UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 26, 2006

Date of Report (Date of earliest event reported)

APEX CAPITAL GROUP, INC.

(Exact name of Registrant as specified in its charter)

Nevada | 000-27001 | 91-1939535 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer File Number) |

No. 507 Royal Plaza, 21-1 Wenyi Road,

Shenhe District, Shenyang City, Liaoning Province, China, Postal Code 110000

(Address of principal executive offices)

(86) 24-31296178

(Registrant’s telephone number, including area code)

69930 Highway 111, Suite 100, Rancho Mirage, California 92270

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the filing of this Current Report on Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

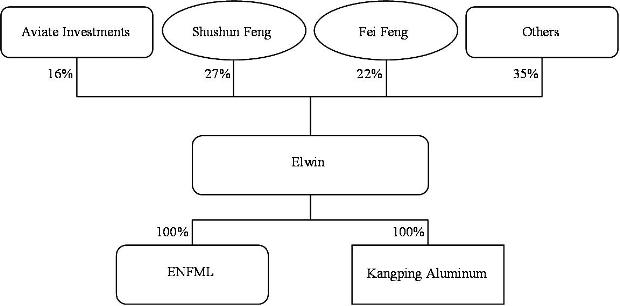

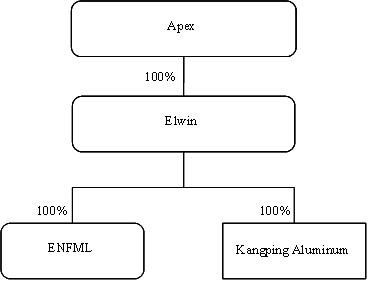

On October 26, 2006, Apex Capital Group, Inc., a Wyoming Corporation (“Apex Wyoming”), and Apex Capital Group, Inc., a Nevada Corporation (“Apex”), entered into an Assignment and Assumption Agreement and Consent to Assignment (the “Assignment”) pursuant to which Apex Wyoming assigned to Apex all of its right, title, and interest in and to the Securities Exchange Agreement, dated as of September 6, 2006 (the “Securities Exchange Agreement”), by and between Apex Wyoming, Dempsey Mork, Elwin Group Limited, a British Virginia Islands corporation (“Elwin”), and Elwin’s shareholders. The Assignment is incorporated herein by reference and filed herewith as Exhibit 10.1. The Securities Exchange Agreement filed with our Current Report on Form 8-K filed on September 7, 2006 is incorporated herein by reference.

Item 2.01. Completion of an Acquisition or Disposition of Assets.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. In addition, pursuant to Item 2.01(f) of Form 8-K, we are providing below the information that would be required if we were filing a general form for registration of securities on Form 10-SB.

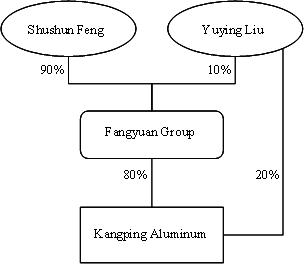

For convenience in this report, unless indicated otherwise, "the company," "we," "us" and "our" refer to Apex and its consolidated subsidiaries, including our operating subsidiary, Shenyang Fangyuan Group Kangping Aluminum Factory Company Limited ("Kangping Aluminum").

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements relating to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to future prospects, developments and business strategies. These forward looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "predict," "project," "should," "will" and similar terms and phrases, including references to assumptions. Such statements are based on current expectations, are inherently uncertain and are subject to changing assumptions.

Such forward-looking statements include, but are not limited to:

| · | estimates of the demand for high purity aluminum and the growth of the high purity aluminum market; |

| · | expectations of our ability to successfully covert our existing operations from the production of primary aluminum to high purity aluminum; |

| · | expectations as to the impact of increasing prices of raw materials and utilities used the production of high purity aluminum; |

| · | expectations about our ability to produce and successfully utilize our intellectual property rights; |

| · | expectations about our ability to retain key personnel; |

| · | expectations about the economic and political stability of China; |

| · | expectations regarding working capital trends and anticipated capital expenditures levels; |

| · | the availability of financial resources to fund our operations in 2006 and beyond; and |

| · | the impact of various market risks, including fluctuations in currency exchange rates, fluctuations in commodity prices and fluctuations in the market price of our common stock. |

Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different. Such factors include, but are not limited to, the following: changes in general economic and business conditions; changes in current pricing and cost levels; changes in political, social and economic conditions and local regulations in China; foreign currency fluctuations; reductions in sales to any significant customers; competition; disruptions of established supply channels; manufacturing capacity constraints; the availability, terms and deployment of capital; and the other factors described under "Risk Factors."

If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected. In addition to other factors that affect our operating results and financial position, neither past financial performance nor our expectations should be considered reliable indicators of future performance. Investors should not use historical trends to anticipate results or trends in future periods. Failure of sales or income in any quarter to meet the investment community's expectations, as well as broader market trends, could have an adverse impact on our stock price. We do not undertake an obligation to update such forward looking statements or risk factors to reflect future events or circumstances.

RISK FACTORS

Risks Related to our Business

We are currently transitioning our business entirely from primary aluminum manufacturing to high purity aluminum manufacturing, and we are therefore subject to the risks generally associated with the formation of any new business and the complete transition of an existing business.

In June, 2006, we began to transition our business entirely from primary aluminum manufacturing to high purity aluminum manufacturing. We have converted one of our 172 electrolytic cells for production of high purity aluminum, and we expect to complete the transition by the end of 2007. Upon completion of this transition, we will manufacture only high purity aluminum. We are therefore subject to the risks generally associated with the formation of any new business and the complete transition of an existing business, including the following risks:

| · | the high purity aluminum market is a developing niche market, and we may have over-estimated demand and growth potential; |

| · | we may have underestimated the level of competition in the high purity aluminum manufacturing market; |

| · | we have no established relationships with customers in the high purity aluminum manufacturing marketplace, and we may be unable to successfully establish or maintain such relationships; |

| · | we may encounter significant technical difficulties in the transition to new manufacturing processes; |

| · | our transition may take much longer or cost much more than expected; and |

| · | we may fail to raise sufficient capital to fund our transition. |

The transition to and implementation of our new business plans will require significant resources and will place a significant strain on our personnel and management team. We have no meaningful high purity aluminum manufacturing operating history upon which investors may evaluate our performance and assess our future prospects. We cannot assure you that we will be able to successfully implement the transition or to establish or maintain a successful high purity aluminum manufacturing business. Accordingly, our financial performance to date may not be indicative of our long-term future performance and may not necessarily reflect what our results of operations, financial condition and cash flows would have been had we been engaged significantly or solely in high purity aluminum manufacturing during the periods presented. If we are unable to successfully transition to and establish our new operations, then our business, financial condition, results of operations and growth prospects will be adversely affected.

If we do not effectively manage our expected growth, then our business, ability to maintain consistent quality control and financial results could be adversely affected.

Based on our estimates of the demand for high purity aluminum in the Peoples Republic of China (“China” or the “PRC”) and the world, we expect our business to grow significantly as a result of our transition to high purity aluminum manufacturing. This growth will place significant demands on our current management resources. Our ability to manage our growth effectively will require us to expand our operational, financial and management information systems and to continue to retain, attract, train, motivate and manage key employees. We cannot assure you that we will be successful in attracting qualified individuals to the extent necessary, and management may expend significant time and energy attracting the appropriate personnel to manage facilities we develop in the future. Also, additional facilities will require us to maintain consistent quality control measures that allow our management to effectively identify deviations that result in manufacturing substandard products. If we are unable effectively to manage our growth or successfully to integrate expansions into our existing business or maintain consistent quality control measures, our business, financial condition and results of operations could be adversely affected.

