On May 11, 2004, we granted Mr. Dennison options to purchase 500,000 shares of our common stock at an exercise price of $4.09 per share. An option to purchase 375,000 shares of our common stock vests ratably on a quarterly basis over four years beginning on May 11, 2004, and an option to purchase 125,000 shares of our common stock vests in full either on (i) May 11, 2007, if the Company meets certain performance criteria for the fiscal year ended December 31, 2006, or (ii) May 11, 2009, if the Company fails to meet such performance criteria. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

On March 17, 2005, we granted Mr. Dennison options to purchase 500,000 shares of our common stock at an exercise price of $2.16 per share. This option vests ratably on a quarterly basis over four years beginning on March 17, 2005. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

On September 30, 2002, we entered into an executive retention and severance agreement with Mr. Dalton pursuant to which he agreed to serve as President and CEO of REALTOR.com®. Additionally, we entered into a compensation arrangement with Mr. Dalton that provides for annual base salary of $325,000. Under his 2005 executive bonus plan, Mr. Dalton was also eligible to receive a performance bonus of up to twice his annual base salary for 2005; he received $630,000.

We reimburse Mr. Dalton for actual and reasonable business expenses. In addition, as described above under “Summary Compensation Table,” Mr. Dalton was reimbursed for reasonable expenses associated with his relocation to our headquarters. This included taxes and tax gross-up amounts associated with payments made to relocate Mr. Dalton to our headquarters. We purchased a residence in the fourth quarter of 2002 from Mr. Dalton for $1.95 million, based on its appraised value, to facilitate his move to our headquarters. We sold this house in 2004 for approximately $1.4 million, net of commissions and operating costs.

Effective October 8, 2002, we granted Mr. Dalton an option to purchase 1,200,000 shares of our common stock at an exercise price of $0.39 per share. This option vested as to 250,000 shares on the date of grant and the remainder vests ratably on a monthly basis over 48 months beginning on November 1, 2002.

In the event of a termination without cause, subject to his provision of transition services if requested and his execution of a release of claims, Mr. Dalton will receive a lump sum payment in an amount equal to his annual base salary, payment of his continued medical coverage premiums for up to 12 months, and a payment in an amount equal to 50% of his target bonus for the year in which his termination occurs (the “Minimum Bonus Payment”). In addition, if the termination occurs after June 30 of any year, and before January 1 of the next year, and our financial performance goals for the year have been achieved, we will pay Mr. Dalton a prorated portion of his target bonus less his Minimum Bonus Payment. All equity awards Mr. Dalton was granted by us prior to September 30, 2002 will vest and any such options will remain exercisable for a period of 12 months following the later of his termination date or the end of any transition services period.

On May 11, 2004, we granted Mr. Dalton options to purchase 350,000 shares of our common stock at an exercise price of $4.09 per share. An option to purchase 262,500 shares of our common stock vests ratably on a quarterly basis over four years beginning on May 11, 2004, and an option to purchase 87,500 shares of our common stock vests in full either on (i) May 11, 2007, if the Company meets certain performance criteria for the fiscal year ended December 31, 2006, or (ii) May 11, 2009, if the Company fails to meet such performance criteria. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

On March 17, 2005, we granted Mr. Dalton options to purchase 350,000 shares of our common stock at an exercise price of $2.16 per share. This option vests ratably on a quarterly basis over four years beginning on March 17, 2005. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

Mr. Belote

We entered into an employment agreement with Mr. Belote dated as of March 6, 2002 that provides for his employment as our chief financial officer.

Mr. Belote’s employment agreement provides for annual base salary of $350,000. We provided Mr. Belote a signing bonus of $350,000 that was paid in four equal quarterly installments, the last of which was paid on January 31, 2003. Under his 2005 executive bonus plan, Mr. Belote was also eligible to receive a performance bonus of up to twice his annual base salary for 2005; he received $540,000.

We granted Mr. Belote a “Sign-On Option,” which fully vested on January 24, 2002, to purchase 432,500 shares of our common stock at an exercise price of $1.76 per share. We also granted Mr. Belote a “Principal Option” to purchase 1,297,500 shares of our common stock at an exercise price of $1.76 per share. Mr. Belote’s Principal Option vested ratably on a monthly basis over 48 months beginning on February 1, 2002 and is now fully vested.

The Sign-On Option and Principal Option may be exercised after a termination of employment (but no later than their expiration date, January 23, 2012) as follows: (i) within 90 days after termination for cause; (ii) within one year after voluntary termination prior to a change in control; or (iii) within three years after termination for any other reason.

We agreed to provide residential accommodations to Mr. Belote within reasonable commuting distance of our offices, with costs not to exceed $5,000 per month. We will reimburse Mr. Belote for actual and reasonable business expenses. If the foregoing reimbursements are subject to federal or state income taxes, we will pay an amount necessary to place Mr. Belote in the same after-tax position as he would have been in had no such taxes been imposed.

If there is a termination of employment without cause, a termination for death or disability or a constructive termination of employment, whether or not in connection with a change in control, subject to his execution of a release of claims, Mr. Belote will receive an amount equal to his annual base salary and his full annual bonus for the fiscal year in which the termination occurs, payable in equal installments over twelve months.

In the event that any portion of the amounts payable are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, we will pay Mr. Belote an amount necessary to place him in the same after-tax position as he would have been in had no such excise tax been imposed.

