SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 000-30078

WAVECOM S.A.

(Exact name of Registrant as specified in its charter)

Not applicable | 3, esplanade du Foncet | Republic of France |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Title of each class: Shares, nominal value €1.00 each* American Depositary Shares, evidenced by American Depositary Receipts, each representing one Share | Name of each exchange on which registered: NASDAQ National Market |

* | Listed not for trading or quotation purposes but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, nominal value €1.00 per share: 15,531,813

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes  No

No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes  No

No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes  No

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer  | Accelerated filer:  | Non-accelerated filer:  |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes  No

No

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17  Item 18

Item 18

“In 2005, we spent significant energy on | |

| deeply analyzing our strategic position” |

THE MESSAGE FROM THE CEO | |

|

|

Dear Stakeholders,

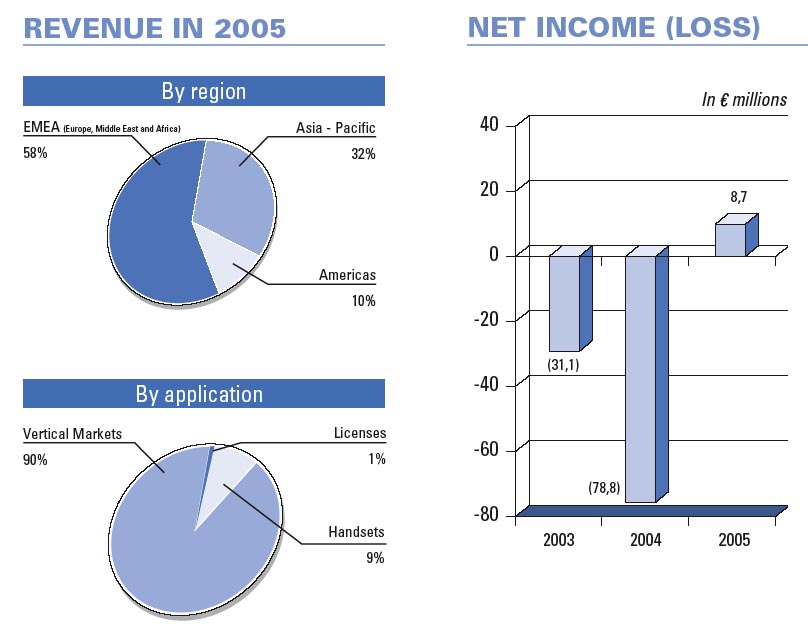

As we look back on 2005 it was clearly a pivotal year for Wavecom as we successfully refocused the company’s business on industrial and automotive wireless solutions, a space where our technology, supply chain management, service and support are highly valued by customers. These efforts produced tangible results, with the company realizing an operating profit of €4.0 million and a net profit of €8.7 million, the first profitable year since 2002. As a result of our focus on costs and supply chain we generated a 46% gross margin in 2005, compared to a 24% gross margin in 2004. In addition, we continued to improve the company’s financial position, ending the year with €60.7 million of cash reserves, an increase of €7.3 compared the previous year end.

Last year was not just about improving financials, however, as we also spent significant energy on deeply analyzing our strategic position and actions that will be required both to grow the market and to increase our share. This effort culminated recently with our announcement to acquire certain assets of Sony Ericsson’s M2M business unit.

We believe the acquisition should strengthen the industry and should accelerate the adoption of industry standards which are needed to stimulate overall market growth. The acquisition should also greatly expand our global presence, especially in North America, and create a development powerhouse. Going forward we will be integrating Sony Ericsson’s M2M Power software into our Open AT® software suite, which we believe is already becoming the standard for automotive and industrial wireless solutions. Additionally, we will benefit from the expanded product portfolio and Sony Ericsson’s unique hardware customization capability. The parts of this business that we acquired are totally complementary to our existing structure and the combined enterprise positions Wavecom as a stronger competitor in 2006 and beyond.

Going forward we will continue to focus on the basics – innovation, operational efficiency, and customer service – to provide our customers the best solutions, and our shareholders industry leading returns. On a personal note, I would particularly like to thank all our employees who have worked diligently to put Wavecom on the right track, as well as our customers, who continue to challenge us to develop the most creative and innovative solutions in our sector.

Dr. Ronald D. Black

Chief Executive Officer

Wavecom

April 13, 2006

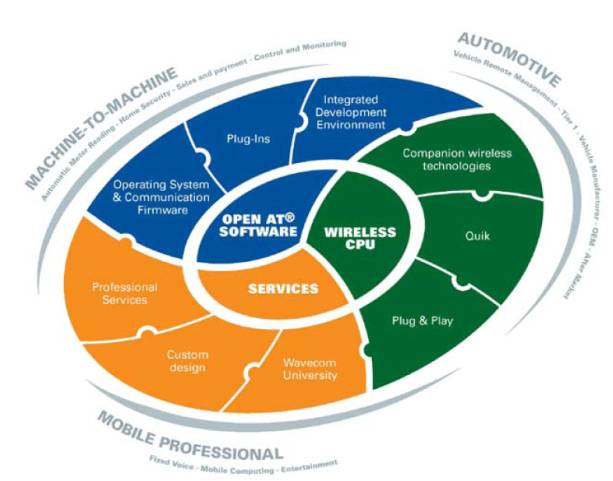

Our products and services

Three central elements: Open AT® Software, Wireless CPUs and Professional Services. Everything we do is designed to help our customers reduce their “Total Cost of Ownership” (TCO) by embedding applications directly onto our Wireless CPUs. By doing this they are able to reduce overall material costs, accelerate revenue generation by shortening time-to-market and ensure post-sale field maintenance through the use of Download Over-The-Air (DOTA) solution upgrade capabilities. Download over-the-air allows our customers to update software which is embedded in their wireless products via radio transmission, without the need to physically visit the application in the field, which is quite often dispersed over a wide geographical area.

Flexibility: Our entire commercial offer is designed to be flexible in a way that the mix of these three elements can be adapted to the unique needs of our customers whether they be start-ups, multinational conglomerates or anywhere in between.

With respect to software flexibility, our Open AT® IDE (Integrated Development Environment) is available for all of our GSM series of products and allows customers to embed and port their own software into our Wireless CPU, thus eliminating the need for external microprocessors and other semiconductor devices. This benefit alone saves a significant amount on the material costs for our customers and the total cost of ownership can be further reduced by other Wavecom offers such as DOTA.

RESULTS

In accordance with U.S. generally accepted accounting principles

(€ in millions or % as indicated) |

| 2003 |

| 2004 |

| 2005 |

|

|

|

|

|

| |||

Revenues |

| 275,6 |

| 151,6 |

| 129,2 |

|

Gross margin |

| 102,5 |

| 36,0 |

| 59,3 |

|

Gross margin as % of revenues |

| 37 | % | 24 | % | 46 | % |

Operating income (loss) |

| (31,0 | ) | (80,9 | ) | 4,0 |

|

Net income (loss) |

| (31,1 | ) | (78,8 | ) | 8,7 |

|

Shareholders’ equity |

| 137,3 |

| 56,5 |

| 64,1 |

|

Working capital (S-T assets - S-T liabilities) |

| 94,6 |

| 35,7 |

| 57,0 |

|

Cash & S/T investments |

| 110,7 |

| 53,3 |

| 60,7 |

|

PRESENTATION OF INFORMATION

Unless the context otherwise indicates, references to “Wavecom” “we”, “us” or the “Company” include Wavecom S.A. and its subsidiaries. References to “U.S. dollars” or “$” contained herein are to the lawful currency of the United States, and references to “euro” or “€” are to the currency of the European Monetary Union.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are usually identified by words such as “believe,” “anticipate,” “plan,” “goal,” “target” and similar expressions. These forward-looking statements are not guarantees of Wavecom’s future operational or financial performance and are subject to risks and uncertainties. Actual operational and financial results may differ materially from Wavecom’s expectations contained in the forward-looking statements as a result of various factors. Factors that may cause such differences include, but are not limited to, the factors discussed in “Item 3 - Key Information-Risk Factors” and “Item 5 - Operating and Financial Review and Prospects.

