Andy Rose – President Joe Hayek – CFO 2020 Jefferies Industrials Conference August 5, 2020

Worthington Industries wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act"). Statements by the Company which are not historical information constitute "forward looking statements" within the meaning of the Act. All forward-looking statements are subject to risks and uncertainties which could cause actual results to differ from those projected. Factors that could cause actual results to differ materially include risks, uncertainties and impacts described from time to time in the Company's filings with the Securities and Exchange Commission, including those related to COVID-19 and the various actions taken in connection therewith, which could also heighten other risks. SAFE HARBOR STATEMENT

COVID-19 Pandemic Response plan Proactive measures taken to ensure a safe workplace, manage operational costs and maintain financial flexibility Health & Safety Established cross-functional COVID-19 taskforce and implemented governance structure involving regular updates at business unit, corporate, and Board levels Implemented best practices to keep workforce safe including additional cleaning and sanitizing, work from home, and physical distancing for employees needing to be onsite Operational cost management Hiring freeze for non-critical roles Rightsizing the workforce to match the current demand environment, mostly through furloughs but also with some permanent reductions Reducing discretionary spend including travel Financial flexibility Maintain a strong balance sheet with $650M of liquidity as of May 31, 2020* and no funded debt maturities until 2024 Deferral of non-essential and non-growth oriented capital expenditures Positioned to emerge from pandemic well capitalized and as a stronger company * Liquidity includes $500M in undrawn revolving credit facilities and $147M of cash as of 05/31/20

Vision To Be the Transformative Partner for our customers, a Positive Force in our communities and earn exceptional returns

Net sales of $3.1 billion FISCAL YEAR 2020 7,500 56 6 4,500

Largest purchaser of flat roll steel behind automakers FORTUNE Most Admired Companies in Metals Industry three times FORTUNE 100 Best Companies to Work For in America four times Best Place to Work in IT by Computerworld 2017-2019 Partner-Level Supplier 2013-2019 and Supplier Hall of Fame by John Deere Military Friendly® Employer by VIQTORY 2016-2020 Top Workplace by Columbus CEO from 2013-2019 Gold Level Fit-Friendly Company by the American Heart Association 2011-2019 TWB Company named a General Motors Supplier of the Year 2019 Manufactured 83MM Cylinders & Accessories (FY20) Sold in 90+ Countries

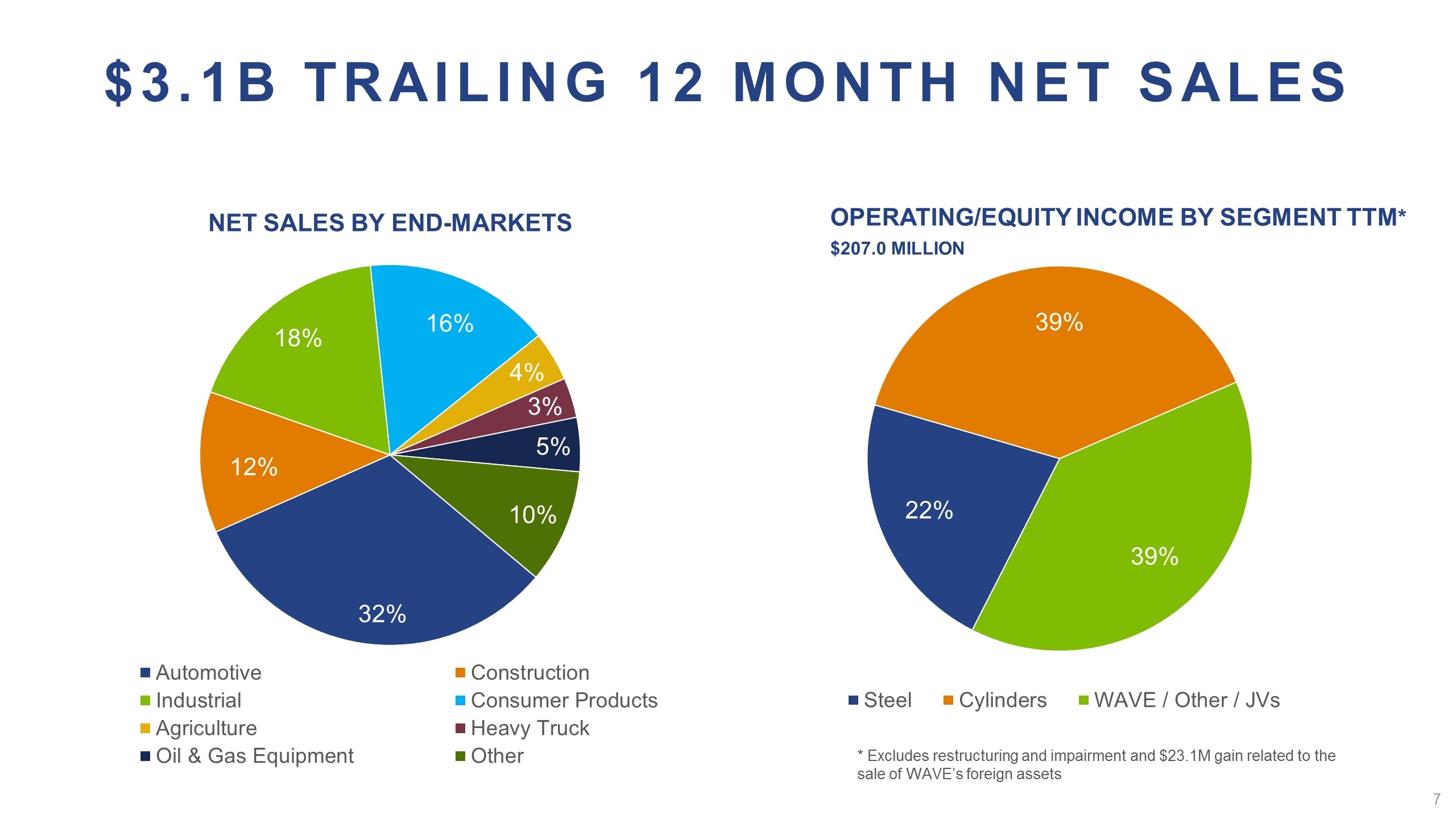

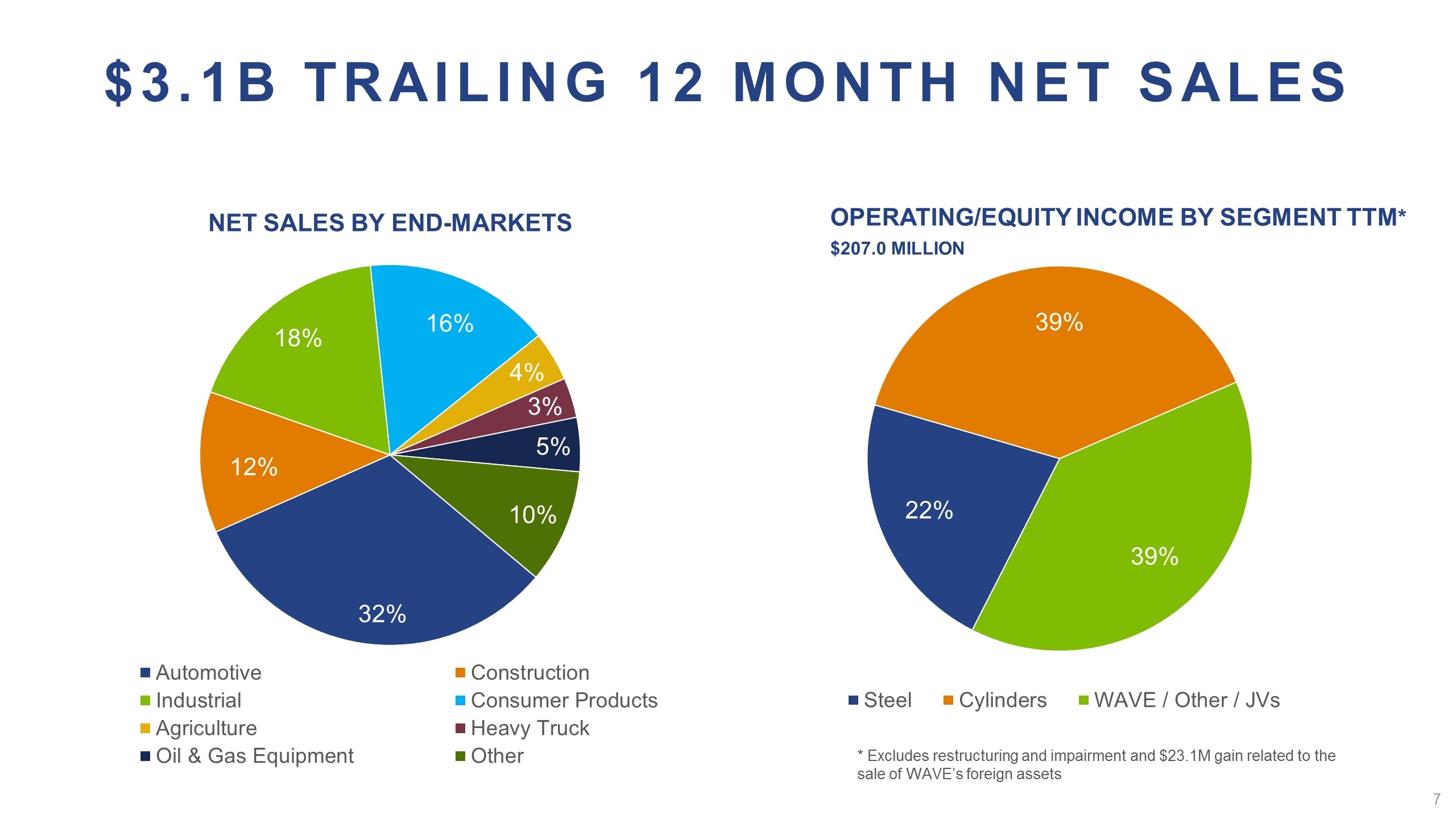

Net Sales by End-Markets $3.1B Trailing 12 Month Net Sales Operating/Equity Income by Segment TTM* $207.0 million * Excludes restructuring and impairment and $23.1M gain related to the sale of WAVE’s foreign assets

