April 16, 2021

VIA EDGAR

Sonny Oh, Esq.

Disclosure Review and Accounting Office

Division of Investment Management

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: Response to SEC Staff Comments on Post-Effective Amendment No. 27 to the

Registration Statement on Form N-4

SEC File Nos. 333-114562 and 811-09327

Allstate Financial Advisors Separate Account I (Registrant)

Allstate Life Insurance Company (Depositor)

Dear Mr. Oh:

On behalf of the above-referenced Registrant, below are responses to Staff comments received orally on Monday, April 12, 2021 on the registration statement noted above, the Putnam Allstate Advisor Apex. Included in this submission are a revised prospectus and Statement of Additional Information which are marked to show the changes described below. Also included is a revised Part C.

The Staff’s comments and our responses are as follows:

1)Comment: Correct name to proper name as used in SEC filings

Response: We have changed “The Putnam Allstate Advisor Apex Variable Annuity” to “Putnam Allstate Advisor Apex”.

2)Comment: Make sure all state variations are disclosed.

Response: Since this contract has not been sold for 18 years, we have deleted the second sentence in the second paragraph on page 1. We confirm that all state variations have been disclosed in Appendix F.

3)Comment: In the key information table, delete the row about Sales Charges Imposed on Purchase Payments and just add a sentence in the Transaction Charges row about the sales charge.

Response: We have deleted the first row and added the following at the end of the Transaction Charges description in the table: “In addition, you may incur sales charges imposed on purchase payments.”

Sonny Oh, Esq.

April 16, 2021

Page 2

4)Comment: Delete “Transfer Fee:” in the beginning of the description of the Transaction Charges in the key information table.

Response: We have made this deletion

5)Comment: Correct cross-references in the fees and expenses section of the key information table.

Response: We have deleted the references in the Charges for Early Withdrawals section for ‘Access to Your Money’ and ‘Income Payments’ and have left in “Expenses” as that section is where the primary disclosures are located with respect to Charges for Early Withdrawals.

6)Comment: Confirm the expenses shown for the Investment Options in the Ongoing Fees and Expenses information in the key information table are gross, before fee waivers.

Response: We have confirmed that the numbers shown are gross before fee waivers.

7)Comment: In the key information table, Ongoing Fees and Expenses section, in the smaller table in the “Optional benefits” row, put ‘for a single optional benefit, if elected’ in parentheses.

Response: We have added the parentheses.

8)Comment: In the Restrictions section of the table, change row heading from “Investment” to “Investments” and delete the 0.50% from the last line in the description.

Response: We have made these two corrections.

9)Comment: In the Optional Benefits section of the table, delete “to receive” from the second line.

Response: We have made this change.

10)Comment: In the Conflicts of Interest section of the table, change the section for “Investment Professional Compensation” to follow the correct language regarding financial incentives.

Response: We have changed the language to conform to what it should be by amending the first sentence and deleting the second sentence and replacing it as follows:

Some investment professionals may receive compensation for selling the Contracts to you in the form of commissions and other non-cash compensation (e.g., marketing allowances). Thus, these investment professionals may have a financial incentive to offer or recommend the Contracts over another investment.

11)Comment: In the Overview of the Contract chart, in the “Purpose” section, add the following disclosure: “The Contract is not intended for people who may need to make early or frequent withdrawals.”

Response: We have added this to the end of the first paragraph in that section.

Sonny Oh, Esq.

April 16, 2021

Page 3

12)Comment: In the expense table, confirm this part of footnote (2): “Currently assessed on Contracts that have total purchase payments of at least $1,000,000.”

Response: We have conferred with the product specifications and confirm that the charge is assessed on contracts of $1,000,000 or greater as stated.

13)Comment: In the introduction paragraph to the Annual Contract Expenses in the Expense Table section, delete “Company” in the second line.

Response: We have made the deletion.

14)Comment: In the Annual Contract Expenses table, in the line “Base Contract Expenses” replace ‘separate account’ with ‘variable account’

Response: We have made this change.

15)Comment: In the Annual Contract Expenses table, confirm there are no administrative fees in the base contract expenses.

Response: We can confirm that there are no administrative fees.

16)Comment: In the introduction paragraph to the Annual Portfolio Company Expenses, reference Appendix A as is required in the form.

Response: What we have as the introduction to the Annual Portfolio Company Expenses is taken from the new Form N-4. Here is what the Form states:

The next item shows the minimum and maximum total operating expenses charged by the Portfolio Companies that you may pay periodically during the time that you own the Contract. [These amounts also include applicable Platform Charges if you choose to invest in certain Portfolio Companies.] A complete list of Portfolio Companies available under the Contract, including their annual expenses, may be found at the back of this document.

This is what we have in the prospectus, except the parenthetical from the form is deleted as it is N/A. This is what we have:

The next item shows the minimum and maximum total operating expenses charged by the Portfolio Companies that you may pay periodically during the time that you own the Contract. A complete list of Portfolio Companies available under the Contract, including their annual expenses, may be found at the back of this document.

I checked and all of our other N-4’s have this same language in there.

17)Comment: in the Example at the end of the Expense Table section, you can combine these three rows into one since they are all the same numbers.

Response: We have combined these into one row and amended the row heading to incorporate all three scenarios.

18)Comment: You may delete the Trial Exam Period section on page 14 since this contract is no longer sold.

Sonny Oh, Esq.

April 16, 2021

Page 4

Response: We have deleted that section.

19)Comment: Confirm hyperlinks are working and they take the reader where they are supposed to go and contain the correct documents / information (ie: see page 17, end of third paragraph of the Investment Alternatives: The Variable Sub-Accounts section.

Response: For the SEC filing, we cannot use an external hyperlink or the filing will be suspended. (When hyperlink is typed out or copy/pasted into browser it will take you to the correct page.) We have confirmed that the hyperlinks are correct and working in the pdf version that will be available online to investors.

20)Comment: Page 23; Expenses section – Explain the Mortality and Expense Risk Charge in relation to the base contract charge and also add in language to explain that the charges described in that section are current charges.

Response: We added the following sentence to that section: The mortality and expense risk charge is included in the base contract expense as shown in the "Expense Table" section. To reflect that the charges shown in the listing in this section are current (versus maximum), we added “current” to the introduction sentence to the list to read: “We deduct a mortality and expense risk charge daily at the following current annual rates (as a percentage of daily net assets):”

21)Comment: Add in sections like the Retirement Income Guarantee Rider Charge for the Earnings Protection Death Benefit Option charges and the Enhanced Beneficiary Protection Option charges.

Response: We have added two sections for these benefit option charges below the Retirement Income Guarantee Rider Charge.

22)Comment: In the “Portfolio Expenses” section, please add the information for the Portfolio annual expenses.

Response: Just before the Appendix A reference in that paragraph, we have added in the following required sentence: “For a summary of Portfolio annual expenses, see the “Expense Table” section of this prospectus.”

23)Comment: In the Benefits Table, remove the “current fee” column

Response: In the new form, for that table (Item 10), instruction 6 states:

6. Current Fee. The Registrant may disclose the current charge in a separate column titled “Current Charge,” if the disclosure of the current charge is no more prominent than, and does not obscure or impede understanding of, the disclosure of the maximum charge.

We believe the table as it is conforms to the form instructions.

24)Comment: In the Benefits Table, make sure the names of the benefits are correctly shown, ie: the DCA should include ‘Basic’.

Sonny Oh, Esq.

April 16, 2021

Page 5

Response: We have corrected the name of the DCA to “Basic Dollar Cost Averaging Fixed Account Options.”

25)Comment: Make sure there are examples for the Basic DCA and the DCA 6 and 12 Month options.

Response: The examples are in Appendix E and we have added a 12 month example and Basic DCA example in addition to the 6 month example that was already shown.

26)Comment: In the Benefits Table, for the DCA, check the bullet points in the restrictions and limitations column and review if they all should be included or removed to the narrative section (if not already in there).

