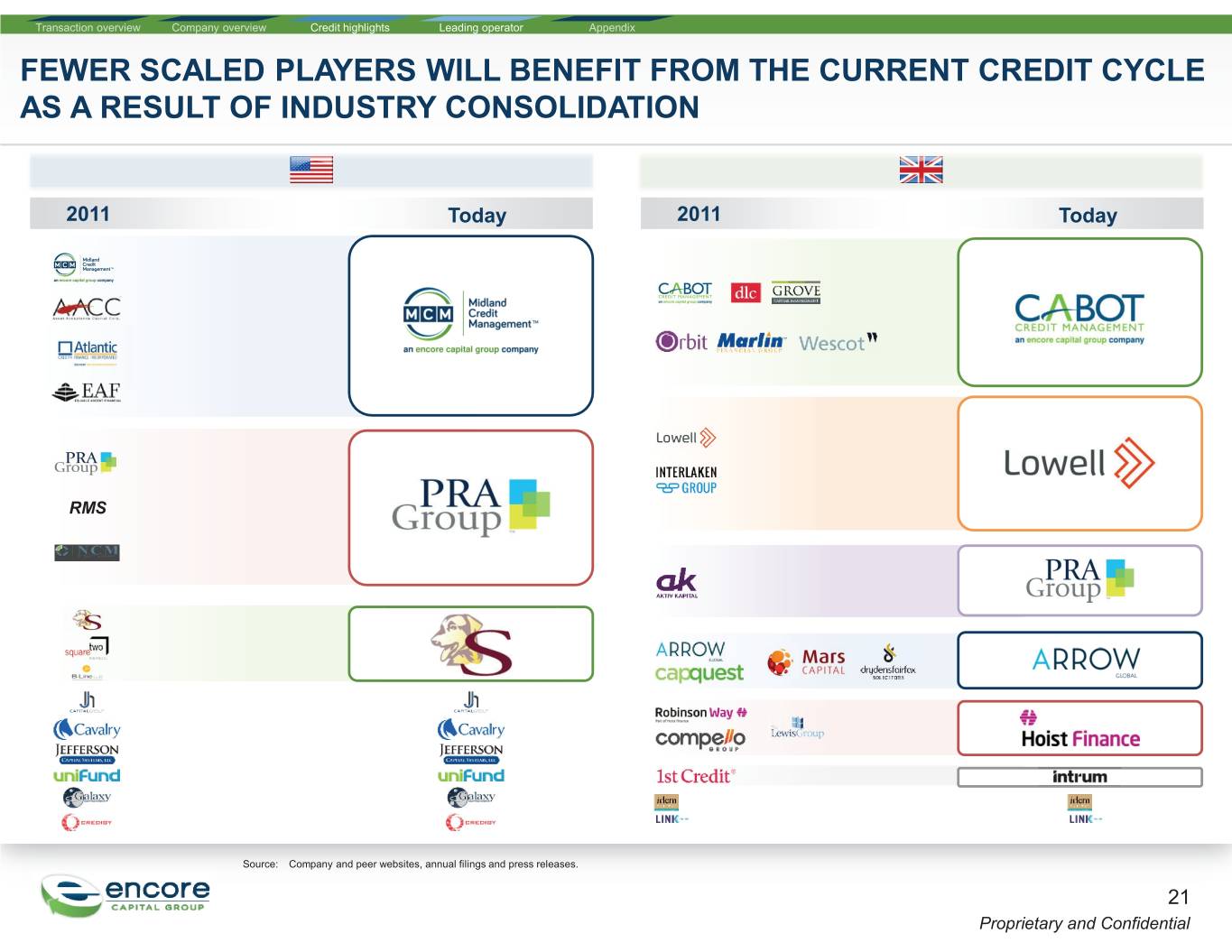

Transaction overview Company overview Credit highlights Leading operator Appendix FEWER SCALED PLAYERS WILL BENEFIT FROM THE CURRENT CREDIT CYCLE AS A RESULT OF INDUSTRY CONSOLIDATION 2011 Today 2011 Today RMS Source: Company and peer websites, annual filings and press releases. 21 Proprietary and Confidential

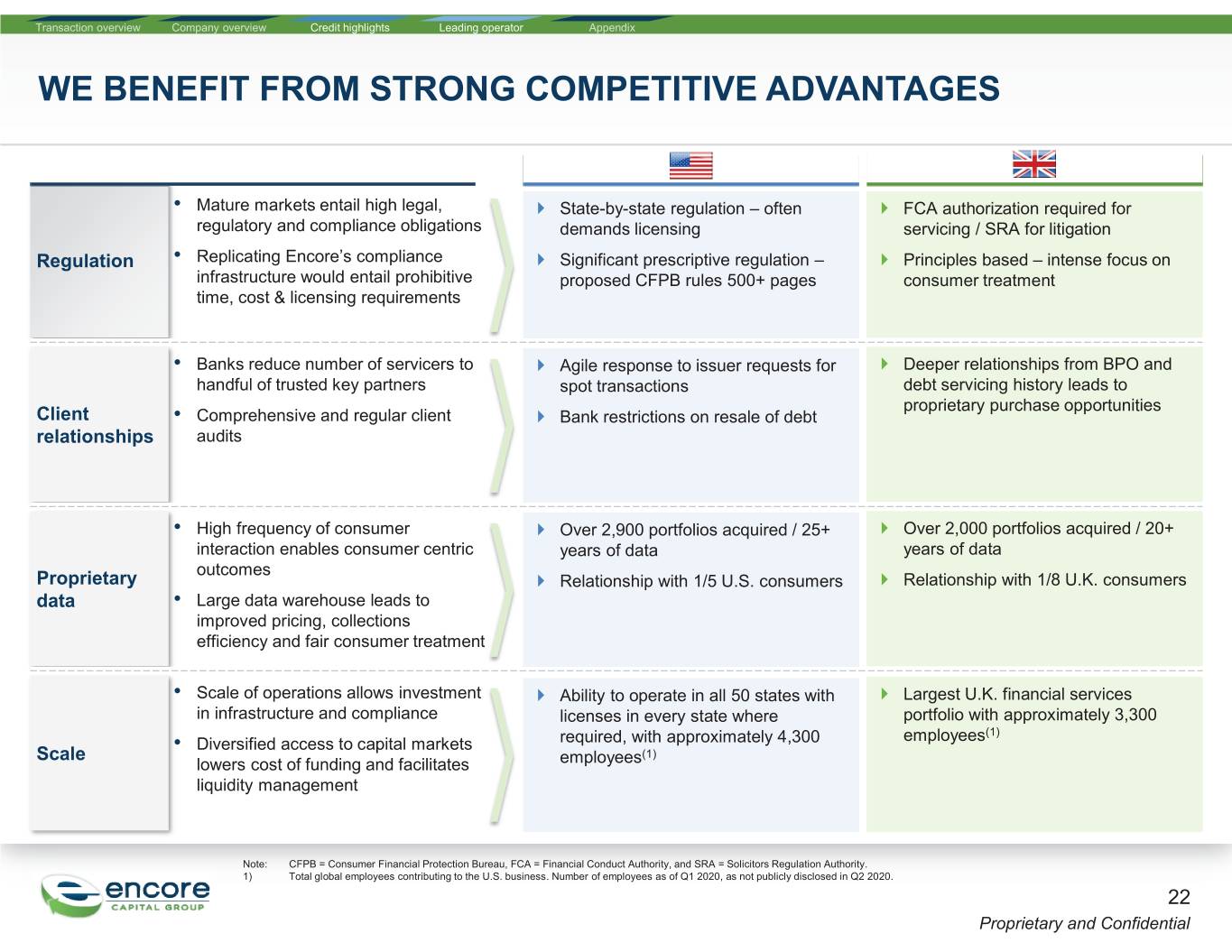

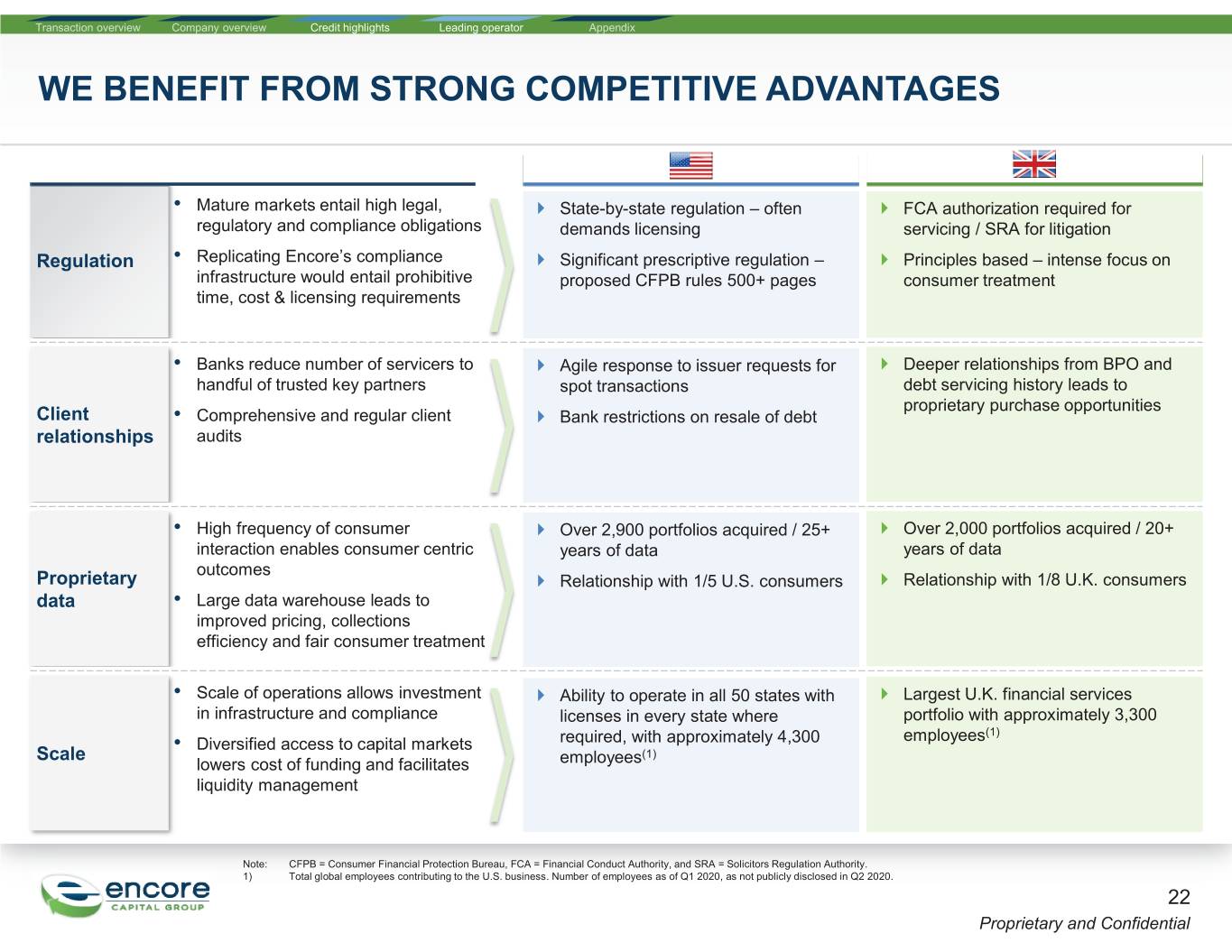

Transaction overview Company overview Credit highlights Leading operator Appendix WE BENEFIT FROM STRONG COMPETITIVE ADVANTAGES • Mature markets entail high legal, ` State-by-state regulation – often ` FCA authorization required for regulatory and compliance obligations demands licensing servicing / SRA for litigation Regulation • Replicating Encore’s compliance ` Significant prescriptive regulation – ` Principles based – intense focus on infrastructure would entail prohibitive proposed CFPB rules 500+ pages consumer treatment time, cost & licensing requirements • Banks reduce number of servicers to ` Agile response to issuer requests for ` Deeper relationships from BPO and handful of trusted key partners spot transactions debt servicing history leads to proprietary purchase opportunities Client • Comprehensive and regular client ` Bank restrictions on resale of debt relationships audits • High frequency of consumer ` Over 2,900 portfolios acquired / 25+ ` Over 2,000 portfolios acquired / 20+ interaction enables consumer centric years of data years of data outcomes Proprietary ` Relationship with 1/5 U.S. consumers ` Relationship with 1/8 U.K. consumers data • Large data warehouse leads to improved pricing, collections efficiency and fair consumer treatmentt • Scale of operations allows investment ` Ability to operate in all 50 states with ` Largest U.K. financial services in infrastructure and compliance licenses in every state where portfolio with approximately 3,300 employees(1) • Diversified access to capital markets required, with approximately 4,300 Scale (1) lowers cost of funding and facilitates employees liquidity management Note: CFPB = Consumer Financial Protection Bureau, FCA = Financial Conduct Authority, and SRA = Solicitors Regulation Authority. 1) Total global employees contributing to the U.S. business. Number of employees as of Q1 2020, as not publicly disclosed in Q2 2020. 22 Proprietary and Confidential

B. Our scale, operational differentiation and compliance excellence drive strong risk adjusted returns 23 Proprietary and Confidential

