UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

/X/ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

/ / | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________.

Commission file number 000-50485

CENTRAL FREIGHT LINES, INC.

(Exact name of registrant as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | 74-2914331 (I.R.S. Employer Identification No.) |

5601 West Waco Drive, Waco, TX 76710

(Address of principal executive offices) (Zip Code)

(254) 772-2120

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class Common stock $0.001 Par Value | Name of each exchange on which registered Nasdaq ® |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes X No __

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

��X Yes No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer __ Accelerated filer __ Non-accelerated filer X

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes X No __

The aggregate market value of the voting stock held by non-affiliates of the registrant was $33,164,410 as of July 1, 2005 (based upon the $2.85 per share closing price on that date as reported by Nasdaq). In making this calculation the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and holders of more than 10% of a class of outstanding common stock, and no other persons, are affiliates.

The number of shares of common stock outstanding at April 25, 2006 was 18,294,454.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K of Central Freight Lines, Inc. for the year ended December 31, 2005, reflects the addition of information required by Items 10, 11, 12, 13, and 14 of Part III and Item 15(b) of Part IV of Form 10-K. Other than these items, none of the information contained in the Company’s Form 10-K filed on April 17, 2006, has been amended or restated.

The terms "we," "our," "us" or the "Company" refer to Central Freight Lines, Inc. and its subsidiary.

TABLE OF CONTENTS

Item | | Page |

| | | | |

| | | PART III | |

| | | | |

| | 10. | Directors and Executive Officers of the Registrant. | 1 |

| | 11. | Executive Compensation. | 6 |

| | 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 14 |

| | 13. | Certain Relationships and Related Transactions. | 16 |

| | 14. | Principal Accountant Fees and Services. | 17 |

| | | | |

| | | PART IV | |

| | | | |

| | 15. | Exhibits and Financial Statement Schedules. | 18 |

PART III

Item 10. Directors and Executive Officers of the Registrant

Information on Members of the Board of Directors

Information concerning the names, ages, positions with Central, tenure as a director and business experience of the members of Central's Board of Directors (the "Board") is as follows:

Robert V. Fasso, 52 Director Since 2002

Robert V. Fasso has served as our Chief Executive Officer and as a member of the Board since January 2002, and as President since March 2002. Mr. Fasso previously served as President - Regional Carrier Group of USF Corporation from 1997 to 2001, running its regional LTL group. Mr. Fasso has 35 years of experience in the LTL industry.

John Breslow, 56 Director Since 2003

John Breslow has served on the Board since Central's initial public offering in December 2003. Mr. Breslow is the owner and, since 1979, Chairman of the Board of Linweld, Inc. Linweld is a retail distributor of welding products and related equipment and a manufacturer and distributor of industrial, medical and specialty gases based in Lincoln, Nebraska. Mr. Breslow previously served two terms as Auditor of Public Accounts for the State of Nebraska between 1991 and 1998. Since 2000, Mr. Breslow has served on the Board of Directors of Stratus Fund, Inc., a registered mutual fund that offers shares in a number of separate investment portfolios. Since 2002, Mr. Breslow has also served as a member of the Board of Directors of EMT Corp., an indirect, wholly-owned subsidiary of Nelnet, Inc., which owns and manages student loan portfolios.

John Campbell Carruth, 75 Director Since 2004

John Campbell ("Cam") Carruth has served on the Board since November 2004. Mr. Carruth retired from his position as Chairman of the Board, Chief Executive Officer and President of USF Corporation in 2000. Mr. Carruth served as Chief Executive Officer and President of USF Corporation from June 1991 to July 2000, and as Chairman of the Board of that company from January 1998 to December 2000. Mr. Carruth was a director of USF Corporation from December 1991 to December 2000. Mr. Carruth is a past President of the Canadian Trucking Association and the Ontario Truck Associations, and is a past Director of the American Trucking Associations.

Porter J. Hall, 62 Director Since 2003

Porter J. Hall has served on the Board since Central's initial public offering in December 2003. Mr. Hall is a certified public accountant. Mr. Hall retired from public accounting in August 2000 after thirty-three years with Arthur Andersen LLP. At the time of his retirement, Mr. Hall was managing partner of Arthur Andersen's Salt Lake City, Utah office. He is an investor in and Chief Executive Officer of MyePhit.com, a fitness and wellness company.

Board of Directors

Meetings of the Board. During the year ended December 31, 2005, the Board met on five occasions. Each of the directors attended 75% or more of the meetings of the Board and the meetings held by all of the committees of the Board on which he served. In addition, from time to time, the Board acts by written consent to approve matters arising between scheduled meetings. The Board acted by written consent on five occasions during the year ended December 31, 2005. We encourage the members of the Board to attend our Annual Meetings of Stockholders. All five of our then-current directors attended the 2005 Annual Meeting of Stockholders.

Director Independence. Central's Common Stock is listed on Nasdaq, and therefore we are subject to the listing standards, including standards relating to corporate governance, embodied in applicable rules promulgated by the National Association of Securities Dealers, Inc. (the "NASD"). Pursuant to NASD Rule 4350(c)(1), our Board has determined that the following directors and nominees are "independent" under NASD Rule 4200(a)(15): John Breslow, Cam Carruth and Porter J. Hall. In accordance with NASD Rule 4350(c)(2), our independent directors hold regularly scheduled meetings, referred to as "executive sessions," at which only the independent directors are present. The independent directors held four such executive sessions in 2005. All independent directors were present at each executive session.

Stockholder Communications. The Board provides a process for stockholders to send written communications to the entire Board or individual directors. Information concerning the manner in which stockholders can send communications to the entire Board or individual directors is available on our website, located at http://www.centralfreight.com.

Committees of the Board

The Board has standing Audit, Compensation and Nominating and Corporate Governance Committees. The Board does not maintain any other standing committees. The table below sets forth the current membership of each of the standing committees of the Board.

Name | | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| John Breslow | | x | | x | | x |

| Cam Carruth | | x | | x | | x |

| Porter J. Hall | | x | | x | | x |

The Audit Committee

Purpose, Functions, Composition and Meetings of the Audit Committee. The Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of any independent public accountants engaged by us for the purpose of preparing or issuing an audit report or performing other audit or similar services for us. The Audit Committee meets with our independent public accountants to discuss our financial statements and matters related to their independence, as well as to ensure that the scope of their activities has not been restricted and that adequate responses to their recommendations and inquiries have been received. The Audit Committee also periodically meets with management to discuss our financial statements and the adequacy of our internal financial controls. In addition, the Audit Committee reviews and approves transactions between us and related parties, in the absence of the appointment of a special committee for that purpose.

The Audit Committee currently is comprised of John Breslow, Cam Carruth and Porter J. Hall. Mr. Hall serves as the Chairman of the Audit Committee. Each member of the Audit Committee satisfies the independence and Audit Committee membership criteria set forth in NASD Rule 4350(d)(2). Specifically, each member of the Audit Committee:

· | Is independent under NASD Rule 4200(a)(15); |

| | |

· | Meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act; |

| | |

· | Did not participate in the preparation of the financial statements of Central or any current subsidiary of Central at any time during the past three years; and |

| | |

· | Is able to read and understand fundamental financial statements, including Central's balance sheet, income statement and cash flow statement |

The Audit Committee met six times during 2005. Each member of the Audit Committee attended all of the Audit Committee meetings during 2005.

Audit Committee Financial Expert. The Board has determined that at least one "audit committee financial expert," as defined under Item 401(h) of Regulation S-K, currently serves on the Audit Committee. The Board has identified Porter J. Hall as an "audit committee financial expert." Mr. Hall is independent, as independence for Audit Committee members is defined under applicable NASD rules.

Audit Committee Charter. Since our initial public offering in December 2003, the Audit Committee has operated pursuant to a written charter detailing its powers and duties. In March 2004, the Board adopted an Amended and Restated Charter to comply with the requirements of NASD Rule 4350(d)(1). A copy the Audit Committee's Amended and Restated Charter was attached as Appendix A to our definitive proxy statement relating to the 2004 Annual Meeting of Stockholders filed with the SEC on April 23, 2004. A copy of the charter is available to stockholders on our website, located at http://www.centralfreight.com.

