|

| OMB APPROVAL |

| OMB Number: | 3235-0059 |

| Expires: | August 31, 2004 |

Estimated average burden

hours per response | 14.73 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No.__ )

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| x | Preliminary Proxy Statement | | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | |

| o | Definitive Proxy Statement | | |

| o | Definitive Additional Materials | | |

| o | Soliciting Material Pursuant to §240.14a-12 | | |

Internet Capital Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| | |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies:

|

(3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | Proposed maximum aggregate value of transaction:

| |

| | (5) | Total fee paid:

| |

| o | Fee paid previously with preliminary materials. | |

| | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | |

| | (1) | Amount Previously Paid:

| |

| (2) | Form, Schedule or Registration Statement No.:

|

| (3) | Filing Party:

|

| (4) | Date Filed:

|

690 LEE ROAD, SUITE 310

WAYNE, PENNSYLVANIA 19087

PHONE: (610) 727-6900

FAX: (610) 727-6901

INTERNET CAPITAL GROUP, INC.

Notice of Annual Meeting of Stockholders

Dear Internet Capital Group Stockholder:

You are invited to attend the Internet Capital Group, Inc. 2004 Annual Meeting of Stockholders.

| | |

| Date: | | April 23, 2004 |

| Time: | | 10:00 a.m. |

| Place: | | The Desmond Great Valley Hotel and Conference Center One Liberty Boulevard Malvern, Pennsylvania 19355 |

Only stockholders who owned stock at the close of business on February 23, 2004 can vote at this meeting or any adjournments that may take place.

The purposes of the Annual Meeting are:

| | (1) | to elect two Class II directors, each for a term of three years and until their respective successors have been elected and qualified; |

| | (2) | to ratify the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004; |

| | (3) | to approve the grant of discretionary authority to the Company’s Board of Directors to amend the Company’s restated certificate of incorporation to effect a reverse stock split of the Company’s issued and outstanding stock; and |

| | (4) | to transact any other business that may properly come before the meeting. |

For those of you who are unable to attend the meeting in person, we invite you to listen over the internet through the Company’s website at http://www.internetcapital.com/investors/.

We consider your vote important and encourage you to vote as soon as possible.

By Order of the Board of Directors,

| | | | |

| /s/ Suzanne L. Niemeyer | | | | |

| | | | |

Suzanne L. Niemeyer Secretary | | | | March [24], 2004 |

PROXY STATEMENT

This proxy statement and the accompanying proxy card are being mailed on or about March [24], 2004, to owners of shares of Internet Capital Group, Inc. (the “Company”) Common Stock in connection with the solicitation of proxies by the Board of Directors for the 2004 Annual Meeting of Stockholders. This proxy procedure is necessary to permit all holders of Common Stock, many of whom live throughout the United States of America and in foreign countries and are unable to attend the Annual Meeting, to vote. The Board of Directors encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

CONTENTS

Internet Capital Group, Inc.

690 Lee Road, Suite 310

Wayne, Pennsylvania 19087

Phone: (610) 727-6900

Fax: (610) 727-6901

www.internetcapital.com

VOTING PROCEDURES

Your vote is very important. Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to ensure that your shares will be represented. Most stockholders have a choice of voting by means of the internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you. Please be aware that if you vote over the internet, you may incur costs such as telephone and internet access charges for which you will be responsible. Also note that proxies submitted by telephone or the internet must be received by 11:59, EDT, on April 22, 2004.

You may revoke this proxy at any time before it is voted by written notice to the Secretary of the Company, by submission of a proxy bearing a later date or by casting a ballot at the Annual Meeting. Properly executed and delivered proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided or, if no directions are provided, your shares will be voted by one of the individuals named on your proxy card as recommended by the Board of Directors. If you wish to give a proxy to someone other than those named on the proxy card, you should cross out those names and insert the name(s) of the person(s) not more than three, to whom you wish to give your proxy.

If you want to vote in person at the meeting and you hold shares of Company common stock in street name, you must obtain a proxy card from your broker and bring that proxy card to the meeting, together with a copy of a brokerage statement reflecting your stock ownership as of the record date.

Who can vote? Stockholders as of the close of business on February 23, 2004 are entitled to vote. On that day, about 732,115,093 shares of Common Stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the Annual Meeting. A list of stockholders eligible to vote will be available at the offices of Dechert LLP, 4000 Bell Atlantic Tower, 1717 Arch Street, Philadelphia, Pennsylvania 19103 beginning April 13, 2004. Stockholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the board recommend I vote? The board recommends a vote FOR each board nominee, FOR ratification of the appointment of KPMG LLP as the Company’s independent auditors and FOR approval of the grant of discretionary authority to the Board of Directors to amend the Company’s restated certificate of incorporation to effect a reverse stock split of the Company’s issued and outstanding common stock.

What shares are included in the proxy card? Each proxy card you receive represents all the shares of Common Stock registered to you in that particular account. You may receive more than one proxy card if you hold shares that are either registered differently or in more than one account. Each share of Common Stock that you own entitles you to one vote.

How do I vote by proxy? Most stockholders have three ways to vote by proxy: by telephone, via the internet or by returning the proxy card. To vote by telephone or via the internet, follow the instructions set forth on each proxy card you receive. To vote by mail, sign and date each proxy card you receive, mark the boxes indicating how you wish to vote, and return the proxy card in the postage-paid envelope provided. Do not return the proxy card if you vote via the internet or by telephone.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of Common Stock entitled to vote, is represented. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners by the tenth day before the Annual Meeting, the nominees may vote those shares only on matters deemed routine by Nasdaq. The three proposals described in this proxy statement are deemed routine matters. On non-routine matters, nominees cannot vote and there is a so-called “broker non-vote” on that matter. Because directors are elected by a plurality of the votes cast, abstentions will have no effect on the election of directors. Because Item 2 must be approved by a majority of the votes cast, abstentions will have the

- 2 -

same effect as a vote against this proposal. Because Item 3 must be approved by two-thirds of the Company’s outstanding shares of common stock, abstentions will have the same effect as a vote against this proposal.

Who will count the vote? The Company’s Transfer Agent and Registrar, Mellon Investor Services LLC, will tally the vote.

Who is soliciting this proxy? Solicitation of proxies is made on behalf of the Board of Directors of the Company. The Company will pay the cost of preparing, assembling and mailing the notice of Annual Meeting, proxy statement and proxy card. The Company has also hired D. F. King & Co., Inc., a proxy solicitation firm, for a fee of $5,000 plus expenses. In addition to the use of mail, proxies may be solicited by directors, officers and regular employees of the Company, without additional compensation, in person or by telephone or other electronic means. The Company will reimburse brokerage houses and other nominees for their expenses in forwarding proxy material to beneficial owners of the Company’s stock.

What if I can’t attend the meeting? If you are unable to attend the meeting in person, the Company invites you to listen to the meeting over the internet through the Company’s website at http://www.internetcapital.com/investors/. Please go to the Company’s website approximately fifteen minutes early to register and download any necessary audio software. If you do not attend the meeting in person and you intend to vote, you must vote your shares by proxy, via the internet or by telephone by the applicable deadline.