Response: We have added the following information to the narrative for the Basic Dollar Cost Averaging Fixed Account Option in the section “The Investment Alternatives: The Fixed Account Options”:

This Option is only available during Accumulation Phase

This Option is not available in Oregon or Washington

We have added the following information to the narrative for the 6 and 12 Month Dollar Cost Averaging Fixed Account Option in the section “The Investment Alternatives: The Fixed Account Options”:

You may not use Automatic Additions Program to allocate purchase payments to either of these Options.

This Option is not available in Oregon.

We have removed bullet #2 in the benefits table. We have confirmed that the other information in the bullets is now included in the narrative for each of the DCAs.

27)Comment: Benefits Table: Need an example for the Standard Death Benefit

Response: This was already included in Appendix C, but we fixed wording to make this clear. Slight calculation adjustment made in the Appendix C table. The existing example covers the sole moving part of the Standard Death benefit. The Death Benefit is the premium, adjusted for withdrawals, which this example illustrates.

28)Comment: In the Benefits Table: for the Enhanced Beneficiary Protection Option, the description in the table doesn’t really line up with the narrative on page 36. Include the bullet regarding withdrawals into the narrative description. Also need an example.

Response: We have amended the description to clarify this option to:

Provides the option for an increased death benefit equal to the Contract Value, plus interest at an annual rate of 5% per year until a specified time.

We have added the information about withdrawals in the fourth bullet for this option to the narrative for this option. The example calculation is in Appendix C.

29)Comment: The examples in Appendix B for the two Retirement Guarantee Options might need more details in the narrative. Please explain.

Sonny Oh, Esq.

April 16, 2021

Page 6

Response: From Calculation Management: There might be some confusion related to the two sets of RIG benefits (RIG 1 and RIG 2) which appear in this prospectus and in the Allstate Advisor prospectus. The naming convention of the benefits is generic. Therefore, the names are the same, but the benefits are different between the two books. The version for the RIG benefits in this book are much simpler than in the other book. Therefore, the examples are also simpler. We believe there is enough detail and narrative provided in the current examples.

30)Comment: In the “Income Plans” sub-section of the “Income Payments” section, add any transfer limitations after the payout start date.

Response: We have moved the information regarding transfers after the payout start date down one line to its own paragraph and added an italicized caption “Transfers:” All transfer limitations are noted in this section.

31)Comment: In the Income Plan 1 and Income Plan 3 sections, add disclosure as to who is paid after the annuitant dies.

Response: We have added the following to these sections: “If the sole surviving Contract Owner dies prior to the payment of all of the guaranteed income payments, the Primary Beneficiary will receive any guaranteed income payments scheduled to continue.”

32)Comment: Please confirm the accuracy of this statement, which is in the second paragraph after Income Plan 3 [emphasis added]:

For example, if you choose an Income Plan with payments that depend on the life of the Annuitant but with no minimum specified period for guaranteed payments, the income payments generally will be greater than the income payments made under the same Income Plan with a minimum specified period for guaranteed payments.

Response: We have deleted this paragraph and replaced it with an easier-to-understand description of the impact of frequency and duration on income payments. The new paragraph is:

Some of the factors that may affect the amount of the income payments include: your age, your Contract Value, the Income Plan selected (including the frequency and duration of payments under the Income Plan selected), number of guaranteed payments (if any) selected, and whether you select variable or fixed income payments. As a general rule, more frequent income payments will result in smaller individual income payments. Likewise, income payments that are anticipated over a longer period of time will also result in smaller individual income phase payments.

33)Comment: In the second paragraph above the “Variable Income Payments” Section the sentence containing the Performance Income Benefit Option, etc. appears N/A as these benefits do not appear in this product.

Response: We agree and have deleted this sentence as N/A.

34)Comment: In the “More Information” section under “The Variable Account” delete ‘Depositor’.

Sonny Oh, Esq.

April 16, 2021

Page 7

Response: We have deleted this.

35)Comment: Verify that the Tax section been updated

Response: Yes, the Tax section has been updated.

36)Comment: Appendix C: Make a cross-reference to the prospectus and make it clearer what this example is for.

Response: We have added the following to the narrative on page 35: “See Appendix C for an example of the Enhanced Beneficiary Protection withdrawal adjustment.” In Appendix C, we have also added “(see the benefit description in the Death Benefit section)” to point the reader to the narrative.

37)Comment: In the SAI, first page fourth paragraph, this needs to be edited to reflect that there is only one contract class.

Response: We have made this change so that it now reads [emphasis added here only] “…prospectus for the Contract, except as specifically noted.” instead of “…prospectus for each Contract that we offer, except as specifically noted.”

38)Comment: In the SAI, add in the section from the prospectus about the Net Investment Factor above the Calculation of Annuity Unit Values.

Response: We have added in that section.

39)Comment: In the Calculation of Annuity Unit Values, in the last paragraph, “accumulation” should be “annuity”

Response: We have made the change

40)Comment: Financial Statement section: this needs to be updated to reflect what is actually being done with the financials, since a 10-k is no longer filed.

Response: We have updated this section to delete the last paragraph that is N/A now.

41)Comment: Part C: Make sure to include (o) and state “Not applicable”

Response: This correction has been made

42)Comment: Part C: Make sure “filed herewith” documents are hyperlinked

Response: The final 485B filing will include all hyperlinks for those documents.

43)Comment: Part C: May omit Item 32 if this is in the N-CEN report

Sonny Oh, Esq.

April 16, 2021

Page 8

Response: We prefer to keep item 32 as it is.

44)Comment: Part C: Table of Exhibits: don’t include an item in the list if it is not included in the file.

Response: We have reviewed the items and believe all are required per the filing rules.

If you have any questions, please call me at (402) 304-7695.

Very truly yours,

/s/ Jan Fischer-Wade

Jan Fischer-Wade

Senior Counsel

PUTNAM ALLSTATE ADVISOR APEX

An individual and group flexible premium deferred variable annuity contract

Registrant: ALLSTATE FINANCIAL ADVISORS SEPARATE ACCOUNT I

Issued by: Allstate Life Insurance Company (“Allstate Life”)

ALLSTATE FINANCIAL ADVISORS SEPARATE ACCOUNT I

Allstate Life Insurance Company

Street Address: 5801 SW 6th Ave., Topeka, KS 66606-0001

Mailing Address: P.O. Box 758543, Topeka, KS 66675-8566

Telephone Number: 1-800-457-7617

Fax: 1-785-228-4584

Prospectus dated April 30, 2021

Allstate Life Insurance Company (“Allstate Life”) offered the Putnam Allstate Advisor Apex Variable Annuity individual and group flexible premium deferred variable annuity contract (“Contract”).

The Contract is no longer offered for new sales effective November 27, 2003. If you have already purchased a Contract you may continue to make purchase payments according to the Contract.

Additional information about certain investment products, including variable annuities, has been prepared by the Securities and Exchange Commission’s staff and is available at Investor.gov.

IMPORTANT INFORMATION

As of January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the annual and semi-annual shareholder reports for portfolios available under your contract are no longer sent by mail, unless you specifically request paper copies of the reports from us. Instead, the reports are available online at www.AccessAllstate.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by calling 1-800-457-7617.

