QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2001

Commission file number:

WAVECOM S.A.

(Exact name of Registrant as specified in its charter)

France

(Jurisdiction of Incorporation or Organization)

12 boulevard Garibaldi

92442 Issy-Les-Moulineaux Cedex,

France

Tel. 011 33 1 46 29 08 00

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Shares, nominal value €1.00 each* American Depositary Shares, evidenced by American Depositary Receipts, each representing one Share. | Nasdaq National Market |

*The Shares are not traded on the Nasdaq National Market but are registered only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

The number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

| Shares | 14,810,614 | |

| American Depositary Shares | 1,039,183 |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark which financial statement item the Registrant has elected to follow.

Item 17 o Item 18 ý

| Item 1: | Identity of Directors, Senior Management and Advisors | |

| Item 2: | Offer Statistics and Expected Timetable | |

| Item 3: | Key Information | |

| Item 4: | Information on the Company | |

| Item 5: | Operating and Financial Review and Prospects | |

| Item 6: | Directors, Senior Management and Employees | |

| Item 7: | Major Shareholders and Related Party Transactions | |

| Item 8: | Financial Information | |

| Item 9: | The Offer and Listing | |

| Item 10: | Additional Information | |

| Item 11: | Market Risk | |

| Item 12: | Description of Securities Other Than Equity Securities | |

PART II | ||

Item 13: | Defaults, Dividend Arrearages and Delinquencies | |

| Item 14: | Use of Proceeds | |

| Item 18: | Financial Statements | |

| Item 19: | Exhibits | |

PRESENTATION OF INFORMATION

Unless the context otherwise indicates, references to "Wavecom," "we" or us include Wavecom S.A. and its subsidiaries. References to "U.S. dollars" or "$" contained herein are to the lawful currency of the United States, and references to "euro" or "€" are to are to the currency of the European Monetary Union.

FORWARD LOOKING STATEMENTS

This annual report contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements are not guarantees of Wavecom's future operational or financial performance and are subject to risks and uncertainties. Actual operational and financial results may differ materially from Wavecom's expectations contained in the forward looking statements as a result of various factors. Factors that may cause such differences include, but are not limited to, factors discussed in "Item 3—Key Information—Risk Factors" and "Item 5—Operating and Financial Review and Prospects."

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Selected Financial Data

The following selected financial data for the five years ended December 31, 2001 are derived from consolidated financial statements of Wavecom, which have been prepared in accordance with U.S. GAAP and have been audited by Ernst & Young Audit, independent auditors. The data should be read in conjunction with "Operating and Financial Review and Prospects," the consolidated financial statements, related notes and other financial information included in this annual report. We derived the amounts shown below from our consolidated financial statements, which for the years ended December 31, 1997 and 1998 we have translated into euro using the exchange rate fixed for French francs and euro on January 1, 1999. Note 1 to these consolidated financial statements explains how the amounts were translated.

| | Years ended December 31, | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 1997 | 1998 | 1999 | 2000 | 2001 | 2001 | ||||||||||||||||

| | (in thousands, except share and per share amounts) | |||||||||||||||||||||

| Consolidated statements of operations data: | ||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||

| Product sales | € | 10,478 | € | 12,796 | € | 34,563 | € | 63,055 | € | 317,571 | $ | 282,670 | ||||||||||

| Technology development and other services | 7,198 | 5,780 | 1,853 | 2,518 | 5,093 | 4,533 | ||||||||||||||||

| License fees and royalties | 979 | 998 | 144 | — | — | — | ||||||||||||||||

| Total revenues | 18,655 | 19,574 | 36,560 | 65,573 | 322,664 | 287,203 | ||||||||||||||||

| Cost of revenues: | ||||||||||||||||||||||

| Cost of goods sold | 9,023 | 10,562 | 26,236 | 51,457 | 254,658 | 226,671 | ||||||||||||||||

| Cost of services | 3,808 | 3,741 | 2,148 | 4,522 | 4,718 | 4,199 | ||||||||||||||||

| Total cost of revenues | 12,831 | 14,303 | 28,384 | 55,979 | 259,376 | 230,870 | ||||||||||||||||

| Gross profit | 5,824 | 5,271 | 8,176 | 9,594 | 63,288 | 56,333 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||

| Research and development | 3,222 | 7,851 | 11,913 | 16,133 | 32,634 | 29,048 | ||||||||||||||||

| Sales and marketing | 1,291 | 2,088 | 3,412 | 5,836 | 12,416 | 11,051 | ||||||||||||||||

| General and administrative | 852 | 1,962 | 3,070 | 5,598 | 13,297 | 11,836 | ||||||||||||||||

| Amortization of goodwill | — | — | — | 47 | 278 | 247 | ||||||||||||||||

| Deferred compensation amortization | — | 126 | 1,608 | 1,758 | 1,711 | 1,523 | ||||||||||||||||

| Provision for loss—ICO Development contract | — | — | 2,607 | — | — | — | ||||||||||||||||

| Total operating expenses | 5,365 | 12,027 | 22,610 | 29,372 | 60,336 | 53,705 | ||||||||||||||||

| Operating income (loss) | 459 | (6,756 | ) | (14,434 | ) | (19,778 | ) | 2,952 | 2,628 | |||||||||||||

| Interest and other financial income (expense), net | (40 | ) | (364 | ) | (207 | ) | 3,734 | 3,969 | 3,532 | |||||||||||||

| Provision for loss on long-term investment | — | — | — | — | (716 | ) | (637 | ) | ||||||||||||||

| Beneficial conversion feature of convertible debt | — | — | (1,072 | ) | — | — | — | |||||||||||||||

| Income (loss) before minority interests and income taxes | 419 | (7,120 | ) | (15,713 | ) | (16,044 | ) | 6,205 | 5,523 | |||||||||||||

| Minority interest | — | — | — | 6 | 804 | (716 | ) | |||||||||||||||

| Income (loss) before income taxes | 419 | (7,120 | ) | (15,713 | ) | (16,038 | ) | 7,009 | 6,239 | |||||||||||||

| Income tax expense (benefit) | 136 | (813 | ) | (736 | ) | (1,534 | ) | (2,299 | ) | (2,046 | ) | |||||||||||

| Net income (loss) | € | 283 | € | (6,307 | ) | € | (14,977 | ) | € | (14,504 | ) | € | 9,308 | $ | 8,285 | |||||||

| Basic net income (loss) per share(1) | € | 0.03 | € | (0.63 | ) | € | (1.26 | ) | € | (1.03 | ) | € | 0.63 | $ | 0.56 | |||||||

| Diluted net income (loss) per share(1) | € | 0.03 | € | (0.63 | ) | € | (1.26 | ) | € | (1.03 | ) | € | 0.61 | $ | 0.54 | |||||||

| Cash dividends declared per share(2) | € | 0.0046 | € | 0.015 | — | — | — | — | ||||||||||||||

| $ | 0.0051 | (3) | $ | 0.016 | (4) | |||||||||||||||||

| Number of shares used in computing basic net income (loss) per share | 10,000,000 | 10,000,000 | 11,922,770 | 14,081,178 | 14,726,647 | 14,726,647 | ||||||||||||||||

| Number of shares used in computing diluted net income (loss) per share | 10,000,000 | 10,000,000 | 11,922,770 | 14,081,178 | 15,359,226 | 15,359,226 | ||||||||||||||||

| | December 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 1997 | 1998 | 1999 | 2000 | 2001 | 2001 | ||||||||||||

| Consolidated balance sheet data: | ||||||||||||||||||

| Total current assets | € | 9,981 | € | 11,322 | € | 34,957 | € | 138,323 | € | 227,028 | $ | 202,078 | ||||||

| Total assets | 12,604 | 15,843 | 41,462 | 158,298 | 259,947 | 231,379 | ||||||||||||

| Total current liabilities | 9,538 | 18,274 | 15,927 | 48,957 | 137,064 | 122,001 | ||||||||||||

| Total long-term liabilities | 583 | 1,414 | 879 | 166 | 638 | 568 | ||||||||||||

| Total shareholders' equity (deficit) | 2,483 | (3,845 | ) | 24,656 | 108,010 | 121,884 | 108,489 | |||||||||||

- (1)

- Net income (loss) per share amounts are computed using the weighted average number of shares outstanding. It excludes options and warrants, and reflects only the actual ordinary shares outstanding..