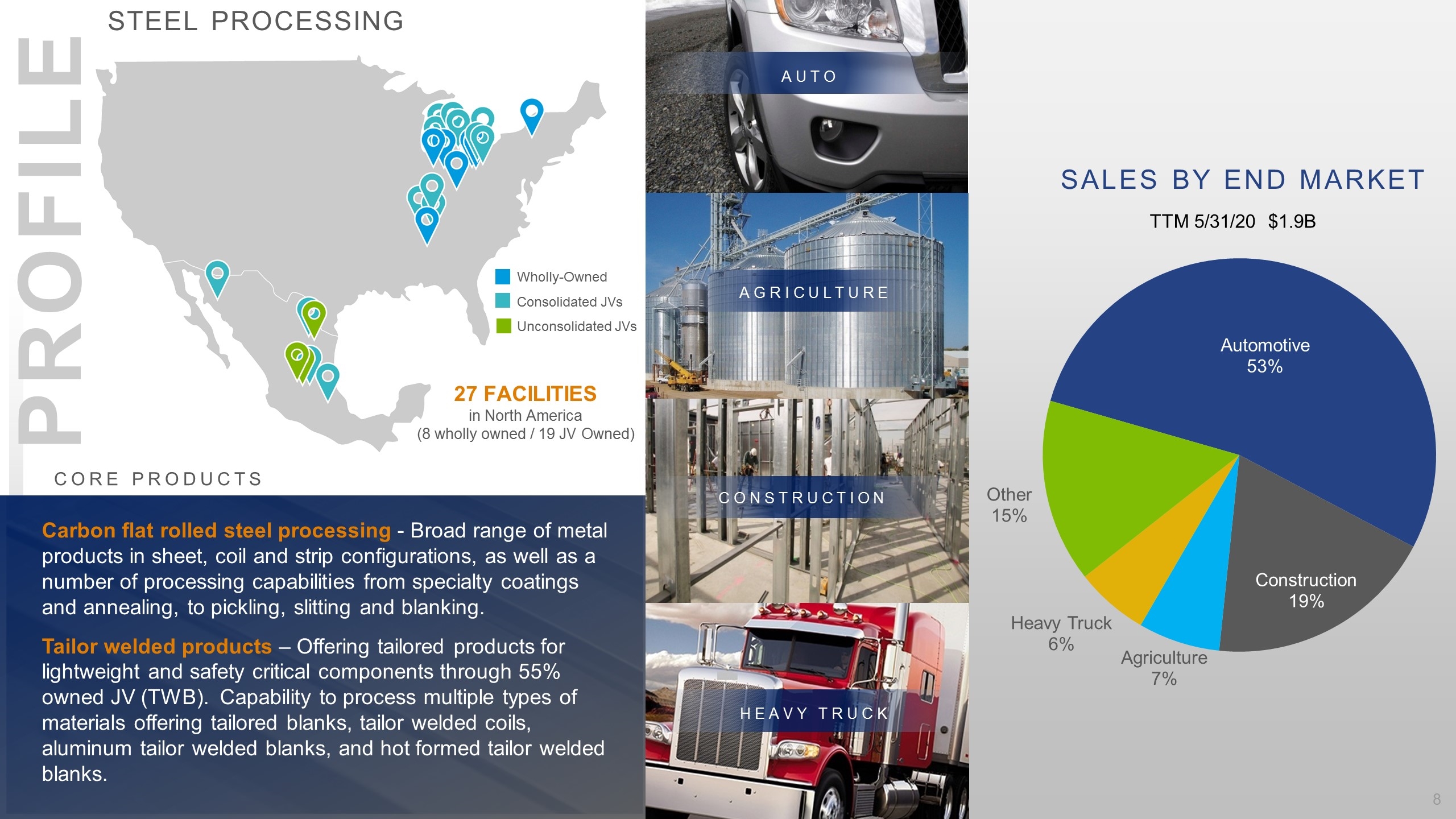

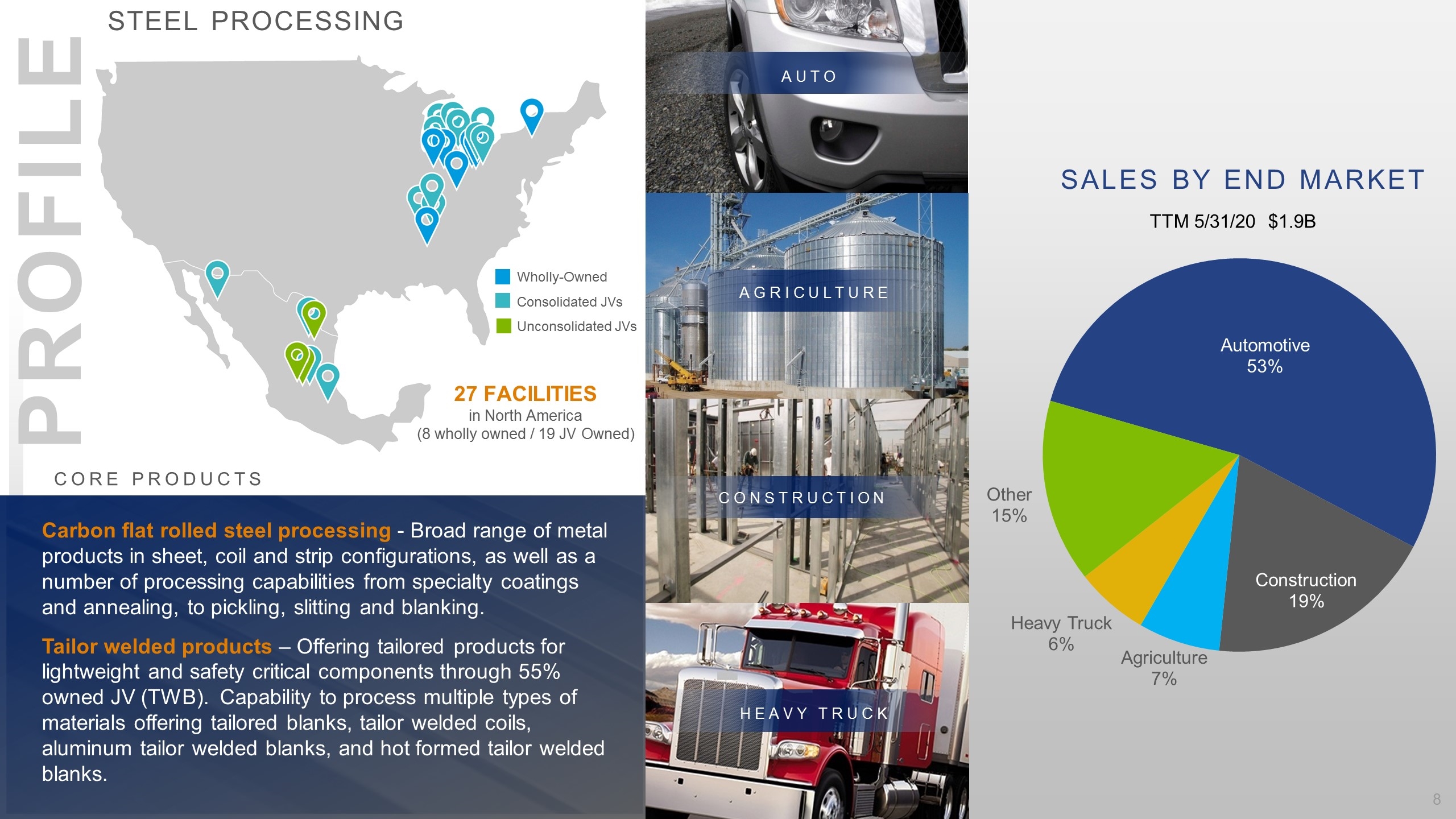

Sales By End Market TTM 5/31/20 $1.9B AUTO CORE PRODUCTS Profile STEEL PROCESSING AGRICULTURE CONSTRUCTION HEAVY TRUCK Carbon flat rolled steel processing - Broad range of metal products in sheet, coil and strip configurations, as well as a number of processing capabilities from specialty coatings and annealing, to pickling, slitting and blanking. Tailor welded products – Offering tailored products for lightweight and safety critical components through 55% owned JV (TWB). Capability to process multiple types of materials offering tailored blanks, tailor welded coils, aluminum tailor welded blanks, and hot formed tailor welded blanks. 27 facilities in North America (8 wholly owned / 19 JV Owned) Wholly-Owned Consolidated JVs Unconsolidated JVs

Profile Sales By SBU Industrial Products - Broad line of pressure cylinders and cryogenic vessels, tanks and trailers for industrial gas storage and transportation Consumer Products – Market-leading brands with products for jobsite, home and outdoor activities Oil & Equipment - Custom solutions for energy storage, processing and transportation TTM 5/31/20 $1.1B CORE PRODUCTS PRESSURE CYLINDERS 16 facilities in North America and Europe

Profile Contribution to WI Equity Income ($M) MARKETS CORE PRODUCTS 5.9% CAGR Sustainable revenue and EBITDA growth with creative fabricated architectural metal components, focusing on superior customer value, industry leading manufacturing, and talent development resulting in low cost construction and enterprise efficiencies Over $800M in dividends paid to Worthington in past 10 years since FY 2011 WAVE (50% JV) 6 facilities in North America * FY20 excludes $23.1M gain related to the sale of WAVE’s foreign assets

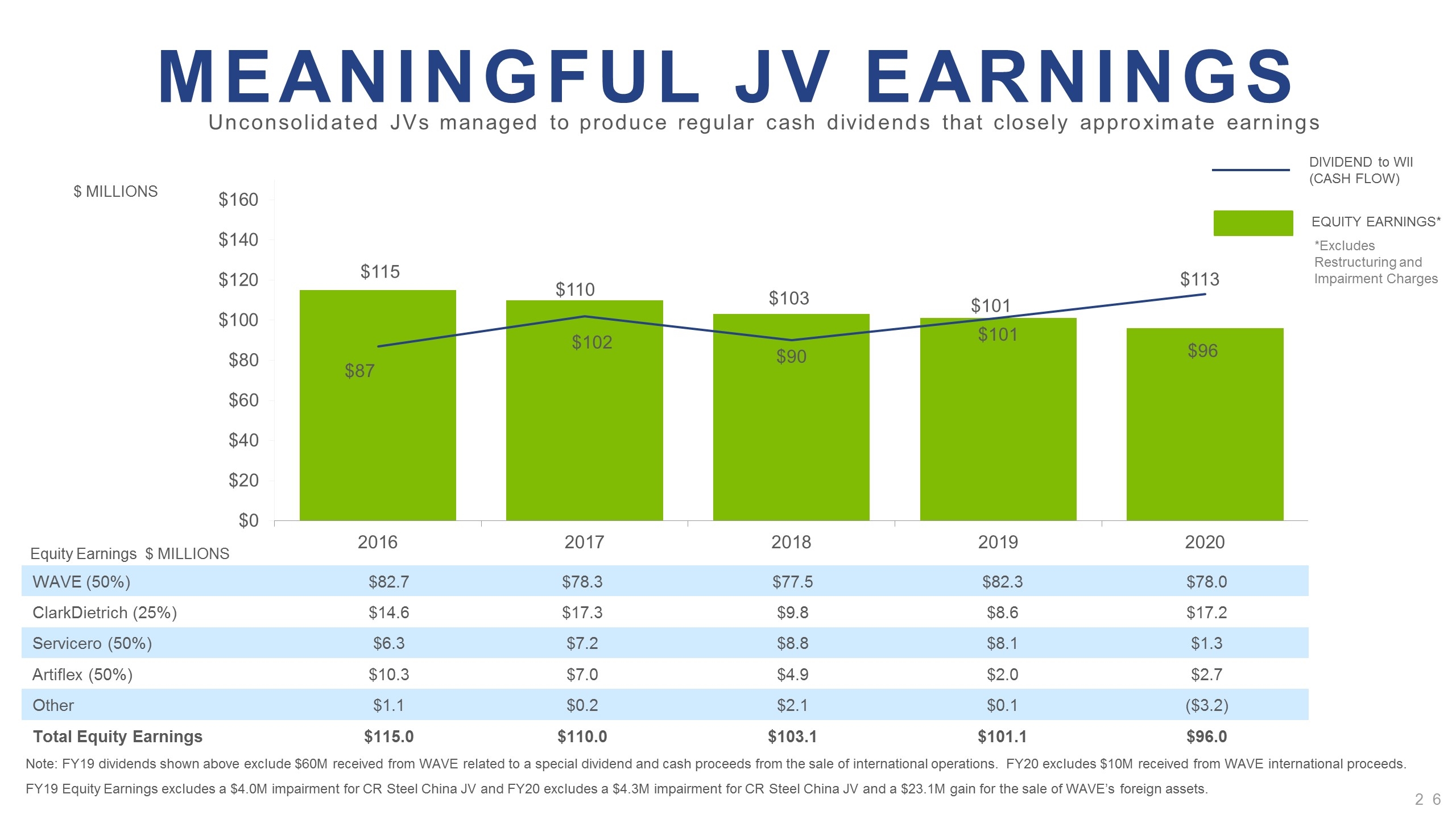

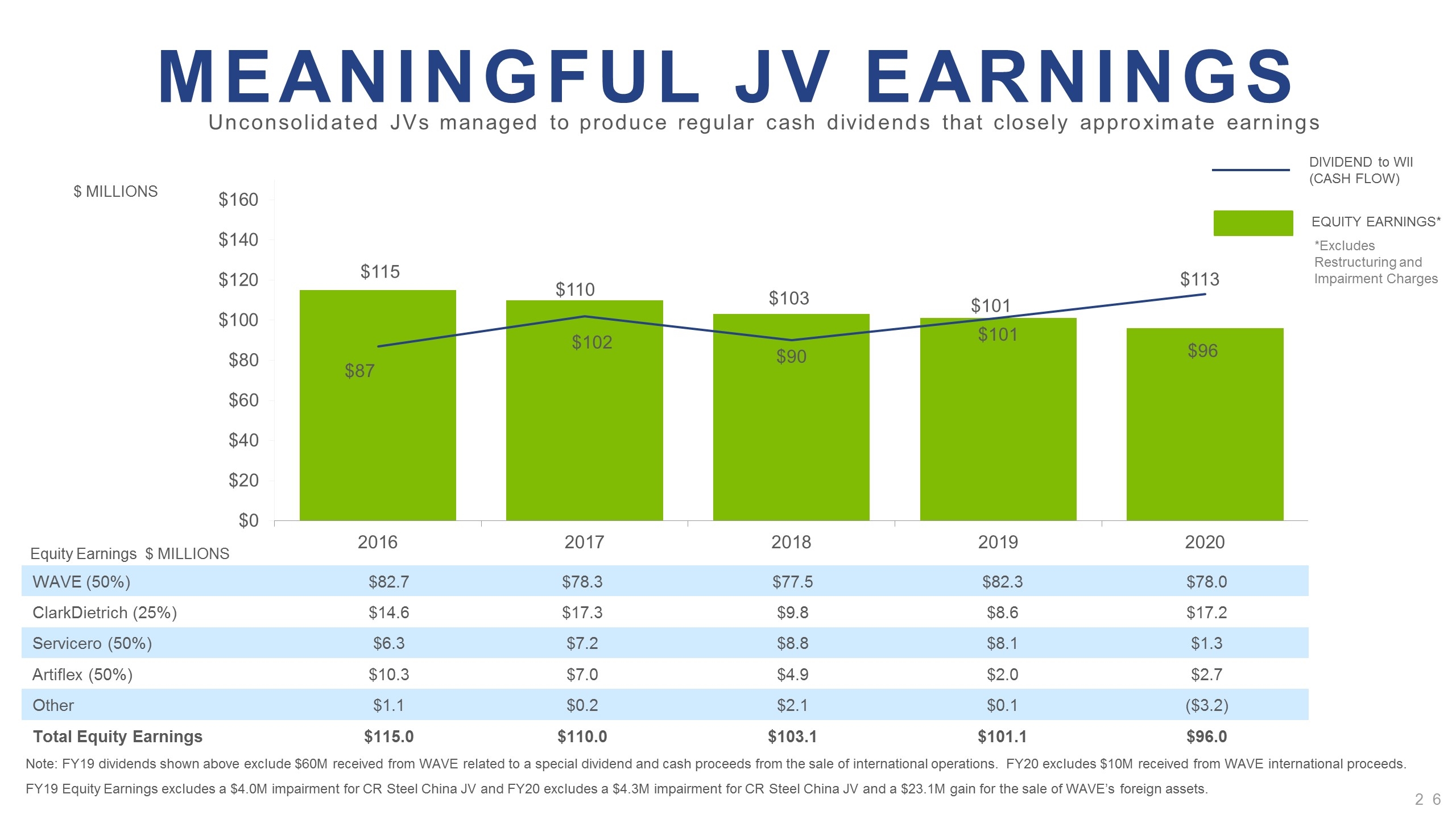

Successful JV portfolio built with trusted partners who help make a business better versus the alternative of going solo JVs managed to produce regular cash dividends that closely approximate earnings Successful Joint Ventures Business Ownership Created WAVE Architectural and acoustical grid ceilings 50% 1992 Serviacero Steel processing in Mexico 50% 2007 ArtiFlex Automotive tooling and stamping 50% 2011 ClarkDietrich Metal framing for commercial construction 25% 2011 Serving automotive and construction end markets Over $1.0B in dividends received from JVs in past 10 years since FY 2011