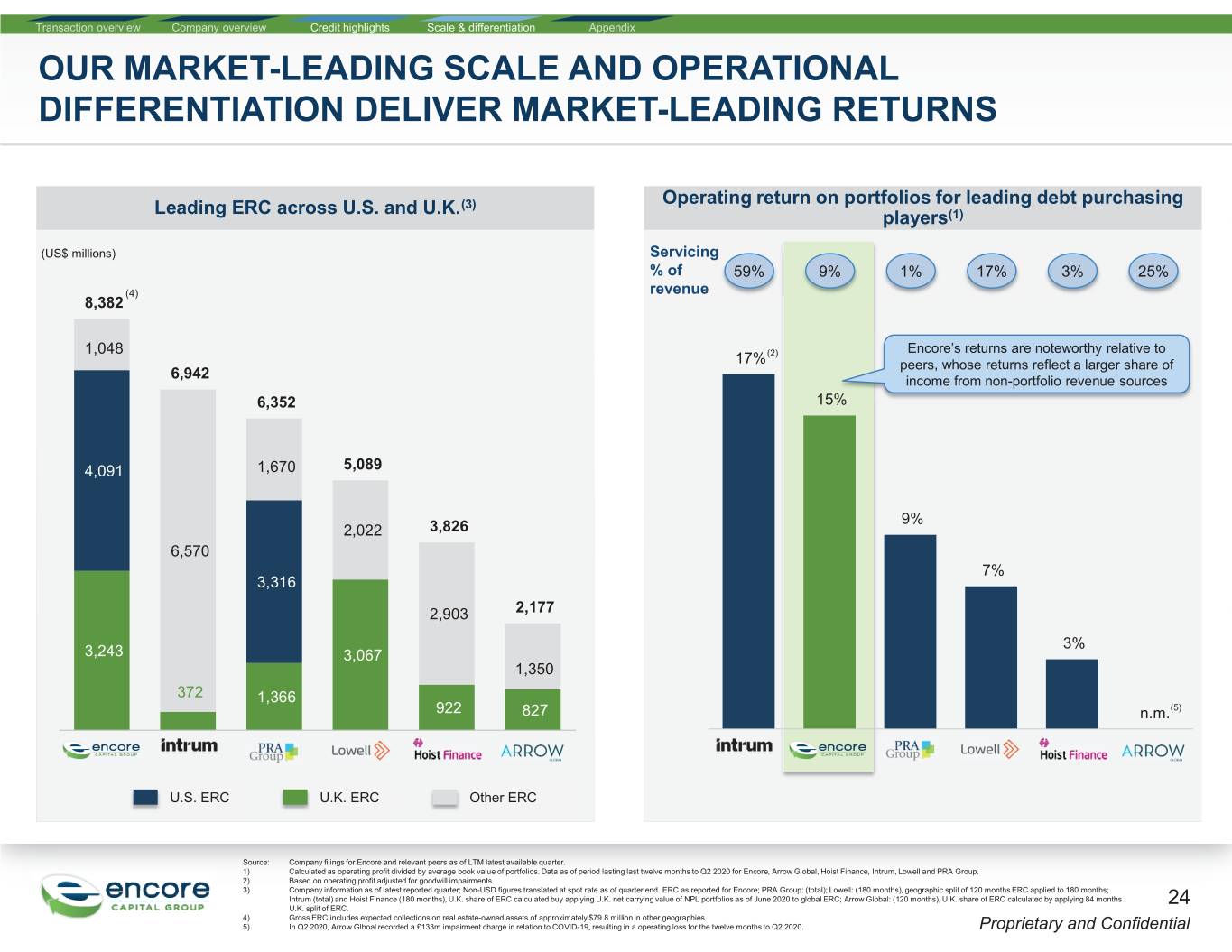

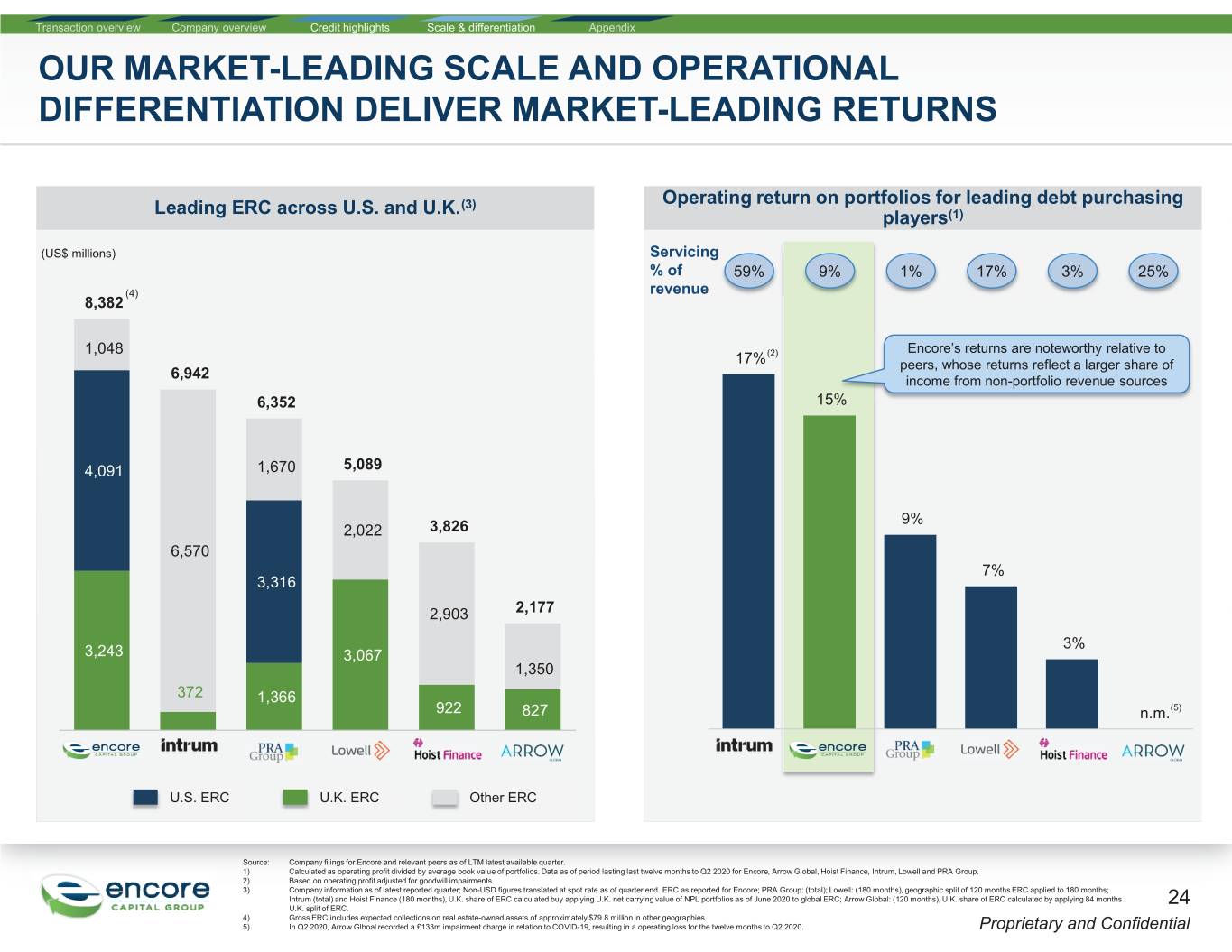

Transaction overview Company overview Credit highlights Scale & differentiation Appendix OUR MARKET-LEADING SCALE AND OPERATIONAL DIFFERENTIATION DELIVER MARKET-LEADING RETURNS Operating return on portfolios for leading debt purchasing Leading ERC across U.S. and U.K.(3) players(1) (US$ millions) Servicing % of 59% 9% 1% 17% 3% 25% (4) revenue 8,382 1,048 (2) Encore’s returns are noteworthy relative to 17% peers, whose returns reflect a larger share of 6,942 income from non-portfolio revenue sources 6,352 15%% 4,091 1,670 5,089 9% 2,022 3,826 6,570 7% 3,316 2,903 2,177 3% 3,243 3,067 1,350 372 1,366 922 827 n.m. (5) U.S. ERC U.K. ERC Other ERC Source: Company filings for Encore and relevant peers as of LTM latest available quarter. 1) Calculated as operating profit divided by average book value of portfolios. Data as of period lasting last twelve months to Q2 2020 for Encore, Arrow Global, Hoist Finance, Intrum, Lowell and PRA Group. 2) Based on operating profit adjusted for goodwill impairments. 3) Company information as of latest reported quarter; Non-USD figures translated at spot rate as of quarter end. ERC as reported for Encore; PRA Group: (total); Lowell: (180 months), geographic split of 120 months ERC applied to 180 months; Intrum (total) and Hoist Finance (180 months), U.K. share of ERC calculated buy applying U.K. net carrying value of NPL portfolios as of June 2020 to global ERC; Arrow Global: (120 months), U.K. share of ERC calculated by applying 84 months 24 U.K. split of ERC. 4) Gross ERC includes expected collections on real estate-owned assets of approximately $79.8 million in other geographies. 5) In Q2 2020, Arrow Glboal recorded a £133m impairment charge in relation to COVID-19, resulting in a operating loss for the twelve months to Q2 2020. Proprietary and Confidential

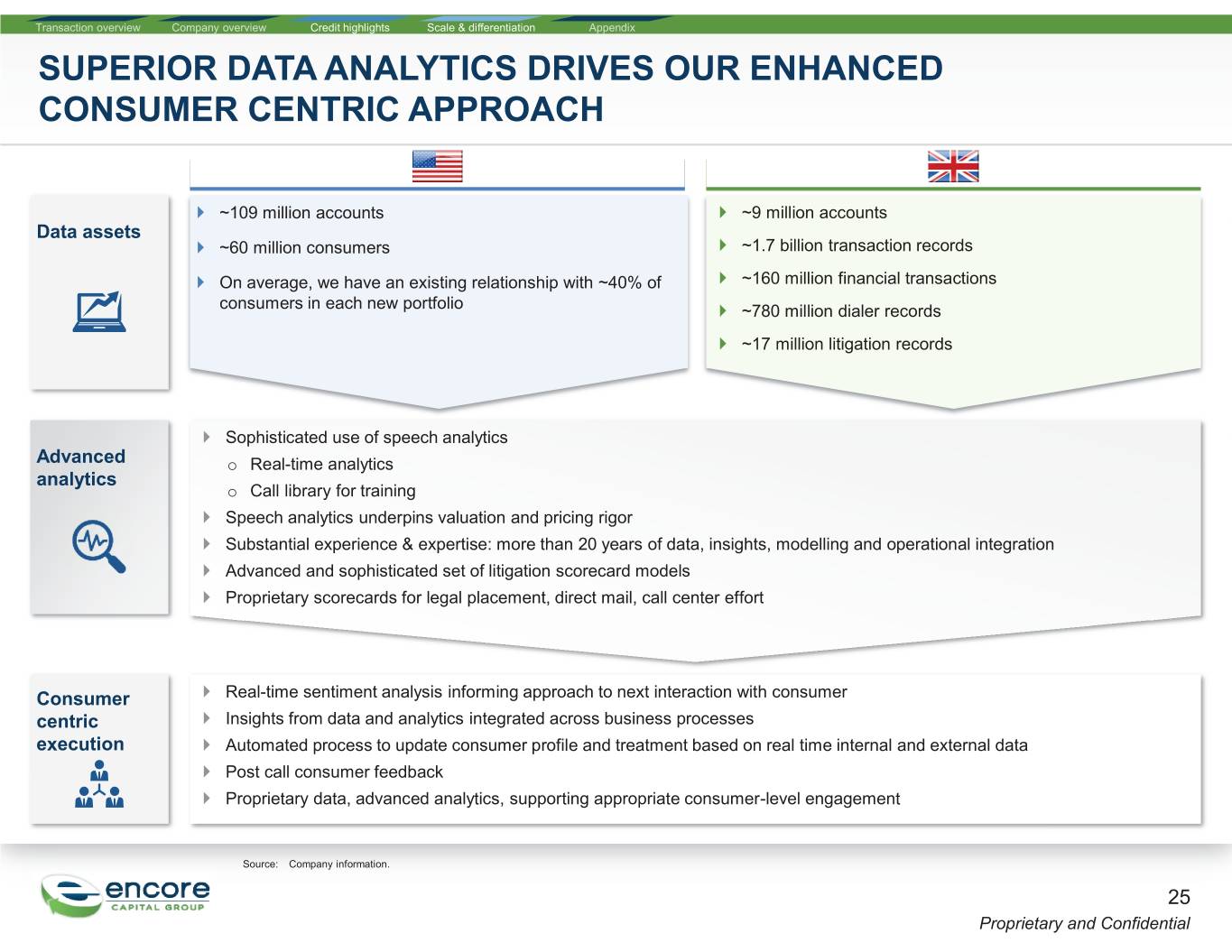

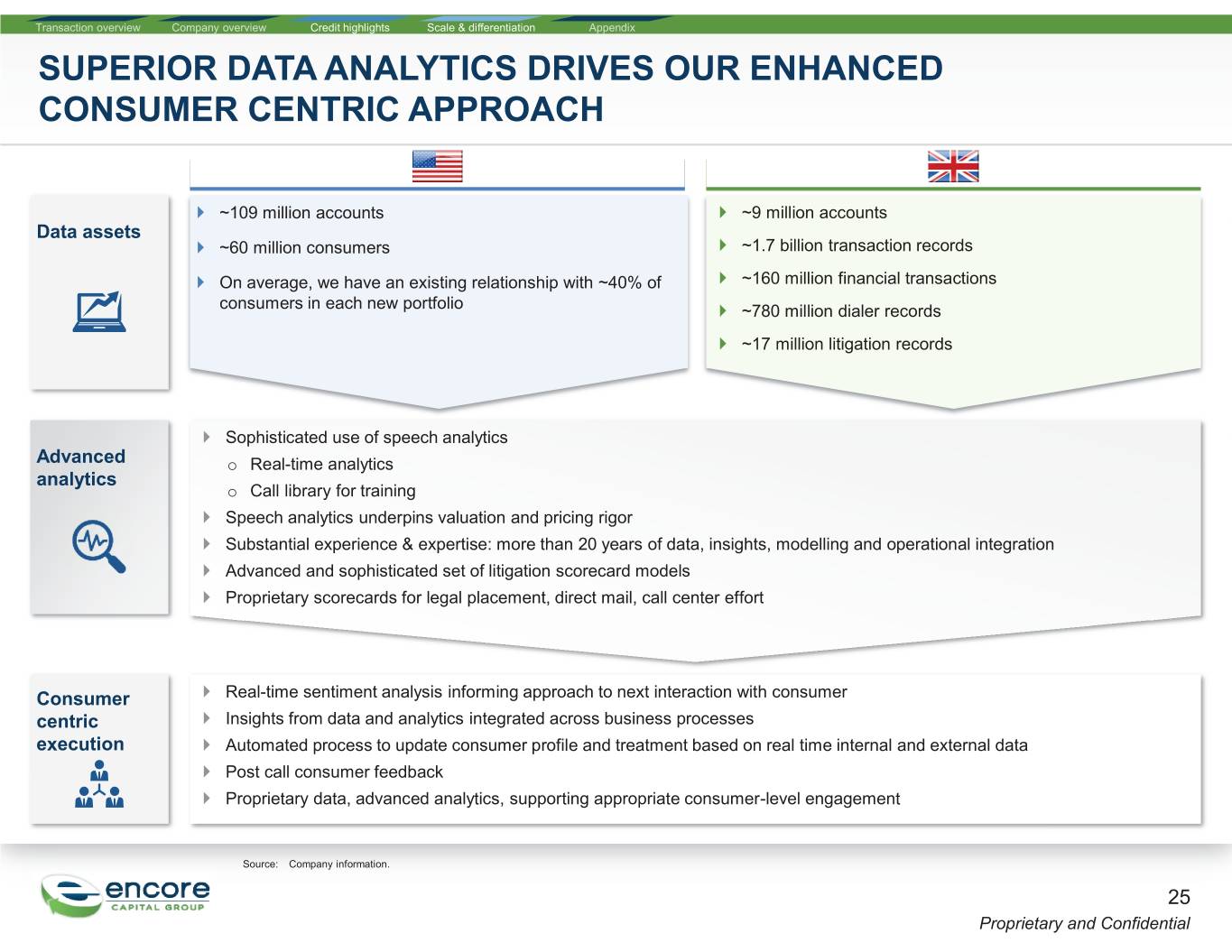

Transaction overview Company overview Credit highlights Scale & differentiation Appendix SUPERIOR DATA ANALYTICS DRIVES OUR ENHANCED CONSUMER CENTRIC APPROACH ` ~109 million accounts ` ~9 million accounts Data assets ` ~60 million consumers ` ~1.7 billion transaction records ` On average, we have an existing relationship with ~40% of ` ~160 million financial transactions consumers in each new portfolio ` ~780 million dialer records ` ~17 million litigation records ` Sophisticated use of speech analytics Advanced o Real-time analytics analytics o Call library for training ` Speech analytics underpins valuation and pricing rigor ` Substantial experience & expertise: more than 20 years of data, insights, modelling and operational integration ` Advanced and sophisticated set of litigation scorecard models ` Proprietary scorecards for legal placement, direct mail, call center effort Consumer ` Real-time sentiment analysis informing approach to next interaction with consumer centric ` Insights from data and analytics integrated across business processes execution ` Automated process to update consumer profile and treatment based on real time internal and external data ` Post call consumer feedback ` Proprietary data, advanced analytics, supporting appropriate consumer-level engagement Source: Company information. 25 Proprietary and Confidential