CORPORATE GOVERNANCE

In accordance with the Delaware General Corporation Law and the Company’s restated certificate of incorporation, as amended, and amended and restated by-laws, the Company’s business, property and affairs are managed under the direction of the Board of Directors. Although directors are not involved in the day-to-day operating details, they are kept informed of the Company’s business through written reports and documents provided to them regularly, as well as by operating, financial and other reports presented by the officers of the Company at meetings of the Board of Directors and committees of the Board of Directors.

Independence. The Board has made the determination that a majority of the Company’s directors are independent as defined in the applicable Nasdaq rules. The following directors were determined to be independent: David J. Berkman, David K. Downes, Thomas P. Gerrity, Philip J. Ringo and Michael D. Zisman.

Meetings of the Board of Directors. The Board of Directors held twelve meetings in 2003. Each of the incumbent directors other than Warren V. Musser attended at least 75% of the Board of Directors meetings and committee meetings to which the director was assigned. From time to time, the Board meets in executive session without members of management present. If you would like to communicate with the Company’s directors, please send a letter to the following address: Internet Capital Group, Inc., Attention: Board of Directors c/o General Counsel, 690 Lee Road, Suite 310, Wayne, PA 19087. The Company’s General Counsel will review each such communication and forward a copy to each member of the Board of Directors. The Company does not have a policy with regard to Board members’ attendance at annual meetings. At the time of the 2003 annual meeting of stockholders the Company had seven directors, three of whom attended such meeting.

Code of Conduct. The Board is committed to ethical business practices. The Company adopted a corporate code of conduct in 2000 and amended and restated this code in 2004. This code of conduct applies to all of the Company’s employees and directors and includes the code of ethics for the Company’s principal executive officer, principal financial officer, principal accounting officer or controller within the meaning of the SEC regulations adopted under the Sarbanes-Oxley Act of 2002. The Company’s corporate code of conduct is posted under the Investor Relations section of its website at www.internetcapital.com. Please note that none of the information on the Company’s website is incorporated by reference in this proxy statement.

Committees of the Board of Directors. The Board of Directors currently has three standing committees. Additionally, during 2003 an Acquisitions Committee

- 3 -

of the Board existed but was inactive. The Acquisitions Committee was dissolved in February 2004.

Audit Committee — The Audit Committee monitors the Company’s compliance with appropriate legal and regulatory standards and requirements. The Audit Committee annually selects independent auditors, reviews the performance of the independent auditors and the terms of their engagement and exercises oversight of their activities. It serves as an independent and objective party to monitor the Company’s financial reporting process and internal control systems, along with reviewing and appraising the audit efforts of the Company’s independent auditors. It also provides an open avenue of communication among the independent auditors, financial and senior management and the Board. A detailed list of the Audit Committee’s functions is included in its charter, which was recently amended and restated and is attached to this proxy statement as Appendix A. The Audit Committee held eight meetings during 2003. The current members of the Audit Committee are Messrs. Berkman, Downes, Ringo and Zisman. The Audit Committee consists entirely of directors who the Board has determined in its business judgment are independent as defined in the applicable Nasdaq rules and the rules under the Securities and Exchange Act of 1934 as in effect on the date this proxy statement is first being mailed to stockholders (the “Exchange Act”). In addition, the Board has determined that David K. Downes is an audit committee financial expert as defined by the rules under the Exchange Act.

Compensation Committee — The Compensation Committee annually reviews the total compensation package of each executive officer and approves the general compensation policy and practice for all other employees. The Compensation Committee reviews and approves, or recommends that the Board approve, the total compensation package for all executive officers, including the grant of stock options and other long-term incentives under the Company’s equity compensation plans. The Committee also evaluates the performance of the Chief Executive Officer against pre-established criteria and it reviews with the Chief Executive Officer the performance of the executive officers who report to the Chief Executive Officer. The Compensation Committee held five meetings during 2003. The current members of the Compensation Committee are Messrs. Gerrity, Keith and Ringo.

Nominating and Governance Committee — In February 2004, the Board created the Nominating and Governance Committee. The primary function of the Nominating and Governance Committee is to focus on issues surrounding the composition and operation of the Board. The Committee identifies and recommends candidates to serve on the Board and takes steps to ensure that the structure and practices of the Board provide for sound corporate governance. The Nominating and Governance Committee consists entirely of directors who the Board has determined in its business judgment are independent as defined in the applicable Nasdaq rules. The current members of the Nominating and Governance Committee are Messrs. Berkman, Gerrity and Zisman. The Nominating and Governance Committee operates pursuant to a charter that was adopted by the Board in February 2004. A copy of this charter is available in the Investor Relations section of the Company’s website at www.internetcapital.com. The Nominating and Governance Committee identifies individuals, including those recommended by stockholders, believed to be qualified as candidates for Board membership. The Nominating and Governance Committee has not established a set of specific criteria for directors but, in identifying candidates, the Nominating and Governance Committee takes into account all factors it considers appropriate, which may include ensuring that a majority of directors satisfy the independence requirements of Nasdaq, the Securities and Exchange Commission (the “SEC”) or other appropriate governing body and that the Board as a whole is comprised of directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. The Nominating and Governance Committee considers stockholder nominees for director in the same manner as nominees for director from other sources. Stockholder suggestions for nominees for director should be submitted to the Company’s Corporate Secretary no later than the date by which stockholder proposals for action must be submitted and should include the following information: (a) the recommending stockholder’s name, address, telephone number and the number of shares of the Company’s stock held by such individual or entity and (b) the recommended candidate’s biographical data, statement of qualification and written consent to nomination and to serving as a director, if elected. The Nominating and Governance Committee has the authority to retain search firms to assist it in identifying candidates to serve as directors. In 2003, prior to the establishment of the Nominating and Governance Committee, the

- 4 -

Company retained a search firm in connection with a director search and paid $32,500 for such services.

Director Compensation. Directors who are also employees of the Company do not receive compensation for their services as directors. All other directors receive cash compensation in the amount of $30,000 per year, paid in quarterly installments of $7,500. Non-employee directors also receive $1,000 for each Board or committee meeting held at the Company’s offices or at an offsite venue that they attend and $500 per telephonic Board or committee meeting that they attend. Non-employee directors who serve as committee chairs also receive $6,000 annually in respect of each committee that they chair.

Non-employee directors are awarded an initial stock option grant of 300,000 shares that vest over four years. Thereafter, on-going non-employee directors are annually awarded a stock option grant of 100,000 shares that vest on the one-year anniversary of the grant date. Non-employee directors who serve as committee chairs of standing committees are annually awarded a stock option grant of 12,000 shares for each committee that they chair, with such options vesting on the one-year anniversary of the grant date, subject to continuous service as chairman. Non-employee directors who serve on standing committees in a capacity other than chairman are annually awarded a stock option grant of 6,000 shares in respect of each committee that they serve on in such capacity, with such options vesting on the one-year anniversary of the grant date, subject to continuous service on such committee. The term of all such options is eight years and such options have an exercise price equal to the market value of the Common Stock on the date of grant.