Report of the Audit Committee

Report of the Audit Committee. In performing its duties, the Audit Committee, as required by applicable rules and regulations promulgated by the SEC, issues a report recommending to the Board that our audited financial statements be included in our Annual Report on Form 10-K, and certain other matters, including the independence of our outside public accountants. The Report of the Audit Committee, which was approved by all members of the Audit Committee in March 2006, is set forth below.

The Report of the Audit Committee shall not be deemed to be incorporated by reference into any filing made by us under the Securities Act of 1933 or the Exchange Act, notwithstanding any general statement contained in any such filings incorporating this Form 10-K by reference, except to the extent we incorporate such report by specific reference.

Report of the Audit Committee of

Central Freight Lines, Inc.

The primary purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities relating to the quality and integrity of Central's financial reports and financial reporting processes and systems of internal controls. Central's management has primary responsibility for Central's financial statements and the overall reporting process, including maintenance of Central's system of internal controls. Central retains independent auditors who are responsible for conducting an independent audit of Central's financial statements, in accordance with generally accepted auditing standards, and issuing a report thereon. In performing its duties, the Audit Committee has discussed Central's financial statements with management and Central's independent auditors and, in issuing this report, has relied upon the responses and information provided to the Audit Committee by management and the independent auditors.

For the fiscal year ended December 31, 2005, the Audit Committee has:

· | Reviewed and discussed the audited financial statements with management and McGladrey & Pullen, LLP, Central's independent auditors; |

| | |

· | Discussed with the auditors the matters required to be disclosed by Statement on Auditing Standards No. 61, as amended, "Communication with Audit Committees or Others with Equivalent Authority and Responsibility"; and |

| | |

· | Received the written disclosures and the letter from the independent auditors required by Independence Standards Board Statement No. 1, as amended, "Independence Discussions with Audit Committees," and discussed with the independent auditors the independent auditors' independence. |

Based on the foregoing reviews and meetings, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the SEC.

Audit Committee

Porter J. Hall, Chairman

John Breslow, Member

John Campbell Carruth, Member

The Compensation Committee

The Compensation Committee currently is comprised of John Breslow, Cam Carruth and Porter J. Hall, with Mr. Breslow as Chairman. The Compensation Committee met once during 2005. The Compensation Committee reviews all aspects of executive compensation, including salary, bonus and equity compensation of the Chief Executive Officer and other executive officers, and makes recommendations on such matters to the Board. The Compensation Committee also reviews and approves stock options granted to other officers and employees.

The Nominating and Corporate Governance Committee

Purpose, Composition and Meetings of the Nominating and Corporate Governance Committee. In March 2004, the Board established a Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently is comprised of John Breslow, Cam Carruth and Porter J. Hall, with Mr. Carruth serving as Chairman. The Nominating and Corporate Governance Committee met once during 2005. The duties of the Nominating and Corporate Governance Committee include, among other things, recommending to the Board potential candidates for election to the Board and making recommendations to the Board concerning issues related to corporate governance. All current members of the Nominating and Governance Committee are independent, as independence for nominating committee members is defined under applicable NASD rules.

The Nominating and Corporate Governance Committee met in March 2006 and recommended that the Board nominate Robert V. Fasso, John Breslow, Cam Carruth and Porter J. Hall for election as directors. Each nominee for election as a director is an executive officer, standing for reelection, or both.

Nominating and Governance Committee Charter. A written charter for the Nominating and Governance Committee was adopted in March 2004. A copy of the charter is available to stockholders on our website, located at http://www.centralfreight.com.

Process for Identifying and Evaluating Director Nominees. Director nominees are chosen by the entire Board, after considering the recommendations of the Nominating and Corporate Governance Committee. As a matter of course, the members of the Nominating and Corporate Governance Committee review the qualifications of various persons to determine whether they might be candidates for consideration for membership on the Board. The Nominating and Corporate Governance Committee also accepts recommendations of director candidates from our executive officers, advisors and stockholders. The Nominating and Corporate Governance Committee will review all candidate recommendations, including those properly submitted by stockholders, in accordance with the mandate contained in its charter. This will include a review of the person's judgment, integrity, experience, independence, knowledge of our industry or other industries related to our business and such other factors as the Nominating and Corporate Governance Committee determines are relevant in light of our needs and the needs of the Board. With regard to specific qualities and skills, the Nominating and Corporate Governance Committee believes it necessary that: (i) at least a majority of the members of the Board qualify as "independent" under NASD Rule 4200(a)(15); (ii) at least three members of the Board satisfy the audit committee membership criteria specified in NASD Rule 4350(d)(2); and (iii) at least one member of the Board eligible to serve on the Audit Committee has sufficient knowledge, experience and training concerning accounting and financial matters so as to qualify as an "audit committee financial expert" within the meaning of Item 401(h) of Regulation S-K. We do not pay a fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees.

Consideration of Director Candidates Recommended by Stockholders. In March 2004, a written charter for the Nominating and Corporate Governance Committee was adopted. Under this charter, the Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, provided that the following procedural requirements are satisfied. Candidate recommendations should be mailed via certified mail, return receipt requested, and addressed to the Nominating and Corporate Governance Committee, Central Freight Lines, Inc., c/o Jeff Hale - Senior Vice President and Chief Financial Officer, 15333 North Pima Road, Suite 230, Scottsdale, Arizona 85260. In order to be considered, a stockholder recommendation must: (i) be received at least 90 days prior to the Annual Meeting of Stockholders (or 120 days prior to the first anniversary of the date of the prior year's annual meeting; (ii) contain sufficient background information, such as a resume and references, to enable the Committee to make a proper judgment regarding his or her qualifications; (iii) be accompanied by a signed consent of the proposed nominee to serve as a director if elected; (iv) state the name and address of the person submitting the recommendation and the number of shares of our Common Stock owned of record or beneficially by such person; and (v) if submitted by a beneficial stockholder, be accompanied by evidence, such as a recent brokerage statement, that the person making the recommendation beneficially owns shares of our Common Stock.

The Special Committee

On September 6, 2005, the Board created the Special Committee to consider the pursuit of a going private transaction or other strategic alternative with Mr. Moyes or others. Cam Carruth and Porter J. Hall served as members of the Special Committee, with Mr. Carruth as Chairman. The Special Committee has met a total of seven times, with four meetings in 2005 and three meetings in 2006 year to date.

Executive Officers of Central

The table below sets forth, as of March 31, 2006, certain information regarding our executive officers.

Name | | Age | | Position |

| | | | | |

| Robert V. Fasso | | 52 | | Chief Executive Officer and President |

| Walter D. Ainsworth | | 53 | | Executive Vice President |

Jeffrey A. Hale | | 46 | | Senior Vice President and Chief Financial Officer |

Richard Stolz | | 52 | | Senior Vice President - Sales and Marketing |

Walter D. Ainsworth has served as our Executive Vice President since July 2004. Mr. Ainsworth served as President of USF Corporation's Eastern Carrier Group from January 2004 to July 2004. Mr. Ainsworth previously served as the President and Chief Executive Officer of USF Dugan from August 2000 to July 2004, and as the Senior Vice President of Operations of USF Reddaway from September 1999 to August 2000. Mr. Ainsworth has over 30 years of experience in the LTL industry.

Jeffrey A. Hale has served as our Senior Vice President and Chief Financial Officer since August 2003. He previously served Central as Vice President - Finance and Chief Financial Officer from June 2002 to August 2003. Prior to joining us, Mr. Hale served as Vice President - Finance and Chief Financial Officer of USF Bestway, Inc., a subsidiary of USF Corporation, from April 1989 to June 2002. Mr. Hale has over 20 years of experience in the LTL industry.

Richard Stolz has served as our Senior Vice President - Sales and Marketing since March 2005. He previously served as a software consultant to the transportation industry from January 2003 to March 2005, as Vice -President of Business Development for Maersk Data from April 2001 to October 2002 and as Vice-President Sales and Marketing for Route Master from May 2000 until April 2001.