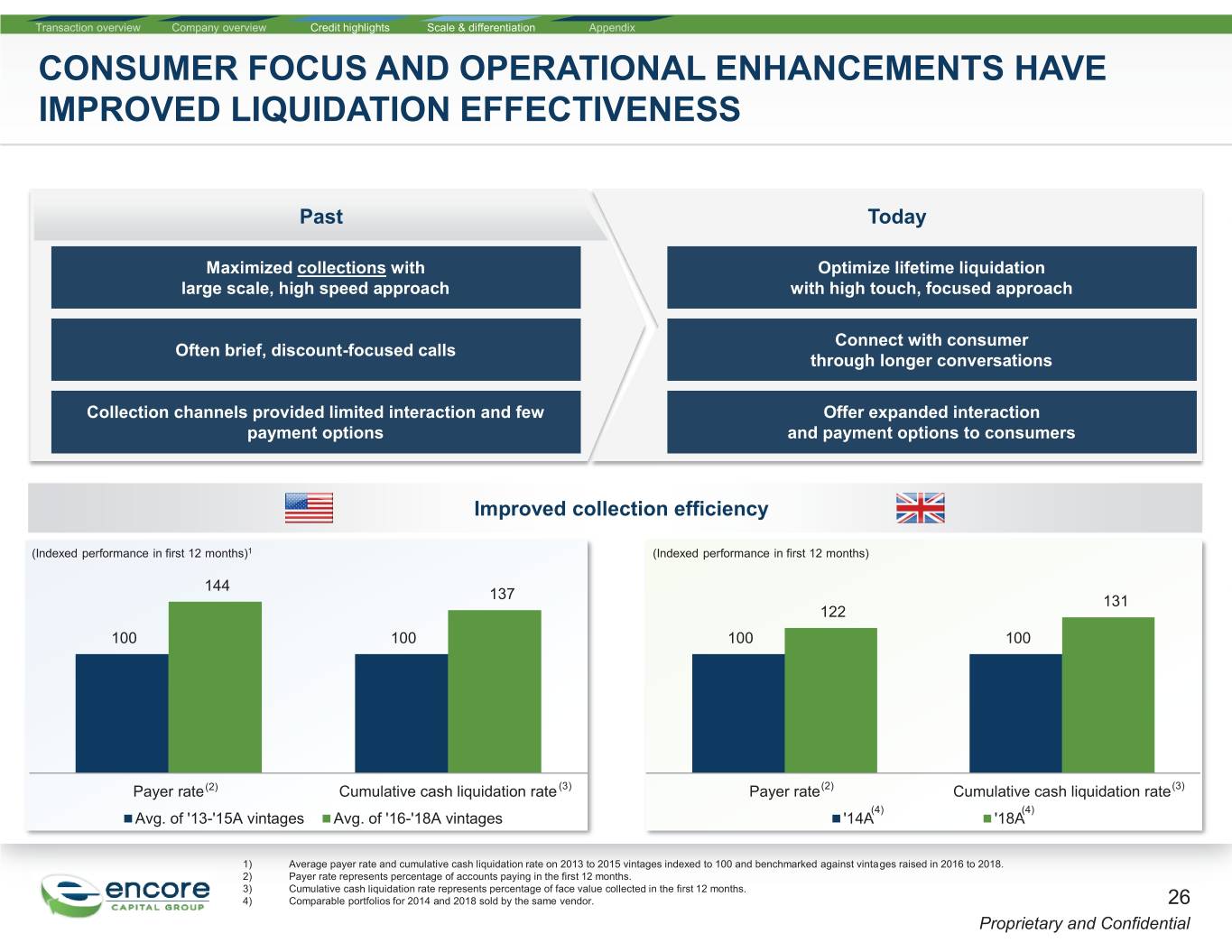

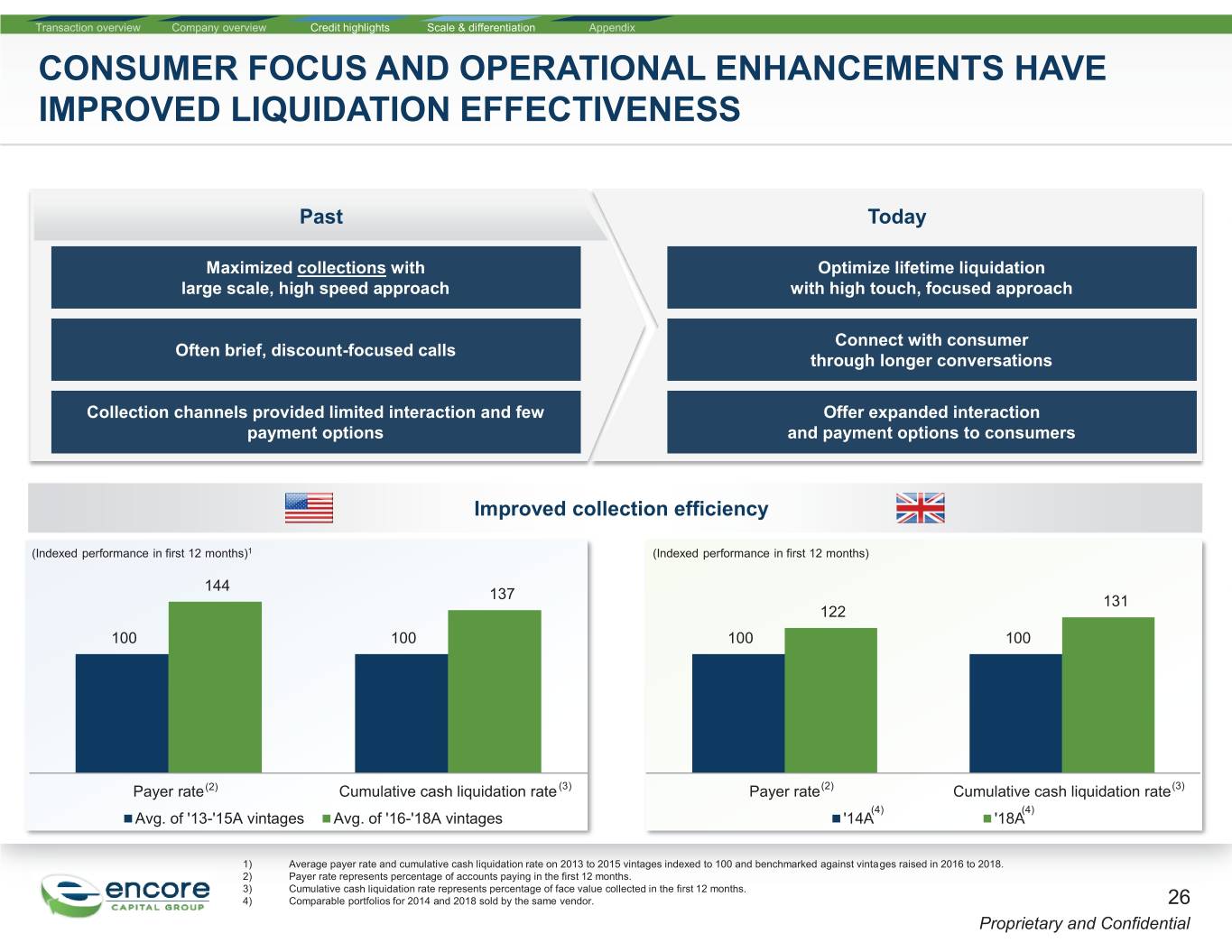

Transaction overview Company overview Credit highlights Scale & differentiation Appendix CONSUMER FOCUS AND OPERATIONAL ENHANCEMENTS HAVE IMPROVED LIQUIDATION EFFECTIVENESS Past Today Maximized collections with Optimize lifetime liquidation large scale, high speed approach with high touch, focused approach Connect with consumer Often brief, discount-focused calls through longer conversations Collection channels provided limited interaction and few Offer expanded interaction payment options and payment options to consumers Improved collection efficiency (Indexed performance in first 12 months)1 (Indexed performance in first 12 months) 144 137 131 122 100 100 100 100 Payer ratee(2) Cumulative cash liquidation ratee (3) Payer rate(2) Cumulative cash liquidation rate(3) (4) (4) Avg. of '13-'15A vintages Avg. of '16-'18A vintages '14AA '18AA 1) Average payer rate and cumulative cash liquidation rate on 2013 to 2015 vintages indexed to 100 and benchmarked against vintages raised in 2016 to 2018. 2) Payer rate represents percentage of accounts paying in the first 12 months. 3) Cumulative cash liquidation rate represents percentage of face value collected in the first 12 months. 4) Comparable portfolios for 2014 and 2018 sold by the same vendor. 26 Proprietary and Confidential

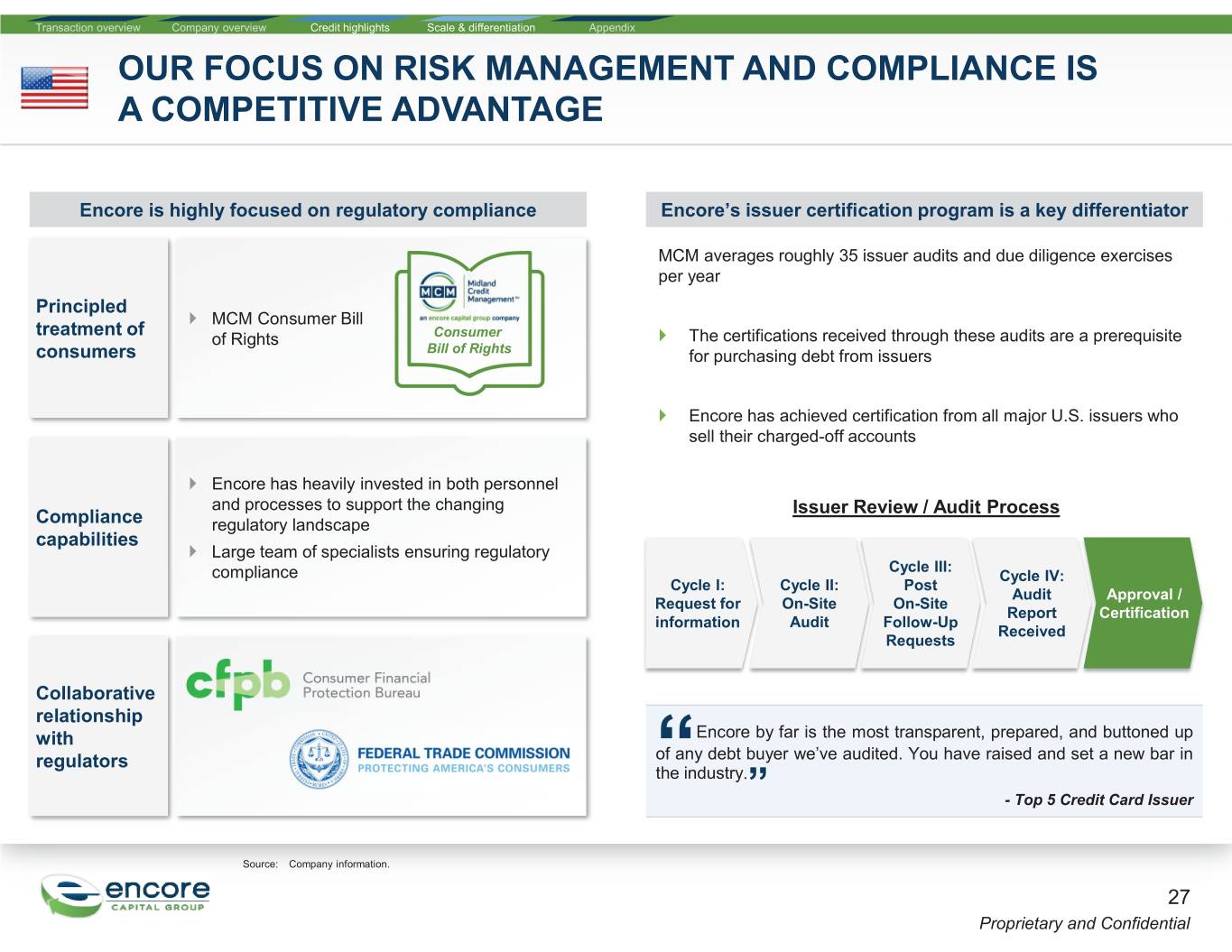

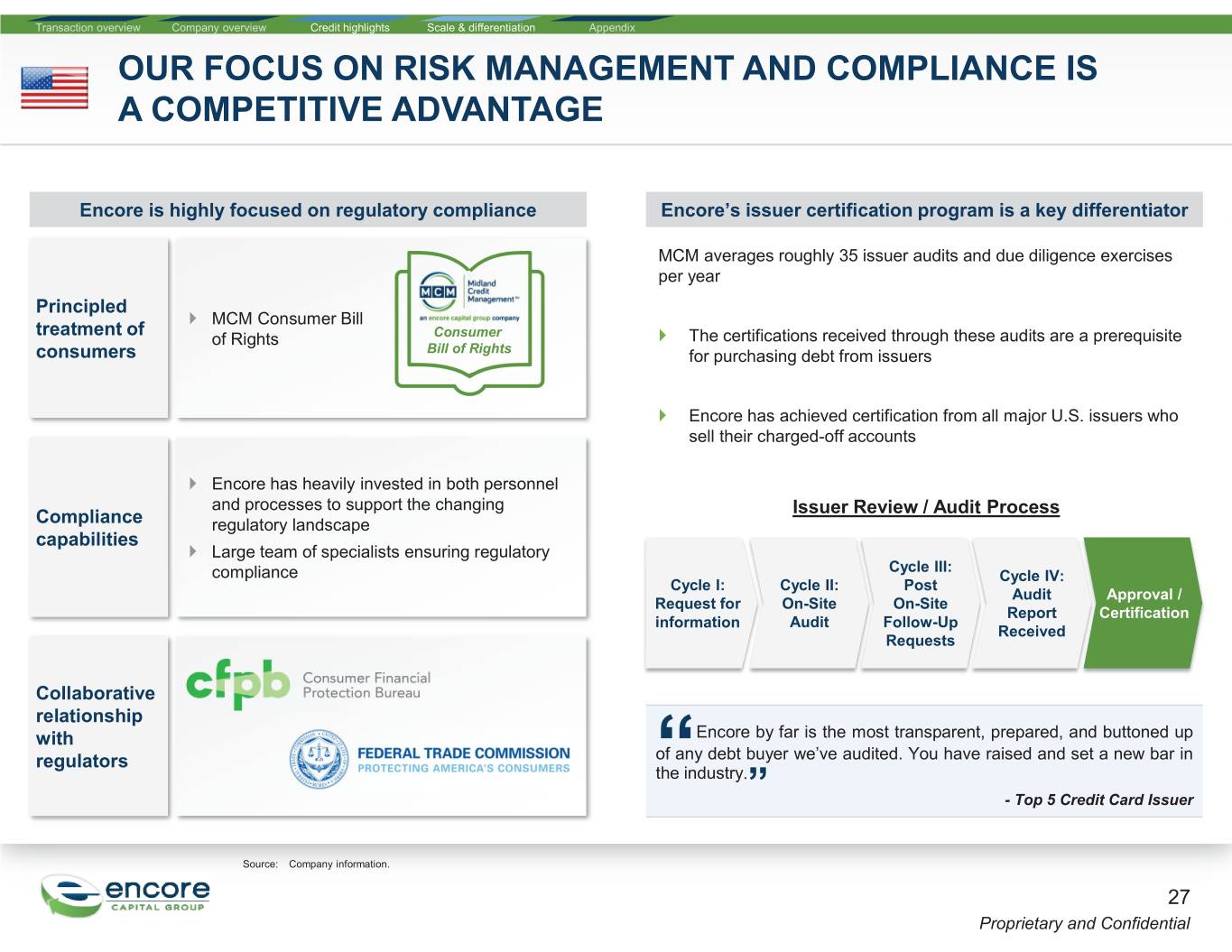

Transaction overview Company overview Credit highlights Scale & differentiation Appendix OUR FOCUS ON RISK MANAGEMENT AND COMPLIANCE IS A COMPETITIVE ADVANTAGE Encore is highly focused on regulatory compliance Encore’s issuer certification program is a key differentiator MCM averages roughly 35 issuer audits and due diligence exercises per year Principled ` MCM Consumer Bill treatment of of Rights Consumer ` The certifications received through these audits are a prerequisite consumers Bill of Rights for purchasing debt from issuers ` Encore has achieved certification from all major U.S. issuers who sell their charged-off accounts ` Encore has heavily invested in both personnel and processes to support the changing Issuer Review / Audit Process Compliance regulatory landscape capabilities ` Large team of specialists ensuring regulatory Cycle III: compliance Cycle IV: Cycle I: Cycle II: Post Audit Approval / Request for On-Site On-Site Report Certification information Audit Follow-Up Received Requests Collaborative relationship with Encore by far is the most transparent, prepared, and buttoned up regulators of any debt buyer we’ve audited. You have raised and set a new bar in “the industry. ” - Top 5 Credit Card Issuer Source: Company information. 27 Proprietary and Confidential

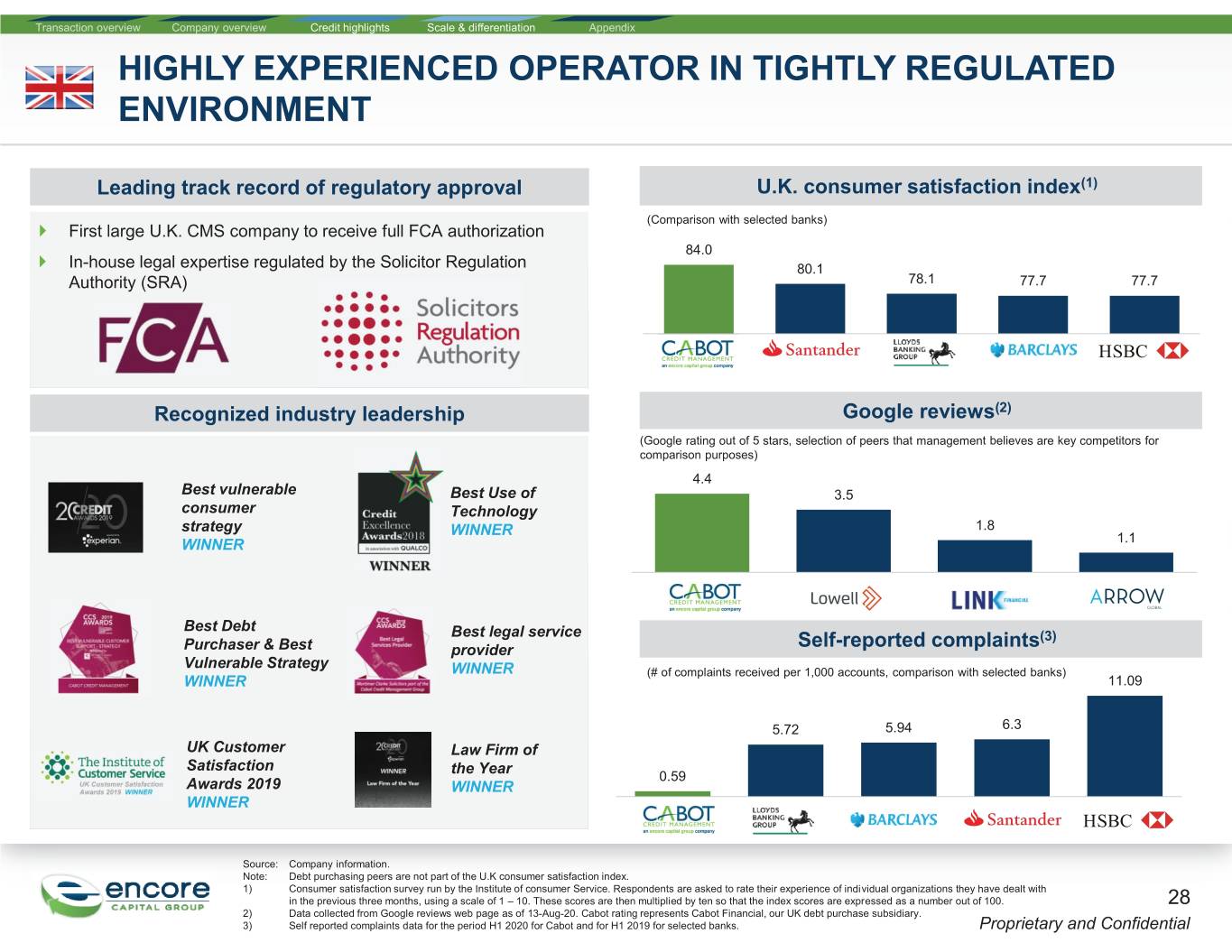

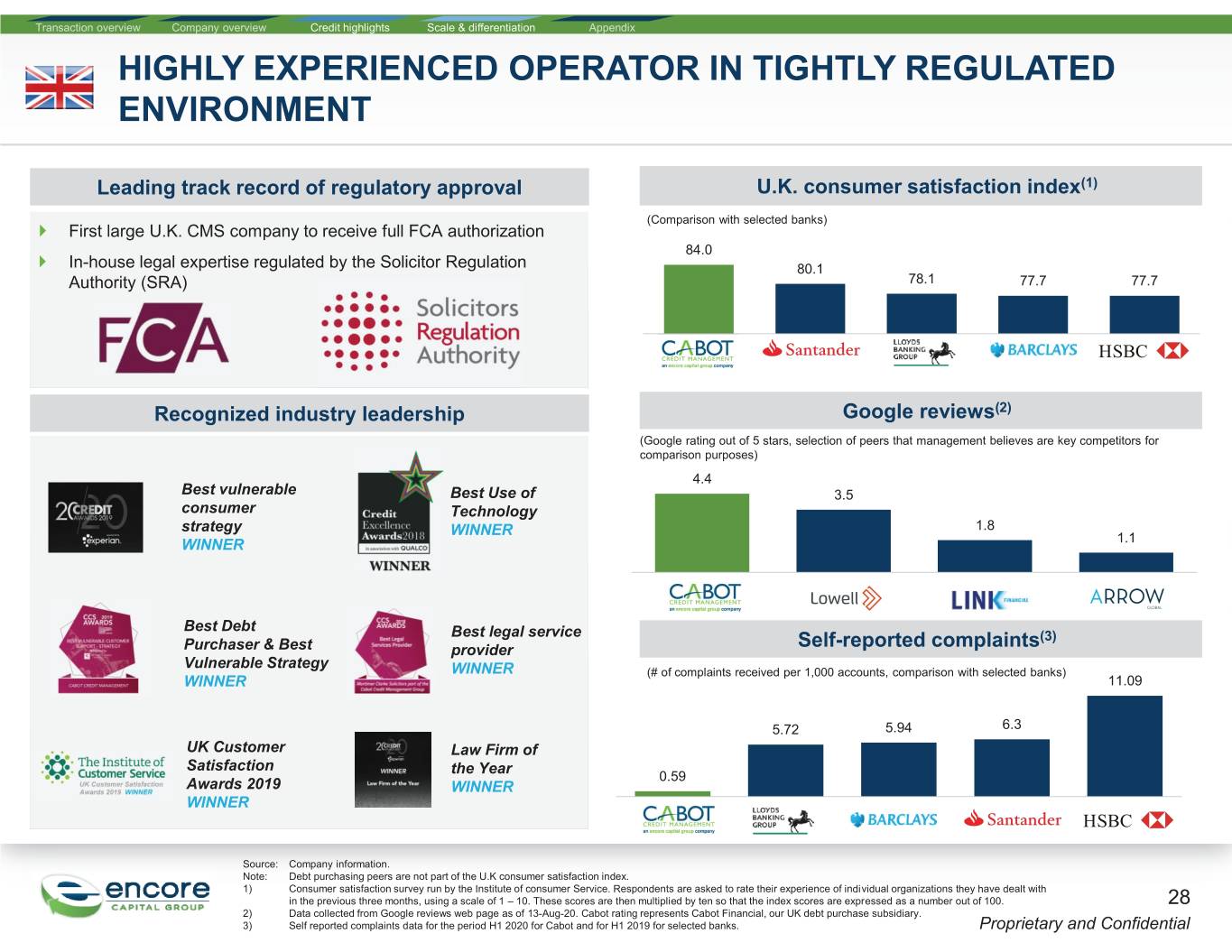

Transaction overview Company overview Credit highlights Scale & differentiation Appendix HIGHLY EXPERIENCED OPERATOR IN TIGHTLY REGULATED ENVIRONMENT Leading track record of regulatory approval U.K. consumer satisfaction index(1) (Comparison with selected banks) ` First large U.K. CMS company to receive full FCA authorization 84.0 ` In-house legal expertise regulated by the Solicitor Regulation 80.1 Authority (SRA) 78.1 77.7 77.7 Recognized industry leadership Google reviews(2) (Google rating out of 5 stars, selection of peers that management believes are key competitors for comparison purposes) 4.4 Best vulnerable Best Use of 3.5 consumer Technology strategy WINNER 1.8 WINNER 1.1 Best Debt Best legal service (3) Purchaser & Best provider Self-reported complaints Vulnerable Strategy WINNER (# of complaints received per 1,000 accounts, comparison with selected banks) WINNER 11.09 5.72 5.94 6.3 UK Customer Law Firm of Satisfaction the Year 0.59 Awards 2019 WINNER WINNER Source: Company information. Note: Debt purchasing peers are not part of the U.K consumer satisfaction index. 1) Consumer satisfaction survey run by the Institute of consumer Service. Respondents are asked to rate their experience of individual organizations they have dealt with in the previous three months, using a scale of 1 – 10. These scores are then multiplied by ten so that the index scores are expressed as a number out of 100. 28 2) Data collected from Google reviews web page as of 13-Aug-20. Cabot rating represents Cabot Financial, our UK debt purchase subsidiary. 3) Self reported complaints data for the period H1 2020 for Cabot and for H1 2019 for selected banks. Proprietary and Confidential

