UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Internet Capital Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

INTERNET CAPITAL GROUP, INC.

690 LEE ROAD, SUITE 310

WAYNE, PENNSYLVANIA 19087

PHONE: (610) 727-6900

FAX: (610) 727-6901

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Internet Capital Group, Inc. Stockholder:

You are invited to attend the Internet Capital Group, Inc. 2007 Annual Meeting of Stockholders.

| | |

| Date: | | June 15, 2007 |

| Time: | | 10:00 a.m., EDT |

| Place: | | The Radnor Hotel |

| | 591 East Lancaster Avenue |

| | St. Davids, Pennsylvania 19087 |

Only stockholders who owned stock at the close of business on April 16, 2007 can vote at this meeting or any adjournments that may take place.

The purposes of the Annual Meeting are:

| | (1) | to elect three Class II directors, each for a term of three years or until their respective successors have been elected and qualified, and one Class III director, for a term of one year or until his successor has been elected and qualified; |

| | (2) | to ratify the appointment of KPMG LLP as ICG’s independent registered public accountant for the fiscal year ending December 31, 2007; and |

| | (3) | to transact any other business that may properly come before the meeting. |

For those of you who are unable to attend the meeting in person, we invite you to listen over the Internet through ICG’s website at http://www.internetcapital.com/investorinfo-preswebcast.htm.

We consider your vote important and encourage you to vote as soon as possible.

| | | | |

| By Order of the Board of Directors, | | | | |

| | |

| /s/ Suzanne L. Niemeyer | | | | April 27, 2007 |

Suzanne L. Niemeyer Secretary | | | | |

INTERNET CAPITAL GROUP, INC.

690 LEE ROAD, SUITE 310

WAYNE, PENNSYLVANIA 19087

PHONE: (610) 727-6900

FAX: (610) 727-6901

www.internetcapital.com

PROXY STATEMENT FOR

2007 ANNUAL MEETING OF STOCKHOLDERS

JUNE 15, 2007

This proxy statement and the accompanying proxy card are being mailed, on or about May 4, 2007, to owners of shares of Internet Capital Group, Inc. (“ICG”) Common Stock in connection with the solicitation of proxies by ICG’s Board of Directors (the “Board”) for ICG’s 2007 Annual Meeting of Stockholders (the “Annual Meeting”). This proxy procedure is necessary to permit all holders of Common Stock, many of whom are unable to attend the Annual Meeting, to vote. The Board encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

CONTENTS

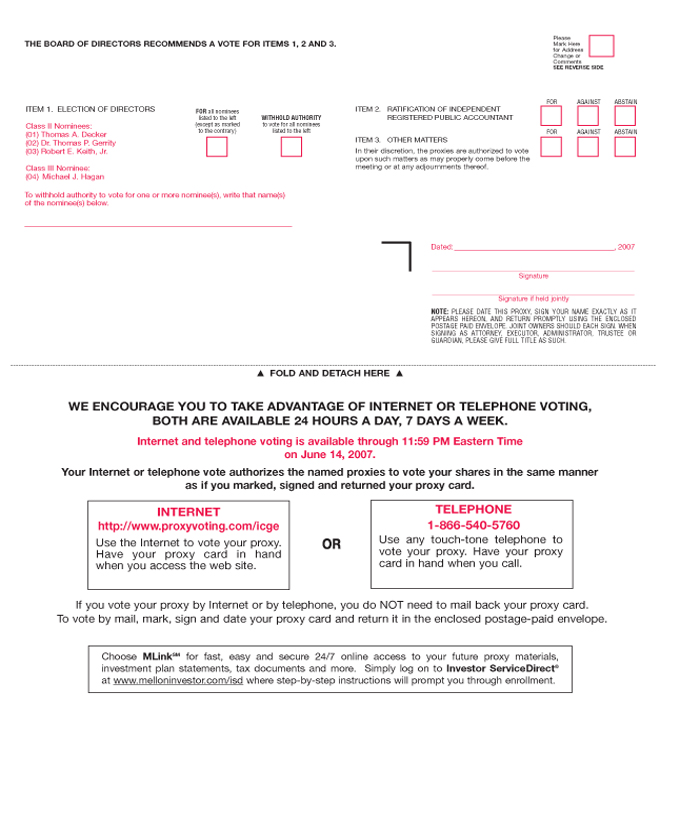

VOTING PROCEDURES

Your vote is very important. Your shares can be voted at the Annual Meeting only if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to ensure that your shares will be represented. Most stockholders have a choice of voting by means of the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs, such as telephone and Internet access charges, for which you will be responsible. Also note that proxies submitted by telephone or the Internet must be received by 11:59 p.m., EDT, on June 14, 2007.

You may revoke this proxy at any time before it is voted by written notice to the Secretary of ICG, by submitting a proxy bearing a later date or by casting a ballot at the Annual Meeting. Properly executed and delivered proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided or, if no directions are provided, your shares will be voted by one of the individuals named on your proxy card as recommended by the Board. If you wish to give a proxy to someone other than those named on the proxy card, cross out the names on the card and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

If you want to vote in person at the Annual Meeting and you hold shares of ICG Common Stock in street name, you must obtain a proxy card from your broker and bring that proxy card to the Annual Meeting, together with a copy of a brokerage statement reflecting your stock ownership as of April 16, 2007.

Who can vote? Stockholders as of the close of business on April 16, 2007 are entitled to vote. On that day, 38,432,432 shares of Common Stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the Annual Meeting. A list of stockholders eligible to vote will be available at the offices of Dechert LLP, Cira Centre, 2929 Arch Street, Philadelphia, Pennsylvania 19104 beginning June 5, 2007. Stockholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the Board recommend I vote? The Board recommends a vote FOR each Board nominee and FOR ratification of the appointment of KPMG LLP as ICG’s independent registered public accountant.

What shares are included in the proxy card? Each proxy card you receive represents all the shares of Common Stock registered to you in a particular account. You may receive more than one proxy card if you hold shares that are either registered differently or in more than one account. Each share of Common Stock that you own entitles you to one vote.

How do I vote by proxy? Most stockholders have three ways to vote by proxy: by telephone, via the Internet or by returning the proxy card. To vote by telephone or via the Internet, follow the instructions set forth on each proxy card you receive. To vote by mail, sign and date each proxy card you receive, mark the boxes indicating how you wish to vote, and return the proxy card in the postage-paid envelope provided. Do not return the proxy card if you vote via the Internet or by telephone.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of Common Stock entitled to vote, is represented. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners, the nominees may vote those shares only on matters deemed routine under the applicable rules of the NASDAQ Stock Market LLC (“Nasdaq”). Items 1 and 2 described in this proxy statement are deemed routine matters. On non-routine matters, nominees cannot vote and there is a so-called “broker non-vote” on that matter. Because directors are elected by a plurality of the votes cast, abstentions will have no effect on the election of directors. Because Item 2 requires for its approval the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Item 2, any abstentions will have the effect of votes against Item 2.

Who will count the vote? ICG’s Transfer Agent and Registrar, Mellon Investor Services LLC, will tally the vote.

2

Who is soliciting this proxy? Solicitation of proxies is made on behalf of the Board. ICG will pay the cost of preparing, assembling and mailing the notice of Annual Meeting, proxy statement and proxy card. ICG has also hired Georgeson Inc., a proxy solicitation firm, for a fee of $7,500, plus expenses. In addition to the use of mail, proxies may be solicited by directors, officers and regular employees of ICG, without additional compensation. Proxies may be solicited by mail, in person or by telephone or other electronic means. ICG will reimburse brokerage houses and other nominees for their expenses in forwarding proxy materials to beneficial owners of ICG’s Common Stock.