We may need additional capital to fund our operations and finance our growth, and we may not be able to obtain it on terms acceptable to us, or at all, which may limit our ability to grow.

Continued expansion of our business may require additional capital, particularly if we were to accelerate our transition or expansion plans. Financing may not be available to us or may be available to us only on terms that are not favorable. If we are unable to raise additional funds or obtain funds on terms acceptable to us, we may have to delay or abandon some or all of our transition or growth strategies. Further, if additional funds are raised through the issuance of additional equity securities, the percentage ownership of our stockholders would be diluted. Any newly issued equity securities may have rights, preferences or privileges senior to those of our common stock. See “Description of Capital Stock.”

The geographic concentration of our facilities could leave us vulnerable to an economic downturn, regulatory changes or acts of nature in those areas, resulting in a decrease in our revenues or an increase in our costs, or otherwise negatively impacting our results of operations.

All of our facilities are located in northeastern China. As a result of this concentration, the conditions of local economies, acts of nature, changes in governmental rules and regulations, particularly with respect to aluminum manufacturing, and other factors that may result in a decrease in demand for high purity aluminum in northeastern China or China in general could have an adverse effect on our revenues, costs and results of operations.

Departure of our chief technology officer or other key technical personnel could harm our business.

Our successful transition to and establishment of our high purity aluminum manufacturing business depends, to a significant extent, upon the continued service of key technical personnel, and in particular our chief technology officer (“CTO”), Prof. Huimin Lu. Our CTO is a leading metallurgist with significant experience successfully applying his technological developments to allow mass production of high purity aluminum. He has signed a 50-year license agreement with us giving us exclusive rights to use, among other things, his recent patent-pending high purity aluminum manufacturing process. Kangping Aluminum has an option to extend the license agreement for an additional 50-year term. We have also entered into a 10-year employment agreement with our CTO pursuant to which he must assign to us any intellectual property rights relating to high purity aluminum and arising during the term of the employment agreement. We believe this agreement is enforceable, but we cannot assure you that we would be able to enforce it if it is challenged. If we were to lose his services, then our transition to high purity aluminum manufacturing, our business, financial results and growth prospects could be adversely affected. If he joins a competitor or forms a competing company, we could lose exclusive access to high purity aluminum manufacturing processes in which he may have rights, as well as lose customers and incur additional expenses to recruit replacements and train personnel.

Elwin’s failure to make full payment for its acquisition of Kangping Aluminum could result in the annulment of Elwin’s acquisition of Kangping Aluminum.

Elwin entered into an agreement to purchase Kangping Aluminum for approximately $16.8 million (RMB133.21 million) on August 10, 2006. The Chinese government approved the acquisition on August 28, 2006 and issued Kangping Aluminum a license to operate as a wholly foreign-owned enterprise on September 4, 2006. Elwin has not yet paid any of the monies owed pursuant to the acquisition of Kangping Aluminum. Under Chinese law, Elwin must pay the entire price within 90 days of the granting of the business license. Although Chinese regulations provide for extensions at the discretion of the government agencies, there is no assurance that we will be able to obtain such an extension. If we fail to raise sufficient funds within the 90 days and we fail to obtain an extension from the Chinese government, Elwin’s acquisition of Kangping Aluminum will be annulled and, Kangping Aluminum will no longer be our subsidiary. As a result, we would have no operating assets.

We generally do not enter into long-term contracts with our suppliers and customers.

| · | our relationships with our customers or suppliers; |

| · | the financial condition of our customers or suppliers; |

| · | short-term or long-term increases in market prices or decreases in supply of our raw materials; and |

| · | short-term or long-term decreases in market prices or demand for our products. |

If our relationship with one of our key suppliers or customers is adversely affected, we may not be able to quickly or effectively replace such supplier or customer.

We have significant customer concentration, and a significant decline in business with of one or more of our major customers could materially impair our business, operating results, prospects and financial condition.

For the year ended December 31, 2005, our largest four customers accounted for approximately 34%, 19%, 9% and 6%, respectively, of our net sales of primary aluminum. For the six months ended June 30, 2006, our largest four customers accounted for approximately 26%, 15%, 6% and 5%, respectively, of our net sales of primary aluminum. Accordingly, prior to completing our conversion to high purity aluminum manufacturing, the loss of, or significant reduction in purchases by, any of these customers or other significant customers could materially impair our operating results and weaken our financial condition. For more information, see “Business—Our Major Primary Aluminum Customers.” We do not currently have established histories with any customers for high purity aluminum.

After our transition to high purity aluminum manufacturing, our revenues will depend initially on sales of one product, and later on sales of a few related high purity aluminum products, and a decline in sales of any of these products could cause our revenues to decrease.

After our transition to high purity aluminum manufacturing, we expect to derive substantially all of our revenue initially from the sale of unfinished high purity aluminum. After we expand our production capabilities to produce high purity aluminum foils and alloys and later super high purity aluminum, we expect to derive substantially all of our revenue from the sale of a few related high purity aluminum products for the foreseeable future. Any factors adversely affecting the pricing of, demand for or market acceptance of high purity aluminum or these related semi-finished products, including increased competition, could cause our revenues to decline and our business and future operating results to suffer. Our failure to develop products that are compatible with market needs could have an adverse effect on our sales and earnings.

Our operations consume substantial amounts of electricity, and our profitability may decline if our electricity costs rise or if electricity supplies are interrupted.

We consume substantial amounts of electricity in our operations, and it accounts for approximately 30% of the total cost of our primary aluminum products and will account for an estimated 40% of the total cost of our high purity aluminum products. Because local governments in the areas we operate desire to encourage local development, we currently pay discounted preferential rates for the electricity we use for our operations. These rates are approximately 20% lower than the normal rates charged for other businesses and are not locked in for any fixed period. The following could adversely affect our results of operations:

| · | we could lose our preferential electricity rates, which would significantly increase our costs; |

| · | electrical power could be interrupted due to unplanned outages, equipment failure or other causes, which could severely damage our manufacturing facilities; |

| · | there could be a reduction in supply of coal, from which the electricity we use is generated, which could interrupt the electrical power supply or cause an increase in the costs of electrical power; and |

| · | one or more of our manufacturing facilities could shut down due to an inability to continue to obtain electrical power on cost-effective terms. |

Moreover, the law relating to intellectual property is not as developed in China, and our intellectual property rights may not be as protected in China as they are in other countries such as the United States. Any patents issued to us, or in which we otherwise have rights, may not be sufficiently broad to protect our proprietary technologies, and given the costs of obtaining patent protection, we may choose not to seek patent protection for certain of our proprietary technologies. We may not be effective in policing unauthorized use of our intellectual property, and even if we do detect violations, litigation may be necessary to enforce our intellectual property rights. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive, could divert our management’s attention and may result in a court determining that our intellectual property rights are unenforceable. If we are not successful in cost-effectively protecting our intellectual property rights, our business, operating results and financial condition could be harmed.

Our use of hazardous or toxic substances in our business may subject us to substantial liabilities, which may exceed the value of the underlying assets and which could materially and adversely affect our liquidity and earnings.

Our aluminum production operations are subject to environmental protection laws and regulations in China that impose such penalties as waste discharge fees, fines or closure of non-compliant plants. Each of our aluminum production plants has implemented a system to control its emissions and to oversee compliance with PRC environmental regulations. The PRC government has taken steps, and may take additional steps, towards more rigorous enforcement of applicable laws or adoption of more stringent environmental standards. If the PRC national or local authorities enact additional regulations or enforce existing or new regulations in a more rigorous manner, we may be required to make additional environmental expenditures, which could have an adverse impact on our financial condition.

We may not be able to successfully implement productivity and cost-reduction initiatives.