PART I

WAVECOM - Annual Report Form 20-F 2005 1 |

Item 1: Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2: Offer Statistics and Expected Timetable

Not applicable.

Selected Financial Data

The following selected financial data for the five years ended December 31, 2005 are derived from the consolidated financial statements of Wavecom, which have been prepared in accordance with U.S. GAAP and have been audited by Ernst & Young Audit, independent auditors. The data should be read in conjunction with “Item 5. Operating and Financial Review and Prospects,” the consolidated financial statements, related notes and other financial information included in this annual report.

2 Annual Report Form 20-F 2005 - WAVECOM |

|

| Years ended December 31, | ||||||||||||||

|

| |||||||||||||||

|

| 2001 |

| 2002 |

| 2003* |

| 2004 |

| 2005 | ||||||

|

|

|

|

|

| |||||||||||

|

| (in thousands, except for share and per share amounts) | ||||||||||||||

Consolidated statements of operations data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

| €317,571 |

|

|

| €549,543 |

|

| €271,773 |

|

| €149,974 |

|

| €125,952 |

Service revenue |

|

| 5,093 |

|

|

| 1,546 |

|

| 3,855 |

|

| 1,580 |

|

| 1,827 |

Licensing revenue |

|

| — |

|

|

| — |

|

| — |

|

| — |

|

| 1,453 |

|

|

|

|

|

|

| ||||||||||

Total revenues |

|

| 322,664 |

|

|

| 551,089 |

|

| 275,628 |

|

| 151,554 |

|

| 129,232 |

|

|

|

|

|

|

| ||||||||||

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

| 254,658 |

|

|

| 371,919 |

|

| 168,465 |

|

| 107,134 |

|

| 69,094 |

Cost of services |

|

| 4,718 |

|

|

| 4,709 |

|

| 4,704 |

|

| 8,391 |

|

| 842 |

|

|

|

|

|

|

| ||||||||||

Total cost of revenues |

|

| 259,376 |

|

|

| 376,628 |

|

| 173,169 |

|

| 115,525 |

|

| 69,936 |

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

| 63,288 |

|

|

| 174,461 |

|

| 102,459 |

|

| 36,029 |

|

| 59,296 |

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

| 32,634 |

|

|

| 64,093 |

|

| 62,123 |

|

| 47,083 |

|

| 24,066 |

Sales and marketing |

|

| 12,416 |

|

|

| 26,600 |

|

| 27,766 |

|

| 15,685 |

|

| 11,725 |

General and administrative |

|

| 13,297 |

|

|

| 26,163 |

|

| 39,141 |

|

| 30,122 |

|

| 17,861 |

Amortization and impairment of intangible assets. |

|

| 278 |

|

|

| — |

|

| 4,244 |

|

| 1,768 |

|

| — |

Restructuring costs |

|

| — |

|

|

| — |

|

| — |

|

| 22,247 |

|

| 1,684 |

Deferred compensation amortization |

|

| 1,711 |

|

|

| 1,587 |

|

| 205 |

|

| — |

|

| — |

|

|

|

|

|

|

| ||||||||||

Total operating expenses |

|

| 60,336 |

|

|

| 118,443 |

|

| 133,479 |

|

| 116,905 |

|

| 55,336 |

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

| 2,952 |

|

|

| 56,018 |

|

| (31,020 | ) |

| (80,876 | ) |

| 3,960 |

|

|

|

|

|

|

| ||||||||||

Gain on sales of long-term investments |

|

| — |

|

|

| — |

|

| — |

|

| 1,166 |

|

| — |

Interest and other financial income (expense), net |

|

| 3,969 |

|

|

| (7,698 | ) |

| 702 |

|

| 966 |

|

| 5,129 |

Provision for loss on long-term investment |

|

| (716 | ) |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

|

|

|

|

| ||||||||||

Income (loss) before minority interests and income taxes |

|

| 6,205 |

|

|

| 48,320 |

|

| (30,318 | ) |

| (78,744 | ) |

| 9,089 |

|

|

|

|

|

|

| ||||||||||

Minority interest |

|

| 804 |

|

|

| 323 |

|

| (38 | ) |

| — |

|

| — |

|

|

|

|

|

|

| ||||||||||

Income (loss) before income taxes |

|

| 7,009 |

|

|

| 48,643 |

|

| (30,280 | ) |

| (78,744 | ) |

| 9,089 |

Income tax expense (benefit) |

|

| (2,299 | ) |

|

| 6,556 |

|

| 861 |

|

| 13 |

|

| 395 |

|

|

|

|

|

|

| ||||||||||

Net income (loss) |

|

| €9,308 |

|

|

| €42,087 |

|

| €(31,141 | ) |

| €(78,757 | ) |

| 8,694 |

|

|

|

|

|

|

| ||||||||||

Basic net income (loss) per share(1) |

|

| €0.63 |

|

|

| €2.82 |

|

| €(2.06 | ) |

| €(5.14 | ) |

| €0.57 |

Diluted net income (loss) per share |

|

| €0.61 |

|

|

| €2.74 |

|

| €(2.06 | ) |

| €(5.14 | ) |

| €0.56 |

Cash dividends declared per share(2) |

|

| — |

|

|

| — |

|

| — |

|

| — |

|

| — |

Number of shares used in computing basic net income (loss) per share |

|

| 14,726,647 |

|

|

| 14,943,048 |

|

| 15,098,795 |

|

| 15,317,661 |

|

| 15,352,233 |

Number of shares used in computing diluted net income (loss) per share |

|

| 15,359,226 |

|

|

| 15,348,985 |

|

| 15,098,795 |

|

| 15,317,661 |

|

| 15,661,001 |

(1) | Net income (loss) per share amounts are computed using the weighted average number of shares outstanding, which excludes options and warrants, and reflects only the actual ordinary shares outstanding. |

(2) | We do not presently intend to pay any cash dividends on our shares in the foreseeable future. |

* | Financial information for the year ended December 31, 2003 has been restated in the amended Annual Report on Form 20-F/A for 2003 filed with the Securities and Exchange Commission on February 28, 2005. |

WAVECOM - Annual Report Form 20-F 2005 3 |

|

| At December 31, | ||||||||||||

|

| |||||||||||||

|

| 2001 |

| 2002 |

| 2003* |

| 2004 |

| 2005 | ||||

|

|

|

|

| ||||||||||

Consolidated balance sheet data: | ||||||||||||||

Total current assets |

|

| €227,028 |

|

| €270,308 |

|

| €211,542 |

|

| €99,174 |

| 94,965 |

Total assets |

|

| 259,947 |

|

| 332,034 |

|

| 275,229 |

|

| 137,206 |

| 120,078 |

Total current liabilities |

|

| 128,487 |

|

| 154,034 |

|

| 116,908 |

|

| 63,437 |

| 37,969 |

Total long-term liabilities |

|

| 9,215 |

|

| 11,143 |

|

| 20,988 |

|

| 17,313 |

| 17,969 |

Total shareholders’ equity |

|

| 121,884 |

|

| 166,819 |

|

| 137,333 |

|

| 56,456 |

| 64,140 |

* | Financial information for the year ended December 31, 2003 has been restated in the amended Annual Report on Form 20-F/A for 2003 filed with the Securities and Exchange Commission on February 28, 2005. |

Exchange Rate Data

The exchange rate for converting U.S. dollars into euros (using the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York) on March 31, 2006 was $1.2139 = €1.00. Fluctuations in the exchange rate between the euro and the dollar will affect the dollar amounts received by owners of ADSs on conversion of dividends, if any, paid in euro on the shares and may affect the dollar price of the ADSs on the Nasdaq National Market.

