Q2 2021 Financial Results July 29, 2021

2 Safe Harbor Statement Some of the statements contained in this presentation that are not purely historical statements, including our GAAP EPS guidance and Adjusted EPS guidance, as well as our effective income tax rate and GAAP and adjusted fully diluted shares for 2021, discuss future expectations or state other forward-looking information related to financial results and business outlook for 2021. Those statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by the statements. The “forward-looking” information is based on management’s current intent, belief, expectations, estimates, and projections regarding our company and our industry. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward- looking statements are disclosed under the heading “Risk Factors” in our most recently filed annual report on Form 10-K. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. This cautionary statement is provided pursuant to Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this presentation are made only as of the date hereof and we undertake no obligation to update publicly any forward-looking statement for any reason, even if new information becomes available or other events occur in the future.

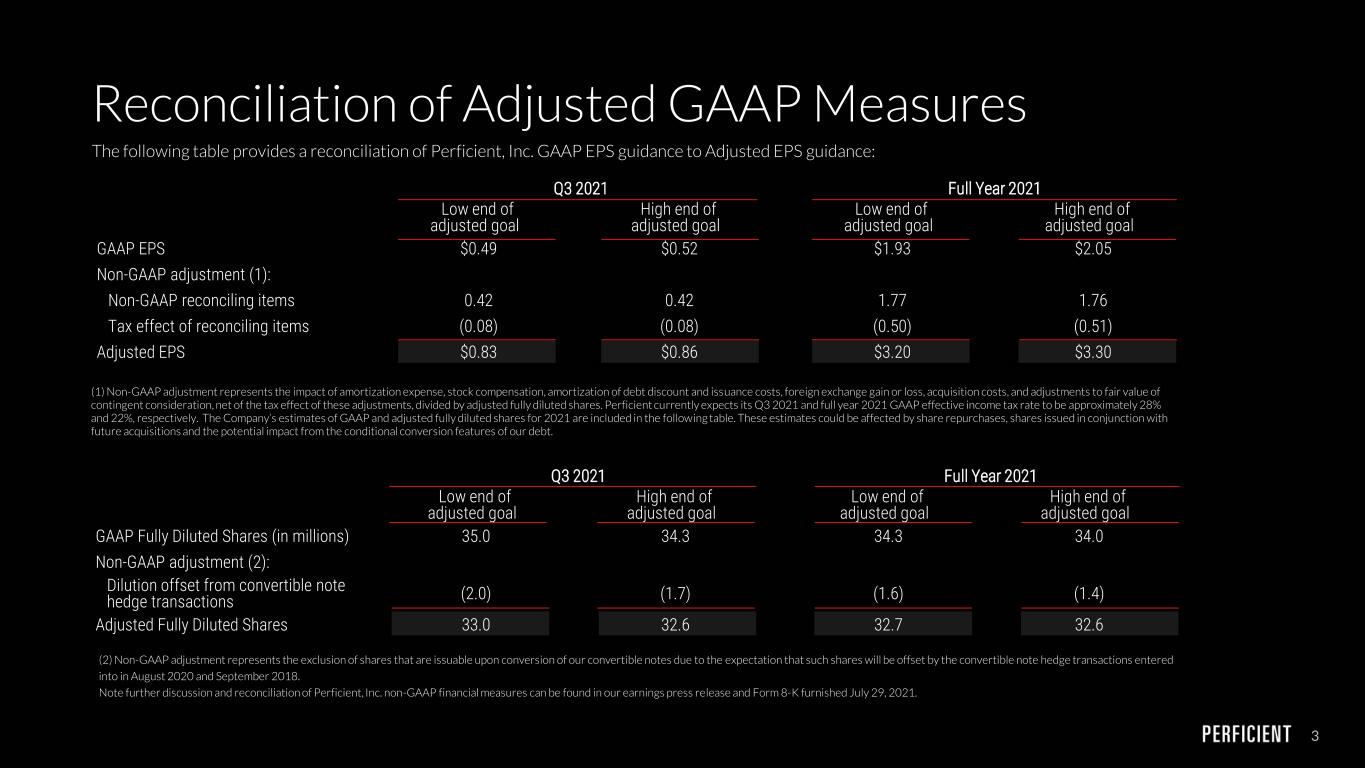

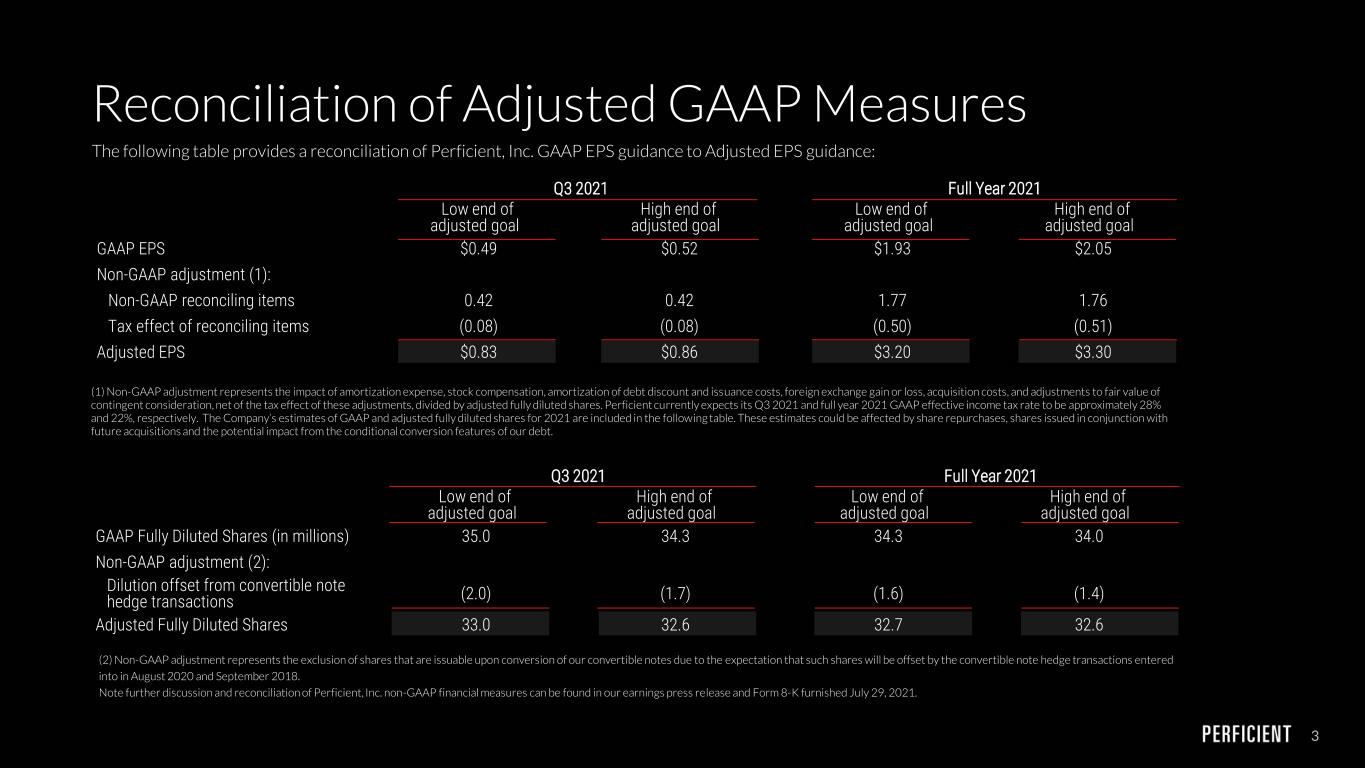

3 Q3 2021 Full Year 2021 Low end of adjusted goal High end of adjusted goal Low end of adjusted goal High end of adjusted goal GAAP EPS $0.49 $0.52 $1.93 $2.05 Non-GAAP adjustment (1): Non-GAAP reconciling items 0.42 0.42 1.77 1.76 Tax effect of reconciling items (0.08) (0.08) (0.50) (0.51) Adjusted EPS $0.83 $0.86 $3.20 $3.30 Reconciliation of