We have undertaken and may continue to undertake productivity and cost-reduction initiatives to improve performance. There can be no assurance that these initiatives will be completed or beneficial to our business or that any estimated cost savings from such activities will be realized.

We may not be able to successfully develop or implement new technology initiatives.

We are working on new technology and manufacturing developments. These developments may not be feasible or beneficial to our business.

We have limited business insurance coverage and may be subject to losses that might not be covered by existing insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. As a result, we do not have business liability or disruption insurance coverage for our operations. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

Risks Related to our Industry

We are exposed to volatility in the aluminum industry, economic conditions generally and aluminum end-use markets.

The aluminum industry is highly cyclical, with prices subject to worldwide market forces of supply and demand and other influences. Prices have been historically volatile and we expect such volatility to continue. Because most of our costs are fixed and we may not be able to respond quickly to any sudden decrease in prices of high purity aluminum, any significant fluctuation in market prices could materially adversely affect our business, financial condition and operating performance.

A decrease in supply or increase in cost of our raw materials could result in a material decline in our profitability.

Because we purchase large volumes of raw materials, such as alumina, any restrictions on the supply or increase in the cost of our raw materials could significantly reduce our profit margins. Efforts to mitigate restrictions on the supply or price increases of our raw materials by productivity improvements or by passing cost increases to our customers may not be successful, and as is typical in China, we do not generally enter into long-term purchase contracts with fixed-price terms. Our profitability depends largely on the price and continuity of supply of these raw materials, which are supplied by a limited number of sources. Our ability to pass on these costs to our customers is, to a large extent, dependent on the terms of our contracts with our customers and industry conditions, including the extent to which our customers would switch to alternative materials that we do not produce in the event of an increase in the prices of our products.

We participate in a highly competitive market.

We believe that there are two other high purity aluminum manufacturers in China, one with an estimated capacity of 15,000 metric tons per year and the other with a capacity of 5,000 metric tons per year. After we complete our transition to high purity aluminum manufacturing, we expect to have a capacity of 20,000 metric tons per year. Our estimates could be wrong, more competitors could enter the marketplace or our competitors could increase their capacity, any of which could limit our ability to sell our products at expected prices, which could have a material adverse effect on our revenues and earnings.

In connection with its accession to the World Trade Organization in 2001, China has undertaken to open up its markets to foreign companies. China reduced its average import tariff rate overall to 10.4% in 2004 and further reduced it to 9.90% in 2005. As a result, foreign competitors may form alliances with or acquire companies in our industry in China. Intensified competition from these foreign competitors may lead to lower profit margins due to price competition, loss of customers and slower than anticipated growth.

Risks Related to Doing Business in China

A slowdown in the growth of the Chinese economy may slow down our growth and profitability.

Our business is primarily dependent upon the economy and the business environment in China. In particular, our growth strategy is based upon the assumption that demand in China for high purity aluminum will continue to grow with the Chinese economy. However, the growth of the Chinese economy has been uneven across geographic regions and economic sectors. Several years ago, the Chinese economy also experienced deflation, which may reoccur in the foreseeable future. There can be no assurance that growth of the Chinese economy will be steady or uniform or that any slowdown will not have a negative effect on our business.

China’s legal system is characterized by uncertainty that could negatively impact our business and results of operations.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little value as precedent. Beginning in 1979, the PRC government promulgated a comprehensive system of laws and regulations governing economic matters, which has had the overall effect of significantly enhancing the protections afforded to foreign invested enterprises in China.

However, these laws, regulations and legal requirements are relatively new and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors. In addition, enforcement of existing laws, or contracts based on existing law, may be uncertain and sporadic, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The relative inexperience of China’s judiciary in many cases creates additional uncertainty as to the outcome of any litigation. Furthermore, interpretation of statutes and regulations may be subject to new government policies reflecting domestic political changes.

Our activities in China will be subject to administrative review and approval by various national and local agencies of the PRC government. Because of the changes occurring in China’s legal and regulatory structure, we may not be able to secure the requisite governmental approval for our activities. Failure to obtain the requisite governmental approval for any of our activities could adversely affect our business and results of operations.

Any recurrence of SARS or another widespread public health problem, such as the emergence of an avian influenza, could negatively impact our business and results of operations.

A renewed outbreak of SARS or another widespread public health problem in China, where substantially all of our revenue is derived and where our operations are located, could have a negative effect on our operations. Our operations may be impacted by a number of health-related factors, including the following:

| · | quarantines or closures of some of our offices, which would severely disrupt our operations; |

| · | the sickness or death of our key officers and employees; and |

| · | a general slowdown in the Chinese economy. |

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our business and results of operations.

Changes in China’s political and economic policies could negatively impact our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject in a significant degree to the economic, political and legal developments in China. China’s economy has historically been a planned economy subject to governmental plans and quotas and has, in certain aspects, been transitioning to a more market-oriented economy. Although we believe that the economic reform and the macroeconomic measures adopted by the PRC government have had a positive effect on the economic development of China, we cannot predict the future direction of these economic reforms or the effects these measures may have on our business, financial position or results of operations. In addition, the Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development (“OECD”). These differences include:

| · | level of government involvement in the economy; |

| · | level of capital reinvestment; |

| · | control of foreign exchange; |

| · | methods of allocating resources; and |

| · | balance of payments position. |

As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Restrictions on foreign currency exchange may limit our ability to receive and use our revenues effectively.

Any future restrictions on currency exchanges may limit our ability to use revenues generated in Renminbi to fund any future business activities outside China or to make dividend or other payments in U.S. dollars or other foreign currencies. Although the PRC government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents. In addition, remittance of foreign currencies abroad and conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi, especially with respect to foreign exchange transactions.

Our operating subsidiary in China is subject to restrictions on dividend payments.

We are a holding company incorporated in Nevada with no operating assets. We rely on dividends and other distributions from our operating subsidiary in the PRC, Kangping Aluminum, to provide us with our cash flow and allow us to pay dividends on our common stock and meet our other obligations. Current regulations in China permit Kangping Aluminum to pay dividends to us only out of its accumulated distributable profits, if any, determined in accordance with its articles of association and PRC accounting standards and regulations. In particular, Kangping Aluminum, as a wholly foreign owned enterprise in China, is required to set aside at least 10% (up to an aggregate amount equal to half of its registered capital) of its after-tax profits each year. Such cash reserve may not be distributed as cash dividends. Currently, the aggregate amount of the reserve fund of Kangping Aluminum is in excess of half of its registered capital, and therefore, Kangping Aluminum is not required to set aside any addition reserve fund. In addition, if Kangping Aluminum incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us.

Fluctuations in the value of the Renminbi could negatively impact our results of operations.

Our reporting currency is the U.S. dollar and our sales, operating expenses and substantially all of our assets and liabilities are denominated in Renminbi. As a result, we are exposed to foreign exchange risk, and our reported profits will decline if the Renminbi depreciates against the U.S. dollar.

The value of the Renminbi is subject to changes in China’s governmental policies and to international economic and political developments. Since January 1, 1994, the PRC government has used a unitary managed floating rate system. Under this system, the People’s Bank of China publishes a daily base exchange rate with reference primarily to the supply and demand of Renminbi against U.S. dollar and other foreign currencies in the market during the previous day. Authorized banks and financial institutions are allowed to quote buy and sell rates for Renminbi within a specified band around the central bank’s daily exchange rate. However, since July 2005 the Renminbi is no longer pegged solely to the U.S. dollar. Instead, it is reported to be pegged against a basket of currencies, determined by the People’s Bank of China, against which it can rise or fall by as much as 0.3% each day. The Renminbi may appreciate or depreciate significantly in value against the U.S. dollar in the long term, depending on the fluctuation of the basket of currencies against which it is currently valued or it may be permitted to enter into a full float, which may also result in a significant appreciation or depreciation of the Renminbi against the U.S. dollar.

