UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

UNDER SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-168527

CANNAPOWDER, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| Nevada | | 20-3353835 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | |

| 20 Raoul Wallenberg St., Tel Aviv, Israel | | 6971916 |

| (Address of Principal Executive Offices) | | (ZIP Code) |

Registrant’s Telephone Number, Including Area Code: +972-3-6130421

Smart Energy Solutions, Inc.

(Former Name of Registrant)

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Exchange Act:Common stock; $0.0001par value

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act) or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-Accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

TABLE OF CONTENTS

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Background and Former Operations

Smart Energy Solutions, Inc. (the “Company” or “Registrant”) was incorporated in 1999 in the state of Utah under the name Datigen.com, Inc. On August 25, 2005, the Registrant was redomiciled from Utah to Nevada pursuant to a merger with and into its wholly-owned subsidiary, Smart Energy Solutions, Inc., a Nevada corporation and, in connection therewith, its name was changed to Smart Energy Solutions, Inc.

Prior to the merger into its wholly-owned subsidiary, the Company was engaged in activities including development and marketing of various internet and internet related products and services, investment in real property related instruments, and providing concrete cutting and finishing services to construction sites seeking to comply with certain provisions of the American Disability Act of 1991. In November 2004, the Company had a change in control as a result of the purchase of a majority of the Company’s outstanding common stock by unaffiliated individuals from certain of the Company’s shareholders, including its then Chief Executive Officer, Joseph Ollivier.

In connection with the change in control, the Company determined to pursue other business opportunities and, as a result, on March 23, 2005, the Company acquired the intellectual property rights and certain other assets relating to a product known as the Battery Brain from Purisys, Inc., a New Jersey corporation in an Asset Purchase Agreement (the “Agreement”) with Purisys and Aharon Levinas, the owner of Purisys and the Battery Brain Assets (the “Assets”). The Battery Brain was a device attached to a motor vehicle battery for the purpose of protecting the vehicle from battery failure and theft.

Following the purchase of the Assets, the Company’s management team devoted its resources to establishing operations and entering into agreements with third parties for the manufacture and distribution of products using the Battery Brain technology, including manufacturers in China and Israel and distributors in the United States, Canada, Italy, and Israel. During the period from the date of the Agreement through the end of 2009, the Company devoted its marketing activities on the following target markets, each of which the Company believed had unique requirements: Automotive Retail; Automobile Dealers; Automotive OEMs; Automotive Specialty; Fleets; Military; Heavy Truck/Bus; Motor Home/Recreational Vehicle; and Marine.

Notwithstanding its sales and marketing efforts and its ability to generate sales revenues from its Battery Brain products, the Company continued to generate losses from operations and, as of its fiscal year-ended December 31, 2008, The Company had an accumulated deficit of in excess of $22 million. The Company continued to file reports under the Exchange Act through its quarterly report on Form 10-Q for the period ended September 30, 2009, during which three and nine-month period the Company reported Net Losses of $232,815 and $1,167,989, respectively. Also, at September 30, 2009, the Company lacked sufficient capital resources to continue to fund the expenses including professional fees associated with being a current, reporting company under the Exchange Act.

As a result, from and after the filing of its 10-Q for the period ended September 30, 2009, the Company ceased active business operations and its board of directors determined to devote its limited and depleting cash resources to seek operations that would generate more revenues and hopefully, positive cash flow from operations than its prior operations exploiting its Battery Brain technology. The Company became delinquent in its reporting obligations under the Exchange Act, failing to file its annual report on Form 10-K for the year ended December 31, 2009 and continued to be a delinquent filer until it filed a Form 15, terminating its registration under Section 12(g) of the Exchange Act on July 24, 2013.

Prior to filing the Form 15, the Company’s assets became subject to a proceeding before the Superior Court of the State of New Jersey, which resulted in the appointment of a receiver in early 2013. The principal creditor in that proceeding was Aharon Levinas, who had sold the Battery Brain Assets formerly owned by Purysis in the Asset Purchase Agreement dated March 23, 2005. On June 7, 2013, in connection with the order of the Superior Court of the State of New Jersey (the “Consent Order Approving Settlement”), the Court authorized and approved the sale, transfer and assignment of all of the Company’s assets to Aharon Levinas, free and clear of any liens, claims or encumbrances and granting Mr. Levinas effective control of the Company.

During November 2014 and March 2015, third-party investors acquired control of the Company by purchasing a control block of shares each holding 137,500 shares representing 88% of the Company’s issued and outstanding shares of common stock. Reference is made to the disclosure under Item 4. “Security Ownership of Certain Beneficial Owners and Management.”

Recent Corporate Developments

On August 30, 2017, a new wholly-owned subsidiary was registered in Israel under the name of Canna Powder Ltd. (“CannaPowder Israel” or the “Subsidiary”), with 100 common shares outstanding, 0.01 NIS par value (the “Subsidiary Shares”), all of which were held in escrow on behalf of the Company by Israel attorney, Alon Nave. On September 27, 2017, pursuant to board resolution, the 100 Subsidiary Shares held in escrow were transferred to the Company.

The Subsidiary’s management includes Lavi Krasney, its CEO, and Rafi Ezra, its CTO. Mr. Ezra is a highly experienced pharmacist with extensive knowledge of the cannabis sector and active experience of leading early-stage pharma companies from early-stage development through commercial launch.

Development is being conducted at the Hebrew University under the supervision of the inventor of the technology, Professor Shlomo Magdassi, pursuant to the term of the Feasibility Study and Option Agreement dated September 14, 2017 (the “Feasibility Study”), a copy of which is attached as Exhibit 10.1 hereto, as more fully discussed below.

On December 27, 2017, a board-resolution was adopted to issue an additional: (i) 800 Subsidiary Shares to the Company; and an additional 100 Subsidiary Shares to Rafi Ezra and, as a result, effective December 27, 2017, Canna Powder Ltd became a 90% owned subsidiary of the Company and a minority interest of 10% owned by Rafi Ezra.

In anticipation of the formation of CannaPowder Ltd, the Company’s newly organized Israeli subsidiary, the Company began to raise capital through the private sale of its equity securities primarily pursuant to the exemptions provided under Regulation S promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Act”) and, to a lesser extent, pursuant to Regulation D promulgated by the SEC under the Act (collectively, the “Equity Raise”). To date, the Company has raised approximately $888,775 in the Equity Raise. Reference is made to the disclosure under Item 10. “Recent Sales of Equity Securities” and Note (7) Subsequent Events, below.

The Equity Raise by the Company was and continues to be for the purpose of funding the Company’s business involving its development program to establish cannabis powder production facilities utilizing the proprietary, licensed technology as more fully-described under “Intellectual Property” below (the “Development Program”). The Company reasonably expects that the Development Program will be completed within three years, with commercial sales starting in 2021, there can be no assurance that the Development Program will, in fact, be successful notwithstanding the Company’s success in its Equity Raise to date, nor can there be assurance that the Company may not require additional capital to fully implement its business plan and complete production of commercially viable products based on its technology which is the subject of the Feasibility Study discussed below under“Planned Research and Development and Current Trends.”