The following table shows the high and low rates of exchange for the number of U.S. dollars per euro for the period from October 1, 2005 to March 31, 2006.

Month |

| High |

| Low | ||

|

| |||||

2006 |

|

|

|

|

|

|

March |

|

| $1.2197 |

|

| $1.1886 |

February |

|

| 1.2100 |

|

| 1.1882 |

January |

|

| 1.2287 |

|

| 1.198 |

2005 |

|

|

|

|

|

|

December |

|

| 1.2041 |

|

| 1.1699 |

November |

|

| 1.2067 |

|

| 1.1667 |

October |

|

| 1.2148 |

|

| 1.1914 |

The following table shows the average rates of exchange for the number of U.S. dollars per euro for the years ended December 31, 2001 to December 31, 2005. Averages are based on daily noon buying rates for cable transfers in New York City certified for customs purposes by the Federal Reserve Bank of New York.

Year ended December 31, |

| Average | |

| |||

2005 |

|

| $1.2449 |

2004 |

|

| 1.2011 |

2003 |

|

| 1.1315 |

2002 |

|

| 1.0485 |

2001 |

|

| 0.8952 |

4 Annual Report Form 20-F 2005 - WAVECOM |

Risk Factors

In addition to the other information contained in this annual report, the following risk factors should be carefully considered in evaluating us and our business. These statements are intended to highlight the material risk factors that may affect our business results.

On March 20, 2006, we announced the signing of an agreement in which we will acquire certain assets from Sony Ericsson’s M2M Communication unit. Finalization of this transaction is subject to a number of usual closing conditions. If these conditions are not met, finalization of the transaction could be jeopardized. If the closing does not happen, it could disappoint the market and we could eventually see a decline in our stock price.

On March 20, 2006, we announced the signing of an agreement with Sony Ericsson Mobile Communications, AB (a 50:50 joint venture between Sony Corporation et Telefonaktiebolaget LM Ericsson. This transaction is subject to usual closing conditions and is expected to close within the month of April 2006. Although we have no reason to believe that these closing conditions will not be met, if they are not, the market could be disappointed, considering the opportunities that this transaction represents for us and therefore, could result in a decline in our stock price.

Risks related to our Business

We may experience integration difficulties or encounter unknown liabilities with respect to the acquisition of assets from Sony Ericsson that we recently announced.

On March 20, 2006 we announced our intention to acquire of certain assets from Sony Ericsson’s M2M Communications business unit in a cash transaction with a purchase price up to a maximum of €32.5 million. This transaction should be finalized shortly pending usual closing formalities. We expect the acquisition will put pressure on our short-term profitability, due to integration costs and other restructuring costs associated with the acquisition. We cannot predict the success of the acquired business and assets once under our control, and we may not achieve the expected rate of return from the acquisition, or may fail to successfully integrate the acquired assets, business or employees into our working environment. An acquisition can also result in unanticipated legal risks, legal costs and liabilities. Our failure to successfully integrate the acquired business into our existing operations may adversely affect our business, financial condition, results of operations, and may deter our ability to execute on our business strategy.

Our primary source of revenue is the vertical markets, or embedded industrial applications, for wireless communication between machines, which are nascent markets. If these markets do not develop at the rate we anticipate, if we are unable to maintain or expand our share of these markets, or if intense competition drives down prices, we may not generate sufficient revenues to cover our operating expense base and therefore operate at a loss.

In September 2004, we announced that our company would focus exclusively on the vertical markets, or embedded industrial applications, for wireless communication between machines, targeting wireless applications in three areas: automotive, industrial machine to machine and mobile professional applications. At the current time, there is limited independent research that confirms our expectations for growth in these markets. These markets have been developing over the past several years, with the latest independent research (source ABI Research showing the global market reaching approximately 14,9 million units shipped for use in wireless-enabled machine applications in 2005. The applications to which we sell our products are extremely fragmented and no single sub-application shows signs that it will expand more quickly than the others. Therefore, the timing of the development of these markets, which will be critical for our success in the future, is not, at this time, well defined.

Based on annual sales and numbers of units delivered in 2005, we estimate that we have a strong global position in the vertical markets for wireless communication between machines. However, our competitors include companies with substantially greater financial and commercial resources that we believe can invest heavily in our sector. It has been our experience that our competitors exert price pressure to increase their market share. We face a variety of competitors in the vertical markets both at the local and on the global level. If we are unable to maintain or expand our share of the vertical markets in both, volume and value, our revenues may not grow at the rate we anticipate, or they may decline.

In addition, it is possible that we could eventually face a situation in the vertical markets similar to that which we faced in the mobile handset market when prices for competing solutions decreased significantly and we were unable to continue to offer our products at competitive prices. If this risk, or the other risks described above, were to materialize, both our revenues and earnings could stagnate or suffer declines. As a result, we may not generate sufficient revenues to cover our operating expense base, and we may therefore operate at a loss.

We may be unable to sustain or increase our profitability and once again suffer operating losses which could lead to a decline in our stock price.

After two years in 2003 and 2004 of posting operating losses, 2005 was profitable following the implementation of a major strategic reorientation and corporate restructuring under the direction of new senior management announced in September 2004. These events and actions led us to exit from the mobile telephone handset market and terminate our silicon chipset development. With our new strategy in place, we have centered our business exclusively on the market for wireless communication between machines. If we are unable to reestablish business growth and maintain the gross margin at the levels we saw in 2005 or if our operating expenses exceed current levels, we may once again suffer operating losses.

Our long sales cycle could result in substantial fluctuations in revenue from quarter to quarter which may make accurate forecasting difficult.

WAVECOM - Annual Report Form 20-F 2005 5 |

The time between the first contact with a customer and the first sale may be long, in particular in the automotive area, since design times and safety certifications for new models take several years. Our typical sales cycle is generally from 6 to 18 months and can be up to two or three years for some customers. In addition, the timing of our sales is often linked with the timing of the launch of our customers’ new products. Any slippage in the launch of a customer’s product could delay the timing of our sales. Consequently, we face difficulties in predicting the quarter in which expected sales to customers will occur.

With the acquisition of certain assets of the Sony Ericsson M2M business unit our cash reserves will decline. As a result, we may experience deterioration in our relationships with customers, suppliers, shareholders and employees.

On March 20, 2006 we announced our intention to acquire certain assets of the Sony Ericsson Business Unit in a cash transaction for a price up to a maximum of €32.5 million which will be financed by our cash reserves. This will reduce our cash reserves and could trigger a lack of confidence among our primary stakeholders including customers, suppliers, shareholders and employees.

From a customer standpoint, a lack of confidence could eventually translate into a loss of orders from customers who have doubts that the Company can continue to operate for the long-term and would therefore be reluctant to do business with us. From a supplier perspective, our main suppliers, and particularly our contract manufacturer in China on whom we rely for all our production needs, may require us to have stricter payment terms or to provide bank guarantees or letters of credit, which would have a negative impact on our cash flows. From a shareholder standpoint, diminishing cash reserves could put the company in jeopardy of not meeting its “ongoing” concern criteria, thereby alarming investors and triggering a decline in stock price. Finally, if employees sense that the cash reserves are not adequate to keep the company in business, they may seek employment elsewhere, thus stripping the company of valuable human resources.