What if I can’t attend the meeting? If you are unable to attend the meeting in person, ICG invites you to listen to the meeting over the Internet through ICG’s website at http://www.internetcapital.com/investorinfo-preswebcast.htm. Please go to ICG’s website approximately fifteen minutes prior to the Annual Meeting to register and download any necessary audio software. If you do not attend the Annual Meeting in person and you intend to vote, you must vote your shares by proxy, via the Internet or by telephone by the applicable deadline.

CORPORATE GOVERNANCE

General. In accordance with the Delaware General Corporation Law and ICG’s Restated Certificate of Incorporation, as amended, and its Amended and Restated By-Laws (the “By-Laws”), ICG’s business, property and affairs are managed under the direction of the Board. Although ICG’s non-management directors are not involved in the company’s day-to-day operating details, they are kept informed of ICG’s business through written reports and documents provided to them regularly, as well as through operating, financial and other reports presented by the officers of ICG at meetings of the Board and committees of the Board.

Director Independence. The Board has determined that seven of the nine directors who served on the Board in 2006, and seven of the eight directors who currently serve on the Board, are “independent,” as such term is defined in the applicable Nasdaq rules. The following current directors were determined to be independent: David J. Berkman, Thomas A. Decker, David K. Downes, Dr. Thomas P. Gerrity, Robert E. Keith, Jr., Warren V. Musser and Philip J. Ringo. Walter W. Buckley, III and Dr. Michael D. Zisman, who served as a director until April 2007, were determined not to be independent. The Board made these determinations because Mr. Buckley is the President and Chief Executive Officer of ICG, and Dr. Zisman, at the time he served on the Board, provided a substantial amount of consulting services for ICG under the terms of an independent contractor agreement, which is described in “Certain Relationships and Related Transactions” below.

Dr. Zisman resigned from the Board in April 2007 as a result of his assumption of increased responsibilities with a number of non-profit organizations. In order to fill the vacancy created by Dr. Zisman’s resignation, Michael J. Hagan has been nominated for election to the Board as a Class III director. The Board has determined that Mr. Hagan is “independent,” as such term is defined in the applicable Nasdaq rules.

In making its determinations regarding director and director nominee independence, the Board considered, among other things:

| | • | | the directors’ and director nominees’ direct and indirect interests in ICG’s partner companies; |

| | • | | transactions between ICG and its partner companies, on the one hand, and the directors and director nominees and their respective affiliates, on the other hand; and |

| | • | | relationships among the directors and director nominees with respect to common involvement with for-profit and non-profit organizations. |

Meeting Attendance by Directors. The Board held seven meetings in 2006. Under ICG’s policy on executive Board sessions, the independent members of the Board met in executive session without members of management present at each regularly scheduled Board meeting. Each of the incumbent directors other than Mr. Keith attended at least 75% of the meetings of the Board and Board committees on which he served in 2006. Mr. Keith, who is not a member of any Board committees, attended 71% of the meetings of the Board in 2006. ICG has a policy that each director is expected to attend ICG’s annual stockholder meeting. Seven of ICG’s nine directors attended the 2006 Annual Meeting of Stockholders.

3

Lead Independent Director.It is the policy of ICG that a lead independent director be elected annually through a rotation among the chairs of ICG’s standing Board committees. The role of lead independent director is to ensure that ICG’s independent directors are presented with the opportunity to hold an executive session of independent directors at each regularly scheduled Board meeting, to act as a liaison between the Chairman and the independent directors, to consult with management regarding the scheduling of Board meetings and the review of Board agendas and to preside at Board meetings when the Chairman is not present (including in the executive sessions of the independent directors). In June 2006, the Board elected Mr. Downes to serve as ICG’s lead independent director until the 2007 Annual Meeting.

Change in Director Occupation or Retirement. Each director must volunteer to resign from the Board when he (a) retires or changes the principal position he held when he was initially elected to the Board or (b) reaches the age of seventy-two. However, this age limitation does not apply to any individual who served as a director as of December 10, 2004.

Director Service on Other Boards.Directors are encouraged to limit the number of boards on which they serve. No director may serve as a director on more than six boards of public, for-profit companies without the prior approval of the Board, and no director may join the board of any public, for-profit company without first notifying the Board.

Communications with the Board of Directors.If you would like to communicate with the Board or any of ICG’s individual directors, please send a letter or other written communication to the Board’s or such director’s attention at the following address: Internet Capital Group, Inc., c/o General Counsel, 690 Lee Road, Suite 310, Wayne, Pennsylvania 19087. ICG’s General Counsel will review each such communication and forward a copy to each member of the Board or the individual director, as applicable.

Code of Conduct. The Board is committed to ethical business practices. ICG adopted a Corporate Code of Conduct in 2000 and amended and restated the code in 2004. This code of conduct applies to all of ICG’s employees and directors and includes the code of ethics for ICG’s principal executive officer, principal financial officer, principal accounting officer or controller within the meaning of U.S. Securities and Exchange Commission (“SEC”) regulations adopted under the Sarbanes-Oxley Act of 2002, as amended. ICG’s Corporate Code of Conduct is posted on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm. Please note that none of the information on ICG’s website is incorporated by reference in this proxy statement.

Committees of the Board of Directors. The Board currently has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee.

Audit Committee. The Audit Committee monitors ICG’s compliance with appropriate legal and regulatory standards and requirements. The Audit Committee annually selects ICG’s independent registered public accountant, reviews the performance and the terms of engagement of the independent registered public accountant and exercises oversight of the activities of the independent registered public accountant. It serves as an independent and objective party to monitor ICG’s financial reporting process and internal control systems and to review and appraise the audit efforts of the independent registered public accountant. It also provides an open avenue of communication among the independent registered public accountant, financial and senior management and the Board. A detailed list of the Audit Committee’s functions is included in its charter, which is posted on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm.

The current members of the Audit Committee are Messrs. Decker, Downes and Ringo. The Audit Committee consists entirely of directors who the Board has determined in its business judgment are “independent,” as defined in applicable Nasdaq rules and rules adopted by the SEC under the Securities and Exchange Act of 1934 as in effect on the date this proxy statement is first being mailed to stockholders (the “Exchange Act”). In addition, the Board has determined that Mr. Downes is an “audit committee financial expert,” as defined by the rules under the Exchange Act. The Audit Committee held seven meetings during 2006.

Compensation Committee. The Compensation Committee reviews and approves ICG’s compensation philosophy and oversees the compensation and benefit programs that cover ICG’s employees. The Compensation Committee reviews and approves, or recommends that the Board approve, the total compensation package for each executive officer, including the grant of equity

4

incentives. The Compensation Committee also evaluates the performance of ICG’s Chief Executive Officer against pre-established criteria and it reviews with the Chief Executive Officer the performance of each executive officer that reports to the Chief Executive Officer. The Compensation Committee operates under a charter that is available on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm. The Compensation Committee delegates certain ministerial functions regarding the administration of ICG’s equity compensation plans to ICG’s human resources department; it does not delegate its authority to any other persons. For a discussion regarding the role of ICG’s management and independent compensation consultant in connection with the compensation of ICG’s executive officers, see “Compensation Discussion and Analysis” below.

The current members of the Compensation Committee are Messrs. Berkman, Downes and Gerrity. The Compensation Committee consists entirely of directors who the Board has determined in its business judgment are “independent,” as defined in applicable Nasdaq rules. The Compensation Committee held five meetings during 2006.