In the commercial stage, the Company’s plan is to establish and operate several production facilities, each located in separate territories determined by the Company according to their size and regulatory environment that permits studies applicable to other activities prerequisite to commercial exploitation of medical cannabis generally and the Company’s plan to develop cannabis-based powders for medical uses. While there can be no assurance, at present the Company believes that it will be able to produce cannabis powders for medical uses at a significant cost advantage.

Planned Research and Development and Current Trends

There is increasing recognition and agreement amongst medical professionals conducting research in hospitals world-wide, including leading hospitals in Israel such as Hebrew University, Jerusalem, Israel and Sheba Academic Medical Center located in Tel Hashomer, Israel, among others, that the therapeutic effect of medical cannabis is due to the total number of cannabinoids working together. There is a scientific effort currently being lead in Israel, as well as other countries to analyze and understand how the various components within cannabis work. including ongoing scientific studies to develop separate medical components for use in treatment of different medical conditions using various components or combinations for each cannabinoid.

The aim of CannaPowder Israel is to identify the active pharmaceutical ingredient (API) and to understand the cannabidiol (CBD) and tetrahydrocannabinol (THC) content of each product. Researchers have discovered approximately in excess of 100 cannabinoids, chemical compounds unique to the cannabis plant. The most common are CBD, cannabinol (CBN) and THC. CBN and THC interact with CB1 and CB2 receptors, which are located throughout the human body. CB1 receptors are primarily located in the brain and central nervous system. CB2 receptors are located throughout the body including the gastrointestinal and urinary tracts that are responsible for regulating neurotransmission. The CB1 and CB2 receptors help control bodily reactions such as inflammation and pain, which are areas are of great therapeutic interest with respect to drug development. Identifying cannabinoid receptors and the compounds that interact with them has helped accelerate clinical investigations of cannabinoid-based drugs. To date, due to the challenges of researching plant-derived cannabinoids in the United States, most U.S. research has been conducted utilizing synthetically produced cannabinoids, which as chemical compounds, are chemically identical to plant-derived cannabinoids.

We believe cannabinoid-based drugs using the powders we plan on developing may provide a superior treatment model for patients suffering from certain diseases, disorders and medical conditions. It is generally agreed that cannabinoid-based drugs have tolerable safety profiles but at present, because of U.S. FDA and DEA restrictions, most companies involved in research and development of cannabinoid therapeutic applications currently use synthetics.

We believe that there will be rising demand for cannabinoid-derived drugs and that future growth is likely to be driven by favorable changes in legislation and demographic factors. Controlled substance laws differ between countries and legislation in certain countries may restrict or limit our ability to distribute our cannabis-based powders, once developed, for us if drugs. Nevertheless, we believe that the U.S. can potentially represent a major market for CannaPowder-based drug candidates. In the European Community, medical cannabis program regulatory frameworks exist in countries, including the Netherlands, Italy, Germany, Finland, Norway, Ukraine, Estonia, Switzerland and the Czech Republic. It is also anticipated that there will be policy changes in many member countries of the European Union regarding the medical use of cannabis and cannabinoid-derived drugs. In addition, medical cannabis and, to some extent, recreation cannabis use by adults, has been decriminalized in Russia, Mexico, Columbia, Uruguay, Paraguay and Colombia.

The objective of our subsidiary, CannaPowder Israel, is to develop nano-cannabis powder, standardized from cannabis oil in a known cannaboid composition. CannaPowder Israel is in the process of licensing what it believes will represent a breakthrough platform technology in drug administration and with the view to applying it to enable the commercial production of cannabis powder.

The technology has been developed by scientists at the Hebrew University, Jerusalem, which technology has been licensed to the Company’s Israeli Subsidiary. Reference is made to the Feasibility Study and Option Agreement attached as exhibit 10.1 attached hereto. It comprises a new technique which enables preparation of nanoparticles from micro emulsions of active ingredients that can be stored as powders and then dissolved in water when required.

Our management team, working in collaboration with the scientists at Hebrew University under the supervision of Professor Shlomo Magdassi, believe this technology may be adapted for many different insoluble drugs to provide enhanced dissolution properties and to improve solubility, bioavailability and storage properties and solutions.

The innovation is as a platform technology for preparing dispersible powders or aqueous dispersions of nanoparticles of water-insoluble organic compounds by converting micro emulsions or nanoemulsions containing the active chemicals into powders.

The key features, we believe, include:

| | ● | Preparation of the nanoemulsions is simple and reproducible, without the use of any special equipment. |

| | ● | Can dilute the powders in water to obtain required concentration of active ingredient. |

| | ● | Reduces dose of drug needed. |

| | ● | Nanoparticles offer improved bioavailability and improved efficacy. |

| | ● | Simple, cost effective technique. |

| | ● | Powders have relatively long shelf life. |

Although there can be no assurance, we believe that our new technology should be ideally suited to cannabis because it is based upon and deals specifically with oily/lipophilic materials which is exactly the form in which cannabis exists. Our plan if for the final product to a micronized powder containing cannabinoids in a particle size of 100 nanometers, easily incorporated in a commercial product, such as a capsule. It is the result of a pharmaceutical not a chemical process.

The process of producing the powders will utilize high pressure emulsifying agents that vaporize water to particles, which evaporation process is expected to take only hours as opposed to days or weeks, meaning that it should be quicker and less expensive than existing processes for producing medical cannabis with consistent dosages. Furthermore, the production process should not be labor intensive or require a large and therefore costly facility, thereby providing the economic advantage of being able to produce commercial quantities of cannabis powder at costs far less than existing methods currently in use by other manufacturers of medical cannabis drugs and treatments.

The Medical Cannabis Market

Cannabis has been used for medicinal purposes for thousands of years and has proven to be an effective treatment for pain relief, inflammation and a number of other medical disorders. According to anIBISWorld report, new medical research and changing public opinion have boosted industry growth.

Doctors may prescribe ‘legalized’ medical cannabis in approved states where patients can receive a “recommendation” from a state-approved, licensed physician for the treatment of certain conditions specified by the state.

Medical cannabis is being used to treat severe or chronic pain, inflammation, nausea and vomiting, neurologic symptoms (including muscle spasticity), glaucoma, cancer, multiple sclerosis, post-traumatic stress disorder, anorexia, arthritis, Alzheimer’s, Crohn’s disease, fibromyalgia, ADD, ADHD, Tourette’s syndrome, spinal cord injury and numerous other conditions. Cannabis oil has also been proven effective in treating epileptic seizures in children.

The worldwide medical cannabis market is anticipated to reach $55.8 billion by 2025, growing at a CAGR of 17.1% from 2013 to 2025, the forecast period (1), compared to $11.4 billion in 2015.