Based on our current plans, we believe that our cash reserves are sufficient to meet our needs for the next 12 months from the date of the publication of this document. If our plans change and if we are not profitable or if our profits are considerably lower than what we expect, we may need to seek additional financing in order to continue to operate.

If we should need additional financing it may be difficult to obtain or to obtain at reasonable rates. And, if we cannot find the necessary capital, we may need to restructure the company or cease operations. Currently, we do not have any bank credit lines in place.

Among the possibilities that this additional financing could take the following are: a capital increase – which could risk dilution of our current capital or taking on debt.

We rely on a single contract manufacturer in China, Solectron, to make all Wavecom products. If Solectron is unable to meet our requirements due to internal or external factors, or if Solectron terminates its agreement with us, we would have to manage a complex transition with one or several other contract manufacturers and possibly suffer increased costs and a loss of business.

Until the end of 2003, we relied on three separate contract manufacturers to produce our wireless CPUs. In October 2003, we decided to concentrate all manufacturing with a single contract manufacturer. We chose Solectron, a global electronics contract manufacturer, using its plant in Suzhou, China. In the second quarter of 2005 we completed concentrating the production of our wireless CPUs at this site.

Although we believe the use of a single contract manufacturer will help us to reduce costs and improve control over the manufacture of our products, the reliance on a single manufacturer increases the risk that we could encounter manufacturing or supply problems at some point in the future.

Using a single contract manufacturer, as opposed to using three as we did in the past, to assemble and test our products increases our control over product delivery schedules, quality assurance, manufacturing yields and costs. However, we are more dependent on this single supplier who assembles and tests our components and our products. They have other customers and may not have sufficient capacity to meet all of our supply, manufacturing, assembly and testing needs during periods of excess demand. They may experience financial difficulties, or delays or disruption to their production, or may fail to meet our specified requirements, notably our quality standards. In addition, a financial or political crisis in China, or a change in the political climate making China less receptive to foreign businesses, could also disrupt our supply of manufactured products or increase costs.

This choice to concentrate all the manufacturing on one contract manufacturer and in one location, as well as the decision to establish a broader commercial relationship with Solectron, made it necessary to substantially review the terms and conditions of the contractual relationship with Solectron. The manufacturing agreement has been renegotiated and provides for termination in a strictly limited and precisely defined number of cases. In case of termination, a six-month exit management plan would be implemented to transition production back to us or to another contract manufacturer. However, the transition to another manufacturing arrangement would be complex and would require substantial management, as well as possibly financial, resources.

In the event any of the risks described above materialize and prevent us from delivering our products to our customers on a timely basis, we could lose a portion of our business temporarily or on a long-term basis, be subject to contract penalties and incur substantial costs to establish a new contract manufacturing relationship.

Quality issues, such as errors in our software, could result in significant losses to us or our customers thus damaging our reputation or increase the potential for product liability claims against us.

We may face quality issues affecting either the hardware or the software in our products. Software frequently contains undetected errors or failures, especially when first introduced or when new versions are released. Several of our products rely on unproven or evolving technologies that may contain defects or other quality

6 Annual Report Form 20-F 2005 - WAVECOM |

or performance problems. Despite testing by us and use by current and potential customers, errors might still be found in our products and product upgrades in the future. The occurrence of these errors could result in significant losses to our customers and in reduced market acceptance of our products. These developments could have a material adverse effect on our reputation, business, operating results and financial condition.

Our sales agreements with our customers typically contain provisions designed to limit our exposure to potential product liability and other claims due to unforeseen errors in software. It is possible, however, that the limitation of liability provisions contained in our sales agreements may not be effective under the laws of certain jurisdictions. Consequently, the sale and support of our products by us entail the risk of these claims in the future. We currently have limited insurance against product liability risks or errors and omissions coverage, and there can be no assurance that the current levels of insurance coverage are adequate or that additional insurance will be available to us on commercially reasonable terms or at all. A product liability claim or claim for economic loss brought against us could have a material adverse effect upon our business, operating results and financial condition.

Our sales and operating results could be adversely affected if the third parties on whom we rely for the supply of our components are unable to meet our supply or quality requirements.

We believe that a number of our suppliers are sole sources for key components. These key components are complex and difficult to manufacture and require long lead times. We work with our suppliers on a twelve-month rolling forecast basis and our close relationship with our critical components suppliers make us believe that we should not have difficulties obtaining supplies for the production forecasts for the next twelve months. However, during late 2005, we began to see signs of temporary lead-time increases for some components, such as flash memories. In the event of a reduction or interruption of supply, or decay in quality, it could take several months before we could begin receiving adequate supplies from alternative sources. Supply interruptions could delay product shipments, causing our revenues to decline and operating results to suffer.

The wireless communication market in which we operate is characterized by rapidly changing and increasingly complex technologies. If we are unable to keep pace with these new technology trends or if the trends move to technologies different from our core competencies, our products may not remain competitive and we may lose customers. On the other hand, if the changes in technology occur more slowly than we expect, we might have spent significant amounts of money to develop products that the market is not ready to buy.

The markets in which we sell our wireless solutions are regularly developing new types of products and new versions of existing products. To be competitive, manufacturers who purchase our solutions for use in their end-products must satisfy market demand at market prices. To meet our customers’ needs, we must continuously update and enhance our products, shortening their life cycles so that they meet the latest standards and include up-to-date features for a wide variety of applications.

To develop these enhancements, new designs and technologies, we must spend time and significant amounts of money on research and development. These investments are generally made before commercial viability for the resulting products is ensured. In addition, some of our technology is forward-looking and offers functionalities which are significantly advanced compared to current market standards. Therefore, there are no assurances that we will achieve net positive earnings from our new products or that they will be commercially successful, particularly if we misjudge a market’s readiness for our products or miss a product life-cycle window. We may lose market share if our competitors, most of which are larger and have greater resources than we do, are more successful or faster than we are in updating and improving products and technology and timing product releases with market demand.

From a technology standpoint, we face competition from both alternative wireless, and non-wireless technologies. Wireless technologies can be roughly characterized as WAN (Wide Area Network) which includes GSM, CDMA, OFDM, UWB, WiMAX followed by WLAN (Wireless Local Area Network) i.e. WiFi and finally PAN (Personal Area Networks) such as Bluetooth or Zigbee. Non-wireless technologies are those which are used to provide mirroring functionality but via a fixed (wired) network such as the fixed line telephone network (PSTN), LAN Ethernet or a more specific M2M example such as PLC (Power Line Control) which is used in the Automatic Meter Management market. If any of these competing technologies becomes successful in one or more of our target market segments while we have decided not to adopt those technologies, we could lose market share in the applicable segments if this should occur.

As the vertical markets for wireless communication between machines evolve, current or future market participants, including ourselves, may seek to consolidate their resources. As a result, we may be acquired; we may decide to acquire more market-related assets or businesses; or we may be excluded from an industry consolidation. Each of these events could create significant financial and/or competitive stresses for our company.

As the vertical markets for wireless communications between machines evolve, current or future market participants may seek to consolidate their resources to create more competitive or commercially effective units. Such industry consolidation may lead to a bid for the acquisition of our business by another group, in which case our shareholders may not be able to benefit from our future long-term development.