As we rely entirely on dividends paid to us by Kangping Aluminum, any significant devaluation of the Renminbi would have a material adverse effect on our revenues and financial condition, and the value of, and any dividends payable on, our shares in foreign currency terms. Conversely, to the extent that we need to convert U.S. dollars we receive from any future primary offering into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar would have an adverse effect on the Renminbi amount we receive from the conversion. Fluctuations in the exchange rate will also affect the earnings from and the value of any U.S. dollar-denominated investments we make in the future.

Our officers and directors, and substantially all of our assets, are located in China, which may make it difficult to obtain jurisdiction over and enforce liabilities against our officers, directors and assets.

Because our executive officers and directors are Chinese citizens living in China it may be difficult, if not impossible, to obtain jurisdiction over them in the event that a stockholder or group of stockholders initiates a lawsuit in the United States against us or any of our officers or directors. We anticipate that our future officers and directors will also be Chinese citizens. Because the majority of our assets are located in China, it would also be extremely difficult to access those assets to satisfy an award entered against us in U.S. court.

SELECTED HISTORICAL FINANCIAL AND OPERATING DATA FOR KANGPING ALUMINUM

The following table sets forth selected historical financial data as of and for each of the years in the five-year period ended December 31, 2005 and for the six months ended June 30, 2006 and 2005 for our operating subsidiary, Kangping Aluminum. Kangping Aluminum's historical statements of operations data for the years ended December 31, 2005, 2004, 2003 and 2002 and balance sheet data as of December 31, 2005, 2004, and 2003 have been derived from its audited financial statements. Kangping Aluminum's financial statements from certain of these periods are included elsewhere in this report. The statements of operations data for the year ended December 31, 2001 and balance sheet data as of December 31, 2002 and 2001 have been derived from Kangping Aluminum's unaudited financial statements. The statements of operations data for the six months ended June 30, 2006 and the balance sheet data as of June 30, 2006 and 2005 are derived from Kangping Aluminum's unaudited interim financial statements included elsewhere in this report.

You should read this information in conjunction with the information under ‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations,’’ ‘‘Business’’ and our historical combined financial statements and the related notes thereto included elsewhere in this report.

Statements of Operations (in U.S. dollars) | | | | | | | | | | Six Months | |

| | | Year Ended December 31, | | Ended June 30, | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2005 | | 2006 | |

| | | (unaudited) | | | | | | | | | | (unaudited) | | (unaudited) | |

| Sales - Unrelated Parties | | | 13,177,281 | | | 11,540,020 | | | 29,680,549 | | | 33,616,221 | | | 26,370,255 | | | 10,875,793 | | | 17,697,440 | |

| Sales - Related Parties | | | 9,076,487 | | | 10,592,798 | | | 12,270,345 | | | 10,204,957 | | | 13,757,972 | | | 3,909,841 | | | 571,234 | |

| Sales | | | 22,253,768 | | | 22,122,818 | | | 41,950,894 | | | 43,821,178 | | | 40,128,227 | | | 14,785,634 | | | 18,268,674 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Cost of Sales | | | 17,858,370 | | | 18,743,827 | | | 36,723,472 | | | 39,306,630 | | | 34,430,828 | | | 12,841,255 | | | 15,773,226 | |

| Gross Profit | | | 4,395,397 | | | 3,378,991 | | | 5,227,422 | | | 4,514,548 | | | 5,697,399 | | | 1,944,379 | | | 2,495,448 | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | | | |

| General & Administrative Expenses | | | 1,090,479 | | | 447,494 | | | 615,904 | | | 771,584 | | | 321,396 | | | 286,505 | | | 319,444 | |

| Income from Operations | | | 3,304,919 | | | 2,931,497 | | | 4,611,518 | | | 3,742,964 | | | 5,376,003 | | | 1,657,874 | | | 2,176,004 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other Income (Expenses) | | | | | | | | | | | | | | | | | | | | | | |

| Interest Income - Related Party | | | - | | | - | | | 885,309 | | | 1,007,289 | | | 959,232 | | | 579,768 | | | 266,633 | |

| Other Income | | | 1,481 | | | 159,479 | | | 224,858 | | | 205,842 | | | 103,750 | | | 56,204 | | | 26,895 | |

| Other Expenses | | | (7,029 | ) | | (15,734 | ) | | (16,162 | ) | | (18,348 | ) | | (26,590 | ) | | (7,414 | ) | | (3,203 | ) |

| Interest Expense - Unrelated Party | | | (373,295 | ) | | (648,797 | ) | | (1,358,196 | ) | | (1,769,241 | ) | | (1,712,986 | ) | | (840,014 | ) | | (869,535 | ) |

| Income Before Income Taxes | | | 2,926,075 | | | 2,426,445 | | | 4,347,327 | | | 3,168,506 | | | 4,699,409 | | | 1,446,418 | | | 1,596,795 | |

| Provision for Income Taxes | | | | | | | | | | | | | | | | | | | | | | |

| Current | | | - | | | - | | | 1,127,613 | | | 1,045,609 | | | 1,626,367 | | | 561,232 | | | 573,288 | |

| Net Income | | | 2,926,075 | | | 2,426,445 | | | 3,219,714 | | | 2,122,897 | | | 3,073,042 | | | 885,186 | | | 1,023,507 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Translation Gain | | | - | | | - | | | - | | | - | | | 627,236 | | | - | | | 119,542 | |

| Comprehensive Income | | | 2,926,075 | | | 2,426,445 | | | 3,219,714 | | | 2,122,897 | | | 3,700,278 | | | 885,186 | | | 1,143,049 | |

Balance Sheet Data (in U.S. dollars) | | As of December 31, | | | As of June 30, | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | | 2006 | |

| | | (unaudited) | | (unaudited) | | | | | | | | | (unaudited) | |

| Cash | | | 841,255 | | | 2,632,623 | | | 1,908,537 | | | 329,398 | | | 118,084 | | | | 4,429,101 | |

| Cash Restricted | | | 1,449,608 | | | 9,217,091 | | | 16,247,600 | | | 2,416,000 | | | 6,510,013 | | | | - | |

| Notes Receivable | | | 639,736 | | | - | | | 338,838 | | | 78,520 | | | 22,940 | | | | 18,760 | |

| Accounts Receivable | | | 31,522 | | | 36,290 | | | 73,230 | | | 300,040 | | | 276,544 | | | | 2,738,703 | |

| Related Party Receivable | | | 14,852,377 | | | - | | | - | | | 6,342,000 | | | 3,676,227 | | | | - | |

| Inventories | | | 2,905,118 | | | 5,361,272 | | | 8,755,329 | | | 13,107,659 | | | 16,018,762 | | | | 12,256,996 | |

| Prepayments & Other Current Assets | | | 1,347,183 | | | 4,910,828 | | | 4,493,236 | | | 666,530 | | | 1,996,769 | | | | 5,875,726 | |

| Total Current Assets | | | 22,066,798 | | | 22,158,103 | | | 31,816,770 | | | 23,240,147 | | | 28,619,339 | | | | 25,319,286 | |

| Total Non-Current Assets | | | 15,637,352 | | | 21,695,081 | | | 20,402,255 | | | 19,341,103 | | | 18,430,512 | | | | 17,838,947 | |

| Total Assets | | | 37,704,150 | | | 43,853,185 | | | 52,219,025 | | | 42,581,250 | | | 47,049,851 | | | | 43,158,233 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Current Liabilities | | | 15,396,566 | | | 26,683,481 | | | 54,907,369 | | | 14,408,388 | | | 12,774,035 | | | | 10,060,506 | |

| Total Long Term Liabilities | | | 7,248,040 | | | 7,248,040 | | | - | | | 19,086,400 | | | 19,282,038 | | | | 19,448,197 | |

| Total Liabilities | | | 22,644,606 | | | 33,931,521 | | | 54,907,369 | | | 33,494,788 | | | 32,056,073 | | | | 29,508,703 | |

| Total Owners' Equity | | | 15,059,544 | | | 9,921,664 | | | (2,688,344 | ) | | 9,086,462 | | | 14,993,778 | | | | 13,649,530 | |

| Total Liabilities & Owners' Equity | | | 37,704,150 | | | 43,853,185 | | | 52,219,025 | | | 42,581,250 | | | 47,049,851 | | | | 43,158,233 | |