You may elect to receive all future shareholder reports in paper free of charge by calling 1-800-457-7617. Your election to receive reports in paper will apply to all portfolios available under your contract.

| | | | | |

| IMPORTANT NOTICES | The SEC has not approved or disapproved the securities described in this prospectus, nor has it passed on the accuracy or the adequacy of this prospectus. Anyone who tells you otherwise is committing a federal crime. The Contracts may be distributed through broker-dealers that have relationships with banks or other financial institutions or by employees of such banks. However, the Contracts are not deposits in, or obligations of, or guaranteed or endorsed by, such institutions or any federal regulatory agency. Investment in the Contracts involves investment risks, including possible loss of principal. The Contracts are not FDIC insured. |

| | | | | |

| Page |

| Overview | |

| Glossary of Terms | |

| Important Information You Should Consider About the Contract | |

| Expense Table | |

| Principal Risks of Investing in the Contract | |

| Contract Features | |

| The Contracts | |

| Purchases | |

| Contract Value | |

| Investment Alternatives: The Variable Sub-Accounts | |

| Investment Alternatives: The Fixed Account Options | |

| Investment Alternatives: Transfers | |

| Expenses | |

| Access to Your Money | |

| Benefits Available Under the Contract | |

| Income Payments | |

| Death Benefits | |

| More Information | |

| Allstate Life | |

| Variable Account | |

| The Portfolios | |

| Principal Underwriter | |

| Non-Qualified Annuities | |

| Legal Matters | |

| Taxes | |

| Appendix A – Investment Portfolios Available Under the Contract | A-1 |

| Appendix B - Examples – Retirement Income Guarantees Riders 1 & 2 | B-1 |

| Appendix C – Withdrawal Adjustment Example – Death Benefits | C-1 |

| Appendix D – Calculation of Earnings Protection Death Benefit Option | D-1 |

| Appendix E – Calculation of Contract Features | E-1 |

| Appendix F – State Variation Chart | F-1 |

GLOSSARY

We set forth here definitions of some key terms used throughout this prospectus. In addition to the definitions here, we also define certain terms in the sections of the prospectus that use such terms.

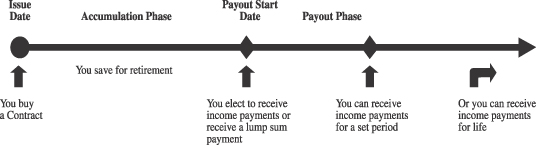

Accumulation Phase: The period that begins on the date we issue your Contract (“Issue Date”) and continues until the Payout Start Date, which is the date we apply your money to provide income payments.

Accumulation Unit: A unit of measurement used to measure the value of your investment in the Variable Sub:Accounts during the Accumulation Phase. To determine the number of Accumulation Units of each Variable Sub-account to allocate to your Contract, we divide (i) the amount of the purchase payment or transfer you have allocated to a Variable Sub-account by (ii) the Accumulation Unit Value of that Variable Sub-account next computed after we receive your payment or transfer.

Accumulation Unit Value: Each Variable Sub-Account has a separate value for its Accumulation Units (this is analogous to, but not the same as, the share price of a mutual fund).

Allstate Life (“we”): The issuer of the Putnam Allstate Advisor Apex Variable Annuity, an individual and group flexible premium deferred variable annuity contract (“Contract”).

Annuitant: The individual whose age determines the latest Payout Start Date and whose life determines the amount and duration of income payments (other than under Income Plan 3). The maximum age of the Annuitant on the date we receive the completed application for each Contract is 90.

Automatic Additions Program: A programs that permits subsequent purchase payments of $50 or more per month by automatically transferring money from your bank account. The Automatic Additions Program is not available for making purchase payments into the Dollar Cost Averaging Fixed Account Option.

Automatic Portfolio Rebalancing Program: A program that provides for the automatic rebalancing of the Contract Value in each Variable Sub-Account and return it to the desired percentage allocations after the performance of each Sub-Account causes a shift in the percentage you allocated to each Sub-Account.

Beneficiary(ies): The person(s) or entity(ies), who will receive the benefits that the Contract provides when the last surviving Contract Owner dies, or, if the Contract Owner is a non-living person, an Annuitant dies. You may name one or more Primary and Contingent Beneficiaries when you apply for a Contract.

1.Primary Beneficiary: the person who may, in accordance with the terms of the Contract, elect to receive the death settlement (“Death Proceeds”) or become the new Contract Owner pursuant to the Contract if the sole surviving Contract Owner dies before the Payout Start Date. If the sole surviving Contract Owner dies after the Payout Start Date, the Beneficiary will receive any guaranteed income payments scheduled to continue.

2.Contingent Beneficiary: the person selected by the Contract Owner who will exercise the rights of the Primary Beneficiary if all named Primary Beneficiaries die before the death of the sole surviving Contract Owner.

Co-Annuitant: An individual who will be considered to be an Annuitant during the Accumulation Phase, except the Co-Annuitant will not be considered an Annuitant for purposes of determining the Payout Start Date. In addition, the “Death of Annuitant” provision of your Contract does not apply upon the death of the Co-Annuitant.

Code: The Internal Revenue Code of 1986, as amended.

Contract: The Putnam Allstate Advisor Apex, an individual and group flexible premium deferred variable annuity contract, is a contract between you, the Contract owner, and Allstate Life, a life insurance company. In certain states the Contract was available only as a group Contract. In these states, we issued you a certificate that represents your ownership and that summarizes the provisions of the group Contract. References to "Contract" in this prospectus include certificates unless the context requires otherwise.

Contract Anniversary: Each twelve-month period from the date of your contract’s issue date.

Contract Owner (“you”): The person(s) having the privileges of ownership defined in the Contract.

Contract Value: During the Accumulation Phase, your contract value is equal to the sum of the value of your Accumulation Units in the Variable Sub-accounts you have selected, plus your value in the Fixed Account Option(s) offered by your Contract.

Contract Year: The annual period of time measured from the date we issue your Contract or a Contract Anniversary.

Dollar Cost Averaging Program: A program that, during the Accumulation Phase, automatically transfers a fixed dollar amount on a regular basis from any Variable Sub-Account or any Fixed Account Option to any of the other Variable Sub-Accounts.

Due Proof of Death: Documentation needed when there is a request for payment of the death benefit. We will accept the following documentation as Due Proof of Death: a certified copy of death certificate, a certified copy of decree of a court of competent jurisdiction as to the finding of death, or any other proof acceptable to us.

Fixed Account Options: Investment Alternatives offered through our general account that credit interest at rates we guarantee. The Fixed Account Options we offer include the Dollar Cost Averaging Fixed Account Option and the Standard Fixed Account Option. We may offer additional Fixed Account Options in the future. Some Options are not available in all states. The guaranteed rate for the Dollar Cost Averaging Fixed Account Option and the Standard Fixed Account Option is 3%.

Good Order: Good Order is the standard that we apply when we determine whether an instruction is satisfactory. An instruction will be considered in Good Order if it is received at our Service Center: (a) in a manner that is satisfactory to us such that it is sufficiently complete and clear that we do not need to exercise any discretion to follow such instruction and complies with all relevant laws and regulations; (b) on specific forms, or by other means we then permit (such as via telephone or electronic submission); and/or (c) with any signatures and dates as we may require. We will notify you if an instruction is not in Good Order.

Income Plan: A series of payments made on a scheduled basis to you or to another person designated by you.

Investment Alternatives: The Fixed Account Options and the Variable Sub-Accounts that invest in the shares of a corresponding Portfolio. Each Portfolio has its own investment objective(s) and policies. For more complete information about each Portfolio, including the investment objective(s), expenses and risks associated with the Portfolio; please refer to the prospectuses for the Portfolios.

Issue Date: The date we issue your Contract.

Payout Phase: The period of time that begins on the Payout Start Date and continues until we make the last payment required by the Income Plan you select.

Payout Start Date: The date we apply your money to provide income payments.

Portfolios: The underlying funds in which a Variable Sub-Accounts invests. Each Portfolio is an investment company registered with the SEC or a separate investment series of a registered investment company.

Qualified Contracts: Contracts held in a plan which provides that the income on tax sheltered is tax deferred, and the income from annuities held by such plans does not receive any additional tax deferral. You should review the annuity features, including all benefits and expenses, prior to purchasing an annuity as a TSA or IRA.

Settlement Value: The amount paid in the event of a full withdrawal of the Contract Value.