Adjusted GAAP Measures The following table provides a reconciliation of Perficient, Inc. GAAP EPS guidance to Adjusted EPS guidance: (1) Non-GAAP adjustment represents the impact of amortization expense, stock compensation, amortization of debt discount and issuance costs, foreign exchange gain or loss, acquisition costs, and adjustments to fair value of contingent consideration, net of the tax effect of these adjustments, divided by adjusted fully diluted shares. Perficient currently expects its Q3 2021 and full year 2021 GAAP effective income tax rate to be approximately 28% and 22%, respectively. The Company’s estimates of GAAP and adjusted fully diluted shares for 2021 are included in the following table. These estimates could be affected by share repurchases, shares issued in conjunction with future acquisitions and the potential impact from the conditional conversion features of our debt. (2) Non-GAAP adjustment represents the exclusion of shares that are issuable upon conversion of our convertible notes due to the expectation that such shares will be offset by the convertible note hedge transactions entered into in August 2020 and September 2018. Note further discussion and reconciliation of Perficient, Inc. non-GAAP financial measures can be found in our earnings press release and Form 8-K furnished July 29, 2021. Q3 2021 Full Year 2021 Low end of adjusted goal High end of adjusted goal Low end of adjusted goal High end of adjusted goal GAAP Fully Diluted Shares (in millions) 35.0 34.3 34.3 34.0 Non-GAAP adjustment (2): Dilution offset from convertible note hedge transactions (2.0) (1.7) (1.6) (1.4) Adjusted Fully Diluted Shares 33.0 32.6 32.7 32.6