INDUSTRY OVERVIEW

The Aluminum Industry

As a raw material for both industrial and consumer products, aluminum has a broad range of applications. It is widely used in the construction, transportation, electric, electronics and other industries. A nation’s per capita consumption of aluminum is highly correlated with its per capita gross domestic product (“GDP”). In other words, the demand for aluminum tends to increase along with the economic development of a particular country. The following table shows the per capita consumption of various countries with varying degrees of economic development in 2004:

Country | | Per Capita GDP (thousands of U.S. dollars) | | Per Capita Aluminum Consumption (Kg)* |

| Norway | | 53.4 | | 53.3 |

| United States | | 48.9 | | 19.6 |

| Japan | | 36.5 | | 15.8 |

| Germany | | 33.1 | | 21.8 |

| Canada | | 32.1 | | 24.3 |

| Australia | | 30.1 | | 15.4 |

| Italy | | 29.1 | | 16.8 |

| Korea | | 14.8 | | 23.2 |

| Russia | | 4.7 | | 7.1 |

| China | | 1.6 | | 4.8 |

Source: 2005 Industry Yearbook, China Non-Ferrous Metals Industry Association (“CNFMIA”).

* Based on our calculation. The consumption data is from the 2005 Industry Yearbook by CNFMIA, and the population data is from the website of the Population Reference Bureau (www.prb.org).

The aluminum industry is a mature industry characterized by intense competition. Almost all major countries in the world have the capacity to manufacture a significant amount of aluminum. No single country or manufacturer dominates the market. The following table shows the amount of aluminum production for various countries which produced more than one million metric tons in 2004:

Country | | Aluminum Production Volume (in millions of metric tons) | | Ranking |

| China | | 6.68 | | 1 |

| Russia | | 3.59 | | 2 |

| Canada | | 2.59 | | 3 |

| United States | | 2.52 | | 4 |

| Australia | | 1.89 | | 5 |

| Brazil | | 1.46 | | 6 |

| Norway | | 1.32 | | 7 |

Source: 2005 Industry Yearbook, CNFMIA.

The manufacturing process of aluminum comprises two phases: (1) conversion of bauxite into alumina and (2) conversion of alumina into aluminum. Some manufacturers produce both alumina and aluminum, while others focus on either alumina or aluminum. Most aluminum manufacturers market aluminum ingots only, whereas some manufacturers further process aluminum into semi-finished products such as aluminum bars, pipes and plates, which usually command a higher price than ingots.

The cost of aluminum depends largely on the cost of alumina and electricity. Our experience shows that the cost of alumina accounts for as much as 60% of the total cost and the cost of electricity accounts for approximately 30% of the total cost. Both alumina and aluminum are fungible commodities. Their prices are subject to a wide range of fluctuation directly related to the supply and demand in the industry. The cost of electricity varies from country to country and is also subject to price fluctuation if the supply or demand of power in a particular country is not stable. The price of aluminum in a particular country reflects, to a large degree, the price of aluminum in the international commodities market. Aluminum manufacturers normally do not have much freedom to set prices. The following table shows the price fluctuations of aluminum in the international commodities market from 2000 to 2005:

Year | | Average Price (U.S. dollars per metric ton)* | | Percentage Change |

| 2000 | | 1,553 | | N/A |

| 2001 | | 1,450 | | (6.6%) |

| 2002 | | 1,353 | | (6.6%) |

| 2003 | | 1,435 | | 6.1% |

| 2004 | | 1,717 | | 19.7% |

| 2005 | | 1,897 | | 10.5% |

Source: London Metal Exchange.

* Yearly averages calculated on the basis of stated monthly prices.

Aluminum can be classified into several different categories according to its content. Alumina is usually refined through the electrolytic method into primary aluminum. The process yields a product with at least 99% aluminum content. Primary aluminum is a common raw material for many industries. Primary aluminum can be further processed to yield a higher aluminum content of at least 99.9% using various technologies including the three-layered electrolytic method. The technologies involved in secondary processing require more technical expertise. As a result, the price and profit margin for high content aluminum are significantly higher. The following table shows the different aluminum classification systems as used in China and the United States:

Chinese Classifications

Classification | | Aluminum Content |

| Primary Aluminum | | 99.00%-99.85% |

| Refined Aluminum | | 99.95%-99.996% |

| High Purity Aluminum | | >99.996% |

Source: Journal dated September 20, 2006 of CNFMIA.

U.S. Classifications

Classification | | Aluminum Content |

| Industrial Pure Aluminum | | 99.50%-99.79% |

| High Purity Aluminum | | 99.80%-99.945% |

| Sub-Hyper-Purity Aluminum | | 99.950%-99.9959% |

| Hyper-Purity Aluminum | | 99.9960%-99.9990% |

| Ultra-Purity Aluminum | | > 99.9990% |

Source: The Minerals, Metals & Materials Society

We refer to all aluminum with higher than 99.99% content as “high purity aluminum.” High purity aluminum is a value-added product and is used in a variety of high-tech industries such as aerospace, aviation, electronics and precision machinery industries. It is also used as a raw material to produce high purity aluminum alloys for high speed trains and other products with special requirements. However, the market for such high content aluminum is not as large as that for primary aluminum. The amount of high content aluminum produced each year is relatively small. According to a journal of the CNFMIA, the worldwide productions of high purity aluminum were approximately 120,000 metric tons and 150,000 metric tons in 2004 and 2005, respectively.

The Aluminum Industry in China

China began its economic reforms in the late 1970s. Since then, China’s economy has grown on average at a rate of approximately 10% per year. Along with rapid economic growth came an enormous increase in the consumption of aluminum. According to the 2005 Industry Yearbook by the CNFMIA, China’s per capita consumption of aluminum has increased from 3.2kg to 4.8kg between 2002 and 2004. China’s aluminum manufacturers have expanded their capacity to meet the increased demand. According to statistics published by the CNFMIA, total output has increased from 850,000 metric tons in 1990 to 6.69 million metric tons in 2004. With continued expansion of China’s economy, we believe the demand for aluminum will continue to increase. The following table shows China’s output increase from 2002 to 2004:

Year | | Amount (millions of metric tons) | | Growth over Previous Year |

| 2002 | | 4.23 | | N/A |

| 2003 | | 5.55 | | 31% |

| 2004 | | 6.69 | | 20% |

Source: CNFMIA website (www.chinania.org.cn)

Most of China’s aluminum refineries are state-owned companies. China Aluminum Co. Ltd. is the largest of these, with a combined capacity of 1.09 million metric tons per year in 2004. More than a dozen other state-owned companies have a capacity of over 100,000 metric tons per year. The rest of the aluminum refineries have a capacity from 10,000 metric tons per year to 100,000 metric tons per year. There are only a few privately owned aluminum refineries, which tend to have smaller capacities in the range of 5,000 to 50,000 metric tons. Below is a table of the top-ten primary aluminum producers in China in 2004:

Company Name | | Production Volume in 2004 (metric tons) | | Ranking |

| China Aluminum Company Qinghai Branch Company | | 286,058 | | 1 |

| Qingtongxia Aluminum Group Company Limited | | 247,743 | | 2 |

| China Aluminum Company Guizhou Branch Company | | 230,001 | | 3 |

| Baotou Aluminum (Group) Company Limited | | 228,458 | | 4 |

| Zhaozuo city Wanfang Aluminum Shares Company Limited | | 226,289 | | 5 |

| Henan Yugang Longquan Aluminum Company Limited | | 204,090 | | 6 |

| Henan Wanji Aluminum Company Limited | | 185,443 | | 7 |

| Yunan Aluminum Shares Company Limited | | 182,023 | | 8 |

| Shandong Yinfa Aluminum Electric Group | | 176,433 | | 9 |

| Fushun Aluminum Factory | | 162,869 | | 10 |

Source: 2005 China Industry Analysis Report, CNFMIA

China’s aluminum market is characterized by a high degree of government intervention, and the PRC government has historically acted to control prices and supplies. However, the policies of the PRC government are sometimes ignored or circumvented by the local governments, which have an economic interest in building more capacity to generate more revenues and employment opportunities. As a result, China’s current aluminum capacity outstrips demand. According to the 2005 Industry Yearbook by the CNFMIA, China produced approximately 6.68 million metric tons, but its consumption was only 5.97 million metric tons. The Yearbook further projected that the total output for 2005 would be 7.6 million metric tons while the demand for 2005 would be 6.86 million metric tons.

Due to government intervention and restrictions, the price for aluminum in China does not always reflect that of the international market. The following table indicates the price of aluminum in China and in the international commodities market from 2000 to 2005:

Year | | Price of Aluminum in China (U.S. dollars per metric ton) | | Price of Aluminum in the International Market (U.S. dollars per metric ton) |

| 2000 | | 1,962 | | 1,553 |

| 2001 | | 1,732 | | 1,450 |

| 2002 | | 1,637 | | 1,353 |

| 2003 | | 1,763 | | 1,435 |

| 2004 | | 1,962 | | 1,717 |

| 2005 | | 2,081 | | 1,897 |

Sources: Shanghai Futures Exchange (www.shfe.com.cn); London Metal Exchange (www.lme.co.uk)

By September 2006, many new alumina manufacturers in China had gone into production and the price of alumina had decreased significantly. Many aluminum refineries have been increasing their output to take advantage of the alumina price drop. We believe that, as a result, a large inventory of primary aluminum will build up and the price will drop accordingly.

Market Opportunity

The Market for Primary Aluminum

Although there will still be room for growth in the primary aluminum business in China in the long term due to China’s rapid economic development, we see very limited opportunity in the primary aluminum business in China for the short term due to overcapacity and downward price trends.

The Market for High Purity Aluminum

We believe there will be opportunities in the high purity aluminum segment due to China’s increasing role as an international manufacturing center. The aerospace industry uses a significant amount of high purity aluminum to make aircraft and spacecraft components. In addition to consuming a large amount of primary aluminum, the electronics industry also utilizes a significant amount of high purity aluminum. For example, high purity aluminum foils are used to make electrolytic capacitors. According to a report by the CNFMIA dated September 20, 2006 (the "CNFMIA Report"), the demands for high purity aluminum in China and globally in 2005 were 50,000 metric tons and 150,000 metric tons, respectively. The same report predicts that demand for high purity aluminum in China will increase at a rate of 20% per annum starting in 2006. There may also be opportunities for exporting high purity aluminum to East Asia and North America.

Because the high purity aluminum market is relatively new with few manufacturers, little third-party data is available. Based on our industry experience, we believe that high purity aluminum typically generates a higher profit margin than primary aluminum. The following table sets forth our current prices and profit margins for primary aluminum and our internal estimates of market prices and profit margins for high purity aluminum and high purity aluminum foils (all amounts in U.S. dollars based on an exchange rate of 1U.S.$ / 7.92 RMB):

| | | Selling Price | | Cost | | Gross Profit | | Gross Margin |

| Primary Aluminum | | 2,149 | | 1,858 | | 291 | | 14% |

| High Purity Aluminum | | 3,793 | | 3,034 | | 759 | | 20% |

| High Purity Aluminum Foils | | 6,953 | | 3,793 | | 3,161 | | 45%* |

* If we have to outsource production of high purity aluminum foil, the gross profit margin will be 29%.

Due to the high level of technical competence required, few aluminum manufacturers in China are able to produce high purity aluminum. We believe that there are currently two high purity aluminum manufacturers in China: Xinjiang Joinworld Aluminum Co. Ltd. (“Joinworld”) and Guizhou Aluminum Company (“Guizhou”). We estimate that Joinworld has a production capacity of 15,000 metric tons per year and Guizhou has a production capacity of 5,000 metric tons per year. In 2005, Joinworld produced 13,000 metric tons while Guizhou produced 4,000 metric tons (Source: CNFMIA Report). We believe that we can successfully take advantage of the high growth potential of this niche market due to our exclusively licensed technology from our CTO.

BUSINESS

Overview

We manufacture, market and sell a variety of primary aluminum products including ingots, bars and pipes. Our refined manufacturing operations involve the extraction of aluminum from aluminum oxide (alumina) through electrolysis processes commonly known as smelting. We further process the extracted liquid aluminum into primary aluminum ingots, bars and pipes through different casting processes. We market and sell primary aluminum products for the commercial aluminum product market consisting of foundries, fabricators and others, as well as finished aluminum products for the energy, electric power, railway, automotive, construction, mechanics, electronic appliance and consumer goods industries.

We have begun converting our facilities so that by the end of 2007, we expect to manufacture and sell principally only high purity aluminum. High purity aluminum is processed into foil to make electrolytic capacitors for industrial and consumer electronics and is sold as ingots or processed into alloys for aerospace components, high-precision instruments and high-speed trains. We sell our products to our customers through direct sales, and our customers take delivery of the products at our refineries. We serve geographic markets covering several provinces in Northeast China, primarily Liaoning Province.

We estimate that we are one of five privately owned aluminum manufacturers in mainland China and the only privately owned aluminum manufacturer in northeastern China. We currently have the capacity to produce 25,000 metric tons of primary aluminum per year. In fiscal year 2005, we manufactured approximately 22,000 metric tons of primary aluminum products, including aluminum ingots, bars, pipes, and plates. Our revenue in 2005 was approximately $40 million with a net profit of approximately $3 million.

In June 2006, we began to convert our business entirely to the production of high purity aluminum. We expect to complete the conversion by the end of 2007 and to have the capacity to produce 20,000 metric tons of high purity aluminum per year. As of October 2006, we have converted one electrolytic cell for production of high purity aluminum. We have produced samples of high purity aluminum, which have received positive test results from China’s National Center for the Analysis and Testing of Non-Ferrous Metals and Electronic Materials and from Shiva Technologies, Inc., a laboratory in the United States. We have an exclusive, long-term license to use an advanced method to manufacture high purity aluminum. We believe that this licensed technology will allow us to offer cost-effective and high-quality high purity aluminum products. By the end of 2007, we plan to have an internal research and development staff of five to ten employees engaged primarily in advancing our high purity aluminum related technologies.

Our Products

Our aluminum manufacturing business can be divided into the following categories:

Primary Aluminum (99.5%-99.8% aluminum content)

We currently have the capacity to produce 25,000 metric tons of primary aluminum per year. Primary aluminum is used by the building materials, rail road, machinery, power, chemical and steel industries. Approximately 50% of the primary aluminum products we sell are semi-finished products, such as aluminum bars, pipes and plates, and the other 50% consists of ingots. By the end of 2007, we plan to have ceased producing primary aluminum.