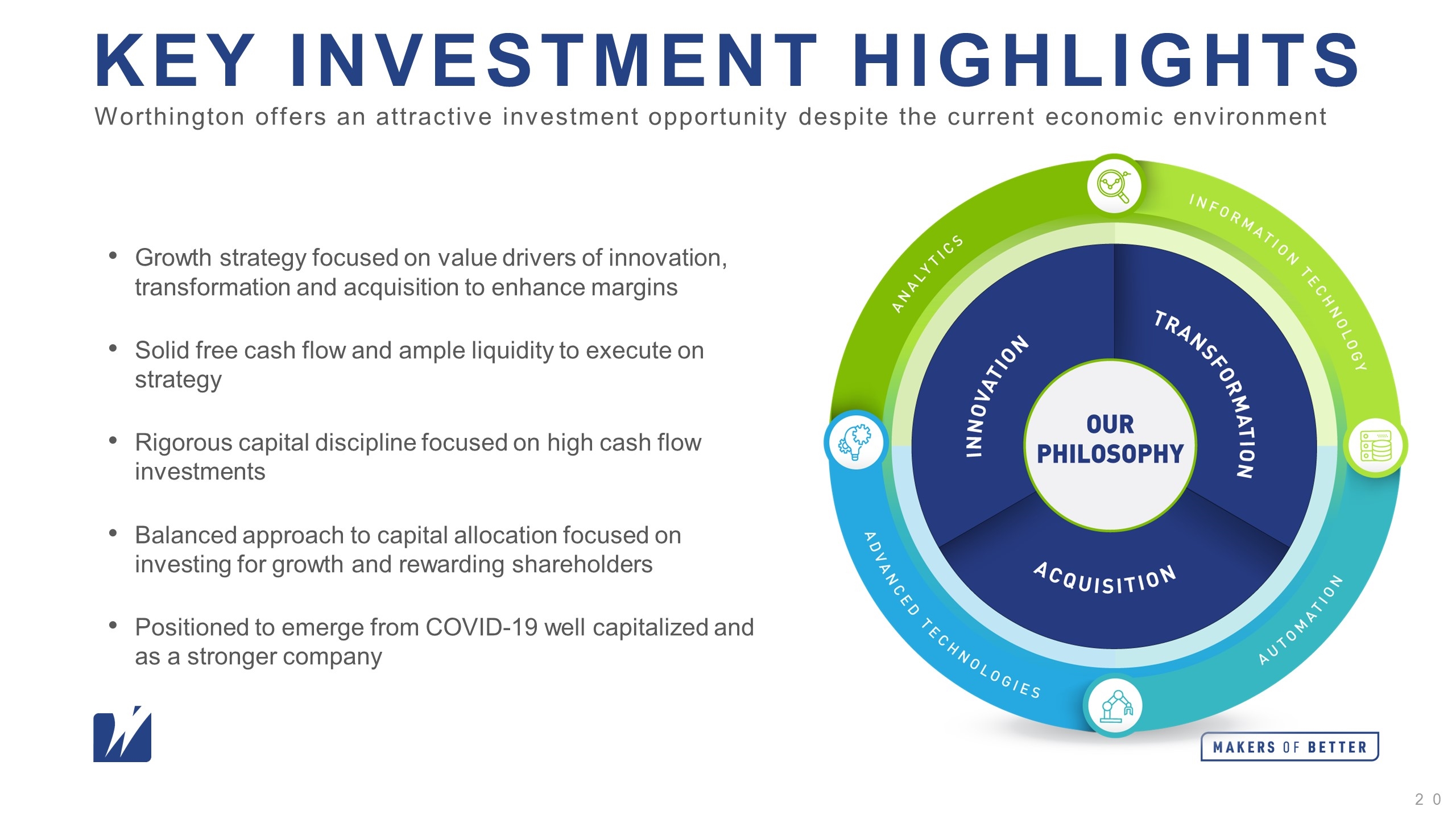

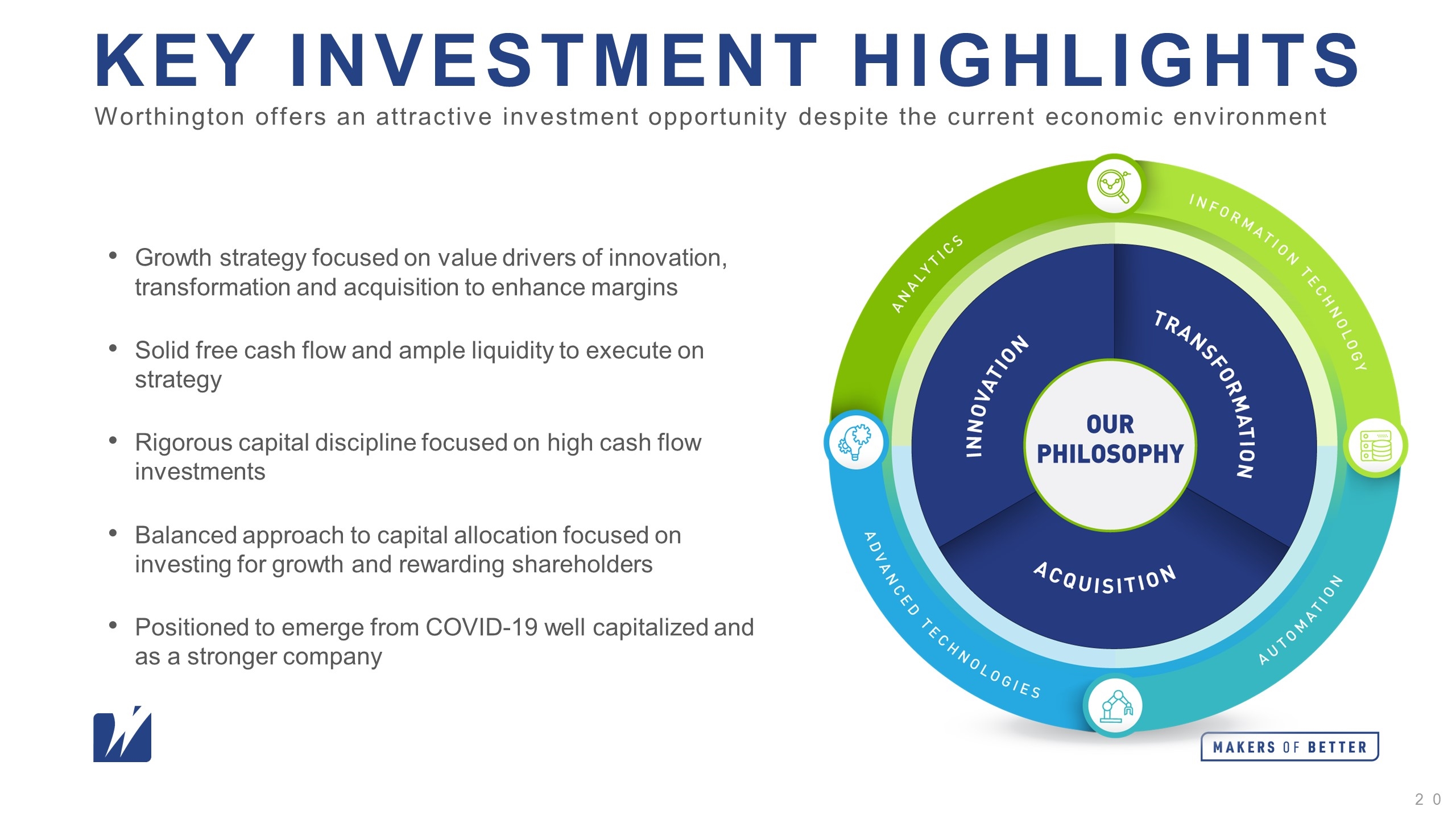

Growth Strategy Working together using technology, analytics and automation enables us to deliver… Successful innovation, transformation, and acquisitions that drive value for customers and earn exceptional returns for our shareholders. All with Our Philosophy at the center.

complementary value drivers are well established Broad based business system focused on: Data-driven decision making Optimizing value streams and eliminating waste Discovering new capabilities through agile teams One system, driven by everyone, not just a central tiger team TRANSFORMATION Innovation as a discipline: New product development Product design & engineering Voice of customer & market research Incorporating advanced technologies Focus on the core: Consolidate higher value add markets Build out product offerings with adjacencies Target industries/sectors we know Focus on higher margin / high cash flow businesses Strong target evaluation process, due diligence and integration to achieve synergies INNOVATION ACQUISITIONS 3