We may also conclude that we must acquire specific additional assets or businesses to reinforce our market position. Were we to pursue one or more acquisitions, there can be no assurance that we will be able to successfully consummate such transactions or achieve the expected rates of return, integrate the acquired assets, business or employees successfully into our working environment. We may further not be able to retain either our or the employees of the acquired business. An acquisition can also result in a dilution of the position of

WAVECOM - Annual Report Form 20-F 2005 7 |

our existing stockholders and our earnings per share as well as result in unanticipated legal risks, legal costs and liabilities.

It is also possible that we will be excluded from an industry consolidation, in which case our competitors may grow stronger and take increased market share. In light of the nascent nature of the vertical markets and our recent financial losses, we may be subject to financial and/or competitive stresses resulting from industry consolidation, and we cannot be certain as to our future position in the industry.

If the ecosystem for wireless-enabled machines does not develop we may not find adequate markets for our products and thus not achieve our growth targets.

The ecosystem for wireless-enabled, communicating machines consists of four main types of players. First are the technology providers, like us, who provide the core wireless technology using all major wireless standards. A category of value-added distributors and design houses play a role in conceptualizing, creating and designing end-products. Next, come the manufacturers who also conceive, create, design and produce a broad range of wireless-enabled devices. Finally, there are the wireless network operators and virtual wireless operators which provide the “air time” to transmit data to end users. If any one of these players does not develop at the same pace as the others, the markets as a whole will have difficulty developing and may in turn keep us from reaching our growth targets.

Our profitability could be hurt if the prices of our key components increase or if they are no longer available.

Throughout most of 2004 and 2005, we experienced declining or stable prices for most of the key components we use in our products. It is possible that these trends could reverse and that we could see component prices increase. The hardware platforms that we sell are made up of components that are made by manufacturers other than us. If our suppliers decide to discontinue manufacturing specific components, we may have to redesign our products, thus adding unplanned development costs. If either of these situations occurs, our cost structure could change, thus limiting our ability to maintain competitive pricing and making it more difficult to continue to be profitable.

Fluctuations in the rate of exchange between our reporting currency, the euro, and the U.S. dollar can affect our net sales and costs.

Although our functional currency is the euro, a significant portion of our revenues and assets are recorded in U.S. dollars. At the same time, most of our components are purchased in U.S. dollars, and a portion of our operating expenses is in U.S. dollars. The value of the euro remained relatively stable against the dollar throughout 2005. If the euro strengthens against the U.S. dollar as we saw in 2004, it could reduce our reported revenues and could negatively affect our reported operating and net results.

We incurred a net foreign exchange gain in 2005 of €4.1 million compared to net foreign exchange losses in 2004 and 2003 (€578,000 and €2.1 million respectively). We may incur foreign exchange losses again in the future. Beginning in January 2003, we put in place a program to hedge our currency risk through the use of forward contracts and put and call options covering expected net cash flows in U.S. dollars. The objective of this program is to minimize our risk, but we will never be able to eliminate the risk.

Our costs may increase or we may have to redesign our products if they infringe other companies’ intellectual property rights.

Other companies have patents, copyrights, trade secrets and other intellectual property rights covering technology used in the wireless communications industry. Although we have entered into intellectual property licenses permitting us to use rights of third parties, if any of our products were found to infringe on protected technology, including products we may acquire, we could be required to redesign them, to obtain further intellectual property licenses or to pay royalties or damages to the owner of the technology. The resulting costs would harm our business. If we were unable to obtain these licenses or to redesign our products to make them non-infringing, we could be prohibited from marketing our products.

Our business could be hurt by the unauthorized use of our technology.

We rely on a combination of patents, copyrights, trade secrets, trademarks and proprietary information to maintain and enhance our competitive position. Despite our efforts, unauthorized parties may attempt to copy, use or make copies of our products or aspects thereof. We might, in addition, face some difficulties in setting up legal actions against any competitor who copies some of the key part of our technology in its products or design. If we were unable to prevent a competitor from using our designs and techniques to produce competing products, our business might be adversely affected.

We need to attract, retain and develop key personnel who are skilled in our business and technology to remain competitive.

It is important to our success that we retain our highly skilled product development, sales, marketing and other key employees, including senior management, and continue to attract and motivate additional skilled employees. We rely to some extent on independent contractors who work for consulting firms.

In October 2003 and January and September of 2004, we announced plans to restructure our business organization which resulted in significant headcount reductions throughout our company. These headcount reductions may make it more difficult for us to attract and retain skilled personnel in the future. If we fail to attract, hire or retain appropriately qualified personnel, we could experience delays in our research and development projects or our product roll-outs which could affect our ability to bring new products to market successfully or on a timely basis.

As a result of our global operations, we are exposed to numerous risks, including logistical difficulties, cultural differences, product localization costs, import and tariff restrictions, adverse foreign tax consequences and fluctuations in currencies.

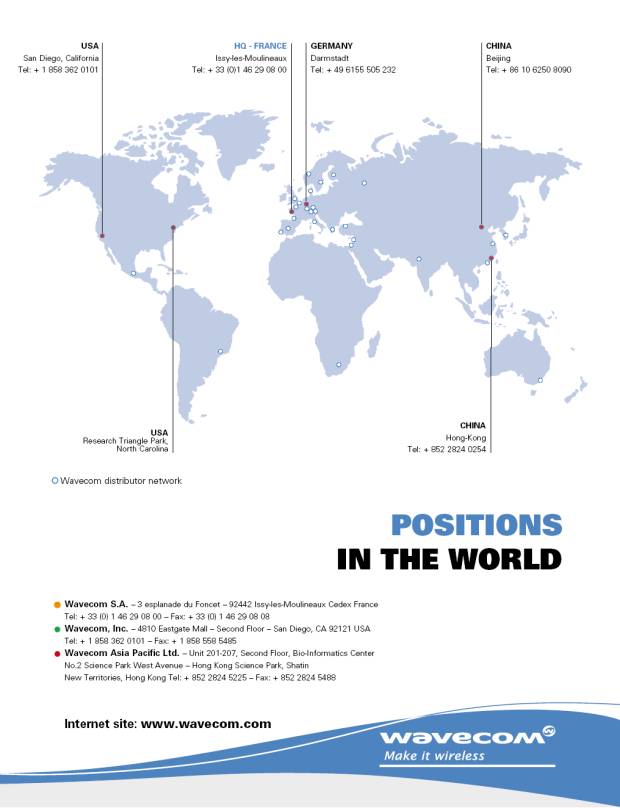

We operate from various locations around the world in Europe, United States and in Asia, using an extensive distributor network.

8 Annual Report Form 20-F 2005 - WAVECOM |

Directly or indirectly, we are selling in more than 115 countries on all continents, and our manufacturing is subcontracted in China.

Worldwide operations are subject to a number of risks, including:

| • | tariffs, duties, export controls and other trade barriers; |

| • | unexpected changes in regulatory requirement and applicable laws; |

| • | the burden of monitoring and complying with a wide variety of foreign laws and regulations; |

| • | political and economical instability; |

| • | potential adverse tax consequences; |

| • | longer payment cycles for sales in certain foreign countries; |

| • | difficulties and costs of staffing and managing international operations; |

| • | fluctuation of foreign exchange currency rates; |

| • | disease and related quarantines; |

| • | cultural differences; and |

| • | aggressive competition from companies based in countries which do not protect intellectual property rights to as great an extent as those of the United States and France. |

Our current products contain amounts of lead which exceed the allowable levels to be considered lead-free. If we have not entered into mass production for currently designed lead-free products for Europe by mid-2006, we may be prevented from selling our products into some geographic markets and we may lose market share.