Standard Fixed Account Option: An option that allows you to allocate purchase payments or transfer amounts into the Standard Fixed Account Option. Each such allocation establishes a “Guarantee Period Account” within the Standard Fixed Account Option (“Standard Fixed Guarantee Period Account”), which is defined by the date of the allocation and the length of the initial interest rate guarantee period.

Systematic Withdrawal Program: A program that permits you to receive systematic withdrawal payments on a monthly, quarterly, semi-annual, or annual basis at any time prior to the Payout Start Date.

Tax Qualified Contracts: Contracts held in a plan which provides that the income on tax sheltered annuities is tax deferred, and the income from annuities held by such plans does not receive any additional tax deferral. You should review the other annuity features, including all benefits and expenses, prior to purchasing an annuity as a TSA or IRA.

Valuation Date: The term used to indicate a “business day,” which means each day Monday through Friday that the New York Stock Exchange is open for business. Our business day closes when the New York Stock Exchange closes for regular trading, usually 4:00 p.m. Eastern Time (3:00 p.m. Central Time).

Variable Account: An account for which the income, gains, and losses are determined separately from the results of our other operations. The Variable Account consists of multiple Variable Sub- Accounts, each of which is available under the Contract.

Variable Sub-Account: An investment in the shares of a corresponding Portfolio. Each Portfolio has its own investment objective(s) and policies.

Important Information You Should Consider About the Contract

| | | | | | | | | | | | | | | | | |

| Fees and Expenses | Location in Prospectus |

| Charges for Early Withdrawals | If you withdraw money from the Contract within one year following your last purchase payment, you will be assessed a maximum Withdrawal Charge of 0.50% of the purchase payments withdrawn, declining to 0% over one year. For example, if you make an early withdrawal, you could pay a Withdrawal Charge of up to $500 on a $100,000 investment. | Expenses |

| Transaction Charges | In addition to Withdrawal Charges, you may also be charged 0.50% of the amount transferred when you transfer cash value between Investment Alternatives. This fee applies solely to the 13th and subsequent transfers within a Contract Year, excluding transfers due to dollar cost averaging and automatic fund rebalancing. In addition, you may incur sales charges imposed on purchase payments. | Expenses and Investment Alternatives: Transfers |

| Ongoing Fees and Expenses (as Annual Charges) | The following table describe the fees and expenses that you may pay each year, depending on the options you choose. Please refer to your Contract data page for information about the specific fees you will pay each year based on the Contract options you have elected. | Expenses, Income Payments and Death Benefits |

| Annual Fee | Minimum | Maximum |

Base Contract

(as a percentage of portfolio average daily net assets) | 0.80% | 0.80% |

Investment Options (Portfolio fees and expenses) (as a percentage of portfolio average daily net assets) | 0.70% | 1.68% |

Optional benefits (for a single optional benefit, if elected)

(as a percentage of portfolio average daily net assets) | 0.05% | 0.50% |

Because your Contract is customizable, the choices you make affect how much you will pay. To help you understand the cost of owning your Contract, the following table shows the lowest and highest cost you could pay each year, based on current charges. This estimate assumes that you do not take withdrawals from the Contract, which could add Withdrawal Charges that substantially increase costs. |

Lowest Annual Cost: $7,281 | Highest Annual Cost: $9,524 |

Assumes: •Investment of $100,000 •5% annual appreciation •Least expensive combination of Contract classes and Portfolio Company fees and expenses •No optional benefits •No sales charges •No additional purchase payments, transfers or withdrawals | Assumes: •Investment of $100,000 •5% annual appreciation •Most expensive combination of Contract classes, optional benefits and Portfolio Company fees and expenses •No sales charges •No additional purchase payments, transfers or withdrawals |

| | | | | | | | |

| Risks | Location in Prospectus |

| Risk of Loss | You can lose money by investing in the Contract. | Principal Risks |

| Not a Short-Term Investment | This Contract is not a short-term investment and is not appropriate for an investor who needs ready access to cash. Withdrawal charges will reduce the value of your Contract if you withdraw money during the period of time that withdrawal charges are assessed on your Contract. Any withdrawals you make prior to the age of 59 ½ may also be subject to an additional federal 10% tax penalty. | Expenses, Investment Alternatives: Transfers, Taxes |

| Risks Associated with Investment Options | An investment in the Contract is subject to the risk of poor investment performance and can vary depending on the performance of the Investment Alternatives available under the Contract (e.g., the Portfolios). Each investment option, including any investment alternatives, will have its own unique risks. You should review these Investment Alternatives before making an investment decision. | Important Notices, Investment Alternatives: The Variable Sub-Accounts |

| Insurance Company Risks | An investment in the Contract is subject to the risks related to Allstate Life. Any obligations (including under any fixed account Investment Alternatives), guarantees, or benefits are subject to the claims-paying ability of Allstate Life. If Allstate Life experiences financial distress, it may not be able to meet its obligations to you. More information about Allstate Life, including its financial strength ratings, is available upon request by calling 1-800-457-7617. | Investment Alternatives: The Fixed Account Options |

| | | | | | | | |

| Restrictions | Location in Prospectus |

| Investments | •Certain Variable Sub-Accounts may not be available depending on the date you purchased your Contract. In addition, Certain Variable Sub-Accounts are closed to Contract Owners not invested in the specified Variable Sub-Accounts by a designated date. •We reserve the right to remove or substitute Portfolios as Investment Alternatives. •Not all Fixed Account Options may be available in all states or with all Contracts. •There may be limitations on transfers of Contract Value among Variable Sub-Accounts and from the Fixed Account.

We reserve the right to assess a charge on each transfer in excess of 12 per Contract Year. | Expenses, Investment Alternatives |

| Optional Benefits | We may discontinue or modify any of the optional benefits at any time prior to the time you elect it. Withdrawals that exceed limits specified by the terms of an optional benefit may affect the availability of the benefit by reducing the benefit by an amount greater than the value withdrawn, and/or could terminate the benefit. | Income Payments and Death Benefits |

| | | | | | | | |

| Taxes | Location in Prospectus |

| Tax Implications | You should consult with a tax professional to determine the tax implications of an investment in and payments received under the Contract. There is no additional tax benefit to You if the Contract is purchased through a tax-qualified plan or individual retirement account (IRA). Withdrawals will be subject to ordinary income tax and may also be subject to an additional federal 10% tax penalty if taken before age 59½. | Taxes |

| | | | | | | | |

| Conflicts of Interest

| Location in Prospectus |

| Investment Professional Compensation | Some investment professionals may receive compensation for selling the Contracts to you in the form of commissions and other non-cash compensation (e.g., marketing allowances). Thus, these investment professionals may have a financial incentive to offer or recommend the Contracts over another investment. | More Information |

| Exchanges | Some investment professionals may have a financial incentive to offer an investor a new contract in place of the one you already own. You should only exchange your Contract if you determine, after comparing the features, fees, and risks of both contracts, that it is preferable for you to purchase the new contract rather than continue to own your existing Contract. | |

| | | | | |

| Overview of the Contract |

| Purpose | This Contract is a variable annuity contract and is designed to help the investor accumulate assets on a tax-deferred basis through an investment portfolio and to provide or supplement the investor’s retirement income. This Contract is appropriate for an investor who has a higher risk tolerance, an understanding of investments, a long-term investment horizon, and has funds available to invest that are not required to meet current needs. The Contract is not intended for people who may need to make early or frequent withdrawals. The Contract has various optional features and benefits that may be appropriate for you based on your financial objectives and situation. These optional features may impose additional fees, as summarized below in the Expense Table. The Contract also offers certain death benefit features, which can be used to transfer assets to your beneficiaries. |

| Phases of the Contract | Accumulation Phase: This is the period of time that begins on the date we issue your Contract (“Issue Date”) and continues until the Payout Start Date, which is the date we apply your money to provide income payments. During the Accumulation Phase, you may allocate your purchase payments to any combination of the Investment Alternatives. If you invest in the Fixed Account Options, you will earn a fixed rate of interest that we declare periodically. If you invest in any of the Variable Sub-Accounts, your investment return will vary up or down depending on the performance of the corresponding Portfolios.