- (2)

- We do not expect to pay any cash dividends on our shares in the foreseeable future.

- (3)

- Translation into U.S. dollars is at the rate of $0.90 = €1.00, based on the noon buying rate for French francs of $0.17 = FF1.00 on June 30, 1997, the date on which the dividend was declared.

- (4)

- Translation into U.S. dollars is at the rate of $0.92 = €1.00, based on the noon buying rate for French francs of $0.16 = FF1.00 on June 30, 1998, the date on which the dividend was declared.

Exchange Rate Data

For your convenience, this annual report contains translations of euro amounts into U.S. dollars at the rate of $0.8901 = €1.00, the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on December 31, 2001. The noon buying rate on June 21, 2002 was $0.9705 = €1.00. Since January 1, 1999 our functional currency has been euro. Fluctuations in the exchange rate between the euro and the dollar will affect the dollar amounts received by owners of ADSs on conversion of dividends, if any, paid in euro on the shares and may affect the dollar price of the ADSs on the Nasdaq National Market.

The following table shows the noon buying rates for the number of U.S. dollars per euro for the period since January 1, 1999. The average is computed using the noon buying rate on the last business day of each month during the period indicated.

| Month | High | Low | ||||

|---|---|---|---|---|---|---|

| 2002 | ||||||

| June (through June 21) | 0.9705 | 0.9390 | ||||

| May | 0.9373 | 0.9022 | ||||

| April | 0.9028 | 0.8750 | ||||

| March | 0.8836 | 0.8652 | ||||

| February | 0.8778 | 0.8613 | ||||

| January | 0.9031 | 0.8594 | ||||

| 2001 | ||||||

| December | 0.9044 | 0.8773 | ||||

Year ended December 31, | Average | |||||

| 2001 | $ | 0.8952 | ||||

| 2000 | 0.9234 | |||||

| 1999 | 1.0667 | |||||

Since the euro did not exist prior to January 1, 1999, we cannot present exchange rates between the euro and the U.S. dollar for the periods prior to that date shown in our consolidated financial statements and in the other financial information discussed in this prospectus. Our functional currency during those periods was the French franc. In order that you may ascertain how the trends in our financial results might have appeared had they been expressed in U.S. dollars, the table below shows the average noon buying rates for the French franc per $1.00 for 1998 and 1997, computed using the noon buying rate on the last business day of each month during the period indicated.

| Year ended December 31, | Average | | ||

|---|---|---|---|---|

| 1998 | FF 5.90 | |||

| 1997 | 5.85 |

Risk Factors

In addition to the other information contained in this annual report, the following risk factors should be carefully considered in evaluating us and our business.

Possible effects of a continued downturn in the global handset market

To date our growth has not been directly tied to trends in the global handset market, but rather to growth of the particular markets served by our customers (primarily in China) and the success of our customers in their markets. Although we do not expect the global market for handsets to experience growth in 2002, and expect that the market may even decline slightly, we believe that our customers are likely to increase their existing shares of local markets in Asia and we expect to add new customers. If the markets in which our customers sell their products should experience a downturn, or if our customers are unable to profit from growth in their local markets or are unable to increase their market share, or if we are unable to win new customers, our revenues may not continue to grow and may even decline.

Lack of growth in the markets for new wireless applications could hurt our business

Our prospects depend upon continued development and growth of markets for wireless communications products. Although we anticipate that the market for mobile telephones will continue to grow in the future, we believe that a significant potential for growth in the demand for our products will be in new wireless applications. These include:

- •

- hand-held portable devices, such as personal digital assistants and computer notebooks;

- •

- automatic vehicle location systems, which provide vehicle tracking and navigation capabilities; and

- •

- devices which require the measurement and transmission of data, such as vending machines, utility meter and security systems.

The markets for these types of products are still in their formative stages. We may not be successful if these and other potential markets for our products do not develop.

The loss of key customers could decrease our revenues

Our performance depends on relatively large orders from a small number of customers. The following table sets forth revenues from our largest customers for the past three years:

| | 1999 | 2000 | 2001 | ||||

|---|---|---|---|---|---|---|---|

| Percentage of total revenues represented by the five largest customers | 49.4% | * | 45.8% | ** | 80.4% | *** | |

| Percentage of total revenues represented by the ten largest customers | 66.2% | 68.4% | 88.1% |

- *

- In 1999, sales to Mitsubishi represented 33.3% of total revenue.

- **

- In 2000, sales to Sewon Telecom represented 14.7% of total revenue.

- ***

- In 2001, sales to Sewon Telecom represented 35.4% of total revenue; sales to Amtal International Ltd., agent for TCL Mobile Communication (HK) Company Ltd., represented 32.9% of total revenue.

Our customers may reduce volumes ordered on relatively short notice, although we had no significant reductions in 2001. We believe that a small number of manufacturers will dominate the market for mobile telephones and other wireless applications. As a result, we expect to continue to depend on large orders from a small number of customers. If our existing customers reduce their orders for our products or if we lose existing customers or fail to attract new customers, our business will suffer.

We must keep pace with technological change and develop new products to remain competitive

The wireless communication markets in which we sell our products are changing very quickly. New types of products and new versions of existing products come to market regularly. Manufacturers who purchase ourWISMO modules and wireless modems for use in their mobile telephones and other applications compete with other manufacturers and, to be competitive, must offer products that satisfy consumer demand for smaller, less expensive products with more features. To meet our customers' needs, we must continuously update and enhance our products so that they meet the latest standards and include up-to-date features. To develop these enhancements, new designs and technologies we must spend significant amounts on research and development. We may lose market share if our competitors, most of which are larger and have greater resources than we do, are more successful or faster than we are in updating and improving products and technology.

We incurred losses in 1999, 2000 and the first quarter of 2001, and may incur losses again in the future

We incurred net losses in each quarter of 1999 and 2000, and in the first quarter of 2001. For the year ended December 31, 1999 we had an operating loss of €14.4 million and negative cash flow from operating activities of €11.7 million. For the year ended December 31, 2000, we had an operating loss of €19.8 million and negative cash flows from operations of €8.6 million. For the year ended December 31, 2001 we had operating income of €3.0 million and positive cash flow from operations of €50.0 million. We believe that we may experience negative cash flow during one or more quarters in 2002 as a result of our current plans for increased spending on research and development projects, particularly related to new products scheduled to be introduced in 2002, and the ongoing ramp-up of production, including the addition of lines of production at Solectron and/or a new subcontractor, tentatively scheduled for mid-year 2002. Based on our current plans, we believe that our currently available capital resources will be adequate to satisfy our cash requirements at least through 2003. If our research and development or manufacturing plans change, or if we do not achieve profits or if our profits are significantly lower than anticipated, we may need additional funding to remain in business.