C. 20+ years of experience have created a large, diversified back-book generating resilient cash flows 29 Proprietary and Confidential

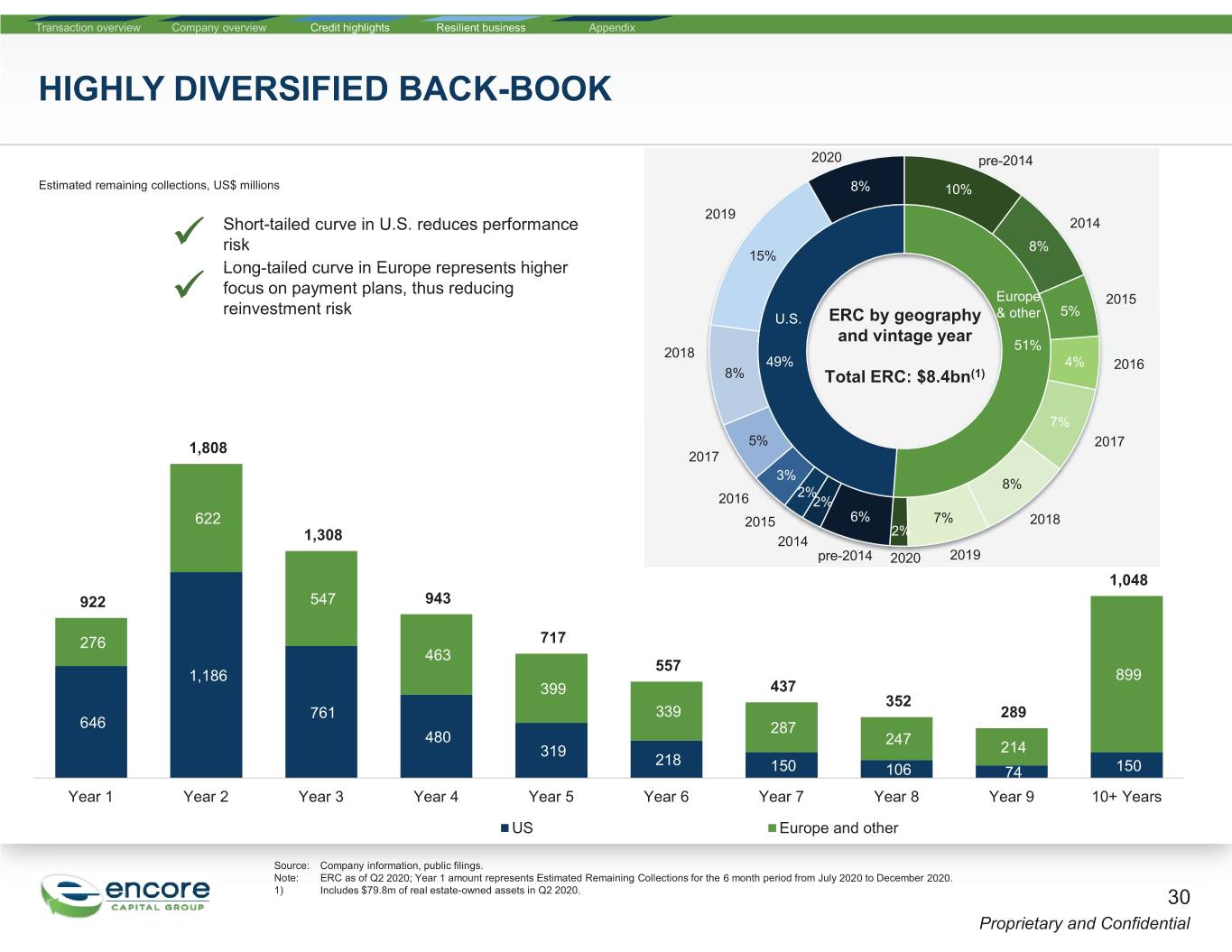

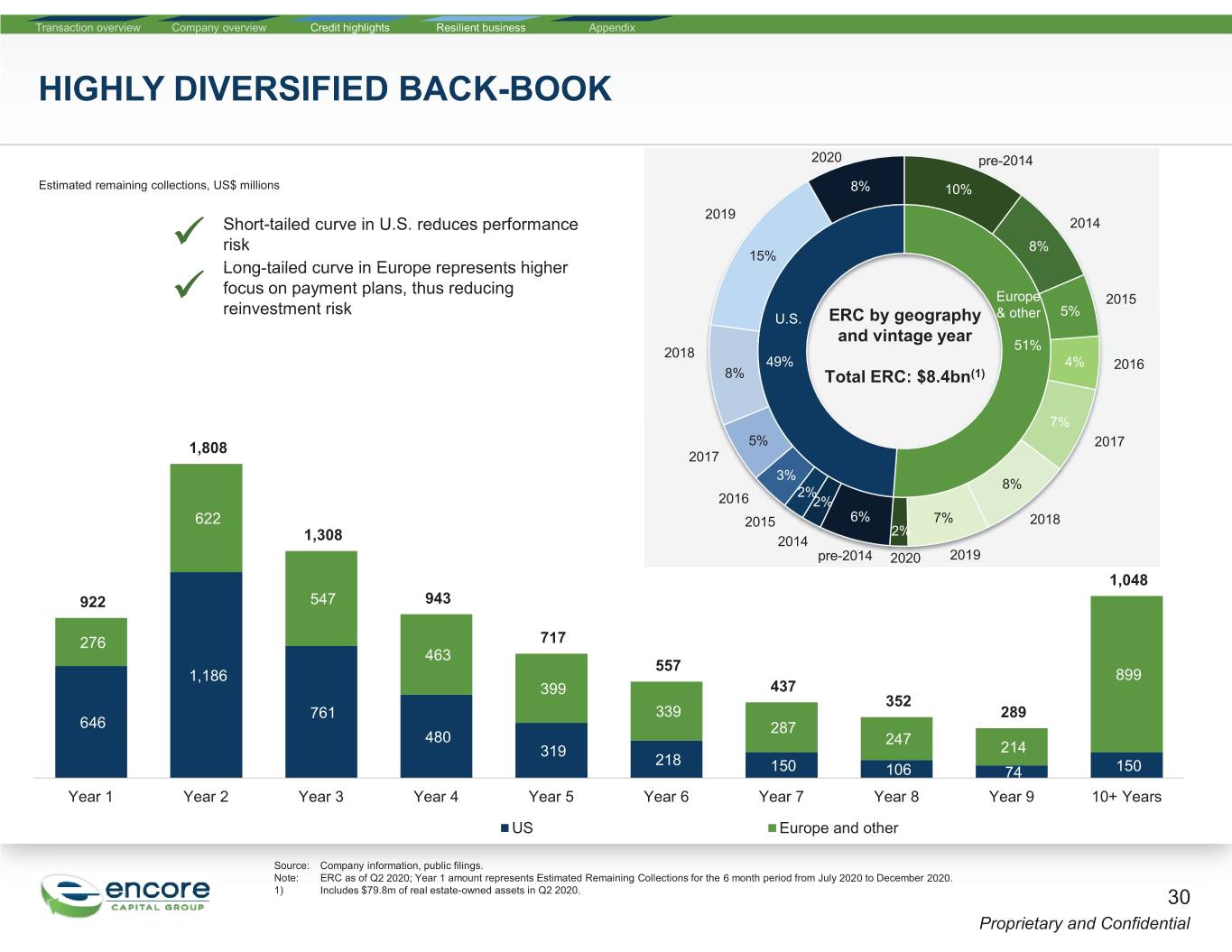

Transaction overview Company overview Credit highlights Resilient business Appendix HIGHLY DIVERSIFIED BACK-BOOK 2020 pre-2014 Estimated remaining collections, US$ millions 8% 10% 2019 Short-tailed curve in U.S. reduces performance 2014 risk 8% 9 15% Long-tailedLong tailed ccurve r e in EEurope rope represents higher focus on payment plans, thus reducing 9 Europe 2015 reinvestment risk 5% U.S. ERC by geography & other and vintage year 51% 2018 49% 4% 2016 8% Total ERC: $8.4bn(1) 7% 1,808 5% 2017 2017 3% 8% 2% 2016 2% 622 2015 6% 7% 2018 2% 1,308 2014 pre-2014 2020 2019 1,048 922 547 943 276 717 463 557 1,186 899 399 437 352 761 339 289 646 287 480 247 319 214 218 150 106 74 150 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 10+ Years US Europe and other Source: Company information, public filings. Note: ERC as of Q2 2020; Year 1 amount represents Estimated Remaining Collections for the 6 month period from July 2020 to December 2020. 1) Includes $79.8m of real estate-owned assets in Q2 2020. 30 Proprietary and Confidential

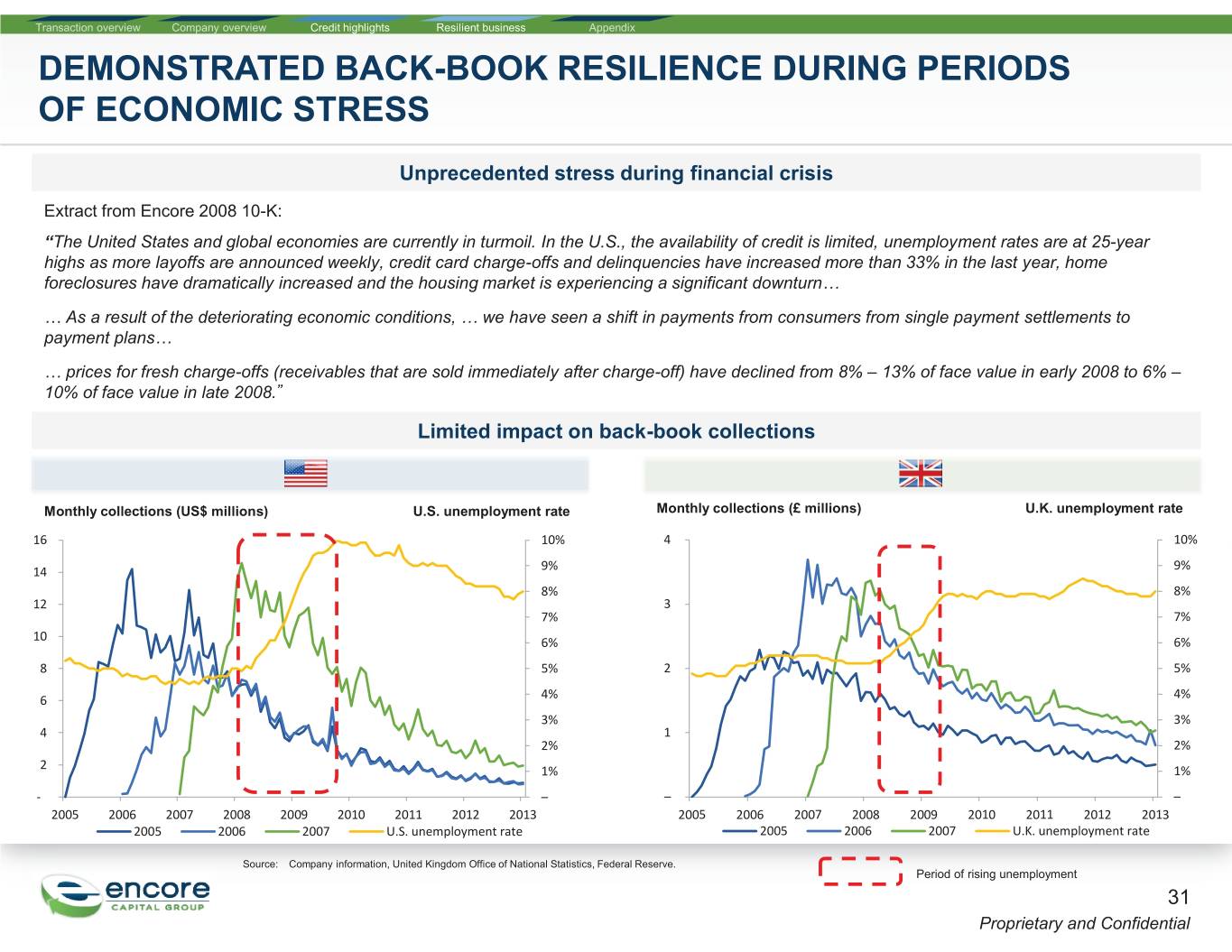

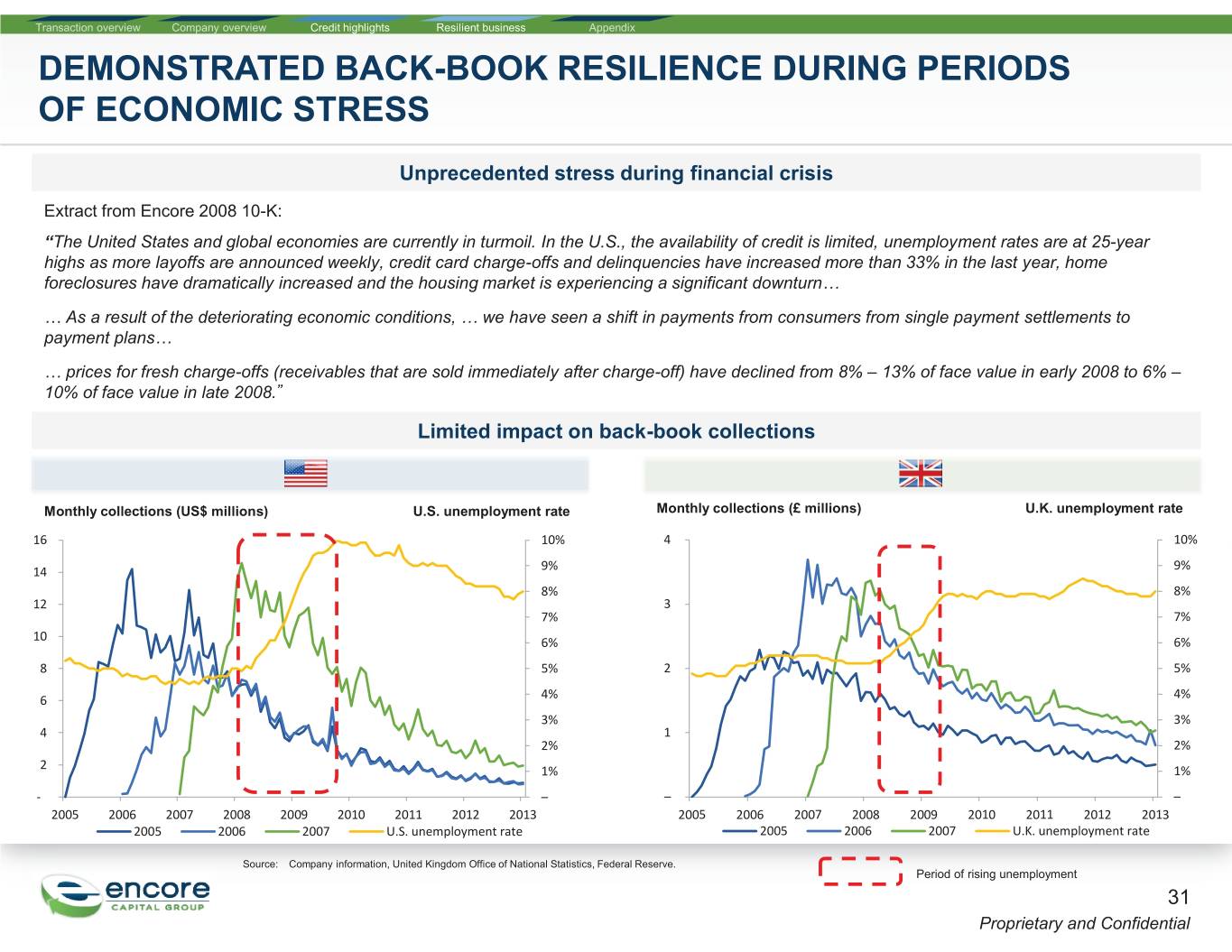

Transaction overview Company overview Credit highlights Resilient business Appendix DEMONSTRATED BACK-BOOK RESILIENCE DURING PERIODS OF ECONOMIC STRESS Unprecedented stress during financial crisis Extract from Encore 2008 10-K: “The United States and global economies are currently in turmoil. In the U.S., the availability of credit is limited, unemployment rates are at 25-year highs as more layoffs are announced weekly, credit card charge-offs and delinquencies have increased more than 33% in the last year, home foreclosures have dramatically increased and the housing market is experiencing a significant downturn… … As a result of the deteriorating economic conditions, … we have seen a shift in payments from consumers from single payment settlements to payment plans… … prices for fresh charge-offs (receivables that are sold immediately after charge-off) have declined from 8% – 13% of face value in early 2008 to 6% – 10% of face value in late 2008.” Limited impact on back-book collections Monthly collections (US$ millions) U.S. unemployment rate Monthly collections (£ millions) U.K. unemployment rate 16 10% 4 10% 14 9% 9% 8% 8% 12 3 7% 7% 10 6% 6% 8 5% 2 5% 6 4% 4% 3% 3% 4 1 2% 2% 2 1% 1% - – – – 2005 2006 2007 2008 2009 2010 2011 2012 2013 2005 2006 2007 2008 2009 2010 2011 2012 2013 2005 2006 2007 U.S. unemployment rate 2005 2006 2007 U.K. unemployment rate Source: Company information, United Kingdom Office of National Statistics, Federal Reserve. Period of rising unemployment 31 Proprietary and Confidential