See "Information on Members of the Board of Directors" above for information concerning the business experience of Robert V. Fasso.

Code of Conduct and Ethics

In 2004, the Board adopted a Code of Conduct and Ethics that applies to all of our directors, officers and employees. The Code of Conduct and Ethics includes provisions applicable to our principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions that constitute a "code of ethics" within the meaning of Item 406(b) of Regulation S-K. A copy of the Code of Conduct and Ethics is available to stockholders on our website, located at http://www.centralfreight.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who own more than 10% of a registered class of our equity securities, to file with the SEC and Nasdaq reports of ownership and changes in ownership of Common Stock and other equity securities. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon a review of the copies of such forms furnished to us, we believe that our officers, directors and greater than 10% beneficial owners complied with all Section 16(a) filing requirements applicable to them during our preceding fiscal year. We post copies of Section 16(a) forms our directors and executive officers file with the SEC on our website at http://www.centralfreight.com.

Item 11. Executive Compensation

Summary Compensation Table

The following table sets forth information concerning the annual and long-term compensation for services rendered in all capacities to Central during each of the three fiscal years ended December 31, 2005, 2004 and 2003, of those persons who were (i) our Chief Executive Officer at December 31, 2005 and (ii) our three other executive officers at December 31, 2005 (collectively, the "Named Executive Officers").

| | | Annual Compensation | | Long-term Compensation | |

| | | | | Awards | | Payouts | |

Name and Principal Position | Year | Salary ($)(1) | Bonus ($) | Other Annual Compensation ($) | | Restricted Stock Award(s) ($) | Securities Underlying Options (#) | | LTIP Payouts | All Other Compensation ($)(2) |

| | | | | | | | | | | |

Robert V. Fasso President and Chief Executive Officer | 2005 2004 2003 | 350,000 362,382 348,077 | -- -- 126,000(3) | -- -- 2,686,706(4) | | -- -- -- | -- -- -- | | -- -- -- | 19,411 14,708 12,973 |

| | | | | | | | | | | |

Walter D. Ainsworth(5) Executive Vice President | 2005 2004 2003 | 300,000 132,393 -- | -- 240,000(6) -- | -- -- -- | | -- -- -- | -- 150,000 -- | | -- -- -- | 20,312 58,257 -- |

| | | | | | | | | | | |

Jeffrey A. Hale Senior Vice President and Chief Financial Officer | 2005 2004 2003 | 215,379 180,652 172,115 | -- -- 50,000(3) | -- -- -- | | -- -- -- | -- -- -- | | -- -- -- | 14,152 13,533 11,625 |

| | | | | | | | | | | |

Richard Stolz(7) Senior Vice President- Sales and Marketing | 2005 2004 2003 | 203,077 -- -- | -- -- -- | -- -- -- | | -- -- -- | 100,000 -- -- | | -- -- -- | 16,186 -- -- |

(1) Includes amounts deferred pursuant to our 401(k) plan. Due to timing, salary payments in 2004 included one additional payroll amount.

(2) Consists of: (a) excess life insurance paid for Mr. Fasso ($828 in 2005, $6,951 in 2004 and $690 in 2003), Mr. Ainsworth ($828 in 2005), Mr. Hale ($540 in 2005, $254 in 2004 and $254 in 2003), and Mr. Stolz ($1,290 in 2005); (b) personal use of a company car for Mr. Fasso ($5,833 in 2005, $6,677 in 2004 and $6,113 in 2003), Mr. Ainsworth ($8,266 in 2005 and $2,120 in 2004), Mr. Hale ($12,022 in 2005, $12,199 in 2004 and $10,576 in 2003), and Mr. Stolz ($2,561 in 2005), (c) moving costs for Mr. Ainsworth ($8,708 in 2005 and $55,837 in 2004) and Mr. Stolz ($12,335 in 2005) and (d) other insurance premiums paid for Mr. Fasso ($12,750 in 2005, $1,080 in 2004 and $6,170 in 2003), Mr. Ainsworth ($2,510 in 2005 and $300 in 2004), and Mr. Hale ($1,590 in 2005, $1,080 in 2004 and $795 in 2003).

(3) Consists of bonuses earned in 2003 and paid in 2004.

(4) Consists of ordinary income recognized in 2003 by Mr. Fasso under federal income tax guidelines upon exercise of vested incentive stock options. No cash was received by Mr. Fasso. The stock options were granted to Mr. Fasso in 2002 pursuant to our Incentive Stock Plan.

(5) Mr. Ainsworth was hired in July 2004, and amounts included in the table above for 2004 are for July to December of that year.

(6) Consists of a bonus earned in 2004, one half of which was paid in 2004 and one half of which was paid in January 2005.

(7) Mr. Stolz was hired in March 2005, and amounts included in the table above for 2005 are for March to December of that year.

Option Grants in Last Fiscal Year

The following table sets forth stock options granted to Named Executive Officers in the fiscal year ended December 31, 2005:

Option Grants in 2005

| | | Individual Grants | | | | |

| | | Number of Securities Underlying Options | | Percent of Total Options Granted to Employees | | Exercise price | | Expiration | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3) |

| Name | | Granted (#) (1) | | in Fiscal Year (2) | | ($/Sh) | | Date | | 5%($) | | 10%($) |

| Robert V. Fasso | | 0 | | — | | — | | — | | — | | — |

| Walter D. Ainsworth | | 0 | | — | | — | | — | | — | | — |

| Jeffrey A. Hale | | 0 | | — | | — | | — | | — | | — |

| Richard Stolz | | 100,000 | | 34.2% | | $ 2.61 | | 04/06/2015 | | $ 164,141 | | $ 415,967 |

(1) Each option represents the right to purchase one share of Common Stock under our incentive stock plan.

(2) During 2005, we granted employees options to purchase an aggregate of 292,500 shares of Common Stock..

(3) We show the potential realizable values net of the options' exercise price, but before the payment of taxes associated with exercise. Potential realizable values are based on a fair market value at the date of grant of $2.61 per share for the underlying Common Stock. The potential realizable values represent hypothetical gains if the holders exercised their options at the end of the option term. The SEC's rules provide the assumed 5% and 10% annual rates of stock price appreciation and measure the appreciation from the grant date.

Except as set forth above, no stock options or stock appreciation rights (SARs) were granted during the 2005 fiscal year to any of the Named Executive Officers.

Aggregated Options Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table

The table below sets forth information with respect to the exercise of stock options during the fiscal year ended December 31, 2005, by the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | Shares Acquired on Exercise | | Value | | Number of Securities Underlying Unexercised Options at FY-End (#) | | Value of Unexercised In-the-Money Options at FY-End ($)(1) |

| Name | | (#) | | Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| Robert V. Fasso | | — | | — | | 252,000 | | 252,000 | | $108,360 | | $108,360 |

| Walter D. Ainsworth | | — | | — | | 150,000 | | 0 | | 0 | | 0 |

| Jeffrey A. Hale | | — | | — | | 60,000 | | 40,000 | | 25,800 | | 17,200 |

| Richard Stolz | | — | | — | | 100,000 | | 0 | | 0 | | 0 |

(1) | Based on the $1.78 per share closing price of our Common Stock on December 30, 2005. |

Employment Agreements

On January 7, 2002, we entered into an employment agreement with Robert V. Fasso. Mr. Fasso's agreement provides for (a) an annual salary of $325,000, which may be increased by merit raises in an amount to be determined annually by the Board and (b) the grant of options to purchase 1,260,000 shares of our stock for $1.35 per share, exercisable for 10 years. Options for 630,000 shares vested immediately upon execution of the employment agreement, options for 126,000 shares vested on January 7 in each of 2003, 2004, 2005 and 2006 and options for the remaining 126,000 shares will vest on January 7, 2007. On November 17, 2003, Mr. Fasso exercised options to acquire 400,000 shares, and on December 5, 2003, Mr. Fasso exercised options to acquire 356,000 additional shares. In addition, Mr. Fasso was allowed to purchase 10% of the membership interests of Southwest Premier for $2.0 million. The purchase price was paid through delivery of a promissory note payable to Southwest Premier that matures on January 30, 2007. On February 6, 2003, the Board approved an increase in Mr. Fasso's salary to $350,000. He is eligible for a bonus of up to $360,000 based on our operating ratio. The actual bonus paid in a given year will range from zero, if our annual operating ratio exceeds 95%, to the full $360,000, if our annual operating ratio is at or below 90%. The employment agreement also requires us to pay the insurance premiums for a $5.0 million term life insurance policy and a $500,000 whole life insurance policy under which Mr. Fasso's family members are the beneficiaries. Mr. Fasso may be terminated at any time upon payment of two years' salary at the then current level. He will not be entitled to receive such payment if he voluntarily terminates his employment.