Nominating and Governance Committee. The primary function of the Nominating and Governance Committee is to focus on issues surrounding the composition and operation of the Board. The Nominating and Governance Committee identifies and recommends candidates to serve on the Board and takes steps to ensure that the structure and practices of the Board provide for sound corporate governance. The Nominating and Governance Committee operates under a charter that is posted on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm. The Nominating and Governance Committee identifies individuals, including those recommended by stockholders, believed to be qualified as candidates for Board membership. In identifying candidates, the Nominating and Governance Committee takes into account all factors it considers appropriate, which include ensuring that a majority of directors satisfy the independence requirements of Nasdaq, the SEC or any other governing bodies, and that the Board as a whole is comprised of directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. The Nominating and Governance Committee has identified the following attributes that it believes would be ideal for new Board members to possess: experience in running and growing a successful business or large division, board experience, knowledge of the technology industry, an entrepreneurial nature, time and energy to commit to being an active Board member, leadership skills, business acumen and strength of character. The Nominating and Governance Committee has the authority to retain search firms to assist it in identifying candidates to serve as directors.

The Nominating and Governance Committee considers stockholder nominees for director in the same manner as nominees for director from other sources. A stockholder wishing to make a nomination for election to the Board or to have a proposal presented at an annual meeting must submit written notice of such nomination or proposal so that the Secretary of ICG receives it not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting. However, in the event that the date of the meeting is advanced by more than 20 days from such anniversary date or delayed by more than 70 days from such anniversary date, notice by the stockholder must be received no later than the close of business on the 10th day following the date on which public announcement of the date of such meeting was made. Stockholder suggestions for nominees for director must include:

| | • | | the recommending stockholder’s name, address, telephone number and the number of shares of ICG’s stock beneficially owned by such individual or entity; and |

| | • | | the recommended candidate’s biographical data, statement of qualification and written consent to nomination and to serving as a director, if elected. |

Other stockholder proposals must include:

| | • | | the proposing stockholder’s name, address, telephone number and the number of shares of ICG’s stock beneficially owned by such individual or entity; and |

| | • | | a description of the proposal, the reasons for the proposal and any material interest of the proposing stockholder in the proposal. |

Mr. Hagan, whose nomination as a Class III director has been recommended by the Nominating and Governance Committee and approved by the full Board, was identified as a director nominee by a number of ICG’s current directors, including Mr. Buckley.

5

The current members of the Nominating and Governance Committee are Messrs. Berkman, Decker and Ringo and Dr. Gerrity. The Nominating and Governance Committee consists entirely of directors who the Board has determined in its business judgment are “independent,” as defined in applicable Nasdaq rules. The Nominating and Governance Committee held two meetings during 2006.

Compensation Committee Interlocks and Insider Participation. Messrs. Berkman and Downes and Dr. Gerrity currently serve, and during 2006 served, on the Compensation Committee. No member of the Compensation Committee is a former or current executive officer or employee of ICG or any of its subsidiaries. No executive officer of ICG or any of its subsidiaries serves, or served during 2006, as a member of the compensation committee or board of directors of any other company that has, or had during 2006, an executive officer serving as a member of ICG’s Board or Compensation Committee.

SUBMISSION OF STOCKHOLDER PROPOSALS AND

DIRECTOR NOMINATIONS FOR THE 2008 ANNUAL MEETING OF STOCKHOLDERS

Under the rules of the SEC, stockholders wishing to have a proposal included in ICG’s proxy statement for its 2008 Annual Meeting of Stockholders must submit the proposal so that the Secretary of ICG receives it no later than January 4, 2008. The SEC rules set forth standards as to what stockholder proposals are required to be included in a proxy statement. Under ICG’s By-Laws, certain procedures must be followed for a stockholder to nominate persons as directors or to introduce a proposal at an annual meeting. ICG’s By-Laws also set forth certain informational requirements for stockholders’ nominations of directors and other proposals. A stockholder wishing to make a nomination for election to the Board or to have a proposal presented at ICG’s 2008 Annual Meeting of Stockholders must submit written notice of such nomination or proposal so that the Secretary of ICG receives it no later than March 17, 2008 and no earlier than February 15, 2008. However, in the event that the Annual Meeting of Stockholders is held prior to May 27, 2008 or later than August 24, 2008, any such nomination or other proposal must be received no later than the close of business on the 10th day following the date on which public announcement of the date of the 2008 Annual Meeting of Stockholders is made.

ELECTION OF DIRECTORS

ITEM 1 ON PROXY CARD

ICG’s By-Laws provide that ICG’s business will be managed by a board of directors of not less than five and not more than nine directors, with the number of directors to be fixed by the Board from time to time. ICG’s By-Laws also divide the Board into three classes of directors: Class I, Class II and Class III, with each class being as nearly equal in number as possible. The directors in each class typically serve terms of three years, until their respective successors have been elected and have qualified. There are three Class I directors, three Class II directors and, following Dr. Zisman’s resignation from the Board in April 2007, two Class III directors. In order to fill the vacancy created by Dr. Zisman’s resignation, Mr. Hagan has been nominated for election to the Board as a Class III director.

The term of office of one class of directors expires each year in rotation so that one class is elected at each annual meeting of stockholders for a three-year term. In order to keep this rotation intact, Mr. Hagan is being nominated to serve a one-year term. The term of the Class II directors, Messrs. Decker and Keith and Dr. Gerrity, will expire at the Annual Meeting. The other five directors will remain in office for the remainder of their respective terms, as indicated below.

The Nominating and Governance Committee identifies and recommends candidates to serve on the Board. Director candidates are nominated by the Board. Stockholders are also entitled to nominate director candidates for the Board in accordance with the procedures set forth in ICG’s By-Laws, as described in “Corporate Governance–Nominating and Governance Committee” above.

6

At the Annual Meeting, three Class II directors and one Class III director are to be elected. All of the director nominees other than Mr. Hagan are currently directors of ICG. All nominees have consented to being named as nominees for directors of ICG and have agreed to serve if elected. The nominees for Class II directors will be elected to serve for three-year terms, until their successors have been elected and have qualified, and Mr. Hagan, the nominee for Class III director, will be elected to serve for a one-year term, until his successor has been elected and has qualified. If some or all of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for any remaining nominee(s) and any substitute nominee(s) designated by the Board. Director elections are determined by a plurality of the votes cast.

Set forth below is information regarding each nominee for Class II director and Class III director, as well as each current Class I and Class III director, each of whose term will continue after the Annual Meeting.

Nominees For Class II Directors

Thomas A. Decker. Mr. Decker has served as a director of ICG since October 2004. Mr. Decker is currently the Chairman of the Pennsylvania Gaming Control Board. From May 2000 through December 2004, he served as Managing Partner of Cozen O’Connor. He previously served as Executive Vice President and General Counsel of Asbury Automotive Group, as Senior Vice President and General Counsel for Unisource Worldwide, Inc., and as Executive Vice President, Chief Operating Officer and General Counsel for Saint-Gobain Corporation. He is a former Commissioner of the Delaware River Port Authority and PATCO. He currently serves as a member of the Board of Trustees of the Gesu School and the Boards of Directors of the YMCA of Philadelphia and Vicinity and the Philadelphia Zoo, and he is a member of the Board of Business Advisors for the University of Virginia Law School. Age: 61.