The EU (European Union) has adopted directives that will come into effect in mid-2006 and which will prohibit the sale, within the European Union, of products containing hazardous substances, including lead, in excess of certain predetermined levels. Some non-European Union countries have already adopted or are considering adopting similar regulations. We have been working toward decreasing the lead content of our products in order to reach levels that comply with the EU directives on a timely basis and anticipated regulations in our major markets.

If, however, our products do not meet the hazardous substance limitations when such limitations come into effect, we may be prohibited from selling our products in the European Union or in other markets that have similar restrictions and we could suffer a loss of revenues for an indefinite period if they decide to redesign their products to remove our non-compliant products. As a result, we may lose potential revenues. In addition, the process of designing our products to meet these restrictions may increase our development costs, thus reducing our profitability.

Business disruptions could seriously harm our operations and financial condition and increase our costs and expenses.

A number of factors, including natural disasters, computer viruses or failure to successfully upgrade and improve operational systems to meet evolving business conditions, could disrupt our business, which could seriously harm our revenues or financial conditions and increase our costs and expenses. For example, some of our facilities are located in potential earthquake or flood zones that could subject these facilities, product development facilities and associated computer systems to disruption.

Our quarterly revenues fluctuate significantly and may affect the price of our shares and ADSs.

Our revenues and operating results fluctuate significantly from quarter to quarter. The many factors that could cause our quarterly results to fluctuate include:

| • | any delay in our introduction of new products or product enhancements; |

| • | the size and timing of customer orders and our product shipments; |

| • | any delay in shipments caused by component shortages or other manufacturing problems; |

| • | the loss of a major customer or a reduction in purchases by a major customer; |

| • | a reduction in the selling price of our products; |

| • | the size, timing and structure of significant license sales; |

| • | customer responses to announcements of new products and product enhancements by our competitors; and |

| • | foreign exchange rate fluctuations, primarily between the euro and the U.S. dollar. |

| • | the booking of one-time, non-recurring expenses such as restructing or acquisition costs. |

Due to these and other factors, our results of operations could fluctuate substantially in the future and quarterly comparisons may not be reliable indicators of future performance. Because many of our expenses for personnel, facilities and equipment are relatively fixed in nature, we may not be able to reduce expenses quickly to balance a decline in our revenues and could experience net losses during extended periods. Quarterly fluctuations may have a negative effect on the price of our shares and ADSs. It is possible that in some future quarter our results of operations will be below the expectations of public market analysts and investors, in which case the price of our shares and ADSs could fall.

Changes in accounting principles may affect our reported earnings and operating income

We currently report in both the U.S. GAAP and, since January 1, 2005, in IFRS (International Financial Reporting Standards), instead of French GAAP. The applicable U.S. GAAP and IFRS accounting standards and related interpretations are highly complex and continue to evolve. The reporting requirements may be contradictory and subject to interpretation. We review our compliance with all new and existing accounting rules and pronouncements on an ongoing basis. Depending on the outcome of these ongoing reviews, the evolution of our business model and the potential issuance of further accounting pronouncements, implementation guidelines and interpretations, particularly with respect to revenue recognition or stock-based compensation, we may be required to modify our accounting policies and business practices which could have a material adverse effect on our results of operations or financial reporting. Our current accounting policies are described in Item 18 and note 1 to our consolidated financial statements.

The requirement to expense stock options in our income statements could have a significant adverse effect on our

WAVECOM - Annual Report Form 20-F 2005 9 |

reported results and we do not know how the market will react to reduced earnings.

On December 16, 2004, the Financial Accounting Standards Board (FASB) issued FASB Statement N° 123 (revised 2004), Share-Based Payment (“SFAS 123R”). SFAS 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values. Pro forma disclosure is no longer an alternative.

On April 14, 2005, the Securities and Exchange Commission announced that the Statement 123R effective transition date will be extended to annual periods beginning after June 15, 2005. We expect to adopt this new standard on January 1, 2006, using the modified prospective method.

As permitted by SFAS 123R, the Company currently accounts for share-based payments to employees using the intrinsic value method set forth in APB 25 (Accounting Principles Board) and, as such, generally recognizes no compensation cost for employee stock options. Accordingly, the adoption of SFAS 123R’s fair value method may have a significant impact on our result of operations, although the impact of adoption of SFAS 123R cannot be predicted at this time, because it will depend on levels of share-based payments granted in the future.

We cannot predict how investors will view this additional expense and, therefore, our stock price may decline.

Adherence to technical requirements or legal regulations, such as section 404 of the Sarbanes-Oxley Act, may increase our cost base and dilute our resources.

The implementation of new technical requirements, environmental or legal regulations, such as the Sarbanes-Oxley Act under U.S. securities laws, or the requirement to report in IFRS International Financial Reporting Standards instead of French GAAP, may require greater investment in and use of resources than have already been anticipated. This could ultimately place significant strains on our organization, increase our cost base and dilute our internal resources currently devoted to general financial and reporting activities.

If, despite our efforts, we are unable to comply with these new laws and standards in the mandated timeframes, or if we encounter deficiencies, or if our chief executive officer, chief financial officer or independent registered public accounting firm determine that our internal control over financial reporting is not effective as defined under section 404, we may experience a loss of confidence by the market, or a declining stock price, either of which could harm our reputation and results of operations.

Our U.S. shareholders could suffer adverse tax consequences if we are characterized as a passive foreign investment company (PFIC).

If, for any taxable year, the portion of our income characterized as “passive” or of our assets that produce “passive” income exceeds levels established under U.S. federal income tax regulations, we may be characterized as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences to our shareholders who are subject to U.S. taxation. U.S. persons should consult with their own U.S. tax advisors with respect to the U.S. tax consequences of investing in our shares or our ADSs. Depending on our operating results and balance sheet situation, we may be characterized as a PFIC for the year ended December 31, 2005, or for future years.

Holders of our shares have limited rights to call shareholders’ meetings or submit shareholder proposals which could adversely affect their ability to participate in the governance of our company.

In general, our Board of Directors may call a meeting of our shareholders. A shareholders’ meeting may also be called by a liquidator or a court appointed agent, in limited circumstances, such as at the request of the holders of 5% or more of our outstanding shares held in the form of ordinary shares. Only shareholders holding a defined number of shares held in the form of ordinary shares or groups of shareholders holding a defined number of voting rights underlying their ordinary shares may submit proposed resolutions for meetings of shareholders. The minimum number of shares required depends on the amount of the share capital of our company and is equal to 776,591 (5% of 15,531,813) ordinary shares based on our share capital as of December 31, 2005. Similarly, a duly qualified association, registered with the AMF Autorité des Marchés Financiers (French stock market authority) and us, of shareholders who have held their ordinary shares in registered form for at least two years and together hold at least a defined percentage of our voting rights, equivalent to 776,591 (5% of 15,531,813) ordinary shares based on our company’s voting rights as of 776,591 (5% of 15,531,813), may submit proposed resolutions for meetings of shareholders. As a result, the ability of our shareholders to participate in and influence the governance of our company will be limited.

Provisions of our articles of association and French law could have anti-takeover clauses and could deprive shareholders who do not comply with such provisions of some or all of their voting rights.