Additional information about each Portfolio is provided in Appendix A to this prospectus.

Payout Phase: You receive income payments during what we call the “Payout Phase” of the Contract, which begins on the Payout Start Date and continues until we make the last payment required by the Income Plan you select. During the Payout Phase, if you select a fixed income payment option, we guarantee the amount of your payments, which will remain fixed. If you select a variable income payment option, based on one or more of the Variable Sub- Accounts, the amount of your payments will vary up or down depending on the performance of the corresponding Portfolios.

Generally, you may not make withdrawals after the Payout Start Date. One exception to this rule applies if you are receiving variable income payments that do not depend on the life of the Annuitant. In that case you may terminate all or part of the Variable Account portion of the income payments at any time and receive a lump sum equal to the present value of the remaining variable payments associated with the amount withdrawn.

After the Payout Start Date, death benefits and any living benefits will terminate.

|

| | | | | |

| Contract Features |

| Death Benefit | At no additional charge, if the Contract Owner or Annuitant die before the Payout Start Date, we will pay a standard death benefit subject to certain conditions.

For an added charge, you can also select an additional death benefit option, which may increase the amount of money payable to your designated beneficiaries upon your death. These benefits are more fully described in the “Death Benefits” section of this prospectus. |

| Accessing Your Money | You may withdraw some or all of your Contract Value at any time during the Accumulation Phase. In general, you must withdraw at least $50 at a time or the total amount in the investment alternative, if less. Withdrawals taken prior to annuitization (referred to in this prospectus as the Payout Phase) are generally considered to come from the earnings in the Contract first. If the Contract is tax-qualified, generally all withdrawals are treated as distributions of earnings. Withdrawals of earnings are taxed as ordinary income and, if taken prior to age 59 1/2, may be subject to a 10% additional tax penalty. A withdrawal charge also may apply.

If the amount you withdraw reduces your Contract Value to less than $1,000, we may treat it as a request to withdraw your entire Contract Value. Your Contract will terminate if you withdraw all of your Contract Value. |

| Optional Withdrawal Benefits | We offer optional benefits riders that, for an additional charge, offer protection against market risk (the risk that your investments may decline in value or underperform your expectations) and guarantee a minimum lifetime income. The optional benefits are the Retirement Income Guarantee Rider 1 and Retirement Income Guarantee Rider 2. |

| Dollar Cost Averaging | Through our Dollar Cost Averaging Program, at no additional charge, you may automatically transfer a set amount every month (or other intervals we may offer) during the Accumulation Phase from any Variable Sub-Account or the Dollar Cost Averaging Fixed Account Option(s) to any Variable Sub-Account. |

| Portfolio Rebalancing | If you select our Automatic Portfolio Rebalancing Program, we will automatically rebalance the Contract Value in each Variable Sub-Account and return it to the desired percentage allocations on a quarterly basis at no additional charge. We will not include money you allocate to the Fixed Account Options in the Automatic Portfolio Rebalancing Program. |

| Systematic Withdrawal Program | This program allows you to receive regular automatic withdrawals from your Contract on a monthly basis at any time prior to the Payout Start Date. |

Expense Table

The following tables describe the fees and expenses that you will pay when buying, owning, and surrendering or making withdrawals from your variable annuity contract. Please refer to your Contract data page for information about the specific fees you will pay each year based on the options you have elected.

The first table describes the fees and expenses that you will pay at the time you buy the Contract, surrender or make withdrawals from the Contract, or transfer Contract value between Investment Alternatives. State premium taxes may also be deducted.

Transaction Expenses

| | | | | |

| Maximum: |

Sales Charges Imposed on Purchase Payments:(1) | 5.75% |

| (as a percentage of purchase payments) |

| |

Withdrawal Charge:(2) | 0.50% |

| (as a percentage of purchase payments withdrawn) |

| |

Transfer Fee(3) | 0.50% |

| (as a percentage of the amount transferred) |

| | | | | | | | | | | |

| (1) | If the Purchase Payment Amount is: | Charge: | |

| Less than $50,000 | 5.75% | |

| At least $50,000 but less than $100,000 | 4.50% | |

| At least $100,000 but less than $250,000 | 3.50% | |

| At least $250,000 but less than $500,000 | 2.50% | |

| At least $500,000 but less than $1,000,000 | 2.00% | |

| At least $1,000,000 | 0.50% | |

| (2) | Currently assessed on Contracts that have total purchase payments of at least $1,000,000. The Withdrawal Charge declines to 0% after one year following your last purchase payment. |

| (3) | There is no charge for the first 12 transfers within a Contract Year, excluding transfers due to dollar cost averaging and automatic portfolio rebalancing. |

The next table describes the fees and expenses that you will pay each year during the time that you own the Contract (not including Portfolio fees and expenses). If you choose to purchase an optional benefit, you will pay additional charges, as shown below.

Annual Contract Expenses

| | | | | | | | |

| Annual Fee | Maximum | Current |

Base Contract Expenses (as a percentage of variable account assets) | 0.80% | 0.80% |

| Optional benefits available for an additional charge: |

Enhanced Beneficiary Protection Option (as a percentage of separate account assets) | 0.25% | 0.15% |

Earnings Protection Death Benefit Option (issue age 0-65) (as a percentage of separate account assets) | 0.30% | 0.20% |

Earnings Protection Death Benefit Option (issue age 66-75) (as a percentage of separate account assets) | 0.50% | 0.35% |

Retirement Income Guarantee Option 1* (as a percentage of Income Base) | 0.15% | 0.05% |

Retirement Income Guarantee Option 2* (as a percentage of Income Base) | 0.50% | 0.30% |

| * We discontinued offering the Retirement Income Guarantee Options as of January 1, 2004 (up to May 1, 2004 in certain states). Fees shown apply to Contract Owners who selected an Option prior to January 1, 2004 (up to May 1, 2004 in certain states). Only one RIG Benefit is allowed on a contract at any time. |

The next item shows the minimum and maximum total operating expenses charged by the Portfolio Companies that you may pay periodically during the time that you own the Contract. A complete list of Portfolio Companies available under the Contract, including their annual expenses, may be found at the back of this document.

Annual Portfolio Company Expenses

| | | | | | | | |

| Minimum | Maximum |

Total Annual Portfolio Operating Expenses (1) (expenses that are deducted from Portfolio assets, which may include management fees, distribution and/or services (12b-1) fees, and other expenses) | 0.70% | 1.68% |

(1) Expenses are shown as a percentage of portfolio average daily net assets (before any waiver or reimbursement) as of December 31, 2020.

EXAMPLE

This example is intended to help you compare the cost of investing in the Contracts with the cost of investing in other variable annuity contracts. These costs include Contract owner transaction expenses, Contract fees, Variable Account annual expenses, and Portfolio fees and expenses.

The Example assumes that you invest $100,000 in the Contract for the time periods indicated. The Example also assumes that your investment has a 5% return each year and assumes the most expensive combination of Annual Portfolio Company Expenses and optional benefits available for an additional charge. These optional benefits include the Retirement Income Guarantee Option 2 and the Earnings Protection Death Benefit Option for a person age 66 or more. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assuming Maximum Total Annual Portfolio Expenses | Assuming Minimum Total Annual Portfolio Expenses |

| 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs |

| If you surrender or annuitize your annuity at the end of the applicable time period, or if you do not surrender your annuity at the end of the applicable time period: | $9,524 | $17,015 | $24,749 | $45,202 | $8,555 | $14,217 | $20,178 | $36,500 |

Principal Risks of Investing in the Contract

Risk of Loss

You can lose money by investing in the Contract.

Not a Short-Term Investment

This Contract is not a short-term investment and is not appropriate for an investor who needs ready access to cash. Withdrawal charges will reduce the value of your Contract if you withdraw money during the period of time that withdrawal charges are assessed on your Contract. Any withdrawals you make prior to the age of 59 ½ may also be subject to a 10% additional tax penalty.