Dr. Thomas P. Gerrity.Dr. Gerrity has served as a director since December 1998. Dr. Gerrity also served as the Dean of The Wharton School of the University of Pennsylvania from July 1990 to June 1999. He is currently Professor of Management and Dean Emeritus at The Wharton School. Dr. Gerrity also serves as a director of CVS Corporation, Hercules, Inc. and Sunoco, Inc. and as a member of the Corporation of the Massachusetts Institute of Technology. Dr. Gerrity was a director of Federal National Mortgage Association (“Fannie Mae”) from September 1991 until December 2006 and served as the chair of Fannie Mae’s audit committee from January 1999 until May 2006. Fannie Mae restated its audited financial statements for certain periods during which Dr. Gerrity was chair of the audit committee. For additional information, see Fannie Mae’s reports filed with the SEC. Age: 65.

Robert E. Keith, Jr. Mr. Keith has served as a director of ICG since its inception in March 1996 and was Chairman of the Board from ICG’s inception until December 2001. Mr. Keith is also a Managing Director of TL Ventures, a group of venture capital funds focused on technology services, software communications and life sciences. In addition to his work with individual companies, Mr. Keith is Chief Executive Officer of Technology Leaders Management Inc., which is responsible for the management of the funds. He is also a senior advisor to, and co-founder of, EnerTech Capital, a specialty firm focused on early to expansion-stage venture investments in principally U.S.-based software, technology and services businesses that serve the energy and communications industries. Prior to his affiliation with TL Ventures in 1989, Mr. Keith held executive positions with Fidelity Bank in Philadelphia for over 20 years, most recently as Vice Chairman. At Fidelity, he headed the Corporate Banking Department, which included specialized and commercial lending groups and several non-banking subsidiaries. Mr. Keith serves on the boards of directors of a number of the TL Ventures portfolio companies. In addition, he is Chairman of Safeguard Scientifics, Inc. and Vice Chairman and a member of the Board of Directors and Executive Committee of Ben Franklin Technology Partners. Age: 65.

Nominee For Class III Director

Michael J. Hagan. Mr. Hagan has served as the Chairman of the Board and Chief Executive Officer of NutriSystem, Inc. (“NutriSystem”) since December 2002 and as President since July 2006. Prior to joining NutriSystem, Mr. Hagan was the co-founder of Verticalnet, Inc. (“Verticalnet”) and held a number of executive positions at Verticalnet since its founding in 1995, including Chairman of the Board from February 2002 to May 2005, President and Chief Executive Officer from January 2001 to February 2002, Executive Vice President and Chief Operating Officer from January 2000 to January 2001 and Senior Vice President prior to that time. Mr. Hagan is also a trustee of American Financial Realty Trust and Saint Joseph’s University and a director of NutriSystem and Verticalnet. ICG held an equity interest in Verticalnet from 1996 through November 2005. Age: 44.

7

The Board of Directors recommends a vote FOR all of the listed nominees.

Incumbent Class I Directors – to Continue in Office for Terms Expiring in 2009

David J. Berkman.Mr. Berkman has served as a director of ICG since January 2001. He is the Managing Partner of Liberty Associated Partners, LLC, a private equity firm primarily engaged in the telecommunications, technology, and Internet market segments. Mr. Berkman serves as a director of Entercom, Inc., the fourth largest US radio broadcaster, Cibernet, Inc., a service provider to the wireless industry, Current Communications Group, LLC, a company that develops powerline technologies, XOS Technologies, Inc., a company that provides sports coaching products and devices and Jingle Networks, a provider of free directory assistance information. Civically, he serves on the Board of Trustees of the Kimmel Center for the Performing Arts, the Board of Overseers for the University of Pennsylvania School of Engineering and The Franklin Institute. Age: 45.

David K. Downes. Mr. Downes has served as a director of ICG since October 2003. Since early 2004, Mr. Downes has served as Independent Chairman of the Board of Trustees of the Quaker Investment Trust, the President and CEO and a director of CRAFund Advisors, Inc. and the President and Treasurer of The Community Reinvestment Act Qualified Investment Fund. Since 2005, Mr. Downes has served as a director of CorrectNet and Oppenheimer Funds. Mr. Downes was also appointed Chair of the U.S. Trust Investment Committee of Glaxo Smith Kline. From 1995 until October of 2003, Mr. Downes served as Chief Operating Officer and Chief Financial Officer of Lincoln National Investment Companies and Delaware Investments, the investment management subsidiary of the Lincoln Financial Group. He also served as the Chairman and Chief Executive Officer of Delaware Investments’ retirement business from 1997 to 2003, President and Chief Executive Officer of Delaware Service Company from 1993 to 2003, and President and Chief Executive Officer of Delaware Investments Family of Funds from 1997 to 2003. In addition, he served as President and a director of Lincoln National Convertible Securities Fund, Inc. and the Lincoln National Income Funds, Inc. from 2000 to 2003. Prior to joining Delaware Investments, Mr. Downes was Vice Chairman, Chief Financial Officer and a member of the Board of Directors of Equitable Capital Management Corporation, an investment subsidiary of the Equitable Assurance Society. Among his earlier achievements, Mr. Downes was the Chief Financial Officer of Merrill Lynch Pierce Fenner and Smith, Inc. and corporate controller of Merrill Lynch & Company, Inc. Age: 67.

Warren V. Musser. Mr. Musser has served as a director of ICG since March 2000. Mr. Musser is the President and Chief Executive Officer of The Musser Group, a financial consulting company, and Chairman Emeritus at Safeguard Scientifics, Inc. He previously served as Chairman and Chief Executive Officer of Safeguard Scientifics, Inc. from 1953 until April 2001. He currently serves as a director of NutriSystem and Health Benefits Direct Corp. and is Chairman of the Board of Directors of Epitome Systems, InfoLogix, Inc. and Telkonet, Inc. Mr. Musser serves on a variety of civic, educational and charitable boards of directors and as Chairman of Economics PA, Chairman of The Eastern Technology Council, Vice Chairman of the National Center for the American Revolution and Vice President of Development for the Liberty Council of the Boy Scouts of America. Age: 80.

Incumbent Class III Directors – to Continue in Office for Terms Expiring in 2008

Walter W. Buckley, III.Mr. Buckley is a co-founder and has been a director of ICG since March 1996, and is currently the Chairman of the Board, Chief Executive Officer and President of ICG. Mr. Buckley has served as Chairman since December 2001, as Chief Executive Officer since March 1996 and as President from March 1996 to December 2001, reassuming the title of President in December 2002. Prior to co-founding ICG, Mr. Buckley worked for Safeguard Scientifics, Inc. beginning in 1987 as a financial analyst and as Vice President of Acquisitions from 1991 to February 1996. Mr. Buckley directed many of Safeguard Scientifics’ investments and was responsible for developing and executing Safeguard Scientifics’ multimedia and Internet investment strategies. Mr. Buckley serves as a director of ICG Commerce Holdings, Inc. Age: 47.

Philip J. Ringo. Mr. Ringo has served as a director of ICG since January 2003. Mr. Ringo is currently the Chairman and Chief Executive Officer of RubberNetwork.com LLC, the first and largest tire and rubber industry strategic sourcing consortium. From 1999 to 2001, Mr. Ringo was the President, Chief Operating Officer and a director of ChemConnect, a leading Internet marketplace serving the global chemicals and plastics industry. Mr. Ringo also serves as a director of Genesee & Wyoming Inc., a world-class

8

provider of rail freight transportation and its supporting services, and Trimac Leasing Services Ltd., a U.S. based provider of services in highway transportation of bulk commodities. Age: 65.