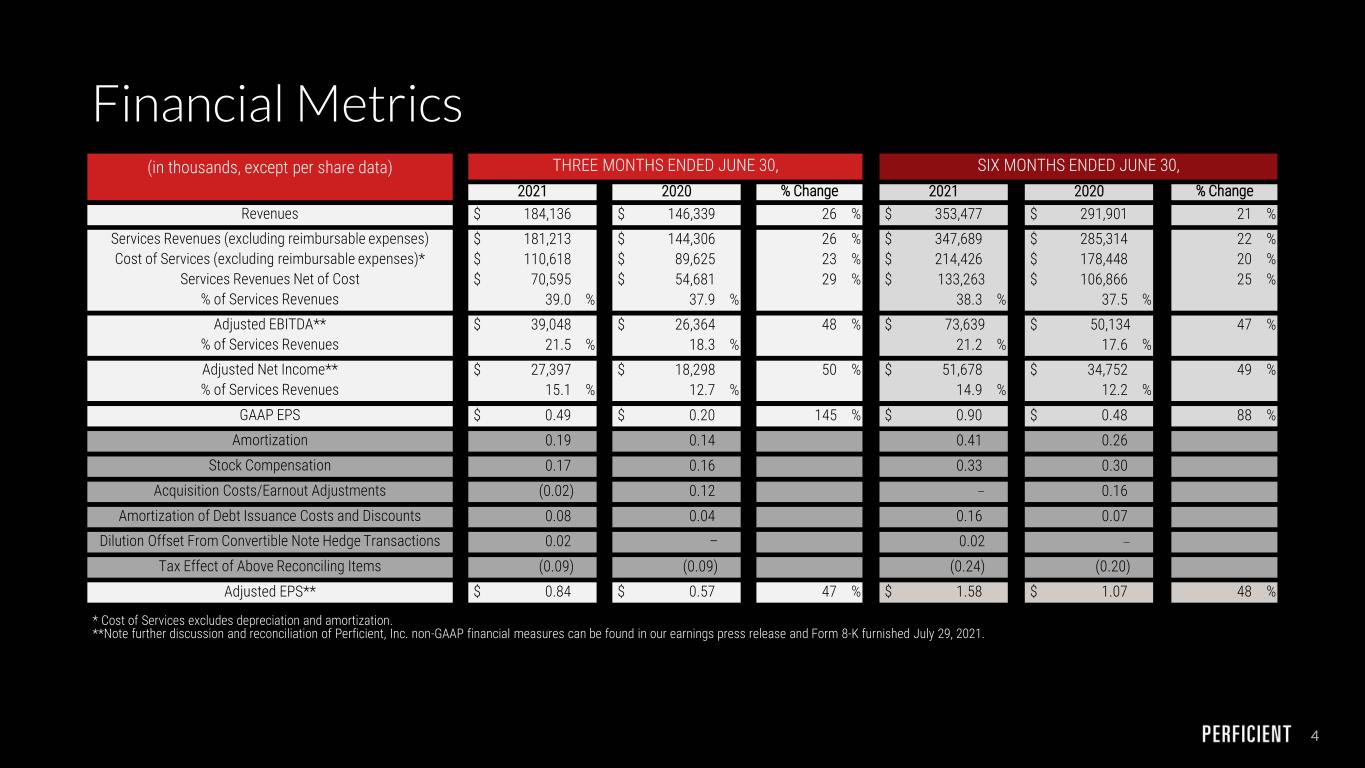

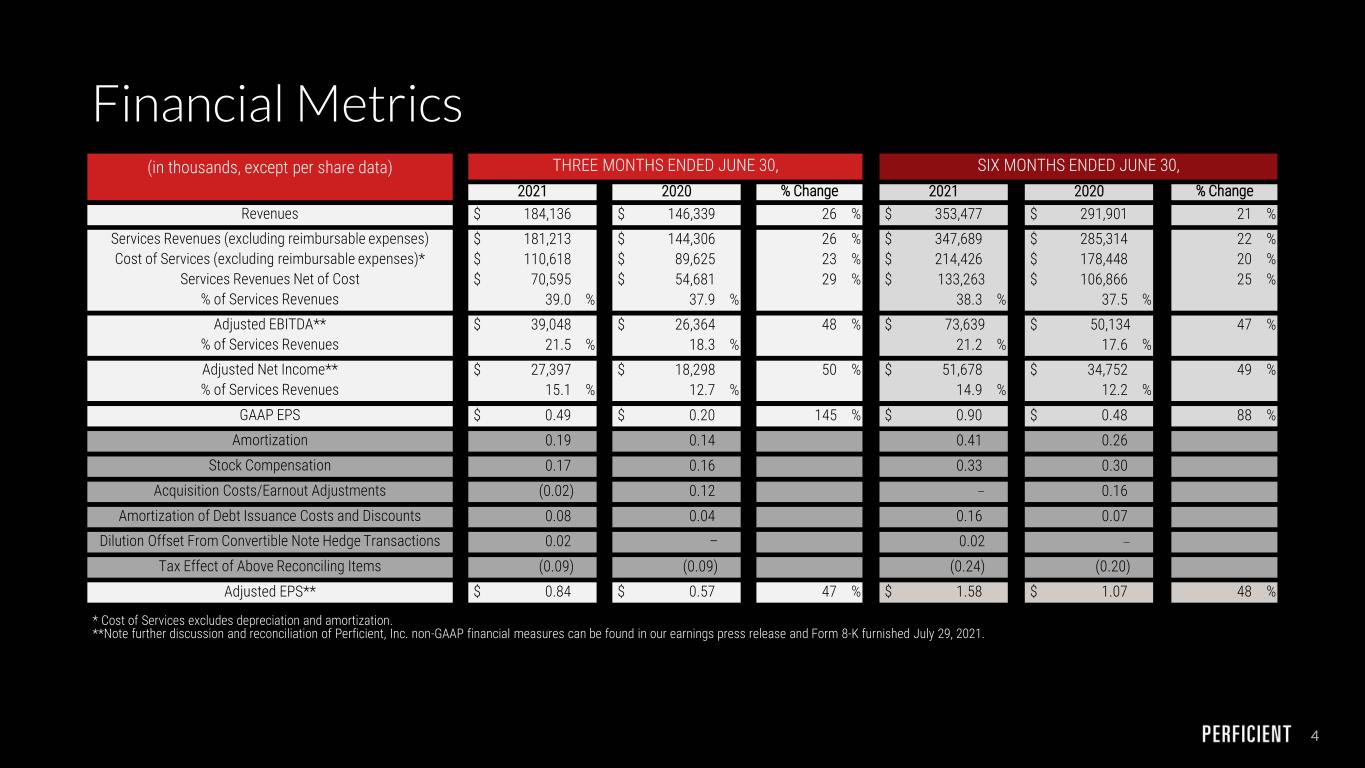

4 Financial Metrics (in thousands, except per share data) THREE MONTHS ENDED JUNE 30, SIX MONTHS ENDED JUNE 30, 2021 2020 % Change 2021 2020 % Change Revenues $ 184,136 $ 146,339 26 % $ 353,477 $ 291,901 21 % Services Revenues (excluding reimbursable expenses) $ 181,213 $ 144,306 26 % $ 347,689 $ 285,314 22 % Cost of Services (excluding reimbursable expenses)* $ 110,618 $ 89,625 23 % $ 214,426 $ 178,448 20 % Services Revenues Net of Cost $ 70,595 $ 54,681 29 % $ 133,263 $ 106,866 25 % % of Services Revenues 39.0 % 37.9 % 38.3 % 37.5 % Adjusted EBITDA** $ 39,048 $ 26,364 48 % $ 73,639 $ 50,134 47 % % of Services Revenues 21.5 % 18.3 % 21.2 % 17.6 % Adjusted Net Income** $ 27,397 $ 18,298 50 % $ 51,678 $ 34,752 49 % % of Services Revenues 15.1 % 12.7 % 14.9 % 12.2 % GAAP EPS $ 0.49 $ 0.20 145 % $ 0.90 $ 0.48 88 % Amortization 0.19 0.14 0.41 0.26 Stock Compensation 0.17 0.16 0.33 0.30 Acquisition Costs/Earnout Adjustments (0.02) 0.12 – 0.16 Amortization of Debt Issuance Costs and Discounts 0.08 0.04 0.16 0.07 Dilution Offset From Convertible Note Hedge Transactions 0.02 – 0.02 – Tax Effect of Above Reconciling Items (0.09) (0.09) (0.24) (0.20) Adjusted EPS** $ 0.84 $ 0.57 47 % $ 1.58 $ 1.07 48 % * Cost of Services excludes depreciation and amortization. **Note further discussion and reconciliation of Perficient, Inc. non-GAAP financial measures can be found in our earnings press release and Form 8-K furnished July 29, 2021.