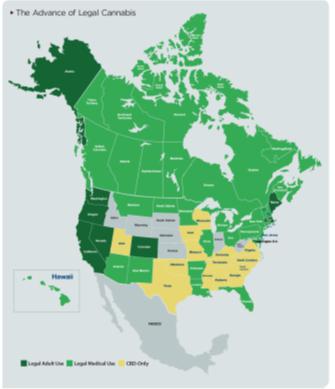

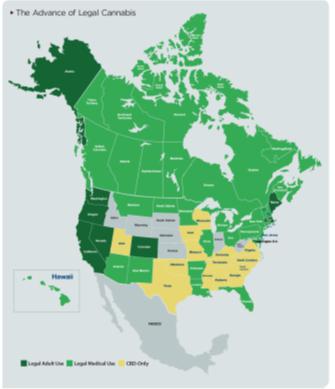

Awareness regarding the medical benefits of cannabis is spurring market growth. Major manufacturers producing medical cannabis remove THC, a psychoactive compound which causes the well-known and recognized euphoria related hallucinations or even what some define as psychotic episodes on the negative spectrum of THC’s potential side effects. The product then only contains cannabidiol (CBD), a chemical compound which provides health benefits. Use of medical cannabis for therapeutic purposes is driving many countries to legalize it. At present, 29 of 50 states in the U.S. permit the prescription and sale of medical cannabis to adults and although there appears to be a trend in the U.S. that additional states will approve medical cannabis, laws at the federal level in the U.S. still treat cannabis, whether for medical or recreational use, as a Class 1 Controlled Substance and illegal.

At present, cannabis is used widely in health foods and pet medicines. Health foods comprise juices, cannabis edibles, and drinkable medicines. For instance, Simply Pure, a U.S. based company offers edibles devoid of gluten and sugar. Auntie Dolores, another U.S. based company manufactures CBD pet treats to relieve pets of anxiety and pain. Cannabis edibles are offered in the form of lozenges, breath strips, and gummies. In an attempt to propel market growth, Microsoft Azure too has offered its Cloud services to industry participants for the sale of cannabis.

The global medical cannabis market is segmented according to applications and regions. Market applications comprise cancer, chronic pain, arthritis, migraine, and others. Chronic pain is the largest application segment due to a huge patient base. It accounted for nearly 40% of global revenues in the same year. It is driven by increasing number of clinical trials that promote the use of medical cannabis in pain management.

The cancer segment is expected to grow rapidly at an 18.2% CAGR during the forecast period. Although, medical use of cannabis is considered illegal, many districts and states are passing amendments to legalize it. A number of clinical trials have demonstrated that medical cannabis has the capacity to destroy cancer cells.

However, this drug is yet to receive U.S. FDA approval for use in cancer treatment. This adversely impacts the growth of the cancer application segment.

North America led the medical cannabis market with nearly 49% shares in 2015. The region is supported by the legalization of cannabis in most states of the U.S. The drug has received approval for recreational use in only eight states. North America is anticipated to grow at a CAGR of 22% during the forecast period. Prohibition of medical cannabis in most of Latin America and Asia has limited the growth of this market to Europe, North America, and other countries world-wide.

Prominent companies presently engaged in this field include: Cannabis Sativa, Inc.; United Cannabis Corporation; Growblox Sciences, Inc.; and GW Pharmaceuticals plc which is a UK pharmaceuticals manufacturer that has gained approval for using medical cannabis in treating various cancers and whose proprietary formula which contains a mixture of THC and CBD was used in a clinical trial to treat brain cancer.

1https://www.mediafound.org/news/medical-cannabis-market-to-grow-at-17-1-cagr-till-2025.htm

Competition

We will face competition from larger companies that are or may be in the process of offering similar products to ours. Many of our current and potential competitors have longer operating histories, significantly greater financial, marketing and other resources than we may be expected to have.

Competitors may include major pharmaceutical and biotechnology companies and public and private research institutions. Management cannot be certain that we will be able to compete against current or future competitors or that competitive pressure will not seriously harm our business prospects. These competitors may be able to react to market changes, respond more rapidly to new regulations or allocate greater resources to the development and promotion of their products than we can.

Furthermore, some of these competitors may make acquisitions or establish collaborative relationships among themselves to increase their ability to rapidly gain market share. Large pharmaceutical companies may eventually enter the market.

Given the rapid changes affecting the global, national, and regional economies in general and cannabis-related medical research and development in particular, we may not be able to create any perceived competitive advantage from our cannabis-based powder formulations in the marketplace.

Our success will also depend on our ability to respond quickly to, among other things, changes in the economy, market conditions, and competitive pressures. Any failure to anticipate or respond adequately to such changes could have a material effect on our financial condition, operating results, liquidity, cash flow and our operational performance.

Intellectual Property

At present, all of our research and development is conducted in Israel and is the subject of the Feasibility Study being conducted at Hebrew University. The cannabinoid-based medicinal powders we intend to develop, contain controlled substance (cannabis) as defined in the Israeli Dangerous Drugs Ordinance [New Version], 5733 - 1973. In Israel, licenses to cultivate, possess and to use cannabis for medical research are granted by the Ministry of Health, IMCU - Israel Medical Cannabis Unit, on an ad-hoc basis.

Government Regulation

United States

The legal cannabis industry has evolved considerably during the past five years and many observers believe that the industry has reached the tipping point for legalization through pressure from citizens’ groups in individual states in the U.S. for the legalization of medical and/or recreational cannabis. At the United States federal level, cannabis is still classified as an illegal substance under the Controlled Substances Act. The classification makes cannabis illegal under federal law to cultivate, manufacture, distribute or possess cannabis, and has created a discrepancy between state’s rights and federal law. It also means that production must be local to consumption as it cannot cross state lines.

Public support has resulted in the passing of new cannabis laws and regulations in a number of countries and individual states in the US. By 2026 many states are expected to build robust legal adult-use markets, and all but a few states will make medical cannabis available legally.

Countries around the world are already responding to the state-by-state dismantling of prohibition in America by moving to allow medical use (as in Australia, Germany, and Colombia) or to outright legalization (as in Uruguay).

We believe cannabinoid-based drugs using the powders we plan on developing may provide a superior treatment model for patients suffering from certain diseases, disorders and medical conditions. It is generally agreed that cannabinoid-based drugs have tolerable safety profiles but at present, because of U.S. FDA and DEA restrictions, most companies involved in research and development of cannabinoid therapeutic applications currently use synthetics.

To the extent that in the future, we shall seek to be able to conduct some of our research and development relating to our cannabis powders in the United States, at which time, we will become subject to the United States’ Federal Controlled Substances Act of 1970 and regulations promulgated thereunder (the “CSA”). While cannabis is a Schedule I controlled substance, drugs approved for medical use in the United States that contain cannabis or cannabis extracts must be placed in Schedules II-V, since approval by the FDA satisfies the “accepted medical use” requirement. If any of our drug candidates will receive approval by the FDA, it must be listed by the Drug Enforcement Agency (“DEA”) as a Schedule II or III controlled substance to be allowed for commercialization. Consequently, the manufacture, importation, exportation, domestic distribution, storage, sale and legitimate use of our future drugs will be subject to a significant degree of regulation by the DEA. In addition, individual states in the United States have also established controlled substance laws and regulations. Though state-controlled substances laws often mirror federal law because the states are separate jurisdictions, they may separately schedule our drugs.