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTANT

ITEM 2 ON PROXY CARD

The Audit Committee has selected KPMG LLP as the independent registered public accountant to audit ICG’s financial statements and internal controls over financial reporting for 2007. Although action by the stockholders on this matter is not required, the Audit Committee and the Board believe it is appropriate to seek stockholder ratification of this selection in light of the role played by the independent registered public accountant in reporting on ICG’s financial statements and related internal controls. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting, in person or by proxy, and voting thereon. If this appointment is not ratified by the stockholders, the Audit Committee may reconsider its selection.

One or more representatives of KPMG LLP are expected to attend the Annual Meeting. The representatives will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Audit and Other Fees

During 2005 and 2006 ICG paid the following amounts to KPMG LLP:

| | | | | | |

| | | 2005 | | 2006 |

Audit Fees(1) | | $ | 1,300,806 | | $ | 1,181,237 |

Audit-Related Fees | | $ | — | | $ | — |

Tax Fees(2) | | $ | 121,665 | | $ | 150,268 |

All Other Fees | | $ | — | | $ | — |

| (1) | | Fees include amounts billed by KPMG LLP for similar services to ICG’s majority-owned subsidiaries and amounts for the audits of (a) the effectiveness of internal control over financial reporting and (b) management’s assessment of the effectiveness of internal control over financial reporting. |

| (2) | | Fees were for tax compliance and consulting services rendered to ICG and its majority-owned subsidiaries. |

The Audit Committee believes that KPMG LLP’s provision of non-audit services is compatible with maintaining KPMG LLP’s independence.

Pre-Approval of Services

The Audit Committee’s policy is to pre-approve the engagement of accountants to render all audit and tax-related services for ICG, as well as any changes to the terms of the engagement. The Audit Committee will also pre-approve all non-audit related services proposed to be provided by ICG’s independent registered public accountant. The Audit Committee reviews the terms of the engagement, a description of the engagement and a budget for the engagement. The request for services must be specific as to the particular services to be provided. Requests are aggregated and submitted to the Audit Committee to be approved in one of the following ways: at a meeting of the Audit Committee, through a written consent or by a designated member of the Audit Committee. The Audit Committee has pre-approved 100% of the total 2006 services provided by KPMG LLP, its independent registered public accountant.

9

The Board of Directors recommends a vote FOR ratification of the appointment of KPMG LLP as ICG’s independent registered public accountant.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that ICG specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee oversees ICG’s financial reporting process on behalf of the Board. Management of ICG is responsible for ICG’s financial reporting process, including its system of internal control, and for the preparation of consolidated financial statements in accordance with U.S. generally accepted accounting principles. ICG’s independent registered public accountant is responsible for auditing those financial statements and expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles, as well as an opinion on management’s assessment of, and the effective operation of, ICG’s internal control over financial reporting. The Audit Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee selects the independent registered public accountant to be retained to audit ICG’s financial statements and internal control over financial reporting, and, once retained, the independent registered public accountant reports directly to the Audit Committee. The Audit Committee consults with and reviews recommendations made by the independent registered public accountant with respect to financial statements, financial records and financial controls of ICG and makes recommendations to the Board as it deems appropriate from time to time. The Audit Committee is responsible for approving both audit and non-audit services to be provided by the independent registered public accountant. The Audit Committee is composed of at least three directors who are “independent,” as that term is defined by applicable Nasdaq and SEC rules. The Audit Committee operates under a written charter adopted by the Board. A copy of the Audit Committee’s charter is posted on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm.

The Audit Committee met with management periodically during fiscal year 2006 to consider the adequacy of ICG’s internal controls and discussed these matters with ICG’s independent registered public accountant, KPMG LLP. The Audit Committee also discussed with senior management ICG’s disclosure controls and procedures and the certifications by ICG’s Chief Executive Officer and Chief Financial Officer, which are required by the SEC under the Sarbanes-Oxley Act of 2002, as amended, for certain of ICG’s filings with the SEC.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the 2006 Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee also reviewed Management’s Report on Internal Control over Financial Reporting with management.

The Audit Committee reviewed with the independent registered public accountant, who is responsible for expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of ICG’s accounting principles, as well as an opinion on management’s assessment of, and the effective operation of, ICG’s internal control over financial reporting. The Audit Committee discussed with ICG’s independent registered public accountant the matters required to be discussed by Statement on Auditing Standards No. 61 and such other matters as are required to be discussed under auditing standards generally accepted in the United States of America. The Audit Committee received the written disclosures and the letter from ICG’s independent registered public accountant relative to their independence with respect to ICG. In addition, the Audit Committee discussed with the independent registered public accountant the compatibility of non-audit services with the independent registered public accountant’s independence.

The Audit Committee discussed with ICG’s independent registered public accountant the overall scope and plans for its 2006 audit. The Audit Committee met with the independent registered public accountant, with and without management present, to discuss the results of its audit, its evaluation of ICG’s internal controls and the overall quality of ICG’s financial reporting.

10

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report for the fiscal year ended December 31, 2006 that was filed with the SEC.

The Audit Committee has selected the firm of KPMG LLP as independent registered public accountant to audit and report upon ICG’s financial statements and internal control over financial reporting for 2007. In making this selection, the Audit Committee has considered whether KPMG LLP’s provision of services other than audit services is compatible with maintaining its independence.

AUDIT COMMITTEE

David K. Downes, Chairman

Thomas A. Decker

Philip J. Ringo

COMPENSATION COMMITTEE REPORT

The Compensation Committee of ICG has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement.

COMPENSATION COMMITTEE

David J. Berkman, Chairman

David K. Downes

Dr. Thomas P. Gerrity

11

COMPENSATION DISCUSSION AND ANALYSIS

ICG’s Compensation Objectives and Philosophy

ICG believes that its management team is one of its most valuable assets and that maintaining a strong pool of executive talent is critical to ICG’s sustained success. ICG’s employee compensation program is designed to attract, retain and motivate exceptional executives. The Compensation Committee structures ICG’s compensation program to align the interests of executives with ICG’s stockholders by tying compensation to the creation of long-term stockholder value and the attainment of appropriate short-term and long-term growth and strategy objectives. ICG seeks to reward executives for their contributions to ICG’s achievements and to encourage executives to operate ICG from the viewpoint of stockholders.

To help it achieve these objectives, ICG pays its executive officers a balanced mix of cash and equity compensation, which consists primarily of:

| | • | | annual cash bonuses based upon the achievement of specific business goals; and |

| | • | | equity-based compensation. |

In addition to these primary components, ICG uses employment agreements and other compensation arrangements with its executive officers; these arrangements are described in the sections that follow and elsewhere in this proxy statement. In establishing executive compensation consistent with its “pay for performance” philosophy, the Compensation Committee believes it is important to place a substantial percentage of executive officers’ total compensation at risk, principally in the form of annual performance-based bonuses and long-term equity-based compensation that is tied to the achievement of specific company goals, as well as individual contributions and accomplishments.

The Role of the Compensation Committee

The Board has delegated to the Compensation Committee primary responsibility for establishing, overseeing and directing ICG’s executive compensation program and policies, as well as administering ICG’s equity compensation plans. The Compensation Committee consists of three non-employee directors, each of whom satisfies Nasdaq’s independence standards. The Compensation Committee operates under a charter, which sets forth the responsibilities of the Compensation Committee. The charter is available on ICG’s website at http://www.internetcapital.com/investorinfo-corpgov.htm.