In June 2002, we hired Jeffrey A. Hale as our Vice President - Finance and Chief Financial Officer. We agreed to pay Mr. Hale an annual salary of $150,000 and agreed to grant him options to acquire 100,000 shares of Common Stock at the fair market value of the stock on the grant date. We also agreed that Mr. Hale would be eligible to participate in our executive bonus program. In September 2003, Mr. Hale became our Senior Vice President and Chief Financial Officer. In March 2005, Mr. Hale's annual salary was increased to $225,000. Mr. Hale may be terminated at any time upon payment of one year's salary at the then current level. He will not be entitled to receive such payment if he voluntarily terminates his employment or is terminated for cause.

In July 2004, we hired Walter D. Ainsworth as our Executive Vice President. We agreed to pay Mr. Ainsworth an annual salary of $300,000 and agreed to grant him options to acquire 150,000 shares of Common Stock at the fair market value of the stock on the grant date. We also agreed that Mr. Ainsworth would be eligible for a bonus of up to 100 percent of his base salary based on our operating ratio. The actual bonus paid in a given year will range from zero, if operating ratio exceeds 95%, to 100 percent of salary, if our operating ratio for the year is below 90%. Mr. Ainsworth may be terminated at any time upon payment of one year's salary at the then current level. He will not be entitled to receive such payment if he voluntarily terminates his employment or is terminated for cause.

In March 2005, we hired Richard Stolz as our Senior Vice President - Sales and Marketing. We agreed to pay Mr. Stolz an annual salary of $240,000 and agreed to grant him options to acquire 100,000 shares of Common Stock at the fair market value of the stock on the grant date. We also agreed that Mr. Stolz would be eligible to participate in its executive bonus program. Mr. Stolz may be terminated at any time upon payment of one year's salary at the then current level. He will not be entitled to receive such payment if he voluntarily terminates his employment or is terminated for cause.

Executive Bonus Program

We have established an executive bonus program for certain of our executive officers, other than Mr. Fasso and Mr. Ainsworth, and other key employees. Bonuses in this program are determined by reference to our fiscal year operating ratio. Participants may receive bonuses ranging from zero, if our operating ratio for the year exceeds 95%, to fifty percent of salary, if our operating ratio for the year is at or below 90%. No bonuses were awarded to our executive officers under this program for 2005.

Incentive Stock Plan

We have an incentive stock plan. The key terms of the incentive stock plan are as follows:

· | We can grant incentive stock options, non-qualified stock options, bonus stock, reload options or any other stock-based award to employees, officers, directors, consultants and any other person determined by the Board to have performed services for or on behalf of Central which merit the grant of an award. |

| | |

· | We reserved 5,000,000 shares of Common Stock for issuance under the plan and have outstanding options covering 1,426,953 of those shares as of March 31, 2006. |

| | |

· | Our Board or its designated committee administers the plan and makes all grants thereunder. |

| | |

· | Options that are canceled, forfeited, expire, or are tendered for tax withholding or to pay the exercise price become available again for use under the plan. |

401(k) Profit Sharing Plan

We maintain a defined contribution retirement plan, which includes a 401(k) option. All employees age 21 or older are eligible to participate after ninety days of service and generally may contribute up to 20% of their annual compensation to the plan. These participant contributions vest immediately. Employees are eligible for matching contributions after one year of service. Our contributions to the plan each year are made at the discretion of our Board. Currently, our matching contributions are between 50% and 100% of a participant's pre-tax contributions, depending on Central's performance, up to a maximum of 5% of the participant's compensation. Matching contributions vest 40% upon completion of two years of service, with an additional 20% vesting each year thereafter through the fifth year of service.

Employee Stock Purchase Plan

We maintain an employee stock purchase plan. Generally, all of our employees who work at least twenty hours a week and more than five months in a calendar year are eligible to participate in the plan. An employee is ineligible to participate, however, if immediately after such grant, such employee would own stock possessing 5% or more of the total combined voting power or value of our Common Stock. The plan permits eligible employees to purchase shares of our Common Stock through payroll deductions. Participation periods are six months in length. In general, for each participation period, eligible employees are allowed to elect to purchase full shares through payroll deductions of up to 15% of compensation, but in no event is the participant's right to purchase shares of Common Stock allowed to accrue at a rate that exceeds $25,000 of fair market value of Common Stock in a calendar year. Further, a participant is not allowed to purchase more than 2,500 shares of Common Stock in any six-month participation period. The purchase price a participant pays for the shares is equal to 90% of the market closing price of the Common Stock on the first business day or the last business day of each participation period, whichever is

lower. If a participant dies, retires or otherwise terminates employment, the participant's accumulated payroll deductions as of the date of death, retirement or other termination is refunded.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently comprised of John Breslow, Cam Carruth and Porter J. Hall. No current member of the Compensation Committee is or has been an officer or employee of Central. There are no interlocking relationships between Central's executive officers and directors and other entities that might affect the compensation of Central's executive officers. See "Certain Relationships and Related Transactions" below, for a description of certain transactions between us and our other directors, executive officers, or their affiliates.

Compensation Committee Report on Executive Compensation

The Compensation Committee Report on Executive Compensation that follows shall not be deemed to be incorporated by reference into any filing made by us under the Securities Act of 1933 or the Exchange Act, notwithstanding any general statement contained in any such filings incorporating this Form 10-K by reference, except to the extent we incorporate such report by specific reference.

The Compensation Committee of the Board approved the following Report on Executive Compensation in March 2006:

Compensation Committee Report on Executive Compensation

The Compensation Committee administers Central's executive compensation program and is responsible for establishing the policies that govern base salary, as well as short and long-term incentives for Central's senior management team. The Compensation Committee believes that the primary objectives of Central's compensation policies are to attract and retain a management team that can implement and execute Central's strategic business plan. These compensation policies include (i) an overall management compensation program that is competitive with management compensation programs at companies of similar sizes and lines of business, (ii) short-term bonus incentives, which may be put in place, for management to meet Central's performance and strategic goals and (iii) long-term incentive compensation in the form of equity awards, such as stock options or restricted stock grants, which will encourage management to focus on stockholder return.

The Compensation Committee's goal is to use compensation policies to align the interests of management with the interests of stockholders in building value for Central's stockholders. The Compensation Committee reviews its compensation policies from time to time in order to determine the reasonableness of Central's compensation programs and to take into account factors that are unique to Central.

Base Salary. Central's Chief Executive Officer and President has a written employment agreement that governs his base salary. In addition, Central hired its Senior Vice President - Sales and Marketing in 2005 pursuant to a written offer of employment that fixed his starting salary in 2005. Within the context of these agreements, the Compensation Committee annually reviews the Chief Executive Officer and President's base salary and consults on the base compensation of the Executive Vice President and each Senior Vice President. The Compensation Committee intends to compensate Central's senior management team, including the Chief Executive Officer and President, fairly and competitively within the trucking industry.