The European Community

Even though we do not currently intend to conduct research and development in the European Community, we may do so in the future. Approximately 250 substances, including cannabis, are listed in the Schedules annexed to the United Nations Single Convention on Narcotic Drugs (New York, 1961, amended 1972), the Convention on Psychotropic Substances (Vienna, 1971) and the Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (introducing control on precursors) (Vienna, 1988). The purpose of these listings is to control and limit the use of these drugs according to a classification of their therapeutic value, risk of abuse and health dangers, and to minimize the diversion of precursor chemicals to illegal drug manufacturers. The 1961 UN Single Convention on Narcotic Drugs, as amended in 1972 classifies cannabis as Schedule I (“substances with addictive properties, presenting a serious risk of abuse”) and as Schedule IV (“the most dangerous substances, already listed in Schedule I, which are particularly harmful and of extremely limited medical or therapeutic value”) narcotic drug. The 1971 UN Convention on Psychotropic Substances classifies THC - the principal psychoactive cannabinoid of cannabis - as a schedule I psychotropic substance (Substances presenting a high-risk of abuse, posing a particularly, serious threat to public health which are of very little or no therapeutic value).

Most countries in Europe are parties to these conventions which govern international trade and domestic control of these substances, including cannabis. They may interpret and implement their obligations in a way that creates a legal obstacle to our obtaining manufacturing and/or marketing approval for our drugs in those countries. These countries may not be willing or able to amend or otherwise modify their laws and regulations to permit our drug candidates to be manufactured and/or marketed or achieving such amendments to the laws and regulations may take a prolonged period. In the European Community, medical cannabis program regulatory frameworks exist in countries, including the Netherlands, Italy, Germany, Finland, Norway, Ukraine, Estonia, Switzerland and the Czech Republic. It is also anticipated that there will be policy changes in many member countries of the European Union regarding the medical use of cannabis and cannabinoid-derived drugs.

Israel

If we intend to develop drugs containing cannabis plant-derived cannabinoids, we may conduct our research and development activities in Israel. The cannabinoid-based drugs we intend to develop, contain controlled substance (cannabis) as defined in the Israeli Dangerous Drugs Ordinance [New Version], 5733 - 1973. In Israel, licenses to cultivate, possess and to use cannabis for medical research are granted by the Ministry of Health, IMCU - Israel Medical Cannabis Unit, on an ad-hoc basis. If we proceed in Israel, we intend to obtain necessary IMCU licenses to carry out our drug development projects. This will require our acquiring the cannabis needed for our research activities from an Israeli government-licensed medical cannabis grower. Because we do not have a license to possess cannabis, the cannabis that will be required for our studies must be transported from the licensed grower directly to our research facilities or those of a contract research organization, in compliance with a license to use cannabis for medical research. If we proceed with research in Israel, we will apply for all necessary licenses needed to conduct our drug development projects. There can be given no assurance that we will obtain all necessary licenses and approvals.

We believe that there will be rising demand for cannabinoid-derived drugs and that future growth is likely to be driven by favorable changes in legislation and demographic factors. Controlled substance laws differ between countries and legislation in certain countries may restrict or limit our ability to distribute our cannabis-based powders, once developed, for us if drugs. Nevertheless, we believe that the U.S. can potentially represent a major market for CannaPowder-based drug candidates.

ITEM 1A. RISK FACTORS

Risks Relating to Our Lack of Operating History and Industry.

Risks Relating to Our Business

Any investment in our shares of common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this annual report before you decide to invest in our common stock. Each of the following risks may materially and adversely affect our business objective, plan of operation and financial condition. These risks may cause the market price of our common stock to decline, which may cause you to lose all or a part of the money you invested in our common stock. We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our business plan. In addition to other information included in this annual report, the following factors should be considered in evaluating the Company’s business and future prospects.

The Company has a limited operating history and very limited resources.

The Company’s recent operations have been limited and has had no revenues from operations. Investors will have no basis upon which to evaluate the Company’s ability to achieve the Company’s plan of operation.

The Company’s officer and director may allocate his time to other businesses thereby causing conflicts of interest in his determination as to how much time to devote to the Company’s affairs. This could have a negative impact on the Company’s ability to implement its plan of operation.

The Company’s officer and director is not required to commit his full time to the Company’s affairs, which may result in a conflict of interest in allocating his time between the Company’s business and other businesses. Management of the Company is engaged in several other business endeavors and is not obligated to contribute any specific number of his hours per week to the Company’s affairs. If Management’s other business affairs require him to devote more substantial amounts of time to such affairs, it could limit his ability to devote time to the Company’s affairs and could have a negative impact on the Company’s ability to implement its plan of operation.

The Company may be unable to obtain additional financing, if required, to complete its plan of operation or to fund the operations and growth of it business, which could compel the Company to abandon its business.

If we require funds, we will be required to seek additional financing. We cannot assure you that such financing would be available on acceptable terms, if at all. To the extent that additional financing proves to be unavailable when needed, we would be compelled to abandon our business plan. In addition, we may require additional financing to fund the operations or growth of the our business. The failure to secure additional financing could have a material adverse effect on the continued development or growth of our business. The Company’s officers, director or stockholders are not required to provide any financing to us.

Broad discretion of Management

Any person who invests in the Company’s common stock will do so without an opportunity to evaluate the specific merits or risks our business. As a result, investors will be entirely dependent on the broad discretion and judgment of Management. There can be no assurance that determinations made by the Company’s Management will permit us to achieve the Company’s business plan.

General Economic Risks.

The Company’s current and future business objectives and plan of operation are likely dependent, in large part, on the state of the general economy. Adverse changes in economic conditions may adversely affect the Company’s business objective and plan of operation. These conditions and other factors beyond the Company’s control include also but are not limited to regulatory changes.

Our control shareholders have significant voting power and may take actions that may be different than actions sought by our other stockholders.

Our control shareholders own approximately 40.2% of the outstanding shares of our common stock. These stockholders will be able to exercise significant influence over all matters requiring stockholder approval. This influence over our affairs might be adverse to the interest of our other stockholders. In addition, this concentration of ownership could delay or prevent a change in control and might have an adverse effect on the market price of our common stock.

Our officers and directors are located in Israel and our assets may also be held from time to time outside of the United States.

Since all of our officers and directors are currently located in and/or are residents of Israel, any attempt to enforce liabilities upon such individuals under the U.S. federal securities and bankruptcy laws may be difficult. In accordance with the Israeli Law on Enforcement of Foreign Judgments, 5718-1958, and subject to certain time limitations (the application to enforce the judgment must be made within five years of the date of judgment or such other period as might be agreed between Israel and the United States), an Israeli court may declare a foreign civil judgment enforceable if it finds that:

- the judgment was rendered by a court which was, according to the laws of the State in which the court is located, competent to render the judgment;

- the judgment may no longer be appealed;

- the obligation imposed by the judgment is enforceable according to the rules relating to the enforceability of judgments in Israel and the substance of the judgment is not contrary to public policy; and

- the judgment is executory in the State in which it was given.