On May 11, 2004, we granted Mr. Belote options to purchase 350,000 shares of our common stock at an exercise price of $4.09 per share. An option to purchase 262,500 shares of our common stock vests ratably on a quarterly basis over four years beginning on May 11, 2004, and an option to purchase 87,500 shares of our common stock vests in full either on (i) May 11, 2007, if the Company meets certain performance criteria for the fiscal year ended December 31, 2006, or (ii) May 11, 2009, if the Company fails to meet such performance criteria. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

On March 17, 2005, we granted Mr. Belote options to purchase 350,000 shares of our common stock at an exercise price of $2.16 per share. This option vests ratably on a quarterly basis over four years beginning on March 17, 2005. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

22

Mr. Merrill

On April 24, 2002, we entered into an executive retention and severance agreement with Mr. Merrill pursuant to which he agreed to continue to serve as executive vice president of strategy and corporate development. Additionally, we entered into a new compensation arrangement with Mr. Merrill that provides for annual base salary of $325,000, effective January 21, 2002. Under his 2005 executive bonus plan, Mr. Merrill was also eligible to receive a performance bonus of up to twice his annual base salary for 2005; he received $550,000.

Effective January 17, 2002, we granted Mr. Merrill an option to purchase 450,000 shares of our common stock at an exercise price of $2.25 per share. This option vests ratably on a monthly basis over 48 months beginning on February 1, 2002. Additionally, effective January 24, 2002, we granted Mr. Merrill an option to purchase 700,000 shares of our common stock at an exercise price of $1.76 per share. This option vested as to 87,500 shares on July 24, 2002 and the remainder vests ratably on a monthly basis over 42 months beginning on August 1, 2002.

In the event of a termination without cause, subject to his provision of transition services if requested and his execution of a release of claims, Mr. Merrill will receive a lump sum payment in an amount equal to his annual base salary, payment of his continued medical coverage premiums for up to 12 months, and a payment in an amount equal to 50% of his target bonus for the year in which his termination occurs (the “Minimum Bonus Payment”). In addition, if the termination occurs after June 30 of any year, and before January 1 of the next year, and our financial performance goals for the year have been achieved, we will pay Mr. Merrill a prorated portion of his target bonus less his Minimum Bonus Payment. All equity awards Mr. Merrill was granted by us prior to April 24, 2002 will vest and any such options will remain exercisable for a period of 12 months following the later of his termination date or the end of any transition services period.

On March 31, 2003, we granted Mr. Merrill an option to purchase 50,001 shares of our common stock at an exercise price of $0.56 per share. This option vests ratably on a monthly basis over 36 months beginning on April 30, 2003. Additionally, on November 24, 2003, we granted Mr. Merrill an option to purchase 500,000 shares of our common stock at an exercise price of $3.24 per share. This option vested as to 125,000 shares on November 24, 2004 and the remainder vests ratably on a monthly basis over 36 months beginning on December 24, 2004.

On May 11, 2004, we granted Mr. Merrill options to purchase 350,000 shares of our common stock at an exercise price of $4.09 per share. An option to purchase 262,500 shares of our common stock vests ratably on a quarterly basis over four years beginning on May 11, 2004, and an option to purchase 87,500 shares of our common stock vests in full either on (i) May 11, 2007, if the Company meets certain performance criteria for the fiscal year ended December 31, 2006, or (ii) May 11, 2009, if the Company fails to meet such performance criteria. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

On March 17, 2005, we granted Mr. Merrill options to purchase 350,000 shares of our common stock at an exercise price of $2.16 per share. This option vests ratably on a quarterly basis over four years beginning on March 17, 2005. In the event of termination upon a change of control, or termination without cause in the absence of a change of control, subject to his provision of transition services if requested and his execution of a release of claims, such options will vest and become exercisable for a period of one year following such termination.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Operating Agreement with the National Association of REALTORS®

In November 1996, we entered into an operating agreement with the National Association of REALTORS® (the “NAR”), which governs how our subsidiary, RealSelect, Inc., operates the REALTOR.com® web site on behalf of the NAR. For a description of the operating agreement, please see Item 1 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

23

Under our operating agreement as originally entered into with the NAR, we were required to make quarterly royalty payments of up to 15% of RealSelect’s operating revenue in the aggregate to the NAR and the entities that provide us the information for our real property listings (“data content providers”).

In 2002, we and the NAR amended the NAR operating agreement. In accordance with the operating agreement, as amended, we paid $1,500,000 to the NAR in 2005 and will make the following fixed payments to the NAR:

| • | For 2006, we must pay $1,542,000 in four installments of $385,500 due on the last day of each calendar quarter of 2006. |

| | |

| • | For 2007 and beyond, we must pay the amount due during the prior calendar year plus or minus, as the case may be, the percentage change in the Consumer Price Index for the prior calendar year, in four equal installments due on the last day of each calendar quarter for that calendar year. |

Transactions with Elevation Partners

On November 29, 2005, pursuant to the terms and conditions of a Preferred Stock Purchase Agreement dated as of November 6, 2005 which we entered into with Elevation Partners, we sold an aggregate of 100,000 shares of our Series B Preferred Stock to Elevation Partners and Side Fund for an aggregate purchase price of $100 million. For a description of the Series B Preferred Stock, please see Note 15, “Series B Convertible Preferred Stock” to our Consolidated Financial Statements contained in Item 8 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

Pursuant to the Elevation Stockholders Agreement, we agreed that, subject to the terms and conditions of the Elevation Stockholders Agreement, Elevation may designate or nominate up to two of our directors. On December 8, 2005, as contemplated by the Elevation Stockholders Agreement, Mr. Anderson and Mr. McNamee were elected as directors to fill newly-created seats on our board. Each of Mr. Anderson and Mr. McNamee is a manager of each of Elevation LLC and Elevation Management. Elevation LLC is the sole general partner of Elevation GP, which is the sole general partner of Elevation Partners. Elevation Management is the sole managing member of Side Fund.