Incentive Bonus. During fiscal year 2005, members of Central's senior management team were eligible for a target annual incentive bonus, generally calculated as a percentage of each officer's base salary. Central's Chief Executive Officer and President and Central's Executive Vice President were eligible for such bonuses under the terms of their employment agreements, while other members of the senior management team were eligible for such bonuses under the terms of Central's executive bonus program. These bonuses provide the executive group with direct cash incentives to achieve corporate financial goals. Bonuses were determined by reference to

Central's fiscal year operating ratio. Central's Chief Executive Officer and President were eligible to receive bonuses ranging from zero, if the operating ratio exceeded 95%, to $360,000, if the operating ratio was at or below 90%. Central's Executive Vice President was eligible to receive a bonus ranging from zero, if the operating ratio exceeded 95%, to 100 percent of salary, if the operating ratio was at or below 90%. Other members of senior management were eligible to receive bonuses ranging from zero, if the operating ratio exceeded 95%, to fifty percent of salary, if the operating ratio was at or below 90%.

The determination of Central's operating ratio was measured objectively. Because Central's operating ratio in 2005 exceeded 95%, no incentive bonuses were awarded to members of the senior management team for 2005.

Equity Awards. The Compensation Committee may award stock options to the members of the senior management team to enhance the link between executive pay and stockholder value. Awards are made pursuant to Central's Incentive Stock Plan. Under the Incentive Stock Plan, the Compensation Committee also has the ability to award other equity-based incentives such as stock appreciation rights or restricted stock, but has not done so to date. The Compensation Committee is responsible for determining who should receive stock option grants, when the grants should be made, the exercise price per share and the number of shares to be granted. To date, stock options have been granted at an option price set at fair market value of Central's common stock on the date of grant. As such, stock options have value only if the stock price appreciates following the date the options are granted. The stock options reflected in the Summary Compensation Table are generally subject to a 60-month vesting period. This approach encourages the creation of stockholder value over the long term. The stock options awarded to the senior management team in fiscal year 2005 were based on the need to attract senior executives and reflected prior option grants made in connection with the hiring of other senior executives.

Compensation of Chief Executive Officer. In 2005, Central's Chief Executive Officer and President, Robert V. Fasso, received salary compensation of $350,000. Mr. Fasso's base salary for 2005 was unchanged from his base salary in 2004. In 2005, Mr. Fasso did not receive any options, due to the prior grant to him of options to purchase 1,260,000 shares of the Company's Common Stock on January 7, 2002 in connection with his hiring. The compensation for Mr. Fasso was based upon the Compensation Committee's analysis of other comparable public companies' chief executive officer's compensation and the performance of Central, including revenue performance, cost controls and profitability.

The Compensation Committee believes that the annual salaries and other compensation of Central's Chief Executive Officer and President and other members of the senior management team are reasonable compared to similarly situated executives of other less-than-truckload and truckload motor carriers.

Compensation Committee

John Breslow, Chairman

John Campbell Carruth, Member

Porter J. Hall, Member

Stock Performance Graph

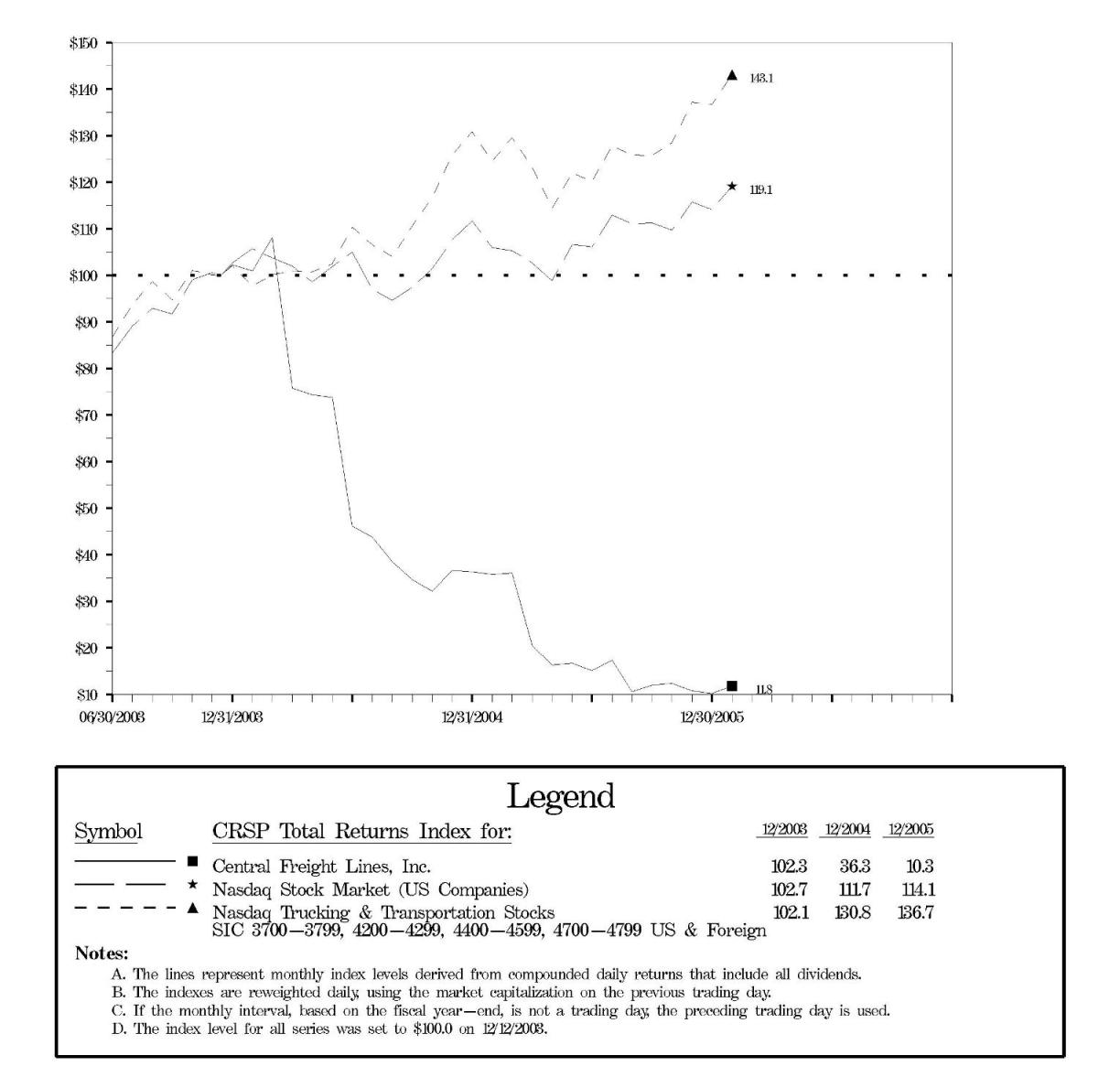

The following graph compares the cumulative total stockholder return of our Common Stock with the cumulative total stockholder return of the Nasdaq Stock Market (U.S. Companies) and the Nasdaq Trucking & Transportation Stocks in the period between December 12, 2003, the date on which public trading of our Common Stock began, and December 31, 2005.

Prepared by CRSP (www.crsp.uchicago.edu), Center for Research in Security Prices, Graduate School of Business, The University of Chicago. Used with permission. All rights reserved.

The stock performance graph assumes $100 was invested on December 12, 2003. There can be no assurance that Central's stock performance will continue into the future with the same or similar trends depicted in the graph above. Central will not make or endorse any predictions as to future stock performance. The CRSP Index for Nasdaq Trucking & Transportation Stocks includes all publicly held less-than-truckload motor carriers traded on the Nasdaq Stock Market, as well as all other Nasdaq companies within the Standard Industrial Code Classifications 3700-3799, 4200-4299, 4400-4599 and 4700-4799 US & Foreign. Central will provide the names of all companies in such index upon request.

