Q1 2019 Financial Results May 2, 2019

Safe Harbor Statement The adjusted GAAP and GAAP earnings per share goals, as well as effective income tax rate and fully diluted shares for 2019, outlined in this presentation are estimates of future company performance and are forward-looking statements within the meaning of the securities laws. These forward-looking statements are subject to risk and uncertainties and are based on management's current expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from management's current expectations and the forward-looking statements made in this presentation. These risks and uncertainties include, but are not limited to, the possibility that our actual results do not meet the projections and guidance contained in this presentation, the impact of the general economy and economic and political uncertainty on our business; potential changes to federal, state, local and foreign laws, regulations, and policies; client demand for our services and solutions; maintaining a balance of our supply of skills and resources with client demand; effectively competing in a highly competitive market; protecting our clients’ and our data and information; risks from international operations including fluctuations in exchange rates; changes to immigration policies; obtaining favorable pricing to reflect services provided; adapting to changes in technologies and offerings; risk of loss of one or more significant software vendors; making appropriate estimates and assumptions in connection with preparing our consolidated financial statements; maintaining effective internal controls; changes to tax levels, audits, investigations, tax laws or their interpretation; risks associated with managing growth organically and through acquisitions; risks associated with servicing our debt, the potential impact on the value of our common stock from the conditional conversion features of our debt and the associated convertible note hedge transactions; legal liabilities, including intellectual property protection and infringement or the disclosure of personally identifiable information; and the risks detailed from time to time within our filings with the Securities and Exchange Commission, including the most recent Form 10-K and Form 10-Q. 2

Reconciliation of Adjusted GAAP Measures The following table provides a reconciliation of Perficient, Inc. GAAP EPS guidance to Adjusted EPS guidance: Q2 2019 Full Year 2019 Low end of High end of Low end of High end of adjusted goal adjusted goal adjusted goal adjusted goal GAAP EPS $ 0.22 $ 0.25 $ 0.90 $ 1.02 Non-GAAP adjustment (1): Non-GAAP reconciling items 0.30 0.30 1.18 1.18 Tax effect of reconciling items (0.06) (0.06) (0.28) (0.28) Adjusted EPS $ 0.46 $ 0.49 $ 1.80 $ 1.92 (1) Non-GAAP adjustment represents the impact of amortization expense, stock compensation, amortization of debt discount and issuance costs, acquisition costs, and adjustments to fair value of contingent consideration, net of the tax effect of these adjustments, divided by fully diluted shares. Perficient currently expects its Q2 2019 and full year 2019 GAAP effective income tax rate to be approximately 28% and 24%, respectively. The Company's estimates of fully diluted shares for 2019, by quarter, are included in the following table. These estimates could be affected by share repurchases and shares issued in conjunction with future acquisitions. Q1 Actual Q2 Q3 Q4 Full Year Fully Diluted Shares for 2019 (in millions) 32.2 31.9 31.8 31.8 32.0 Note further discussion and reconciliation of Perficient, Inc. non-GAAP financial measures can be found in our earnings press release and Form 8-K furnished May 2, 2019. 3