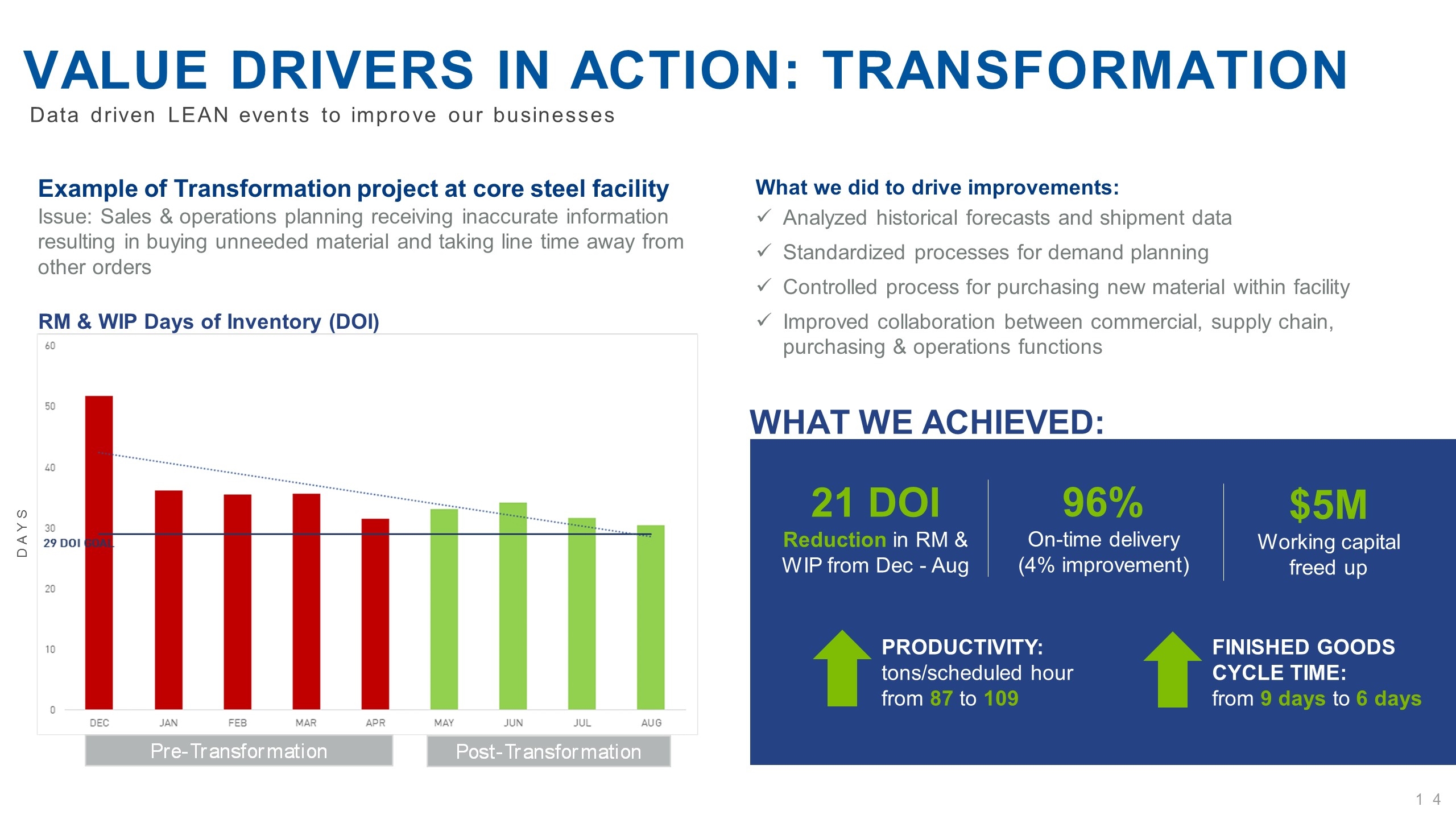

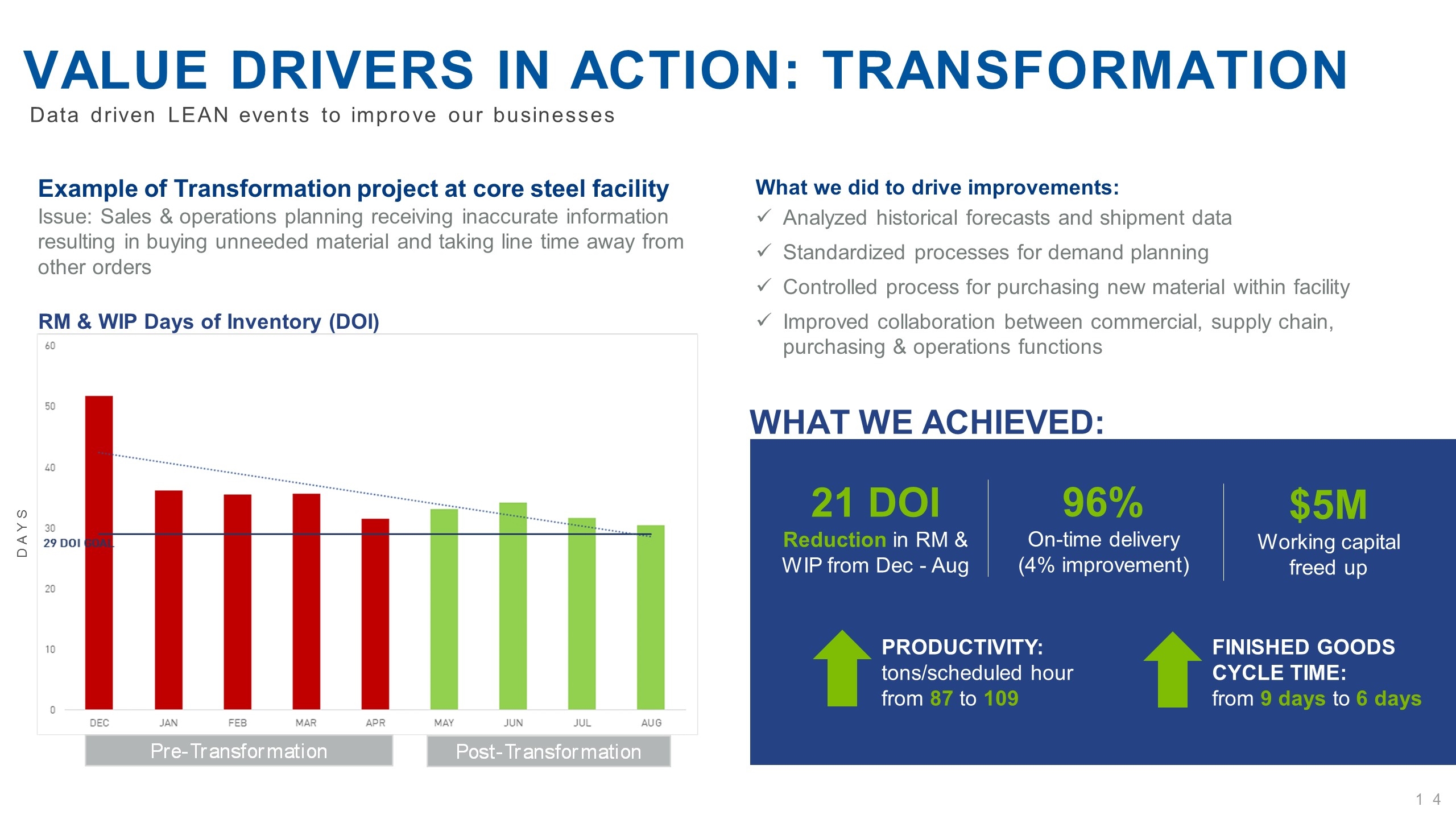

Value drivers in action: Transformation Data driven LEAN events to improve our businesses Example of Transformation project at core steel facility Issue: Sales & operations planning receiving inaccurate information resulting in buying unneeded material and taking line time away from other orders What we did to drive improvements: Analyzed historical forecasts and shipment data Standardized processes for demand planning Controlled process for purchasing new material within facility Improved collaboration between commercial, supply chain, purchasing & operations functions What we achieved: 21 DOI Reduction in RM & WIP from Dec - Aug $5M Working capital freed up 96% On-time delivery (4% improvement) Productivity: tons/scheduled hour from 87 to 109 Finished goods cycle time: from 9 days to 6 days RM & WIP Days of Inventory (DOI) DAYS

Creating innovative solutions to meet the needs of customers and expand into new markets Value drivers in action: innovation Cannabis Extraction Cylinders Need for cleaner alternative to traditional steel 100# tank identified Voice of customer work conducted to understand need and size opportunity Repurposed existing assets and production line, minimizing capital investment and increasing speed to market Product team focused on identifying opportunities to develop additional premium products for this rapidly growing market

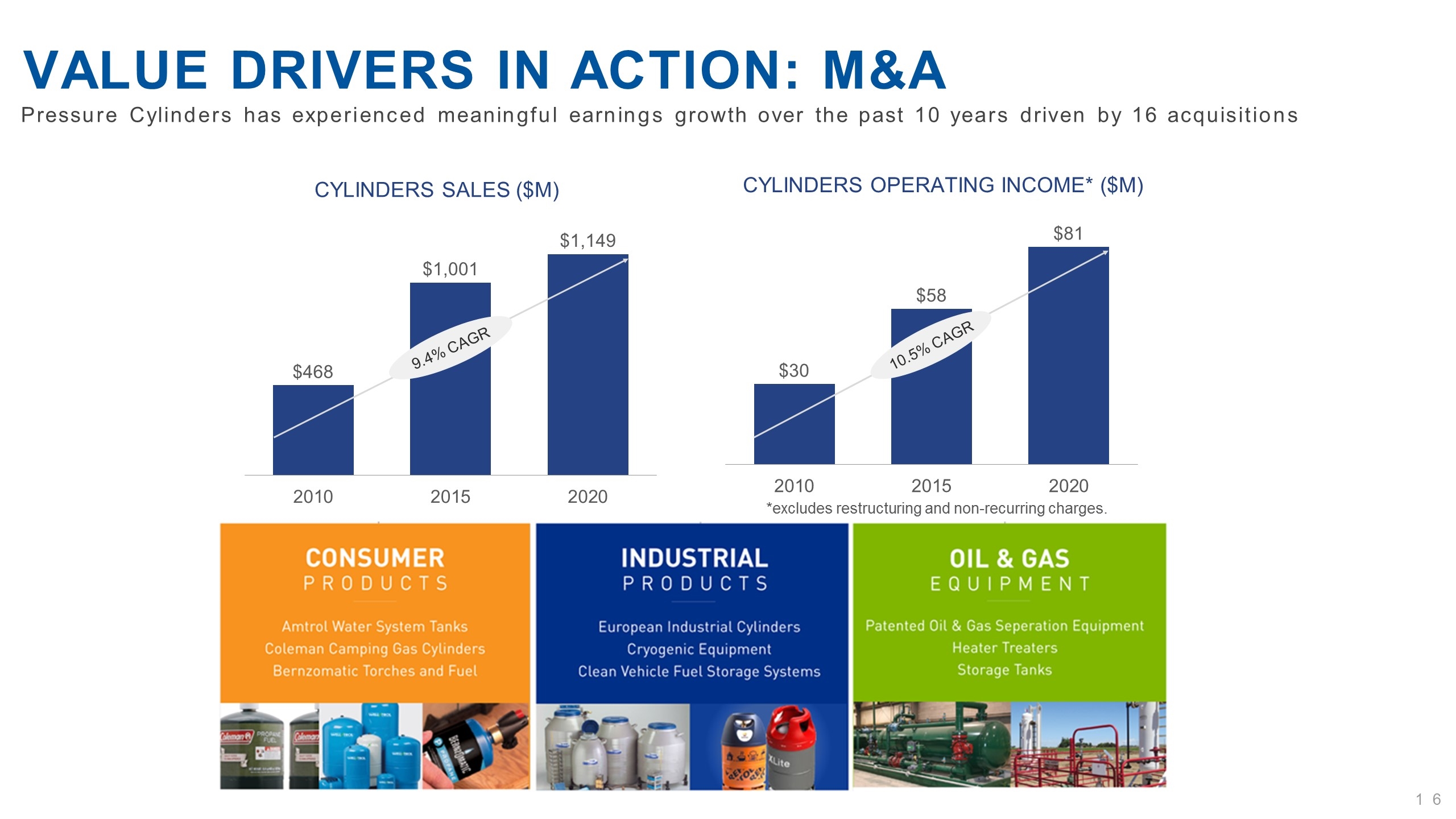

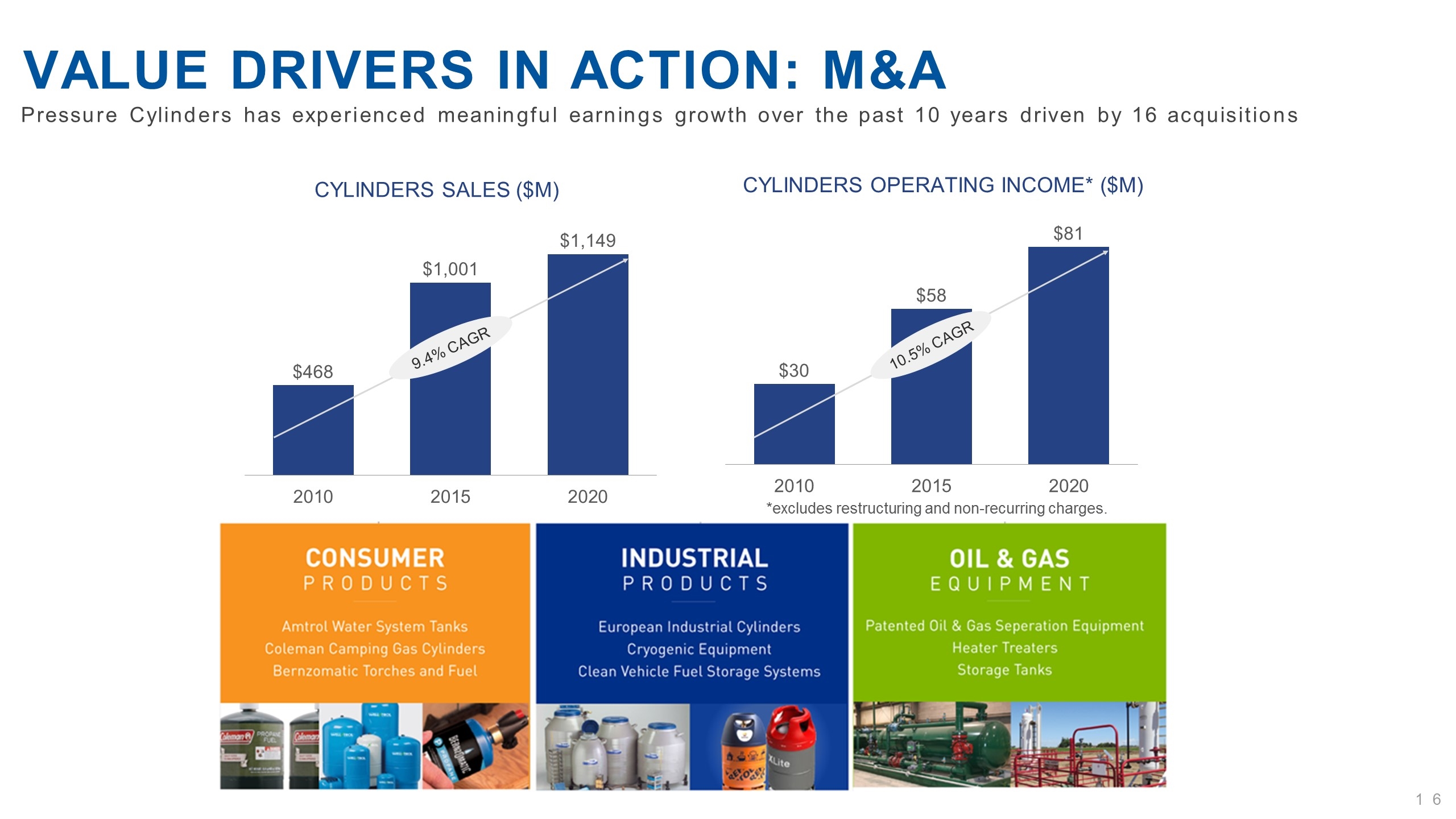

Pressure Cylinders has experienced meaningful earnings growth over the past 10 years driven by 16 acquisitions Value drivers in action: m&a Cylinders Sales ($M) 9.4% CAGR Cylinders Operating income* ($M) 10.5% CAGR *excludes restructuring and non-recurring charges.