In connection with the sale of our Series B Preferred Stock to Elevation, we made the following payments in 2005:

| (i) | a $1,000,000 million transaction fee to Elevation Management; |

| | |

| (ii) | a $163,765 payment to Elevation Management to reimburse it for professional fees it paid to consultants and travel expenses associated with the due diligence investigation of us conducted on behalf of Elevation in connection with the purchase of our Series B Preferred Stock; and |

| | |

| (iii) | direct payments in an aggregate amount of $1,157,812 to a law firm and an accounting firm for legal and accounting fees and expenses incurred in connection with services rendered by each of them to Elevation in connection with the purchase of our Series B Preferred Stock. |

Loans to and Transactions with Executive Officers

As part of an employment agreement entered into in 2002, we reimburse Mr. Long for the actual and reasonable fixed operating costs and the actual and reasonable business related variable operating costs of an airplane that is owned indirectly by him. Total reimbursement for usage in 2005 was approximately $1.68 million.

24

REPORT OF THE AUDIT COMMITTEE

To The Board of Directors:

The Audit Committee of the Board of Directors of Homestore, Inc. (the “Company”) reviewed and discussed the audited financial statements for the year ended December 31, 2005 with Company management and with Ernst & Young LLP, the Company’s independent registered public accounting firm. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as then in effect. The Audit Committee received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as then in effect, and has discussed with the auditors their independence. Based on the review and discussions described in this Report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission.

The written charter of the Audit Committee reflecting amendments made to the charter by the Board of Directors in 2006 is included as Appendix A to the Company’s proxy statement in which this Report is to be included.

| By the Audit Committee

of the Board of Directors |

| |

| Kenneth K. Klein, Chairman |

| V. Paul Unruh |

| Bruce G. Willison |

INDEPENDENT AUDITORS

The Audit Committee has retained Ernst & Young as our independent certified public accountants to audit the our consolidated financial statements for the year ending December 31, 2006. Representatives of Ernst & Young are expected to be present at the annual meeting, with the opportunity to make a statement should they desire to do so, and to be available to respond to questions, as appropriate.

Fees Billed for Services Rendered by Independent Auditors

Ernst & Young LLP (“Ernst & Young”) served as the Company’s principal independent accountants to audit the Company’s financial statements for the fiscal years ended December 31, 2004 and December 31, 2005. The fees billed in the fiscal years ended December 31, 2004 and December 31, 2005 for Ernst & Young’s services to us were:

| | Year ended

December 31, 2004 | | Year ended

December 31, 2005 | |

| |

|

| |

|

| |

Audit Fees (1) | | $ | 2,892,000 | | $ | 1,956,000 | |

Audit-Related Fees (2) | | | — | | | — | |

Tax Fees (3) | | | 94,000 | | | 253,000 | |

All Other Fees (4) | | | — | | | — | |

| |

|

| |

|

| |

Total Fees | | $ | 2,986,000 | | $ | 2,209,000 | |

| |

|

| |

|

| |

|

(1) | “Audit fees” are fees billed by the independent auditors for professional services for the audit of the consolidated financial statements included in our Form 10-K and review of financial statements included in our Form 10-Qs, or for services that are normally provided by the auditors in connection with statutory and regulatory filings or engagements. |

25

(2) | “Audit-related fees” are fees billed by the independent auditors for assurance and related services that are reasonably related to the performance of the audit or review of the financial statements, and are not reported under audit fees. |

| |

(3) | “Tax fees” are fees billed by the independent auditors for professional services for tax compliance, tax advice, and tax planning. |

| |

(4) | “All other fees” are fees billed by the independent auditors to the Company for any services not included in the first three categories, and include fees for accounting services provided to us and in connection with our response to inquires from the SEC. |

The audit committee’s policy is to approve in advance all audit and permitted non-audit services provided by the independent accountant. In 2005, the audit committee approved in advance any services provided by the independent auditors and the related fees. Those services only involved accounting consultation and general corporate tax services. In addition, in December 2003, the audit committee authorized the committee’s audit committee financial expert to pre-approve on behalf of the audit committee permitted auditing and non-auditing services of $50,000 or less to be provided by Ernst & Young or any other accounting services firms, with the audit committee financial expert to report each pre-approval of services to the full committee at its next scheduled meeting after such pre-approval.

None of the audit and non-audit services described above were approved by the audit committee pursuant to the waiver of pre-approval provisions set forth in applicable rules of the SEC.

26

REPORT OF THE MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE

To The Board of Directors:

The Management Development and Compensation Committee (the “Committee”) of the Board of Directors of Homestore, Inc. (the “Company”) makes final decisions regarding compensation and grants of incentive and equity awards to executive officers and directors.

General Compensation Policy

The Committee acts on behalf of the board of directors to establish the general compensation policy of the Company. The Committee reviews base salary levels, target bonuses, and other elements of compensation for the chief executive officer (“CEO”) and other executive officers of the Company each year. The Committee also administers the Company’s incentive and equity plans, including the Company’s 1999 Stock Incentive Plan and 2002 Stock Incentive Plan. The Committee believes that, to help the Company become a strong, profitable, and attractive enterprise, a proper combination of cash and equity compensation provides the best incentive to attract talented management, encourage outstanding performance and align management and stockholder interests.

The Committee’s philosophy in compensating executive officers of the Company is to relate compensation to corporate, business unit and individual performance, and increases in shareholder value, while providing a total compensation package that is competitive and enables the Company to attract, motivate, reward and retain key executives and employees. Consistent with this philosophy, annual salary adjustments and the cash incentive component of executive officer compensation is determined after a review of the Company’s and individual’s performance for the previous year. The long-term equity incentives for executive officers may be stock options and/or restricted stock granted under the Company’s stock incentive plans. In order to ensure that the compensation program is competitive and appropriate, the Committee has from time to time retained an independent consulting firm to review the compensation policy for Company executives and to compare it to executive compensation provided by other companies considered comparable to the Company in terms of size, type of business, performance, position and compensation philosophy. The Committee also uses salary surveys obtained from time to time for reference purposes, but it does not target salaries to a specific level of comparable compensation.