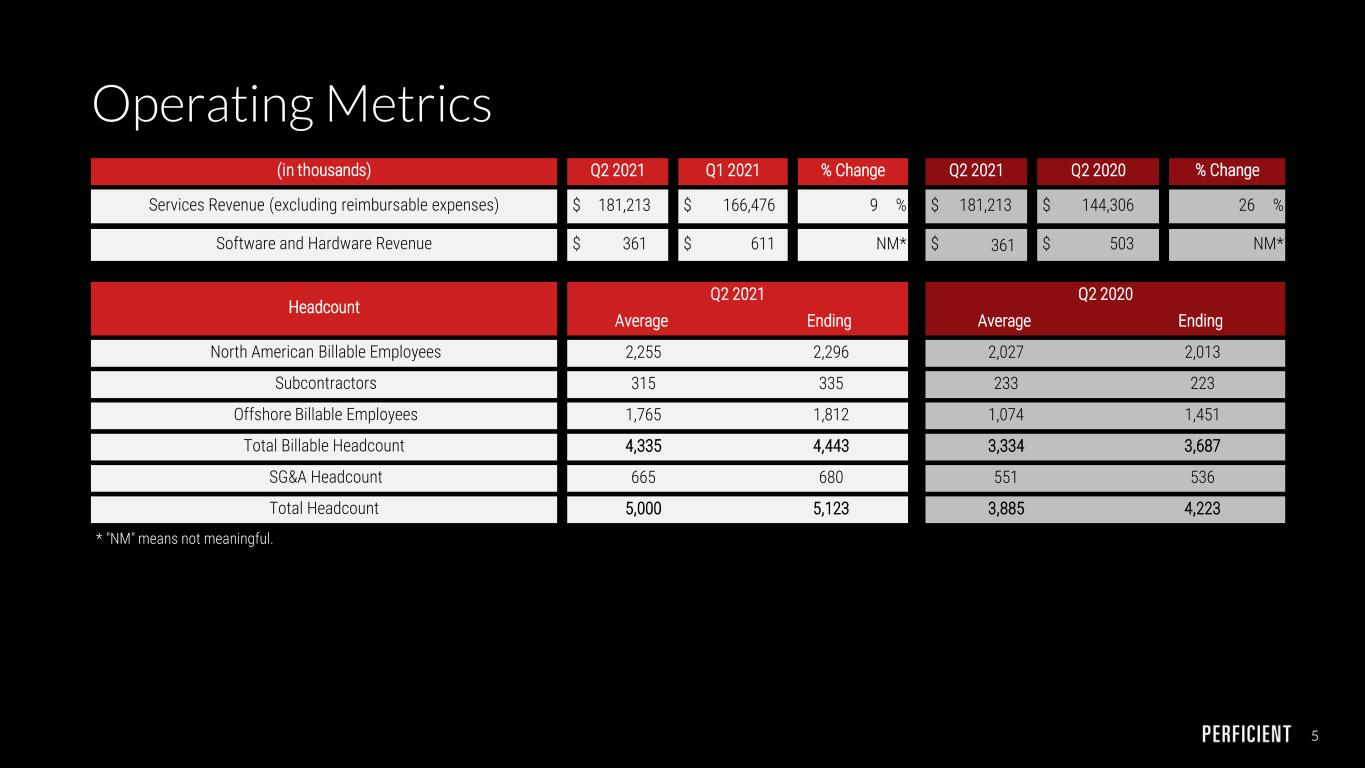

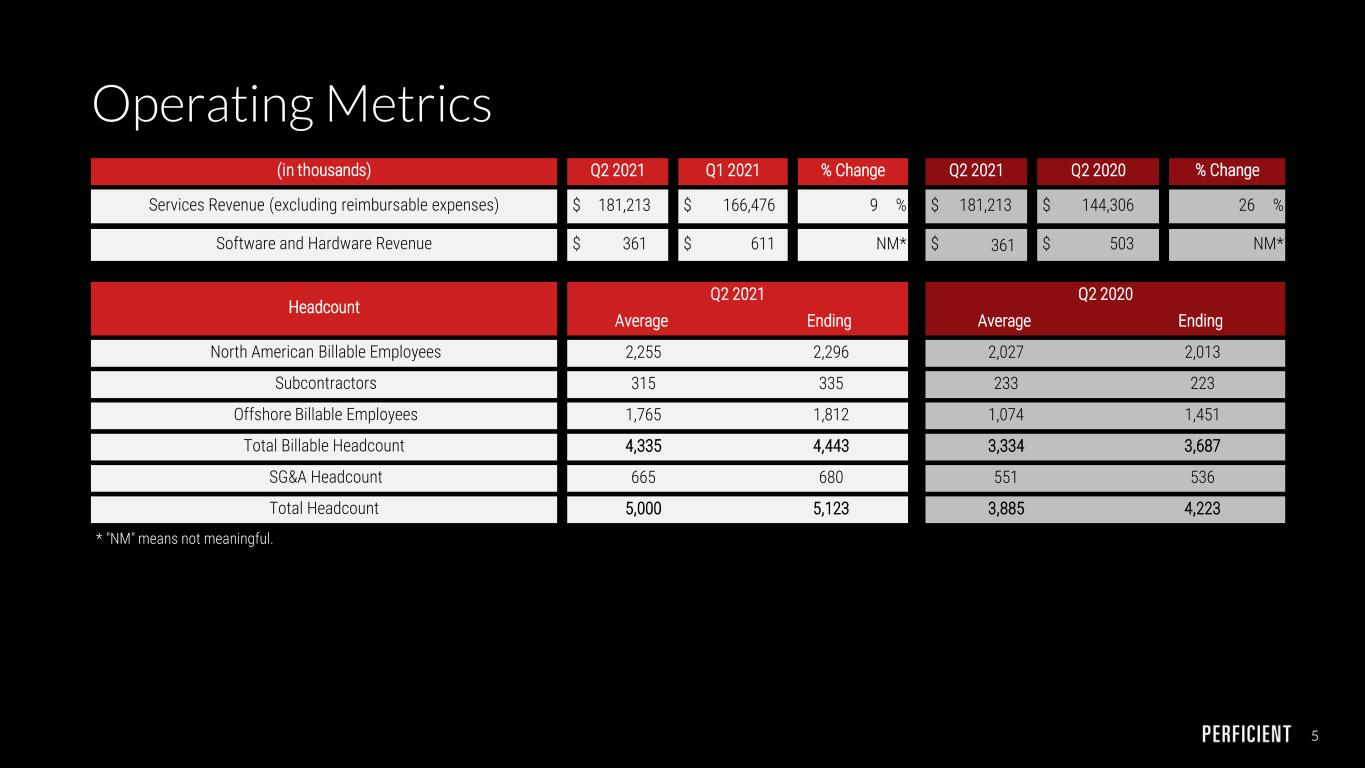

5 Operating Metrics (in thousands) Q2 2021 Q1 2021 % Change Q2 2021 Q2 2020 % Change Services Revenue (excluding reimbursable expenses) $ 181,213 $ 166,476 9 % $ 181,213 $ 144,306 26 % Software and Hardware Revenue $ 361 $ 611 NM* $ 361 $ 503 NM* Headcount Q2 2021 Q2 2020 Average Ending Average Ending North American Billable Employees 2,255 2,296 2,027 2,013 Subcontractors 315 335 233 223 Offshore Billable Employees 1,765 1,812 1,074 1,451 Total Billable Headcount 4,335 4,443 3,334 3,687 SG&A Headcount 665 680 551 536 Total Headcount 5,000 5,123 3,885 4,223 * "NM" means not meaningful.

6 Industry Data Revenue by Industry Q2 2021 Q1 2021 Q2 2020 Healthcare/Pharma/Life Sciences 31% 32% 32% Financial Services/Banking/Insurance 18% 17% 14% Automotive and Transport Products 10% 10% 10% Manufacturing 9% 9% 11% Retail and Consumer Goods 9% 9% 8% Electronics and Computer Hardware 6% 5% 7% Leisure, Media and Entertainment 6% 6% 5% Business Services 5% 6% 3% Other 6% 6% 10%