Financial goals Grow EBITDA & free cash flow every year 10%+ return on capital Raise margins Reduce earnings volatility Balanced capital allocation Modest leverage / ample liquidity (investment grade) Rigorous capital discipline

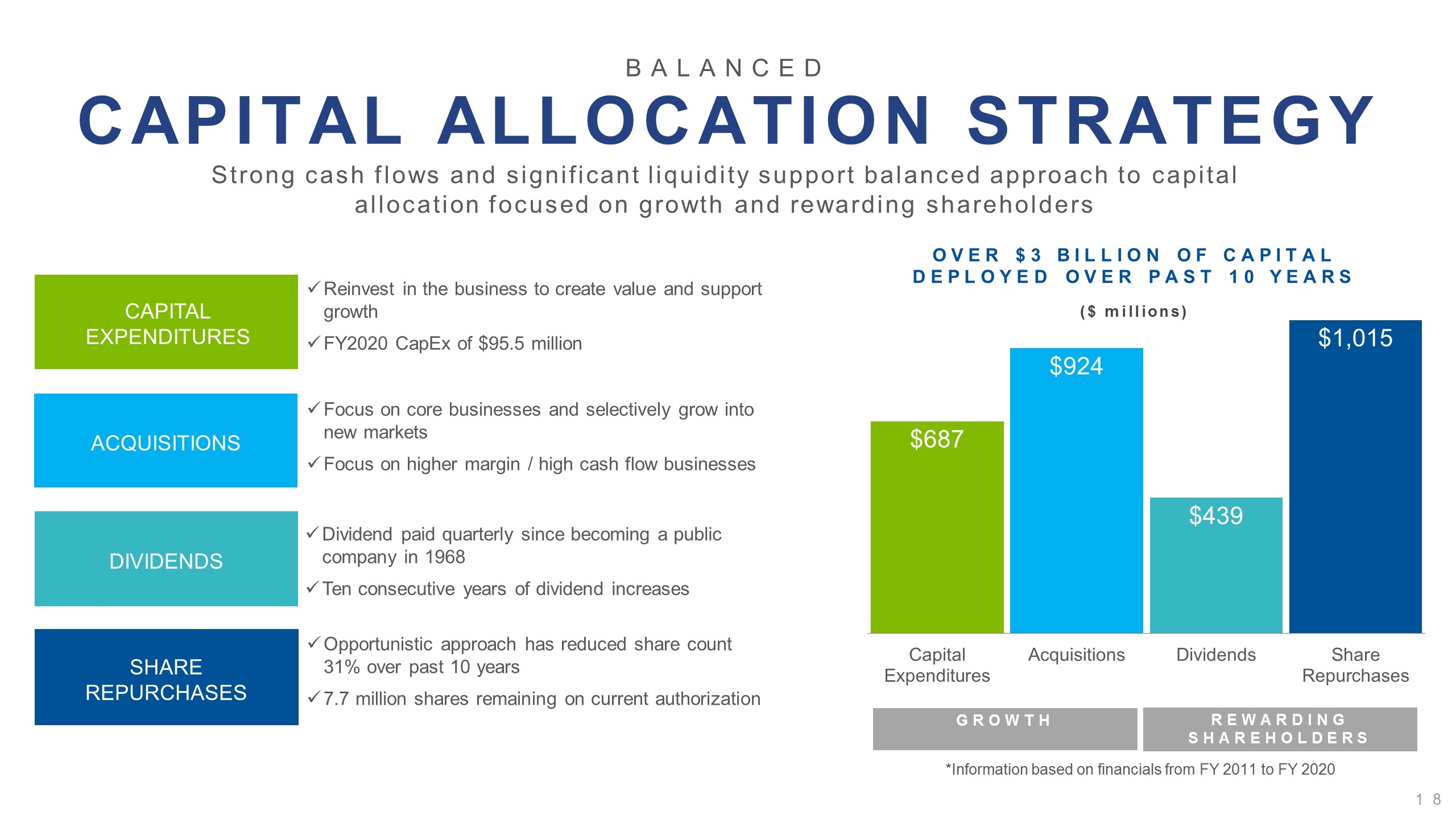

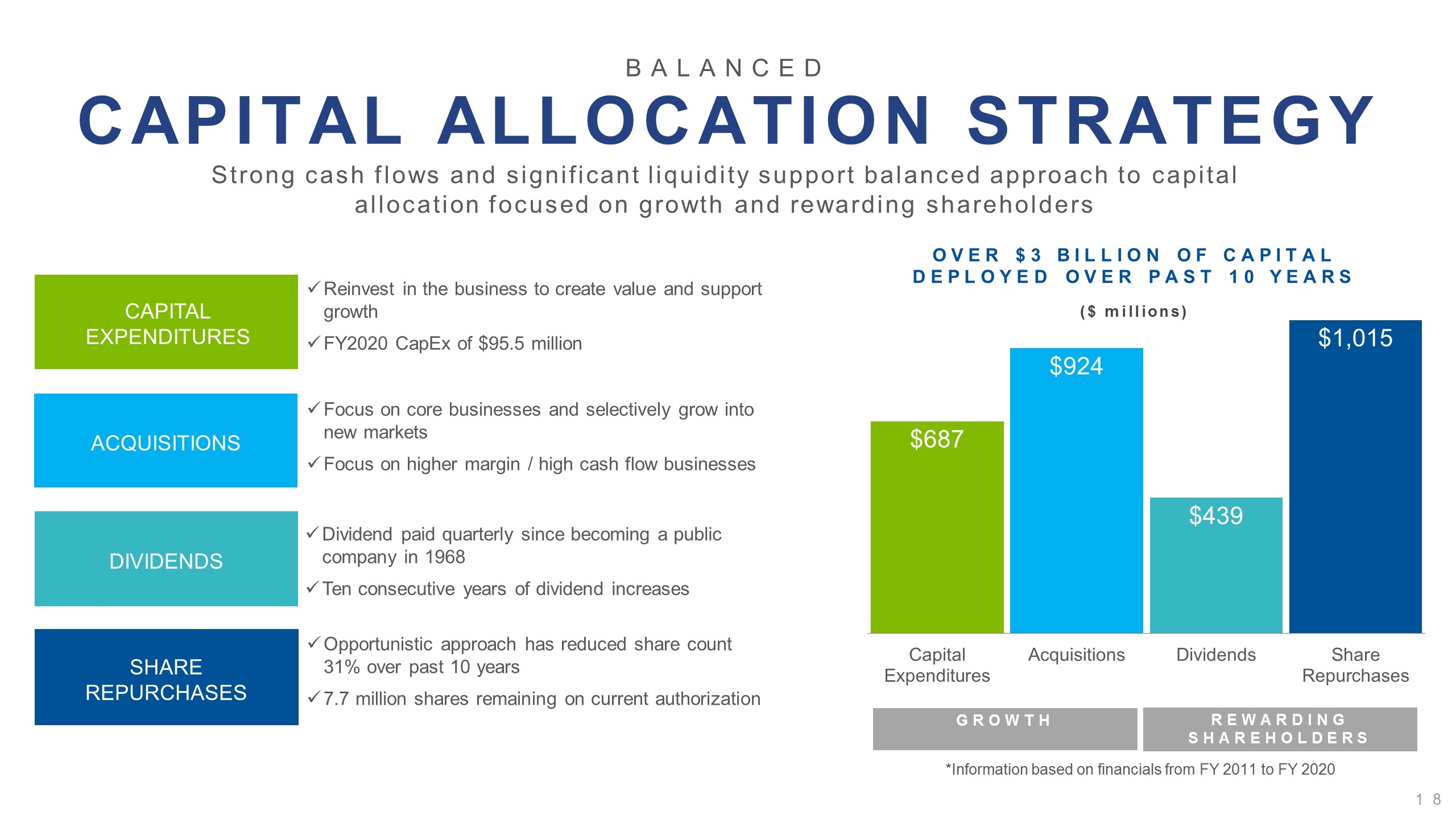

Balanced CAPITAL ALLOCATION STRATEGY Strong cash flows and significant liquidity support balanced approach to capital allocation focused on growth and rewarding shareholders Capital Expenditures Acquisitions Dividends Share Repurchases Reinvest in the business to create value and support growth FY2020 CapEx of $95.5 million Focus on core businesses and selectively grow into new markets Focus on higher margin / high cash flow businesses Dividend paid quarterly since becoming a public company in 1968 Ten consecutive years of dividend increases Opportunistic approach has reduced share count 31% over past 10 years 7.7 million shares remaining on current authorization over $3 billion of capital deployed over past 10 years ($ millions) Growth Rewarding Shareholders *Information based on financials from FY 2011 to FY 2020