Director Compensation

In 2005, directors who were not 10% stockholders, officers, or employees ("Outside Directors") received an annual retainer of $20,000, plus (a) $1,500 for each meeting of the Board they attend in person, (b) $1,500 for each meeting of a Board committee they attend in person, if such meeting is not on the same day as a meeting of the full Board, (c) $750 for each meeting of a Board committee they attend in person, if such meeting is on the same day as a meeting of the full Board and (d) $750 for each telephonic meeting of the Board or a Board committee they attend. In addition, the Chairman of the Audit Committee received an annual retainer of $20,000, the Chairman of the Compensation Committee received an annual retainer of $1,500, the Chairman of the Nominating and Corporate Governance Committee received an annual retainer of $1,500 and the Chairman of the Board received an annual retainer of $20,000. In January 2006, our Board also agreed to pay $30,000 to the Chairman of the Special Committee in recognition of the time and effort expended in evaluating the Merger and negotiating the Merger Agreement. We also reimburse directors for travel and other related expenses incurred in attending a meeting.

On December 11, 2003, we granted to each of John Breslow and Porter J. Hall options to purchase 20,000 shares of our Common Stock at $15.00 per share. On November 5, 2004, we granted to Cam Carruth options to purchase 20,000 shares of our Common Stock at $5.82 per share. These options originally vested at the rate of 1,000 shares per meeting attended. On June 16, 2005, the Compensation Committee and the Board approved the acceleration of vesting of substantially all stock options outstanding under our Incentive Stock Plan that had exercise prices per share higher than the closing price of our Common Stock on June 16, 2005, which was $2.49. The options that were accelerated included all options held by our directors.

Directors who are employees or 10% stockholders do not receive compensation for Board or committee service. We do, however, reimburse them for travel and other related expenses.

In our Articles of Incorporation, we have agreed to indemnify our officers and directors against liabilities they may incur while serving in such capacities to the fullest extent allowed by Nevada law. Further, in March 2005, we entered into separate indemnification agreements with each of our directors. Under the indemnification provision of our Articles of Incorporation and these indemnification agreements, we are generally required to indemnify each of our directors and officers against any reasonable expenses actually incurred in the defense of any action, suit or proceeding, to which the director or officer is a party by reason of his or her service to Central. We will also advance expenses incurred by a director or officer in defending such an action, suit or proceeding if that director or officer first agrees to repay those advances if: (i) a court establishes that his or her acts or omissions involved intentional misconduct, fraud or a knowing violation of law; and (ii) such acts were material to the cause of action. In addition, we maintain insurance for directors and officers for liability they may incur as a result of service to Central.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 31, 2006, the number and percentage of outstanding shares of our Common Stock beneficially owned by each person known by us to beneficially own more than 5% of such stock, by each director and Named Executive Officer and by all directors and executive officers of Central as a group. According to Central's transfer agent, Central had outstanding 18,291,032 shares of Common Stock as of March 31, 2006.

Name and Address of Beneficial Owner(1) | | Amount and Nature of Beneficial Ownership(2) | | Percent of Class(2) |

| | | | | |

Jerry and Vickie Moyes(3) | | 5,766,351 | | 31.5% |

Contrarian Capital Management, L.L.C.(4) | | 1,282,128 | | 7.0% |

Robert V. Fasso(5) | | 1,134,000 | | 6.1% |

John Breslow(6) | | 83,000 | | * |

John Campbell Carruth(7) | | 30,000 | | * |

Porter J. Hall(8) | | 20,000 | | * |

Walter D. Ainsworth(9) | | 150,000 | | * |

Jeffrey A. Hale(10) | | 60,000 | | * |

Richard Stolz(11) | | 100,000 | | * |

| | | | | |

| All directors and executive officers as a group (7 persons) | | 1,577,000 | | 8.3% |

*Less than one percent.

(1) Unless otherwise indicated, the business address of the persons named in the above table is care of Central Freight Lines, Inc., 5601 West Waco Drive, Waco, Texas 76710.

(2) For purposes of this table, a person or group of persons is deemed to have "beneficial ownership" of any shares which such person has the right to acquire within sixty days. For purposes of computing the percentage of outstanding shares held by each person or group of persons named above, any security which such person or group of persons has the right to acquire within sixty days is deemed to be outstanding for the purpose of computing the percentage ownership for such person or persons, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. As a result, the denominator used in calculating the beneficial ownership among our stockholders may differ, but are not deemed outstanding for purposes of computing the percentage ownership of any other person.

(3) Includes 12,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days. Of the shares attributed to Jerry Moyes, 1,046,002 are held by Jerry and Vickie Moyes as trustees of the Jerry and Vickie Moyes Family Trust (the "Moyes Family Trust"), 4,708,348 are held by Gerald F. Ehrlich as trustee of the Moyes Children's Trust (the "Moyes Children's Trust") and 12,001 shares (including 12,000 shares under option) are held by Mr. Moyes individually. Mr. Ehrlich has sole voting and investment power for the Moyes Children's Trust. Mr. Moyes disclaims beneficial ownership of the shares held by Mr. Ehrlich as trustee of the Moyes Children's Trust. The business address of Mr. Moyes, Mrs. Moyes and the Family Trust is care of Swift Aviation Group, Inc., 22710 E. Old Tower Road, Phoenix, AZ 85034. The business address of the Children's Trust is 4001 North Third St., Suite 400, Phoenix, AZ 85012.

(4) As reported on Schedule 13G filed with the SEC on March 6, 2006. The business address of Contrarian Capital Management, L.L.C., as reported in such Schedule 13G, is 411 West Putnam Avenue, Suite 225, Greenwich, CT 06830.

(5) Includes 378,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days. Mr. Fasso's business telephone number is (480) 361-5295.

(6) Includes (a) 50,000 shares held by Linweld, Inc. and (b) 20,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days. The business address of Mr. Breslow is 2900 South 70th Street, Suite 400, Lincoln, NE 68506.

(7) Includes 20,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days. The business address of Mr. Carruth is 316 Rivershire Court, Lincolnshire, IL 60069.

(8) Includes 20,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days. The business address of Mr. Hall is 2825 East Cottonwood Parkway, Suite 300, Salt Lake City, UT 84121.

(9) Includes 150,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days.

(10) Includes 60,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days.

(11) Includes 100,000 shares beneficially owned under options that are currently exercisable or will become exercisable within sixty days.

Equity Compensation Plan Information

The following table provides certain information, as of December 31, 2005, with respect to our compensation plans and other arrangements under which shares of our Common Stock are authorized for issuance.

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted average exercise price of outstanding options warrants and rights | | Number of securities remaining eligible for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Plan category | | (a) | | (b) | | (c) |

| | | | | | | |

Equity compensation plans approved by security holders | | 1,426,245 | | $ 3.42 | | 991,258 |

| | | | | | | |

Equity compensation plans not approved by security holders | | - | | - | | - |

| | | | | | | |

| Total | | 1,426,245 | | $ 3.42 | | 991,258 |

Item 13. Certain Relationships and Related Transactions

Since our initial public offering, we have maintained a policy that transactions with affiliated persons or entities will be on terms, on the whole, no less favorable to us than those that could be obtained from unaffiliated third parties on an arm's length basis, and that any such transaction must be reviewed and approved by our Audit Committee or another committee of the Board comprised entirely of directors who are independent under NASD Rule 4200(a)(15).

We currently lease twenty-two active terminals and four dormant terminals from Southwest Premier. Southwest Premier is owned by some of our directors, executive officers and existing stockholders, including 77% by Jerry Moyes and 10% by Robert V. Fasso. In 1998, we sold these properties to Southwest Premier, along with additional terminals that have since been sold, for an aggregate of $27.8 million in a sale-and-leaseback transaction that was accounted for as a financing transaction. We also have operating leases for two active terminals owned by Jerry Moyes. We incurred aggregate expense to Southwest Premier of approximately $6.8 million in 2005. We incurred aggregate lease expense to Mr. Moyes of approximately $0.3 million in 2005.

Swift Transportation Co., Inc. ("Swift") and Central Refrigerated Service, Inc. ("Central Refrigerated") provide us with a variety of transportation services. Jerry Moyes is a director and significant stockholder of Swift and the owner and Chairman of the Board of Central Refrigerated. Together, these companies provided us with approximately 28.8% of all third-party linehaul transportation services in 2005. Under these arrangements, Swift provided us with approximately $14.3 million in services in 2005. At year end, we owed Swift approximately $0.7 million. Central Refrigerated provided us with approximately $0.3 million in services in 2005. At year end, we had no liability to Central Refrigerated. We believe that the amounts paid are equivalent to rates that could have been obtained in an arm's length transaction with an unrelated third party.