High Purity Aluminum (99.990%-99.996%, or 4N-4N6, aluminum content)

We have begun to convert our facility into one that will be able to produce high purity aluminum. We have finished one electrolytic cell and have successfully produced samples of high purity aluminum. We expect to complete the conversion by the end of 2007 and to have the capacity to produce 20,000 metric tons of high purity aluminum per year. Initially, we plan to produce and sell unfinished high purity aluminum ingots, and shortly thereafter we plan to start processing the ingots into high purity aluminum foils and alloys. High purity aluminum ingots and alloys are used to manufacture aerospace components, high-precision instruments, such as high-definition telescopes, and high-speed trains. High purity aluminum foils are used to make electrolytic capacitors for industrial and consumer electronics, such as computers, cell phones, televisions and MP3 players. Foils are also starting to be used in automobile electronics and mirrors.

We take pride in our quality control. We have established quality assurance systems for our products and have passed ISO 9001 in 2001. We are seeking to continuously improve our production systems and processes and to meet the latest requirements of ISO 9001 (Version 2000).

Super High Purity Aluminum (99.999%-99.9999%, or 5N-6N, aluminum content)

Within two years after our conversion to high purity aluminum production, we plan to begin to manufacture super high purity aluminum. Our CTO is developing technology to produce high purity aluminum at 5N to 6N aluminum content. We believe that only one other company in the world (Hydro Aluminum, in Norway) currently has the technology to produce aluminum at this level of purity. We believe that the selling prices and profit margins for 5N and 6N aluminum would be significantly higher than those for 4N aluminum. Aluminum with a purity level of 5N to 6N is used in the defense industry and for large-scale integrated circuits, semiconductor components and super-conductors.

Competitive Strengths

We believe we have the following competitive strengths:

| · | Privately Owned. We believe we are one of only five privately owned aluminum manufacturers in China and that we will be the only privately owned high purity aluminum manufacturer in China. Most aluminum manufacturers in China are state owned and employ an average of approximately 300 employees for every 10,000 metric tons of production capacity. We use only approximately 150 employees for every 10,000 metric tons of production capacity. Therefore, we believe our average production costs are lower than those of the state-owned enterprises. We believe we are also flexible and quick in our decision-making process and in adapting our business to market conditions. We believe we are good at tailoring our production to the needs of our customers and thus have strong relationships with our customers. |

| · | Cutting-Edge Technologies for High-Purity Aluminum. We believe that, after our conversion to high purity aluminum manufacturing, we will be one of only three companies in China that will be able to produce high purity aluminum. We have a long-term exclusive license to use new high purity aluminum production technology developed by our CTO. We believe that this technology is superior to that used by other high purity aluminum manufacturers in China, because we expect it to require less capital investment in manufacturing facilities, use less electricity and produce high purity aluminum of more consistently high quality than the technology used by the other manufacturers. Our CTO is also developing additional technology for us, including methods for producing super high purity aluminum. |

| · | More Semi-finished Products. We believe that most other primary aluminum manufacturers in China produce ingots only, whereas we process half of our primary aluminum into semi-finished products such as bars, plates and pipes. These semi-finished products have a higher profit margin, which amounts to approximately $120 more per metric ton. Most of our competitors do not produce such semi-finished products. As a result, we believe that we are more diversified in the primary aluminum products we manufacture, we can better satisfy our customers’ primary aluminum product needs and we have higher over-all profit margins from primary aluminum products than most primary aluminum manufacturers in China. |

| · | Advanced Environmental and Recycling Technologies. We believe that our facilities are newer than those of most of our competitors and that we have more advanced, effective and efficient environmental technology in place. Our environmental and recycling equipment was installed in 2000 and 2003. We have passed the inspections by the municipal and the provincial environmental agencies every year since our inception and have consistently achieved results that are better than the national standards. Because some of this new technology enables us to recycle certain chemicals we use in manufacturing, it helps reduce our costs related to environmental protection. |

| · | Limited Obligations to Retirees. We believe that most of our current competitors and all of our post-conversion competitors in China are state owned. State-owned aluminum manufacturers in China typically have substantial ongoing obligations to support a large number of retirees through the pension funds they must maintain. In contrast, we do not currently have any financial obligations to retirees beyond our required payroll contributions to state-administered pension programs. These contributions typically amount to between 8% and 20% of salaries. Unlike our state-owned competitors, after employees leave our company, we have no further support obligations to them. |

Growth Strategy

Our growth strategy includes converting our current primary aluminum manufacturing facilities into high purity aluminum manufacturing facilities, increasing our product line to include semi-finished high purity aluminum products, such as foils and alloys, gradually implementing plans for super-high purity aluminum production, conducting research and development to further our high purity aluminum manufacturing technologies, building a strong management team and broadening our customer base. We strive to become a market leader of high purity aluminum products in China and, eventually, in the global market.

Capitalize on Growing High Purity Aluminum Markets

Global market for high purity aluminum. Because the market for high purity aluminum is relatively recent with few manufacturers, very little independent market data is available. In 2004, the total global capacity for high purity aluminum production was approximately 120,000 metric tons. In 2005, the capacity increased to approximately 150,000 metric tons (Source: CNFMIA Report). The current high purity aluminum producing countries include Japan, Norway, Germany, China, Russia, U.S. and France. To the best of our knowledge, only one company, Hydro Aluminum, a Norwegian company, is currently able to produce aluminum with a purity level of 5N (99.999%) or above. Recently, global demand has had an estimated average year-over-year growth rate of approximately 6%. With the advent of electronic automobile technology, it has been estimated that the average growth rate could soon reach 8 to 10% (Source: Guotai Junan Securities Research Report on Joinworld, dated July 6, 2006 (“Guotai Report”)).

Demand for high purity aluminum in China. By 2006, China’s yearly high purity aluminum production has increased to an estimated 20,000 metric tons. (Source: Guotai Report). This increase is almost entirely attributable to the increases in production capacity of Joinworld. It is estimated that, in recent years, China’s demand for high purity aluminum has been increasing at 20% per year, compared to an estimated 8 to 10% per year growth rate for the world’s entire high purity aluminum market. Because of the current large-scale development of modern telecommunications networks in China, we believe high purity aluminum products are, and will continue to be, in great demand. Although manufacturers in China currently have an estimated capacity to produce 20,000 metric tons of high purity aluminum and high purity aluminum alloys per year, current demand in China for these products is estimated to be 50,000 metric tons per year (Source: CNFMIA Report). Therefore, we believe our high purity aluminum products will be in demand.

Growing demand for aluminum electrolytic capacitors. About 75% of high purity aluminum produced each year is processed into high-voltage electrolytic aluminum foil, which is an essential component of aluminum electrolytic capacitors. Together with electrolytes, they account for 30% to 70% of the raw material cost of aluminum electrolytic capacitors. The estimated global sales volume of electrolytic capacitors was $4.62 billion in 2003 and $5.0 billion in 2005. It is projected that the global sales volume could reach $5.25 billion in 2006 and $5.5 billion in 2007 (Source: Guotai Report). The rapidly growing telecommunications and automobile industries, the continued increase of digitizing homes and other forms of automated business processes and the expansion of the aerospace industry are expected to continue to create an increasing demand and lead to further increases in the consumption of aluminum capacitors. We believe that our conversion to high purity aluminum manufacturing will position us well to capitalize on this growing market.

With the recent rapid growth in China’s electronics industries, many consumer electronics products have become affordable to more people in China. These products require aluminum electrolytic capacitors, thus increasing demand in China for high purity aluminum foils. According to the data from the Information Center of China Electronic Component Association, China produced 70 billion aluminum electrolytic capacitors, with a value of approximately $846 million, in 2004, accounting for about 40% of the world total. The demand in China in 2004 was about 85.5 billion aluminum electrolytic capacitors with a value of approximately $1.039 billion. We have concluded that China’s demand for aluminum electrolytic capacitors is significantly greater than its domestic supply.