Risks Associated with Investment Alternatives

An investment in the Contract is subject to the risk of poor investment performance and can vary depending on the performance of the Investment Alternatives available under the Contract (e.g., the Portfolios). Each investment option, including any fixed account investment option, will have its own unique risks. You should review these Investment Alternatives before making an investment decision.

Insurance Company Risks

An investment in the Contract is subject to the risks related to Allstate Life. Any obligations (including under any fixed account Investment Alternatives), guarantees, or benefits are subject to the claims-paying ability of Allstate Life. If Allstate Life experiences financial distress, it may not be able to meet its obligations to you. More information about Allstate Life, including its financial strength ratings, is available upon request by calling 1-800-457-7617.

Investment Risk

Amounts you allocate to Variable Sub-Accounts may grow in value, decline in value, or grow less than you expect, depending on the investment performance of the Portfolios in which those Variable Sub-Accounts invest. You bear the investment risk that the Portfolios might not meet their investment objectives. Shares of the Portfolios are not deposits, or obligations of, or guaranteed or endorsed by any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency. In other words, you could lose your investment.

Access to Cash Value

You can withdraw some or all of your Contract Value at any time during the Accumulation Phase, but you may be subject to a withdrawal charge and other fees and taxes. Withdrawals also are available under limited circumstances on or after the Payout Start Date. You can withdraw money from the Variable Account and/ or the Fixed Account Options. The amount payable upon withdrawal is the Contract Value (or portion thereof) less any withdrawal charges, contract maintenance charges, income tax withholding, and any premium taxes. In general, you must withdraw at least $50 at a time.

Tax Consequences

If you make a partial withdrawal under a Non-Qualified Contract, the amount you receive will be taxed as ordinary income, rather than as return of cost basis, until all gain has been withdrawn. If you make a full withdrawal under a Non-Qualified Contract, the amount received will be taxable only to the extent it exceeds your cost basis in the Contract. Any withdrawals you make prior to the age of 59 ½ may also be subject to an additional 10% tax penalty.

The Contracts

CONTRACT OWNER

Each Contract is an agreement between you, the Contract Owner, and Allstate Life, a life insurance company. As the Contract Owner, you may exercise all of the rights and privileges provided to you by the Contract. That means it is up to you to select or change (to the extent permitted):

• the investment alternatives during the Accumulation and Payout Phases,

• the amount and timing of your purchase payments and withdrawals,

• the programs you want to use to invest or withdraw money,

• the income payment plan(s) you want to use to receive retirement income,

• the Annuitant (either yourself or someone else) on whose life the income payments will be based,

• the Beneficiary or Beneficiaries who will receive the benefits that the Contract provides when the last surviving Contract Owner or the Annuitant dies, and

• any other rights that the Contract provides, including restricting income payments to Beneficiaries.

If you die, any surviving joint Contract Owner or, if none, the Beneficiary may exercise the rights and privileges provided to them by the Contract. If the sole surviving Contract Owner dies after the Payout Start Date, the Primary Beneficiary will receive any guaranteed income payments scheduled to continue.

If the Annuitant dies prior to the Payout Start Date and the Contract Owner is a grantor trust not established by a business, the new Contract Owner will be the Beneficiary(ies).

The Contract cannot be jointly owned by both a non-living person and a living person unless the Contract Owner(s) assumed ownership of the Contract as a Beneficiary(ies). The maximum age of any Contract Owner on the date we receive the completed application for each Contract is 90.

If you select the Enhanced Beneficiary Protection Option, Earnings Protection Death Benefit Option or a Retirement Income Guarantee Rider, the maximum age of any Contract Owner on the date we receive the completed application or request to add the Option, whichever is later ("Rider Application Date") is currently 75.

The Contract can also be purchased as an IRA or TSA (also known as a 403(b)). The endorsements required to qualify these annuities under the Code may limit or modify your rights and privileges under the Contract. We use the term “Qualified Contract” to refer to a Contract issued as an IRA, 403(b), or with a Qualified Plan.

Except for certain retirement plans, you may change the Contract Owner at any time by written notice in a form satisfactory to us. Until we receive your written notice to change the Contract Owner, we are entitled to rely on the most recent information in our files. We will provide a change of ownership form to be signed by you and filed with us. Once we accept the change, the change will take effect as of the date you signed the request. We will not be liable for any payment or settlement made prior to accepting the change. Accordingly, if you wish to change the Contract Owner, you should deliver your written notice to us promptly. Each change is subject to any payment we make or other action we take before we accept it. Changing ownership of this Contract may cause adverse tax consequences and may not be allowed under Qualified Contracts. Please consult with a competent tax advisor prior to making a request for a change of Contract Owner.

ANNUITANT

The Annuitant is the individual whose age determines the latest Payout Start Date and whose life determines the amount and duration of income payments (other than under Income Plan 3). You may not change the Annuitant at any time. You may designate a joint Annuitant, who is a second person on whose life income payments depend, at the time you select an Income Plan. Additional restrictions may apply in the case of Qualified Plans. The maximum age of the Annuitant on the date we receive the completed application for each Contract is age 90.

If you select the Enhanced Beneficiary Protection Option, Earnings Protection Death Benefit Option or a Retirement Income Guarantee Rider, the maximum age of any Annuitant on the Rider Application Date is 75.

If you select an Income Plan that depends on the Annuitant or a joint Annuitant’s life, we may require proof of age and sex before income payments begin and proof that the Annuitant or joint Annuitant is still alive before we make each payment.

BENEFICIARY

You may name one or more Primary and Contingent Beneficiaries when you apply for a Contract. The Primary Beneficiary is the person who may, in accordance with the terms of the Contract, elect to receive the death settlement (“Death Proceeds”) or become the new Contract Owner pursuant to the Contract if the sole surviving Contract Owner dies before the Payout Start Date. A Contingent

Beneficiary is the person selected by the Contract Owner who will exercise the rights of the Primary Beneficiary if all named Primary Beneficiaries die before the death of the sole surviving Contract Owner.

You may change or add Beneficiaries at any time, unless you have designated an irrevocable Beneficiary. We will provide a change of Beneficiary form to be signed by you and filed with us. After we accept the form, the change of Beneficiary will be effective as of the date you signed the form. Until we accept your written notice to change a Beneficiary, we are entitled to rely on the most recent Beneficiary information in our files. We will not be liable for any payment or settlement made prior to accepting the change. Accordingly, if you wish to change your Beneficiary, you should deliver your written notice to us promptly. Each Beneficiary change is subject to any payment made by us or any other action we take before we accept the change.

You may restrict income payments to Beneficiaries by providing us with a written request. Once we accept the written request, the restriction will take effect as of the date you signed the request. Any restriction is subject to any payment made by us or any other action we take before we accept the request.

If you did not name a Beneficiary or, unless otherwise provided in the Beneficiary designation, if a named Beneficiary is no longer living and there are no other surviving Primary or Contingent Beneficiaries when the sole surviving Contract Owner dies, the new Beneficiary will be:

• your spouse or, if he or she is no longer alive,

• your surviving children equally, or if you have no surviving children,

• your estate.

If more than one Beneficiary survives you (or the Annuitant, if the Contract Owner is a grantor trust), we will divide the Death Proceeds among the surviving Beneficiaries according to your most recent written instructions. If you have not given us written instructions in a form satisfactory to us, we will pay the Death Proceeds in equal amounts to the surviving Beneficiaries. If there is more than one Beneficiary in a class (e.g., more than one Primary Beneficiary) and one of the Beneficiaries predeceases the Contract Owner (the Annuitant if the Contract Owner is a grantor trust), the remaining Beneficiaries in that class will divide the deceased Beneficiary’s share in proportion to the original share of the remaining Beneficiaries.