We currently lease terminal space from Swift in Memphis, Tennessee at a lease rate of $15,836 per month and in Fontana, California at a lease rate of $58,500 per month. We also sublease portions of our terminal facilities to Swift at four different locations. Swift leases property from us (i) in Tyler, Texas for $3,750 per month, (ii) in Houston, Texas, for $6,000 per month, (iii) in Little Rock, Arkansas, for $1,000 per month, (iv) in San Antonio, Texas for $7,675 per month, (v) in Shreveport, Louisiana for $160 per month and (vi) in Amarillo, Texas for $800 per month. All leases with Swift are, either by their terms or due to expiration of the contract, on a month-to-month basis. Under these subleases and other subleases that we formerly had with Swift, the rental income to us from Swift was approximately $0.2 million in 2005. We believe that the amounts paid are equivalent to lease terms and rates that could have been obtained in an arms' length transaction with an unrelated third party.

On January 30, 2006, we entered into an Agreement and Plan of Merger (the "Merger Agreement") with North American Truck Lines, LLC ("NATL") and Green Acquisition Company ("Green"), pursuant to which Green will merge with and into Central (the "Merger"), with Central continuing as the surviving corporation. Both Green and NATL are controlled by Jerry Moyes, with Green being a wholly-owned subsidiary of NATL. Pursuant to the Merger Agreement, at the effective time of the Merger, all Central stockholders, other than Mr. Moyes and certain Moyes family trusts, will receive cash in an amount equal to $2.25 per share of our common stock.

Effective April 15, 2006, we entered into a month-to-month lease agreement for revenue equipment with Interstate Equipment Leasing, Inc., a company owned by Mr. Moyes ("Interstate"). We have the right to renew or terminate this lease agreement each month on a rolling basis. We will pay Interstate approximately $109,000 per month under this agreement for as long as we retain the equipment. We believe that the terms of this transaction are at least equivalent to those could have been obtained in an arm's length transaction with an unrelated third party.

Item 14. Principal Accountant Fees and Services

Principal Accounting Fees and Services

The Company's principal independent public accountant was McGladrey & Pullen, LLP ("McGladrey") for the year ended December 31, 2005, and KPMG LLP ("KPMG") for the year ended December 31, 2004. Fees billed or to be billed in connection with services rendered for these years are as follows:

| | | 2005 | | 2004 |

Audit Fees(1) | | $ 256,318 | | $ 994,625 |

Audit-Related Fees | | -- | | -- |

Tax Fees | | -- | | -- |

All Other Fees(2) | | -- | | -- |

Total | | $ 256,318 | | $ 994,625 |

(1) Audit Fees. Audit fees were for professional services rendered for the audit and quarterly reviews of the Company's financial statements for the applicable fiscal year.

(2) All Other Fees. For the fiscal years ended December 31, 2005, and December 31, 2004, the Company was not billed for any other services.

In addition to the fees above, KPMG billed a total of $673,229 audit fees in 2005 prior to their dismissal and the engagement of McGladrey. These fees consisted of quarterly reviews and audit planning for 2005.

Pre-Approval Policy

Since September 22, 2003, we have maintained a policy pursuant to which our Audit Committee pre-approves all audit, audit-related, tax and other permissible non-audit services provided by our principal independent public accounting firm in order to assure that the provision of such services is compatible with maintaining the accounting firm's independence. Under this policy, the Audit Committee pre-approves, on an annual basis, specific types or categories of engagements constituting audit, audit-related, tax or other permissible non-audit services to be provided by the principal independent public accounting firm. Pre-approval of an engagement for a specific type or category of services generally is provided for up to one year and typically is subject to a budget comprised of a range of anticipated fee amounts for the engagement. Management and the independent public accounting firm are required to periodically report to the Audit Committee regarding the extent of services provided by the principal independent public accounting firm in accordance with the annual pre-approval and the fees for the services performed to date. To the extent that management believes that a new service or the expansion of a current service provided by the principal independent public accounting firm is necessary or desirable, such new or expanded services are presented to the Audit Committee for its review and approval prior to the engagement of the principal independent public accounting firm to render such services. No audit-related, tax, or other non-audit services were approved by the Audit Committee pursuant to the de minimus exception to the pre-approval requirement under Rule 2-01, paragraph (c)(7)(i)(C), of Regulation S-X during the fiscal years ended December 31, 2005 and 2004.

PART IV

Item 15. Exhibits and Financial Statements Schedules

(b)

Exhibit | |

Number | Descriptions |

| | |

| 2.1 | Amended and Restated Asset Purchase Agreement dated April 18, 2002, by and among Central Refrigerated Service, Inc., a Nebraska corporation, and Simon Transportation Services Inc., a Nevada corporation, and its subsidiaries, Dick Simon Trucking, Inc., a Utah corporation, and Simon Terminal, LLC, an Arizona limited liability company. (Incorporated by reference to Exhibit 2.1 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 2.2(a) | Separation Agreement dated November 30, 2002, by and among Central Freight Lines, Inc., a Texas corporation, Central Refrigerated Service, Inc., a Nebraska corporation, the Jerry and Vickie Moyes Family Trust, Interstate Equipment Leasing, Inc., an Arizona corporation, and Jerry Moyes individually. (Incorporated by reference to Exhibit 2.2(a) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 2.2(b) | Amendment Number One to Separation Agreement dated December 23, 2002, by and among Central Freight Lines, Inc., a Texas corporation, Central Refrigerated Service, Inc., a Nebraska corporation, the Jerry and Vickie Moyes Family Trust, Interstate Equipment Leasing, Inc., an Arizona corporation, and Jerry Moyes individually. (Incorporated by reference to Exhibit 2.2(b) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 2.2(c) | Amendment Number Two to Separation Agreement effective as of October 28, 2003, by and among Central Freight Lines, Inc., a Texas corporation, Central Refrigerated Service, Inc., a Nebraska corporation, the Jerry and Vickie Moyes Family Trust, Interstate Equipment Leasing, Inc. an Arizona corporation, and Jerry Moyes individually. (Incorporated by reference to Exhibit 2.2(c) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 3.1 | Amended and Restated Articles of Incorporation of Central Freight Lines, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 3.1(b) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 3.2 | Bylaws of Central Freight Lines, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 3.2 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 4.1 | Amended and Restated Articles of Incorporation of Central Freight Lines, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 3.1 to this Report on Form 10-K.) |

| | |

| 4.2 | Bylaws of Central Freight Lines, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 3.2 to this Report on Form 10-K.) |

| | |

10.1(a)† | Central Freight Lines, Inc. 401(k) Savings Plan. (Incorporated by reference to Exhibit 10.1(a) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.1(b)† | First Amendment to Central Freight Lines, Inc. 401(k) Savings Plan. (Incorporated by reference to Exhibit 10.1(b) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.2(a)† | Central Freight Lines, Inc. Incentive Stock Plan. (Incorporated by reference to Exhibit 10.2(a) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.2(b)† | Form of Stock Option Agreement. (Incorporated by reference to Exhibit 10.28 to the Company's Report on Form 10-Q for the quarterly period ended July 2, 2005.) |