In 2003 the Compensation Committee granted stock options to new non-employee directors as follows: David K. Downes, 306,000 options priced at $0.42 on October 10, 2003 and Philip J. Ringo, 300,000 options priced at $0.42 on January 6, 2003, 6,000 options priced at $0.37 on February 14, 2003 and 6,000 options priced at $0.32 on April 3, 2003. Additionally, a one-time award of 40,000 shares to each non-employee director was approved in 2002 and granted in January 2003. Annual option grants to non-employee directors with respect to 2003 Board and committee service were made on December 10, 2002 in accordance with the foregoing policy. Annual grants of 100,000 options to non-employee directors in respect of Board service during 2004 were made on February 13, 2004 and annual option grants to non-employee directors in respect of committee service during 2004 are expected to be made in March or April of 2004.

SUBMISSION OF STOCKHOLDER PROPOSALS AND

DIRECTOR NOMINATIONS

Under the rules of the SEC, stockholders wishing to have a proposal included in the Company’s proxy statement for the 2005 Annual Meeting of Stockholders must submit the proposal so that the Secretary of the Company receives it no later than November 24, 2004. The SEC rules set forth standards as to what stockholder proposals are required to be included in a proxy statement. Under the Company’s by-laws, certain procedures must be followed for a stockholder to nominate persons as directors or to introduce a proposal at an annual meeting. A stockholder wishing to make a nomination for election to the Board of Directors or to have a proposal presented at an annual meeting must submit written notice of such nomination or proposal so that the Secretary of the Company receives it not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting; provided; however, that in the event that the date of the meeting is advanced by more than 20 days from such anniversary date or delayed by more than 70 days from such anniversary date, notice by the stockholder must be received no later than the close of business on the 10th day following the date on which public announcement of the date of such meeting was made. The Company’s by-laws set forth certain informational requirements for stockholders’ nominations of directors and proposals.

- 5 -

ELECTION OF DIRECTORS

ITEM 1 ON PROXY CARD

The Company’s by-laws provide that the Company’s business shall be managed by a Board of Directors of not less than five and not more than nine directors, with the number of directors to be fixed by the Board of Directors from time to time. The Company’s by-laws also divide the Company’s Board of Directors into three classes: Class I, Class II and Class III, each class being as nearly equal in number as possible. The directors in each class serve terms of three years and until their respective successors have been elected and have qualified. There are currently three Class I directors, two Class II directors and three Class III directors.

The term of office of one class of directors expires each year in rotation so that one class is elected at each annual meeting of stockholders for a three-year term. The term of the two Class II directors, Thomas P. Gerrity and Robert E. Keith, Jr., will expire at the Annual Meeting. The other six directors will remain in office for the remainder of their respective terms, as indicated below.

The Nominating and Governance Committee identifies and recommends candidates to serve on the Board. Director candidates are nominated by the Board of Directors. Stockholders are also entitled to nominate director candidates for the Board of Directors in accordance with the procedures set forth in the Company’s by-laws.

At the Annual Meeting, two Class II directors are to be elected. All of the director nominees are currently directors of the Company. All nominees have consented to being named as nominees for directors of the Company and have agreed to serve if elected. The directors will be elected to serve for three-year terms and until their successors have been elected and have qualified. If some or all of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for any remaining nominee and any substitute nominee(s) designated by the Board of Directors. Director elections are determined by a plurality of the votes cast.

Set forth below is information regarding each nominee for Class II director and each Class I and Class III director, each of whose term will continue after the Annual Meeting.

Nominees For Class II Directors

Dr. Thomas P. Gerrity. Dr. Gerrity has served as a director since December 1998. Dr. Gerrity also served as the Dean of The Wharton School of the University of Pennsylvania from July 1990 to June 1999. He is currently Professor of Management at The Wharton School. Dr. Gerrity also serves as a director of CVS Corporation, Fannie Mae, Hercules, Inc., Knight-Ridder, Inc. and Sunoco, Inc. Age: 62.

Robert E. Keith, Jr. Mr. Keith has served as a director of the Company since its inception in March 1996 and was Chairman of the Board of Directors from inception until December 2001. Mr. Keith is also a Managing Director of TL Ventures, a $1.4 billion group of venture capital funds focused on technology services, software communications and life sciences. In addition to his work with individual companies, Mr. Keith is Chief Executive Officer of Technology Leaders Management Inc., which is responsible for the management of the funds. He is also a senior advisor to, and co-founder of, EnerTech Capital, a $290 million specialty firm focused on early to expansion-stage venture investments in principally U.S.-based software, technology and services businesses that serve the energy and communications industries. Prior to his affiliation with TL Ventures in 1989, Mr. Keith held executive positions with Fidelity Bank in Philadelphia for over 20 years, most recently as Vice Chairman. At Fidelity, he headed the Corporate Banking Department, which included specialized and commercial lending groups and several non-banking subsidiaries. Mr. Keith serves on the Boards of Directors of a number of the TL portfolio companies. In addition he is Chairman of Safeguard Scientifics, Inc., Vice Chairman and a member of the Board and Executive Committee of Ben Franklin Technology Partners, and is a board member and Chairman of the Investment Committee of TRF Urban Growth Partners L.P. Age: 62.

- 6 -

The Board of Directors recommends a vote FOR all of the listed nominees.

Incumbent Class III Directors – to Continue in Office for Terms Expiring in 2005

Walter W. Buckley, III. Mr. Buckley is a co-founder and has been a director of the Company since March 1996 and is currently the Chairman of the Board, Chief Executive Officer and President of the Company. Mr. Buckley has served as Chairman since December 2001, as Chief Executive Officer since March 1996, and as President from March 1996 to December 2001 and reassumed the title of President in December 2002. Prior to co-founding the Company, Mr. Buckley worked for Safeguard Scientifics, Inc. as Vice President of Acquisitions from 1991 to February 1996. Mr. Buckley directed many of Safeguard Scientifics’ investments and was responsible for developing and executing Safeguard Scientifics’ multimedia and internet investment strategies. Mr. Buckley serves as a director of CommerceQuest, Inc., eCredit.com, Inc., ICG Commerce Holdings, Inc., Marketron International, Inc. and Verticalnet, Inc. Age: 43.

Philip J. Ringo. Mr. Ringo has served as a director of the Company since January 2003. Mr. Ringo is currently the Chairman and Chief Executive Officer of RubberNetwork.com LLC, the first and largest tire and rubber industry strategic sourcing consortium. From 1999 to 2001, Mr. Ringo was the President, Chief Operating Officer and a director of ChemConnect, a leading internet marketplace serving the global chemicals and plastics industry. Mr. Ringo also serves as a director of Australian Railroad Group Pty. Ltd., one of Australia’s largest private rail operators, Genesee & Wyoming Inc., a world-class provider of rail freight transportation and its supporting services, and Trimac Corporation, North America’s premier provider of services in highway transportation of bulk commodities through Trimac Transportation Services. Age: 62.