Convert Our Current Facilities to Manufacture High Purity Aluminum Exclusively

We currently have 172 electrolytic cells, which have the capacity to manufacture 25,000 metric tons of primary aluminum per year. Our plan is to fully convert our current primary aluminum manufacturing facilities into high purity aluminum manufacturing facilities with the capacity to manufacture 20,000 metric tons of high purity aluminum per year by the end of 2007. We have converted one primary aluminum electrolytic cell into a high purity aluminum electrolytic cell. We have produced sample products with the newly converted high purity aluminum electrolytic cell. The sample has been tested by China’s National Center for the Analysis and Testing of Non-Ferrous Metals and Electronic Materials, whose report shows our samples contain on average 99.9953% of aluminum. The sample has also been tested by Shiva Technologies, Inc. in the U.S., whose report shows our samples contain 99.995% of aluminum.

Build Facilities to Manufacture High Purity Aluminum Foils and High Purity Aluminum Alloys

Once we are able to produce high purity aluminum in large quantities, we plan to build facilities for production of high purity aluminum products, such as high purity aluminum foils and high purity aluminum alloys. By the end of 2008, we plan to have the capacity to process 15,000 metric tons of high purity aluminum into high purity aluminum foils. If we do not obtain sufficient funds to build such facilities, we plan to sub-contract the production of high purity aluminum foil to third-party foil factories in China. We intend to leverage our raw material supply advantage to become a more vertically integrated producer, which we expect to further enhance our profit margins.

Develop Cutting Edge Processes and Products Through Expanded Research and Development

We plan to develop new technologies in our manufacturing processes. We expect that our use of high purity aluminum manufacturing processes already developed by our CTO will reduce our production costs significantly. We currently have a five-member research and development staff at our aluminum plant in Liaoning Province. Our total projected 2007 research and development budget is $700,000. We plan to establish a research and development center in Beijing, which will house a research and development staff of five to ten employees with a budget of $250,000 for 2007. The current goal of our research and development efforts is to improve our current technologies and develop new technologies and techniques for high purity aluminum and related products such as super high purity aluminum with 99.999% to 99.9999% content, high purity aluminum alloys to use for high-precision instruments, auto mirrors and pitted foils for high voltage capacitors. Our research and development efforts will be aimed at finding new varieties of products, improving existing products, improving existing product quality and reducing production costs.

Build a Strong Management Team

Our experienced management team has strong capabilities in leadership and execution. Under their leadership, we have a demonstrated record of rapid and orderly growth of our business. Most of the members of our management team have more than ten years of industry experience. To meet the challenges of our growing business, we plan to grow our management team by recruiting more people with international and management experience. We believe a strong management team will ensure our continued success in this industry.

Building a Broad Customer Base

We currently have three sales staff because little marketing is needed in our current market. In connection with our conversion to high purity aluminum manufacturing, we plan to increase sales staff in the near future to market high purity aluminum and high purity aluminum products and to provide related technical support. We plan to set up sales or liaison offices in other parts of China where there is a high concentration of electronics manufacturers including the Beijing metropolis, the Yangtze River Delta and the Pearl River Delta. We also plan to attend industry trade shows and exhibitions to market our new products.

Our Refining Technology

Primary Aluminum

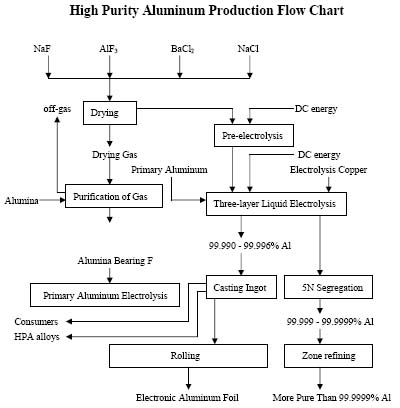

For our current production of primary aluminum, we use the Hall-Héroult process, in which alumina is reduced to aluminum metal by an electrolytic process involving carbon electrodes and cryolite flux (3NaF· AlF3). The electrolytic reduction process is carried out in electrolytic cells (we use prebake or Soderberg cells). Alumina is dissolved in the cell in an electrolyte at a high temperature (930 to 950 degrees Celsius) and a low voltage (4.1 to 4.5 volts). A high current is applied to the melted fraction. The alumina is reduced to aluminum at the cathode, and the metal sinks to the bottom of the electrolytic cell. The aluminum is then removed by siphoning and taken from the cell to holding furnaces from which it is poured into molds and cast into aluminum ingots, ballets and pipes according to orders. Our production process for primary aluminum is depicted below:

High Purity Aluminum

We are using the three-layer electrolytic process to produce high purity aluminum. Converting industrial-grade primary aluminum manufacturing to high purity aluminum manufacturing requires changes to our technology and our manufacturing facilities. We will not increase the amount of alumina used in the production, but we estimate that the selling prices and profit margins for high purity aluminum will be significantly higher than those for primary aluminum. Our production process for high purity aluminum is depicted below:

Further Improving Our High Purity Aluminum Technology

Our CTO is developing technology for us to produce super high purity aluminum (5N to 6N). Under his license agreement with us, we will have exclusive rights to use this technology. We plan to continue to improve our technology and gradually implement these technologies in our production to produce these much higher value-added aluminum material products. Our objective is to become one of the world’s leading specialized aluminum product suppliers.

Source of High Purity Aluminum Technology

General technological theories and methodologies for making high purity aluminum are well documented and widely shared among metallurgic scholars. However, it is very difficult to apply these theories and methodologies in large-scale commercial production and to produce high purity aluminum in bulk quantity with consistent quality. Among the difficulties are the following:

| · | it is very difficult to develop a set of electrolyte formulas to ensure that the electrolyte remains clean, has high electricity conductivity and a low melting point during production; |

| · | it is very difficult to design a large-scale three-layered liquid electrolytic cell and develop a comprehensive set of equipment to ensure lower consumption of electricity, higher production efficiency and current efficiency; |

| · | it requires specialized technology to produce the cathode of the electrolytic cell to produce consistently high-quality high purity aluminum; |

| · | it is very difficult to optimize the magnetic field, electric field and liquid field in the electrolytic cells to maintain a stable three layers (cathodic layer, electrolyte layer and anodic alloy layer); |

| · | it is very difficult to develop economical production methods to achieve electrical current efficiency over 98%, which allows for a consistently high quality product with lower consumption of electricity; and |

| · | it is very difficult to keep the purity grade of the high purity aluminum between 99.990 and 99.999%. |

Various factors have to be considered, continuously monitored and adjusted precisely to commercially produce aluminum of 99.990-99.996% content. Commercial production of high purity aluminum requires mastery of a combination of specialized know-how, industrial experience and manufacturing expertise. We believe that the only other companies in China that have mastered the manufacturing technologies for high purity aluminum are Joinworld and Guizhou. In addition, we believe that several other better-funded aluminum refineries have attempted to produce high purity aluminum, but that none of them has been successful, further demonstrating the difficulty of commercially producing high purity aluminum. We do not believe that either Joinworld or Guizhou currently has the research and development capability to further improve their existing production process and develop new technologies.

We benefit from our CTO’s many years of research work and commercial application experience. He is widely recognized in China as a foremost expert in advanced light metal production and application technology, especially in high purity aluminum related technologies. In addition, he has hands-on experience in the high purity aluminum industry. In his former work with the Beijing University of Science and Technology, Prof. Lu led several research lab efforts focusing on high purity aluminum production methods and innovation.