10.3† | Form of Outside Director Stock Option Agreement. (Incorporated by reference to Exhibit 10.3 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.4(a) | First Amended and Restated Revolving Credit Loan Agreement, dated July 28, 2004, by and between Central Freight Lines, Inc., a Texas corporation, and SunTrust Bank, a Georgia state banking corporation. (Incorporated by reference to Exhibit 10.4(a) to the Company's Report on Form 10-Q for the quarterly period ended July 3, 2004.) |

| | |

| 10.4(b) | Revolving Credit Note, dated July 28, 2004, by Central Freight Lines, Inc., a Texas corporation, in favor of SunTrust Bank, a Georgia state banking corporation. (Incorporated by reference to Exhibit 10.4(b) to the Company's Report on Form 10-Q for the quarterly period ended July 3, 2004.) |

| | |

| 10.4(c) | First Amendment to First Amended and Restated Revolving Credit Loan Agreement, dated July 28, 2004, by and between Central Freight Lines, Inc., a Texas corporation, and SunTrust Bank, a Georgia state banking corporation. (Incorporated by reference to Exhibit 10.4(c) to the Company's Report on Form 10-K for the year ended December 31, 2004.) |

| | |

| 10.5 | Guaranty, dated July 28, 2004, by Central Freight Lines, Inc., a Nevada corporation, in favor of SunTrust Bank, a Georgia state banking corporation. (Incorporated by reference to Exhibit 10.5 to the Company's Report on Form 10-Q for the quarterly period ended July 3, 2004.) |

| | |

| 10.6 | Security Agreement, dated July 28, 2004, by and between Central Freight Lines, Inc., a Texas corporation and Suntrust Bank, a Georgia state banking corporation. (Incorporated by reference to Exhibit 10.6 to the Company's Report on Form 10-Q for the quarterly period ended July 3, 2004.) |

| | |

| 10.7(a) | Loan Agreement dated April 30, 2002, by and among Central Receivables, Inc., a Nevada corporation, Three Pillars Funding Corporation, a Delaware corporation, and Suntrust Capital Markets, Inc., a Tennessee corporation, as agent. (Incorporated by reference to Exhibit 10.8(a) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.7(b) | First Amendment to Loan Agreement dated April 29, 2003, by and among Central Receivables, Inc., a Nevada corporation, Three Pillars Funding Corporation, a Delaware corporation, and SunTrust Capital Markets, Inc., a Tennessee corporation, as agent. (Incorporated by reference to Exhibit 10.8(b) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.8 | Receivables Purchase Agreement dated April 30, 2002, by and between Central Freight Lines, Inc., a Texas corporation, and Central Receivables, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 10.9 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.9 | Second Amended and Restated Master Lease Agreement — Parcel Group A dated February 20, 2003 by and between Southwest Premier Properties, L.L.C., a Texas limited liability company, and Central Freight Lines, Inc., a Texas corporation. (Incorporated by reference to Exhibit 10.10 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.10 | Second Amended and Restated Master Lease Agreement — Parcel Group B dated February 20, 2003 by and between Southwest Premier Properties, L.L.C., a Texas limited liability company, and Central Freight Lines, Inc., a Texas corporation. (Incorporated by reference to Exhibit 10.11 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.11 | Amended and Restated Lease dated February 20, 2003 by and between JVM Associates and Central Freight Lines, Inc., a Texas corporation. (Incorporated by reference to Exhibit 10.12 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| 10.12 | Amended and Restated Lease dated February 20, 2003 by and between Jerry and Vickie Moyes and Central Freight Lines, Inc., a Texas corporation. (Incorporated by reference to Exhibit 10.13 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.13 | Amended and Restated Lease dated February 20, 2003 by and between Jerry and Vickie Moyes and Central Freight Lines, Inc., a Texas corporation. (Incorporated by reference to Exhibit 10.14 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.14† | Employment Agreement dated January 7, 2002, by and between Central Freight Lines, Inc., a Texas corporation, and Robert V. Fasso. (Incorporated by reference to Exhibit 10.15 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.15† | Employment Offer Letter to Jeffrey A. Hale, dated June 7, 2002, by Central Freight Lines, Inc. (Incorporated by reference to Exhibit 10.19 to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.16(a) | Indemnification Agreement, effective as of December 31, 2002, by and between Central Freight Lines, Inc., a Texas corporation, and Central Refrigerated Service, Inc., a Nebraska corporation. (Incorporated by reference to Exhibit 10.23(a) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

| 10.16(b) | Amendment Number One to Indemnification Agreement effective as of December 31, 2002, by and between Central Freight Lines, Inc., a Texas corporation, and Central Refrigerated Service, Inc., a Nebraska corporation. (Incorporated by reference to Exhibit 10.23(b) to the Company's Registration Statement on Form S-1 No. 333-109068.) |

| | |

10.17† | Employment Offer Letter to Walt Ainsworth, dated July 15, 2004, by Central Freight Lines, Inc. (Incorporated by reference to Exhibit 10.24 to the Company's Report on Form 10-K for the year ended December 31, 2004.) |

| | |

| 10.18(a) | Amended and Restated Credit Agreement, dated March 24, 2005, by and among the Financial Institutions named Therein as the Lenders, Bank of America, N.A. as the Agent, and Central Freight Lines, Inc., a Texas corporation, as the Borrower. (Incorporated by reference to Exhibit 10.26 to the Company's Report on Form 10-Q for the quarterly period ended April 2, 2005.) |

| | |

| 10.18(b) | First Amendment to Amended and Restated Credit Agreement, dated May 12, 2005, by and among Central Freight Lines, Inc., a Texas corporation, Required Lenders under the Credit Agreement, Bank of America, N.A., in its capacity as Agent for Lenders under the Credit Agreement. (Incorporated by reference to Exhibit 10.27 to the Company's Report on Form 10-Q for the quarterly period ended April 2, 2005.) |

| | |

| 10.18(c) | Second Amendment to Amended and Restated Credit Agreement, dated November 9, 2005, by and among Central Freight Lines, Inc., a Texas corporation, Required Lenders under the Credit Agreement, Bank of America, N.A., in its capacity as Agent for Lenders under the Credit Agreement. (Incorporated by reference to Exhibit 10.18(c) to the Company's Report on Form 10-K for the year ended December 31, 2005.) |

| | |

| 10.19 | Obligation Guaranty dated January 31, 2005, by Central Freight Lines, Inc., a Nevada corporation, for the benefit of Bank of America, N.A., in its capacity as Agent for the benefit of the Lenders. (Incorporated by reference to Exhibit 10.25 to the Company's Current Report on Form 8-K filed on February 4, 2005.) |

| | |

| 10.20 | Form of Director Indemnification Agreement. (Incorporated by reference to Exhibit 10.29 to the Company's Report on Form 10-Q for the quarterly period ended October 1, 2005.) |

| | |

| 11.1 | Schedule of Computation of Net Income Per Share. (Incorporated by reference to Exhibit 11.1 to the Company's Report on Form 10-K for the year ended December 31, 2005.) |

| 21.1 | Subsidiary of Central Freight Lines, Inc., a Nevada corporation. (Incorporated by reference to Exhibit 21.1 to the Company's Report on Form 10-K for the year ended December 31, 2005.) |

| | |

| 23.1 | Consent of McGladrey & Pullen, LLP. (Incorporated by reference to Exhibit 23.1 to the Company's Report on Form 10-K for the year ended December 31, 2005.) |

| | |

| 23.2 | Consent of KPMG LLP. (Incorporated by reference to Exhibit 23.2 to the Company's Report on Form 10-K for the year ended December 31, 2005.) |

| | |

| 31.1* | Certification pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, by Robert V. Fasso, the Company's Chief Executive Officer. |

31.2* | Certification pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, by Jeffrey A. Hale, the Company's Chief Financial Officer. |

32.1* | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, by Robert V. Fasso, the Company's Chief Executive Officer. |

32.2* | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, by Jeffrey A. Hale, the Company's Chief Financial Officer. |

| | |

________________

* Filed herewith.

† Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 1, 2006 | By: | /s/ Robert V. Fasso |

| | Name: | Robert V. Fasso |

| | Title: | Chief Executive Officer and President |

Signature and Title | | Date |

/s/ Robert V. Fasso | | May 1, 2006 |

Robert V. Fasso President, Chief Executive Officer; and Director (principal executive officer) | | |

/s/ Jeffrey A. Hale | | May 1, 2006 |

Jeffrey A. Hale Senior Vice President and Chief Financial Officer (principal financial and accounting officer) | | |

/s/ J.C. Carruth | | May 1, 2006 |

J. C. Carruth Director | | |

/s/ John Breslow | | May 1, 2006 |

John Breslow Director | | |

/s/ Porter J. Hall | | May 1, 2006 |

Porter J. Hall Director | | |