An Israeli court will not declare a foreign judgment enforceable if:

- the judgment was obtained by fraud;

- there is a finding of lack of due process;

- the judgment was rendered by a court not competent to render it according to the laws of private international law in Israel;

- the judgment is in conflict with another judgment that was given in the same matter between the same parties and that is still valid; or

- the time the action was instituted in the foreign court, a suit in the same matter and between the same parties was pending before a court or tribunal in Israel.

Furthermore, Israeli courts may not adjudicate a claim based on a violation of U.S. securities laws if the court determines that Israel is not the most appropriate forum in which to bring such a claim. Even if an Israeli court agrees to hear such a claim, it may determine that Israeli law, not U.S. law, is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proven as a fact, which can be a time-consuming and costly process.

Our assets may also be held from time to time outside of the United States. Since our directors and executive officers are foreign citizens and do not reside in the United States, it may be difficult for courts in the United States to obtain jurisdiction over our foreign assets or persons, and as a result, it may be difficult or impossible for you to enforce judgments rendered against us or our directors or executive officers in United States courts. Thus, investing in us may pose a greater risk because should any situation arise in the future in which you would have a cause of action against these persons or against us, you may face potential difficulties in bringing lawsuits or, if successful, in collecting judgments against these persons or against the Company.

Regulatory Risks

We face risks related to compliance with corporate governance laws and financial reporting standards.

The Sarbanes-Oxley Act of 2002, as well as related new rules and regulations implemented by the Securities and Exchange Commission and the Public Company Accounting Oversight Board, require changes in the corporate governance practices and financial reporting standards for public companies. These new laws, rules and regulations, including compliance with Section 404 of the Sarbanes-Oxley Act of 2002 relating to internal control over financial reporting, have materially increased the legal and financial compliance costs of small companies and have made some activities more time-consuming and more burdensome.

We may not have effective internal controls.

In connection with Section 404 of the Sarbanes-Oxley Act of 2002, we need to assess the adequacy of our internal control, remedy any weaknesses that may be identified, validate that controls are functioning as documented and implement a continuous reporting and improvement process for internal controls. We may discover deficiencies that require us to improve our procedures, processes and systems in order to ensure that our internal controls are adequate and effective and that we are in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act. If the deficiencies are not adequately addressed, or if we are unable to complete all of our testing and any remediation in time for compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the SEC rules under it, we would be unable to conclude that our internal controls over financial reporting are designed and operating effectively, which could adversely affect investor confidence in our internal controls over financial reporting.

Risks Relating to Operating in Israel.

We conduct our operations in Israel and therefore our results may be adversely affected by political, economic and military instability in Israel or the Middle East.

Our subsidiary offices and our officers and directors are located in Israel. Accordingly, political, economic and military conditions in Israel and the Middle East may directly affect our business. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors. Any hostilities involving Israel or the interruption or curtailment of trade within Israel or between Israel and its trading partners could adversely affect our operations and could make it more difficult for us to raise capital. Since September 2000, terrorist violence in Israel has increased significantly and negotiations between Israel and Palestinian representatives have not achieved a peaceful resolution of the conflict. The establishment in 2006 of a government in Gaza by representatives of the Hamas militant group has created additional unrest and uncertainty in the region.

Further, Israel is currently engaged in an armed conflict with Hamas, which until Operation Cast Lead in January 2009 had involved thousands of missile strikes and had disrupted most day-to-day civilian activity in southern Israel. The missile attacks by Hamas did not target Tel Aviv, the location of our principal executive offices; however, any armed conflict, terrorist activity or political instability in the region may negatively affect business conditions and could significantly harm our results of operations.

Risks Related to Our Common Stock

Our historic stock price has been volatile and the future market price for our common stock is likely to continue to be volatile. Further, the limited market for our shares will make our price more volatile. This may make it difficult for you to sell our common stock.

The public market for our common stock has been very volatile. Over the past three fiscal years and subsequent quarterly periods, the market price for our common stock has ranged from $0.35 to $2.70 (See “Market for Common Equity and Related Stockholder Matters” in this annual report). Any future market price for our shares is likely to continue to be very volatile. This price volatility may make it more difficult for you to sell shares when you want at a price you find attractive. Further, the market for our common stock is limited and we cannot assure you that a larger market will ever be developed or maintained. Market fluctuations and volatility, as well as general economic, market and political conditions, could reduce our market price. As a result, this may make it difficult or impossible for you to sell our common stock.

The Company’s shares of common stock are quoted on the OTC Pink Sheet market, which limits the liquidity and price of the Company’s common stock.

The Company’s shares of common stock are traded on the OTC Pink Sheet market. Quotation of the Company’s securities on the OTC Pink Sheet market limits the liquidity and price of the Company’s common stock more than if the Company’s shares of common stock were listed on The Nasdaq Stock Market or a national exchange. There is currently no active trading market in the Company’s common stock. There can be no assurance that there will be an active trading market for the Company’s common stock following a business combination. In the event that an active trading market commences, there can be no assurance as to the market price of the Company’s shares of common stock, whether any trading market will provide liquidity to investors, or whether any trading market will be sustained.

Our common stock is subject to the Penny Stock Rules of the SEC and the trading market in our common stock is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our common stock.

The Securities and Exchange Commission has adopted Rule 3a51-1 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 require:

- that a broker or dealer approve a person’s account for transactions in penny stocks; and

- the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

- obtain financial information and investment experience objectives of the person; and

- make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

- sets forth the basis on which the broker or dealer made the suitability determination; and

- that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

State blue sky registration; potential limitations on resale of the Company’s common stock

The holders of the Company’s shares of common stock registered under the Exchange Act and those persons who desire to purchase them in any trading market that may develop in the future, should be aware that there may be state blue-sky law restrictions upon the ability of investors to resell the Company’s securities. Accordingly, investors should consider the secondary market for the Registrant’s securities to be a limited one.

It is the intention of the Registrant’s Management following the consummation of a business combination to seek coverage and publication of information regarding the Registrant in an accepted publication manual which permits a manual exemption. The manual exemption permits a security to be distributed in a particular state without being registered if the Registrant issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. Furthermore, the manual exemption is a nonissuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities.

Most of the accepted manuals are those published by Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

Dividends unlikely

The Company does not expect to pay dividends for the foreseeable future because it has no revenues or cash resources. The payment of dividends will be contingent upon the Company’s future revenues and earnings, if any, capital requirements and overall financial conditions. The payment of any future dividends will be within the discretion of the Company’s board of directors as then constituted. It is the Company’s expectation that future management, following a business combination, will determine to retain any earnings for use in its business operations and accordingly, the Company does not anticipate declaring any dividends in the foreseeable future.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND PLAN OF OPERATION

The following Management’s Discussion and Analysis of Financial Condition and Plan of Operations (“MD&A”) is intended to help you understand our historical results of operations during the periods presented and our financial condition. This MD&A should be read in conjunction with our consolidated financial statements and the accompanying notes to consolidated financial statements and contains forward-looking statements that involve risks and uncertainties. See section entitled “Forward-Looking Statements” above.

Plan of Operation

At present, we are a Company with only limited operations and no revenues from our plan of operations. There is substantial doubt that we can continue as an on-going business for the next twelve months.