2005 Executive Compensation

Executive compensation for 2005 included base salary, cash bonuses, and stock option grants. Base salaries for the Company’s executive officers are evaluated annually and are based on the executive’s contribution to Company performance, level of responsibility, experience and breadth of knowledge. In the second quarter of 2005, the Committee approved a bonus plan for 2005 for the Company’s executives for performance based on the following measures: Company results of operations, Company financial position, and the executive’s individual contribution to the Company’s results.

The Company in the past has relied heavily on long-term equity-based compensation to compensate and incentivize its executive officers. In 2005, stock options were granted to certain executive officers to aid in retaining them and to align their interests with those of the stockholders. Stock options typically have been granted to executive officers when the executive first joins the Company, in connection with a significant change in responsibilities and periodically to achieve equity within the executive’s peer group and comparable companies. The number of shares subject to options granted is within the discretion of the Committee and is based on the executive’s anticipated future contribution to corporate and/or business unit results, past performance, and work consistency within the executive’s peer group.

2005 CEO Compensation

As described in the section of the Company’s proxy statement in which this Report is to be included entitled “Employment-Related Agreements,” the Company entered into an employment agreement with Mr. Long with respect to his services as CEO commencing in January 2002. The Committee’s executive compensation philosophy described above applies in all respects to Mr. Long. The Committee believes that Mr. Long’s base salary for 2005,

27

$500,000, was commensurate with the compensation paid to chief executive officers with similar experience at comparable companies. Mr. Long was awarded a $775,000 cash bonus for 2005 related to his continuing contributions to the Company’s restructuring and integration efforts, achievement of the Company’s first calendar year of positive net income and the achievement of individual performance objectives set by the Committee.

Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code of 1986, as amended, disallows the deduction for certain compensation in excess of $1 million paid to certain executive officers of the Company, unless the compensation qualifies as “performance-based” as defined in the Code and applicable regulations. In order to maintain flexibility, the Committee reserves the discretion to determine whether to seek to comply with the requirements of 162(m) based on the goals and objectives established by the Committee. The Company believes that stock options granted in 2005 satisfy the requirements for “performance-based compensation,” but all other compensation of executives in 2005 was subject to the Section 162(m) limits on deductibility.

| By the Management Development and Compensation Committee of the Board of Directors |

| |

| |

| Bruce G. Willison, Chairman |

| Joe F. Hanauer |

Compensation Committee Interlocks and Insider Participation

As of January 1, 2005, the management development and compensation committee was composed of three non-employee directors, Messrs. Hanauer, Doerr and Willison, none of whom have any interlocking relationships as defined by the SEC. In March 2005, Mr. Doerr resigned from the management development and compensation committee. During the remainder of 2005, this committee was composed of Messrs. Hanauer and Willison, who are the current members of this committee.

28

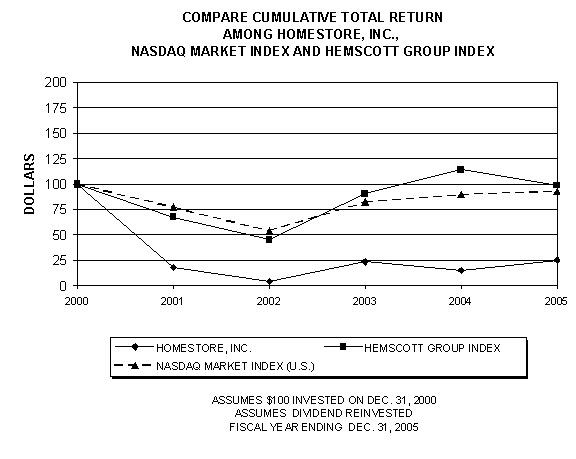

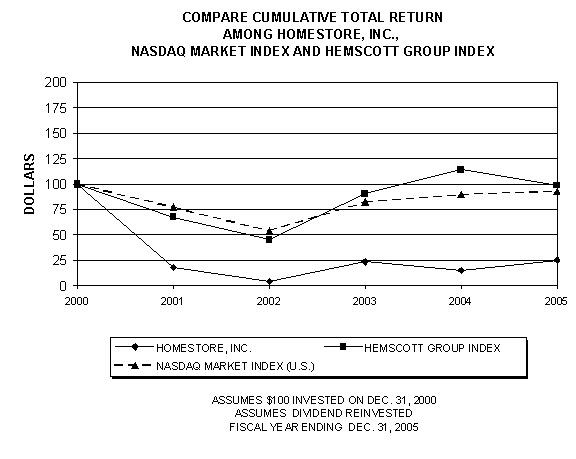

STOCK PERFORMANCE GRAPH

The following graph compares, for the period beginning December 29, 2000 through December 30, 2005, during which our common stock has been registered under Section 12 of the Exchange Act (including the period from November 18, 2002 through January 2, 2004 during which our common stock was listed on the NASDAQ SmallCap Market), the cumulative total stockholder return for our common stock, The NASDAQ National Market Index (U.S. Companies), and the Hemscott Group Index (formerly Media General’s Internet and Software Services Index). The results reflected in the graph assume the investment of $100 on December 31, 2000 in our common stock and those indices and reinvestment of dividends by those companies that paid dividends. The information contained in this graph was prepared by Hemscott, Inc.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and beneficial owners of more than 10% of our common stock (the “Reporting Persons”), to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Reporting Persons are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of Section 16(a) reports received or written representations from certain Reporting Persons, we believe that all reporting requirements under Section 16(a) for the fiscal year ended December 31, 2005 were met in a timely manner by the Reporting Persons.