For purposes of this Contract, in determining whether a living person, including a Contract Owner, Primary Beneficiary, Contingent Beneficiary, or Annuitant (“Living Person A”) has survived another living person, including a Contract Owner, Primary Beneficiary, Contingent Beneficiary, or Annuitant (“Living Person B”), Living Person A must survive Living Person B by at least 24 hours. Otherwise, Living Person A will be conclusively deemed to have predeceased Living Person B.

Where there are multiple Beneficiaries, we will only value the Death Proceeds at the time the first Beneficiary submits the necessary documentation in good order. Any Death Proceeds amounts attributable to any Beneficiary which remain in the Variable Sub-Accounts are subject to investment risk. If there is more than one Beneficiary taking shares of the Death Proceeds, each Beneficiary will be treated as a separate and independent owner of his or her respective share of the Death Proceeds. Each Beneficiary will exercise all rights related to his or her share of the Death Proceeds, including the sole right to select a death settlement option, subject to any restrictions previously placed upon the Beneficiary. Each Beneficiary may designate a Beneficiary(ies) for his or her respective share, but that designated Beneficiary(ies) will be restricted to the death settlement option chosen by the original Beneficiary.

If there is more than one Beneficiary and one of the Beneficiaries is a corporation, trust or other non-living person, all Beneficiaries will be considered to be non-living persons.

MODIFICATION OF THE CONTRACT

Only an Allstate Life officer may approve a change in or waive any provision of the Contract. Any change or waiver must be in writing. None of our agents has the authority to change or waive the provisions of the Contract. We may not change the terms of the Contract without your consent, except to conform the Contract to applicable law or changes in the law. If a provision of the Contract is inconsistent with state law, we will follow state law.

ASSIGNMENT

You may not assign an interest in this Contract as collateral or security for a loan. However, you may assign periodic income payments under this Contract prior to the Payout Start Date. No Beneficiary may assign benefits under the Contract until they are due. We will not be bound by any assignment until the assignor signs it and files it with us. We are not responsible for the validity of any assignment. Federal law prohibits or restricts the assignment of benefits under many types of retirement plans and the terms of such plans may themselves contain restrictions on assignments. An assignment may also result in taxes or assessment of the 10% additional tax penalty. You should consult with an attorney before trying to assign periodic income payments under your Contract.

Purchases

MINIMUM PURCHASE PAYMENTS

The minimum initial purchase payment for Non- Qualified Contracts is $10,000, ($2,000 for Contracts issued with an IRA or TSA). All subsequent purchase payments under the Contract must be $500 or more ($50 for automatic payments). You may make purchase payments at any time prior to the Payout Start Date. We may limit the amount of any additional purchase payment to a maximum of $1,000,000. We reserve the right to accept a lesser initial purchase payment amount or lesser subsequent purchase payment amounts. We reserve the right to limit the availability of the investment alternatives for additional investments. We also reserve the right to reject any application. We may apply certain limitations, restrictions, and/or underwriting standards as a condition of acceptance of purchase payments.

AUTOMATIC ADDITIONS PROGRAM

You may make subsequent purchase payments of $50 or more per month by automatically transferring money from your bank account. Please consult with your sales representative for detailed information. The Automatic Additions Program is not available for making purchase payments into the Dollar Cost Averaging Fixed Account Option.

See Appendix E for numerical examples that illustrate how the Automatic Additions Program works.

ALLOCATION OF PURCHASE PAYMENTS

At the time you apply for a Contract, you must decide how to allocate your purchase payment among the investment alternatives. The allocation you specify on your application will be effective immediately. All allocations must be in whole percentages that total 100% or in whole dollars. You can change your allocations by calling us at 1-800-457-7617.

We will allocate your purchase payments to the investment alternatives according to your most recent instructions on file with us. Unless you notify us otherwise, we will allocate subsequent purchase payments according to the allocation for the previous purchase payment. We will effect any change in allocation instructions at the time we receive written notice of the change in good order.

We will credit the initial purchase payment that accompanies your completed application to your Contract within two business days after we receive the payment at our home office. If your application is incomplete, we will ask you to complete your application within five business days. If you do so, we will credit your initial purchase payment to your Contract within that five business day period. If you do not, we will return your purchase payment at the end of the five business day period unless you expressly allow us to hold it until you complete the application. We will credit subsequent purchase payments to the Contract at the close of the business day on which we receive the purchase payment at our service center in Good Order.

We use the term “business day” to refer to each day Monday through Friday that the New York Stock Exchange is open for business. We also refer to these days as “Valuation Dates.” Our business day closes when the New York Stock Exchange closes for regular trading, usually 4:00 p.m. Eastern Time (3:00 p.m. Central Time). If we receive your purchase payment after 3:00 p.m. Central Time on any Valuation Date, we will credit your purchase payment using the Accumulation Unit Values computed on the next Valuation Date.

There may be circumstances where the New York Stock Exchange is open, however, due to inclement weather, natural disaster or other circumstances beyond our control, our offices may be closed or our business processing capabilities may be restricted. Under those circumstances, your Contract Value may fluctuate based on changes in the Accumulation Unit Values, but you may not be able to transfer Contract Value, or make a purchase or redemption request.

With respect to any purchase payment that is pending investment in our Variable Account, we may hold the amount temporarily in a suspense account and may earn interest on amounts held in that suspense account. You will not be credited with any interest on amounts held in that suspense account.

Contract Value

On the Issue Date, the Contract Value is equal to your initial purchase payment. Thereafter, your Contract Value at any time during the Accumulation Phase is equal to the sum of the value of your Accumulation Units in the Variable Sub-Accounts you have selected, plus your value in the Fixed Account Option(s) offered by your Contract.

ACCUMULATION UNITS

To determine the number of Accumulation Units of each Variable Sub-Account to allocate to your Contract, we divide (i) the amount of the purchase payment or transfer you have allocated to a Variable Sub-Account by (ii) the Accumulation Unit Value of that Variable Sub-Account next computed after we receive your payment or transfer. For example, if we receive a $10,000 purchase payment allocated to a Variable Sub-Account when the Accumulation Unit Value for the Sub-Account is $10, we would credit 1,000 Accumulation Units of that Variable Sub-Account to your Contract. Withdrawals and transfers from a Variable Sub-Account would, of course, reduce the number of Accumulation Units of that Sub-Account allocated to your Contract.

ACCUMULATION UNIT VALUE

As a general matter, the Accumulation Unit Value for each Variable Sub-Account for each Contract will rise or fall to reflect:

1.changes in the share price of the Portfolio in which the Variable Sub-Account invests, and

2.the deduction of amounts reflecting the mortality and expense risk charge.

We determine any applicable withdrawal charges, Rider Fees (if applicable), transfer fees, and contract maintenance charges separately for each Contract. They do not affect the Accumulation Unit Value. Instead, we obtain payment of those charges and fees by redeeming Accumulation Units.

We determine a separate Accumulation Unit Value for each Variable Sub-Account for each Contract on each Valuation Date. We also determine a separate set of Accumulation Unit Values that reflect the cost of each optional benefit, or available combination thereof, offered under the Contract.

CALCULATION OF ACCUMULATION UNIT VALUES

The value of Accumulation Units will change each Valuation Period according to the investment performance of the Portfolio shares purchased by each Variable Sub-Account and the deduction of certain expenses and charges. A "Valuation Period" is the period from the end of one Valuation Date and continues to the end of the next Valuation Date. A Valuation Date ends at the close of regular trading on the New York Stock Exchange (currently 3:00 p.m. Central Time).

The Accumulation Unit Value of a Variable Sub-Account for any Valuation Period equals the Accumulation Unit Value as of the immediately preceding Valuation Period, multiplied by the Net Investment Factor (described below) for that Sub-Account for the current Valuation Period.