Dr. Michael D. Zisman. Dr. Zisman has served as a director of the Company since June 2001. Dr. Zisman is a Vice President in the Corporate Strategy Group of IBM Corporation. During 2001 and 2002, Dr. Zisman worked in the IBM Storage Systems Group. In 2002, he was General Manager of Storage Software, a new “start-up” within IBM. From 1997 through 2000, he led IBM’s entry into the knowledge management market and distributed learning market. In 1995 and 1996, Dr. Zisman was CEO of Lotus Development Corporation. Prior to becoming CEO of Lotus, he was Senior Vice President of the Lotus Communications Products Group. Dr. Zisman has served on the IBM Worldwide Management Council and the IBM Corporate Technology Council. Dr. Zisman joined Lotus in 1994 after the acquisition by Lotus of Soft-Switch, Inc., a software firm that he founded in 1979 and headed until its acquisition by Lotus. Soft-Switch was the leading supplier of software and systems products to interconnect the wide range of electronic mail systems that were popular in the 1980s. Prior to founding Soft-Switch, he was a member of the faculty at the Sloan School of Management at MIT. Dr. Zisman serves as a trustee of the University of Pennsylvania and Lehigh University and an overseer of the University of Pennsylvania School of Engineering and Applied Science. He also serves as a director of 4R Systems, Inc. and Kamoon, Inc. Age: 55.

Incumbent Class I Directors – to Continue in Office for Terms Expiring in 2006

David J. Berkman. Mr. Berkman has served as a director of the Company since January 2001. He is the Managing Partner of Liberty Associated Partners, LLC, a private equity firm primarily engaged in the telecommunications, technology, and internet market segments. Formerly, Mr. Berkman was the Executive Vice President and a director of the Associated Group, Inc., a publicly traded firm sold to AT&T and Liberty Media Corp. Mr. Berkman serves as a director of Entercom, Inc., the fourth largest US Radio Broadcaster, V-Span, Inc., a video conferencing service provider, Cibernet, Inc., a service provider to the wireless industry, and Current Communications Group, LLC, a company that develops powerline technologies. Civically, he serves on the Board of Trustees of the Kimmel Center for the Performing Arts, the Board of Overseers for the University of Pennsylvania School of Engineering and The Franklin Institute. Age: 42.

Warren V. Musser. Mr. Musser has served as a director of the Company since March 2000. Mr. Musser is the Managing Director of The Musser Group, a financial consulting company, and Chairman Emeritus at Safeguard Scientifics, Inc. He previously served as Chairman and Chief Executive Officer of Safeguard Scientifics, Inc. from 1953 until April 2001. Mr. Musser is a Managing Director of Intrepid Capital Partners. He also serves as a director of CompuCom Systems, Inc., a director and Vice Chairman of Nutri/System, Inc. and Chairman of the Board of Telkonet, Inc. Mr. Musser serves on a variety of civic, educational and charitable boards of directors, and serves as Co-Chairman of The Eastern Technology Council and Chairman of Economics PA. Age: 77.

- 7 -

David K. Downes. Mr. Downes has served as a director of the Company since October 2003. Since early 2004 Mr. Downes has served as Independent Chairman of the Board of Trustees of the Quaker Investment Trust, the President and CEO of CRAFund Advisors, Inc. and the President and Treasurer of The Community Reinvestment Act Qualified Investment Fund. From 1995 until October of 2003, Mr. Downes served as Chief Operating Officer and Chief Financial Officer of Lincoln National Investment Companies and Delaware Investments, the investment management subsidiary of the Lincoln Financial Group. He also served as the Chairman and Chief Executive Officer of Delaware Investments’ retirement business from 1997 to 2003, President and Chief Executive Officer of Delaware Service Company from 1993 to 2003, and President and Chief Executive Officer of Delaware Investments Family of Funds from 1997 to 2003. In addition, he served as President and a member of the board of Lincoln National Convertible Securities Fund, Inc. and the Lincoln National Income Funds, Inc. from 2000 to 2003. Prior to joining Delaware Investments, Mr. Downes was Vice Chairman, Chief Financial Officer and a member of the board of directors of Equitable Capital Management Corporation, an investment subsidiary of the Equitable Assurance Society. Among his earlier achievements, Mr. Downes was the Chief Financial Officer of Merrill Lynch Pierce Fenner and Smith, Inc. and corporate controller of Merrill Lynch & Company, Inc. Age: 64.

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

ITEM 2 ON PROXY CARD

The Audit Committee has selected KPMG LLP, certified public accountants, as independent auditors to examine the financial statements of the Company for 2004. Although action by the stockholders on this matter is not required, the Audit Committee and the Board of Directors believe it is appropriate to seek stockholder ratification of this selection in light of the critical role played by the independent auditors in maintaining the integrity of the Company’s financial reporting. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting, in person or by proxy, and voting thereon. If this appointment is not ratified by the stockholders, the Audit Committee may reconsider its selection.

One or more representatives of KPMG LLP are expected to attend the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Audit Fees

The aggregate fees billed by KPMG LLP for professional services rendered for the audit of the Company’s annual financial statements (including international statutory audits) for the fiscal years ended December 31, 2003 and 2002 and the reviews of the financial statements included in the Company’s Forms 10-Q for such fiscal years were $379,000 and $300,000, respectively. In addition, aggregate fees billed by KPMG LLP for similar services to the Company’s majority-owned subsidiaries for the fiscal years ended December 31, 2003 and 2002 were $466,197 and $445,000, respectively.

Audit-Related Fees

For the fiscal year ended December 31, 2003, KPMG LLP billed $46,000 for services related primarily to consulting on financial accounting/reporting matters and an audit of the Company’s 401(k) plan. For the fiscal year ended December 31, 2002, KPMG LLP billed $10,000 for services related to an audit of the Company’s 401(k) plan.

Tax Fees

For the fiscal years ended December 31, 2003 and 2002, KPMG LLP billed $245,214 and $234,500, respectively, for tax compliance services and $33,100 and $15,000, respectively, for tax consulting services rendered to the Company and its majority-owned subsidiaries.

- 8 -

All Other Fees

For the fiscal years ended December 31, 2003 and 2002, KPMG LLP billed $9,340 and $32,000, respectively, in fees for professional services rendered to the Company other than those noted above. In 2002, these fees were generally for services related to human resource consulting.

The Audit Committee believes that KPMG LLP’s provision of non-audit services is compatible with maintaining such firm’s independence.

Pre-approval of services

The Audit Committee’s policy is to pre-approve the engagement of accountants to render all audit and tax-related services for the Company, as well as any changes to the terms of the engagement. The Audit Committee will also pre-approve all non-audit related services proposed to be provided by the Company’s independent auditors. The Audit Committee reviews the terms of the engagement, a description of the engagement, and a budget for the engagement. The request for services must be specific as to the particular services to be provided. Requests are aggregated and submitted to the Audit Committee in one of the following ways: requesting approval of services at a meeting of the Audit Committee, through a written consent or by a designated member of the Audit Committee. The Audit Committee has approved 64% of the total 2003 fees. The items not approved were performed prior to the effective date of the pre-approval policy.

The Board of Directors recommends a vote FOR ratification.