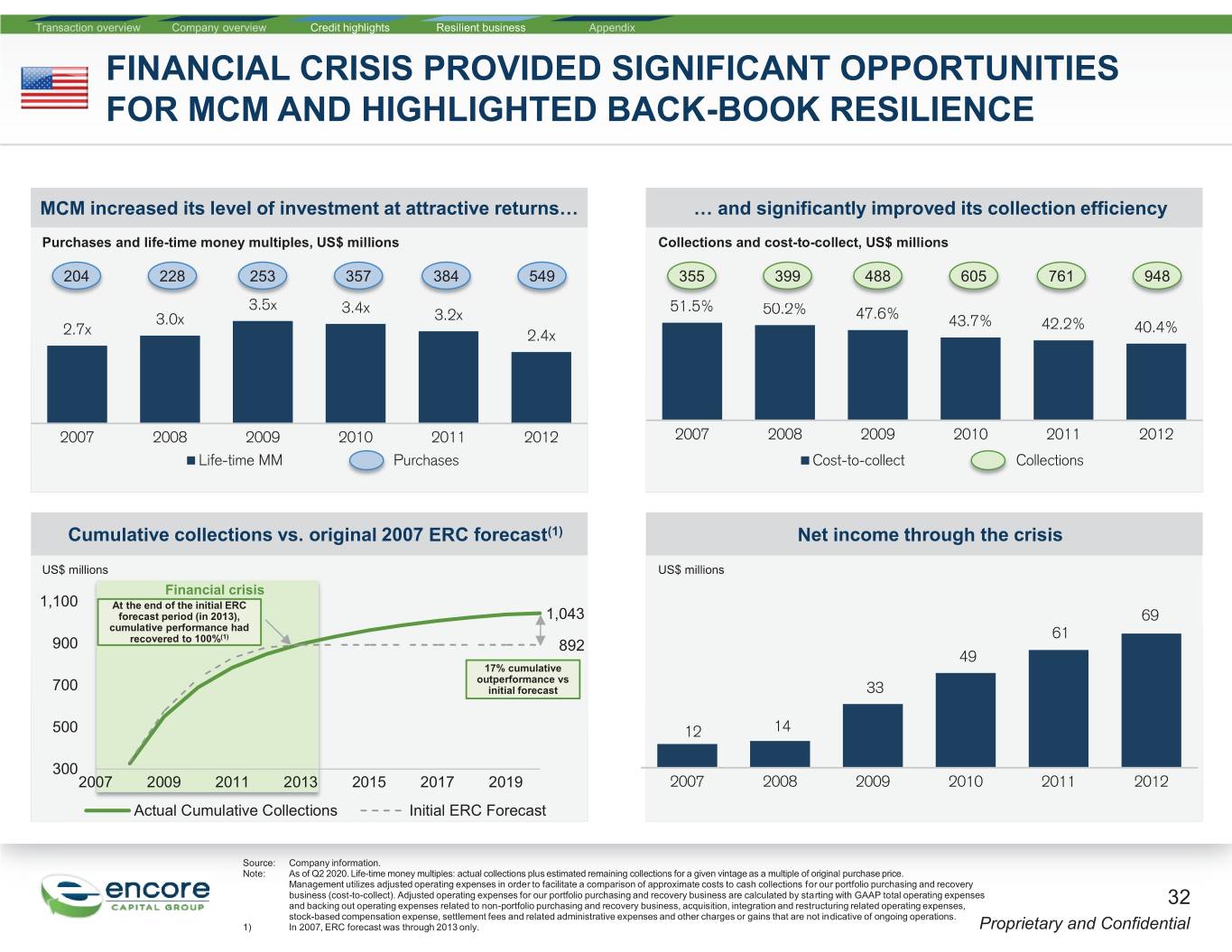

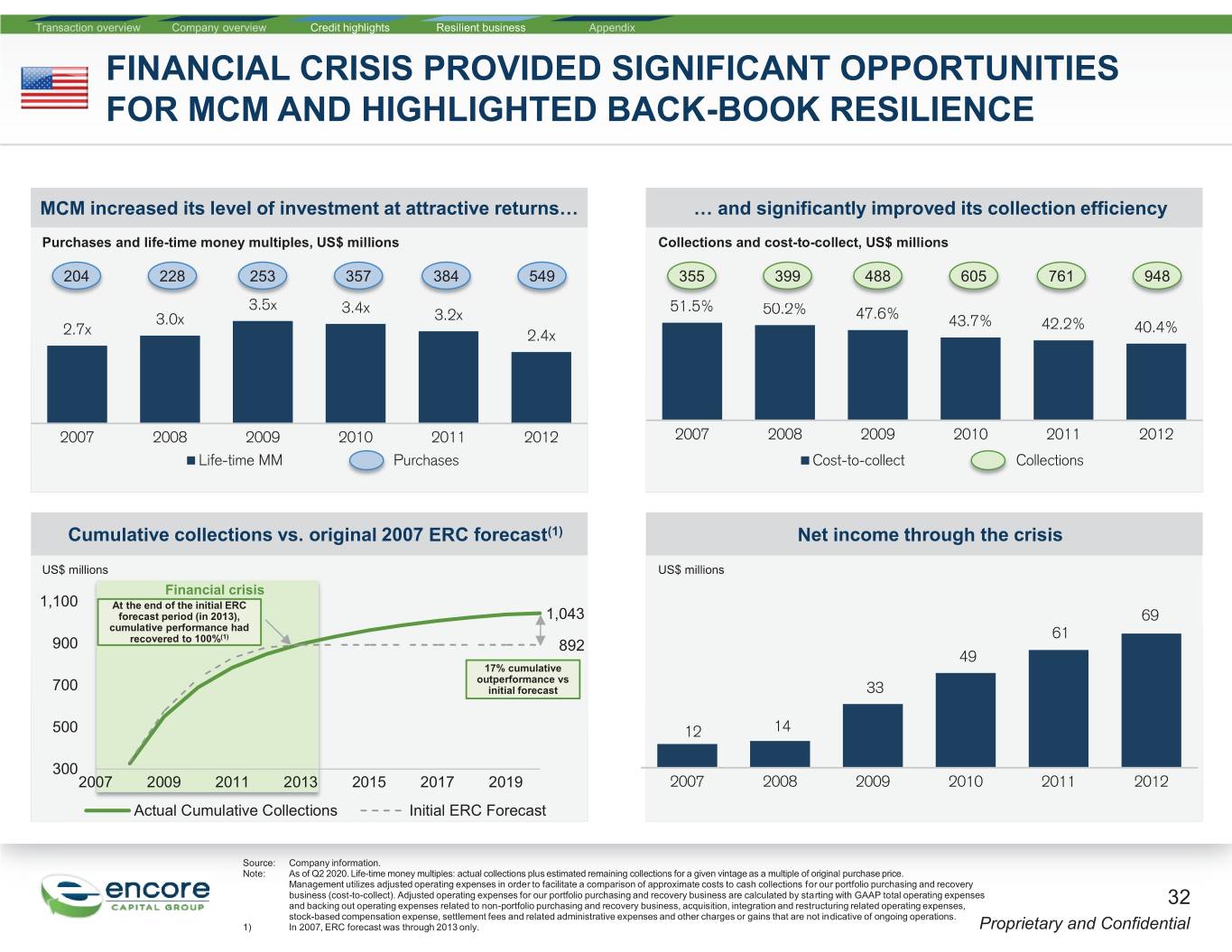

Transaction overview Company overview Credit highlights Resilient business Appendix FINANCIAL CRISIS PROVIDED SIGNIFICANT OPPORTUNITIES FOR MCM AND HIGHLIGHTED BACK-BOOK RESILIENCE MCM increased its level of investment at attractive returns… … and significantly improved its collection efficiency Purchases and life-time money multiples, US$ millions Collections and cost-to-collect, US$ millions 204 228 253 357 384 549 355 399 488 605 761 948 35x33.5x 3.4x34 51.5%51 5% 5050.2% 2% 3.0x 3.2x 47.6% 43.7% 42.2% 40.4% 2.7x 2.4x 2007 2008 2009 2010 2011 2012 2007 2008 2009 2010 2011 2012 Life-time MM Purchases Cost-to-collect Collections Cumulative collections vs. original 2007 ERC forecast(1) Net income through the crisis US$ millions US$ millions Financial crisis 1,100 At the end of the initial ERC forecast period (in 2013), 1,043 69 cumulative performance had (1) 61 900 recovered to 100% 892 49 17% cumulative outperformance vs 700 initial forecast 33 500 12 14 300 2007 2009 2011 2013 2015 2017 2019 2007 2008 2009 2010 2011 2012 Actual Cumulative Collections Initial ERC Forecast Source: Company information. Note: As of Q2 2020. Life-time money multiples: actual collections plus estimated remaining collections for a given vintage as a multiple of original purchase price. Management utilizes adjusted operating expenses in order to facilitate a comparison of approximate costs to cash collections for our portfolio purchasing and recovery business (cost-to-collect). Adjusted operating expenses for our portfolio purchasing and recovery business are calculated by starting with GAAP total operating expenses and backing out operating expenses related to non-portfolio purchasing and recovery business, acquisition, integration and restructuring related operating expenses, 32 stock-based compensation expense, settlement fees and related administrative expenses and other charges or gains that are not indicative of ongoing operations. 1) In 2007, ERC forecast was through 2013 only. Proprietary and Confidential

Transaction overview Company overview Credit highlights Resilient business Appendix U.K. PAYERS ARE RESILIENT – PAYING ACCOUNTS COMPRISE MORE OF OUR U.K. COLLECTIONS POST CRISIS Cumulative performance of 2005 vintage vs IC(1) estimates Greater proportion of collections from resilient sources Overall collections from payers Settlement cash from litigation 112% 93% 98% 7% 77% 77% 3% 86% 74% Settlements Regular payers Total 2006 2019 9 Overall cumulative performance at 98% of initial pricing 9 Greater proportion of collections from payers (payment curve plans and settlements), who demonstrated resilience during the financial crisis 9 Cash flow tail still generates incremental value – 3.9% of investment value in 2019 9 Increase in collections from litigation activity (including security over property) 9 Demonstrates resilience of regular payers during financial crisis 9 Significant reduction in collections expected to be at risk in the event of macro economic stress (down from 23% to 7%) Note: Cabot + Marlin U.K. portfolios originated in 2005. 1) Cumulative performance up until Q2 2020. IC estimates refer to initial estimates approved by the investment committee. 33 Proprietary and Confidential

D. Strong operating performance and discipline support Encore’s healthy financial profile 34 Proprietary and Confidential