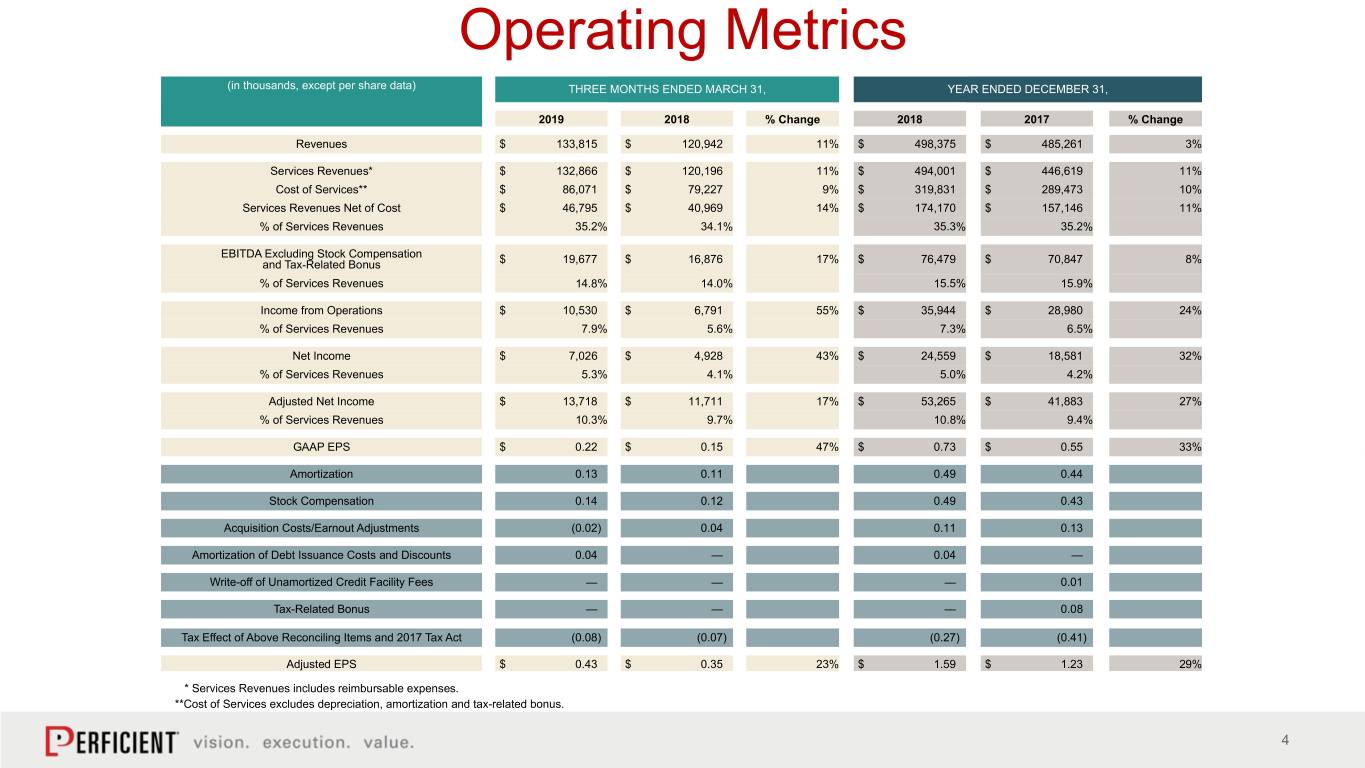

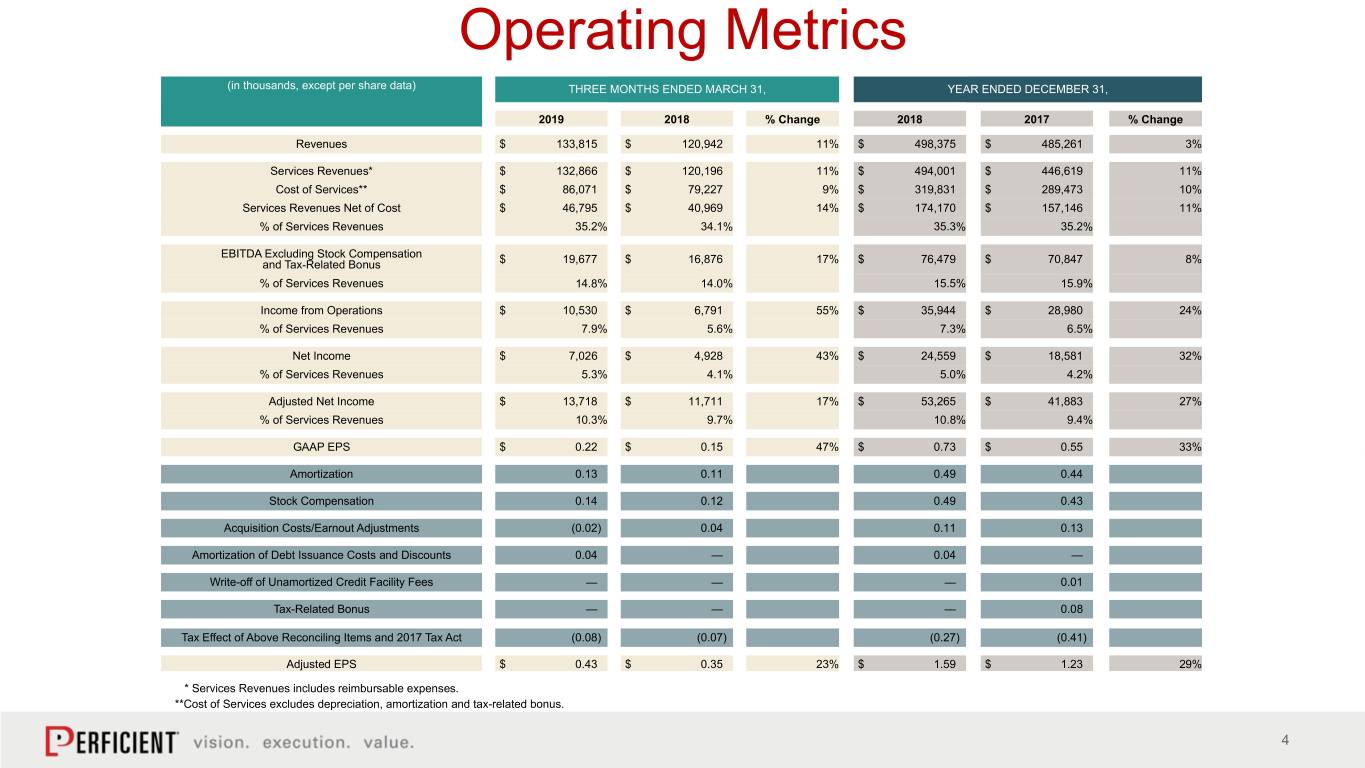

Operating Metrics (in thousands, except per share data) THREE MONTHS ENDED MARCH 31, YEAR ENDED DECEMBER 31, 2019 2018 % Change 2018 2017 % Change Revenues $ 133,815 $ 120,942 11% $ 498,375 $ 485,261 3% Services Revenues* $ 132,866 $ 120,196 11% $ 494,001 $ 446,619 11% Cost of Services** $ 86,071 $ 79,227 9% $ 319,831 $ 289,473 10% Services Revenues Net of Cost $ 46,795 $ 40,969 14% $ 174,170 $ 157,146 11% % of Services Revenues 35.2% 34.1% 35.3% 35.2% EBITDA Excluding Stock Compensation and Tax-Related Bonus $ 19,677 $ 16,876 17% $ 76,479 $ 70,847 8% % of Services Revenues 14.8% 14.0% 15.5% 15.9% Income from Operations $ 10,530 $ 6,791 55% $ 35,944 $ 28,980 24% % of Services Revenues 7.9% 5.6% 7.3% 6.5% Net Income $ 7,026 $ 4,928 43% $ 24,559 $ 18,581 32% % of Services Revenues 5.3% 4.1% 5.0% 4.2% Adjusted Net Income $ 13,718 $ 11,711 17% $ 53,265 $ 41,883 27% % of Services Revenues 10.3% 9.7% 10.8% 9.4% GAAP EPS $ 0.22 $ 0.15 47% $ 0.73 $ 0.55 33% Amortization 0.13 0.11 0.49 0.44 Stock Compensation 0.14 0.12 0.49 0.43 Acquisition Costs/Earnout Adjustments (0.02) 0.04 0.11 0.13 Amortization of Debt Issuance Costs and Discounts 0.04 — 0.04 — Write-off of Unamortized Credit Facility Fees — — — 0.01 Tax-Related Bonus — — — 0.08 Tax Effect of Above Reconciling Items and 2017 Tax Act (0.08) (0.07) (0.27) (0.41) Adjusted EPS $ 0.43 $ 0.35 23% $ 1.59 $ 1.23 29% * Services Revenues includes reimbursable expenses. **Cost of Services excludes depreciation, amortization and tax-related bonus. 4