Declining sales prices of mobile telephones and other wireless products could hurt our revenues

The prices of mobile telephones have tended to decrease steadily over time. We believe that the prices of other wireless communications products will also decrease over time. As a result, prices for ourWISMO modules and wireless modem products have declined and are likely to continue to decline. More importantly, in order for us to address a larger market, and in order for our customers to introduce attractively priced products, we believe we must continue to reduce our selling prices. We will be unable to maintain profitability unless we can offset these price decreases with increases in unit volume or reductions in per unit costs.

We depend on a limited number of suppliers and subcontractors who could be difficult or expensive to replace

We rely on third parties to manufacture components of our products and to assemble all of our products and to test some of our products. Philips, Toshiba, Intel, Sony and RF Micro Devices currently manufacture key components of our products. We also currently use two subcontractors, Solectron and Thales Microelectronic, to assemble and test our products. Using third parties to manufacture components of our products and to assemble and test our products reduces our control over product delivery schedules, quality assurance, manufacturing yields and costs. The third parties who manufacture, assemble and test our products also have other customers and may not have sufficient capacity to meet all of our manufacturing, assembly and testing needs during periods of excess demand.

We expect that each of our individual products or product families may be assembled by a sole-source subcontractor until at least mid-year 2002. We could suffer a significant delay in meeting our customers' orders for products if one of our suppliers or subcontractors cannot meet our requirements. Although we are currently planning to add production capacity at new subcontractors, it could take a long time to establish a strategic relationship with the new manufacturer. Any of these problems could significantly harm our business.

A financial crisis or political upheaval in Asia, particularly in China, could hurt our revenues

In 1999, sales to Asian customers represented 5.9% of revenues. Sales to Mitsubishi's U.K. subsidiary, whose products were intended for end users in Asian markets, represented an additional 33.3% of our revenues in 1999. In 2000 and 2001, sales to Asian customers represented 33.9% and 83.6%, respectively, of revenues reflecting shipments pursuant to large contracts with customers in China, Taiwan and Korea. We expect that, for the foreseeable future, a significant portion of our revenues will be generated from Asian customers, and in particular from customers based in China or serving the Chinese market. A new financial crisis in Asia, particularly in China, could substantially reduce our revenues from Asian customers or customers selling to end users in Asia. In addition, political upheaval in China or a change in the political climate making China a less favorable environment for foreign businesses, could substantially reduce our revenues.

Because some of our key components come from a single source, or require long lead times, we could experience unexpected interruptions which could cause our operating results to suffer

We believe that a number of our suppliers are sole sources for key components. These key components are complex and difficult to manufacture and require long lead times. In September 2000, the unavailability of a sole-source combined flash memory and RAM component resulted in a two-week interruption of production. We work with our suppliers on a twelve-month rolling forecast basis and we currently believe that we have secured adequate supply based on our production forecasts for the next twelve months. In the event of a reduction or interruption of supply, or a degradation in quality, a number of months could be required before we could begin receiving adequate supplies from other suppliers. Supply interruptions could delay product shipments, causing our revenues and operating results to decline.

If we do not effectively manage our growth, it could affect our ability to pursue business opportunities and expand our business

Growth in our business has placed and will continue to place a significant strain on our management systems and resources. We will need to continue to improve our operational and financial systems and managerial controls and procedures and expand, train and manage our workforce. We will have to maintain close coordination among our technical, accounting, marketing, sales and research and development departments. If we fail to effectively manage our growth and address the above concerns, it could affect our ability to pursue business opportunities and expand our business.

Our costs may increase or we may have to redesign our products if they infringe other companies' intellectual property rights

Other companies have patents, copyrights, trade secrets and other intellectual property rights covering technology used in the wireless communications industry. Currently, we have licenses to use only some of these rights. If any of our products were found to infringe on protected technology, we could be required to redesign them, to obtain licenses for this technology or to pay royalties or damages to its owner. The resulting costs would harm our business. If we were unable to obtain these licenses or to redesign infringing products, we could be prohibited from marketing them. As explained under "Business—Intellectual Property," however, owners of some of this protected technology must provide us with a license on fair, reasonable and non-discriminatory terms.

Our business could be hurt by the unauthorized use of our technology

We rely on a combination of patents, copyrights, trade secrets, trademarks and proprietary information to maintain and enhance our competitive position. We might, however, have difficulty taking effective legal action against a competitor who copied important parts of the technology we use in our products and processes. If we were unable to prevent a competitor from using our designs and techniques to produce competing products, our business would be adversely affected.

We may not be able to sell our products under the Wavecom name in North America or Japan

We have not registered the Wavecom name in North America or Japan. Several other companies, some of which are in businesses similar to our own, use the word Wavecom or a similar word as either a trade name or as a brand name for their products. This could cause confusion in the marketplace and harm our sales. If one of these other companies were to take effective legal action to prohibit us from continuing to use the name Wavecom in North America or Japan, we could be forced to use a different name and, as a result, it would be more difficult for customers to identify us and our sales might suffer.

We need to attract and retain key personnel who are skilled in our business and technology to remain competitive

Our success depends on the skills of some of our key employees, including two of Wavecom's founders, Michel Alard, who is currently Chairman of the Board and Chief Executive Officer (Président Directeur Général), and Aram Hékimian, who is currently the Deputy Chief Executive Officer (Directeur Général Délégué). If either of these individuals were to leave Wavecom, the loss of their key management and technical skills could harm the development and implementation of our long-term strategy, customer relationships, operations and growth.

It is important to our success that we retain our highly skilled product development, sales and marketing employees and continue to attract, train and retain additional skilled employees. We rely to a large extent on independent contractors who work for consulting firms. In the future, it may become more difficult to recruit and retain the employees and independent contractors that we would need to continue to grow. Any failure to attract, hire or retain personnel could delay our research and development projects or reduce the sales of our products.

Our quarterly revenues fluctuate significantly and may affect the price of our shares and ADSs

Our revenues and operating results fluctuate significantly from quarter to quarter. The many factors that could cause our quarterly results to fluctuate include:

- •

- any delay in our introduction of new products or product enhancements;

- •

- the size and timing of customer orders and our product shipments;

- •

- any delay in shipments caused by component shortages or other manufacturing problems;

- •

- the loss of a major customer;

- •

- a reduction in the selling price of our products;

- •

- the impact of seasonal variations in demand linked to the timing of holiday buying seasons, such as the Chinese New Year; and

- •

- customer responses to announcements of new products and product enhancements by our competitors.

Due to these and other factors, our results of operations could fluctuate substantially in the future and quarterly comparisons may not be reliable indicators of future performance. In addition, because many of our expenses for personnel, facilities and equipment are relatively fixed in nature, if revenues fail to meet our expectations we may not be able to reduce expenses accordingly. As a result, we could experience less than expected net income or we could experience net losses. These quarterly fluctuations may have a negative effect on the price of our shares and ADSs. It is possible that in some future quarter our results of operations will be below the expectations of public market analysts and investors, in which case the price of our shares and ADSs could fall.

Our U.S. shareholders could suffer adverse tax consequences if we are characterized as a passive foreign investment company

If, for any taxable year, our passive income or our assets that produce passive income exceed levels provided by law, we may be characterized as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences to our shareholders who are subject to U.S. taxation. U.S. persons should consult with their own U.S. tax advisors with respect to the U.S. tax consequences of investing in our shares or our ADSs. See "Item 10—Additional Information—Taxation—United States Taxation—Passive Foreign Investment Company".

Events anticipated in forward-looking statements in this annual report may not occur

This annual report contains forward-looking statements that involve risks and uncertainties. These forward-looking statements are usually accompanied by words such as "believe," "anticipate," "plan," "expect" and similar expressions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including the risks faced by us described above and elsewhere in this annual report.