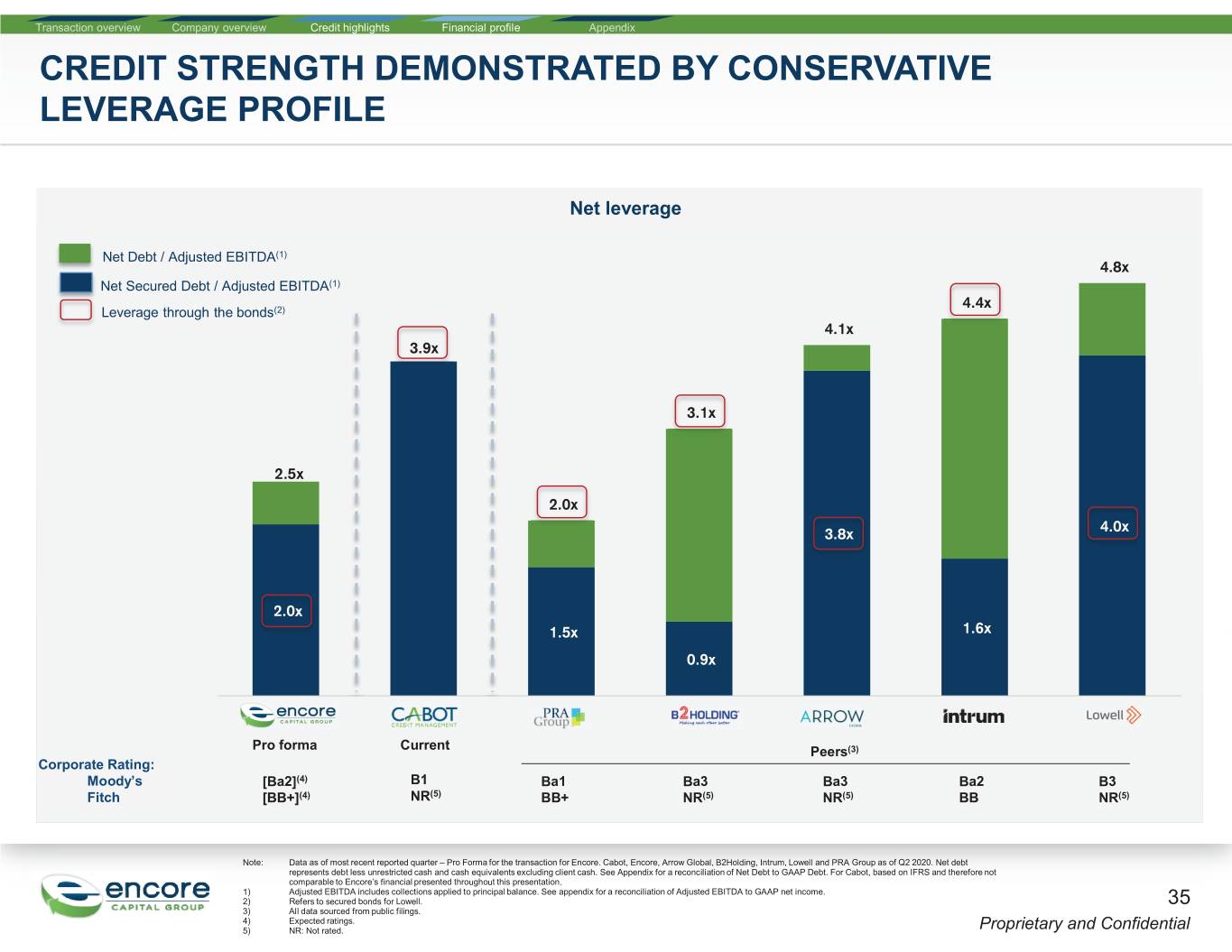

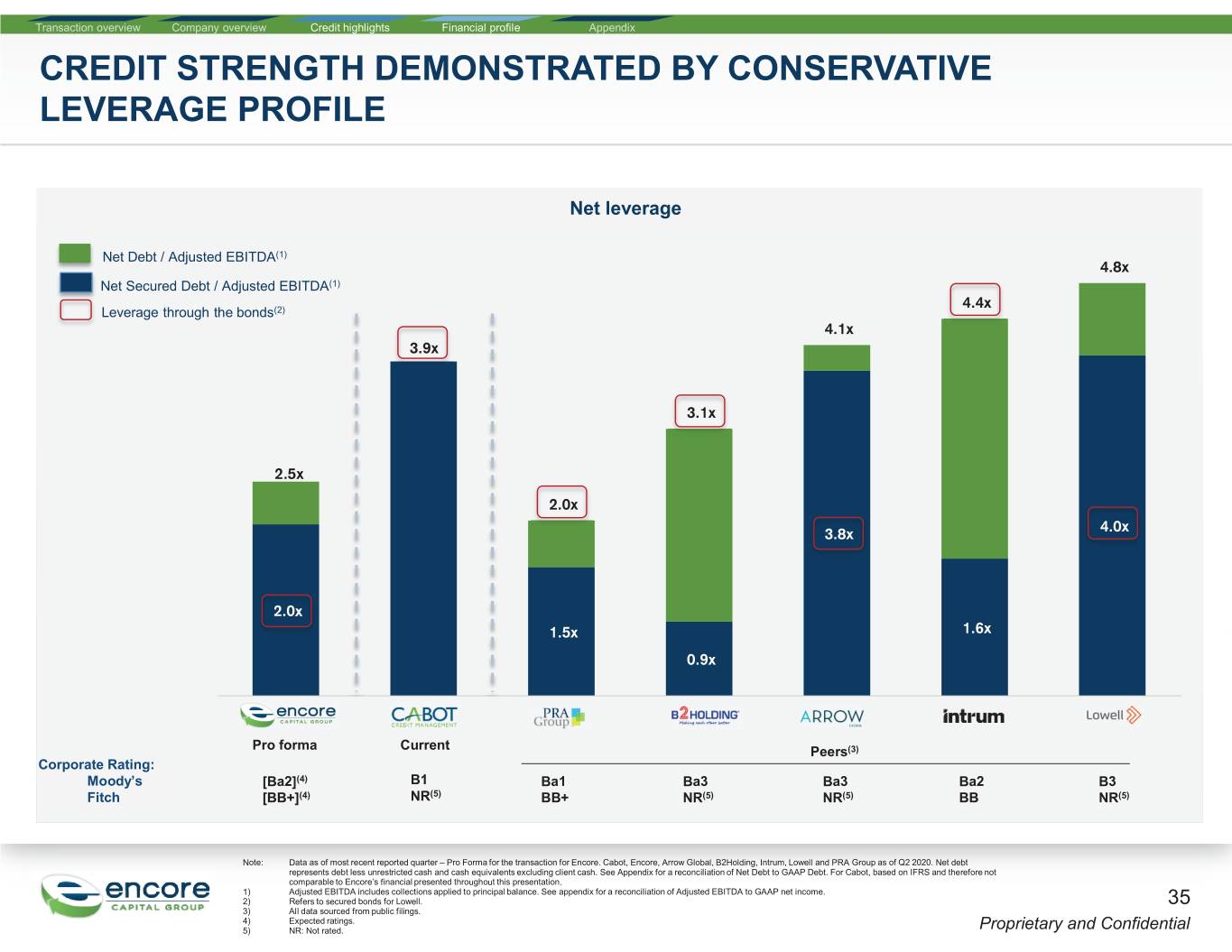

Transaction overview Company overview Credit highlights Financial profile Appendix CREDIT STRENGTH DEMONSTRATED BY CONSERVATIVE LEVERAGE PROFILE Net leverage Net Debt / Adjusted EBITDA(1) 4.8x Net Secured Debt / Adjusted EBITDA(1) 44.4x.4x Leverage through the bonds(2) 4.1x 3.9x 3.1x 2.5x 2.0x 4.0x4.0x 3.8x 2.0x 1.5x 1.6x 0.9x Pro forma Current Peers(3) Corporate Rating: Moody’s 㻌 [Ba2](4) B1 Ba1 Ba3 Ba3 Ba2 B3 Fitch (4) NR(5) (5) (5) (5) [BB+] BB+ NR NR BB NR Note: Data as of most recent reported quarter – Pro Forma for the transaction for Encore. Cabot, Encore, Arrow Global, B2Holding, Intrum, Lowell and PRA Group as of Q2 2020. Net debt represents debt less unrestricted cash and cash equivalents excluding client cash. See Appendix for a reconciliation of Net Debt to GAAP Debt. For Cabot, based on IFRS and therefore not comparable to Encore’s financial presented throughout this presentation. 1) Adjusted EBITDA includes collections applied to principal balance. See appendix for a reconciliation of Adjusted EBITDA to GAAP net income. 2) Refers to secured bonds for Lowell. 35 3) All data sourced from public filings. 4) Expected ratings. 5) NR: Not rated. Proprietary and Confidential

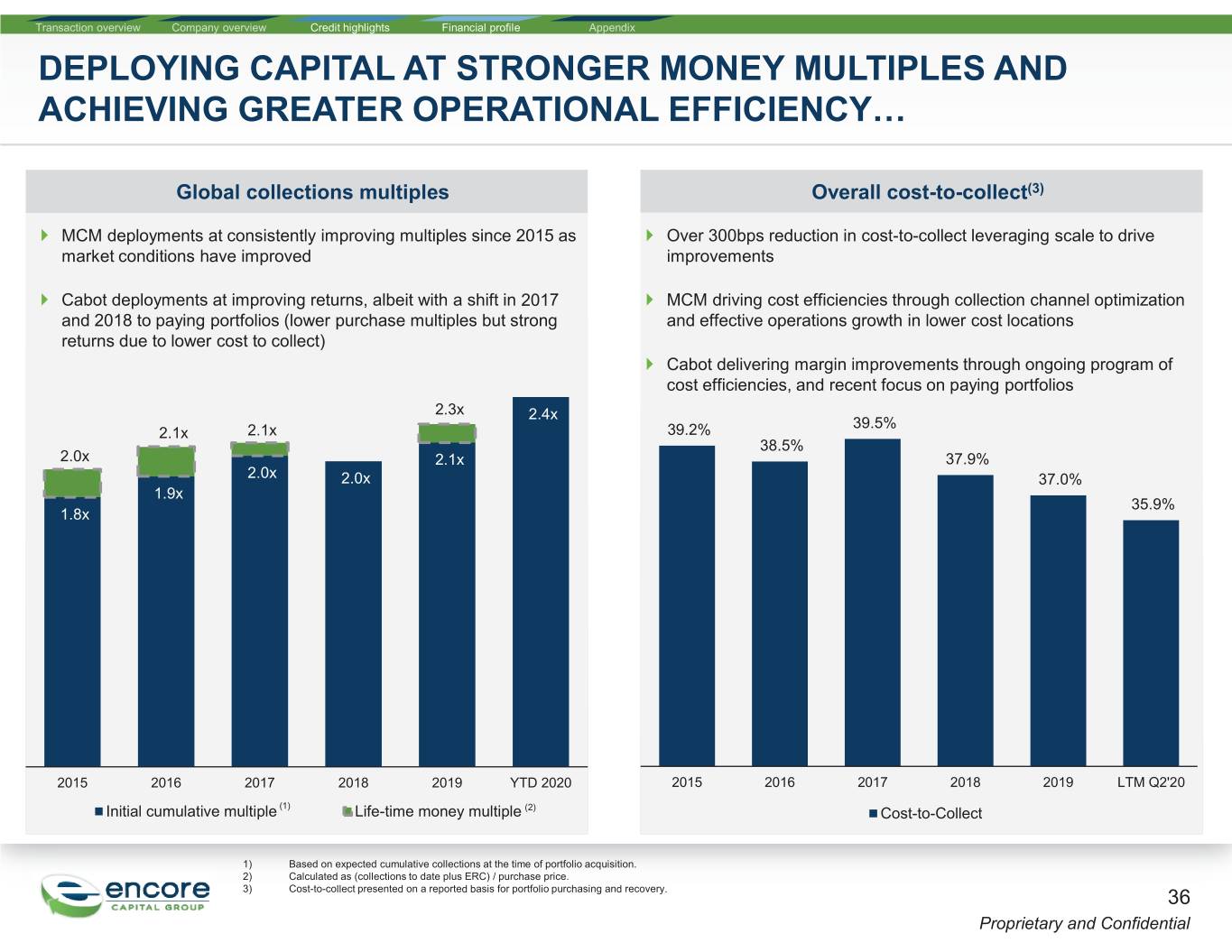

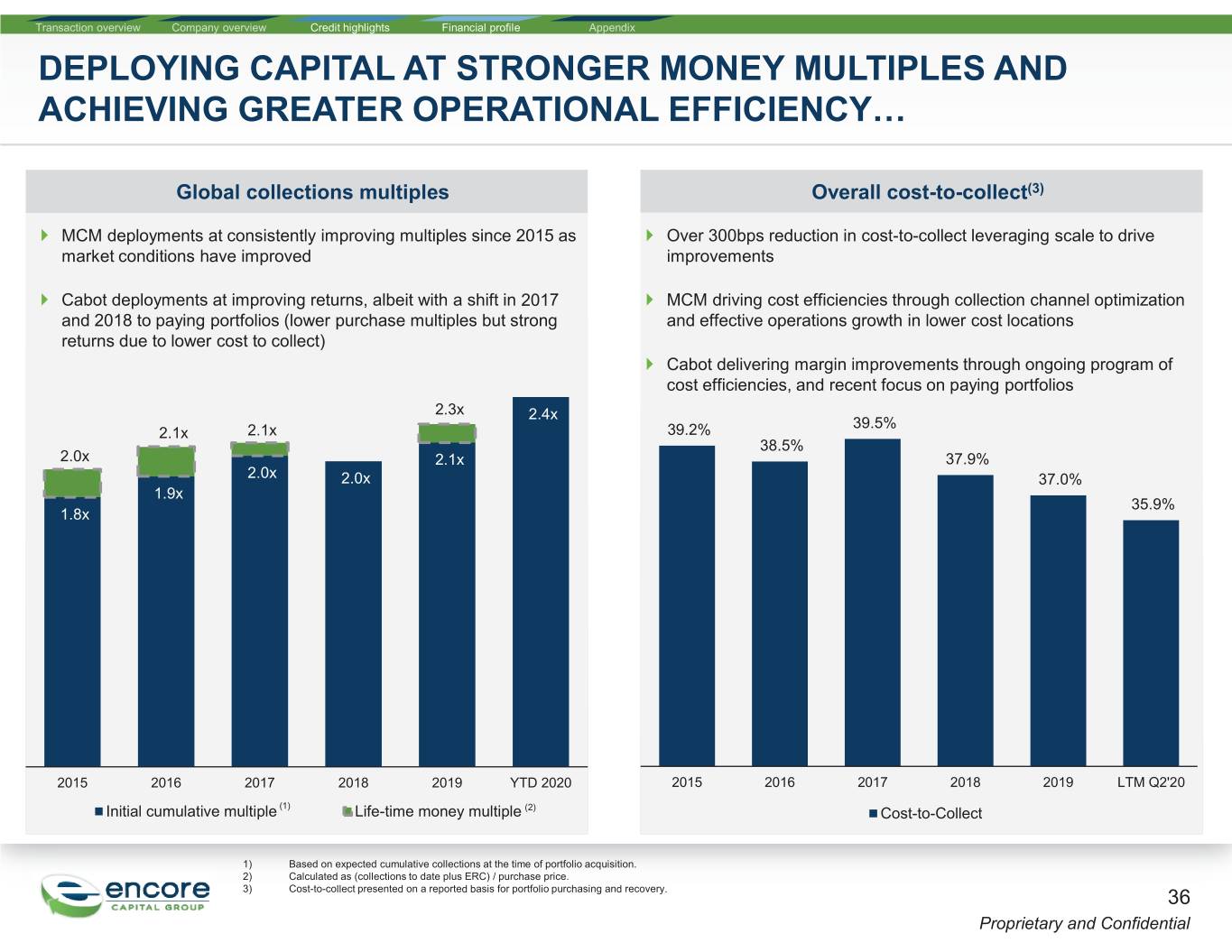

Transaction overview Company overview Credit highlights Financial profile Appendix DEPLOYING CAPITAL AT STRONGER MONEY MULTIPLES AND ACHIEVING GREATER OPERATIONAL EFFICIENCY… Global collections multiples Overall cost-to-collect(3) ` MCM deployments at consistently improving multiples since 2015 as ` Over 300bps reduction in cost-to-collect leveraging scale to drive market conditions have improved improvements ` Cabot deployments at improving returns, albeit with a shift in 2017 ` MCM driving cost efficiencies through collection channel optimization and 2018 to paying portfolios (lower purchase multiples but strong and effective operations growth in lower cost locations returns due to lower cost to collect) ` Cabot delivering margin improvements through ongoing program of cost efficiencies, and recent focus on paying portfolios 2.3x 2.4x 39.5% 2.1x 2.1x 39.2% 38.5% 2.0x 2.1x 37.9% 2.0x 2.0x 37.0% 1.9x 35.9% 1.8x 2015 2016 2017 2018 2019 YTD 2020 2015 2016 2017 2018 2019 LTM Q2'20 (1) Initial cumulative multiple Life-time money multiple (2) Cost-to-Collect 1) Based on expected cumulative collections at the time of portfolio acquisition. 2) Calculated as (collections to date plus ERC) / purchase price. 3) Cost-to-collect presented on a reported basis for portfolio purchasing and recovery. 36 Proprietary and Confidential

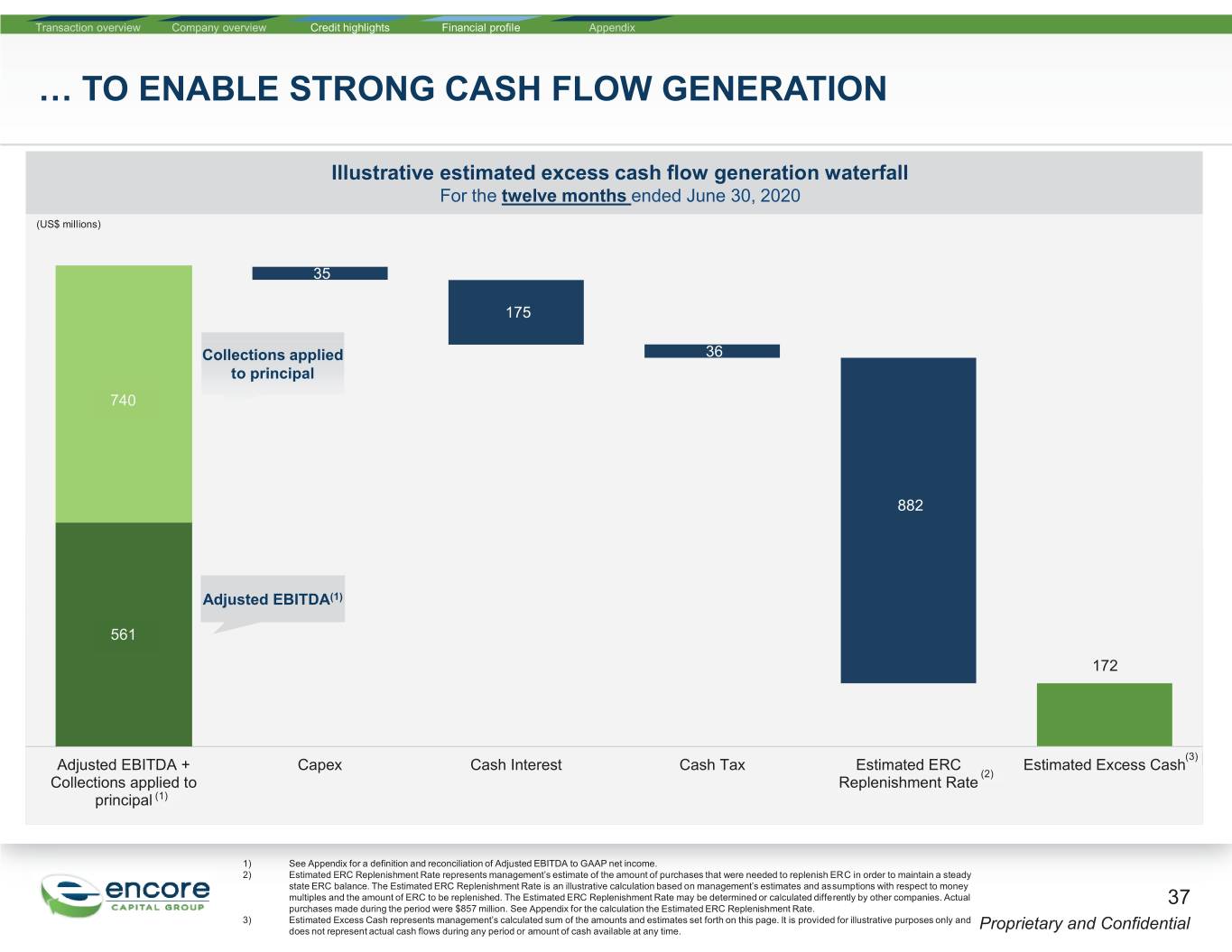

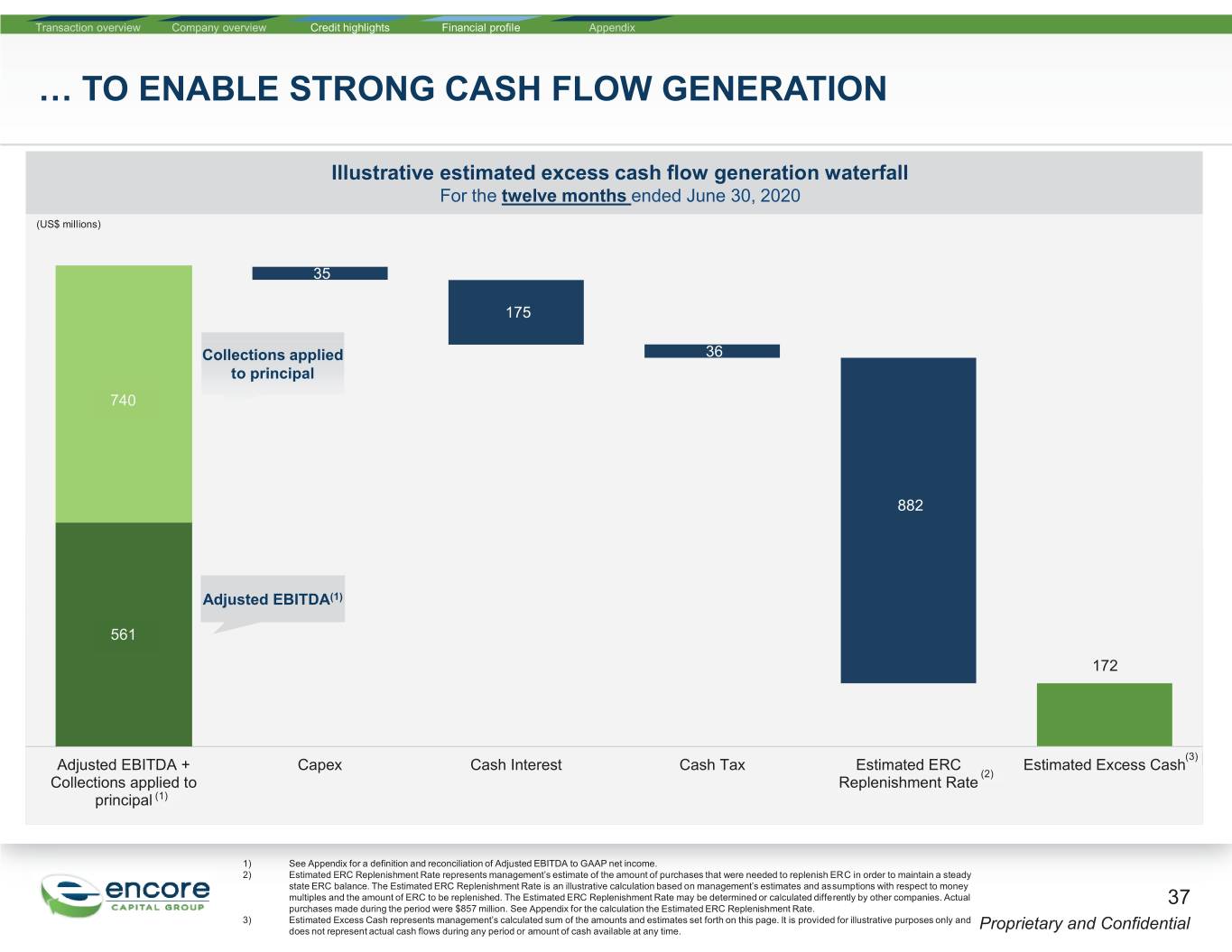

Transaction overview Company overview Credit highlights Financial profile Appendix … TO ENABLE STRONG CASH FLOW GENERATION Illustrative estimated excess cash flow generation waterfall For the twelve months ended June 30, 2020 (US$ millions) 35 175 Collections applied 36 to principal 740 882 Adjusted EBITDA(1) 561 172 (3) Adjusted EBITDA + Capex Cash Interest Cash Tax Estimated ERC Estimated Excess Cashh (2) Collections applied to Replenishment Rate principal (1) 1) See Appendix for a definition and reconciliation of Adjusted EBITDA to GAAP net income. 2) Estimated ERC Replenishment Rate represents management’s estimate of the amount of purchases that were needed to replenish ERC in order to maintain a steady state ERC balance. The Estimated ERC Replenishment Rate is an illustrative calculation based on management’s estimates and assumptions with respect to money multiples and the amount of ERC to be replenished. The Estimated ERC Replenishment Rate may be determined or calculated differently by other companies. Actual 37 purchases made during the period were $857 million. See Appendix for the calculation the Estimated ERC Replenishment Rate. 3) Estimated Excess Cash represents management’s calculated sum of the amounts and estimates set forth on this page. It is provided for illustrative purposes only and does not represent actual cash flows during any period or amount of cash available at any time. Proprietary and Confidential