Provisions of our articles of association and French law may impede the accumulation of our shares by third parties seeking to gain a measure of control over our company. For example, French law as well as our articles of incorporation provides that any individual or entity (“person”), acting alone or in concert with others, that becomes the owner or ceases to be the owner of more than 5%, 10%, 15%, 20%, 25%, 1/3, 50%, 2/3, 90%, 95% of the share capital or voting rights of our company is required to notify (i) us and (ii) the AMF by registered letter (with return receipt) within five trading days of crossing such thresholds. The AMF makes the notice public. Additionally, any person acquiring more than 10% or 20% of the share capital or voting rights of our company must notify us and the AMF within 10 trading days of crossing any of these thresholds and file a statement of their intentions relating to future acquisitions or participation in the management of our company for the following 12-month period, including whether or not this person is acting alone or in concert and whether or not they intend to continue their purchases to acquire control of our company or to seek nominations to our board of directors. This person may amend their stated intentions, provided that they do so, on the basis of significant changes in their own situation or stockholding. Upon any changes of intentions, they must file a new statement. The AMF makes these statements public. Any shareholder who fails to comply

10 Annual Report Form 20-F 2005 - WAVECOM |

with these requirements shall have voting rights for all shares in excess of the relevant threshold suspended for two years following the completion of the required notification. Moreover, this shareholder may have all or part of its voting rights within our company suspended for up to five years by the relevant commercial court at the request of our chairman, any of our shareholders or the AMF. In addition, such shareholders may be subject to fines for violation of the share ownership notification requirement and for violation of the notification requirement regarding the statement of intentions. Under the terms of the deposit agreement relating to our ADSs (American Depository Shares), if a holder of ADSs fails to instruct the depositary in a timely and valid manner how to vote such holder’s ADSs with respect to a particular matter, the depositary will deem that such holder has given a proxy to the chairman of the meeting to vote in favor of each proposal recommended by our board of directors and against each proposal opposed by our board of directors and will vote the ordinary shares underlying the ADSs accordingly. This provision of the depositary agreement could deter or delay hostile takeovers, proxy contests and changes in control or management of our company.

Interests of our shareholders will be diluted if they are not able to exercise preferential subscription rights for our shares.

Under French law, shareholders have preferential subscription rights (droits préférentiels de souscription) to subscribe for issuances of new shares or other securities with preferential subscription rights, on a pro rata basis, such purchases to be paid in cash. Shareholders may waive their right specifically in respect of any offering, either individually or collectively, at an extraordinary general meeting. Preferential subscription rights, if not previously waived, are transferable during the subscription period relating to a particular offering of shares and may be quoted on the exchange for such securities on Euronext Paris S.A. Holders of our ADSs may not be able to exercise preferential subscription rights for these shares unless a registration statement under the Securities Act is effective with respect to such rights or an exemption from the registration requirements is available. If these preferential subscription rights cannot be exercised by holders of ADSs, we will make arrangements to have the preferential subscription rights sold and the net proceeds of the sale paid to such holders. If such rights cannot be sold for any reason, we may allow such rights to lapse. In either case, the interest of holders of ADSs in our company will be diluted, and, if the rights lapse, such holders will not realize any value from the granting of preferential subscription rights.

It may be difficult for holders of our ADSs rather than our ordinary shares to exercise some of their rights as shareholders.

It may be more difficult for holders of our ADSs to exercise their rights as shareholders than it would be if they directly held our ordinary shares. For example, if we offer new ordinary shares, and a holder of our ADSs has the right to subscribe for a portion of them, the Bank of New York, as the depositary, is allowed to sell for such ADS holder’s benefit that right to subscribe for new ordinary shares of our company instead of making it available to such holder in its own discretion. Also, to exercise their voting rights, holders of our ADSs must instruct the depositary how to vote their shares. Because of this extra procedural step involving the depositary, the process for exercising voting rights will take longer for a holder of our ADSs than it would for holders of our ordinary shares.

Fluctuation in the value of the U.S. dollar relative to the euro may cause the price of our ordinary shares to deviate from the price of our ADSs.

Our ADSs trade in U.S. dollars and our ordinary shares trade in euros. Fluctuations in the exchange rates between the U.S. dollar and the euro may result in temporary differences between the value of our ADSs and the value of our ordinary shares, which may result in heavy trading by investors seeking to exploit such differences.

We have not distributed dividends to our shareholders in the past nor do we intend to in the near future.

We currently intend to use all of our operating cash flow to finance the development of our business for the foreseeable future. We have never distributed cash dividends to our shareholders, and we currently have no plan to distribute cash dividends. If we distribute a portion of our earnings as dividends to shareholders in the future, the determination of whether to declare dividends and, if so, the amount of such dividends will be based on facts and circumstances existing at the time of determination.

Our share price has been and may continue to be volatile.

Our share price has been volatile due, in part, to generally volatile securities markets, and the volatility in the telecommunications and technology companies’ securities markets in particular. Factors other than our financial results that may affect our share price include, but are not limited to, market expectations of our performance, capital spending plans of our customers, the level perceived growth of the industries in which we participate and any perceived need for us to raise additional capital through the sale of securities. Any future sale of equity or convertible securities we may consider could depress our stock price.

We may have difficulty in accessing capital to grow the business if we are unable to obtain short-term bank loans in the future.

At some point in the future, we may have need for short-term financing in order to continue to grow our business. If we are unable to obtain a traditional bank loan, due to a decline in our credit rating or due to the unwillingness of a bank to make a business loan, we may have to seek alternative financing that could be both difficult and expensive. The banking practices in France are different from traditional banking practices in other countries, like the United States for example, and obtaining a traditional bank loan is often difficult and may carry a very high interest rate.

We hold some of our own shares in treasury stock. If our share price declines significantly, we may be required to take a provision for the loss in value.

As of December 31, 2005 we held 156,345 shares of our own stock in treasury for a total value of €1,321,215. If our stock price declines by 10% as compared to the average value share purchase price, we could be required to take a provision for depreciation of €131,215 in our statutory accounts (comptes annuels).

WAVECOM - Annual Report Form 20-F 2005 11 |

Item 4: Information on the Company

We were incorporated as a French société anonyme on June 28, 1993, for a duration of 99 years under the name of Wavecom, S.A. We are registered in Nanterre, France, registration number 391 838 042. Our headquarter’s offices are located at: 3 esplanade du Foncet, in Issy-les-Moulineaux, France, where our phone number is +33 (1) 46 29 08 00.

Business overview and recent evolution

Overview

We are a global technology company that develops markets and sells wireless platforms that can be embedded into virtually any machine or device, thus enabling it to transmit and receive both data and voice communications via wireless cellular network operators. Our highly sophisticated wireless platforms, are sold as central processing units (CPUs - including both smart modems and modules) and integrate all of the necessary software and hardware on miniature circuit board platforms that can be used for a wide variety of applications. We also provide our customers with development tools and engineering support services to facilitate the design and operation of innovative wireless products. Our tag line—”Make it wireless”—succinctly describes our business.

With over twelve years’ enterprise experience, we have developed a talented team of managers and employees who are focused on creating and selling these wireless platforms. Our engineering teams have highly specialized expertise and know-how in the development and integration of radio-frequency-designed circuitry and communications software. Our direct marketing and sales teams and extensive network of value-added distributors reach a large number of diverse customers and prospects throughout the world. Although we do not operate our own production facilities, our operations teams have acquired substantial expertise in producing and manufacturing our wireless CPUs through working closely with our contract manufacturing partner located in China.

Recent developments

On March 20, 2006 we announced our intention to acquire certain assets of Sony Ericsson’s M2M Communications Business Unit in a cash transaction with a purchase price up to a maximum of €32.5 million.