In December 2017 a new wholly-owned subsidiary was registered in Israel under the name of Canna Powder Ltd. (“CannaPowder”) with Rafi Ezra as its CEO. He is a highly experienced pharmacist with extensive knowledge of the cannabis sector and hands on experience of leading early stage pharma companies from early development through to commercial launch. Development is being carried out at the Hebrew University under the supervision of the inventor of the technology Professor Shlomo Magdassi.

CannaPowder is raising funds to finance a development program to establish cannabis powder production facilities utilizing the licensed technology. The program is expected to be completed within three years, with commercial sales starting in 2021. Once reaching the commercial stage, CannaPowder is expected to establish and operate several production facilities, each located in individual territories selected according to their size and favorable regulation for medical cannabis. The facilities will produce cannabis powders at very competitive prices and we expect to quickly capture market share.

Products will be supplied to producers of medical cannabis products. The ability to produce a more effective, consistent product in terms of quality and composition will provide an important advantage when targeting the medical market.

Results of Operations during the year ended December 31, 2017 as compared to the year ended December 31, 2016

During 2017 and 2016 we generated revenues of $0 and $0, respectively. Our general and administrative expense increased to $75,177 during 2017 compared to $2,601 during the same period in prior year and our research and development expenses increased to $10,007 during 2017 compared to $0 during the same period in the prior year both increases were due to costs incurred in relation to our new subsidiary CannaPowder. We incurred a net loss of $85,970 during 2017 compared to a net loss of $2,644 in 2016.

Liquidity and Capital Resources

Our balance sheet as of December 31, 2017 reflects $330,926 in total assets consisting of cash and cash equivalents of $326,730 and prepaid assets of $4,196. As of December 31, 2016, our balance sheet reflects assets of $0.

As of December 31, 2017, we had total current liabilities of $800 consisting of accounts payable and accrued liabilities and $2,687 of long term liabilities consisting of notes payable. As of December 31, 2016, we had total current liabilities of $2,144 consisting of accounts payable and $800 of long term liabilities consisting of notes payable.

We had positive working capital of $330,126 as of December 31, 2017 compared to negative working capital of $2,144 at December 31, 2016. Such working capital has been sufficient to sustain our operations to date. Our total liabilities as of December 31, 2017 were $3,487 compared to $2,944 at December 31, 2016.

During 2017, we used $91,560 in our operating activities. This resulted from a net loss of $85,970, decrease to accounts payable and accrued expenses of $1,344 decrease in prepaid expenses of $4,196 and gain on settlement of $50.

During 2016, we used $800 in our operating activities. This resulted from a net loss of $2,644 offset by an increase to accounts payable and accrued expenses of $1,844.

During the year ended December 31, 2017, we financed our negative cash flow from sale of common stock in the amount of $413,000, borrowings on debt of $19,190 which were offset by principal payment on debt of $17,253.

During the year ended December 31, 2016, we financed our negative cash flow from borrowings on debt of $800.

While management of the Company believes that the Company will be successful in its current and planned operating activities, there can be no assurance that the Company will be successful in the achievement of sales of its products that will generate sufficient revenues to earn a profit and sustain the operations of the Company.

Our ability to create sufficient working capital to sustain us over the next twelve-month period, and beyond, is dependent on our entering into additional licensing agreement and on our success in issuing additional debt or equity or entering into strategic arrangement with a third party. There can be no assurance that sufficient capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Going Concern Consideration

There is substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures with respect to this matter.

The Company currently plans to satisfy its cash requirements for the next 12 months through the issuance of equity and borrowings from its controlling shareholders and believes it can satisfy its cash requirements so long as it is able to obtain financing from its controlling shareholders. The Company expects that money borrowed will be used during the next 12 months to satisfy the Company’s operating costs, professional fees and for general corporate purposes.

The Company has only limited capital. Additional financing is necessary for the Company to continue as a going concern. Our independent auditor has issued an unqualified audit opinion for the years ended December 31, 2017 and 2016 with an explanatory paragraph on going concern.

Off-Balance Sheet Arrangements

As of December 31, 2017, and 2016, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K promulgated under the Securities Act of 1934.

Contractual Obligations and Commitments

As of December 31, 2017, and 2016, we did not have any contractual obligations.

Critical Accounting Policies

Our significant accounting policies are described in the notes to our financial statements for the years ended December 31, 2017 and 2016 and are included elsewhere in this annual report.

ITEM 3. PROPERTIES

Our corporate office, which consists of approximately 150 square feet, is located at 40 Wall Street, 28th Floor New York, NY 10005, at a monthly cost of $300. Our Subsidiary leases offices located at 20 Raul Wallenberg Street, Tel Aviv, Israel consisting of 1200 square feet at a base monthly rent of $500. These offices are leased from an entity related to Attribute Ltd (See Item 4 below) which rent represents the fair market value of the facilities. The Company believes that its facilities are sufficient for the foreseeable future and until we actively commence our sales and marketing efforts. At such time, we believe that adequate facilities will be available for our Subsidiary’s operations at terms satisfactory to the Company.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of April 20, 2018. The information in this table provides the ownership information for: each person known by us to be the beneficial owner of more than 5% of our common stock; each of our directors; each of our executive officers; and our executive officers and directors as a group.

| Name of Beneficial Owner | | Common Stock Beneficially Owned (1) | | | Percentage of Common Stock Owned (1) | |

| Attribute Ltd. | | | 787,500 | | | | 8.9 | % |

| 20 Raul Wallenberg Street | | | | | | | | |

| Tel Aviv, Israel | | | | | | | | |

Kfir Silberman and L.I.A. Pure Capital

(entity controlled by Kfir Silberman) | | | 787,500 | | | | 8.9 | % |

| 3 Ha’armonim St., | | | | | | | | |

| Ramat Gan, Israel | | | | | | | | |

| Amir Uziel | | | 787,500 | | | | 8.9 | % |

| 5 Shira St Street | | | | | | | | |

| Rishon Lezion, Israel | | | | | | | | |

| Lavi Krasney | | | 787,500 | | | | 8.9 | % |

| 8 Paamoni Street | | | | | | | | |

| Rishon Lezion, Israel | | | | | | | | |

| Liron Carmel, CEO and Chairman | | | 300,000 | | | | 3.4 | % |

| 40 Wall Street, 28th Floor | | | | | | | | |

| New York, NY 10005 | | | | | | | | |

| Oded Gilboa, CFO | | | 0 | | | | 0.00 | |

| 40 Wall Street, 28th Floor | | | | | | | | |

| New York, NY 10005 | | | | | | | | |

| Total Officers (2 people) | | | 300,000 | | | | 3.4 | % |

(1) Applicable percentage ownership is based on 8,875,577 shares of common stock issued as of April 20, 2018. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of April 20, 2018 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS

Our directors hold office until the next annual general meeting of the stockholders or until their successors are elected and qualified. Our officers are appointed by our Board of Directors and hold office until the earlier of their death, retirement, resignation, or removal.