Item 4. Information on the Company

Business Overview

Wavecom develops, markets and sells a line of digital wireless standard modules, known asWISMO modules, for use in mobile telephones and other wireless applications based on the Global System for Mobile Communications ("GSM") and GPRS standards. We are in the process of developingWISMO modules based on UMTS (commonly known as "third generation" or "3G" technology). Following our acquisition of Iconn Wireless, a San Diego-based Code Division Multiple Access ("CDMA") technology company, in December 2001, we have also begun the development of a CDMA module. When we are able to offerWISMO modules in GSM, GPRS, CDMA and UMTS versions, we believe we should be able to address nearly all the world's principal wireless markets.

WISMO modules are compact devices that include substantially all of the hardware, software and other technology needed to enable wireless communications.WISMO modules offer a quick and simple way to integrate digital wireless communications in mobile telephones, wireless modems and a wide range of other applications requiring wireless communications in our target markets: automotive, telemetry, multimedia and telephony. Examples of these applications include automotive navigation and information systems, personal digital assistants with wireless communication functions and devices enabling communication between vending machines or utility meters and central control centers. In order to help our customers, we provide them with the services and expertise required to integrateWISMO modules into their mobile telephones and other wireless applications. We also sell wireless stand-alone and integrated modems that incorporateWISMO modules.

Our products incorporate digital wireless technology that we have developed since 1993, when Wavecom was founded. Our product development calls for highly specialized technical know-how and experience in digital and radio frequency circuit design and microchip architecture, the design of real-time software and, most importantly, the optimal integration of these technologies. Between 1993 and 1996, we focused mainly on providing engineering services for our clients' customized digital wireless products. Building on engineering expertise developed during this period, we commercially introduced the first version of theWISMO module in January 1997. We were the first company to commercialize GSM technology in the form of a standard module and believe that our currentWISMO Quik andWISMO Pac modules, are among the smallest wireless standard modules available.

In March 2000 we began mass production of two dual-band versions of ourWISMO Quik 2300 module (formerly known as theWISMO2C module). In the fourth quarter of 2001, we commenced mass production of ourWISMO Pac 3100 (formerly known asWISMO3) module in two dual-band versions. TheWISMO Pac module is more compact than theWISMO Quik module and uses new packaging technology, known as Chip-Pac® technology, which allows our customers to solder theWISMO Pac module onto the printed circuit board of the mobile telephone or other wireless application in a much more efficient manner than the manual connection process necessary for theWISMO Quik module. Both theWISMO Quik andWISMO Pac modules are now designed to operate on both GSM and GPRS networks.

We expect to commence production of a number of newWISMO modules during 2002. In the second quarter, we plan to launch the thinner, lighter-weightWISMOQuik 2400 module. In the fourth quarter, we expect to introduce a quad-band version of theWISMO Quik module that will operate on all four GSM/GPRS frequencies (900MHz and 1800MHz for the European and Asian markets and 1900MHz and 850MHz for the U.S. GSM and GPRS markets). Our objective is to put a CDMA version of theWISMO Quik module into mass production by the end of 2002.

Background of the wireless communications industry

The wireless communications industry has grown rapidly over the past decade as wireless communications products and services have become widely available and increasingly affordable. Technological advances, changes in telecommunications regulations and the allocation and licensing of additional radio spectra have helped fuel this growth worldwide and have led to the development of competing wireless communications services. At the same time, consumer demand for increased mobility has led to the use of wireless technology both in products that were previously available only in "wired" versions and in completely new applications.

Consumers and businesses are demanding to have access to information and to be able to react based on that information anywhere, anytime. Availability of information will be provided by the Internet; the ability to access and act on that information immediately will be supplied by wireless communications technology.

Transmission standards

The wireless communications market is characterized by a proliferation of transmission standards in different parts of the world, including first generation analog standards, second generation digital standards, such as GSM, and so-called "2.5 generation" standards, such as GPRS and CDMA 1xRTT. Digital wireless systems generally operate on the 850MHz, 900MHz, 1800MHz or 1900MHz frequency bands. GSM is currently the dominant standard in Europe for both voice and data transmission.

The wireless communications industry is currently developing specifications for third generation ("3G") standards to accommodate increased capacity and to allow for faster data transmission. Universal Mobile Telecommunication Systems ("UMTS"), the primary proposed 3G transmission standard, was introduced commercially in a limited geographic area in Japan in 2001 and is generally expected to be introduced commercially in Europe and the rest of Asia by 2003 or 2004. The increased capabilities of UMTS are expected to attract subscribers from other wireless standards in use around the world. To enable the introduction of broadband wireless services, which enable faster data transmissions, prior to the widespread availability of UMTS, the wireless industry is developing interim "2.5 generation" solutions based on existing second generation technology. These solutions include general packet radio services ("GPRS"), which is a transmission standard being developed to support packet-oriented data applications on GSM, and code division multiple access ("CDMA") 1xRTT. GPRS and CDMA 1xRTT, which will enable a more efficient use of a wireless communications network and provide faster transmission speeds, are expected to be implemented fully in the second half of 2002 or early 2003, for GPRS (CDMA 1xRTT has just recently been implemented).

Gartner, a market research firm, projects that the worldwide wireless communications market will increase from approximately 938 million subscribers in 2001 to approximately 1.5 billion subscribers in 2005, with handset sales increasing from 400 million units in 2001 to approximately 545 million units in 2005. Gartner also projects that GSM/GPRS handset sales will increase from approximately 233 million in 2001 to approximately 320 million in 2005, which would represent 58% of the total estimated worldwide market for wireless handset sales. CDMA and CDMA 1xRTT subscriptions represented nearly 16% of new subscribers in 2001 and are expected to represent more than 21% of new subscribers in 2005, according to Gartner. The W-CDMA variant of UMTS, which Wavecom intends to introduce in future products, is expected by Gartner to represent more than 9% of new subscribers in 2005.

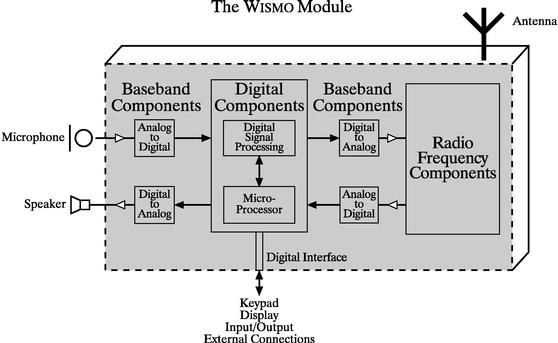

Wireless terminals

A typical wireless terminal, such as a mobile telephone, contains baseband, digital and radio frequency hardware components and related software. Baseband components process analog signals and convert signals from analog to digital or from digital to analog. Digital components control the wireless device's circuitry and send data to and receive data from the network through the terminal's radio frequency components. They also process all of the information within the device and manage information going to and from the user. Radio frequency components amplify, transmit and receive the high frequency analog signals that carry the information being communicated. Typically, up to two-thirds of the development effort for a wireless communications application consists of writing software that integrates and manages the hardware components. The wireless applications designed for each band and transmission standard generally require different hardware and software.

Currently, prior to being placed in service, each new wireless communications device must satisfy a series of technical tests meeting the requirements of the relevant regulatory authority (for example, the Federal Communications Commission in the United States). The process, commonly known as "full type approval," can take up to six months, depending on the experience of the applicant and the familiarity of the regulator with the particular product. In European Community countries, a recent directive is being implemented which provides that sales of wireless communication products into the European Community will no longer require full-type approval provided that the manufacturer makes a declaration of conformity with the requirements of the directive.