The assets we are acquiring include a line of wireless modules similar to our own. These products however provide strengths in markets and geographies that are complementary to our business. We believe that the acquisition of these assets offers numerous synergies and benefits, specifically in scale and geographic presence. The acquisition will bring to us a solid customer base from the North American automotive and fleet management market that should further reinforce Wavecom’s already diverse automotive customer base in Europe. Overall, this acquisition fits entirely with our long term strategy and vision.

The assets we have acquired include Sony Ericsson’s new GX64 GSM/GPRS product family, the GX47/48 GSM/GPRS product family, the CM42/52 CDMA/1xRTT product family, as well as global assets and activities in M2M research & development, marketing, and sales. Approximately 90 people will be joining our company, of which around 60 are R&D engineers and 30 are sales and marketing professionals.

This acquisition is expected to put pressure on Wavecom’s short-term profitability while in the long-term should enhance shareholder value. As our management team is still refining the integrated organization, expectations on the expense structure and potential restructuring costs are still being determined.

12 Annual Report Form 20-F 2005 - WAVECOM |

The year 2005 - a year of transition

2005 marked the first full year that we operated our company exclusively dedicated to embedded industrial wireless applications. Prior to 2005 we actively marketed our solutions to both this market, predominantly in the European, Middle East and Africa region, as well as to the telephone handset market, mainly to customers in the Asia Pacific region. Sales to Asian handset manufacturers had driven company revenues during the period from 1999 to early 2003. For the full year 2002, revenues to the telephone handset market made up 82% of total company revenues. Beginning in the first quarter of 2003, we experienced lagging sales to our customers who produced mobile telephone handsets. Declining sales in this market were due to our customers’ increasing technological competence and their desire to make their telephone handsets based on reference designs rather than our complete “pre-packaged” solutions. Our non-handset customers did not, however, pursue this practice because they did not have sufficient scale to justify the required investment in research and development.

In September 2004, we announced our decision to exit the mobile telephone handset market and to terminate silicon chipset development. This announcement included a plan to significantly reduce headcount. During 2004, we implemented a total of three separate restructuring plans and when these plans were completed in the second quarter of 2005, global headcount had been reduced by 62% from 863 employees and independent contractors at the end of 2003 to 330 employees and independent contractors at the end of 2005. Restructuring costs included headcount reductions of €15,4 million and additional charges of €6,8 million for a total of €22,2 million in 2004 and a remaining amount (€1,7 million) was taken in 2005.

Having stopped future development for the mobile telephone handset market, we reformulated our business strategy to focus exclusively on wireless communication between machines. Under the direction of our new chief executive officer, Dr. Ronald D. Black, who joined the company in August of 2004, we put in place an organizational structure designed to reflect the change in the company’s strategic direction. This structure included the establishment of management by geographic segment: EMEA (Europe Middle-East and Africa), APAC (Asia-Pacific) and the Americas (North and South America). Each of these regions is headed by a Group Vice President who has responsibility for developing customer relations and managing the profitability of the region. The regions are supported from a product standpoint by marketing and technology, research and development, and operations (manufacturing). From an administrative standpoint the overall company is supported by finance, human resources and quality departments.

With our new strategy and organization in place, and the restructuring behind us, we returned the company to profitability in the second quarter of 2005, a trend which continued for the following two quarters. We registered an operating profit of €4.0 million and net profit of €8.7 million for the full year 2005 compared to an operating and net losses in 2004 of €80.9 million and €78.8 million respectively.

For 2005, our total revenues amounted to €129.2 million, with sales in EMEA, APAC and the Americas representing 58%, 32% and 10% of total sales, respectively. For further information on our recent results and the impact of our exiting the mobile telephone handset market, see Item 5 Operating and Financial Review and Prospects.

Trends

2005 was a pivotal year for Wavecom as we successfully refocused our activities on embedded industrial wireless solutions.

We achieved our main objective in 2005 which was to reach operating profitability producing an operating profit of €4.0 million and a net profit of €8.7 million compared to an operating loss of €80.9 million and a net loss of €78.8 million in 2004.

Concerning our revenues, our objective is to continue offering additional features and functionality to our products. In particular, we intend to improve the functionality of each element of our software suite, Open AT® and we will add more functionality such as real-time with new communication protocols such as EDGE and Bluetooth as well as offering the possibility to download, via the cellular networks (DOTA – Download Over The Air) allowing remote upgrades and enhancements to the operating system, the application layers and the network software. We intend to continue to enhance our service offer with the introduction of services like Wavecom University, a professional training program designed to help clients take full advantage of all of Wavecom’s software including our Open AT® software suite. Finally, we expect to benefit from potential development in the vertical markets. Our recent announcement to acquire certain assets from Sony Ericsson should allow us to merge our product offerings with those acquired from Sony Ericsson’s M2M communications business unit.

Although the backlog increased significantly from the third quarter to the fourth quarter 2005, from €36.6 million to €39.1 million and considering we expect to add revenues from the assets acquired from Sony Ericsson business, there still remains a number of variables, both positive and negative that could influence our revenues which are difficult to quantify at this point in time. These elements include: the integration of the Sony Ericsson M2M product line, the level of sales from some handset business, the possible licensing agreements and finally the risks related to our supply chain. Regarding the supply chain, we have begun to see some difficulties in obtaining the supply of some components such as flash memory for us as well as some of our customers which could impact our shipments. It should be noted that the backlog as of December 31, 2005 included approximately 23% of firm orders from a customer which has been in court-supervised receivership since February 2006. At this time,

WAVECOM - Annual Report Form 20-F 2005 13 |

we expect to deliver a portion of these orders based on prepayment before delivery throughout 2006.

We have made to following assumptions regarding the factors that could have the greatest impact on our revenues in 2006: 1) volume growth and costs for the vertical markets should be similar to 2005 levels, 2) a continued decline in our average selling price but not faster than what we experienced in 2005, 3) expected pressure on our average margin rate given the fact that the product margin for the soon to be acquired Sony Ericsson M2M business unit products is lower than ours and 4) our operating expenses will possibly incorporate the acquired businesses as of the second quarter 2006.

The market for wireless communication between machines

The market for machines with wireless communication capabilities, which we call the “vertical markets”, is a developing business sector. Based on our own internal data and independent research, principally from ABI Research (most current being 2004), we estimated the global size of the vertical markets to be approximately 14.85 million units (wireless enabling devices) delivered in 2005. The market per se, is difficult to measure with any degree of certainty and our estimates do not include wireless PDAs (Personal Digital Assistants) or mobile computing (wireless PC cards). We believe that the global size of the vertical markets should continue to expand in the coming years as the usefulness of wireless-enabled machines is recognized for increasingly diverse applications.

Factors favorable to the growth of the vertical markets

We believe that wireless operators are beginning to look beyond consumer voice applications to develop the market for wireless-enabled machine communications. Major wireless network operators in Europe, the United States and Asia have begun offering fee schedules and, in some cases, service packages for data transmission between machines. We are also seeing the emergence of virtual operators who purchase and re-sell air time from the network operators mainly for data communication.

Other trends we see emerging that could help the expansion of the vertical markets include:

| • | increasing demands for wireless products in the security/alarm sector; |

| • | European Union initiatives (eCall Driving Group) aimed at reducing the number of road deaths by 50% between now and 2010, thus opening up a market for embedded communication devices for each new car to be sold in Europe by 2009 (15 million units/year); |

| • | insurance industry plans to implement “Pay-As-You-Drive” programs using wireless connectivity to monitor driving patterns and performance in order to customize premiums; |

| • | an aging population is creating a niche market for wireless health applications; and |

| • | utility de-regulation, resulting from environmental protection plans, is opening up the metering market. |