29

STOCKHOLDER PROPOSALS FOR THE 2007 ANNUAL MEETING OF STOCKHOLDERS

Proposals of stockholders that are intended to be presented at our 2007 annual meeting must be received by us no later than January 24, 2007 in order that they may be included in the proxy statement and form of proxy relating to that meeting. Notice of a stockholder-sponsored proposal submitted outside of the process of Rule 14a-8 under the Exchange Act (i.e., a proposal to be presented at the 2007 annual meeting of stockholders but not submitted for inclusion in our proxy statement) will be considered untimely under our bylaws unless it is received between March 24, 2007 and April 23, 2007.

OTHER MATTERS

We know of no other matters to be submitted to the stockholders at the annual meeting. If any other matters properly come before the stockholders at the annual meeting, it is the intention of the persons named on the enclosed proxy card to vote the shares they represent as the board may recommend.

ADDITIONAL INFORMATION

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, as well as our proxy statements and other information, with the Securities and Exchange Commission, or SEC. A copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2005 accompanies this proxy statement. In most cases, those documents are available, without charge, on our website at http://ir.move.com as soon as reasonably practicable after they are filed electronically with the SEC. Copies are also available, without charge, from Homestore, Inc., Investor Relations, 30700 Russell Ranch Road, Westlake Village, CA 91362. You may also read and copy these documents at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549 under our SEC file number (000-26659), and you may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. In most cases, these documents are available over the Internet from the SEC’s web site at http://www.sec.gov.

30

Appendix A

HOMESTORE, INC.

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

I. Purpose

The purpose of the Audit Committee (the “Committee”) of the Board of Directors (the “Board”) of Homestore, Inc. (the “Company”) is to assist the Board in fulfilling its statutory and fiduciary oversight responsibilities relating to the Company’s financial accounting, reporting and controls. In particular, the Committee’s purpose is to assist Board oversight of (1) the integrity of the Company’s financial statements, (2) the Company’s compliance with legal and regulatory requirements, (3) the independent auditors’ qualifications and independence and (4) the performance of the Company’s internal audit staff and independent auditors.

As such, the Committee shall have the following primary responsibilities: (a) to independently and objectively monitor the periodic reporting of the Company’s financial condition and results of operations; (b) to monitor reviews of the adequacy of the accounting and financial reporting processes and systems of internal control conducted by the Company’s independent auditors and financial and senior management; (c) to review and evaluate the independence and performance of the Company’s independent auditors; (d) to retain and manage the relationship with the Company’s independent auditors; and (e) to facilitate communication among the Company’s independent auditors, internal auditors, management and the Board, within the scope of this Charter of the Audit Committee of the Board of Directors (the “Charter”) and consistent with the Certificate of Incorporation and Bylaws of the Company, as the Committee deems necessary or appropriate. The Committee will fulfill these functions primarily by carrying out the activities enumerated in Part IV of this Charter. In order to serve these functions, the Committee shall have unrestricted access to Company personnel (including its legal and financial advisors) and documents and shall have authority to direct and supervise an investigation into any matters within the scope of its duties, including the power to retain outside counsel or other advisors in connection with any such investigation.

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete, accurate and prepared in accordance with generally accepted accounting principles or to certify the Company’s financial statements. Those processes and determinations are the responsibility of management and/or the Company’s independent auditors. Similarly, it is not the duty of the Committee to conduct investigations or to assure the compliance of the Company’s policies and procedures with applicable laws and regulations.

II. Membership

All members of the Committee will be appointed by the Board based on the recommendation of the Company’s Governance and Nominating Committee. Further, all Committee members shall be members of, and serve at the discretion of, the Board. Unless a chairperson (“Chairperson”) is appointed by the full Board, the members of the Committee may designate a Chairperson by majority vote of the Committee membership. The Board may at any time remove one or more directors as members of the Committee and may fill any vacancy on the Committee.

The Committee shall consist of at least three, but no more than five members, with the exact number being determined by the Board. No member of the Committee shall be an officer, employee or consultant of the Company or any subsidiary or have any other relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Committee member. Each member of the Committee shall be “independent” as defined by applicable law, SEC rules and regulations, and the rules of the NASDAQ, each as they may be interpreted and amended from time to time, as well as other legal requirements applicable to the Company (“Applicable Law, Rules and Regulations”), except as otherwise permitted by Applicable

A-1

Law, Rules and Regulations and as determined by the Board’s independence review process. Each member of the Committee shall have the ability to read and understand fundamental financial statements and a working familiarity with basic finance and accounting principles at the time he or she joins the Committee, and at least one member shall have met the requirements of an “audit committee financial expert” as required by Applicable Law, Rules and Regulations. No member of the Committee shall have been a partner or employee of the Company’s independent auditors, or former partner or former employee of such auditors, for a period of three years after that person’s employment with such auditors terminates and no member of the Committee shall have participated in the preparation of the financial statements of the Company or of any current subsidiary of the Company at any time during the past three years.

III. Meetings

The Committee shall meet with such frequency, and at such times as its Chairperson, or a majority of the Committee, or the Board, determines or as frequently as required by Applicable Law, Rules and Regulations; provided, however, that the Committee shall meet no less frequently than once per quarter. The Committee may establish rules and procedures for the conduct of its meetings that are consistent with this Charter. A majority of the members of the Committee shall constitute a quorum. When a quorum is present at any meeting, a majority of the Committee members present may take any action or make any recommendation to the Board, except where otherwise required by Applicable Law, Rules and Regulations. Written minutes should be kept of all such meetings of the Committee.