NET INVESTMENT FACTOR

The Net Investment Factor for a Valuation Period is a number representing the change, since the last Valuation Period, in the value of Variable Sub-Account assets per Accumulation Unit due to investment income, realized or unrealized capital gain or loss, deductions for taxes, if any, and deductions for the mortality and expense risk charge and administrative expense charge. We determine the Net Investment Factor for each Variable Sub-Account for any Valuation Period by dividing (A) by (B) and subtracting (C) from the result, where:

(A) is the sum of:

(1) the net asset value per share of the Portfolio underlying the Variable Sub-Account determined at the end of the current Valuation Period; plus,

(2) the per share amount of any dividend or capital gain distributions made by the Portfolio underlying the Variable Sub-Account during the current Valuation Period;

(B) is the net asset value per share of the Portfolio underlying the Variable Sub-Account determined as of the end of the immediately preceding Valuation Period; and

(C) is the mortality and expense risk charge corresponding to the portion of the 365 day year (366 days for a leap year) that is in the current Valuation Period.

You should refer to the prospectuses for the Portfolios for a description of how the assets of each Portfolio are valued, since that determination directly bears on the Accumulation Unit Value of the corresponding Variable Sub-Account and, therefore, your Contract Value.

Investment Alternatives: The Variable Sub-Accounts

You may allocate your purchase payments to various Variable Sub-Accounts. Each Variable Sub-Account invests in the shares of a corresponding Portfolio. Each Portfolio has its own investment objective(s) and policies. Information regarding each Portfolio Company, including its name, its type (e.g., money market fund, bond fund, balanced fund, etc.) or a brief statement concerning its investment objectives, its investment adviser and any sub-investment adviser, current expenses, and performance is available in Appendix A.

Each Portfolio Company has issued a prospectus that contains more detailed information about the Portfolio Company. For more complete information about each Portfolio, including the investment objective(s), expenses and risks associated with the Portfolio, please refer to the prospectus for the Portfolios. The Variable Sub-Accounts that you select are your choice - we do not provide investment advice, nor do we recommend any particular Variable Sub-Account. Please consult with a qualified investment professional if you wish to obtain investment advice. You should carefully consider the investment objectives, risks, charges and expenses of the underlying Portfolios when making an allocation to the Variable Sub-Accounts. To obtain any or all of the underlying Portfolio prospectuses, please contact us at 1-800-457-7617 or visit us online at www.annuityregulatorydocuments.com.

Dividends and Capital Gain Distributions. We automatically reinvest all dividends and capital gains distributions from the Portfolios in shares of the distributing Portfolio at their net asset value.

Following the detection of excessive short-term trading activity and in response to requests from the fund investment advisors, Allstate currently limits new premium allocations and transfers into all Sub-Accounts other than the Money Market Sub-Account to a maximum of $50,000 per day. If we receive a transfer request that exceeds the limitation, we will be unable to process the request and will promptly contact you and request that you submit a transfer request that complies with the Sub-Account limitation. If you wish to transfer more than $50,000 into a Sub-Account, you may submit a single request that Allstate transfer $50,000 per day into that Sub-Account until the total desired amount has been transferred.

For example, if you wish to transfer $500,000 into a Sub-Account, you may submit a single request that Allstate transfer $50,000 per day for 10 business days until the full $500,000 has been transferred.

If, as of the effective date of the Sub-Account restriction, you were enrolled in one of our special services automatic transaction programs, such as automatic additions, portfolio rebalancing or dollar cost averaging, we will continue to effect automatic transactions to the Sub-Accounts without regard to the $50,000 limitation. Shares may be redeemed at any time.

Amounts you allocate to Variable Sub-Accounts may grow in value, decline in value, or grow less than you expect, depending on the investment performance of the Portfolios in which those Variable Sub-Accounts invest. You bear the investment risk that the Portfolios might not meet their investment objectives. Shares of the Portfolios are not deposits, or obligations of, or guaranteed or endorsed by any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency.

Investment Alternatives: The Fixed Account Options

You may allocate all or a portion of your purchase payments to the Fixed Account Options. We currently offer the basic Dollar Cost Averaging Fixed Account Option, and we may offer the additional Dollar Cost Averaging Fixed Account Options described below. However, the 6 and 12-month Dollar Cost Averaging Options currently are not available.

Please consult with your financial advisor for current information. The Fixed Account supports our insurance and annuity obligations, which includes death benefits and other benefits under the Contracts. The Fixed Account consists of our general assets other than those in segregated asset accounts. The Fixed Account is part of the Company's general account. Insurance and annuity obligations and the guaranteed benefits under the Contracts are supported by the Company's general account and are subject to the Company's claims paying ability. Therefore, contract owners should look to the financial strength of the company for its claims paying ability.

We have sole discretion to invest the assets of the Fixed Account, subject to applicable law. Any money you allocate to a Fixed Account Option does not entitle you to share in the investment experience of the Fixed Account.

DOLLAR COST AVERAGING FIXED ACCOUNT OPTIONS

Basic Dollar Cost Averaging Fixed Account Option. You may establish a Dollar Cost Averaging Program, as described in the “Transfers” section of this prospectus, by allocating purchase payments to the Basic Dollar Cost Averaging Fixed Account Option. This Option is only available during the Accumulation Phase. Purchase payments that you allocate to the Basic Dollar Cost Averaging Fixed Account Option will earn interest for a 1-year period at the current rate in effect at the time of allocation. We will credit interest daily at a rate that will compound over the year to the annual interest rate we guaranteed at the time of allocation. Rates may be different than those available for the Guarantee Periods described below. After the one-year period, we will declare a renewal rate which we guarantee for a full year. Subsequent renewal dates will be every twelve months for each purchase payment. Renewal rates will not be less than the minimum guaranteed rate found in the Contract, which is 3%.

You may not transfer funds from other investment alternatives to the Basic Dollar Cost Averaging Option. This Option is not available in Oregon or Washington.

6 and 12 Month Dollar Cost Averaging Fixed Account Options. In the future, we may offer 6 and 12-month Dollar Cost Averaging Fixed Account Options. Under these options, you may establish a Dollar Cost Averaging Program by allocating purchase payments to the Fixed Account either for 6 months (the “6 Month Dollar Cost Averaging Fixed Account Option”) or for 12 months (the “12 Month Dollar Cost Averaging Fixed Account Option”). You may not use the Automatic Additions Program to allocate purchase payments to either of these Options. Your purchase payments will earn interest for the period you select at the current rates in effect at the time of allocation. Rates may differ from those available for the Guarantee Periods described below. However, the crediting rates for the 6 and 12 Month Dollar Cost Averaging Fixed Account Options will never be less than 3% annually.

You must transfer all of your money out of the 6 or 12 Month Dollar Cost Averaging Fixed Account Options to the Variable Sub-Accounts in equal monthly installments. If you discontinue a 6 or 12 Month Dollar Cost Averaging Fixed Account Option prior to last scheduled transfer, we will transfer any remaining money immediately to the Money Market Variable Sub-Account, unless you request a different Variable Sub-Account.

You may not transfer funds from other investment alternatives to the 6 or 12 Month Dollar Cost Averaging Fixed Account Options. Transfers out of the Dollar Cost Averaging Fixed Account Options do not count towards the 12 transfers you can make without paying a transfer fee. We may declare more than one interest rate for different monies based upon the date of allocation to the Dollar Cost Averaging Fixed Account Options. For availability and current interest rate information, please contact your sales representative or our customer support unit at 1-800-457-7617.

See Appendix E for numerical examples that illustrate how the Dollar Cost Averaging Programs work. This Option is not available in Oregon.

GUARANTEE PERIODS

You may allocate purchase payments or transfers to one or more Guarantee Periods of the Fixed Account (“Guarantee Periods”). Each payment or transfer allocated to a Guarantee Period earns interest at a specified rate that we guarantee for a period of years. We will offer a 1-year Guarantee Period. We offer additional Guarantee Periods at our sole discretion. We currently offer a 1 year and a 6-year Guarantee Period.