APPROVAL OF THE GRANT OF DISCRETIONARY AUTHORITY TO THE BOARD OF DIRECTORS TO AMEND THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY’S ISSUED AND OUTSTANDING COMMON STOCK

ITEM 3 ON PROXY CARD

The Company’s Board of Directors adopted a resolution seeking stockholder approval to grant the Board of Directors discretionary authority to amend the Company’s restated certificate of incorporation to effect a reverse stock split of its common stock. If the reverse stock split is approved by the Company’s stockholders, the Board of Directors may subsequently effect, in its sole discretion, the reverse stock split based upon any of the following five ratios: one-for-ten, one-for-fifteen, one-for-twenty, one-for-twenty-five or one-for-thirty. The approval of holders of two-thirds of the Company’s shares of common stock entitled to vote at the annual meeting is required to approve the grant of discretionary authority to the Company’s Board of Directors to amend the Company’s restated certificate of incorporation to effect a reverse stock split of the Company’s common stock. A reverse stock split would not be effective until the amendment to the Company’s restated certificate of incorporation, substantially in the form attached as Appendix B hereto, is filed with the Secretary of State of the State of Delaware. Approval of Proposal No. 3 would give the Board of Directors authority to implement a reverse stock split at any time prior to the date of the Company’s 2005 annual meeting of stockholders. Even if the Company’s stockholders approve the amendment, the Board of Directors has reserved the discretion not to effect the reverse stock split and abandon effecting the reverse stock split without further action by stockholders.

Reasons for a Reverse Stock Split

The Company’s common stock is currently quoted on the Nasdaq SmallCap Market under the symbol “ICGE.” Companies listed on the Nasdaq SmallCap Market are required to maintain a minimum bid price of $1.00 per share. When the Company transferred from the Nasdaq National Market to the Nasdaq SmallCap Market, the Company’s securities were trading below $1.00. As a result of the Company’s transfer to the Nasdaq SmallCap Market, the Company was granted an initial grace period lasting until October 22, 2002 to regain compliance with the $1.00 per share minimum bid price requirement. On October 23, 2002, the Company was granted a second grace period, lasting 180 calendar days, to regain compliance. On April 21, 2003, the Company was granted a third grace period lasting 90 calendar days to regain compliance. On July 23, 2003, the Company received a delisting determination

- 9 -

from the Nasdaq staff stating that the Company had not regained compliance with the Nasdaq SmallCap Market’s $1.00 per share minimum bid price requirement. The Company appealed this determination and on October 10, 2003, the Company was granted an exception to the bid price requirement through December 1, 2003. On December 15, 2003, the Company was granted an exception to the bid price requirement through January 30, 2004 to allow for developments in the SEC rulemaking process with respect to a proposed rule that would afford SmallCap Market issuers additional grace periods to remedy a minimum bid price deficiency. Under the proposal, an issuer could receive up to a two-year grace period provided that it continued to meet certain listing requirements and provided that it committed to seek stockholder approval for a reverse stock split to address the bid price deficiency at or before a meeting scheduled to occur no later than two years from the original notification of bid price deficiency. The Company’s two-year deadline expires on April 24, 2004.

In December 2003, the SEC approved the proposed rule change regarding grace periods. Based on the SEC’s approval of this proposed rule change, Nasdaq notified the Company that in order to remain listed, it must commit to seeking stockholder approval for a reverse stock split sufficient to remedy its bid price deficiency prior to April 24, 2004. On January 9, 2004, the Company notified Nasdaq of its determination that, if its stock price does not regain compliance with the SmallCap Market’s minimum bid price requirement, it will seek to obtain stockholder approval by April 24, 2004 for a reverse stock split sufficient to support the Company’s compliance with the requirement. Based on this determination, Nasdaq granted the Company an exception to the bid price requirement through April 24, 2004. In order to meet the minimum bid price requirement the Company’s common stock would need to trade at or above $1.00 per share for at least ten consecutive business days during the grace period.

The Company’s Board of Directors believes that it is in the best interests of the Company’s stockholders and the Company for the Board of Directors to have the discretionary authority to effect a reverse stock split in an effort to return the Company’s stock price to a higher price level. The Company’s Board of Directors believes that if the Company’s common stock maintains a higher price after a reverse stock split, the higher price may facilitate the Company’s ability to satisfy the listing requirements of the Nasdaq SmallCap Market. The Company’s Board of Directors also believes that if the Company’s common stock maintains a higher price after a reverse stock split, the higher price may meet investing guidelines for certain institutional investors and investment funds. In addition, the Company’s Board of Directors believes that the Company’s stockholders will benefit from relatively lower trading costs for a higher priced stock because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher priced stocks.

The Company’s Board of Directors believes that stockholder approval of several potential exchange ratios (rather than a single exchange ratio) will provide it with the flexibility necessary to achieve the desired results of the reverse stock split. If the Company’s stockholders approve this proposal, the reverse stock split will be effected, if at all, only upon a determination by the Company’s Board of Directors that the reverse stock split is in the best interests of the Company’s stockholders and the Company at that time. In connection with any determination to effect a reverse stock split, the Company’s Board of Directors will set the timing for such a split and select the specific ratio from among the five ratios described in this proxy statement. No further action on the part of the stockholders will be required to either implement or abandon the reverse stock split. If the Company’s Board of Directors does not implement the reverse stock split prior to the date of the Company’s 2005 annual meeting of stockholders, the authority granted in this proposal to implement the reverse stock split on these terms will terminate. The Company’s Board of Directors reserves its right to elect not to proceed, and to abandon, the reverse stock split if it determines, in its sole discretion, that this proposal is no longer in the best interests of the Company and its stockholders.

Certain Risks Associated with the Reverse Stock Split

There can be no assurance that the total market capitalization of the Company’s common stock (the aggregate value of all the Company’s common stock at the then current market price) after the reverse stock split will be equal to or greater than the total market capitalization before the reverse stock split or that the per share market price of the Company’s common stock following the reverse stock split will either equal or exceed the then current per share market price.

- 10 -

There can be no assurance that the market price per share of the Company’s common stock after the reverse stock split will remain unchanged or increase in proportion to the reduction in the number of old shares of the Company’s common stock outstanding before the reverse stock split. Accordingly, the total market capitalization of the Company’s common stock after the reverse stock split may be lower than the total market capitalization before the reverse stock split and, in the future, the market price of the Company’s common stock following the reverse stock split may not exceed or remain higher than the market price prior to the reverse stock split.

If the reverse stock split is effected, the resulting per-share stock price may not attract institutional investors or investment funds and may not satisfy the investing guidelines of such investors.

While the Company’s Board of Directors believes that a higher stock price may help generate investor interest, there can be no assurance that the reverse stock split will result in a per-share price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds.

A decline in the market price of the Company’s common stock after the reverse stock split may result in a greater percentage decline than would occur in the absence of a reverse stock split, and the liquidity of the Company’s common stock could be adversely affected following such a reverse stock split.

If the reverse stock split is effected and the market price of the Company’s common stock declines, the percentage decline may be greater than would occur in the absence of a reverse stock split, and the liquidity of the Company’s common stock could be adversely affected.