The Compensation Committee meets at least two times per year (and more often if necessary) to complete its assigned responsibilities. In 2006, the Compensation Committee met five times. The Compensation Committee periodically reviews and approves ICG’s ongoing compensation strategy. In the beginning of each fiscal year, the Compensation Committee establishes corporate goals and objectives relevant to incentive-based executive compensation for the upcoming year. After the completion of each fiscal year, the Compensation Committee evaluates corporate performance in light of the year’s corporate goals and objectives and approves a bonus pool based on that performance. In addition, the Compensation Committee reviews the total compensation package for each of ICG’s executive officers on an annual basis. Tally sheets are used in connection with this review so that the Compensation Committee can evaluate each executive officer’s compensation as a whole, as opposed to assessing each component of compensation individually. If the Compensation Committee determines that a change in the compensation of an executive officer is warranted, it approves, or recommends that the Board approve, such change in compensation.

The Role of the Compensation Consultant

Under its charter, the Compensation Committee is authorized to engage independent advisors, including compensation consultants, to receive advice on matters related to executive compensation. The Compensation Committee is also authorized to approve the fees and

12

other terms of any such engagement and to terminate any such engagement in accordance with its terms. The Compensation Committee engages compensation consultants in connection with its review of trends in management compensation and models of new compensation programs. The compensation consultant:

| | • | | reports directly to the Compensation Committee; |

| | • | | periodically participates in the meetings of the Compensation Committee; |

| | • | | provides evaluations of the compensation offered by ICG’s peers; and |

| | • | | makes recommendations to the Compensation Committee regarding executive officer compensation. |

During 2006, the Compensation Committee engaged Radford Surveys + Consulting, a business unit of Aon (“Radford”), to provide compensation consulting services. In early 2006, Radford’s engagement focused on advising the Compensation Committee in respect of the establishment of ICG’s 2006 bonus plan and the bonus determination made with respect to ICG’s 2005 bonus plan. In late 2006, the Compensation Committee initiated a comprehensive review of executive and director compensation. In connection with this review, the Compensation Committee instructed Radford to analyze ICG’s executive and director compensation programs in light of current marketplace and peer comparisons. The Compensation Committee authorized this engagement due to its increased focus on ICG’s ability to retain executives in light of superior financial incentives being offered by private equity and venture capital firms with which ICG competes for talent. Radford made recommendations with respect to executive officer cash compensation in December 2006 and early 2007. In addition, Radford provided information and analysis relating to the equity grants of ICG’s peer groups to be used by the Compensation Committee in connection with potential future equity grants.

The Role of Management and Other Employees

ICG’s Chief Executive Officer meets with the Compensation Committee and is responsible for evaluating the performance of ICG’s other executive officers and making recommendations to the Compensation Committee with respect to the kinds and amounts of compensation paid to such individuals. Senior management is responsible for evaluating and setting compensation with respect to ICG’s other employees. Management also recommends annual bonus goals to the Compensation Committee based on ICG’s strategic initiatives and partner company financial plans.

ICG’s employees, particularly the members of its human resources and legal departments, support the Compensation Committee in its work. They do so by providing the committee with reports and other compensation data and analyses, answering the committee’s inquiries regarding compensation and preparing and revising documentation relating to ICG’s compensation plans, agreements and other arrangements.

Peer Analysis

One tool used by the Compensation Committee in determining executive compensation is peer benchmarking. The Compensation Committee has recognized the increasing importance of analyzing executive compensation packages at firms with which ICG competes for talent so that ICG can provide competitive compensation packages to attract and retain key executives. Peer companies are selected by the Compensation Committee with input from management and the compensation consultant. Given ICG’s unique structure as a holding company with interests in many partner companies, identification of peers that are publicly traded is challenging. Accordingly, the Compensation Committee has recently increased its focus on the compensation packages offered by private equity and venture capital firms (a) with an amount of assets under management comparable to those managed by ICG and (b) of the type with which ICG competes for talent. In evaluating such packages, the Compensation Committee has relied on published market surveys and related analyses supplied by ICG’s compensation consultant, as well as the personal knowledge of certain Board members who have experience with private equity and venture capital firms.

ICG did not perform any peer benchmarking analysis in connection with its executive compensation for fiscal year 2006, which did not change materially from ICG’s executive compensation for fiscal year 2005. Due to its increased focus on ICG’s ability to attract and retain executives, the Compensation Committee performed peer benchmarking analysis in late 2006 and early 2007. In

13

connection with this review, the Compensation Committee analyzed compensation data provided by ICG’s Compensation Consultantwith respect to two separate peer groups:

| | • | | a group of seven publicly traded companies, each of which, like ICG, is situated as a holding company; and |

| | • | | a group of privately held companies of the type that compete with ICG for talent. |

The Compensation Committee considered the following public companies to be ICG peers due to the similarities between their respective holding company structures and ICG’s structure: Allied Capital Corporation, American Capital Strategies, Ltd., Capital Southwest Corporation, CMGI Inc., Harris & Harris Group, Inc., Safeguard Scientifics, Inc. and Rand Capital Corporation. Radford reviewed executive compensation data extracted from the SEC filings of these public companies and prepared a detailed analysis of this data for the Compensation Committee. In addition, the Compensation Committee looked at the executive compensation data of private companies focused on private equity and venture capital, since ICG typically competes with these types of companies for executive talent. Radford obtained compensation data with respect to these private companies from the following sources and prepared a detailed analysis of this data for the Compensation Committee:

| | • | | the McLagan Partners 2006 Private Equity/Venture Capital Survey of mid-size companies with assets under management of under $1 billion; and |

| | • | | the 2006 Private Equity Analyst-Holt Compensation Study of mid-size private equity firms with assets under management of between $300 million and $1 billion. |

The Compensation Committee recognizes that it is difficult to compare ICG with private equity and venture capital firms, and that it is also difficult for ICG to compete with such firms for executive talent. These difficulties arise because private equity and venture capital firms typically deliver all or most of their equity-based compensation in the form of carried interests, that is, partnership interests that allow the executive recipients to share directly in the profits of such firms, while ICG’s equity-based compensation consists of stock options, restricted stock and stock appreciation rights (“SARs”), instruments that are less tax efficient for their recipients than carried interests.

Radford recommended that in order to keep ICG’s executive compensation competitive with the marketplace, ICG should offer its executive officers base salaries and total cash compensation between the 50th and 75th percentiles of ICG’s peer comparison groups described above. Accordingly, the Compensation Committee generally targets its executive officers’ base salaries and total cash compensation within those ranges.

Elements of ICG’s Compensation Program

In order to attract, retain and motivate exceptional executive officers and to align the interests of its executive officers with ICG’s stockholders, ICG pays its executive officers a balanced mix of cash and equity compensation. This compensation consists primarily of:

| | • | | annual cash bonuses based upon the achievement of specific business goals; and |

| | • | | equity-based compensation. |

ICG has employment agreements and other compensation arrangements in place with its executive officers; those arrangements are described in the sections that follow and elsewhere in this proxy statement.

Base Salaries

The Compensation Committee aims to provide competitive base salaries for its executive officers. Accordingly, base salaries are generally targeted at a level between the 50th and 75th percentiles of ICG’s peer comparison group. However, peer comparisons are only one factor taken into account by the Compensation Committee in establishing the base salaries of executive officers. The committee also takes into consideration an executive’s skill set, experience and responsibilities within ICG, as well as internal pay equity among ICG executives, in setting base salaries.

14

The Compensation Committee reviews the base salaries of all executive officers on an annual basis but does not typically adjust salaries annually. Aside from salary increases in connection with promotions, the base salaries of ICG’s executive officers remained relatively flat between 2002 and 2006.