In addition to testing to confirm compliance with regulatory requirements, prior to commercialization, each new wireless application must be field tested in its target markets to ensure that it operates properly with each wireless network for which it is intended to be used. These networks all vary due to different infrastructure design and the ongoing evolution of GSM network software, which is managed independently by each network operator.

Our market

The market for wireless communications terminals has generally been characterized by rapid growth, evolving industry transmission standards and the frequent introduction of new applications. Manufacturers of mobile telephones must continually re-design their products to meet consumer demands for an increased number of functions, a wider variety of styles, smaller and lighter equipment, longer battery life and greater reliability, all at reduced costs. With the slowing of demand in 2001, mobile telephone manufacturers are under increased pressure to achieve profitability. Manufacturers of many other wireless communications products must offer compact, cost-effective products that provide a wide range of functionality and can be quickly brought to market. As segments of the wireless communications market evolve, the industry must offer a wider range of products to better meet the specific needs of individual consumers.

These market demands have made it increasingly difficult for manufacturers to develop and supply all the technology they need for new wireless applications, to meet regulatory requirements and to complete field testing, all in a timely and cost-effective manner. Developing and producing the software, chip sets and other integrated components in a compact wireless communications product requires significant expertise. Some manufacturers of products for the wireless market choose not to develop this technology in-house, preferring to rely on a third party supplier so that they may focus on their core competencies. In addition, other consumer products companies do not have the financial means or technical resources to develop their own wireless technology. As a result, many manufacturers rely increasingly on subcontractors to develop and supply critical digital wireless components.

Strategy

We believe that as the wireless communications industry matures, it will evolve from a model where providers of wireless applications manufacture all of the technology in the end product to a model where each provider of the end product focuses on branding, marketing, distribution and product design, favoring a trend toward outsourcing the wireless communication technology function.

Wavecom's products are designed to enable product manufacturers to incorporate advanced digital wireless technology quickly and efficiently into their applications. We strive to maintain technological leadership and to be a leading independent vendor of wireless standard modules, wireless modems and related support services for our products' integration in consumer and business digital wireless applications. Key elements of our strategy include:

- •

- Mobile Telephones: We believe that there is a significant opportunity for us to supplyWISMO modules both to new entrants in the mobile telephone market, as well as to established manufacturers who are increasingly looking to outsource wireless technology.

- •

- New wireless applications. Wireless communications allow many types of equipment that are currently tied to wired telephone networks to be freed of locational constraints and the need for costly infrastructure investment. Wireless communications can also be used to enhance such products as portable computers by enabling them to send and receive data without being attached to a landline. Our strategy is to expand the use of our products in a broad range of wireless applications.

- •

- Adapting our technology for use with evolving digital transmission standards. The current versions of theWISMO module are based on GSM and GPRS technology. We intend to produceWISMO modules that support new wireless communications standards as they are introduced. We are developing products for the CDMA 1xRTT standard and we are also focusing our research and development efforts on products for the UMTS standard.

- •

- Working closely with customers in the early stage of product development. Our success to date has been based on our technical expertise and collaboration with a number of strategic customers. We will continue to work with customers early in their product design stage in order to help them develop applications in a way that will easily support the integration of theWISMO module. We believe that early collaboration allows customers to lower their development costs and reduce the time required to introduce new products and enter new markets. It also enables Wavecom to better anticipate and meet its customers' future wireless technology requirements.

- •

- Pursuing strategic acquisitions. We intend to pursue acquisitions of businesses, products, services and technologies that are complementary to our existing business in order to expand our position in the wireless communications market. Although we have no present commitments or agreements regarding any acquisitions, we believe that there are acquisition candidates that could enhance our position in this market. A likely goal of any such acquisitions would be to acquire technology that would allow us to achieve our research and development objectives more quickly or efficiently.

- •

- Expanding sales to additional geographic markets. We are expanding our sales and marketing capabilities in order to address the worldwide market for our products. We increased our direct sales capabilities from six sales people at the end of 1998 to 16 at the end of 2001. We increased our distributor network from seven in 1998 to 25 at the end of 2001. We opened branch offices in Tokyo (April 2000), Seoul (January 2001), and Darmstadt, Germany (October 2001) and a liaison office in Taipei (February 2002). We expect to open further branch offices or subsidiaries in Europe and in the Asia-Pacific region during 2002.We intend to add direct sales staff in all three regions and to continue to expand indirect channels by adding more distributors.

Expanding the use ofWISMO products in mobile telephones and new wireless applications

Products

WISMOmodules

WISMO modules are compact devices that incorporate substantially all baseband, digital and radio frequency hardware and software needed for a digital wireless terminal.WISMO modules are offered either with standard software interfaces or with customized software (which may be developed by the customer or by Wavecom to the customer's specifications). Prior to 2001, when our production volumes were under one million units per year, product segmentation was not a cost-effective strategy and we followed a "one-size-fits-all" approach. In 2001 we announced the creation of differentiated lines ofWISMO modules, beginning with the introduction of theWISMO Pac modules in November 2001 We currently offer two different lines ofWISMO modules: theWISMO Quik line (previously known as theWISMO2 line of modules) and theWISMO Pac line (which includes the products previously referred to as theWISMO3 module and theWISMO5 module). The difference between the two product lines is essentially in their packaging. TheWISMO Quik line has a connector, and is more suitable for integration in automotive and telemetry applications. TheWISMO Pac line has the form of a single component and includes our patented Column Grid Array™ (CGA) design. Used to provide shielding as well as connectivity, the CGA enablesWISMO Pac to be automatically positioned and soldered onto a circuit board like any traditional integrated circuit, representing efficiencies in terms of industrial design and assembly.

TheWISMO Quik line of modules currently consists of theWISMO Quik 2300 series, which has been in production since March 2000. The Q2300 series is available in GSM/GPRS in two dual-band versions that operate either on the 900MHz/1800MHz bands or the 900MHz/1900MHz bands, and measures 58x32x6 mm and weighs 18g. TheWISMO Pac line currently comprises theWISMO Pac 3100 series. The P3100 series, like the Q2300 series, is available in GSM/GPRS in two dual-band versions that operate either on the 900MHz/1800MHz bands or the 900MHz/1900MHz bands. However, the P3100 series is more compact than the Q2300 series with an area of less than 15cm2, a thickness of 5.1mm and weight of 11g. We commenced mass production of theWISMO Pac 3100 series in December 2001.

The first generationWISMO1 module was introduced in 1997, but by mid 2000 allWISMO1 module customers had migrated to ourWISMO Quik 2300 module (formerly known as theWISMO2C module); production ofWISMO1 modules ceased during the third quarter of 2000. We began commercial shipments of theWISMO2A module, which operates on the 900MHz band only, in January 1999. That product was superseded by theWISMO2C product in the second quarter of 2000.

Sales ofWISMO modules represented 26.2% of our revenues in 1999, 59.4% in 2000 and 88.6% in 2001. Sales of assembled mobile telephones that incorporatedWISMO modules represented an additional 33.3% of our revenues in 1999.

Basic features of theWISMO module include all standard voice functions now available on the market, including conferencing, call hold, call waiting and call forwarding. Main data features of theWISMO module include the ability to send and receive short text messages and facsimiles from a mobile telephone. TheWISMO module can send or receive data in multiple modes at rates up to 9,600 or 14,400 bits per second, depending on the GSM network, and theoretically up to 42,800 bits per second (for GPRS class 2) or up to 85,600 bits per second (GPRS class 10), depending on the GPRS network. At this time, the GPRS rates remain theoretical goals in laboratory conditions and realizable rates are much lower. AWISMO module has interfaces for an antenna, a subscriber identity module, an LCD screen, a keypad, microphone input and earphone output.