Certain Effects of a Reverse Stock Split

If approved and effected, the reverse split will not affect the registration of common stock under the Exchange Act, nor will it change the Company’s periodic reporting or other obligations thereunder. If approved and effected, the reverse stock split will be realized simultaneously by all of the Company’s stockholders and the exchange ratio will be the same for all of the Company’s common stock. The reverse stock split will affect all of the Company’s stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the reverse stock split would otherwise result in any of the Company’s stockholders owning a fractional share. As described below, stockholders otherwise entitled to fractional shares as a result of the reverse stock split will be entitled to cash payments in lieu of such fractional shares. These cash payments will reduce the number of post-reverse stock split stockholders to the extent there are stockholders presently who would otherwise receive less than one share of the Company’s common stock after the reverse stock split. Additionally, the reverse stock split will not affect any stockholder’s percentage ownership or proportionate voting power (subject to the treatment of fractional shares). However, because the number of authorized shares of the Company’s common stock will not be reduced, the reverse stock split will increase the total number of authorized and unissued shares of common stock that the Company’s Board of Directors may issue in the future, in certain cases without further stockholder action.

The Company has certain outstanding stock options and warrants that entitle the holders to purchase shares of the Company’s common stock. Under the terms of the outstanding options and warrants, a reverse stock split would reduce the number of shares of the Company’s common stock issuable upon the exercise of such options and warrants proportionately based upon the reverse stock split ratio selected by the Company’s Board of Directors and would proportionately increase by the same factor the exercise price per share of such options and warrants. Also, the Company would reduce by the same factor the number of shares reserved for issuance under the Company’s existing stock option plans.

The reverse stock split would not affect the par value of the Company’s common stock. As a result, as of the effective time of the reverse stock split, the stated capital attributable to the Company’s common stock on the Company’s balance sheet (which is based on par value) would be reduced proportionately based on the reverse stock split ratio selected and effected by the Company’s Board of Directors and the additional paid-in capital account

- 11 -

would be increased with the amount by which the stated capital is reduced. The per share net income (loss) and stockholders’ deficit of the Company’s common stock would be restated because there would be fewer shares of common stock outstanding.

Effect on Fractional Stockholders

If the Company’s stockholders approve a reverse stock split and the Company’s Board of Directors elects to implement the reverse stock split, no scrip or fractional share certificates will be issued in connection with the reverse stock split. Instead, the Company’s transfer agent would aggregate all fractional shares and sell them as soon as practicable after the effective date at the then prevailing prices on the open market, on behalf of those stockholders who would otherwise be entitled to receive fractional shares. The Company expects that its transfer agent would conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of common stock. After the completion of such sale, the stockholders would receive a cash payment from the Company’s transfer agent in an amount equal to their pro rata share of the total net proceeds of that sale. No transaction costs would be assessed on this sale; however, the proceeds would be subject to federal income tax (and may be subject to state or local income taxes). In addition, no stockholder would be entitled to receive interest for the period of time between the effective date of the reverse stock split and the date the stockholder receives payment for the cashed-out fractional shares. The payment amount would be paid to the holder in the form of a check in accordance with the procedures outlined below.

After the reverse stock split, stockholders would have no further interest in the Company with respect to any cashed-out shares. A person otherwise entitled to a fractional interest would not have any voting, dividend or other rights except to receive payment as described above.

NOTE: If you do not hold sufficient shares to receive at least one share in the reverse stock split and you want to continue to hold the Company’s common stock after the reverse stock split, you may do so by taking either of the following actions far enough in advance so that it is completed by the effective date of the reverse stock split:

(1) purchase a sufficient number of shares of the Company’s common stock so that you hold at least an amount of shares of the Company’s common stock in your account prior to the reverse stock split that would entitle you to receive at least one share of the Company’s common stock on a post-reverse stock split basis; or

(2) if applicable, consolidate your accounts so that you hold at least an amount of shares of the Company’s common stock in one account prior to the reverse stock split that would entitle you to receive at least one share of the Company’s common stock on a post-reverse stock split basis. Shares held in registered form (that is, shares held by you in your own name in the Company’s stock records maintained by the Company’s transfer agent) and shares held in “street name” (that is, shares held by you through a bank, broker or other nominee), for the same investor will be considered held in separate accounts and will not be aggregated when effecting the reverse stock split.

You should be aware that, under the escheat laws of the various jurisdictions where you reside, where the Company is domiciled and where the funds will be deposited, shares that are not exchanged and sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Procedure for Effecting a Reverse Stock Split and Exchange of Stock Certificates

If the Company’s stockholders approve the grant of discretionary authority to the Company’s Board of Directors to amend the Company’s restated certificate of incorporation to effect a reverse stock split of the Company’s common stock and the Company’s Board of Directors elects to implement the reverse stock split, the reverse stock split would become effective as set forth in an amendment to the Company’s restated certificate of incorporation, substantially in the form set forth in Appendix B hereto, filed with the Secretary of State of the State of Delaware.

- 12 -

At the effective time set forth in the amendment, all of the Company’s current common stock would be converted into new common stock.

If the Board implements the reverse split, as soon as practicable after the effective date, stockholders will be notified that the reverse stock split has been effected, and the Company’s transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of the pre-reverse stock split shares will be asked to surrender to the transfer agent certificates representing pre-reverse stock split shares in exchange for a book entry (direct registration) or certificates representing post-reverse stock split shares, in accordance with the procedures to be set forth in a letter of transmittal to be sent by the Company. No new book entry will be made, and no new certificates will be issued to a stockholder, as applicable, until the stockholder has surrendered to the transfer agent all outstanding common stock certificates with the properly completed and executed letter of transmittal. Beginning on the effective date, each certificate representing pre-reverse stock split shares will be deemed for all purposes to evidence ownership of post-reverse stock split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL REQUESTED TO DO SO.

No Dissenters’ Rights

Under the Delaware General Corporation Law, stockholders are not entitled to dissenters’ rights with respect to the proposed amendment to the Company’s restated certificate of incorporation to effect a reverse stock split of the common stock at any time prior to the date of the Company’s 2004 annual meeting of stockholders. The Company will not independently provide its stockholders with this right.

Federal Income Tax Consequences of a Reverse Stock Split

The following description of federal income tax consequences of a reverse stock split is based on the Internal Revenue Code of 1986, as amended (the “Code”), the applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices as in effect on the date of this proxy statement. Changes to the law could alter the tax consequences described below, possibly with retroactive effect. This discussion is for general information only and does not address all the tax consequences that may be relevant to a particular stockholder (such as a stockholder who holds this stock as part of a “straddle,” a “hedge” or a “conversion transaction,” a person that has a “functional currency” other than the U.S. dollar, an investor in a pass-through entity, a non-resident alien, a broker-dealer, or an insurance company). This summary assumes that shares of the current common stock were and the shares of new common stock would be held as a “capital asset,” as defined in the Code (generally, property held for investment). Furthermore, no foreign, state or local tax consequences are discussed in this proxy statement. The Company’s view regarding the tax consequences of the reverse stock split is not binding on the Internal Revenue Service or the courts. ACCORDINGLY, STOCKHOLDERS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS TO DETERMINE THE SPECIFIC TAX CONSEQUENCES OF A REVERSE STOCK SPLIT TO THEM.