The Committee shall report its activities and recommendations to the Board at the Board’s next scheduled meeting or as otherwise appropriate, including through the preparation of a quarterly written report to the Board summarizing the Committee’s activities, conclusions, and recommendations, which report shall include, but not be limited to, the information required in the Company’s annual proxy statement and/or annual report. The Committee members, or the Chairperson of the Committee on behalf of all of the Committee members, should communicate with management, internal auditors and the independent auditors on a quarterly basis in connection with their review of the Company’s financial statements. The Committee must disclose that (1) each member has met, and continues to meet, the independence and other Committee membership requirements; (2) it has adopted a written charter; and (3) it has annually reviewed and reassessed the adequacy of its charter. The Committee shall disclose in the Company’s proxy statement that the Committee is governed by a charter and include a copy of the charter in the proxy statement at least once every three years.

IV. Responsibilities and Duties

The following shall be the principal recurring processes of the Committee in carrying out its oversight responsibilities. These processes are set forth as a guide, with the understanding that the Committee may supplement them as appropriate and may establish other policies and procedures from time to time that it deems necessary or advisable in fulfilling its responsibilities. To these ends, the Committee shall have and may exercise all of the powers and authority of the Board to the extent permitted under the Delaware General Corporation Law.

Oversight of Financial Statements and Disclosure Practices

1. | Review the independent auditors’ audit plan and discuss with the independent auditors the Company’s general accounting policies and practices. |

| |

2. | Discuss with the independent auditors: all critical accounting policies and practices to be used; all alternative treatments within generally accepted accounting principles for policies and practices related to material items that have been discussed with management, including ramifications of the use of such alternative disclosures and treatments and the treatment preferred by the independent auditors; other material written communications between the independent auditors and management, such as any management letter or schedule of unadjusted differences; and any other matter that generally accepted accounting standards require that the independent auditors should communicate with the Committee. |

A-2

3. | At least quarterly, meet separately with management, the independent auditors, and the internal audit staff (or other personnel responsible for the internal audit function) to review the adequacy and appropriateness of the Company’s accounting and financial reporting processes, systems of internal control (including computerized information system controls and security), the adequacy of the systems of reporting to the Committee by each such group and any recommendations that each such group may have, the fullness and accuracy of the Company’s financial statements, and any other matters that the Committee or any such group believes should be discussed privately with the Committee. |

| |

4. | Review with the independent auditors and the internal audit staff the completeness of audit coverage, reduction of redundant efforts, and the effective use of audit resources. |

| |

5. | Determine, as regards to new transactions or events, the independent auditors’ reasoning for the appropriateness of the accounting principles and disclosure practices adopted by management. |

| |

6. | Discuss with management and the independent auditors the effect of regulatory and accounting initiatives, as well as any off-balance sheet structures, on the Company’s financial statements. |

| |

7. | Discuss with management and the independent auditors, as appropriate, the Company’s risk assessment and risk management policies, including the Company’s major financial risk exposures and steps taken by management to monitor and control such exposures. |

| |

8. | Determine open years on federal, state and local tax returns and whether there are any significant items in dispute with the Internal Revenue Service or state or local taxing authorities that might result or have resulted in litigation; inquire as to the status of related tax reserves and interest accruals. |

| |

9. | Review the results of the annual audits of Committee member reimbursements, directors’ and officers’ expense accounts and management perquisites as prepared by internal audit staff and the independent auditors. |

| |

10. | Review whether management has sought a second opinion regarding any significant accounting issue and, if so, obtain the rationale for the particular accounting treatment chosen. |

| |

11. | Review, and discuss with management and the independent auditors, as appropriate, the Company’s quarterly and annual financial statements, including any report or opinion of the independent auditors, and earnings press releases (including the Company’s use of “pro-forma” or “adjusted” non- GAAP financial information), as well as financial information and earnings guidance provided to analysts and ratings agencies, prior to distribution to the public or filing with the Securities and Exchange Commission. |

| |

12. | In connection with the Committee’s review of the annual financial statements: |

| |

| • | Receive and review a draft of the financial statements section of the Company’s annual report, complete with footnotes, and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the report. |

| | |

| • | Discuss with the independent auditors, internal auditors and management the financial statements section, including the results of the independent auditors’ audit of the financial statements, and the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| | |

| • | Discuss any items required to be communicated by the independent auditors in accordance with Statement of Accounting Standards (“SAS”) 61, as amended. These discussions should include the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles, the reasonableness of significant judgments, the clarity of the disclosures in the Company’s financial statements, any audit problems or difficulties, including any restrictions on the scope of work or access to required information, and management’s response to these matters. |

A-3

| • | Discuss with management and/or the independent auditors any questions or concerns pertaining to the fullness and accuracy of the Company’s financial statements and any other matters the Committee believes should be so discussed. |

| | |

13. | In connection with the Committee’s review of the quarterly financial statements: |

| |

| • | Receive and review a draft of the financial statements section of the Company’s quarterly reports, complete with footnotes, and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the reports. |

| | |

| • | Discuss with the independent auditors, internal auditors and management the financial statements section, including the results of the independent auditors’ SAS 71 review of the quarterly financial statements, and the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| | |

| • | Discuss significant issues, events and transactions and any significant changes regarding accounting principles, practices, judgments or estimates with management and the independent auditors, including any problems or difficulties among management and the independent auditors and management’s response. |

| | |

| • | Discuss with management and/or the independent auditors any questions or concerns pertaining to the fullness and accuracy of the Company’s financial statements and any other matters the Committee believes should be so discussed. |