The principal advantages of theWISMO solution for our customers are that:

- •

- The customer can acquire digital wireless technology without significant internal research and development investment. This reduces product development and field-test time, resulting in a reduced time to market.

- •

- The small size of theWISMO module provides our customers with significant flexibility in designing their wireless applications.

- •

- WISMO modules are pre-tested by authorized type approval certification laboratories, which results in a stream-lined regulatory approval, and which allows our customers to more easily confirm compliance with regulatory requirements.

- •

- We assist our customers in performing field tests in their target markets to ensure that their applications operate properly with each wireless network for which they are intended to be used.

- •

- By integrating all of the key electronic components, including the sensitive radio frequency components, into our product, we can help our customers achieve higher yields in their production process since we have already addressed most technical quality issues during our own production.

- •

- A customer who has integrated aWISMO module into a product based on one band can rapidly integrate aWISMO module based on another band into the same product, providing rapid access to new markets.

- •

- Unlike some other suppliers of digital wireless technology, we are an independent supplier and do not compete with our customers who manufacture products for the end user market.

New WISMOproducts under development

WISMOQuik modules. We are currently developing the following new products for theWISMO Quik line:

- •

- TheWISMO Quik 2400 series will concentrate all components on one side of the module, resulting in a thinner (3.9mm) and lighter (11g) product, compared to the Q2300 series, while keeping the same length and width. We expect to commence mass production of the Q2403 in the second quarter of 2002 with a GSM/GPRS dual-band version (900MHz/1800MHz). We expect to begin mass production of a quad-band version (Q2486), covering 850MHZ, 900MHz, 1800MHZ and 1900MHz, by the end of 2002.

- •

- A dual-band CDMA version (800MHz/1900MHz) of ourWISMO Quik module is under development and will be identical in size and mechanical footprint to the Q2300 GSM/GPRS version. Our objective is to commence mass production in the fourth quarter of 2002.

WISMOPac modules. We are currently developing the next generation ofWISMO Pac modules which will be GSM/GPRS quad-band (850MHZ/900MHz/1800MHZ/1900MHz) and in a smaller form factor than the P3100 series. We are currently designing our own baseband chipset in order to attain size and cost reductions, as well as increasing features and functions. Working samples of the baseband chipset are expected to be available in mid-2002. We expect to commence mass production of the new series in the first half of 2003.

Wireless modems

In addition to theWISMO module product line, we offer a GSM-based external stand-alone wireless modem, the FASTRACK, designed for data, fax, short message service and voice applications. In response to customer demand for smaller modems which can be more easily integrated into a product, we introduced an integrated wireless modem, the INTEGRA, in the second quarter of 2000 that is intended to be soldered onto a printed circuit board. Our wireless modems have full type approval and therefore can be used off-the-shelf. This enables a customer to incorporate immediately wireless connectivity in its own application without any delays related to type approval. Typical uses for wireless modems include vehicle fleet management and remote measuring and reporting of information in such applications as utility meters, vending machines or security systems. WhereasWISMO modules are typically purchased by product manufacturers for integration into mobile telephones, personal digital assistants and other high volume products, wireless modems are more commonly purchased by customers seeking an off-the-shelf wireless solution for relatively small volume applications where size is not a critical factor. In 2001, our average sale price for wireless modems was €136 compared to €154 in 2000, although prices may vary significantly depending on volume. Sales of wireless modems represented 31.8% in 1999, 36.8% in 2000 and 9.9% in 2001.

Customer service and technical support

We believe that providing customers with comprehensive product service and support is critical to maintaining a competitive position in the wireless communications market. Our support services enable the customer to pass rapidly through the development phase and to begin production. Services include:

- •

- product design assistance and support;

- •

- development of application specific software;

- •

- validation and field testing;

- •

- assistance in obtaining full type approval where required; and

- •

- provision of production test tools.

We also assist our customers by providing them with software development tools. Our MUSE Platform™, or Modular User Software Environment™ is an open software environment that allows our customers' software engineers to easily develop and embed wireless applications directly ontoWISMO modules and modems. Our first product available based on the MUSE Platform, Open AT, was launched in the fourth quarter of 2001 and is designed for vertical applications such as telemetric, automotive and multimedia systems. Relying on AT commands to drive theWISMO, Open AT lets developers take advantage of available processing capacity and intelligence ofWISMO modules and modems. Open AT allows our customers to have more autonomy and flexibility when developing their wireless applications. Open MMI, a product designed for use in developing handsets, is expected to be available in the third quarter of 2002.

We believe that close contact with our customers improves their level of satisfaction and provides us with insights into their future product development plans. To expand our customer base, we offerWISMO modules as part of starter kits, enabling potential customers to perform initial feasibility studies. As of December 31, 2001, we had 14 technical support personnel in France, Hong Kong and San Diego (compared with eight in 2000).

Applications

We are an established third-party supplier of digital wireless modules for the mobile telephone market and new and emerging wireless applications markets. We are targeting four wireless applications markets that we believe will generate the most significant demand for our products over the next three to five years. We have included our direct product sales by wireless application as a percentage of total product sales for 2001 and 2000. Indirect sales to our distributors consist primarily of sales of modems, which we believe are used mainly for automotive and telemetry applications. In 2001, product sales to our distributors accounted for 13.2% of our total product sales (32.3% in 2000).

Telephony

We market theWISMO module to mobile telephone manufacturers. TheWISMO module allows telephone manufacturers to introduce a product to the market quickly, to minimize their internal research and development costs and to focus their efforts on product design, marketing and distribution. Our customers typically assemble their own mobile telephones using aWISMO module. For certain customers in the past we have also agreed to sell assembled mobile telephones or to customize theWISMO module to meet their needs. Companies that have integrated or are in the process of integrating our products or technology into their mobile telephones include China Kejian Corporation, Mitsubishi, NEC, Philips Consumer Communications, Samsung, Sewon Telecom Co., Ltd., Guangzhou Southern High-tech Co., Ltd. ("Soutec") and TCL Mobile Communications Co. Ltd.

In 2001 revenues from direct product sales for telephony applications were 69.6% of total product sales (23.8% in 2000).

Automotive

Automotive applications combine digital wireless technology with global positioning system technology which together provide interactive information regarding traffic, emergency assistance, routing, local businesses and places of interest. Automotive applications could also include an emergency assistance feature that would provide information, including vehicle location, in the case of accidents or theft. These applications also include the provision of a wireless telephone as a standard equipment option in an automobile. We are supplyingWISMO modules to SiemensVDO and Magneti Marelli, two of Europe's largest automotive equipment suppliers. In late 2000, we announced a contract with Trimble for integration ofWISMO modules into a fleet management product.

This category also includes applications for fleet management. Digital wireless technology in combination with global positioning system technology allows the location of trucks, taxis, and other vehicles to be monitored from a central location.

In 2001 direct product sales for automotive applications accounted for 2.3% of total product sales (10.1% in 2000).

Telemetry

Telemetry is the use of communications networks to obtain information from remote locations, and is sometimes known as "machine-to-machine communication". The use ofWISMO modules makes telemetry possible where the installation of landlines is not practical. Applications include remote meter reading by utility companies, real-time updating of information on electronic billboards, credit card authorization for mobile payment terminals and remote messaging from vending machines to report inventory levels or maintenance requirements. Falcom GmbH, a German integrator of wireless products, has builtWISMO modules into terminals for specialized applications in vending machines, hospitals, high technology companies, homes and other market sectors. Necta (formerly Zanussi) has incorporatedWISMO modules into its vending machines. In addition, utilities in Australia and Finland use our modems for remote reporting of electric power consumption. In 2001 direct product sales for telemetry applications accounted for 5.4% of our total product sales (19.5% in 2000).