Other than the cash payments for fractional shares discussed below, no gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-reverse stock split shares for post-reverse stock split shares pursuant to the reverse stock split. The aggregate tax basis of the post-reverse stock split shares received in the reverse stock split would be the same as the stockholder’s aggregate tax basis in the pre-reverse stock split shares exchanged therefore, except that, as described below, if cash is received in lieu of fractional shares, the stockholder’s aggregate tax basis would be reduced by the amount attributable to the fractional shares. In general, stockholders who receive cash in exchange for their fractional share interests in the post-reverse stock split shares as a result of the reverse stock split would recognize a gain or loss based on their adjusted basis in the fractional share interests redeemed. The stockholder’s holding period for the post-reverse stock split shares would include the period during which the stockholder held the pre-reverse stock split shares surrendered in the reverse stock split.

The receipt of cash instead of a fractional share of the Company’s common stock by a United States holder of the Company’s common stock would result in a taxable gain or loss to such holder for federal income tax purposes

- 13 -

based upon the difference between the amount of cash received by such holder and the adjusted tax basis in the fractional shares as set forth above. The gain or loss would constitute a capital gain or loss and would constitute a long term capital gain or loss if the holder’s holding period is greater than one year as of the effective date. If you receive cash in lieu of a fractional share of the Company’s common stock, your aggregate tax basis in the post-reverse stock split shares would be reduced by the basis attributable to such fractional shares.

The Board of Directors recommends that the Company’s stockholders vote FOR the approval of the grant of discretionary authority to the Company’s Board of Directors to amend the Company’s restated certificate of incorporation to effect a reverse stock split of the Company’s issued and outstanding common stock at any time before the date of the Company’s 2005 annual meeting of stockholders.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Company’s Board of Directors. Management of the Company is responsible for the Company’s financial reporting process including its system of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee selects the independent auditor to be retained to audit the Company’s financial statements, and once retained, the independent auditor reports directly to the Audit Committee. The Audit Committee consults with and reviews recommendations made by the independent auditor with respect to financial statements, financial records and financial controls of the Company and makes recommendations to the Board of Directors as it deems appropriate from time to time. The Audit Committee is responsible for approving both audit and non-audit services to be provided by the independent auditors. The Audit Committee is composed of at least three directors who are independent as that term is defined by applicable Nasdaq rules. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee’s charter, as amended and restated, is attached as Appendix A.

The Audit Committee met with management periodically during fiscal year 2003 to consider the adequacy of the Company’s internal controls, and discussed these matters with the Company’s independent auditors, KPMG LLP. The Audit Committee also discussed with senior management the Company’s disclosure controls and procedures and the certifications by the Company’s Chief Executive Officer and Chief Financial Officer, which are required by the SEC under the Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the SEC.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the 2003 Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles. The Audit Committee discussed with the Company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 and such other matters as are required to be discussed under auditing

- 14 -

standards generally accepted in the United States of America. The Audit Committee received the written disclosures and the letter from the Company’s independent auditors required by Independence Standards Board Standard No. 1. In addition, the Audit Committee discussed with the independent auditors their independence, including the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their 2003 audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee held eight meetings during the fiscal year 2003.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report for the fiscal year ended December 31, 2003 for filing with the SEC.

The Audit Committee has selected the firm of KPMG LLP, independent certified public accountants, as independent auditors to audit and report upon the Company’s financial statements for 2004. In making this selection, the Audit Committee has considered whether KPMG LLP’s provision of services other than audit services are compatible with maintaining their independence.

The members of the Audit Committee are not employees of the Company and have not conducted a separate audit of the Company’s financial statements. Therefore, the Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent auditors included in their report on the Company’s financial statements. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent auditors are in fact independent.

|

AUDIT COMMITTEE David K. Downes, Chairman David J. Berkman Philip J. Ringo Dr. Michael D. Zisman |

COMPENSATION COMMITTEE REPORT

Role of Committee

The Compensation Committee establishes, oversees and directs the Company’s executive compensation programs and policies and administers the Company’s equity compensation plans. The Compensation Committee seeks to align executive compensation with Company objectives and strategies, business financial performance and enhanced stockholder value. The Compensation Committee consists of three non-employee directors.

The Compensation Committee regularly reviews and approves generally all compensation and fringe benefit strategies of the Company and also reviews and determines, or recommends that the Board approve, the actual compensation of the Company’s executive officers. The Compensation Committee also reviews and makes recommendations to the Board of Directors on the Company’s management structure and organization.

- 15 -

The Compensation Committee’s objectives include (i) attracting and retaining exceptional individuals as executives and key employees and (ii) providing executives and key employees with motivation to perform to the full extent of their abilities in order to maximize the Company’s performance and to deliver enhanced value to the Company’s stockholders. Executive compensation consists primarily of an annual salary, annual bonuses linked to the performance of the Company and long-term, equity-based compensation. The Compensation Committee believes it is important to place a high percentage of executive officers’ total compensation at risk, principally in the form of annual bonuses based upon short-term business performance and stock options vesting over time whose value will be directly linked to stockholder value created.

Compensation

Annual cash compensation consists of base salaries and incentive bonuses. Base salaries are established initially on the basis of subjective factors, including experience, individual achievements and the level of responsibility assumed at the Company, as well as compensation practices by competitive peers and other competitors for talent. The Compensation Committee reviews executive officers’ compensation each year to adjust annual compensation based on each executive officer’s past performance, expected future contributions, compensation practices among competitive peers and competitors for talent, and the scope and nature of responsibilities of the executive officer, including changes in such responsibilities.

The Compensation Committee believes that a significant portion of each executive officer’s total compensation, in the form of incentive bonuses, should be tied to the achievement of the Company’s annual goals, overall company success and individual performance. Such goals primarily relate to the Company’s liquidity, debt and partner company business results (growth in revenues and improvement in net income (loss)). At the end of each bonus period, the Compensation Committee evaluates how the Company and its partner companies performed against the specific goals established and determines an appropriate bonus achievement level and the amount of funds available for distribution to employees. Each executive officer’s bonus is also based on subjective criteria particular to each executive officer’s individual performance.

In addition to base salaries and incentive bonuses, the Compensation Committee also grants equity compensation, including stock options, to executive officers, key employees and other employees of the Company in order to focus the efforts of these employees on the long-term enhancement of profitability and stockholder value and to retain their services to the Company. The stock options granted by the Company have a fixed exercise price, generally vest over a three-year or four-year period and have an exercise price equal to the market value of the Common Stock on the date of grant. In certain cases, the vesting of options is less than three or four years if certain EBITDA and net income targets are met. No stock options were granted to employees in 2003.

2003 Chief Executive Officer Compensation

The Compensation Committee determined the 2003 annual compensation of Mr. Buckley, Chief Executive Officer and President, in accordance with the above discussion. The Compensation Committee set Mr. Buckley’s target eligibility under the 2003 incentive bonus plan at 150% of his base salary.

In February 2003, the Compensation Committee established specific business goals against which the Company’s executive officers would be measured for purposes of awarding bonuses. The three primary objectives of this bonus plan were to drive the Company’s partner companies towards positive cash flow, meet cash objectives and reduce the Company’s convertible debt.