The following table sets forth the names and ages of the members of our Board of Directors and our executive officers and the positions held by each.

| Name | | Age | | Title |

| Liron Carmel | | 34 | | CEO and sole director |

| Oded Gilboa | | 45 | | CFO |

Liron Carmel, 34, has been CEO, CFO and sole director of the Company since December 2014. From December 2014 to August 2015, Mr. Carmel was the CEO and CFO of Zaxis International Inc.

From 2010 through December 2014, Mr. Carmel served as a senior analyst in the Investment Division of Excellence Group, a leading investment firm in Israel. In such capacity, Mr. Carmel specialized in risk management and special debt financing including participation in and leading negotiations with major institutional investors in Israel. From 2009 to 2010, Mr. Carmel was an analytical consultant for Precise Group, an Israeli financial institution.

Oded Gilboa, 45, was appointed to be the Company’s CFO on January 1, 2018. He is a licensed CPA in the United States and Israel. He was the CFO of TechCare Corp. (OTCQB: TECR17) from December 2013 to October 2016. Prior to his appointment as CFO of TechCare Corp., Mr. Gilboa served as TechCare’s finance and accounting consultant. Mr. Gilboa has over 16 years of experience in finance and public accounting, having served as a senior finance executive in the technology and biotech industries with responsibilities in corporate finance, accounting, strategic planning and operational and financial management. From 2010 through 2012, Mr. Gilboa served as the Revenue Accounting and Finance Manager of Mylan Specialty, a subsidiary of Mylan Inc. (NASDAQ: MYL), a global company focused on the development, manufacturing and marketing of prescription drug products. From 2007 through 2009, Mr. Gilboa was the Executive director of Finance and US Controller of Taro Pharmaceuticals (NASDAQ: TAROF), a global pharmaceutical company. From 1998 through 2007 Mr. Gilboa held various financial positions with IDT Corporation (NYSE: IDT), a world-wide provider of telecommunications and media services, where in his most recent role he served as director of Finance. Mr. Gilboa began his career in public accounting, auditing both public and private companies and holds a B.A in Economics and Accounting from Tel-Aviv University and an M.B.A. from Recanati Business School at Tel-Aviv University.

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our Board of directors. As such, our entire Board of directors acts as our audit committee.

Involvement in Legal Proceedings

None of our directors, nominees for directors, or officers has appeared as a party during the past ten years in any legal proceedings that may bear on his ability or integrity to serve as a director or officer of the Company.

Code of Ethics

The Company has adopted a code of ethics applicable to our principal, executive and financial officers.

Potential Conflict of Interest

Since we do not have an audit or compensation committee comprised of independent directors, the functions that would have been performed by such committees are performed by our Board of directors. Thus, there is a potential conflict of interest in that our directors have the authority to determine issues concerning management compensation, in essence their own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or directors.

Board’s Role in Risk Oversight

The Board assesses on an ongoing basis the risks faced by the Company. These risks include financial, technological, competitive, and operational risks. The Board dedicates time at each of its meetings to review and consider the relevant risks faced by the Company at that time. In addition, since the Company does not have an Audit Committee, the Board is also responsible for the assessment and oversight of the Company’s financial risk exposures.

ITEM 6. EXECUTIVE COMPENSATION

The following table sets forth information concerning the total compensation that we have paid or that has accrued on behalf of our chief executive officer and other executive officers with annual compensation exceeding $100,000 during the fiscal years ending December 31, 2017, 2016 and 2015.

| | | | | | | | | | | | | | | Long Term | | | | |

| | | | | | Annual Compensation | | | Compensation Awards | | | | |

| | | | | | | | | | | | Other | | | Restricted | | | Securities | | | | |

| | | | | | | | | | | | Annual | | | Stock | | | Underlying | | | All Other | |

| | | | | | Salary | | | Bonus | | | Compensation | | | Award(s) | | | Options | | | Compensation | |

| Name and Principal Position | | Year | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Liron Carmel, CEO, and Director (1) | | 2017 | | | | 15,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2016 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2015 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oded Gilboa, CFO (1) | | 2017 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2016 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | 2015 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

We do not currently have a stock option plan. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to any executive officer or any director since our inception; accordingly, no stock options have been granted or exercised by any of the officers or directors since we were founded.

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. No individual grants or agreements regarding future payouts under non-stock price-based plans have been made to any executive officer or any director or any employee or consultant since our inception; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by any of the officers or directors or employees or consultants since we were founded.

Compensation of Directors

There are no current agreements pursuant to which directors are or will be compensated in the future for any services provided as a director.

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

There are no employment contracts in place, no employees were terminated and no change in control arrangements have been signed with the company.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

During the years ended December 31, 2017 and 2016, the Company issued the following restricted securities to “affiliated purchasers”:

On October 17, 2017, the Company issued and sold a total of 2.6 million restricted shares of common stock to four accredited investors (650,000 shares to each) at $0.01 per share for a total cash consideration of $26,000. Reference is made to Item 4. Security Ownership of Certain Beneficial Owners and Management. As a result of these issuances, the four accredited investors became greater than 5% shareholders.

ITEM 8. LEGAL PROCEEDINGS

We know of no material, active or pending legal proceedings against our Company, nor of any proceedings that a governmental authority is contemplating against us. We know of no material proceedings to which any of our directors, officers, affiliates, owner of record or beneficially of more than 5 percent of our voting securities or security holders is an adverse party or has a material interest adverse to our interest.

ITEM 9. MARKET FOR REGISTRANT’S COMMON STOCK AND RELATED STOCKHOLDER MATTER

Market Information

Our common stock is quoted on the OTC Pink Sheets Market under the symbol SMGY, an inter-dealer automated quotation system for equity securities not included on The Nasdaq Stock Market. Quotation of the Company’s securities on the OTC Pink Sheets Market limits the liquidity and price of the Company’s common stock more than if the Company’s shares of common stock were listed on The Nasdaq Stock Market or a national exchange. For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The below prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

| | | Price Range | |

| Period | | High | | | Low | |

| Year Ended December 31, 2015: | | | | | | | | |

| First Quarter | | $ | 2.70 | | | $ | 1.01 | |

| Second Quarter | | $ | 2.69 | | | $ | 0.99 | |

| Third Quarter | | $ | 0.99 | | | $ | 0.86 | |

| Fourth Quarter | | $ | 0.75 | | | $ | 0.60 | |

| Year Ended December 31, 2016: | | | | | | | | |

| First Quarter | | $ | 0.48 | | | $ | 0.35 | |

| Second Quarter | | $ | 0.35 | | | $ | 0.35 | |

| Third Quarter | | $ | 0.35 | | | $ | 0.35 | |

| Fourth Quarter | | $ | 0.35 | | | $ | 0.35 | |

| Year Ending December 31, 2017: | | | | | | | | |

| First Quarter | | $ | 1.00 | | | $ | 0.35 | |

| Second Quarter | | $ | 0.51 | | | $ | 0.51 | |

| Third Quarter | | $ | 1.00 | | | $ | 0.51 | |

| Fourth Quarter | | $ | 0.62 | | | $ | 0.51 | |

| Year Ending December 31, 2018: | | | | | | | | |

| First Quarter (through April 20, 2018) | | $ | 1.50 | | | $ | 0.52 | |

Our stock transfer agent is Transfer Online, Inc., with offices located at 512 SE Salmon Street, Portland, OR 97214. Their phone number is (503) 227-2950 and email address is: info@transferonline.com.