Operating Metrics (in thousands) Q1 2019 Q4 2018 % Change Q1 2019 Q1 2018 % Change Services Revenue (including reimbursable expenses) $ 132,866 $ 130,015 2 % $ 132,866 $ 120,196 11% Software and Hardware Revenue $ 949 $ 1,687 (44)% $ 949 $ 746 27% Time & Materials ABR Q1 2019 Q4 2018 North American Employees $147 $146 Utilization Q1 2019 Q4 2018 North American Employees (Organic) 81% 80% Headcount Q1 2019 Q4 2018 Average Ending Average Ending North American Billable Employees 1,910 1,927 1,850 1,867 Subcontractors 267 289 247 239 Offshore Billable Employees 721 740 686 689 Total Billable Headcount 2,898 2,956 2,783 2,795 SG&A Headcount 519 525 493 504 Total Headcount 3,417 3,481 3,276 3,299 5

Solutions Data Revenue by Solution (Top 10) Q1 2019 Q4 2018 Q1 2018 Analytics 16% 12% 10% Custom Applications 15% 16% 15% Management Consulting 14% 15% 14% Commerce 9% 10% 11% Content Management 8% 8% 10% Portals/Collaboration 8% 9% 6% Business Integration 7% 7% 7% Customer Relationship Management 3% 4% 5% Business Process Management 3% 3% 4% Platform 2% 2% 3% 6

Industry Data Revenue by Industry (Top 10) Q1 2019 Q4 2018 Q1 2018 Healthcare/Pharma/Life Sciences 30% 30% 26% Financial Services/Banking/Insurance 17% 15% 14% Automotive and Transport Products 10% 10% 10% Retail and Consumer Goods 9% 11% 10% Manufacturing 9% 10% 10% Telecommunications 6% 6% 6% Electronics and Computer Hardware 5% 5% 8% Business Services 5% 4% 4% Energy and Utilities 3% 4% 3% Leisure, Media and Entertainment 3% 3% 3% 7

Platform Data Revenue by Platform Q1 2019 Q4 2018 Q1 2018 IBM/Redhat 21% 21% 25% Microsoft 16% 16% 18% Adobe/Magento/Marketo 15% 13% 11% Oracle 6% 6% 10% Sitecore 4% 5% 2% Pivotal 4% 4% 2% Salesforce 3% 3% 3% Other Technologies 26% 27% 23% Management Consulting* 5% 5% 6% *Platform independent 8