Multimedia

WISMO modules can enable personal digital assistants, smartphones, notebook computers and other portable devices to be connected to a wireless communications network. We believe that the introduction of the GPRS standard, with its increased speed and efficiency, will accelerate the demand for these applications, by allowing easier access to e-mail and the Internet. We currently sellWISMO modules to Handspring Inc. for integration into its Treo line of wireless personal digital assistants, to Inventec Corp. for integration into a wireless Internet access device and to Matsushita for integration into a Panasonic reinforced portable computer for industrial use. In 2001 direct product sales for multimedia applications accounted for 9.5% of our total product sales (14.3% in 2000).

Sales, marketing and distribution

We use a direct sales force to sell our line ofWISMO modules and wireless modems, and to market related services. We also use distributors to sell wireless modems. Because modems are sold as a finished product, their applications do not require Wavecom's technical expertise, which is necessary to integrateWISMO modules. We currently work with distributors covering territories including approximately 60 countries in Europe, the Asia-Pacific region and the Americas. Our sales, marketing and distribution efforts are organized into three geographical areas. Our Paris head office is responsible for Europe, the Middle East and Africa, with assistance from a branch office near Frankfurt, Germany. Our San Diego office is responsible for the Americas. Our Hong Kong office is responsible for the Asia-Pacific region and overseeing our offices in Tokyo, Seoul and Taipei. At December 31, 2001, we had 47 sales and marketing employees and independent contractors..

Manufacture and assembly

We use the fabless business model in which we outsource the manufacture, assembly and most testing of our products. By using third-party manufacturers, we gain access to up-to-date facilities and processes without significant capital outlay and are able to focus our resources on research and development, product design, quality assurance, marketing and customer support. Through our third-party manufacturers, we order components for our products from microchip foundries, including Philips, Toshiba, Intel, Sony and RF Micro Devices. Non-standard components are based on our design. In order to streamline the purchasing process for our products and to benefit from the leverage of our manufacturers' higher volumes, in January 2000 we transferred responsibility for components purchasing logistics to our manufacturers. During 2000 and most of 2001, our purchasing staff negotiated the cost of components used in our products primarily with our manufacturers. We added personnel to our purchasing staff in 2001 and, by the end of the year, had become more involved in the direct negotiations with the component suppliers. We work with our manufacturers on a twelve-month rolling forecast basis with firm orders placed two months in advance. In addition, our sales contracts generally require our customers to provide us with a six- to twelve-month product purchasing forecast that we use as the basis for preparing our own forecasts and negotiations with suppliers to secure the supply of components for our products.

We use two third-party manufacturers to assemble and test our products. Solectron Corporation produces the majority of ourWISMO modules and assembles our wireless integrated modems. Over the course of the fourth quarter of 2001, and ending in January 2002, production ofWISMO modules at Solectron was transferred from their plant in Bordeaux, France to their factory in Timisoara, Romania. In 2001, one production line forWISMO modules was established at Thales, near Rennes, France, which previously only assembled our wireless external modems. The production facility at Thales was established in order for us to have a platform on which to produce new products which remains close to our French headquarters, as well as to provide additional production capacity. Each of these manufacturers is certified to applicable ISO 9000 and 14,000 series specifications, which means that their operations have in each case been determined by independent examiners to comply with internationally developed quality control standards. Solectron and Thales are important suppliers for us, and should either of them fail to meet our requirements, we may have difficulty meeting customer demand. We have, however, identified other manufacturers that could replace them. We are currently actively seeking to qualify a third subcontractor and expect to begin production with the new supplier in the second half of 2002.

In 1999, we entered into a contract for manufacturing and related services with Solectron-France S.A. Pursuant to this agreement, Solectron manufactures, assembles and tests ourWISMO module lines. The term of the agreement is for one year and is automatically renewed for additional terms of one year each, unless written notice to the contrary is sent by one of the parties at least 90 days before the anniversary date of the agreement. The total term of the agreement may not exceed three years. We are currently in the process of renegotiating the contract with Solectron.

The manufacturing services provided by Thales through the end of 2001 were based upon an informal arrangement. A formal contract with Thales was signed in early 2002.

Our arrangements with both Solectron and Thales call for us to purchase the tested finished products. Component purchasing is the responsibility of the third-party manufacturer. The third-party manufacturer issues purchase orders to the component suppliers based on the quantities of finished goods ordered from Wavecom. In general, components need to be ordered two to four months before they enter the production process. In the event that we initiate an engineering change that results in the obsolescence of components specific to our products, the third-party manufacturer may invoice Wavecom for the cost of these unusable components.

Wavecom owns all testing equipment related to the manufacturing of its products and could transfer it to a different manufacturer if necessary. We conduct our own quality control at the premises of our third-party manufacturers. As of December 31, 2001 we had 108 employees and independent contractors in production oversight, manufacturing, purchasing and quality assurance.

Research and development

To keep pace with rapid technological changes and market pressures in our industry, we maintain a substantial program of research and product development. This program focuses primarily on developing new products that are progressively smaller and lighter, with higher performance levels and enhanced features and functions, as well as adapting our products to evolving and new transmission standards.

We intend to continue internal product development to further reduce the size of theWISMO modules, to reduce their power consumption and to enhance their functionality. Our current projects include the introduction of the next generation of theWISMO Quik module, the 2400 series. TheWISMO Quik 2400 module is fully compatible with theWISMO Quik 2300 module in terms of mechanical footprint and software and hardware interfaces, but is 40% thinner (at 3.9 millimeters) and 45% lighter (at 11 grams) than theWISMO Quik 2300 module. We expect to commence mass production of theWISMO Quik 2400 module in the second quarter of 2002. We expect to commence mass production of a quad-band version of theWISMO Quik module, which will operate on the 850MHz, 900MHz, 1800MHz and 1900MHz bands, and a CDMA version of theWISMO Quik module in the second half of 2002. We believe that we will be the first company to have a quad-band solution on the market and the first company to have pin-to-pin compatible GSM/GPRS and CDMA wireless modules.

We expect to commence mass production of a thinner, lighter version of theWISMO Pac 3000 module in the second half of 2002 and we expect to have prototypes of theWISMO Pac 5000 series (formerlyWISMO5) module by the end of 2002. TheWISMO Pac 5000 series is expected to be roughly half the size of theWISMO Pac 3000 module. We are currently working on proprietary chipset designs that we intend to integrate in the next generation of theWISMO Pac module, which is expected to weigh in at 6 grams and to go into mass production in early 2003.

We also intend to continue to focus significant research and development efforts on the introduction in the second half of 2003 of a new line ofWISMO modules which will use the 3G UMTS standard and which will be dual-mode with GSM/GPRS.

We introduced our MUSE (Modular User Software Environment) Platform in the third quarter of 2001.

Wavecom's research and development expenditures totaled approximately €11.9 million in 1999 (32.6% of revenues), €16.1 million in 2000 (24.6% of revenues) and €32.6 million in 2001 (10.1% of revenues). We intend to maintain a substantial research and development program and expect research and development expenses to increase in the future. As of December 31, 2001, our research and development staff included 244 salaried employees and 110 independent contractors, all of whom work in France except for 59 personnel located at our subsidiaries. The research and development personnel located at our subsidiaries include engineers who joined us following our acquisitions of Iconn Wireless in December 2001, who are dedicated to developing a CDMA version of ourWISMO Quik module, and Arguin Communications in October 2000, who are working on our UMTS technology development. We use independent contractors to gain access to their specialized expertise and to give us greater flexibility in staffing particular projects.