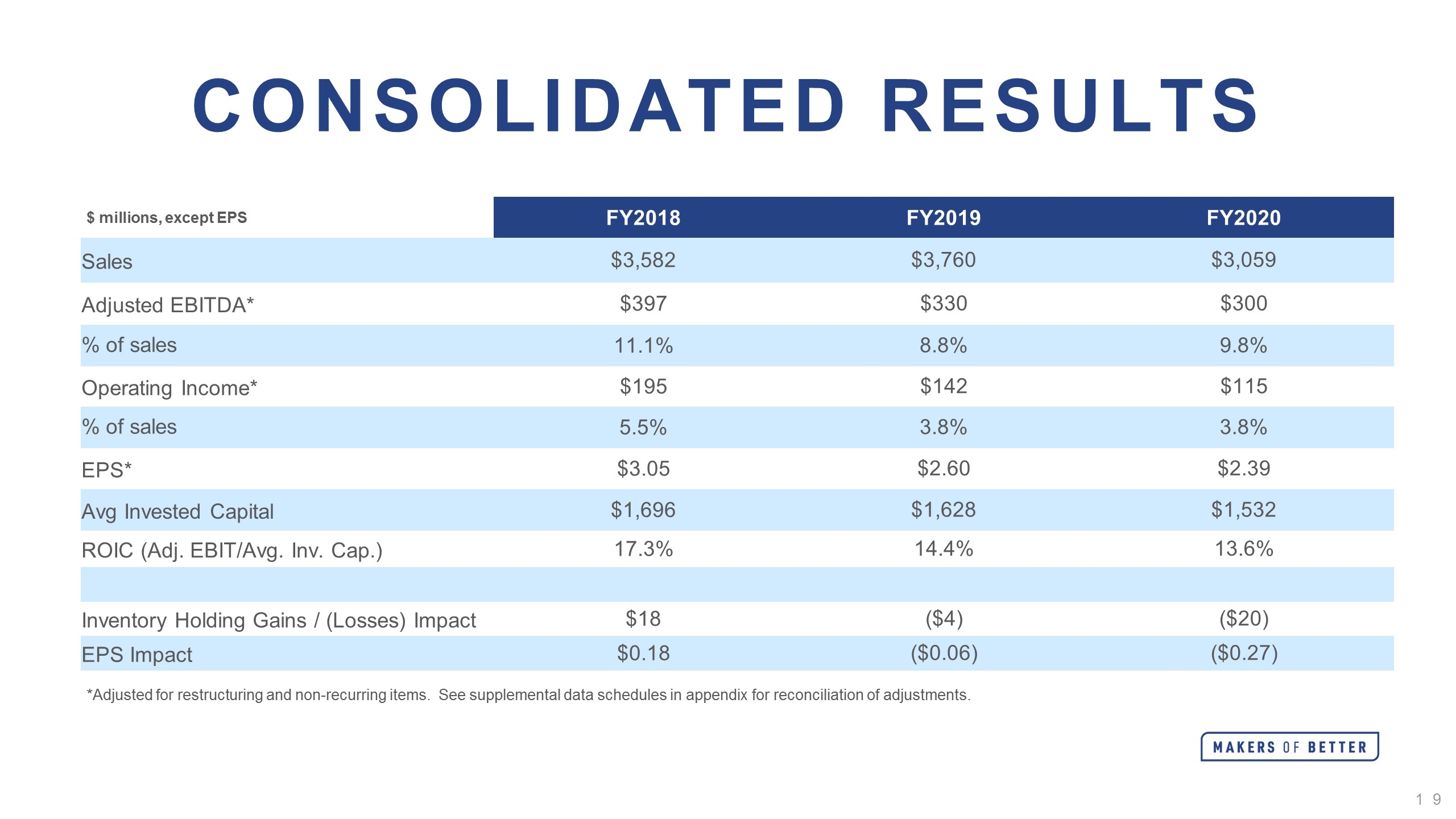

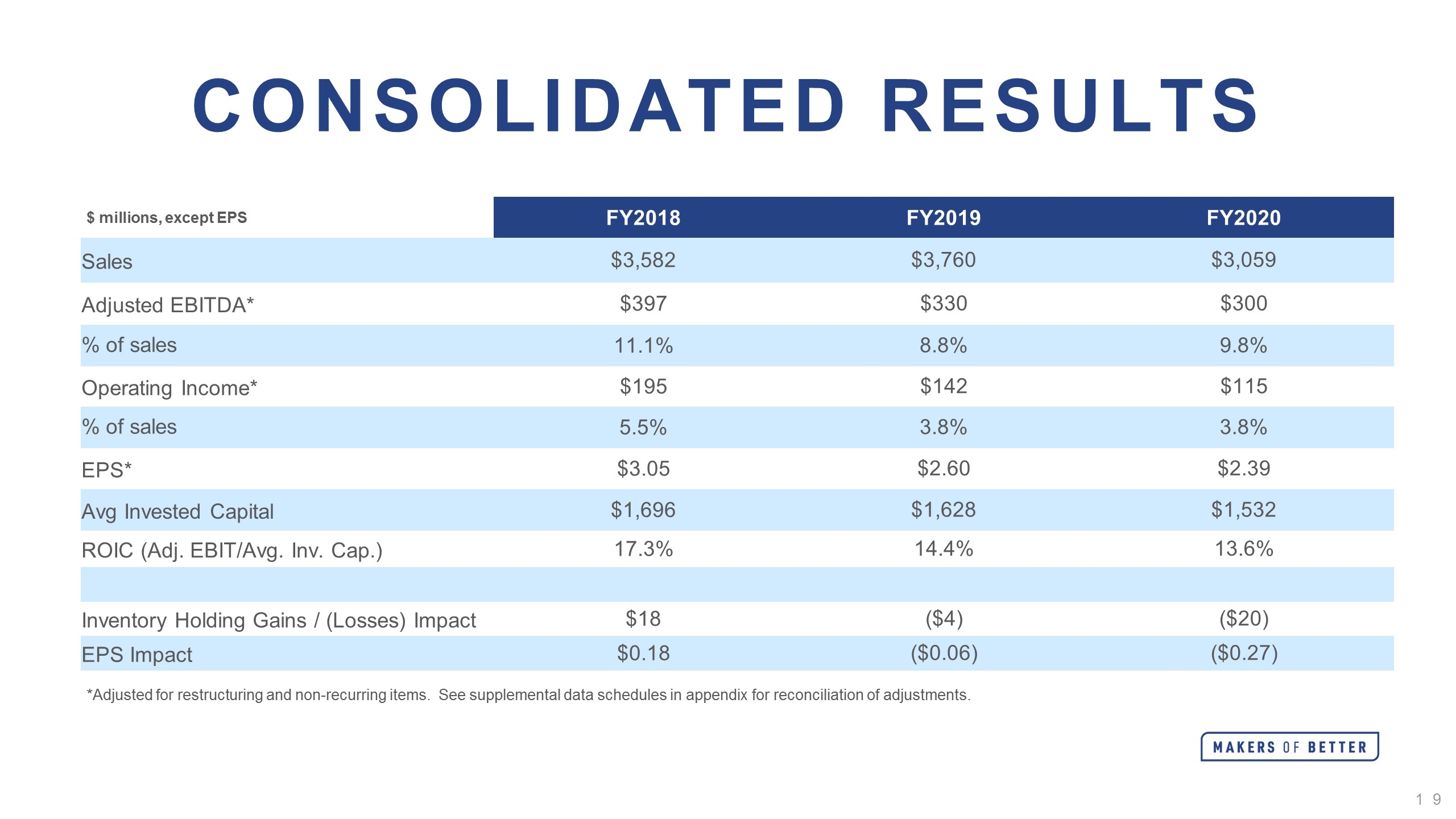

Consolidated Results *Adjusted for restructuring and non-recurring items. See supplemental data schedules in appendix for reconciliation of adjustments. $ millions, except EPS FY2018 FY2019 FY2020 Sales $3,582 $3,760 $3,059 Adjusted EBITDA* $397 $330 $300 % of sales 11.1% 8.8% 9.8% Operating Income* $195 $142 $115 % of sales 5.5% 3.8% 3.8% EPS* $3.05 $2.60 $2.39 Avg Invested Capital $1,696 $1,628 $1,532 ROIC (Adj. EBIT/Avg. Inv. Cap.) 17.3% 14.4% 13.6% Inventory Holding Gains / (Losses) Impact $18 ($4) ($20) EPS Impact $0.18 ($0.06) ($0.27)

Key investment highlights Growth strategy focused on value drivers of innovation, transformation and acquisition to enhance margins Solid free cash flow and ample liquidity to execute on strategy Rigorous capital discipline focused on high cash flow investments Balanced approach to capital allocation focused on investing for growth and rewarding shareholders Positioned to emerge from COVID-19 well capitalized and as a stronger company Worthington offers an attractive investment opportunity despite the current economic environment

SUPPLEMENTAL DATA

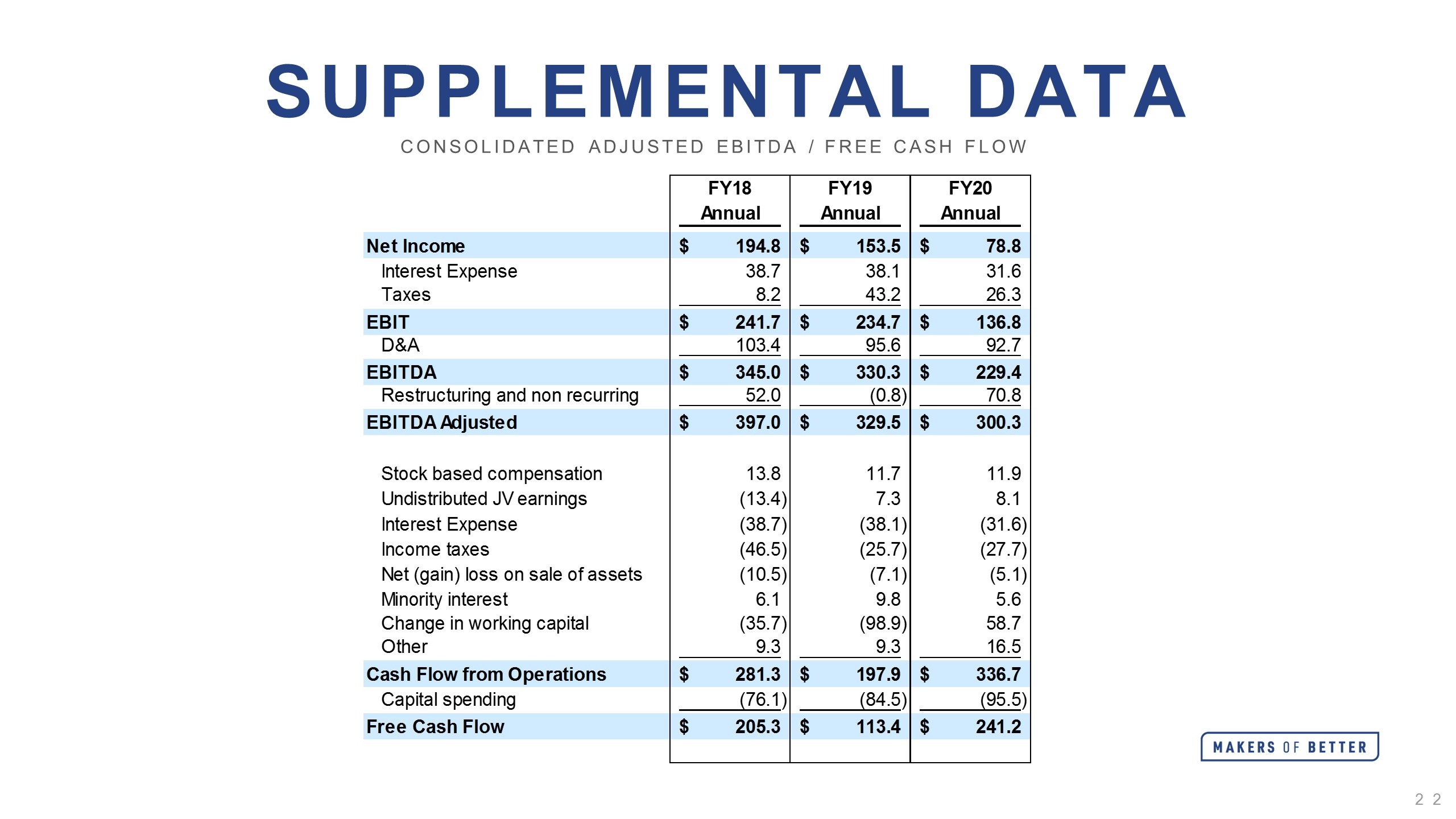

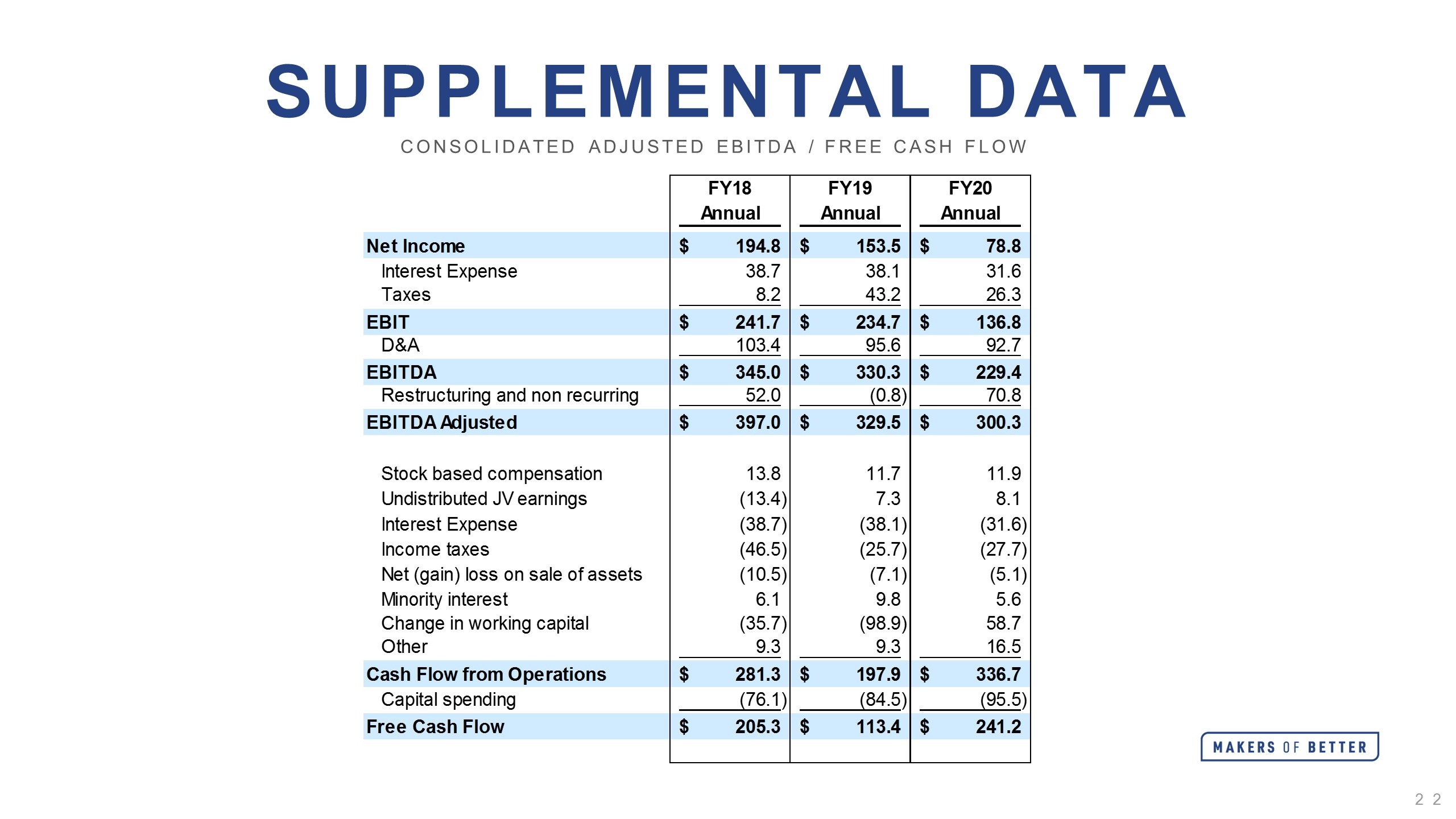

Supplemental Data Consolidated Adjusted EBITDA / Free Cash Flow Cash Flow ($ in Millions) FY18 FY19 FY20 Annual Annual Annual Net Income $,194,794,485.7699999 $,153,454,753.391 $78,796,380.547000006 Interest Expense 38,675,487.564999998 38,062,649.381999999 31,616,039.923999999 Taxes 8,219,684.9929999998 43,183,492.6999999 26,341,893.2999999 EBIT $,241,689,657.63499999 $,234,700,894.78 $,136,754,313.47400001 D&A ,103,358,983.388 95,602,469.376000002 92,677,987.67000002 EBITDA $,345,048,641.23 $,330,303,364.15600002 $,229,432,300.54100001 Restructuring and non recurring 51,955,907.828000002 -,786,021.45099999988 70,832,296.152999997 EBITDA Adjusted $,397,004,548.861 $,329,517,342.70499998 $,300,264,596.69300002 Stock based compensation 13,757,523 11,732,828.300000001 11,883,407.189999999 Undistributed JV earnings ,-13,352,140.91 7,346,919.3200000003 8,106,204.3289999999 Interest Expense ,-38,675,487.564999998 ,-38,062,649.381999999 ,-31,616,039.923999999 Income taxes ,-46,456,631.993000001 ,-25,748,754.6999999 ,-27,651,334.2999999 Net (gain) loss on sale of assets ,-10,522,486.506999999 -7,058,865.429999996 -5,057,219.2970000003 Minority interest 6,056,013.8609999996 9,818,024.9059999995 5,648,331.6270000003 Change in working capital ,-35,729,552.413000017 ,-98,948,757.792999983 58,676,306.768000022 Other 9,262,759.2990000024 9,262,757.2540000007 16,471,492.871000003 Cash Flow from Operations $,281,344,546.45200002 $,197,858,846.25999999 $,336,725,746.255 Capital spending ,-76,087,910.944999993 ,-84,498,302.790999994 ,-95,502,705.195999995 Free Cash Flow $,205,256,635.50700003 $,113,360,543.469 $,241,223,041.5900002 Check- EBITDA Adjusted 9.9999904632568359E-3 0 -9.9998712539672852E-4 Check- Free Cash Flow 0 0 9.9998712539672852E-4