Holders.As of April 20, 2018, there 189 registered stockholders holding had 8,875,577 Common Stock.

Dividends.We have never declared or paid any cash dividends on our common stock nor do we anticipate paying any in the foreseeable future. We expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Equity Compensation Plans.We do not have any equity compensation plans.

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES

During the years ended December 31, 2016 and 2015, the Company did not sell any unregistered securities.

Sales of Unregistered Securities in 2017:

On October 17, 2017, the Company sold 6,300,000 shares to 13 shareholders, each an “accredited investor” as that term is defined in Rule 501 of Regulation D promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Act”), for $0.01 a share for a total cash consideration of $63,000.

On October 24, 2017, the Company issued 666,667 shares to one shareholder at $0.075 per share for cash consideration of $50,000.

During the period from November 15, 2017 to December 7, 2017, the Company sold a total of 1,000,000 units to accredited investors for cash consideration of $300,000 at price of $.30 per unit (the “$0.30 Units”), each consisting of: (i) one share of Common Stock; and (ii) one class A warrant exercisable at $0.60 per share with a term of 24 months (the “Class A Warrants”). During the period from March 20, 2018 to April 17, 2018, the Company sold a total of 793,000 units to accredited investors for aggregate cash consideration of $475,775 at a price of $0.60 per unit (the “$0.60 Units”), each consisting of: (i) one share of Common Stock; and (ii) one class B warrant exercisable at $1.20 per share with a term of 24 months (the “Class B Warrants”). In connection with the sale of the $0.60 Units, a total of 234,000 shares of Common Stock have been issued to date and an additional 559,000 shares of Common Stock are pending issuance by the transfer agent but have not yet been issued.

As discussed above, the Company is continuing to raise capital through the private sale of its equity securities, primarily pursuant to the exemptions provided under Regulation S and to a lesser extent pursuant to Regulation D, both promulgated by the SEC under the Act. To date, the Company has raised approximately $888,775 in the Equity Raise.

The Company believes that the issuances and sale of the restricted securities were exempt from registration pursuant to Section 4(2) of the Act and Regulation S and Regulation D promulgated by the SEC under the Act, as privately negotiated, isolated, non-recurring transactions with accredited investors not involving any public solicitation. The subscribers, in each case, represented to the Company their intention to acquire the securities for investment only and not with a view to the distribution thereof. Appropriate restrictive legends are affixed to the stock certificates issued in such transactions. All recipients of restricted securities represented by the shares of Common Stock and the Units either received adequate information about the Company or had access, through employment, relation and/or business relationships with the Company to such information and each of the subscribers is an accredited investor.

ITEM 11. DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED

Common Stock

We are authorized to issue 495,000,000 shares of common stock with a par value of 0$.00001 per share (“Common Stock”). As of April 20, 2018, 8,875,577 shares of our Common Stock were issued and on record with our transfer agent, Transfer Online Inc. Some of the shares of Common Stock issuable in connection with the Company’s Equity Raise have not been yet been issued but are pending issuance.

Each outstanding share of Common Stock that is on record with our transfer agent is entitled to one vote, either in person or by proxy, on all matters that may be voted upon by the owners thereof at meetings of the stockholders.

Our shareholders have no pre-emptive rights to acquire additional shares of Common Stock. The Common Stock is not subject to redemption or any sinking fund provision, and it carries no subscription or conversion rights. In the event of our liquidation, the holders of the Common Stock will be entitled to share equally in the corporate assets after satisfaction of all liabilities.

The description contained in this section does not purport to be complete. Reference is made to our certificate of incorporation and bylaws which are available for inspection upon proper notice at our offices, as well as to the Nevada Revised Statutes for a more complete description covering the rights and liabilities of shareholders.

Holders of our Common Stock

| | (i) | have equal ratable rights to dividends from funds legally available therefore, if declared by our Board of Directors, |

| | | |

| | (ii) | are entitled to share ratably in all our assets available for distribution to holders of Common Stock upon our liquidation, dissolution or winding up; |

| | | |

| | (iii) | do not have preemptive, subscription or conversion rights or redemption or sinking fund provisions; and |

| | | |

| | (iv) | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote at all meetings of our stockholders. |

The holders of shares of our Common Stock do not have cumulative voting rights, which means that the holders of more than fifty percent (50%) of outstanding shares voting for the election of directors can elect all of our directors if they so choose and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

Preferred Stock

The Company’s Articles of Incorporation, as amended, authorize 5,000,000 shares of preferred stock, par value $0.00001 per share, which may be issued by the Board of Directors from time to time in one or more series. Our Board of Directors, without further approval of our stockholders, is authorized to fix the dividend rights and terms, conversion rights, voting rights, redemption rights, liquidation preferences and other rights and restrictions relating to any series of preferred stock that may be issued in the future. Issuances of shares of preferred stock, while providing flexibility in connection with possible financings, acquisitions and other corporate purposes, could, among other things, adversely affect the voting power of the holders of our Common Stock and prior series of preferred stock then outstanding.

Dividends

We have no history of paying dividends, moreover, there is no assurance that we will pay dividends in the future.

Shares Eligible for Future Sale

Our shares are thinly traded on the OTC Market, and we cannot assure you that a significant public market for our Common Stock will be developed. Sales of substantial amounts of Common Stock in the public market, or the possibility of substantial sales occurring, could adversely affect prevailing market prices for our Common Stock or our future ability to raise capital through an offering of equity securities.

As of April 17, 2018, 8,787,881 shares of Common Stock of the total 8,875,577 issued and outstanding shares of Common Stock are “restricted” shares as that term is defined under the Act. We have not entered into any agreement to register any of our issued and outstanding shares, although such agreement may be entered into in the future, or such an agreement may be made part of the terms of a future equity raise or other transactions.

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our bylaws and articles of incorporation provide that our officers and directors are indemnified to the fullest extent provided by the Nevada Revised Statutes (“NRS”).

Under the Nevada Revised Statutes, director immunity from liability to a company or its shareholders for monetary liabilities applies automatically unless it is specifically limited by a company’s Articles of Incorporation. Our Articles of Incorporation do not specifically limit the directors’ immunity. The NRS excepts from that immunity (a) a willful failure to deal fairly with the company or its shareholders in connection with a matter in which the director has a material conflict of interest; (b) a violation of criminal law, unless the director had reasonable cause to believe that his or her conduct was lawful or no reasonable cause to believe that his or her conduct was unlawful; (c) a transaction from which the director derived an improper personal profit; and (d) willful misconduct.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

The Company has not purchased insurance for the directors and officers that would provide coverage for their acts as an officer or director of the Company.

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMNTARY DATA

ITEM 14. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 15. FINANCIAL STATEMENTS AND EXHIBITS

INDEX TO FINANCIAL STATEMENTS