In February 2006, R. Kirk Morgan was promoted to the position of Chief Financial Officer. In connection with this promotion, the Compensation Committee approved the terms of an employment agreement between ICG and Mr. Morgan that provided for an increase in Mr. Morgan’s base salary.

Dr. Zisman, a member of the Board from June 2001 until April 2007, began providing ICG with consulting services in late 2004 through Wayne Strategy Consultants, Inc. (“WSCI”), an entity controlled by Dr. Zisman. Based on the nature and amount of services provided by Dr. Zisman to ICG, in February 2006 the Board determined that Dr. Zisman was an executive officer of ICG. In July 2006 and April 2007, the Board approved amendments to ICG’s consulting agreement with WSCI and Dr. Zisman. Under the 2006 amendment, the amount of time to be devoted by Dr. Zisman to ICG business matters was reduced, effective September 1, 2006, from 90% to 50% of Dr. Zisman’s total work hours, and, under the 2007 amendment, the amount of time to be devoted by Dr. Zisman to ICG business matters was reduced, effective April 1, 2007, from 50% to 25% of Dr. Zisman’s total work hours. Each of the amendments provided for a reduction in Dr. Zisman’s cash compensation and a partial forfeiture by Dr. Zisman of certain unvested equity awards granted in July 2005. These compensation reductions and equity award forfeitures, which are described in “Related Party Transactions” below, correspond with the reductions in the percentage of Dr. Zisman’s work hours devoted to ICG business matters. As a result of the 2006 reduction in the amount of his time devoted to ICG business matters, Dr. Zisman ceased serving as an executive officer of ICG.

Beginning in late 2006, Radford studied the cash compensation being paid to chief executives and other executive officers of the members of ICG’s peer comparison groups identified above. As a result of its study, Radford determined that ICG’s target total compensation for executive officers was trailing an increasingly competitive marketplace based upon the tenure and experience of the management. Accordingly, Radford recommended changes to the cash compensation of ICG’s executive officers.

In addition, Radford performed a separate analysis in late 2006 relating to other terms and conditions, including change of control and severance arrangements, contained in the employment agreements of chief executive officers. Radford used the following data sources in performing its analysis of such terms and conditions:

| | • | | the SEC filings of the seven publicly traded peer companies identified by Radford and the Compensation Committee for their peer group analysis regarding executive compensation generally; |

| | • | | a Radford proprietary database of approximately 50 high technology companies; and |

| | • | | a November 2005 Frederick W. Cook and Company study of the top 50 New York Stock Exchange and Nasdaq companies (used for analysis of change of control provisions only). |

Based upon its review, Radford recommended that certain terms of Mr. Buckley’s employment agreement, which was up for renewal at the end of 2006, be amended due to changes at ICG and in the competitive marketplace since the date the agreement was structured.

During late 2006 and early 2007, in light of Radford’s peer group analysis relating to cash compensation and other employment terms of chief executives, the Chairman of the Compensation Committee negotiated the terms of a new employment agreement with Mr. Buckley, and in February 2007, ICG entered into a new employment agreement with Mr. Buckley. The new agreement, which was approved by the full Board after recommendation by the Compensation Committee, resulted in an increase in Mr. Buckley’s base salary and a reduction in his severance and change of control benefits to make those terms more consistent with the market terms reflected in Radford’s peer group data. A more complete description of the terms of Mr. Buckley’s employment agreement is contained in the “Employment Agreements” and “Potential Payments Upon Termination or Change of Control” sections below.

During early 2007, in light of the increased role of Douglas A. Alexander as Managing Director, Operations of ICG, as well as Radford’s peer group analysis relating to executive cash compensation, the Chairman of the Compensation Committee negotiated the terms of a new employment agreement with Mr. Alexander to replace his existing agreement. In April 2007, ICG entered into a new employment agreement with Mr. Alexander. The agreement, which was approved by the Compensation Committee, resulted in an increase in Mr. Alexander’s base salary and his severance and change of control benefits to make those terms substantially similar to

15

those reflected in Mr. Buckley’s new employment agreement. A more complete description of the terms of Mr. Alexander’s employment agreement is contained in the “Employment Agreements” and “Potential Payments Upon Termination or Change of Control” sections below.

In February 2007, in light of Radford’s peer group analysis, ICG entered into a new employment agreement with R. Kirk Morgan to replace his previous employment agreement. The new agreement resulted in an increase in Mr. Morgan’s base salary, target bonus and severance benefits to make those terms more consistent with the market terms reflected in Radford’s peer group data. The terms of Mr. Morgan’s employment agreement, which was approved by the Compensation Committee, are described in greater detail in the “Employment Agreements” and “Potential Payments Upon Termination or Change of Control” sections below.

Bonuses

At the beginning of each year, the Compensation Committee establishes a bonus plan to motivate ICG’s employees to achieve specified corporate goals. After a recommendation from the Compensation Committee, the bonus plan is approved by the full Board. Typically, 80% of the bonus is tied to quantitative goals regarding the financial performance of ICG and its partner companies, and 20% of the bonus is tied to qualitative factors. The bonus plan sets forth short-term goals designed to focus ICG’s management on achievements that the Compensation Committee believes will ultimately increase stockholder value and to reward employees for performance.

Most of the quantitative targets are designed to incentivize ICG’s management to drive the growth of partner companies’ businesses, either by increasing revenues and improving EBITDA performance or by increasing the net asset value of the partner companies. The goals are generally tied to partner company financial plans that management and the Compensation Committee view as fairly aggressive, such that achievement of the bonus is not intended to be a foregone conclusion. The Compensation Committee usually establishes a performance band for each partner company, under which no bonus can be awarded with respect to such company for the quantitative targets described above unless the partner company achieves a minimum threshold performance.

The qualitative elements of the bonus plan focus on ICG’s achievement of certain strategic objectives that are identified at the beginning of the measurement period, as well as the ability of ICG’s executive officers to manage unforeseen circumstances.

The goals underlying the bonus plans are generally designed to limit the Compensation Committee’s discretion in making awards. The structure of the quantitative goals of the bonus plan, which comprise 80% of the total bonus, precludes the use of discretion in determining achievement of such goals other than with respect to changed circumstances, such as the sale of a partner company during the measurement period or a decision by ICG to opportunistically repurchase debt. However, because determinations regarding the achievement of qualitative goals, which account for 20% of the total bonus, are somewhat subjective by their nature, a limited opportunity exists for the use of discretion by the Compensation Committee.

A target bonus is established each year for each ICG executive officer. This target bonus is tied to a percentage of the executive officer’s base salary. In 2006, the target bonuses for ICG’s executive officers ranged from 60% to 150% of base salary. Actual bonus awards can range from 0% to 200% of an individual’s target award. Bonus awards for ICG’s executive officers under ICG’s annual bonus plan are tied primarily to ICG’s achievement of the bonus goals. Individual performance and achievement of individual goals may also factor into bonuses awarded under the bonus plan. A large portion of the target cash compensation of ICG’s executive officers is tied to the bonus plan. The Compensation Committee believes that this structure is appropriate because it aligns the interests of management and stockholders by rewarding executives for strong annual company performance.