Transaction overview Company overview Credit highlights Financial profile Appendix LIQUIDITY CHARACTERISTICS OF ENCORE’S BUSINESS ` Compared to other financial services companies, Encore has a high cash conversion rate: ` For every $1 of gross collections, we generate ~$0.50 in cash before portfolio purchases (but after interest and taxes). ` This is equivalent to ~$80 million of cash generated per month after interest and taxes ` In the event collections were to decline significantly, we have great flexibility to reduce portfolio purchases and operating expenses (much of which are variable and directly related to collections) ` Lower portfolio purchases don’t jeopardize back book collections ` Unlike issuers of consumer credit, our consumers don’t need to be supported with further lending from us ` If we ever need to shrink the business, we can generate a large amount of cash in almost any environment 38 Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix ENCORE – A HIGHLY ATTRACTIVE CREDIT STORY A leading operator in our core U.S. and U.K. markets with attractive long term growth A prospects and strong competitive advantages Our scale, operational differentiation and compliance excellence drive strong risk B adjusted returns 20+ years of experience have created a large, diversified back-book generating C resilient cash flows Strong operating performance and capital allocation discipline support Encore’s healthy D financial profile 39 Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix CONCLUSION Combination leverages the size of Encore and Cabot to create a Global leader Broad geographic footprint across the most mature markets Sophisticated compliance and regulatory stakeholder management Diversified asset base and cycle-tested business providing attractive free cash flow profile Enhanced access to capital markets across continents Prudent leverage vs. peers – guidance of 2.0x – 3.0x reflecting conservative capital management strategy 40 Proprietary and Confidential

Appendix 41 Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix KEY PERFORMANCE INDICATORS Operating (all figures in USD 000s) 31-Dec-17 31-Dec-18 31-Dec-19 31-Mar-20 30-June-20 30-June-20 (LTM) (2) (2) (2) (2) 84m ERC 6,013,943 6,284,688 6,875,307 6,948,213 6,877,976 6,877,976 (2) 180m ERC 6,955,314 7,164,099 7,825,474 8,458,948(2) 8,381,829(2) 8,381,829(2) (1) Purchases 1,045,829 1,131,095 988,292 209,045 141,613 839,013 Purchase multiple (for the year) 2.0x 2.0x 2.1x 2.3x 2.4x 2.2x (3) Servicing as % of total revenue (for the period) 8% 11% 10% 11% 6% 9% Cost to collect 40% 38% 37% 37% 31% 36% Performance 31-Dec-17 31-Dec-18 31-Dec-19 31-Mar-20 30-June-20 30-June-20 (LTM) Total collections 1,767,644 1,967,620 2,026,928 527,279 508,215 2,033,688 (4) Total revenue 1,187,038 1,362,030 1,397,681 289,081 426,033 1,418,844 Adjusted EBITDA & collections applied to principal 31-Dec-17 31-Dec-18 31-Dec-19 31-Mar-20 30-June-20 30-June-20 (LTM) Adjusted EBITDA 406,607 461,557 505,851 62,640 236,218 560,929 Collections applied to principal 673,035 759,014 765,748 268,575 106,921 739,593 Profitability 31-Dec-17 31-Dec-18 31-Dec-19 31-Mar-20 30-June-20 30-June-20 (LTM) (6) Operating margin 27% 30% 32% 16% 52% 34% RoAE 14.6% 16.6% 18.2% NM(4) 13.4% 20.8% Credit statistics 31-Dec-17 31-Dec-18 31-Dec-19 31-Mar-20 30-June-20 30-June-20 (LTM) (5) Gross debt / Adjusted EBITDA 3.3x 2.9x 2.8x 2.7x 2.6x 2.6x (5) Net debt / Adjusted EBITDA 3.1x 2.8x 2.7x 2.6x 2.4x 2.4x (5) Adjusted EBITDA / Interest expense 5.3x 5.1x 5.6x 6.1x 6.8x 6.1x LTV (Net debt as % of 84m ERC) 55% 55% 50% 47% 46% 46% LTV (Net debt as % of 180m ERC) 48% 48% 44% 39% 37% 37% Source: Company information. 1) Net of put backs and co-investment purchases. 2) Includes $92.4m, $86.2m and $79.8m of real estate-owned assets in Q4 2019, Q1 2020 and Q2 2020, respectively. Prior years of reported ERC figures did not include real estate-owned assets. 3) Represents servicing revenue and other revenues. 4) Q1 2020 includes a non-cash charge of $109m related to anticipated collection delays due to the COVID-19 pandemic. 42 5) Adjusted EBITDA includes collections applied to principal balance. 6) Calculated as operating income divided by total revenue. Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix LIMITED NEAR TERM DEBT MATURITIES Disciplined construction of capital stack with well spread debt maturities post-transaction Amended Private Placement Notes (Encore) 2021 Convert (Encore) 2022 Convert (Encore) 2025 Convert (Encore) 2023 Exchangeable Notes (Encore) 2025 ABL Facility (Cabot) Amended Senior Secured Notes (Cabot) Amended Floating Rate Notes (Cabot) Global Revolver New secured financingg (1) 2,500 2,000 1,500 1,000 500 - 2H 2020 1H 2021 2H 2021 1H 2022 2H 2022 1H 2023 2H 2023 1H 2024 2H 2024 1H 2025 2H 2025 Source: Company information. 1) Assumes that the Stretch Facility is fully refinanced with debt which is pari passu to the existing Cabot SSNs. 43 Proprietary and Confidential

Transaction overview Company overview Credit highlights Appendix ESTIMATED ERC REPLENISHMENT RATE CALCULATION ERC Replenishment Rate Calculation Footnotes and definitions For the twelve-month period ending June 30, 2020 1) Average 12-month ERC represents management’s estimate of the amount of ERC that would need to be replenished in order to maintain a steady state ERC balance. Utilizing the Average 12- month ERC to estimate the ERC Replenishment Rate may result in understating the ERC Replenishment Rate as the method 12 month ERC at June 30, 2020 1,852 a assumes that all purchases are made at period end. Management utilizes Average 12-month ERC to estimate the ERC Replenishment Rate to enable comparability amongst 12 month ERC at June 30, 2019 1,853 b competitors, many of whom utilize this same method. Average 12 month ERC1 1,852 (a+b)/2=c 2) Money multiples represent total expected gross cash collections divided by portfolio acquisition price. Initial money multiple represents the money multiple reported at the end of the year of Estimated initial money multiple2 2.1x2. d acquisition. 3) Estimated ERC Replenishment Rate represents management’s Estimated 12M ERC Replenishment Rate3 88288 c/d estimate of the amount of purchases that were needed to replenish ERC in order to maintain a steady state ERC balance. The Estimated ERC Replenishment Rate is an illustrative calculation based on management’s estimates and assumptions with respect to money multiples and the amount of ERC to be replenished. The Estimated ERC Replenishment Rate may be In line with: determined or calculated differently by other companies. Actual ¾ Average initial money multiple over the past ten years purchases during the period were $857 million. ¾ 2019 initial money multiple Source: Company information. 44 Proprietary and Confidential

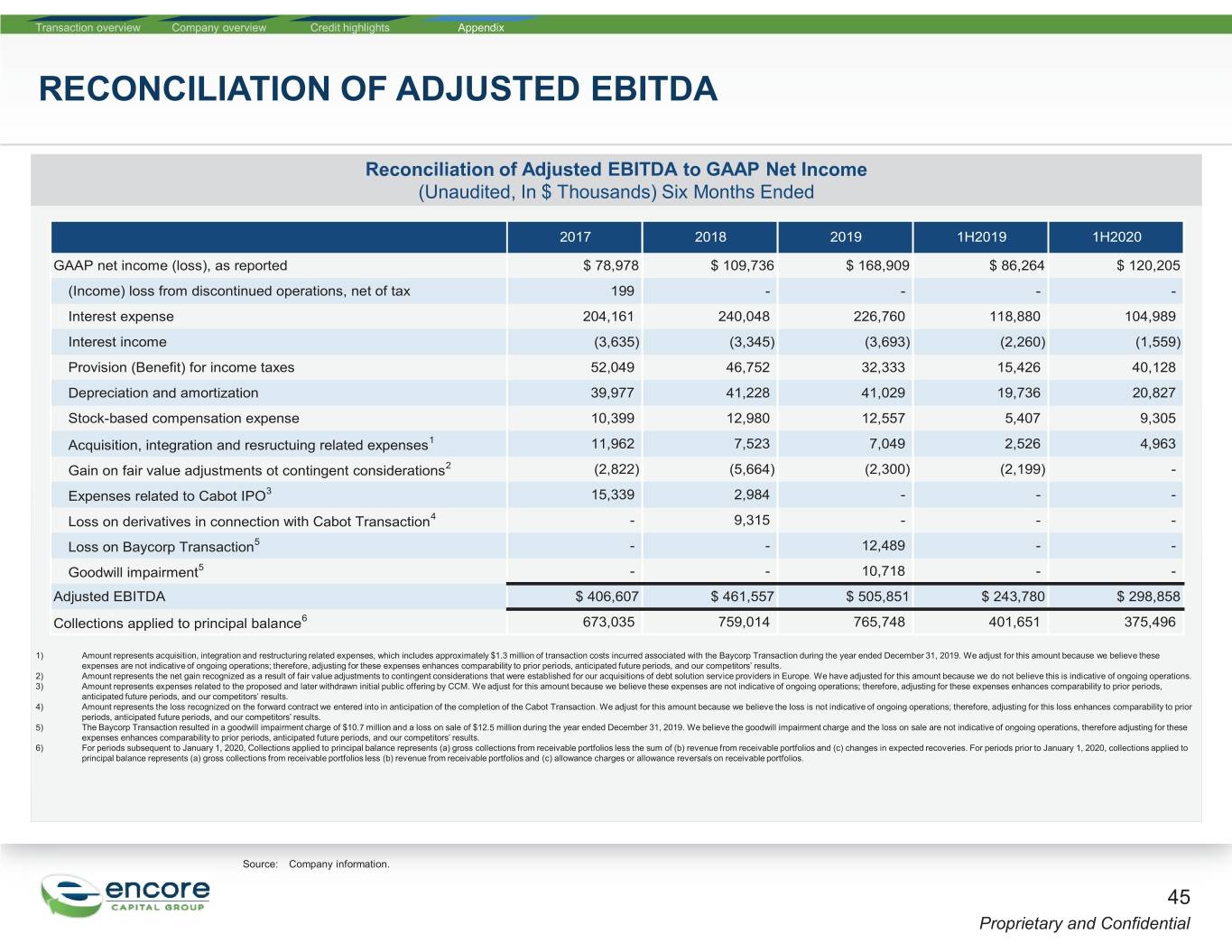

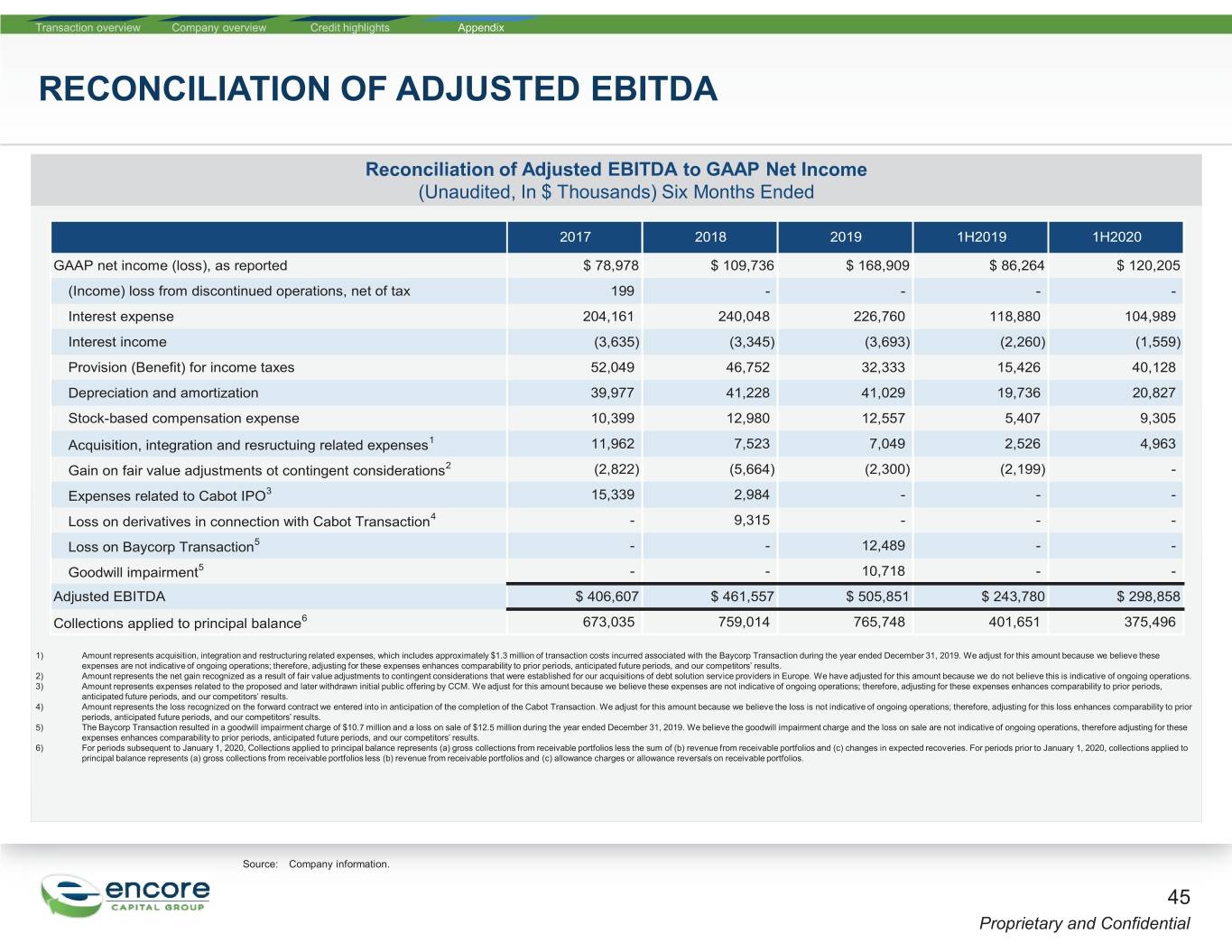

Transaction overview Company overview Credit highlights Appendix RECONCILIATION OF ADJUSTED EBITDA Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Six Months Ended 2017 2018 2019 1H2019 1H2020 GAAP net income (loss), as reported $ 78,978 $ 109,736 $ 168,909 $ 86,264 $ 120,205 (Income) loss from discontinued operations, net of tax 199 - - - - Interest expense 204,161 240,048 226,760 118,880 104,989 Interest income (3,635) (3,345) (3,693) (2,260) (1,559) Provision (Benefit) for income taxes 52,049 46,752 32,333 15,426 40,128 Depreciation and amortization 39,977 41,228 41,029 19,736 20,827 Stock-based compensation expense 10,399 12,980 12,557 5,407 9,305 Acquisition, integration and resructuing related expenses1 11,962 7,523 7,049 2,526 4,963 Gain on fair value adjustments ot contingent considerations2 (2,822) (5,664) (2,300) (2,199) - Expenses related to Cabot IPO3 15,339 2,984 - - - Loss on derivatives in connection with Cabot Transaction4 - 9,315 - - - Loss on Baycorp Transaction5 - - 12,489 - - Goodwill impairment5 - - 10,718 - - Adjusted EBITDA $ 406,607 $ 461,557 $ 505,851 $ 243,780 $ 298,858 Collections applied to principal balance6 673,035 759,014 765,748 401,651 375,496 1) Amount represents acquisition, integration and restructuring related expenses, which includes approximately $1.3 million of transaction costs incurred associated with the Baycorp Transaction during the year ended December 31, 2019. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 2) Amount represents the net gain recognized as a result of fair value adjustments to contingent considerations that were established for our acquisitions of debt solution service providers in Europe. We have adjusted for this amount because we do not believe this is indicative of ongoing operations. 3) Amount represents expenses related to the proposed and later withdrawn initial public offering by CCM. We adjust for this amount because we believe these expenses are not indicative of ongoing operations; therefore, adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 4) Amount represents the loss recognized on the forward contract we entered into in anticipation of the completion of the Cabot Transaction. We adjust for this amount because we believe the loss is not indicative of ongoing operations; therefore, adjusting for this loss enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 5) The Baycorp Transaction resulted in a goodwill impairment charge of $10.7 million and a loss on sale of $12.5 million during the year ended December 31, 2019. We believe the goodwill impairment charge and the loss on sale are not indicative of ongoing operations, therefore adjusting for these expenses enhances comparability to prior periods, anticipated future periods, and our competitors’ results. 6) For periods subsequent to January 1, 2020, Collections applied to principal balance represents (a) gross collections from receivable portfolios less the sum of (b) revenue from receivable portfolios and (c) changes in expected recoveries. For periods prior to January 1, 2020, collections applied to principal balance represents (a) gross collections from receivable portfolios less (b) revenue from receivable portfolios and (c) allowance charges or allowance reversals on receivable portfolios. Source: Company information. 45 Proprietary and Confidential