The bonus plan was structured so that 80% of the bonus target was tied to quantitative goals, with the remaining 20% based on qualitative measures. The quantitative goals consisted of: (1) achievement of net income and revenue goals for core partner companies, with the performance of individual partner companies weighted based on the perception of the relative value of such companies to the Company; (2) attainment of a year-end cash balance target; and (3) reduction of the balance of the Company’s convertible debt to a targeted level. The qualitative goals included the following factors: (1) performance/competency of partner company executives; (2) strategic

- 16 -

initiatives; (3) reaction to unforeseen market/business conditions; (4) budget performance; (5) stockholder returns; and (6) emerging company performance.

In February 2004, the Compensation Committee evaluated the performance of the Company in realizing the specific business goals established for the 2003 incentive bonus plan and reviewed management’s analysis of execution against the 2003 bonus goals. Mellon Human Resources and Investor Solutions, an independent human resources consulting firm, participated in the Compensation Committee meetings regarding bonus determinations and indicated its agreement with management’s analysis.

In 2003, under Mr. Buckley’s leadership the stated quantitative goals were largely achieved. The Company made significant progress against its goal for its thirteen private core partner companies (excluding OneCoast Network Holdings, Inc. due to the disposition of its assets in 2003) of reducing losses and moving towards profitability, exceeding the target net income goal. Overall, annual aggregate net income (loss) for private core partner companies improved from a loss of $134 million in 2002 to a loss of $54 million in 2003. Four private core partner companies achieved positive net income for the fourth quarter of 2003. The private core partner companies grew aggregate revenues from $319 million in 2002 to $352 million in 2003 but did not reach the target revenue goals, principally as the result of continued difficulty in technology spending and elongated sales cycles. Based on the quantitative achievements related to net income and revenue targets, the Compensation Committee determined that the Company had earned a 34% performance level out of a potential 40% achievement level.

The Company exceeded its December 31, 2003 cash balance goal of $45 million by ending the year with $50.6 million in cash on a parent company only basis. Twenty percent of the overall bonus plan was tied to this target. The Company achieved its goal by reducing its annual corporate run rate (excluding interest) from $15 million at the end of 2002 to approximately $10 million at the end of 2003, by using a selective and disciplined investment strategy with respect to funding existing partner companies and by satisfying debt through debt for equity exchanges. Based on the fact that the Company exceeded its cash balance goal, the Compensation Committee determined that allocating a 26% achievement level to this goal was appropriate.

In respect of the third quantitative goal, the Company made good progress in reducing the balance of its convertible debt in 2003, beginning the year with a balance of $283 million and ending the year with a balance of $173.9 million. While the Company did not realize the stated goal of a $141.5 million year-end convertible debt balance, it was able to capture an average 35% discount on the notes satisfied in 2003. Based on its level of achievement with respect to the debt balance goal, the Compensation Committee determined that a 15% performance level out of a potential 20% performance level had been earned.

Based on the achievement of the foregoing partner company net income (loss) and revenue, cash balance and convertible debt targets, the Compensation Committee determined that the quantitative goals of the 2003 bonus plan were largely achieved.

Next the Compensation Committee considered the qualitative elements of the 2003 incentive bonus plan. During the year the Company succeeded in preserving cash levels and reducing debt by effecting debt for equity exchanges rather than monetizing assets prematurely. The Company also performed well in reducing corporate expenses and eliminating several large contingent liabilities. The Compensation Committee noted that the increase in the value of the Company’s public partner companies during 2003 was a positive development. While the Company did not meet its qualitative goals related to improving the Company’s stock price, the Compensation Committee recognized that the Company’s financial condition improved significantly from 2002 to 2003. Accordingly, the Compensation Committee determined that awarding 20% of the target bonus with respect to the achievement of qualitative factors was appropriate.

Based on the Compensation Committee’s foregoing evaluation of the Company’s execution against its 2003 quantitative and qualitative goals, and taking into account the recommendation of Mellon Human Resources and Investor Solutions, the Compensation Committee recommended awarding 95% of Mr. Buckley’s target bonus. [The

- 17 -

Company’s Board, including all independent directors, approved of Mr. Buckley’s bonus award in accordance with the recommendation of the Compensation Committee.] Fifty percent of the amount of the bonus awarded to Mr. Buckley, net of taxes, was paid in the form of Company common stock.

2003 Compensation for Other Executive Officer

The Compensation Committee determined the 2003 annual compensation of the Company’s other executive officer in accordance with the above discussion on annual compensation. The Compensation Committee set the target eligibility under the 2003 incentive bonus plan for such executive officer at 100% of base salary, with the actual award based primarily upon achievement of the quantitative and qualitative objectives outlined above. Based upon overall achievement of the Company against these established goals, the Compensation Committee recommended awarding a bonus for such executive officer that was consistent with his performance and Company results. [The Company’s Board, including all independent directors, approved of this bonus award in accordance with the recommendation of the Compensation Committee.] Fifty percent of the amount of the bonus awarded to such executive officer, net of taxes, was paid in the form of Company common stock.

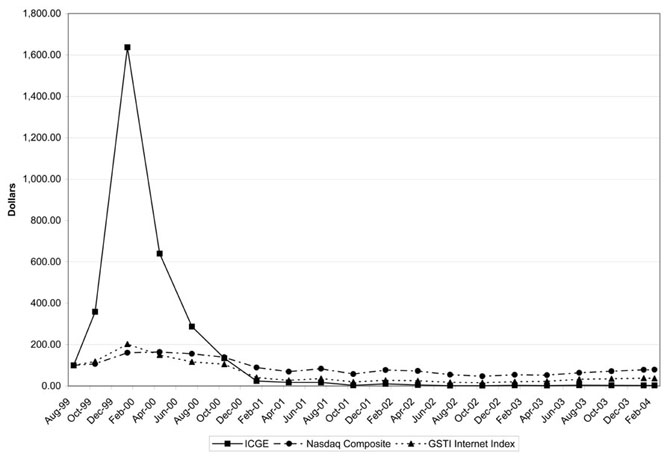

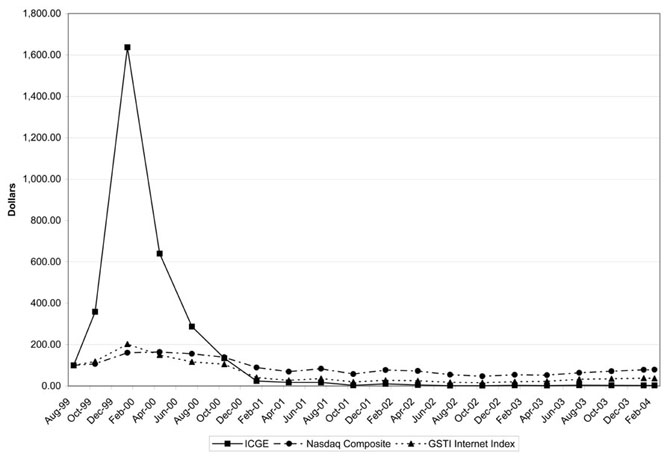

Deductibility of Compensation