Competition

Competition in our markets is intense. In the mobile telephones and personal digital assistants markets, while we believe we are the only supplier of a complete modular solution, we face competition from engineering design firms, such as TTP Communications, as well as from companies such as Infineon, Texas Instruments, Analog Devices and Lucent Technologies, Inc., who supply both components and reference designs for wireless technology. In 2001, both Motorola and Ericsson announced that they would license their technology to makers of mobile phones and personal digital assistants, but we believe the solutions of both companies are based on reference designs and are not complete modular solutions. For other wireless applications we face competition from large integrated consumer electronics companies and from several companies that design and manufacture wireless standard modules and wireless modems, including Ericsson, Nokia, Motorola, Siemens, Sierra Wireless, Novatel Wireless and Xircom. We believe that our ability to compete successfully in the wireless communications market depends upon a number of factors within and outside our control, including price, quality, availability, product performance and features; the timing of new product introductions by us, our customers and competitors; and customer service and technical support. Some of our customers could choose to develop and manufacture their own wireless products and solutions and could elect to compete with us at any time.

Intellectual property

The European Telecommunications Standards Institute ("ETSI") has a policy that allows third parties to disclose intellectual property rights which they believe are essential to the use or operation of GSM/GPRS-based equipment. Once an owner of such a right gives notice to ETSI, it must grant irrevocable licenses to third parties on fair, reasonable and non-discriminatory terms and conditions to allow the manufacture and sale of equipment. Some owners of GSM/GPRS-related patents may not have notified them to ETSI.

In order to produce and market our GSM/GPRS-basedWISMO modules and wireless modems, we must assess whether licenses from third-party patent owners are required. Because of the intense competition in our industry, there may be a substantial number of patents to consider and it is difficult to identify all those which may have an impact on our products. We believe that most of the patents important to us are the GSM/GPRS patents covered by ETSI's policy. These include patents of Motorola, Siemens, Philips, Nokia, Mitsubishi, NEC, and Alcatel. At this time, we have licenses to use GSM/GPRS-essential patents of Motorola, Siemens and Philips and are currently negotiating licenses with Mitsubishi, NEC, Alcatel, Nokia, Ericsson and Matra Communications. As we identify other potentially essential patents, we may need to enter into additional license agreements. Should we fail to identify all patents needed to produce our products or to obtain the required license agreements, we could be found to have infringed the patent rights of third parties. In addition, as new digital transmission standards develop, we will have to acquire additional licenses for new essential patents.

In January 1999 we entered into a cross license agreement with Motorola Inc. Under this agreement, Motorola and Wavecom each grant to the other a license to use the intellectual property rights it owns or develops for the GSM standard. In addition, the agreement requires us to pay to Motorola a license fee for each GSM product we sell. The agreement remains effective as long as both Motorola and Wavecom continue to manufacture products which use the GSM standard and as long as the licensed GSM/GPRS essential patents remain in force.

In September 2001, we entered into a cross license agreement with Philips N.V. whereby Philips has granted us a license to use GSM/GPRS essential patents that Philips owns or develops for the GSM/GPRS standard in consideration for our payment to Philips of a fixed fee covering all past and future royalties due. In addition, under this agreement, we have granted Philips a royalty bearing license to use GSM/GPRS essential patents that we own or develop for the GSM/GPRS standard. The agreement remains in effect for so long as the licensed GSM/GPRS essential patents remain in force.

In January 2002, we entered into a cross license agreement with Siemens A.G. whereby Siemens has granted us a license to use GSM/GPRS essential patents that Siemens owns or develops for the GSM/GPRS standard in consideration for our payment to Siemens of a fixed fee covering past royalties due and a royalty percentage based on each GSM/GPRS product we sell in the future. In addition, under this agreement, we have granted Siemens a royalty free license to use GSM/GPRS essential patents that we own or develop for the GSM/GPRS standard. The agreement remains in effect for so long as the licensed GSM/GPRS essential patents remain in force.

In order to produce and market CDMA-basedWISMO modules and wireless modems, we entered into a cross license agreement with Qualcomm in May 2002. Under this agreement, Qualcomm has granted us a license to use CDMA essential patents that Qualcomm owns or is able to license for the CDMA standard in consideration for our payment to Qualcomm of a up-front fee and a royalty percentage based on each CDMA product we sell in the future. In addition, under this agreement, we have granted Qualcomm a royalty free license to use CDMA essential patents that we own or develop for the CDMA standard. We have been granted an option to include WCDMA and/or TD-SCDMA at Qualcomm's then-standard terms and conditions for a license to such standard.

To protect the intellectual property we have developed in the course of our research and development activities, we rely upon a variety of legal measures, including patents and patent applications. Our employment agreements contain provisions to protect our trade secrets by forbidding the unauthorized disclosure of confidential information. Our independent contractors are required to enter into confidentiality agreements that also assign us rights to inventions they make while engaged by us. We have also entered into non-disclosure agreements to protect our confidential information delivered to third parties in conjunction with possible collaborations and for other purposes.

In October 1999, we established an employee patent incentive program designed to recognize employee-inventors and to encourage employee-inventors to sponsor patent applications. The patent incentive program provides French employees who have developed an invention in the course of their employment with cash compensation if and when a patent application is filed by us and a second cash payment upon the effective commercial use of the patent within five years after the filing of the patent.

We currently own seven French patents expiring at various dates beginning in 2015. We have filed twelve other patent applications currently undergoing evaluation, and have begun proceedings for the extension of some of our patents to other jurisdictions.

We have registered trademarks or filed applications for such registration for "WAVECOM", "WISMO", "WVCM", "WISMO WITHIN", "CHIP-PAC", "THE HEART OF THE MATTER", "MUSE Platform" and "MODULAR USER SOFTWARE ENVIRONMENT" in France. We have also registered these trademarks or filed applications for such registration in certain other jurisdictions. We do not have the trademark "Wavecom" registered in North America or Japan, where there are several other companies using that name.

Backlog

At December 31, 2001 our product backlog was approximately €129 million. We include in our backlog all accepted product purchase orders for which delivery has been specified within one year, however, we do not require customers to place firm orders more than four months in advance. Product orders in our backlog are subject to changes in delivery schedules or to cancellation at the option of the purchaser without significant penalty. Our backlog may vary significantly from time to time depending upon the level of capacity of our suppliers and subcontractors available to satisfy unfilled orders. Accordingly, although useful for scheduling production, backlog as of any particular date may not be a reliable indicator of sales for any future period.

Capital expenditures

Capital expenditures since January 1, 1998 have related primarily to the purchase of laboratory, testing and computer equipment, principally at the company headquarters in France. Total expenditures on property and equipment were €3.5 million in 1999 (€2.7 million internally financed and €0.8 million financed by capital leases), €8.4 million in 2000 (all internally financed), and €10.3 million in 2001 (all internally financed).

Corporate Information

Wavecom S.A. is asociété anonyme, or limited liability company, organized under the laws of France in 1993 with authorization to operate for a period of 99 years, which period may be extended by vote of the shareholders. Our registered offices are at 12 boulevard Garibaldi, 92442 Issy-Les-Moulineaux Cedex, France and our telephone number is (011 33 1) 46 29 08 00. Our principal offices in the United States are at 4810 Eastgate Mall, 2nd Floor, San Diego, CA 92121, and our telephone number at that address is +1 858 362 0101.

Wavecom S.A. owns majority interests in four subsidiaries:

Wavecom Asia Pacific Limited, Hong Kong, Republic of China (wholly owned)

Wavecom Inc., San Diego, California, United States (wholly owned)