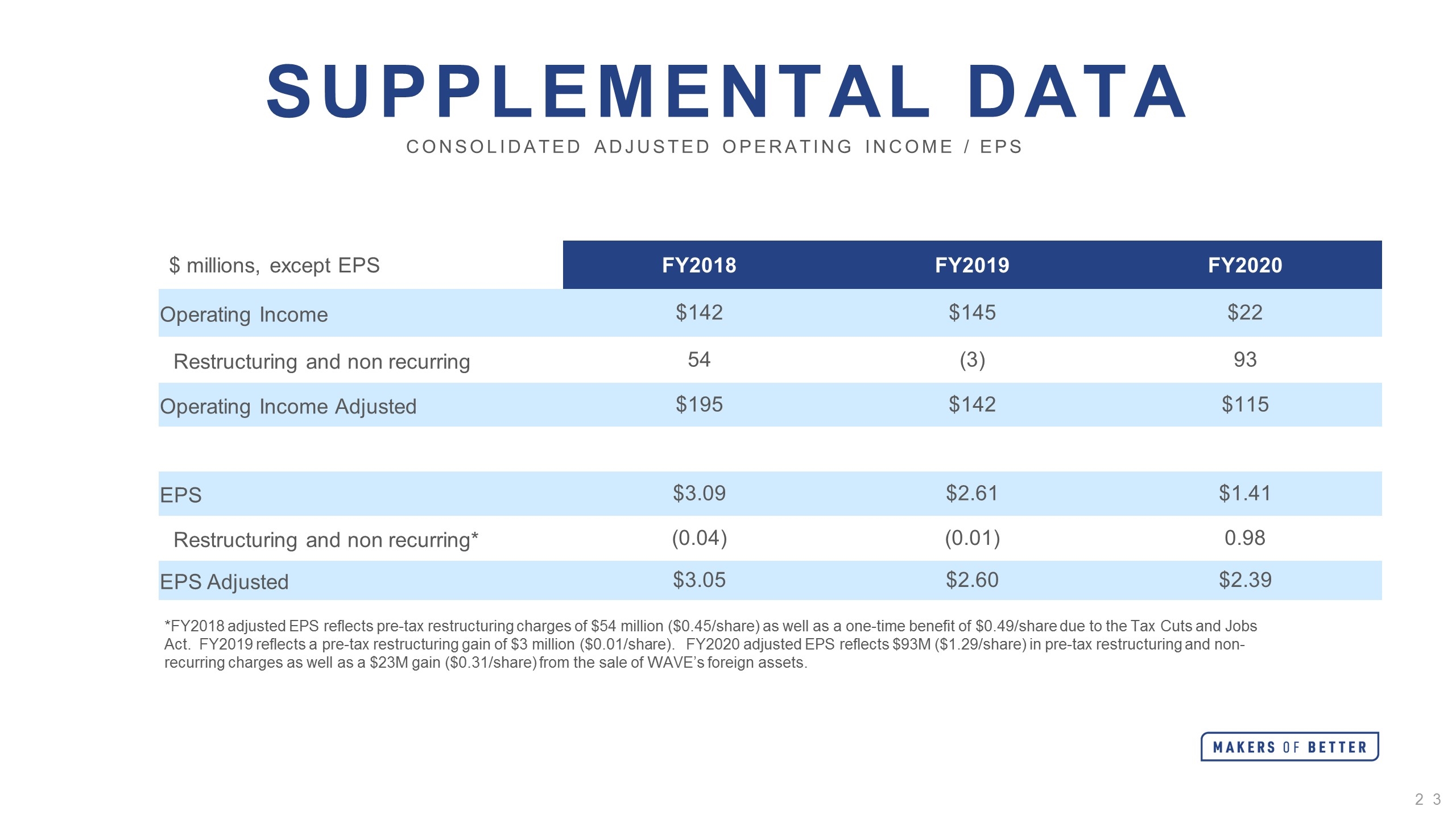

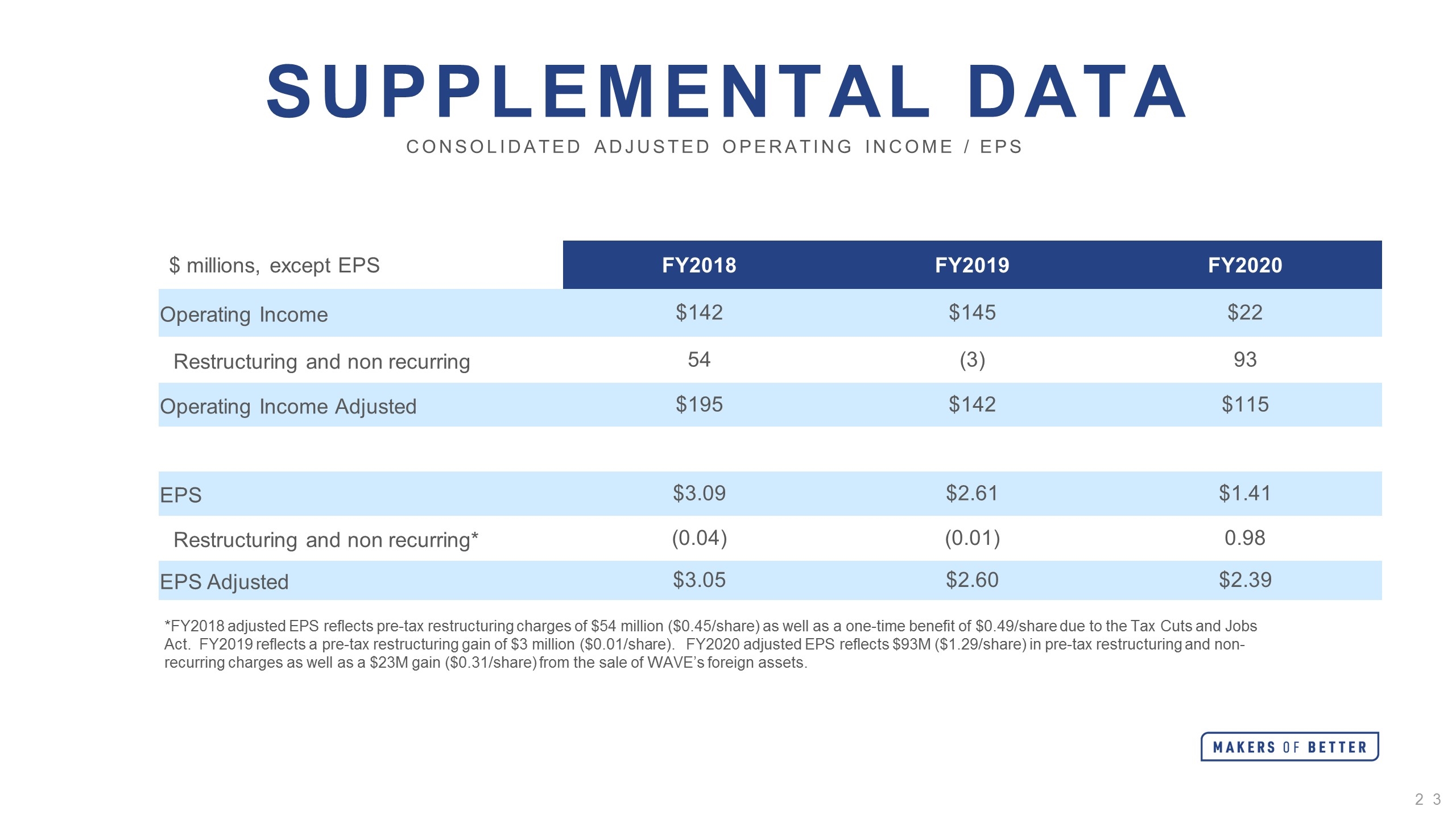

Supplemental Data Consolidated Adjusted Operating Income / EPS *FY2018 adjusted EPS reflects pre-tax restructuring charges of $54 million ($0.45/share) as well as a one-time benefit of $0.49/share due to the Tax Cuts and Jobs Act. FY2019 reflects a pre-tax restructuring gain of $3 million ($0.01/share). FY2020 adjusted EPS reflects $93M ($1.29/share) in pre-tax restructuring and non-recurring charges as well as a $23M gain ($0.31/share) from the sale of WAVE’s foreign assets. $ millions, except EPS FY2018 FY2019 FY2020 Operating Income $142 $145 $22 Restructuring and non recurring 54 (3) 93 Operating Income Adjusted $195 $142 $115 EPS $3.09 $2.61 $1.41 Restructuring and non recurring* (0.04) (0.01) 0.98 EPS Adjusted $3.05 $2.60 $2.39