| | |

14. | Review the Company’s disclosure controls and procedures and internal controls and procedures for financial reporting and the certifications required to be made by any officer of the Company in each of the Company’s quarterly reports on Form 10-Q and the Company’s annual report on Form 10-K. |

| |

15. | Review disclosures made to the Committee by the Company’s principal executive officer and principal financial officer during their certification process for each Form 10-K and Form 10-Q relating to any significant deficiencies in the design or operation of internal controls or material weaknesses therein and any fraud involving management or other employees who have a significant role in maintaining the Company’s internal controls. |

| |

16. | Request a letter from the independent auditors to management concerning any significant weaknesses or breaches in internal controls discovered during their audit. Discuss any comments or recommendations of the independent auditors outlined in their such management letter or in discussions. Review any management response letters to the independent auditors. Approve a schedule for implementing any recommended changes and monitor compliance with that schedule. |

| |

Oversight of Independent Auditors |

|

1. | With sole authority and responsibility, the Committee shall appoint, retain, compensate and, if necessary, replace the independent auditors. The Committee shall be directly responsible for the evaluation and oversight of the work of the Company’s independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company; provided, that the Committee shall be prohibited from retaining independent auditors if any member of the Company’s senior management was a partner or employee of such auditors within the prior two years. The Board of Directors may approve a waiver of the preceding proviso if (a) the Company acquires a member of senior management who was a partner or employee of a retained independent auditing firm as a result of a future acquisition or (b) if necessary to permit competition for retention by at least two national independent auditing firms. With sole authority, the Committee shall approve all audit engagement fees and terms, which fees and related costs the Company shall pay promptly to the independent auditors in accordance with the Company’s normal business practices. The Committee shall pre-approve, including pursuant to established policies and procedures for pre-approval, or have pre-approved by a member of the Committee delegated the authority to grant pre-approvals, any audit or significant permitted non-audit service provided to the Company by the Company’s independent auditors and ensure that any such non-audit service be disclosed to stockholders in the appropriate periodic report of the Company. If a member of the Committee pre-approves such service, the decisions of such member shall be presented to the full Committee at its next scheduled meeting. No such services that are prohibited under applicable law shall be approved. The Company shall not be prohibited from retaining the independent auditors to assist in tax matters. |

A-4

2. | Communicate with the Company’s independent auditors about the Company’s expectations regarding its relationship with the auditors, including the following: (i) the independent auditors’ ultimate accountability to report directly to the Committee; and (ii) the ultimate authority and responsibility of the Committee to appoint, retain, compensate, evaluate and, where appropriate, replace the independent auditors. |

| |

3. | At least annually, make inquiries of management and internal auditor staff regarding the qualification, independence and performance of the independent auditors. |

| |

4. | At least annually, obtain and review a report by the independent auditors describing: the independent auditors’ internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the independent auditors, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the independent auditors, and any steps taken to deal with any such issues; and (to assess the independent auditors’ independence) all relationships between the independent auditors and the Company. |

| |

5. | Review and approve processes and procedures to ensure the continuing independence of the Company’s independent auditors. These processes shall include obtaining and reviewing, on an annual basis, a letter from the independent auditors describing all relationships between the independent auditors and the Company required to be disclosed by Independence Standards Board Standard No. 1, reviewing the nature and scope of such relationships and requiring discontinuance of any relationships that the Committee believes could compromise the independence of the auditors (including but not limited to requiring audit partner rotation every five years or otherwise in accordance with Applicable Laws, Rules and Regulations and requiring that the independent auditors have no conflicts of interests with the Company), and setting clear Company hiring policies for employees or former employees of the independent auditors, which shall include, among other policies, prohibitions on the hiring of any partner or employee of the Company’s independent auditors, or former partner or former employee of such auditors, for a period of three years after that person’s employment with such auditors terminates, to serve as a member of management in the finance and accounting department of the Company. |

| | |

Oversight of Internal Auditors |

|

1. | Review the activities of the internal audit department, including the proposed annual audit plan, periodic progress reports on the status of the plan and all concluded internal audits, including summaries of any significant issues raised during the performance of the internal audits. |

| |

2. | Discuss with the independent auditors and management the internal audit department responsibilities, budget and staffing and any recommended changes in the planned scope of the internal audit function. |

| |

Oversight of Compliance with Legal and Regulatory Requirements |

|

1. | At least quarterly, meet with the Company’s external and internal legal counsel to review the status of any legal or regulatory matters that could have a material impact on the Company’s financial statements; inquire as to any related reserves taken with respect thereto. |

| |

2. | Review all related-party transactions for potential conflict of interest situations on an ongoing basis and approve only those that are the subject of arms length negotiations and have terms that would be no worse than those that could be obtained by negotiating with an outside party. Review all transactions with the National Association of Realtors® and the National Association of Homebuilders with a value in excess of one million dollars. |

A-5

3. | Engage and retain such outside counsel, experts and other advisors as the Committee may deem appropriate or necessary to carry out its duties in its sole discretion. Approve related fees and retention terms, which fees and related costs the Company shall pay promptly to such advisors in accordance with the Company’s normal business practices. To the extent that the Committee chooses to retain such advisors to investigate any circumstances that come to the attention of the Committee related to the risk of financial misstatements or fraud, such advisors shall be persons completely independent of the Company. |

| |

4. | Determine and approve ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties, which fees and related costs the Company shall pay promptly in accordance with the Company’s normal business practices. |

| |

5. | Establish and maintain procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| |