In February 2006, the Compensation Committee and the full Board approved ICG’s 2006 bonus plan. Fifty percent of the potential bonus award was tied to the realization of a specified increase in the aggregate value of ICG’s core partner companies, 10% of the potential bonus award was linked to the achievement of a specified increase in the aggregate value of ICG’s other assets, and 20% of the potential bonus award related to ICG’s effective deployment of capital. Twenty percent of the bonus was tied to ICG’s execution of the following qualitative goals:

| | • | | improvement in communicating the value of ICG’s underlying assets; |

16

| | • | | building the ICG brand; |

| | • | | performance and effectiveness of partner company executives; |

| | • | | reaction to unforeseen market/business conditions; and |

| | • | | overall execution of strategic initiatives. |

In February 2007, the Compensation Committee evaluated ICG’s 2006 performance to determine the extent to which ICG achieved its 2006 goals. The committee declared a bonus for 2006 performance based on 93% achievement of ICG’s goals. This was comprised of an award of 73% out of a possible 80% with respect to ICG’s quantitative goals and 20% out of a possible 20% with respect to ICG’s qualitative goals. Actual amounts paid to each of ICG’s named executive officers under the 2006 bonus plan are set forth in the “Summary Compensation Table” below.

Occasionally, ICG will award special bonuses outside of ICG’s annual bonus plan. Such bonuses are intended to reward employees for exceptional individual performance. In October 2006, the Compensation Committee awarded a special bonus in the amount of $350,000 to Mr. Alexander. This bonus was granted in light of Mr. Alexander’s increased responsibilities at ICG, as well as Mr. Alexander’s performance in connection with strategic guidance provided to LinkShare Corporation (“LinkShare”), one of ICG’s partner companies, which was sold in 2005. Mr. Alexander’s bonus was paid in connection with the release to ICG of approximately $14.7 million of escrowed funds, which represented the final amount of the approximately $150.1 million of cash proceeds received by ICG in the LinkShare sale. In January 2007, the Compensation Committee awarded a special bonus in the amount of $165,000 to Dr. Zisman. This bonus was granted in light of Dr. Zisman’s performance in connection with strategic guidance provided to several of ICG’s partner companies in 2006.

Equity Grants

The Compensation Committee believes that ICG’s executive officers should focus on building long-term value for ICG’s stockholders and operate ICG from the perspective of those stockholders. Thus, under ICG’s compensation program, a significant portion of each executive officer’s compensation consists of equity awards that are directly linked to the creation of stockholder value. The Compensation Committee further believes that the alignment of the interests of ICG’s management and its stockholders should be as direct as possible. Accordingly, the Compensation Committee seeks to have a meaningful portion of ICG’s outstanding equity continually retained by ICG’s executive officers. This goal is accomplished in part through ICG’s stock ownership guidelines, which are described more fully below.

ICG’s equity grants have taken the form of restricted stock, stock options and SARs. When determining the kind and amount of equity awards to grant, the Compensation Committee considers the accounting and tax implications of such awards, as well as the dilutive impact that such awards will have on ICG’s stockholders. Over time, ICG has shifted from awards of stock options to awards of restricted stock and SARs. The reason for this shift is that ICG has found that, through the granting of restricted stock and SARs, it is able to provide employees with the same or a similar level of economic benefits and incentives as are provided by options, with less dilution to ICG’s stockholders.

Equity awards are generally made to employees at the first Compensation Committee or Board meeting occurring after the employee’s employment is commenced. Thereafter, awards are made periodically in an effort to retain and motivate employees, as well as to ensure continuing alignment of executive and stockholder interests. ICG last made equity grants to its executive officers in July 2005. These awards vest over a four-year period from the grant date. Because the July 2005 equity grants were substantial, ICG did not make any equity grants to its executive officers in 2006. The Compensation Committee plans to continue to use equity grants as a tool to retain and motivate executive officers, but it does not currently have any specific plans regarding future equity grants to its executive officers. When making any such grants, the Compensation Committee will consider, among other things, the amount of outstanding unvested equity awards, which provide incentives for executive officers to continue their employment with ICG, held by each executive officer.

Awards to executive officers are determined by the Compensation Committee following input from the independent compensation consultant and ICG’s management. The Compensation Committee seeks a level of award that will provide an equity incentive that is

17

competitive with the awards granted by ICG’s peers, that will preserve ICG’s internal equity standards and that will serve as a retention tool. Awards generally vest over a three-year to four-year period. However, in some instances, vesting accelerates upon the achievement of certain company performance objectives.

Severance

In order to attract and retain executive talent, ICG generally provides severance benefits to each of its executive officers. Such benefits generally consist of a cash payment, continuation of medical benefits, outplacement services and accelerated vesting on a portion of equity awards in the event that the executive officer is terminated without cause and executes a release in favor of ICG. Any severance benefits associated with a company change in control are based on a “double trigger,” such that benefits are paid only in the event that the executive is terminated without cause or, in some cases, resigns for good reason in connection with a change in control. A detailed discussion of the severance benefits payable to ICG’s named executive officers is set forth in “Potential Payments Upon Termination or Change of Control” below.

Retirement Plans

ICG maintains a qualified 401(k) plan for its employees. All employees are eligible to participate in this plan. Prior to 2007, ICG did not provide any matching funds. In January 2007, after consultation with the independent compensation consultant, the Compensation Committee approved a matching program under which ICG will match 100% of the amount contributed by each employee, subject to four-year vesting and an annual cap equal to the statutory maximum contribution for each employee, which is $15,500 for 2007. This matching program was implemented to provide a compensation package competitive with the companies in ICG’s peer group.

ICG does not provide any pension or other retirement benefits to its executive officers.

Deferred Compensation Plan

ICG maintains a deferred compensation plan under which each executive officer may elect to defer up to 75% of his or her base salary and/or up to 100% of his or her cash bonus. Interest accrues on deferred amounts at a rate equal to the prime rate of interest plus three percent. To date, no executive officer has ever deferred any cash compensation under this plan.

Other Compensation

ICG provides its executive officers with medical, dental, vision, long-term disability and term life insurance benefits, except that Dr. Zisman, who is not an employee of ICG and who is no longer an executive officer of ICG, does not receive any such benefits. These benefits are the same as those provided to all full-time employees, except that executive officers (other than Dr. Zisman) and their spouses are provided with certain additional medical services of up to $8,000 annually and a portable supplemental long-term disability policy. ICG does not provide its executive officers with any other perquisites.

Equity Awards Practices

Grants of equity awards are typically made by the Compensation Committee or the full Board at regularly scheduled meetings. Neither the full Board nor the Compensation Committee has delegated any authority to management with respect to the approval of the grants of equity awards. ICG has priced all of its stock options and SARs based on the “fair market value” of ICG’s Common Stock, as such term is defined in ICG’s equity compensation plans. ICG’s equity compensation plans historically defined fair market value as the closing price of ICG’s Common Stock as reported by Nasdaq on the trading day immediately prior to the date of grant. On February 28, 2007, ICG amended the definition of fair market value in its equity compensation plans to provide that fair market value will be determined for future grants by reference to the closing price of ICG’s Common Stock on the date of grant (or the closing price of the next trading day if there are no trades in ICG’s stock on the date of grant). This change was prompted by a perceived preference by the SEC for companies to use this methodology of determining the fair market value of their equity grants.

18

ICG is confident in the integrity of its historical equity granting practices. ICG believes that it has never backdated any option or engaged in any manipulative practices with respect to the timing of equity grants. On February 26, 2007, the Compensation Committee enacted a formal equity award grant policy. This policy provides that:

| | • | | equity grants may be made only by the full Board or the Compensation Committee at a meeting at which minutes are taken, which minutes must set forth the details of such grants; |

| | • | | the exercise price of the equity grants, if applicable, must equal the fair market value on the date of the grant; and |

| | • | | grants may not be made during any period in which ICG is in possession of material non-public information. |

Executive Officer Stock Ownership Guidelines