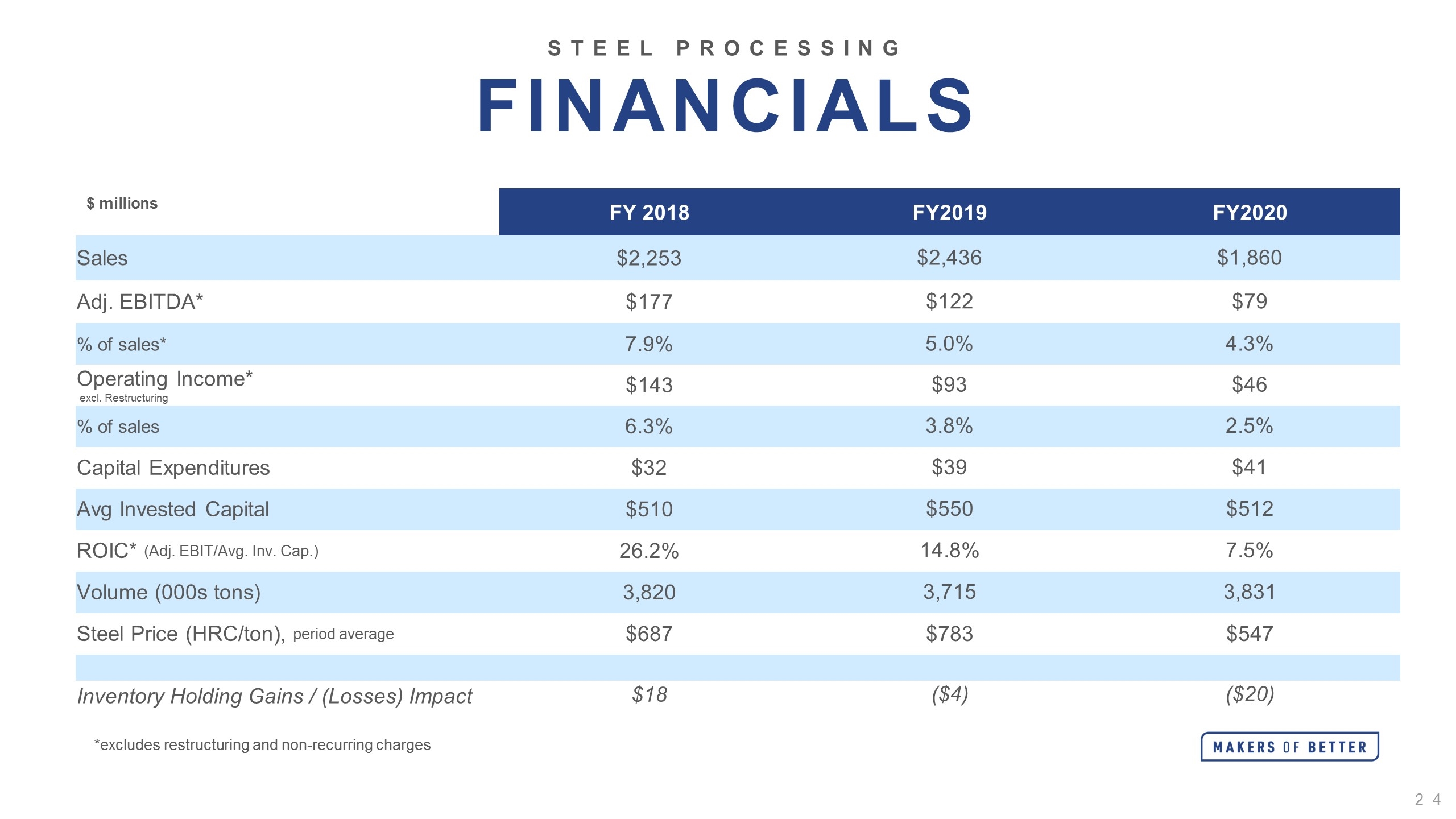

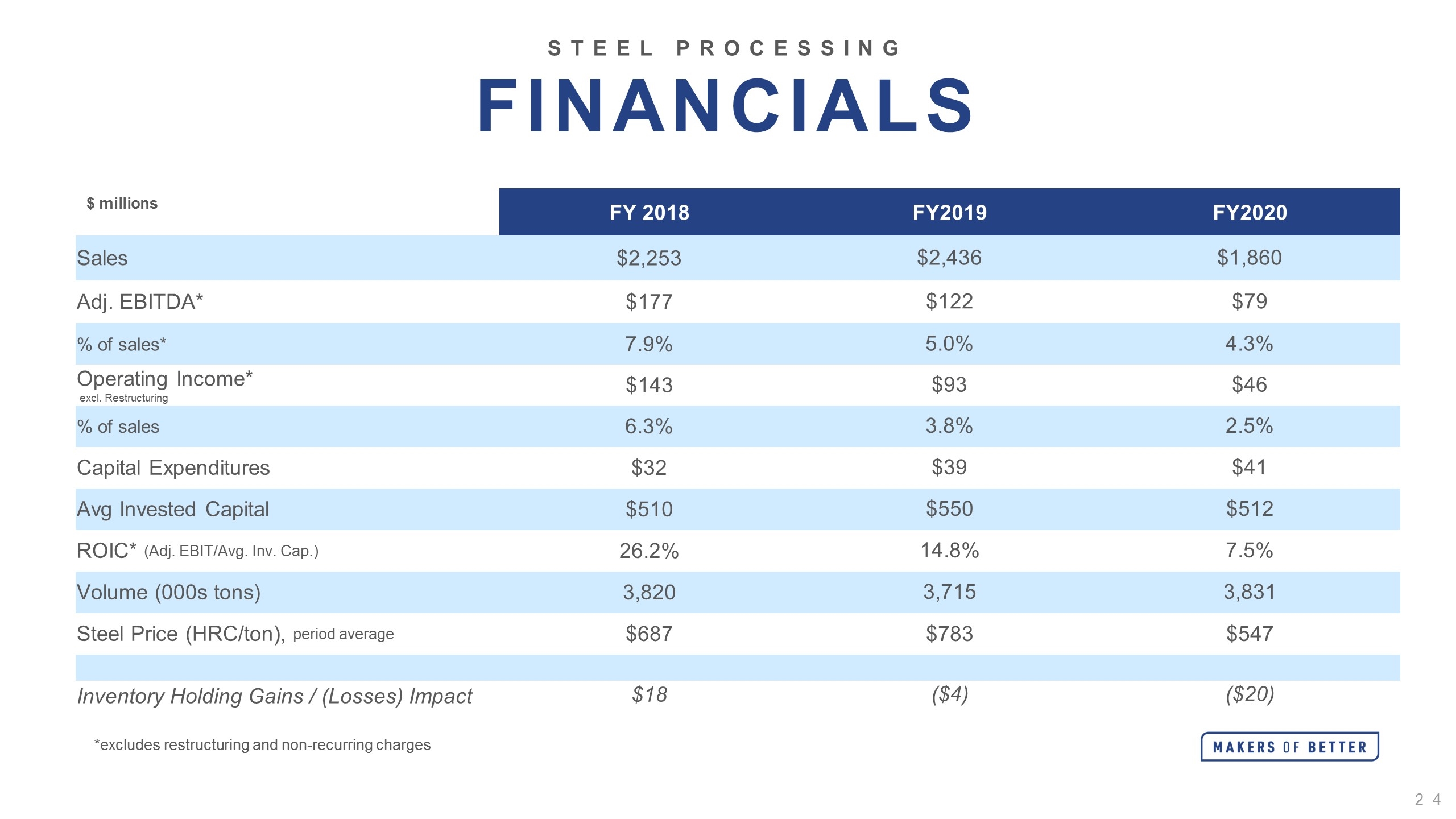

$ millions FY 2018 FY2019 FY2020 Sales $2,253 $2,436 $1,860 Adj. EBITDA* $177 $122 $79 % of sales* 7.9% 5.0% 4.3% Operating Income* excl. Restructuring $143 $93 $46 % of sales 6.3% 3.8% 2.5% Capital Expenditures $32 $39 $41 Avg Invested Capital $510 $550 $512 ROIC* (Adj. EBIT/Avg. Inv. Cap.) 26.2% 14.8% 7.5% Volume (000s tons) 3,820 3,715 3,831 Steel Price (HRC/ton), period average $687 $783 $547 Inventory Holding Gains / (Losses) Impact $18 ($4) ($20) STEEL PROCESSING Financials *excludes restructuring and non-recurring charges

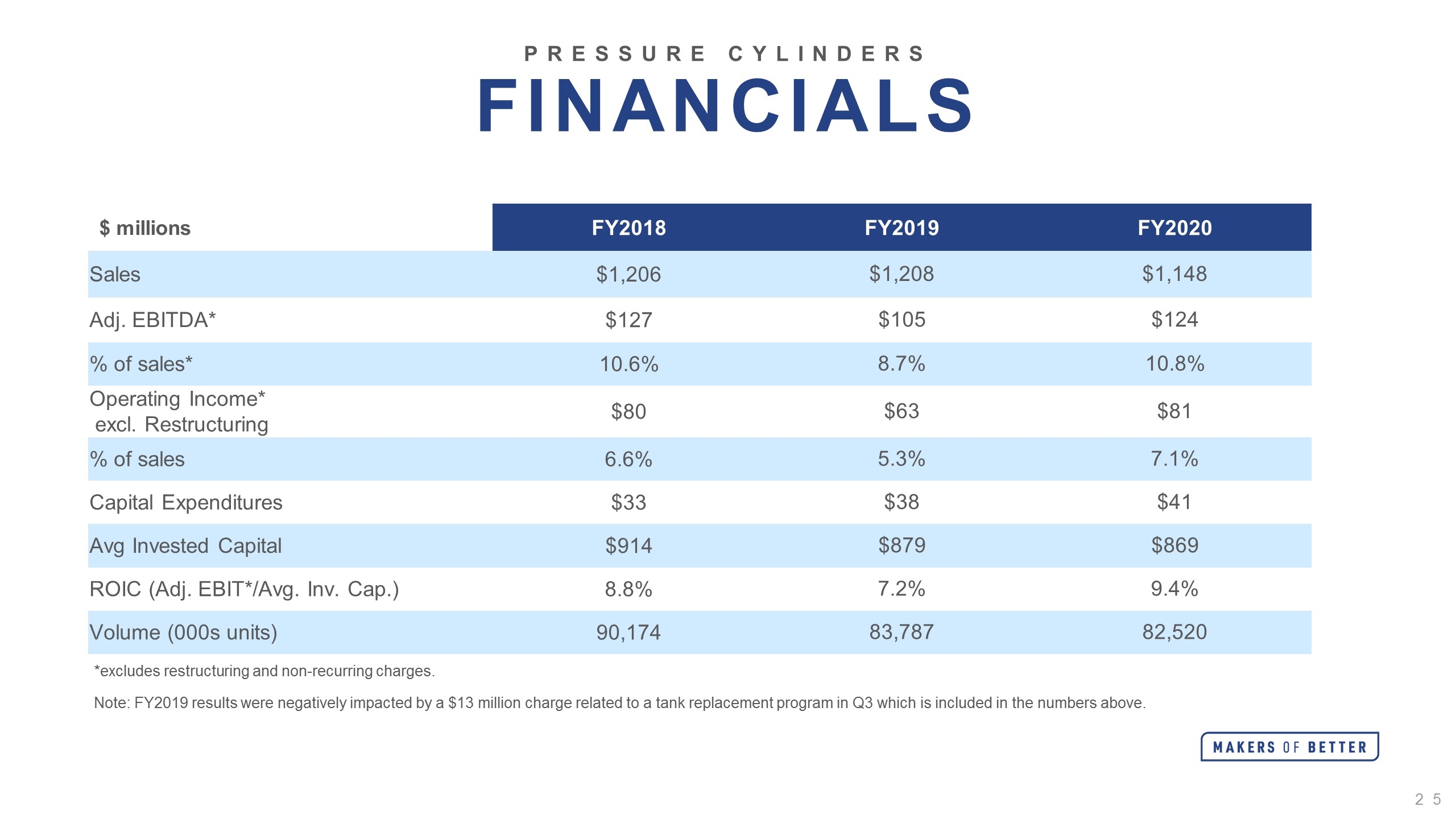

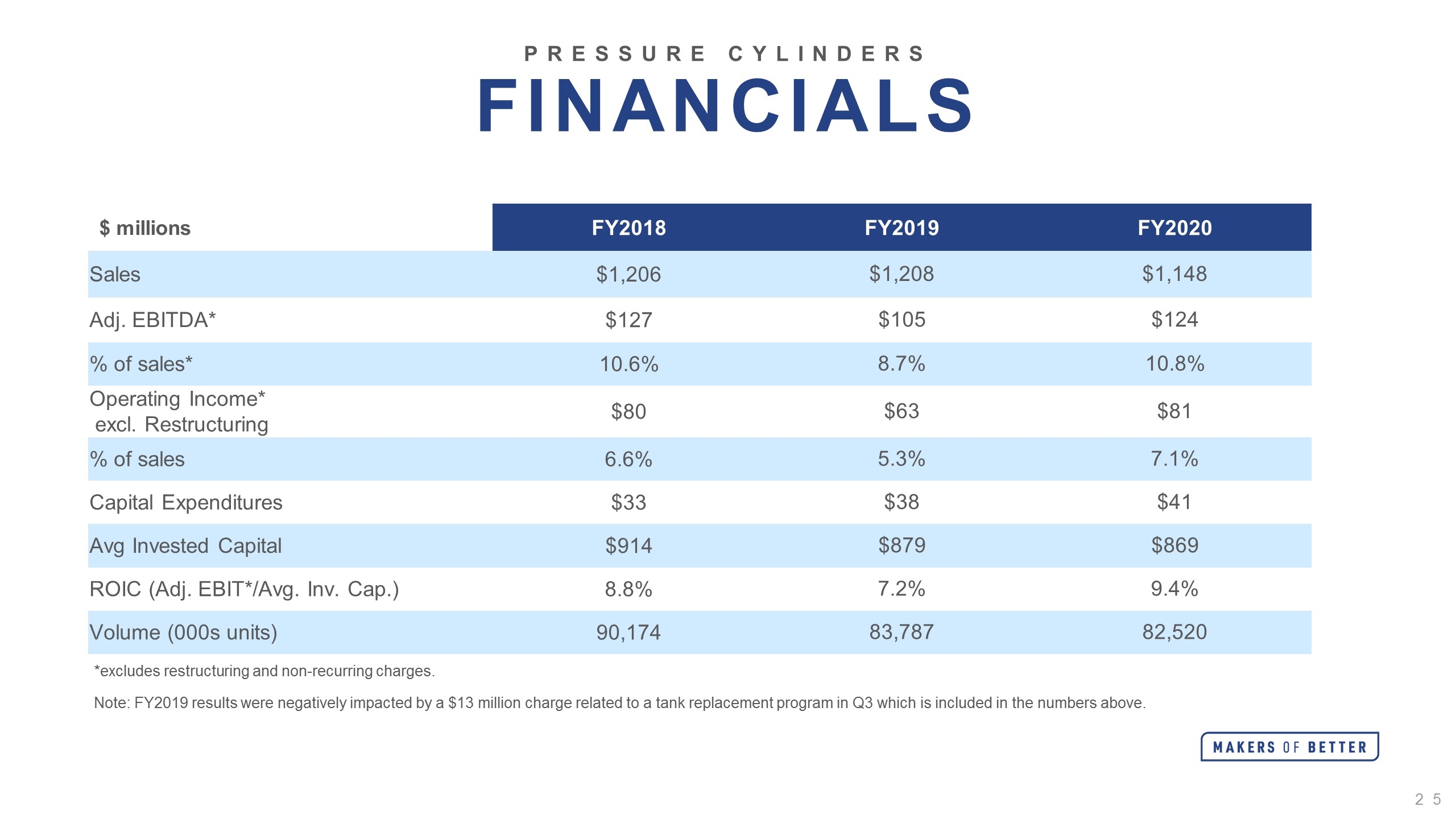

Pressure Cylinders Financials $ millions FY2018 FY2019 FY2020 Sales $1,206 $1,208 $1,148 Adj. EBITDA* $127 $105 $124 % of sales* 10.6% 8.7% 10.8% Operating Income* excl. Restructuring $80 $63 $81 % of sales 6.6% 5.3% 7.1% Capital Expenditures $33 $38 $41 Avg Invested Capital $914 $879 $869 ROIC (Adj. EBIT*/Avg. Inv. Cap.) 8.8% 7.2% 9.4% Volume (000s units) 90,174 83,787 82,520 *excludes restructuring and non-recurring charges. Note: FY2019 results were negatively impacted by a $13 million charge related to a tank replacement program in Q3 which is included in the numbers above.

*Excludes Restructuring and Impairment Charges DIVIDEND to WII (CASH FLOW) EQUITY EARNINGS* Equity Earnings $ MILLIONS WAVE (50%) $82.7 $78.3 $77.5 $82.3 $78.0 ClarkDietrich (25%) $14.6 $17.3 $9.8 $8.6 $17.2 Servicero (50%) $6.3 $7.2 $8.8 $8.1 $1.3 Artiflex (50%) $10.3 $7.0 $4.9 $2.0 $2.7 Other $1.1 $0.2 $2.1 $0.1 ($3.2) Total Equity Earnings $115.0 $110.0 $103.1 $101.1 $96.0 Note: FY19 dividends shown above exclude $60M received from WAVE related to a special dividend and cash proceeds from the sale of international operations. FY20 excludes $10M received from WAVE international proceeds. FY19 Equity Earnings excludes a $4.0M impairment for CR Steel China JV and FY20 excludes a $4.3M impairment for CR Steel China JV and a $23.1M gain for the sale of WAVE’s foreign assets. $ MILLIONS Unconsolidated JVs managed to produce regular cash dividends that closely approximate earnings Meaningful JV Earnings

Safe Harbor Statement Worthington Industries wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act"). Statements by the Company which are not historical information constitute "forward looking statements" within the meaning of the Act. All forward-looking statements are subject to risks and uncertainties which could cause actual results to differ from those projected. Factors that could cause actual results to differ materially include risks, uncertainties and impacts described from time to time in the Company's filings with the Securities and Exchange Commission, including those related to COVID-19 and the various actions taken in connection therewith, which could also heighten other risks. 614.840.4663 Marcus.Rogier@WorthingtonIndustries.com CONTACT