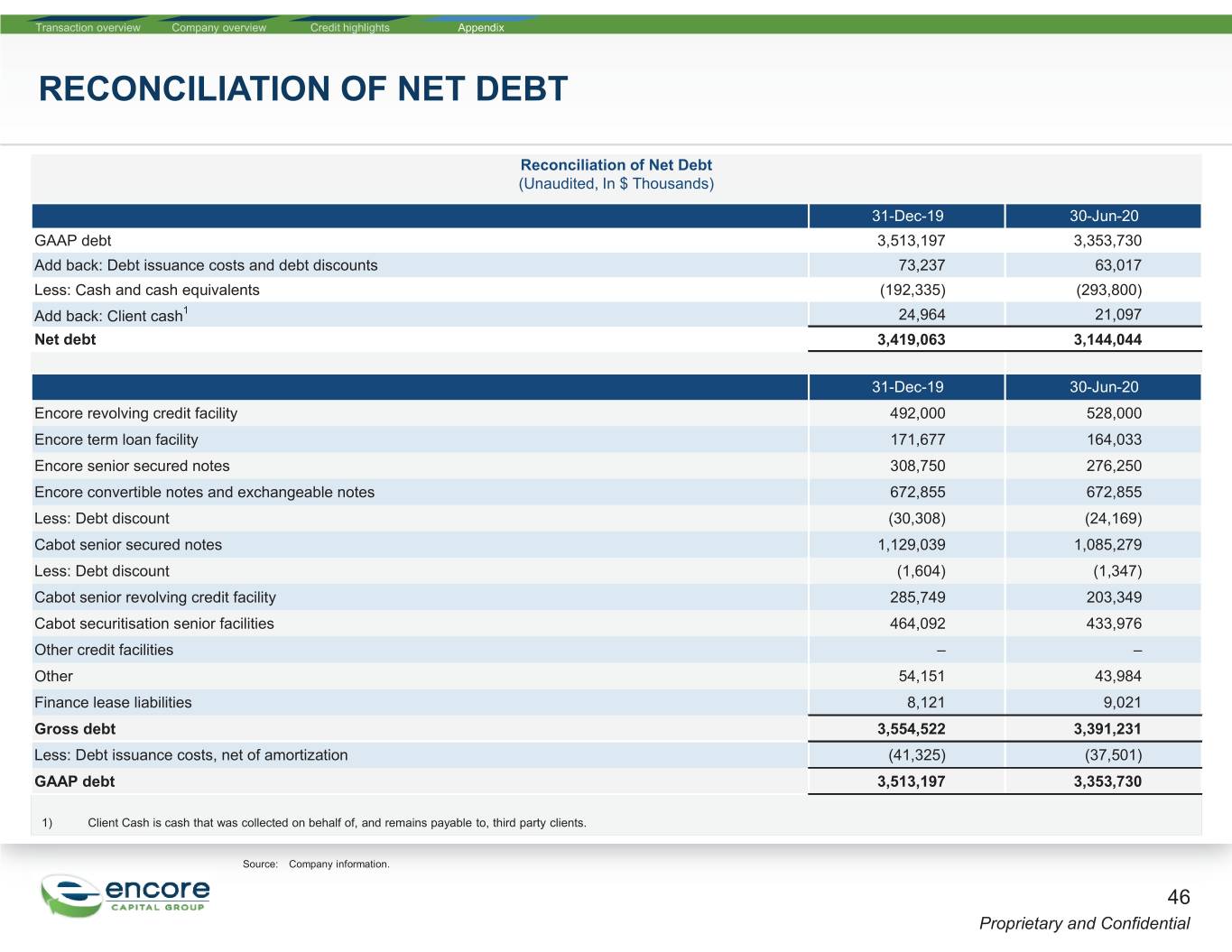

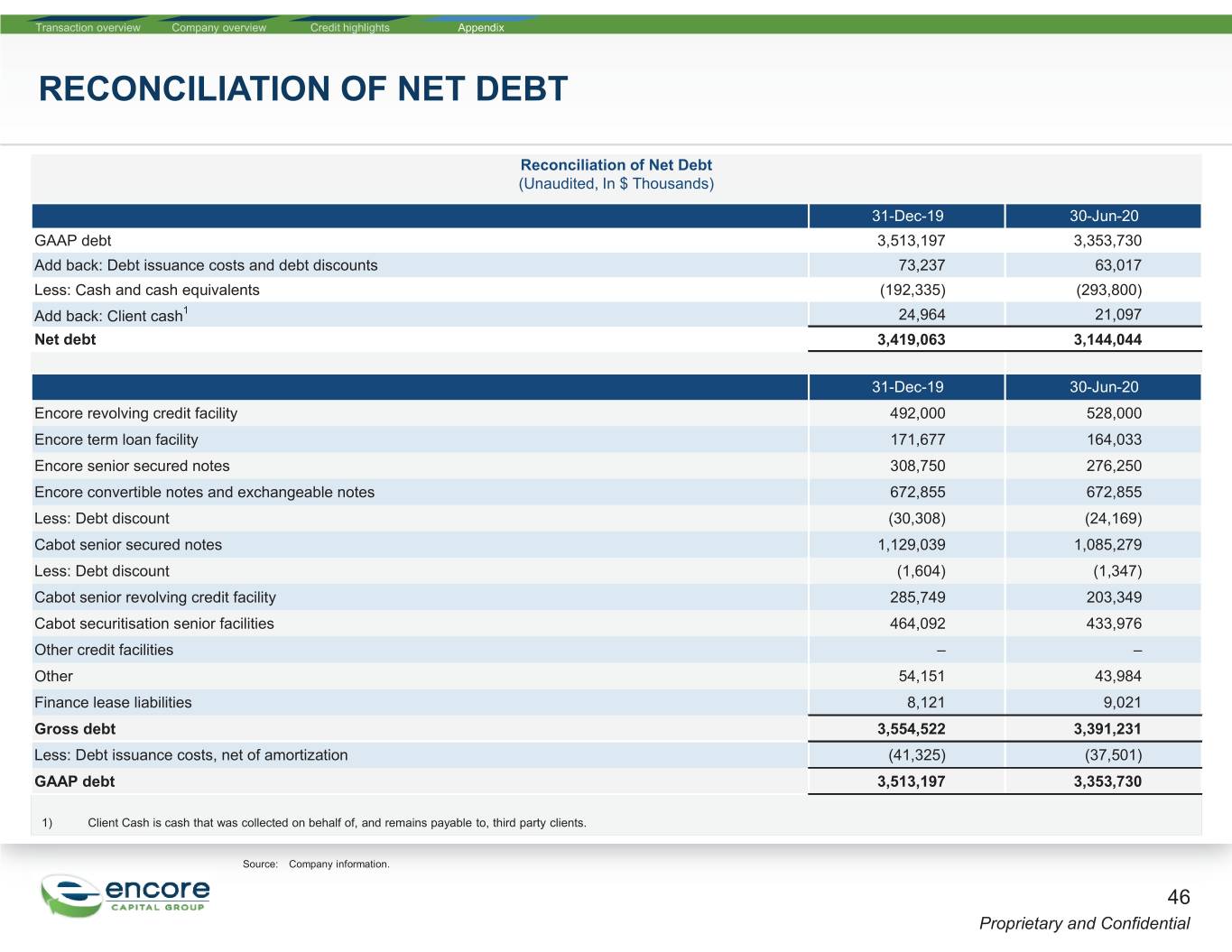

Transaction overview Company overview Credit highlights Appendix RECONCILIATION OF NET DEBT Reconciliation of Net Debt (Unaudited, In $ Thousands) 31-Dec-19 30-Jun-20 GAAP debt 3,513,197 3,353,730 Add back: Debt issuance costs and debt discounts 73,237 63,017 Less: Cash and cash equivalents (192,335) (293,800) Add back: Client cash1 24,964 21,097 Net debt 3,419,063 3,144,044 31-Dec-19 30-Jun-20 Encore revolving credit facility 492,000 528,000 Encore term loan facility 171,677 164,033 Encore senior secured notes 308,750 276,250 Encore convertible notes and exchangeable notes 672,855 672,855 Less: Debt discount (30,308) (24,169) Cabot senior secured notes 1,129,039 1,085,279 Less: Debt discount (1,604) (1,347) Cabot senior revolving credit facility 285,749 203,349 Cabot securitisation senior facilities 464,092 433,976 Other credit facilities –– Other 54,151 43,984 Finance lease liabilities 8,121 9,021 Gross debt 3,554,522 3,391,231 Less: Debt issuance costs, net of amortization (41,325) (37,501) GAAP debt 3,513,197 3,353,730 1) Client Cash is cash that was collected on behalf of, and remains payable to, third party clients. Source: Company information. 46 Proprietary and Confidential

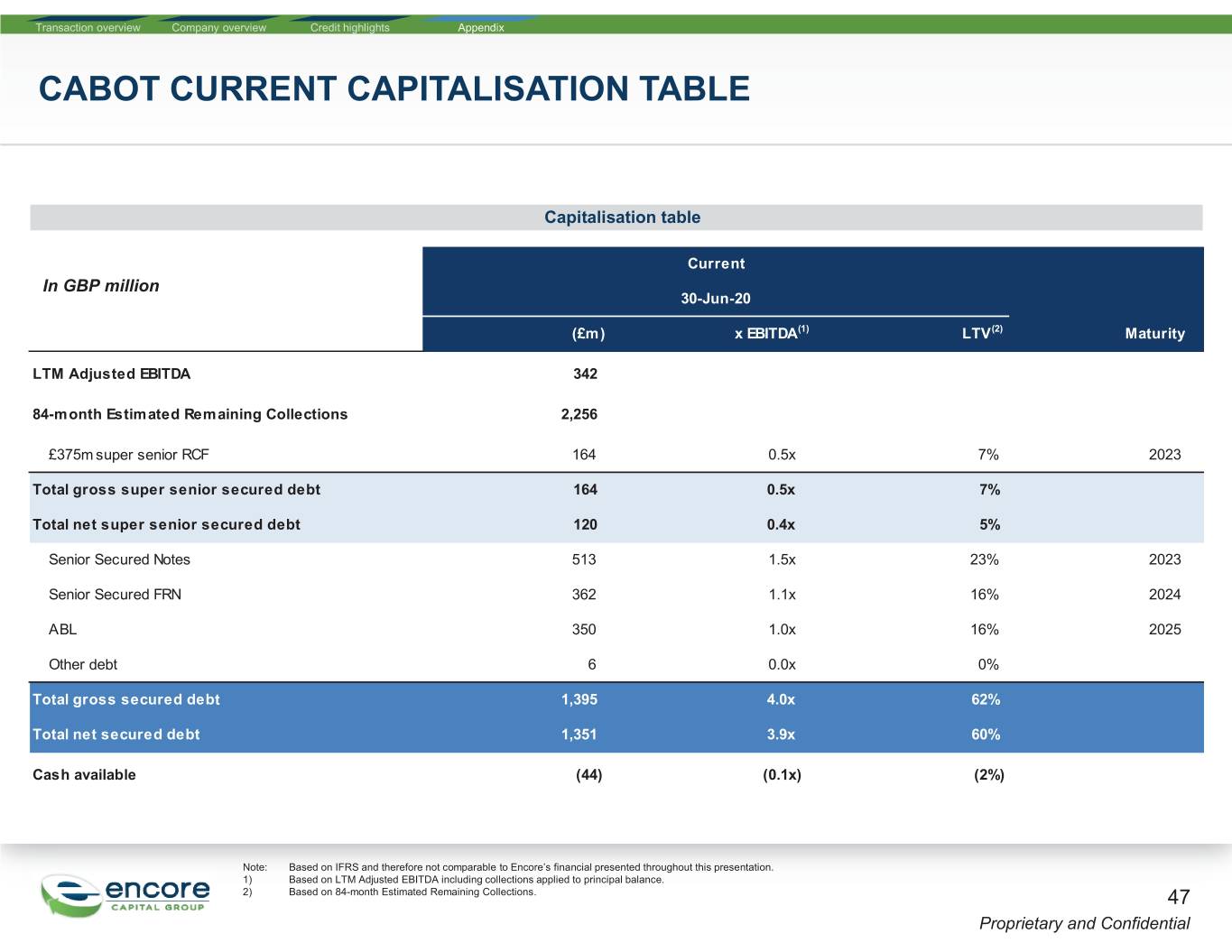

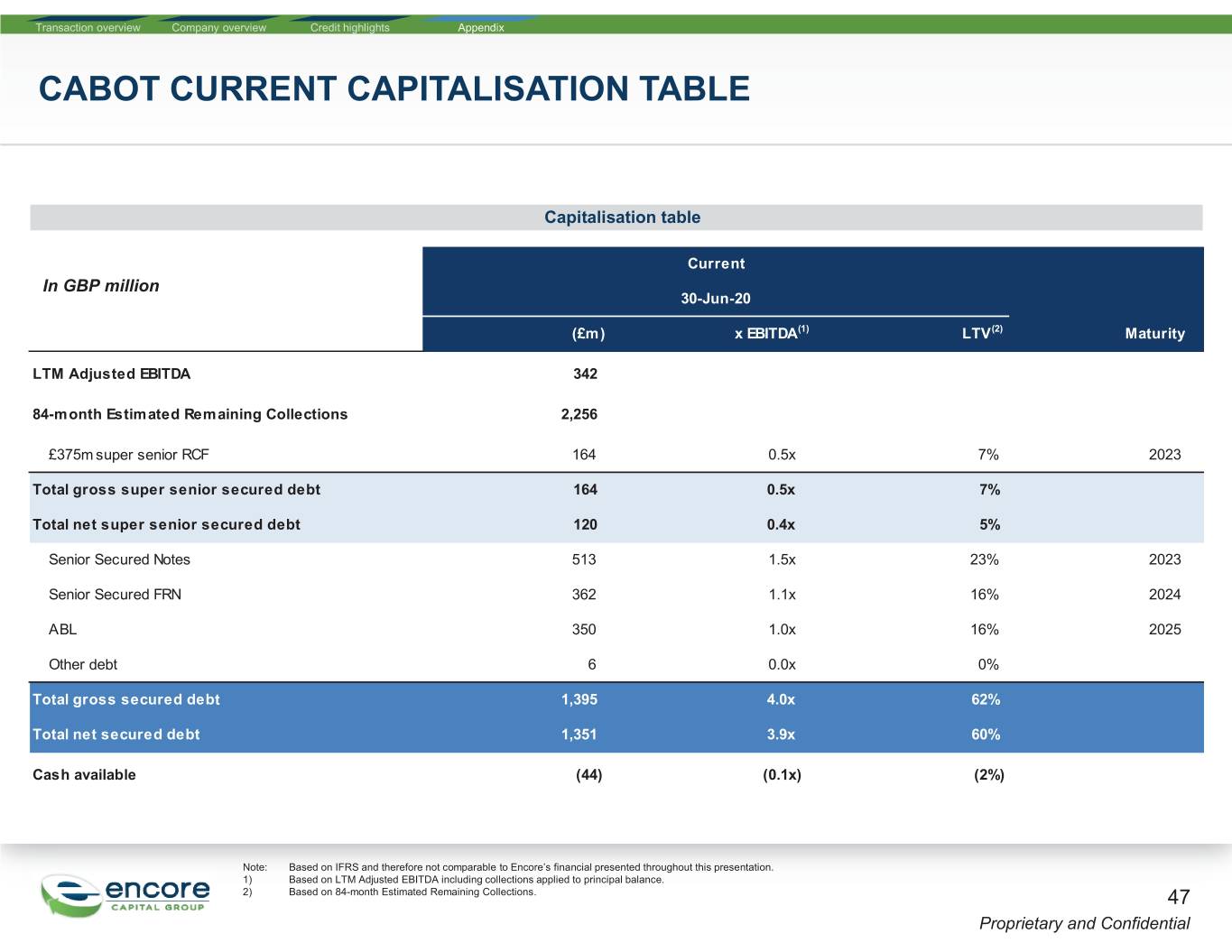

Transaction overview Company overview Credit highlights Appendix CABOT CURRENT CAPITALISATION TABLE Capitalisation table Current In GBP million 30-Jun-20 (£m) x EBITDA(1) LTV(2) Maturity LTM Adjusted EBITDA 342 84-month Estimated Remaining Collections 2,256 £375m super senior RCF 164 0.5x 7% 2023 Total gross super senior secured debt 164 0.5x 7% Total net super senior secured debt 120 0.4x 5% Senior Secured Notes 513 1.5x 23% 2023 Senior Secured FRN 362 1.1x 16% 2024 ABL 350 1.0x 16% 2025 Other debt 6 0.0x 0% Total gross secured debt 1,395 4.0x 62% Total net secured debt 1,351 3.9x 60% Cash available (44) (0.1x) (2%) Note: Based on IFRS and therefore not comparable to Encore’s financial presented throughout this presentation. 1) Based on LTM Adjusted EBITDA including collections applied to principal balance. 2) Based on 84-month Estimated Remaining Collections. 47 Proprietary and Confidential