6. | Review compliance by directors, officers and employees with the Company’s Code of Conduct and Business Ethics, including the Policies and Procedures for Reporting by Attorneys Pursuant to the Sarbanes-Oxley Act Standards of Professional Conduct addendum thereto. |

| |

7. | Annually conduct and present to the Board a performance evaluation of the Committee and make recommendations to the Board on such matters within the scope of its functions as may come to its attention and which in its discretion warrant consideration by the Board. |

| |

8. | Annually prepare a report to the Company’s stockholders for inclusion in the Company’s annual proxy statement as required by the rules and regulations of the Securities and Exchange Commission as they may be amended from time to time. |

| |

9. | At least annually review the adequacy of this Charter and recommend any proposed changes to the Board for approval. Include a copy of this Charter as an appendix to the Company’s proxy statement at least once every three years as required by the rules and regulations of the Securities and Exchange Commission as they may be amended from time to time. |

| |

10. | Perform any other activities required by Applicable Law, Rules and Regulations and perform other activities that are consistent with this Charter, the Company’s Bylaws and governing laws, as the Committee or the Board deems necessary or appropriate. |

| |

11. | Implement and enforce, together with the Company’s Chief Executive Officer and Chief Financial Officer, a revenue recognition policy at the Company that conforms to all relevant accounting standards, including generally accepted accounting principles in the United States, and that is designed to prevent material misstatements and omissions in the Company’s financial statements. Fully apprise all employees of the Company involved in revenue recognition of such revenue recognition policy. |

In addition to the indemnification, exculpation and similar rights and provisions contained in the Company’s Certificate of Incorporation and Bylaws or in statutory and common law and in addition to applicable insurance, the Committee, and each member of the Committee in his or her capacity as such, shall be entitled to rely, in good faith, on information, opinions, reports or statements, or other information prepared or presented to them by (i) officers and other employees of the Company, whom such member believes to be reliable and competent in the matters presented; and (ii) counsel, public accountants or other persons as to matters which the members believe to be within the professional competence of such person.

A-6

| | | | | | | | Please

Mark Here

for Address

Change or

Comments | o |

| | | | | | | | SEE REVERSE SIDE |

| | | | | | | | Please mark

your votes as

indicated in

this example | x |

| | | | | | | | FOR | AGAINST | ABSTAIN |

1. | ELECTION OF

DIRECTORS

NOMINEES:

01 V. Paul Unruh and

02 Bruce G. Willison | FOR all nominees listed

to the left (except as

indicated to the contrary)

o | WITHHOLD AUTHORITY

to vote for all nominees

listed to the left

o | | 2. | APPROVAL OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION. Approval of an amendment to the Restated Certificate of Incorporation to change the Company’s name from “Homestore, Inc.” to “Move, Inc.” | | o | o | o |

| | | | | | |

(INSTRUCTIONS: To withhold authority to vote for any individual

nominee write the name of that nominee in the space below.) | | 3. | OTHER BUSINESS. In their discretion, the Proxy Holders are authorized to vote upon such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof. The board of directors of Homestore currently knows of no other business to be presented by or on behalf of Homestore or the board at the annual meeting. |

| | |

| | | The undersigned hereby ratifies and confirms that all the Proxy Holders, or any of them, or their substitutes, shall lawfully do or cause to be done by virtue hereof, and hereby revokes any and all proxies heretofore given by the undersigned to vote at the Annual Meeting. The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders, the Proxy Statement accompanying that notice and the audited financial statements of Homestore delivered with or prior to that notice. |

| | | | | YES | NO | |

| |

| Will you be attending

the annual meeting? | | o | o | |

| (Please Print Name)___________________________________________(Signature of Holder of Common Stock)_____________________________Dated__________2006 |

| (Please date this Proxy and sign above as your name(s) appear(s) on this card. Joint owners each should sign personally. Corporate proxies should be signed by an authorized officer. Executors, administrators, trustees, etc. should give their full titles). |

|

FOLD AND DETACH HERE FOLD AND DETACH HERE

|

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Internet | | Telephone | | Mail |

| |

| |

|

http://www.proxyvoting.com/homs | OR | 1-866-540-5760 | OR | Mark, sign and date your proxy card and return it in the enclosed postage-paid envelope. |

Use the internet to vote your proxy. Have your proxy card in hand when you access the web site. | Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

HOMESTORE, INC.

PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 22, 2006

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

| The undersigned holder(s) of Homestore, Inc. (“Homestore”) common stock hereby nominate(s), constitute(s) and appoint(s) Lewis R. Belote, III and Michael R. Douglas (together, the “Proxy Holders”), and each of them, the attorneys, agents and proxies of the undersigned, with full power of substitution to each, to attend and act as proxy or proxies of the undersigned at the annual meeting of stockholders (the “Annual Meeting”) of Homestore to be held at the Hilton Los Angeles Airport located at 5711 West Century Blvd., Los Angeles, California 90045-5631 on June 22, 2006 at 10:30 a.m., local time, or any postponement or adjournment thereof, and to vote as specified herein the number of shares which the undersigned, if personally present would be entitled to vote. | |

| | |

| The board recommends a vote FOR the election of the directors nominated by the board and FOR the approval of the Amendment to the Restated Certificate of Incorporation. The proxy when properly executed shall be voted as directed. If no direction is made regarding the election of directors, the proxy will be voted FOR the election of the directors nominated by the board; if no direction is made regarding approval of the Amendment to the Restated Certificate of Incorporation, the proxy will be voted FOR the approval of the Amendment to the Certificate of Incorporation. | |

(Continued and to be marked, dated and signed, on the other side)

Address Change/Comments (Mark the corresponding box on the reverse side) |

|

|

FOLD AND DETACH HERE FOLD AND DETACH HERE

|

FOLD AND DETACH HERE

FOLD AND DETACH HERE